With just one trading day left in Q1, risk sentiment has collapsed across Asia and Europe.

Markets have been shaken by Trump’s tariff agenda.

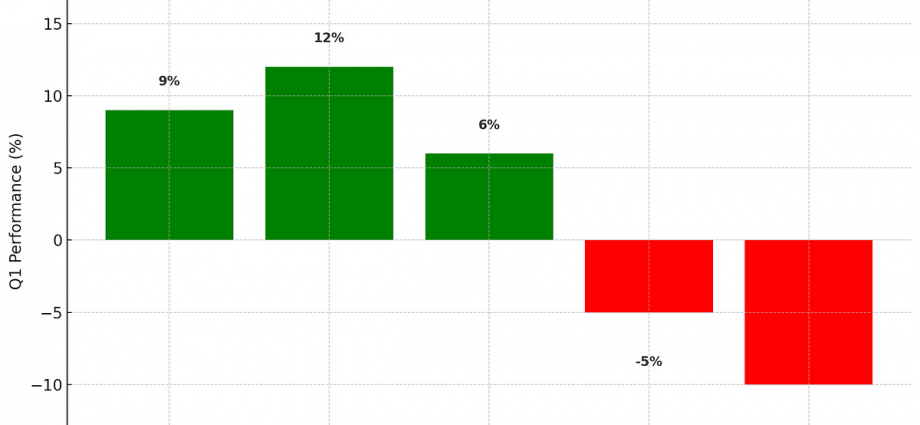

- EuroStoxx 50: +9%

- DAX: +12%

- FTSE 100: +6%

- S&P 500: -5%

- Nasdaq: -10% (officially in correction territory)

Even the DAX, which had led early gains, lost steam in March. Carmakers and luxury stocks were hit hardest.

Pain is spreading beyond tech:

- Delta: -27%

- United Airlines: -25%

- Ralph Lauren: -20%

- Lululemon: -19%

- Push US inflation up by 1%

- Cut GDP by 0.8%

- Drive the dollar even lower (USD is G10’s worst performer in 2025)

- Boost safe havens like

gold and

ruble (top FX performer so far this year!)

But… analysts are still bullish on the S&P 500

Earnings season will tell us whether this optimism is justified.

If tariffs exceed 15%, US GDP could shrink by over 1%. That would be a big red flag

US stocks

USD

Gold

US bonds

- +138k nonfarm payrolls

- Unemployment: 4.1%

- Wages: +4% YoY

- Rebound after weather disruptions

- Reversals of gov’t grant freezes

- Front-loading of hiring ahead of tariffs

- Headline CPI expected at 2.2% (down from 2.3%)

- Core CPI at 2.5% (down from 2.6%)

- Tariffs =

short-term volatility

- Jobs =

signs of resilience

- Inflation =

central bank decisions ahead

The Week Ahead: Liberation Day or Market Meltdown? | by NordFX | Coinmonks | Mar, 2025

The Week Ahead: Liberation Day or Market Meltdown? | by NordFX | Coinmonks | Mar, 2025