Cryptocurrency

Bitcoin Traders Eye Breakout to Highs as Trump Says Tariff Deals Progressing

Published

4 weeks agoon

By

NewsAdmin

The crypto market remains in prolonged consolidation with the overall market cap approaching $3 trillion as analysts eye a possible bitcoin (BTC) breakout that could push the market higher.

Bitcoin hovered near $95,00 on Thursday, while ether (ETH), BNB Chain’s BNB and Solana’s SOL remained stagnant. XRP and Cardano’s ADA dropped 2%, while dogecoin (DOGE) fell 3%.

Spot bitcoin exchange-traded funds (ETFs) lost $56 million on Wednesday, breaking an eight-day streak that saw nearly $3 billion flow into these U.S.-listed products.

Markets have been generally range-bound in the past week, setting the course for what could be an explosive move higher, some say.

“Such long consolidations usually accumulate strength for further movement. The next major trigger is likely to be Friday’s labour market data,” Alex Kuptsikevich, FxPro chief market analyst, told CoinDesk in an email.

“For the past five days, the market has fluctuated in a very narrow range, with some tendency towards shallower declines. Still, it has been unable to exceed its 200-day moving average, which is now passing through $3.01 trillion. A global positive is needed for a breakout, but it would open the way to the $3.5 trillion area,” Kuptsikevich added, indicating strong movements in altcoins.

Pat Zhang, head of research at WOO X, mirrored the sentiment. “BTC continues to experience volatility, forming a consolidation range between $93,000 and $95,000 since April 25, building momentum for a potential breakout,” he said in a Telegram message.

“The average funding rate for BTC has been negative over the past week, which is rare, indicating intense whale activity both on and off exchanges,” Zhang added.

Over the past two years, the financing rate for bitcoin contracts has been negative only four times, specifically during Sept. 19- Sept. 22, 2023, Oct. 20-Oct. 27, 2023, Aug. 16- Aug. 24, 2024, and Sept. 10- Sept. 17, 2024.

“Following these periods of negative financing rates, BTC experienced strong upward trends, suggesting that whale accumulation could be positioning BTC for a potential upward move,” Zhang noted.

Macroeconomic sentiment remains dented as traders globally eye the next steps made by President Donald Trump in the ongoing tariff tussles.

Per Bloomberg, Trump acknowledged Wednesday that his tariff program had a perception problem and posed a significant political risk, but he remained determined to push on. He said “potential deals” with South Korea, India, and Japan were already in place and that a deal with China was progressing in his favor.

You may like

Cryptocurrency

BNB Rises as Global Trade Tensions Drive Demand for Crypto Market Alternatives

Published

5 minutes agoon

May 29, 2025By

NewsAdmin

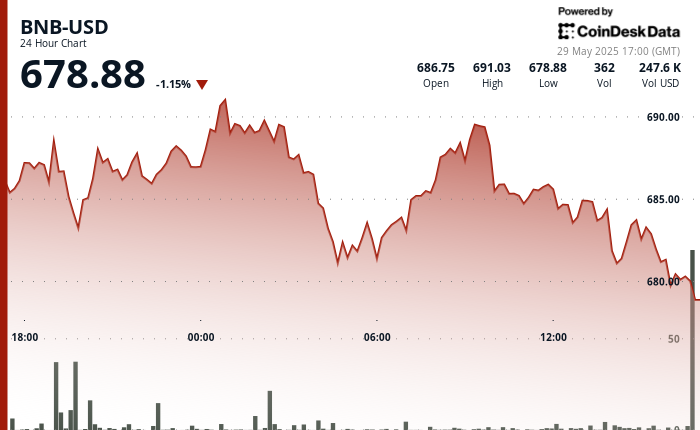

Recent escalations in global trade disputes have created a complex backdrop for cryptocurrency markets, with BNB demonstrating notable strength despite economic headwinds.

The token’s upward momentum comes as investors seek alternative assets amid traditional market volatility caused by ongoing geopolitical tensions.

While central banks worldwide adjust monetary policies to combat inflation, digital assets like BNB are increasingly viewed as potential hedges against economic uncertainty.

Technical Analysis Highlights

- Price action formed a clear uptrend, breaking through key resistance at $687.50 with above-average volume during the 00:00 hour push to $691.06, establishing new support at the $688.70 level.

- Most significant price movement occurred between 23:00-00:00 when BNB surged on 45,675 units of volume (well above the 24-hour average), confirming strong buyer conviction.

- In the last hour, BNB experienced a notable price correction, retreating from its earlier peak of $690.11 at 01:21 to $688.87 by 02:06, representing a 0.18% decline.

- Increased volatility between 01:50-01:53 when it briefly rallied to $689.85 before encountering resistance, followed by a sharper downward movement at 01:57.

- Price dropped from $689.53 to $689.13 on significantly higher volume (926.88 units), suggesting profit-taking after the earlier uptrend.

External References

Cryptocurrency

SEC Commissioner Hester Peirce Says “We Can’t Ignore It” in Bitcoin 2025 Fireside Talk

Published

10 minutes agoon

May 29, 2025By

NewsAdmin

Bitcoin Magazine

SEC Commissioner Hester Peirce Says “We Can’t Ignore It” in Bitcoin 2025 Fireside Talk

At the Bitcoin 2025 Conference this morning, U.S. Securities and Exchange Commissioner Hester Peirce took the stage with Fold’s General Counsel Hailey Lennon for a fireside chat that pulled no punches.

Opening with a question about enforcement priorities since the change in administration, Lennon asked, “What are the current enforcement priorities, if any, in the digital asset space?” Peirce acknowledged the public’s frustration: “Some people have taken the fact that we haven’t moved forward with a ton of these cases as inaction—but there’s a lot to digest.” She stressed that the agency is actively bringing in outside perspectives, stating, “That’s really the way to get to good rules.”

A core theme of the conversation was regulatory uncertainty. “One complaint I’ve had,” Peirce said, “is that in an environment of regulatory uncertainty, it’s much harder to identify bad actors—and it gives them more room to operate. Meanwhile, it pushes legitimate actors out of the U.S. or out of the industry entirely. We need to create a good environment for the good actors and a bad one for the bad actors.”

Peirce also addressed her recent tweet hinting at disclosure requirements for projects potentially considered securities.

Here's what the Crypto Task Force has been doing and some things we're thinking about: https://t.co/YHXAYhr23P

— Hester Peirce (@HesterPeirce) May 19, 2025

When asked about the explosion of memecoins and speculative tokens, Peirce didn’t hold back: “If you’re expecting to buy a memecoin and become a billionaire—buyer beware. Be an adult. If you want to speculate, go for it, but if something goes wrong, don’t come complaining to the government.” This confirms the value, and security of Bitcoin.

She emphasized the importance of community participation, noting that “government works for the people,” and encouraged attendees to weigh in on issues like surveillance and financial freedom. “In the United States, we are all about freedom. Freedom to innovate. Your voices are so important for helping us think through these issues.”

Peirce’s remarks echo the statements that JD Vance touched on yesterday during his speech at the Bitcoin 2025 Conference. They both emphasized that we, the American people, have the power to transform the traditional financial system, and fuel Bitcoin.

Discussing Bitcoin’s growing presence in traditional finance, Lennon asked whether the SEC is prepared for that convergence. Peirce replied, “We can’t ignore it. When people are free to use something, it will eventually be incorporated into traditional financial products. We need to think about how it interacts with our regulatory framework—but the key is preserving people’s ability to transfer value on their own terms.”

Looking ahead, Peirce left attendees with a powerful reminder: “You don’t have to wait for the government. Demand transparency. Learn from failures. Pick yourself up, dust yourself off, and do better next time.”

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below:

This post SEC Commissioner Hester Peirce Says “We Can’t Ignore It” in Bitcoin 2025 Fireside Talk first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

Cryptocurrency

DeepSeek Claims Upgraded Model Approaching ChatGPT, Gemini

Published

17 minutes agoon

May 29, 2025By

NewsAdmin

DeepSeek, a China-based artificial intelligence company, has announced an upgrade to its AI chatbot, saying it can now offer enhanced overall logic, mathematics and programming with a reduced hallucination rate.

According to DeepSeek, the upgraded model — DeepSeek-R1-0528 — has “significantly improved its depth of reasoning and inference capabilities.” The startup said the model’s overall performance is now “approaching that of leading models, such as O3 and Gemini 2.5 Pro.”

DeepSeek’s debut of its R1 chatbot in January sent shockwaves through the AI industry and further established China as an AI force. The company’s first AI model had a training cost of $6 million and similar performance to leading AI models trained on significantly larger sums of capital.

According to data from Business of Apps, DeepSeek has been downloaded 75 million times since its launch and had 38 million monthly active users (MAU) as of April. In a recent antitrust lawsuit, Google estimated that Gemini reached 350 million active users in March, while OpenAI’s ChatGPT claimed 600 million active users in the same month.

Related: China’s DeepSeek launches new open-source AI after R1 took on OpenAI

Chinese-American AI race heats up

The United States government is planning to restrict the sale of advanced chip design software to China. According to a Bloomberg report, the move seeks to limit China’s ability to advance its domestic semiconductor manufacturing capabilities.

Semiconductors are critical for a wide range of technologies, including AI, where they serve as the hardware backbone for training and running complex models.

New China AI models, such as Tencent’s T1 and Alibaba’s Qwen3, have also emerged in the first few months of 2025, spurring the AI race along.

Magazine: AI Eye: 9 curious things about DeepSeek R1

9 Exercises To Grow Arms at Home | Increase Arm Strength Without Equipment BECOME TALLER & GET SLIMMER /11 MIN FULL BODY EXERCISES ROUTINES TO GROW TALLER AT HOME_ Shrilyn Good Morning America Full Broadcast — Monday, May 19, 2025 Kim Zolciak & Kroy Biermann, Timeline of Their Relationship Drama The Worst Mistake for a Flat Stomach 15-minute arm workout with dumbbells for biceps and triceps The Weeknd And Jenna Ortega Star In A Dull Film Doctor Answers Physical Therapy Questions | Tech Support | WIRED

Draper vs Monfils LIVE: French Open scores and updates with Fearnley also in action

Trump administration orders ICE to more than triple number of arrests

Andrew and Tristan Tate will return to UK to face charges, lawyer says

![]()

9 Exercises To Grow Arms at Home | Increase Arm Strength Without Equipment

![]()

BECOME TALLER & GET SLIMMER /11 MIN FULL BODY EXERCISES ROUTINES TO GROW TALLER AT HOME_ Shrilyn

![]()

Good Morning America Full Broadcast — Monday, May 19, 2025

Trending

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()