Bitcoin (BTC USD) is officially back in the spotlight; this time, the numbers are even crazier.

After rocketing past $95,000 this week, Bitcoin price is flashing some of its strongest technical signals since the 2020-2021 bull market.

Top crypto analysts aren’t longer calling for a $100K breakout. Some are projecting that BTC USD could hit $130K, $163K, and even $200K before the end of 2025.

Bitcoin Analysts Spotlight Bitcoin Power Law Curve For BTC USD Acceleration

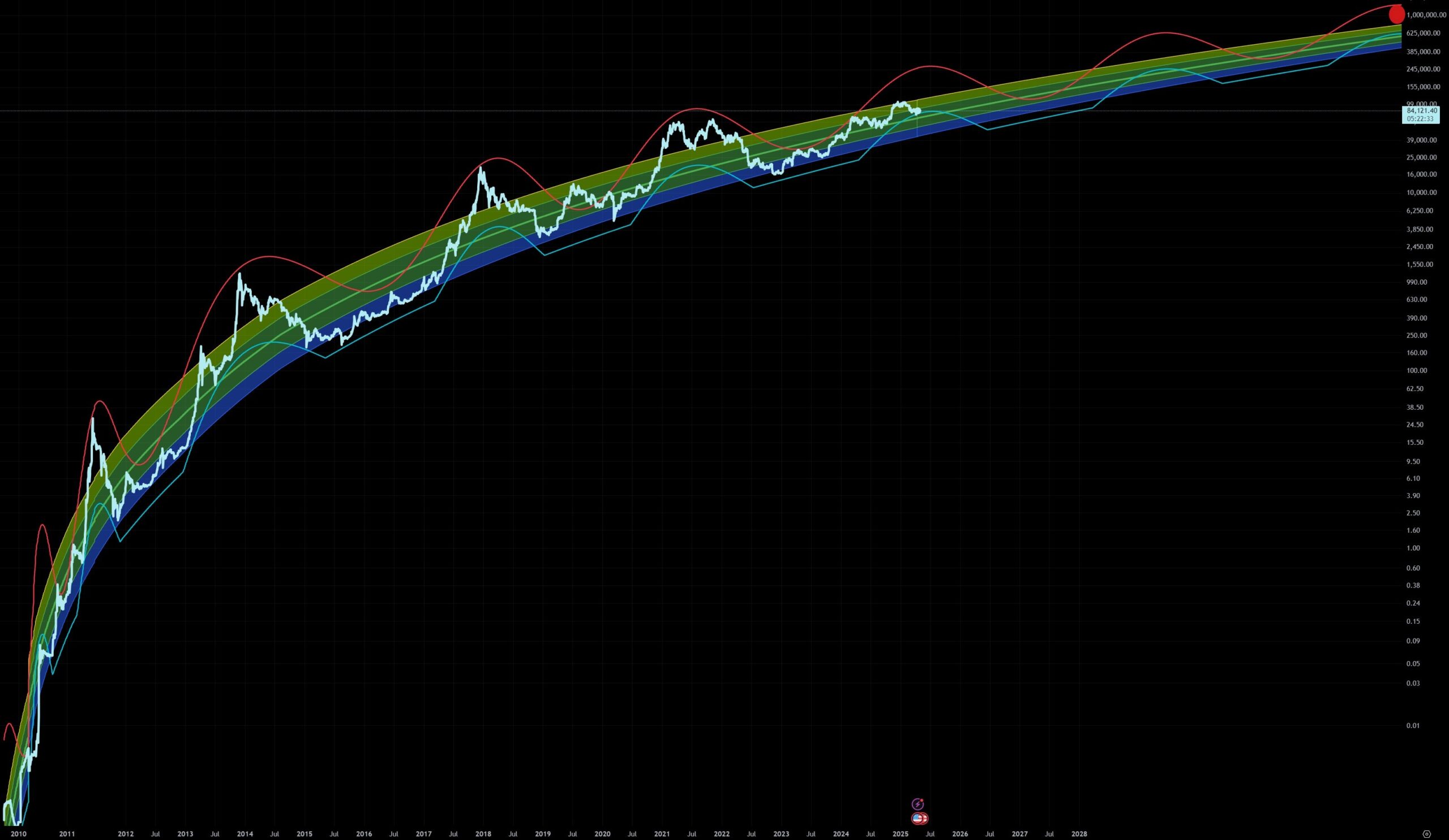

One of the most exciting models fueling this new optimism is the Bitcoin Power Law curve, a long-term framework based on network growth, first popularized by 21st Capital’s Sina.

According to the model, Bitcoin’s surge into the “transition zone” earlier this month signals that an acceleration phase could be imminent, pushing BTC price targets higher and faster than many expected.

(Source)

Even more aggressive predictions are emerging. Pseudonymous analyst apsk32 now projects Bitcoin reaching $200,000 or more by Q4 2025, based on historic four-year cycle patterns and the gold-BTC lag effect.

And the momentum isn’t just technical.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Bitcoin Spot ETF Inflows Roar Back to Life: $ 2.7Bn Institution Buys Form Biggest Week Since December

ETF inflows have roared back, with over $2.7 billion pouring into Bitcoin ETFs this week alone, the largest since December 2024.

Short-term holders are selling into strength, while long-term diamond hands are stacking at one of the fastest recorded rates. Meanwhile, traditional risk assets like stocks and gold are faltering, hinting at an accelerating decoupling that could leave Bitcoin soaring.

In short: this could be the moment Bitcoin decouples, accelerates, and never looks back – exactly what early investors have been waiting years to see.

But here’s the kicker: While Bitcoin is gearing up for a potential six-figure rally, most retail investors are still sitting on the sidelines. Many missed Bitcoin’s early days when 10,000 BTC could buy two pizzas.

Now, with Bitcoin already near $95,000, many feel that riding this next explosive wave without a six-figure starting point is out of reach.

That’s where BTC Bull Token ($BTCBULL) enters the scene – offering one of the most exciting ways for everyday investors to lock into Bitcoin’s upside.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

The Next Bitcoin Boom Is Coming and BTC Bull Token ($BTCBULL) Could Be the Smartest Way to Play It

Bitcoin’s recent breakout above $90,000 isn’t just another price surge – it’s a bull signal.

The smart money, long-term holders, ETF giants, and now whales stacking at record rates – are preparing for something bigger: the long-awaited second $100,000 breach.

ETF inflows are surging, options traders are loading up on $100K+ call bets, and historical on-chain patterns are flashing signs of a major supply crunch ahead.

But here’s the reality: buying a whole Bitcoin at these levels is out of reach for most people. Even owning Bitcoin doesn’t guarantee capturing the explosive upside at key moments.

Early movers are turning to the BTC Bull Token ($BTCBULL), a groundbreaking project that rewards holders with real Bitcoin every time BTC surpasses major price milestones.

This isn’t just another crypto token promising the moon.

BTC Bull has built a real economic model directly tied to Bitcoin’s historic trajectory. As Bitcoin powers through $100K, $150K, $200K, and beyond, $BTCBULL holders receive Bitcoin airdrops – actual BTC flowing to their wallets, triggered automatically by success.

Every significant price jump doesn’t just reward you. It also triggers a permanent burn of $BTCBULL supply, meaning fewer tokens chasing bigger rewards as Bitcoin’s bull market heats up.

This mechanism mirrors the magic that made Bitcoin what it is today: scarcity and rising demand.

Already, the presale has raised over $5 million. Momentum is building fast, and the early advantage window is rapidly closing with the next price hike just days away.

At just $0.00248, BTC Bull Token offers the ground-floor positioning that most people dream about when they look back at Bitcoin’s $1 or $10 days.

And thanks to complete audit certifications from Coinsult and SolidProof, plus full integration with Best Wallet for instant staking and airdrop tracking, BTC Bull isn’t just a clever idea — it’s a fully operational system designed to reward long-term conviction.

In the past, the Bitcoin opportunity was only available to the few who acted before the rest of the world caught on.

Today, BTC Bull Token gives everyday investors a second shot.

The next Bitcoin milestones are coming. Will you watch? Or will you collect rewards every step of the way?

Visit BTC Bull Token and Get Started Now

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post BTC USD Rockets Higher as Analysts Adjust to $200K Bitcoin Target Amid Retail Rush appeared first on 99Bitcoins.

Source link

Gym & Fitness4 weeks ago

Gym & Fitness4 weeks ago

Gym & Fitness6 days ago

Gym & Fitness6 days ago

Entertainment1 month ago

Entertainment1 month ago

Gym & Fitness4 weeks ago

Gym & Fitness4 weeks ago

Entertainment2 weeks ago

Entertainment2 weeks ago

Gym & Fitness2 weeks ago

Gym & Fitness2 weeks ago

Gym & Fitness2 weeks ago

Gym & Fitness2 weeks ago

Entertainment1 month ago

Entertainment1 month ago