Crypto World

Zoof Partners with ZyfAI for Deterministic Yield

Zoof Wallet has officially partnered with ZyfAI, marking a major expansion of Zoof’s DeFi capabilities. With this integration, Zoof moves beyond liquidity provisioning and borrowing/lending into deterministic stablecoin yield generation — widely regarded as one of the most promising frontiers in DeFi today.

This partnership brings together Zoof’s AI-native wallet experience with ZyfAI’s rule-based yield optimization infrastructure, delivering a smarter, more automated approach to on-chain income strategies.

What This Integration Means for Zoof Users

By integrating ZyfAI directly into the Zoof Wallet, users gain access to:

-

Deterministic, rule-based stablecoin yield strategies

-

Improved capital efficiency without constant manual rebalancing

-

AI-assisted portfolio and income management

-

Seamless, native DeFi interactions inside a single wallet interface

Instead of jumping between protocols, dashboards, and third-party tools, users can now manage yield generation directly within Zoof — faster, cleaner, and with less cognitive overhead.

Zoof Wallet: AI-Native DeFi, All in One Place

Zoof is an EVM-compatible wallet with AI at its core, designed to translate natural language into on-chain actions and automations. Whether you’re a newcomer or a seasoned DeFi user, Zoof abstracts away complexity while preserving power and flexibility.

Key Features of Zoof Wallet

-

Natural Language → On-Chain Actions

Tell Zoof what you want to do, and the AI handles execution and automation. -

Deep Virtuals Ecosystem Integration

Zoof will become the go-to app for users and builders in the Virtuals ecosystem. Projects can connect directly, allowing their agents and data to appear natively inside the wallet — no separate apps, no redirects. -

Income-First Design

Zoof focuses heavily on yield and income strategies:-

Recommending optimal liquidity pools

-

Managing positions automatically

-

Reinvesting rewards directly within the app

-

-

Flexible Wallet Creation

Create a wallet using email, social login, or a traditional seed phrase — all gasless, fast, and intuitive.

From booking a trip to trading with leverage or buying new prototypes, Zoof aims to be the single interface for both Web3 finance and real-world actions.

Who Is ZyfAI?

ZyfAI is a Switzerland-based Web3 lab specializing in Account Abstraction and DeFi infrastructure. Their core focus is improving capital efficiency through:

-

Personalized Safe Smart Wallets

-

Deterministic, rule-based rebalancing agents

-

Secure, programmable transaction execution

ZyfAI’s approach replaces reactive yield chasing with predictable, rules-driven strategies — a critical shift for sustainable DeFi yield.

What Is the ZyfAI SDK?

At the heart of this integration is the ZyfAI SDK, a powerful TypeScript library that simplifies access to ZyfAI’s yield optimization infrastructure.

At the heart of this integration is the ZyfAI SDK, a powerful TypeScript library that simplifies access to ZyfAI’s yield optimization infrastructure.

ZyfAI SDK Capabilities

-

Safe Smart Wallet Deployment

Deploy ERC-4337 and ERC-7579 compliant Safe smart accounts. -

Flexible Authentication

Supports private keys and modern wallet providers with automatic SIWE authentication. -

Multi-Chain Support

Works seamlessly across: -

Session Key Management

Create and manage session keys for delegated transaction execution. -

Yield Optimization Access

Plug into multiple DeFi protocols and deterministic strategies. -

Position Tracking & Analytics

Monitor positions, earnings, APY history, and overall portfolio performance.

All SDK methods are fully typed, include built-in error handling, and are designed for easy integration into production-grade applications.

Why This Partnership Matters

The Zoof × ZyfAI partnership represents a broader shift in DeFi:

-

From manual yield farming → automated, deterministic strategies

-

From fragmented tooling → native, wallet-level integrations

-

From complexity → AI-assisted simplicity

By embedding ZyfAI’s infrastructure directly into Zoof Wallet, users get institutional-grade yield optimization wrapped in a consumer-friendly experience.

Final Thoughts

This integration positions Zoof Wallet as more than just a wallet — it becomes an AI-powered DeFi operating system, with deterministic yield strategies as a core primitive rather than an afterthought.

For users seeking predictable income, reduced friction, and smarter automation, the Zoof × ZyfAI partnership is a meaningful step toward the next generation of DeFi.

If DeFi is evolving from “click-heavy speculation” to “automated financial infrastructure,” this is exactly what that future looks like.

ZOOF WALLET OFFICIALS

Website | X(Twitter) | Telegram

ZYFAI OFFICIALS

REQUEST AN ARTICLE

Crypto World

Metaplanet stock falls as massive Bitcoin bet backfires

Metaplanet stock edged up just about 3% on the daily chart following the earnings release, but the broader trend remains under pressure. Despite the short-term bounce, the stock is still down roughly 37% over the past month, highlighting investor concerns over the company’s aggressive Bitcoin accumulation strategy and volatile earnings profile.

Summary

- Metaplanet stock rose about 3% after earnings, but remains down roughly 37% over the past month, reflecting continued investor caution.

- The company reported ¥8.9 billion in revenue (+738% YoY) and ¥6.3 billion in operating profit, but posted a ¥95 billion ($619 million) net loss due to Bitcoin-related valuation losses.

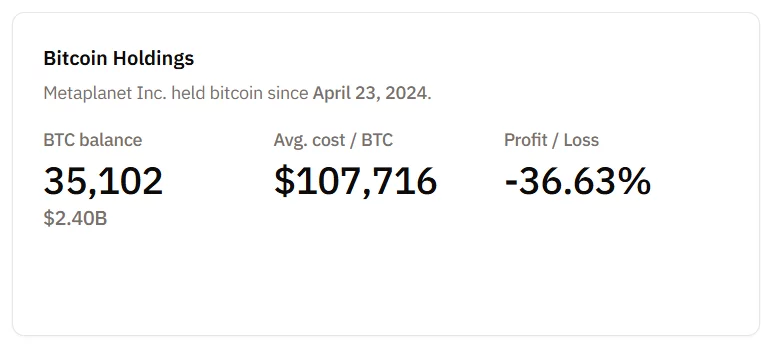

- With 35,102 BTC on its balance sheet, Metaplanet’s share price is increasingly tied to Bitcoin volatility, amplifying both gains and losses.

The Tokyo-listed Metaplanet’s stock dropped from around ¥540–¥550 levels to approximately ¥338, according to the latest monthly chart data. The sharp decline reflects market reaction to the company’s latest fiscal year results and the risks tied to its sizable Bitcoin exposure.

Metaplanet stock reacts to FY results amid Bitcoin volatility risk

In its latest full-year results, Metaplanet reported a dramatic surge in revenue, driven largely by its Bitcoin (BTC) focused operations.

For the year ending December 31, 2025, the company recorded ¥8.905 billion (about $58 million) in revenue, a 738% increase year-over-year, and reported an operating profit of ¥6.287 billion (around $41 million), up nearly 1,700% from the prior year.

Despite the strong operational performance, Metaplanet posted a net loss of roughly ¥95 billion (about $619 million), largely due to a non-cash valuation loss of approximately ¥102.2 billion (about $660 million) on its Bitcoin holdings as prices declined during the reporting period.

As accounting rules require digital asset holdings to reflect market value changes, swings in BTC prices can heavily distort bottom-line results.

Bitcoin-heavy strategy amplifies volatility

Metaplanet has rapidly scaled its crypto treasury, ending 2025 with 35,102 Bitcoin, up from just 1,762 BTC the year before, a roughly 1,892% increase, making it one of the largest corporate holders globally and the largest in Japan.

That Bitcoin stack now represents a core part of its balance sheet and revenue model, with much of its income tied to Bitcoin-related trading and yield activities.

However, the sharp correction in Bitcoin prices over recent months has turned what once were unrealized gains into deep paper losses, eroding investor confidence and weighing on the share price.

Metaplanet’s approach effectively makes the stock a leveraged play on Bitcoin itself, which has heightened market sensitivity as the crypto asset swings.

For traders and shareholders, the near-38% monthly drop underscores the risk of coupling equity valuation tightly to a volatile crypto asset, even when underlying operations are growing. Until Bitcoin stabilizes, Metaplanet’s share performance will likely continue to track broader crypto market sentiment.

Crypto World

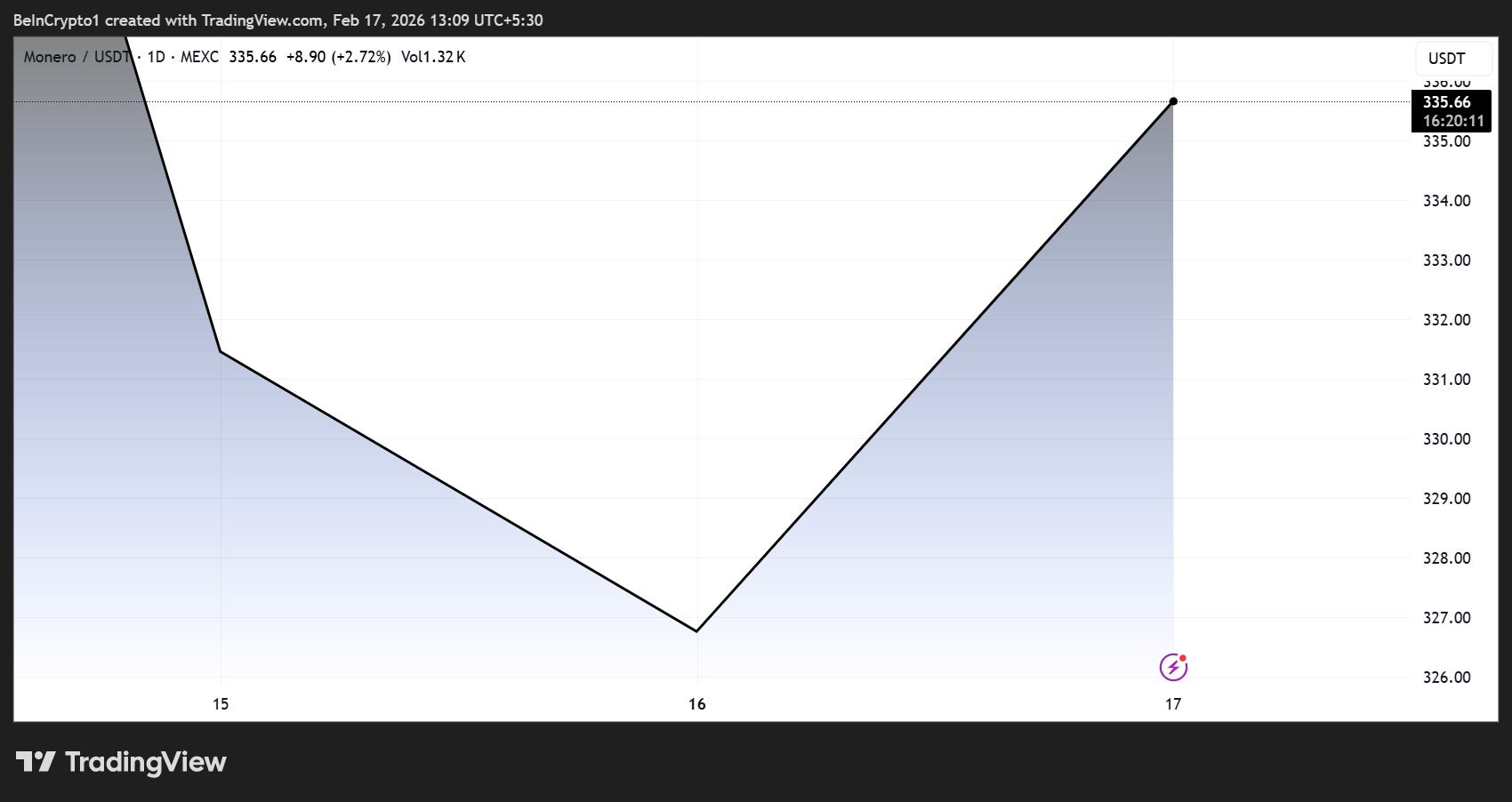

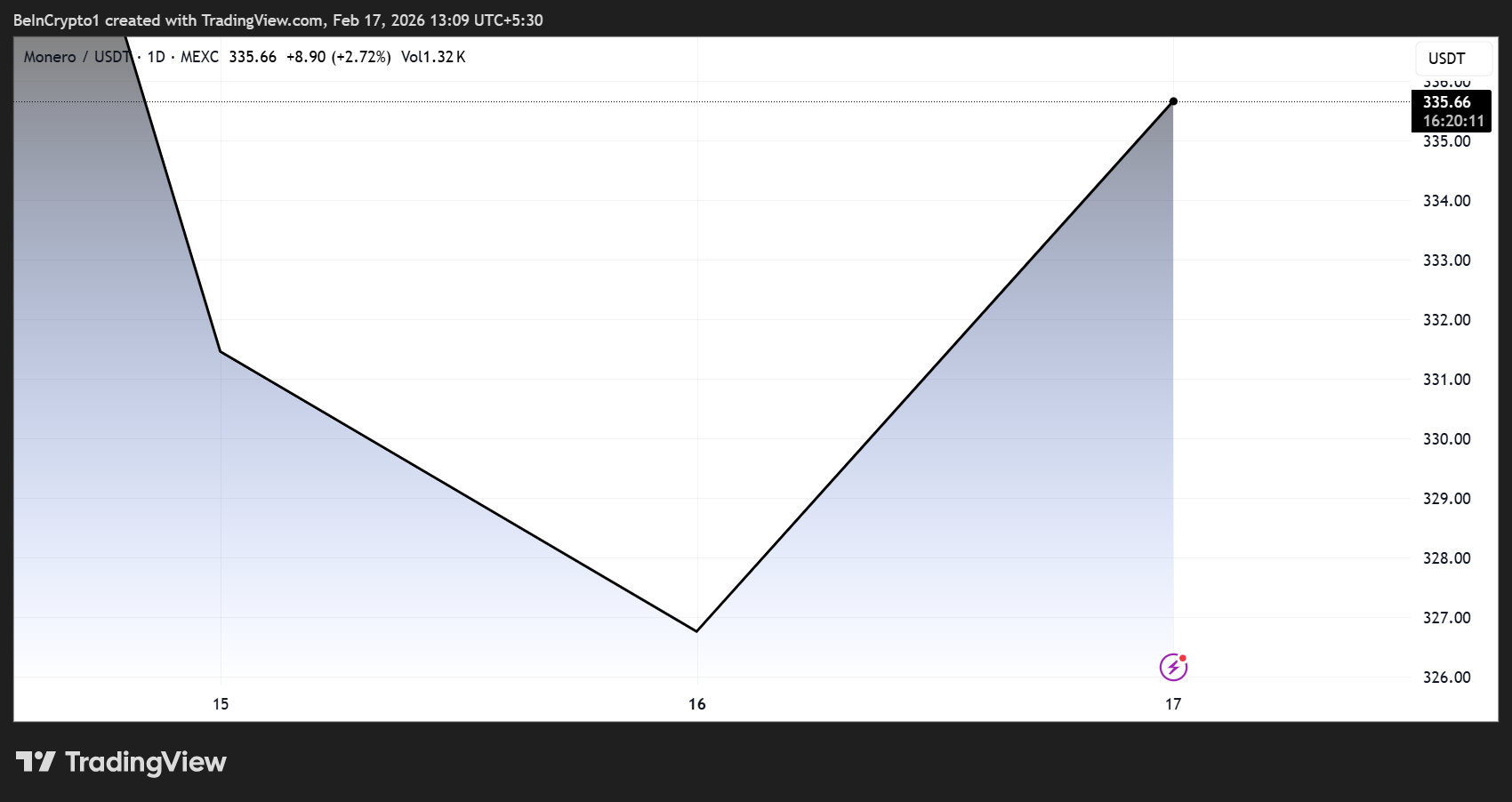

Monero price confirms bullish reversal pattern, eyes rebound to $420

Monero price confirmed a bullish reversal pattern as dip buyers capitalized on a recent drop. XMR now eyes a potential rally to as high as $420 over the coming weeks, as demand for privacy solutions is on the rise.

Summary

- Monero price has broken out of a falling wedge pattern on the daily chart.

- Demand for privacy tokens to circumvent government surveillance, and their large-scale usage in illicit markets has been benefiting XMR.

According to data from crypto.news, Monero (XMR) price rose nearly 9% to an intraday high of $344 on Tuesday, Feb. 17, while its market cap moved back above $6.3 billion.

Dip buyers took an interest in the token after it fell to a yearly low of $284 earlier this month. While it has retraced some of the losses, XMR still lies 57% below its yearly high of $788.50.

Now, on the daily chart, Monero price has confirmed a breakout from a falling wedge pattern, one of the most popular bullish reversal patterns formed by two converging and descending lines. Historically, a breakout from such patterns has been followed by days of consistent uptrend before losing momentum.

The technical breakout gains strength from a bullish MACD crossover and an RSI that is trending close to oversold levels.

Hence, the next key resistance level for Monero lies at $381, the 200-day EMA, which would serve as the final hurdle to validate a long-term trend reversal.

Breaking above this level could offer bulls the support needed to test the psychological resistance level at $420. XMR price breakouts have stalled around this area in past market cycles.

There are multiple catalysts that are driving the Monero rebound today and could continue to act as a tailwind in the days ahead.

First, investors seem to be rotating capital from other privacy-centric tokens such as Zcash (ZEC) and Dash (DASH) as they rebalance their portfolios. Zcash, for instance, has lost much of its investor appeal after its core development team resigned last month.

Second, Monero is also benefiting from a renewed demand for privacy tokens, especially as regulators across the globe are tightening oversight. New reporting standards across many jurisdictions now require platforms to share user identities and transaction histories with authorities, which has sparked concerns over the sector’s privacy ethos.

At the same time, recent reports suggest XMR has become a popular means of payment across darknet marketplaces, where large-scale transactions are creating an additional source of demand.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Will Hyperliquid price crash as bearish crossover forms and revenue drops?

Hyperliquid price has remained in a downtrend over the past two weeks, dropping nearly 20% since its yearly high as network revenues have slumped. Will the token crash now that it has confirmed a bearish crossover?

Summary

- Hyperliquid price has fallen 25% from its yearly high.

- Bitcoin’s ongoing downtrend and a cooldown in network activity have hurt the token’s price.

- A bearish MACD crossover on the daily chart could spell more trouble for the token in the coming sessions.

According to data from crypto.news, Hyperliquid (HYPE) price fell 25% to a monthly low of $28.5 on Wednesday last week after it hit a yearly high of $37.8. It has since managed to retrace some of its losses, exchanging hands at $30.2 when writing.

Hyperliquid price has been in a downtrend due to lingering bearish sentiment in the crypto market after Bitcoin (BTC), the bellwether crypto asset, fell through multiple key psychological resistance levels one after the other, dampening investor appetite for other major cryptocurrencies.

The token’s price has fallen amid weakness in key fundamental metrics. Data from DeFiLlama shows that the weekly revenue generated by the network has dropped 55% to $11.8 million last week, while the total value locked in the platform has dropped from its yearly high of $4.7 billion to $4.24 billion.

A drop in TVL and revenue generated on the network suggests that trading activity on the exchange is cooling off. Specifically, a drop in revenue generated by the platform also lowers the total amount of capital the platform gets to buy back and burn tokens from the market. This reduction in deflationary pressure makes it harder for the price to recover while sell-side pressure remains high.

The short-term outlook for Hyperliquid price also appears to be bearish when looking at its daily chart. Notably, the MACD lines have confirmed a bearish crossover with growing red histograms signaling that selling pressure seems to overwhelm buyers.

HYPE’s daily RSI has also entered into a descending channel formation and was close to dropping below the neutral threshold. Furthermore, HYPE price was drawing closer towards the 38.2% Fibonacci retracement level at $28.4, drawn from last year’s April low to September high.

A break below this key psychological level risks a move toward $21.10. Between the bearish technical crossover and underwhelming weekly revenue, the token is trending toward the target nearly 20% lower than current prices.

On the contrary, if HYPE manages to bottom and rebound from $28.4, it could retrace back toward its yearly high of $37.8. This would likely require a broader recovery in the crypto market as well, alongside a resurgence in trading volumes on the Hyperliquid platform to drive the necessary demand.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

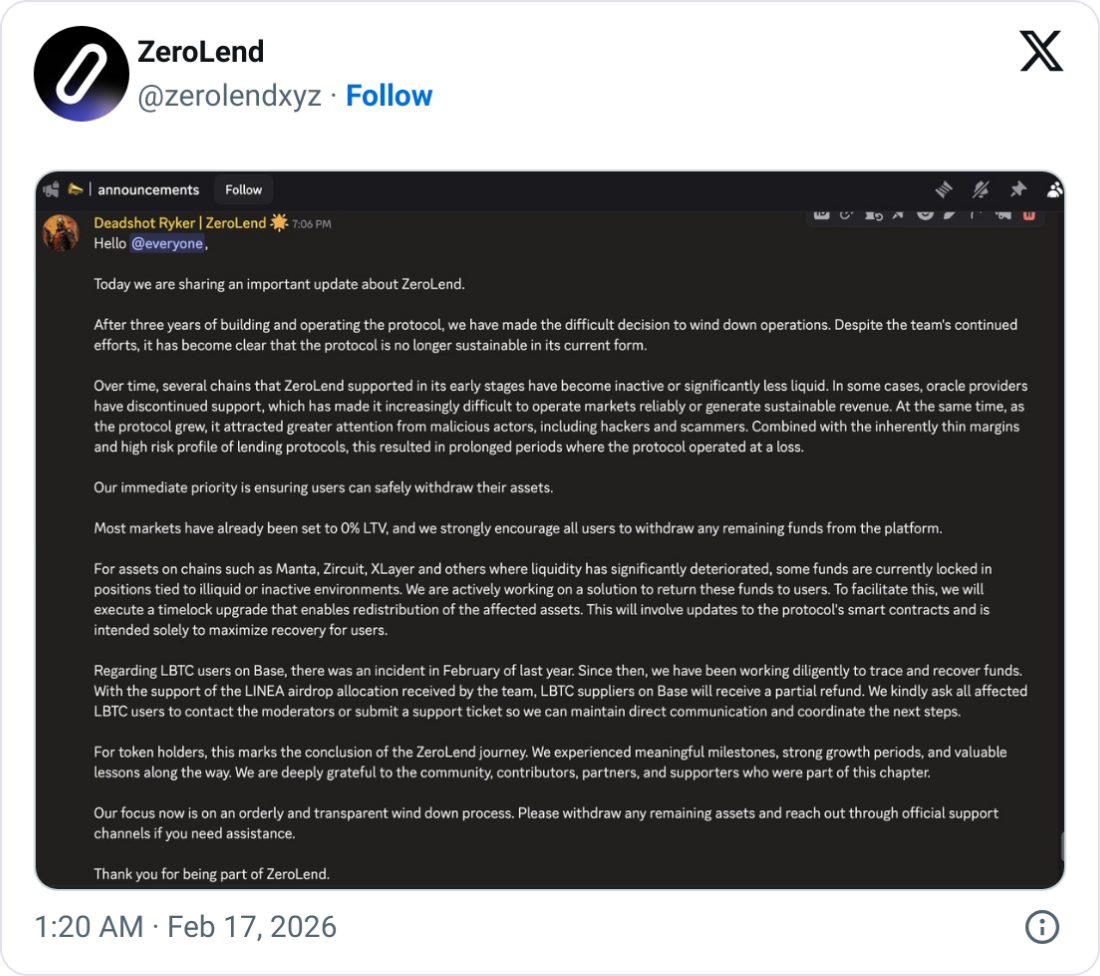

Zerolend Shutters as Founder Says It’s ‘No Longer Sustainable’

Decentralized lending protocol ZeroLend says it is shutting down completely after the blockchains it operates on have suffered from low user numbers and liquidity.

“After three years of building and operating the protocol, we have made the difficult decision to wind down operations,” ZeroLend’s founder, known only as “Ryker,” said in a post the protocol shared to X on Monday.

“Despite the team’s continued efforts, it has become clear that the protocol is no longer sustainable in its current form,” he added.

ZeroLend focused its services on Ethereum layer-2 blockchains, once touted by Ethereum co-founder Vitalik Buterin as a central part of the network’s plan to scale and remain competitive.

However, Buterin said earlier this month that his vision for scaling with layer 2s “no longer makes sense,” that many have failed to properly adopt Ethereum’s security, and that scaling should increasingly come from the mainnet and native rollups.

ZeroLend operated at loss due to illiquid chains, says Ryker

ZeroLend’s Ryker said the reason for the shutdown is that several blockchains the protocol supported “have become inactive or significantly less liquid.”

He added that in some cases, oracle providers — services that fetch data and are often crucial to running protocols — have stopped support on some networks, making it “increasingly difficult to operate markets reliably or generate sustainable revenue.”

“At the same time, as the protocol grew, it attracted greater attention from malicious actors, including hackers and scammers,” Ryker said. “Combined with the inherently thin margins and high risk profile of lending protocols, this resulted in prolonged periods where the protocol operated at a loss.”

He added that the protocol will ensure users can withdraw their assets, adding, “We strongly encourage all users to withdraw any remaining funds from the platform.”

Ryker said some user funds may be locked on blockchains that have seen “significantly deteriorated” liquidity, and ZeroLend will upgrade the protocol’s smart contracts with the aim of redistributing stuck assets.

Related: TradFi giant Apollo enters crypto lending arena via Morpho deal

He added that ZeroLend has also been working to trace and recover funds tied to an exploit in February last year, where protocol users of a Bitcoin (BTC) product on the Base blockchain were exploited after an attacker drained lending pools.

Ryker said that suppliers of the product affected by the incident will receive a partial refund funded by an airdrop allocation received by the ZeroLend team.

At its height in November 2024, ZeroLend commanded a total value locked of nearly $359 million, but that has since sunk to $6.6 million, according to DefiLlama.

The ZeroLend (ZERO) token has fallen by 34% in the last 24 hours in reaction to the protocol’s shutdown and has also lost nearly all its value since hitting a peak of one-tenth of a cent in May 2024, according to CoinGecko.

Magazine: Ethereum’s Fusaka fork explained for dummies — What the hell is PeerDAS?

Crypto World

UK crypto rules moving too slowly to secure global hub status, says FCA-registered stablecoin Issuer Agant

The U.K.’s crypto regulatory framework is moving in the right direction, but not fast enough to support the country’s ambitions of becoming a global digital asset hub, Andrew MacKenzie, CEO of sterling stablecoin developer Agant, told CoinDesk.

The government has repeatedly pledged to position London as a center for global crypto and digital asset activity. However, comprehensive legislation governing stablecoins and wider crypto activity is expected to be approved by parliament only later this year and won’t come into force until 2027.

MacKenzie said this timeline contradicts the government’s goal of remaining globally competitive within the industry.

“I think the most damaging thing today has been the time that it’s taken to get to where we are just now,” MacKenzie said in an interview at Consensus Hong Kong. “People just want clarity … If there’s anything I’d like to see from the regulators, it’s just an acceleration in the pace with which we can do things.”

The London-based company recently joined the small group of cryptoasset businesses registered with the Financial Conduct Authority (FCA) under money laundering regulations, an approval process widely regarded as one of the most stringent globally. FCA registration is a prerequisite for operating certain cryptoasset activities in the U.K., and the process has earned a reputation for being both exacting and slow.

A hard-won regulatory milestone

For Agant, which plans to issue a fully backed pound sterling stablecoin called GBPA, the registration signals institutional intent rather than a retail crypto push. The company has positioned the token as infrastructure for institutional payments, settlement and tokenized assets.

The firm maintains active dialogues with the Treasury, the FCA and the Bank of England, MacKenzie said, describing engagement as constructive, but iterative.

“There are certain aspects that we don’t like, and we’re very vocal about them,” he said, referring in part to proposed limits within the Bank of England’s stablecoin framework.

Still, he said, regulators are listening.

“The most promising aspect when we speak to regulators is the fact that they’re willing to implement changes if there’s true justification there.”

Stablecoins as a tool, not a threat

When asked if he viewed European central banks’ and U.S. private banks’ opposition to stablecoins as a problem for the future of his project, MacKenzie dismissed their concerns over financial stability and unfair competition, saying stablecoins can strengthen sovereign monetary reach.

“When you see the penny drop with central bankers, you realize that this is actually an amazing way for them to export sovereign debt,” he said. By issuing a pound-pegged stablecoin, firms like Agant could distribute digital pounds globally, increasing exposure to sterling-denominated assets and potentially lowering funding costs. “We can go and sell pounds globally,” he said. “The cost of carry for the central bank is just reduced somewhat.”

Rather than eroding sovereignty, he said, properly structured stablecoins can extend it.

For commercial banks, the concern is that if consumers hold funds in stablecoins rather than depositing them, they could lose their ability to lend.

MacKenzie rejected that premise. “I don’t think it is a valid argument. What it really brings to the table is that banks need to become more competitive.”

Credit would not disappear, he added, but could shift toward alternative providers if incumbent banks fail to adapt. In that sense, stablecoins may increase competition in financial services rather than diminish credit availability.

UK banks shift from skepticism to acceleration

Bankers in the U.K. are paying closer attention to cryptocurrency projects, MacKenzie said. Conversations have escalated up the hierarchy.

“It’s now a C-suite conversation,” he said. “There’s an exponential acceleration to banks’ adoption of blockchain technology.”

Banks increasingly recognize efficiencies in programmable reconciliation, instant settlement and cross-border interoperability, he said. Even though the transition may take decades, as it did with the shift to digital banking, momentum is building.

“The banks themselves have expressed they see this as a 30-year transition.”

If the U.K. intends to compete with faster-moving jurisdictions in Europe, the Middle East, and Asia, time may prove the most critical variable.

Whether Britain can convert ambition into leadership may depend less on regulatory design and more on how quickly policymakers move.

“Zoom out and look at the macro,” MacKenzie said. “Nothing is set in stone.”

Crypto World

New Report Sends Monero (XMR) Price Soaring 10%

The XMR price climbed nearly 10% on Tuesday following the release of a new report by TRM Labs highlighting Monero’s resilience and growing adoption in privacy-focused markets despite delistings from major exchanges.

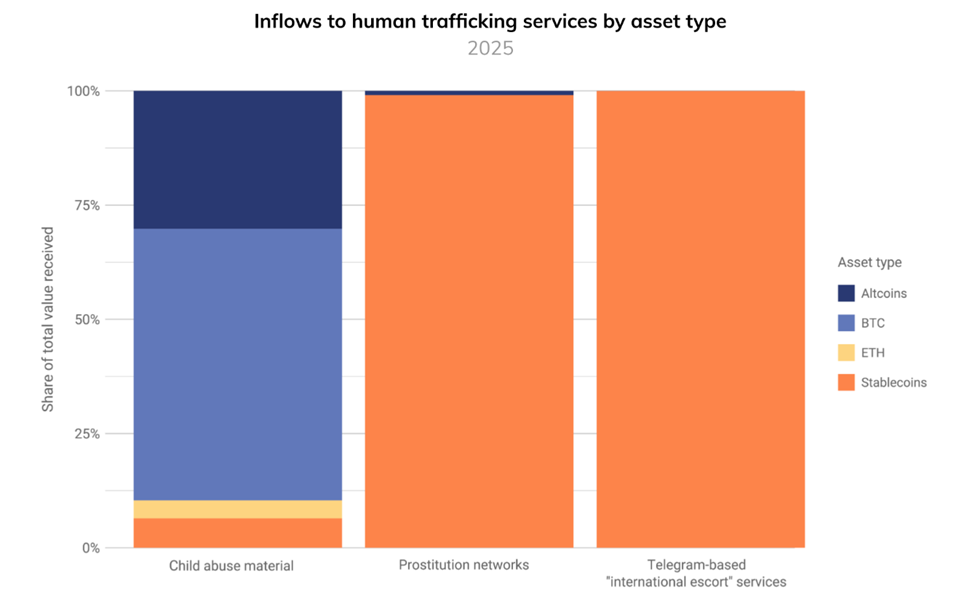

The research sheds light on the increasing use of Monero in high-risk environments, including darknet marketplaces, while also revealing subtle network-layer behaviors that could influence real-world privacy assumptions.

Monero’s Shadow Market Growth and Network Insights Drive XMR Price Surge

As of this writing, XMR was trading for $335.66, up by nearly 10% in the last 24 hours.

Sponsored

Sponsored

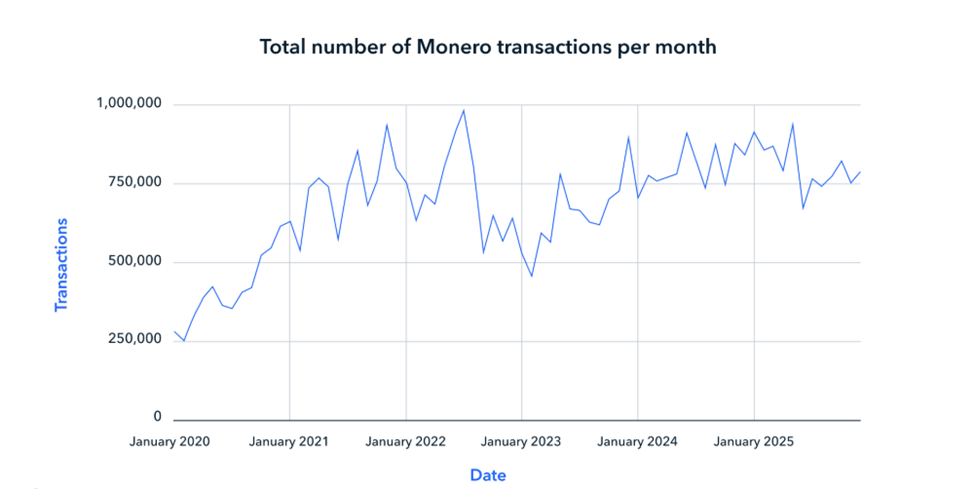

According to TRM Labs, Monero’s on-chain transaction activity remained broadly stable in 2024–2025 and consistently higher than pre-2022 levels.

This trend persisted despite restrictions from leading platforms such as Binance, Coinbase, Kraken, and Huobi, which have increasingly limited access to XMR due to regulatory and traceability concerns.

“Despite exchange delistings and enforcement pressure, XMR activity on Monero remains above pre-2022 levels,” TRM Labs noted.

According to the firm’s research:

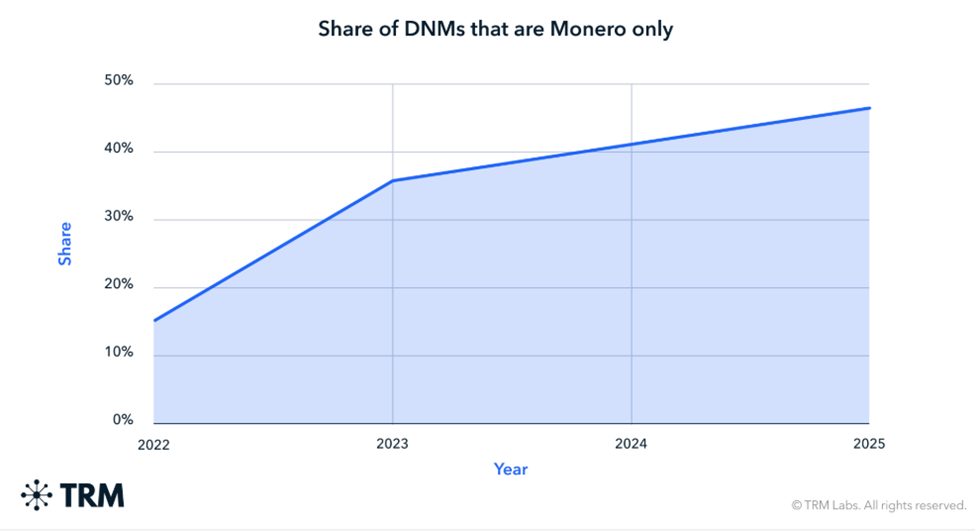

- 48% of new darknet markets in 2025 were XMR-only.

- Most ransomware payments still occur in BTC — liquidity matters.

- 14–15% of Monero peers show non-standard network behavior.

Monero’s cryptography remains strong, but network-layer dynamics can influence real-world privacy assumptions.

The report emphasizes that Monero’s resilience is not primarily driven by casual retail trading. Instead, it reflects a core user base that actively seeks privacy-preserving transactions, even when faced with higher friction, fewer on-ramps, and reduced liquidity.

Sponsored

Sponsored

Transaction volumes in 2024 and 2025 were materially higher than in early 2020–2021, indicating sustained demand rather than sporadic, speculative spikes.

This stability is particularly notable given that, according to some reports, 73 exchanges delisted Monero in 2025 alone.

As a result, liquidity for XMR is increasingly concentrated on offshore or lower-compliance venues, which partially explains why most ransomware payments still occur in Bitcoin.

While actors frequently request Monero for its privacy features, Bitcoin remains easier to acquire, move, and convert at scale.

Sponsored

Sponsored

Monero Adoption on the Rise Among Darknet Markets

Meanwhile, the report also acknowledges that Monero’s adoption in darknet markets continues to grow.

TRM Labs data shows that 48% of newly launched darknet marketplaces in 2025 now support XMR exclusively, a sharp increase compared to previous years.

This trend is especially pronounced in Western-facing markets, reflecting a direct response to enhanced tracing capabilities on Bitcoin and US dollar-backed stablecoins.

It aligns with a recent BeInCrypto report, which cited the increasing use of XMR in illegal activities.

Sponsored

Sponsored

Network-Layer Insights With Privacy in Practice

Beyond market behavior, TRM Labs conducted empirical research into Monero’s peer-to-peer (P2P) network. The analysis found that 14–15% of reachable Monero peers displayed non-standard behavior, including:

- Irregular message timing

- Handshake patterns, and

- Infrastructure concentration.

While these anomalies do not indicate protocol failures or malicious activity, they highlight how network-layer dynamics can subtly affect theoretical anonymity models, even as Monero’s on-chain cryptography remains strong.

Monero occupies a unique position in the crypto ecosystem. While transparent networks and stablecoins have become increasingly traceable and regulated, Monero continues to offer privacy-preserving functionality that appeals to users operating in high-risk or privacy-conscious environments.

TRM Labs’ findings highlight both the strengths and nuances of Monero’s privacy design. It shows that real-world usage patterns and network behavior can affect the practical efficacy of anonymity protections.

Crypto World

SBI Holdings Targets Majority Stake in Singapore Exchange Coinhako

Japanese financial conglomerate SBI Holdings is moving to deepen its presence in the crypto sector, announcing plans to take a controlling position in Singapore-based exchange Coinhako.

In a Friday announcement, the Tokyo-listed firm said its wholly owned subsidiary, SBI Ventures Asset, has signed a letter of intent with Coinhako’s parent company, Holdbuild, to inject capital into the business and purchase shares from existing investors. If completed, the transaction would give SBI Holdings a majority stake and make Coinhako a consolidated subsidiary, subject to regulatory approval.

“Bringing Coinhako into the SBI Group as a consolidated subsidiary is not merely an investment in a single platform,” chairman and CEO Yoshitaka Kitao said, describing the acquisition as part of a broader effort to build international infrastructure for digital assets, including tokenized securities and stablecoins.

Financial terms and ownership details were not disclosed, and both the structure of the investment and share purchases remain under discussion, per the announcement. The nonbinding deal would give SBI a licensed base in Singapore, one of Asia’s key regulated crypto hubs.

Related: The future of crypto in the Asia-Middle East corridor lies in permissioned scale

Coinhako operates licensed crypto trading platform in Singapore

Founded in Singapore, Coinhako operates a regional digital asset trading platform and related services through Hako Technology, a Major Payment Institution (MPI) licensed by the Monetary Authority of Singapore (MAS). The group also runs Alpha Hako, a registered virtual asset service provider overseen by the British Virgin Islands Financial Services Commission.

In 2021, SBI Holdings invested in Coinhako through the SBI-Sygnum-Azimut Digital Asset Opportunity Fund, a joint vehicle with Switzerland’s Sygnum Bank.

Coinhako co-founder and CEO Yusho Liu said the new partnership would allow the exchange to scale institutional-grade systems and meet “surging demand for tokenized assets and stablecoins, ensuring Singapore remains at the heart of the world’s next-generation financial system.”

Cointelegraph reached out to SBI Holdings for comment, but had not received a response by publication.

Related: Singapore’s ‘finance-savvy’ crypto retail prefers trust over low fees: Survey

SBI Holdings expands blockchain footprint

SBI Holdings has been active in blockchain ventures for several years, investing in tokenization projects, payment networks and crypto-related businesses.

In December 2025, SBI partnered with Web3 infrastructure company Startale Group to develop a fully regulated Japanese yen-denominated stablecoin aimed at tokenized asset markets and cross-border settlement. The token is to be issued and redeemed by Shinsei Trust & Banking, a unit of SBI Shinsei Bank, while licensed crypto exchange SBI VC Trade will handle its circulation.

In August, SBI Group partnered with blockchain oracle network Chainlink to build digital asset tools for financial institutions in Japan and across the Asia-Pacific.

Magazine: Here’s why crypto is moving to Dubai and Abu Dhabi

Crypto World

Crypto exchange Kraken vows to support “Trump Accounts” in Wyoming

Crypto exchange Kraken has vowed to support President Donald Trump’s “Trump Accounts” initiative in Wyoming.

Summary

- Kraken will sponsor Trump Accounts for every child born in Wyoming in 2026.

- The program grants eligible U.S. newborns a one-time Treasury contribution, with funds invested in market index funds.

- Wyoming Senator Cynthia Lummis has welcomed the move.

According to the official announcement from Kraken, the crypto exchange will sponsor Trump Accounts for every child born in Wyoming in 2026 by making a financial contribution to each eligible account as part of the federal program.

For those unaware, Trump Accounts are a new type of tax-advantaged retirement account that allows parents or legal guardians to open and contribute funds for children under 18.

Under a federal pilot program, every U.S. citizen newborn born between Jan. 1, 2025, and Dec. 31, 2028, is entitled to a one-time $1,000 seed contribution from the U.S. Treasury. These funds are invested in eligible market index funds and grow on a tax-deferred basis until the beneficiary reaches adulthood.

“By seeding accounts for every newborn in 2026, we are backing families from day one and reinforcing Wyoming’s role as America’s home for responsible crypto leadership,” Kraken Co-CEO Arjun Sethi said in a statement.

Pro-crypto Wyoming Senator Cynthia Lummis praised Kraken’s decision to sponsor Trump Accounts in the state, adding that the investment “will ensure children in Wyoming have a financial head start.”

“I’m grateful to Kraken for their commitment to Wyoming’s next generation and to the Cowboy State’s economic future,” she added.

Kraken has not disclosed how much it will contribute to this initiative, but said the decision was driven by Wyoming’s favorable regulatory climate, where it was able to become the nation’s first Special Purpose Depository Institution under the state’s crypto-specific banking framework.

“We picked Wyoming as our global HQ because it leads with thoughtful, responsible crypto policy,” co-CEO Dave Ripley wrote in an X post.

Kraken joins Coinbase and a slew of other financial giants like JPMorgan Chase that have publicly endorsed and supported the Trump Accounts initiative.

In a similar gesture toward community support, crypto-based prediction platform Polymarket opened a temporary free grocery store in New York City, offering food assistance and pledging millions of meals for local residents.

Crypto World

Crypto Funds See 4th Week of Outflows, but XRP and SOL Shine: CoinShares Report

Four consecutive weeks of crypto fund outflows hit $3.74 billion, but altcoins outperform as US investors retreat from the market.

Investment products linked to digital assets experienced their fourth consecutive week of outflows, recording $173 million and pushing cumulative losses over four weeks to $3.74 billion. Early in the week, inflows reached $575 million amidst brief optimism, but continued price weakness, which ended up triggering $853 million in outflows soon after.

Sentiment stabilized slightly on Friday following softer CPI data, as these investment vehicles witnessed $105 million of inflows. Trading activity also cooled significantly, and ETP volumes fell to $27 billion, less than half of the record $63 billion seen the week before.

Altcoin Appetite Surges

In the latest edition of the “Digital Asset Fund Flows Weekly Report,” CoinShares revealed Bitcoin continued to lag in terms of sentiment after seeing $133 million pulled from investment products tied to the asset. Short Bitcoin products also moved lower as combined losses reached $15.4 million over the past two weeks, a pattern frequently observed near cyclical lows, according to the asset manager.

Ethereum followed a similar path after seeing $85.1 million withdrawn, while Hyperliquid recorded $1 million in losses. Multi-asset strategies declined as well, with $14 million leaving the category. On the other hand, appetite remained strong for altcoin-focused investment products such as XRP, Solana, and Chainlink, which attracted $33.4 million, $31 million, and $1.1 million, respectively. Litecoin also gained a modest $0.4 million.

Regional sentiment showed a clear divide between the US and international markets. While the US experienced $403 million in outflows, other regions collectively saw $230 million in new capital. Germany led with $115 million, followed by Canada with $46.3 million and Switzerland with $36.8 million. Brazil added $14 million, Australia nearly $10 million, and Sweden $2.8 million during the same period.

Predictable Correction?

Bitcoin has shed almost 50% since its all-time high last October, prompting market analysts to predict the price could drop to as low as $50,000 before any meaningful recovery. Meanwhile, Hedy Wang, fintech veteran and founder of BlockStreet, believes that the current turbulence is a feature of a maturing market rather than a fundamental collapse. In a statement to CryptoPotato, Wang said,

“Unlike earlier speculative bubbles, the current Web3 ecosystem is supported by a more resilient and collaborative community ethos focused on long-term building. Therefore, an analytical view suggests the market is undergoing a natural, albeit volatile, evolutionary phase, with data pointing towards a repeating historical pattern rather than an unprecedented crisis.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

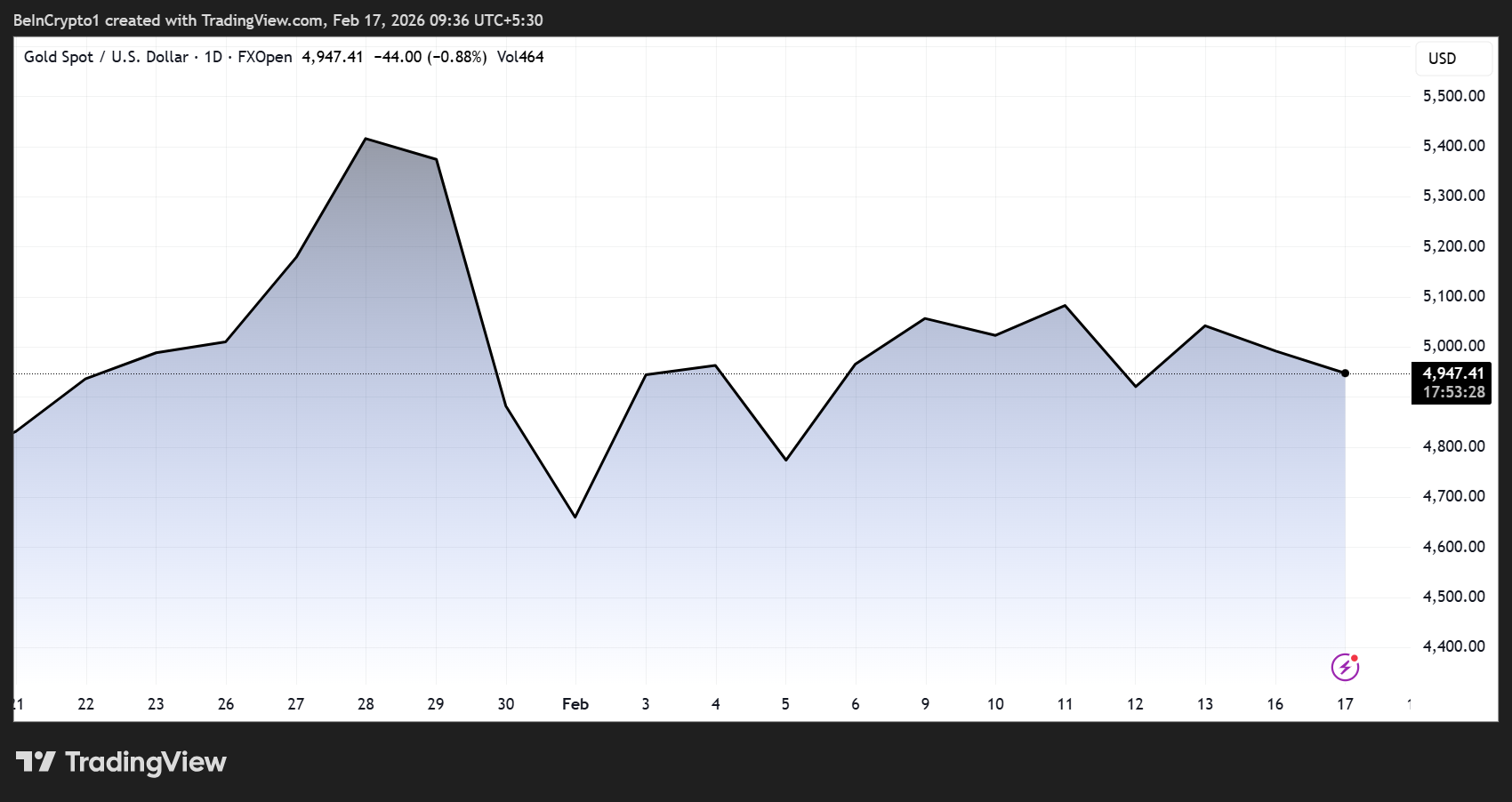

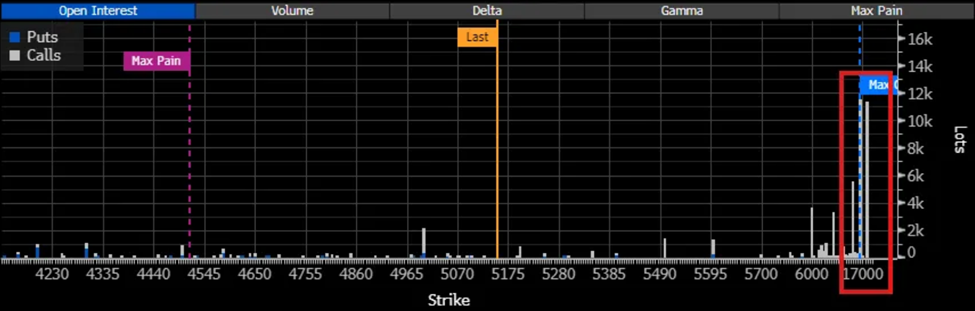

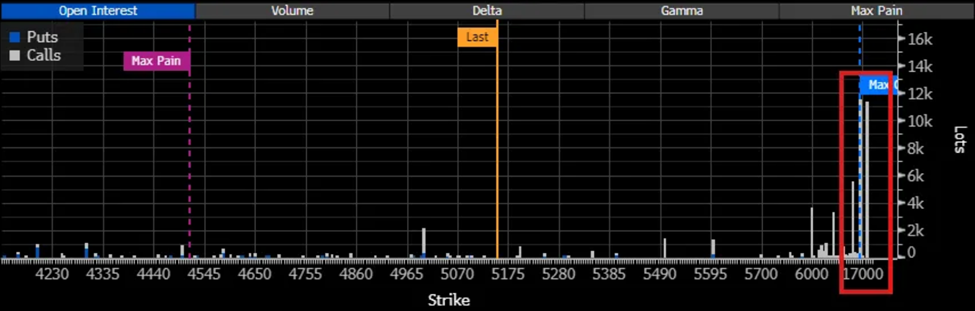

Why Traders Are Betting on $20,000 Gold

The gold price recently plunged in one of the sharpest one-day declines in decades after briefly topping $5,600 per ounce. Yet, traders continue to place aggressive bets that the metal could surge to $20,000 or more.

The divergence highlights a market driven by macroeconomic forces, speculation, geopolitical uncertainty, and shifting central bank behavior.

Sponsored

Sponsored

Massive Bullish Gold Bets Despite Volatility

According to market commentary from traders and analysts, roughly 11,000 contracts tied to December $15,000/$20,000 gold call spreads have been accumulated.

“Gold $20,000 calls surge despite record selloff. Deep out-of-the-money bullish bets on gold are building even after a historic correction… The position has since grown to roughly 11,000 contracts, even with prices consolidating near $5,000,” commented Walter Bloomberg.

This optimism comes even as the XAU price consolidates near $5,000. The scale of these trades is striking, given the distance from current prices.

Such trades function as low-cost, high-upside wagers. For the spreads to expire in the money, gold would need to nearly triple by December, a scenario that would require a major macroeconomic or geopolitical shock.

Yet the presence of these bets has already affected market forces, pushing implied volatility (IV) higher in far-out-of-the-money calls and signaling demand for extreme upside exposure.

Against this backdrop, some analysts argue that gold’s broader trajectory remains intact despite recent turbulence.

Sponsored

Sponsored

“If you start zooming out on the macroeconomic factors, then it’s quite clear that the markets of Gold haven’t peaked at all. Yes, they can peak in the short term and have a 1-2 year consolidation period, but that doesn’t mean we aren’t in a larger bull market in Gold. As a matter of fact, I think we are. That’s why I’m buying Gold in the next 30-50% dip,” expressed Macro analyst Michael van de Poppe.

This perspective reflects a growing view among macro investors that gold’s rally is tied to structural shifts in the global financial system rather than purely cyclical factors.

Bull Market or Temporary Pause as Short-Term Constraints Remain?

Despite bullish long-term narratives, near-term volatility remains high. Commodities strategist Ole Hansen recently noted that gold rebounded above $5,000 after softer US inflation data pushed bond yields lower and revived expectations for interest-rate cuts.

Sponsored

Sponsored

This suggests that while macro tailwinds exist, trading activity and liquidity conditions, particularly in China, can significantly influence short-term price moves.

The bullish sentiment comes alongside a surge in speculative activity across metals markets. Trading volumes in Chinese aluminum, copper, nickel, and tin futures contracts have soared to levels far exceeding historical norms, driven in part by retail investors.

Exchanges have repeatedly tightened margin requirements and trading rules to curb excessive speculation, reflecting the scale of the frenzy.

Such conditions often amplify price swings, creating both rapid rallies and sharp corrections.

Sponsored

Sponsored

Another factor reinforcing the gold narrative is central-bank diversification. Economist Steve Hanke has pointed to China’s shift away from US Treasuries toward gold reserves, a trend widely interpreted as part of a broader move to reduce reliance on dollar-denominated assets.

This pattern has fueled speculation that gold could play a larger role in global reserves if geopolitical tensions or currency instability intensify.

However,not everyone is convinced the rally is sustainable. Commodity strategist Mike McGlone has cautioned that the metals sector may be overheating, drawing parallels to previous peaks where extreme positioning preceded corrections.

Stretched valuations, elevated volatility, and surging speculative flows could leave markets vulnerable to another sharp downturn if macro conditions shift.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video16 hours ago

Video16 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech5 hours ago

Tech5 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics7 days ago

Politics7 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal