Crypto World

BTC climbs to $67,000 as Trump says U.S. deficit cut by 78%

Bitcoin trading remained volatile on Thursday, rising to around $67,000 after briefly dipping near $65,900, as traders weighed a new message from U.S. President Donald Trump claiming the nation’s trade deficit has been cut by 78% thanks to tariffs and could turn positive later this year.

“The United States trade deficit has been reduced by 78% because of the tariffs being charged to other companies and countries,” Trump said in a Truth Social post late Wednesday. “Ot will go into positive territory during this year, for the first time in many decades.”

The claim matters for crypto less because of the math in any single post and more because it pulls the market back to a familiar pressure point.

Tariffs can act like a tax on imports, which can lift prices in the real economy and complicate the path for interest rates. When markets start pricing “rates higher for longer,” the dollar tends to firm and risk assets tend to lose oxygen.

Bitcoin has spent the past two weeks trading like a macro proxy again, reacting to shifts in liquidity and rate expectations rather than any crypto specific catalyst.

There is also a real data backdrop that makes trade a live topic. In early January, the U.S. trade deficit narrowed sharply to about $29.4 billion, the lowest since 2009, with analysts pointing to a drop in imports, a jump in exports and the knock on effects of tariff threats.

But economists also noted that a big part of the swing came from non monetary gold flows, which can make month to month numbers look cleaner than the underlying trend.

If the tariffs story hardens into a stronger dollar and tighter financial conditions, rallies can struggle to stick. If it fades into political noise, crypto goes back to watching flows, leverage and whether buyers can reclaim lost levels.

Crypto World

event contracts must follow DCM rulebook

The CFTC has issued a new advisory on prediction‑market event contracts, telling designated contract markets to apply full Part 38 oversight, especially for sports and other sensitive bets.

Summary

- The advisory reminds DCMs that event contracts sit under the Commodity Exchange Act and DCM Core Principle 3, with Appendix C as the guide for listing and surveillance.

- CFTC stresses DCMs are frontline regulators, expected to vet product design, monitor trading, and reassess compliance as prediction‑market volumes and complexity grow.

- Sports and other real‑world event contracts are flagged as higher‑risk, signaling that venues listing them will face a higher bar to show they are not de facto gambling products.

The U.S. Commodity Futures Trading Commission (CFTC) has issued a new consultation opinion on prediction-markets and event contracts, warning designated contract markets that they must tighten compliance with existing derivatives law as the sector grows.

CFTC tightens lens on event contracts

According to the CFTC’s notice, the agency wants to “encourage the growth and innovation” of prediction markets while reminding exchanges that they remain fully bound by the Commodity Exchange Act (CEA) and Commission regulations. The opinion specifically points to CEA Section 5(d), Part 38, Designated Contract Market (DCM) Core Principle 3, and Appendix C as the key regulatory anchors that must guide how event contracts are listed and monitored.

The document stresses that DCMs are the frontline regulators of their own markets and must proactively ensure that listed event contracts continue to comply with federal law as trading volumes and product complexity increase. That includes robust product submission processes, surveillance, and ongoing oversight, rather than treating prediction markets as a gray area outside normal futures and options governance.

Implications for prediction markets and sports contracts

The CFTC singles out sports-related event contracts as an area requiring particular attention, flagging that some structures may raise distinct policy and compliance questions. While the opinion does not ban specific products, it signals that prediction venues listing sports, political, or other sensitive event contracts will face a higher bar in demonstrating that their markets meet CEA and Part 38 standards.

For real-money prediction platforms and any exchange experimenting with event-based derivatives, the message is blunt: innovation is welcome, but it must sit squarely inside the existing DCM framework. Platforms that have treated event markets as lightly regulated side products will need to reassess listing practices, surveillance, and disclosures if they want to stay aligned with the CFTC’s evolving expectations.

Crypto World

A New Staked Ether ETF for Yield-Seeking Investors (Report)

The financial vehicle will begin trading on Nasdaq today under the ticker ETHB.

Nearly two years since the debut of the traditional exchange-traded funds tracking the performance of the largest altcoin, the world’s biggest asset manager is reportedly launching a staking version on Nasdaq today.

BlackRock’s iShares Staked Ethereum Trust ETF (ETHB) will hold spot ETH and stake a portion of the AuM to benefit from staking rewards.

According to the report, ETHB will be BlackRock’s first and only cryptocurrency fund incorporating staking rewards alongside spot exposure.

Consequently, the asset manager will now have three spot crypto ETFs after the debut of IBIT in January 2024 and ETHA six months later. Both spot ETFs tracking the two largest cryptocurrencies are the leaders in their highly competitive markets, with AuM of over $55 billion for IBIT and $6.5 billion for ETHA.

ETHB will stake a portion of the ether holdings on the Ethereum network, which will allow it to potentially generate additional yield through staking rewards while still tracking the asset’s market price.

Jay Jacobs, BlackRock’s US head of equity ETFs, commented on the new product, indicating that it’s “really about investor choice,” before he added:

“While ETHA has developed liquidity and a growing derivatives market, some investors are focused on maximizing total returns by combining ether price exposure with staking rewards.”

After Ethereum’s merge from proof of work to proof of stake, the network allows ether holders to lock the asset up to help validate transactions and secure the blockchain. They receive rewards for their participation in the form of a feature similar to yield in traditional finance.

You may also like:

Jacobs further noted that certain investors who already hold ETH directly were staking it and weren’t ready to move into an ETF because they would lose that possibility. Now, though, ETHB will allow them to “keep the benefits of staking while gaining the operational advantages of an ETF structure.”

All Ethereum ETFs have attracted more than $11.6 billion in cumulative net inflows since their debut in July 2024. That figure is down from the early October 2025 all-time high of more than $15 billion.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Grayscale launches GAVA Avalanche Staking ETF on NASDAQ

Editor’s note: Grayscale has launched the Grayscale Avalanche Staking ETF (GAVA), now trading on NASDAQ as a new exchange traded product. The fund seeks to provide exposure to AVAX while also enabling participation in the Avalanche network’s staking process, potentially earning staking rewards. This represents a move to combine price exposure with on‑chain activity within a regulated‑style vehicle, reflecting growing interest in crypto assets accessible through exchange‑traded formats. Investors should review the disclosures and risks before investing.

Key points

- GAVA trades on NASDAQ as a new exchange traded product (ETP) providing AVAX exposure and staking participation.

- Staking introduces potential rewards tied to network participation and its associated risks.

- GAVA is not registered under the Investment Company Act of 1940 and carries notable risk and volatility disclosures.

- Avalanche uses a Proof of Stake model and supports configurable blockchains, appealing to enterprise and institutional users.

“Investors across the market continue to seek simple ways to incorporate digital assets into their portfolios,” said Inkoo Kang, Senior Vice President, ETFs, at Grayscale. “GAVA complements our existing suite of more than 40 digital asset products and provides investors with the ability to gain exposure to one of the market’s leading smart contract platforms, supported by Grayscale’s scale, research, and infrastructure. By integrating staking into the Fund’s strategy, GAVA also enables investors to access the potential economic benefits of participating in Avalanche’s Proof of Stake network through an ETP structure.”

Why this matters

Avalanche’s PoS architecture and Grayscale’s scale and research infrastructure provide a tangible way for investors to gain exposure to a leading smart contract platform while incorporating staking into an ETF-like vehicle. By combining price exposure with potential staking rewards, GAVA broadens access to crypto yields through a regulated channel and reflects ongoing demand for practical crypto investment solutions. The approach underscores how staking economics and on-chain activity can be integrated into traditional investment products.

What to watch next

- NASDAQ trading activity for GAVA, including liquidity and volumes.

- Updates on staking rewards and how they are distributed to fund holders.

- Risk disclosures and investor guidance from Grayscale.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Grayscale Avalanche Staking ETF (Ticker: GAVA) Debuts on NASDAQ with AVAX Staking Exposure

Offers exposure to Avalanche, a smart contract platform supporting customizable blockchain infrastructure for the real world

STAMFORD, Conn., March 12, 2026 – Grayscale Investments®, the world’s largest digital asset-focused investment platform*, today announced that Grayscale Avalanche Staking ETF (Ticker: GAVA) has begun trading on NASDAQ as a new exchange-traded product (ETP).

Grayscale Avalanche Staking ETF (Ticker: GAVA) seeks to provide exposure to AVAX, the native token of the Avalanche network, while also enabling participation in the network’s staking process. Through staking, GAVA may earn rewards associated with participation in the network.

Grayscale Avalanche Staking ETF (“GAVA” or the “Fund”), an exchange traded product, is not registered under the Investment Company Act of 1940 (the “40 Act”) and therefore is not subject to the same regulations and protections as 40 Act-registered ETFs and mutual funds. An investment in the Fund is subject to significant risk and heightened volatility. GAVA is not suitable for an investor that cannot afford the loss of the entire investment. An investment in the Fund is not a direct investment in AVAX.

Avalanche is a multi-chain smart contract platform designed to help address the common blockchain challenge of balancing scalability, security, and decentralization. Its architecture is optimized for core functions like creating and transferring digital assets, executing smart contracts, and enabling custom blockchains, called Avalanche L1s. Together, this design helps support high-throughput applications while providing a high level of configurability and control valued by enterprise and institutional users.

Avalanche utilizes a Proof of Stake consensus model, allowing AVAX token holders to delegate or validate in order to secure the network.** By incorporating staking into its investment strategy, GAVA aims to provide investors with exposure not only to the price performance of AVAX, but also to the economic activity associated with network participation.

“Investors across the market continue to seek simple ways to incorporate digital assets into their portfolios,” said Inkoo Kang, Senior Vice President, ETFs, at Grayscale. “GAVA complements our existing suite of more than 40 digital asset products and provides investors with the ability to gain exposure to one of the market’s leading smart contract platforms, supported by Grayscale’s scale, research, and infrastructure. By integrating staking into the Fund’s strategy, GAVA also enables investors to access the potential economic benefits of participating in Avalanche’s Proof of Stake network through an ETP structure.”

“Avalanche was designed from day one to support real-world applications at scale,” said John Wu, President of Ava Labs. “Built for business, Avalanche enables financial services, enterprise platforms, and tokenized real-world assets through a customizable, flexible architecture that gives institutions the performance, security, and control needed for production deployment.”

Since launching in 2020, Avalanche has evolved into a diverse, flexible ecosystem used by developers, enterprises, and institutions building applications across gaming, financial services, and tokenized real-world assets (RWAs). With more than 11.4 billion transactions since inception, Avalanche has demonstrated sustained network activity and continued growth and adoption.***

Grayscale Avalanche Staking ETF was first launched as a private placement in August 2024 as one of the first investment vehicles enabling investors to gain exposure, and not a direct investment, to AVAX, the platform token underlying the Avalanche platform.

For additional information about GAVA please visit: https://etfs.grayscale.com/gava

About Grayscale

Grayscale is the world’s largest digital asset-focused investment platform* with a mission to make digital asset investing simpler and open to all investors. Founded in 2013, Grayscale has been at the forefront of bringing digital assets into the mainstream. The firm has a long history of firsts, including launching the first Bitcoin and Ethereum exchange traded products in the United States. Grayscale continues to pioneer the asset class by providing investors, advisors, and institutional allocators with exposure to more than 45 digital assets through a suite of over 40 investment products, spanning ETFs, private funds, and diversified strategies. For more information, please follow @Grayscale or visit grayscale.com.

*Largest digital asset-focused investment platform based on AUM as of December 31, 2025. For other companies in this category, AUM is considered as of most recent public disclosure.

**Avax.network as of February 23, 2026

***Explorer.avax.network as of February 23, 2026

Please read the prospectus carefully before investing in the Fund. Foreside Fund Services, LLC is the Marketing Agent and Grayscale Investments Sponsors, LLC is the Sponsor of GAVA.

As a non-diversified and single industry fund, the value of the shares may fluctuate more than shares invested in a broader range of industries. There is no guarantee that a market for the shares will be available which will adversely impact the liquidity of the Fund. The value of the Fund relates directly to the value of Avalanche, the value of which may be highly volatile and subject to fluctuations due to a number of factors.

Extreme volatility of trading prices that many digital assets have experienced in recent months and may continue to experience, could have a material adverse effect on the value of the Fund and the shares could lose all or substantially all of their AVAX. AVAX may have concentrated ownership and large sales or distributions by holders of AVAX could have an adverse effect on the market price of such digital assets. The value of the Fund relates directly to the value of AVAX, the value of which may be highly volatile and subject to fluctuations due to a number of factors. Because the value of the Fund is correlated with the value of AVAX, it is important to understand the investment attributes of, and the market for, AVAX. Please consult with a financial professional.

When the Fund stakes AVAX, AVAX is subject to the risks attendant to staking generally. Staking requires that the Fund lock up AVAX for the period of time required by the staking protocol, meaning that the Fund cannot sell or transfer the staked AVAX, thereby making it illiquid for the period it is being staked. Staked AVAX is also subject to security breaches, network downtime or attacks, smart contract vulnerabilities, and validator or custodian failure or compromise, which can result in a complete loss of the staked AVAX or a loss of any rewards. Potential staking rewards are earned by the Fund and not issued directly to investors.

Media Contact

press@grayscale.com

Client Contact

866-775-0313

info@grayscale.com

Crypto World

Brian Armstrong Denies Lobbying Against Bitcoin De Minimis Tax Exemption

Brian Armstrong says claims Coinbase opposed a Bitcoin de minimis tax exemption in Washington are “totally false.”

Brian Armstrong, CEO of Coinbase, has pushed back against claims that his company’s lobbyists are working to block a Bitcoin (BTC) tax exemption in Washington, calling the allegations “totally false.”

The dispute has drawn in Bitcoin advocates, tax lawyers, and crypto lobbyists, and cuts to the center of a wider debate about who the biggest companies in crypto actually represent when they walk the halls of Congress.

What the Accusations Said

The allegations were made by Truth for the Commoner (TFTC), a Bitcoin-focused media account with nearly 100,000 followers on X, which posted on March 11 that Coinbase had told legislators “no one is using Bitcoin as money” and that a BTC de minimis exemption would be “DOA.”

According to TFTC, Coinbase has a financial motive for opposing the BTC tax exemption. The account claimed that the exchange earned $1.35 billion last year in stablecoin revenue, with almost all the money coming from interest on U.S. Treasuries held in reserves backing USDC.

TFTC also suggested that a de minimis rule that covers BTC but not stablecoins would make the king crypto a more attractive payment option, and that would pull users away from Coinbase’s yield-generating stablecoin ecosystem.

Recall that last year, Wyoming Senator Cynthia Lummis introduced digital asset tax legislation seeking to provide a de minimis exemption for crypto gains taxes on crypto transactions of up to $300. According to TFTC, the House version of the bill caps at $200 and only covers stablecoins.

Armstrong directly responded to the accusations against Coinbase, saying:

You may also like:

“Not sure where you’re getting this misinformation (perhaps you can share?) but it’s totally false. I’ve spent a bunch of time lobbying for Bitcoin’s de minimis tax exemption, and will continue doing so.”

However, TFTC co-founder Mart Bent didn’t back down, telling Armstrong:

“I have sources that say otherwise, not you personally but your team and/or lobbyists.”

He also asked whether the Coinbase chief would walk away from the market structure bill if it failed to have a Bitcoin de minimis exemption, as he had done earlier in the year, when he withdrew support for the CLARITY Act after disagreements over stablecoin yield.

A Policy Debate With Numerous Moving Parts

Meanwhile, tax lawyer Jason Schwartz, known as “CryptoTaxGuy” on X, has tried to offer some context in the exchange between Armstrong and TFTC.

According to him, the discussion might be mixing up four separate policy ideas, which are a personal use de minimis rule, a gas fee exemption, a change in stablecoin reporting, and a plan to consider stablecoin gains and losses as zero.

Schwartz added that different market participants will naturally advocate harder for different provisions, and this alone shouldn’t be seen as one party trying to “kill” another provision.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

DeepSnitch AI Presale Launch Date: Traders Gear Up for 100x-300x Returns After Uniswap Listing, HEXY Raises $700K, SUBBD Onboards New Creators

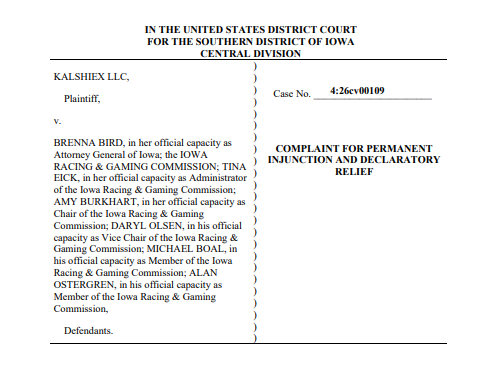

Kalshi made a preemptive strike against Iowa regulators after a meeting switched from tax legislation into an interrogation by the state’s legal team. The company filed suit in Iowa federal court after the Attorney General’s office refused to guarantee it wouldn’t pursue enforcement against Kalshi.

This is the third active lawsuit for Kalshi as prediction markets gain acceptance, but face increased legal scrutiny.

In the trenches, however, the legal drama is nothing but noise. This is especially true for the ICO community, where the DeepSnitch AI presale launch date sparked FOMO for what could be one of the biggest presales in 2026.

Kalshi strikes back

Kalshi filed suit against Iowa Attorney General Brenna Bird and the Iowa Racing and Gaming Commission on March 11, claiming federal law takes precedence over state rules in relation to its contracts.

The lawsuit came after a company representative attended what was described as a tax bill discussion, only to face a panel of state attorneys questioning whether Kalshi’s federally regulated products violated Iowa law.

Regulatory certainty in the US is moving, but the results are uneven, to say the least. Projects with confirmed launch dates and completed products are not waiting for the courts to sort it out.

At the same time, retail traders are finding ways to expand their 2026 bags, and DeepSnitch AI presale launch date announcement materialized at exactly the right time to provide the perfect entry point.

Hottest items in the current ICO calendar

1. DeepSnitch AI presale launch date confirmed: March 31 is the last chance to snag DSNT at an affordable price

As courtroom drama deepens, presale projects are trucking along. After a series of bullish developmental updates (one of which announced the analytics layer is live), DeepSnitch AI token launch finally received a clear target: 31 March.

With community projections rising to as high as 300x, the hype is undeniable, especially considering the overall DeepSnitch AI presale timeline, which culminated in over $2M being raised, has been focused solely on development and organic community building.

Nevertheless, the DeepSnitch AI presale launch date marks the moment after which holders will receive a 7-day window to claim tokens, bonuses (such as the DSNTVIP300 that unlocks 300% on $30K+ allocations), and staked tokens (41.7M of DSNT is already staked).

DSNT will list on Uniswap, and there will likely be additional listings on major CEXs and DEXs.

That’s just the beginning, though, as the DeepSnitch AI roadmap is also locked in. This includes the deployment of SnitchGPT and SnitchCast – both are dropping in Q2 2026. The segmented approach will keep interest high and ensure that early investors always have new things to look forward to.

2. Hexydog: Is there long-term conviction for HEXY?

As DeepSnitch AI presale launch date will open access to a set of AI tools that traders have always wanted, Hexydog presents a novel concept that no one knew they actually wanted. The $700K raised by Hexydog proves that the interest is there, despite how gimmicky the project may seem.

Targeting the pet care niche, Hexydog will allow traders to pay for pet care services using HEXY tokens, with a portion of the proceeds being donated to animal shelters.

Yet, while the concept seems interesting and offers a nice entry at $0.0059, there’s a possibility that the project won’t be able to retain its growing community unless the conviction grows.

3. SUBBD: Is SUBD a good investment?

In contrast to Hexydog, SUBBD goes for the tried and true approach. Tack creator monetization with blockchain payments and AI tools baked in, SUBBD has already onboarded 2K creators that opened the platform to their 250M followers.

The project also raised $1.48M with an entry of $0.057, meaning that the fundamentals are certainly robust.

In addition to the lack of a clear launch date, SUBBD may also struggle to convert the initial buzz into consistent use, especially considering that many users will likely stick to traditional social media channels instead of jumping into a whole new platform.

Final words: Don’t wait for the FOMO to get to you

Despite the bear market, crypto is as active as ever. Yet, despite all the noise, the DeepSnitch AI presale launch date broke through and sparked massive hype and FOMO.

The reason for this is simple: projects like DeepSnitch AI are a rare sight, and seldom do ICOs provide a full package from the onset. As 100x-300x projections continue to circulate, this launch isn’t something you want to miss, as the price is expected to skyrocket as soon as the Uniswap listing kicks in.

Keep the FOMO at bay by reserving your spot in DeepSnitch AI presale and becoming a part of the community chat on X or Telegram.

FAQs:

1. What happens after the DeepSnitch AI presale launch date on March 31?

Token holders get a 7-day claim window for DSNT, staking rewards, and bonuses, including DSNTVIP300. Uniswap listing follows, with CEX and DEX listings expected after. SnitchGPT and SnitchCast deploy Q2 2026, keeping momentum going post-launch.

2. How does Hexydog compare to DeepSnitch AI as a presale investment?

Hexydog raised $700K targeting the pet care niche at $0.0059. Legitimate concept with real community interest, but the addressable market has natural limits. DeepSnitch AI’s daily-use analytics suite targets every active crypto trader, giving it significantly broader retention potential.

3. Is SUBBD a strong alternative to the DeepSnitch AI presale?

SUBBD’s 2K creators and 250M follower network is a genuinely impressive distribution. However, no confirmed launch date and the challenge of pulling users away from established platforms are real risks.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

POAP Moves to Maintenance Mode as Founders Eye Next Generation of Digital Collectibles

The pioneering Web3 attendance protocol will stop onboarding new issuers on March 16, as its team turns its attention to building open infrastructure for digital collectibles.

POAP, the blockchain-based platform that turned event attendance into digital collectibles, is entering maintenance mode — ending active development on its current platform after nearly seven years as a fixture of the Web3 community.

In a post on X, POAP co-founder and general manager Isabel Gonzalez announced that starting March 16, 2026, new issuers will no longer be able to create POAPs through the platform’s issuer interfaces. Existing issuers, integrations, and collector-facing tools will continue to function, but the platform itself will no longer receive active development.

“Some operations may also run more slowly as we reduce the resources allocated to the service,” Gonzalez wrote.

The decision, she said, reflects both what POAP accomplished and where its growth ultimately stalled.

“The platform found a clear niche and a group of users who made thoughtful use of it,” she acknowledged. “At the same time, POAP did not expand much beyond that niche.”

From ETHDenver Hackathon to Web3 Staple

POAP’s origins trace back to February 2019, when founder Patricio Worthalter distributed the first digital badges to attendees of the ETHDenver hackathon. Participants claimed the tokens through a link distributed at the event, receiving an ERC-721 NFT that served as a verifiable blockchain record of their attendance.

The idea caught on quickly.

By 2020, POAP migrated to the xDai sidechain — now known as Gnosis Chain — to reduce gas fees and scale issuance. As the crypto ecosystem expanded, POAPs became a popular way for communities to recognize participation and create on-chain memories.

Discord communities, DAOs, DeFi protocols, and metaverse platforms adopted POAPs to reward engagement, gate token drops, experiment with governance, and build loyalty programs.

The platform’s reach soon extended beyond crypto-native communities. Brands including Adidas, Porsche, Johnnie Walker, and TIME Magazine experimented with POAP-based campaigns to engage event audiences and reward participation.

In 2022, POAP raised $10 million in a seed round led by Archetype, with participation from investors including Sapphire Sport, Collab+Currency, Protocol Labs, and MetaCartel Ventures.

By mid-2023, more than 6.7 million POAPs had been minted by over 37,000 unique issuers.

Growth That Hit a Ceiling

Despite that adoption, Gonzalez’s announcement acknowledges the limits of POAP’s model.

The platform successfully carved out a niche — particularly within crypto-native communities — but struggled to evolve into the broader infrastructure for digital collectibles that the team had originally envisioned.

The company had already hinted at sustainability challenges. In April 2023, POAP announced it would begin charging commercial clients for access to its services, ending years of unlimited free minting for all users. At the time, Gonzalez said the change was intended to support the platform’s “long-term sustainability.”

That shift appears not to have generated enough momentum to sustain further expansion.

“Running POAP has made it clear to us that digital collectibles are still an emerging medium,” Gonzalez wrote. “The tools that exist today often reflect the constraints of the systems they were built on, rather than the needs of the communities using them.”

A Pivot, Not a Shutdown

Gonzalez framed the move not as a shutdown but as a strategic shift.

The POAP team is now focusing on building what she described as “a standard for open collectibles” alongside a platform that would offer a canonical implementation — a more permissionless and sustainable foundation for digital collectibles.

“If collectibles are going to become a durable part of how people organize events, recognize participation, and preserve shared moments, they will need better foundations,” she wrote.

The current POAP platform could eventually connect to whatever system the team builds next, though Gonzalez said those details remain undecided.

For existing issuers, the immediate impact is limited. Their drops remain intact, integrations continue to function, and previously minted POAP tokens will remain on-chain.

The main change taking effect March 16 is that new issuers will no longer be able to join the platform.

The End of an Era for Web3 Memory-Making

POAP’s move into maintenance mode marks the end of an important chapter in Web3’s social infrastructure.

For years, a POAP badge was one of the simplest and most recognizable signals in the crypto community — proof, literally, that you were there. Wallets filled with POAPs became a kind of on-chain résumé, documenting conferences attended, communities joined, and moments shared across the crypto ecosystem.

Whether the next iteration of what POAP is building will recapture that cultural significance — and expand it beyond crypto-native communities — remains an open question.

But Gonzalez closed the announcement with a note of gratitude for the community that helped shape the platform.

“Many of the most interesting ideas about digital collectibles did not come from us but from the people experimenting with the tools,” she wrote.

“Thank you to everyone who helped test the limits of what this first version could do.”

Crypto World

fewer side events, more AI agents and builder focus

ETHDenver 2026 saw side events collapse, prize pools slashed, and AI × crypto dominate the floor, leaving a leaner, builder‑driven conference with prediction markets in focus.

Summary

- Side events dropped from 668 in 2025 to about 215, as timing near Lunar New Year, rival gatherings like WLFI’s Mar‑a‑Lago forum, and tighter budgets cut global attendance.

- AI × crypto became the main story, with Futurllama tracks, Sentient’s Open AGI Summit, and robotics projects making the venue feel closer to an AI expo than a DeFi show.

- The BUIDLathon stayed builder‑centric but with prize pools slashed from roughly $1.03m to $132k, messy judging, and a tilt toward AI‑agent, UX‑heavy and prediction‑market experiments.

ETHDenver 2026 saw side events crater from 668 in 2025 to roughly 215 this year, a brutal 68% drop that signals a tighter, efficiency‑driven market. Timing near Lunar New Year hurt Asian teams, while competing gatherings like the WLFI Forum at Mar‑a‑Lago siphoned OGs and core builders away. The result: ETHDenver remained a North American hub, but with visibly fewer international attendees and reduced global influence.

Public chain ecosystems also pulled back from the old spray‑and‑pray visibility model. Monad and X Layer were relatively active, with Monad hosting three events and X Layer sponsoring the main stage, while Solana limited itself to one small but high‑quality event. Across the board, teams shifted to a minimal, symbolic presence and cost‑effectiveness over sheer volume and hype.

AI × Crypto Becomes the Main Narrative

Onsite, ETHDenver felt less like a pure crypto conference and more like an AI × crypto expo. The venue split into five stages, with the Futurllama track (AI/DePIN and frontier trends) drawing the largest crowds. Parallel AI‑themed gatherings like Sentient’s Open AGI Summit were packed, in some cases busier than official main‑venue areas.

The project mix changed accordingly. Robots, robotic arms, and embodied intelligence plays like PrismaX and Gensyn made the floor look more like CES than a DeFi show. Many teams still wore the Web3 label, but their core story shifted from chains, DeFi, or wallets to agents, chatbots, and application‑layer AI products. One exchange strategy lead said the real opportunity is not building “big models” but embedding AI directly into exchange products, including an in‑exchange LLM that reads real‑time news, recommends trades, and executes them inside a chat interface.

Builder Culture Intact, But Prize Pools Shrink

Despite the AI pivot, ETHDenver remained builder‑centric. The final day’s schedule handed the expo floor entirely to the hackathon and Builder Workshop, while side events from chains like Base were pointed squarely at developers. Base also tested Braindate, a structured social tool where attendees could spin up or join themed sessions instead of aimless networking.

The BUIDLathon format shifted to a front‑loaded model, adding an online hacking phase with topics announced a week early; on‑site days were cut from eight to four, turning Denver into a finishing sprint rather than the starting gun. The money told the harsher story: the prize pool collapsed from 1.03 million dollars last year to 132,000 dollars, with sponsor budgets more concentrated and skewed toward AI‑oriented tracks. Judges rewarded projects that translated AI + crypto into mass‑market use cases, from an “AI girlfriend” with tipping incentives to an AI‑agent ad protocol using on‑chain validators to prove task completion before paying out budgets.

Messy Judging, But Diverse Builders

The hackathon judging process felt improvised. Teams pitched the main track in five‑minute slots to 2–3 judges, favoring projects that could communicate clearly, be memorable, and entertain over pure technical rigor or polish. Sponsor‑track judging, including Base and others, was described as more chaotic, with unclear queues that stressed teams’ ability to navigate on‑site logistics as much as present their work.

Still, the participant base was notably diverse: students, veteran builders, industry lifers, and playful creators, spanning AI, DeFi, GameFi, and hybrid experiments. Newcomers were not locked into “classic” crypto primitives; instead they blended AI, gaming, advertising, and social layers with on‑chain rails as a default assumption.

Prediction Markets and Bear‑Market Resilience

Prediction markets got their own spotlight at a Monad‑hosted Frontier Markets event. Speakers flagged three main structural pain points: liquidity scarcity, constantly expiring markets that fragment and migrate liquidity, and the difficulty of attracting LPs to long‑tail markets versus the perpetual futures model familiar to traditional market makers. Because prediction markets can gap to zero at settlement, leverage, MM design, and risk controls are more complex, further deterring large traditional players.

At the same time, popular markets tend to pull in retail‑heavy liquidity, suggesting the key edge is not another generic prediction DEX but whoever can consistently create compelling markets and wrap them in a better UX. Overall, ETHDenver 2026 reads as a bear‑market snapshot: less euphoria, smaller budgets, but a core of builders, early‑stage investors, and imperfect yet promising business models feeling around for the next crypto cycle.

Crypto World

What Whale Dormancy Could Mean for the Market

Retail traders are selling Bitcoin at losses while long-term holders remain inactive, a split analysts say could tighten supply conditions.

Bitcoin is trading near the $70,000 mark, with on-chain data showing a widening gap between retail investors dumping their holdings and long-term holders staying completely still.

That split is drawing attention from analysts who say the pattern could be setting up conditions for a supply squeeze.

Exchange Reserves Are Falling While Small Holders Sell

According to analyst GugaOnChain, since the start of the year, Bitcoin exchange reserves have dropped by around 204,000 BTC, going from 2.99 million to 2.786 million BTC. This means that there are fewer units available on exchanges for selling, even with short-term holders offloading their stash.

The analyst mentioned that a metric tracking whether recent buyers are gaining or losing when they sell, known as the Short-Term Holder Spent Output Profit Ratio (SOPR-STH), is at 0.97. According to them, a reading below 1.0 means that holders are in the red, which could be because they are selling out of panic rather than as part of a strategy.

Meanwhile, long-term whales are not moving, with GugaOnChain pointing out that older coins, most of which are sitting on huge unrealized gains, have not been touched. Per the on-chain technician, selling pressure at this stage is “purely emotional,” driven mostly by newer traders who bought their BTC at higher prices and are now cutting losses.

A market update from fellow CryptoQuant contributor burakkesmeci added a related data point. They wrote that Bitcoin whales who have held the cryptocurrency for less than 155 days are sitting on an average cost basis of about $85,600. And with BTC trading well below that level, it means that those newer whales are underwater.

According to the analyst, Bitcoin’s bull cycles have only resumed once the price reclaims and holds above this group’s cost basis.

You may also like:

“Looking at Bitcoin’s cycles, the pattern is consistent,” they wrote. “When price falls below the STH whale cost basis, bear season begins — when price reclaims and holds above it, bull season follows.”

Apparently, that level was tested in January but held as resistance and subsequently pushed BTC down to the $60,000 level.

Stress Test Passed, But Questions Remain

Last weekend gave the market an unexpected data point when oil prices jumped sharply, but Bitcoin held above $70,000. Fundstrat’s Tom Lee said it was a sign that Bitcoin was “coming back in vogue as a store of value.”

That argument got a brief test yesterday, when the king cryptocurrency whipsawed between roughly $69,000 and $71,200 after U.S. President Donald Trump claimed on social media that there was “nothing left to target” in Iran. Within minutes, his comment added nearly $2,000 to BTC’s price, even though it later retreated.

At the time of writing, price data from CoinGecko showed Bitcoin down 3.7% over the last seven days, underperforming the broader crypto market, which dropped around 1.7% in the same period. Meanwhile, the one-year return is at -15%, with Bitcoin also sitting nearly 45% below its all-time high.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Senate Votes to Include CBDC Ban in Bipartisan Housing Bill

The United States Senate took a clear stance on central bank digital currencies (CBDCs) by attaching a prohibition to the 21st Century Road to Housing Act. In a vote that reflected strong bipartisan skepticism about a government-issued digital dollar, the chamber approved an amendment barring the Federal Reserve from issuing CBDCs through December 31, 2030. The measure, which passed 89-10, would force the Fed to refrain from creating or facilitating a central bank digital currency or any digital asset substantially similar to one, whether directly or through intermediaries. While the amendment imposes a hard stop on CBDCs, it leaves room for private, dollar-denominated digital currencies that are open, permissionless, and private—such as stablecoins.

Beyond the legislative language, the discussion underscored a broader rift over the future of digital money in the United States. Proponents of private digital dollars argue that dollar-pegged, open financial instruments could bolster payment efficiency and resilience, while CBDC skeptics warn of state surveillance and centralized control. The amendment’s language and the surrounding debate reflect a pivotal moment in which lawmakers weigh the balance between financial innovation and constitutional protections.

Key takeaways

- The Senate approved an amendment to the 21st Century Road to Housing Act that would block the Federal Reserve from issuing a central bank digital currency until at least the end of 2030, in a 89-10 vote.

- The amendment prohibits the Board of Governors of the Federal Reserve System or a Federal Reserve Bank from issuing or creating a CBDC, or any digital asset substantially similar to a CBDC, directly or indirectly through a financial intermediary.

- Open, permissionless, and private dollar-denominated digital currencies—such as stablecoins—are explicitly not prohibited by the bill, signaling a preference for private digital dollars over a government-run CBDC.

- Lawmakers framed CBDCs as potential tools for surveillance and control, with a coordinated push from some members to secure a permanent ban rather than a temporary moratorium.

- Prominent voices in the debate, including Representative Ralph Norman and Representative Warren Davidson, criticized CBDCs as threats to economic freedom and privacy, while figures such as Ray Dalio warned of expanded government reach under a CBDC regime.

Market context: The bill arrives amid ongoing national discussions about how to regulate and deploy digital money, balancing innovation with consumer protections and privacy considerations. The stance on CBDCs could influence how the administration and regulators approach digital payments, stablecoins, and potential future policy tools in a rapidly evolving sector.

Why it matters

The amendment’s passage signals a legislative preference for limiting federal influence over the form and reach of digital money in the near term. By barring CBDC issuance through 2030, lawmakers create a period of regulatory ambiguity for the Fed and other federal agencies, potentially slowing any centralized digital-dollar program and shaping private sector experimentation in stablecoins and other dollar-linked instruments. The carve-out for open, permissionless, private digital currencies acknowledges the continued vitality of the private sector in building digital payment rails, while also underscoring that Congress remains wary of government-run monetary infrastructure.

The rhetoric surrounding the bill reflects broader concerns about financial sovereignty. Critics argue that CBDCs could enable pervasive financial surveillance, programmable money, and coercive policy tools, whereas proponents contend that a well-regulated CBDC could modernize payments, increase financial inclusion, and improve monetary policy transmission. The debate has drawn inputs from lawmakers across the spectrum, including a March 6 letter signed by more than 30 representatives urging a permanent CBDC ban rather than a temporary halt. The document frames CBDCs as a potential expansion of governmental power over the private economy, a theme that recurs in the remarks of opponents who emphasize civil liberties and market freedom.

In parallel, notable financial thinkers have weighed in on the implications of CBDCs. Ray Dalio, a prominent investor, has warned that CBDCs could drastically expand governmental control over individuals’ finances, with remarks highlighting concerns about privacy and state reach. These comments have fed into the broader political narrative that a centralized digital dollar would reshape how citizens interact with money and how monetary policy translates into daily life. At the same time, discussions about stablecoins—dollar-pegged instruments issued by private entities—are often cited as a counterpoint to CBDCs, with supporters arguing they offer a market-driven alternative while critics worry about regulatory gaps and systemic risk.

Overall, the Senate’s move to insert a CBDC prohibition into housing legislation places the issue at the intersection of monetary policy, civil liberties, and the evolving infrastructure of digital finance. The amendment’s language draws a bright line around government-issued digital money, while leaving room for private digital currencies to operate under market-driven incentives and existing financial regulations. The contrast between a centrally administered CBDC and privately issued stablecoins represents a central tension in the governance of digital money—a tension that lawmakers will continue to navigate as the policy conversation unfolds.

What to watch next

- Bridge to the House: Monitor whether the House of Representatives adopts a companion provision or different language regarding CBDCs in the ongoing version of the bill.

- Averting amendments: Track any amendments introduced in committee that could alter the CBDC ban’s scope or timing.

- GENIUS Act progress: Follow developments related to the Guiding and Empowering Nation’s Innovation for US Stablecoins (GENIUS) Act and its implications for private digital currencies.

- Fed communications: Watch for forthcoming statements or policy papers from the Federal Reserve that outline its stance on digital currencies and potential future pilots or research.

- Regulatory framework for stablecoins: Expect continued scrutiny of dollar-denominated private digital currencies and any broader regulatory proposals affecting stablecoins.

Sources & verification

- Text of the amendment in the 21st Century Road to Housing Act (PDF MIR26311) from the US Senate.

- Senate vote tally showing the 89-10 passage of the amendment.

- Letter signed by over 30 lawmakers urging a permanent CBDC ban, discussed in public statements and on social media.

- Interviews and remarks cited regarding CBDC surveillance concerns, including comments from investors and policymakers.

- Documentation and analysis related to the GENIUS Act and its relevance to private stablecoins.

Why it matters (expanded)

The legislative stance reflected in the amendment provides a concrete waypoint in the United States’ evolving stance on digital money. If the House and the executive branch align with or diverge from this approach, the policy trajectory for CBDCs could become clearer or more contested. For market participants, the absence of an immediate CBDC program reduces near-term policy risk around central bank digital money while maintaining a focus on the growth and regulation of private digital currencies. For builders and investors, the distinction between a regulated private dollar and a hypothetical government-issued CBDC continues to shape product design, compliance strategies, and the risk calculus around digital payment ecosystems.

Key figures and next steps

Lawmakers cited in the debate emphasize a preference for preserving financial privacy and avoiding centralized tools that could enable monetary controls. While the Senate acted decisively on the amendment, observers say the broader fight over CBDCs and digital dollars will likely persist across committee hearings, floor votes, and regulatory proposals. The coming months could reveal whether the administration decides to pursue a CBDC variant through different channels or to double down on private-sector-led digital currencies as the primary vector for modernization in payments and monetary policy tools.

What this means for users and investors

For users and investors, the latest development signals a continued preference for private, dollar-denominated digital assets over a federally issued CBDC in the near term. It also reinforces the importance of robust regulatory frameworks for stablecoins and other digital instruments that could influence liquidity, settlement speed, and monetary policy transmission in the digital asset space. As lawmakers debate the pros and cons of centralized digital money, the market will likely watch for any shifts in Fed communications, related legislative efforts, or new initiatives aimed at balancing innovation with privacy and financial stability.

Crypto World

Outset Media Index debuts to standardize media analysis as AI answers challenge the old search model

Outset Media Index (OMI) is now in soft launch, introducing what its creators describe as the first standardized system for benchmarking media outlets.

OMI organizes familiar traffic indicators from partner sources such as Similarweb and Moz, adds proprietary research metrics for practical context and turns this data into a single analytical framework that makes analysis repeatable, transparent and adaptable to different workflows.

Teams that run media operations, including advertisers, marketers, PR agencies and publishers, can use OMI to plan campaigns with greater clarity, manage media budgets more deliberately and improve campaign outcomes over time.

Internally, the platform is supported by a broader analytical layer within the Outset PR ecosystem. While OMI focuses on measuring how outlets perform, Outset Data Pulse interprets those signals through research reports that examine media trends and structural changes shaping the industry.

Additional tools help track how coverage circulates after publication. A syndication map follows how articles travel through aggregators and secondary outlets, while an automated parser monitors republications across large numbers of media sites.

Behind the index sits a methodology designed to keep rankings consistent. Before scoring, inputs are reviewed, normalized and consolidated into several weighted parameters that apply across all listed outlets.

Importantly, OMI operates independently from commercial influence. Positions in the index cannot be bought or negotiated. Publications do not pay for placement, and scores cannot be adjusted on request.

Structured intelligence that examines what other monitoring tools miss

Outset Media Index currently tracks over 340 outlets with active crypto coverage, including specific publications and broader fintech portals with dedicated crypto sections, through 37 metrics and two scoring frameworks.

Traffic estimates, SEO visibility, pricing, referral patterns and market knowledge all reveal something, but rarely in one comparable structure. OMI brings those signals together so users can see not just how visible a media outlet looks at a glance, but also how it behaves over time, how audiences interact with it, how the editorial team approaches collaboration and how coverage continues to move after publication.

Some metrics focus on scale and traffic quality. Others show where the readership is concentrated and how well a publication fits regional or language-specific campaigns. The framework also includes indicators designed to capture signals that traffic alone cannot explain.

For example, Unique Score separates outlets with a stable audience from those driven mostly by short bursts of attention. Reading Behavior highlights where people spend time with content and where they simply pass through. Reprints and a corresponding Reprints Score track how original coverage echoes through aggregators and help identify strong syndication networks.

“We also introduced two summary scores,” said Sofia Belotskaia, product lead at Outset Media Index. “The General Score shows how an outlet performs overall, while the Convenience Score looks at the practical side of collaboration – editorial control, turnaround speed, coverage options and price-to-reach alignment. The idea is to make it possible for users to see both the actual performance of a publication and the realities of working with it without having to dig through dozens of separate indicators.”

Among other things, OMI reflects the discovery layer forming around AI, surfacing outlets that receive traffic from LLM-driven interfaces.

If AI answers the question, who clicks the article?

Across the publishing industry, AI-generated answers now appear directly inside search results. Users no longer need to click through to websites for information. The change raises an uncomfortable question: what happens when search stops sending readers?

Some findings suggest referrals from search engines could fall by as much as 43% over the next three years as AI summaries and chat-style tools increasingly answer questions directly on the results page.

The Guardian recently cited data showing that search traffic to news sites has already fallen by roughly a third in the past year, and AI-generated overviews are showing up in about 10% of search results in the United States.

For publishers that spent years building strategies around search visibility, the change is impossible to ignore. If readers no longer need to click through to a story to get information, the click itself becomes a less reliable signal of where attention is actually going.

“Since AI answers started replacing links, the way we look at media performance has had to change as well,” said Mike Ermolaev, founder of Outset Media Index and Outset PR. “That’s the kind of environment OMI is meant to help people navigate.”

When discovery changes, measurement follows

For now, Outset Media Index enters the industry conversation as an early attempt to make sense of ongoing media shifts. The platform offers one way of analyzing how media attention moves today – not only through traffic, but through engagement, distribution and the practical dynamics of working with outlets.

What that approach ultimately becomes will depend on how the system develops from here. The soft launch will reveal how the index may grow into a broader reference point for teams working in a complex, high-cost media landscape where the path between a story and its audience is becoming less direct.

-

Business6 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

News Videos3 days ago

News Videos3 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Ann Taylor

-

Crypto World3 days ago

Crypto World3 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech2 days ago

Tech2 days agoA 1,300-Pound NASA Spacecraft To Re-Enter Earth’s Atmosphere

-

Tech2 days ago

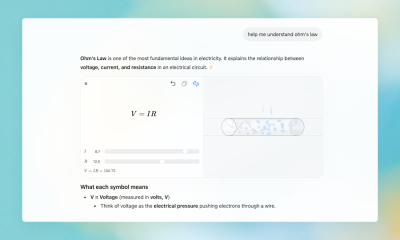

Tech2 days agoChatGPT will now generate interactive visuals to help you with math and science concepts

-

Politics6 days ago

Politics6 days agoTop Mamdani aide takes progressive project to the UK

-

Business2 days ago

Business2 days agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Sports5 days ago

Sports5 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports5 days ago

Sports5 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

NewsBeat1 day ago

NewsBeat1 day agoResidents reaction as Shildon murder probe enters second day

-

Entertainment6 days ago

Entertainment6 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business4 days ago

Business4 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Business2 days ago

Business2 days agoSearch Enters Sixth Week With New Leads in Tucson Abduction Case

-

NewsBeat3 days ago

NewsBeat3 days agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech3 days ago

Tech3 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Business3 days ago

Business3 days agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat1 day ago

NewsBeat1 day agoI Entered The Manosphere. Nothing Could Prepare Me For What I Found.

-

Business6 days ago

Business6 days agoIran war enters second week as Trump demands ’unconditional surrender’

-

Sports4 days ago

Sports4 days agoSkateboarding World Championships: Britain’s Sky Brown wins park gold