Cryptocurrency

All Been Crypto — Week 25 April 2025 | by Bat Tai Chi | Coinmonks | Apr, 2025

Apologies for the lack of a letter last week but it was Easter and I was out needed to touch some grass. We’ve finally had a decent green week with BTC touching back above 93k up 10% Wow and ETH at 1800 +11% bringing our total market cap back to 3tr. Major outperformers where however TRUMP +60% after reports that top holders would be invited for private dinner with him, and SUI +55% on rumors of a collaboration with Pokémon. On the flipside we had OM which dropped >90% past 2 weeks with ongoing drama and fingerpointing at exchanges MM and the founding team. In the news we have a new CEO of the TON foundation, more capital market updates with new crypto investment vehicles launched and existing upsized, Vitalik proposing a move away from EVM long term, Russia’s central bank mulling to have their own crypto exchange and the FED withdrawing crypto related guidance for banks. Enjoy the good times while they last!

Bat Tai Chi — btc21@mail.com

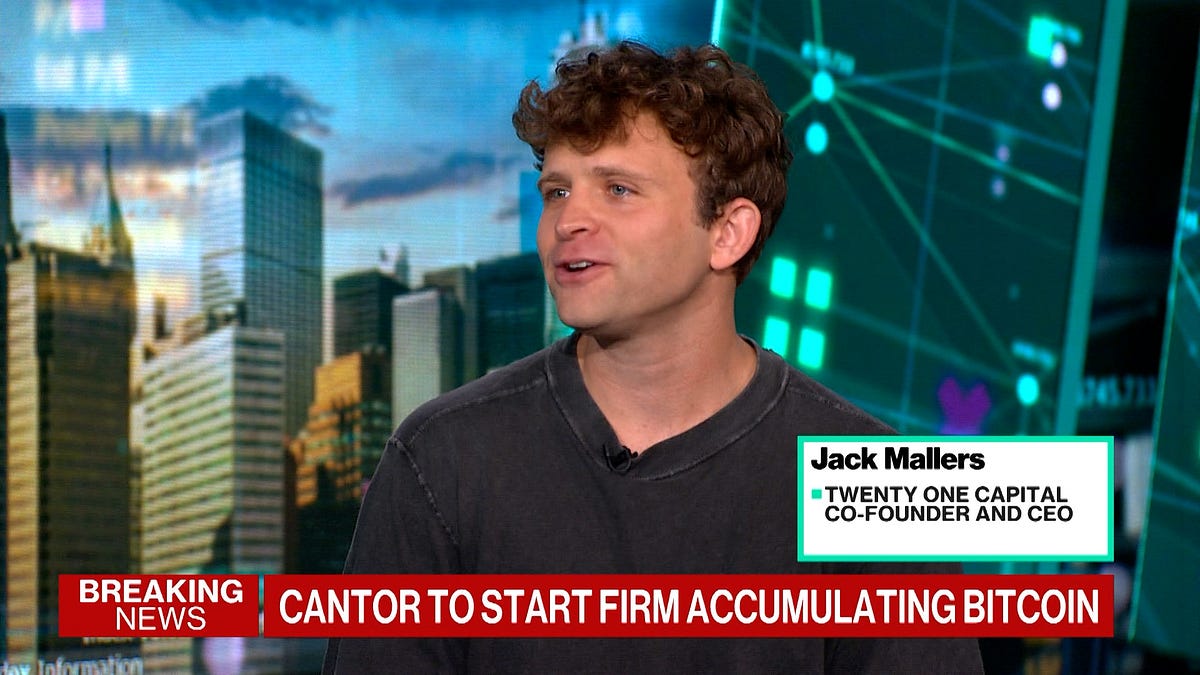

One sign of our industry becoming more and more entrenched with wallstreet is the engagement and sheer pace at which new vehicles are being now launched to give access/levered access to the asset class. Yes there are multiple ETFs launched with out side of TOP 10 coins and staking and I’m sure we’ll see more ‘creative’ ways to enhance returns via these vehicles but we also so ‘actively’ managed shell companies that are replicating the Michale Saylor playbook. There’s been two with SOL recently. Canada based SOL Strategy this week secured a 500mm convertible note to purchase more SOL and of course stake it inhouse. Then there’s Janover an outfit of ex Kraken executives that follows similar path of SOL purchases and self staking plus getting some business from Kraken. AND of course the headline Twenty One the SPAC from Cantro will be lead by Jack Mallers the CEO of Stripe and a well know BTC Maxi and will do pretty much what MSTR does, raise capital to buy BTC. Tether Softbank and Bifinex allegedly coming in with the 3bn in BTC to seed and then the vehicle is off to the races raising external capital but the ideas is to go further. They want to build financial products on Bitcoin, so potentially borrow lending ect. To enhance their key performance metric bitcoin per share. Very high quality players involved and so definitely one to watch out the gates. SPACs could also see a come back here then maybe? There’s the rumor mill already going wild on an ETH themed MSTR and more.

Since the start of the Ukraine war and the seizure of Russian overseas assets as well as the weaponization of SWIFT obviously the regime has more actively explored alternatives. There have been anecdotes of Russia using crypto for cross border trade with friendly/neutral nations and it’s an open secret that settling in BTC can help ease sanction pressure. Russian has also started to be more favorable of the industry by updating the tax code (see ABC 22 Nov 2024) thereby bringing it under the legal framework out of the grey. Now it seems like the country is going a step further as local media is mulling the intentions of setting up an exchange for qualified investors overseen by the Russian Central Bank and the Ministry of Finance. To be ‘qualified’ it seems like just a simple asset threshold would do. Individuals whose investments in securities and deposits exceed 100mm rubles (~$1.2mm), or annual income over 50mm rubles (~$600k).

EVM has been the winning blockchain programming language with only Solana’s Virtual Machine really coming close when you look at onchain activity and TVL. Now there are of course more choices but we have seen last cycle that many projects pivoted to also launch EVM which obviously helps bootstrap an initial ecosystem if you can easily port code from other functioning environments and simply fork the code. This has become somewhat a moat although not necessary for Etherum itself but for everyone using EVM. Now I don’t think anyone out there would argue that it’s the most performant and that there are no good sensible upgrades to be made but one of the main values is that it’s got wide adoption across existing infro, devs and is therefore also somewhat battle tested. Now as to the rational for this proposal it’s clear that Ethereum needs some way to scale long term and so there’s many options on the table, this is just one that would help with certain type on inscriptions. I’m no expert on RISC-V but apparently one of the primary benefits of RISC-V is its native support for certain kinds of encryption which would be of course superior than patching in all kinds of ZKverifications into the EVM. But we are talking Long Term here and this is an early stage proposal, the significance for me lies more in the fact that there seems to be more willingness from the EF to consider bolder more risky steps in the face of successful competition.

Our expectation is that with the changing regulatory environment, we are hopeful and likely to be able to launch direct spot crypto [trading] and our goal is to do that in the next 12 months

Charles Schwab Corp. CEO Rick Wurster

This [setting up a Crypto Exchange] will legalize crypto assets and bring crypto operations out of the shadows. Naturally, this will not happen domestically, but as part of the operations permitted under the experimental legal regime

Russian Finance Minister Anton Siluanov

At this point the magic of crypto is gone, and we’re at a “we know they know we know” point. There’s no unfathomable wonder, no distant frontier left. Some of the original magical ideas turned out to be right, such as bitcoin as SoV and public vs private blockchains. 95% of the idealism, hopes and dreams became -99% coins. For the last couple of years the once totally isolated, wonky and deeply idiosyncratic crypto community has become more mainstream, cross-pollinating with other futurist communities. As that’s happening it will also naturally become less crypto and more general technooptimism/-pessimism or even something like tpot The people that made the magic of crypto happen are beginning to influence society, in many cases by wielding the technology they grew up with, but also by using the strategies they learned in crypto to quickly adopt other technologies, such as AI, robotics, and perhaps even next gen biotech and transhumanism when it’s time for that

Rune Christensen — Founder of SKY (former MakerDAO)