Crypto World

Bitcoin Trading at 41% Discount, Power-Law Model Shows $122K Fair Value

Bitcoin slipped below $71,000, but one analyst says the cryptocurrency is trading about 41% below its long-term fair value.

Bitcoin (BTC) recently slipped below $71,000, erasing all the gains made since the U.S. presidential election in late 2024.

However, one analyst argues that the asset is trading at a 41% discount to its long-term historical trend value.

Market Stress and a Growing Valuation Gap

Using a power-law valuation model, market observer David placed Bitcoin’s fair value at $122,762, compared with spot prices around $72,000 at the time. That implied a gap of roughly $51,000, or about 41%, which he described as well below Bitcoin’s normal historical range.

David’s analysis focused on the mechanics behind the move rather than macro headlines. He said current price action appears to be driven mainly by forced flows in derivatives markets, such as hedging and liquidation-related selling, rather than long-term holders distributing their BTC.

One metric he highlighted was Bitcoin’s z-score, a measure of how far the current price varies from the trend, which he estimated at minus 0.76, suggesting the price has moved far below its typical deviation from the long-term trend.

Positioning data reinforced that view, considering that over the past 30 days, Bitcoin’s price is down approximately 20%, while open interest has risen nearly 7%, according to figures cited in the post.

David described these trends as a sign that leveraged exposure is increasing even with the price weakening. In his words, price is falling while leveraged bets are growing, a setup that can lead to sharp, forced moves in either direction.

You may also like:

He also pointed to elevated volatility, with 20-day implied volatility above 43, and combined futures and options open interest of more than $2.3 billion. Under those conditions, the analyst estimated a 70% probability of a squeeze if the price begins to move higher, noting that positioning could “flip very fast.”

Furthermore, he identified the area near $73,000 as a key gamma level, where moves below it may amplify volatility, while moves above it could dampen price swings.

Price Action Reflects Leverage

At the time of writing, the flagship cryptocurrency was trading around the $70,500 level, according to CoinGecko, marking a nearly 8% drop in the last 24 hours and a close to 20% dip over seven days. In the past month, BTC is down almost 25%, with the losses pushing it 44% below its all-time high from October last year.

This decline triggered a wave of liquidations that hit the market, with data from analytic firm CoinGlass showing that more than 154,000 traders were liquidated in 24 hours, with total losses near $718 million.

Another entity that has been significantly affected by BTC’s recent dip is Strategy, which recently purchased 855 BTC for $75.3 million. According to the Kobeissi Letter, the firm’s Bitcoin position has moved deeper into the red, with paper losses rising to $40 billion in the last four months.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Multiliquid, Metalayer Roll Out Instant Redemptions for Tokenized RWAs

Multiliquid and Metalayer Ventures have launched an institutional liquidity facility to provide instant redemptions for tokenized real-world assets (RWAs) on Solana.

The facility allows holders of tokenized assets to convert positions into stablecoins instantly. The vehicle is raised and managed by Metalayer Ventures, with infrastructure and market support provided by Uniform Labs, the developer behind the Multiliquid protocol, according to an announcement shared with Cointelegraph.

“Traditional finance has repo markets, prime brokerage and overnight lending facilities. Tokenized markets have had nothing comparable, until now,” said Will Beeson, founder and CEO at Uniform Labs. “This is the liquidity infrastructure that institutional RWA markets will require at scale.”

Last year, the Bank for International Settlements warned that tokenized money market funds face liquidity mismatches that could amplify stress during periods of elevated redemption demand.

Related: Startale, SBI launch blockchain for institutional FX, RWA trading

Standing buyer delivers instant RWA liquidity

Metalayer’s facility functions as a standing buyer of tokenized RWAs, purchasing assets at a dynamic discount to net asset value.

Metalayer Ventures supplies and manages the capital backing redemptions, while Multiliquid provides the smart contract infrastructure used for pricing, compliance enforcement and settlement.

The vehicle will initially support tokenized assets issued by companies including VanEck, Janus Henderson and Fasanara, covering tokenized Treasury funds and select alternative investment products.

Related: True tokenization demands asset composability, not wrapped bubbles

Solana gains ground in tokenized RWAs

Solana (SOL) has emerged as a growing venue for tokenized RWAs. It ranks eighth among blockchains by total RWA value with about $1.2 billion represented across 343 assets, according to RWA.xyz data. While its market share remains modest at 0.31%, Solana is showing steady momentum, with RWA value up by more than 10% in the past month.

Canton Network, Ethereum (ETH) and Provenance are the three largest blockchains for tokenized RWAs by total value.

Canton dominates the market with more than $348 billion in RWAs and over 88% market share. Ethereum ranks second with $15 billion in tokenized assets, while Provenance also holds $15 billion with fewer assets.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Tether Makes $100M Strategic Equity Investment in Anchorage Digital

Tether, issuer of the stablecoin USDT, said it has made a $100 million equity investment in Anchorage Digital, deepening an existing relationship between the two firms.

In a blog post the firm said the investment is being made through Tether Investments and reflects growing focus between stablecoin issuers and federally regulated financial institutions as digital assets continue to integrate into mainstream finance.

Strengthening Regulated Digital Asset Infrastructure

Anchorage Digital Bank N.A. is the first federally chartered digital asset bank in the United States, providing institutions with custody, staking, governance, settlement, and stablecoin issuance services.

Tether said the investment reflects its view that Anchorage plays a critical role in enabling digital assets to operate safely and at scale within established regulatory frameworks.

Both firms said they are focused on the foundational infrastructure that supports institutional participation in crypto markets especially as regulatory scrutiny intensifies globally.

Strategic Focus Beyond Capital

Tether said its growth has been made by a stronger emphasis on regulatory focus and collaboration with institutions operating under clear legal oversight.

Anchorage Digital’s position at the intersection of regulation and security made it a natural partner as Tether looks to support long-term market integrity.

The relationship between the two companies predates the investment. Anchorage Digital Bank is the issuer of USAT giving Tether direct experience operating within Anchorage’s compliance, custody, and banking framework. That operational familiarity has informed Tether’s decision to take an equity stake.

Institutional Confidence in Stablecoin Infrastructure

“Tether exists to challenge the status quo and build global infrastructure for freedom,” said Paolo Ardoino, CEO of Tether. “Our investment in Anchorage Digital reflects a shared belief in the importance of secure, transparent, and resilient financial systems.”

Anchorage Digital CEO and co-founder Nathan McCauley said the investment validates the firm’s long-term approach. “We’ve believed from day one that digital assets would only scale through secure, regulated foundations,” he said.

Positioning for the Next Phase of Adoption

For Tether the investment reinforces a broader strategy centered on long-term partnerships with regulated institutions that are helping define how stablecoins function within existing financial systems.

As policymakers and institutions continue to shape the future of digital money, infrastructure providers like Anchorage Digital are increasingly seen as critical intermediaries.

Tether and Anchorage Digital said they aim to support broader participation in digital assets while promoting stability, transparency and confidence — pillars they view as essential for the next phase of global digital asset adoption.

The post Tether Makes $100M Strategic Equity Investment in Anchorage Digital appeared first on Cryptonews.

Crypto World

BTC price news: Bitcoin falls under $68,000

Bitcoin slid under the $68,000 level in U.S. morning hours Thursday, extending a week-long selloff that has tracked weakness across global risk assets and deepened concerns about near-term downside.

Crypto liquidations crossed $1 billion over the past 24 hours, wiping out about $980 million million in bullish leveraged bets as the slide forced traders to close positions they could not keep funded.

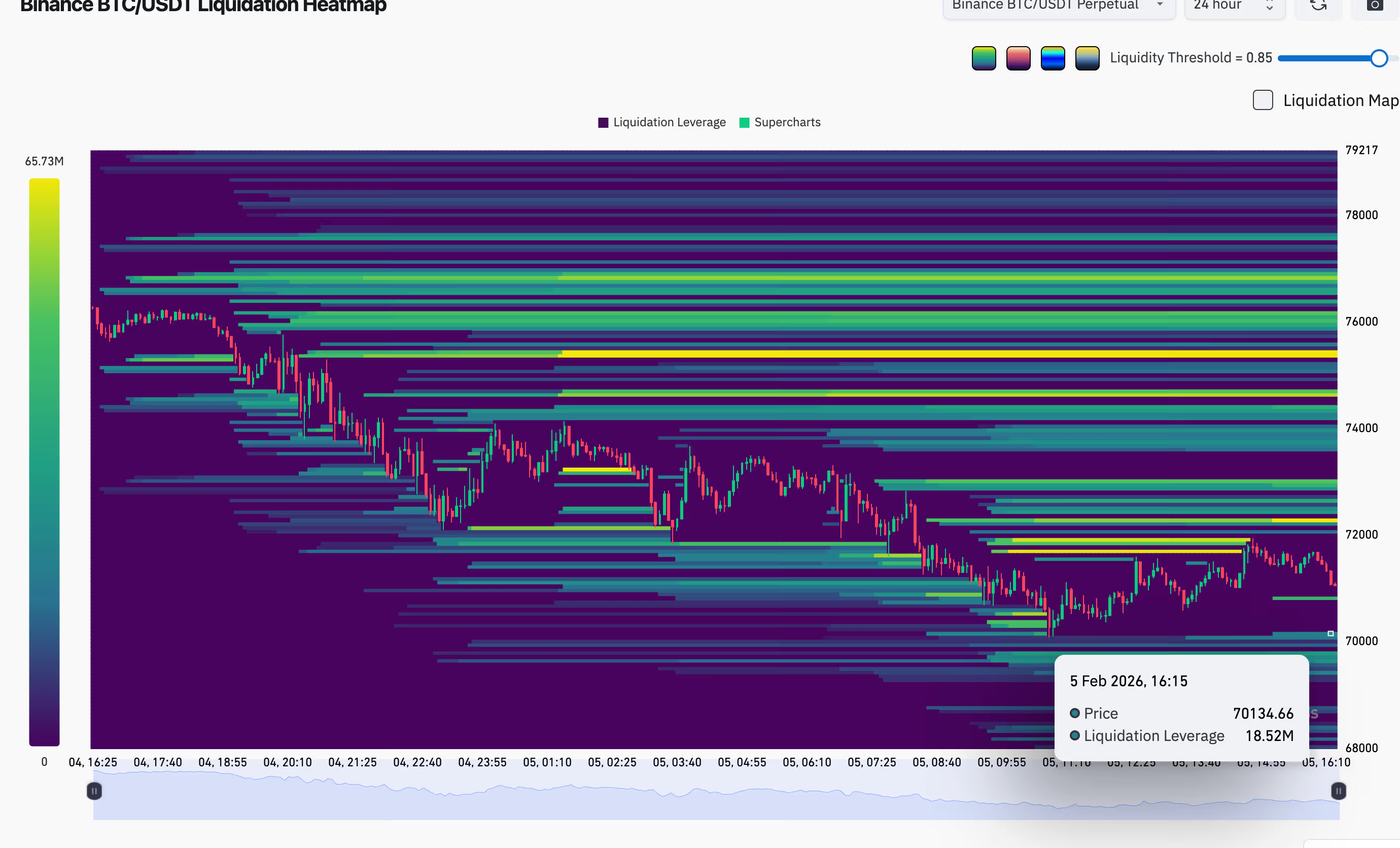

Price fel lunder $70,000 earlier in the day, with liquidity heatmaps pointing to further downside.

Liquidity thins out quickly until just under $70,000, per Coinglass data, where another smaller cluster appears. That makes $70,000 a mechanically important level. If price pushes cleanly through it, there’s less forced buying from liquidations to slow the move, raising the risk of a faster flush toward the high $60,000s.

A liquidation heatmap is a map of where leveraged traders are most likely to get forced out. Bright bands mark price levels with lots of estimated liquidation points, which can act like short term magnets for price moves. Traders use it to spot crowded zones and likely volatility pockets, not exact turning points.

Crypto World

Tether invests $100 million in U.S.-regulated crypto bank Anchorage

Tether, the company behind the world’s largest stablecoin USDT said it has invested $100 million in Anchorage Digital, a federally regulated digital asset bank.

Anchorage, which holds a national banking charter in the U.S., offers custody, staking, settlement and stablecoin issuance services to institutional clients.

The two companies already had a working relationship, with Anchorage serving as the banking partner behind Tether’s USAT stablecoin, designed specifically for the U.S. market to comply with local regulations.

The investment gives Tether a foothold in the fast-growing U.S. stablecoin infrastructure, which is moving towards regulated players after the GENIUS Act was written into law last year. Tether, headquartered and regulated in El Salvador, traditionally focuses on offshore users and emerging markets with its $185 billion USDT token.

“Tether exists to challenge the status quo and build global infrastructure for freedom,” said Paolo Ardoino, CEO of Tether, said in a statement. “Our investment in Anchorage Digital reflects a shared belief in the importance of secure, transparent, and resilient financial systems.”

Crypto World

Michael Saylor missed out on a $33 billion profit at Strategy

Strategy (formerly MicroStrategy) managed to turn an unrealized bitcoin (BTC) profit of $32.6 billion into a $2.2 billion loss thanks to founder Michael Saylor’s reluctance to sell.

To be specific, four months ago on October 6, the company owned 640,031 BTC acquired for $73,983 apiece but worth $125,000 apiece at prevailing market prices.

As of yesterday’s Nasdaq close, however, Strategy now owns 713,502 BTC acquired for $76,052 and worth just $72,925.

In other words, Strategy had an unrealized BTC profit of $32.6 billion on October 6 that has turned into a $2.2 billion loss.

Even excluding the last four months of purchases to restrict yesterday’s figure to the original 640,031 BTC, that still recalculates to an equally embarrassing swing from a $32.6 billion profit to a $670 million loss on only the BTC the company owned four months ago.

Read more: Michael Saylor is running out of ways to boost Strategy’s BTC per share

New lows across multiple metrics

Management’s choice to not sell means Strategy’s balance sheet has $33 billion less in assets than it could have, less capital gains tax.

This figure also ignores the effects on BTC’s price of Strategy selling such large sums.

As of yesterday’s close, the company’s common stock MSTR had a market capitalization of just 0.82x the value of the company’s BTC holdings — down 75% from its November 2024 high of 3.4x.

In addition to a 76% loss since its November 2024 high, including its latest 52-week decline of 61%, Strategy leadership has also failed to capture those tens of billions of dollars of investment income along the way.

It might seem tempting, given these losses, to point to a reminder of Saylor’s previously devout and confident proclamations that he never intended to sell Strategy’s BTC.

Unfortunately, he did say those things in the distant past, but even that promise has been deteriorating along with most other metrics at Strategy.

Indeed, Saylor now discusses the possibility of selling Strategy’s BTC, including official statements from the company and its CEO, albeit in euphemisms such as raising capital or covering dividend obligations.

Moreover, the company recently diluted equity holders for $1.44 billion with $0 in associated BTC purchases in order to shore up USD, not BTC, for a rainy day. That day might be arriving soon.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Playnance unveils Web2-to-Web3 gaming ecosystem after years in stealth mode

- Playnance unveils Web2-to-Web3 gaming infrastructure after years operating privately at scale.

- The platform processes 1.5 million daily on-chain transactions with over 10,000 active users.

- Playnance focuses on simplifying blockchain access through Web2-style onboarding systems.

Playnance has made its first public announcement, revealing itself as a Web3 infrastructure and consumer platform company that has been operating a live ecosystem aimed at onboarding mainstream Web2 users into blockchain-based environments.

The announcement was made on February 5, 2026, from Tel Aviv, marking the company’s first formal introduction after several years of developing and running its technology and platforms privately.

Founded in 2020, Playnance has positioned itself as a Web2-to-Web3 gaming infrastructure layer.

The company integrates with more than 30 game studios and enables the conversion of thousands of games into fully on-chain experiences, where all gameplay actions are executed and recorded directly on blockchain networks.

Infrastructure built to simplify blockchain adoption

Playnance’s core offering focuses on removing technical barriers commonly associated with blockchain usage.

The company’s products are designed to allow users to interact with on-chain systems without needing direct knowledge of blockchain mechanics.

Instead, users access platforms through familiar Web2-style interfaces, including standard account creation and login processes, while blockchain functionality operates in the background.

The company stated that its live platforms currently process approximately 1.5 million on-chain transactions daily and support more than 10,000 daily active users.

According to Playnance, a significant portion of its user base originates from traditional Web2 environments.

These users are reportedly able to onboard and interact with blockchain-based systems without using external wallets or managing private keys, suggesting continued on-chain engagement from audiences outside the traditional crypto sector.

The company’s ecosystem also includes the G Coin initiative, which is currently operating in pre-sale mode and is accessible through the Playnance official website.

Consumer platforms showcase operational ecosystem

Playnance operates several consumer-facing platforms designed to demonstrate its infrastructure capabilities.

Among these are PlayW3, Up vs Down, and other products that run on shared on-chain infrastructure and wallet systems.

The integrated structure allows users to move between platforms without repeating onboarding procedures.

All user interactions across these platforms are executed and recorded on-chain while remaining non-custodial, aligning with the company’s focus on user control and blockchain transparency.

The shared wallet and infrastructure framework also supports cross-platform engagement within the broader Playnance ecosystem.

“Our focus was on building systems that people could use without needing to understand blockchain mechanics,” said Pini Peter, CEO of Playnance. “We prioritized live operation and user behavior over public announcements, and this is the first time we are formally introducing the company after reaching scale.”

Expansion strategy centred on user behaviour

Playnance stated that its infrastructure is designed to support high-volume consumer activity and continuous on-chain execution.

The company’s approach reflects a broader industry shift toward practical blockchain applications targeting mainstream audiences.

Looking ahead, Playnance indicated that its ecosystem expansion will be guided by observed user behaviour and platform performance.

The company emphasised that its development roadmap will focus on real usage data rather than speculative adoption models.

Playnance describes itself as a company focused on reducing friction between user behaviour and blockchain execution by operating consumer platforms at scale.

Crypto World

Hex Trust Adds Custodial FXRP Minting and FLR Staking for Institutions

Institutional custodian Hex Trust has expanded its long-standing partnership with Flare through a new collaboration aimed at delivering institutional access to native FLR staking and FXRP minting.

Under the agreement, Hex Trust said it will provide custody, governance, and compliance infrastructure, while Flare supplies the underlying protocol layer.

The update is now live for Hex Trust’s institutional clients and positions Hex as a primary gateway into the Flare ecosystem, offering a standardized and secure interface for interacting with Flare-native assets.

Gateway Into the Flare Ecosystem

The partnership allows institutions to mint and redeem FXRP — a non-custodial 1:1 representation of XRP on Flare — and to participate in native FLR staking directly through Hex Trust’s platform.

These activities underpin economic activity on Flare, supporting network security, liquidity and decentralized finance use cases. By firm combines Flare’s protocol infrastructure with Hex Trust’s regulated custody and operational controls.

In December, Hex Trust announced the launch of Wrapped XRP (wXRP) on Thursday, deploying the token across Ethereum, Solana, Optimism, and HyperEVM with $100 million in initial liquidity.

The move aims to anchor Ripple’s RLUSD stablecoin pairs on EVM chains. XRP remained flat on the news, while RLUSD supply held steady at 1.3 billion.

Solving Institutional Risk and Custody Constraints

The firm claims many institutions, direct engagement with staking or bridging has been constrained by the need for hot wallet connections and limited governance controls. As a result, assets such as XRP and FLR have often remained sidelined, despite growing onchain demand.

Hex Trust said it addresses this by maintaining a strict chain of custody while allowing participation in Flare’s DeFi ecosystem via WalletConnect. This structure allows institutions to access native FLR staking and XRP-based DeFi strategies through FXRP minting without compromising internal risk frameworks.

Turning Idle Assets Into Productive Collateral

“The expansion of token wrapping to assets like XRP marks a significant shift in market structure,” said Giorgia Pellizzari, CPO and head of custody at Hex Trust.

She notes that the integration allows traditionally static assets to become productive, liquid collateral while remaining within an enterprise-grade governance framework.

Hugo Philion, co-founder and CEO of Flare, said the partnership is designed to unlock smart contract utility for assets that lack native programmability. “Working with Hex Trust empowers institutions to put their assets to work without compromising on security or compliance,” he said.

Institutional-Grade DeFi Infrastructure

Flare’s FAssets system enables non-smart contract assets to be represented on-chain in a trust-minimized manner, supporting use cases such as staking and lending.

The system has been built with institutional requirements in mind, incorporating external audits, continuous monitoring and safeguards to protect solvency and system integrity.

Minting and redemption actions under the collaboration are governed by Hex Trust’s transaction policy engine, which supports customizable, multi-approval workflows.

As Flare expands support for other assets such as BTC, Hex Trust said it will continue to provide the secure infrastructure enabling institutions to participate at scale.

The post Hex Trust Adds Custodial FXRP Minting and FLR Staking for Institutions appeared first on Cryptonews.

Crypto World

Bitcoin May Dip Below $64K as Veteran Warns of ‘Campaign Selling’

Bitcoin (CRYPTO: BTC) extended its pullback, slipping more than 22.5% over the past week to hover around $69,000 as traders weigh supply and demand dynamics. The retreat follows a period in which miners and US spot BTC ETFs trimmed exposure, adding modest selling pressure to an already fragile downtrend. The market has shown little appetite for a rebound, underscoring how thin liquidity and cautious sentiment can magnify losses in a risk-off environment. On-chain data and fund flows paint a nuanced picture: distribution signals from large holders sit alongside episodes of fading demand, complicating bets on a swift recovery.

Key takeaways

- Campaign selling by institutions, particularly miner-related activity and ETF exposure reductions, is pressing BTC lower rather than providing a floor.

- A potential bottom zone remains visible in the $54,600–$55,000 area, but confirmation requires sustained demand and stabilizing on-chain metrics.

- On-chain data shows miners shifting toward net distribution, signaling that fresh supply is hitting the market as January closes.

- Bitcoin spot ETF balances have declined to about 1.27 million BTC, echoing cooled institutional exposure and a potential headwind for price recovery.

- Market indicators, including the Coinbase premium, have retreated to yearly lows, suggesting waning institutional interest in this phase of the cycle.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. The combination of ongoing distribution by miners and reduced ETF exposure signals further near-term downside risk.

Trading idea (Not Financial Advice): Hold. The current setup implies caution until there are clearer signs of demand and a firmer base forming around key support zones.

Market context: The BTC move unfolds amid a broader risk-off environment and evolving ETF flows that continue to influence spot prices. With liquidity patterns tightening and macro uncertainty lingering, price action remains highly data-dependent, with on-chain signals and fund flows providing mixed signals about when a durable bottom might form.

Why it matters

The ongoing pressure on Bitcoin highlights how interlinked the crypto market has become with macro liquidity and institutional participation. As miners and spot ETFs pull back, the supply-demand balance tilts toward hodlers and short-term traders, potentially elevating the risk of sharper moves if selling accelerates. The situation underscores the importance of on-chain dynamics—especially miner behavior and exchange balances—in gauging how much selling pressure the market can absorb before a meaningful rebound takes hold. For participants watching risk, the dynamics around BTC’s supply chain—miner distributions and ETF outflows—remain a critical lens for assessing whether the market is merely digesting a correction or entering a more extended phase of weakness.

From a technical perspective, several indicators point to a challenging landscape ahead. Veteran analyst Peter L. Brandt has highlighted what he describes as “campaign selling”—a deliberate, sustained distribution by large institutions rather than a reflexive, retail-led decline. The observation aligns with an impairment of bid strength as price trends lower highs and lower lows. While this framing does not guarantee further downside, it does suggest that the near term could remain precarious absent a meaningful change in buying interest or a reinterpretation of macro catalysts. The price path toward potential targets, such as the bear-flag scenario around the $63,800 level and the broader zone near mid-$50,000s, remains a focal point for traders watching for a possible inflection.

On-chain temperature checks reinforce the sense of a market in flux. Data indicate that miners have shifted from a net accumulation posture to distribution in January, sending BTC toward exchanges. Such movements can amplify selling pressure if capitulation accelerates or if external demand does not step in to absorb the newly minted supply. This dynamic dovetails with the retreat in the Coinbase premium, a gauge closely watched for institutional appetite; the premium slipping to yearly lows implies that institutions may be pulling back from aggressive entry points that previously provided steadying support. The mix of on-chain distribution and weakened exchange inflows contributes to a narrative in which BTC could spend additional time testing support levels rather than staging a rapid rebound.

Two additional threads bear watching. First, the official balance of Bitcoin held by spot ETFs has continued to drift lower, with total BTC under management dipping to about 1.27 million as of the latest reads. Second, some analysts point to a possible longer-horizon accumulation window that could materialize later in the cycle—potentially around mid-2026—driven by timing dynamics in credit spreads and historical lag effects between price bottoms and accumulation phases. These lines of inquiry do not imply an imminent rally, but they offer a framework for understanding where and when demand might re-enter with more conviction. For context, historical analysis has surfaced instances where price convergences toward accumulation bands signaled times of capitulation followed by assertive recoveries, albeit on longer horizons than immediate, intraday moves.

Looking back, the market has shown that the path from capitulation to accumulation can be gradual. In 2022, for instance, BTC dipped into a zone near $20,000 before a bottom formed and a subsequent rally pushed prices higher in the following year. The current cadence—sliding into a zone around $54.6K as an accumulation signal emerges—has prompted some to suggest that the asset is nearing a decisive juncture: the point at which sellers exhaust and buyers begin to re-enter, setting the stage for a more sustained recovery if macro conditions improve and institutional participation returns.

As one analyst put it, the convergence toward a band signaling the start of the accumulation phase around $54.6K could indicate we are transitioning from capitulation to accumulation. Such a reading does not guarantee a reversal on the immediate horizon, but it frames a potential pause in the downtrend and a setup for a more deliberate, value-oriented accumulation once conditions improve. The broader framework also includes a comparative timing signal that some researchers say could push a renewed cycle of accumulation toward mid-2026, a view anchored in widening credit spreads and other macro timing data. Taken together, the signals suggest that investors should monitor rather than chase, awaiting more robust evidence of demand and a firmer foundation beneath prices.

Ultimately, the market’s sensitivity to institutional flows and on-chain movements means BTC’s fate remains tethered to the behavior of large players and the health of the broader liquidity environment. While there is recognition of potential relief points—whether from a stabilization around the $55k zone or a delayed uptick in ETFs’ appetite—the current configuration favors caution. For traders, the narrative remains one of careful risk management, waiting for clearer catalysts that could flip the narrative from bear to bull—or at least reduce the downside risk to a more manageable level.

What to watch next

- Watch BTC price behavior around the $54,600–$55,000 support zone for signs of accumulation or further breakdown.

- Monitor miner activity and distribution trends as January closes, weighing any shift back toward net accumulation against ongoing selling pressure.

- Track US spot BTC ETF balances for continued outflows or stabilization that could influence price direction.

- Observe the Coinbase premium and other institutional indicators for renewed appetite from large buyers.

- Follow commentary and data on the potential mid-2026 accumulation window linked to credit-spread timing and macro liquidity cycles.

Sources & verification

- Peter L. Brandt’s commentary on “campaign selling” and its implications for price structure (as discussed on X).

- On-chain signals showing miner net position change shifting toward distribution in January (Glassnode data).

- Bitcoin ETF balances and trends indicating reduced exposure among spot ETFs.

- Coinbase premium readings signaling shifts in institutional demand.

- Analyses projecting a potential accumulation window around mid-2026 based on credit-stress timing data.

Market reaction and near-term risks for BTC

Bitcoin (CRYPTO: BTC) faced a renewed test of support as miners and spot ETFs reduced their BTC exposure, intensifying near-term supply pressure in a market already sensitive to liquidity and macro cues. The price moving through the mid-to-lower $60k range would not be surprising if current distribution persists, particularly given a backdrop of subdued buying interest from institutions and cautious sentiment among traders. The bear-case scenario identified by technical observers centers on a continuation toward the bear-flag target around $63,800, a level that could become a catalyst for new momentum if sellers accumulate pressure without a compelling counterparty bid. Conversely, a stabilization near $55,000 could pave the way for a measured recovery if institutional demand returns and miners slow their distribution cycles.

In this context, the on-chain picture remains a critical barometer. Miners’ net position changes have shifted to a net outflow pattern in January, suggesting that fresh BTC supply is entering the market at a pace that could sustain pressure on prices near key supports. This dynamic aligns with a decline in spot ETF balances and a cooling of the Coinbase premium, both of which imply that institutional demand has yet to reassert itself with vigor. For traders, the combination of persistent distribution signals and softening buy-side signals means the price could hinge on the next wave of macro and liquidity catalysts—the kind of inputs that often determine whether a market tests lower supports or finds a foothold for a multi-week bounce.

At the same time, several analysts point to potential longer-term inflection opportunities. A subset of commentary highlights the possibility of an accumulation window emerging after mid-2026, tied to timing patterns around widening credit spreads and the historical cadence of BTC market bottoms. While such forecasts are inherently probabilistic, they offer a framework for considering how a cycle may pivot from capitulation to accumulation, even if the timing remains uncertain. For now, the dominant narrative remains one of vigilance: a phase in which buyers must demonstrate conviction and where the absence of a clear catalyst keeps risk balanced on the knife-edge between a renewed rally and a deeper drawdown.

https://platform.twitter.com/widgets.js

Crypto World

Bitcoin May Drop Below $64K as Veteran Raises ‘Campaign Selling’ Alarm

Bitcoin risks a deeper slide as miners and US spot ETFs cut BTC exposure, adding supply pressure during a fragile downtrend.

Bitcoin (BTC) price dropped by more than 22.5% in the past week to $69,000 on Thursday, wiping out 15 months of gains entirely. However, the downtrend may not be over, according to veteran trader Peter Brandt.

Key takeaways:

-

Brandt says “campaign selling” is pressuring BTC, with miners and ETFs also cutting exposure.

-

A potential bottom zone is near $54,600–$55,000.

Bitcoin may drop another 10% as miners, ETFs cut BTC exposure

BTC’s decline left behind a sequence of daily lower highs and lower lows. Simply put, the lack of even modest rebounds suggests few traders are stepping in to buy the dip, at least for now.

This structure, according to Brandt, had “fingerprints of campaign selling,” a deliberate, sustained distribution by large institutions, not retail liquidation.

Onchain data supports Brandt’s outlook. For instance, as of Thursday, the BTC miner net position change metric was showing a clear shift into net distribution throughout January, with miners consistently sending more BTC to the market.

US spot Bitcoin ETFs also reduced their exposure, with net BTC balances falling to 1.27 million BTC as of Wednesday from 1.29 million at the beginning of the year.

Related: Bhutan makes second Bitcoin transfer in a week, worth $22M

The Coinbase premium, a barometer linked to institutional interest, also fell to yearly lows.

This distribution boosted Bitcoin’s chances of reaching its bear flag target of around $63,800, down 10% from current levels, as shown below, based on Brandt’s technical setup.

Bitcoin may bottom below $55,000

Bitcoin risks a deeper drop toward $54,600 amid continued institutional selling, according to onchain analyst GugaOnChain.

The downside target is aligned with the lower zone (red) highlighted in the BTC DCA Signal Cycle metric below. This zone reflects Bitcoin’s one-week to one-month realized price and helps identify periods when BTC is structurally undervalued.

In 2022, the signal turned bullish as BTC fell below the same red zone near $20,000, forming a bottom around the level, before rallying to over $30,000 a year later.

GugaOnChain said:

“The current price convergence toward the band signaling the start of the accumulation phase, situated around $54.6K, suggests we are in the critical transition between Capitulation and Accumulation.”

Meanwhile, another analysis highlights a potential accumulation window emerging after July 2026, based on historical lag effects between widening credit spreads and Bitcoin market bottoms.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

How To Launch Your Neo Bank With White Label BaaS Model In Poland?

“Speed and compliance beat ambition alone.” Investors who act on that truth win. Picture a crypto neo bank that plugs into Poland’s payment fabric, issues virtual IBANs and cards, settles cross-border payroll in stablecoins, and provides custody-grade controls investors can audit in real time. This is practical, not hypothetical. It is a repeatable deployment that converts frequent payment flows into predictable revenue and institutional margin.

For serious investors, the criteria are tight: prove custody safety, guarantee instant liquidity, and demonstrate regulator-ready compliance. If those boxes are checked, scaling follows; if not, growth stalls. White label Banking-as-a-service (BaaS) model combines hardened BaaS infrastructure, threshold key custody, and automated KYT so you capture speed without regulatory compromise. Opportunity windows close fast. Expect measurable KPIs and audit-ready evidence from day one.

Let’s scroll through the blog to know in detail.

Why is Poland Strategically Attractive Right Now?

Poland’s payments infrastructure is exceptionally modern. Instant rails and local schemes drive very high transaction frequency, creating a fertile environment for an integrated crypto-fiat product that sits beside existing behavior and improves margins for merchants and corporates. Recent regulatory clarity across Europe introduces a harmonized rulebook for crypto assets, reducing regulatory uncertainty for licensed providers. At the same time, demand for seamless fiat-on and off-ramps, corporate treasury efficiency, and lower cross-border friction creates a commercial runway for crypto-friendly neo banking solutions. These structural elements combined deliver both an attractive top line and predictable regulatory paths for institutional-grade services.

What Pain Points Does a Crypto Neo Bank Solve in Poland?

- Costly cross-border business payments and remittances, especially for SMEs with EU and non-EU suppliers. Stablecoin rails reduce time and FX slippage and open new settlement patterns.

- Fragmented on/off ramps. Consumers and merchants juggle centralized exchanges, separate wallets, and traditional bank accounts. An integrated account that tokenizes settlement and offers instant conversion removes friction.

- Inefficient corporate treasury for companies paying international contractors. Crypto-native treasury offers options for FX hedging and programmable payroll.

- Poor merchant acceptance paths for crypto receipts. Many merchants want exposure to crypto settlement but need instant conversion to PLN. A neo bank with native conversion fixes this.

- Trust and custody concerns among institutional counterparties. A regulated custody and compliance stack is table stakes for enterprise adoption. These are solvable with best-practice custody and a compliant CASP model.

Top-Notch Reasons to Launch a White Label Neo Bank App in Poland Now

- Digitally mature payments ecosystem- Poland’s widespread adoption of instant payments and digital banking reduces adoption friction and accelerates transaction volumes from day one.

- Regulatory clarity at the EU level- A defined compliance framework provides predictability for investors, lowers regulatory uncertainty, and supports structured market entry.

- High-value, enterprise-driven demand- SMEs, cross-border businesses, and merchants actively seek faster settlement, efficient treasury management, and seamless fiat-crypto interoperability.

- Attractive and diversified revenue model- Multiple monetization layers, including interchange, conversion fees, custody services, treasury subscriptions, and enterprise APIs improve margin resilience.

- Strong unit economics potential- High transaction frequency, lower customer education costs, and enterprise-led onboarding shorten CAC payback periods.

- Rapid go-to-market feasibility- Mature fintech infrastructure and availability of BaaS, BIN, and PSP partnerships significantly compress launch timelines.

- Scalability beyond Poland- A Poland-first strategy enables structured expansion across the EU using a single compliance and product framework.

- Growing institutional interest in Web3 infrastructure- Increasing demand for regulated crypto banking solutions positions early movers for long-term strategic advantage.

- Clear strategic exit pathways- Regulated neo-banking and crypto infrastructure assets remain attractive acquisition targets for banks, fintechs, and payment platforms.

Make sure that you hire the best white label neo bank development company globally that holds years of experience and expertise in designing business-tailored solutions along with legal and regulatory assistance.

How to Deploy Your Crypto Neo Bank With White-Label BaaS in 1 Week?

This must not sound so realistic to you, but launching an impactful white-label crypto neo banking platform is a realistic task for an experienced company, but a conditioned one too. One week is feasible as a minimum viable commercial deployment if three prerequisites are met in advance. First, a preapproved suite of partners must be in place. Second, compliance artifacts must be ready for the target customer profile. Third, the white-label BaaS must be truly modular with production-grade connectors. If those conditions exist, you can go live with a limited product set in seven days. Here is a practical day-by-day playbook.

Day 1: Provision core accounts and sandbox APIs

• Provision the tenant in the BaaS platform.

• Configure product catalog: e-wallet, virtual card, fiat wallet, crypto wallet.

• Route test BINs and IBAN ranges, and create webhooks for events.

Day 2: Integrate identity and compliance flows

• Wire KYC/KYB flows into onboarding.

• Configure AML/KYT thresholds and alerting.

• Set KYT rules for on-chain and fiat monitoring.

Day 3: Custody and liquidity setup

• Connect to custodial key management or MPC node.

• Wire liquidity provider for instant conversion between crypto and PLN.

• Sanity test settlement loops.

Day 4: Card issuance and payment rails

• Configure BIN sponsor for virtual cards and enable BLIK/SEPA rails.

• Run end-to-end card lifecycle tests.

Day 5: UX polish, risk rules, and enterprise onboarding

• Finalize frontend flows and onboarding.

• Implement throttles and risk rules for high-value transactions.

Day 6: Compliance signoff and sandbox transactions

• Execute a full test cycle for compliance reporting and audit trails.

• Load test critical flows.

Day 7: Soft launch with invited customers

• Onboard pilot SMEs and retail cohort.

• Monitor metrics and iterate immediately.

Architecture & Tech Stack Investors Must Demand

- Modular customized BaaS software core with multi-tenant isolation and secure multi-cloud deployment.

- Custody layer with MPC and institutional-grade key management, BLS or threshold signatures, and auditable signer logs.

- A compliance layer that merges on-chain KYT and fiat AML telemetry into a single risk engine.

- Payments layer with BIN orchestration, card lifecycle management, IBAN issuance, and local scheme adapters like BLIK.

- Liquidity and settlement layer with automated market making or liquidity pools for instant fiat conversion.

- Observability and audit trail stack with immutable logging, transaction reconstruction, and regulatory reporting exports.

- Upgradeable smart contract modules and off-chain reconciliations respecting MiCA reporting expectations.

Rolling Out Crypto Neo-Banking in Poland with White-Label BaaS

How Can a Blockchain Company Deliver a Customized BaaS App in a Short Time?

A credible white label BaaS service provider will present prebuilt connectors to KYC, BIN, IBAN, custody, and liquidity partners; a template-driven UI kit; a compliance module with configurable rules; and hardened APIs for enterprise integration. Critical differentiators include white box compliance for investor due diligence, turnkey custody certificates and SOC reports, and documented latency SLAs for settlement. For enterprise adoption, the provider must supply SDKs, sandbox keys, and a preconfigured regulatory evidence pack ready for KNF and other supervisors. Investors should insist on runbooks, incident response, and a roadmap for issuing CASP/CASP filings where required.

Legal & Compliance Support To Expect From a White-Label BaaS Partner

- Regulatory clarity from day one- Clear mapping of your crypto neo-banking model against EU and Polish regulatory requirements, avoiding ambiguity or rework later.

- Licensing and registration guidance- End-to-end support for CASP or VASP readiness, including scope definition, documentation, and regulator-ready submissions.

- Built-in AML and transaction monitoring- Configured AML and KYT frameworks covering both fiat and on-chain transactions with real-time alerts and audit trails.

- Enterprise-grade KYC and KYB workflows- Seamless onboarding flows with configurable risk scoring aligned with Polish and EU expectations.

- Custody and asset protection compliance- A documented custody model with institutional controls, segregation of assets, and audit-ready evidence.

- Regulatory reporting and audit readiness- Automated compliance reports, immutable logs, and support during regulator or banking partner reviews.

- Data protection and privacy alignment- GDPR-compliant data handling, storage, and access controls embedded into the platform.

- Ongoing compliance support- Continuous updates for regulatory changes, policy refinement, and compliance health monitoring post-launch.

The Bottom Line

Poland is a market where modern payment rails, technical literacy, and regulatory convergence create a window to deploy a crypto neo bank that is both profitable and compliant. For investors, the opportunity is to own a differentiated payments and treasury platform that captures recurring, high-frequency flows and monetizes custody and enterprise services.

We bring the technical architecture, custody know-how, and regulatory playbooks necessary to execute. Our team has deep experience delivering production BaaS and crypto custody integrations, and we work closely with legal partners to map MiCA obligations and local procedural requirements so your deployment is defensible and auditable from day one. We will deliver a white label crypto neo bank app with a full compliance pack, a hardened custody solution, and commercial integrations so your capital can be deployed with confidence.

Frequently Asked Questions

01. What advantages does Poland’s payment infrastructure offer for crypto neo banks?

Poland’s modern payment infrastructure, characterized by instant rails and high transaction frequency, creates a favorable environment for integrated crypto-fiat products, enhancing margins for merchants and corporates while benefiting from recent regulatory clarity.

02. What key pain points does a crypto neo bank address for businesses in Poland?

A crypto neo bank solves issues such as costly cross-border payments, fragmented on/off ramps for consumers and merchants, inefficient corporate treasury management, and poor merchant acceptance paths for crypto receipts.

03. What are the essential criteria for investors in the crypto banking sector?

Investors require proof of custody safety, guaranteed instant liquidity, and demonstrated regulator-ready compliance to ensure scalability and avoid growth stalls in the crypto banking sector.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 hours ago

NewsBeat4 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

With

With

All actions are governed by…

All actions are governed by…