Business

SEC Chairman Paul Atkins halts trading in China-linked ramp-and-dump stocks

SEC Chairman Paul Atkins joins ‘Mornings with Maria’ to discuss crypto regulation, market innovation and efforts to keep U.S. financial leadership onshore.

The Securities and Exchange Commission has announced enforcement actions against stocks it suspects are involved in “pump-and-dump” or “ramp-and-dump” schemes tied to foreign-based companies, including entities with operations in China. SEC Chairman Paul Atkins said the agency is intensifying its crackdown on these manipulative practices to protect U.S. investors.

In September 2025, the SEC announced the formation of a Cross-Border Task Force within its Division of Enforcement to investigate potential violations of U.S. securities laws by foreign-based companies, including market manipulation. Atkins said the agency began investigating one such case as recently as last week.

Atkins said the SEC has seen a rise in so-called “ramping-and-dumping” schemes, in which prices are artificially inflated before insiders sell their shares at elevated levels. These manipulative practices can leave retail investors with significant losses.

KEVIN O’LEARY WARNS CANADA OVER CHINA TIES AS TRUMP THREATENS 100% TARIFF ON NORTHERN NEIGHBOR

Paul Atkins, chairman of the US Securities and Exchange Commission (SEC), prior to a Bloomberg Television interview in Washington, DC, US, on July 18, 2025 (Stefani Reynolds/Bloomberg via Getty Images)

“Especially it’s some East Asia, China-related, companies where they’re small, kind of penny stocks on Nasdaq,” said Atkins Friday on “Mornings with Maria.”

Atkins pointed to a recent investigation involving a New York Stock Exchange-listed company, where trading was halted after the firm failed to provide a satisfactory explanation for a sudden spike in its stock price.

TRUMP TO BEGIN STOCKPILING CRITICAL MINERALS WITH $12 BILLION IN SEED MONEY

He said the company informed regulators that it had no material news or information that would explain the unusual rise in its stock price.

Paul Atkins, chairman of the U.S. Securities and Exchange Commission, speaks at the New York Stock Exchange in New York on Dec. 2, 2025. (Michael Nagle/Bloomberg via Getty Images)

“So we halted that. New York Stock Exchange is investigating it. So hopefully, you know, we’ll get to the bottom of that,” he added.

PALANTIR EXECUTIVE PREDICTS AI BECOMING ‘MASSIVELY MERITOCRATIC FORCE’ IN WORKPLACE

The SEC’s Cross-Border Task Force announced it would focus on “investigating potential U.S. federal securities law violations related to foreign-based companies,” including market manipulation schemes like pump-and-dump and ramp-and-dump. It also will scrutinize gatekeepers such as auditors and underwriters that assist these companies in accessing U.S. capital markets.

Securities and Exchange Commission Chair Paul Atkins wears a hat reading “Make IPOs Great Again” on the floor of the New York Stock Exchange in New York City on Dec. 2, 2025. (Spencer Platt / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“We welcome companies from around the world seeking access to the U.S. capital markets,” said Atkins during the task force announcement.

“But we will not tolerate bad actors – whether companies, intermediaries, gatekeepers or exploitative traders – that attempt to use international borders to frustrate and avoid U.S. investor protections,” he continued.

SEC Chairman Paul Atkins joins ‘Mornings with Maria’ at the NYSE to discuss the rise of digital trading, the shift on Wall Street, and why U.S. markets remain the world’s benchmark.

Business

Uber ordered to pay $8.5m over claim driver raped passenger

The verdict is expected to influence the outcome of thousands of other cases against the ride hailing firm.

Business

Cigna Revenue Lifted by Growth in its Evernorth Unit

Cigna CI 3.09%increase; green up pointing triangle Group logged higher revenue in its latest quarter as its pharmacy-benefit business Evernorth continues to grow.

The healthcare company on Thursday posted a profit of $1.2 billion, or $4.64 a share, compared with $1.4 billion, or $5.13 a share, a year earlier.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Form 13G FIRST TRUST EXCHANGE-TRADED FUND III For: 6 February

Form 13G FIRST TRUST EXCHANGE-TRADED FUND III For: 6 February

Business

More baby formula products recalled over toxin fears

Danone and Nestle have given assurances to the FSA that recalled batches were produced some time ago and are unlikely still to be on UK shop shelves. However, they may be in cupboards at home, which is why parents and caregivers are being asked to check their supplies.

Business

Best Tech Stocks To Buy On The Earnings Week Dip

Steven Cress is VP of Quantitative Strategy and Market Data at Seeking Alpha. Steve is also the creator of the platform’s quantitative stock rating system and many of the analytical tools on Seeking Alpha. His contributions form the cornerstone of the Seeking Alpha Quant Rating system, designed to interpret data for investors and offer insights on investment directions, thereby saving valuable time for users. He is also the Founder and Co-Manager of Alpha Picks, a systematic stock recommendation tool designed to help long-term investors create a best-in-class portfolio.Steve is passionate and dedicated to removing emotional biases from investment decisions. Utilizing a data-driven approach, he leverages sophisticated algorithms and technologies to simplify complex, laborious investment research, creating an easy-to-follow, daily updated grading system for stock trading recommendations.Steve was previously the Founder and CEO of CressCap Investment Research until its acquisition by Seeking Alpha in 2018 for its unparalleled quant analysis and market data capabilities. Prior to that, he had also founded the quant hedge fund Cress Capital Management, after spending most of his career running a proprietary trading desk at Morgan Stanley and leading international business development at Northern Trust.With over 30 years of experience in equity research, quantitative strategies, and portfolio management, Steve is well-positioned to speak on a wide range of investment topics.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given that any particular security, portfolio, transaction or investment strategy is suitable for any specific person. The author is not advising you personally concerning the nature, potential, value or suitability of any particular security or other matter. You alone are solely responsible for determining whether any investment, security or strategy, or any product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. Steven Cress is the Head of Quantitative Strategy at Seeking Alpha. Any views or opinions expressed herein may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank.

Business

What Threat Detection Looks Like in a Large Organisation

Bobby Acri is a cybersecurity analyst based in Winnetka, Illinois, who focuses on threat detection, incident response, risk mitigation, and secure systems design.

His work centres on protecting large, complex systems in environments where small weaknesses can create outsized risk.

Born on 17 May 1991 at Evanston Hospital, Bobby grew up on Chicago’s North Shore. He attended Hubbard Woods Elementary, Washburne Middle School, and New Trier Township High School. Early on, he gravitated towards how systems behave under pressure, not just how they look when everything is running smoothly. He built that mindset through computer science coursework, networking classes, and hands-on tech support for school events.

Bobby earned a B.S. in Computer Science from the University of Illinois Chicago in 2013, with a practical focus on operating systems, networking, and applied cryptography-type work. A 2012 internship with NorthShore University HealthSystem gave him early exposure to enterprise controls in a healthcare setting, where access and process matter.

He began his career in enterprise IT at CDW, then moved into systems administration at Aon, working closely with identity and endpoint workflows. In 2018, he transitioned into security operations at CME Group as a SOC analyst, investigating SIEM alerts, triaging phishing reports, and producing clean incident timelines. Since 2021, he has worked at United Airlines as a cybersecurity analyst, partnering across teams to improve detections, reduce alert fatigue, and strengthen controls before incidents escalate. Known for calm, methodical execution and strong documentation, Bobby leads through clarity, repeatable processes, and continuous improvement.

Where did your interest in cybersecurity begin?

It started with problem solving and systems thinking. Even early on, I cared less about surface level functionality and more about what happens when something breaks or gets stressed. That way of thinking stayed with me through school and into work.

How did your education shape your approach?

I studied Computer Science at the University of Illinois Chicago and finished in 2013. I focused on practical, systems-oriented classes like operating systems and networking, plus applied cryptography-type work. That foundation still shows up in how I investigate issues. I want to understand what the system is doing, not just what a tool says.

What did you learn from your first real enterprise experience?

In 2012, I interned with NorthShore University HealthSystem in IT support. I worked ticket queues, device imaging, and account and password issues. It was also my first close look at a setting where policy and access controls are taken seriously. You learn quickly that process is not optional when sensitive systems are involved.

How did your early career roles prepare you for security work?

I started at CDW as a service desk analyst supporting business clients. The work taught me how enterprise environments fail in everyday ways, and how users experience risk. I also built a habit of writing things down. If a fix works once, it should be repeatable. From 2015 to 2018 at Aon, I worked in systems administration with identity and endpoint support. That role put me close to account provisioning, group policy, patch coordination, and security-adjacent issues like phishing and compromised accounts. It was a clear view of how security, compliance, and business urgency collide.

What changed when you moved into a SOC role at CME Group?

The pace and the signal-to-noise problem got real. From 2018 to 2021, I monitored SIEM alerts, investigated endpoint and network anomalies, and triaged phishing reports. A big part of the job is working out what is just noisy and what is actually dangerous. I focused on clean timelines and clear incident notes. If the timeline is messy, the response is messy. I also started writing runbooks and checklists that other analysts used. That helped the team move faster and more consistently.

What does your role at United Airlines look like today?

Since 2021, I have worked as a cybersecurity analyst focused on threat detection and incident response. I investigate anomalies and support response work, but I also spend time on improvements that prevent repeat issues. That includes partnering with IT and engineering on hardening controls and reducing alert fatigue. If you do not address fatigue, you miss real problems because everything starts to look the same.

How would you describe your working style?

Methodical. Calm under pressure. I use precise language and I separate confirmed findings from suspected ones. I document as I go. I treat near misses as valuable because they show you where the gaps are, without the cost of a full incident.

What do you pay attention to as the field keeps changing?

Evolving attack vectors, cloud security trends, and the regulatory frameworks that shape large enterprises. Cybersecurity demands constant education. I do not treat learning as a side project. It is part of the job.

What keeps you grounded outside of work?

Endurance running along Lake Michigan, strategy board games, and reading history and behavioural science. Those interests connect back to the work in a quiet way. They reinforce patience, pattern recognition, and an understanding of the human side of risk.

Business

Ethereum Climbs 11% In Bullish Trade

Ethereum Climbs 11% In Bullish Trade

Business

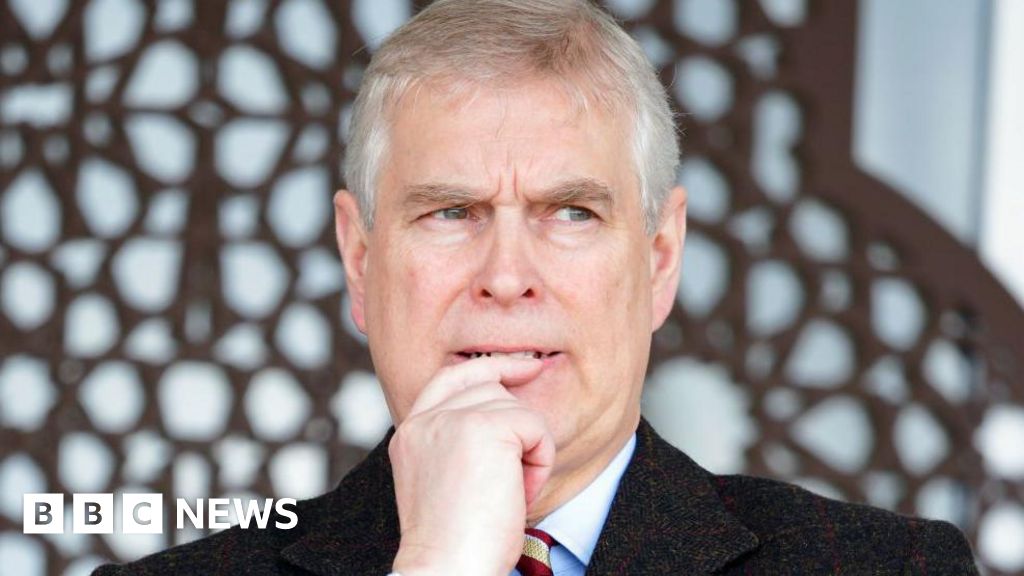

Epstein emails: So-called 'shady financier' was Andrew's 'trusted money man'

Andrew seemed keen for Epstein to do business with David Rowland, but Epstein was wary, emails suggest.

Business

Viterra merger ‘already delivering results,’ Bunge CEO says

Sales climb 32% in fiscal 2025.

Business

Barrick Mining: Meet The New Boss, Not The Same As The Old Boss

Barrick Mining: Meet The New Boss, Not The Same As The Old Boss

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports11 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat6 hours ago

NewsBeat6 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Tech6 days ago

Tech6 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined

-

Crypto World1 day ago

Crypto World1 day agoHeads Up! Bitcoin Enters Capitulation Mode, Trades In a ‘Phase That Rewards Discipline Over Prediction’