Business

AMD Sales Climb on Help From Data-Center Business

Advanced Micro Devices AMD -1.69%decrease; red down pointing triangle recorded a 34% jump in fourth-quarter sales as its data-center business boomed.

The chip maker Tuesday posted a profit of $1.51 billion, or 92 cents a share, in the quarter ended in late December, compared with $482 million, or 29 cents a share, a year earlier.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Quarterly Refunding To Overload Treasury Bills

Quarterly Refunding To Overload Treasury Bills

Business

LTC Properties: Growth Plan Comes With Risks (NYSE:LTC)

I analyze securities based on value investing, an owner’s mindset, and a long-term horizon. I don’t write sell articles, as those are considered short theses, and I never recommend shorting.I was initially interested in a career in politics, but after reaching a dead-end in 2019 and seeing the financial drain this posed, I choose a path that would make my money work for me and protect me from more setbacks. This brought me to study value investing, in order to grow wealth with risk management in mind.From 2020 to 2022, I worked in a sales role at a law firm. As the top-grossing salesman, I eventually managed a team and contributed to our sales strategy. I spent much of my free time reading books and annual reports, steadily building my vault of knowledge about public companies. This period has since been useful in helping me assess a company’s prospects by its sales strategy. I particularly get excited when the product seems to sell itself.From 2022 to 2023, I worked as an investment advisory rep with Fidelity, primarily with 401K planning. My personal study before that allowed me to pass my Series exams two weeks ahead of schedule, and I once again found myself excelling at the job. I learned a few useful things from this more formal setting, but my main frustration was that I was still a value investor, and Fidelity’s 401K planning was based on modern portfolio theory. Lacking a way to change positions internally, I chose to walk away after a year.I gave writing for Seeking Alpha a try in November of 2023, and I’ve been here since. As I spent those years saving aggressively and building up my base of capital, I also actively invest now. My articles are how I share the opportunities that I seek for myself, and my readers are effectively walking this road alongside me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Bob’s Discount Furniture (BOBS) to start trading on NYSE after IPO

The Bob’s Discount Furniture logo is seen above the entrance to its store at the Paxton Town Center near Harrisburg.

Sopa Images | Lightrocket | Getty Images

Bob’s Discount Furniture will start trading on the New York Stock Exchange Thursday after pricing its initial public offering at $17 per share.

That price came in within Bob’s expected range of $17 to $19 per share.

The Manchester, Conn.-based company, which was founded in 1991, has grown to 206 showrooms across 26 states, as of Sept. 28, according to its S-1 filing. It plans to more than double that store count to more than 500 locations by 2035, the filing said.

Bob’s is known for selling lower-priced couches, rugs, dining room tables and other furniture. It has an average order value of about $1,400 per transaction, excluding sales at its outlets, according to its S-1 filing. The retailer estimates its prices are on average about 10% lower than its value-focused furniture competitors’ lowest promoted prices or about 20% to 25% below their listed prices.

To keep prices low, the company said it relies on a “curated merchandising strategy, longstanding sourcing relationships and efficient supply chain,” according to the filing. It carries roughly one-third fewer items than value-oriented competitors, but orders in larger quantities, the filing said.

It’s also tried to stand apart from other furniture retailers with quicker deliveries. Instead of customers waiting for weeks or months, most purchases can be delivered in as few as three days, the company said in the filing.

The stock will trade on the NYSE under the ticker symbol BOBS.

Business

BNP Paribas SA 2025 Q4 – Results – Earnings Call Presentation (NEOE:BNP:CA) 2026-02-05

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

Business

House Judiciary Committee opens investigation into South Korean regulators

U.S. Trade Representative Jamieson Greer discusses President Donald Trump’s decision to raise tariffs on South Korea and a trade agreement between India and the EU on ‘Kudlow.’

FIRST ON FOX: The House Judiciary Committee has opened a formal investigation into actions by South Korean regulators that lawmakers say may discriminate against American technology companies. In an attempt to learn more about the abuses against American companies, it has issued a subpoena to U.S. e-commerce giant Coupang for documents and testimony on its experiences.

The e-commerce company listed on the New York Stock Exchange, has emerged as one of the most visible examples cited by U.S. officials, lawmakers and investors of the abuse of U.S. companies by Seoul to better enable scrutiny of South Korea’s regulatory environment has intensified.

US-SOUTH KOREA TRADE TENSIONS FLARE OVER TREATMENT OF AMERICAN TECH FIRMS INCLUDING COUPANG

Committee Chairman Jim Jordan and Subcommittee Chairman Scott Fitzgerald said the probe will examine whether foreign laws and enforcement actions are being used to target U.S. firms and undermine their ability to compete globally, according to a Feb. 5 letter sent to Coupang leadership.

A U.S. flag flies in front of the U.S. Capitol dome on Dec. 16, 2019 in Washington, DC. (Photo by Samuel Corum/Getty Images / Getty Images)

Lawmakers wrote that the committee is conducting oversight into “how and to what extent foreign laws, regulations, and judicial orders are being used to discriminate against innovative American companies and infringe on the rights of U.S. citizens.”

The subpoena requests communications between Coupang and South Korean authorities, as well as testimony from company representatives, as Congress seeks to determine the scope of what it views as potentially unfair enforcement practices.

Logos on facade at the shared headquarters of Internet company Coupang and security company SentinelOne in the Silicon Valley town of Mountain View, California, October 28, 2018. (Smith Collection/Gado/Getty Images / Getty Images)

The committee cited concerns about the Korea Fair Trade Commission and other agencies, arguing they have subjected U.S. firms to “punitive obligations, excessive fines, and discriminatory enforcement practices” in ways that could benefit domestic competitors.

Lawmakers also pointed to recent regulatory actions involving Coupang, including scrutiny and potential penalties following a data-related incident, which they said illustrate broader concerns about how American-owned companies are treated under South Korean enforcement.

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

South Korea says that the U.S. will review its subsidies to EV owners after South Korea brought up concerns on how the law would negativley impact Korean car manufacturers. Pictured: an American and South Korean flag hang together at Yongin, South Ko (Ken Scar/U.S. Army/Handout via Reuters / Reuters Photos)

According to the letter, the investigation is intended to inform potential legislation aimed at protecting U.S. companies and citizens from what Congress describes as discriminatory foreign regulations and enforcement decisions.

The committee said obtaining records from Coupang will help lawmakers assess how foreign policies and enforcement practices may affect Americans’ due process rights and U.S. companies’ ability to compete in global markets, as part of its oversight responsibilities.

Business

Bitcoin Price Plunges Below $70,000 as Volatility Roars Back

Bitcoin’s price slid sharply today, falling to roughly the high‑$69,000 range as a wave of selling pressure hit the broader crypto market and erased tens of billions of dollars in value from the world’s largest digital asset. The drop marks a pullback of around 5 percent over the last 24 hours, underscoring how quickly sentiment can swing in an asset still dominated by speculative trading and macro‑driven flows.

Bitcoin hovers near $69,000 amid sharp daily drop

Real‑time quote data shows Bitcoin changing hands around 69,000 to 69,500 dollars today, with most major trading venues and trackers clustering in that band. One widely referenced feed lists Bitcoin at about 69,146 dollars, down more than 3,800 dollars on the session and more than 5 percent on the day. Other large aggregators and exchanges quote spot prices in a similar zone, generally between 69,100 and 69,400 dollars, after an overnight selloff knocked the token firmly below the 70,000‑dollar threshold.

The sell‑off comes after Bitcoin recently traded near 73,000 dollars within the last 24 hours, meaning the coin has given up several thousand dollars from its intraday high in a relatively short window. Market‑cap estimates put Bitcoin’s total network value around 1.38 trillion dollars at current levels, cementing its position as the most valuable cryptocurrency by a wide margin even after the decline.

From record highs to deep pullback

Despite today’s weakness, Bitcoin remains dramatically higher than its long‑term lows, but it has retreated steeply from the record levels set in recent months. Recent data show a 52‑week high above 120,000 dollars, meaning the coin now trades roughly 40 to 45 percent below its peak depending on the source and timestamp.

Shorter‑term trend gauges highlight the depth of the correction. One real‑time feed lists Bitcoin’s 50‑day moving average near 88,000 dollars and its 200‑day moving average above 103,000 dollars, indicating that the current spot price is well below both key technical levels. On some major retail platforms, Bitcoin is also down double digits over the past month and week, reflecting a sustained cooling after a powerful rally earlier in the cycle.

At the same time, several trackers point out that Bitcoin is still up strongly over the last year despite the recent turbulence, a reminder of just how volatile the asset can be across different time frames.

Volume remains heavy as traders reposition

Even as prices fall, trading activity remains intense. One large global data source shows 24‑hour volume for Bitcoin in the tens of billions of dollars, with estimates ranging from roughly 90 billion to more than 110 billion dollars depending on methodology. Another venue reports that more than 1.3 million BTC—worth well over 120 billion dollars at recent prices—has changed hands in the last day on its platform alone.

That elevated turnover suggests today’s declines are being driven by active repositioning rather than a quiet drift lower, as both leveraged traders and longer‑term holders respond to shifting signals from macro markets, regulation and sentiment. Several data providers also note that Bitcoin continues to dominate overall crypto market value, representing around 60 percent of total capitalization and outpacing major rivals in trading activity.

Macro jitters, regulatory headlines weigh on sentiment

Analysts say today’s pullback comes against a backdrop of renewed anxiety over interest‑rate policy, risk‑asset valuations and ongoing regulatory scrutiny of the crypto sector. While specific catalysts vary by region and venue, professional observers have repeatedly pointed to Bitcoin’s growing sensitivity to macroeconomic headlines, including inflation releases, central‑bank commentary and equity‑market swings.

Recent commentary from major exchanges and price‑tracking services emphasizes that a combination of market sentiment, user adoption trends, institutional flows and regulatory developments continues to drive sharp intraday moves in Bitcoin. Some platforms also highlight that the latest halving cycle and the maturation of derivatives markets may be altering traditional boom‑and‑bust patterns, though the asset’s core volatility remains firmly intact.

Exchanges show tight spreads, deep liquidity

Order‑book data from multiple centralized exchanges indicate that Bitcoin remains highly liquid, with tight spreads and substantial depth on both sides of the market. One popular aggregator lists leading BTC/USDT trading pairs on major venues with spreads around 0.01 percent and individual 24‑hour volumes in the billions of dollars.

That liquidity helps facilitate rapid repricing when sentiment shifts but can also amplify volatility when large orders or cascades of liquidations hit leveraged structures. Market‑structure analysts say today’s slide appears consistent with a high‑liquidity environment where short‑term traders aggressively sell into weakness while longer‑term buyers selectively step in at lower prices.

Investors weigh long-term thesis against short-term pain

For long‑term believers, today’s pullback is another chapter in Bitcoin’s history of steep drawdowns followed by extended recoveries. Supporters point to the asset’s capped supply of 21 million coins, its growing institutional custody and ETF infrastructure, and its increasing role as a macro hedge for some investors as reasons they remain confident despite near‑term turbulence.

But critics and cautious traders note that the same volatility which has fueled Bitcoin’s upside can just as easily generate rapid, deep losses, particularly for newcomers using leverage or concentrating too much of their portfolio in a single speculative asset. With the price currently well below both medium‑term moving averages and recent highs, many technical analysts are watching closely to see whether Bitcoin can establish a firm base around the high‑$60,000 zone or whether further downside pressure emerges.

What today’s move means for everyday traders

For retail traders and long‑term holders watching today’s red numbers, professionals emphasize several key points:

- Bitcoin’s price routinely experiences swings of 5 percent or more in a single day, and today’s move, while uncomfortable, is not historically unusual for the asset class.

- Elevated volume suggests strong two‑sided interest, with some investors viewing the pullback as a buying opportunity while others lock in profits from earlier rallies.

- The coin remains firmly in the number‑one spot by market cap, and its dominance over other cryptocurrencies continues to reinforce its central role in the digital‑asset ecosystem.

Risk specialists continue to urge would‑be investors to research carefully, size positions conservatively and consider the potential for large, rapid price moves in either direction. They also stress the importance of using reputable platforms, securing private keys or exchange accounts properly, and understanding the tax and regulatory implications of crypto transactions in their home jurisdictions.

As Bitcoin hovers around the 69,000‑dollar mark after today’s drop, the market’s next moves will likely hinge on a familiar mix of macroeconomic data, regulatory headlines and the ever‑shifting tide of investor psychology — factors that have long made the original cryptocurrency both a symbol of digital‑age opportunity and a lightning rod for debates over risk.

Business

10 Must-Know Facts About Eileen Gu in 2026

At 22 years old, Eileen Gu has already lived several lifetimes in the spotlight. The Chinese-American freestyle skier, who captivated the world during the 2022 Beijing Olympics, continues to dominate headlines in 2026 as both an athlete and a cultural force. Born in San Francisco, trained in California, and competing under the Chinese flag, Gu remains one of the most polarizing and powerful figures in international sports.

Here are the 10 essential things every sports fan, cultural observer and casual follower should know about Eileen Gu right now.

1. Olympic Gold Medal Haul & Historic Beijing Performance

At the 2022 Winter Olympics in Beijing, 18-year-old Gu became the breakout star of the Games. She won three medals—two gold (big air and halfpipe) and one silver (slopestyle)—making her the first freestyle skier to medal in all three events at a single Olympics. Her big-air gold was particularly dramatic: she landed a double cork 1620 on her final run, a trick no woman had ever attempted in competition, to clinch the title.

Gu’s three-medal haul tied her with American skier Chloe Kim for the most medals by a female freestyle skier in a single Games.

2. Decision to Compete for China Sparked Global Debate

Gu was born and raised in the United States and holds U.S. citizenship. In 2019, at age 15, she announced she would compete for China in international competitions while retaining U.S. citizenship. The move triggered intense scrutiny and polarized opinions: some praised her as a bridge between cultures; others accused her of opportunism or questioned her motives amid U.S.–China geopolitical tensions.

Gu has consistently described the decision as personal and family-driven. “I’m American when I’m in the U.S., Chinese when I’m in China,” she said in a 2022 interview. She has never renounced U.S. citizenship and remains eligible to represent the U.S. in future competitions if she chooses.

3. Record-Breaking Junior & Early Pro Career

Before Beijing, Gu was already a prodigy. She won her first X Games gold at age 13 (2018 big air) and became the youngest X Games champion in history. Between 2017 and 2021 she won 11 X Games medals (7 gold) and multiple World Cup titles. She is the only female skier to land a left-side double cork 1620 in competition.

Her technical difficulty—especially on jumps—remains unmatched among women.

4. Academic Excellence & Stanford Commitment

Gu graduated high school early and was accepted to Stanford University, where she enrolled in 2022. She has taken a leave of absence to focus on skiing but plans to return and major in computer science or data science. She has spoken openly about balancing elite sports with academics, often studying between training sessions.

In 2025 she completed her first full academic year at Stanford remotely while competing, maintaining a high GPA.

5. Massive Commercial Empire & Highest-Paid Female Athlete

Gu is one of the most marketable athletes in the world. In 2025 Forbes listed her as the highest-paid female athlete, earning an estimated $45 million ($5 million in on-snow earnings, $40 million in endorsements). Major partners include Red Bull, Visa, Tiffany & Co., Fendi, IWC Schaffhausen, Anheuser-Busch, and Chinese brands such as Anta and Mengniu.

She has appeared in global campaigns for Louis Vuitton, starred in a feature-length documentary, and launched her own apparel line. Her net worth is estimated at $80–100 million.

6. Return from Injury & Dominant 2025–2026 Season

Gu suffered a season-ending ACL tear in training in March 2023, forcing her to miss the entire 2023–24 season. She returned in December 2024 and immediately showed no rust, winning World Cup events in Copper Mountain (halfpipe) and Calgary (big air) in early 2025. In the 2025–26 season she has won four of six World Cup starts and leads the FIS freestyle overall standings.

Her comeback has been described as “the most dominant post-ACL return in freestyle skiing history.”

7. Cultural Bridge & Dual Identity

Gu speaks fluent Mandarin and frequently posts in both English and Chinese on social media (Instagram: 4.2 million followers; Weibo: 9.8 million). She has become a symbol of cross-cultural identity, especially among Asian-American youth. She has spoken at length about navigating racism in the U.S. and stereotypes in China, positioning herself as a voice for multicultural belonging.

In a 2025 TEDx talk she said: “I’m not half-American, half-Chinese. I’m fully both.”

8. Philanthropy & Education Initiatives

Gu founded the Gu Sports Foundation in 2023 to provide scholarships and training opportunities for underprivileged youth in skiing and snowboarding. She has donated more than $2 million to youth sports programs in China and the U.S., with a particular focus on girls’ participation in action sports. She also mentors young athletes through her summer camps in California and Beijing.

9. Fashion & Media Presence

Beyond sports, Gu is a legitimate fashion figure. She has walked runways for Louis Vuitton and Fendi, appeared in Vogue China and Vogue US, and was named to Time’s 100 Next list in 2022. Her red-carpet appearances during fashion weeks consistently trend online.

She has also acted in small roles (a cameo in a Chinese blockbuster) and hosted segments on CCTV and NBC.

10. 2026 Goals: Defend Olympic Titles & Push for Gender Equity

Gu has already qualified for the 2026 Winter Olympics in Milan-Cortina (Italy) and is the clear favorite to defend her titles in halfpipe and big air. She has spoken about wanting to push for equal prize money and visibility in freestyle skiing and has quietly advocated for better athlete mental-health resources.

If she sweeps again in 2026, she would become the most decorated female freestyle skier in Olympic history.

Eileen Gu is no longer just a skier—she is a global brand, a cultural symbol, and a generational talent. Whether on the slopes, in boardrooms, or on magazine covers, she continues to redefine what it means to be a modern athlete in an increasingly interconnected world.

Business

Portsmouth Water installs huge wall at Havant Thicket reservoir

A major engineering milestone has been reached on what is set to become the UK’s first new reservoir in more than three decades.

Portsmouth Water said teams at Havant Thicket Reservoir installed a 20‑tonne steel cut‑off wall during a continuous 72‑hour operation at the start of the year.

The wall, which is 13m (43ft) high and 9m (29ft) wide, was built on site before being lifted into a deep trench using a 100‑tonne crane in a continuous operation over three days.

Business

Earnings call transcript: BNP Paribas Q4 2025 earnings beat expectations

Earnings call transcript: BNP Paribas Q4 2025 earnings beat expectations

Business

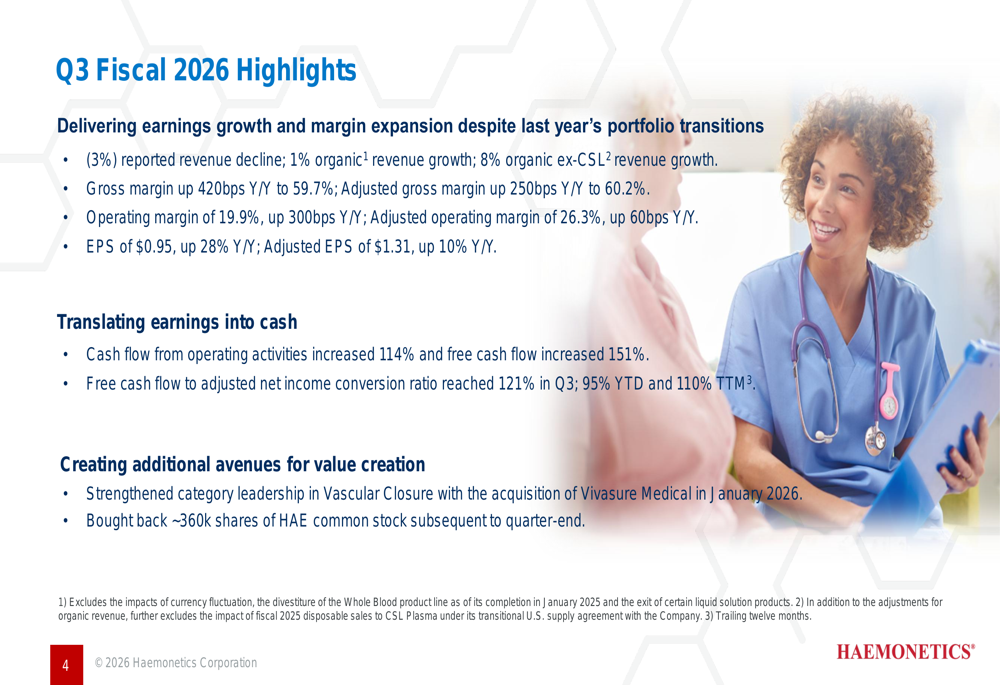

Haemonetics Q3 2026 slides: Margin expansion and cash flow surge despite revenue transition

Haemonetics Q3 2026 slides: Margin expansion and cash flow surge despite revenue transition

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 hours ago

NewsBeat4 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report