Crypto World

Bitcoin ETFs Hold On Amid Price Plunge, Analyst Says

US-based spot Bitcoin ETF holders are showing resilience despite a four-month downtrend in Bitcoin (CRYPTO: BTC), according to ETF analyst James Seyffart. In a recent post on X, he noted that the ETFs are “hanging in there pretty good,” even as the underlying asset has endured a prolonged slide. While acknowledging the pain of the current stretch—Bitcoin trading below $73,000 has left ETF holders with what he described as their largest paper losses since the January 2024 launch—the way flows have behaved contrasts with the height of the market cycle. The narrative is nuanced: inflows have cooled from peak levels, but the existing positions remain broadly intact as investors weather the drift in price.

Key takeaways

- Spot Bitcoin ETF holders are currently underwater but continuing to hold positions, signaling a degree of conviction despite the drawdown.

- Net ETF inflows had reached roughly $62.11 billion before the October downturn, and have since cooled to around $55 billion, according to preliminary data from Farside Investors.

- Bitcoin’s price trajectory has contributed to paper losses for ETF holders, with the broader market down about 24% over a 30-day window and the spot price near $70,537 at the time of reporting.

- Industry observers highlight a pattern of extended outflows, noting that three consecutive months of withdrawals marked a first in the history of higher-frequency ETF data monitoring.

- Industry voices emphasize a longer-term perspective, arguing that Bitcoin’s performance since 2022 has outpaced traditional assets in several periods, challenging the sentiment of a uniformly bearish cycle among analysts.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Negative. ETF holders remain underwater as Bitcoin’s price decline drags on, though the net inflow dynamics offer a counterpoint to pure price Action.

Trading idea (Not Financial Advice): Hold. The combination of persistent holdings by ETF investors and improving inflows relative to peak levels suggests patience may be warranted amid ongoing price volatility.

Market context: The ETF landscape sits at the intersection of liquidity, risk appetite, and macro flows. Inflows into BTC-linked vehicles have cooled after a major cycle, while on-chain and market indicators show divergent signals about near-term momentum. The mix of price pressure and ongoing institutional participation shapes a cautious but not collapsing narrative for Bitcoin-focused ETFs.

Why it matters

The behavior of spot BTC ETFs helps illuminate a broader dynamic in crypto markets: institutional vehicles can provide a stabilizing, if not yet growth-driven, channel for price discovery. Even as price declines stretch across several weeks, the fact that ETF inflows remain sizable—albeit down from the peak—suggests that investors are maintaining exposure rather than exiting en masse. This matters for market liquidity, as ETF flows can dampen sharp price moves when buying or selling pressure intensifies, particularly in a sector as sensitive to macro headlines as crypto.

The discourse around investor sentiment is nuanced. On one hand, there is acknowledgment of substantial paper losses among ETF holders during the recent downturn, with Bitcoin navigating lower levels and volatility elevated. On the other hand, observers highlight that Bitcoin’s recovery potential remains tethered to macro risk appetite and the pace of flows into crypto vehicles. The conversation is further complicated by longer-term performance comparisons: Bitcoin has, in multiple cycles, outperformed traditional assets over extended horizons, which some argue justifies a longer view despite the near-term pain.

Analysts and researchers stress that focusing solely on near-term drawdowns can obscure the more complex picture of investor behavior and market structure. For instance, a well-known market observer suggested that Bitcoin’s strength in previous years—particularly its outsized gains through 2023 and 2024—remains a reference point for evaluating current demand. While the market may appear to be in a risk-off phase, the longer arc of Bitcoin’s price action has historically included substantial rallies following consolidation periods, underscoring the difficulty in drawing conclusions from a single quarter’s results.

Another thread in the discussion centers on the prudence of staying invested when ETF holders are effectively “underwater and collectively holding,” as some observers phrase it. This stance mirrors a broader crypto investing paradigm where conviction and time horizons matter as much as timing. In a space where episodic headlines can swing prices, the behavior of ETF holders offers a degree of reflexivity: ongoing participation from established vehicles can support price resilience, even when volatility remains elevated.

The discourse also touches on narrative risk—whether market participants are overly pessimistic about BTC’s near-term prospects. Some voices argue that evaluating Bitcoin’s performance in a post-2022 context should consider its outsized gains relative to gold and traditional assets, suggesting that the market’s recovery potential remains intact even after a difficult stretch. While sentiment among analysts fluctuates, the fact that a broad spectrum of commentators continues to discuss Bitcoin’s long-term trajectory hints at a market that is more nuanced than a straightforward bullish or bearish verdict.

The price action is clear: Bitcoin has shed nearly a quarter of its value in the last 30 days, with BTC trading around $70,537, according to CoinMarketCap. The linkage between ETF flows and price remains an evolving interplay, and investors are watching for how upcoming data and regulatory signals might shape the next leg of the cycle.

In the broader ecosystem, crypto analytics firms and market researchers have highlighted a pattern that may be drawing attention beyond immediate price moves. A widely cited analyst pointed out that the current period marks a historic phase in which consecutive outflows have occurred, raising questions about the implications for liquidity, volatility, and the resilience of BTC-linked products. Yet, this is not the first time the market has faced a testing environment, and some observers emphasize that Bitcoin’s fundamental narratives—scalability, network activity, and institutional adoption—remain central to the longer-term thesis.

Meanwhile, voices from the analytics community caution against a purely short-term lens. The market’s reaction to liquidity shifts, regulatory signals, and ETF flows can diverge from what is visible in day-to-day price movements. By examining the total inflows and outflows relative to the size of the market, investors can form a more balanced view of risk and opportunity in the BTC ETF space, rather than focusing solely on immediate losses or gains.

Eric Balchunas, a veteran ETF analyst, has emphasized that Bitcoin’s performance since 2022 has delivered outsized gains compared with gold and silver, arguing that those who judge BTC on a single year’s performance may be missing the broader arc. His comment underscores the importance of framing BTC’s story within a multiyear horizon, especially for investors considering exposure through spot BTC ETFs rather than direct spot markets. The ongoing debate about risk and return continues to shape how market participants approach BTC-focused ETFs and related products.

Ki Young Ju, CEO of CryptoQuant, summed up a meta-view that reflects a cautious mood among market participants: “every Bitcoin analyst is now bearish,” a remark that underscores the prevailing mood while leaving room for a counterpoint in a market that has historically proven contrarian at pivotal moments. The tension between bearish sentiment and the potential for a longer-term rebound remains a defining feature of BTC discourse as traders weigh the odds of a renewed upshift in price against continued macro uncertainty.

What to watch next

- Next wave of ETF flow data from Farside Investors and other researchers, which could show whether the contraction in inflows accelerates or stabilizes.

- Bitcoin price behavior over the next several weeks, particularly in response to macro cues and any regulatory developments impacting crypto markets.

- Further commentary from major ETF analysts and researchers on whether the current drawdown is a pause or the onset of a deeper correction.

- Updates on institutional participation in BTC-linked products, including any changes in flows into other crypto ETFs or related vehicles.

Sources & verification

- Preliminary net inflows data for spot BTC ETFs from Farside Investors (as cited in the article).

- Public X posts by James Seyffart discussing ETF holders’ performance and sentiment.

- Public X posts by Jim Bianco and Rand analyzing ETF holder underwater percentages and historical comparisons.

- Price data for Bitcoin from CoinMarketCap at the time of publication (BTC price around $70,537).

- Comments from Eric Balchunas regarding BTC’s performance since 2022 relative to other assets.

- Ki Young Ju’s remarks from CryptoQuant on market sentiment.

Bitcoin ETF flows and price action amid a four-month decline

US-based spot BTC ETFs are navigating a difficult phase that has stretched over several months, marked by a meaningful rally-to-correction cycle that has dragged prices lower while inflows have not collapsed as some bears expected. The conversation among analysts centers on a paradox: even as many investors sit underwater, the aggregate posture remains constructive enough to sustain a broad layer of market liquidity and investor confidence. From the vantage point of ETF market structure, the persistence of holdings and the scale of inflows before October point to a durable base of participants who view BTC exposure as a core, long-term component of a diversified portfolio rather than a speculative, short-term bet.

As price action remains volatile, the ETF community continues to balance risk and opportunity. The data show that, despite the downturn, the community of ETF holders has not rushed to exit en masse. This behavior aligns with a longer-run thesis that Bitcoin, despite reputational cycles, has established a persistent presence in institutional portfolios. The tension between near-term losses and longer-term potential remains a central theme in assessing BTC’s role within the ETF ecosystem, with analysts urging caution not to conflate short-term price dynamics with the asset’s ultimate trajectory.

In practical terms, the ongoing observation is that ETF inflows, while reduced from peak levels, still reflect a non-negligible demand for BTC exposure. The numbers suggest a market that is not capitulating, even as the price declines continue. For traders and investors, the key takeaway is that the ETF framework provides a stable, regulated channel for exposure that can influence liquidity dynamics in ways that are distinct from the spot market alone. The evolving narrative around ETF flows—alongside Bitcoin’s price path and macro signals—will continue to shape market psychology and the pace of the next leg in BTC’s cycle.

For readers who want to verify the underlying data and quotes, the linked posts and price data points in this report provide direct sources. The discussion around ETF flows, price levels, and analyst commentary reflects a broad cross-section of market voices, each contributing to a composite view of a market that remains highly reactive to both micro and macro catalysts. As regulation, classification of crypto assets, and ETF product design continue to mature, observers anticipate that flows into BTC-linked vehicles will adjust in response to evolving expectations for risk, return, and liquidity in the crypto space.

The subscription template at the end of the article is included to reflect ongoing engagement opportunities for readers seeking deeper insights into crypto market dynamics.

Notes: The coverage above preserves the factual statements and linked references as presented, while restructuring them into a professional, journalistic narrative. No promotional boilerplate from the publisher is included in this rewritten article.

Crypto World

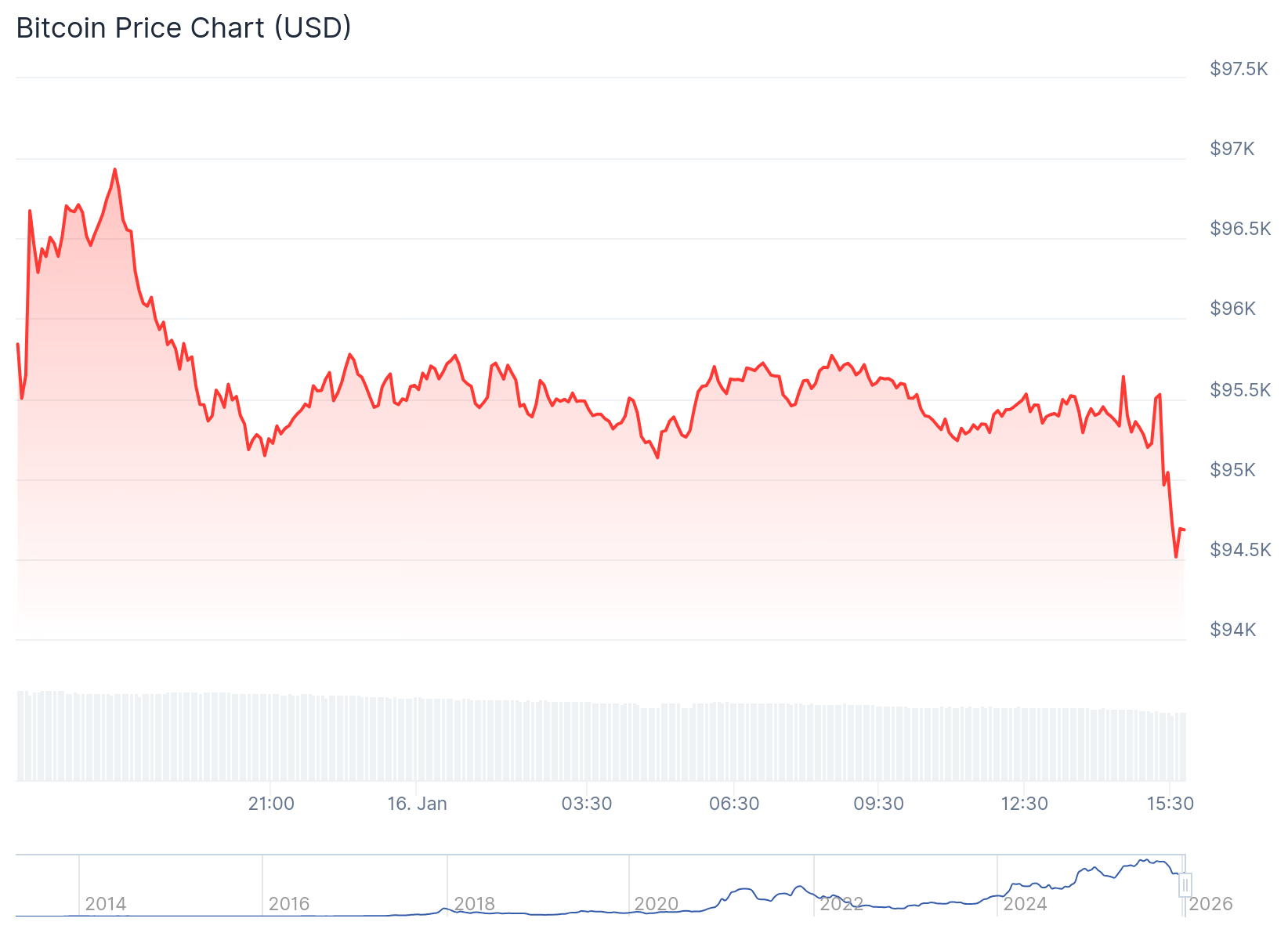

Bitcoin Fills $94,800 CME Gap, Eyes $100K Rally

Join Our Telegram channel to stay up to date on breaking news coverage

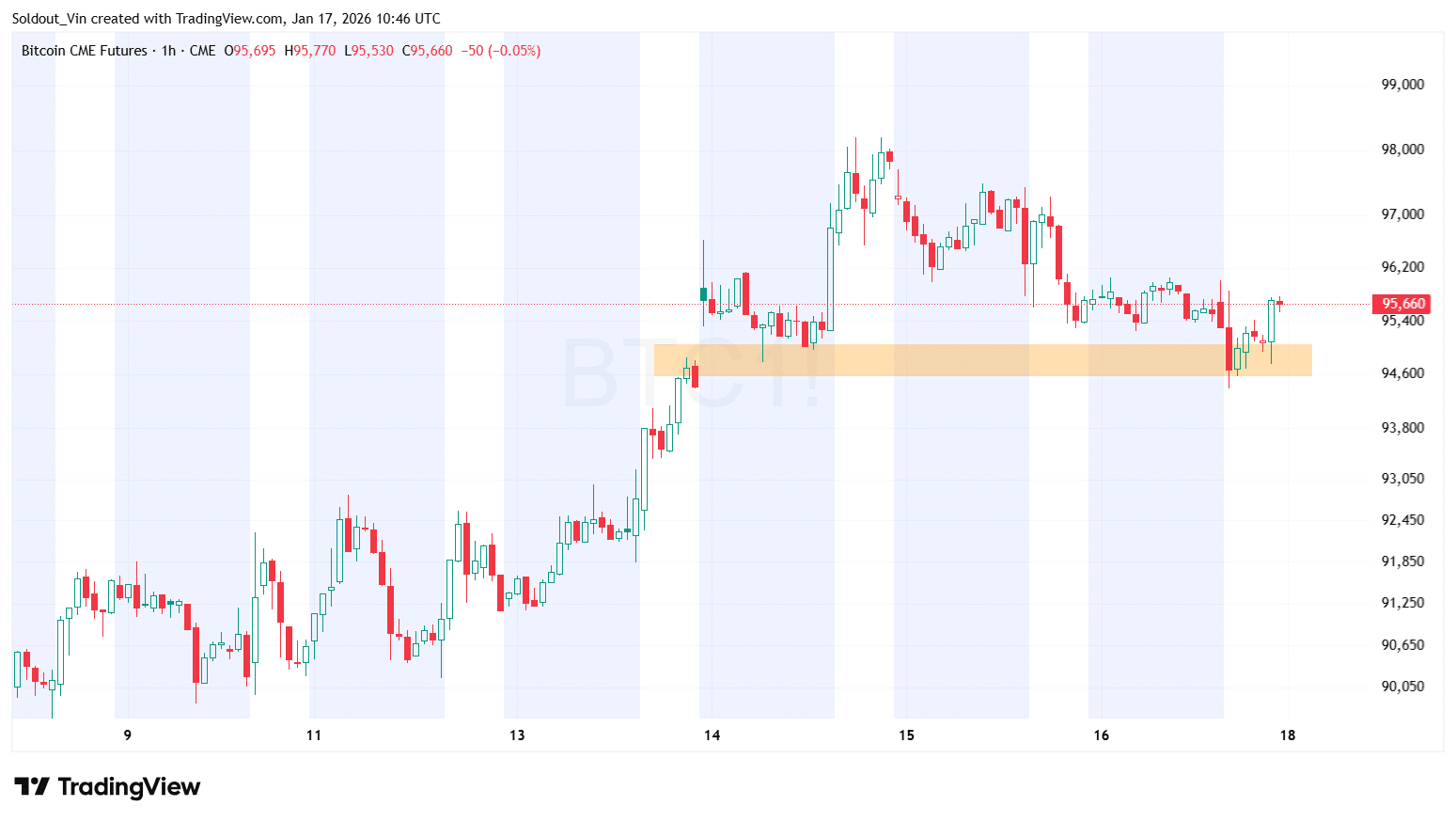

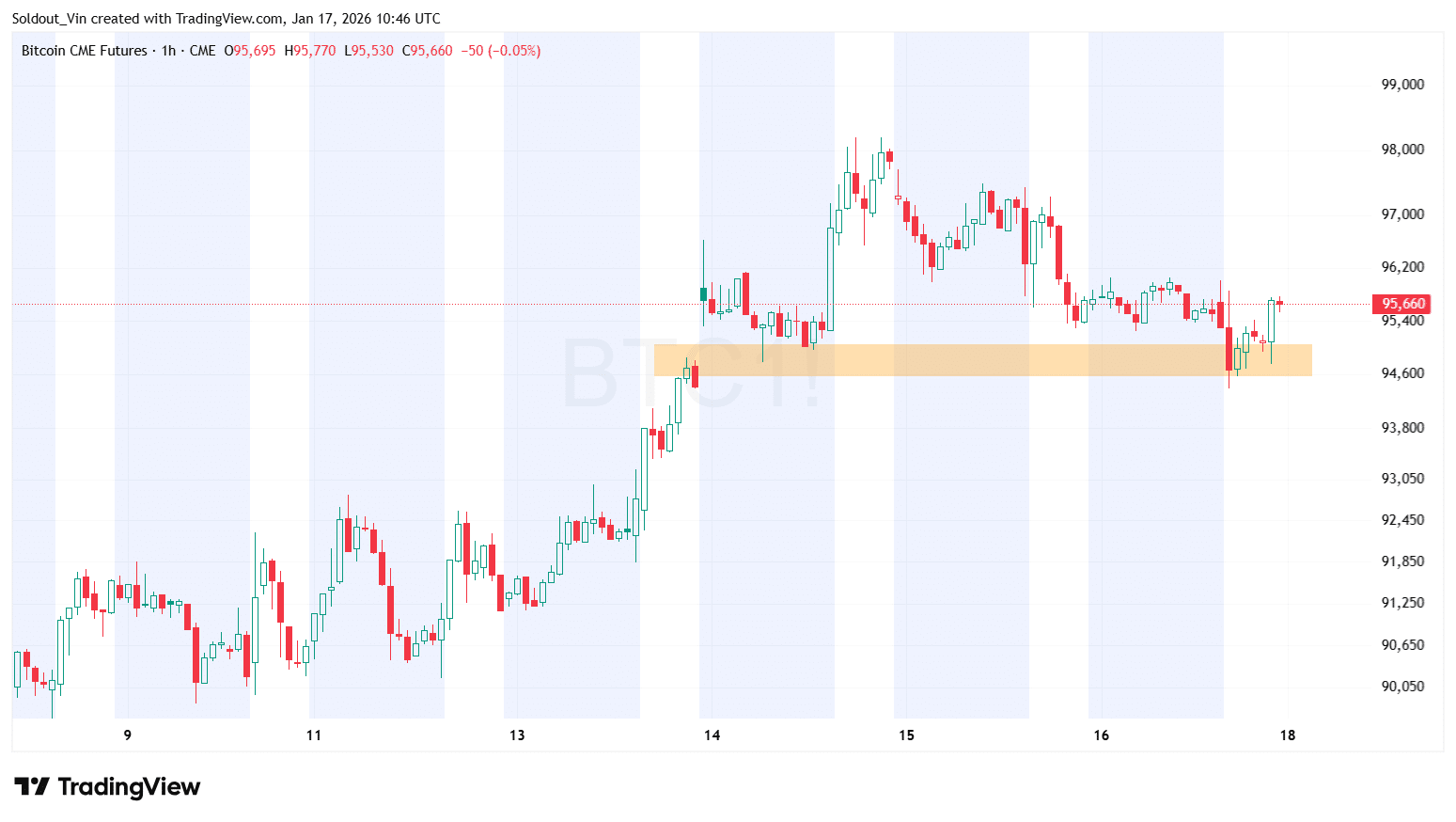

Bitcoin has closed the CME futures gap near $94,800, a technical milestone that analysts view as a bullish signal.

CME gaps form when Bitcoin’s weekend price movements on 24/7 spot markets create unfilled price ranges on the CME futures chart, which does not trade over weekends.

Historically, if these gaps act as focal points for technical traders, they tend to be revisited and filled by subsequent price action.

Based on the BTC CME futures chart, the gap near $94,800 has now been filled, a condition for further upside. Therefore, a weekly close above the $94,000 level may open the door for BTC to extend its rally toward the $100,000 threshold.

The CME gap is a significant level amid recent price resilience above $90,000, where bulls have defended support areas before staging rebounds. BTC dropped to below $94,000 and has since moved toward $95,000, filling the gap.

Bitcoin Heads for Weekly Gain After Muted New Year

Bitcoin is up 5% this week, as it also benefited from some bargain buying after a muted start of the new year.

A bulk of the coin’s gains this week came after top corporate holder, Strategy, disclosed a purchase of over $1 billion worth of BTC, drumming up some hopes over improving corporate demand for the King of crypto.

Strategy has acquired 13,627 BTC for ~$1.25 billion at ~$91,519 per bitcoin. As of 1/11/2026, we hodl 687,410 $BTC acquired for ~$51.80 billion at ~$75,353 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/bIbPbFAbTa

— Strategy (@Strategy) January 12, 2026

However, retail demand remained under pressure, as broader sentiment towards the crypto space remained skittish. The Bitcoin price continued to trade at a discount, indicating that retail sentiment remained weak.

This comes as US lawmakers earlier this week delayed a key discussion on a planned crypto regulatory framework, after Coinbase opposed the bill in its current version.

BTC is now down just a fraction of a percentage to trade at $95,100 as of 6:26 a.m. EST, according to Coingecko data.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Bitcoin erases 15 months of gains, falls below $70K amid $840M liquidations

- Bitcoin temporarily fell below $70,000, erasing gains built over the past 15 months.

- Over $840 million in leveraged long positions were liquidated during the sell-off.

- Traders now watch $65,000 support and $72,000 resistance for direction.

Bitcoin has suffered one of its sharpest corrections in recent years, wiping out roughly 15 months of bull market gains in a swift and brutal sell-off.

The world’s largest cryptocurrency temporarily plunged below the psychologically important $70,000 level, shocking traders who had grown accustomed to sustained upside momentum.

The move did not happen in isolation, as it was accompanied by heavy liquidations, weakening sentiment, and visible stress across centralised exchanges.

What initially appeared to be a routine pullback quickly evolved into a deeper reset for the broader crypto market.

Bitcoin price crash wipes out 15 months’ gains

Bitcoin’s drop to the $69,000–$70,000 range marked its lowest level in around 15 months, effectively erasing much of the progress made during the previous bull cycle.

This decline pushed BTC back toward price zones last seen before institutional inflows and ETF-driven optimism reshaped market expectations.

As the price broke below the key support level at $70,000, selling pressure intensified, and confidence among short-term traders deteriorated rapidly.

The correction also dragged down major altcoins, reinforcing the idea that this was a market-wide deleveraging event rather than a Bitcoin-only move.

From a market structure perspective, the fall represented a decisive break from the higher-highs and higher-lows pattern that had defined Bitcoin’s uptrend.

Liquidations accelerate the sell-off

One of the most significant drivers behind the crash was a massive wave of forced liquidations across crypto derivatives markets.

CoinGlass data shows that more than $840 million worth of leveraged positions were wiped out in a short period, with long positions accounting for the majority of losses.

As Bitcoin slipped below critical price thresholds, automated liquidation engines kicked in, amplifying downside momentum.

This cascade effect turned a controlled decline into a sharp flush, catching overleveraged traders off guard.

The liquidation-heavy nature of the drop suggests the move was driven more by market positioning than by a single fundamental catalyst.

After months of elevated leverage and crowded long trades, the market finally reached a breaking point.

Massive Bitcoin outflows from exchanges

At the same time, on-chain data from CryptoQuant shows notable Bitcoin outflows from major exchanges, particularly Binance.

A community-driven withdrawal campaign contributed to a sharp net outflow of BTC, briefly reducing exchange reserves.

In a recent press release, Binance publicly addressed speculation about these movements, denying claims of financial instability and emphasising that withdrawals were proceeding normally.

The exchange also encouraged users to practice self-custody if they felt uncertain, which further highlighted shifting trust dynamics within the market.

Despite the price crash, some analysts view sustained exchange outflows as a sign that long-term holders are not panic-selling.

This divergence between short-term trader behaviour and longer-term investor positioning adds complexity to the current market narrative.

Bitcoin price forecast – what to look at in the coming days

Looking ahead, traders should closely watch several key levels as Bitcoin attempts to stabilise after the sell-off.

The $70,000 zone now acts as immediate support, and a break below this level could push the price towards the $65,000 area, which stands out as a major support zone, as it aligns with previous consolidation ranges.

A deeper breakdown could expose Bitcoin to a move toward the $60,000 psychological level, where buyers may attempt a stronger defence.

On the upside, a sustained recovery above $72,000 would be an early sign that selling pressure is easing.

For now, volatility remains elevated, and traders are likely to stay cautious until Bitcoin establishes a clearer direction.

Crypto World

Galaxy Tokenizes First CLO on Avalanche With $50M Grove Allocation

Galaxy CLO 2025-1 totals $75 million and brings a private credit deal onchain.

Galaxy revealed on Jan. 15 that it has issued its first collateralized loan obligation (CLO) and tokenized the deal on Avalanche, a Layer 1 blockchain with a total value locked (TVL) of over $1.2 billion.

The instrument, dubbed Galaxy CLO 2025-1, totals $75 million and includes a $50 million allocation from Grove, an institutional credit protocol that operates as a Star, or SubDAO, within the Sky Ecosystem.

A CLO is a structured credit product that bundles corporate loans and sells them to investors across different risk tiers. Galaxy said the transaction will support its lending activities.

Avalanche said the CLO’s debt tranches were issued and tokenized on its network and are listed on INX for qualified investors. The network added that tokenization could enable lower-cost trading and faster settlement, while also improving transparency for investors.

“This transaction marks another meaningful step forward for onchain credit, demonstrating how familiar securitization structures can be brought onchain without compromising institutional standards,” said Sam Paderewski, co-founder at Grove Labs.

Paderewski added that Grove’s investment underscores its focus on supporting onchain tokenized credit products.

The allocation adds to Grove’s activity on Avalanche, according to the announcement. Grove previously deployed $250 million into tokenized real-world assets (RWAs) on the Avalanche network.

The announcement comes as more private credit products move onchain. Avalanche cited other institutional credit products already running on its network, including tokenized funds tied to Janus Henderson’s Anemoy Fund and Apollo’s ACRED.

Private credit remains the largest category in tokenized RWAs, with about $19.1 billion in onchain value, followed by tokenized securities, mainly Treasuries, at roughly $9 billion, according to a December report from RWAio.

AVAX, Avalanche’s native token, was trading around $13.74 on Thursday, down about 6.2% over 24 hours, according to CoinGecko. The token had roughly $388 million in daily trading volume.

Meanwhile, Galaxy (GLXY) shares were up about 13% on Thursday, trading around $31.90, according to Google Finance.

Crypto World

Bitcoin Trading at 41% Discount, Power-Law Model Shows $122K Fair Value

Bitcoin slipped below $71,000, but one analyst says the cryptocurrency is trading about 41% below its long-term fair value.

Bitcoin (BTC) recently slipped below $71,000, erasing all the gains made since the U.S. presidential election in late 2024.

However, one analyst argues that the asset is trading at a 41% discount to its long-term historical trend value.

Market Stress and a Growing Valuation Gap

Using a power-law valuation model, market observer David placed Bitcoin’s fair value at $122,762, compared with spot prices around $72,000 at the time. That implied a gap of roughly $51,000, or about 41%, which he described as well below Bitcoin’s normal historical range.

David’s analysis focused on the mechanics behind the move rather than macro headlines. He said current price action appears to be driven mainly by forced flows in derivatives markets, such as hedging and liquidation-related selling, rather than long-term holders distributing their BTC.

One metric he highlighted was Bitcoin’s z-score, a measure of how far the current price varies from the trend, which he estimated at minus 0.76, suggesting the price has moved far below its typical deviation from the long-term trend.

Positioning data reinforced that view, considering that over the past 30 days, Bitcoin’s price is down approximately 20%, while open interest has risen nearly 7%, according to figures cited in the post.

David described these trends as a sign that leveraged exposure is increasing even with the price weakening. In his words, price is falling while leveraged bets are growing, a setup that can lead to sharp, forced moves in either direction.

You may also like:

He also pointed to elevated volatility, with 20-day implied volatility above 43, and combined futures and options open interest of more than $2.3 billion. Under those conditions, the analyst estimated a 70% probability of a squeeze if the price begins to move higher, noting that positioning could “flip very fast.”

Furthermore, he identified the area near $73,000 as a key gamma level, where moves below it may amplify volatility, while moves above it could dampen price swings.

Price Action Reflects Leverage

At the time of writing, the flagship cryptocurrency was trading around the $70,500 level, according to CoinGecko, marking a nearly 8% drop in the last 24 hours and a close to 20% dip over seven days. In the past month, BTC is down almost 25%, with the losses pushing it 44% below its all-time high from October last year.

This decline triggered a wave of liquidations that hit the market, with data from analytic firm CoinGlass showing that more than 154,000 traders were liquidated in 24 hours, with total losses near $718 million.

Another entity that has been significantly affected by BTC’s recent dip is Strategy, which recently purchased 855 BTC for $75.3 million. According to the Kobeissi Letter, the firm’s Bitcoin position has moved deeper into the red, with paper losses rising to $40 billion in the last four months.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Miners are being squeezed as bitcoin’s $70,000 price fails to cover $87,000 production costs

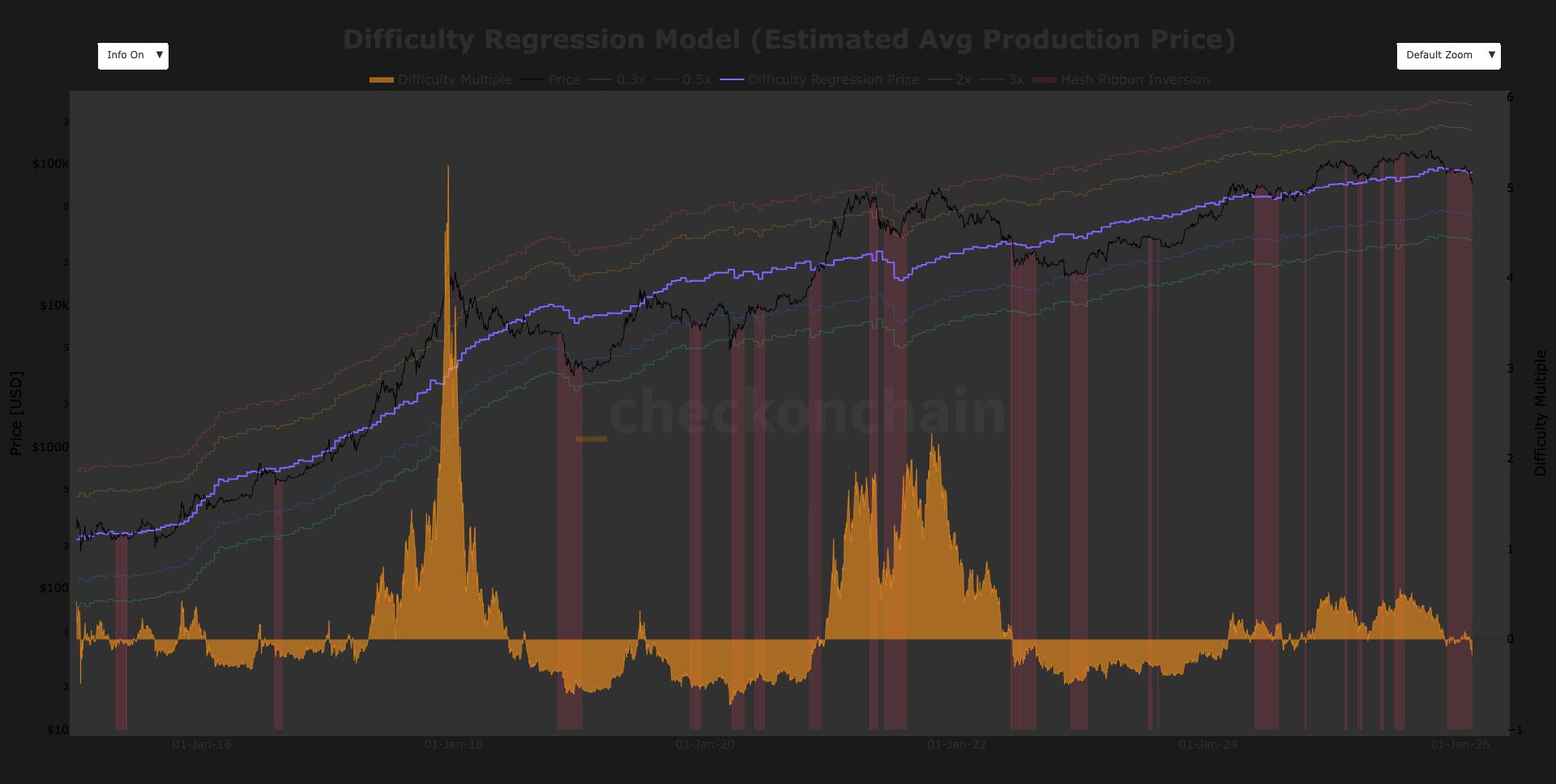

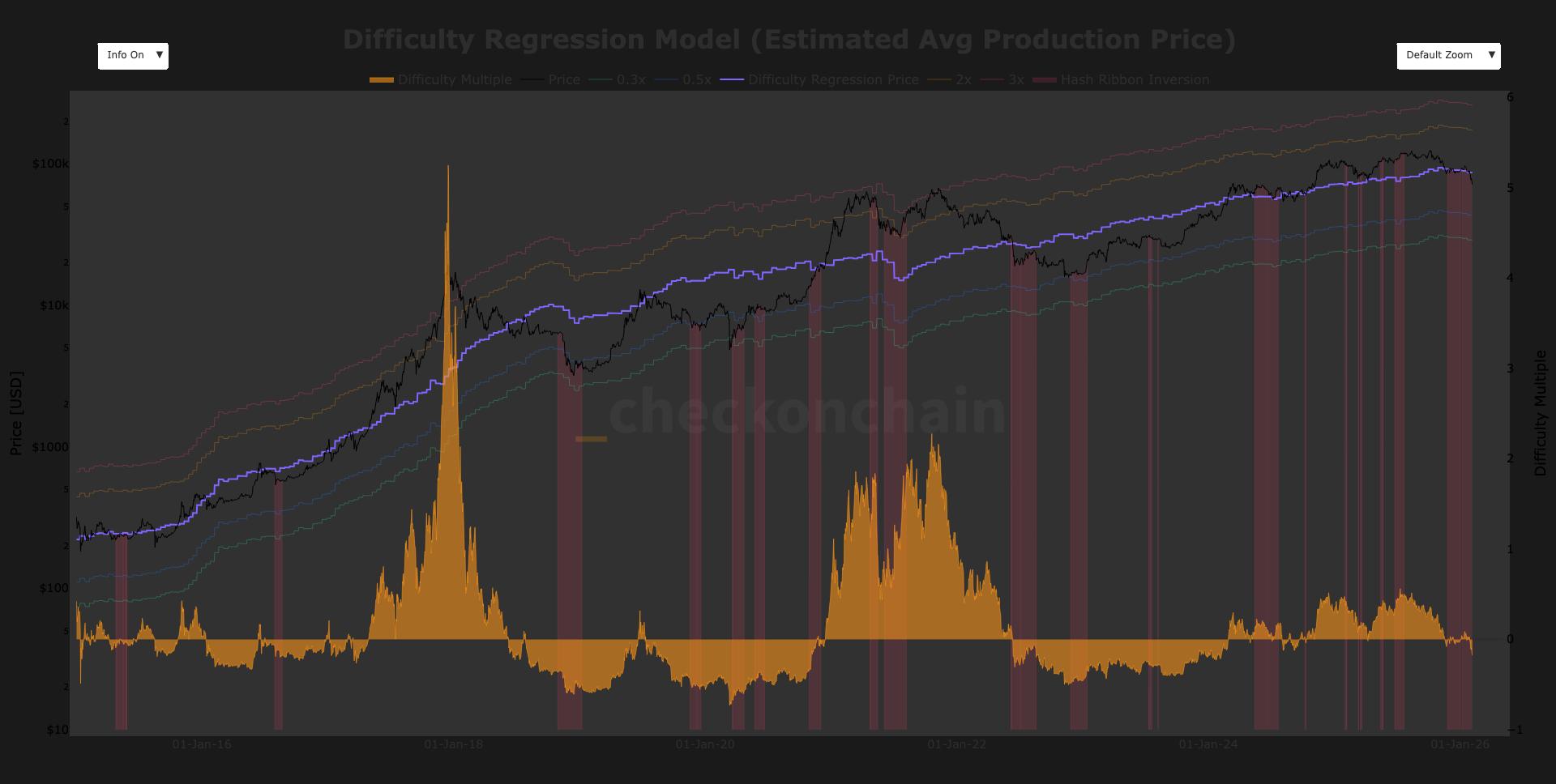

Bitcoin is now approximately 20% below its estimated average production cost, increasing financial pressure across the BTC mining sector.

The average cost to mine one bitcoin is around $87,000, according to data from Checkonchain, while the spot price has fallen towards $70,000. Historically, trading below production cost has been a feature of a bear market.

The production estimate uses network difficulty as a proxy for the industry’s all-in cost structure. By linking difficulty to bitcoin’s market capitalization, the model provides an estimate of average mining costs.

In previous bear markets, including 2019 and 2022, bitcoin traded below production cost before gradually converging back toward it.

Hashrate, which measures the total computational power securing the bitcoin network, peaked near 1.1 zettahash (ZH/s) in October, subsequently declining by roughly 20% as less efficient miners were forced offline. More recently, hash rate has rebounded to 913 EH/s, suggesting some stabilization.

However, many miners remain unprofitable at current prices. With revenues below operating costs, miners are continuing to sell bitcoin holdings to fund day-to-day operations, cover energy expenses, and service debt. This ongoing miner capitulation highlights persistent stress in the sector.

Crypto World

Toobit Bridges Traditional Finance and Crypto with Launch of Tokenized Stock Futures

Toobit is an award-winning international cryptocurrency exchange, and it has just announced the launch of Stock Futures.

This move is aimed at bridging the gap between traditional equity markets and the broader digital asset ecosystem. It allows traders to gain access to 10 high-demand US equities, including Tesla (TSLA), Nvidia (NVDA), and Apple (AAPL).

A Range of Benefits

The abovementioned assets are offered as USDT-settled perpetual contracts, which feature:

- Flexible leverage: Up to 25x leverage to maximize capital efficiency.

- Two-way trading: Support for Long and Short positions, allowing traders to capitalize on both upward and downward price movements.

- 24/7 accessibility: Continuous trading that goes beyond traditional market hours, allowing traders to access global equities around the clock, including weekends and holidays.

Speaking on the matter was Mike Williams, the Chief Communication Officer at Toobit, who said:

“Our mission has always been to provide our traders with a comprehensive suite of trading tools. […] By tokenizing stock indices into perpetual contracts, we are removing the geographical and operational barriers of Wall Street, allowing anyone, anywhere, to trade the world’s most influential companies using USDT.”

Toobit Ventures into RWA Derivatives

Toobit’s new TradFi initiative comes as the demand for real-world assets (RWAs) derivatives grows. In 2026, tokenized RWAs have evolved into a primary market driver, with on-chain value surpassing $21 billion, a 232% annual increase. Currently, 76% of global enterprises plan to integrate tokenized assets, with equity derivatives becoming the preferred vehicle for traders seeking 24/7 access and capital efficiency.

The new feature offers a direct path to diversifying into the stock market without having to face the hurdles of traditional brokerage accounts or currency conversions.

Traders are able to access the new Stock Futures in the TradFi tab within the Futures section on both the mobile app and the Toobit web version. This centralized hub now integrates all traditional asset classes, merging existing forex and metals, including EUR, XAU, and XAG, into a single, unified trading environment.

To further support this launch, Toobit has unveiled a 200,000 USDT reward campaign running from February 2 to February 28, 2026. It features a multi-tiered reward structure, including 50,000 USDT in new trader rewards, a first trade protection fund that provides up to 100% loss compensation for newcomers, and a high-stakes trading challenge where top-ranked spot and futures traders can compete for a share of 100,000 USDT.

For more information about Toobit, visit: Website | X | Telegram | LinkedIn | Discord | Instagram

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and to do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin Slips Below $95K as Analysts Flag Make-Or-Break Zone

Crypto markets are mostly lower today as momentum fades and analysts flag a key range for Bitcoin.

Crypto markets pulled back slightly on Friday morning, Jan. 16, giving up some recent gains after a short-lived rally earlier this week.

As of press time, Bitcoin (BTC) was trading around $94,700, down about 1.2% on the day, after reaching over $96,900 in the past 24 hours. Despite the downturn, BTC is still up over 4% on the week, rising out of the holiday doldrums.

Total crypto market capitalization fell to roughly $3.3 trillion, slipping 1.7% on the day.

All of the top-10 cryptocurrencies by market capitalization were slightly lower on the day, with Dogecoin (DOGE) losing the most in 24 hours, down 4%.

Ethereum (ETH) is down 1.8% today, but still posting weekly gains of 5.5%, trading above $3,365 at press time.

BTC at Key Inflection Point

In a post on X today, glassnode analyst Chris Beamish said Bitcoin is nearing a “key inflexion point,” adding that the BTC price reclaiming the short-term holder cost basis “would signal that recent buyers are back in profit, typically a prerequisite for momentum to re-accelerate. “

At the same time, in another X post glassnode analysts pointed to growing activity on Ethereum, saying a sharp rise in month-over-month retention among new users is signaling a “wave of first-time wallets interacting with the network rather than activity driven only by existing participants.”

Mike Marshall, head of research at blockchain analytics firm Amberdata, said several signals still look constructive beneath the surface.

“Bitcoin’s price movement appears driven by a convergence of on-chain and market-structure signals,” Marshall said in commentary shared with The Defiant.

Marshall also pointed to recent stablecoin minting, signs that ETF outflows are slowing, and derivatives markets showing accumulation, while warning that “portfolio rotations and broader macro uncertainty could introduce volatility” later in Q1.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, privacy-focused cryptocurrency DASH led gains again, rising about 15% today, following its recent 50% rally. The next biggest gainer today is SKY, which is up roughly 4.8% on the day, according to CoinGecko.

On the downside, POL (ex-MATIC) dropped around 8% after its recent rally, making today’s biggest loser among the top-100 crypto assets.

Liquidations remained relatively muted over the past 24 hours with total crypto liquidations reaching roughly $239 million, per Coinglass data. Long positions made up $181 million, compared with $58 million in short ones.

Bitcoin liquidations totaled about $62.5 million, followed by Ethereum at roughly $38 million, with another $31 million across altcoins.

ETFs and Macro Conditions

On Thursday, Jan. 15, spot Bitcoin ETFs recorded net inflows of $100.2 million, bringing cumulative inflows to $58.2 billion, per data from SoSoValue.

Meanwhile, spot Ethereum ETFs continued to see stronger demand, posting $164.4 million in net inflows on the day, while total net assets across spot Ethereum ETFs climbed to about $20.4 billion.

On the macro side, U.S. Treasury yields were mixed, with the 10-year around 4.18% and the 30-year near 4.8%, as markets stayed on edge over geopolitical concerns, including U.S. President Donald Trump’s renewed push to take control of Greenland, per CNBC.

According to the U.S. Labor Department’s Bureau of Labor Statistics, import prices rose 0.4% between September and November, even as imported fuel prices fell 2.5% over the same period.

In terms of geopolitical moves, traders were also eyeing Canada’s deepening ties with China. Prime Minister Mark Carney said today that Canada is moving toward a “new strategic partnership” with Beijing, signaling a break from the U.S. on tariffs amid what he described as a shifting global order, Bloomberg reports.

“I’m extremely pleased that we are moving ahead with our new strategic partnership,” Carney said during meetings with China President Xi Jinping, framing the move as preparation for what he called a “new world order.”

Crypto World

OpenSea Rewards Its NFT Users With Pudgy Penguins SBTs

Join Our Telegram channel to stay up to date on breaking news coverage

OpenSea, the world’s largest non-fungible token market platform by trading sales volume, has partnered with Igloo Inc., the parent company behind the globally acknowledged non-fungible token series Pudgy Penguins, to reward its top marketplace users with Soulbound tokens (SBTs). In response to this integration, the Pudgy Penguins NFT collection has seen its floor price rise by 2% over the past 24 hours.

OpenSea x Pudgy Penguins Integration

In a January 16 blog post, the OpenSea NFT team confirmed that it has launched its fourth wave of rewards to its marketplace users. Launched in December 2017, OpenSea is the world’s largest decentralized marketplace for buying, selling, and trading NFTs and crypto collectibles. It functions like an eBay for unique digital assets, such as art, virtual land, and game items, all verified on blockchains like Ethereum and Polygon. It allows users to create (mint), list, and trade these unique digital items through smart contracts, giving creators a platform and collectors a way to own verifiable digital property.

Some people opening Chests are noticing that their Rewards includes a special item – the chance to mint a @PudgyPenguins SBT.

Anyone with a Tier 5 Treasure or above earned in Wave 4 is eligible to mint. Head to your Rewards tab on OpenSea or or go to the link below to mint.👇 pic.twitter.com/8xfOu6OSc3

— OpenSea (@opensea) January 16, 2026

The OpenSea NFT marketplace launched its pre-token generation reward program, including the “Treasure Chests” and XP system, starting in phases around mid-September 2025, leading up to the expected $SEA token launch in early 2026. This initiative, which funnels 50% of NFT platform fees into user rewards and boosts activity for future token allocation, marked a major shift toward a broader on-chain trading hub, with new features and an AI-powered mobile app.

From January 16, 2026, some people opening Chests are noticing that their Rewards include a special item giving them a chance to mint a Pudgy Penguins SBT. Anyone with a Tier 5 Treasure or above earned in Wave 4 is eligible to mint. OpenSea chest is a feature in OpenSea’s rewards program, where users level up a virtual chest by completing activities like buying and selling NFTs and tokens, earning XP, and completing “Voyages” (quests) to unlock rewards like NFTs and crypto at the end of each reward wave.

OpenSea x Pudgy Penguins SBT Overview

In its fourth-round wave of rewards, the OpenSea team has integrated with Pudgy Penguins team to launch soulbound tokens (SBTs.) These SBTs commemorate all individuals who used the NFT marketplace OpenSea to purchase Pudgy Penguins or Lil Pudgy NFTs. The OpenSea SBT honors Pudgy Penguin or Lil Pudgy NFT buyers on the OpenSea who have never sold their NFT collections.

Related NFT News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Ripple Integrates Hyperliquid, Bridging DeFi with Traditional Finance

Ripple has announced the inclusion of Hyperliquid on its multi-asset prime brokerage platform, marking the first integration of decentralized finance (DeFi) into its services. This move enables institutional clients to tap into on-chain derivatives liquidity while managing their DeFi exposures alongside traditional assets. By integrating DeFi into its platform, Ripple aims to bridge the gap between traditional finance and decentralized markets.

Ripple Prime now supports Hyperliquid as its first DeFi venue, offering access to advanced trading infrastructure. With this integration, clients will be able to cross-margin their DeFi exposures with all other asset classes supported by the platform. The service promises to offer institutions centralized risk management, a single counterparty relationship, and consolidated margin across portfolios.

This strategic move positions Ripple to strengthen its offerings for institutional clients by enhancing access to decentralized markets. The inclusion of Hyperliquid allows Ripple Prime’s clients to benefit from faster on-chain liquidity and greater trading efficiency. According to Ripple Prime CEO Michael Higgins, the integration helps address the growing demand for decentralized finance, providing clients with scalable access while maintaining capital efficiency.

Ripple’s Mission to Integrate DeFi and Traditional Finance

Ripple’s expansion into DeFi is part of its broader mission to merge traditional finance (TradFi) with decentralized finance. The firm aims to offer institutions a unified framework that combines both asset classes into a single, efficient platform. Through this integration, Ripple Prime hopes to enhance liquidity access and foster further innovation in institutional crypto trading.

In the release, Ripple highlighted that the inclusion of Hyperliquid will support institutions as they scale their DeFi operations. The crypto firm noted that clients will benefit from improved capital efficiency and a robust risk management system, while enjoying access to on-chain liquidity. This development could pave the way for more institutional players to enter the DeFi space, signaling the growing influence of decentralized markets in mainstream finance.

Ripple’s initiative is seen as a significant step forward in the institutional adoption of DeFi. By offering clients integrated access to both traditional and decentralized markets, Ripple is positioning itself as a key player in the evolving crypto trading landscape. The move is expected to attract greater institutional participation and further blur the lines between traditional finance and decentralized finance.

Impact on XRP and Hyperliquid (HYPE)

Ripple’s move is set to have significant implications for both XRP and the Hyperliquid (HYPE) token. With the integration, XRP is expected to gain more institutional interest, particularly in the form of perpetual trading and spot pairs. This increased liquidity could drive up demand for XRP and create additional trading opportunities for Ripple’s institutional clients.

The Hyperliquid platform, now linked with Ripple Prime, stands to benefit from increased exposure and trading volume. As more institutions engage with the platform, trading fees will likely rise, providing more liquidity to Hyperliquid. This increase in activity may result in more buybacks of the HYPE token, further supporting its value.

By expanding its offerings and securing greater access to DeFi markets, Ripple is positioning itself to become a significant player in the crypto institutional space. The integration of Hyperliquid into Ripple Prime is seen as a win for both the Ripple ecosystem and the broader DeFi market.

Crypto World

Treasury Draws Firm Line as Bitcoin Reserve Debate Roils Capitol Hill

The U.S. Treasury faced sharp questions Tuesday over Bitcoin policy during a tense Capitol Hill hearing. Lawmakers focused on whether the government should purchase Bitcoin or allow federal assets to back crypto. Treasury Secretary Scott Bessent firmly stated that taxpayer funds would not be used to buy or support digital currencies.

Treasury Blocks Bitcoin Intervention Despite Pressure

During a House Financial Services Committee hearing, Rep. Brad Sherman pressed Bessent about potential Bitcoin-related bailouts. Sherman suggested the Treasury could direct banks to hold Bitcoin or tweak reserve policies to support crypto. However, Bessent responded that the law gives him no such authority, and he cannot compel banks to make crypto purchases.

Bessent further clarified that taxpayer funds cannot be invested in digital currencies or in any tokens, including Solana-based meme assets. He emphasized that his role under current regulations does not permit using federal funds for Bitcoin exposure. Sherman countered by raising concerns over private banking funds, but Bessent maintained that those are not public monies.

The exchange intensified when Sherman questioned if the government would ever use tax revenue to accumulate Bitcoin reserves. Bessent reiterated that only seized Bitcoin is held by the U.S. government under existing forfeiture processes. He cited prior seizures totaling $1 billion, with $500 million retained and now worth over $15 billion.

TRUMP Coin Draws Fire During Crypto Oversight Talks

Rep. Sherman also referenced the “TRUMP” meme coin issued on the Solana blockchain, linking it to speculation and volatility. He asked if such coins could ever qualify for government-backed purchases or policy inclusion. Bessent replied that neither the Treasury nor the FSOC has the authority to act on speculative meme coins.

While Bessent stayed neutral on the TRUMP coin, Sherman emphasized its unregulated nature and alleged political branding. He warned that using public resources for these assets could set a dangerous precedent. The discussion signaled growing discomfort among lawmakers about crypto products perceived to be linked to public figures.

Bessent declined to provide specific commentary on TRUMP coin but reinforced that the Treasury does not engage in speculative crypto activities. He stood by the department’s position that taxpayer dollars should not enter volatile or unregulated digital markets. This stance continues to define Treasury policy amid rising political attention on meme coins.

World Liberty Financial Raises Scrutiny Over Security Risks

Rep. Gregory Meeks shifted focus to World Liberty Financial, citing concerns about foreign ties and investor transparency. He referenced statements from founder Eric Trump, who claimed he had undisclosed yet “meaningful” investors. Meeks argued that such ambiguity could pose national security risks, especially if linked to foreign capital.

The lawmaker also pointed out that the WLFI token had lost over 50% of its value, adding to concerns of instability. He said discussion forums revealed unease about governance, suggesting that the Trump family controlled key decisions. Meeks argued this ownership structure could allow selective profit-taking from token sales.

Senator Elizabeth Warren had previously called for an investigation into a deal involving a UAE royal entity and World Liberty Financial. Meeks followed up by urging tighter oversight of any bank license applications tied to the firm. However, Bessent refused to intervene, stating that the Office of the Comptroller of the Currency operates independently.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards