Business

Form 144 TFS FINANCIAL CORPORATION For: 4 February

Business

Streaming-only Super Bowl ads gain traction on NBC’s Peacock

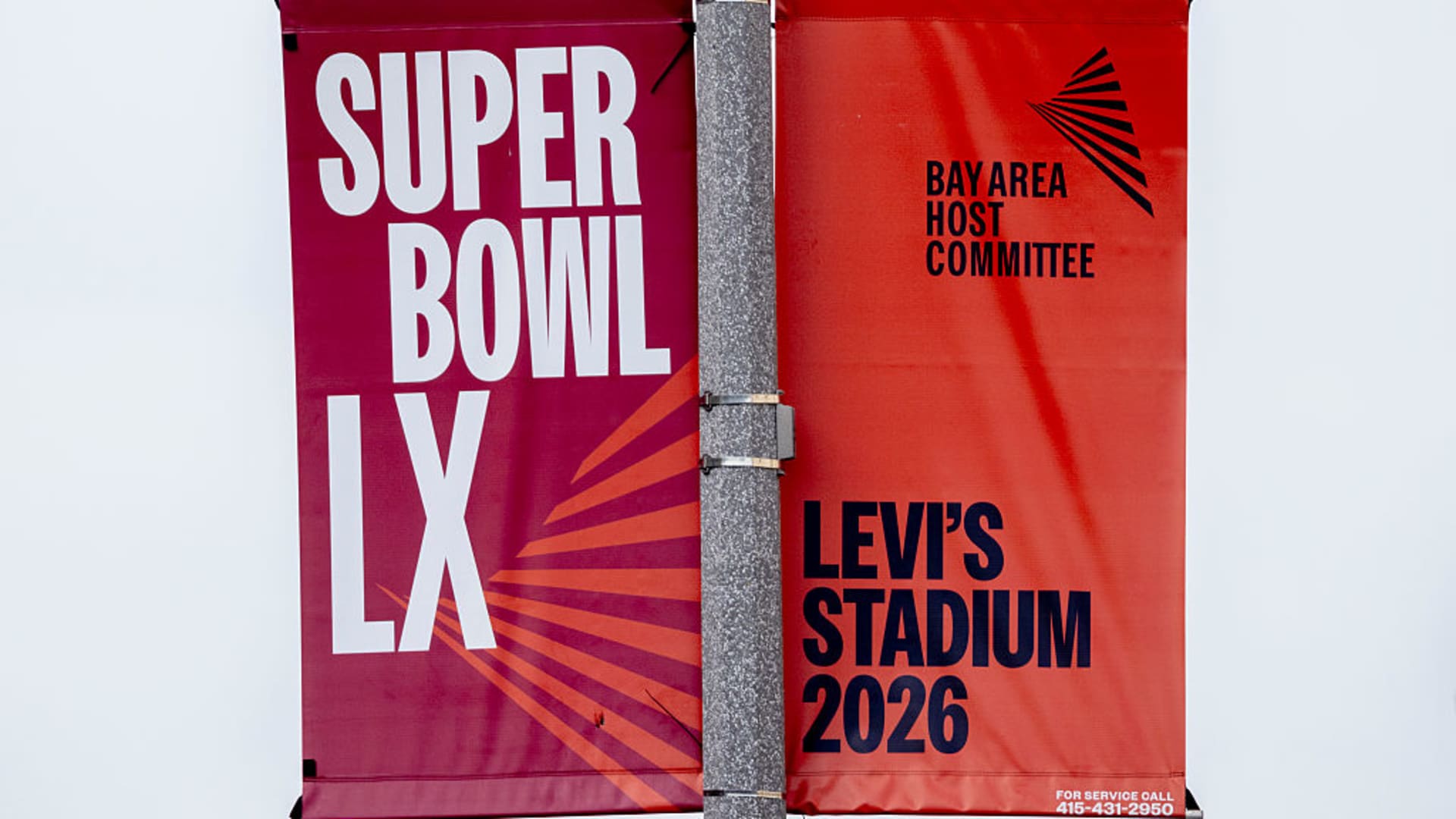

A Super Bowl LX sign is seen at Civic Center Plaza in San Francisco, Friday, Jan. 30, 2026.

Stephen Lam | San Francisco Chronicle | Hearst Newspapers | Getty Images

The Super Bowl is prime real estate every year for advertisers eager to get their brands in front of millions of consumers at once. It’s also costly.

That’s why a small subset of ad space for streaming-only commercials is gaining traction and granting smaller brands time during TV’s biggest night of the year.

Comcast’s NBC broadcast network will air Super Bowl 60 this year, with the Seattle Seahawks and New England Patriots facing off from Levi’s Stadium in Santa Clara, California. NBC’s streaming service, Peacock, will simulcast the event. While streaming has generally become the overwhelmingly popular way to consume content, the Super Bowl is still primarily watched via the broadcast network.

The streaming simulcast — gaining viewers each year — features certain ad spots earmarked only for that audience.

Streaming-only spots make up about 10% of the full ad inventory during the Super Bowl and cost about half of what a traditional TV commercial goes for, said Mark Marshall, NBC’s chairman of global advertising and partnerships.

“So cheaper, but still not cheap,” said Marshall. “And part of it is also you don’t have many of these spots, right? So I think people caught on to this trick over the past couple years, and it’s done really well in streaming. And as a result, a lot of people are lining up and wanting to do that.”

Each year the cost of the national ads for the Super Bowl breaks a record. NBC sold out of ad inventory for the Super Bowl, averaging $8 million per 30-second commercial, with between five and 10 ads selling for more than $10 million each, CNBC previously reported.

The streaming-only ads, which still appear nationally, fill the slots that would host regional commercials during the traditional TV broadcast.

These spots bring in new advertisers outside of the mainstays like Budweiser and Lay’s. All of the Peacock-only commercials this year are new advertisers to NBC’s Super Bowl slate, Marshall said. For example, cowboy boots brand Tecovas and family location safety app Life360 both bought streaming-only ad spots this year.

The chief marketing officers for both brands noted the impact of the Super Bowl — as well as steep cost — in explaining their decision to go all in on Peacock.

Tecovas CMO Krista Dalton in an email called the company’s debut via streaming “a deliberate choice,” allowing the brand to get the impact of the Super Bowl with “a highly engaged environment while staying disciplined with our investment.”

Life360 CMO Mike Zeman said via email, “Streaming is a great way for us to test what being integrated into such a monumental cultural moment can deliver to our brand and business. It allows us to reach a massive, highly engaged audience of modern, connected families with an ‘out of pocket’ investment that doesn’t break the bank or occupy too large a percentage of our overall marketing budget.”

Last year nearly 128 million viewers watched the Super Bowl on TV and via streaming, according to Nielsen.

While NBC has had a digital offering for its last four Super Bowl telecasts, Marshall said more advertisers have been vying for streaming space as the platform reached 44 million subscribers.

And fittingly, that growth has been driven largely by NBC’s push into live sports. This month NBC will air the Super Bowl and the Winter Olympics — which begin on Friday — along with the NBA All-Star game. It’s a live sports slate the company is billing as “Legendary February.”

“It’s obviously a huge year for NBC, and Peacock is more sold-out than usual. We’re seeing a lot of brands leaning in with Peacock,” said Doug Paladino of ad agency PMG.

Paladino noted brands have seen good results advertising during Sunday Night Football games that are simulcast on Peacock, particularly due to the audience targeting capabilities on streaming.

The streaming-only commercials can also be something of an on-ramp for burgeoning brands that want to get their foot in the door of the big game.

Last year, direct-to-consumer health startup Ro bought its first ad during the Super Bowl — on Fox’s streaming service Tubi.

“The results that they got out of the Super Bowl for what they paid were an order of magnitude above what the traditional spot is,” said Philip Inghelbrecht, CEO and co-founder of tech firm Tatari, which works with brands and advertisers and helped Ro land the 2025 streaming-only ad slot.

This year, Ro, which offers access to GLP-1 medications and telehealth appointments, ramped up its commitment to the Super Bowl and bought a spot in the traditional game broadcast on NBC. Tennis superstar Serena Williams will anchor the ad.

“Last year we dipped our toes into advertising in the Super Bowl through a buy on Tubi. It was a really attractive chance for us to really understand how our brand and our creative performed in that environment,” said Will Flaherty, senior vice president of growth at Ro.

Smaller brands have other more-affordable options to test the waters, too.

Manscaped, the men’s grooming company, decided to buy a spot before kickoff — a time slot less coveted than during the game itself, but still pricy — to push the next chapter of its business.

Manscaped Super Bowl LX campaign.

Courtesy: Manscaped

“Manscaped is a brand that has been around for a few years now, but we’re at this very important moment in our trajectory, which is a big push for products beyond the groin, which is our first claim to fame,” said Chief Marketing Officer Marcelo Kertesz. “We have something new to communicate to the world.”

“We know the spot itself is

just one piece of it, a very important and very expensive piece of it, but it does make sense for us to do that in this moment,” said Kertesz. “It’s a desire I would guess all brands, at some point, have to be on that stage.”

Business

TAT Organizes Muay Thai Festival 2026 to Showcase Muay Thai on the Global Stage

The Tourism Authority of Thailand will host the “Amazing Muay Thai Festival 2026” from February 4-7 in Hua Hin, promoting sports tourism and honoring Muay Thai’s cultural heritage with various events and activities.

Key Points

- The Tourism Authority of Thailand (TAT) will host the “Amazing Muay Thai Festival 2026” from February 4-7 at Rajabhakti Park, Hua Hin, aiming to promote sports tourism and celebrate Muay Thai as cultural heritage.

- Activities will include professional matches, traditional rituals, demonstrations, and training in four Muay Thai styles, along with local cuisine, shopping, and concerts. The festival is expected to attract over 18,000 visitors and generate approximately 214 million baht.

- A highlight on February 6, National Muay Thai Day, will feature a traditional worship ceremony and a large performance honoring King Suriyenthrathibodi, recognized as the Father of Muay Thai.

The Tourism Authority of Thailand (TAT) will organize the “Amazing Muay Thai Festival 2026” to promote sports tourism and elevate Muay Thai as a cultural heritage on the international stage.

TAT’s Deputy Governor for Tourism Products and Business Nat Kruthasoot announced that TAT, together with Prachuap Khiri Khan Province and partner agencies, will host the festival under the theme “Ultimate Muay Thai Experience” from February 4 to 7, 2026, at Rajabhakti Park in Hua Hin District, Prachuap Khiri Khan.

The event will highlight Muay Thai as Thailand’s cultural heritage and support sports tourism. Activities include professional bouts, exhibitions on traditional ranking rituals, demonstrations and training in the four traditional Muay Thai schools: Muay Chaiya, Muay Korat, Muay Tha Sao, and Muay Lopburi, as well as Muay Thai training courses. Visitors can enjoy local cuisine, shopping, leisure activities, and concerts by renowned Thai artists.

TAT expects the festival to attract over 18,000 visitors and generate at least 214 million baht in economic activity.

A key highlight is scheduled for February 6, 2026, National Muay Thai Day. The program will feature a traditional worship ceremony and the Muay Thai Wai Khru ritual, led by master instructors, followed by a large-scale performance with over 1,500 participants to honor King Suriyenthrathibodi, also known as Phra Chao Sue, who is revered as the Father of Muay Thai.

Source : TAT Hosts Amazing Muay Thai Festival 2026 to Elevate Muay Thai to Global Stage

Other People are Reading

Business

Stillfront Group AB (publ) (STLFF) Q4 2025 Earnings Call Transcript

Alexis Bonte

Group Chief Executive Officer, President & Interim EVP of BA MENA/APAC

Good morning, and welcome to the Stillfront Q4 Presentation. I am Alexis Bonte, the CEO of Stillfront. I’m joined today by our CFO, Emily Villatte, who joined us in December. I would like also to take the opportunity to thank Tim Holland for his work as interim CFO during 2025.

As we summarize the first quarter of 2025, I am pleased to report that Stillfront is delivering margin expansion despite revenue decline. We successfully expanded our adjusted EBITDAC margin to 27%, up from 25% in Q4 last year despite an organic revenue decline of 9%. This follows our cost savings efforts during the year, disciplined deployment of UAC alongside the continued rollout of our direct-to-consumer channel.

Looking at our business areas. In Europe, we delivered a big franchise new game launch with early positive signs, and we divested our noncore narrative portfolio, which has been impacting our organic growth. In North America, the continued revenue decline reflects a deliberate strategy of prioritizing cash flow and efficiency over short-term volume. MENA and APAC delivered strong results with 7% organic growth.

Now let’s dive into the details. So first, turning to Europe. Net revenue in BA Europe landed at SEK 622 million for the quarter. That represents an organic decline of 6%. The revenue performance in Europe has been heavily impacted by the narrative games portfolio. And in late December, we concluded the divestment of the narrative franchise for a

Business

New commissioners for Tourism WA

WA’s Tourism Minister Reece Whitby has added a Seven West Media executive, a former Fremantle mayor and an east coast rugby league expert to the Tourism WA board.

Business

Netflix CEO rejects GOP claim that nearly half of kids content pushes trans ideology

Netflix CEO Ted Sarandos argued it was inaccurate information that nearly half of the platform’s content for children promotes transgenderism, after he was pressed about the matter during a Senate hearing Tuesday by Sen. Josh Hawley (R-Mo.).

During a heated Senate hearing Tuesday on Netflix’s proposed deal with Warner Bros. Entertainment, Sen. Josh Hawley, R-Mo., pressed the streaming platform’s CEO on a recent statistic from a conservative women’s policy organization arguing nearly half of Netflix’s content for kids “promotes transgender ideology.”

Hawley cited his own experience as a parent of young kids, pointing out he does not let them “watch anything” on Netflix unless he previews it first because he does not “have confidence of what is on [Netflix’s] platform,” the GOP senator told Netflix CEO Ted Sarandos.

But Sarandos clapped back at Halwey’s claim, arguing that data point that “almost half” of Netflix’s children’s programming promotes trangenderism was “inaccurate.”

NETFLIX SET TO AIR TRANSGENDER COAL MINER FILM ‘QUEEN OF COAL’ IN DECEMBER

“Senator, Netflix has no political agenda of any kind,” Sarados told the GOP senator Tuesday.

Netflix CEO Ted Sarandos provides testimony to U.S. Senators on Capitol Hill Tuesday, Feb. 3, 2025. (ROBERTO SCHMIDT / AFP via Getty Images / Getty Images)

“Well, then why is your children’s programming so full of this highly sexualized, highly controversial – highly controversial – agenda? I don’t understand it. It seems strange to me,” Hawley shot back before Srandos could finish.

“Respectfully, sir, it’s because it’s inaccurate. We have millions of hours of children’s programming. I –,” the Netflix CEO continued saying before the GOP senator cut him off again.

“You don’t have a trans – you don’t feature trans characters, trans storylines, trans themes? It’s not in your programming?” Hawley shot back.

“I’m saying we feature a wide variety of stories and programs that meet a wide variety of people’s tastes,” Sarandos clarified.

But Hawley kept drilling in that nearly half of Netflix’s content for kids promotes transgender ideology, a statistic first shared by the conservative women’s public policy group known as Concerned Women for America (CWA).

CWA released a report in December, claiming they found that 41% of G-rated series on Netflix and 41% of TV-Y7 rated shows on Netflix contain content that can be construed as pro-LGBTQ+.

Netflix CEO Ted Sarandos seen shaking hands with Sen. Josh Hawley, R-Mo., at a Tuesday hearing on Capitol Hill amid the streaming platform’s attempt to buy out Warner Bros. (Graeme Sloan/Bloomberg via Getty Images / Getty Images)

In defense of Hawley’s accusations, Sarandos highlighted that the platform has built out “state-of-the-art tools” for parents to manage their video streaming choices for their children. He added that folks at Netflix were parents too, and shared the “same concerns about raising kids” that Hawley has.

The research released by CWA on Netflix’s pro-trans content came just a few days after Netflix announced an agreement to acquire Warner Bros. film and television studios, as well as HBO and HBO Max, which would make the streaming platform one of the most dominant in the world.

President Donald Trump has raised antitrust concerns over the proposed Netflix takeover of Warner Bros. (Dado Ruvic/Illustration/Reuters / Reuters)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

While the deal has been announced, it still must undergo regulatory scrutiny. Other companies have also submitted rival offers aimed at undercutting Netflix’s ambitions.

“You want the United States government to allow you to become one of the largest – if not the largest – streaming monopolist in the world,” Hawley highlighted to Sarandos during the Tuesday hearing. “I think we ought to be concerned about what content you’re promoting.”

Business

Ranked & Reviewed for Maximum Impact

In 2026, Australia’s PR landscape is more dynamic than ever. With digital transformation accelerating, crisis management in high demand amid economic shifts, and brands prioritizing authentic storytelling across social, media, and influencer channels, the right PR agency can skyrocket visibility, reputation, and ROI. From Sydney’s powerhouse networks to Melbourne’s creative hubs and Brisbane’s emerging innovators, top firms blend traditional media relations with digital PR, SEO-integrated strategies, and data-driven campaigns.

This comprehensive review ranks the 20 best PR agencies in Australia for 2026, based on recent industry rankings (Clutch.co February 2026, PRovoke Media Asia-Pacific 2025 insights extended, The Ardor, DesignRush, Goodfirms, and client feedback). Factors include client results, awards, innovation in digital/hybrid PR, sector expertise (corporate, consumer, tech, fashion/lifestyle, crisis), and national reach. Whether you’re a startup seeking buzz or a corporate needing reputation protection, these agencies lead the pack.

1. Edelman Australia – Best Overall & Global Powerhouse

Edelman Australia tops many 2026 lists for its unmatched scale and expertise. Part of the global Edelman network, it excels in corporate communications, crisis management, public affairs, and integrated campaigns. With offices in Sydney, Melbourne, and beyond, Edelman handles high-profile clients across tech, finance, and government. Strengths: Data-driven insights via Trust Barometer, strong media relationships, and award-winning work in sustainability and issues management.

Pros: Global resources, proven crisis handling, broad sector coverage. Cons: Higher fees for larger enterprises. Best for: Multinational brands and complex reputation challenges.

2. Ogilvy Australia – Creative Excellence & Integrated PR

Ogilvy stands out for blending PR with advertising and digital creativity. Recognized in PRovoke’s best agencies, it delivers storytelling that cuts through noise, with expertise in consumer brands, health, and tech. Sydney and Melbourne bases ensure national coverage.

Pros: Award-winning creative campaigns, strong influencer integration. Cons: More advertising-focused than pure PR. Best for: Brands wanting PR that feels like bold marketing.

3. Burson (Burson Australia) – Strategic Depth & Merger Strength

Post-merger evolution makes Burson a 2026 leader in strategic communications, public affairs, and corporate PR. Excellent in B2B, government relations, and crisis.

Pros: Deep policy expertise, robust analytics. Cons: Less boutique feel. Best for: Corporate and public sector clients.

4. Herd MSL – Consumer & Lifestyle Specialist

Herd MSL shines in consumer, lifestyle, and brand storytelling, with creative campaigns that drive earned media and social buzz.

Pros: Strong influencer and experiential focus. Cons: More niche in consumer sectors. Best for: Fashion, beauty, FMCG brands.

5. ICON Agency – Multi-City Award-Winner

With offices in Sydney, Melbourne, Brisbane, and Canberra, ICON is one of Australia’s most awarded PR firms. It excels in integrated PR, digital, and creative services across corporate, government, and consumer.

Pros: National footprint, award haul. Cons: Broad services may dilute pure PR focus. Best for: Brands needing cross-channel campaigns.

6. Thrive PR + Communications – Boutique Powerhouse

Family-owned and female-led, Thrive dominates in Sydney (with ANZ reach) for corporate, tech, finance, and crisis PR. Over 20 years of results-driven work.

Pros: Personalized service, crisis expertise. Cons: Smaller scale. Best for: Mid-sized businesses seeking high-touch PR.

7. Berkeley Communications Group – Dynamic & Reputation-Focused

Frequently ranked high on Clutch.co, Berkeley excels in media relations, brand reputation, and public affairs in Sydney.

Pros: Strong earned media results. Cons: Primarily Sydney-centric. Best for: Tech and professional services.

8. Sling & Stone – Digital PR Leader

Named ANZ PR Agency of the Year in recent awards, Sling & Stone blends digital PR, influencer, and content for modern brands.

Pros: Innovative digital strategies. Cons: Emerging vs. legacy giants. Best for: Tech startups and e-commerce.

9. AMPR Group – Impactful & Results-Driven

Sydney and Melbourne-based, AMPR delivers measurable campaigns in fashion, retail, beauty, and hospitality.

Pros: Creative, culture-aligned work. Cons: Sector-specific strengths. Best for: Lifestyle and consumer brands.

10. Reconnect PR – Rising Star on Clutch & Manifest

Surry Hills-based, Reconnect earns top reviews for strategic PR, media training, and brand storytelling.

Pros: High client satisfaction scores. Cons: Boutique size. Best for: SMEs and startups.

11. Eleven – Creative & Strategic

Part of PRovoke’s best, Eleven focuses on innovative campaigns across consumer and corporate.

Pros: Fresh ideas, strong execution. Cons: Competitive field. Best for: Disruptive brands.

12. History Will Be Kind – Boutique Innovator

Noted for thoughtful, narrative-driven PR in PRovoke rankings.

Pros: Deep storytelling. Cons: Niche appeal. Best for: Purpose-driven organizations.

13. Bench PR – Emerging Excellence

Recognized in Asia-Pacific best lists for agile, effective PR.

Pros: Nimble and responsive. Cons: Newer player. Best for: Fast-growing companies.

14. Adoni Media – Media Training & PR

Brisbane/Spring Hill focus, strong in public relations and media training.

Pros: Crisis and spokesperson prep. Cons: Regional emphasis. Best for: Executives and public figures.

15. The Atticism PR and Brand – Boutique Specialist

High ratings on Manifest for brand-focused PR.

Pros: Personalized, creative. Cons: Smaller team. Best for: Lifestyle and professional services.

16. Pure Public Relations – Results-Guaranteed

Sydney-based, guarantees outcomes for SMEs and NFPs.

Pros: Performance-based. Cons: Focused on smaller clients. Best for: Budget-conscious brands.

17. Sefiani – Strategic & Sustainability-Focused

Award-winning Sydney firm for corporate, investor relations, and sustainability PR.

Pros: Issues management strength. Cons: B2B lean. Best for: Corporate reputation.

18. Media Key – Melbourne Standout

Goodfirms-listed for dynamic publicity in arts, entertainment, and lifestyle.

Pros: Creative projects. Cons: Sector-specific. Best for: Entertainment brands.

19. Think HQ – Public Affairs Expert

Melbourne-based, excels in government relations and public affairs.

Pros: Policy influence. Cons: Less consumer-focused. Best for: Advocacy and public sector.

20. PRLab – International Reach with Local Expertise

Global network with strong Australian presence for tech and startup PR.

Pros: Cross-border capabilities. Cons: More digital-heavy. Best for: Tech and innovation sectors.

Key Trends Shaping PR in Australia 2026

- Digital Integration → Top agencies merge PR with SEO, social, and influencer for amplified reach.

- Crisis & Trust → Economic uncertainty boosts demand for reputation management.

- Sustainability & Purpose → Brands prioritize authentic ESG storytelling.

- Measurement → ROI via media value, sentiment analysis, and conversions.

- Regional Strength → Sydney leads in corporate, Melbourne in creative/lifestyle, Brisbane in emerging consumer.

How to Choose the Right PR Agency in 2026

- Define goals (brand awareness, crisis, launches?).

- Check portfolios and case studies.

- Prioritize Tier-1 regulators and ethics.

- Request references and metrics.

- Start with a pilot or retainer.

- Budget: Boutique $5k–$15k/month; global $20k+.

Australia’s PR scene offers options for every need—from global giants like Edelman to agile boutiques like Thrive. Partner with one of these top 20 to elevate your brand in 2026’s competitive market.

Business

Yum Brands (YUM) Q4 2025 earnings

A customer enters a Taco Bell restaurant in El Cerrito, California, US, on Tuesday, April 29, 2025.

David Paul Morris | Bloomberg | Getty Images

Yum Brands on Wednesday reported mixed quarterly results, despite strong demand for Taco Bell.

Here’s what the company reported for the period ended Dec. 31 compared with what Wall Street was expecting, based on a survey of analysts by LSEG:

- Earnings per share: $1.73 adjusted vs. $1.77 expected

- Revenue: $2.51 billion vs. $2.45 billion expected

Yum reported fourth-quarter net income of $535 million, or $1.91 per share, up from $423 million, or $1.49 per share, a year earlier.

Excluding tax benefits and other one-time items, the restaurant company earned $1.73 per share.

Net revenue rose 6% to $2.51 billion.

Yum’s global same-store sales increased 3%, fueled by strong performance at Taco Bell and in KFC’s international markets.

Taco Bell’s same-store sales spiked 7% in the quarter, topping Wall Street expectations of 5.6% growth, according to StreetAccount.

The Mexican-inspired chain is the gem of Yum’s portfolio, regularly outperforming the broader fast-food industry, thanks to a mix of value offerings and buzzy menu items.

KFC saw its global same-store sales rise 3%. The fried chicken chain’s international locations reported same-store sales growth of 3%, while restaurants in the U.S. saw a same-store sales increase of 1%. KFC has been undergoing a turnaround in its home market, where it has ceded market share to upstarts like Raising Cane’s in recent years.

Wall Street analysts had expected KFC to report same-store sales growth of 2.1%, according to StreetAccount.

And once again, Pizza Hut was the laggard of the portfolio. The embattled pizza chain reported that its same-store sales declined 1%, driven by a 3% drop in the U.S. and slightly edging out Wall Street estimates of a 1.7% decline during the period.

In November, the company said it would explore strategic options for Pizza Hut. Yum on Wednesday said that the review had begun but did not share more details.

Business

Wabash National reports Q4 EPS miss, narrow revenue beat

Wabash National reports Q4 EPS miss, narrow revenue beat

Business

Energy, Infrastructure, And Industrials – My Favorite Places To Invest For The Next Decade

Energy, Infrastructure, And Industrials – My Favorite Places To Invest For The Next Decade

Business

Eli Lilly (LLY) earnings Q4 2025

Eli Lilly and Company’s logo is displayed during a press conference in Houston, Texas, U.S., Sept. 23, 2025.

Antranik Tavitian | Reuters

Eli Lilly on Wednesday posted fourth-quarter earnings and revenue and 2026 guidance that blew past estimates, as demand for its blockbuster weight loss drug Zepbound and diabetes treatment Mounjaro soars.

The pharmaceutical giant anticipates its 2026 revenue will come in between $80 billion and $83 billion. Analysts expected revenue of $77.62 billion, according to LSEG.

Lilly also expected adjusted earnings to be between $33.50 and $35 per share for the year. That compares with analysts’ estimate of $33.23 per share, according to LSEG.

The strong outlook comes days after Lilly CEO Dave Ricks told CNBC in an exclusive interview that he expects upcoming government Medicare coverage of obesity treatments to expand the U.S. market for those drugs this year, saying it’s a “big multiplier on the eligible pool” of patients.

Lilly’s guidance comes in stark contrast to the outlook of rival Novo Nordisk, which is also grappling with lower prices in the U.S. following landmark deals both companies struck with President Donald Trump to slash obesity and diabetes drug costs. Unlike Lilly, Novo warned on Tuesday that it sees sales and profit declining this year, as prices fall in the U.S. and exclusivity expires for its blockbuster obesity and diabetes drugs in China, Brazil and Canada.

Lilly is working to maintain its dominance in the booming market for those drugs, called GLP-1s, as Novo sees an explosive U.S. launch for its new Wegovy pill for obesity. Lilly hopes to win approval for its own oral weight loss drug, orforglipron, later this year.

Mounjaro raked in $7.41 billion in revenue for the quarter, up 110% from the same period a year ago. U.S. sales for Mounjaro were $4.1 billion, up 57%, as demand climbed but realized prices were lower. Those numbers surpassed what analysts were expecting for the quarter, according to StreetAccount.

Zepbound, which entered the market roughly three years ago, posted $4.2 billion in U.S. revenue for the fourth quarter. That’s up 122% from the year-earlier period, as demand for the drug also rose while realized prices dropped. Analysts were expecting $3.91 billion in U.S. sales for Zepbound, according to StreetAccount.

Here’s what the company reported for the fourth quarter compared with what Wall Street was expecting, based on a survey of analysts by LSEG:

- Earnings per share: $7.54 adjusted vs. $6.67 expected

- Revenue: $19.29 billion vs. $17.96 billion expected

Eli Lilly shares climbed more than 7% in premarket trading.

The company posted fourth-quarter revenue of $19.29 billion, up 43% from the same period a year ago.

Revenue in the U.S. climbed to $12.9 billion. Eli Lilly said that was driven by a 50% increase in volume — or the number of prescriptions or units sold — for its products, primarily for Mounjaro and Zepbound. That was partially offset by lower realized prices of those drugs, the company said.

The pharmaceutical giant booked net income of $6.64 billion, or $7.39 per share, for the fourth quarter. That compares with net income of $4.41 billion, or $4.88 per share, a year earlier.

Excluding one-time items associated with the value of intangible assets and other adjustments, Eli Lilly posted earnings of $7.54 per share for the fourth quarter.

Novo and Lilly’s deals with Trump are expected to eventually increase the number of prescriptions but ultimately hurt total sales.

Under the agreements, Lilly and Novo agreed to slash the prices of those treatments for Medicare and Medicaid beneficiaries in 2026 and offer them directly to consumers at a discount on the Trump administration’s direct-to-consumer platform, TrumpRx, which has yet to launch.

In return, both companies will also get a three-year exemption from tariffs.

In the interview with CNBC on Friday, Lilly’s Ricks acknowledged that under the drug pricing deal, there will be “a step down in pricing” early this year. But he said volume growth of the company’s drugs “will ramp on the back half of the year.”

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 hours ago

Tech5 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World14 hours ago

Crypto World14 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards