Crypto World

Bitcoin Crashes to $60K as Sentiment Hits 2022 Lows

Crypto market sentiment has slumped to its lowest level in over three and a half years amid Bitcoin falling by double-digit percentage points to a low of around $60,000.

The Crypto Fear & Greed Index fell to a score of 9 out of 100 on Friday, indicating “extreme fear” in the market and hitting its lowest point since June 2022, when sentiment and the market fell in the wake of the collapse of the Terra blockchain a month earlier.

The index has been at a low for the last fortnight as Bitcoin (BTC) has tanked 38% from its 2026 high of $97,000 in just three weeks, wiping out all gains for the past sixteen months.

Bitcoin falls to $60,000 on Coinbase

Bitcoin fell to its lowest level since October 2024 at a little over $60,000 on Coinbase in early trading on Friday morning, according to TradingView.

It is currently trading at just over $64,000 after dumping 13% over the past 24 hours and losing over $10,000 in its largest daily loss since mid-2022.

Related: Coinbase premium hits yearly low, hinting at institutional selling

Bitcoin has now collapsed below the 200-week exponential moving average, a long-term trend indicator, which has only previously happened in the depths of a bear market. It is currently 50% down from its all-time high of $126,000 in early October.

Over the past 24 hours, more than 588,000 traders were liquidated for $2.7 billion, 85% of them were leveraged longs predominantly in Bitcoin, according to CoinGlass.

Tech stock slump and Fed caution behind the crash

Jeff Ko, chief analyst at CoinEx Research, told Cointelegraph that Bitcoin’s more than 20% drawdown in a week comes alongside a selloff in US tech stocks “where stretched valuations and lingering concerns around an artificial intelligence-driven bubble have long been highlighted by the market.”

“Even Amazon suffered a double-digit decline overnight following a mixed earnings release,” he added. “Investors are increasingly reassessing Bitcoin’s failure to function as a safe haven compared to gold.”

LVRG Research director Nick Ruck said Bitcoin’s fall and a broader market decline comes amid “heightened risk aversion” triggered by “softer US job market signals, including rising unemployment claims that raise doubts about sustained economic strength and potential Fed caution on aggressive rate cuts.”

Magazine: DAT panic dumps 73,000 ETH, India’s crypto tax stays: Asia Express

Crypto World

Transacta Partners with CryptoJets to Support Growing Demand for Crypto Payments in Private Aviation

[PRESS RELEASE – Tallinn, Estonia, March 4th, 2026]

CryptoJets, a global private jet and helicopter brokerage, has announced a partnership with Transacta to support the growing demand for cryptocurrency payments in private aviation.

The growing demand for fast and secure crypto payments

Demand for cryptocurrency payment options in luxury travel continues to grow as wealth shifts toward younger generations. The private aviation sector is increasingly embracing digital currencies, driven by both practical needs and broader market development.

Built for travelers who value privacy, speed, and flexibility, CryptoJets operates with access to a global network of more than 5,000 charter operators, providing on-demand private jet and helicopter services to clients worldwide.

As the volume of crypto-funded bookings continued to grow, the company identified the need to further optimize payment speed, settlement reliability, and geographic coverage. Through its partnership with Transacta, CryptoJets is expanding its route network and operational capacity across 180 countries while offering clients a more streamlined way to process high-value charter payments.

“Crypto payments have already been part of how our clients prefer to pay,” said Erik Rand, Head of Operations at CryptoJets. “This partnership allows us to process those payments faster, improve settlement across markets, and scale our operations without compromising on compliance or client experience.”

Expertise in settling high-value transactions for luxury merchants worldwide

Built on years of experience working with luxury businesses, Transacta delivers payment solutions for merchants handling large, complex deals — without operational friction and under bespoke client requirements.

Transacta‘s financial rails allow CryptoJets to process large transactions in crypto and settle them in fiat to their bank account within 1–2 business days, meeting all legal requirements.

“We’re starting a new chapter together with CryptoJets. And for us, this partnership is a challenge we’re excited to take on — improving the speed and overall quality of payment processing for high-value charter transactions.” said Dmitrijs Maceraliks, CEO of Transacta.

About Transacta:

Founded in Estonia in 2018, Transacta (previously Transcrypt OÜ) offers a regulated payment infrastructure that enables merchants to accept crypto payments with instant fiat settlement. Transacta is licensed by the Estonian Financial Intelligence Unit, registered with FinCEN in the U.S. and FINTRAC in Canada, and operates under FINMA supervision.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Star Trek’s Captain Kirk Unveils X Money as Limited Beta Goes Live

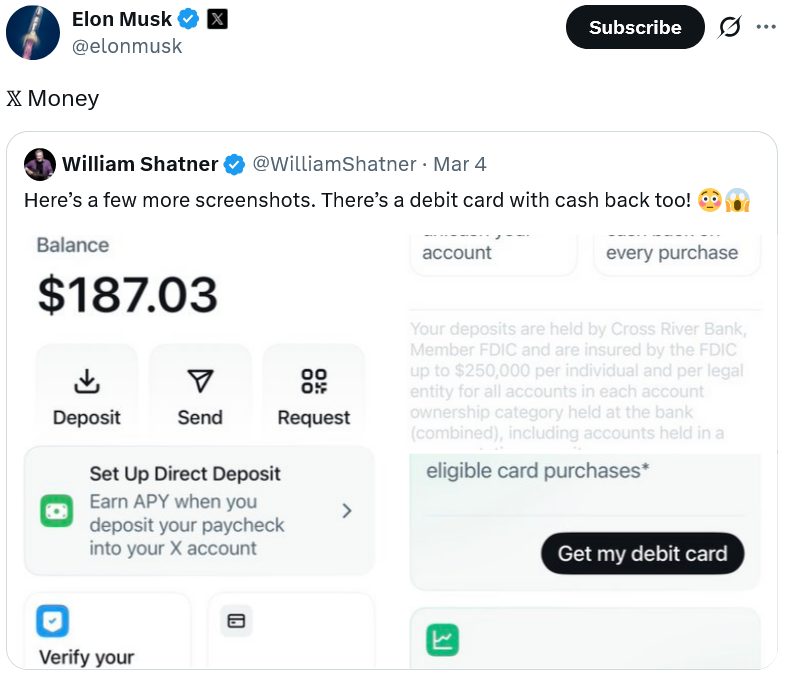

Dogecoin (CRYPTO: DOGE) sits at the edge of a broader push by Elon Musk to turn X into a pervasive payments platform, as the company tests external beta features for X Money. The early test phase highlights cashback on certain card purchases and a 6% annual percentage yield on deposits, according to screenshots and posts from beta testers that circulated this week. Hollywood actor William Shatner, famous for his Star Trek captain role, was among the first to publicly participate, signaling Musk’s intent to generate buzz through high-profile user involvement. Deposits in the beta are reportedly held by Cross River Bank and insured by the FDIC up to $250,000 per person, adding a familiar consumer-protection layer to the experiment. The effort underscores Musk’s broader plan to fuse payments, messaging, and AI-driven functionality into a single app ecosystem.

Key takeaways

- External beta testing for X Money is underway, with screenshots showing cashback on select card purchases and a 6% APY on deposits.

- Deposits are held by Cross River Bank and FDIC-insured up to $250,000 per person, aligning with standard U.S. consumer protections.

- William Shatner participated in the beta rollout, and engaged in an auction-based approach to invite a broader set of testers.

- Several links suggest X Money is still tightly aligned with Musk’s goal of an all-in-one platform, but the extent of any crypto integration remains unclear.

- X Money’s progress sits within a broader narrative of Musk’s push to expand payments functionality and digital services on X, including licensed money transmission and peer-to-peer payments initiatives.

Tickers mentioned: $DOGE

Sentiment: Neutral

Price impact: Neutral. The rollout appears to be a strategic product test rather than a market-moving initiative.

Market context: The beta reflects a growing trend of tech platforms expanding payment rails and financial services, even as the regulatory and compliance framework for such services continues to evolve. The move also aligns with broader industry activity around on-platform payments, wallet features, and bank-partnered deposit solutions as tech giants explore monolithic app ecosystems.

Why it matters

The X Money beta narrative is more than a product test; it signals Musk’s intent to transform X into a centralized hub for financial and digital services. By layering cashback rewards and a comparatively high yield on deposits, the program aims to demonstrate real-world value for users who might otherwise rely on standalone payment apps or traditional banks. The involvement of a high-profile tester like William Shatner — who has publicly advanced charity efforts tied to the beta — illustrates a strategy to accelerate user acquisition through media attention and social reach.

From a regulatory and risk perspective, the move to partner with Cross River Bank and FDIC insurance offers some reassurance to users wary of digital wallets. The “everything app” concept, which Musk has described as a place where all money flows through X, relies heavily on a broad regulatory permission set, including state money transmitter licenses and FinCEN-registration for peer-to-peer payments. As X expands its financial services ambitions, observers will be watching how the company navigates licensing, consumer protections, and interoperability with existing payment rails. The absence of a clear, public crypto integration within X Money—despite Musk’s long-running affinity for meme-based assets—also matters, as it signals a cautious, perhaps modular approach to crypto features rather than an immediate push.

On the crypto front, speculation remains active around whether DOGE could be woven into future X Money features, given Musk’s past affinity for the memecoin. A direct crypto integration has not been announced, and the beta materials focus on fiat-based rewards and insured deposits rather than on-chain assets. This restraint may reflect a prudent step as the platform tests core payments and deposit mechanics, while keeping potential future crypto capabilities as a future-leaning option rather than a current priority. The existing environment around payments on social platforms — including licenses, security standards, and consumer protections — will continue to shape whether and when deeper crypto integrations might appear.

X, Shatner to expand beta testing

The beta rollout has taken a noticeable step forward with a public auction approach to inviting testers. Shatner has used a $42 handout from Musk to raise funds for charity, and, with X’s permission, auctioned 42 beta invites for $1,000 each. The winners receive a $25 welcome gift card and a metal X Money debit card bearing their X username from Visa’s partnership. This approach, which blends charitable framing with premium access, aims to generate momentum and equity among early adopters. A second auction round subsequently opened, offering an additional 166 beta invites at the same price point. The model appears designed to monetize scarcity while building a small, engaged testing community that can provide real-world feedback before broader deployment.

Participation criteria are straightforward but precise: US residents over 18 who maintain an active X account in good standing qualify for eligibility. This gating ensures compliance with banking and payments regulations while allowing Musk’s team to observe how a controlled cohort interacts with cashback incentives, deposit yields, and ATM-like features that may be part of the X Money experience. Those involved in the beta can look forward to a metal debit card and other tangible perks as the program scales, though the exact timelines for a wide rollout remain fluid.

Meanwhile, the crypto question lingers. While Dogecoin speculation continues to hover around the project, there is no explicit confirmation of crypto payments or token integration within X Money in the current beta materials. Musk’s broader aim to transform X into an essential, all-purpose platform remains evident, with X Money acting as a critical piece of the puzzle rather than the entire blueprint. The strategic emphasis appears to be on securing a reliable, regulated base for payments and deposits, possibly paving the way for optional crypto features once the core system proves stable and scalable.

No sign of crypto

The public-facing beta materials emphasize consumer banking-like features rather than on-chain instruments. DOGE speculation is part of the broader discourse around X’s future, but no concrete integration has been announced in the current beta. The focus remains on tangible benefits for users through cashback and deposit yields, along with a secure, insured funding arrangement via a vetted banking partner. This careful stance suggests that any crypto functionalities would be evaluated separately, ensuring compliance and user protection before any broader integration is pursued.

What to watch next

- How many additional beta invites are issued and the pace of expansion beyond the initial rounds.

- Whether X reveals more details about crypto capabilities or any planned DOGE-related features inside X Money.

- Regulatory updates or additional licensing steps across states as X deepens its payments infrastructure.

- Updates on the user experience of cashback and deposit yields, including any changes to FDIC insurance coverage or partner banks.

- Public statements from Musk or X leadership outlining a concrete timeline for a wider launch and potential product integrations.

Sources & verification

- Elon Musk: X Money external beta live next 1-2 months (Cointelegraph article)

- Elon Musk confirms X Money beta-testing launch 2025 (Cointelegraph article)

- Elon Musk X Financial Services X Money App 2025 (Cointelegraph article)

- Dogecoin price index (DOGE) (Cointelegraph DOGE index)

- Kraken wins Kansas City Fed approval for limited master account access (Cointelegraph article)

What the rollout means for users and the market

The X Money beta illuminates a broader trend of technology platforms expanding financial services with a regulatory-compliant backbone. By partnering with established banks and offering FDIC-insured deposits, X attempts to balance user appeal with consumer protections. The charity-driven invitation strategy, highlighted by Shatner’s involvement, underscores a marketing approach aimed at accelerating adoption while maintaining a narrative around social impact. For builders and investors, the test signals how a technology-first platform may evolve to handle payments, wallets, and identity services in a tightly controlled environment before any broader crypto integration is contemplated.

From a market perspective, the experiment sits against a backdrop of liquidity and risk sentiment shaped by macro developments and regulatory scrutiny. The emphasis on real-world benefits—cashback and yields—coupled with a robust compliance footprint, could influence user expectations for digital wallets and platform-based payments. If X Money proves scalable and reliable, it may set a benchmark for other social platforms seeking to monetize user activity through financial services without compromising security and regulatory alignment.

What to watch next

- Upcoming beta expansion milestones and any official timeline updates from X.

- Clarity on crypto-related features or token support within X Money, if any.

- Regulatory developments affecting money transmission licenses and P2P payment capabilities on X.

Crypto World

Ripple (XRP) Price Predictions for This Week

XRP downtrend resumes. Can buyers put a stop to it?

Ripple (XRP) Price Predictions: Analysis

Key support levels: $1

Key resistance levels: $1.4

XRP’s Downtrend Resumes

After the price spiked in both directions, sellers appear to have gained the upper hand, as they managed to defend the $1.4 resistance, which is currently preventing bulls from regaining the initiative.

At the time of this post, XRP is struggling to hold above $1.35 and may retest the $1.28 level, which briefly halted the downtrend last week.

Bears Have the Initiative

With the past two weekly candles closing in red, sellers have full control over the price action right now. This makes the outlook bearish and may open the way for XRP to fall all the way to $1. This is the most important support level on the chart.

Buyers could return around $1.2, but it is too early to say if they will manage to reverse the downtrend there since any weakness could encourage sellers to increase their pressure.

You may also like:

MACD Wants to Reverse

The MACD is already bullish on the daily timeframe and is signaling a potential reversal on higher timeframes, such as the 3-day view. The histogram is making higher lows and appears ready to move to the positive side.

If the 3-day MACD crosses bullish, buyers will have a clear opening to regain control of the price and begin a relief rally. That will be confirmed if they manage to turn $1.4 into a key support later on.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Elon Musk Taps Captain Kirk to Showcase X Money

Elon Musk’s new payment app X Money has rolled out limited external beta testing this week, with early screenshots showing that users will be eligible for cashback and yield on deposits.

One of the beta testers was Hollywood actor William Shatner, who played Captain Kirk in the original Star Trek series.

Several screenshots shared by Shatner show that X Money users will be able to earn cashback on certain card purchases and earn 6% annual percentage yield on deposits.

Another screenshot shows that deposits are held by Cross River Bank, a member of the Federal Deposit Insurance Corporation, and are insured up to $250,000 per person.

X Money is part of Musk’s “everything app” vision

On Feb. 11, Musk said X Money would go to external beta before launching to X users worldwide. It had been in closed beta testing since at least May 2025.

The integration of crypto payments into X Money remains a mystery, however.

X Money is part of Musk’s broader vision to make X an everything app, from payments and private messaging to AI chatbot services through Grok, creator content, identity and more.

“This is intended to be the place where all money is. The central source of all monetary transactions,” Musk said in February, calling it a “game changer.”

X, Shatner to expand beta testing

Shatner has since used the $42 Musk sent him to raise money for charity. With the permission of X, Shatner auctioned out 42 X Money beta invites for $1,000 each.

Each of the 42 winning bidders would receive a $25 welcome gift card from X and also $1, initially sent to Shatner by Musk.

After the first auction, Shatner and X opened up a second round of invites, auctioning out another 166 beta invites, also for $1,000.

To be eligible, users must be US residents over 18 and maintain an active X account in “good standing.”

Those who register will be able to receive a metal X Money debit card with their username from X’s partner, Visa, Shatner noted.

No sign of crypto

Musk’s appreciation for Dogecoin (DOGE) has sparked speculation in the crypto community that the memecoin could be part of X’s future, but nothing concrete has come of it, let alone any integration into X Money.

Related: Kraken wins Kansas City Fed approval for limited master account access

X Money marks a return to the payment space for Musk, having founded X.com in the late 1990s before it merged to become PayPal.

Over the last few years, X has secured money transmitter licenses in over 40 US states and registered with the Financial Crimes Enforcement Network to make peer-to-peer payments possible on the platform.

Magazine: Musk’s ‘AI in space’ plan, vending machine calls in FBI over $2 fee: AI Eye

Crypto World

Major Rally Ahead or Another Dead-Cat Bounce?

BTC at a crossroads: surge to $75K or correction to $65K?

The primary cryptocurrency has shown remarkable resilience amid the ongoing military conflict in the Middle East, briefly rising to a monthly peak of almost $72,000.

The big question now is whether this marks the start of a real breakout – or just another bull trap.

Further Gains Ahead?

The war between the USA (supported by Israel) and Iran has dominated global attention as the conflict intensifies, reshaping geopolitical alliances and fueling uncertainty across financial markets. Bitcoin (BTC) reacted negatively to the initial attack over the weekend, with its price plunging below $64,000.

In the following days, though, it reclaimed some of the lost ground, while several hours ago it pumped to a one-month high of nearly $72,000 before retreating to the current $71,000. A potential catalyst for the revival could be emerging reports that Iran has offered to discuss terms for ending the war.

Multiple analysts noted BTC’s resurgence, claiming it may have more fuel left to post an additional increase. The popular trader, using the X moniker Crypto Tony, believes a reclaim of $71,500 could open the door to a push to $74,000. X user exitpump shared a similar thesis, suggesting that a retest and hold of the $70K level may pave the way for a move above $75K.

Ash Crypto also chipped in. The analyst with more than 2 million followers on the social media platform said BTC’s weekly Relative Strength Index (RSI) has plunged to an all-time low. This means the price has dropped too much in a short period, making the asset oversold and ready for a potential comeback. Additionally, Ash Crypto outlined that sentiment among investors is at maximum fear: a development that could have marked the cycle bottom.

The Bears Are Not Done Yet

X user Ted drew an interesting parallel between the Russia-Ukraine war and the current Middle East conflict. He reminded that shortly after the Russian invasion in February 2022, BTC experienced a major pump, speculating that history could repeat itself and the asset may soar to as high as $80K in the near future. However, Ted warned that the surge in 2022 was short-lived and followed by a major pullback, hinting that a similar pattern might unfold in the coming weeks.

You may also like:

Prior to that, the analyst argued that a daily close beyond $70,000 “will be good for markets.” At the same time, he warned that failing to hold above that mark could lead to a retest of the $65,000-$66,000 support zone.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Swiss Lawmakers Warn UBS Over Ermotti’s Role in $26B Capital Reform Battle

TLDR:

- Swiss lawmakers warned UBS to reduce CEO Ermotti’s public profile amid the capital reform lobbying row.

- Finance Minister Keller-Sutter rejected a cross-party compromise proposal, deepening the two-year standoff.

- UBS’s board is in talks with Ermotti about extending his tenure past his planned April 2027 departure date.

- UBS has identified internal successors including Iqbal Khan, Robert Karofsky, Ivanovic, and Bea Martin.

UBS has been advised to dial back its lobbying campaign against Swiss government capital reform plans. Swiss lawmakers privately warned the bank to reduce CEO Sergio Ermotti’s public profile in opposing the changes.

The government is seeking to raise UBS capital requirements by up to $26 billion. The standoff has now stretched nearly two years, and a recent compromise proposal was firmly rejected.

Meanwhile, the bank’s board is actively exploring an extension of Ermotti’s tenure beyond April 2027.

Swiss Lawmakers Push Back on UBS Lobbying Strategy

UBS’s aggressive campaign against capital reforms has drawn notable criticism from Swiss parliamentarians. Lawmakers warned the bank that its current approach was working against its own cause.

One lawmaker acknowledged that many in parliament actually agree with UBS on a key point of contention. Even so, Ermotti’s public statements were described as unhelpful to the broader negotiation process.

A cross-party group of Swiss politicians presented a set of compromise proposals back in December 2025. Those proposals were widely regarded as a potential turning point in the prolonged dispute.

However, Finance Minister Karin Keller-Sutter rejected the compromise proposals entirely. That rejection effectively closed a door many had believed was starting to open.

The relationship between UBS leadership and Keller-Sutter has since deteriorated further. A member of Switzerland’s upper house privately advised the bank to reconsider its lobbying strategy.

The parliamentarian singled out Ermotti’s public-facing statements as a specific concern. Those statements, lawmakers argued, were hardening positions rather than encouraging dialogue.

Despite these warnings, UBS has shown no sign of pulling Ermotti back from the public stage. One person familiar with the bank’s lobbying efforts said reducing his profile was not being considered.

UBS publicly confirmed that Ermotti would remain Group CEO until at least early 2027. The bank maintained its position on capital reform remains both justified and well-founded.

Ermotti’s Tenure Extension Enters Board-Level Discussions

UBS’s board of directors is now open to keeping Ermotti in his role beyond his planned exit. The board has entered talks with Ermotti about staying past his originally planned April 2027 departure.

The aim is for him to lead the bank until there is greater certainty around its capital position. A final decision on whether he remains beyond that date has not yet been made.

Ermotti, who is 65, initially planned to step down once the Credit Suisse integration was complete. He returned to lead UBS in 2023 following the state-orchestrated takeover of Credit Suisse.

He had previously stated he would lead the bank until “at least” late 2026 or early 2027. Swiss newspaper NZZ was the first to report UBS was exploring an extended tenure for him.

The board has identified a shortlist of potential successors within the bank. Among those being considered are wealth management co-heads Iqbal Khan and Robert Karofsky.

Asset management chief Aleksandar Ivanovic and Chief Operating Officer Bea Martin are also on the list. UBS confirmed the board would evaluate both internal and external candidates when the time comes.

UBS noted the Credit Suisse integration would be substantially complete by end of 2026. The bank said it was premature to discuss a specific timeline for Ermotti’s departure.

There remains considerable work ahead in preparing the bank for its next strategic phase. The ongoing capital reform dispute continues to shape UBS’s leadership planning in meaningful ways.

Crypto World

Will ETH Finally Secure the $2K Breakout?

Ethereum is still trying to transition from capitulation into stabilization, with the price holding above the key $1,800 demand zone while repeatedly pressing into resistance near $2,150. The higher timeframe trend remains bearish, but the short-term structure is improving, so the next clean break from this range will likely set the tone for the next multi-week move.

Ethereum Price Analysis: The Daily Chart

On the daily chart, ETH is still trading below the 100-day moving average and the 200-day moving average, and both are sloping lower, which keeps the broader bias bearish. The asset is also respecting a descending channel, and the latest bounce is happening from the lower end of that structure rather than from a reclaimed trend level. The nearest overhead supply remains the $2,300 to $2,400 zone, which has acted as a pivot area during the previous distribution phase.

The most important support remains $1,800, which has been tested and defended after the sharp breakdown. If ETH loses $1,800 on a daily close, the next downside magnets are $1,600 and then $1,400, where prior demand zones sit on the chart. On the upside, a daily reclaim of $2,400 would be the first meaningful step toward shifting structure, with the next major resistance band near $2,800 to $3,000.

ETH/USDT 4-Hour Chart

On the 4-hour chart, ETH has been carving out a clear range, with buyers defending the $1,800 support area while sellers repeatedly cap the price near the $2,150 mark. This kind of consolidation after a hard sell-off often becomes a decision point, because liquidity builds at both ends, and the breakout can travel quickly. A clean push above $2,150 that holds would put $2,300 to $2,400 back in play as the next target zone.

If ETH fails again at $2,150 and rolls over, the immediate focus returns to the $1,800 area. The risk with repeated support tests is that each bounce can weaken the bid over time, especially if broader market sentiment stays fragile. A breakdown below $1,800 would likely trigger another volatility expansion move because it removes the main demand shelf that has been absorbing selling pressure.

On-Chain Analysis

The exchange reserve chart shows a sustained downtrend in ETH held on exchanges, falling toward roughly 15.9 million ETH. In general, declining exchange reserves are associated with reduced immediate sell-side supply, because fewer coins are sitting on venues where they can be quickly sold. That can support stronger rebounds when demand returns, especially if the price is already basing near support.

The key nuance is timing. During a bear phase, reserve declines can reflect a mix of cold storage withdrawals, staking, and migration to on-chain venues, not necessarily aggressive accumulation. If reserves keep falling while price holds above $1,800 and starts reclaiming resistance, it would strengthen the case for a recovery move. If reserves flatten or begin rising again while ETH remains rejected under $2,150, it can signal renewed distribution and increase the odds of another sweep back into the $1,800 support area.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Ripple Price Analysis: XRP at a Make-or-Break Level

XRP is still trading under a broader bearish structure, but the recent price action looks like a base attempt after the sharp drawdown. For buyers, the main job is to reclaim key resistance zones and break the downtrend structure. Otherwise, this remains a sideways pause inside a larger downtrend.

Ripple Price Analysis: The USDT Pair

On the daily XRPUSDT chart timeframe, Ripple’s token is trading around $1.40 inside a descending channel and below both the 100-day and 200-day moving averages, which are still acting as overhead pressure. The nearest resistance sits around $1.70 to $1.80, where prior demand flipped into supply and where the 100-day moving average area is also located. The higher boundary of the descending channel is also located just above this area.

On the other side, support is defined around $1.20 to $1.10, which is the key floor that has to hold to keep the base intact. If XRP can reclaim $1.85, the next major upside zone is around $2.45 to $2.50, but if $1.20 fails, downside risk expands quickly because it breaks the current support shelf.

The BTC Pair

On the daily XRPBTC chart, the token is pressing into a key support region near 2,000 sats. The asset is also sitting below the 100-day and 200-day moving averages, so relative strength versus Bitcoin is still weak.

If 2,000 sats hold and XRP can reclaim 2,200 and 2,500 sats, the next upside target becomes 2,700 sats, with 3,000 sats as the key, higher resistance zone. However, if the 2,000 sats support zone breaks on a clean daily close, the next major demand area comes in way deeper at around the 1,500 sats zone.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Stable Yuan, Shrinking Flight: What China’s NPC Means for Crypto

China’s National People’s Congress opened on March 5 with signals that will reshape crypto capital flows for years to come. A stable yuan, record fiscal spending, and a structural push toward equity financing and RWA markets — these are the numbers that matter for digital asset investors.

However, the headlines stopped at China’s growth target of 4.5–5%, the lowest range since 1991. They shouldn’t, because the math tells a bigger story.

A Small Percentage of a Very Large Number

China’s economy surpassed $20 trillion for the first time in 2025, cementing its status as the world’s second-largest economy. Even at the floor of the new target range, China still adds roughly $900 billion to global output this year. The Netherlands, Saudi Arabia, Poland, and Switzerland each run economies of roughly $1 trillion to $1.3 trillion, and China is generating nearly that much in new economic activity, on top of what it already has.

In 2025, China contributed around 30% of total global economic expansion, reinforcing its role as the world’s primary growth engine. That share holds even if 2026 comes in at the lower end of the stated range. The rate of growth is decelerating, but the sheer weight behind it is not shrinking.

Why the Framing Matters for Markets

On the property side, Beijing stopped well short of a sweeping bailout. Policymakers pledged to coordinate orderly risk resolution across real estate, local government debt, and smaller financial institutions. The “white list” mechanism for housing projects continues, and unsold homes will be purchased for government-subsidised use — but there is no aggressive reflation of the sector. That measured stance keeps a lid on near-term expectations for iron ore and copper demand.

For crypto, Beijing’s broader policy package carries more signal than the growth target itself. China reaffirmed loose monetary policy and flagged RRR and interest rate cuts as active options going forward. Total general public budget expenditure hits 30 trillion yuan for the first time, with the overall deficit at 5.89 trillion yuan.

Macquarie’s chief China economist noted that if exports falter, Beijing will dial up domestic stimulus to defend the GDP target. The floor under Chinese liquidity is meaningfully higher than the headline growth figure suggests.

Yuan Stability Is the Real Signal

Beijing’s commitment to a basically stable yuan matters more than the growth number for near-term currency and crypto flows. Analysts see Beijing tolerating gradual yuan appreciation toward 6.70 against the dollar, while resisting sharper moves that would erode China’s hard-won competitive edge. A controlled, modestly stronger yuan reduces the pressure from capital flight that has historically driven Chinese retail demand toward Bitcoin and dollar-pegged stablecoins.

The 15th Five-Year Plan: Quality Over Speed

The annual growth target is only part of what the NPC unveiled on March 5. Beijing simultaneously released the 15th Five-Year Plan, setting the strategic framework through 2030. Previously, the headline theme was technological innovation; now, a modernized industrial system stands at the forefront, with innovation following directly after. The sequencing is intentional — turning lab breakthroughs into scalable production capacity, not just patents.

Central to the plan is an R&D spending target of more than 3.2% of GDP, a record high aimed at overcoming what Beijing calls “chokepoint” technologies. Advanced manufacturing, semiconductors, next-generation IT, and aerospace are the designated priority sectors.

The digital economy’s targeted share of 12.5% of GDP by 2030, combined with an embedded “AI-Plus” consumption model, is the number most relevant for crypto and digital asset markets. This planning cycle is less about acceleration and more about reengineering the vehicle itself — and at $20 trillion in scale, that vehicle is large enough that even a cautious rebuild moves global markets.

Crypto World

Fold Pays Off $66M Debt, Frees Up BTC Collateral

Fold, a Nasdaq-listed Bitcoin financial services firm, has removed a major liability from its balance sheet after eliminating $66.3 million in convertible debt. The move also released 521 Bitcoin previously pledged as collateral, giving the company direct access to assets that had been locked against its financing obligations. By removing convertible notes that could have been turned into equity, Fold has reduced potential share dilution while gaining more operational flexibility. The restructuring comes as the company prepares to expand its consumer-facing product lineup, including a Bitcoin rewards credit card designed to attract mainstream users interested in accumulating digital assets through everyday spending.

Key takeaways

- Fold retired $66.3 million in convertible debt, removing the possibility of future equity dilution tied to those notes.

- The repayment freed 521 Bitcoin previously used as collateral, restoring full corporate control over the assets.

- With the debt eliminated, the company says it now operates under fewer financing constraints.

- Fold is preparing to launch a consumer Bitcoin rewards credit card as part of its growth strategy.

- The firm became publicly listed in February 2025 after completing a SPAC merger with FTAC Emerald Acquisition.

- Competition among crypto rewards cards is intensifying, with multiple platforms offering similar spending incentives.

Tickers mentioned: $BTC, $FLD

Sentiment: Neutral

Price impact: Neutral. The balance sheet improvement may strengthen fundamentals, but no immediate market reaction is indicated.

Market context: Crypto-financial companies are increasingly exploring debit and credit card products that reward users in digital assets, reflecting broader efforts to integrate cryptocurrency with everyday payments.

Why it matters

Balance sheet restructuring can significantly affect how financial technology companies operate in volatile markets. By removing convertible debt, Fold eliminates a potential source of dilution that could have impacted shareholders if the notes were converted into stock. For investors, this simplifies the company’s capital structure and clarifies its long-term financial obligations.

The release of more than 500 Bitcoin also increases the firm’s strategic flexibility. Digital asset reserves can be used for corporate operations, liquidity management or ecosystem initiatives, particularly as competition among crypto-financial platforms continues to intensify.

More broadly, Fold’s focus on rewards-based Bitcoin accumulation highlights a growing trend within the industry. Instead of positioning cryptocurrency primarily as a speculative asset, many platforms are now embedding it within consumer finance tools, potentially accelerating mainstream adoption.

What to watch next

- The rollout timeline and adoption metrics for Fold’s planned Bitcoin rewards credit card.

- How the newly released Bitcoin holdings are allocated within the company’s corporate strategy.

- Potential financial disclosures showing the impact of the debt restructuring on Fold’s balance sheet.

- Competitive responses from other crypto card providers expanding into consumer payment services.

Sources & verification

- Fold’s official disclosure announcing the elimination of its convertible debt.

- Public filings and investor communications regarding the company’s capital restructuring.

- Market data showing Fold’s share performance following its Nasdaq listing.

- Public announcements from crypto payment platforms offering reward-based cards.

Fold removes debt overhang as crypto rewards competition intensifies

Fold, a publicly traded financial technology company focused on Bitcoin (CRYPTO: BTC) services, has eliminated $66.3 million in convertible debt, a move that simplifies its financial structure and restores access to digital assets that had previously been pledged as collateral. The decision removes a potential source of future shareholder dilution while improving the company’s operational flexibility as it prepares to expand its consumer products.

According to the company’s disclosure, Fold repaid two outstanding convertible notes. These financial instruments allow lenders to convert debt into equity at a later date under predetermined terms. While such financing can provide early-stage capital, it also carries the possibility of share dilution if creditors exercise conversion rights.

By retiring the notes entirely, Fold removed that risk. The company’s management indicated that the repayment strengthens the balance sheet and clarifies its capital structure, which can be particularly important for publicly traded firms navigating volatile market conditions.

The restructuring also released 521 Bitcoin that had been locked as collateral for the debt. With the notes settled, the digital assets are no longer encumbered and can be redeployed for corporate use. This may include treasury management, strategic initiatives or other operational needs as the company continues expanding its services.

Access to those holdings could become increasingly important as Bitcoin-focused financial companies look to build new products around digital asset accumulation and spending. While Fold has not detailed how it intends to deploy the newly available BTC, the company emphasized that the removal of financing restrictions provides greater flexibility for future initiatives.

Founded in 2019, Fold built its reputation through a consumer rewards platform that allows users to earn Bitcoin while making everyday purchases. The company’s core offering includes a debit card linked to a rewards system in which spending in traditional currency generates BTC cashback instead of points or fiat rewards.

That model aims to encourage gradual accumulation of cryptocurrency without requiring users to directly buy or trade digital assets. For many consumers, rewards-based programs offer a simpler entry point into the crypto ecosystem.

Fold entered public markets in February 2025 following a special purpose acquisition company merger with FTAC Emerald Acquisition. The transaction resulted in Fold shares trading on the Nasdaq under the ticker FLD (NASDAQ: FLD), making it one of the first companies dedicated to Bitcoin-based financial services to list on a major US exchange.

Since its public debut, the company has faced the same volatility affecting many crypto-related equities. Market data shows that the stock has declined significantly since listing, reflecting broader market uncertainty and the fluctuating performance of digital asset markets.

Despite these challenges, Fold continues to focus on expanding its consumer-facing offerings. One of the company’s most anticipated upcoming products is a Bitcoin rewards credit card. Unlike the existing debit-based rewards system, the new card would allow customers to accumulate BTC through credit purchases, potentially increasing engagement and transaction volumes.

The launch comes amid rising competition in the crypto rewards card market. Several companies are now targeting consumers who want exposure to digital assets through everyday financial tools rather than direct trading.

For example, the Coinbase Card enables users to spend cryptocurrency balances while earning crypto rewards on transactions. The product forms part of Coinbase’s broader strategy to integrate payments, trading and financial services into a unified digital platform.

Other providers have adopted slightly different models. The Nexo Card allows customers to borrow against their crypto holdings and spend fiat without liquidating their assets, while still earning rewards on purchases.

Meanwhile, exchanges such as Bybit and Crypto.com offer Visa-branded cards that distribute rewards in tokens associated with their platforms. These products aim to create loyalty incentives while also encouraging users to remain within each company’s ecosystem.

Traditional financial networks are also entering the space. Mastercard has collaborated with MetaMask to introduce a crypto-linked payment card that converts digital assets into fiat at the point of sale, enabling purchases at any merchant accepting Mastercard.

Such developments highlight the increasing overlap between cryptocurrency infrastructure and mainstream financial services. As payment networks, fintech firms and exchanges compete for users, reward-based incentives have become a central strategy for attracting and retaining customers.

Fold’s debt repayment and product expansion plans therefore arrive at a time when the sector is becoming more crowded and technologically advanced. The company’s focus on Bitcoin accumulation rather than direct spending positions it somewhat differently from competitors that emphasize transactional crypto payments.

Whether that strategy resonates with a broader consumer base will depend on adoption of its forthcoming credit card and the effectiveness of its rewards program. If successful, the model could appeal to users who prefer gradually earning Bitcoin through spending rather than purchasing it outright.

For now, the elimination of convertible debt represents a structural improvement for Fold’s financial position. By removing potential dilution and reclaiming control of its BTC collateral, the company has taken a step toward strengthening its balance sheet at a time when crypto-focused businesses continue to navigate rapidly evolving market dynamics.

-

Politics6 days ago

Politics6 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat4 days ago

NewsBeat4 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Business7 days ago

Business7 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business6 days ago

Business6 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics4 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

Crypto World6 days ago

Crypto World6 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business6 days ago

Business6 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video7 days ago

Video7 days agoXii English top Selected mcq “Money Madness” Board Exam 2026, #chseodisha #hksir #mychseclass