Crypto World

24/7 Futures Trading for Modern Markets

Markets have modernized in almost every way—except one. Trading infrastructure has gone digital, execution is instantaneous, and information moves globally in real time. Yet most traditional markets still shut down on nights, weekends, and holidays.

This is where TradFi intersects with crypto-native infrastructure. Platforms like Phemex are narrowing that gap by listing TradFi futures—price-tracking contracts tied to assets such as gold and silver—on infrastructure built for continuous markets.

Spot trading vs futures contracts

Spot and futures markets work differently, and that difference explains why TradFi futures matter. Put simply, spot trading means you buy the asset itself at the current price, whereas a futures contract tracks price under contract terms rather than giving direct ownership.

In traditional spot trading, buying a share or commodity involves a complex chain of custody, legal ownership transfer, and T+2 settlement cycles. This infrastructure requires banks and clearinghouses to be open, which is why trading halts on weekends and holidays.

A futures contract is a derivative, an agreement based on the price of an asset, not the exchange of the asset itself. Because of this, there is no physical action or need for a transfer in the event of a closed exchange market.

When the market closes, only the conventional infrastructure ceases to function; assets retain their worth. Phemex fills this gap by delivering a marketplace where price discovery and risk management continue uninterrupted.

Macro News Don’t Wait for Monday

Traditional finance (TradFi) and cryptocurrency markets are increasingly moving in the same direction. As crypto trading has matured, digital asset prices have become more closely linked to macroeconomic indicators that have long driven equities and commodities.

Interest rate decisions by the U.S. Federal Reserve, inflation data, labor market reports, and geopolitical developments now influence both stock indices and major cryptocurrencies. This growing correlation has reshaped how traders think about risk, timing, and market access across asset classes.

The introduction of TradFi futures on crypto-native trading platforms allows traders to respond to macroeconomic developments in real time. Instead of waiting for traditional market hours, traders can hedge positions or manage volatility as events unfold—an approach that is increasingly central to modern risk management.

Whether it is hedging a position or capitalizing on volatility, the ability to execute trades based on real-time macro news is no longer a luxury,; it is a necessity for modern risk management.

Why TradFi Futures Matter for 24/7 Market Access

The 24/7 openness of markets, remaining functional even during holidays and non-working days, is not merely a new generation innovation; it represents the natural evolutionary progression of trading. In the traditional financial world, when the market is closed, uncertainty and suspense tend to take hold.

If a major event occurs over the weekend, traditional investors face significant gap risk, where the price jumps or drops substantially between Friday’s close and Monday’s open.

Through TradFi futures trading found on Phemex, traders can manage their positions at any time, day or night. This eliminates the waiting game that often leaves investors vulnerable to global news cycles that do not stop for bank holidays.

Unified Trading Across Crypto and TradFi Futures on a Single Platform

Phemex focuses on reducing the liquidity and access friction typical of traditional markets.

The platform offers USDT-settled derivatives linked to traditional assets such as gold, silver, and selected stocks, alongside crypto derivatives. This structure allows traders to access multiple asset classes from a single account, without opening separate brokerage relationships or navigating lengthy funding and settlement processes.

(USDT-settled derivatives mean that profits and losses are settled in USDT rather than through delivery of the underlying asset.)

Phemex operates a unified margin system, enabling the same USDT balance to be used across gold, silver, and crypto futures. Because these contracts track price rather than involve physical settlement, custody and operational complexity are reduced.

As with cryptocurrency perpetual contracts, TradFi futures can be traded with leverage, allowing traders to increase exposure and improve capital efficiency without committing the full notional amount typically required by traditional brokers. Historically, access to equities or commodities—whether via direct ownership, ETFs, or futures—often required substantial upfront capital and fragmented infrastructure.

As demand grows for continuous market access and more flexible risk management, crypto-native platforms are increasingly addressing these structural limitations. Phemex positions itself within this shift by offering infrastructure designed for continuous, multi-asset trading.

The Modern Market Is Open 24/7

Market evolution is no longer a question of if, but how. As crypto and traditional assets increasingly respond to the same macro forces, their separation at the infrastructure level has started to break down.

The objective isn’t to replicate stock exchanges on crypto platforms. It’s to build faster, more flexible systems that allow traders to access traditional asset exposure with the efficiency they expect from modern markets.

Phemex is approaching this by replacing ownership friction with futures-based access. By using price-tracking contracts rather than physical settlement, traditional assets can be traded alongside crypto within a unified, USDT-settled environment.

Moving into the second quarter of 2026, trading across asset classes from a single margin currency is no longer a differentiator; it’s becoming the baseline for how modern markets operate.

As part of the launch of its TradFi futures offering, Phemex has introduced a limited-time campaign aimed at familiarizing traders with the new product. The campaign includes a temporary zero-fee trading period, loss-protection incentives for first trades, trading leaderboards, and task-based rewards. The initiative is designed to support early adoption and allow traders to explore TradFi futures within a controlled, risk-aware framework.

Crypto World

Global X says double down on emerging markets

It may be time to dive deeper into the emerging markets trade.

Despite risks tied to the war with Iran, Global X ETFs’ Malcolm Dorson points to weaker dollar trends and uncertainty at home as a tailwind for the group.

“It might be time to double down,” the firm’s senior portfolio manager told CNBC’s “ETF Edge.”

He expects a burst of U.S. war spending will soften the greenback, which jumped this week, and create a favorable backdrop for emerging markets.

When asked about whether the dollar’s near-term strength could stick, Dorson responded, “for sure.”

However, it’s not his base case.

“A lot of people are trying to say this is going to be over in a week or two. We’re not sure,” he said. “However, I do think there are a lot of reasons to take advantage, to buy the dip here [in emerging markets.]”

As of Wednesday’s market close, the iShares MSCI Emerging Markets ETF (EEM) is off more than 5% week to date. It’s still up almost 37% over the past year.

VettaFi’s Cinthia Murphy also sees advantages by putting money to work abroad and finds investors have grown accustomed to geopolitical noise.

“There is no question that international has been the flavor of the year,” the firm’s director of research said.

Murphy indicates energy is the area to watch if the Iran conflict becomes prolonged.

“European markets are super dependent on energy and oil coming out of the Middle East,” she said. “So, I think it could really shake things up a lot.”

Murphy listed the United States Oil Fund (USO) as a potential way to play energy. It’s up 12% so far this week and up 32% this year, as of Wednesday’s close.

Crypto World

US Bitcoin Reserve Has No Purchase Plans

One year ago, US President Donald Trump signed an executive order establishing a strategic crypto stockpile. Now, one year later, its value has decreased by billions.

At the beginning of his administration, Trump formed a working group to study how the government could best implement and regulate crypto. This included the Bitcoin (BTC) and crypto reserves.

Much has happened since. The first year of the Trump administration brought a number of macroeconomic and policy changes. Some of these, like new, friendly regulations from Washington, have been good for crypto. Others, like punitive tariffs and geopolitical escalation, have not.

Now the US’ crypto stockpile sits, with its token reserves largely unchanged since its establishment.

Little change in Trump’s crypto stockpile

On March 6, Trump formed the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile by executive order.

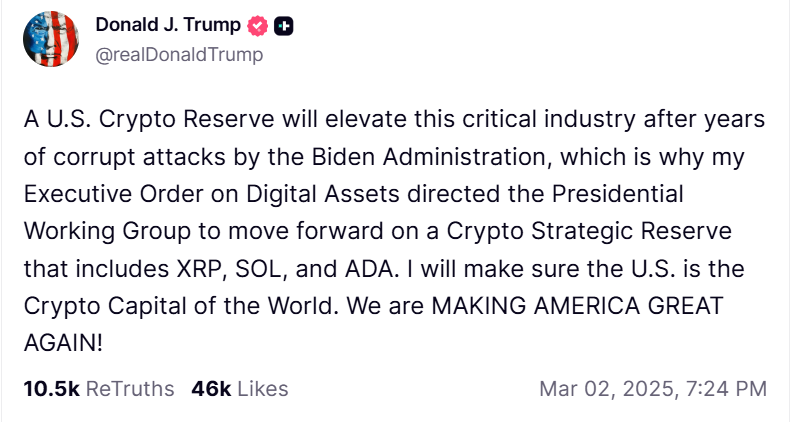

The Bitcoin reserve would comprise solely that asset, while the crypto stockpile would be a diverse collection of altcoins. Ahead of the executive order, Trump said that it would include XRP (XRP), Solana (SOL) and Cardano (ADA).

Both would “not acquire additional assets for the U.S. Digital Asset Stockpile beyond those obtained through forfeiture proceedings.”

The order effectively consolidated the forfeited assets, which at the time were spread across many different federal regulatory and law enforcement agencies. According to the order, it would also create an opportunity for the government to capitalize on the seized crypto.

“Taking affirmative steps to centralize ownership, control, and management of these assets within the Federal government will ensure proper oversight, accurate tracking, and a cohesive approach to managing the government’s cryptocurrency holdings,” the order stated.

The government does not publish the exact details of either the Bitcoin reserve or the crypto asset stockpile, but blockchain analysis firm Arkham Research has identified several blockchain wallets associated with the US government.

At publishing time, government crypto holdings are valued at $22,393,867,000, some $22 billion of which alone is Bitcoin. Other major holdings are stablecoin USDC (USDC), Ether (ETH), Wrapped Bitcoin (WBTC) and BNB (BNB).

How much these assets constitute the formal stockpile itself, or how and whether they were moved, is still not public information. But the dollar value has fallen significantly. According to Arkham, the US’ cumulative holdings were worth over $30 billion when Trump signed the order. At publishing time, they are worth $22 billion, a 26% decrease.

The White House appears unshaken by this. Deputy Press Secretary Kush Desai said regarding the recent price slump, “Volatility in a free market in which the government does not set prices is not going to change the Trump administration’s commitment to ensuring American dominance in cryptocurrency and other cutting-edge technologies of the future.”

Bitcoin token balance unchanged with no plans to buy

Despite hopes from Bitcoin maximalists that the US would start buying Bitcoin, the balance remains unchanged. Since the executive order, the US government has held 328,272 BTC.

The token balance of Ether, the next top asset by holdings in the US government’s portfolio, dropped off following the executive order, suggesting either an exchange or transfer. But after April 2025, the token balance stayed much the same.

Tether’s USDt (USDT), the largest stablecoin by token balance in the US’ portfolio, saw a significant jump in May 2025 of over 200 million tokens, before decreasing to pre-March 2026 levels.

These buying and selling patterns are not particularly clear. As noted above, the government makes no public disclosures about volumes.

While the new crypto reserve strategy did not completely preclude the government from buying Bitcoin, it required any purchases to be done in a budget-neutral fashion. AI and crypto czar David Sacks said last year, “It cannot add to the deficit, it cannot add to the debt, it cannot tax the American people.”

“It won’t cost the taxpayer dimes, but if the secretaries can figure out how to accumulate more bitcoin without costing taxpayers anything, then they are authorized to do that.”

One year on, it isn’t clear how or whether the administration has developed such a strategy.

Jason Yanowitz, co-founder of crypto firm Blockworks, told the BBC last year that a crypto stockpile made of several different assets could negatively impact markets. “Without a clear framework, we risk arbitrary asset selections, which would distort the markets and drive a loss of public trust.”

“Ensuring transparency through independent audits and public reporting is crucial for fostering innovation instead of favouritism,” he said.

The idea of Bitcoin reserves, be they at the state or corporate level, grew last year following the success of software company-cum-Bitcoin investment vehicle Strategy. The narrative of Bitcoin as digital gold made holding the asset an attractive prospect for government budgets.

According to data from tracking site BitcoinTreasuries.net, 10 countries hold Bitcoin, including the US, China, Ukraine, El Salvador, the United Kingdom and North Korea.

At the corporate level, analysts are expecting consolidation as the bear market continues. Wojciech Kaszycki, chief strategy officer of crypto infrastructure and treasury company BTCS, previously told Cointelegraph that companies with Bitcoin treasuries below net asset value will be acquired by operating businesses.

Bitcoin reserves are still a new idea that has yet to be tested in the depths of crypto winter.

Magazine: Bitcoin may face hard fork over any attempt to freeze Satoshi’s coins

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

Revolut Renews US Banking Push with Charter Application and New US CEO

Fintech company Revolut has filed a new application for a US national bank charter as it renews its push into the North American market, marking the company’s second attempt to secure a US banking license.

The London-based company said Thursday that it submitted an application to the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation to establish “Revolut Bank US, N.A.”

The company also appointed fintech veteran Cetin Duransoy as the company’s new US CEO. Duransoy brings more than two decades of experience in banking, payments and technology. He previously served as US CEO of fintech marketplace Raisin. Duransoy replaces Sid Jajodia, who will remain with the company as global chief banking officer.

“The United States is a key pillar of our global growth strategy,” Revolut founder and CEO Nik Storonsky said. “Filing for a national bank charter is a major milestone toward our vision of building the world’s first truly global banking platform,” he added.

Related: Stripe-Owned Bridge Gets OCC Conditional Approval for Bank Charter

US bank charter would unlock nationwide operations

If approved, the license would allow Revolut to operate under a single federal regulatory framework across all 50 US states. The charter would also give the company direct access to payment systems such as Fedwire and ACH, enable it to offer insured deposits through the FDIC and expand into products such as personal loans and credit cards.

Revolut previously attempted to secure a US banking license in 2021 through California regulators. That effort stalled and was eventually withdrawn in 2023 following regulatory hurdles and internal control concerns.

Revolut says it currently serves over 70 million customers globally and operates in 40 markets. In November 2025, the company completed a secondary share sale that valued the company at $75 billion.

Revolut’s move to apply for a US banking license comes as the company shifts away from earlier plans to acquire an American bank as it expands globally.

Related: Nubank wins conditional US approval to form national bank

More fintech firms seek OCC bank charters

More fintech and crypto firms are seeking US banking licenses through the OCC. In January, Nubank received conditional approval from the regulator to establish a national bank in the United States, while crypto exchange Crypto.com secured similar approval in February.

In December 2025, the OCC also conditionally approved five national bank charter applications for Circle, Ripple, BitGo, Fidelity Digital Assets and Paxos.

Big Questions: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Game developer Sillytuna reports losing $24M of crypto in UK ‘wrench’ attack

Game developer and erstwhile crypto enthusiast Alex Amsel, aka Sillytuna, has reported being forced to hand over almost $24 million worth of crypto in a violent robbery.

The attack involved “weapons, kidnap and rape threats,” according to Amsel’s post on X. He reports being “bruised,” and suggests that attackers had “axes over [his] hands and feet.”

He’s also appealed to “all those who trace such things,” and has offered a 10% bounty of any funds recovered, “even if you were involved.”

Read more: Copy, Paste, Rekt: Ethereum address poisoning strikes again

The transfer was flagged by blockchain security firm Peckshield, which seemingly assumed the loss was due to “address poisoning.” Amsel responded to the post to deny the claim, but multiple crypto news outlets ran with the address poisoning angle regardless.

These reports also mention the physical attack, indicating either a misunderstanding of what an address poisoning attack is, or an inability to differentiate between a copy-paste error and a violent kidnapping.

Similarly, Alex Svanevik, CEO of analytics platform Nansen, posted an AI analysis which identified the incident as address poisoning, and recommended contacting Maker to freeze the DAI (which isn’t possible).

However, Svanevik does admit that the analysis is “experimental” and may be “incorrect.”

In a message to Protos, Amsel said, “I can’t divulge any more info than I have on Twitter but it’s nothing to do with poisoning.

“I’m not anon so not hard to track down IRL, nor are many other peope who sadly this is going to happen to if we don’t crack down and show you can’t walk away with the money.

“There are substantial efforts behind the scenes as I’m acutely aware that timing is critical.”

Follow the money

Shortly after 5pm UTC on Wednesday, $23.6 million of Aave-USDC was transferred to the attackers on Ethereum.

Blockchain analytics firm Arkham traced the onward movement of funds. The majority of funds are held in two Ethereum addresses which hold $20 million in the (unfreezable) DAI stablecoin.

Additionally, the attackers bridged around $2.5 million to Hyperliquid via Arbitrum, using Wagyu accounts to withdraw as privacy coin monero. A further $1 million was bridged to bitcoin via LiFi.

Wagyu’s developer came under harsh criticism from the crypto security community for not blocking the transfers. The developer, who goes by the pseudonym PerpetualCow, defended themselves, claiming they were sleeping while the transactions were ongoing; they also insist they “didn’t make any money off this.”

Yesterday’s incident is the latest in a line of increasingly common physical attacks on crypto users, often dubbed “wrench” attacks, in reference to a viral xkcd comic.

These attacks often follow the leaks of personal data of crypto-linked individuals.

Read more: DeFi karma: Garden hacked for $11M after bridging Lazarus’ loot

End of the road

In December of last year, Sillytuna posted a blog to Medium, in which he says he’s left crypto behind.

The industry, he wrote, “became dominated by Silicon Valley, the worst of tech bros, and the ever present scammers.”

Despite crediting crypto with being able to “semi-retire and go back to my love of making indie games,” he felt unable to “stand by and support the direction things have gone, politically and otherwise.”

In response to the robbery, he jokingly said the “worst thing about all this” is being called a crypto influencer. The funds were “long-term holdings” set aside for “future causes, open source, that kind of thing.”

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Amprius Technologies (AMPX) Stock Surges 8% on Strong Q4 Earnings Beat

Key Highlights

- Q4 earnings per share reached -$0.01, surpassing analyst consensus of -$0.05 by $0.04

- Quarterly revenue totaled $25.23M, exceeding Wall Street projections of $22.91M–$24.5M

- Shares climbed approximately 8% to reach $12.56 in Wednesday trading

- Company insiders offloaded more than 2.39 million shares valued at roughly $26.4M during the previous quarter

- Analyst consensus rating stands at “Moderate Buy” with a mean price target of $16.63

Amprius Technologies delivered quarterly results that exceeded analyst projections, propelling shares higher by roughly 8% during Wednesday’s session.

The battery technology company reported quarterly earnings per share of -$0.01, outperforming Wall Street’s consensus forecast of -$0.04 to -$0.05 by $0.03 to $0.04. Quarterly sales registered at $25.23 million, surpassing analyst expectations that spanned from $22.91M to $24.5M.

Shares concluded midday trading at $12.56, representing a $0.93 gain for the session. Volume activity hit 9.53 million shares, exceeding the typical daily average of 8.12 million.

Amprius Technologies, Inc., AMPX

However, beneath the positive earnings surprise, the financial metrics reveal ongoing profitability challenges. The company recorded a net loss of $24.4 million for the quarter, representing a significant increase from the $11 million loss reported in the comparable year-ago period.

Net margin registered at -53.16% while return on equity came in at -38.85%. While these figures remain deeply negative, investors appeared to focus primarily on the upside earnings surprise and improving operational trajectory.

Looking forward to fiscal 2026, company management issued guidance calling for EPS of approximately -$0.06, indicating continued red ink in upcoming quarters.

Notable Insider Transaction Activity

While market participants reacted positively to the quarterly results, recent insider selling activity suggests a more measured outlook from company leadership.

Chief Technology Officer Constantin Ionel Stefan divested 492,827 shares on January 22nd at a mean price of $12.04 per share, generating proceeds of approximately $5.93 million. This sale reduced his ownership position by 39.7%.

Board member Kang Sun unloaded 950,548 shares on January 16th at $11.07 per share, totaling roughly $10.52 million in proceeds — representing a 40.38% decrease in his holdings.

Cumulatively, company insiders have disposed of 2,392,269 shares valued at approximately $26.4 million during the preceding three-month period. Current insider ownership stands at 12.8% of outstanding shares.

Institutional investors control 5.04% of the company. Bank of America expanded its position by 31.1% during Q4, while Rhumbline Advisers boosted its holdings by 61.1%.

Wall Street Analyst Coverage and Targets

The analyst community maintains a generally optimistic outlook on AMPX shares.

Needham launched coverage on January 29th, assigning a Buy rating alongside a $20 price objective. Craig Hallum initiated coverage on February 23rd, also establishing a Buy rating with a $17 target.

Cantor Fitzgerald upgraded its price target from $12 to $16 while maintaining an Overweight rating. Oppenheimer reiterated an Outperform rating with a $17 target in December.

Weiss Ratings represents the sole bearish voice, continuing to maintain a Sell rating.

Currently, eight analysts assign Buy ratings to the stock, while one maintains a Sell recommendation. The overall consensus rating is “Moderate Buy” with a mean price objective of $16.63.

The equity has traded within a 52-week range of $1.70 to $16.03 and has delivered a remarkable 506% return over the trailing twelve months.

Amprius management is slated to participate in the Cantor Global Tech Conference along with additional investor meetings scheduled for March, which the company highlighted as part of its ongoing shareholder engagement initiatives.

Crypto World

Will Elon Musk’s X Money Feature Crypto Integrations? What We Know So Far

As part of his ideas when acquiring Twitter a few years ago, Elon Musk touted the plan of turning it into the “everything up.” An important missing piece of that plan for X is its payments arm – X Money.

It appears that the effort is starting to take shape. With Musk’s extensive history and involvement in the crypto industry, the question many now ask is – will it have crypto integrations?

Already Live in Closed Beta

During a presentation in February 2026, Elon Musk said that X Money is already live and that the app is being handled in a closed beta within the company.

He also confirmed that it should soon move to a limited external beta before eventually rolling it out worldwide.

This is further confirmed by the fact that William Shatner was tapped by the company to give out invites.

Shatner himself shared some screenshots, while also outlining that the app will feature a debit card with cashback available.

Here’s a few more screenshots. There’s a debit card with cash back too! 😳😱 pic.twitter.com/yeKE1gXAjQ

— William Shatner (@WilliamShatner) March 3, 2026

You may also like:

What About Crypto, Though?

Musk has been pretty vocal in his involvement with the industry, especially when it comes to Dogecoin. Let’s not forget that he spearheaded a government agency that carries the DOGE abbreviation after all. Amusingly enough, his posts about the meme coin have caused multiple massive price pumps.

Indeed, it seems that the most entertaining outcome is the most likely.

Musk reposted a tweet by Teslaconomics, which, among other things, outlined the following:

… Then, there will be high-yield savings, you can invest, you can get loans, have money market accounts, maybe even treasury access, cool smart cashtags that let you see live stock prices in your timeline and execute trades seamlessly, crypto integration, potentially full asset management…

Musk simply said, “This will be big.”

But what does it mean for crypto? Well, even if X Money does support crypto payments, it wouldn’t be the first one. Many financial applications, including Revolut, support crypto transactions. Even PayPal does.

So, it’s not necessarily a major catalyst to look forward to, but it certainly cements cryptocurrencies’ place in general finance when it comes to retail-facing applications.

That mass adoption really seems to be en route.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Palladyne AI (PDYN) Stock: Revenue Decline Masked by Surging Backlog and Defense Expansion

Key Takeaways

- Annual 2025 revenue decreased 33% to $5.2 million, while fourth-quarter revenue surged 118% year-over-year to reach $1.7 million

- Full-year operating losses expanded to $32.4 million, yet GAAP net income reached $10 million driven by warrant fair value adjustments

- November 2025 brought three strategic acquisitions — GuideTech, MKR Fabricators, and Warnke — expanding into avionics, fabrication, and precision machining

- Backlog expanded to approximately $18 million by mid-February 2026, supporting management’s 2026 revenue forecast of $24–$27 million

- First commercial customer signed for Palladyne IQ 2.0, plus new missile propulsion subsystem agreement secured with defense prime contractor

Palladyne AI experienced a challenging revenue year in 2025, yet the underlying narrative centers on strategic groundwork being laid for future expansion.

Annual revenue totaled $5.246 million, representing a 33% decline compared to 2024. The reduction stemmed from discontinued legacy hardware sales that were non-recurring and delays in services milestone recognition. While the full-year number appears concerning, the fourth-quarter performance paints a contrasting picture — Q4 revenue skyrocketed 118% year-over-year to $1.7 million.

Operating losses grew to $32.4 million compared to $26.9 million in the prior year. Research and development expenditures increased 24% to $12.9 million as the organization accelerated software validation and product innovation initiatives.

Net income registered at $10 million annually, reversing from a net loss of $72.6 million in 2024. This turnaround was primarily attributable to warrant fair value fluctuations rather than operational performance.

Basic earnings per share reached $0.26, while diluted EPS came in at $0.24.

Strategic Acquisition Strategy

November 2025 represented a transformative period for Palladyne. The company completed three strategic acquisitions — GuideTech, MKR Fabricators, and Warnke Precision Machining. These transactions integrated avionics design, fabrication services, and precision machining operations into the company’s portfolio.

These newly acquired manufacturing divisions contributed $0.6 million in revenue during their initial operating period. While modest initially, this figure demonstrates the company’s evolution beyond pure software development.

The organization also established Palladyne Defense during 2025, representing a deliberate expansion into defense contracting that extends considerably beyond its core autonomy software offerings.

Progress in Software, UAV Systems, and Aerospace

Palladyne IQ 2.0 achieved commercial launch in 2025, with the company securing its first revenue-generating customer for the solution. The organization also successfully demonstrated collaborative autonomous swarm coordination between its Gremlin-X UAV and Red Cat systems — representing a significant technical achievement for its SwarmOS platform.

A missile propulsion subsystem agreement was finalized with an additional defense prime contractor, broadening the company’s program portfolio.

In the aerospace sector, Palladyne deepened its collaboration with the Air Force Research Laboratory and Portal Space Systems. The company secured an additional patent while submitting several applications focused on swarming technologies and decentralized autonomy frameworks.

The organization appointed a new President of Commercial and Industrial to spearhead expansion in civilian market segments.

Backlog measured $13.5 million at 2025 year-end. By mid-February 2026, it had climbed to approximately $18 million — predominantly with secured funding.

Management confirmed its 2026 revenue projection of $24 million to $27 million. The latest analyst coverage on PDYN assigns a Buy rating with an $11.00 price target.

Crypto World

Berkshire Hathaway begins repurchasing shares, CEO Greg Abel buys $15 million in stock

Greg Abel speaks during the Berkshire Hathaway Annual Shareholders Meeting in Omaha, Nebraska on May 3, 2025.

CNBC

Berkshire Hathaway said Thursday it has resumed repurchasing its own shares for the first time since 2024 and separately new CEO Greg Abel purchased $15 million worth of stock himself, an amount equal to his after-tax annual salary.

Abel told CNBC he will continue using his full salary amount to purchase Berkshire shares every year.

The Omaha-based conglomerate disclosed in a regulatory filing that it began buying back its Class A and Class B shares on Wednesday. Berkshire’s policy allows the company to repurchase stock whenever the chief executive, after consultation with the chairman of the board i.e. Warren Buffett, believes that the repurchase price is below Berkshire’s intrinsic value, according to its annual report released over the weekend.

“I absolutely talked to Warren. So how I approached it was, obviously looking at the value, having a view of intrinsic value, consulted with Warren relative to the value and the timing,” Abel told CNBC’s “Squawk Box” on Thursday.

Abel said normally the company wouldn’t disclose the start of the repurchases. “We felt it was important to communicate to our shareholders, our partners, our owners, with the transition of leadership,” he said.

Abel took over for Buffett, 95, in January. Shares of Berkshire have fallen 3% this year and 10% from their record high last May. The stock came under pressure earlier this week after the firm reported a near 30% decline in its operating earnings for the fourth quarter, due in large part to weakness in the insurance business.

The last time Berkshire repurchased shares was the second quarter of 2024. Berkshire B shares added 1% in early trading Thursday following the news.

Abel’s personal buying

In a separate filing, Abel disclosed that he personally purchased $15 million worth of the conglomerate’s stock. The 62-year-old executive’s purchase came a little more than two months into his tenure running the Omaha-based conglomerate.

The transaction increases his personal stake in Berkshire at a time when some investors have questioned whether Buffett’s successor has comparable “skin in the game.” Buffett owns about 37.5% of Berkshire’s Class A shares and has no intention of selling his stake aside from his charitable giving. He has previously said the conglomerate represents roughly 99.5% of his net worth.

“Absolute alignment with our shareholders, our partners, our owners, is critical,” Abel told CNBC. “I already have some shares, but the goal was to continue to demonstrate alignment with them… As the CEO, I absolutely, obviously, believe in Berkshire. with the transition from Warren, and I inherited a company that has an incredible foundation.”

Before the latest purchase, Abel, a longtime Berkshire executive who previously oversaw the company’s non-insurance operations, owned $164.4 million worth of Berkshire stock, according to FactSet.

The CEO said he was committed to doing this every year he is at the helm of Berkshire, which Abel said he hopes is “20 years.”

Abel has emphasized continuity with Buffett’s investment philosophy since taking the helm. He used his first annual shareholder letter over the weekend to reassure investors that the conglomerate’s culture of financial conservatism and disciplined investing will continue “into perpetuity.”

Crypto World

Why is the crypto market up today? Bitcoin and utility protocols reveal on-chain whale inflows

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Fresh institutional inflows into Bitcoin are driving a crypto market rebound, while on-chain data shows whales increasingly moving capital into utility protocols like Mutuum Finance.

Summary

- U.S. spot Bitcoin ETFs saw about $458m in net inflows, helping BTC recover to around $68k after weekend volatility.

- Funds such as iShares Bitcoin Trust (IBIT) from BlackRock led the inflows as institutions treated the recent decline as a buying opportunity.

- Mutuum Finance has raised over $20.7m and launched its V1 lending protocol on the Sepolia testnet, signaling growing interest in utility-driven projects.

The digital asset market is experiencing a notable upward trend. This recovery follows a weekend of high volatility where geopolitical tensions briefly pushed prices lower. The current rally is largely driven by a significant return of institutional confidence, particularly through U.S.-based spot Bitcoin ETFs. Market data shows that large investors are not only stabilizing the “king of crypto” but are also beginning to shift their focus toward emerging utility protocols that offer functional financial tools.

Bitcoin

The primary reason for today’s market surge is the aggressive buying behavior from institutional investors. On Monday, March 2, U.S. spot Bitcoin ETFs recorded approximately $458 million in net inflows. This massive injection of capital effectively absorbed the “weekend shock” that had briefly sent Bitcoin tumbling toward the $63,000 level. By Tuesday morning, Bitcoin had reclaimed the $68,000 mark, signaling a swift rejection of the lower price range.

BlackRock’s IBIT fund remains the dominant force in this recovery, accounting for roughly half of the recent inflows. Over the last three trading sessions alone, U.S. spot ETFs added nearly $1.1 billion in total. This level of buying suggests that institutional desks are treating the recent war-driven volatility as a “dip-buying” opportunity.

In addition to direct ETF buying, the options market shows a measured response to recent headlines. While short-term volatility briefly spiked, it retraced quickly. This indicates that traders are hedging for short-term risks rather than preparing for a long-term bear market. With Bitcoin holding steady near $68,000, the “leverage flush” that occurred in February appears to be over, leaving the market in a much healthier position for growth throughout March.

Utility protocols reveal on-chain whale inflows

While Bitcoin provides the market’s foundation, on-chain data shows that “whales” are increasingly moving capital into utility protocols. These are platforms that provide financial services—like lending, borrowing, and yield generation. As the top-tier market recovers, these utility projects often see the highest growth because they offer yield generated from protocol fees.

One project in this space is Mutuum Finance (MUTM). Mutuum Finance is a decentralized lending protocol that has raised over $20.7 million from a global base of 19,000 investors. Currently, the MUTM token is priced at $0.04. The steady growth of its investor base suggests that whales are looking for projects with high technical transparency and a clear path to delivery.

The power of a detailed roadmap

Utility protocols historically attract large-scale capital by providing a well-explained and detailed roadmap. Professional investors prefer projects that deliver their technology piece by piece. When a team consistently meets its development goals, it builds trust that makes it more attractive during market recoveries. By showing exactly how the technology will scale, these protocols reduce the perceived risk for large-holders.

The Mutuum Finance roadmap is divided into clear phases aimed at building a full-suite decentralized bank. The project is currently in Roadmap Phase 3, but the overall roadmap focuses on:

One-click borrow presets: Simplified risk profiles (Safe, Balanced, Aggressive) to make DeFi accessible to non-technical users. This feature is already integrated into the V1 protocol on the Sepolia testnet, allowing the community to test how these presets adjust the Stability Factor.

Buy-and-redistribute mechanism: Using protocol fees to buy MUTM tokens and reward those who stake in the “Safety Module.” This mechanism is specifically designed to create consistent MUTM buy pressure in the long run, linking the protocol’s growth and transaction volume to the market demand for its native token.

Native over-collateralized stablecoin: The team is planning a native over-collateralized stablecoin to provide a stable medium of exchange within the ecosystem, backed by the interest-bearing assets. This digital asset is designed to maintain its peg through redundant value backing, allowing users to mint liquidity against their holdings without selling their underlying positions.

Layer-2 expansion: To reduce costs, the protocol will expand to L2 networks, ensuring fast and cheap transactions for all users as the platform scales. This migration will significantly lower the gas fees associated with frequent interactions like interest compounding or adjusting collateral positions.

What Mutuum Finance has already delivered

Mutuum Finance has already delivered its functional V1 protocol on the Sepolia testnet. This allows its 19,000 investors to test lending & borrowing mechanisms and core features such as mtTokens (yield-bearing receipts) and automated liquidation bots in a live risk-free environment.

The project has also secured a manual security audit from Halborn and a high safety score from CertiK. By providing a working testing environment before the full mainnet launch, Mutuum is proving that it can meet its technical milestones, which is exactly the kind of delivery that attracts long-term whale interest.

The crypto market’s upward move today is a classic example of institutional “dip-buying” meeting technical delivery. With $458 million flowing into ETFs and Bitcoin stabilizing at $68,000, the path is clear for utility protocols to take center stage. Mutuum Finance, which combines a $20.7 million funding base with a functional V1 protocol, is benefiting from this shift in whale focus.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

NYSE-owner ICE forges strategic partnership with crypto exchange OKX

Global trading giant Intercontinental Exchange (ICE) has begun a strategic partnership with cryptocurrency trading firm OKX to launch new products.

The deal will see the New York Stock Exchange owner license OKX’s spot crypto prices for crypto futures products, and OKX offer ICE futures and tokenized equities, the companies said on Thursday.

ICE also made a strategic investment in OKX, reflecting a valuation of $25 billion, according to a press release. The terms of the investment were not disclosed.

Alongside the investment, ICE will have a board seat on OKX’s board of directors and establish a broad collaboration to leverage OKX’s blockchain infrastructure alongside ICE’s market technology, said the release.

The joint venture will also aim to advance clearing and risk management solutions, multi-chain custody and wallet architecture, the companies said.

“Our strategic relationship with OKX will expand global retail access to ICE’s pre-eminent regulated markets and accelerate our plans to offer on-chain infrastructure and tokenized assets to U.S. investors,” said Jeffrey C. Sprecher, ICE chair and CEO.

The relationship brings together the operators of two high-performance matching engines and transparent order books, said Star Xu, founder and CEO of OKX, “to help build a more reliable market structure that bridges digital assets and equities, strengthens cross-market price formation, and meets institutional standards for risk and compliance.”

OKX global managing director, Haider Rafique – who played an instrumental part in securing the deal with ICE – said via email: “This relationship is truly unique. We couldn’t be more excited about the new opportunities and products we’ll be able to unlock by collaborating with such a respected and focused partner.”

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

Tech7 hours ago

Tech7 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World7 days ago

Crypto World7 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business7 days ago

Business7 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes