Crypto World

Arthur Hayes predicts AI credit crisis as Bitcoin sounds liquidity alarm

Arthur Hayes believes Bitcoin is signaling that markets are underestimating a coming credit shock.

Summary

- Arthur Hayes argues Bitcoin is signaling a looming credit shock, citing its sharp drop from $126,000 to $60,000 while the Nasdaq remained relatively stable.

- He estimates AI-driven job losses among knowledge workers could trigger over $500 billion in consumer and mortgage defaults, potentially hitting U.S. bank equity by 13%.

- Hayes expects a deflationary phase first, followed by aggressive Federal Reserve money printing, which he believes would ultimately push Bitcoin higher.

In his latest Substack essay, “This Is Fine,” the BitMEX co-founder argues that Bitcoin (BTC) acts as a “global fiat liquidity fire alarm.” Its sharp drop from $126,000 to around $60,000, while the Nasdaq 100 remained relatively stable, reflects tightening dollar liquidity and rising deflation risk.

AI job losses may trigger $500B bank losses, Arthur Hayes says

Hayes links that risk to artificial intelligence. He estimates there are 72.1 million knowledge workers in the U.S., many of whom carry significant consumer debt and mortgages. If AI tools rapidly replace even 20% of those workers, he projects major stress for the banking system.

Using Federal Reserve data, Hayes calculates roughly $3.76 trillion in bank-held consumer credit, excluding student loans. He also estimates knowledge workers carry an average mortgage balance of about $250,000.

If widespread layoffs occur, he projects $330 billion in consumer credit losses and $227 billion in mortgage losses. After accounting for reserves, that would translate to roughly a 13% hit to U.S. commercial bank equity.

Hayes argues that while the largest “too big to fail” banks may withstand the shock, smaller regional lenders could face severe stress. Lending would tighten, credit would contract, and economic demand would weaken. Markets would first price in deflation before policymakers intervene.

He points to several early warning signs. Software and SaaS stocks have underperformed broader tech indices. Consumer staples are outperforming discretionary stocks, suggesting households are cutting back. Credit card delinquencies are rising. Meanwhile, gold has strengthened relative to Bitcoin, another sign of defensive positioning.

Despite the near-term risk, Hayes remains structurally bullish on Bitcoin. He argues that deflationary shocks eventually force the Federal Reserve to restart aggressive liquidity programs. Political tensions may delay action, but once banking stress intensifies, he expects policymakers to “print” on a large scale.

Hayes outlines two scenarios. Either Bitcoin’s drop to $60,000 marked the bottom and equities will follow lower before liquidity returns, or Bitcoin could fall further if credit conditions worsen. In both cases, he believes renewed monetary expansion would ultimately push Bitcoin to new highs.

For now, Hayes advises caution and limited leverage. The alarm may be ringing, but he argues the real opportunity comes when the money printer starts again.

Crypto World

US CLARITY Act Could Pass by April, Says Senator Bernie Moreno

The US CLARITY Act, a long-awaited framework intended to clarify how the United States will regulate the burgeoning crypto sector, could be on track for a congressional pass in the coming weeks, according to crypto-friendly policymakers. Senator Bernie Moreno suggested a potential April milestone as he spoke to CNBC in Florida, where he was touring President Donald Trump’s Mar-a-Lago resort. The remarks came as Coinbase CEO Brian Armstrong joined Moreno for a discussion that touched on market structure and the regulatory path forward at a gathering organized by the World Liberty Financial crypto forum.

Armstrong described the current climate as offering a “path forward” that might yield a balanced outcome for the industry, traditional banks, and American consumers. He noted that earlier iterations of the draft included provisions that would ban interest-bearing stablecoins and would place the U.S. Securities and Exchange Commission in a central regulatory role over crypto markets. Those elements proved problematic for the exchange and had contributed to a pause in its public backing for the bill. At the same time, members of the crypto community have emphasized the need for a predictable regulatory framework that can spur investment and innovation while protecting consumers and the broader financial system.

Moreno, who co-authored or championed the legislation’s bipartisan path, signaled that the sticking point on stablecoins—particularly the idea of rewarding users with yield—has shifted toward a more workable compromise. In his view, the debate over stablecoin rewards “shouldn’t be part of this equation,” and he indicated that lawmakers were looking to refine the language so it could pass with broad support. The discussion has not been simple, given the various interests involved, from traditional banking to fintech platforms and consumer advocates. But with executives from the crypto industry at the table alongside bankers and lawmakers, the atmosphere has become more conducive to finding a compromise that can be signed into law.

From the trading floor to the Capitol, the conversation has also been about market structure and consumer protections. Armstrong invoked a vision of a “win-win-win” scenario where the bill would advance the interests of the crypto industry, safeguard banks, and benefit American consumers by consolidating a coherent national framework. The idea is to harmonize the fast-moving crypto markets with existing financial regulations, reducing uncertainty for businesses and investors alike. The discussions have taken place against a backdrop of broader regulatory activity, including ongoing policy reviews at the White House and within Congress, and amid an intensifying push from both parties to deliver tangible crypto reforms.

The regulatory conversation has not occurred in a vacuum. Polymarket, a prediction market for crypto policy, offered a glimpse into market sentiment by showing the odds of the CLARITY Act passing in 2026 swing between 90% and roughly 72% around the time of the interview. The volatility in these odds underscores the uncertainty that still surrounds the drafting process and the political dynamics at play in a year marked by competing priorities for lawmakers. While Moreno suggested a constructive path forward, he also acknowledged that the timetable is influenced by technical details that still require resolution, particularly around stablecoins and the precise allocation of regulatory authority among federal agencies.

Key takeaways

- The CLARITY Act is gaining momentum in Congress, with a potential passage window cited as “April” by Senator Bernie Moreno in a CNBC interview conducted at Mar-a-Lago.

- Coinbase previously withdrew support over provisions that would ban interest-bearing stablecoins and centralize crypto regulation under the SEC, complicating the bill’s path; the White House reportedly viewed the move as a unilateral action.

- Armstrong and Moreno signaled a renewed effort to achieve a balanced compromise that would advance crypto market structure while addressing concerns from the banking sector.

- Market-facing sentiment on the bill has fluctuated, with Polymarket showing odds of passage in 2026 ranging from 90% to 72% around the talks.

- The discussions emphasize restoring clarity for market participants, investors, and consumers, potentially shaping the United States’ stance on crypto policy for years to come.

Sentiment: Bullish

Market context: The rhetoric around the CLARITY Act reflects a broader push for regulatory clarity in a volatile asset class, as lawmakers seek a stable framework to accommodate innovation while safeguarding financial stability and consumer protections in a rapidly evolving market.

Why it matters

The CLARITY Act represents more than a regulatory tweak; it signals a concerted attempt to establish a nationwide standard for crypto assets, a move that could significantly influence how exchanges, wallet providers, and fintech firms operate in the United States. By aiming to clarify which activities trigger regulatory oversight and which agencies oversee them, the bill seeks to reduce the current fragmentation that has left many market participants navigating a patchwork of state and federal rules. If enacted, the act could provide a predictable environment for investment, product development, and institutional participation, potentially attracting capital that has been cautious due to regulatory ambiguity.

However, the path to passage remains contingent on reconciling divergent priorities. The debate over stablecoins—whether to treat certain yields as permissible rewards or to prohibit certain yield-bearing mechanisms—highlights the trade-offs lawmakers face between fostering innovation and protecting financial stability. The White House’s reaction to Coinbase’s withdrawal illustrates the delicate political optics involved in crypto legislation, with officials wary of any moves that could cast the administration as unfavorably aligned with industry players or skeptical of robust consumer protections. As talks continue, stakeholders on all sides are watching for a clearer set of draft language that can win broad bipartisan support and withstand evolving regulatory scrutiny.

For investors and users, the potential passage of the CLARITY Act could usher in a period of relative regulatory certainty, enabling more precise risk assessment and potentially more defined product offerings. The balance being sought is delicate: too lenient a regime could invite operational risk, while overly restrictive provisions might stifle innovation and push activity offshore or into less regulated ecosystems. The ongoing discussions at the WLF crypto forum, coupled with public comments from industry leaders, show a sector eager for governance that protects consumers without quashing growth.

What to watch next

- Upcoming committee hearings or markup sessions in Congress that could reveal the final language of the CLARITY Act.

- Any revisions to stablecoin treatment within the bill, particularly around yield-bearing arrangements and consumer protections.

- White House statements or official remarks that signal shifting positions or tailored guidance on crypto regulation.

- Respective statements or filings from Coinbase and other major players to gauge industry alignment with the revised draft.

- Follow-up coverage on the World Liberty Financial crypto forum and any subsequent policy pledges or compromises announced by lawmakers.

Sources & verification

- CNBC interview at Mar-a-Lago featuring Senator Bernie Moreno and Coinbase CEO Brian Armstrong.

- World Liberty Financial crypto forum discussions on market structure and regulatory pathways.

- Coinbase withdrawal of support for the CLARITY Act and White House reaction documenting the administration’s stance.

- Polymarket odds page tracking the CLARITY Act’s passage probability in 2026.

- David Sacks statements cited by Cointelegraph regarding confidence in the bill’s trajectory.

US CLARITY Act gains momentum as lawmakers edge toward April passage

The ongoing dialogue around the CLARITY Act underscores a broader shift in how the United States intends to regulate crypto markets. As policymakers seek a cohesive and comprehensive framework, industry leaders are pushing for a balance that preserves innovation while ensuring consumer protection and financial stability. The discussions at the Mar-a-Lago event and the WLF crypto forum point to a willingness to negotiate, even if core points—from stablecoin policy to the SEC’s regulatory role—remain contested. If April proves to be a viable milestone, as Moreno suggested, lawmakers may be positioned to deliver a bill that could redefine the U.S. market structure for years to come. The unfolding narrative will likely influence investor sentiment, the trajectory of exchange policies, and the pace at which traditional financial institutions engage with crypto products in a regulated environment.

As the sector awaits more precise legislative language, participants will be closely watching for any signals that the political calculus has shifted enough to secure bipartisan support. The balance of risk and opportunity in the year ahead will hinge on how effectively the bill reconciles the industry’s demand for clarity with the banking sector’s emphasis on safety and soundness. The next few weeks could prove pivotal for a piece of legislation that many view as a potential turning point for mainstream crypto adoption in the United States.

Crypto World

Coinbase and Ledn Scale Crypto Lending Amid Market Dip

Digital asset lending company Ledn has completed the first-ever transaction of its kind in the asset-backed debt market, selling $188 million in securitized bonds backed by Bitcoin (BTC).

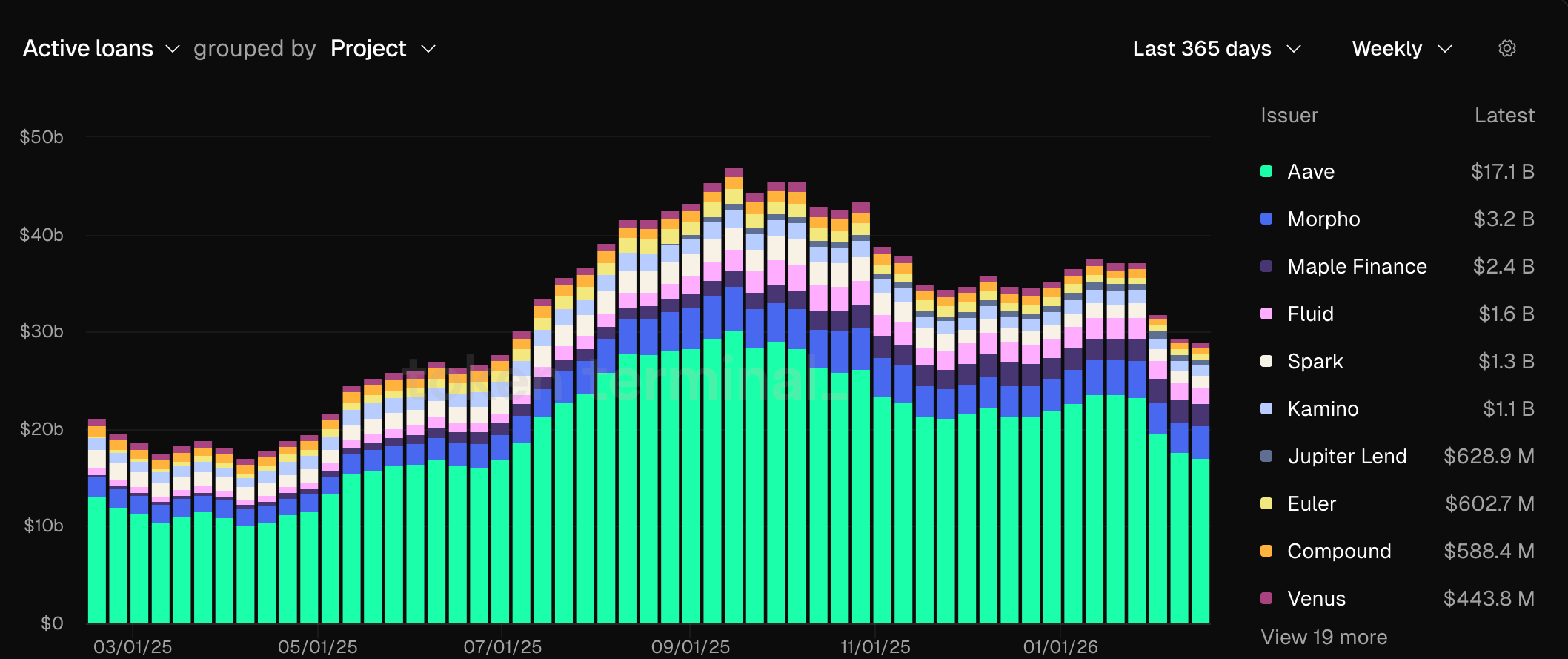

This development emerges as the lending market confronts a volatile environment. Active loans have fallen to around $30 billion, and liquidation risks are rising with persistent price declines.

Sponsored

Sponsored

Coinbase and Ledn Double Down on Crypto Lending

Bloomberg, citing sources familiar with the matter, reported that the deal consists of two bonds. One portion, rated investment-grade, was priced at a spread of 335 basis points above the benchmark rate.

According to a report from S&P Global Ratings, the bonds are secured by a pledge of 4,078.87 Bitcoin. The fair market value stands at approximately $356.9 million.

The loans carry a weighted average interest rate of 11.8%. Jefferies Financial Group Inc. served as the lead manager, structuring agent, and initial purchaser.

“Ledn’s liquidation engine is an algorithmic trading program that sources prices on multiple exchanges and/or is available through multiple trading partners. Ledn has successfully liquidated BTC collateral to repay 7,493 loans in its seven-year history, with an average LTV at liquidation of 80.32%, a maximum LTV at liquidation of 84.66%, and has never experienced a loss. On a WA basis, liquidation upon an LTV EOD has taken under 10 seconds, with minimal “price slippage” in execution,” the report reads.

Beyond Ledn, Coinbase is expanding its footprint in crypto-backed lending. In a recent update, the exchange said users can borrow up to $100,000 in USDC, the stablecoin issued by Circle, by pledging XRP (XRP), Cardano (ADA), Dogecoin (DOGE), or Litecoin (LTC) as collateral through the decentralized finance protocol Morpho.

The offering is available across the US, with the exception of New York, according to the company.

Sponsored

Sponsored

Crypto Lending Shrinks 36% as Active Loans Fall

This comes at a pivotal moment for the crypto lending sector, which has contracted sharply amid broader market weakness. Data from TokenTerminal showed that as of February 2026, total active loans across lending protocols stand at roughly $30 billion, down 36% from the September peak of $46.96 billion.

The decline coincides with a sustained downtrend in the crypto market since October, which likely amplified the contraction. Falling asset prices reduce the dollar value of posted collateral, tightening borrowing capacity and contributing to liquidations or voluntary deleveraging.

This compresses outstanding loan balances while mechanically lowering total value locked when measured in USD terms. Increased volatility further pressures leveraged positions, reinforcing the decline in active loans.

“Quick loan refresher during volatile markets: As BTC price drops, LTV rises, Higher LTV = higher liquidation risk, Adding collateral or repaying part of the loan lowers LTV, Tools exist to help, but understanding the mechanics always comes first,” Ledn posted.

At the same time, total value locked across lending protocols fell from more than $89.7 billion in October to roughly $52 billion, according to DefiLlama. This represented a decline of around 42%.

The decline reflects both asset price depreciation and capital outflows, as weaker market conditions reduced risk appetite, suppressed new borrowing demand, and prompted users to deleverage or rotate into lower-risk assets.

Crypto World

What happens on prediction platforms can steer traditional markets, NYSE chief says

PALM BEACH, Fla. — Prediction markets are starting to play a role in how traditional financial markets move, New York Stock Exchange President Lynn Martin said Wednesday at the World Liberty forum in Palm Beach.

“It was very clear for us… that prediction markets [were being used] as an input to traditional markets,” she said at the event hosted at Mar-a-Lago, pointing to a moment during the 2024 U.S. presidential election when S&P futures spiked unexpectedly. According to Martin, the move was later explained by crypto-based prediction platform Polymarket having shown Donald Trump as the likely winner before other sources did.

The comment highlights a growing awareness among institutional players of how on-chain information can influence market behavior. Unlike traditional polling or slow-moving forecasts, Polymarket’s real-time pricing offers a kind of crowdsourced probability feed that traders may find useful.

The NYSE’s interest goes beyond observation. Intercontinental Exchange (ICE), which owns the NYSE, made a $2 billion strategic investment in Polymarket in October, signaling that the world’s largest stock exchange operator sees a future in blockchain-based forecasting tools.

CFTC Chair Michael Selig, who took office late last year, echoed Martin’s comments on prediction markets’ role in society, saying they have national security implications and act as a check on traditional newspaper journalism. He also referenced their role in entertainment and sports — the latter being an area state regulators are paying particular attention to.

“The states have really led this campaign of open warfare against markets that are in the jurisdiction of the CFTC,” Selig said. “The CFTC has for decades [overseen] prediction markets.”

He referenced the amicus brief the CFTC filed earlier this week in the Ninth Circuit Court of Appeals in one case, which hours later rejected prediction market provider Kalshi’s request for a stay against the state of Nevada’s efforts to shutter its sports-related prediction markets.

“We’re going to fight this, we’re going to make sure our markets are free and fair and have integrity,” he said. “We won’t have state gaming commissions telling us how to regulate our markets.”

Crypto World

Gemini Stock Drops Following Leadership Overhaul

Centralized exchange Gemini recently announced that it parted ways with three senior executives. The leadership changes come amid broader operational cutbacks and workforce reductions.

Following the announcement, the company’s shares declined further, extending a downward trend that has persisted since Gemini went public last September. The latest developments have prompted renewed scrutiny over the exchange’s long-term outlook.

Sponsored

Executive Shakeup Follows Deep Cuts

In a recent blog post, Tyler and Cameron Winklevoss announced that Gemini had parted ways with its Chief Financial Officer, Chief Legal Officer, and Chief Operating Officer. They said interim replacements had been appointed for the CFO and CLO roles, while the COO position would not be filled.

The founders characterized the changes as part of a broader transformation at the company, referring to the initiative as “Gemini 2.0.” They noted that recent developments in the crypto industry have influenced this shift.

“During this time, but really more recently, rapid breakthroughs in AI have begun to dramatically transform the way we work at Gemini. Simultaneously, the advent of prediction markets has begun to dramatically transform marketplaces, including our own,” the blog post stated.

The announcement drew heightened attention as it followed Gemini’s decision weeks earlier to reduce its global workforce by 25%. In addition, Gemini has exited several international markets, including the United Kingdom, the European Union, and Australia.

The latest developments prompted renewed volatility in the company’s stock, extending a steep decline that has persisted since its September listing. Investors who purchased GEMI at its $28 IPO price are now facing losses of roughly 77%.

Sponsored

In a recent SEC filing, the company also disclosed an estimated net loss of approximately $595 million for 2025.

Taken together, these developments have intensified scrutiny of the exchange’s valuation.

Public Markets Reprice Gemini Growth

The sharp repricing of Gemini’s stock has renewed debate over whether the exchange was fundamentally overvalued at its initial public offering (IPO).

Sponsored

Its initial valuation reflected expectations of sustained trading volumes and revenue expansion. Given the cyclical nature of the crypto market, pricing may have been influenced by elevated trading activity and heightened retail participation.

The subsequent decline, unfolding amid a broader market downturn, suggests a reassessment of earnings expectations.

The developments also highlight intensifying competitive pressures between centralized exchanges.

Market share and liquidity remain concentrated among larger platforms with deeper order books and stronger network effects. Meanwhile, mid-tier exchanges face rising fixed costs without equivalent trading scale to support margins.

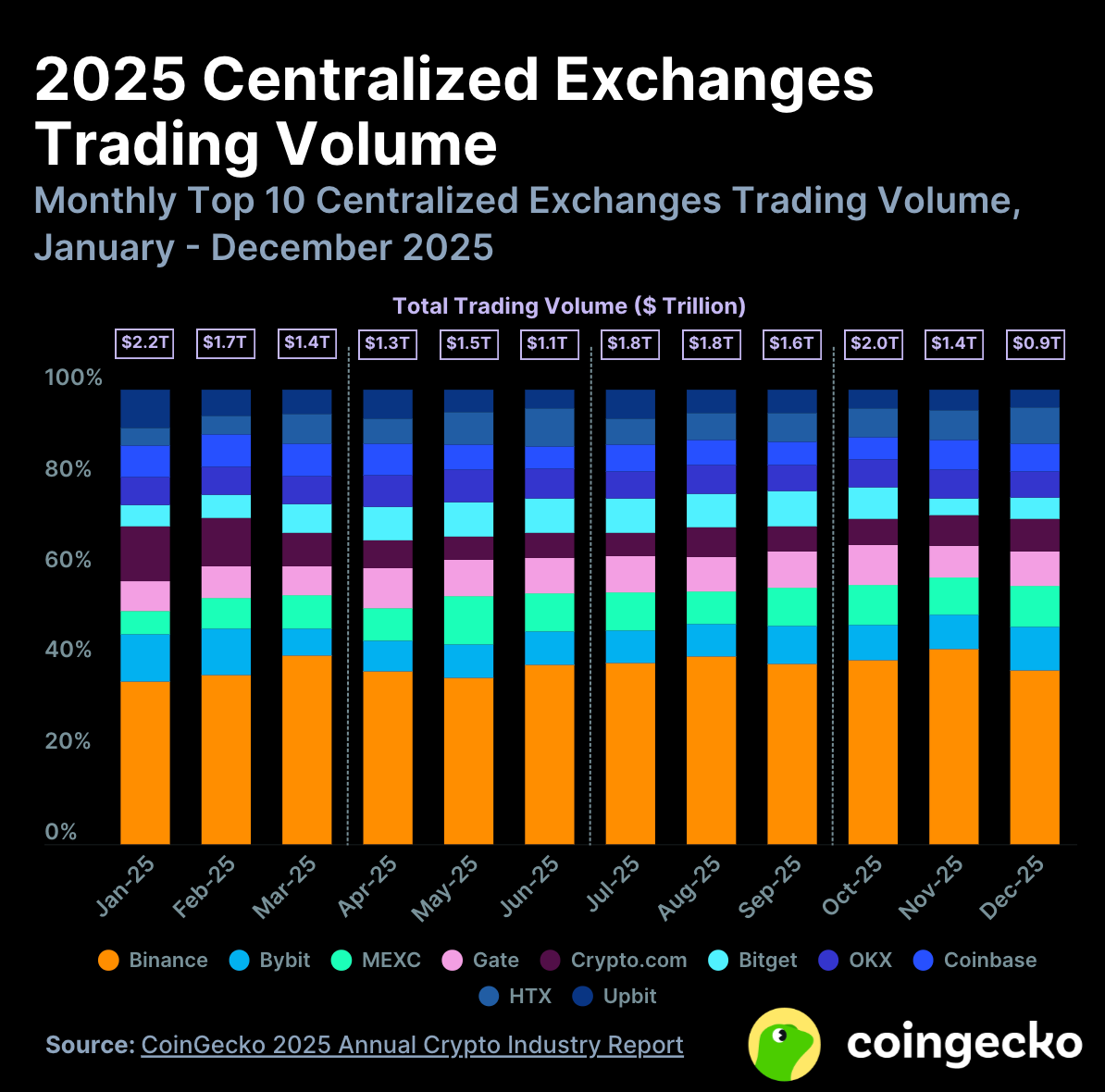

Recent data from CoinGecko supports the situation.

Sponsored

In a January report on centralized exchange market share by trading volume, the data aggregator found that in 2025, Binance accounted for 39.2% of total spot volume among the top exchanges, processing $7.3 trillion in volume. Other leading platforms, including Bybit, MEXC, and Coinbase, also maintained meaningful shares of global volume.

Gemini did not place among the top 10. According to CoinMarketCap data, the exchange currently ranks 24th, with a 24-hour trading volume of $54 million.

Within that context, workforce reductions and geographic pullbacks may represent cost-control measures and strategic adjustments to an increasingly consolidated market.

How Gemini executes this transition will likely shape whether shareholders view the current turbulence as a short-term adjustment or a sign of longer-term structural challenges.

Crypto World

OpenAI launches smart contract security evaluation system

OpenAI has introduced a new system called EVMbench, designed to measure how well artificial intelligence agents can find and fix security flaws in crypto smart contracts.

Summary

- OpenAI has introduced EVMbench, a new framework designed to measure how well AI agents can detect, fix, and exploit smart contract vulnerabilities.

- Developed with Paradigm, the benchmark is built on real audit data and focuses on practical, high-risk security scenarios.

- Early results show strong progress in exploit tasks, while detection and patching are still challenging.

The company announced on Feb. 18 that it has developed EVMbench in partnership with Paradigm. The benchmark focuses on contracts built for the Ethereum Virtual Machine and is meant to test how AI systems perform in real financial settings.

OpenAI said smart contracts currently secure more than $100 billion in open-source crypto assets, making security testing increasingly important as AI tools become more capable.

Testing how AI handles real security risks

EVMbench evaluates AI agents across three main tasks: detecting vulnerabilities, fixing flawed code, and carrying out simulated attacks. The system is built using 120 high-risk issues drawn from 40 past security audits, many of them from public auditing competitions.

Additional scenarios were taken from reviews of the Tempo blockchain, a payments-focused network designed for stablecoin use. These cases were added to reflect how smart contracts are used in financial applications.

To build the test environment, OpenAI adapted existing exploit scripts and created new ones where needed. All exploit tests run in isolated systems rather than on live networks, and only previously disclosed vulnerabilities are included.

In detection mode, agents review contract code and try to identify known security flaws. In patch mode, they must fix those flaws without breaking the software. In exploit mode, agents attempt to drain funds from vulnerable contracts in a controlled setting.

Early results and industry impact

OpenAI said a custom testing framework was developed to ensure results can be reproduced and verified.

The company tested several advanced models using EVMbench. In exploit mode, GPT-5.3-Codex achieved a score of 72.2%, compared with 31.9% for GPT-5, released six months earlier. Detection and patching scores were lower, showing that many vulnerabilities are still difficult for AI systems to handle.

Researchers observed that agents performed best when goals were clear, such as draining funds. Performance dropped when tasks required deeper analysis, such as reviewing large codebases or fixing subtle bugs.

OpenAI acknowledged that EVMbench does not fully reflect real-world conditions. Many major crypto projects undergo more extensive reviews than those included in the dataset. Some timing-based and multi-chain attacks are also outside the system’s scope.

The company said the benchmark is intended to support defensive use of AI in cybersecurity. As AI tools become more powerful, they could be used by both attackers and auditors. Measuring their capabilities is seen as a way to reduce risk and encourage responsible deployment.

Alongside the release, OpenAI said it is expanding security programs and investing $10 million in API credits to support open-source and infrastructure protection. All EVMbench tools and datasets have been made public to support further research.

Crypto World

Dogecoin and Ripple-linked token holders now eligible for U.S. loans

Coinbase is expanding its crypto-backed lending product in the U.S. to include XRP, , Cardano’s ADA and , widening access to a service it has pitched as a way for customers to unlock liquidity without selling their holdings.

The product allows users to post crypto as collateral and borrow up to $100,000 in Circle’s USDC stablecoin. The loans are routed through Morpho, a decentralized lending protocol, meaning the borrowing mechanics are handled on-chain rather than through Coinbase’s own balance sheet.

The service is available across the U.S., excluding New York.

The move brings some of crypto’s most retail-heavy tokens into a product that previously focused on bitcoin and ether. While Ethereum and Cardano holders can already earn yield through staking on their native networks, assets like XRP, DOGE and Litecoin do not offer built-in reward mechanisms.

For those investors, borrowing against their holdings has become one of the few ways to access liquidity without exiting the position.

Coinbase is also expanding the potential pool of collateral on its platform. The exchange reported it held $17.2 billion worth of XRP as of Dec. 31, according to an SEC filing, making the token one of the larger assets sitting in customer accounts.

Crypto-backed loans have long been marketed as a tax-efficient strategy, since borrowing against an asset does not trigger capital gains in the same way selling does.

But the structure comes with sharp risks when markets move quickly. If the value of the collateral falls too far relative to the loan, the position can be liquidated, meaning a third party can repay the debt and seize the collateral at a discount.

Coinbase applies an extra buffer when users take out a loan to reduce liquidation risk and sends notifications as the threshold is approached. Still, the exchange has also warned that collateral used through the product is wrapped, a process that allows tokens like XRP to exist on Ethereum-compatible networks.

Crypto World

BTC can bounce but market still lacks fuel for a real run

Bitcoin is finding space to bounce, but not yet the fuel to run.

The macro backdrop has improved just enough to give bulls something to work with. Cooling headline inflation has strengthened expectations for three rate cuts this year, reviving the familiar playbook in which easier monetary policy supports risk assets.

And it could signal the possibility of liquidity slowly returning after months of tight financial conditions for crypto markets.

But caution against reading too much into that shift. The Federal Reserve is unlikely to embark on an aggressive easing cycle. Instead, it appears set for a measured approach that rebuilds liquidity gradually. That creates an environment where bitcoin can stage tactical rallies yet struggle to hold them.

Bitfinex analysts describe the market as one prone to moves in waves rather than clean breakouts.

“In this environment, volatility remains likely,” the firm said in a note shared with CoinDesk. “Tactical upside moves can occur when positioning becomes overly defensive, but a durable structural advance will require clearer confirmation from both macro disinflation trends and sustained spot demand.”

Spot recoveries continue to meet steady selling. Each bounce is absorbed more smoothly than earlier in the quarter, suggesting some stabilization.

The overnight tape is a good example. Bitcoin traded as high as $68,500 before rolling over during the U.S. afternoon and sliding under $66,000, a move that lined up with a stronger dollar and hawkish Fed minutes. That kind of intraday reversal is the market’s way of saying rallies are still fragile, and that traders are quick to sell the moment macro conditions turn even slightly less friendly.

“It is alarming that Bitcoin’s dynamics mirror the recent strengthening of the dollar. When investors become convinced that the rise of the dollar is a trend, there may be a sharp increase in volatility,” Alex Kuptsikevich, the FxPro chief market analyst, said in an email.”

“Volatility seems to have been turned off in this market, while stock indices are much livelier. There, investors are actively buying up dips, relying on support in the form of important moving averages: 50-day for the Dow Jones and Russell 2000 and 200-day for the Nasdaq100. The crypto market is now below its 50- and 200-day curves by 17% and 31%, respectively,” he added.

Sentiment remains fragile, meanwhile, as a crypto fear gauge has printed single digits on nine of the past fourteen days, territory rarely seen outside prior cycle lows.

At the same time, stablecoin outflows from major exchanges point to tighter liquidity, and long-term holders have shown signs of stress comparable to late bear-market phases in 2022, according to Glassnode.

For now, bitcoin appears caught between improving macro optics and stubborn supply. Tactical upside remains possible, especially when positioning leans too defensive.

A durable advance, however, likely requires clearer evidence of disinflation, a softer dollar and consistent spot demand. Until then, the path higher may be uneven.

Crypto World

Fueling Saudi Arabia’s Vision 2030

Editor’s note: Global Games Show Riyadh 2026 signals a turning point for Saudi Arabia’s digital entertainment ecosystem as the kingdom accelerates growth across gaming, esports, and Web3. This press release outlines a multi-day program that combines live demonstrations, developer workshops, and high-profile panels, underscoring Riyadh’s emergence as a regional hub for interactive technology. The show also reinforces collaboration among startups, creators, and investors through dedicated networking spaces and matchmaking sessions. By bringing together leaders from across the industry, the event aims to catalyze partnerships and accelerate the creative economy envisioned in Vision 2030.

Key points

- Global Games Show Riyadh 2026 brings together gaming, esports, and Web3 within Saudi Vision 2030.

- The event features live demos, workshops, panels, and networking with industry leaders, indie developers to global publishers.

- It is organized by VAP Group and powered by Times of Games, with parallel events Global AI Show and Global Blockchain Show on a single ticket.

Why this matters

By concentrating expertise and investment in Riyadh, the Global Games Show aims to accelerate Saudi Arabia’s creative economy and position the Kingdom as a regional and global hub for interactive technology. The conference highlights trends in immersive gaming, cloud gaming, and monetization strategies, and emphasizes collaboration across startups, developers, and publishers, aligning with Vision 2030’s diversification goals.

What to watch next

- Updates on Day 1 and Day 2 sessions and key speakers.

- Public announcements of participating companies and partnerships.

- Ticketing details for the Global AI Show and Global Blockchain Show, accessible with one ticket.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Global Games Show Riyadh 2026 : Fueling Saudi Arabia’s Vision 2030

Global Games Show Riyadh 2026 Riyadh edition is poised to become the ultimate destination for gaming enthusiasts, developers, and investors alike. Organized by VAP Group and powered by the Times of Games, the event promises a vibrant lineup of discussions and engaging experiences that symbolize the rapidly changing gaming sphere.

Participants can explore the latest in game development, esports, and interactive entertainment, with live demonstrations, workshops, and panels led by industry leaders. From indie developers to global publishers, companies will present their most innovative games and technologies, providing attendees with insights into the future of gaming.

Educational and strategic sessions focus on trends such as immersive gaming, cloud gaming, and monetization strategies. These discussions equip participants with knowledge to navigate challenges, leverage opportunities, and scale their ventures effectively.

Day 1 is all about the future of gaming technology, with talk on Saudi Arabia becoming a world esports capital, the next phase of gaming engines with Unreal Engine 6, brain–computer interfaces, and AI-generated game design. Experts will also discuss what the future of esports will look like in the Kingdom and how it is increasingly driving Vision 2030’s creative economy.

Day 2, entitled “Gameconomics,” explores the gaming business—from crowdfunded games to mobile gaming opportunity, player-coined communities, and developer–investor partnerships that form industry expansion.

By bringing a diverse mix of professionals under one roof, the Global Games Show strengthens Riyadh’s position as a hub for interactive technology and digital entertainment. Attendees also get access to other parallel flagship events, the Global AI Show and the Global Blockchain Show with just one ticket. GGS is a convergence of ideas, creativity, and opportunity in the gaming world.

Media enquiries :

Press contact : media@globalblockchainshow.com

Crypto World

Moonwell’s AI-coded oracle glitch misprices cbETH at $1, drains $1.78M

Moonwell’s lending pools racked up about $1.78M in bad debt after a cbETH oracle mispriced the token at nearly $1 instead of around $2.2k, enabling bots and liquidators to drain collateral within hours of a misconfigured Chainlink-based update reportedly using AI-generated logic.

Summary

- Misconfigured cbETH oracle set price near $1 vs roughly $2.2k, triggering a ~99% valuation gap that broke Moonwell’s collateral math.

- Liquidators repaid around $1 per position to seize over 1,096 cbETH, leaving Moonwell with roughly $1.78M in protocol-level bad debt.

- Faulty formula and scaling logic were reportedly co-authored by AI model Claude Opus 4.6, spotlighting new DeFi risk around AI-written oracle and pricing code.

Decentralized finance lending protocol Moonwell suffered a $1.78 million exploit due to a pricing oracle bug that misvalued Coinbase-wrapped ETH (cbETH), according to reports from the platform.

The vulnerability originated in oracle calculation logic reportedly generated by the AI model Claude Opus 4.6, which introduced an incorrect scaling factor in the asset price feed, according to the protocol’s disclosure. Attackers borrowed against severely underpriced collateral, extracting funds before the error was detected and corrected.

The cbETH mispricing effectively collapsed the collateral requirement for borrowing within affected pools. Because lending systems rely on accurate collateral ratios, the incorrect price allowed attackers to extract assets with minimal backing value, according to the protocol’s technical analysis.

Price oracles represent critical security components in DeFi lending systems. Incorrect asset valuation can enable under-collateralized borrowing or liquidation failures. Many major DeFi exploits have historically involved oracle manipulation or pricing errors rather than core protocol flaws, according to industry security reports.

The Moonwell incident differs from traditional oracle exploits in that the faulty logic appears linked to automated AI code generation rather than malicious oracle data feeds, according to the protocol’s preliminary investigation.

The exploit highlights risks associated with AI-assisted smart-contract development in financial applications. Language models can accelerate coding workflows, but financial protocols require precise numerical correctness, unit handling and edge-case validation, according to blockchain security experts.

In DeFi systems, small arithmetic or scaling mistakes can translate into systemic vulnerabilities affecting collateral valuation and solvency. The incident raises questions about whether AI-generated contract components may require stricter auditing standards than manually written code, according to security researchers.

AI-assisted development is increasingly used across Web3 engineering workflows, from contract templates to integration logic. Security models and audit frameworks have not yet fully adapted to AI-generated contract code, according to industry observers.

The broader implications center on how automated code generation errors in financial logic represent a new category of DeFi risk. Oracle math, scaling factors and unit conversions remain high-precision domains where automation failures can propagate into protocol-level vulnerabilities, according to technical analysis of the incident.

As AI-assisted smart-contract development expands, audit methodologies will likely need to evolve toward verifying not only code correctness but generation provenance and numerical invariants, according to blockchain security firms.

Crypto World

Kalshi Data Could Inform Fed Reserve Policy, Say Researchers

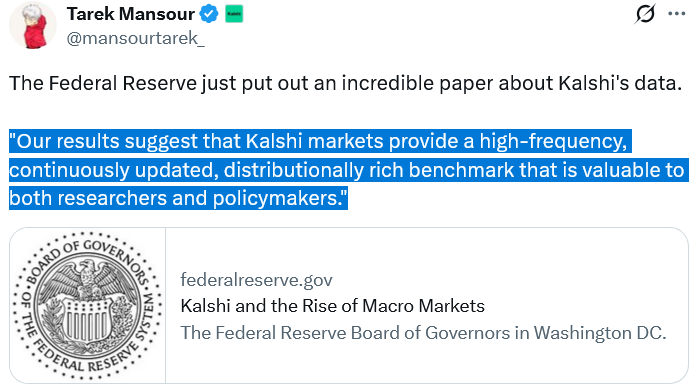

Three researchers at the US Federal Reserve argue that prediction market Kalshi can better measure macroeconomic expectations in real time than existing solutions and thus should be incorporated into the Fed’s decision-making process.

The “Kalshi and the Rise of Macro Markets” paper was released on Feb. 12 by Federal Reserve Board principal economist Anthony Diercks, Federal Reserve research assistant Jared Dean Katz and Johns Hopkins research associate Jonathan Wright.

Kalshi data was compared with traditional surveys and market-implied forecasts to examine how beliefs about future economic outcomes change in response to macroeconomic news and statements from policymakers.

“Managing expectations is central to modern macroeconomic policy. Yet the tools that are often relied upon—surveys and financial derivatives—have many drawbacks,” the researchers said, adding that Kalshi can capture the market’s “beliefs directly and in real time.”

“Kalshi markets provide a high-frequency, continuously updated, distributionally rich benchmark that is valuable to both researchers and policymakers.”

Kalshi traders can bet on a range of markets tied to the Federal Reserve’s decision-making, including consumer price index inflation and payroll, in addition to other macroeconomic outcomes such as gross domestic product growth and gas prices.

The Fed researchers said Kalshi data should be used to provide a risk-neutral probability density function, which shows all possible outcomes of Fed interest rate decisions and how likely each one is.

“Overall, we argue that Kalshi should be used to provide risk-neutral [probability density functions] concerning FOMC decisions at specific meetings” arguing that the current benchmark is “too far removed from the monetary policy interest rate decision.”

However, Fed research papers are only “preliminary materials circulated to stimulate discussion” and do not impact the central bank’s decision-making.

Prediction markets became one of the hottest use cases in crypto last year and have consistently surpassed $10 billion in monthly trading volume. Kalshi and competitor platform Polymarket have been aggressively marketing their products to retail users in recent months despite some state regulators seeking to restrict the industry.

Kalshi is more reactive than existing expectations tools

The Federal Reserve noted one advantage Kalshi has in examining macroeconomic expectations is its “rich intraday dynamics.”

Related: Treasury bills seen as primary driver of Bitcoin’s price: Report

“These probabilities respond sharply and sensibly to major developments,” the researchers said, pointing out an example where the implied probability of a rate cut in July rose to 25% following remarks from Federal Reserve Governors Christopher Waller and Michelle Bowman before falling after a stronger-than-expected June employment report.

“Kalshi provides the fastest-updating distributions currently available for many key macroeconomic indicators,” the researchers added.

Magazine: Brandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment16 hours ago

Entertainment16 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech21 hours ago

Tech21 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports1 hour ago

Sports1 hour agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment8 hours ago

Entertainment8 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business22 hours ago

Business22 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World11 hours ago

Crypto World11 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit