Crypto World

Bitcoin’s Shot at $90K by March Is Slim

The flagship cryptocurrency has come under renewed selling pressure, extending a slide that has left market participants cautious about any near-term rebound. The latest move comes as a combination of softer U.S. job data and renewed concerns about AI-sector capital expenditure weigh on risk appetite. The price retreat follows a roughly 30% decline from a late-January high after a failed attempt to push above the $90,500 level on Jan. 28. As macro cues accumulate, derivatives markets hint at a cautious stance, suggesting that a rapid snapback may be unlikely in the near term as investors digest the evolving risk backdrop.

Key takeaways

- Bitcoin slipped below $63,000, entering a seasonally volatile zone as macro data challenges persist and AI-sector investment concerns mount.

- Options markets imply a relatively low probability of a swift rally back to $90,000 by March, with pricing signaling a muted upside scenario.

- Concerns over quantum computing risks and the prospect of forced liquidations by debt-funded Bitcoin holders have amplified risk-off sentiment.

- Public-company Bitcoin holdings and equity-structure dynamics show growing strain, as some firms face large unrealized gaps between market value and cost bases.

- Broader tech and AI narratives—capped by elevated capital expenditure plans and supply-chain bottlenecks—contribute to a cautious market tone across traditional equities as well as crypto.

- Risk-off conditions intensified after a run of negative headlines across large-cap names and an uptick in January layoffs across the U.S. economy.

Tickers mentioned: $BTC, TRI, PYPL, HOOD, APP, QCOM, MSTR, MPJPY

Sentiment: Bearish

Price impact: Negative. The ongoing price drift below key support levels reflects a softer near-term outlook and heightened risk-off sentiment.

Trading idea (Not Financial Advice): Hold. Caution remains warranted as macro headlines and AI investment cycles influence liquidity and risk appetite.

Market context: The current environment blends macro fragility with sector-specific dynamics in AI and tech, creating a cautious tone for risk assets. Liquidity conditions and derivative positioning continue to shape price action as investors weigh near-term catalysts against longer-term macro trends.

Why it matters

The forces weighing on Bitcoin are not isolated to crypto alone. A broader risk-off mood is filtering through global markets, with technology and AI-driven narratives playing a central role. The debilitation of a near-term revival above important thresholds underscores a structural challenge for the asset class: while institutional interest remains, upside momentum has been tempered by macro headwinds and the fear of swift retracements triggered by external shocks.

On the derivative side, traders are pricing in relatively modest odds of a dramatic rally, with call options at elevated strike levels pricing in limited upside potential. For context, on the Deribit exchange, a March 27 call option with a strike of $90,000 traded at around $522, suggesting that market participants assign a low probability to a rapid surge in price in the weeks ahead. The corresponding put options reveal a sense of potential downside risk priced into the market as well, underscoring a balanced but cautious risk-reward calculus in the near term. These dynamics echo the broader tension between bull-case scenarios and risk-off realities facing cryptos amid evolving macro data and capital allocation concerns.

Beyond price dynamics, a suite of fundamental developments has intensified risk aversion. Quantum computing fears—specifically worries that advanced quantum systems could threaten private keys—have led some investors to rethink crypto exposure. In mid-January, Christopher Wood, global head of equity strategy at Jefferies, removed a 10% Bitcoin allocation from his model portfolio, arguing that quantum threats introduce a material tail risk to hodling strategies and that the market could respond abruptly to new information. While such positioning shifts reflect sentiment rather than immediate price catalysts, they contribute to a cautious macro backdrop for crypto markets.

On the corporate front, the landscape of on-chain exposure among publicly traded firms remains a focal point. MicroStrategy (MSTR) remains the largest holder with on-chain BTC reserves, but the company’s enterprise value has fallen to around $53.3 billion while its cost basis sits near $54.2 billion. Similar gaps exist for Metaplanet (MPJPY US), where the market cap stood at roughly $2.95 billion against an acquisition cost of about $3.78 billion. The potential for a prolonged bear phase to force such entities to sell reserve holdings to service debt has investors watching balance sheets closely, even as executives underscore long-term conviction in the technology and underlying use cases.

Additional macro factors are weighing on risk assets as well. The week’s early data showed broad risk-off momentum, with silver, often viewed as a risk-off asset, retreating sharply after reaching an all-time high in late January. While crypto markets are distinct from traditional commodities, the cross-asset pull—driven by higher risk sentiment and macro uncertainties—helps explain the correlation in recent weeks between the performance of large-cap equities and crypto assets.

In the broader tech arena, larger dynamics around AI investment cadence are shaping the indirect risk profile for crypto markets. Google’s parent company signaled that capital expenditure in 2026 will be materially higher than in 2025, highlighting a continued push into data-center infrastructure. At the same time, Qualcomm reported softer guidance as supplier capacity shifts toward high-bandwidth memory for data centers, underscoring a delicate balance between innovation cycles and near-term profitability. Analysts anticipate that AI spending could deliver longer payoff horizons than many investors currently expect, a factor that compounds uncertainty for risk-sensitive assets, including crypto.

Against this backdrop, Bitcoin appears unlikely to stage a rapid rebound toward the $90,000 region in the near term. The price action around $62,000–$63,000 has become a focal point for traders watching for a sustainable bottom or a capitulatory event that could usher in a new phase for accumulation. The path forward for the asset will likely depend on a combination of macro resilience, continued liquidity, and the pace at which AI-capital expenditure and its supply-chain constraints unwind.

What to watch next

- Upcoming U.S. payrolls data and macro indicators, which could shape risk sentiment and liquidity conditions.

- Derivative flows and March expiry activity (including BTC options around key strike levels like $90,000).

- Updates on AI-capex realization and supply-chain bottlenecks affecting tech stocks and related risk assets.

- Monitor developments around large on-chain BTC holdings and any potential forced-liquidation events tied to debt covenants.

- Central bank signals and policy expectations that could influence risk appetite across crypto and traditional markets.

Sources & verification

- Deribit options data for March 27 BTC calls and puts, including the $90,000 strike call and $50,000 strike put pricing.

- Public-company BTC holdings and balance-sheet implications (on-chain context and company-level risk exposure).

- Jefferies note referencing a reduced Bitcoin allocation due to perceived quantum-computing risks.

- January layoff data from Challenger, Gray & Christmas (108,435 layoffs) and related macro commentary.

- Alphabet (EXCHANGE: GOOG) capex trajectory for 2026 and Qualcomm (EXCHANGE: QCOM) guidance signals; broader AI-funding implications.

Bitcoin under pressure in a cautious macro environment

Crypto World

XOM Shares Reach Record Peak Amid Escalating Middle East Tensions

TLDR

- Exxon Mobil’s share price reached a record $159.15, bringing its valuation to $635.43 billion.

- The stock has surged 41.69% in the past twelve months.

- Escalating Middle East conflicts — including a purported assault on Saudi Arabia’s Ras Tanura facility and warnings regarding the Strait of Hormuz — are boosting oil prices.

- XOM climbed 2% on Monday; ConocoPhillips (COP) posted the strongest performance with a 3.3% increase.

- Market watchers anticipate capital flowing into major energy corporations including XOM, CVX, COP, and EOG in the immediate future.

Shares of Exxon Mobil (XOM) reached an unprecedented peak of $159.15 during Monday’s trading session on March 2, driven by intensifying geopolitical instability in the Middle East that sent crude oil prices climbing and lifted the entire energy sector.

The energy giant’s shares advanced approximately 2% during morning trading hours. This latest gain extends an impressive 41.69% rally over the trailing twelve months, elevating XOM’s total market value to $635.43 billion.

Other major energy players posted similar advances. Chevron (CVX) appreciated 1.1%, ConocoPhillips (COP) jumped 3.3%, while Occidental Petroleum (OXY) climbed 1.9%. Each of these stocks exhibited even stronger momentum during pre-market hours before moderating slightly after the opening bell.

The primary driver was a sharp intensification of Middle Eastern hostilities throughout the weekend. News emerged regarding an alleged assault on Saudi Arabia’s Ras Tanura refinery, recognized as among the planet’s most significant oil export terminals. Additionally, three American service members lost their lives in Kuwait, while Israel maintained ongoing military exchanges with Hezbollah forces in Lebanon.

Iranian officials allegedly declared that vessels would be prohibited from transiting the Strait of Hormuz — a critical waterway responsible for transporting approximately 20% of global oil supplies. Although Tehran hasn’t officially blockaded the strait, mere speculation proved sufficient to influence commodity markets.

Why Large-Cap Energy Names Are in Focus

Mizuho analyst Nitin Kumar indicated his expectation that market participants will “favor large, bellwether stocks” such as Exxon, Chevron, ConocoPhillips, EOG Resources (EOG), and Occidental Petroleum during this period of uncertainty. While smaller or more highly leveraged companies might present greater upside potential, institutional capital is projected to concentrate on industry leaders in the near term.

Alpine Macro strategist Dan Alamariu put it plainly: “Out-of-region energy stocks should gain disproportionately; they track oil and gas prices and would be the only available source of supply if the Persian Gulf is shut off.”

It bears mentioning that XOM’s remarkable ascent hasn’t been entirely smooth. Data from InvestingPro indicates the shares might be trading above their Fair Value benchmark, despite hovering near their 52-week peak.

Recent XOM Developments

Fourth-quarter earnings figures fell short of year-over-year comparisons but managed to narrowly exceed Wall Street expectations, supported by output expansion in Guyana and the U.S. Permian Basin operations. BMO Capital subsequently elevated its price objective to $155 while retaining a Market Perform stance. Freedom Capital Markets maintained its Sell recommendation with a $123 valuation target.

Regarding legal matters, ExxonMobil’s Australian subsidiary received an $11.3 million penalty from the Federal Court of Australia for disseminating misleading information about fuel products in Queensland during the period spanning August 2020 through July 2024.

The corporation continues pursuing financial restitution for petroleum assets confiscated in Cuba over six decades ago, with judicial proceedings still underway.

XOM achieved its intraday peak of $159.15 on March 2, 2026.

Crypto World

ProCap Buys 450 BTC, Repurchases Shares Below NAV

Bitcoin treasury company ProCap Financial has added to its digital asset reserves as it steps up efforts to reduce the gap between its share price and underlying net asset value (NAV), underscoring a focused capital allocation strategy amid volatility in the crypto and equity markets.

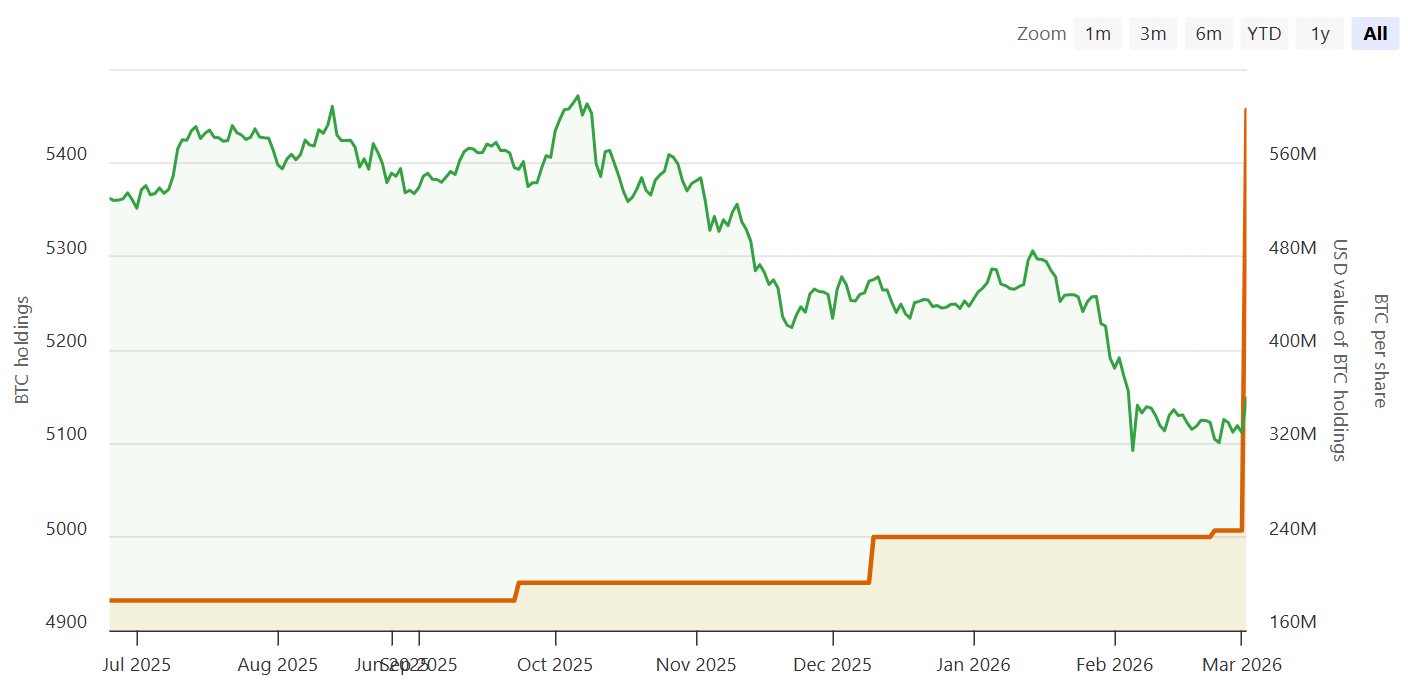

ProCap disclosed Monday that it acquired 450 Bitcoin (BTC) during the recent market pullback, bringing its total holdings to 5,457 BTC. The additional purchase also helped reduce the company’s average cost basis per coin.

At the same time, ProCap said it repurchased 782,408 of its shares over the past 10 days at prices trading significantly below its calculated NAV per share, narrowing the discount between market price and intrinsic value. The Nasdaq-traded shares were up 7.17% at last look in Monday morning trading, to $2.84 per share, according to Yahoo Finance.

ProCap emerged last year as a Bitcoin-native financial services company, raising more than $750 million in its initial funding, before going public through a SPAC merger.

The combined moves show ProCap increasing its Bitcoin exposure while attempting to address the discount between its share price and the value of its underlying assets. Buying back shares below NAV reduces the number of shares outstanding, which can increase NAV per share and potentially narrow the discount if market conditions stabilize.

Related: NAV Collapse Creates Rare Opportunity in Bitcoin Treasurys — 10x Research

NAV compression tests Bitcoin treasury model

Bitcoin treasury companies have come under pressure amid the months-long downturn in digital asset markets, leading to a broad compression in net asset value (NAV) premiums across the sector.

NAV represents the total value of a company’s assets — in this case, primarily Bitcoin holdings — minus liabilities, divided by the number of shares outstanding. For Bitcoin treasury companies, investors often focus on multiple-to-NAV (mNAV), which measures how a company’s market capitalization compares to the value of its underlying Bitcoin per share.

When mNAV is above 1.0, a company’s shares trade at a premium to its net asset value; below 1.0, they trade at a discount. ProCap’s mNAV is currently around 0.24, according to BitcoinTreasuries.NET data.

However, some industry observers question whether mNAV fully captures the value of Bitcoin treasury companies. NYDIG research head Greg Cipolaro has argued that the traditional mNAV framework may be incomplete because it does not account for operating businesses or strategic initiatives beyond simply holding digital assets.

Crypto World

Energym Ad’s Dystopian AI Future Collides with Real-World Layoffs

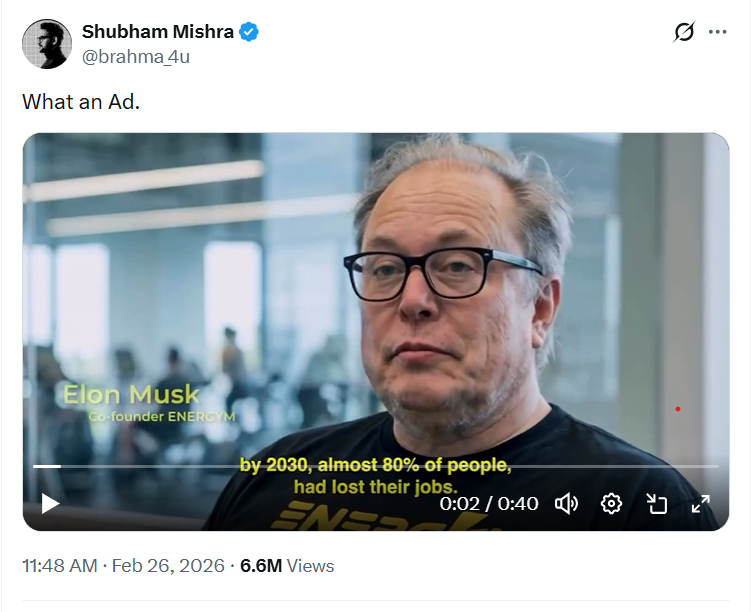

A viral spoof “Energym” advertisement set in a 2030s world where 80% of people have lost their jobs to artificial intelligence has struck a nerve as companies accelerate automation, job openings slump and investors grapple with darker AI scenarios.

The video clip, created by Belgian studio AiCandy, uses AI-aged versions of Elon Musk, Sam Altman and Jeff Bezos to hawk a fictional gym where unemployed workers pedal bikes and row machines to power the very AI systems that replaced them, trading lost income for a new sense of “purpose.”

Energym’s dystopia meets real AI layoffs

The satire lands amid a real wave of tech restructuring built around AI tools rather than human staff.

On Friday, Jack Dorsey’s fintech firm Block announced that it was cutting more than 4,000 roles (close to 40% of its workforce), in a bid to go lean using intelligence tools, paired with “smaller and flatter teams.”

Related: Bitcoin to see tailwinds if AI prompts ‘easier monetary policy’: NYDIG

Fresh labor market data from the US Bureau of Labor Statistics show demand for some office jobs has cooled. Finance and insurance openings fell to 134 a month by December 2025, 50% lower than the year prior, marking a decade-long low.

Market jitters over where this trajectory leads intensified in February when a 7,000‑word scenario from Citrini Research, a US firm that provides insights on “transformative” trends, sketched out a future of AI agents, cascading layoffs, falling wages, and a deep market crash later this decade.

The report, framed as a scenario rather than a forecast, nevertheless helped drive a sell-off in software and payments stocks, with companies such as Uber, American Express, and Mastercard dropping between 4% and 6% in one session as investors reassessed how quickly AI could erode demand for human labor.

Crypto-native agents as an alternative to “Energym?”

For David Minarsch, CEO of Valory and founding member of Olas Network, a crypto protocol for co-owned AI agents, the Energym vision is one possible path if AI remains “built as black boxes” and owned by a handful of centralized platforms.

He told Cointelegraph that rapid AI deployment was already reshaping software engineering, with almost all his team’s code now generated by AI under human oversight compared to mostly human-written code just six months ago.

Related: AI ‘vibe coding’ could put Ethereum roadmap ahead of schedule: Vitalik Buterin

“If this trend accelerates,” he said, we are on a path to a future that’s caricatured in the Energym ad,” arguing that society was at a “pivotal inflection point.”

Minarsch warned that a world where AI agents are granted something like personhood and legal protections could permanently “disenfranchise humans” by turning capital, rather than labor, into the dominant input for production.

He pointed to AI labs that describe models as being “retired” as an early step toward treating systems as stakeholders in their own right.

Minarsch said that projects like Olas were betting that giving people direct ownership and control over AI agents, rather than renting them from platforms, could be one way to stop the Energym scenario from becoming a reality.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Nasdaq follows Cboe joining world of ‘binary bets’ as prediction market craze hits Wall Street

The Nasdaq stock exchange wants to list binary options tied to its flagship stock indexes, a move that would let traders place yes-or-no bets on the direction of major equity benchmarks like the Nasdaq-100.

In a Monday filing with the U.S. Securities and Exchange Commission (SEC), the exchange said it also plans to offer binary options on the Nasdaq-100 Micro Index.

A binary option is a bet with only two outcomes. Either the condition is met, and the bettor walks away with a profit, or the option expires worthless. Nasdaq’s proposed contracts would be priced between 1 cent and $1, reflecting the market’s view of the probability that a specific outcome will occur.

If approved, the products would function similarly to contracts on prediction market platforms such as Polymarket and Kalshi, giving traders a new way to express short-term views on the performance of one of the market’s most closely watched stock indexes.

The filing marks Nasdaq’s entry into a fast-growing corner of derivatives markets that blends traditional finance with the mechanics of prediction platforms. Rival exchange Cboe also announced plans to expand into the prediction markets business as interest in event-based trading has surged.

That push follows the rapid growth of platforms such as Polymarket and Kalshi, which allow users to trade on the outcomes of events ranging from elections to economic data releases. Those platforms are regulated by the Commodity Futures Trading Commission (CFTC) because they offer event contracts tied to real-world outcomes.

Binary options, however, fall under the SEC’s jurisdiction. Nasdaq’s proposal underscores how established exchanges are seeking to adapt the prediction-style format to regulated securities markets. Nasdaq had not responded to a request for comment by publication time.

Crypto exchanges have also moved quickly.

Coinbase recently rolled out prediction markets on its platform, giving digital asset traders access to contracts linked to political, economic and cultural events. Gemini received CFTC approval in December to operate as a Designated Contract Market (DCM), allowing the firm to offer regulated prediction markets to U.S. customers.

Crypto World

Qivalis in talks with crypto exchanges ahead of euro stablecoin launch

Qivalis, the group of European Union banks developing a MiCA-compliant euro stablecoin, is in advanced discussions with crypto exchanges, market makers and liquidity providers as it prepares to roll out in the second half of this year, Spanish business daily Cinco Días reported on Monday.

The group, which includes ING, UniCredit, BNP Paribas, CaixaBank and BBVA, wants to ensure the token is available on regulated trading platforms from day one to ensure liquidity, according to Qivalis CEO Jan Sell.

The initiative is designed to provide a European alternative to the U.S.-dominated stablecoin market, contributing to the EU’s strategic autonomy in payments, the banks said. A euro-pegged token would allow businesses and consumers in the bloc to make blockchain-based payments and settlements using euros, without relying on traditional financial rails or foreign third-party providers.

The Netherlands-based venture is considering European and international venues as it seeks to position the stablecoin as a regulated alternative to U.S. dollar-denominated tokens and a tool for real-time cross-border corporate payments.

Spanish crypto exchange Bit2Me confirmed it has held talks with one of the group’s banks, though most platforms declined to comment.

Qivalis did not immediately respond to a CoinDesk request for confirmation.

According to Cinco Dias, Qivalis also disclosed details about the token’s reserve structure. The stablecoin will be backed 1:1, with at least 40% of reserves held in bank deposits and the remainder allocated to high-quality, short-term euro-area sovereign bonds diversified across EU countries. The reserves will be held with multiple highly rated credit institutions, and the design includes 24/7 redemption for token holders.

The consortium is seeking authorization from the Dutch central bank under the EU’s Markets in Crypto-Assets (MiCA) framework.

Crypto World

XRP Price May Drop Another 30% Amid Increased Exchange Inflows

XRP (XRP) risked a further drop below $1 as its bearish technical setup converged with increased inflows to exchanges.

Key takeaways:

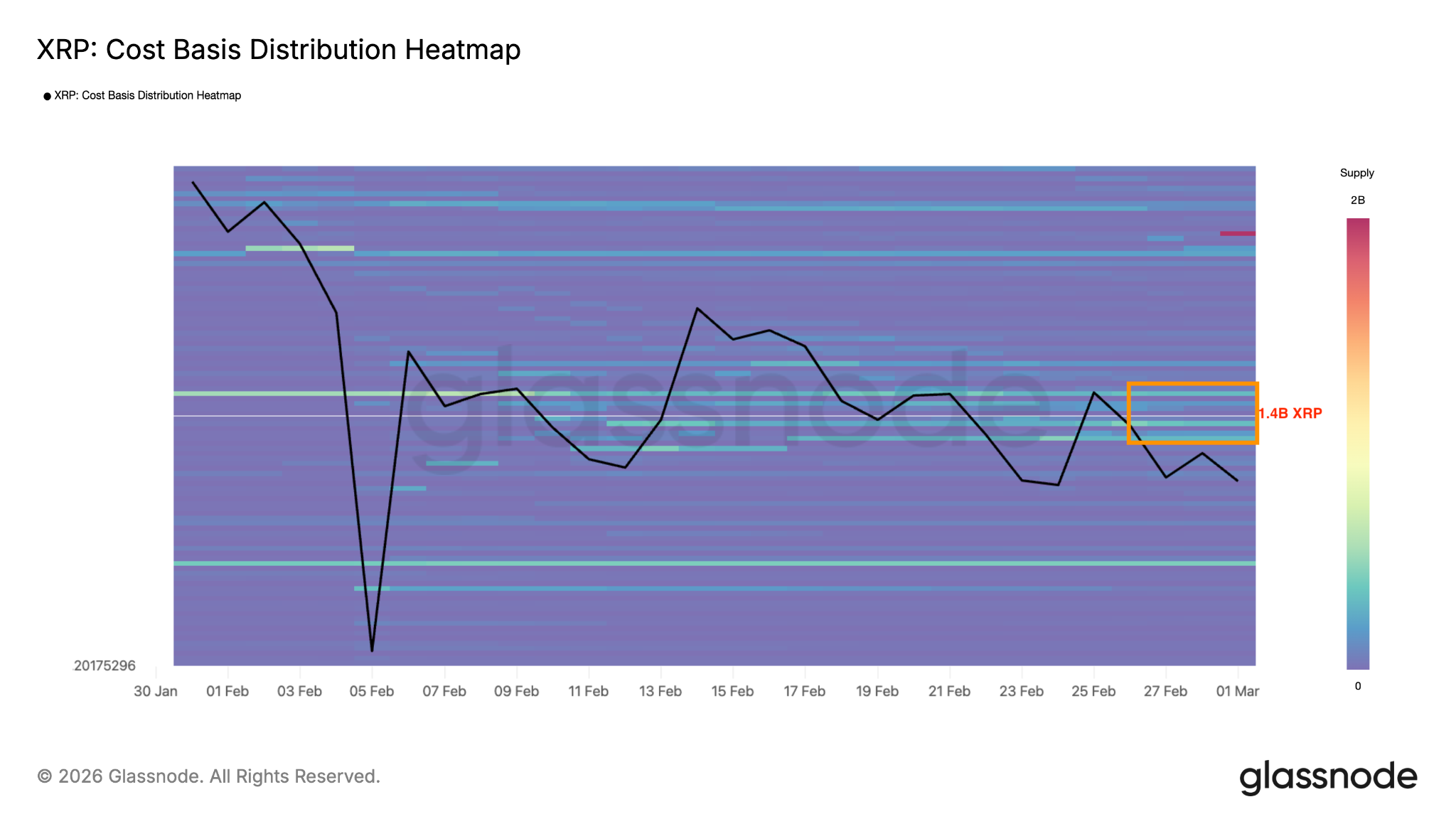

XRP faces overhead resistance at $1.42

XRP’s 13% rally to $1.43 between Saturday and Sunday ran into a resistance wall at $1.39-$1.43, causing it to retrace to the current price of $1.34.

The cost-basis distribution heatmap shows that a large cluster of supply is within this area, where nearly 1.48 billion XRP were acquired over the last 30 days. This marks an area of stiff resistance for XRP, limiting upside potential.

The daily XRP price chart below shows that this area coincides with the upper trend line of a symmetrical triangle, which has suppressed the price since Feb. 1.

Related: XRPL Foundation patches ‘critical’ flaw that almost made it to mainnet

The XRP/USD pair is trading below the lower trend line of the triangle at $1.35. A daily candlestick close below this level would validate the symmetrical triangle, clearing the path for a deeper correction.

The measured target of the prevailing chart pattern, calculated by adding the triangle’s height to the breakout point, is $0.95, about 29% below the current level.

As Cointelegraph reported, a break and close below the lower boundary of a falling channel at $1.20 puts the Feb. 6 low of $1.11 at risk of breaking down. XRP may then tumble to the psychological support at $1.

Analyst BitGuru commented on the support level at $1.20-$1.22, saying:

“If this base holds and buyers step in, a rebound toward $1.80–$2.20 could happen quickly, signaling the start of a recovery move.”

Meanwhile, the two-day chart also puts a drop to $0.80 in play, fueled by selling from whales.

XRP supply on exchanges rises

Over the past week, more than 472 million XRP, worth about $652 million, were transferred to Binance, marking the largest inflow to exchanges in February, according to data resource CryptoQuant.

The transfer of tokens to exchanges often signals a potential willingness to sell or at least to position liquidity closer to the market.

“Such inflows typically reflect a more defensive posture from investors holding XRP,” CryptoQuant analyst Darkfost said in a QuickTake note on Monday, adding:

“When the amount of flows like this are recorded, they can create the conditions for a sudden wave of selling pressure capable of impacting price action in the short term.”

As a result, XRP balance on Binance has grown to 2.73 billion tokens from 2.55 billion in mid-February. This represents a total increase of about 180 million (+7%) in less than three weeks.

Increasing XRP supply on exchanges is a classic bearish signal that can outpace demand, increasing sell-pressure.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Nvidia Commits $2 Billion Investment to Lumentum (LITE) in Major AI Infrastructure Deal

TLDR

- Nvidia commits $2 billion capital investment in Lumentum alongside a multibillion-dollar agreement to purchase advanced laser technology.

- LITE shares climbed 7.6% during premarket hours Monday after the partnership was revealed.

- Lumentum serves as the exclusive laser provider for Nvidia’s SpectrumX and QuantumX AI networking equipment.

- Stifel analysts elevated their LITE price target from $480 to $800 while reaffirming their Buy recommendation.

- LITE shares have skyrocketed approximately 897% during the past 12 months, approaching the 52-week peak of $765.

Nvidia revealed a significant $2 billion capital commitment to Lumentum Holdings (LITE) on Monday, accompanied by a multibillion-dollar agreement to procure advanced laser technology components.

This strategic partnership represents Nvidia’s expanded effort to develop optical networking infrastructure critical for artificial intelligence systems.

The arrangement is structured as nonexclusive, providing Nvidia with preferential access to future production capacity for sophisticated laser components manufactured by Lumentum.

LITE shares surged 7.6% during premarket sessions. Trading later on Monday showed the stock elevated approximately 4.9%.

Shares currently trade close to the 52-week peak of $765, representing a remarkable climb of nearly 897% over the previous 12-month period.

Lumentum maintains an exclusive role within Nvidia’s manufacturing ecosystem. The company serves as the singular provider of laser components utilized in Nvidia’s SpectrumX and QuantumX AI networking platforms, which employ co-packaged optics technology — an innovative approach that positions optical components directly adjacent to semiconductor chips.

Nvidia’s $2 billion capital injection will fuel Lumentum’s research initiatives, expand manufacturing capabilities, and support ongoing operations. A portion of these funds will be allocated to constructing a new production facility on U.S. soil.

“Optical interconnects and advanced package integration are foundational to the next phase of AI infrastructure, as they unlock ultrahigh-bandwidth, energy-efficient connectivity across AI factories,” Nvidia said in a statement.

Analyst Upgrades Follow the News

Stifel elevated its LITE price objective to $800 from $480 on Monday, maintaining its Buy recommendation. The investment firm indicated it is bringing its projections into closer alignment with broader market consensus.

Stifel highlighted the recent certification of Lumentum EML laser technology at Fabrinet and Nvidia’s networking division performance as encouraging indicators for Lumentum’s immediate business prospects.

The investment firm anticipates networking requirements within AI infrastructure deployments will expand significantly throughout coming years, propelled by demand from agentic artificial intelligence applications and reasoning-centric network architectures.

Based on InvestingPro information, 18 financial analysts have adjusted their earnings projections upward for the forthcoming reporting period.

Stifel acknowledged, however, that valuation analysis indicates the stock price may exceed fundamental value at present trading levels.

Strong Recent Earnings Add to the Case

Lumentum additionally delivered robust fiscal second-quarter 2026 financial results, surpassing Wall Street consensus projections for both revenue generation and earnings per share metrics.

The company’s forward guidance for the third quarter substantially exceeded market analyst expectations.

In response to these results, Needham elevated its price objective to $550, Rosenblatt boosted its target to $580, and Stifel had previously increased its target to $480 — all firms maintained Buy recommendations.

LITE stock value has approximately doubled since Barron’s published favorable coverage of the company during early January, identifying Nvidia’s implementation of co-packaged optics technology as a significant growth catalyst.

The Nvidia investment partnership and purchasing commitment were publicly announced Monday, March 2, 2026.

Crypto World

Bitcoin and WW3: 5 Key Indicators as BTC Eyes Global Liquidity Surge

Bitcoin (BTC) acts as a barometer for global fear, but the latest geopolitical flare-up, which has many fearing for WW3, has failed to break the asset’s bullish prospects.

While headlines scream conflict, Bitcoin is holding the $60,000 line, eyeing a liquidity-driven breakout rather than a capitulation event.

Traders are now pricing in resilience, looking past the initial volatility to the underlying supply mechanics that favor the bulls.

The market climaxed with a sharp dip near $63,000 over the weekend before buyers stepped in, rejecting lower lows.

This price action suggests the market is desensitizing to headline risk, shifting focus back to the monetary drivers that typically fuel Q4 rallies. It is a clash of narratives: geopolitical uncertainty versus undeniable on-chain strength.

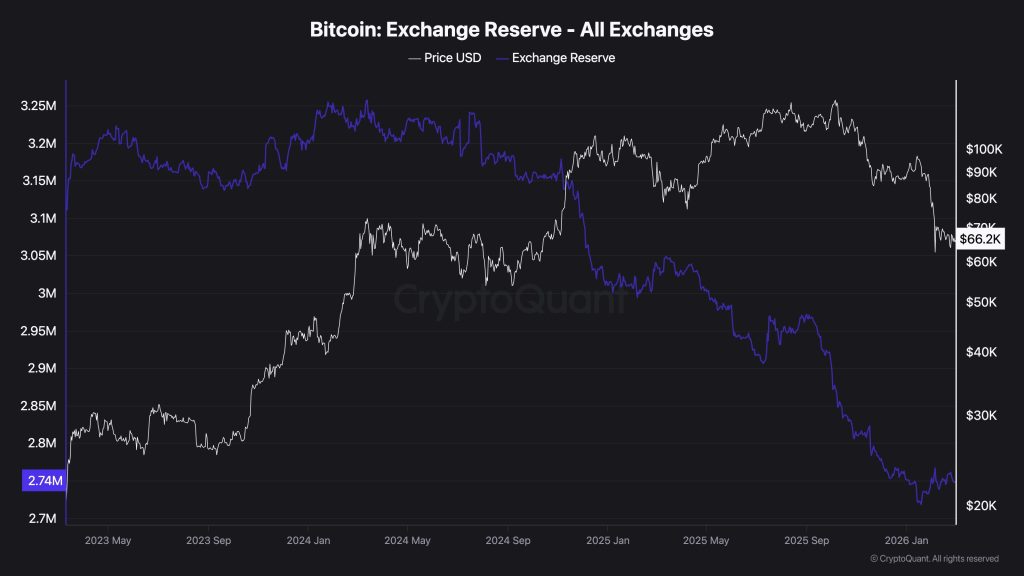

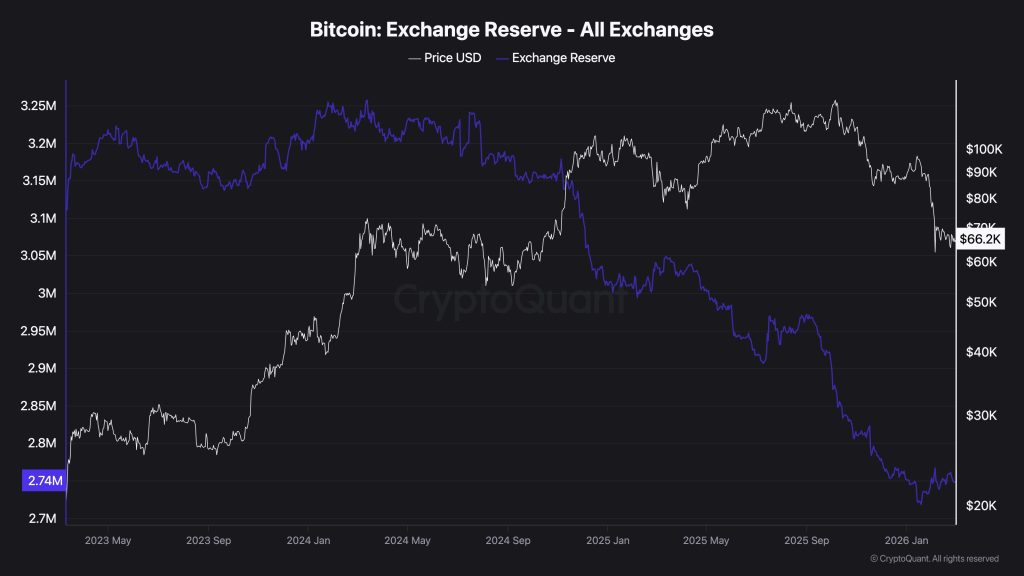

- Bitcoin Exchange Reserves have dropped to levels not seen since 2018, creating a significant supply shock as demand creates a floor.

- Spot BTC ETF Inflows are absorbing retail panic selling, with institutional players treating dips as accumulation opportunities.

- Global Liquidity M2 is expanding again, historically a primary driver for crypto asset repricing regardless of news cycles.

Indicator 1: Bitcoin Exchange Reserves Signal Supply Shock

The most critical on-chain metric currently is the rapid depletion of Bitcoin Exchange Reserves. According to data from CryptoQuant, reserves have fallen to approximately 2.6 million BTC, the lowest level since 2018. This is a structural supply squeeze that cannot be ignored.

When coins leave exchanges, they move to cold storage or custody solutions, effectively removing them from the immediate sellable supply.

The implication is straightforward: fewer coins available for sale means it takes less buy volume to push prices higher. In previous cycles, sharp declines in exchange balances often preceded supply shock rallies.

This drain on liquidity suggests that while weak hands are selling into headline fear, long-term holders are moving assets off the ledger. We are witnessing a transfer of wealth from impatient retail traders to high-conviction entities who understand the scarcity mechanics of the halving year.

Discover: The best crypto to diversify your portfolio with

Indicator 2: Bitcoin (BTC) ETF Inflows vs. Spot Selling

Institutional demand continues to act as a massive buffer against spot market volatility. Despite the bearish sentiment on social media, Spot BTC ETF Inflows tell a different story.

Recent weeks have seen net inflows effectively neutralizing the selling pressure from short-term holders, with the last week generated net inflows of $787.3 million, according to data by SoSoValue.

So, funds like BlackRock’s IBIT continue to attract capital even as price action chops sideways. This divergence of falling price against rising inflows is a classic accumulation signal. Institutional accumulation is not slowing down; it is accelerating during dips.

Adding to this institutional bedrock, major financial players are deepening their infrastructure. Morgan Stanley has moved to hold client crypto directly, signaling that the smart money thesis remains focused on long-term adoption rather than short-term geopolitical noise.

Indicator 3: How Bitcoin is Breaking the Downtrend Despite WW3 Fears

Technically, Bitcoin is respecting critical levels. The weekend dip found support before reaching the psychological $60,000 barrier, a level many traders had eyed for aggressive longs.

Trader CrypNuevo noted on X that a trip to anywhere between $60,000 and $61,000 would be a prime long entry, but the market front-ran that level, showing eagerness to buy.

A clean break above $70,000 would invalidate the downtrending structure that has plagued the chart since March.

Support at $60,000 is the line in the sand; lose that, and the conversation shifts to $55,000 or lower. If Bitcoin can hold the line, the path back to six figures by Summer remains open.

Indicator 4: Global Liquidity and Central Bank Easing

Bitcoin is, above all else, a liquidity sponge. The current expansion of Global Liquidity M2, a measure of global liquidity that takes into account cash, checking and savings deposits, money market securities, and other near-cash assets, is the macro tailwind that bearish traders are overlooking.

As central banks from the ECB to the Fed signal or enact rate cuts, the cost of capital decreases, forcing money out of risk-free assets and into growth vehicles.

Historically, Bitcoin’s parabolic runs align perfectly with cycles of M2 expansion. We are currently in the early stages of a global easing cycle. While inflation data may cause temporary pauses in the Fed’s roadmap, the broader trend is clear: money printers are warming up.

Given the historic lag between M2 liquidity expansion cycles and Bitcoin bull markets, the injections hitting the system now will likely reflect in asset prices in Q4 2024 and Q1 2025.

Traders betting on a crash are effectively betting against the central bank liquidity cycle, a wager that rarely pays off in the crypto markets.

Discover: The best crypto to buy now

Indicator 5: Bitcoin Sees Geopolitical Resilience Despite WW3 Fears

The market’s reaction to recent Middle East tensions reinforces the “digital gold” narrative, albeit with high beta volatility.

While the initial reaction was a sell-off, Bitcoin rebounded swiftly after the shock, erasing nearly all losses within 48 hours. This V-shaped recovery is a hallmark of a resilient bull market structure.

Analyst consensus is shifting away from “World War Three” scenarios toward a contained conflict narrative, limiting the downside risk for risk assets.

However, the connection between energy prices and crypto remains tight. As oil prices react to Iran tensions, inflation expectations could tick up, complicating the Fed’s pivot. Yet, Bitcoin has shrugged off this correlation for now, trading more on idiosyncratic crypto flows than petrodollar dynamics.

Data from CoinGlass shows that the initial dip flushed out over-leveraged longs, resetting open interest to healthier levels. The market is now lighter, cleaner, and ready for organic price discovery without the weight of excessive leverage.

Ultimately, with institutional accumulation quietly putting a floor under price and Bitcoin Exchange Reserves draining, the path of least resistance appears to be upwards despite WW3 fears. The Bitcoin market has already priced in the conflict shock. Now it waits for the liquidity surge.

The post Bitcoin and WW3: 5 Key Indicators as BTC Eyes Global Liquidity Surge appeared first on Cryptonews.

Crypto World

Bitcoin miner turned Ethereum treasury firm stakes over $6B in ETH as BMNR shares slide and ether dips.

Bitmine Immersion Technologies (BMNR) on Monday reported purchasing nearly 51,000 more ETH tokens last week, increasing its holdings to 4.474 million.

“In the midst of this ‘mini crypto winter,’ our focus continues to be on methodically executing our treasury strategy and steadily acquiring ETH and in turn, optimizing the yield on our ETH holdings,” said Chairman Tom Lee.

The company said it now has 3,040,483 ETH staked, worth about $6 billion at current prices. Lee said annualized staking revenue stands at $172 million. At full scale, staking rewards could reach $253 million annually based on a 2.86% yield over the last seven days, Lee continued.

The company holds 4,473,587 ether (ETH), valued at $1,976 per token, along with 195 bitcoin and $868 million in cash, as well as a $200 million stake in Beast Industries and a $14 million investment in Eightco Holdings. Bitmine said its ether position represents 3.71% of Ethereum’s 120.7 million token supply.

Lee added that the firm is developing its Made in America Validator Network, or MAVAN, a staking platform slated for launch in early 2026. Bitmine said it is working with three staking providers as it builds the network.

Crypto World

BTC takes aim at $69,000 as stocks shrug off Iran strikes

Crypto prices are rebounding from their worst weekend levels in early U.S. trading on Monday alongside a sizable bounce in U.S. equity indices.

Roughly one hour into the session, the Nasdaq is down just 0.1% after futures at one point overnight had indicated a plunge of more than 2%. The S&P 500 and DJIA are also posting just very modest losses.

Gold remains higher by 2% and crude oil by 7%. The U.S. dollar index is having one of its strongest sessions in weeks, gaining 1%.

Bitcoin has moved up to $68,600, ahead 2.3% over the past 24 hours. Ether (ETH) is higher by 1.4%, with solana (SOL) and XRP (XRP) up similar amounts.

Crypto-related stocks are posting even larger gains, led by Circle’s (CRCL) 12% advance. Strategy (MSTR) is higher by 6% and Galaxy Digital (GLXY) by 4.7%.

On the macro side, the ISM manufacturing PMI came in at 52.4, for February, marking another month of sector expansion and the first consecutive run of prints above 50 since the fourth quarter of 2022. This follows Friday’s Chicago Business Barometer, which rose to 57.7 in February 2026 from 54 previously and well above expectations of 52.8. The reading signals only the second expansion since November 2023 and reflects the strongest pace of US activity growth since May 2022.

Against the backdrop of conflict in the Middle East, reaccelerating manufacturing activity, hotter-than-expected PPI data last week, and higher oil prices driven by geopolitical tensions, a March rate cut now appears effectively off the table ahead of the Federal Reserve’s March 18 meeting.

Normally, that might be considered a headwind for crypto prices, but it’s quite possible that markets had already priced in tighter than previously expected U.S. monetary policy.

-

Sports7 days ago

Sports7 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics7 days ago

Politics7 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Iris Top

-

Business6 days ago

Business6 days agoTrue Citrus debuts functional drink mix collection

-

Politics4 days ago

Politics4 days agoITV enters Gaza with IDF amid ongoing genocide

-

Tech2 days ago

Tech2 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports3 days ago

The Vikings Need a Duck

-

Crypto World6 days ago

Crypto World6 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

NewsBeat5 days ago

NewsBeat5 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat2 days ago

NewsBeat2 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Tech6 days ago

Tech6 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 days ago

NewsBeat5 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat2 days ago

NewsBeat2 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat1 day ago

NewsBeat1 day ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat2 days ago

NewsBeat2 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoPolice latest as search for missing woman enters day nine

-

Entertainment9 hours ago

Entertainment9 hours agoBaby Gear Guide: Strollers, Car Seats

-

Business5 days ago

Business5 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business4 days ago

Business4 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech3 days ago

Tech3 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

(@CrypNuevo)

(@CrypNuevo)