Business

Strengthening ASEAN Currency Resilience: Towards Financial Independence

ASEAN currencies demonstrate resilience through economic fundamentals and integration efforts. Initiatives like local currency frameworks and fintech development reduce reliance on the US dollar, enhancing regional stability and investment opportunities.

ASEAN currencies have shown significant resilience to global economic shocks driven by robust domestic economic fundamentals, effective policy buffers, growth in FDI and investments and global developments, such as geopolitical uncertainties, trade tensions and financial crises.

Key Points

- Resilience of ASEAN currencies

- Strong domestic fundamentals, prudent monetary policies, and large foreign reserves have helped withstand global shocks.

- Growth in exports (US$1.9 trillion in 2024) and FDI (US$234 billion in 2023) supports stability.

- Geopolitical pressures and USD reliance

- Sanctions on Russia and global trade tensions highlight vulnerabilities of USD dependence.

- ASEAN nations are diversifying reserves and promoting intra-regional trade to reduce reliance on the dollar.

Mounting geopolitical uncertainties and trade tensions, exacerbated by sanctions against Russia, have challenged the US dollar’s dominance driving a need for ASEAN countries to deepen integration, diversify currency reserves, and promote intra-regional trade to build resilience against future crises and reduce reliance on external currencies, the US dollar in particular.

At present, the ASEAN nations are developing an independent and more resilient regional financial system through integration and cooperation initiatives such as Regional Payment Connectivity, integrated QR payments, financial safety nets, Digital Economy Framework and Central Bank Digital currencies that aim to strengthen the payment connectivity among these nations while withstanding external shocks and future crises.

The development of fintech and digital banking in ASEAN has brought in stability to the banking system in the region offering broader currency and economic stability. The evolving fintech and digital banking landscape in the region is offering significant investment opportunities for investors in digital payments and lending, neobanking, embedded finance, investment technology and infrastructure.

ASEAN’s Emergence as a Global Powerhouse Supports Financial Resilience

The ASEAN region, with a total population of 682.7 million and a combined GDP of US$3.8 trillion ranks as the fifth-largest economy in the world. The region has evolved into a rapidly growing hub maintaining strong economic resilience driven by robust household consumption, steady increase in foreign direct investment (FDI), economic diversification and access to developed export markets.

Regional integration initiatives

- Local Currency Settlement frameworks (Indonesia, Malaysia, Thailand) encourage trade in local currencies.

- Regional Payment Connectivity (RPC) and interoperable QR payments lower transaction costs and improve cross-border efficiency.

- Chiang Mai Initiative (US$240 billion swap arrangement) provides financial safety nets.

The manufacturing sector continues to play a crucial role as the key driver of economic growth in the region. Manufactured goods such as electronics, automobiles and parts, textile & garments and agricultural products (such as palm oil, rice and rubber) dominate the exports in the ASEAN region.

In 2024, region’s exports reached US$1.9 trillion (7.7% of global exports) growing from US$1.1 trillion in 2016. Over the past decade, ASEAN’s exports to the US alone have increased roughly from 10% to 17%, highlighting the increased role of ASEAN in international trade.

During the last decade, ASEAN also has demonstrated strong performance in services trade, whereas service exports expanded by 8.0% in 2023 to US$554.2 billion.

During this period, intra-ASEAN trade also experienced significant growth with the removal of tariff on most products across the region (through ATIGA) which has helped build an integrated and stable regional market. In 2023, intra-ASEAN trade exports contributed to 22.1% of total ASEAN exports, growing at an average annual growth rate of 7.3% between 2003-2023.

Intra-ASEAN services trade also has experienced sustained growth over the years accounting for 14% of ASEAN’s total trade in services in 2023 (vs 12.6% in 2022). This strong growth in intra-ASEAN services trade further emphasizes the interdependence among ASEAN nations and strong regional integration.

Having a strong export sector and deep intra-regional integration have helped these nations generate significant foreign exchange earnings that have helped currency resilience through building large foreign exchange reserves.

Exports and foreign investments have been key drivers of economic growth in the region and have helped reduce the need for external borrowings in foreign currency. This has paved the way for the development of strong local currency bond markets which has helped build further resilience by reducing dependence on foreign funding.

Prudent monetary policies (such as interest rate and foreign reserve management) aimed at inflation targeting also has offered currency stability in the region. The inflation across most countries in the region has moderated and remains largely within the target.

Source: Source: Board of Governors of the Federal Reserve System (US)

Central banks in countries such as Indonesia and Vietnam have set higher local interest rates which has helped attract foreign investments due to higher yields, driving local currency appreciation.

The inward foreign direct investment flows into ASEAN have shown steady growth over the years (from US$119 billion in 2015 to US$234 billion in 2023) despite seeing a temporary decline in 2020 due to the COVID-19 outbreak. This growth has been driven by a large consumer market, strong economic fundamentals, diversification of supply chains and favorable government policies.

Geopolitical Uncertainties Create a Need for Building Resilience

The US Dollar has been dominating the global trade for decades, and ASEAN has been no exception. The ASEAN nations rely heavily on the US dollar (USD) as the primary currency for trade with the US and other nations including for intra-regional transactions. However, mounting geopolitical uncertainties and trade tension have challenged the USD’s dominance during the past few years, and the economic sanctions levied against Russia in response to its invasion of Ukraine further exacerbated this situation.

This resulted in a need for the countries in ASEAN to further deepen their integration and cooperation to diversify reserves and promote intra-regional trade. Moreover, this created a desire for ASEAN nations to bolster their resilience to weather future crises by reducing their dependence on external currencies.

ASEAN currencies are now less tied to the USD than before, and during the past decade, the exchange rate/USD (weighted average currency index) has shown less volatility compared to other emerging economies.

De-Dollarization in ASEAN: A Collective Effort

Local Currency Settlement Frameworks (LCS): The member states in ASEAN are implementing bilateral and multilateral LCS frameworks to promote the use of local currencies for intra-regional trade and investment. The goal is to reduce exposure to external currency volatility while enhancing efficiency for businesses in the region. At present, operational frameworks exist between Indonesia, Malaysia and Thailand, and as a result, transactions in local currencies within ASEAN have seen tremendous growth during the past five years.

Regional Payment Connectivity (RPC): In November 2022, five ASEAN member states (namely Indonesia, Malaysia, The Philippines, Singapore and Thailand) signed a MoU on cooperation on RPC which aims to strengthen bilateral and multilateral payment connectivity among the nations. This has supported faster, cheaper, transparent and more inclusive cross-border payments in the region. The initiative has now been extended to other member states including Vietnam (2023), Brunei (2024), Lao PDR (2024) and Cambodia (2025). The development of the RPC has also attracted countries outside the ASEAN.

Investment opportunities

- Rising demand for fintech, neobanks, embedded finance, and digital infrastructure.

- Strong manufacturing and services sectors continue to attract investors.

Integration of QR Payments: Having an ASEAN interoperable Quick Response (QR) payment is a key focus area of RPC that aims to encourage integration across participating central banks to standardize national payment systems through a common QR code format, ensuring seamless cross-border transactions. QR code systems of several member states including Cambodia (KHQR), Indonesia (QRIS), Lao PDR (Lao QR), Malaysia (DuitNow), The Philippines (QR Ph), Singapore (PayNow), Thailand (PromptPay), and Vietnam (VietQR) have already been connected. These initiatives are expected to lower transaction costs while mitigating foreign exchange risk. In the meantime, Japan is also reportedly exploring the integration of its QR payment system into RPC, with full implementation expected by end-2025.

Regional Financial Safety Nets: A multilateral currency swap arrangement (The Chiang Mai Initiative Multilateralisation (CMIM)) with a funding size of US$240 billion has been in place among the ASEAN+3 member countries (ASEAN, China, Japan, and South Korea) to address balance of payment and short-term liquidity crises (by enabling rapid financing facilities) in the region.

The regulators and central banks in the region have launched several policy frameworks to facilitate seamless transaction in the region.

The ASEAN Policy Framework is a regional initiative that provides the guiding principles for the implementation of interoperable, real-time payment systems across the region. These include common standards, data security (ISO:20022) and linkages between national QR systems.

The Local Currency Transaction Framework is an initiative by the central banks of Indonesia, Malaysia and Thailand to promote the use of local currencies for trade and investment thereby reducing reliance on USD. This framework was extended in 2025 to include portfolio investments to further strengthen financial cooperation in the region.

The ASEAN Digital Economy Framework Agreement (DEFA) is a comprehensive roadmap negotiated by the countries to create the world’s first comprehensive digital trade rules through harmonizing standards, digital trade, cybersecurity and digital payments. Negotiations are expected to conclude, with the agreement signed by 2026.

In addition to the above, the countries in the region are in the process of adopting international standards such as ISO:20022 messaging standard to facilitate data exchange for regulatory compliance and greater transparency.

Central Bank Digital Currencies (CBDCs) to Further Strengthen Regional Integration

ASEAN Countries are actively exploring CBDCs to further enhance financial inclusion and cross-border payments while further strengthening regional efforts to reduce US dollar reliance. While Singapore (a trial is expected in 2026) is at the forefront, Thailand, Indonesia and Malaysia have already launched pilot projects exploring both wholesale and retail applications as a means of modernizing cross-border payments. The other countries in the region including The Philippines, Cambodia and Vietnam have already initiated several measures (such as receiving training, ongoing research, etc.) related to CBDCs to enhance cross-border interoperability.

CBDCs, if made interoperable with systems of other countries, have the potential to reduce transaction costs by cutting down transaction times and facilitating deeper economic ties with other economies in the region. This offers unique advantages to countries in ASEAN by enabling direct settlement in local currencies thereby reducing US dollar dependency and stability against currency volatility.

Fintech and Digital Banking Further Boost Currency Resilience

The development of fintech and digital banking in ASEAN has further enhanced currency resilience by complementing the regional cooperation initiatives. As countries in the region attempts to interlink economies and financial systems, fintech has offered various measures to achieve the above through streamlining cross-border payments.

Digital transformation

- Fintech and digital banking enhance financial inclusion and stability.

- Central Bank Digital Currencies (CBDCs) are being piloted to strengthen cross-border payments and reduce USD dependency.

Digital banks and fintechs in the region offer services such as mobile money, digital wallets and micro-credit to population which were previously unbanked as well as to SMEs in the region promoting financial inclusion. Strong and inclusive economies are inherently more resilient to external pressures which in turn supports currency strength.

In general, fintech applications leverage big data, AI and blockchain that enable financial institutions to accurately assess risk and manage liquidity in real-time. This offers stability to the banking system and resilience to external shocks which in turn provides the foundation for broader currency and economic stability.

Investment Implications for ASEAN

As fintech firms in the region play a crucial role in developing a robust ecosystem for local currency transactions in the region, there has been strong demand for fintech, digital banks and RegTech (regulatory technology) offerings. The acceleration of digital payment platforms and cross-border payment systems such as the RPC initiative have created a fertile ground for fintech investment in ASEAN. Neobanks are rapidly growing in the region targeting its large underbanked population presenting significant opportunities for innovation and growth. At the same time, embedded finance is also transforming ASEAN’s fintech landscape offering significant opportunities in areas including payments, lending, wealth management and insurance infrastructure. In addition to diversified manufacturing and service hubs in ASEAN offering attractive investment opportunities, investors should also look at companies that stand to benefit from this evolving fintech transition (such as infrastructure and technology providers).

Conclusion

The use of local currencies in cross-border transactions in ASEAN is increasing driven by geopolitical uncertainties and trade tensions. Strengthening macroeconomic fundamentals and deepening regional financial integration and payment connectivity have promoted cross-border settlements in ASEAN, accelerating the move away from the USD. The policy makers and central banks in the region have introduced several policy frameworks to develop an independent financial system thus bringing in further resilience to ASEAN currencies.

An evolving fintech and digital banking landscape in the region have further supported this move by improving the efficiency of cross-border transactions. The investors in ASEAN are increasingly hedging their USD exposures with slowdown in the US economy driving further demand for ASEAN currencies. An attractive bond market in the region (including higher yields compared to other developed markets) also offers investors an opportunity for portfolio diversification.

Despite the cooperation among ASEAN countries and the significant progress made towards building an independent financial system in the region, diverse regulatory landscapes among countries, varied stages of digital infrastructure development and the need to harmonize data protection protocols need to be addressed to achieve an independent financial system. While US dollar’s dominance is expected to continue, ongoing collaboration among ASEAN nations have paved the way for gradual development of an independent financial ecosystem.

This article was written by Smartkarma, in collaboration with ASEAN Exchanges.

Source : Currency Resilience in ASEAN: Moving Towards an Independent Financial System

Other People are Reading

Business

Bessent Doubles Down on FSOC’S New Deregulatory, Pro-growth Agenda

Treasury Secretary Scott Bessent is testifying before Congress, and he’s reinforcing his new approach to financial stability.

In prepared remarks before the House Financial Services Committee, Bessent said that the financial watchdog–Financial Stability Oversight Council (FSOC)–is paring back existing regulations and centering its efforts on economic growth and security.

“Going forward, regulation and supervision should address material risks, enhance transparency, and reduce unnecessary burdens—particularly for community banks,” he said.

Business

AMD Earnings Beat Expectations. Why It’s One of the S&P 500’s Worst Stocks Today.

AMD Earnings Beat Expectations. Why It’s One of the S&P 500’s Worst Stocks Today.

Business

Berkeley file $US1.25b claim against Spain over Salamanca issues

A subsidiary of Perth-based uranium miner Berkeley Energia has filed a US$1.25 billion compensation claim against Spain over its hamstrung Salamanca uranium project.

Business

Technical snag at NSDL delays settlement of trades since Tuesday

The likely cause is a technical disruption inside NSDL that affected its ability to process inter-depository transfers with its bigger rival, CDSL. Since several trading settlements often require securities to move across the two depositories––a routine process, any snag in NSDL’s inter-depository routing hinders the credit of shares to individual client demat accounts.

As a result, securities have been credited to broker pool accounts but have not been allocated to end-investor demat accounts, leaving clients temporarily unable to trade those holdings, sources said.

“This was not some isolated case; clients of all broking firms face issues because of the issue in inter-depository transfer emanating from NSDL,” said the chief of a brokerage on condition of anonymity.

While brokers did not report similar settlement delays at rival depository CDSL, NSDL is understood to have moved to its Disaster Recovery (DR) site to address the issue. The exact reason behind the snag at NSDL could not be ascertained. Email queries to NSDL remained unanswered until press time.

India’s equity settlement process follows a T+1 cycle. After trades are completed on the exchange, the clearing corporation settles them the next day before 10:30 am by collecting securities and funds from brokers and releasing payouts by the afternoon, around 3:30 pm. After this, depositories credit shares to investors’ demat accounts.

This week, the technical disruption at NSDL delayed this final step.“Due to a glitch on NSDL’s end, inter-depository transfer of shares has been impacted, due to which brokers were unable to complete pay-ins to clearing corporations,” said the chief operating officer of a retail brokerage who did not want to be named.

“Clearing corporations have transferred some shares from CDSL to the brokers’ CDSL Pool account, which ideally should have gone directly to customers’ Demat accounts. NSDL was unable to do BOD (Beginning Of Day) of its systems to the next working day until this afternoon, due to which operations have been delayed.”BOD is the depository’s opening snapshot of the investors’ demat account. If shares aren’t there at the start of the day, investors can’t use or sell them that day.

Business

Warning of long airport queues under new EU border control system

Airport organisation says queues could last up to six hours over the summer holidays.

Business

RBI infuses Rs 50,000 crore into system through OMO

The OMO received bids of ₹87,161 crore, and three out of the seven bonds in the auction were accepted at lucrative levels than market prices, treasury heads said.

The 7.18% GS 2033 paper saw the most demand, with ₹26,406 crore offered, of which the RBI accepted ₹20,346 crore. While the 6.92% GS 2039 paper saw the least demand with markets offering ₹1,999 crore, of which the RBI accepted ₹1,780 crore.

A ₹50,000 crore Open Market Operation auction saw better-than-expected demand, leading to a rally in bond yields. The 10-year benchmark yield dropped four basis points to 6.65%. This operation, part of the RBI’s liquidity infusion measures, is expected to move system liquidity into a comfortable surplus.

“The OMO was definitely better than expected and as soon as the cut off prices were released, the 10-year paper saw a rally. The RBI took some bonds at lucrative levels than the market, especially the 6.33% GS 2035 paper,” said Gopal Tripathi, head of treasury at Jana Small Finance Bank.

The price of 6.33% GS 2035 paper was trading at 97.97, while the RBI accepted the paper at 98.18.

Similarly the 6.28% GS 2035 paper was trading at a price of 98.68, while the RBI accepted the paper at 98.73, CCIL and RBI data showed.

The OMO auction was part of the RBI’s recent liquidityinfusing measures and marked the final operation in the current OMO calendar.

Experts do not expect additional steps in the near term, as system liquidity is likely to move into a comfortable surplus once the proceeds from this OMO auction are fully infused into the banking system.

“I do not expect any immediate announcement on liquidity in the policy on Friday. With this OMO auction, the system liquidity will be around ₹2.50 lakh crore. Additionally, the pressure on rupee is lifted after the trade deal, hence outflows via intervention, if any, would be minimal” Tripathi said.

Banking system liquidity stood at a surplus of ₹1.95 lakh crore on Wednesday.

Business

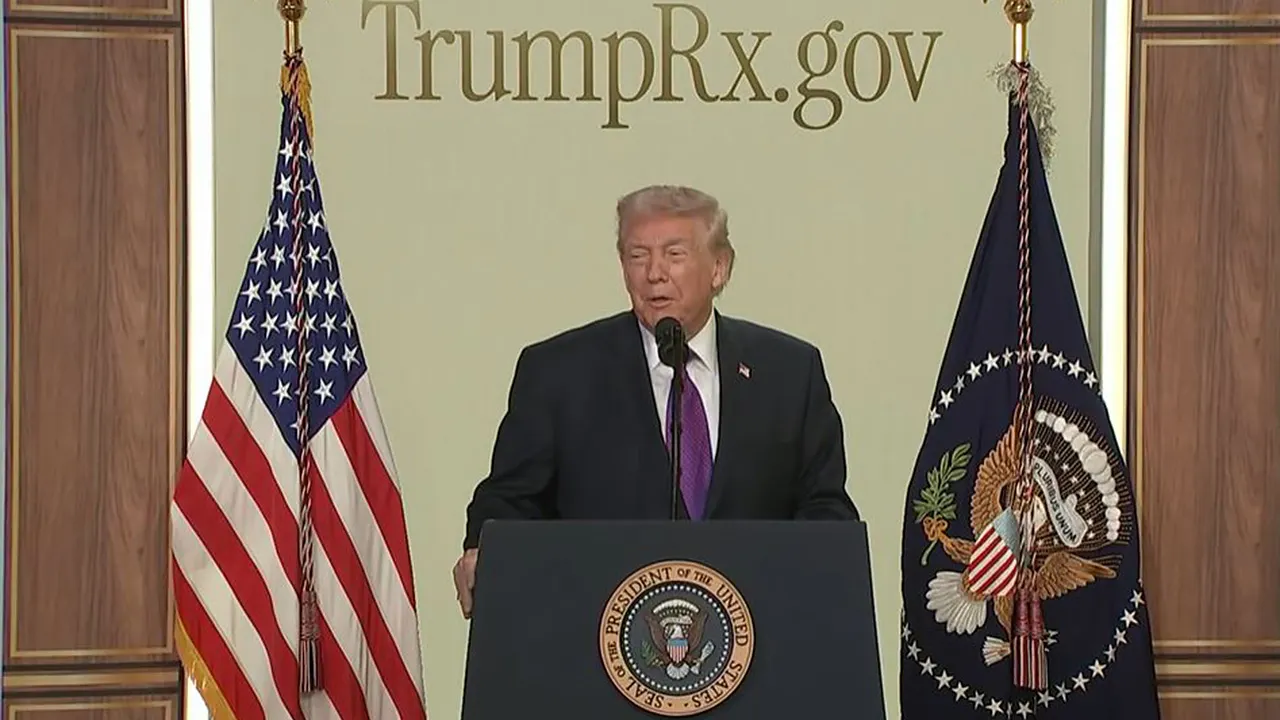

Trump launches TrumpRx website for discounted prescription drugs

Pfizer CEO Albert Bourla discusses Pfizer’s Q4 adjusted earnings and the competitive landscape for weight-loss drugs on ‘The Claman Countdown.’

President Donald Trump unveiled TrumpRx.gov, a new government-backed website aimed at giving Americans access to discounted prescription drugs.

Speaking at the website launch Thursday evening at the White House, Trump argued that Americans have long paid far more for prescription drugs than consumers in other countries and called the price differences unprecedented.

“Americans have long been paying the highest drug prices anywhere in the world, while other countries often paid pennies on the dollar for the exact same drugs,” Trump said. “We were essentially subsidizing the entire world by hundreds of billions of dollars every year.”

He added that despite accounting for a small share of the global population, Americans bear a disproportionate share of drug costs.

FOX NEWS POLL: VOTERS SOUND ALARM ON HEALTHCARE COSTS

President Donald Trump announces the launching of the TrumpRx.gov prescription website on Thursday at the White House in Washington, D.C. (Pool / Fox News / Fox News)

“The United States is just 4% of the world’s population and consumes only 13% of all prescription drugs,” he said before confirming new agreements would change that dynamic.

“Under the agreements my administration has negotiated, the United States will pay the lowest price paid by any other country,” he said. “We’re taking the lowest price anywhere in the world. That’s the price you’re going to be paying,” Trump added.

“They’re going way down for the United States — by differences of as much as 300, 400, 500, even 600%” Trump said. “In some cases, even more.”

Trump announced the website at a White House event alongside Centers for Medicare & Medicaid Services Administrator Dr. Mehmet Oz and National Design Studio Director Joe Gebbia, the Airbnb co-founder advising the administration on digital design and user experience.

The initiative follows agreements between the Trump administration and 16 of the world’s largest pharmaceutical companies under so-called “most-favored-nation” pricing deals.

“All of these discounts and more will be available directly to consumers starting today at TrumpRx.gov,” Trump said, adding that 16 of the 17 largest pharmaceutical companies have signed on, with the remaining company expected to join.

HOUSE GOP SEEKS OFF-RAMP TO SKY-HIGH HEALTH INSURANCE COSTS FOR MILLIONS OF AMERICANS

President Donald Trump and Centers for Medicare and Medicaid Services Administrator Dr. Mehmet Oz discuss the TrumpRx.gov prescription website, Thursday, at the White House in Washington, D.C. (Pool / Fox News / Fox News)

In exchange for exemptions from U.S. tariffs, participating drugmakers agreed to lower prices for the federal Medicaid program and extend those reduced prices to cash-paying consumers through TrumpRx.

Among the participating companies are Eli Lilly and Novo Nordisk, which agreed to cut prices on popular GLP-1 weight-loss drugs.

The administration said the agreements are expected to reduce monthly costs for Americans to an average range of $149 to $350.

The administration highlighted price reductions across a range of medications, including inhalers, HIV treatments, diabetes drugs and IVF medications.

The website slashes the price for popular weight loss drugs like Wegovy. (Michael Siluk/UCG/Universal Images Group via Getty Images / Getty Images)

Trump cited reductions in weight-loss drugs and inhalers, as well as fertility treatments.

“Novo Nordisk will be slashing the price of Wegovy from more than $1,300 to $199,” Trump said. “AstraZeneca is slashing the price of a common inhaler from $458 to $51.”

“We’re also delivering historic discounts for couples struggling with infertility,” he added, saying manufacturers would dramatically cut the cost of commonly used IVF drugs, including Gonal-F.

The TrumpRx.gov displays discounted prescription drugs, showing users the percentage savings off the original price and generating a coupon for each medication.

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

Consumers can print the coupon or save it to a mobile wallet and present it at participating pharmacies to receive the discount at checkout. For specialty drugs, the site directs users to mail-order pharmacies that can deliver medications directly to their homes.

According to administration officials, purchases made through the website will generally not count toward insurance deductibles.

Business

'My bills are lower and I'm warmer in energy efficient home'

179,000 households meet the Department for Communities’ fuel poverty criteria, spending at least 10% of their income to cover domestic energy bills.

Business

AMD Can’t Bridge the Gap Between AI Hope and Near-Term Reality

AMD Can’t Bridge the Gap Between AI Hope and Near-Term Reality

Business

Sebi proposes tighter rules for single-stock derivatives strategy

Under the proposal, the benefit of offsetting positions across different expiries will not be available on the day of expiry for singlestock derivative contracts expiring that day.

The review follows feedback from market participants flagging potential risks arising from calendar-spread benefits on expiry days for single-stock contracts. A calendar spread is when a trader holds the same stock’s derivatives with two different expiry dates, which lowers margin because the positions offset each other. The risk appears on expiry day when the near-month contract expires and the hedge no longer exists. This leaves the trader exposed to one-way moves on the remaining position.

“It is clarified that the existing margin calculations for calendar-spread positions shall remain unchanged for calendar-spread positions involving all expiries other than the contracts expiring on a given day,” Sebi said in a circular. The new rule will take effect three months from the date of the circular.

Currently, for index derivatives, calendar-spread benefits are already unavailable on the day of expiry for contracts maturing that day.

Sebi said the proposal would align the treatment of calendar spreads in single-stock derivatives with that of index derivatives and give trading members sufficient time either to bring in additional margin on expiry day or roll over positions.

“In the absence of such formulation, there remains a risk of sudden increase in margin on the day following expiry of one leg of the calendar-spread position, with limited recourse available to trading members in case of margin shortfall or an open leg showing significant adverse price movement,” it added.

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business10 hours ago

Business10 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat16 hours ago

NewsBeat16 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report