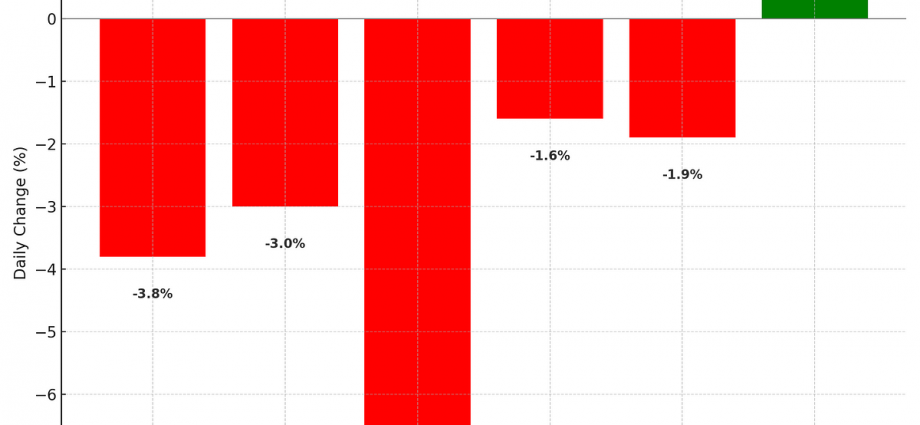

Hong Kong tech index

Japan’s policymakers

Despite January’s 0.5% hike, real rates still “significantly negative”.

One member sees rates at 1% by end-2025.

PM Ishiba plans swift anti-inflation steps after fiscal 2025 budget passes.

Inflation hit 3.6% in Dec 2024 — highest since Jan 2023.

Markets price out worst-case tariff fears ahead of Trump’s April 2

Targeted tariffs likely on 15 countries, not broad industry-wide.

Indonesia’s currency tumbles

PBOC allows banks to bid for different rates on 1-year loans — a new step in revamping monetary policy.

Chairman Joseph Tsai signals end to headcount decline after 12 quarters.

Says Xi Jinping’s recent meeting with tech leaders was a clear hiring signal.

• Oil (WTI): holding steady

• Gold: $3,015/oz

• USD Index: flat

• EUR: $1.0803

• JPY: ¥150.56

• bitcoin -1.6% to $86,504

• ether -1.9% to $2,045

Treasurer Jim Chalmers to announce

Expected deficit: A$40bn through June 2026 (vs Dec forecast: A$46.9bn).