Business

PSU banks and capex stocks leading market gains: Dipan Mehta

PSU Banks Gain Ground

“Plenty happening within Indian markets. PSU banks are doing very well for themselves. In fact, the Nifty Bank has outperformed in the last couple of days,” Mehta said in an interview to ET Now. He highlighted that PSU banks are closing a multi-decade gap with private sector banks in both valuations and performance.

“There was a time when private sector banks were gaining market share. Their growth rates were far superior, anywhere from double the growth rates of the industry, and the PSU banks’ NPA levels were well below. But now many PSU banks are giving private sector banks a run for their money, and investors recognize that. Balance sheet qualities are far better, they are back into growth mode, and that is reflected in the stock prices. Still, there is a lot of gap between the two segments within the banking industry,” he added.

Mehta believes the rerating of PSU banks is likely to continue, but cautions that sustaining current NIMs in an increasingly competitive banking sector will be challenging.

Capital Goods Sector on an Upward Trajectory

On capital goods companies like BHEL, Mehta emphasized the significance of execution. “Execution is the biggest risk in capital goods manufacturing companies, and sometimes execution is not only at their end but also at the customer end because sometimes the customer is not ready to let the project go ahead.”

Despite execution risks, Mehta sees strong potential due to robust order books and capex cycles. “We are in a nice upward cycle as far as capex is concerned, and across the board, capital goods, engineering, procurement, and construction companies are sitting on record order book positions, great earning visibility for the next two to three years, and reasonable valuations.” He also favors companies with overseas orders such as L&T and KEC International, which benefit from diversified revenue streams.

FMCG Leadership and Investment Caution

Mehta expressed caution on FMCG stocks like Dabur. “Frankly, Dabur has just gone off the grid, and so is the case with a lot of FMCG stocks. We just do not track them anymore because, for us, the benchmark to evaluate a company is at least it should grow more than the nominal GDP growth rate, which is 11% or thereabouts. If a business is not growing topline growth of more than 11%, it just kind of falls through our grid. I do not have any view on Dabur or FMCG for that matter, or rather I have a view, and that is negative. Investors who are there in this stock need to diversify out of FMCG.”Infrastructure and Engineering Opportunities

Mehta highlighted the enduring strength of companies with large and diversified order books. “You must have a large proportion of your portfolio in all these engineering, procurement, and construction companies, and the best bet still remains L&T. It is hitting an all-time high, and as I said earlier, we prefer companies which have a diversified order base. L&T has almost 40-50% revenues on order books from outside India, and those order books are at reasonable margins. Certain projects within India can only be executed by L&T, putting them in a different league altogether.”

Other firms of interest include VA Tech Wabag, focused on water projects, as well as various power equipment companies covering solar, wind, and electric distribution equipment.

Wires and Cable Sector

On the wires and cable space, Mehta noted strong quarterly performance despite rising copper prices. “The numbers coming from the cable industry certainly seem to surprise us quarter after quarter. Despite increases in copper prices, they have been able to pass on the price increases and improve their margins. A lot of these companies have built solid brands, which is difficult for new entrants to replicate. The industry is doing well because of investment in renewable energy, which requires more transmission and copper cables, and also due to industrialization and data centres, all of which improve demand for cables.”

However, he cautioned on valuations. “I would remain invested, only reason it is not a buy for us is because the valuations are very rich. They are trading anywhere from 40 to 60 times, which is expensive considering it is largely a B2B business and there is no real product differentiation over there.”

Business

Red Lobster considers more restaurant closures after 2024 bankruptcy filing

Check out whats clicking on FoxBusiness.com.

Red Lobster is considering closing more locations as it continues to reevaluate its restaurant footprint in the wake of its 2024 bankruptcy.

The seafood chain shuttered roughly 130 restaurants when it went through the bankruptcy process and Red Lobster CEO Damola Adamolekun told The Wall Street Journal in an interview that the company is continuing to review its locations and leases as it considers ways to curb costs.

Adamolekun said in the interview that visits have risen, with sales up about 10% from last year, but they haven’t recovered to pre-bankruptcy levels and many of the chain’s locations need upgrades.

“There’s a lot of positive signs, but we inherited a very damaged brand, so there’s still work to do to repair all of that,” he told the Journal.

AMERICAN SEAFOOD CHAIN IS BETTING BIG ON NOSTALGIA AND BARGAINS TO WIN BACK DINERS

Red Lobster is weighing additional location closures as it continues to restructure its business. (Justin Sullivan/Getty Images)

Red Lobster filed for bankruptcy in May 2024 after it racked up steep losses amid reduced sales and losses generated from an endless shrimp deal that was originally priced at $20.

The company is also dealing with the fallout from a 2014 move that sold off ownership of the chain’s real estate and saddled the company with lease payments.

Some of those leases involve multiple restaurants, which Adamolekun said has made it difficult to close some poorly performing locations because their lease is linked with higher performing ones.

RED LOBSTER’S ENDLESS SHRIMP DEAL CREATED ‘A LOT OF CHAOS,’ NEW CEO DIVULGES ON BANKRUPTCY

Damola Adamolekun was named CEO of Red Lobster in August 2024. (Fortress Investment Group)

The Journal reported that people familiar with the company’s discussions said Red Lobster would ideally have dozens fewer restaurants in its portfolio so that it could focus on higher-performing locations.

Adamolekun was hired as CEO by the chain’s new ownership in August 2024 after he led a restructuring effort at P.F. Chang’s.

The company has cut roughly 10% of its corporate staff in recent months and the Journal’s report noted that Red Lobster is negotiating with seafood vendors as tariffs have pushed the costs of imported seafood higher.

EXPERTS SAY RED LOBSTER’S SHRIMP EXCUSE IS ‘SMOKE SCREEN’ FOR REAL PROBLEMS

A waitress carries a tray of a lobster kettle and a crab trio dish at a Red Lobster restaurant in Yonkers, New York. (Michael Nagle/Bloomberg via Getty Images)

Adamolekun told the Journal that once the company has dealt with struggling locations, Red Lobster could look to expand in upstate New York and New England, where it has a limited presence.

He’s also considering franchise deals for international locations as well as selling more Red Lobster-branded products, like Cheddar Bay Biscuit mixes, through retail channels.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

FOX Business reached out to Red Lobster for comment.

Business

Straumann beats Q4 sales estimates, keeps margin guidance despite China slowdown

Straumann beats Q4 sales estimates, keeps margin guidance despite China slowdown

Business

Keystone Law reports revenue and profit ahead of market expectations

Keystone Law reports revenue and profit ahead of market expectations

Business

General Mills cuts profit forecast as shoppers change buying habits

‘The Big Money Show’ panel analyzes the ‘gray-shaped economy’ and the January jobs report.

Cheerios maker General Mills cut its annual sales and profit forecasts, citing weak consumer sentiment and a shift toward healthier and lower-cost food options that are pressuring demand for packaged products.

“Weak consumer sentiment, heightened uncertainty, and significant volatility have weighed on category growth and impacted consumer purchase patterns, resulting in a slower pace and higher cost of volume recovery than initially expected,” the company said in a statement ahead of its presentation at the Consumer Analyst Group of New York (CAGNY) conference on Tuesday morning.

The shifting consumer landscape, driven in part by the growing preference for healthier options and increased adoption of GLP-1 weight-loss drugs, is adding further pressure to packaged food demand.

Packages of Cheerios, a brand owned by General Mills, are seen in a store in Manhattan. (Andrew Kelly/Reuters)

WENDY’S TO CLOSE HUNDREDS OF RESTAURANTS AS COMPANY LOOKS TO FOCUS ON VALUE TO BOOST SALES

General Mills CEO Jeff Harmening said during the company’s presentation at CAGNY that the growing competition for protein options is also a factor. General Mills has its own line of protein cereals.

“We expect GLP-1 and other anti-obesity medications to have a lasting influence in the food and nutrition landscape, nudging some consumers toward smaller portions and more nutrient-dense protein and fiber-forward foods,” Harmening said.

The chief executive also said the company recognizes that its lower- and middle-income consumers have increasingly focused on value as economic pressures continue to weigh on their budgets.

“Cost of living and housing pressures are reshaping spending patterns and value is a core expectation that is here to stay,” Harmening said.

Cheerios for sale at a grocery store on Dec. 22, 2025 in Durham, North Carolina. (Al Drago/Getty Images)

Earlier this month, PepsiCo cut prices on core brands such as Lay’s and Doritos by up to 15% following a consumer backlash against earlier price hikes.

Peer Conagra, maker of Slim Jim meat snacks, has maintained its annual sales and profit targets despite reporting a muted second quarter.

General Mills, which left its annual outlook unchanged in December, has been grappling with muted demand as Americans curb discretionary spending and shift to cheaper pantry staples.

A woman shops for Cheerios at a Price Chopper supermarket in South Burlington, Vermont, Nov. 6, 2017. (Robert Nickelsberg/Getty Images)

General Mills now expects annual sales to decline 1.5% to 2%, compared with its prior range of down 1% to up 1%.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GIS | GENERAL MILLS INC. | 44.96 | -3.38 | -6.99% |

The company also forecast annual adjusted operating profit and adjusted earnings per share will fall 16% to 20% in constant currency, versus its previous outlook for a 10% to 15% decline.

CLICK HERE TO GET FOX BUSINESS ON THE GO

Reuters contributed to this report.

Business

Tesla avoids California suspension after ending ‘autopilot’ marketing

FOX Business’ Grady Trimble has the details from inside an autonomous robotaxi on ‘Varney & Co.’

Tesla will avoid a 30-day suspension of its dealer and manufacturer licenses in California after complying with a state order to stop using the term “autopilot” when marketing its vehicles, state regulators said Tuesday.

The decision comes after the California Department of Motor Vehicles (DMV) found in December 2025 that Tesla violated state law by misleadingly marketing its electric vehicles with the terms “autopilot” and “full self-driving.”

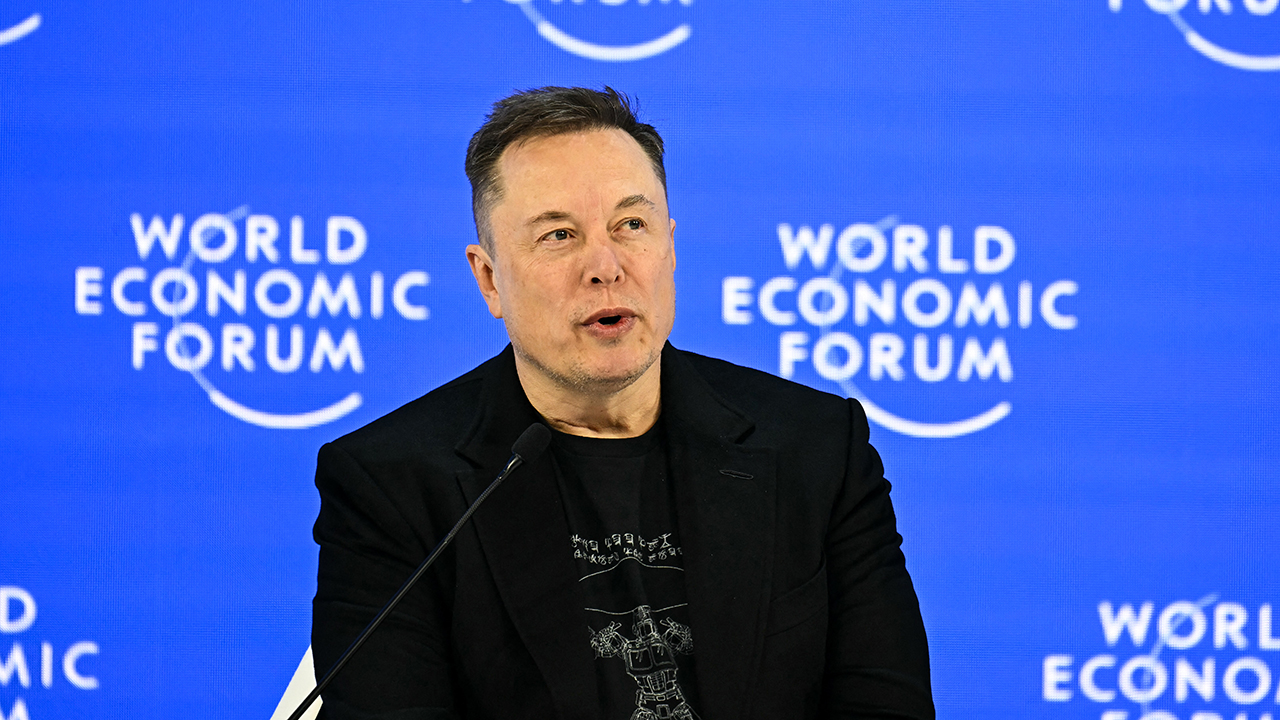

The regulator said Tuesday that Elon Musk’s electric vehicle company took “corrective action” and had stopped using the term “autopilot,” and noted that Tesla already modified its use of the term “full self-driving” by clarifying that driver supervision is required.

CHINA MOVES TO BAN FEATURE COMMONLY SEEN ON TESLA VEHICLES OVER FEAR OF TRAPPED PASSENGERS

Tesla avoided a 30-day suspension of its California sales licenses after regulators said the company complied with an order to stop using the term “autopilot” in its marketing. (Yichuan Cao/NurPhoto / Getty Images)

“The DMV is committed to safety throughout all California’s roadways and communities,” California DMV Director Steve Gordon said in a statement. “The department is pleased that Tesla took the required action to remain in compliance with the State of California’s consumer protections.”

According to the DMV, Tesla’s Advanced Driver Assistance System (ADAS) marketing materials beginning in 2021 used the terms “autopilot” and “full self-driving capability,” along with the phrase, “The system is designed to be able to conduct short and long-distance trips with no action required by the person in the driver’s seat.”

However, the DMV said the vehicles “could not at the time of those advertisements, and cannot now, operate as autonomous vehicles.”

The DMV filed accusations against Tesla’s manufacturer and dealer licenses in November 2023, and the automaker Tesla discontinued use of the term “full self-driving capability” after noting that the system required driver supervision.

TESLA ENDS PRODUCTION OF MODEL S AND MODEL X VEHICLES, WILL FOCUS ON ROBOTS IN 2026

California regulators said Tesla took corrective action in its marketing of driver-assistance features, avoiding a temporary suspension of its sales licenses. (Eric Thayer/Bloomberg via Getty Images / Getty Images)

Last year, the California Office of Administrative Hearings held a hearing before an administrative law judge, who issued a proposed decision in November finding that the term “autopilot” violated state law.

The DMV had given Tesla 60 days to take corrective action. By complying, Tesla avoided a temporary suspension in California — its largest U.S. market.

According to its website, Tesla’s “autopilot” feature allows vehicles to match the speed of traffic and assists with steering within a marked lane.

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

Tesla, led by Elon Musk, complied with a state order to stop using the term “autopilot” in California advertising, regulators said. (Fabrice COFFRINI/AFP via Getty Images / Getty Images)

The “full self-driving (supervision)” feature alerts drivers of stop signs and traffic lights, and can slow the vehicle to a stop while approaching the signal, all with driver supervision.

FOX Business reached out to Tesla for comment.

Business

Glencore profit falls 6%, announces $2 billion shareholder return

Glencore profit falls 6%, announces $2 billion shareholder return

Business

Opinion: Systems change to unlock innovation

OPINION: Overcoming systemic challenges can help businesses unlock innovation.

Business

Lower fuel prices and airfares help drive inflation down

The rate at which prices are rising is slowing down, which could lead to lower interest rates.

Business

Thailand Futures Exchange announces TFEX Best Award 2025 for outstanding derivatives brokers

TFEX announced the “TFEX Best Award 2025” to recognize broker excellence. Awards went to MTSGF, PI, KGI, KKPS, YUANTA, CAF, and INVX for outstanding performance and market contributions.

KEY POINTS

- TFEX announced the “TFEX Best Award 2025”, recognizing member companies for excellence in the areas of investor base expansion, market maker performance and active trading.

- Seven awarded brokers were MTSGF, PI, KGI, KKPS, YUANTA, CAF, and INVX

BANGKOK, February 16, 2026 – Thailand Futures Exchange pcl (TFEX) announced the recipients of the TFEX Best Award 2025, an annual recognition program honoring member companies for their excellence and outstanding performance across key areas of the derivatives market. TFEX Managing Director Triwit Wangvorawudhi emphasized that the strong cooperation and continued support from all members have been instrumental in driving the development and growth of Thailand’s derivatives market.

The “TFEX Best Award of Honor 2025” was presented to brokers that have demonstrated exceptional and consistent excellence for at least three consecutive years. The following companies received this distinction:

- MTS Capital Co., Ltd. (MTSGF) – Market Maker Best Performance

- Pi Securities pcl (PI) – Active Agent

- KGI Securities (Thailand) pcl (KGI) – Most Active House and Active Prop-Trading

For the “Best of the Year Award 2025”, the following brokers were recognized for their outstanding achievements based on trading performance and investor base expansion in each category:

- Kiatnakin Phatra Securities pcl (KKPS) – Most Active House Award

- Yuanta Securities (Thailand) Co., Ltd. (YUANTA) – Active Agent Award

- Classic Ausiris Investment Advisory Securities Co., Ltd. (CAF) – Active Prop-Trading Award

- InnovestX Securities Co., Ltd. (INVX) – Popular Agent Award

- KGI Securities (Thailand) pcl (KGI) – Market Maker Best Performance Award

Source : Thailand Futures Exchange announces TFEX Best Award 2025 for outstanding derivatives brokers

Other People are Reading

Business

City of Perth policy limits councillor’s emails

The City of Perth has started to implement suggestions from the psychosocial risk assessment, including addressing a councillor’s “inappropriate communication to staff”.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Business8 hours ago

Business8 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video23 hours ago

Video23 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World22 hours ago

Crypto World22 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

Business6 days ago

Business6 days agoAn Activist Investor Enters Wall Street Banks’ Cozy Club