Crypto World

Arthur Hayes Reportedly Dumps These DeFi Tokens: Full Details

The former BitMEX CEO has moved millions of dollars worth of certain DeFi tokens, here’s which ones.

Arthur Hayes, perhaps best known for his leadership at BitMEX years ago, has made several high-value transfers for numerous altcoins, mostly from the DeFi space, which caught the attention of monitoring resources such as Lookonchain.

Given his history of offloading similar tokens in times of market uncertainty, the analysts speculated that he had likely made the transfers to sell $1.06 million worth of ENA, $954,000 worth of ETHFI, and $1.14 million worth of PENDLE.

Arthur Hayes(@CryptoHayes) is selling DeFi tokens.

In the past 15 minutes, he moved out 8.57M $ENA($1.06), 2.04M $ETHFI($954K), and 950K $PENDLE($1.14M) — likely to sell.https://t.co/loeYKUb9rN pic.twitter.com/ZOJnUHCTdr

— Lookonchain (@lookonchain) February 8, 2026

Hayes made several big sell-offs in August last year, claiming that the crypto market was due for a large correction. However, the market went the other direction, and some of the assets he sold, such as ETH, skyrocketed in the following weeks.

Just days later, he regretted his decision with a post on X. Hayes explained that he had to buy it all back at higher prices, asked for forgiveness from the Ethereum community, and promised not to take ETH profits again.

In November, though, further on-chain data from Lookonchain showed that he disposed of 520 ETH for $1.66 million, alongside ENA and ETHFI.

Another report from late December 2025 indicated that he had sold additional ETH and purchased PENDLE, LDO, ENA, and ETHFI again. If he indeed offloaded the DeFi tokens now, it would result in a substantial loss given the latest market correction.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Tether Scales Operations Globally as CFO McWilliams Strengthens Governance

TLDR:

- Tether now manages 140 investments, actively moving beyond stablecoin operations worldwide.

- The company hires 150 staff, boosting engineering, finance, and regulatory teams globally.

- CFO Simon McWilliams centralizes London operations to strengthen governance and reporting.

- Tether scales down $20B fundraising plan to $5B, focusing on investors and profitability.

Tether, issuer of the dominant stablecoin USDT with about $187 billion in circulation, is diversifying beyond crypto payments.

It is moving into a global investment group as investors pushback trim a planned $15–$20 billion capital raise to around $5 billion.

CEO Paolo Ardoino says the firm remains profitable and strategically aligned, while expanding hires, investments, and governance under new CFO Simon McWilliams.

Tether Expands Beyond Stablecoins into a Global Investment Group

Tether, the issuer of the widely used stablecoin USDT, is accelerating its transformation from a crypto infrastructure provider into a diversified global investment group.

According to the Financial Times, the company now manages around 140 investments spanning artificial intelligence, commodities, sports equity, and other sectors.

This strategic shift aims to reduce reliance on stablecoin operations while broadening revenue streams and market influence

To support this growth, Tether’s workforce is scaling. The company currently employs roughly 300 staff and plans to hire 150 more.

These new roles focus on engineering, regulatory compliance, finance, and venture investments. Offices in London, the UAE, Brazil, and Ghana indicate a deliberate push toward global reach and regulatory alignment.

Leadership changes are central to the expansion. New CFO Simon McWilliams is centralizing finance and operations in London.

Sources say he is enhancing governance, streamlining reporting, and improving operational discipline. Centralizing key functions in a major financial hub positions Tether closer to traditional markets, signaling its intent to bridge crypto and conventional finance.

Despite growth, regulatory scrutiny remains. Market participants and regulators continue to request independent audits of Tether’s reserves, even though the company issues quarterly attestations.

Executives argue that strong profitability and transparent reserve management provide flexibility to pursue long-term growth while maintaining market confidence.

Capital Strategy, Investor Response, and Market Position

Tether is simultaneously managing its capital strategy amid investor scrutiny. FT and Reuters report that the company considered a $15–20 billion fundraising scenario, potentially valuing it near $500 billion.

Following investor feedback, the company is considering a smaller raise, possibly around $5 billion, emphasizing strategic alignment rather than headline figures. CEO Paolo Ardoino clarified that the higher amounts were hypothetical, used for planning, and not formal targets.

Profitability underpins this approach. Tether projects continued earnings growth in 2026, reducing reliance on external capital.

Internal reinvestment allows the company to fund expansion into diversified sectors while maintaining operational control.

Investor sentiment is mixed. Some remain cautious due to valuation and transparency concerns.

Nevertheless, Tether’s market dominance is a stabilizing factor. With USDT circulation exceeding $185 billion, the company maintains a strong revenue base and liquidity position.

This allows it to pursue investments across multiple sectors while mitigating crypto-specific risks. In conclusion, Tether is evolving from a stablecoin issuer into a diversified investment and technology platform.

Through strategic hiring, governance enhancements, portfolio expansion, and disciplined capital management, the company balances ambition with prudence, positioning itself for sustainable long-term growth across digital and traditional financial markets.

Crypto World

Solana Whales Rotate Capital Toward On-Chain Perps During Renewed Volatility

Solana (SOL) has once again captured market attention amid volatility, as news reports continue to show whales rotating capital out of the ecosystem. Analysts continue to say the recent surge and renewed interest in on-chain perpetual futures (perps) is fueling the rotation.

Despite SOL trading at a low price, whales are selling and stealthily rotating their portfolios. These shifts are a classic trend where liquidity and risk exposure move dynamically in response to volatility.

Whales are increasingly positioning in the next 100x projects, decentralized perpetual markets. One that continued to surface across different traders’ watchlists is HFDX. Read on.

Solana Whales Continue To Rotate, Here’s Why.

Solana has stood tall amidst the beneficiaries of the ongoing price crash in the cryptocurrency market, following the market tides. SOL is currently trading at $91.91, down 25% over the past seven weeks.

Solana’s repeated price crashes in the market had caused its whale holders to move their tokens to exchanges and sell off. A few hours ago, Whales_alert reported that 505,554 SOL tokens, worth over $50 million, were transferred from an unknown wallet to Binance.

Historically, such off-chain transfers signal whales selling ahead of an incoming bearish season. On-chain monitors have revealed that the liquidated funds are being rotated into on-chain perps. While these moves are being made quietly, their footprints are evident, especially in a project called HFDX

HFDX, The New Gold Investors Are Rotating Into

HFDX is a decentralized perpetual futures infrastructure that enables traders to:

- Open and manage leveraged positions on a variety of assets

- Do so non-custodially (you keep control of your keys)

- Operate fully on-chain via smart contracts

HFDX lets you trade perpetual futures without relying on a central exchange; your positions and liquidity live in transparent smart contracts. With recent Inflows and heightened interest in on-chain perps, HFDX offers what whales cannot afford to miss.

What HFDX offers:

- Non-custodial on-chain perp trading – all positions settle via smart contracts, reducing counterparty risk.

- Shared liquidity pool model – designed to increase capital efficiency across markets.

- Multi-chain access — enabling traders to follow momentum across different blockchains without lock-in to a single ecosystem.

- Transparent execution — all trades and settlement processes are auditable on-chain.

Structured liquidity instruments like Liquidity Loan Notes (LLNs) are tied to actual trading fees and activity (not token emissions).

This infrastructure is structured for traders and liquidity providers who prioritize transparency, decentralized risk controls, and access across markets, not just within one layer-1 ecosystem like Solana.

Given the rotation toward on-chain perps on Solana during heightened volatility, several factors are driving interest toward platforms like HFDX:

- Self-custody preference: The idea of having full control over their private keys, compared to centralized players, is making traders jump in.

- Diverse market access: HFDX offers Multi-chain perpetual markets that allow capital to rotate fluidly across ecosystems.

- Transparency: HFDX’s on-chain settlement and public audit trails appeal to risk-aware traders.

- Capital efficiency: Shared liquidity models can offer deeper markets without siloed constraints.

Rather than promising guaranteed returns, this reflects a broader shift in trader behavior, where on-chain infrastructure capable of capturing diversified derivatives flows is in focus, particularly amid persistent volatility and macro uncertainty.

Solana’s whale rotation into on-chain perps highlights how large holders respond to market volatility and liquidity opportunities across decentralized markets. At the same time, HFDX is capturing attention for providing transparent, multi-chain perpetual infrastructure that aligns with professional traders’ risk and access preferences.

As capital continues to seek flexible, decentralized derivatives solutions, understanding how these ecosystems interrelate will remain key for sophisticated market participants.

Make Your Money Work Smarter And Unlock A Wealth Of Opportunities With HFDX Today!

Website: https://hfdx.xyz/

Telegram: https://t.me/HFDXTrading

X: https://x.com/HfdxProtocol

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

INVESTING YACHTS Launches RWA Yacht Charter Model

[PRESS RELEASE – Ibiza, Spain, February 8th, 2026]

Investing Yachts today introduced its real-world asset (RWA) yacht charter model, a blockchain-based approach designed to tokenize exposure to potential double-digit revenue generated by luxury yacht charter operations via their upcoming $YATE token. Being their ultimate goal to democratize access to all private equity sectors.

Positioning itself at the intersection of yachting and on-chain finance, Investing Yachts is built to remove traditional barriers associated with yacht investing—such as high minimum capital requirements, illiquidity, and operational complexity—by offering a token-based structure intended to be tradable on markets and supported by a managed charter fleet.

How the model is designed to work

At the core of the Investing Yachts model, the $YATE ecosystem connects charter activity to tokenholder incentives through a rules-based framework:

- Charter profit distribution: Up to 65% of annual net charter profits is intended to be distributed to tokenholders who lock $YATE into protocol “vaults,” with different lock periods associated with different maximum shares of the profit pool.

- Buyback & burn: A defined portion of net profits, 10%, is earmarked for buying back tokens and burning them, aiming to reduce circulating supply over time.

- Asset-tied issuance: New tokens are being minted in connection with acquiring additional yachts or other real-world assets, using a NAV-based issuance framework designed to align token supply with the underlying asset base and charter activity.

$YATE Token Pre-Sale

Investing Yachts states that the $YATE pre-sale is scheduled to open on February 25, 2026, with the goal of expanding community participation ahead of broader exchange availability.

As described on the website and in the whitepaper documentation, the pre-sale pricing is structured as follows:

- Initial price: 0.10 USDT per $YATE

- Dynamic increase: +0.75% price increase every 24 hours

- Duration: 9 months

- Target post–pre-sale listing price: 1.00 USDT

The documentation also outlines vesting terms for pre-sale tokens, as well as other mechanisms aligned to provide sustainable growth stability for the project, rewarding long-term holders and early adopters.

Broker Network and Market Positioning

The global yacht charter and yachting services market represents a multi-billion-dollar industry, traditionally limited to a small group of high-capital participants. Investing Yachts aims to use its RWA structure to broaden access by enabling community participation through $YATE, bringing a token-based framework to a segment that has historically remained offline and illiquid.

Investing Yachts has established relationships with experienced yacht brokers and industry intermediaries to support fleet sourcing and charter deployment. These connections are intended to strengthen the project’s ability to identify acquisition opportunities, negotiate terms, and access vessels aligned with demand in key charter regions.

Community and updates

Investing Yachts is publishing updates via social channels and encourages supporters to follow the project for pre-sale announcements, documentation updates, and roadmap progress:

About Investing Yachts

Investing Yachts is a blockchain platform described as an RWA project focused on tokenizing exposure to luxury yacht charter economics through the $YATE token (Ethereum ERC-20).

Investing Yachts lists a management team and advisory group spanning technology, yacht operations, finance, media, and international legal expertise. It counts on leadership with backgrounds in algorithmic trading, yacht charter operations, and institutional markets, including experience at major international banks.

Disclaimer: This press release is for informational purposes only and does not constitute investment advice.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Pi Network Users Criticize Core Team After Celebratory Post

The first Friday of February was supposed to be a day of joy for Pi Network, but it backfired.

Although it was created over half a decade ago, the controversial Pi Network project and its native token officially launched just under a year ago. Since then, the Core Team has deployed numerous updates, it has dabbled with AI, tried to improve some of its sluggish systems, but the results have been… mixed, so far.

The latest post from the Core Team was meant to be more positive and to celebrate a valid portion of the vast Pi Network community. However, it attracted significant backlash immediately.

Celebrating Pi Network Moderators

Every First Friday of February (FFF day), Pi celebrates Moderator Appreciation Day! Today is about recognizing the moderators who make the Pi Network community what it is. Thanks to all Pi moderators for their incredible volunteer efforts in supporting the Pi community—assisting…

— Pi Network (@PiCoreTeam) February 6, 2026

The video itself tried to recognize moderators who “make Pi Network’s community what it is,” as they are volunteers and are not employed or paid by the Core Team. They help moderate charts, answer Pioneers’ questions, monitor Pi apps and products, report bugs, and test new features.

Additionally, they translate Pi into other languages, moderate Fireside Forums, and try to keep the conversations helpful, safe, and respectful.

“Behind answered questions, updates, and chatrooms, Moderators help ensure the Pi experience runs smoothly for everyone!”

The Backlash

It was a statement like that last one that caught the attention of some of the Pi Network Pioneers. While many users agreed that Moderators should be praised and respected, some raised valid questions about the lack of tangible progress on several fronts.

Joann&Joe urged the Core Team to “speed up the progress-it’s been dragged out over and over again,” after indicating that they should “stop messing around with all that superficial nonsense.”

You may also like:

Chialo20’s approach was similar, indicating that the team behind Pi Network has been holding him for “7years plus now not to migrate my Pi coins, just migration stage, and this is not fair.”

A. A. Gada tried to remind the Core Team that “many pioneers are still stuck in ‘tentative approval’ for their KYC status. We hope you can improve this situation.”

It’s worth noting that the team recently published an update claiming that they have unblocked millions for mainnet migration, and promised new changes are coming soon.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Michael Saylor Reveals Strategy Can Pay Dividends ‘Forever’ With 1.25% Bitcoin Growth

TLDR:

- Strategy requires only 1.5% annual Bitcoin appreciation to sustain $888 million dividend obligations

- The company maintains a $2.25 billion cash reserve, providing 30 months of dividend coverage independently

- Strategy holds 713,502 Bitcoin, representing 3.4% of total supply at $76,052 average purchase price

- The firm operates with 13% leverage versus 23% for investment-grade companies, with 42 basis point debt

Michael Saylor unveiled a dividend sustainability model that requires Bitcoin to appreciate just 1.25% annually for perpetual payments.

The Strategy Inc. Executive Chairman made this revelation during the company’s Q4 2025 earnings call on February 6, 2026.

The announcement came as Bitcoin plunged to $63,596.56, marking a 13% single-day decline. Strategy reported a $12.4 billion net loss, yet Saylor defended the treasury strategy with confidence.

Minimal Bitcoin Growth Sustains Perpetual Dividend Model

Saylor’s dividend framework centers on an exceptionally low appreciation threshold for long-term sustainability. CEO Phong Le explained that the company needs Bitcoin to increase by only 1.5% annually to maintain payments indefinitely.

The model functions by selling incremental Bitcoin holdings to cover dividend obligations while preserving the core treasury position.

Strategy holds approximately $45 billion in Bitcoin reserves against annual dividend commitments of $888 million across preferred equity instruments.

This ratio provides 67 years of dividend coverage based solely on current holdings without any price appreciation. The mathematical simplicity of the model demonstrates the company’s confidence in Bitcoin’s long-term value trajectory.

Saylor extended the scenario even further during the earnings call, addressing the possibility of zero Bitcoin appreciation.

He stated that even if Bitcoin stopped appreciating entirely, Strategy would have “80 years to figure out what to do about that.”

This timeline provides substantial flexibility for strategic pivots while maintaining current dividend commitments to shareholders.

Cash Reserves and Financial Buffers Strengthen Payment Certainty

Strategy established a $2.25 billion USD cash reserve in Q4 2025 specifically to address dividend reliability concerns.

CFO Andrew Kang noted this reserve provides 30 months of coverage without requiring any Bitcoin sales. The cash buffer insulates dividend payments from short-term Bitcoin price volatility and market downturns.

Michael Saylor’s post on X highlighted the multi-layered approach to dividend security that Strategy has implemented.

The company designed this structure to weather extended bear markets while maintaining shareholder distributions. The combination of cash reserves and Bitcoin holdings creates redundant payment mechanisms across different time horizons.

The dividend adjustment framework recently shifted to monthly volume-weighted average price calculations instead of five-day periods.

This change addresses trading patterns around record dates and payment dates. Strategy’s Stretch digital credit product trades near its $100 stated amount with an 11.25% annualized dividend rate.

Bitcoin Holdings Position Company for Long-Term Execution

Strategy held 713,502 Bitcoin as of February 1, 2026, with total acquisition costs reaching $54.26 billion. The average purchase price stands at $76,052 per coin, representing roughly 3.4% of Bitcoin’s total supply.

The company maintains its position as the world’s largest corporate Bitcoin holder despite recent price declines.

The company achieved a 22.8% BTC yield for 2025, exceeding the lower end of its target range. This metric measures the percentage increase in Bitcoin per share, demonstrating acquisition rates faster than shareholder dilution. The strategy’s accumulation strategy continues regardless of short-term price movements or accounting losses.

The Q4 2025 net loss of $12.6 billion stemmed primarily from mark-to-market accounting on Bitcoin holdings. Operating losses reached $17.4 billion, while earnings per share came in at negative $42.93 versus forecasts of positive $2.97. However, the software business generated $123 million in revenue, exceeding expectations by 3.53%.

Market Volatility Tests Dividend Thesis Amid Capital Raising Success

Strategy’s stock closed at $119.74 in aftermarket trading, down 17.12% following the earnings announcement on February 6, 2026.

Bitcoin’s simultaneous decline to $63,596.56 intensified selling pressure across cryptocurrency-related equities. The company’s Bitcoin holdings fell below their cumulative cost basis for the first time since 2023.

Saylor appeared undaunted during the conference call, emphasizing that the company’s Bitcoin treasury strategy was built to withstand volatility.

He noted that Bitcoin’s 45% drawdown from its all-time high four months earlier was consistent with the asset’s 45% volatility profile. This perspective frames current losses as expected fluctuations rather than fundamental flaws.

Strategy raised $25.3 billion in capital during 2025, becoming the largest U.S. equity issuer for two consecutive years. The company raised an additional $3.9 billion in January 2026 and acquired 41,002 Bitcoin during challenging conditions.

Strategy operates with 13% leverage compared to 23% for investment-grade companies, with convertible debt carrying a 42 basis point average interest rate.

Crypto World

Monero (XMR) Seeks Rebound But Death Cross Emerges

Monero has faced intense selling pressure over the past month, with the price collapsing nearly 60% in just four weeks. The sharp decline erased weeks of gains and pushed XMR into a sustained downtrend.

This move signals quickly weakening investor confidence, as long-term holders and short-term traders alike reduce exposure amid broader market stress.

Sponsored

Sponsored

Monero Traders Are Stepping Back

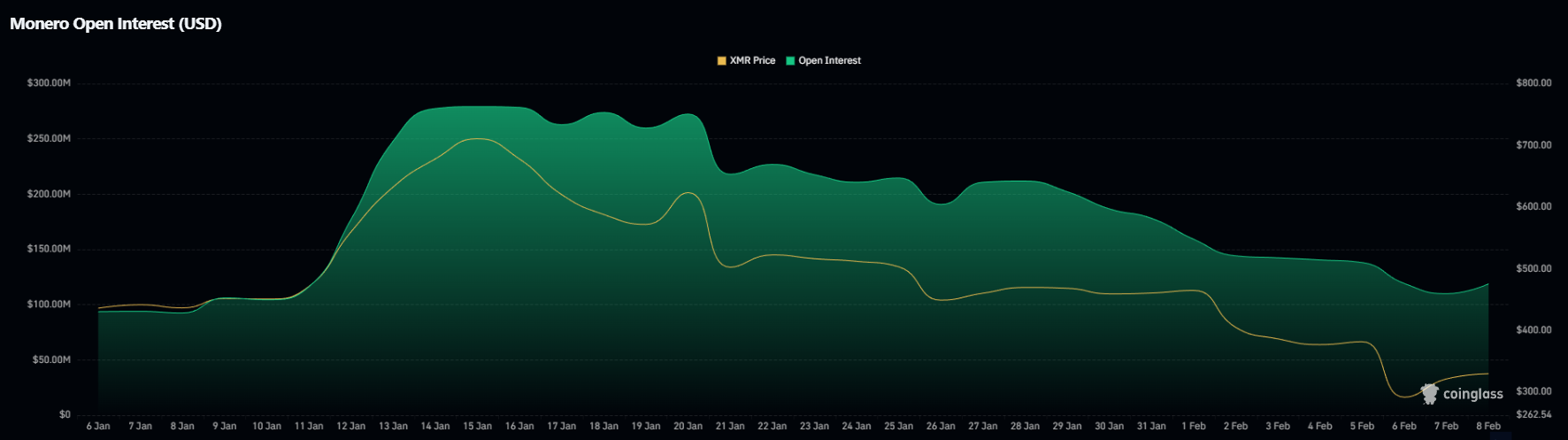

Derivatives data points to a clear trader exodus from Monero. Open interest has dropped sharply, falling from roughly $279 million in mid-January to about $118 million. This 57% decline reflects reduced participation across futures markets, signaling fading speculative interest in XMR.

Two factors largely explain this contraction. First, profit-taking followed earlier price spikes. Second, bearish market conditions eroded confidence among traders as participants exited positions, and liquidity thinned.

Lower engagement often weakens price support, increasing sensitivity to further selling pressure and volatility.

Despite declining participation, short-term momentum indicators suggest selling pressure may be easing. The Money Flow Index is forming a bullish divergence against the XMR price. While price continues to post lower lows, the MFI has produced higher lows, signaling declining downside momentum.

Sponsored

Sponsored

This divergence indicates sellers are losing strength, even though the price has not yet responded. Historically, such setups can precede stabilization or short-term recoveries.

While not a guarantee of reversal, the signal suggests XMR may avoid immediate deeper losses if demand stabilizes.

XMR Price Recovery May Be Slow

XMR price is attempting a gradual recovery but lacks strong bullish confirmation. At the time of writing, Monero trades near $326, sitting just below the $335 resistance. Price remains locked within a nearly four-week-long downtrend, limiting upside potential for now.

A breakout above $335 appears challenging under current conditions. The next major resistance stands near $357, which could cap recovery attempts. Without renewed inflows or improving sentiment, XMR is more likely to consolidate within this range as buyers and sellers remain cautious.

Downside risk persists if bearish momentum intensifies. A potential Death Cross could form if the 200-day EMA moves above the 50-day EMA. Such a signal often marks prolonged weakness. Under this scenario, XMR could fall below $291 and slide toward $265 or lower, extending the decline.

Crypto World

Block (XYZ) weighs cutting up to 10% of jobs: Bloomberg

Block Inc. (XYZ), the payments company run by Jack Dorsey, may reduce its workforce by as much as 10%, Bloomberg reported, citing people familiar with the matter.

Hundreds of employees at the bitcoin -supporting owner of Cash App and Square have been told their jobs are at risk, Bloomberg said. The reviews are part of a broader overhaul of the Oakland, California-based company’s business, it said.

In addition to the payment apps, which allow individuals and businesses to transact in bitcoin, Block has Bitkey, a bitcoin self-custody hardware wallet, and Proto, a suite of bitcoin mining products and services. Its Spiral unit builds and funds open-source projects advancing bitcoin adoption.

The company introduced a 12,000-employee cap in 2023 and reiterated its commitment to the number in its third-quarter earnings report. It had fewer than 11,000 in November, Bloomberg said.

Shares in the company have dropped 14% this year while the S&P 500 index, which it joined in July, rose 1.27%. The stock lost 23% in 2025.

Block is due to post fourth-quarter earnings on Feb. 26. Adjusted earnings are forecast to come in at $403 million, or 68 cents a share, Bloomberg said. The company posted adjusted EPS of 71 cents in fourth-quarter 2024.

The company did not respond to an emailed request for comment sent outside regular U.S. business hours.

Crypto World

Pi Network price gets oversold ahead of a big unlock and potential Kraken listing

Pi Network price continued its strong downward trend this week and is nearing its lowest level on record as traders anticipated a big token unlock this week.

Summary

- Pi Network price continued its strong downward trend last week.

- The network will unlock 82 million tokens in the next seven days.

- A potential catalyst for the coin is Kraken listing.

Pi Coin (PI) token was trading at $0.1450 on Sunday, a few points above the all-time low of $0.1305. It has dropped by over 90% from its all-time high, erasing billions of dollars in value.

Pi token may come under pressure this week as the network unlocks over 82 million coins in the next seven days. At the current price, these coins are valued at over $11 million. These coins are part of the 206 million tokens that come online this month.

Token unlocks are risky for a cryptocurrency because they boost the circulating supply. Soaring supply at a time when demand is not rising will always put pressure on the price.

Pi Network’s supply will also jump in March when the team will issue the validator rewards. In a recent note, they said that they had completed the design and were currently testing it, with the implementation happening in March.

While many validators will hold their tokens, some will dump, leading to lower prices over time.

On the positive side, Pi Network has a major catalyst in that it was added on Kraken’s roadmap list. In most cases, this is usually the first stage before the company lists a token. A Kraken listing would be highly bullish for Pi because of its scale as the second-biggest American crypto exchange after Coinbase.

Pi Network price prediction: technical analysis

The daily timeframe chart shows that the value of Pi has remained under pressure in the past few months. It recently crossed the crucial support level at $0.1520, its previous all-time low.

The coin has remained below the 50-day and 100-day Exponential Moving Averages. It also sits below the Supertrend indicator, a highly bearish sign in technical analysis.

On the positive side, the coin has become highly oversold, with the Relative Strength Index remaining below 30. Therefore, the most likely scenario is where it remains in this range this week. A move above the key resistance at $0.1520 will invalidate the bearish outlook and point to more gains.

Crypto World

Strategy’s Bitcoin Treasury Is Underwater But 2025 Results Still Impressive

Bitcoin dips near $60K, leaving Strategy’s $59.75 billion holdings underwater.

Strategy, the world’s largest corporate Bitcoin holder, reported owning 713,502 BTC, worth approximately $59.75 billion as of February 1st. The company’s total cost basis for these holdings is $54.26 billion, which translates to an average cost of $76,052 per bitcoin.

With Bitcoin dropping to almost $60,000, well below Strategy’s average purchase price, the firm’s vast BTC treasury is currently underwater.

Treasury Under Strain

In 2025, Strategy achieved a full-year BTC yield of 22.8% and recorded gains of 101,873 BTC. The company continued to expand its BTC treasury in January 2026 and ended up acquiring an additional 41,002 BTC.

Strategy started in 1989 as a traditional software company focused on data analytics. In 2020, co-founder Michael Saylor made a major pivot to Bitcoin, seeing it as a safer alternative to cash during pandemic-era stimulus and low interest rates. The company began using BTC as a long-term treasury asset.

By 2025, it rebranded as Strategy and fully embraced its role as a BTC-first company. The pivot drew attention from regulators and index providers, who questioned whether a firm dominated by crypto should remain in major indices. MSCI suggested companies holding more than half their assets in Bitcoin might be considered non-operating. Strategy, however, argued that it actively uses Bitcoin to raise capital and drive shareholder value. Attempts to join the S&P 500 in September and December 2025 also failed.

Despite this, Strategy’s Bitcoin holdings have remained central to its financial structure and are closely tied to its digital credit instruments, particularly STRC, which acts as a complementary tool for risk management and capital amplification. STRC’s growth to $3.4 billion has been supported by higher liquidity and lower volatility in the crypto markets.

The company raised $25.3 billion in 2025 to support its BTC treasury and preferred stock offerings, which made it the largest US equity issuer for the second consecutive year. It also maintains a $2.25 billion USD Reserve, covering over 2.5 years of preferred stock dividends and interest obligations, providing additional stability amid market swings.

You may also like:

The recent dip in the leading crypto asset has renewed concerns about corporate BTC exposure. Popular investor Michael Burry recently claimed that Bitcoin’s behavior as a speculative asset, rather than a hedge, could pose significant risks for companies holding large BTC treasuries. He observed that further price declines could leave major holders, including Strategy, deeply underwater and potentially limit access to capital markets, thereby amplifying financial stress.

Losses Surge in Q4

Meanwhile, Strategy’s operating losses for the quarter were found to be $17.4 billion, entirely due to unrealized losses on digital assets, compared with a $1.0 billion operating loss in Q4 2024 under the prior accounting model.

Net loss for the quarter was $12.4 billion, up from $670.8 million in the same period of 2024. Cash and cash equivalents rose to $2.3 billion from $38.1 million, driven largely by the establishment of the USD Reserve.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Jack Dorsey’s Block Could Cut Up to 10% of Staff, Report Says

Block Inc. is pursuing a broad restructuring designed to sharpen efficiency, align its product lines, and knit together Cash App’s consumer payments with Square’s merchant services. The plan has prompted conversations within the company about role reductions during annual performance reviews, a sign that management is tightening cost controls as it recalibrates its business mix. People familiar with the matter say as many as 10% of Block’s workforce could be affected, a substantial slice for a company that employed just under 11,000 people as of late November. The move arrives as Block seeks to balance near-term profitability with long-running bets in crypto and fintech innovation.

The restructure, which began taking clearer form after a 2024 reorganization, is intended to bring Cash App more tightly in line with Square, Block’s merchant services division. By integrating the consumer-to-business payments ecosystem, executives hope to create a more seamless flow of users across services and reduce redundancies within operations. The strategy reflects a broader industry trend: fintech firms are recalibrating their internal structures to preserve margins as competition intensifies and users demand more integrated products.

Beyond cost discipline, Block has pressed ahead with growth initiatives that extend well beyond payments. The company has been expanding its newer lines, including a Bitcoin (CRYPTO: BTC) mining venture under Proto and an artificial intelligence project known as Goose. While some investors worry about “growth at any cost” disclosures, Block is positioning these projects as long-duration bets that could diversify revenue streams in a crypto-rich future. The balance sheet, however, continues to reflect the complexity of crypto exposure: the company’s third-quarter results highlighted both the potential and the risk of its bitcoin activities.

Block shares rallied on the latest trading day, ending Friday up nearly 5%. The move underscores a market that remains sensitive to earnings trajectories and the trajectory of Block’s efficiency drive as investors weigh the potential upside from its crypto and AI bets against the near-term impact of cost reductions.

The company is set to report its fourth-quarter results on February 26. Analysts surveyed by Bloomberg expected adjusted earnings of about $403 million, or 68 cents per share, on roughly $6.25 billion in revenue. Those projections sit against Block’s prior quarter, when it posted net income of $461.5 million on $6.11 billion in revenue. Gross profit rose 18% year over year, driven by 24% growth in Cash App and 9% growth in Square, though some performance metrics missed Wall Street expectations and weighed on sentiment.

On the revenue mix, Bitcoin contributed a significant portion in the third quarter, generating roughly $1.97 billion in revenue, a decline from $2.4 billion a year earlier but still the company’s second-largest revenue stream. Block held 8,780 BTC worth over $1 billion by the end of September, though the company logged a quarterly valuation loss of about $59 million on its bitcoin holdings. Those figures illustrate the tension between crypto as a revenue engine and the volatility that accompanies digital asset exposure.

Block’s push into crypto-enabled payments has been a core feature of its broader strategy. In November of last year, Square, Block’s payments arm, rolled out a Bitcoin payments option at checkout via its point-of-sale terminals, enabling merchants to accept BTC directly and offering multiple pathways for conversion and settlement. The feature builds on earlier tools that let merchants convert a portion of daily card sales into Bitcoin as part of Square’s wallet ecosystem, reinforcing the company’s aim to embed cryptocurrency into everyday transactions. The expansion has reached millions of sellers across eight countries, underscoring Block’s ambition to normalize crypto in everyday commerce.

The broader narrative around Block’s strategy also touches on how it manages digital-asset capabilities within a traditional payments framework. Some observers have flagged regulatory and market risks inherent in crypto-adjacent businesses, while others highlight the potential for cash flows from both merchant services and consumer wallets to harness network effects. In parallel with its payments ambitions, Block has signaled interest in stablecoins and other crypto-facilitated capabilities. The company’s crypto endeavors are occasionally framed as a hedge against the volatility of traditional payments margins, even as they introduce new layers of risk that investors must monitor closely. For readers tracking this space, it’s worth noting that stablecoin-related developments have drawn scrutiny and interest from regulators, a dynamic that could influence Block’s product roadmap and timing of crypto-enabled features.

Why it matters

The near-term significance lies in Block’s attempt to fuse its consumer and merchant ecosystems more tightly while continuing to push into crypto and AI experimentation. If the restructuring yields meaningful cost savings without sacrificing growth, Block could improve its operating leverage at a time when fintechs face margin pressure and competitive intensity. The company’s ability to deliver a coherent cross-sell thesis—pulling Cash App users into Square’s merchant services and vice versa—could unlock higher lifetime value per customer and create a more resilient revenue base.

From a crypto perspective, the scaling of BTC-related revenue and the ongoing mining and AI ventures signal a deliberate, long-horizon approach to digital assets as a core strategic differentiator. The Q3 bitcoin rebound in revenue—despite a year-over-year decline—demonstrates that crypto remains a material driver of Block’s top line, even as the company navigates volatility in asset prices and the valuation challenges that come with large BTC holdings. The question for investors is whether the company’s crypto investments translate into durable cash flows or whether they remain a portfolio of bets requiring ongoing capital allocation and risk management.

For users and developers in the payments and fintech space, Block’s moves underscore a broader shift toward platform-centric models that knit together payments, wallets, and crypto services. If successful, the integration of Cash App with Square could yield more seamless onboarding, better data integration, and richer product ecosystems, enabling the company to monetize increasingly large audiences across both consumer and merchant segments. The ongoing expansion into mining and AI suggests Block intends to diversify away from reliance on any single revenue source, a strategy that could resonate with investors seeking exposure to multiple growth vectors within a single corporate banner.

What to watch next

- Feb. 26 – Block’s fourth-quarter earnings release and accompanying guidance, including updated profit metrics and potential commentary on the restructuring’s impact on margins.

- Progress updates on the 2024 reorganization, specifically any milestones tied to aligning Cash App with Square and improving cross-product customer journeys.

- Operational updates from Proto (BTC mining) and Goose (AI) projects, including any partnerships, capital deployments, or pilot milestones.

- Regulatory developments or market signals affecting crypto-enabled payments and stablecoins, which could influence product timing and capital allocation.

Sources & verification

- Bloomberg article on Block cutting up to 10% of staff as part of an efficiency push.

- Block’s reported third-quarter results: net income, revenue, gross profit growth, and Bitcoin revenue details.

- Square’s November rollout of Bitcoin payments for merchants and related capabilities.

- Block’s anticipated fourth-quarter earnings release date (Feb. 26) and consensus estimates.

Block’s restructuring tightens focus on payments and crypto ventures

Block Inc. is pursuing a broad restructuring designed to sharpen efficiency, align its product lines, and knit together Cash App’s consumer payments with Square’s merchant services. The plan has prompted conversations within the company about role reductions during annual performance reviews, a sign that management is tightening cost controls as it recalibrates its business mix. People familiar with the matter say as many as 10% of Block’s workforce could be affected, a substantial slice for a company that employed just under 11,000 people as of late November. The move arrives as Block seeks to balance near-term profitability with long-running bets in crypto and fintech innovation.

The restructure, which began taking clearer form after a 2024 reorganization, is intended to bring Cash App more tightly in line with Square, Block’s merchant services division. By integrating the consumer-to-business payments ecosystem, executives hope to create a more seamless flow of users across services and reduce redundancies within operations. The strategy reflects a broader industry trend: fintech firms are recalibrating their internal structures to preserve margins as competition intensifies and users demand more integrated products.

Beyond cost discipline, Block has pressed ahead with growth initiatives that extend well beyond payments. The company has been expanding its newer lines, including a Bitcoin (CRYPTO: BTC) mining venture under Proto and an artificial intelligence project known as Goose. While some investors worry about “growth at any cost” disclosures, Block is positioning these projects as long-duration bets that could diversify revenue streams in a crypto-rich future. The balance sheet, however, continues to reflect the complexity of crypto exposure: the company’s third-quarter results highlighted both the potential and the risk of its bitcoin activities.

Block shares rallied on the latest trading day, ending Friday up nearly 5%. The move underscores a market that remains sensitive to earnings trajectories and the trajectory of Block’s efficiency drive as investors weigh the potential upside from its crypto and AI bets against the near-term impact of cost reductions.

The company is set to report its fourth-quarter results on February 26. Analysts surveyed by Bloomberg expected adjusted earnings of about $403 million, or 68 cents per share, on roughly $6.25 billion in revenue. Those projections sit against Block’s prior quarter, when it posted net income of $461.5 million on $6.11 billion in revenue. Gross profit rose 18% year over year, driven by 24% growth in Cash App and 9% growth in Square, though some performance metrics missed Wall Street expectations and weighed on sentiment.

On the revenue mix, Bitcoin contributed a significant portion in the third quarter, generating roughly $1.97 billion in revenue, a decline from $2.4 billion a year earlier but still the company’s second-largest revenue stream. Block held 8,780 BTC worth over $1 billion by the end of September, though the company logged a quarterly valuation loss of about $59 million on its bitcoin holdings. Those figures illustrate the tension between crypto as a revenue engine and the volatility that accompanies digital asset exposure.

Block’s push into crypto-enabled payments has been a core feature of its broader strategy. In November of last year, Square, Block’s payments arm, rolled out a Bitcoin payments option at checkout via its point-of-sale terminals, enabling merchants to accept BTC directly and offering multiple pathways for conversion and settlement. The feature builds on earlier tools that let merchants convert a portion of daily card sales into Bitcoin as part of Square’s wallet ecosystem, reinforcing the company’s aim to embed cryptocurrency into everyday transactions. The expansion has reached millions of sellers across eight countries, underscoring Block’s ambition to normalize crypto in everyday commerce.

The broader narrative around Block’s strategy also touches on how it manages digital-asset capabilities within a traditional payments framework. Some observers have flagged regulatory and market risks inherent in crypto-adjacent businesses, while others highlight the potential for cash flows from both merchant services and consumer wallets to harness network effects. In parallel with its payments ambitions, Block has signaled interest in stablecoins and other crypto-facilitated capabilities. The company’s crypto endeavors are occasionally framed as a hedge against the volatility of traditional payments margins, even as they introduce new layers of risk that investors must monitor closely. For readers tracking this space, it’s worth noting that stablecoin-related developments have drawn scrutiny and interest from regulators, a dynamic that could influence Block’s product roadmap and timing of crypto-enabled features.

Block’s restructuring and crypto bets illustrate a deliberate attempt to diversify revenue streams while strengthening core services. If the company can successfully integrate Cash App with Square, it would enable more robust cross-selling opportunities and a cohesive loyalty proposition that could boost retention and lifetime value. At the same time, the BTC mining and Goose AI initiatives serve as parallel growth rails, potentially generating new cash flows even as they introduce volatility and execution risk. The next earnings cycle will be crucial in signaling whether the restructuring translates into measurable margin improvement and sustainable long-term growth.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech4 days ago

Tech4 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics6 days ago

Politics6 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports1 day ago

Sports1 day agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Former Viking Enters Hall of Fame

-

Crypto World6 days ago

Crypto World6 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports2 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 hours ago

Business3 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports6 days ago

Sports6 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat6 days ago

NewsBeat6 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat1 day ago

NewsBeat1 day agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World5 days ago

Crypto World5 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat5 days ago

NewsBeat5 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World3 days ago

Crypto World3 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World3 days ago

Crypto World3 days agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation