Crypto World

Cardano price prediction ahead of CME ADA futures launch

Cardano price continued its strong downward trend, reaching its lowest level since February 2021, as the crypto market crash accelerated.

Summary

- Cardano price dropped to a crucial support level as the crypto market crash continued.

- CME will launch its ADA futures on Monday next week.

- ADA’s price action will depend on the performance of the broad crypto market.

Cardano (ADA) token was trading at $0.2650, down by 80% from its highest point in December 2024. It has also retreated by 91% from its all-time high of $3.

A potential catalyst for ADA’s price will be the upcoming CME Group futures listing on February 9 this year. This is a major listing that will make it available to institutional and retail traders.

Historically, such important launches normally lead to higher prices. For example, tokens such as Solana (SOL) and Ripple (XRP) jumped after their futures launched.

However, in Cardano’s case, there is a possibility that the rebound will not happen after the futures launch. First, the launch will occur during a crypto market crash. As such, the broader sentiment in the industry may outweigh the importance of the futures listing.

Second, Cardano may remain under pressure since the ADA futures launch has been priced in by market participants. Additionally, Cardano has lost favor with investors in the past few years because it has been left behind by similar chains like Solana, BNB Chain, and Ethereum.

Cardano has failed to attract major oracle networks like Chainlink. Its total value locked in the DeFi industry is less than $300 million, which is much lower than the billions in assets in the industry. Also, it has a small market share in the stablecoin industry, with just $30 million in assets.

Charles Hoskinson and the team are working to address these issues through a 70 million ADA fund launched last year. The fund’s goal is to attract more oracles, tier-1 stablecoins, and analytics tools. Also, Cardano is preparing for the Midnight mainnet launch either this month or in March.

Cardano price technical analysis

The weekly chart shows that the ADA token has been in a strong downtrend in the past few months. It retreated from a high of $1.3296 in December 2024 to a low of $0.2360. Its lowest level this week was notable as it has failed to move below it several times since December 2022.

ADA price has moved below the 50-week and 100-week Exponential Moving Averages, which have made a bearish crossover. The Relative Strength Index has moved into the oversold zone at 30.

Therefore, the most likely Cardano price prediction is neutral. On the positive side, it has always bounced back whenever it reached this support level. This means that it may rebound again in the coming weeks.

On the other hand, losing this support will lead to more downside, potentially to the key level at $0.100.

Crypto World

Crypto Crash Sparks Political Divide as Democrats Target Trump

TLDR

- The Democratic Party’s tweet linking Trump to the crypto crash sparked backlash from both political and financial leaders.

- Anthony Scaramucci criticized the Democrats’ tweet, calling it foolish and highlighting Trump’s advantage in the political arena.

- Bitcoin’s price dropped to $60,245, leading to a $2.6 billion market liquidation, but the cryptocurrency quickly rebounded.

- Ethereum and other altcoins showed recovery, with XRP surging by 22% and Solana and Dogecoin seeing gains.

- Despite the rebound, analysts remain cautious about Bitcoin’s long-term price stability amid market volatility.

The recent crypto crash has sparked political tensions, with the Democratic Party drawing criticism for its reactions to Bitcoin’s decline. Bitcoin’s value dropped significantly to $60,000, triggering a loss of billions in investor wealth. The Democratic Party’s controversial social media post has added fuel to the fire, leading to backlash from both political and financial leaders.

Democrats Criticize Trump Amid Crypto Crash

The Democratic Party’s recent tweet linked President Donald Trump to the crypto crash, showing a chart of Bitcoin’s fall. The post included an image of Trump wearing a MAGA hat, which immediately caused a stir among investors and party members. Many saw the tweet as insensitive, especially as it highlighted the financial pain affecting crypto investors.

Anthony Scaramucci, former White House communications director, sharply criticized the tweet, calling it “tops” in terms of foolishness. He argued that the best asset Trump has is the Democratic Party’s inability to handle the situation. The crypto market experienced heavy losses, with Bitcoin dropping by 33.1% over the past year.

The tweet followed a statement from California Governor Gavin Newsom’s office, further criticizing Trump’s role in the crypto market’s downturn. Newsom’s press office suggested that Trump was crashing the market faster than he could manage a scandal. This comment heightened partisan tensions, drawing further attention to the role of politicians in the crypto space.

Bitcoin’s Volatile Price and Its Impact

Bitcoin has been at the center of the crypto crash, with its price plummeting to as low as $60,245. The cryptocurrency’s value quickly bounced back to $70,000 in a single day, showing its volatile nature. As Bitcoin’s price fluctuates, investors remain on edge, with many seeing the dip as an opportunity to buy.

The volatility of Bitcoin is heightened by a large number of options set to expire, worth over $2.1 billion. A significant portion of liquidations came from long positions, with $1.35 billion attributed to Bitcoin. This shows how deeply the market is influenced by investor behavior, making it prone to rapid changes.

While Bitcoin has seen a short-term recovery, analysts are cautious about its future performance. The put/call ratio at 0.60 reflects an earlier bullish sentiment before the price drop. Investors are watching closely to see whether Bitcoin’s bounce will be sustained or if further declines are ahead.

Ethereum and Other Altcoins Also Recover

Alongside Bitcoin, Ethereum has also shown signs of recovery after the market’s recent downturn. Ethereum’s value has increased by 5.8% in the past 24 hours, reflecting a broader positive trend in the altcoin market. Other cryptocurrencies like XRP, Solana, and Dogecoin have also experienced gains.

XRP surged by 22%, while Solana and Dogecoin each rose by over 4%. These altcoins have proven resilient amid the larger crypto crash, with many investors shifting focus to these assets. As a result, the overall crypto market cap rose by 4%, reaching $2.39 trillion.

While Bitcoin’s volatility continues to be a concern, altcoins are showing promise as a safer alternative. Ethereum’s rise in particular suggests that the broader market may be slowly stabilizing after the crypto crash.

Crypto World

Galaxy Digital shares jump 18% after company approves $200 million buyback

Shares of Galaxy Digital (GLXY) jumped 18% to $19.90 on Friday after the company approved a share repurchase program of up to $200 million, giving it authority to buy back its Class A common stock over the next 12 months.

The buybacks may be executed through the open market, privately negotiated transactions or other methods, including trading plans under Rule 10b5-1, the company said. Galaxy added that it retains the right to suspend or discontinue the program at any time, depending on market conditions and other factors.

The announcement signaled confidence from management that Galaxy’s shares are undervalued and that the firm has excess capital to deploy. Share repurchase programs often support stock prices by reducing the number of shares outstanding, which can boost earnings per share and signal balance-sheet strength. In volatile markets, buybacks can also reassure investors that management believes the company’s fundamentals remain intact.

“We are entering 2026 from a position of strength, with a strong balance sheet and continued investment in Galaxy’s growth,” said Mike Novogratz, founder and CEO of Galaxy. “That foundation gives us the flexibility to return capital to shareholders when we believe our stock doesn’t reflect the value of the business.”

The sharp move higher reflects investor approval of that message.

Galaxy reported fourth-quarter earnings earlier this week that initially weighed on the stock. The company posted a net loss of $482 million for the quarter, sending shares down initially. Despite the quarterly loss, Galaxy said it generated $426 million in adjusted gross profit for the full year and ended the year with $2.6 billion in cash and stablecoins, underscoring its liquidity position.

Other crypto stocks and major cryptocurrencies were also green no the day’s trading, with bitcoin climbing back to $70,000 and ethereum breaking $2,000 over the last 24 hours. Coinbase (COIN) had climbed over 10% to $163. In more traditional markets, the Dow Jones Industrial Average broke 50,000 for the first time.

Crypto World

Zcash Down Over 50% Since Winklevoss-Backed DAT’s Last Purchase

Cypherpunk launched in November and has accumulated about 290K ZEC so far.

Zcash (ZEC) has fallen roughly 60% from its November 2025 high, extending a multi-month slide that has reversed much of the asset’s Q4 gains.

The privacy-focused coin, which was the top-performing large-cap crypto asset of 2025, began its downward trend in December, shortly after the Winklevoss-backed Zcash treasury company Cypherpunk Technologies last disclosed a ZEC purchase, its third since launching.

Cypherpunk, which launched in November as a Zcash-focused treasury company, last reported buying ZEC on Dec. 30, 2025, bringing its holdings to 290,062.67 ZEC. The spot price of Zcash has dropped over 50% since then.

The firm hasn’t announced any new purchases, and CoinGecko data shows total holdings have remained the same since.

Data shows the company paused accumulation after reaching about 1.76% of ZEC’s total supply. Cypherpunk has said it aims to build a position equal to 5% of the token’s supply.

With an average ZEC purchase price of about $334, Cypherpunk Technologies is sitting on an unrealized loss of $25.73 million, down 26.5%, with ZEC trading around $245 at press time.

ZEC kicked off a multi-month rally this fall, starting in late September, reaching as high as $700 in mid-November. While the privacy coin has retraced much of its 2025 gains, it’s still trading almost 400% higher than its pre-rally levels in September.

The Defiant reached out to Cypherpunk to clarify its plans for the DAT, but hasn’t received a response by press time.

Meanwhile, Cypherpunk’s shares have dropped about 40% over the past 30 days, though they remain over 100% higher than in November, before the company rebranded from a biotech firm, Leap Therapeutics, Inc, to a Zcash DAT, according to data from Google Finance.

Top DATs Keep Buying

Cypherpunk’s pace of ZEC purchases stands out against more aggressive digital asset treasury (DAT) strategies elsewhere in crypto. The original and largest DAT, Michael Saylor’s Strategy, has been making its BTC purchases on a weekly basis for over a year, with few exceptions.

While Strategy’s unrealized losses have ballooned to about $4.36 billion amid the market downturn, the firm has kept up its accumulation cadence, making five Bitcoin purchases so far in 2026, according to the company’s data.

Tom Lee’s BitMine, the largest Ethereum DAT, has kept pace so far this year with the same number of ETH purchases, per data from DefiLlama. BitMine’s unrealized losses reached $6 billion this week as the spot price of ETH slipped below $2,000.

Amid Cypherpunk’s dropping shares and rising paper losses, Gemini, the crypto exchange founded by the Winklevoss twins, announced this week that it’s restructuring its business.

The company said in a blog post on Thursday, Feb. 5, that it plans to cut roughly 25% of its remaining workforce and exit Europe, the UK, and Australia, as it doubles down on the U.S. market.

Crypto World

Vitalik Buterin Increases ETH Selling as Price Falls Below $2K

Vitalik Buterin sold over 6,100 ETH as prices slid below $2,000, adding to heavy whale-led selling pressure.

Ethereum co-founder Vitalik Buterin sold thousands of ETH over the past few days as the token fell below $2,000, according to on-chain data shared by Lookonchain.

The sales came during a broader wave of large-holder deleveraging that pushed ETH to multi-month lows and added to already heavy selling pressure across the market.

ETH Sales Coincide With Heavy On-Chain Distribution

On February 5, Lookonchain reported that wallets linked to the blockchain developer had sold 2,961 ETH worth about $6.6 million over three days at an average price near $2,228. Less than 24 hours later, the analytics account said total sales over the same three-day window had risen to 6,183 ETH, or roughly $13.2 million, with the average exit price closer to $2,140 as ETH continued to slide.

Some of the proceeds were quickly redirected, with Buterin transferring about $500,000 he earned from the sale of 212 ETH on February 2 to Kanro, a philanthropic initiative tied to open-source biomedical research.

Kanro Fund confirmed the transfer the same day and said the funds will be used to support anti–airborne-disease and pandemic-related projects. The group also pointed out that the Ethereum stalwart has been funding similar efforts for nearly three years, including a $20 million personal contribution made in October 2025.

Buterin has publicly addressed his broader plans, saying in a recent post on X that he withdrew 16,384 ETH to support work spanning biotech, secure hardware, privacy-focused software, and other areas outside Ethereum’s core protocol. He framed the move as part of a period of tighter spending at the Ethereum Foundation.

Institutions and Whales Repositioning

The price of ETH has faced some severe action in the last few days, falling well below the $2,100 level that many traders viewed as a key support area and underperforming Bitcoin as risk appetite faded across altcoins.

You may also like:

At the time of writing, the world’s second-largest cryptocurrency was trading around $1,900 after losing about 7% in the last 24 hours and more than 30% over the past week. On-chain data suggests the pressure is not limited to retail traders, with a February 5 CryptoQuant report showing U.S. investors have been selling ETH at a discount, pushing the Coinbase Premium Index to its lowest level since July 2022. That pattern points to institutional de-risking during the current correction.

According to Lookonchain, other large holders have also been active. The firm reported on February 6 that Trend Research sold more than 170,000 ETH in under 10 hours to repay loans, while Aave founder Stani Kulechov sold about 4,500 ETH near $1,900.

At the same time, some entities moved the other way, with serial crypto investors, 7 Siblings, buying 9,000 ETH for just under $2,000 each as prices dipped.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin price bounces to $67,000 after Thursday’s bloodbath

- Bitcoin price plunged to $60,000, its biggest single-day fall since the FTX crash.

- Prices rose to above $66,000 as analysts forecast a potential dead cat bounce.

- Market sentiment remains in extreme fear.

Bitcoin fell sharply on Friday, crashing to lows of $60,000, which ignited widespread selling before swiftly staging a dramatic recovery to around $67,100.

The volatile swing has sent the cryptocurrency market sentiment into extreme fear, with top altcoins, including Ethereum, XRP, and Solana, hitting critical support levels below $1,900, $1.40, and $80, respectively.

But after experiencing one of its most severe single-day plunges in history, can bulls sustain the flip?

Bitcoin sees biggest 24-hour dip since FTX crash

As noted, Bitcoin plummeted more than $10,000 in a matter of hours on Thursday, briefly dipping to lows near $60,000.

While Bitcoin has since recovered some ground and stabilised near $67,000 at the time of writing, the broader market remains under pressure following the cryptocurrency’s sharpest one-day decline since the collapse of FTX in November 2022.

Unlike previous sell-offs triggered by clear catalysts such as regulatory actions or exchange failures, the latest downturn appears to have been driven largely by technical factors.

Analysts have pointed to a wave of liquidations and forced unwinding of highly leveraged positions, as traders who had positioned for continued gains were caught off guard by the sudden reversal in momentum.

Crypto analyst and investor Lark Davis shared the following on X:

There’s discussion that Bitcoin’s dump is part of a bigger domino effect.

People borrowed money to buy Bitcoin, gold, and silver. When prices dropped, lenders said “give us more money NOW or we’ll sell your stuff.”

The problem: People didn’t have cash, so they sold their OTHER…

— Lark Davis (@LarkDavis) February 6, 2026

Data from Coinglass showed that more than $2.6 billion worth of cryptocurrency positions were liquidated over the past 24 hours, with Bitcoin derivatives accounting for the largest share.

The sell-off spread across major altcoins. Ethereum fell below $1,800 for the first time in more than a year, while Solana slid to around $67, its lowest level since December 2023.

XRP also came under heavy pressure, touching lows near $1.13 and raising the risk of a move back below the $1 mark for the token linked to Ripple.

Market participants noted that open interest in Bitcoin futures had climbed to record levels before the downturn, leaving heavily leveraged long positions exposed when prices reversed sharply.

Bitcoin price outlook: dead cat bounce or sustained rally?

As Bitcoin trades near $66,000, traders are weighing whether the rebound marks the start of a sustained recovery or represents a short-lived “dead cat bounce” that could give way to renewed losses.

Bearish sentiment remains dominant, with market confidence sliding to extreme lows.

The CoinMarketCap Fear and Greed Index is currently at 5 out of 100, signalling severe investor anxiety.

Despite this, some analysts argue that supportive factors are still present.

The scale of the recent sell-off, driven in part by heavy long liquidations, has raised the possibility of a short squeeze.

If short sellers continue to cover positions, prices could extend their recovery.

For bulls, a sustained move above $70,000 and a retest of $73,000 would be key technical milestones.

However, if momentum weakens amid ongoing macroeconomic and geopolitical pressures, Bitcoin could slip toward $60,000, undermining the rebound.

In that scenario, some market participants see $50,000 as the next potential downside target.

Crypto World

Ripple linked token rockets 18% as bitcoin breaks $70,000

XRP staged a sharp rebound on Friday, rising about 18% over 24 hours to trade near $1.49 after a deep selloff a day earlier made it the worst performer among major tokens.

The move came as bitcoin briefly rose over $70,000 in U.S. morning hours, reversing Thursday’s sharp declines ahead of the weekend.

The bounce came after XRP collapsed to roughly $1.14 in the prior session, a move that triggered heavy liquidations and flushed out traders who had been leaning too hard on leverage.

Data shows short liquidations of roughly $26 million in the past 24 hours, compared with around $30 million in longs from earlier Thursday.

That imbalance matters. It suggests the market wasn’t reacting to fresh bad news as much as it was mechanically clearing out bullish bets as prices slid. Once those positions were forced shut, selling pressure eased and XRP was able to rebound quickly.

The recovery also comes at an awkward time for XRP’s broader narrative. Ripple and its ecosystem have spent the past week pitching a more institutional future for the XRP Ledger, including plans for permissioned markets, lending and privacy tools.

Flare, a closely watched project trying to bring DeFi-style utility to XRP through FXRP, also expanded institutional access through custody firm Hex Trust.

But none of that helped XRP sentiment when the market cracked.

Friday’s rally, then, looks less like investors suddenly buying into the “institutional DeFi” pitch and more like a classic crypto snapback: a steep fall, a leverage wipeout, then a fast rebound once forced sellers are gone.

Meanwhile, a ratio of bullish versus bearish bets on futures tracking XRP shows retail longs got rinsed, but big traders were leaning the other way.

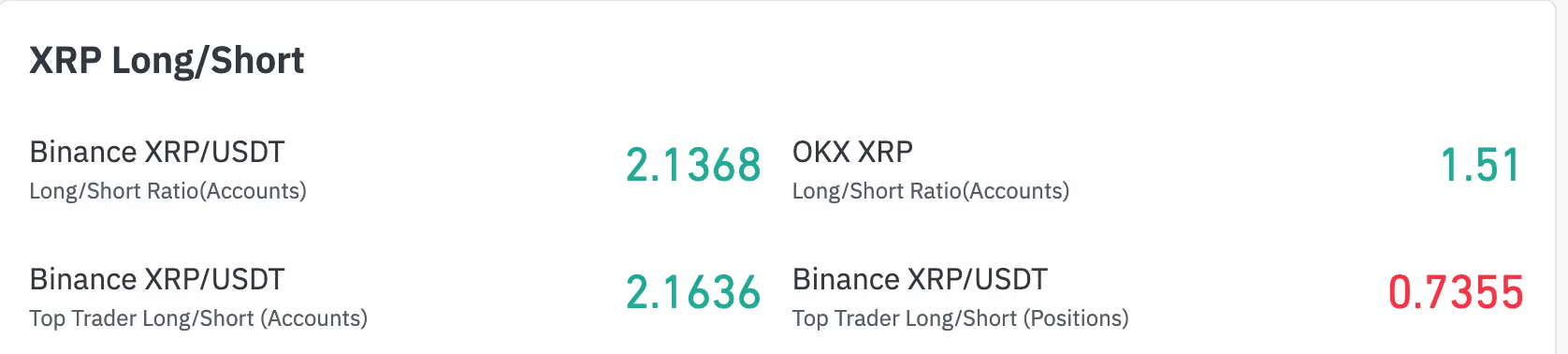

On Binance, the overall account-based long/short ratio is 2.13 as of Friday, meaning there were about 2x more accounts positioned long than short. That’s usually a sign of crowded bullish positioning — lots of smaller traders expecting a bounce.

But at the same time, Binance’s top trader long/short (positions) is ~0.73, which means the biggest traders on Binance were net short.

That split suggests XRP’s dump wasn’t random: it likely ran into a market where smaller traders were stubbornly long, while larger players were positioned to profit from a flush.

And once those longs were cleared, XRP did what it usually does after a wipeout: it snapped back violently, because there wasn’t much selling left.

Crypto World

Sberbank moves toward crypto-backed lending as Russia readies regulation

Russia’s largest bank, Sberbank, is moving toward offering loans secured by cryptocurrency and said Friday it is prepared to coordinate with the country’s central bank on shaping the necessary regulatory framework, according to Reuters.

The lender has already tested the model in January. The bank issued the country’s first bitcoin-backed loan to one of its largest bitcoin miners, IntelionData, calling the transaction a pilot and suggesting it was keen to issue more in the future.

The volume of digital financial asset issuances on the platform hit 408 billion rubles (about $5.3 billion) in 2025 — an increase of 5.6 times versus 2024 (73 billion rubles, or $948 million) and 204 times greater than 2023 (2 billion rubles or $26 million).

Sberbank’s regulated digital financial asset (DFA) business expanded rapidly in 2025, with total issuance reaching RUB 408 billion ($4.9 billion), more than 5.6 times the 2024 level, while the bank’s own DFA holdings grew sevenfold in six months to RUB 185 billion ($2.2 billion).

The growth comes alongside a still-dominant traditional balance sheet: in December, Sber’s corporate loan portfolio stood at RUB 30.4 trillion ($365 billion), its retail loan book at RUB 18.8 trillion ($226 billion), and client deposits at RUB 33.1 trillion ($398 billion), highlighting the relatively small but fast-scaling role of tokenized assets within Russia’s largest lender.

When announcing the trial loan, Anatoly Popov, Sberbank’s deputy chairman, said the bank already offers clients structured bonds and digital financial assets with investments in bitcoin and ether. Popov also said the bank was currently testing decentralized finance (DeFi) instruments and supports the gradual legalization of cryptocurrencies within the Russian legal framework.

Another major lender, Sovcombank, became the first Russian bank to roll out crypto-backed lending on Feb. 5 to individuals and businesses legally holding bitcoin.

In December 2025, it reopened the cryptocurrency market to the public with new rules laid out by the country’s central bank. Officials expect to complete legislation governing crypto assets by July 1, 2026.

Sberbank said the planned lending program would target not only mining companies but also businesses that hold cryptocurrency on their balance sheets.

Crypto World

Polymarket Parent Blockratize Inc. Seeks Trademark for ‘POLY’ Token

TLDR

- Blockratize Inc., the parent company of Polymarket, has filed trademark applications for the terms “POLY” and “$POLY.”

- The trademark filings cover various services, including digital token and cryptocurrency trading, as well as platform-as-a-service offerings.

- Both trademark applications were filed on February 4 and are currently listed as “live” and “pending” by the U.S. Patent and Trademark Office.

- The filings were submitted on an “intent to use” basis, meaning the marks are not yet in active commercial use.

- Polymarket executives have previously confirmed plans to launch a native POLY token alongside an airdrop, but no official launch timeline has been provided.

Blockratize Inc., the parent company of the crypto-powered prediction platform Polymarket, has filed trademark applications in the U.S. for “POLY”. These filings, made on February 4, signal the company’s ongoing plans to launch a native token. The applications are currently listed as “live” and “pending,” suggesting the project is moving forward.

The trademark filings span multiple classes, covering digital token services, cryptocurrency trading, and platform-as-a-service offerings. This move aligns with previous statements from Polymarket executives about the potential launch of a native token, adding a formal legal step to their plans. While the filings don’t specify a timeline, they confirm ongoing preparations for the launch of the POLY token.

Trademark Filings Confirm Polymarket’s Token Plans

Polymarket’s trademark applications cover a range of services, including downloadable software for cryptocurrency trading and financial services. These filings have been submitted on an “intent to use” basis, meaning they are not yet in active commercial use. The company has also applied for digital token and cryptocurrency services as part of its broader market strategy.

While the trademark filings do not mention specific dates or mechanics, they do reinforce earlier statements from Polymarket executives. In October, Polymarket’s Chief Marketing Officer, Matthew Modabber, confirmed the company’s plans for the POLY token launch. Founder Shayne Coplan also teased the token’s release, with both executives noting that the U.S. app’s relaunch would take precedence over the token rollout.

Polymarket’s Expansion and Token Speculation

Polymarket has become one of the largest global venues for prediction markets, with $7.7 billion in trading volume last month. This growth has spurred anticipation for the POLY token, particularly as speculation around the launch continues to build. With the increasing popularity of prediction markets in politics, sports, and macro events, the token launch has captured the attention of the broader cryptocurrency community.

The company has secured significant investments, including a $2 billion deal with the Intercontinental Exchange, parent of the New York Stock Exchange. Polymarket has also formed strategic partnerships with major names like Google Finance, Yahoo Finance, DraftKings, and the National Hockey League.

Crypto World

XRP Jumps Nearly 20% as Ripple Teases Major XRPL Upgrades

The token is outperforming the broader crypto market amid a string of Ripple announcements.

XRP outperformed the broader cryptocurrency market on Friday, Feb. 6, rising nearly 20% over the past 24 hours.

The token was trading around $1.50, after briefly touching a high near $1.53, per The Defiant’s price page. XRP’s market capitalization now stands at about $91.3 billion. XRP also strengthened against Bitcoin (BTC), gaining more than 13% on the BTC pair, according to CoinGecko. Meanwhile, 24-hour trading volume climbed to roughly $16.5 billion.

The rally came as investor sentiment improved following a series of Ripple announcements this week, with the latest being the company teasing major upgrades to the XRP Ledger (XRPL) on Feb. 5.

In a blog post, Ripple outlined how new and upcoming features on the XRP Ledger would expand XRP’s real-world utility beyond payments. The company also said that XRP is increasingly being used across stablecoin settlement, FX, tokenized assets, and lending.

“With each use case, XRP’s role becomes more intertwined in institutional finance, either as the asset being moved, the bridge facilitating exchange, or the reserve currency backing network security,” the post reads.

Earlier this week, the team also announced that Ripple Prime added support for Hyperliquid – the largest decentralized perpetual futures platform by trading volume and open interest (OI), according to DeFiLlama. The move aims to provide institutional clients with on-chain derivatives liquidity through Ripple’s prime brokerage platform.

“At Ripple Prime, we are excited to continue leading the way in merging decentralized finance with traditional prime brokerage services, offering direct support to trading, yield generation and a wider range of digital assets,” said Michael Higgins, International CEO, Ripple Prime. “This strategic extension of our prime brokerage platform into DeFi will enhance our clients’ access to liquidity, providing the greater efficiency and innovation that our institutional clients demand.”

XRP’s rebound comes amid a broader market downturn that has stretched for weeks. Bitcoin (BTC) is currently trading under $70,000 – a price point not seen since Nov. 2024. Meanwhile, Ethereum (ETH) is currently changing hands at $2,000, down 25% on the week.

Crypto World

Gold Below $5,000 as Firmer Dollar Weighs

Gold prices edged lower in early trading, holding below the $5,000 mark in the absence of fresh catalysts and amid a stronger dollar.

Futures in New York fell 0.1% to $4,944 a troy ounce, while the U.S. dollar index—which measures the greenback against a basket of major currencies—is up 0.1% at 97.71.

“A stronger USD weighed on investor appetite,” ANZ analysts said. “This offset any gains coming from rising haven buying as geopolitical tensions rise in the Middle East.”

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports10 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat6 hours ago

NewsBeat6 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Tech6 days ago

Tech6 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined

-

Crypto World1 day ago

Crypto World1 day agoHeads Up! Bitcoin Enters Capitulation Mode, Trades In a ‘Phase That Rewards Discipline Over Prediction’