Crypto World

Crypto News Today: $2.6 Billion Options Expiry With Volatility Expected

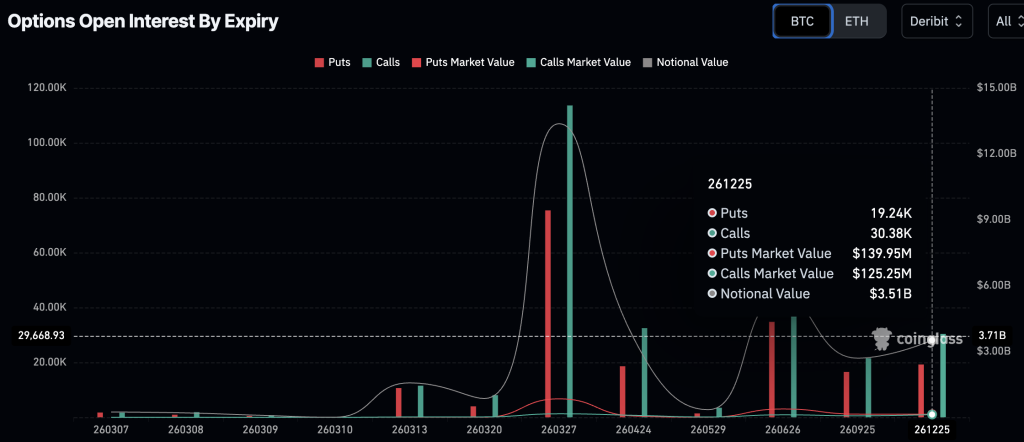

In crypto news today, the markets are bracing for a spike in Bitcoin volatility as approximately $2.6Bn in options contracts are set to expire across major exchanges. Bitcoin USD is currently holding firmly above the $70,000 threshold, but derivatives data indicate a potential gravitational pull downward toward the ‘max pain’ price of $69,000.

With 31,700 Bitcoin contracts and 184,000 Ethereum contracts rolling off the board, traders are watching closely to see if the 08:00 UTC settlement triggers a relief rally or a short-term correction.

The expiry comes as spot markets attempt to consolidate after adding +$150Bn to the total market cap earlier this week, as it reached $2.5 trillion once more.

Prices have been cooling off since Friday morning, and the divergence between the current spot price and the max pain levels suggests the next few hours could be choppy.

Bitcoin Options: $69,000 Max Pain Level — What It Means for BTC Price

The lion’s share of today’s expiry lies in Bitcoin, with a notional value of roughly $2.2Bn. Data from CoinGlass highlights a max pain point of $69,000, slightly below the current trading range. If prices gravitate toward this level before settlement, Bitcoin could see a sharp flush to punish over-leveraged longs.

The put/call ratio for this batch of contracts sits at 1.7, indicating a heavy dominance of bearish bets. A ratio significantly above 1.0 typically signals that traders are hedging against downside risk, with more expiring shorts (puts) than longs (calls) in the mix.

Open interest (OI) on Deribit remains highest at the $60,000 strike price, suggesting that while the immediate max pain is near $69,000, the broader market structure still has significant defensive positioning lower down.

If Bitcoin holds above $70,000 through the settlement window, the failure of these bearish puts to profit could force a rapid unwinding, potentially fueling a move toward $75,000.

Discover: The best crypto to diversify your portfolio with

Ethereum Options: $1,950 Max Pain: Volatility Risk for ETH USD

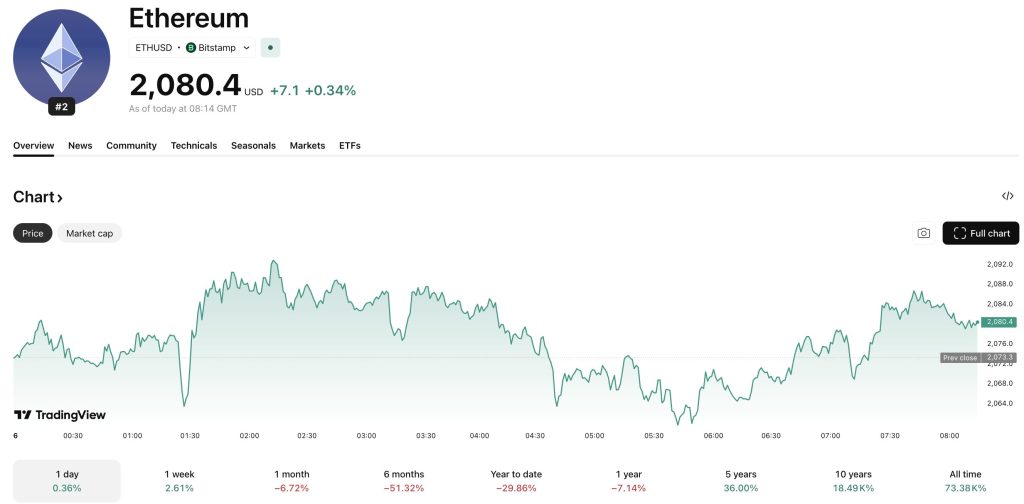

Ethereum faces its own settlement pressure today, with approximately 184,000 contracts expiring carrying a notional value of around $380M. Unlike Bitcoin’s bearish skew, Ethereum’s put/call ratio stands at 0.85, signaling a more balanced but slightly bullish sentiment among traders.

However, the max pain price for ETH is significantly lower at $1,950. With Ethereum trading well above this level, the risk of a “pinning” event, in which price is pulled down to maximize option writer profits, is less severe but not impossible.

Recent discussions around Ethereum’s roadmap have added fundamental noise to the price action, but today’s moves will likely be driven by these derivatives flows.

If ETH can maintain its distance from the $1,950 max pain point, it confirms strong spot demand, potentially setting the stage for a run at $2,200.

Analyst Views: Is a Relief Rally Coming, or is a Deeper Correction Next?

Market watchers are divided on whether this option’s expiry will mark a local top or a refueling station for the next leg up. Data from GreeksLive shows that selling call options has dominated trading over the last 48 hours.

“Despite ongoing price gains, momentum has slowed,” the firm noted, pointing out that Bitcoin is poised to challenge $75,000 only if it can shake off the expiry-induced drag.

A contrarian view suggests that the high put/call ratio on Bitcoin acts as a signal for a squeeze. When the crowd is heavy on puts, the market often moves the opposite way to punish the majority.

Market sentiment has suddenly flipped in recent days, and if spot buyers absorb the selling pressure at $69,000, the path of least resistance remains up.

Discover: The hottest meme coins in crypto

The post Crypto News Today: $2.6 Billion Options Expiry With Volatility Expected appeared first on Cryptonews.

Crypto World

Binance Fires Back at Senate Inquiry, Calls Media Allegations False and Defamatory

TLDR:

- Binance processed over 71,000 law enforcement requests in 2025, helping seize $752 million in illicit assets worldwide.

- Exposure to illicit wallets on Binance dropped nearly 97% between January 2024 and July 2025, per blockchain analytics data.

- Hexa Whale and Blessed Trust were offboarded following proactive internal investigations, not media pressure or regulatory orders.

- Binance denied WSJ claims of 2,000 Iranian-linked accounts, linking the allegation to its ongoing VPN circumvention detection efforts.

Binance has formally responded to a February 24, 2026 letter from U.S. Senator Richard Blumenthal of the Permanent Subcommittee on Investigations.

The exchange giant directly challenged allegations drawn from recent media reports by the New York Times, Fortune, and the Wall Street Journal.

In its response, the company defended its compliance program, disputed claims about Iranian user accounts, and addressed the treatment of former employees. The letter was published publicly on March 6, 2026.

Compliance Record and Enforcement Cooperation

The company stated that it has invested hundreds of millions of dollars building its compliance infrastructure. Over 1,500 specialists currently work across sanctions, counter-terrorism financing, and financial crime investigations.

Binance also deploys more than 25 advanced monitoring tools for transaction screening and behavioral analytics.

In 2025, the exchange processed more than 71,000 law enforcement requests globally. Over the past three years, it also assisted in seizing more than $752 million in illicit assets, with nearly $579 million recovered for U.S. agencies. These figures reflect a broad commitment to supporting law enforcement operations worldwide.

Richard Teng, Binance’s CEO, addressed the matter publicly on social media. He wrote, “We’ve voluntarily responded to Senator Blumenthal’s inquiry which raises false and defamatory allegations reported by the WSJ.” He further noted that the company’s response was meant to protect its more than 300 million users.

Additionally, blockchain analytics data showed that Binance’s exposure to illicit wallets dropped from 0.284% to just 0.009% of total exchange volume between January 2024 and July 2025.

That represents a decrease of nearly 97% over the period. Exposure to major Iranian crypto exchanges also fell by 97.3% in two years, from $4.19 million to $110,000.

The response also referenced the T3 Financial Crime Unit, which froze over $300 million in its first year of operation alone. This network operates in real time and acts before tainted funds can move further in the system.

Hexa Whale, Blessed Trust, and Employee Matters

Regarding the two entities named in the Senator’s letter, Binance clarified that both investigations began following law enforcement inquiries.

In April 2025, law enforcement flagged wallet addresses with potential terrorist financing ties. Binance then launched a comprehensive internal review that went beyond the original request. Hexa Whale was subsequently offboarded on August 13, 2025.

Similarly, the Blessed Trust investigation began in summer 2025 after a separate law enforcement request. After a thorough source of funds analysis, Binance offboarded the entity in January 2026. The company stated that no Binance account had transacted directly with an Iran-based entity in either case.

On the Iranian account allegation, the company was direct. The WSJ claim that Binance identified 2,000 Iranian-linked accounts was described as false.

The company suspects the claim relates to its ongoing efforts to detect VPN circumvention rather than any confirmed Iranian user base. All users must complete mandatory identity verification to use the platform.

On employee matters, the company confirmed that some compliance staff had recently left. Most departures were voluntary resignations.

One employee was terminated for leaking internal user data, not for raising compliance concerns. The company stated clearly that no workers were dismissed for escalating issues internally.

Binance closed its response by affirming its continued commitment to compliance improvements, law enforcement cooperation, and user protection across the global crypto ecosystem.

Crypto World

Bitcoin Data Shows Why 3-Year Holders Avoid Losses

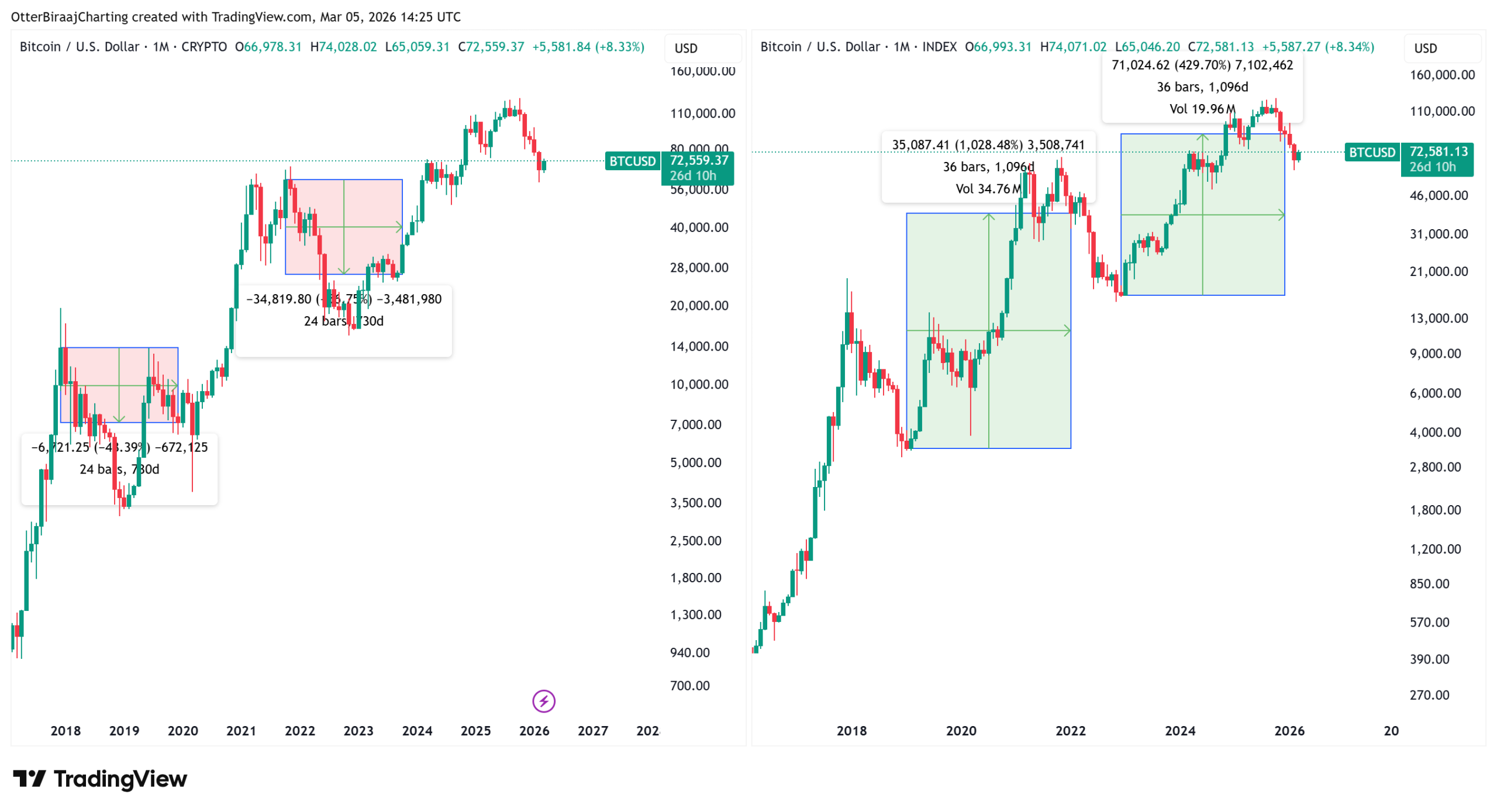

Bitcoin (BTC) gets a bad name among some investors due to its steep double-digit drawdowns that punish late buyers, but data suggests the outcome can change with time.

Since 2017, investors who bought BTC near the market highs faced losses of about 40%–50% in the next two years, but data shows many of those positions turned profitable when held for longer than three years.

By contrast, entries near bear-market lows have historically produced triple-digit percentage returns over similar two to three-year periods. Onchain valuation metrics further help explain where these stronger accumulation zones tend to appear.

Bitcoin cycle data reveals how entry timing affects gains

Bitcoin’s (BTC) long-term performance appears volatile across the shorter two-year holding period. The cycle comparisons show a massive change when the positions extend to three years.

Investors who bought near the 2017 market peak faced a 48.6% loss after two years during the 2018 bear market. Extending the holding period to three years turned that position into a 108.7% gain.

A similar trajectory appeared in the next market cycle. Buyers entering near the 2021 high recorded losses of 43.5% after two years. By the third year, the same entry produced a 14.5% profit.

The entries near bear-market lows generated far larger gains. Buying close to the 2019 bottom produced returns of 871% after two years and 1,028% after three years.

The 2022 cycle low followed a comparable path. Buy positions initiated near that period generated roughly 465% returns after two years and about 429% after three years.

Together, the data highlighted a consistent pattern. Two-year windows expose investors to large drawdowns when entries occur near cycle highs. Three-year holding periods historically move most entries into positive territory, while bottom entries capture the strongest price expansion in both holding periods.

Related: These 4 Bitcoin charts say BTC price is forming a bottom

BTC realized price zones guide bottom entries

BTC’s onchain valuation metrics help identify where these bottom entries have historically occurred.

Bitcoin’s realized price measures the average acquisition price of coins based on their last onchain movement. Deeper drawdowns frequently extend toward the shifted realized price, which smooths the metric forward and highlights the stronger value zones.

These bands have identified long-term accumulation ranges since 2015. Bitcoin’s realized price currently sits near $55,000, while the shifted realized price is around $42,000.

Since 2015, Bitcoin’s realized price bands have repeatedly coincided with the cycle lows, with the price recoveries from these zones initiating multi-year rallies.

The behavior connects closely with the earlier return data. Investors who accumulated near bear-market lows typically entered while the price traded around or below these valuation bands.

Institutional research also highlighted the role of longer holding periods. Bitwise chief information officer Matt Hougan cited a study showing that adding Bitcoin to a traditional 60/40 portfolio increased cumulative and risk-adjusted returns in every three-year period studied. The win rate is 93% across two-year periods, with a roughly 5% allocation producing the strongest balance.

A separate Bitwise review of Bitcoin data from July 2010 through February 2026 showed the probability of loss falls to 0.7% when BTC is held for three years. The risk drops to 0.2% over five years and reaches zero across ten-year holding periods.

The shorter horizons carry more uncertainty. Day traders historically faced a 47.1% chance of losses, while the one-year holding periods still showed a 24.3% probability of being underwater.

Related: Bitcoin bears ‘annihilated’ as analysis sees $65K support test next

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

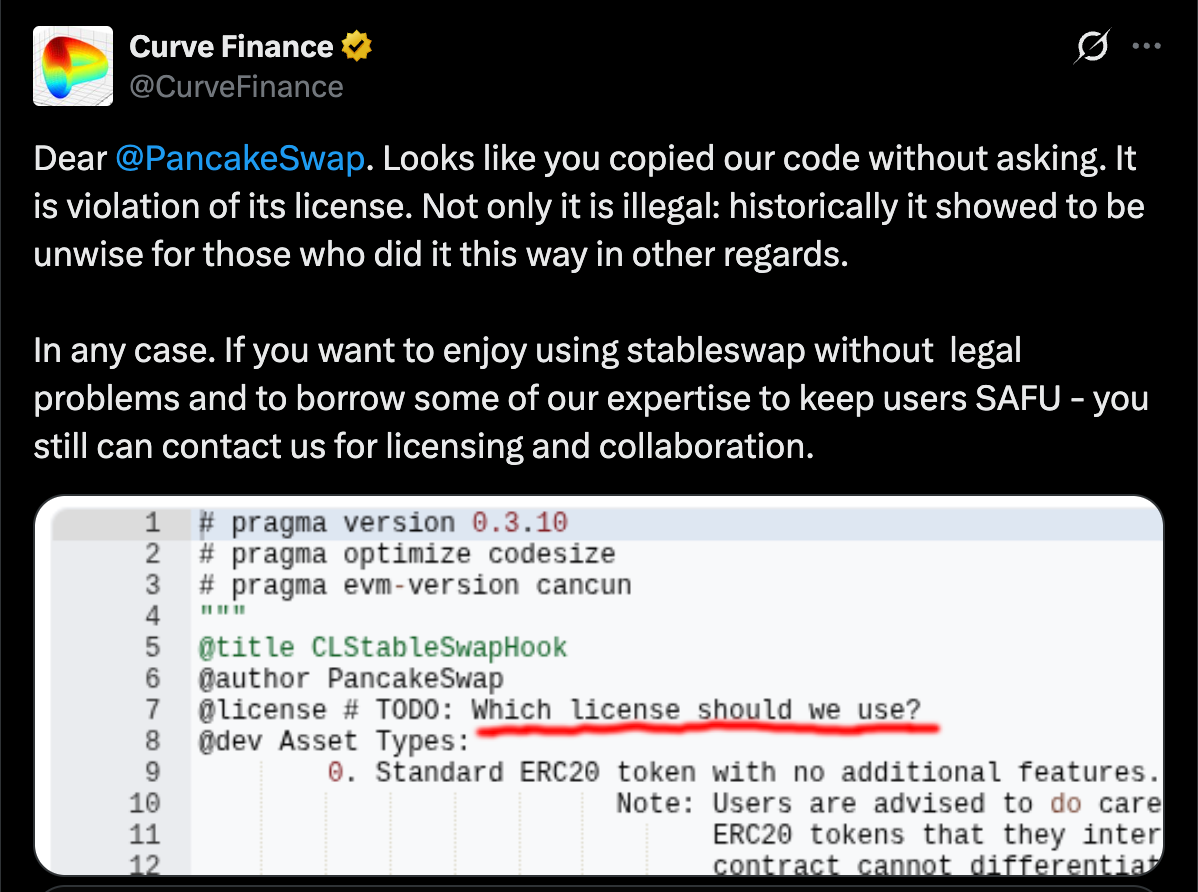

Curve Finance claims PancakeSwap copied its StableSwap code

A code dispute has surfaced between Curve Finance and PancakeSwap over the use of StableSwap technology.

Summary

- Curve Finance says PancakeSwap copied parts of its StableSwap code without permission, calling it a license violation.

- PancakeSwap responded that its team is reaching out to Curve to discuss the matter.

- Both sides signaled they prefer cooperation and possible licensing over a legal dispute.

Curve Finance (CRV) has publicly accused PancakeSwap (CAKE) of copying parts of its code without permission.

The allegation was posted on X on March 6. Curve claimed PancakeSwap used code from its StableSwap implementation without following the license terms.

Dispute over StableSwap code

In the post, Curve directly addressed PancakeSwap and said the exchange copied its code “without asking,” which it described as a violation of the software license.

Curve said the issue is both legal and technical. According to the team, similar situations in the past created problems for projects that reused the code without proper handling.

The post included a screenshot that appeared to highlight parts of the code in question. Curve suggested the file attribution listed PancakeSwap as the author even though the logic originated from Curve’s StableSwap system.

StableSwap is one of Curve’s main innovations. The automated market maker model is designed to allow low-slippage swaps between stablecoins and other tightly pegged assets. It uses a specialized mathematical formula that blends constant-product and constant-sum curves to keep prices stable during trades.

The system is widely used across decentralized finance. Curve’s smart contracts are open source, but the license requires proper attribution and compliance with the terms.

PancakeSwap response and possible resolution

PancakeSwap responded shortly after the post. The exchange said its team would contact Curve directly to discuss the matter. Curve welcomed the response and said it would prefer co-operation over conflict.

“Better to be friends and build together,” Curve wrote in a follow-up message.

The issue appears connected to PancakeSwap’s recent “Infinity StableSwap” upgrade announced earlier in March. The update brings better pricing for stablecoin swaps, with lower slippage and dynamic fees.

Curve cautioned that there may be technical risks if StableSwap code is copied directly or improperly modified. Forks of comparable systems in earlier DeFi projects occasionally encountered vulnerabilities or exploits due to improper code implementation.

As of right now, it appears that both teams are open to discussing a solution. Curve noted that PancakeSwap could still obtain a proper license and collaborate if it wants to use the technology without legal issues.

Crypto World

Perplexity AI Predicts the Price of XRP, Solana and Shiba Inu by The End of 2026

Global headlines may be dominated by reports of conflict, but crypto is holding steady. According to projections generated by Perplexity, holders of XRP, SOL, and SHIB could still see significant gains this year.

Many say that geopolitical risk may already have been priced into markets after Donald Trump’s previous warnings about possible U.S. military escalation involving Greenland and Iran earlier this year.

With uncertainty still lingering, we examine how realistic Perplexity’s projections are.

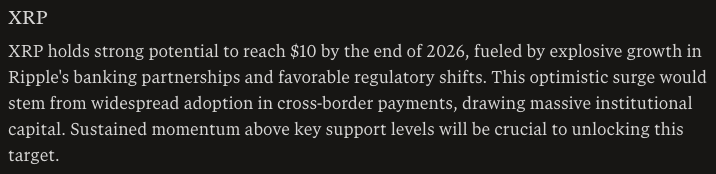

XRP ($XRP): Perplexity Projects a Potential 7x Surge by Year-End

In a recent update, Ripple reaffirmed that XRP ($XRP) plays a central role in the XRP Ledger’s (XRPL) growth into a global payments infrastructure designed for enterprise use.

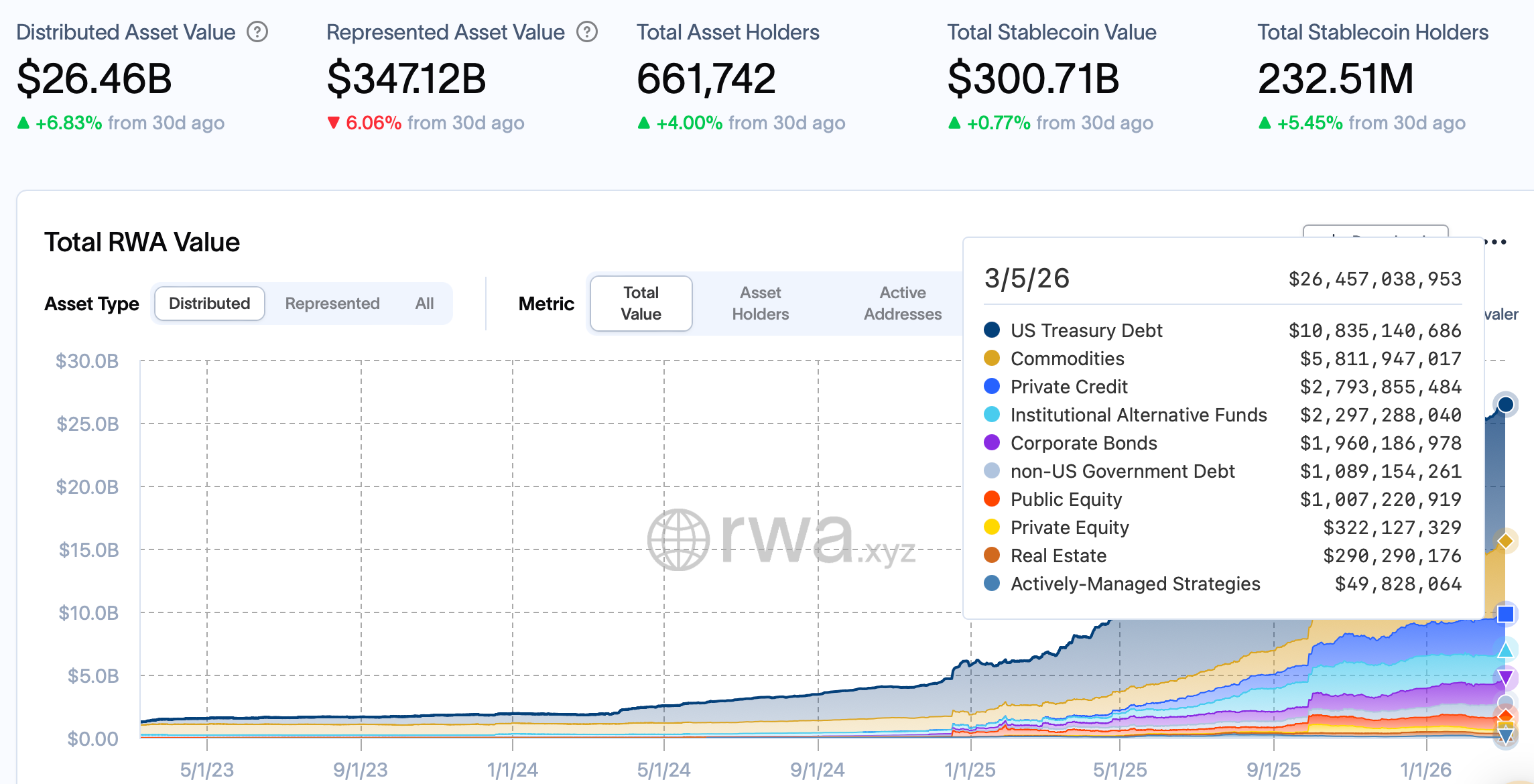

XRP enables near-instant settlement and extremely low transaction fees, positioning the network to capture two rapidly expanding sectors in crypto: stablecoins and tokenized real-world assets.

With XRP currently trading close to $1.36, Perplexity AI predicts the asset could potentially climb to around $10 in 2026, representing a little over sevenfold return for current HODLers.

XRP’s relative strength index (RSI) currently sits near 42, while price movement has begun stabilized around its 30-day moving average, suggesting perhaps the extended consolidation period is nearing its end.

Several catalysts could further strengthen XRP’s outlook, including rising institutional demand following the launch of U.S.-listed XRP exchange-traded funds, Ripple’s expanding network of international partnerships, and comprehensive crypto legislation (the CLARITY Act) in the United States.

Solana (SOL): Could Solana Soon Hit $700?

Solana ($SOL) currently secures around $6.7 billion in total value locked and has a market capitalization of $48 billion.

Institutional interest increased after the introduction of Solana-based exchange-traded funds by prominent asset managers such as Bitwise and Grayscale.

However, SOL crashed toward the end of 2025 and spent much of February trading below the $100 mark.

Perplexity sees Solana rising from $84 today to approximately $700 by Christmas. That would give 8x returns and price Solana more than double it’s January 2025 ATH of $293 recorded.

Moreover, major asset managers like Franklin Templeton and BlackRock have begun issuing tokenized assets on Solana.

Shiba Inu (SHIB): Perplexity Forecasts a Potential 2,000% Rally

Originally launched in 2020 as a tongue-in-cheek Dogecoin challenger, Shiba Inu ($SHIB) has since developed into a broader ecosystem with a market capitalization of $3.2 billion.

Currently around $0.000005359, Perplexity’s analysis suggests that a decisive breakout above the $0.000025–$0.00003 resistance range could trigger strong upward momentum. Under that scenario, SHIB could potentially climb toward $0.00008 before the end of the year.

Such a move would represent gains of roughly 15x, or around 1,400%, bringing it a hair’s breadth beneath its October 2021 ATH of $0.00008616.

Beyond its meme coin reputation, the project has introduced practical utility through Shibarium, its Ethereum Layer-2 scaling solution. Shibarium delivers faster transactions, lower fees, enhanced privacy features, and improved developer tools for building decentralized applications.

Maxi Doge: Emerging Meme Coin Aims for Rapid Growth

Perplexity’s projection of a potential 14x surge for Shiba Inu reflects expectations that a new meme coin cycle could accompany the next crypto bull market. However, projects at earlier stages often present even greater growth potential.

One project gaining attention is Maxi Doge ($MAXI), which has already raised $4.7 million through its ongoing presale as early investors accumulate what some believe could become the next Shiba Inu.

Maxi Doge is the loud, louche and degenerate distant cousin to Dogecoin, embracing a comic marketing approach inspired by the chaotic enthusiasm of the 2021 meme coin boom.

MAXI is an ERC-20 asset on Ethereum’s proof-of-stake network, giving it a significantly smaller environmental footprint compared with Dogecoin’s proof-of-work system.

Early participants in the presale can currently stake MAXI for yields reaching up to 67% APY. These rewards gradually decrease as more tokens enter the staking pool.

The token is currently priced at $0.0002807 during the latest presale phase, with automatic price increases scheduled at each new funding milestone. Investors can purchase the token using supported wallets such as MetaMask and Best Wallet.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Maxi Doge Website Here

The post Perplexity AI Predicts the Price of XRP, Solana and Shiba Inu by The End of 2026 appeared first on Cryptonews.

Crypto World

Kraken rolls out xChange engine to power tokenized stock markets

Kraken’s tokenized equities platform xStocks has launched xChange, an onchain trading engine designed to facilitate trading of tokenized stocks across the Ethereum and Solana networks.

According to the company, the system supports trading of more than 70 tokenized equities backed 1:1 by underlying shares held in custody, with prices intended to track the corresponding public market stocks.

The launch adds new trading infrastructure for tokenized equities, part of the broader tokenized real-world asset market that aims to bring traditional financial instruments such as stocks onto blockchain-based trading systems.

Kraken launched xStocks in June, offering tokenized versions of publicly traded companies issued by Backed Assets, though the products are not available to users in the United States, the United Kingdom or other restricted jurisdictions.

Since then, the platform has recorded $3.5 billion in onchain transaction volume and about $25 billion in total trading volume across exchanges, with about $225 million in tokenized assets held across about 80,000 blockchain wallets, according to company data.

The move from Kraken comes days after the exchange said its banking unit, Kraken Financial, had been granted a limited-purpose master account by the Federal Reserve Bank of Kansas City, giving it direct access to the Fedwire payments network used by banks and credit unions.

Related: Kraken introduces fixed-rate crypto loans for its Pro users

Traditional and crypto exchanges build rails for tokenized stocks

Kraken is not alone in exploring infrastructure for tokenized securities, as both crypto exchanges and traditional market operators experiment with ways to bring stocks onto blockchain-based trading systems.

In December, Coinbase announced that it plans to launch Coinbase Tokenize, an institutional platform designed to support the issuance and management of tokenized real-world assets, including equities.

About a month later, the owner of the New York Stock Exchange, Intercontinental Exchange, said it is developing a platform to support trading of tokenized securities, including stocks and exchange-traded funds.

The proposed system would combine the exchange’s existing matching engine with blockchain-based settlement infrastructure and could support round-the-clock trading with near-instant settlement, potentially using stablecoins instead of the current one-day settlement cycle in US equity markets.

The London Stock Exchange Group has also said it is developing blockchain-based infrastructure intended to support the trading and settlement of tokenized securities such as equities and bonds.

Nasdaq, meanwhile, has proposed integrating tokenized versions of stocks and exchange-traded products into its existing trading infrastructure, a change that could increase liquidity for tokenized securities if approved by regulators.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

as WTI rips past $90, is there a weekend opportunity?

Oil’s violent intraday squeeze is colliding with fragile crypto risk sentiment, setting up a tense weekend for Hyperliquid oil perps and broader macro-linked digital assets.

Summary

- WTI crude spiked 13% intraday, pushing toward the key $90 level per barrel.

- The move comes as rate-cut expectations firm and crypto trades lower across majors.

- Hyperliquid oil perps now sit at the crossroads of an energy shock narrative and a tired crypto risk complex.

WTI crude’s surge to around $89.21 per barrel, a 13% intraday jump is a full-blown squeeze into a psychologically loaded $90 handle, leading to what analysts say could be a $100 or even $200 barrel price as the war with Iran rages on.

Coupled with that, WTI has ripped to fresh highs with daily relative strength index (RSI) pushing above +88, a momentum extreme ZeroHedge notes hasn’t been seen since the Kuwait War, as crude rockets through resistance on Iran‑linked supply fears and panic‑level volatility. That combo – geopolitics, stretched positioning, and technicals at blow‑off levels – is exactly what’s now bleeding into Hyperliquid perps, Polymarket oil markets, and, by extension, the entire crypto macro trade.

The immediate backdrop is a macro tape increasingly conditioned on Federal Reserve cuts later this year, with multiple officials signaling openness to easing if data cooperates and market pricing in a non-trivial probability of a June cut. In that context, oil ripping higher injects an inflationary tail-risk back into the narrative right as investors were starting to price a smoother disinflation glide path.

Oil and the broader crypto market

Crypto is not trading in a vacuum here. Majors like BTC (BTC), ETH (ETH), and BNB (BNB) are flashing red, with BTC around $68,446.80, ETH near $1,981.04, and BNB at $631.50, all down between roughly 3–5% on the day. Even HYPE (HYPE), a proxy for appetite around Hyperliquid’s ecosystem, is off about 2.62% at $29.81. In a classic macro playbook, higher oil plus fading momentum in crypto raises the probability of a broader de-risking if energy stays bid into next week.

Hyperliquid oil-linked futures volume surges

Hyperliquid has already shown what an Iran weekend looks like in the perps tape. During the first wave of strikes last weekend, the exchange saw nearly 17 million dollars in oil derivatives volume and roughly 148 million dollars in gold trading in a single weekend session, pushing total 24‑hour commodity turnover close to 200 million dollars while COMEX and CME were dark. Subsequent reports put open interest in Hyperliquid’s CL USDC oil perpetuals above 50 million dollars and highlighted gold and silver perps turning into a de facto 24/7 macro hedge, with some instruments briefly trading above 5,400 dollars per ounce as traders rushed to price Iran risk before legacy benchmarks reopened.

For Hyperliquid traders running oil perps into the weekend, the setup is binary and unforgiving. On one side, if $90 breaks and holds, you are effectively long an inflation scare that could bleed into rates, equities, and high-beta crypto, with oil longs and defensive tokens outperforming.

On the other, if this move is an overextended squeeze driven by positioning and thin liquidity, mean reversion early next week could crush late longers while offering crypto a brief relief window as real-yield fears ebb. With Fed expectations fragile, upcoming data and any geopolitical headlines around supply will matter more than usual.

Oil’s spike is not just about Fed cuts and positioning; it is about Iran risk bleeding into the tape. A widening U.S.–Israel confrontation with Tehran and shipping disruptions around the Strait of Hormuz have injected a hard geopolitical premium into crude, with analysts warning that up to a third of global seaborne supply and a fifth of LNG flows sit in the crosshairs if transit is impaired. Even before WTI flirted with $90, oil had been grinding higher on fears of supply shocks and potential blockage scenarios, keeping prices elevated despite otherwise comfortable inventories. For Hyperliquid oil perps, that means you are no longer just trading a chart; you are implicitly taking a view on whether Iran risk escalates into a genuine supply event or fades back into background noise as flows normalize.

Polymarket oil market opportunities?

Polymarket’s crude oil markets are already trying to price that regime shift in real time, with contracts on where CL settles by month‑end and whether oil prints specific upside targets effectively encoding crowd probabilities on an Iran‑driven spike. As of March 26, Polymarket traders are pricing $150 barrel oil at 9%, while bettors see a $100 barrel at 71%.

Crypto World

Coinbase Prime Integrates Regulated Futures and Cross-Margin Trading for Institutional Crypto

TLDR:

- Coinbase Prime now offers 20+ CFTC-regulated futures contracts with 24/7 trading through Coinbase Financial Markets.

- Unified cross-margin allows institutions to manage spot and futures exposures within one single capital framework.

- Assets are secured under Coinbase’s NYDFS-regulated custodian, keeping all trading within a fully regulated structure.

- Coinbase’s Deribit acquisition moves the platform closer to one unified exchange for spot, futures, and options.

Coinbase Prime has taken a major step forward in institutional crypto infrastructure. The platform announced integrated regulated futures trading and unified cross-margin functionality across spot and derivatives markets.

Through Coinbase Financial Markets, its CFTC-regulated futures commission merchant, institutions now access over 20 futures contracts.

These include perpetual-style products with round-the-clock trading availability. The launch positions Coinbase Prime as a full-service, regulated prime brokerage built specifically for institutional-grade digital asset operations.

Unified Cross-Margin Reshapes Capital Management for Trading Desks

Traditionally, spot and futures trading required separate collateral pools and independent risk systems. That separation often created inefficiencies for institutional trading desks managing complex multi-market strategies. Coinbase Prime now brings both under one capital framework through unified cross-margin.

With this setup, institutions can evaluate spot and futures exposures together within a single portfolio view. Capital moves more freely across strategies, while risk is monitored holistically across the entire platform.

This is particularly useful for basis trading, where hedged positions can benefit from more efficient margin treatment.

Coinbase Institutional shared the development on X, stating that Prime is now “the most comprehensive operating system for institutional crypto.”

The post noted that institutions can now “trade, finance, and manage assets within a regulated full-service crypto prime brokerage framework.”

Prime’s deterministic risk model also allows trading desks to calculate margin requirements before execution. That transparency reduces reliance on opaque margin engines that have historically complicated pre-trade planning for institutions.

Regulated Infrastructure Brings Futures Directly Into the Prime Workflow

Futures access through Coinbase Financial Markets, a CFTC-regulated FCM, is now embedded directly into the Prime workflow.

Institutions no longer need separate platforms to access derivatives markets. Execution, custody, and risk management now operate within a single environment.

Assets remain secured within Coinbase’s NYDFS-regulated qualified custodian throughout the trading lifecycle. This structure allows institutions to operate within a fully regulated framework while accessing both spot and derivatives markets simultaneously.

Beyond futures, Coinbase Prime also covers financing, lending, and operational infrastructure at institutional scale.

The platform is designed so trading desks no longer need to coordinate across fragmented or self-assembled systems.

Coinbase’s recent acquisition of Deribit, the world’s leading crypto options exchange, further broadens this ecosystem.

The goal is a single platform where institutions can access spot, futures, perpetuals, and options together. That consolidated model reflects Coinbase Institutional’s broader objective of building what it describes as an “Everything Exchange” for professional market participants.

Crypto World

Curve Finance Warns PancakeSwap About Licensing Violation

The team behind the Curve Finance decentralized finance (DeFi) platform accused the PancakeSwap decentralized exchange (DEX) of using its code without the proper licensing.

The code is tied to the “StableSwap” feature used for swapping stablecoins and “tightly-pegged” assets on PancakeSwap Infinity, the latest version of the PancakeSwap DEX.

“If you want to enjoy using stableswap without legal problems and to borrow some of our expertise to keep users SAFU, you still can contact us for licensing and collaboration,” the Curve team said on X.

In a separate post, Curve said “deep stableswap expertise” is needed to safely integrate swap features, and cited the 2022 hack of the Saddle Finance DEX and the $116 million hack of DeFi protocol Balancer in 2025 as examples of swap-based code exploits.

The PancakeSwap team said it would reach out to Curve Finance to discuss the issue. “Indeed, better to be friends and build together,” the Curve team responded.

Cointelegraph reached out to both teams but did not receive a response by the time of publication.

The incident highlights the potential cybersecurity and legal issues that arise in decentralized finance as projects and protocols continue to iterate on products and expand features.

Related: Curve founder says DeFi must ditch token emissions for real revenue

PancakeSwap Infinity launches and goes cross-chain

PancakeSwap Infinity launched on the Arbitrum network and BNB Chain in April 2025, following the integration of one-click, cross-chain swaps that allow users to move digital assets between blockchain protocols.

The updated DEX introduced “hooks,” smart contract plug-ins that customize parameters for liquidity pools, including dynamic fee structuring, tailored rebates and onchain limit orders that execute when preset conditions are met.

The upgrade also lowered pool creation fees by up to 99% and was built to accommodate different liquidity strategies, according to PancakeSwap.

In July 2025, PancakeSwap Infinity launched on Base, an Ethereum layer-2 (L2) scaling network, and touted up to 50% cheaper trading fees when Ether (ETH), the native token of the Ethereum layer-1 blockchain network, was traded against ERC-20 tokens.

ERC-20 is the token standard for most assets minted on Ethereum, including the gas and governance tokens of Ethereum L2s, memecoins, and other projects issuing tokens on Ethereum.

Magazine: MakerDAO’s plan to bring back ‘DeFi summer’ — Rune Christensen

Crypto World

Kazakhstan’s Central Bank to Invest $350 Million in Crypto Assets

Kazakhstan’s central bank has announced a strategic move to invest up to $350 million in cryptocurrency assets, marking a significant shift in its reserve management strategy.

Kazakhstan’s central bank has unveiled plans to invest up to $350 million in cryptocurrency assets. This decision represents a substantial policy shift aimed at diversifying the country’s reserves.

Kazakhstan has emerged as a significant player in the global crypto mining sector, contributing approximately 6-8% of Bitcoin’s global mining due to its low electricity costs. The government is also working on a regulatory framework to legalize and tax crypto mining and trading, further solidifying its position as a crypto-friendly nation, according to Reuters.

The central bank, which oversees Kazakhstan’s monetary policy and manages its currency reserves, is implementing this investment strategy as part of a broader approach to reserve management.

This move is likely to influence neighboring Central Asian countries, encouraging them to consider similar investments or regulatory measures. The shift could potentially transform the regional crypto landscape, making Central Asia a hub for cryptocurrency development and innovation.

The investment decision aligns with global trends where central banks are increasingly exploring crypto assets as part of their reserve diversification strategies.

This article was generated with the assistance of AI workflows.

Crypto World

Bitcoin Exchange Outflows Signal Holder Conviction Amid Hormuz Crisis

Bitcoin outflows from exchanges continued during the Hormuz crisis, signaling holders are moving coins into cold storage rather than selling.

Bitcoin (BTC) held near $70,000 on March 6 after a geopolitical shock tied to tensions around the Strait of Hormuz pushed energy prices higher and triggered risk-off behavior across global markets.

Despite the turbulence, blockchain data shows BTC continuing to leave exchanges, suggesting many holders are not preparing to sell.

Energy Shock Rattles Markets

Analyst GugaOnChain linked the latest volatility to disruptions around the Strait of Hormuz, a major energy shipping route, which remains effectively closed amid the U.S.-Israeli war on Iran.

The market watcher noted that Brent crude traded near $85 and West Texas Intermediate around $81 as the situation pushed up fuel costs, including a $0.27 increase in U.S. gasoline prices during the week.

According to the same analysis, the shock drained liquidity across global markets and led to outflows of just under $228 million from Bitcoin exchange-traded funds on March 5. However, exchange flow data showed an unusual divergence. Using a seven-day moving average, Bitcoin’s net exchange flows remained negative, meaning more coins were leaving exchanges than entering them. Daily data showed withdrawals of 500 BTC, while the weekly total reached about 6,500 BTC, leaving trading venues.

According to GugaOnChain, such movements often signal that investors are transferring holdings into cold storage, which reduces the supply immediately available for sale.

“Given the notable on-chain resilience, the directive is to adopt a tactical defensive stance, maximizing cash now and awaiting confirmation of a reversal in institutional flows before raising exposure again,” the analyst advised.

Trading Activity Intensifies on Major Exchanges

While coins are leaving exchanges overall, trading activity inside platforms has accelerated. Data shared by Arab Chain on March 6 showed Bitcoin turnover on Binance reaching about 425,000 BTC over the past 30 days, one of the highest readings since December.

You may also like:

Binance’s Bitcoin reserves currently stand near 660,000 BTC, and compared with the 30-day turnover figure, the liquidity ratio sits around 0.64, meaning about 64% of those reserves have been traded or transferred during the period.

That pattern suggests the same coins are changing hands repeatedly within a short time frame, which reflects increased speculative activity and stronger liquidity circulation within the market.

Bitcoin has fallen from a monthly peak attained earlier in the week, with price data from CoinGecko showing the asset trading just under $71,000 at the time of writing, down about 2% in the last 24 hours but still up close to 5% over seven days.

At the moment, the flagship cryptocurrency is sitting between renewed institutional demand and global macro pressure. Exchange withdrawals imply that many holders are waiting rather than rushing to exit positions, even as traders remain active inside the market.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Business8 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports7 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports1 day ago

Sports1 day ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Fashion5 hours ago

Fashion5 hours agoWeekend Open Thread: Ann Taylor

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion5 days ago

Fashion5 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

Keep an eye on price action

Keep an eye on price action