Business

The Czech Tennis Phenom Breaking Into the WTA Top 100

At only 20 years old, Sara Bejlek has already established herself as one of the most promising young talents on the WTA Tour. The Czech left-hander, once the world’s No. 4 junior, has transitioned to the professional ranks with impressive speed and maturity. In 2026 she sits inside the top 100 for the first time in her career and is widely regarded as the next big breakout star from the tennis powerhouse nation that produced Petra Kvitová, Karolína Plíšková, Barbora Krejčíková and Markéta Vondroušová.

Here are the 10 essential things every tennis fan should know about Sara Bejlek right now.

1. Record-Setting Junior Career

Bejlek was one of the most dominant juniors of her generation. She reached a career-high junior ranking of No. 4 in the world and won four ITF junior titles, including back-to-back Grade 1 titles in 2021 (Czech Indoor and Czech Open). She made the semifinals of the 2022 Australian Open juniors and the quarterfinals of the French Open juniors the same year. Her junior highlight came at the 2021 US Open juniors, where she reached the final before falling to Robin Montgomery.

She turned pro full-time at 16 and never looked back.

2. Fastest Climb to the WTA Top 200

Bejlek cracked the WTA top 200 for the first time in May 2023 at age 17 after winning three consecutive ITF W60 titles on clay (Prerov, Otočec, Prague). She became the youngest Czech woman to reach that milestone since Karolína Muchová in 2015. By the end of 2024 she was ranked No. 139 and in 2025 she finished the year at No. 92—her first top-100 season.

3. Clay-Court Specialist with Serious Power

Bejlek is a classic clay-court player with heavy topspin groundstrokes, excellent movement, and a dangerous lefty forehand that can flatten out into winners. Her average forehand speed on clay exceeds 78 mph, placing her among the fastest-hitting teenagers on tour. She won 78% of her main-draw ITF matches on clay between 2022 and 2025.

She is particularly dangerous when dictating with her forehand from the baseline and using sharp angles to open the court.

4. Breakthrough 2025 Season: First WTA Quarterfinal & Top-100 Finish

2025 was the breakout year. Bejlek reached her first WTA quarterfinal at the Prague Open in July (lost to Linda Nosková), made the third round of the US Open as a qualifier (defeating former top-20 player Elise Mertens), and finished the season inside the top 100 for the first time. She won two ITF W75 titles and reached the final of an ITF W100, posting a 52–19 win-loss record.

5. First WTA-Level Win Over a Top-20 Player

In the second round of the 2025 US Open, Bejlek defeated world No. 18 Elise Mertens 6–4, 7–5 in a tense three-set battle that lasted 2 hours 18 minutes. It was her first victory over a top-20 opponent and the biggest win of her career at the time. She followed it with a gritty third-round loss to eventual semifinalist Jessica Pegula.

6. Mental Toughness & Clutch Play

Bejlek has already shown championship-level composure in deciding sets. In 2025 she won 14 of her last 17 deciding sets and converted 68% of her break points in matches that went the distance. Coaches and opponents frequently praise her “ice-in-the-veins” mentality on big points.

7. Left-Handed Advantage & Serve Potential

As a lefty, Bejlek creates unique angles with her forehand and serve that right-handers find difficult to read. Her first serve averages 105–108 mph and she has been working intensively on adding kick and slice variety to her second serve. Analysts believe her serve could become a significant weapon once she adds more consistency and placement.

8. Czech Tennis Factory Continues to Produce

Bejlek is the latest product of the Czech tennis development system that has produced more Grand Slam champions per capita than any other nation over the last 15 years. She trains at the Prague Tennis Academy under coach David Škoch (former Davis Cup player) and frequently practices with Karolína Muchová and Linda Nosková. The Czech Republic now has six women ranked inside the top 100 in early 2026 — the most of any country outside the United States.

9. Off-Court Personality & Growing Brand

Bejlek is known for her dry humor, love of heavy metal music (she has Metallica and Slipknot tattoos), and candid interviews. She frequently engages with fans on social media and has built a loyal following in Central Europe. Her signature celebration—a quick double fist-pump followed by a point to the sky—has become recognizable.

She signed endorsement deals with Nike, Babolat, and a Czech energy-drink brand in 2025 and is starting to appear in fashion campaigns in Prague.

10. 2026 Goals: Top 50, First WTA Title & Grand Slam Fourth Round

Entering the 2026 season ranked No. 92, Bejlek is projected by most analysts to finish the year inside the top 50. Her goals are clear: win her first WTA title, reach the fourth round of a Grand Slam, and break into the top 40. With a healthy clay-court swing (she excels in Europe’s spring swing) and continued improvement on hard courts, many believe 2026 could be the year she truly announces herself as a top-30 player.

Business

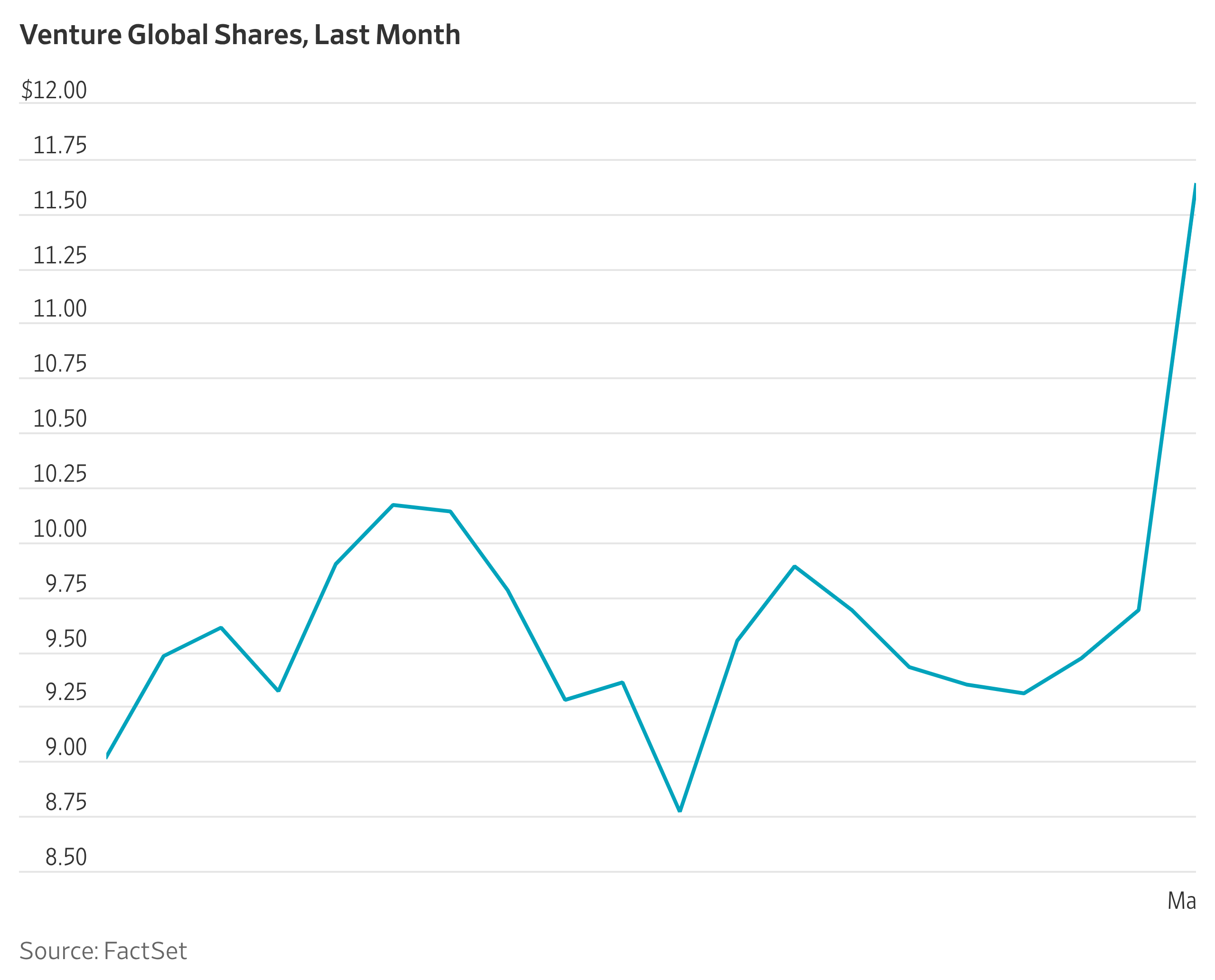

U.S. LNG Exporter Venture Global Stock Surges

Natural gas prices are rocketing. So are shares in a U.S. exporter that could emerge as a beneficiary of Middle East supply disruption. Venture Global, a liquefied natural-gas exporter, was up 17% in premarket trading.

European natural-gas prices rose nearly 50% on Monday. QatarEnergy, the world’s largest LNG producer, said it would halt output following an attack on its operations.

Venture Global, which exports LNG from the U.S. and sells on the spot market, should be best positioned to capitalize from the higher prices, analysts at Mizuho wrote.

Business

Gold surges above $5,400 after Trump’s Iran strikes, could prices hit $6,000 next?

Gold has surged back above $5,400 an ounce in early trading following US missile strikes on Iran, prompting fresh speculation over whether the precious metal could break through $6,000 in the coming weeks.

The renewed rally comes after a volatile start to the year for bullion. Gold hit a record high of more than $5,550 in late January, before tumbling sharply to around $4,700 by early February. Silver followed a similar path, sliding from above $120 to roughly $82. Both metals are now climbing again, with silver edging back toward $100.

The latest spike follows coordinated US and Israeli strikes on Iran over the weekend, which reportedly killed Supreme Leader Ayatollah Ali Khamenei and triggered retaliatory action by Tehran against US allies in the Gulf. Tensions around the Strait of Hormuz, a critical artery for global oil supplies, have intensified, pushing oil and safe-haven assets higher.

Market analysts describe the situation as a “classic risk-off scenario”, with investors flocking to traditional stores of value amid fears of broader regional escalation, oil supply disruption and renewed inflationary pressures.

Cameron Parry, founder and CEO of TallyMoney, said the moves were entirely consistent with previous geopolitical crises.

“Both the oil and gold price were up Monday morning, as the Strait of Hormuz and safe-haven assets became the point of focus for markets,” he said. “Geopolitical crises like the one unfolding currently will invariably apply upward pressure on the gold price and that’s precisely what is happening this time round.

“We are in a classic risk-off scenario and gold is the classic go-to asset. Gold was already benefiting from strong demand globally, not just from central banks but also retail investors keen to get exposure in an increasingly volatile geopolitical climate.

“That demand could now spike further as nations and individuals alike seek the safety of the world’s ultimate store of value. Few would bet against gold.”

Riz Malik, director at R3 Wealth, said the scale of any further gains would depend heavily on how long the conflict lasts and how Iran responds.

“Monday morning immediately saw a sharp rise in the demand for gold,” he said. “How much it will rise will depend on how prolonged this campaign is and the level of the Iranian retaliation.

“Once again global instability has been pushed to Defcon 4 and that only means one thing for precious metals. Namely, their price is set to go up.”

However, not all analysts believe a rapid surge to $6,000 is imminent.

Tony Redondo, founder at Cosmos Currency Exchange, said that while the $6,000 mark is conceivable in the near term, it would require sustained escalation.

“Even before Saturday’s military operations in Iran, the price of gold had catapulted up to the $5,300 level, but hitting $6,000 by next week would require a 15 per cent surge, a feat usually reserved for total systemic collapse,” he said.

“However, while $6,000 is unlikely within days, it is a high-probability target for March or April, especially if the Strait of Hormuz is compromised on a longer-term basis or the conflict broadens.”

Redondo added that silver’s structural supply deficit could amplify its price reaction. “Silver is closing in on $100 and its supply constraints make $120 a realistic target in the months ahead as a coiled spring reaction to geopolitical fear,” he said, cautioning that sharp rallies often invite profit-taking.

Others argue that while geopolitical shocks can act as catalysts, deeper macroeconomic forces will ultimately determine gold’s trajectory.

Anita Wright, chartered financial planner at Ribble Wealth Management, said structural pressures in the US financial system were equally important.

“This weekend’s missile strikes will undoubtedly affect the gold price, but it is important not to confuse a catalyst with the underlying driver,” she said. “Gold does not move to $6,000 because of a single weekend’s events. It moves there, if it does, because of monetary conditions.

“The US faces trillions in refinancing requirements alongside persistent fiscal deficits. Foreign appetite for US Treasuries shows visible strain, long-dated yields are rising, and equity valuations remain stretched. History tells us that when bond yields rise into an overvalued equity market, instability follows.”

Wright said that while an immediate jump to $6,000 was unlikely, materially higher gold prices over the medium term were plausible if bond market stress intensifies and the Federal Reserve returns to liquidity support.

Nouran Moustafa, practice principal and IFA at Roxton Wealth, urged investors not to chase sharp moves driven by headlines.

“Gold was expected to open higher as investors moved into safe havens after the latest escalation, and so it did,” she said. “However, a jump to $6,000 in days would require something far more severe such as direct energy supply disruption or broader financial market stress.

“Without that, we’re more likely to see sharp volatility than a sustained vertical rally.”

She warned that emotional investing during times of geopolitical stress can be costly. “Gold can act as portfolio insurance, but chasing rapid spikes rarely ends well. Sensible allocation and risk management matter more than reacting emotionally to breaking news.”

With tensions in the Middle East showing little sign of easing and global markets already on edge, gold’s next move will likely hinge on whether the conflict remains contained — or spills into something far more disruptive for energy markets and global growth.

Business

RLJ Lodging Remains A High-Yield REIT That Is Betting On Hotel Upgrades (NYSE:RLJ)

Albert Anthony is the pen name of a Croatian-American business author who is a contributing analyst on investor platform & financial media site Seeking Alpha, where he has over +1,000 followers, & also has written for platforms like Investing dot com. He is the author of a new book on Amazon called Investing in REITs: A Fundamental & Technical Analysis (2026 Edition).The author’s career focus as a business & information systems analyst also included the IT department at top 10 financial firm Charles Schwab, where he supported several enterprise applications and the trading platform StreetSmart Edge. His data-driven, process-oriented background has served him well in launching his own boutique equities research firm, Albert Anthony & Company, a Texas-registered business which he manages 100% remotely on his own, and paved the way for his becoming a regular contributor to Seeking Alpha, publishing actionable insights for investors worldwide.Having grown up in the New York City area to a 1st generation Croatian family in the US, he also called home the Austin Texas area, as well as Croatia where he participated in dozens of business & innovation conferences, trade shows, and panel discussions, and hosted an informational program for Online Live TV Croatia, covering business & innovation conferences and destinations as a media personality.The author completed his B.A. in Political Science degree from Drew University in the US, is certified in Microsoft Fundamentals, CompTIA Project+, and also earned the Risk Management specialization from the Corporate Finance Institute (CFI), following trends in compliance, regulatory frameworks, and market risk. Besides appearing in financial media platforms, he is growing the Albert Anthony channel on YouTube (@author.albertanthony), where he talks about REITs, since he himself is an active investor in his own portfolio of REIT stocks.For any business email please use his official mail address: contact@albertanthony.usPlease note: The author does not write about non-publicly traded companies, small cap stocks, or startup CEOs, so any such mail received and pitches from PR agencies will be deleted.*Disclaimer: Albert Anthony and Albert Anthony & Co, as a US-based sole proprietorship registered as a trade name in Austin, Texas, are not registered financial advisors and do not provide personalized financial advisory services to clients nor manage client funds but provide general markets commentary and research as well as actionable insights based on publicly-available data and our own analysis. We do not sell or market financial products and services, nor are compensated by any company for rating them. The author does not hold any material position in any stock he rates at the time of writing, unless otherwise disclosed. All investment is assumed to be at risk and readers are expected to do their due diligence beyond the scope of this author’s commentary, agreeing to indemnify the author of any liability for potential investment losses.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RLJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author invests in a small amount of hotel REIT stocks including RLJ and APLE.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

HBO Max, Paramount+ streaming services will merge after WBD deal

Paramount+ and HBO Max signage.

Reuters | Getty Images

Paramount+ and HBO Max will be combined into one streaming service if regulators approve Paramount Skydance’s acquisition of Warner Bros. Discovery, Paramount CEO David Ellison said on a conference call Monday.

A combined service would have about 200 million subscribers given existing totals, Ellison said during his company’s investor call about the WBD transaction. Paramount and Warner Bros. Discovery said last week they had struck an agreement to sell WBD for $31 per share after Netflix backed out of the prolonged bidding war.

Paramount executives didn’t offer any details Monday on how the company may price a combined service or what it would be called. Still, Ellison said he wouldn’t disrupt the HBO brand.

“HBO should stay HBO,” he said, citing its long history of quality programming.

HBO is likely to be a sub-brand within the larger service, according to a person familiar with Paramount’s plans. HBO is currently run by Casey Bloys, whose contract runs out in 2027, another person said. Bloys declined to comment.

Paramount also touted the strength of its sports offering on a combined service, bringing together TNT Sports with CBS Sports.

Paramount executives said they haven’t heard anything from regulators to signal that the breadth of their sports offerings — which would include March Madness, NFL, MLB, NHL, Nascar, French Open, The Masters, college football and more — would trigger any antitrust concerns.

Business

Will petrol and diesel prices go up because of the Iran war?

There might also be a more direct impact on food. “Some elements of crude oil are used in fertiliser, and so there could be a cost implication in terms of food prices,” Benjamin Goodwin, partner at banking advisory firm PRISM Strategic Intelligence told the BBC.

Business

NVIDIA Stock Dips After Blockbuster Earnings as Investors Digest Massive Growth and Next-Gen AI Roadmap

NVIDIA Corp. shares pulled back in recent trading despite the company posting record-breaking fiscal 2026 results and issuing upbeat guidance, as Wall Street parsed details on capital allocation, China export dynamics and the rapid evolution of AI infrastructure demand.

The chipmaker’s stock (NASDAQ: NVDA) closed at $177.19 on Feb. 27, 2026, down $7.70 or 4.16% from the prior session, with after-hours activity showing further softening to around $173. Shares have traded in a range of $173.13 to $182.59 recently, retreating from a pre-earnings peak near $195. The pullback follows a strong run, with the stock still up significantly year-to-date amid the ongoing AI boom, though it sits below its 52-week high of $212.19.

AFP

NVIDIA reported fiscal fourth-quarter results on Feb. 25, delivering record revenue of $68.1 billion, up 20% sequentially and 73% year-over-year. Full-year fiscal 2026 revenue reached $215.9 billion, a 65% increase from the prior year. Data center revenue — the AI powerhouse segment — hit $62.3 billion in the quarter, surging 22% from the previous period and 75% annually, while full-year data center sales totaled $193.7 billion, up dramatically from $15 billion in fiscal 2023.

Profitability remained exceptional, with GAAP earnings per diluted share at $1.76 and non-GAAP at $1.62 for the quarter. For the full year, GAAP EPS stood at $4.90 and non-GAAP at $4.77. Gross margins expanded to 71%, operating margins to 60.6% and net profit margins to 55.6%, generating $120.1 billion in net income for fiscal 2026.

CEO Jensen Huang highlighted the “agentic AI inflection point” and positioned NVIDIA’s platforms as leaders in both training and inference. The Grace Blackwell system with NVLink offers order-of-magnitude lower cost per token for inference, while the upcoming Vera Rubin platform — now in full production and set to ship in the second half of 2026 — promises up to 10x reductions in inference token costs compared to Blackwell.

Guidance for the first quarter of fiscal 2027 called for revenue around $78 billion, plus or minus 2%, well ahead of consensus estimates and signaling continued acceleration despite concerns about potential slowdowns. The outlook excludes contributions from China, where export restrictions have complicated sales, though recent U.S. policy shifts have allowed certain chips like the H200 to resume shipments under conditions.

On March 2, NVIDIA announced a multiyear strategic partnership with Lumentum Holdings, including a $2 billion investment to advance optics technologies, R&D and U.S.-based manufacturing capacity for next-generation AI infrastructure. The deal aims to support innovations in data center optics and systems design, underscoring NVIDIA’s push to build out the full AI ecosystem.

Analysts remain largely bullish. Morgan Stanley suggested in late February that stocks like NVIDIA have “more room to run” in March, citing sustained AI demand. Some valuations point to significant upside: one analysis using free cash flow margins estimated potential for a $263 price target, implying nearly 50% gains from recent levels if high FCF generation persists amid projected 2026 revenue around $365 billion.

Yet the post-earnings dip reflects investor caution. Shares fell as much as 5.5% in the session following results, with some viewing the massive capital expenditures and ecosystem investments as delaying near-term shareholder returns. Questions linger about the pace of payoff from AI infrastructure buildouts and competition in inference-focused technologies. Technical indicators showed the stock dipping below key moving averages, potentially inviting further selling.

NVIDIA’s dominance in accelerated computing and generative AI continues to drive hyperscaler spending. Partnerships, including expanded deployments with Meta involving millions of Blackwell and Rubin GPUs, plus Grace CPUs for energy-efficient data centers, highlight the company’s ecosystem strength. Gaming revenue rose 47% year-over-year to $3.7 billion in the quarter, though it moderated sequentially after holiday demand.

The company maintains a quarterly dividend of $0.01 per share, payable April 1, 2026, to shareholders of record March 11. A substantial share repurchase authorization remains, with nearly $60 billion available as of recent filings.

Market capitalization hovers around $4.3 trillion, with a forward-looking valuation that some describe as stretched but justified by explosive growth. Dividend yield is minimal at 0.02%, appealing more to growth investors than income seekers.

As NVIDIA navigates the shift from AI training to inference and prepares for Vera Rubin’s rollout, the stock’s trajectory hinges on execution amid geopolitical factors and competitive pressures. Upcoming quarters will test whether the company’s unmatched position in AI chips can sustain its remarkable momentum.

Investors eye the next earnings cycle for updates on Blackwell production ramps, China contributions and Vera Rubin traction. For now, NVIDIA remains the bellwether of the AI era, even as volatility tests its post-earnings resilience.

Business

Bunzl plc 2025 Q4 – Results – Earnings Call Presentation (OTCMKTS:BZLFY) 2026-03-02

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

Business

Monster benefits from surge in energy demand

Both sugar and zero sugar formats are performing well in the United States.

Business

KeyBanc names 7 undervalued energy stocks amid Iran conflict

KeyBanc names 7 undervalued energy stocks amid Iran conflict

Business

Thousands more flights cancelled as Iran strikes continue

From the UK, flights have also been cancelled for many Middle East destinations, including all flights to Israel and Bahrain, three quarters of the day’s scheduled flights to the United Arab Emirates, and more than two thirds (69%) of flights to Qatar.

-

Sports7 days ago

Sports7 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics7 days ago

Politics7 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Iris Top

-

Business6 days ago

Business6 days agoTrue Citrus debuts functional drink mix collection

-

Politics4 days ago

Politics4 days agoITV enters Gaza with IDF amid ongoing genocide

-

Tech1 day ago

Tech1 day agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports2 days ago

The Vikings Need a Duck

-

Crypto World6 days ago

Crypto World6 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

NewsBeat5 days ago

NewsBeat5 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat2 days ago

NewsBeat2 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Tech6 days ago

Tech6 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 days ago

NewsBeat5 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat2 days ago

NewsBeat2 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat1 day ago

NewsBeat1 day ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat2 days ago

NewsBeat2 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoPolice latest as search for missing woman enters day nine

-

Entertainment7 hours ago

Entertainment7 hours agoBaby Gear Guide: Strollers, Car Seats

-

Business4 days ago

Business4 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business4 days ago

Business4 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech3 days ago

Tech3 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS