Over the past few years, CoinGeek has been reporting on BRICS’ moves to de-dollarize, form new payment systems, and gain financial independence from SWIFT and the U.S. dollar.

While some initiatives, such as the BRICS currency, are premature, the alliance has been making efforts to trade in the national currencies of member states.

Building on this, Russian Finance Minister Anton Siluanov told TASS they are looking at a cross-border payment system using their own currencies “taking into account digital technologies and digital financial assets.”

Russia has been warming up to digital currencies and assets

Along with the wider BRICS alliance, we’ve been reporting on how Russia has been warming up to digital currencies and assets.

After launching the digital ruble in 2023, the Russian government legalized digital currency mining in 2024; it even offered BTC miners excess energy at discounted rates in specific regions. The most sanctioned country in the world also legalized the use of digital currencies in international trade and recently passed laws to allow wealthy individuals to invest in them.

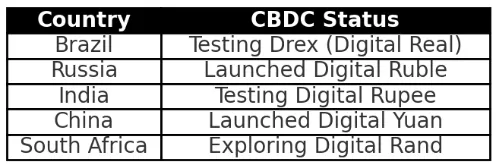

Zooming out, a pattern is becoming clear: BRICS isn’t planning to launch a new currency unit anytime soon, but its member states are all making moves to use digital currencies like BTC and Ethereum in trade. Most of them also have national digital currencies or central bank digital currencies (CBDCs) in various phases, with China’s digital yuan being the most advanced.

If the goal is to de-dollarize and trade in digital national currencies, BRICS is already well on the way. Of course, every effort will be made to stop this, and United States President Donald Trump has made clear he won’t stand by and watch it happen without a fight.

There’s no need to build a new system because the ultimate one already exists

In this author’s view, BRICS can trade in the national currencies of its member states if it desires. However, there’s no need to build a new cross-border settlement system from the ground up. In fact, the ultimate ledger on which to conduct trade already exists, and issuing CBDCs or digital currencies on it is relatively easy.

The BSV blockchain follows the principles laid out in Satoshi Nakamoto’s 2008 Bitcoin white paper. As such, all transactions happen on the blockchain, are time-stamped and immutably recorded, and cost fractions of a penny. The recent Teranode upgrade means BSV can handle one million transactions per second (TPS) for an average fee of $0.00001.

BSV also has all the advanced features needed to conduct international trade. It has token protocols capable of handling digital currencies, smart contracts to allow for programmable payments, and automated compliance for trade. As a global, decentralized network, BSV already functions as a battle-tested, proven global settlement network.

While Russia may have some issues, given the current sanctions against it, other BRICS nations can freely issue digital currencies and trade with each other without permission. There’s no central authority through which issuers have to go: India, Brazil, China, or any others can mint currencies on and start trading on BSV today.

The downsides are limited (some loss of control), and the upsides are many: a trusted system anyone can audit, which is already live and is ready to handle the sort of transaction throughput global trade requires, and which no single entity can censor or control. BSV is nothing like BTC or Ethereum; it was designed from the outset with payments at scale in mind. BRICS, or any other nation or group of nations, could save years and tens of millions in costs by utilizing the world’s fastest, least expensive settlement system: the original Bitcoin protocol in all its glory.

It’s time for all nations to stop trying to flex on each other and dictate who can trade with whom and under what conditions. Bitcoin was made to allow anyone, anywhere, to trade freely with anyone, anywhere else, regardless of politics, religion, or any other attributes. Perhaps if we use it as such, we can avoid some of the conflicts that may lie in our future, and humanity can prosper together.

Any entity, be it a business, a country, or a group of nations, looking for an edge or to create alternative payment or cross-border settlement systems today, not years in the future, can build on BSV. Entrepreneurs, policymakers, central bankers, and others should test it and see its awesome power for themselves.

Watch: Teranode is the digital backbone of Bitcoin

title=”YouTube video player” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross-origin” allowfullscreen=””>