Business

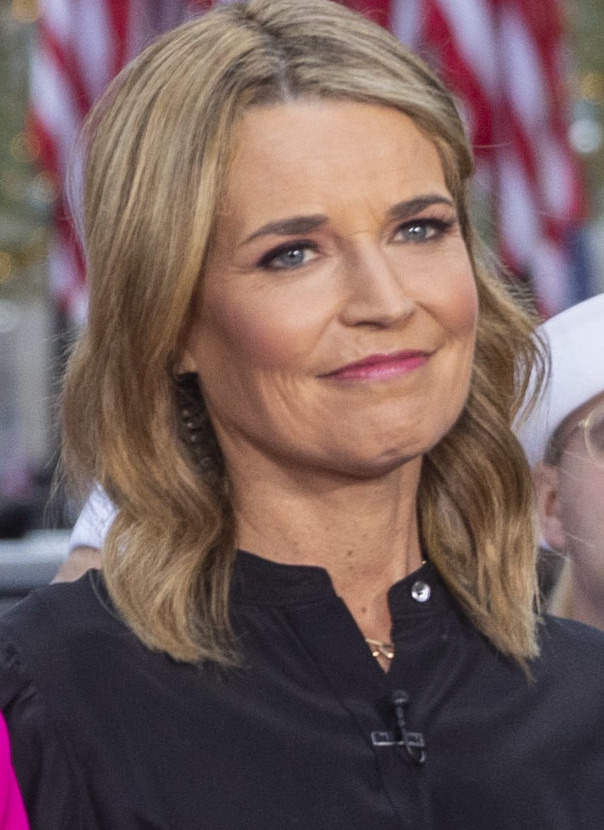

Chilling Bitcoin Ransom Demand Emerges in Search for Savannah Guthrie’s Mother

The investigation into the suspected abduction of Nancy Guthrie, the 84-year-old mother of Today show co-anchor Savannah Guthrie, has taken a high-tech and harrowing turn. Federal and local authorities confirmed Friday that multiple ransom notes, including a demand for millions of dollars in Bitcoin, are being treated as credible leads in the search for the missing octogenarian.

Nancy Guthrie was reported missing from her home in the Catalina Foothills, north of Tucson, on Feb. 1 after failing to appear for a Sunday church service. Five days into the search, the Pima County Sheriff’s Department and the FBI are racing against a ticking clock, complicated by the victim’s fragile health and the digital wall of a cryptocurrency ransom.

A ‘Credible’ Digital Ransom

The FBI’s Phoenix field office revealed that several media organizations, including TMZ and local station KOLD-TV, received messages purportedly from the kidnappers. According to FBI Special Agent in Charge Heith Janke, these notes contained “specific details” about the Guthrie residence that had not been released to the public, including references to a floodlight and an Apple Watch.

The primary demand is for a “substantial amount” of Bitcoin, reportedly totaling millions of dollars. The kidnappers established a hierarchy of deadlines: an initial cutoff of 5 p.m. on Thursday, followed by a secondary deadline this coming Tuesday.

“Every transaction in Bitcoin is logged on an open public ledger,” noted Ari Redbord, a former Department of Justice official now with TRM Labs. While the semi-anonymous nature of cryptocurrency often appeals to criminals, experts say law enforcement’s ability to “follow the money” on the blockchain provides a digital trail that cash or gold cannot match.

Evidence of a Struggle

The case was upgraded from a missing person report to a criminal investigation early in the week. Pima County Sheriff Chris Nanos confirmed that DNA testing of blood found on the porch of Nancy Guthrie’s home matched the 84-year-old.

Additional forensic evidence paints a chilling timeline of the abduction:

- Saturday, 9:30 p.m.: Family members drop Nancy off at her home after dinner.

- Sunday, 1:45 a.m.: The home’s doorbell camera is physically disconnected.

- Sunday, 2:28 a.m.: Software monitors indicate that Nancy’s pacemaker disconnected from her personal device, suggesting she was moved out of range of her home network.

“We believe Nancy is still out there,” Sheriff Nanos said during a press conference. “Our protocol is to assume she is alive until we are told otherwise, and we’re going to continue thinking that way until we find her.”

The Family’s Heartfelt Plea

Savannah Guthrie, who has taken an indefinite leave of absence from NBC, released a poignant video alongside her siblings, Annie and Camron. In the footage, Savannah’s voice breaks as she addresses the captors directly.

“We are ready to talk. However, we live in a world where voices and images are easily manipulated. We need to know without a doubt that she is alive.”

The plea for “proof of life” highlights the modern challenges of kidnapping in the age of AI. The family expressed fears that deepfake technology could be used to simulate Nancy’s voice or likeness to extract a ransom without her actually being safe.

The family also emphasized Nancy’s medical needs. The 84-year-old requires daily medication for heart issues and high blood pressure. “Her heart is fragile. She lives in constant pain,” Savannah said. “She needs her medicine to survive.”

Hoaxes and Red Herrings

The high-profile nature of the case has already attracted opportunists. On Thursday, authorities arrested Derrick Callella in Los Angeles. Callella is accused of sending “imposter” ransom notes to the Guthrie family demanding Bitcoin. Investigators clarified that Callella is a “scammer” attempting to profit from the tragedy and is not believed to be involved in the actual disappearance.

Ongoing Investigation

The FBI is currently offering a $50,000 reward for information leading to Nancy Guthrie’s return. President Donald Trump has also reportedly directed federal resources to assist in the search, calling the circumstances “very unusual.”

As the Tuesday deadline approaches, the Catalina Foothills community remains on edge. Neighbors have turned the local Saint Philip’s in the Hills Episcopal Church into a site for continuous prayer vigils, with a large photo of Nancy Guthrie illuminated by hundreds of candles.

Authorities are asking anyone with information, or anyone who may have seen a white van reported in the neighborhood prior to the disappearance, to contact the Pima County Sheriff’s Department immediately.

Business

Societe Generale Raises 2026 Profitability Target

Societe Generale GLE -2.21%decrease; red down pointing triangle raised its profitability target for this year, projecting higher revenue and lower costs, after reporting a stronger net profit for the fourth quarter.

The French bank said Friday that it expects a return on tangible equity—a key profitability metric for banks—of more than 10% this year, up from a previous target range of 9% to 10%.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Vijay Kedia Portfolio Check: 7 stocks slide up to 50%, 2 big winners shine, plus 2 fresh picks

Investors often track the portfolios of seasoned market veterans for insights. In this context, ETMarkets reviewed the investment holdings of veteran investor Vijay Kedia. According to the latest available data for the December 2025 quarter, Kedia has publicly disclosed stakes in around 17 companies, with a combined market value of approximately Rs 1,118 crore as of February 6, 2026. This marks a decline of nearly 19% from Rs 1,378 crore recorded in March 2025.

Business

Novo Nordisk Stock: There’s Plenty Of Value In Avoiding This Stock (NYSE:NVO)

I prefer to look for GARP (growth at a reasonable price) stocks but also look for opportunities everywhere else. I don’t have a specified time horizon. I invest in a stock for as long as my thesis holds true, and I get out when the facts change. In addition, I’ve developed market-beating algorithms with Python that have helped me find attractive investment opportunities within my own portfolio, and I have been investing since 2016.On top of that, I’ve worked at TipRanks as an analysis/news writer and even as an editor for a few years, which not only kept me on top of the market but also helped me understand what people are interested in reading. Further, as an editor, I learned to pay attention to detail and found that there’s plenty of misinformation and “fluff” out there that needs to be corrected. Thus, my goal is to provide accurate and useful information to the best of my abilities.I was previously associated with Investor’s Compass.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

SBI Q3 Results: Profit jumps 24% YoY to Rs 21,028 crore, NII rises 9%

The company’s operating profit (before provisions and contingencies) grew 40% YoY to Rs 32,862 crore.

The profit reported during the quarter was highest-ever for the bank, which came on the back of healthy loan growth.

The lender’s net interest margin stood at 2.99% in Q3FY26, while domestic NIM came in at 3.12%. For the nine months ended December 2025, domestic NIM was 3.08%.

Asset quality continued to improve, with the gross NPA ratio declining to 1.57%, down 50 basis points YoY. Net NPA ratio improved to 0.39%, lower by 14 basis points.

Provision coverage ratio, including AUCA, stood at 92.37%, while PCR excluding AUCA was 75.54%. Slippage ratio for the quarter remained contained at 0.40%, and credit cost stood at 0.29%.

On the balance sheet front, SBI’s total business crossed Rs 103 lakh crore, with deposits exceeding Rs 57 lakh crore and advances crossing Rs 46 lakh crore. The bank’s advances grew 15% YoY, led by domestic advances growth of 15%. Retail advances rose 16%, with all sub-segments reporting double-digit growth. SME advances expanded sharply by 21%, while agricultural advances grew 16% and retail personal loans increased 15%. Corporate advances also recorded a healthy growth of 13%.

Deposits grew 9% YoY, with CASA deposits rising 9%. The CASA ratio stood at 39.13% as of December 2025, while retail term deposits grew 14%, reflecting sustained traction in liability mobilisation.

The bank’s capital position remained comfortable, with the capital adequacy ratio at 14.04% and CET-1 ratio at 10.99%. Digital adoption also remained strong, with over 68% of savings bank accounts opened through Yono in Q3 and alternate channels accounting for nearly 98.6% of total transactions during the nine-month period.

Business

PayPal's Price Finally Fits (Rating Upgrade)

PayPal's Price Finally Fits (Rating Upgrade)

Business

Could a slowdown U.S. population growth impact output? Morgan Stanley weighs in.

Could a slowdown U.S. population growth impact output? Morgan Stanley weighs in.

Business

Alphabet-backed Aye Finance raises Rs 454 crore from anchor investors ahead of IPO; Goldman Sachs key investor

The company informed stock exchanges that it allocated equity shares to anchor investors at Rs 129 per share, the upper end of its price band. The anchor book saw participation from a clutch of global and domestic institutional investors, including Goldman Sachs, Societe Generale, HDFC Life, BNP Paribas Financial Markets, Bay Pond Partners and Ithan Creek Master Investors (Cayman), according to the filing.

The anchor allocation comes days ahead of the Rs 1,010 crore IPO, which will open on February 9 and close on February 11, with listing scheduled for February 16 on the BSE and NSE. The issue comprises a fresh issue of shares worth Rs 710 crore and an offer for sale of Rs 300 crore by existing investors, including Alpha Wave India I LP, MAJ Invest Financial Inclusion Fund II, CapitalG LP, LGT Capital Invest Mauritius and Vikram Jetley.

Aye Finance has fixed the price band for the issue at Rs 122 to Rs 129 per share, with a face value of Rs 2 per share. Investors can bid for a minimum of 116 shares and in multiples thereafter. At the upper end of the price band, the retail application size works out to Rs 14,964.

Also Read | Radhika Gupta urges investors to ignore ‘cats’ and think like a goldfish amid market chaos

Founded in 1993, Aye Finance is a non-banking financial company in the middle layer category, focused on providing secured and unsecured business loans to micro-scale MSMEs. Its borrowers are spread across manufacturing, trading, services and allied agriculture sectors. As of September 30, 2025, the company had 586,825 active customers across 18 states and three union territories and assets under management of over Rs 6,027 crore, according to a CRISIL report.

The lender specialises in small-ticket loans, with an average disbursement ticket size of around Rs 0.18 crore, and has built underwriting capabilities around assessing cash flows of micro enterprises clustered across different geographies. This approach has helped the company maintain stable credit costs while scaling its loan book, industry analysts said.

On the financial front, Aye Finance reported revenue from operations of Rs 843 crore for the six months ended September 30, compared with Rs 692 crore in the year-ago period. For FY25, revenue stood at Rs 1,460 crore, while net profit rose to Rs 175 crore, up sharply from Rs 40 crore in FY23.

Axis Capital, IIFL Capital Services, JM Financial and Nuvama Wealth Management are the book-running lead managers to the issue, while KFin Technologies is the registrar. The offer is being made through the book-building route, with up to 75% reserved for qualified institutional buyers, and the rest allocated to non-institutional and retail investors.

The strong anchor response is expected to lend momentum to the IPO as it opens amid active primary market conditions and rising investor interest in profitable, scalable NBFC business models.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times.)

Business

OneMain Financial Stock: A Secure Dividend With Capital Appreciation Potential (NYSE:OMF)

Over fifteen years of experience making contrarian bets based on my macro view and stock-specific turnaround stories to garner outsized returns with a favorable risk/reward profile. If you want me to cover a specific stock or have a question for an article, just let me know!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Thousands in Islamabad mourn 31 killed in suicide bombing of Shi’ite mosque

Thousands in Islamabad mourn 31 killed in suicide bombing of Shi’ite mosque

Business

Is European travel to the US recovering?

Is European travel to the US recovering?

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports7 days ago

Sports7 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World7 days ago

Crypto World7 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech14 hours ago

Tech14 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports6 hours ago

Sports6 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports24 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat19 hours ago

NewsBeat19 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat7 hours ago

NewsBeat7 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”