Politics

Reva Gudi: When principle meets power we must surely always hold the line?

Dr Reva Gudi is GP and healthcare leader in Hayes, Middlesex, she is also a former Conservative parliamentary candidate, and serves as a local school governor and charity trustee.

Of late, following on from more scandals, standards rows and ministerial controversy, I asked myself whether the Nolan Principles of public life are still fit for purpose. Perhaps outdated? Too idealistic? Impossible to live up to in modern politics?

And yet, as expected, UK political parties either implicitly or explicitly ask candidates to sign up to the Nolan principles, as the ethical standards of public life.

As a GP working in the NHS, I’m held to the same standards, if not higher.

In 1995, Committee on Standards in Public Life articulated seven principles intended to underpin public office in the United Kingdom: selflessness, integrity, objectivity, accountability, openness, honesty and leadership.

3 decades on trust in politicians is fragile, arguably, the lowest it’s ever been.

After giving this a great deal of thought, I’ve concluded that the problem is not the principles themselves, but us.

Putting myself forward as a parliamentary candidate at the 2024 General Election, on the doorstep, I noticed something telling. When I introduced myself as a GP, there was an immediate assumption of integrity with trust extended almost instinctively. The title itself carried expectations of candour, duty and care. When I then added that I was a political candidate something shifted. The warmth cooled ever so slightly. The scrutiny sharpened, as I expected, and the exchanges were a touch more sceptical.

Doctors consistently rank among the most trusted professionals in the country. Politicians do not. And yet both are bound, at least in theory, by the same ethical framework: selflessness, integrity, objectivity, accountability, openness, honesty and leadership. Not radical aspirations but rather the minimum moral standards of public life.

It then struck me that asking whether we should rethink the Nolan Principles in politics, was asking the wrong question.

The real question, I believe, is whether political culture has drifted so far from ethical expectation that the principles now feel aspirational rather than operational.

Because politics today plays out in a relentless media cycle, where statements make headlines and conspiracy theories do the rounds. Social media rewards outrage more than nuance, with AI backed content that is getting more sophisticated by the minute. Tribal loyalty can crowd out independent judgment. In such an environment, compromise can be seen as betrayal, or dithering, all error is framed as incompetence, (understandably, though), and political disagreement is often conflated with moral failure. Add to this the constant pressure to win, to retain authority, self-preservation, all in an unforgiving electoral cycle.

However, none of the above renders the principles obsolete. If anything, it makes them even more necessary.

The world of medicine, where I have spent most of my working life, offers a useful contrast. In clinical practice, honesty is comparatively straightforward. A test result is abnormal, or it is not. Evidence supports a treatment or it does not. The doctor–patient relationship is built on trust, and candour is expected.

On the other hand, politics is more complex. Policies involve trade-offs. Economic forecasts are uncertain. Negotiations require discretion. Honesty is not optional that can be set aside when circumstances become complicated. It must sit alongside judgment. Knowing when to speak, how much to disclose, and how to protect sensitive negotiations is not the same as misleading. There is of course a need to recognise the clear moral line between careful laying out facts in sequence, and intentional falsehood. Transparency at every moment is not always compatible with effective governance, and every decision made, will usually have winners and losers in the electorate.

Let’s take the two-child benefit cap. It was introduced on the grounds of fiscal restraint and fairness to working taxpayers and criticised for its impact on child poverty. Parties, across the spectrum, take different positions, with differences within the party, and you will see positions evolving when moving from opposition to government, when confronted with economic realities. It is where ideology, competing principles, compassion, redistribution, fiscal sustainability and electoral mandate collide head on. It does illustrate how political decision making rarely involves a single moral axis.

It is within this terrain that ethical standards must operate.

One can argue that the Nolan Principles are unrealistic in the rough-and-tumble of modern political life. I disagree. If anything, those who wield power over millions should be held to higher standards, not lower ones. Decisions about taxation, welfare, defence and public services shape lives at scale. But we must also acknowledge that democracy is inherently adversarial. Cross party consensus, which often exists, stays behind closed doors.

I quickly learnt that expecting politics to feel like a consulting room is naïve. Expecting it to be ethical is not.

To me there exists an uncomfortable truth: Signing up to the Nolan Principles, as a doctor, feels intuitive; as a political candidate, can sometimes feel ceremonial. Ministers affirm them, Councillors sign codes of conduct. Yet public cynicism persists.

So, what can we do?

If left up to me, I would say instead of strengthening the wording of the principles let’s strengthen the culture and consequences surrounding them. Standards must be reinforced by meaningful accountability, by incentives that reward integrity rather than performative outrage, and by a collective refusal to excuse evasiveness when it suits our side. Ethical public life is sustained by consistent application of the principles, alongside signing a code of conduct.

As citizens we too, have a role. If we demand honesty but reward outrage, if we condemn compromise yet expect delivery, if we treat every unpopular decision as evidence of possible corruption, we contribute to the erosion of trust we claim to lament. Trust is reciprocal and cannot be legislated for.

So, should we rethink the Nolan Principles?

No. We should reclaim them, as they are enduring moral standards.

What has changed is the intensity of scrutiny and the speed of judgment. The answer to that pressure is not to dilute our standards but to live them more deliberately. We know that public life will never be flawless; democracy is too human for that. But abandoning shared ethical commitments because they are difficult would be a far greater failure. To be honest, the real question is whether we have the steadiness across parties and across society, to uphold them, in an environment that tests them relentlessly.

After all, politicians, and medical professionals alike are capable of integrity and of failure.

The principles endure. The question is whether we do.

Politics

Bridgerton’s Nicola Coughlan Slams ‘Boring’ Conversations About Her Body

Nicola Coughlan has laid out why she’s definitely not here for the discussions about her body that have arisen since she shot to international fame in Bridgerton.

During a new interview with Elle UK, the outspoken former Derry Girls star explained: “The thing I say sometimes that pisses people off is I have no interest in body positivity.

“When I was a kid growing up, I never thought about that. I didn’t look at actors and think about their bodies. So, I actually don’t care.”

Nicola pointed out that there are “a lot of things I’m passionate about”, but discussions about body positivity are not one of them, insisting that this is something that’s been projected onto her by “someone else”.

She went on to explain that ahead of Bridgerton’s third season – in which she took the lead alongside co-star Luke Newton – she’d been exercising “a lot” and had lost “a bunch of weight”.

“I was probably a size 10 and one of the corsets was a size eight,” she said. “And then people talked about how I was ‘plus size’ and I was like, ‘How fucked are we that I am the biggest woman you want to see on screen?’.”

Nicola went on to recall one incident in which she was cornered in a public bathroom and told by a “really drunk girl” about how much she loved Bridgerton “because of your body”.

As the person in question began talking more about her body, Nicola admitted she became deeply uncomfortable (“I was like, ‘I want to die. I hate this so much’,” she commented).

“It’s really hard when you work on something for months and months of your life, you don’t see your family, you really dedicate yourself and then it comes down to what you look like,” she concluded. “It’s so fucking boring.”

Back in 2024, around the release of Bridgerton’s third season, Nicola shared that she’d grown tired of people suggesting her nude scenes in the Netflix period drama were “brave”.

“Don’t call me brave. I have a cracking pair of boobs,” she said at the time. “There’s nothing brave about that, that’s actually just me showing them off.”

She noted: “I’m a few sizes below the average size of a woman in the UK and I’m seen as a ‘plus-size heroine’.”

“Making it about how I look is reductive and boring,” she added. “What if I was suddenly going to play a ballerina and lose a shit ton of weight, are you not going to like me anymore? That’s insane and so insulting.”

Before that, Nicola claimed that she’d “specifically asked for certain lines and moments to be included” in the latest season of Bridgerton as a direct response to body-shaming she’s experienced in her career.

“There’s one scene where I’m very naked on camera, and that was my idea, my choice. It just felt like the biggest ‘fuck you’ to all the conversation surrounding my body,” she said, describing the sequence as “amazingly empowering”.

Read Nicola Coughlan’s full interview with Elle UK here.

Politics

Victoria Beckham Sends Brooklyn A Birthday Message Amid Fall-Out Drama

Victoria Beckham has joined her husband Sir David in wishing their son Brooklyn a happy birthday, despite their eldest child no longer being on speaking terms with them.

Across several social media posts, he accused them of “performative” and “controlling” behaviour over the course of his “entire life”, as well as claiming that they had tried “endlessly” to “ruin” his relationship with his wife Nicola Peltz Beckham.

Neither Sir David nor Victoria has commented publicly on Brooklyn’s claims, but on Wednesday, the football legend shared an old family photo to commemorate his son’s 27th birthday.

After reposting her husband’s message, the former Spice Girls star then shared one of her own, writing alongside an old photo of herself and her son: “Happy 27th birthday Brooklyn, I love you so much.”

Victoria Beckham/Instagram

The morning after Brooklyn’s social media post confirming the fall-out, Sir David made an appearance at the World Economic Forum in Davos, Switzerland, where he dodged numerous questions about the family drama.

During a subsequent interview, he made a timely comment about social media use among young people, explaining: “I’ve tried [with] my children to educate them. They make mistakes. Children are allowed to make mistakes. That’s how they learn.

“That’s what I try to teach my kids. But you know, you have to sometimes let them make those mistakes as well.”

In the weeks before Brooklyn’s posts, it had been reported in the press that Sir David and Victoria had unfollowed him on Instagram, to which his brother Cruz Beckham made a public statement in retaliation.

“My mum and dad would never unfollow their son,” he insisted, before alleging: “They woke up blocked… as did I.”

A representative for Victoria also told People magazine around this time that it was “not true” that she had unfollowed Brooklyn.

Politics

The House | We are closer than ever to allergy-safe schools. Now Parliament must finish the job

Benedict Blythe

3 min read

For more than a decade, families, clinicians and coroners have warned that allergy safety in our schools is too often left to chance. During that time, children have died. My son Benedict was one of them.

In the years since his death, we have campaigned for what has become known as Benedict’s Law, a straightforward set of protections: spare adrenaline auto-injectors in every school, proper allergy training for staff, and clear whole-school policies so that everyone knows how to respond in an emergency. These are basic safeguards that most parents assume already exist.

This week, the Government launches a consultation on new statutory guidance for supporting pupils with medical conditions and allergies. That is a significant moment. After years in which allergy safety struggled to gain political attention, Ministers have listened. The commitment to strengthen guidance shows that this issue is finally being taken seriously.

From September, schools in England will be expected to have clearer allergy policies, ensure staff are trained to recognise anaphylaxis, and strengthen arrangements around emergency medication. That will make children safer, it will provide clarity for schools and it marks real progress.

But guidance is not the same as law.

In Benedict’s case, his school did not have spare allergy pens available and the signs of anaphylaxis were not recognised quickly enough. Adrenaline was administered too late to save his life. These systemic gaps were the result of inconsistent standards and unclear expectations, not the failings of individual teachers.

The new guidance addresses much of that ambiguity, and is to be welcomed. But there remains a crucial difference between statutory guidance and legislation.

While statutory guidance sets expectations, they do not create a legal duty and are not legally enforceable. Guidance does not guarantee funding and it does not ensure consistent implementation in every school. Legislation does.

If the core elements of Benedict’s Law are written into statute, schools would be held to a clear, consistent standard. Crucially, funding would accompany that duty. That matters because schools are not operating in equal financial circumstances. Headteachers today are managing SEND pressures, attendance challenges, safeguarding responsibilities and rising costs within increasingly tight budgets. Schools in more deprived communities or carrying existing deficits are under particular strain. Asking them to implement additional medical safeguards without funded support risks creating uneven provision. In those circumstances, even strong statutory guidance can leave gaps.

Some schools will be able to go further and faster. Others may struggle to meet expectations. The result could be a postcode lottery of protection, where children with allergies in more affluent areas are better safeguarded than those in communities already facing disadvantage. We know from Dr Paul Turner’s published research that altering the distribution model of allergy pens -by providing them directly to schools rather than an oversupply of extras to young pupils – can release enough funding to pay for spare adrenaline devices, meaning no extra cost burden on the treasury. Delivering safer spaces at no extra cost has to be something universally supported.

The recent vote in the House of Lords recognised the need for government to go further. Peers supported an amendment to the Children’s Wellbeing and Schools Bill that would write the protections of Benedict’s Law into legislation and provide the funding mechanism to support delivery. When that amendment returns to the House of Commons it offers MPs an opportunity to build on this constructive step forward.

We are closer than ever to allergy-safe schools. Progress has been made. The government has showed it takes the protection of children with allergies seriously, the question now is whether we can secure that progress in a way that guarantees equal protection for every child in every classroom, for children like our son.

Benedict’s life mattered. His death must matter too.

Politics

Newslinks for Thursday 5th March 2026

Labour MP’s husband in China spy investigation

“Labour was plunged into a fresh China spying crisis on Wednesday after an MP’s husband was arrested. Lobbyist David Taylor, who is married to Labour MP Joani Reid, was held by Scotland Yard on suspicion of assisting a foreign intelligence service. Police also picked up two other men, believed to have been advisers during the Tony Blair government, during a series of raids. All three suspects were being questioned on suspicion of helping Chinese intelligence amid claims of ‘foreign interference targeting UK democracy’. The shock development threatened to reignite the row over Labour’s relationship with Beijing after the collapse of an unrelated prosecution of a parliamentary researcher and his English teacher friend who were accused of passing on Whitehall secrets.” – Daily Mail

- MP not seen anything to suspect husband has ‘broken any law’ – BBC

- Tories redouble demands on Labour to axe approval for Beijing mega-embassy in London in wake of latest shock spying allegations – Daily Mail

Iran 1) Allies dismay at “weak” UK response

“Britain’s allies in the Gulf and Cyprus have accused Sir Keir Starmer of failing to do enough to protect the region and UK citizens from Iranian missile strikes. The Times has been told that Bahrain and the United Arab Emirates have concerns about the UK’s response to the Middle East conflict. At the same time Cyprus’s high commissioner to the UK said the “least” his country expected was for the government to provide a robust defence of the island that is home to two British bases.” – The Times

- US did not share details with the UK before attacking Iran, sources say – The Guardian

- Stock markets and oil prices still volatile over fears Iran war may drag on – BBC

- How attacking Iran may help Netanyahu’s election chances – The Times

>Today: Bob Seely on Comment: Starmer’s standing by his principles and defending them, but he’s confused and not defending us

Iran 2) Badenoch calls for stronger action

“Sir Keir Starmer has defended the government’s approach to the conflict in Iran, saying protecting British nationals is his “number one priority”. It comes after President Trump criticised the prime minister for refusing to allow the use of UK bases in the initial US-Israel strikes on Saturday, saying he is “no Winston Churchill”. During Prime Minister’s Questions Conservative leader Kemi Badenoch accused Sir Keir of “asking our allies to do what we should be doing ourselves” by not taking “offensive action” after British bases in Bahrain and Cyprus were attacked. But the PM said he was not prepared for the UK to join a war without “a lawful basis and a viable, thought-through plan.” – BBC

- First UK government flight for Britons stuck in Middle East yet to take off – BBC

- Starmer’s slow start in the war against Iran could leave UK playing catch-up – The Guardian

- Iran war has exposed the depths to which our once all-conquering Royal Navy has been allowed to sink – Leader, The Sun

- Britain’s shrunken armed forces are an embarrassment – Leader, The Times

>Today: ToryDiary: Shadow Cabinet League Table: Badenoch may not be popular with Starmer but she’s dominant with Conservatives

>Yesterday: Video: PMQs: Badenoch “The PM is catching arrows not dealing with the archers”

Iran 3) Miliband led Cabinet revolt against war

“Ed Miliband led Cabinet opposition to US military action in Iran and the use of Britain’s bases. In a meeting on Friday ahead of the strikes, Mr Miliband, Rachel Reeves and Yvette Cooper are understood to have strongly opposed British support for pre-emptive military action, which they believed would be illegal. Sir Keir Starmer backed them, and resisted pressure from Donald Trump to allow the US to fly bombing runs to Iran from RAF bases in Gloucestershire and the Chagos Islands. The Prime Minister changed his position less than 48 hours later and American B-2 stealth bombers are due to arrive at Diego Garcia, the military base in the Chagos Islands, in the next few days to fly “limited, defensive” missions.” – Daily Telegraph

Iran 4) US submarine sinks Iranian warship off Sri Lanka

“A torpedo fired by a US submarine sank an Iranian warship off the south coast of Sri Lanka as the Trump administration followed through on its threats to destroy Tehran’s military and political leadership. At least 87 Iranian sailors were killed in the attack on the Iris Dena on Wednesday. The frigate was sailing in international waters as it returned from a naval exercise organised by India in the Bay of Bengal. The torpedo strike prompted questions from former US officials about whether Washington’s aim of eliminating all of Iran’s military breached international law.” – The Guardian

- Ground invasion launched against Iran as thousands of US-backed Kurdish fighters storm border – Daily Mail

Iran 5) Neil: Starmer has made a grave error

“International law may be an opaque, malleable, even mysterious construct with controversial rulings involving judges sometimes appointed by dictators. But when it comes to a choice between international law and the national interest, Starmer chooses international law every time. Request denied, the Americans were told. Cue the biggest crisis in Anglo-American relations of modern times. Donald Trump lashed out at Starmer from the Oval Office on Tuesday. He lumped Britain with the viscerally anti-American socialist government of Spain. He painted us as far worse even than the usually US-sceptic French. Nowhere near as good as the Germans, whose Chancellor was sitting beside him, offering no words in Starmer’s defence. So much for all that cosying up to Europe. Now you don’t have to agree with everything Trump said – far from it – to recognise Starmer had made a grave error.” – Andrew Neil, Daily Mail

Other comment

- What does victory in Iran look like? Here are three possible answers – Tobias Ellwood, Daily Telegraph

- By betraying our allies, Starmer is demonstrating he is our Neville Chamberlain – Dan Hodges, Daily Mail

- As the liberal order dies, Starmer’s Britain is doubling down on its stupidity – Allister Heath, Daily Telegraph

- The Iran war may be lawful, but not for the reasons Trump gives – Geoffrey Robertson, Daily Telegraph

- The cynical opportunities of ‘Epic Fury’ – Martin Wolf, Financial Times

- The terrifying gap in Britain’s defences that means Iran could launch drones at our towns and cities – Jake Wallis Simons, Daily Mail

- The PM must publish the Iran legal advice – Leader, Daily Telegraph

- Women’s celebration of tyrant Khamenei’s death was joy to behold – Janice Turner, The Times

- I am sick of the US bossing us about – Peter Hitchens, Daily Mail

- Trump is pushing Britain closer to Europe – Leader, The Guardian

Ex-Labour mayor and councillor join Reform UK

“Former Labour mayor of Newham Sir Robin Wales and ex-councillor Clive Furness have joined Reform UK. Furness has been selected as the Reform’s candidate for mayor of Newham, while Sir Robin will act as the party’s London director of local government. Announcing the move at a press conference alongside Reform leader Nigel Farage, Sir Robin, who was the UK’s longest serving mayor when he was deselected by Labour in 2018, said the party had “a lot of rough edges” but represented a chance to “transform our society”. Furness said the “balkanisation of Britain”, with people voting along religious and racial lines, was among the reasons he was joining Reform.” – BBC

- Reform pledges to give Wales lowest income tax in UK – Daily Telegraph

- Reform would prioritise Welsh people for social housing, party says – BBC

Mahmood warns Labour MPs to back laws to stop illegal migration or lose trust

“Failing to stop illegal migration will demolish trust in the state, the home secretary will warn on Thursday as new legislation to scale back asylum support is introduced in parliament. In a call on Labour MPs to back her, Shabana Mahmood says that without changes there would be a rise of “ethno-nationalism” on the “far right”. Despite calls from some backbenchers for a tack to the left after last week’s by-election loss to the Greens, she rejects pandering to “student politics”. Mahmood is expected to acknowledge voters’ frustration with levels of illegal migration after last year became the second-highest on record for small-boat arrivals, at 41,472.” – The Times

- Foreign criminals will be thrown out of taxpayer-funded hotels – Daily Telegraph

- Restoring order at the border speaks to Labour values. Without that, we won’t be able to do anything else at all – Shabana Mahmood, The Guardian

OBR warns Government will struggle to cushion energy price surge

“The UK government is poorly positioned to cushion the blow to households from surging energy prices given the mountain of public debt it is trying to manage, a top economist has warned. David Miles, a senior official at the Office for Budget Responsibility, said this week’s jump in oil and gas prices driven by the war in Iran was “unambiguously bad” for a major energy importer such as the UK and that it would be “understandable” if there was public pressure for the government to intervene if energy costs continued to spiral upwards. But he added that it came at a “particularly difficult time” given that the government had been attempting to bring borrowing down and stop the debt-to-GDP ratio from continuing to rise.” – Financial Times

- Another gas shock and Europe’s still not ready – Juliet Samuel, The Times

Labour waters down ‘Islamophobia’ definition to head off a free speech backlash

“Labour has watered down its controversial “Islamophobia” definition to head off a free speech backlash. Ministers have struck out references to the “racialisation” of Muslims amid concern it is a vacuous term that could be weaponised to silence critics of the religion. The phrase was included in the original definition drafted by a working group but is not expected to make the final version when it is published as soon as next week. Despite pressure from community leaders, Labour has also refused to use the word “Islamophobia”, opting instead to define “anti-Muslim hatred”. Wrangling over the wording has dragged on for more than a year, despite Labour pledging an Islamophobia definition in its election manifesto.” – The Sun

Other political news

- Phillipson launches review into surging anti-Semitism in schools – Daily Telegraph

- Burnham drops new leadership hint – Daily Express

- Lobbyists send legal threats to councils over anti-wood burner campaigns – The Guardian

- Describing workplaces as ‘competitive’ is too masculine, says Labour – Daily Telegraph

- Green Party faces gender-critical group lawsuit over trans ‘witch-hunt’ – The Times

- BBC to call for permanent charter and end of political appointments to board – The Guardian

- Reeves’s claim of £1,000-a-year boost ‘may be as little as £40’ – The Times

- Councillors scrap 2050 carbon neutral target – BBC

- Police Federation boss is arrested for corruption – Daily Mail

- Asylum seekers waiting over a year for claim in UK may be allowed to work under new measures – The Guardian

- Migrants will have to speak English to A-level standard before they can settle permanently in Britain – The Sun

- 60% of Welsh voters unaware of how new system will work in May elections – The Guardian

- Minister fails to say if Labour will bring down benefits bill – The Times

- Revealed: the student loan reforms backed by Labour MPs – Daily Telegraph

News in brief

- ‘Whose side are you on?’: How Keir Starmer alienated Britain’s allies over Iran – Tim Shipman, The Spectator

- Free trade among free nations – Pierre Poilievre, CapX

- Who is Keir Starmer without Morgan McSweeney? – Ailbhe Rea, New Statesman

- Reform is making a mistake on Iran – Ben Sixsmith, The Critic

- Is this the end of Hezbollah? – Michal Kranz, Unherd

Politics

Politics Home Article | Fox hunting: an April fool or a resolution upheld?

As we stand on the threshold of rebirth, will the government listen to the thousands of people who demand change, writes Emma Slawinski, CEO of the League Against Cruel Sports

This month the Secretary of State for the Environment, Emma Reynolds, is due to launch Defra’s long-teased consultation on banning trail hunting, in a bid to tighten up existing hunting laws in England and Wales.

But we’ve been here before.

On April 1 last year, animal welfare organisations were promised that there would be a consultation on strengthening hunting laws “later this year”.

We were April fooled.

Then, when the government’s Animal Welfare Strategy landed just before Christmas, the minister for animal welfare, Baroness Sue Hayman, said: “We are working out the best approach to take the ban forward and will run a consultation to seek views in the new year.”

Apparently that New Year’s resolution held as firmly as a Christmas trifle.

Now, as we stand at the threshold of the season of nature’s rejuvenation, we are renewing our calls for proper hunting laws to protect our wild mammals and to see a rebirth of this government’s commitment to doing so.

Make no mistake, every time this consultation is delayed, and the legislation that must surely follow, more innocent animals are condemned to death. Hunts will continue to persecute not just foxes, but deer, otter, mink, and hares. Animals will suffer, and they will die. It is unacceptable, but it seems we are expected to wait patiently while the government and Defra dithers and delays yet again.

Since the government came to power the League Against Cruel Sports has compiled 648 individual reports of foxes being chased. That’s 648 times a wild mammal has been pursued by a pack of hounds since a government that has specifically pledged to stop illegal hunting has been in power.

On February 18, 2025, on the twentieth anniversary of the Hunting Act coming into force, we delivered a petition signed by 104,000 people urging the government to close the law’s myriad loopholes and properly ban hunting.

On February 18, 2025, on the twentieth anniversary of the Hunting Act coming into force, we delivered a petition signed by 104,000 people urging the government to close the law’s myriad loopholes and properly ban hunting.

In January this year, with still no movement from Whitehall we wrote an open letter to Sir Keir Starmer and Emma Reynolds with a view to handing it in at Number 10 this February.

In just four short weeks more than 36,000 people, including other animal welfare and environmental organisations, signed it.

When it comes to strengthening hunting laws and banning so-called ‘trail’ hunting, most people think a stronger law is a better law. Polling carried out by FindOutNow and Electoral Calculus in 2024 showed 76 per cent support stronger hunting laws.

And they expect action, not further delays.

Those who defend hunting wild mammals with dogs will use any argument to prevent the law being strengthened, including trying to obfuscate the overwhelming evidence that time is up for trail hunting: The public are on our side. The police are on our side. Most MPs are on our side.

This government was elected with a manifesto pledge to end hunting. It could not be clearer that the time for change is now. Further delays are no longer acceptable. It is time to end hunting.

Find out more about the consultation at league.org.uk/hunting_consultation

Politics

Private Eye Puts 4 Brutal Spins On Donald Trump’s Iran Situation Room Snap

Private Eye put not one, not two, not three — but FOUR — mocking spins on the image of Donald Trump, Secretary of State Marco Rubio and CIA Director John Ratcliffe in a makeshift situation room at the president’s luxury Mar-a-Lago resort during the start of U.S.-Israel military operations against Iran this weekend.

The satirical magazine reproduced the image below, with speech bubbles coming out of the trio, four times, under the headline “Trump Attacks Iran: How Operation Epic Fury Unfolded.”

See the cover on Instagram.

In one picture, Ratcliffe is depicted asking “Is the Supreme Leader dead?” And Rubio replies: “No, Trump always looks like this.”

In another, Ratcliffe boasts “Mission accomplished,” to which Trump, wearing a white “USA” cap, replies “Yes, I’ve killed the Epstein story.”

A third picture shows Ratcliffe asking, “What happens next?” Trump says, “Popular revolt and regime change,” and Rubio replies, “In America.”

The final image shows Ratcliffe asking Trump: “Why have you started this war?”

Trump replies: “So that I can stop it.” Rubio responds, “I’ll ring the Nobel committee.”

The cover was hailed by commenters on Instagram as “Absolutely spot on,” “brilliant” and “so bloody true.”

Private Eye has ripped Trump on countless occasions before, previously poking him over his failure to broker an end to Russia’s invasion of Ukraine (despite vowing to do so in his 2024 campaign) and trolling him with a sarcastic message on his return to the White House.

Politics

Harry Styles Speaks Candidly ‘Special’ Bandmate And Friend Liam Payne’s Death

Harry Styles has spoken publicly for the first time about the loss of his former One Direction bandmate Liam Payne.

During a recent interview with Apple Music’s Zane Lowe to promote his new album Kiss All The Time. Disco, Occasionally, Harry opened up about Liam’s death, admitting it was something he has “struggled” to address over the last two years.

“There was a period when he passed away where I really struggled with kind of acknowledging how strange it is to have people kind of own part of your grief, in a way,” the Aperture singer shared.

“I [had] such strong feelings around my friend passing away, and then suddenly, being aware [that] there [was] maybe a desire from other people [for] you to convey that in some way – or it means you’re not feeling what you’re feeling or something.”

Harry continued: “It’s so difficult to lose a friend. It’s difficult to lose any friend, but it’s so difficult to lose a friend who is so like you in so many ways.

“It’s like, I saw [in Liam] someone with the kindest heart, who just wanted to be great.”

David Fisher/Shutterstock

The Grammy winner added: “It was a really important moment for me in terms of taking a look at my life, and being able to say to myself, ‘OK, what do I want to do with my life? How do I want to live my life?’.

“And I think the greatest way you can honour your friends who pass away is by living a life to the fullest.”

Harry then remembered Liam as a “super special person”, and lamented that his sudden death in October 2024 was a “really sad” situation.

Liam died at the age of 31 after falling from a third-floor balcony while on holiday in Argentina, while under the influence of several substances.

Following his death, his One Direction bandmates issued a joint statement, in which they said: “The memories we shared with him will be treasured forever. For now, our thoughts are with his family, his friends, and the fans who loved him alongside us.

“We will miss him terribly. We love you Liam.”

Harry later posted an individual tribute, remembering his “lovely friend” as “warm, supportive, and incredibly loving”.

“The years we spent together will forever remain among the most cherished years of my life. I will miss him always,” he wrote.

All four members of One Direction later attended Liam’s funeral, as did the group’s former mentor Simon Cowell.

Politics

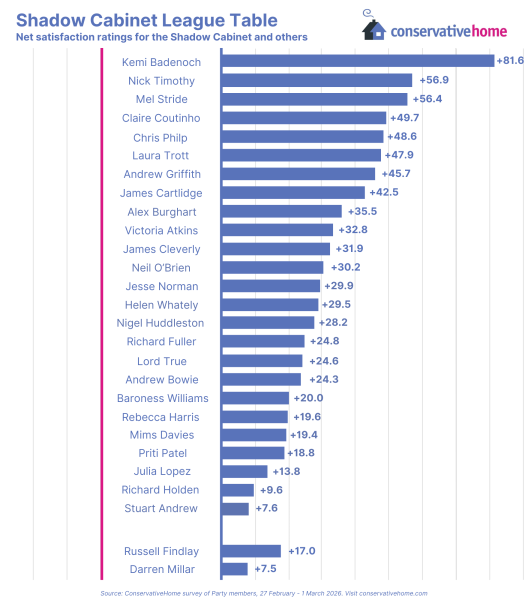

Shadow Cabinet League Table: Badenoch may not be popular with Starmer but she’s dominant with Conservatives

There was something of a coordinated hit job attempted by Labour’s loyalist outriders online yesterday.

Whether upset that Kemi Badenoch had described their backbenchers as ‘a sea of orcs and goons’ or that she simply wouldn’t meekly praise the Prime Minister for the inaction and weakness she felt he has shown over Iran, their instructions and mission were far more obvious than anything he might have given our military:

‘Tweet to denigrate her credentials and style as Leader of the Opposition’.

In Tolkein’s works Orcs “yammer and bleat” so if it was a bit of name calling in the midst of a rather serious session it also reflects their regular behaviour towards her when she stands up each Wednesday at PMQs.

The PM has taken weeks of battering by Badenoch and yesterday seemed surprised and horrified that the leader of the official opposition – that’s the one with an actual Shadow cabinet – does her job and opposes him, and does it bluntly.

It’s partly these performances, but also on the airwaves, and in speeches, that the days last year of her being a Leader stuck in the middle order of our Shadow Cabinet League Table are gone. Our Survey responders are clear, she’s leading from the front.

It’s not just that her former rival Robert Jenrick is no longer there. He placed consistently at the top in the middle of last year but didn’t reach the margin of lead she has now. Interesting that his replacement as Shadow Justice Secretary Nick Timothy comes in second, on his debut to this league table.

That lead at 81.6 is 21.7 points higher than Timothy, a margin alone that’s more than 9 of her colleagues score in their own right. But the good news is that compared to ten months ago where Badenoch was on zero, now no member of the shadow team is on zero or in negative numbers, even those who’ve stayed regularly at the bottom. In May last year half of them were in negative territory.

Sir Mel Stride, who has taken flak from some members for his past close association with Rishi Sunak, and support for his government, has actually, if one looks back over time, been consistently in the top three for months. It’s clear to another set of members, those on our panel, that he’s not just doing a good job but he’s seen to be doing that.

Neil O’Brien, Richard Fuller all do creditably given they are relative newcomers to the team. And team is what Badenoch keeps trying to stress and demonstrate. She has a full shadow cabinet, and though she leads, and is quite clearly seen to by members, she likes to stress that this is a team sport, and she likes it that way.

There is of course still a problem, as this site is often at pains to point out. Whilst you cannot renew a brand with a leader who is unpopular in the party and the country, you cannot renew a brand with a popular leader in the party and the country alone. The work to translate the Badenoch bounce into a Tory bounce, is a grinding toil that will have to continue, however high she charts now.

Politics

Cyprus Criticises UK Over Iran Attack Prevention Efforts

A senior Cypriot official has accused the UK of not doing enough to defend the island from Iranian attacks.

Kyriacos Kouros, the Cypriot high commissioner to the UK, said “the people are disappointed” by Britain’s efforts since the war began last weekend.

The RAF base Akrotiri, which is sovereign British territory, was struck by Iranian drones on Sunday, while further attacks were intercepted on Monday.

And while Greek forces are on the island and France has pledged support, the British warship HMS Dragon is not expected to arrive in the area until next week.

Kouros told the BBC: “The people are disappointed, people are scared, the people could expect more.

“I represent a practical people. We want to see the results.”

Speaking to Sky News, he said: “Already we have the presence of Greek forces on the island. Two frigates arrived, four aircraft arrived, all of them with abilities to combat drones.

“The French are coming. So… the least we expect is the Britons to also be present since, as I said, we are not only defending Cypriots on the island.”

Politics

Karoline Leavitt Says Trump Bombed Iran Due To A ‘Feeling, Based On Fact’

White House press secretary Karoline Leavitt became the subject of much social media mockery on Wednesday for her explanation behind President Donald Trump’s recent decision to bomb Iran.

The administration has offered a series of shifting reasons for the strikes, but Leavitt added one more to the mix: vibes, basically.

During Wednesday’s press briefing, a reporter from The Independent asked why the administration “can’t say what the imminent threat against the United States was” that required the US to launch Operation Epic Fury.

The press secretary declared that she would “explain to you exactly what led the president to make the decision” — and it seemed to boil down to feelings.

“This decision to launch this operation was based on a cumulative effect of various direct threats that Iran posed to the United States of America, and the president’s feeling, based on fact, that Iran does pose an imminent and direct threat to the United States of America,” she said.

Leavitt called Iran “the world’s leading state sponsor of terrorism,” said it was “rapidly and aggressively building up” its missile programme, and accused the country of being “hellbent on death and destruction.”

She continued: “The president had a feeling, again, based on fact, that Iran was going to strike the United States, was going to strike our assets in the region, and he made a determination to launch Operation Epic Fury based on all of those reasons.”

You can see the complete exchange in the video below.

Considering that “facts don’t care about your feelings” is a pet phrase of many conservatives thanks to podcaster Ben Shapiro, many people on social media couldn’t help but notice Leavitt’s phrasing.

-

Politics6 days ago

Politics6 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Tech3 hours ago

Tech3 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics4 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World6 days ago

Crypto World6 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business7 days ago

Business7 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes