Crypto World

Bitcoin’s volatility spikes to its highest since FTX’s collapse as prices crater to nearly $60,000

Bitcoin’s Wall Street-like fear gauge has spiked to its highest level since the collapse of the FTX exchange in 2022, signaling intense market panic as prices plummeted to nearly $60,000.

Volmex’s bitcoin volatility index (BVIV), which represents the annualized expected price turbulence over four weeks, jumped to nearly 100% from 56% on Thursday.

The index serves as a crypto equivalent to Cboe’s VIX, the so-called fear/panic gauge, which indicates the 30-day implied volatility of the S&P 500 and rises during market panics as traders bid up options prices to hedge against declines in the index.

The BVIV does the same more often than not, rising during market panics as observed on Thursday.

“A wave of panic swept through crypto markets this week, correlated to a sharp risk-off move across various asset classes. Bitcoin’s 30-day implied volatility, as measured by the BVIV Index, surged from just over 40 to 95 in a matter of days, levels not seen since the infamous collapse of FTX at the end of 2022,” Cole Kennelly, founder and CEO of Volmex Labs, told CoinDesk in a Telegram chat.

Implied volatility is influenced by demand for options, or derivative contracts that help traders make asymmetrical gains from uptrends in the underlying asset and hedge downside risks. Call options are used to bet on the upside, while put options are typically bought as insurance against price drops.

On Thursday, traders scrambled to buy Deribit-listed options, especially puts, as bitcoin’s price tanked from $70,000 to nearly $60,000. The top five most traded options of the past 24 hours are all puts at strikes ranging from $70,000 to $20,000, according to data source Deribit Metrics. The $20,000 put represents a bet that prices will fall below that level.

“Volatility markets reacted sharply to last night’s price drop. Front-end volatility surged as dealers adjusted for gamma [near-term risks]. Short-dated vols led the surge, showing higher demand for protection, while longer-dated vols lagged, keeping the volatility curve steeply inverted,” Jimmy Yang, co-founder of institutional liquidity provider Orbit Markets, told CoinDesk.

Yang’s clients rushed to buy downside protection, fearing the price crash could devastate digital asset treasuries that bought bitcoin at higher levels. These firms could now liquidate at a loss, leading to a deeper slide in bitcoin’s price.

“With significant uncertainty still ahead — particularly around the DATs and the risk of further unwind cascades, we’ve seen a lot of client demand for downside protection,” he added.

Bitcoin’s price has bounced to over $64,000 at the time of writing, an over 5% recovery from overnight lows, according to CoinDesk data. Yang expects volatility to stabilize.

“Sentiment is deep in extreme fear, but bitcoin’s price seems to have found a base near $60K. If price action stabilizes, volatility looks stretched and could quickly pull back,” he said.

Crypto World

Bitcoin ETFs Record $434M Outflows Amid BTC Slide Below $70K

Bitcoin exchange-traded funds (ETFs) continued to see outflows on Thursday, shedding almost $1 billion over the past two days as debate grows over their potential impact on the market.

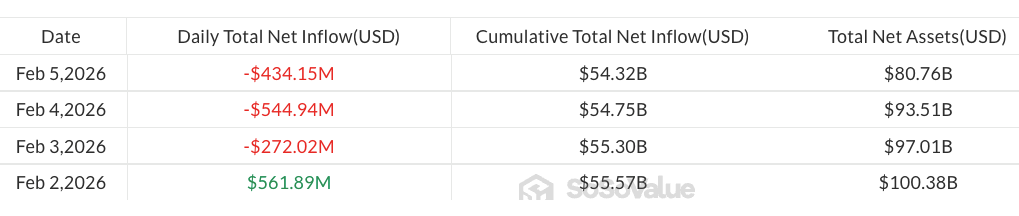

Data from SoSoValue shows that spot Bitcoin (BTC) ETFs recorded $434 million in net outflows on Thursday, following $545 million in redemptions the previous day.

Monday’s $561 million in inflows was not enough to offset losses, leaving net weekly outflows at about $690 million as of Friday morning.

The latest withdrawals came amid a sharp drop in Bitcoin’s price, which briefly touched $60,000 for the first time since October 2024, according to CoinGecko.

The community has struggled to identify clear catalysts for the downturn, and some have started to criticize Bitcoin ETFs even as analysts point to their resilience.

ETFs face “paper Bitcoin” criticism

The launch of spot Bitcoin ETFs in January 2024 was one of the most anticipated events in Bitcoin history, and was widely expected to accelerate BTC adoption through institutionalization.

Some analysts, however, argue that the institutionalization of Bitcoin via ETFs may have done more harm than good, claiming it contributed to undermining the asset’s scarcity — a key feature of Bitcoin’s fixed supply of 21 million coins.

“The same 1 BTC can now support an ETF unit, a future contract, a perpetual swap, an options delta, a broker loan, a structured note. All at once,” Bob Kendall, technical analyst and author of The Kendall Report, said in a Wednesday X post.

“That is not a market. That is a fractional reserve price system,” he added.

Kendall’s concerns echo those previously raised by his peers about Bitcoin ETFs becoming a tool for Wall Street to “trade against” Bitcoin.

Before crypto ETFs launched, Josef Tětek, a Bitcoin analyst at hardware wallet provider Trezor, warned that such products could enable the “creation of millions of unbacked Bitcoin,” potentially depressing the value of actual Bitcoin.

Related: BlackRock’s IBIT hits daily volume record of $10B amid Bitcoin crash

As of Friday, total assets in spot Bitcoin ETFs stood at about $81 billion, with cumulative net flows totaling $54.3 billion, according to SoSoValue.

Altcoin ETFs showed a mixed picture, with Ether (ETH) funds shedding $80.8 million in outflows, while XRP (XRP) and Solana (SOL) ETFs saw minor inflows at $4.8 million and $2.8 million, respectively.

Magazine: Bitcoin’s ‘miner exodus,’ UK bans some Coinbase crypto ads: Hodler’s Digest, Jan. 25 – 31

Crypto World

How to Build Event-Driven & Prediction-Ready Crypto Exchange Software?

When TradFi Launches Prediction Markets, Exchange Design Changes

Robinhood rolled out its YES/NO event contracts, and it wasn’t a quirky new trading format experiment. Traders aren’t just seeking exposure to prices, but also to outcomes.

“Will the Fed cut rates?”

“Will a Bitcoin ETF get approved?”

“Will a protocol ship its upgrade on time?”

These aren’t random casino questions but decision markets. And they’re far more intuitive, engaging, and scalable than yet another spot or perpetual pair.

For founders building cryptocurrency exchange software in 2026, this matters because price-based trading markets are getting saturated. Fees are compressing, UI differences barely make a difference, and liquidity is expensive to bootstrap.

Event-based trading opens a new frontier for cryptocurrency exchange development, including new markets, users, and revenue streams. Major market trading platforms already sensed the air and have already launched their event contracts trading platforms.

Major Crypto Trading Platforms & Their Prediction Market Strategies

| Platform | Status | The Engine (Provider) | Key Details & Differentiator |

|---|---|---|---|

| Coinbase | Live (Jan 2026) | Kalshi (Partnership) | Integrated Kalshi markets directly into the main app. Users trade election/econ events alongside their spot crypto portfolio. |

| Webull | Live | Kalshi (Partnership) | Focuses on “Hourlies” (e.g., Will S&P 500 be up at 2 PM?) and Sports. Targets active retail traders with short-term outcomes. |

| Crypto.com | Live (B2B) | CDNA (Own Exchange) | Instead of just a retail app, they use their CFTC-regulated exchange (CDNA) to power other platforms. Currently powering Truth Social’s “Truth Predict” and High Roller casino. |

| Gemini | Live (Dec 2025) | Gemini Titan (Own Exchange) | Built their own CFTC-licensed exchange (Gemini Titan). They frame predictions as a serious asset class (“Gemini Predictions”), not a game. |

| Kraken | Planned (2026) | Small Exchange (Acquisition) | Acquired Small Exchange (a regulated futures exchange) to build a native event contract product from scratch, aiming for lower fees than the Kalshi partners. |

| ForecastEx | Live | Interactive Brokers (Subsidiary) | A dedicated CFTC exchange for “Forecast Contracts.” Key Feature: They pay interest on the collateral you lock up in positions, attracting institutional hedging flow. |

| Jupiter | Live (Feb 2026) | Polymarket (Integration) | Became the first Solana UI to natively integrate Polymarket. Allows Solana users to trade Polymarket events without bridging to Polygon. |

| Hyperliquid | Live (HIP-4) | Native L1 (Outcome Trading) | Launched native “Outcome Trading” on their high-speed L1. Uses their massive perpetual liquidity to seed prediction markets, solving the “chicken and egg” liquidity problem. |

What Is YES/NO Event-Based Trading?

Event-based trading lets users trade outcomes rather than assets. Each market is framed as a simple YES/NO question tied to real-world or crypto-native events. Traders take positions based on conviction; the truth unfolds when the event concludes, and settlement is immediate.

Unlike traditional crypto exchange software, there’s no long-term holding, no complex leverage math, and no dependence on continuous price movement. The trade is binary, time-bound, and information-driven.

They are also called binary markets because they strip away all complexity and leave traders with only two possibilities. Unlike a stock or digital asset price, which can go up, down, or stay the same, a binary event contract has no middle ground. The event either happens (YES) or it doesn’t (NO).

How Event Contracts Trading Differs From Spot, Perpetual, and Prediction Markets?

| Dimension | Spot Trading | Perpetuals & Futures | Prediction Markets | Event-Based Trading |

|---|---|---|---|---|

| What users trade | Asset price | Leveraged price exposure | Forecasts | Event outcomes (YES/NO) |

| Complexity | Low | High (funding, liquidation) | Medium | Low |

| Time horizon | Open-ended | Continuous | Often long | Short, predefined |

| Risk profile | Capital-intensive | Liquidation risk | Thin liquidity | Capped, transparent |

| User intent | Hold or speculate | High-frequency speculation | Forecast accuracy | Decision-driven trading |

| Exchange advantage | Commoditized | Liquidity wars | Niche usage | High engagement, new markets |

For those planning retail-focused crypto exchange development, integrating these event tap trading games improves engagement and diversifies revenues, without adding leverage risk or launching tokens.

How Event-Driven Trading Fits Crypto Exchange Development?

Cryptocurrency exchange software is structurally built for event contracts trading. On-chain or hybrid trading software enables near-instantaneous settlement, global participation, and round-the-clock access, exactly what short-duration, outcome-based markets require. Like the spot or perpetual crypto markets, traders react to news and volatility in real time. Event-based trading only gives that behavior a cleaner, more explicit trading surface.

However, this model shifts the focus away from endless price charts toward outcome-driven markets with clear questions and resolution. Instead of asking whether BTC ticks up or down, cryptocurrency exchange software can list events such as ETF approvals, network upgrades, governance votes, or regulatory decisions. This way, YES/NO event trading merges into the existing exchanges and brings higher engagement, faster trader cycles, and diversified revenue.

Core Modules Required to Support Binary Event Contracts Trading At Scale

If you’re planning to integrate event contracts trading into cryptocurrency exchange software development, you must ensure to build and implement the following modules:

1. Event Lifecycle Engine

The backbone of the event contracts trading system.

- Event creation (question framing, expiry, resolution source)

- Status transitions: Market opens → the stakes on YES/NO are locked → event resolves → markets settle

- The event-trading system enforces non-negotiable technical locks once an event reaches its cutoff time.

Without deterministic lifecycle rules, outcome markets lose trust fast.

2. YES/NO Market & Pricing Logic

Each event spawns two tradable positions – YES and NO.

- People buy YES if they think it’ll happen.

- People buy NO if they think it won’t.

- The price moves based on how many people believe each side. If more people bet YES, it gets expensive, and if confidence drops, YES gets cheaper.

There’s no Bitcoin price here like in crypto exchange software. The price simply reflects belief and probability, not charts and candles.

3. Resolution & Oracle Layer

This layer is responsible for feeding the event contracts trading system with information about whether the event happened or not.

- The system checks a trusted source, which may be an official announcement, blockchain data, or a regulator notice.

- If needed, it checks more than one source.

- Only in rare cases do humans step in, and that action is recorded publicly.

If outcomes are disputed or distorted, users leave the cryptocurrency exchange software featuring event contracts trading instantly. This layer ensures the result is boring, obvious, and defensible.

4. Risk & Exposure Controls

These mechanisms impose limits that stop people or whales from breaking the market. The limits ensure the following:

- One user can’t bet unlimited money on one event.

- One event can’t grow so big that it threatens the platform.

- Some events are hidden or blocked in certain countries.

Unlike crypto spot and perpetual markets, event markets don’t require leverage but guardrails. They keep the platform defensible and prevent whale distortion.

5. Settlement and Payout Engine

This exchange software development module is responsible for closing the market and paying winners. This is what happens at the settlement stage:

- Event ends.

- Outcome is confirmed.

- Winners get credited automatically.

- Losers are done.

No positions are ongoing after the event ends. There’s no waiting and no funding fees. The settlement in these event-based tap trading models is fast, clean, and without any drag or mess.

6. Admin and Compliance Layer

For centralized and hybrid settings, this dashboard lets the admin control:

- Which events go live?

- Audit trails for resolution decisions.

- Region-based market visibility

For regulated prediction markets and event contracts trading platforms, this control panel is the regulators’ first choice.

How Founders Can Build event contracts trading Platform Using White Label Crypto Exchange Software?

As stated above, event-trading infrastructure fits perfectly within the crypto exchange software, as the trading logic remains the same. By opting white label crypto exchange software that supports derivatives trading, exchanges can build outcome-driven trading modules. Here’s the blueprint:

1. Start With an Event-Native Core

- Businesses can choose white label crypto exchange software that supports event lifecycles, not just asset pairs.

- Events must have:

- fixed start and end times

- immutable rules once live

- deterministic settlement logic

If the platform treats events like “just another trading pair,” walk away.

2. Define Events as Financial Contracts (Just like Robinhood)

- Each event must be:

- binary (YES / NO)

- objectively verifiable

- time-bounded

- Resolution sources must be locked before trading opens.

3. Plug Event Markets Into the Existing Matching Engine

- Reuse your order-matching or liquidity logic

- Replace price feeds with probability-driven pricing

- Ensure markets auto-freeze at expiry

At this stage, you leverage an existing white label crypto exchange infrastructure to build outcome markets that feel native and not bolted on.

4. Use a Controlled Oracle, Resolution, and Risk Limiting Layer

As stated above, these layers ensure the following:

- Pre-approved data sources only

- Multi-source validation, where possible

- Public audit trails for every resolution

- Cap exposure per user per event

- Max open interest per market

- Region-specific event visibility

5. Automate Settlement and Setup Admin and Compliance Layer

As said above, the settlement layer ensures fast and efficient settlement of the events and automates payouts. The administration and compliance layer, on the other hand, ensures that event workflows are supervised, immutable, and can be stopped anytime during an emergency.

How to Ensure that Event Contracts Trading Doesn’t Seem Like Gambling?

If you’re building event-based trading into your cryptocurrency exchange software development, this question will come up from partners, regulators, and even internal teams. The answer depends on how you design the product.

Robinhood didn’t present YES/NO events as entertainment or betting. It framed them as financial contracts linked to verifiable outcomes. Similarly, these are the factors that differentiate gambling platforms, unregulated prediction markets, and event-based trading.

| Aspect | Gambling Platforms | Unregulated Prediction Markets | Event-Based Trading |

|---|---|---|---|

| What users act on | Chance | Opinions | Known events |

| Outcome logic | Random / house-defined | Often subjective | Predefined & verifiable |

| Risk exposure | Open-ended | Unclear | Capped upfront |

| Settlement | House-controlled | Inconsistent | Rule-based & automatic |

| Product intent | Entertainment | Forecasting | Trading decisions |

If outcomes are random or house-controlled, regulators call it gambling. If outcomes are unclear or poorly governed, it lands in grey territory.

Event contracts trading avoids both if structured correctly.

Founders seeking regulatory defensability while building event trading into cryptocurrency exchange software development must ensure the following:

- Events are tied to objective, externally verifiable facts.

- Resolution rules are defined before trading starts.

- No post-expiry changes happen ever.

- Clear limits on exposure and participation are imposed.

- Full audit trails are maintained for event approval and settlement

Monetization Models Founders Can Actually Scale

- Per-event trading fees: This is usually a small and flat fee per YES/NO trade. It ensures predictable revenue without relying on leveraged volume.

- Event creation fees: The event trading enabling crypto exchange software charges projects, institutions, and DAOs for launching custom or premium events

- Liquidity incentives: The event contracts trading platform rewards early market makers on high-value events to ensure tight spreads and faster price discovery.

- Institutional & B2B event markets: The cryptocurrency exchange software featuring YES/NI event contracts may also charge funds, DAOs, enterprises, or research firms for private or permissioned events.

- Revenue diversification advantage: Earnings come from several events and engagements, not just raw trading volume, reducing dependence on fee wars.

Expand tradeable markets with YES/NO binary event trading

Closing: Build Before the Giants Dominate

Event contracts trading platforms aren’t for pure meme exchanges or platforms without risk or compliance maturity, but if you’re any of the following, you must start building event contracts trading infrastructure:

- Exchange operators seeking differentiation

- Web3 startups fighting fee compression

- Fintechs expanding into crypto trading

Many market giants have launched event-based trading as a core-primitive and not a side feature. Even if you’re leveraging white label crypto exchange software to build your event contracts trading platform, you must not treat it as a side feature. This is why Gemini, Kraken, Hyperliquid, and ForecastEx launched separate platforms for outcome-driven trading. This way, event-based exchanges look more like:

- Information markets

- Decision markets

- Outcome-based financial layers

Robinhood and other major event contracts trading platforms just validated a direction, and the rest of the founders can blaze the trail with product differentiation. They can also target new trader segments or create stronger engagement loops by partnering with an exchange software development company that specializes in digital asset trading infrastructures as well as prediction markets.

Antier delivers enterprise-grade white label crypto exchange software with native event-contract trading infrastructure, engineered for compliant, outcome-driven markets at scale.

Share your requirements today.

Crypto World

Fourth quarter loss comes in at $12.4 billion, or $42.93 per share.

Strategy (MSTR) reported a net loss of $12.4 billion in the fourth quarter of 2025 as the price of bitcoin tumbled from about $120,000 on October 1 to roughly $89,000 to close the year.

Things have only gotten worse since, with the price of bitcoin falling hard in recent weeks and finally crashing on Thursday to the $64,000 level ahead of the Strategy results. Strategy shares closed the session down 17% in one of their worst performances in years. The stock’s up modestly in after hours trade.

Led by Executive Chairman Michael Saylor, the company, which is the largest corporate owner of bitcoin, currently holds 713,502 BTC, purchased at an average price of $76,052 (which includes several billion dollars in purchases since the end of the fourth quarter).

The company ended the year with $2.25 billion in cash, which would allow for 2.5 years of dividend coverage on its preferred stock as well as interest on debt.

The fourth quarter results being of little surprise, investors will look to the earnings call at 5 pm ET for Saylor and team’s comments about their plans given the current state of the market.

Read more: Strategy has $6.5 billion loss on BTC, but continues trading at premium to value of its assets

Crypto World

Tether Bets $150M on Gold.com to Scale Gold Tokenization

The investment arm of stablecoin issuer Tether revealed on Thursday a $150 million stake in Gold.com, the online marketplace for gold and other precious metals. The move equates to roughly 12% of Gold.com and lays the groundwork for embedding a tokenized gold layer into the platform’s offerings. In practice, the plan includes integrating Tether Gold into Gold.com’s ecosystem, enabling users to access tokenized gold through a familiar, regulated marketplace. This marks another step in Tether’s broader strategy to blend digital assets with traditional stores of value, while preserving the asset’s backing and recognized value.

Gold.com is a publicly listed online marketplace that sells gold and other precious metals, including silver and platinum, to markets including the United States and beyond. The collaboration will align Gold.com’s catalog with a tokenized gold framework, as developers explore ways for customers to interact with digital gold alongside physical holdings within a familiar shopping experience.

“Gold has played a central role in preserving value for centuries, particularly during periods of monetary stress and geopolitical uncertainty,” said Paolo Ardoino, Tether’s chief executive. “Gold exposure is not a trade for Tether; it is a hedge and a long-term allocation to protect our user base and ourselves in a world that is becoming increasingly unstable.” He added that the investment reflects a long-term belief that gold should be as accessible, transferable, and usable as modern digital money, without compromising on physical backing or ownership.

Key takeaways

- Tether’s investment arm is purchasing roughly a 12% stake in Gold.com for about $150 million, with plans to integrate Tether’s gold-backed token into the platform.

- The tie-up signals a deeper push to bring tokenized precious metals to mainstream crypto users and traditional gold buyers on a regulated marketplace.

- Beyond tokenized gold, the partners are exploring ways for customers to buy physical gold using Tether’s USD-backed stablecoins and related US-market tokens.

- The development comes as gold prices surged over the prior year, briefly peaking around $5,600 per ounce before easing to the mid-$4,800s in recent days.

- Separately, Tether disclosed a separate $100 million equity investment in Anchorage Digital to support wider USAt adoption, with Anchorage aiming to advance toward a public listing next year.

- Tether reported a $10 billion profit in 2025, driven mainly by interest income on its large USDT reserves backing USDt obligations.

Tickers mentioned: $XAUt, $USDT, $USAT

Sentiment: Neutral

Market context: The deal aligns with a broader shift toward tokenized assets and on-chain settlement in the precious metals space, while stability and regulatory considerations continue to influence stablecoin use and cross-asset integrations.

Why it matters

For investors and users, the partnership could lower barriers to accessing gold through a digital wrapper that preserves physical backing while improving liquidity and settlement speed. By embedding a gold-backed token into a widely used marketplace, Gold.com could broaden the audience for tokenized precious metals beyond niche crypto circles into mainstream retail investors and institutions alike. The move also highlights Tether’s strategic emphasis on expanding utility for its suite of stablecoins and tokenized assets, creating a potential blueprint for other traditional commodities to leverage blockchain rails without sacrificing physical custody or auditability.

The collaboration also reflects a growing appetite among crypto-native firms and regulated platforms to bridge the gap between digital currencies and real-world assets. The emphasis on a regulated marketplace aims to address concerns about transparency, custody, and transparency—issues that have historically vexed both crypto enthusiasts and traditional precious metals buyers. If the integration proceeds as planned, it could pave the way for more cross-asset products that blend the reliability of physical gold with the efficiency of on-chain transfers and programmable payments.

Beyond Gold.com, the broader strategy includes expanding the use of stablecoins in tangible assets, such as physical metals, and leveraging Tether’s footprint in regulated financial ecosystems. The separate investment in Anchorage Digital underscores another pillar of this strategy: enabling USAt adoption within a compliant, bank-partnered framework as the new US-regulated stablecoin aims to gain traction in the American market while the parent company contemplates a future public listing. Collectively, these moves illustrate a deliberate attempt to normalize and scale tokenized gold as a legitimate instrument for hedging, allocation, and everyday commerce within a regulated environment.

From a financial perspective, the developments come amid positive momentum for gold in macro contexts marked by uncertainty and shifting risk appetite. Gold’s performance over the past year showed a notable run-up before some retracement, a pattern that can benefit tokenized representations by offering a familiar, tradable exposure that blends physical value with blockchain-enabled features like fractional ownership, faster settlement, and cross-border accessibility.

In tandem, Tether’s financial disclosures signal the broader health of the stablecoin ecosystem. The company reported a substantial profit in 2025, largely supported by interest earnings tied to its USDt reserves, which back USDt liabilities across the ecosystem. While this profitability does not guarantee future performance, it reinforces the scale at which stablecoin markets operate and the potential financial bedrock for continued investment in on-chain asset classes.

The evolving narrative around tokenized gold and stablecoin-enabled purchases could transform how ordinary investors interact with precious metals. If successful, Gold.com’s platform could become a practical gateway for users to convert digital liquidity into tangible metal holdings, while enabling new on-ramps and off-ramps that tie digital wallets to regulated, physical markets. This convergence of digitized assets and real-world goods represents a continuation of a broader fintech trend: the digitization of traditional assets with the added benefits of programmability, auditability, and cross-border efficiency.

What to watch next

- Timeline for integrating the tokenized gold layer (XAUt) into Gold.com’s user experience and any custody or compliance milestones.

- Regulatory updates affecting tokenized precious metals and stablecoins in major markets, including disclosures around reserves and audit practices.

- Adoption metrics for USDT and USAt within Gold.com and related platforms, including any pilot programs for gold purchases with stablecoins.

- Progress of Anchorage Digital’s USAt initiative and any forthcoming regulatory or market-facing milestones, including the planned public listing.

Sources & verification

- Tether’s official press release announcing the $150 million strategic investment in Gold.com and its plans to expand access to tokenized and physical gold. See: Tether makes a $150 million strategic investment in Gold.com.

- Gold.com platform overview and listing details (public marketplace for precious metals).

- Tether’s separate $100 million equity investment in Anchorage Digital aimed at accelerating USAt adoption and the bank’s impending public listing.

- Gold price context referenced: approximately 80% rally over the prior 12 months, peaking near $5,600 per ounce and retreating to around $4,800 at the time of reporting.

- Tether’s 2025 profitability mentioned in relation to USDT reserve-backed income and overall reserve profile.

Tether expands tokenized-gold access with Gold.com stake

The disclosure of a $150 million investment for a roughly 12% stake signals a deliberate, strategic step for Tether into the intersection of tokenized commodities and regulated retail platforms. The proposed path—embedding Tether Gold into Gold.com’s existing ecosystem—suggests a roadmap where physical gold and digital representations can be bought, held, and exchanged with comparable ease to other digital assets. By tying a publicly accessible marketplace to a token representing real-world gold, the arrangement is designed to deliver on the promise of on-chain liquidity without sacrificing the security and custody that come with physical metal ownership.

From a narrative standpoint, the deal sits at the crossroads of longstanding financial prudence and modern digital finance. Gold has historically served as a hedge during periods of monetary stress, and proponents argue that tokenized gold can offer similar hedging benefits with the added advantages of transparency, faster settlement, and global reach. The collaboration aligns with an ongoing effort to make gold more usable in everyday commerce, rather than a passive, siloed store of value. As the two entities work toward practical implementations, observers will be watching for regulatory clarity on tokenized precious metals, reserve disclosures to ensure physical backing, and user-friendly features that safeguard ownership while enabling efficient cross-border transfers.

At the heart of the project is a careful balance between accessibility and custodial responsibility. The tokenized representation of gold—whether through a token like XAUt or other digital wrappers—needs to be backed by verifiable physical gold holdings and auditable reserves. Tether’s emphasis on maintaining robust backing and a clear, auditable linkage between the digital token and the underlying metal is essential to sustaining trust in both the token and the broader platform. The integration into Gold.com—an established, publicly listed marketplace—could help normalize tokenized gold as a legitimate instrument for both retail and professional investors, especially if the process remains seamlessly integrated with conventional payment rails and secure custody solutions.

Another dimension of the story concerns the broader ecosystem around stablecoins and their role in real-world asset markets. The push to enable USDT and USAt payments for physical gold hints at a potential tipping point in how on-chain liquidity is channeled into tangible assets. The USAt initiative, described in tandem with Anchorage Digital, underscores a broader ambition to advance regulated, US-facing stablecoins within a framework that aligns with formal banking and custody standards. As markets become more comfortable with stablecoins as a medium of exchange for real assets, the prospects for a more interconnected financial system—where tokenized commodities and traditional assets coexist on integrated platforms—could improve both efficiency and investor confidence.

In this broader context, Gold.com’s positioning as a gateway to tokenized and physical gold could reshape how ordinary investors approach precious metals. If the partnership proves durable, it could encourage other marketplaces to explore tokenized representations of widely traded commodities, expanding the menu of digital-physical hybrids available to users. Yet the path is not without risk: the success of such a venture depends on continued regulatory clarity, rigorous reserve management, and the ability to deliver a user experience that minimizes complexity while maximizing transparency. As with any cross-asset initiative, the outcome will hinge on execution, governance, and the ability to demonstrate tangible value for both token holders and traditional gold buyers alike.

Crypto World

Tether (USDT) buys $150 million stake in Gold.com to boost tokenized gold distribution

Tether, issuer of the world’s most popular stablecoin , has acquired a $150 million minority stake in Gold.com (GOLD), deepening its push into the gold market just as the yellow metal gains traction with investors seeking stability in volatile times.

The investment, announced on Thursday in a blog post, gives Tether a 12% stake in Gold.com, a platform that enables access to both physical and tokenized gold. As part of the partnership, Tether will integrate XAUT, its gold-backed token, into Gold.com’s infrastructure.

The companies will also explore enabling purchases of physical gold using Tether’s U.S. dollar stablecoin USDT and its recently launched U.S.-regulated stablecoin, USAT.

Gold.com’s publicly-traded shares rose 6% after Thursday market hours.

Tether’s investment follows a steep rally in gold prices, which topped $5,000 per ounce last week. Meanwhile, the market for blockchain-based gold tokens also ballooned, growing from $1.3 billion to more than $5.5 billion. Tether’s XAUT token currently makes up over 60% of the tokenized gold market and is backed one-to-one by physical gold held in Swiss vaults.

“Gold has played a central role in preserving value for centuries, particularly during periods of monetary stress and geopolitical uncertainty, said Paolo Ardoino, CEO of Tether.

“Gold exposure is not a trade for Tether,” he added. “It is a hedge and a long-term allocation to protect our user base and ourselves in a world that is becoming increasingly unstable.”

Earlier Thursday, Tether also announced an investment in Anchorage Digital, a U.S. federally regulated crypto bank and key partner in the rollout of USAT.

Crypto World

What Triggered the Latest Bitcoin and Altcoin Crash?

Analysts explain what took place in the crypto markets in the past 24 hours or so, and whether the worst is behind us.

It’s safe to say that this is no longer a bull phase. After all, BTC dumped by more than 50% since its October all-time high and plummeted to around $60,000 late on Thursday.

But in this article, we will focus more on the events that took place yesterday than on the overall decline over the past several months. In the span of just 24 hours, the cryptocurrency plummeted from $77,000 to $60,000 in one of its worst single-day trading performances since its inception.

Multiple altcoins registered even more profound losses of up to 20%, as was the case with XRP. The total value of wrecked positions in just one day shot up to $2.6 billion, according to Coinglass data. Nearly 600,000 traders were liquidated.

Despite bouncing off local lows, BTC and the altcoins erased months and years of gains, returning to levels last seen before the US presidential elections at the end of 2024. During and after similar calamities, the most obvious question is why. Here’s a breakdown through the eyes of the Kobeissi Letter.

What Happened?

First things first, the analyst reassured that although bitcoin has plummeted by over $30,000 in the past couple of months, the “fundamental picture for crypto” has remained “vastly unchanged.” They added that the answer to why the asset class is tanking lies in the October 10 crash, when over $19 billion in leveraged positions were wiped out. They believe “something structural” changed on that day.

The answer to this question requires going back to October 10th.

The most recent TOP in crypto came on October 6th, just 4 days before the -$19.5 billion record liquidation.

Something structural appears to have shifted on October 10th.

And, markets never truly recovered. pic.twitter.com/l07mKRBAbQ

— The Kobeissi Letter (@KobeissiLetter) February 5, 2026

Although BTC remained entirely rangebound for two months between November 15 and January 15, the analysts said there were brief periods of liquidation with “gaps” in both directions, which were another sign of the market’s structural collapse. They noted that sentiment is “all that matters” during crypto cycles, and it was broken after the October crash.

You may also like:

“The result is a massive virtuous cycle, shifting from liquidations to sentiment deterioration, and back. Since January 24th, we have seen $10 billion worth of levered positions liquidated. That’s ~55% of the record amount seen on October 10th. It’s a structural decline.”

The analysts offered more evidence showing the nature of the structural collapse, including the spread of selling pressure into other asset classes, and that BTC’s market depth, the capital available to absorb large orders, is still more than 30% below its October peak. The latest time it hit such numbers was after the FTX crash in 2022.

Lastly, the Kobeissi Letter indicated that a large player, perhaps an institution, sold or was liquidated during the violent trading session, given BTC’s rapid and massive correction.

Today’s decline was particularly noteworthy as Bitcoin fell over -$9,000 and selling pressure was constant.

At times, Bitcoin would fall $2,000+ in a matter of minutes.

It seems that a large player, perhaps an institutional investor, sold/liquidated during today’s session. pic.twitter.com/EWnLxUT1Vl

— The Kobeissi Letter (@KobeissiLetter) February 5, 2026

When Bottom?

The second popular question after a crypto market collapse is whether we have bottomed out or if there is more pain ahead. The analysts answered that bitcoin would bottom once “structural liquidity is restored.”

“This will be a combination of both capitulation in price and leverage, as well as maximum bearish sentiment.”

The good news is that they added, “we seem to be somewhat near that point.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Big Bitcoin Holders’ Supply Dips to 9-Month Low

Large Bitcoin holders are tightening their grip on the market while the smallest buyers surge in a contrasting trend, highlighting a bifurcated on-chain landscape as traders weigh whether the current pullback has run its course. New data from the sentiment analytics firm Santiment shows that the total share of the supply controlled by whales—wallets holding between 10 and 10,000 BTC—has slid to a nine-month low. At the same time, the same period has seen a sharp drawdown in the number of coins held by these large holders, underscoring a wave of offloading that accompanied a sizable price retreat.

Bitcoin (CRYPTO: BTC) has been a focal point for on-chain watchers, with Santiment reporting on X that whale and shark wallets collectively owning a dominant slice of the supply have fallen to roughly 68.04% of all BTC. The firm highlighted a dramatic dump of 81,068 BTC in an eight-day window, a move that coincided with a slide in price from around $90,000 to roughly $65,000—a decline of about 27% in short order. At the time of publication, the asset traded near $64,792, having touched a 24-hour low just above $60,000.

Bitcoin large wallet holders appear to be offloading aggressively. Source: Santiment

Market participants frequently monitor the behavior of big holders to gauge whether the asset is peaking or set for an uptrend. In this cycle, the on-chain dynamic appears to be tilting toward caution among the largest entities, even as a different cohort—retail investors—picks up the pace elsewhere in the ecosystem.

Evidence of a broader mood shift emerged as Ki Young Ju, the CEO of CryptoQuant, posted on X that “every Bitcoin analyst is now bearish,” a sentiment mirrored by the widely watched Fear & Greed Index. The index’s Friday reading landed at 9 out of 100, its lowest level since mid-2022 when anxiety spiraled in the wake of the Terra collapse. The downgrade in sentiment comes as institutions and individuals reassess exposure in a market characterized by heightened volatility and regulatory chatter.

The split in on-chain behavior—whales trimming exposure while retail buyers maneuver into positions—arrives amid a historical backdrop. The Fear & Greed gauge, which aggregates multiple data points to measure market sentiment, has repeatedly shown that extremes can precede sharp reversals, though they do not by themselves guarantee a bottom. This pattern—whales selling into uncertainty while smaller buyers accumulate—has historically appeared during bear phases, suggesting that the current configuration could sustain a prolonged period of price consolidation. Index

Meanwhile, a separate part of the on-chain narrative concerns the so‑called “shrimp wallets”—addresses with less than 0.1 BTC. These micro-holders have climbed to a 20-month high, a trend that Santiment notes has persisted since June 2024, when Bitcoin traded near $66,000 before dipping to the $50s later that year. The uptick in shrimp wallets indicates a renewed grassroots interest among smaller participants, a development that often accompanies a more distributed demand profile and can complicate attempts to chart a clear macro top or bottom.

Historical context also looms large: Bitcoin briefly reached the $100,000 milestone in December 2024 amid a wave of speculative exuberance and a political pivot in the United States, a reminder that sentiment can swing in cycles even as on-chain fundamentals evolve. As of the latest readings, the cohort of these small holders represents about 0.249% of the total supply, amounting to roughly 52,290 BTC. This pinpoints an ever-narrowing window for the top-tier holders relative to the broader supply base, even as the market navigates a patchwork of macro headlines and shifting liquidity conditions.

Bitcoin is down 29.62% over the past 12 months. Source: CoinMarketCap

As the market digests these on-chain signals, traders are watching the price action with heightened sensitivity. The current price level—roughly mid‑$60,000s—positions BTC in a range that is susceptible to both macro risk-off moves and any rapid shifts in liquidity. The discordant signals from different market segments—whale selling versus retail accumulation—could prolong a period of consolidation, especially if macro data or regulatory headlines tilt risk appetite in either direction. The ongoing divergence also raises questions about the durability of any potential countertrend rally until whales either re-enter or their offloading abates meaningfully.

Crypto World

Bitcoin isn’t losing to gold. It is navigating a liquidity squeeze that the yellow metal never had: Asia Morning Briefing

Good Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

The market has been asking whether bitcoin is losing to gold. Darius Sit, co-founder and Managing Partner at QCP Capital, says the debate is often framed around price when liquidity realities matter more.

Singapore-based QCP is one of Asia’s largest trading desks, with over $60 billion in annual volume.

“If you’re comparing Bitcoin to gold, it’s not a like-for-like comparison… you’re talking about almost like a mouse versus an elephant kind of comparison,” Sit told CoinDesk. “You have two different sets of idiosyncratic market forces affecting market price in the short term, but on the longer-term narrative, I think, [they] remain quite similar.”

Gold’s dominance reflects sovereign demand, entrenched market structure, and sheer scale. Bitcoin’s lag owes more to position unwinds than thesis collapse. Gold’s market cap is so large that its daily swings can exceed bitcoin’s entire valuation, turning short-term divergence into a physics problem rather than a narrative verdict.

However, “in the longer term, narrative looks the same,” Sit said.

A bigger inflection point, in his view, isn’t bullion’s rally but crypto’s Oct. 10 (now called 10/10) deleveraging event. That episode drew a hard line between bitcoin and the rest of the digital asset complex, exposing how liquidity and credit mitigation diverge once leverage snaps.

“October 10 revealed that … there is a very clear line in terms of the liquidity between crypto, altcoins and bitcoin,” Sit said. The takeaway isn’t that crypto lost its appeal, but that much of the market discovered its true depth only after forced unwinds cleared the book. What remained was a thinner landscape where price moves sharply in either direction.

One of the most important lessons of “10/10” was how crypto venues handle credit when things break.

Sit drew a stark contrast with traditional markets, where layered broker and clearinghouse structures absorb shocks before losses reach end users.

Native crypto exchanges, by comparison, often operate as single points of failure, relying on shareholder equity, insurance funds, and, in extreme cases, socialized loss.

“The moment you trigger socialized loss, your platform will lose trust,” Sit said, describing what he views as the industry’s real institutional ceiling. Volatility isn’t the deterrent. The problem emerges when traders cannot predict how liquidations and counterparty risk will be managed in a stress event.

Socialized loss occurs when an exchange’s insurance fund cannot cover bankrupt positions, forcing the platform to close out profitable traders’ positions to cover the shortfall, effectively making winners pay for others’ losses. This happened on many major exchanges during the Oct. 10 market crash.

He added that participants perceived the rules as inconsistent, with some products or counterparties appearing insulated while others absorbed the hit.

That perception lingers longer than the price drawdown itself. Markets can rebuild leverage and volume, but trust in liquidation governance is slower to return.

The result is a divided landscape where bitcoin retains credibility due to deeper liquidity and clearer use as collateral, while the broader altcoin complex trades with a structural discount tied less to macro direction than to venue design and counterparty confidence.

In Sit’s view, bitcoin still behaves like a long-horizon inflation hedge and an increasingly legible form of collateral, whereas the broader altcoin universe is more directly subject to venue governance and order-book depth than to macro narratives alone.

“When something has poor liquidity, it can go down a lot. It can go up a lot,” Sit said.

Market Movement

BTC: Bitcoin swung violently but edged up about 5% in the last hour as extreme volatility followed a liquidation-driven plunge toward $60,000, with the RSI near 17 signaling historically oversold conditions that often precede sharp relief bounces even as price hovers near the $58,000 to $60,000 support zone.

ETH: Ether traded around $1,895, rebounding about 7% in the past hour after a liquidation-driven selloff, with volatility surging as deeply oversold momentum conditions triggered a short-term relief bounce despite double-digit losses over the past 24 hours.

Gold: Gold slipped about 3.7% to roughly $4,740 per ounce in a broad risk-asset pullback and profit-taking wave, but analysts argue the longer-term uptrend remains supported by persistent central-bank buying, debt and currency-confidence concerns, and forecasts that still see potential for prices to push toward $7,000 later in 2026 despite short-term volatility.

Nikkei 225: The Nikkei 225 slipped about 1% to extend a three-day losing streak as a Wall Street tech rout spilled into Asia, dragging South Korea’s Kospi down as much as 5%, pressuring Hong Kong and Australian equities, and reinforcing a broader risk-off tone that also weighed on silver and other volatile assets.

Elsewhere in Crypto

Crypto World

MicroStrategy Explains What Happens First in a Bitcoin Collapse

MicroStrategy (Strategy) released its Q4 2025 earnings report and, along with it, disclosed an extreme downside scenario that would begin to strain its Bitcoin treasury model.

The CEO’s remarks provided rare insight into how far the market could fall before the company’s capital structure comes under serious pressure.

MicroStrategy Finally Reveals What Would Be Its Breaking Point as Bitcoin Price Drops

During its latest earnings discussion, MicroStrategy CEO Phong Le said that a 90% decline in Bitcoin’s price to roughly $8,000 would mark the point where the firm’s Bitcoin reserves roughly equal its net debt.

Sponsored

Sponsored

At that level, the company would likely be unable to repay convertible debt using its BTC holdings alone. As a result, it may need to consider restructuring, issuing new equity, or raising additional debt over time.

Leadership emphasized that such a scenario is viewed as highly improbable and would unfold over several years, giving the firm time to respond if markets deteriorated significantly.

“In the extreme downside, if we were to have a 90% decline in Bitcoin price to $8,000, which is pretty hard to imagine, that is the point at which our BTC reserve equals our net debt and we’ll not be able to then pay off of our convertibles using our Bitcoin reserve and we’d either look at restructuring, issuing additional equity, issuing an additional debt. And let me remind you: this is over the next five years. Right, So I’m not really worried at this point in time, even with Bitcoin drops,” said Le.

Meanwhile, it is worth noting that Le’s remarks come only months after the Strategy executive admitted a situation that would compell the firm would sell Bitcoin. As BeInCrypto reported, Phong Le cited a Bitcoin sale trigger tied to mNAV and liquidity stress.

Speaking on What Bitcoin Did, CEO Phong Le outlined the precise trigger that would force a Bitcoin sale:

- First, the company’s stock must trade below 1x mNAV, meaning the market capitalization falls below the value of its Bitcoin holdings.

- Second, MicroStrategy must be unable to raise new capital through equity or debt issuance. This would mean capital markets are closed or too expensive to access.

Therefore, the latest statement does not contradict Phong Le’s earlier position but adds another layer of risk.

Previously, a Bitcoin sale depended on stock trading below mNAV and capital markets’ closing. Now, he clarifies that in an extreme 90% crash, the immediate issue would be debt servicing, likely addressed first through restructuring or new financing—not necessarily selling Bitcoin.

Sponsored

Sponsored

Massive Bitcoin Exposure Comes with Large Losses

Strategy remains the world’s largest corporate holder of Bitcoin, reporting 713,502 BTC as of early February 2026. The company acquired the holdings at a total cost of about $54.26 billion, according to its fourth-quarter financial results.

However, Bitcoin’s decline during the final months of 2025 significantly impacted the balance sheet. The firm reported $17.4 billion in unrealized digital-asset losses for the quarter and a net loss of $12.4 billion. This highlights the sensitivity of its financial performance to market swings.

At the same time, Strategy continued to raise substantial capital. The company said it raised $25.3 billion in 2025, making it one of the largest equity issuers in the US.

Meanwhile, they also reportedly built a $2.25 billion USD reserve designed to cover roughly two and a half years of dividend and interest obligations.

Executives argue that these measures strengthen liquidity and provide flexibility, even during periods of market stress.

Sponsored

Sponsored

Bitcoin Volatility Brings the Risk Into Focus

The disclosure comes amid heightened volatility in crypto markets. Bitcoin traded near $70,000 in early February before extending successive legs lower to an intraday low of $60,000 on February 6. This shows how quickly price movements can reshape the outlook for highly leveraged treasury strategies.

Strategy’s capital structure relies heavily on debt, preferred equity, and convertible instruments used to accumulate Bitcoin over multiple years.

While this approach has amplified gains during bull markets, it also magnifies losses during downturns, drawing increasing scrutiny from investors and analysts.

However, the company’s leadership maintains that the long-dated nature of much of its debt provides time to manage through cycles. This, they say, reduces the risk of forced liquidations in the near term.

Saylor Doubles Down on Long-Term Thesis

Elsewhere, executive chair Michael Saylor reiterated his conviction in Bitcoin despite recent losses, describing it as the “digital transformation of capital” and urging investors to “HODL.”

Sponsored

Sponsored

Saylor and other executives argue that Bitcoin remains the hardest form of money and that the company’s long-term strategy is built around holding the asset indefinitely, rather than attempting to time market cycles.

The firm has also expanded its financial engineering efforts, including scaling its Digital Credit instruments and preferred equity offerings. According to management, these are designed to reduce volatility and diversify funding sources while continuing to accumulate Bitcoin.

Investors Split on the Risks Ahead

Market reaction to the earnings disclosures and downside scenario has been mixed. Supporters argue that Strategy’s massive Bitcoin reserves, ability to issue equity, and multi-year debt maturities provide sufficient flexibility to navigate even severe downturns.

Critics, however, warn that a prolonged bear market could still force difficult choices. Potential risks cited by investors include shareholder dilution, pressure on the capital structure, or the possibility of selling Bitcoin if funding conditions tighten.

“The company is currently facing a whopping -$7.3 billion loss on their Bitcoin investments,” said Jacob King.

For now, Strategy appears committed to its high-conviction approach. However, by acknowledging that its Bitcoin reserves would merely match its debt, the company has made clear that even the most aggressive corporate Bitcoin strategy still has a theoretical breaking point, one defined not just by market prices but by the limits of leverage itself.

Crypto World

Bitcoin Slips Below $70K as Extreme Fear Grips Crypto Markets

TLDR:

- Bitcoin slipping below $70K triggers renewed selling pressure as sentiment moves into extreme fear.

- Crypto Fear & Greed Index drops near its lowest levels this year, reflecting intense market anxiety.

- BTC hits a low near $67,000, the weakest level since late 2024, deepening the downtrend.

- Broader risk asset sell‑offs contribute to crypto market losses and heightened caution.

Bitcoin slipping below $70K deepened the market’s downturn. The asset price has dropped to $67,000, a 15‑month low and about 46% below its all‑time high.

Volatility surge has intensified selling pressure across crypto markets, pushing sentiment into Extreme Fear. The market reacted with broader risk asset sell‑offs, even as some long‑term models suggest potential recovery paths.

Market Reaction and Oversold Conditions

Bitcoin slipping below $70K dropped nearly 8% on the day, positioning the cryptocurrency approximately 46% below its all-time high. The Fear & Greed Index currently reads Extreme Fear, reflecting widespread caution among traders.

Headlines have emphasized the bearish sentiment, but statistical models present a different narrative. Breaking below a round number like $70K often triggers emotional reactions.

Psychological floors make declines feel more dramatic, creating heightened fear. Historically, similar breaches represent temporary overshoots rather than structural breakdowns.

Volatility is a normal feature of Bitcoin’s late-cycle patterns, which test market conviction and penalize impatience.

Using a 15+ year Bitcoin power-law model with R² = 0.961, the current spot price of $67.7K is roughly 45% below the modeled fair value of ~$123K. This deviation indicates a historically large gap between price and trend.

At 22 months post-halving, typical cycles show overbought conditions, yet Bitcoin is registering a Z-score of -0.85—the lowest recorded at this stage. Such readings signal statistical undervaluation rather than structural weakness.

Historically, oversold regimes have produced consistent forward returns. One-year forward performance was 100% positive, with average gains exceeding 100%.

The correlation between 18-month Z-scores and future returns stands at -0.745, meaning the depth of undervaluation explains over half of forward return variance.

Patience and Recovery Potential

Mean reversion plays a key role in Bitcoin’s response to oversold conditions. The estimated half-life of deviation is approximately 133 days, suggesting that time could help align price with trend levels.

Based on historical patterns, this positions Bitcoin for a gradual path toward ~$111K by mid-2026. Market sentiment is heavily influenced by short-term fear.

Social media and headlines have amplified declines, but statistical evidence provides a clearer perspective. Past cycles demonstrate that patient positioning in oversold phases is historically rewarded.

Temporary volatility and drawdowns are part of the market’s mechanism, allowing long-term value to compound quietly. Even with the current discomfort, these conditions represent an opportunity.

Price reacts to leverage, flows, and sentiment, while value accumulates in the background. Historical data confirms that statistically cheap levels rarely remain undervalued for long, offering a disciplined path for market participants to navigate short-term fear.

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business15 hours ago

Business15 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat22 hours ago

NewsBeat22 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World15 hours ago

Crypto World15 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World14 hours ago

Crypto World14 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation