Crypto World

China’s Luckin Coffee opens its first high-end store

Chinese coffee giant Luckin opened its first flagship with premium drinks as the company takes on Starbucks Reserve.

Luckin Coffee

BEIJING — China’s Luckin Coffee is taking direct aim at Starbucks‘ high-end roastery chain with a new flagship store in the country’s south that sells premium drinks.

It’s Luckin’s first major departure from its original strategy of operating budget-priced coffee kiosks – a move that helped the company overtake Starbucks in terms of the number of storefronts in China.

Now, with the U.S. company selling off most of its struggling China business to a local investment firm, Luckin is proving it’s more than made a comeback from fraud allegations in 2020 that forced it to delist from the Nasdaq.

The Chinese company on Sunday officially opened its two-floor Luckin Coffee Origin Flagship in Shenzhen on the border with Hong Kong.

In contrast to Luckin’s typical offerings priced at roughly $1 or $2 for an Americano or latte, the flagship store has nudged prices slightly higher for a range of pour-over and cold brew coffee drinks. Customers can choose beans from Brazil, Ethiopia or China’s Yunnan province, as Luckin taps into the geographical sourcing “origin” theme popular with Starbucks and other coffee companies.

The new store also sells several specialty drinks such as a “tiramisu latte” with a pastry on top, according to posts on Chinese social media platform Xiaohongshu. Users have started posting about 1 to 3 hour waits for the drinks since the store’s soft launch on Jan. 20.

The 420-square-meter (4,521 square feet) store signals how intense the competition in China has become for Starbucks. Back in 2017, the U.S.-based coffee giant chose Shanghai for its second-ever Reserve Roastery “megastore,” after launching the premium store concept in Seattle three years earlier.

But as coffee has taken off in China, traditionally a tea-drinking market, Starbucks has run into a slew of competitors from boutique cafes to chains such as Cotti Coffee and Manner — which often sell drinks at half the price as Starbucks.

Luckin reported revenue of $1.55 billion for the three months ended Sept. 30, 2025, a nearly 48% increase from a year earlier.

That’s just for the company’s self-operated stores, which account for well over half of Luckin’s China locations and most of its handful of overseas stores. The new Shenzhen location is billed as Luckin’s 30,000th store. The company reported a total of 29,214 stores worldwide as at Sept. 30.

Pictured here is the second floor of Luckin’s new flagship in Shenzhen, China, that officially opened on Feb. 8, 2026.

Luckin

In contrast, Starbucks has just over 8,000 stores in China and around 16,900 in the U.S., its biggest market.

The Seattle-based coffee giant reported a 6% year-on-year increase in China net revenue to $831.6 million for the three months ended Sept. 28. Comparable same-store sales, a standard industry metric, was just 2%, but improved to 7% for the quarter ended Dec. 28.

Starbucks did not share China net revenue for the latest quarter. The company expects to close a deal in the spring to sell 60% of its China business to Boyu Capital, while retaining a 40% stake. When the deal was announced in November, Starbucks said it values its China business at $13 billion, including future licensing fees.

Luckin, whose shares still trade over-the-counter in the U.S., had a market value of around $10.46 billion as of Thursday.

Re-listing and expansion plans

Late last year, Luckin’s CEO Jinyi Guo hinted at plans to re-list the company in the U.S. He did not specify a date. Founded in late 2017, the company achieved a $2.9 billion valuation just 18 months later and listed on the Nasdaq in May 2019. But about a year later, Luckin said it discovered much of its 2019 sales were fabricated, leading to the stock’s delisting.

The Chinese coffee company continued to operate many of its stores — and kept its name and logo.

Luckin also jumped to attract consumers through a slew of timely collaborations — with premium spirits brand Moutai, the Minions cartoon characters and the hit video game Black Myth: Wukong just days after it surged in popularity.

What sets Luckin apart has been its ability to build a robust pool of private user traffic through its smartphone ordering app, said Mingchao Xiao, founder of Zhimeng Trends Consulting. Rather than placing orders with a counter clerk, Luckin customers select and pay for drinks directly through an app.

China’s coffee market is still in a period of rapid change, Xiao said. He added that young consumers today are more willing to try different experiences, and seek emotional fulfillment, which can be met through cross-industry brand collaborations.

Like many Chinese companies, Luckin is also ramping up its global expansion.

Last summer, Luckin opened its first U.S. stores in New York City. It debuted its 10th store in the city on Feb. 6.

Luckin also has 68 stores in Singapore after it entered the market nearly three years ago, and 45 jointly operated locations in Malaysia.

Crypto World

Anthropic Takes Legal Action Against Pentagon Following AI Security Blacklist

Key Points

- On March 9, 2026, Anthropic launched two separate legal challenges against the Pentagon and federal agencies

- The Defense Department classified Anthropic as a “supply-chain risk” following the company’s refusal to eliminate AI safety protections

- President Trump directed all federal entities to cease using Claude, the company’s AI assistant

- The AI firm contends that government actions breach First Amendment protections and due process requirements

- Following Anthropic’s blacklisting, OpenAI secured a new contract with the Defense Department

An AI company has taken the unprecedented step of suing multiple U.S. government entities after being placed on a Defense Department security blacklist this week.

The litigation consists of two distinct cases — one submitted to the Northern District of California court and another to the D.C. Circuit Court of Appeals. Both filings contest the federal government’s determination that Anthropic poses supply-chain threats.

The controversy emerged from disagreements about military applications of Claude, Anthropic’s AI assistant. Pentagon officials requested unrestricted “lawful use” access to the technology. However, the company maintained its position on keeping protective measures that prevent the system from being deployed for autonomous weaponry or domestic monitoring operations.

Defense Secretary Pete Hegseth formally issued the supply-chain risk designation on February 27, with official notification reaching the company on March 3.

President Trump escalated the situation through a social media directive, commanding every federal department and agency to discontinue Claude usage, significantly expanding the initial Pentagon action.

The company characterized the government’s decisions as “unprecedented and unlawful,” asserting that both its “reputation and core First Amendment freedoms are under attack.” According to Anthropic, these measures constitute retaliation for exercising protected speech rights rather than representing genuine national security concerns.

“The Constitution does not allow the government to wield its enormous power to punish a company for its protected speech,” the company stated in court documents.

Financial Impact in the Hundreds of Millions

According to company statements, the security designation is already “jeopardizing hundreds of millions of dollars” in revenue opportunities. The Pentagon has awarded contracts valued at up to $200 million each to leading AI developers including Anthropic, OpenAI, and Google within the last year.

Wedbush analyst Dan Ives cautioned that the blacklisting might prompt corporate customers to suspend Claude implementations pending judicial resolution.

Dario Amodei, Anthropic’s CEO, clarified that he doesn’t categorically oppose AI-powered weapons systems but maintains that existing AI capabilities lack the precision required for completely autonomous military operations. He emphasized that the Pentagon designation has a “narrow scope” and won’t impact business relationships outside the Defense Department.

A leaked internal communication from Amodei, disclosed by The Information, suggested Pentagon decision-makers were influenced by Anthropic’s failure to offer “dictator-style praise to Trump.” Amodei subsequently issued an apology for the memo’s contents.

The Path Forward

The company indicated that filing lawsuits doesn’t preclude ongoing dialogue with government officials. A Defense Department representative declined to discuss active litigation, while a Pentagon official confirmed last week that direct negotiations between the parties had ceased.

The secondary lawsuit addresses broader supply-chain legislation that could expand the blacklist beyond military applications to encompass civilian federal operations. The reach of such a designation hinges on an interagency assessment still in progress.

Shortly following Anthropic’s blacklisting, OpenAI revealed an agreement to supply its AI systems to Pentagon infrastructure. Sam Altman, OpenAI’s CEO, stated that Defense Department requirements aligned with his company’s guidelines regarding human control over weapons systems and rejection of widespread domestic surveillance.

Sources indicate that Anthropic’s financial backers are actively attempting to mitigate consequences stemming from the federal government dispute.

Crypto World

Bitcoin quietly crosses 20 million mined as scarcity era begins

Bitcoin has passed 20 million mined coins, hardening its ultra‑scarce supply just as macro volatility, lost BTC, and a shift toward fee‑driven security reshape the network’s next century.

Summary

- Over 20 million BTC are now mined, with fewer than 1 million left over the next century as halvings push issuance toward zero.

- Lost coins may cut effective circulating supply to roughly 15.8–17.5 million BTC, amplifying scarcity beyond the raw 21 million cap.

- Despite supply being on rails, BTC, ETH, SOL and XRP still trade like macro‑sensitive risk assets, moving with data prints and policy signals.

Bitcoin’s (BTC) 20 millionth coin has quietly tipped the network into a new structural phase, one where hard‑coded scarcity collides head‑on with a still‑fragile macro regime built on cheap liquidity and leveraged risk.

Supply is (almost) done

According to real‑time data from CloverPool’s Bitcoin explorer, more than 20 million BTC have now been mined, meaning roughly 95% of the protocol’s fixed 21 million cap is already in existence. Analysts notes that as the 20 millionth coin is mined, 95.24% of the total supply will be in circulation, leaving fewer than 1 million BTC to be created over more than a century as halving cycles grind issuance toward zero. Others quoted in a recent market note described the event as “a powerful testament to the resilience and predictability of the protocol,” arguing that Bitcoin has effectively transitioned from a high‑inflation asset to an “ultra‑scarce” monetary instrument.

That long tail is not trivial: the final satoshi will be mined “around 2140,” with the 2032 halving already cutting rewards to 0.78125 BTC per block and pushing miners further toward a fee‑driven security model, analysts added. On top of that, between 2.3 and 3.7 million BTC may be permanently lost, implying an effective circulating supply closer to 15.8–17.5 million coins rather than the raw on‑chain 20 million headline.

Macro‑driven tape

Price action, meanwhile, still looks more human than the issuance curve. Bitcoin traded around $68,191 at press time, down about 3.95% over the past 24 hours, with a 24‑hour range between $67,790 and $71,520 as spot volumes hovered near $48.5 billion. That keeps BTC pinned in a choppy range even as the structural supply story hardens in one direction only. Ethereum changed hands near $2,000, Solana around $83, and XRP just above $1.33, each slipping or grinding within a few percentage points on the day as majors continue to trade like high‑beta plays on global risk sentiment rather than slow‑moving monetary experiments.

The tension is obvious to anyone watching the order book: issuance is on rails for the next century, but valuations still breathe with every data print and policy whisper. “Scarcity is no longer a thesis, it’s a live parameter,” one analyst said, adding that from here, “macro, positioning, and fees will do more work than block rewards.”

Crypto World

Zcash Devs Raise $25M From Major VCs After ECC Split

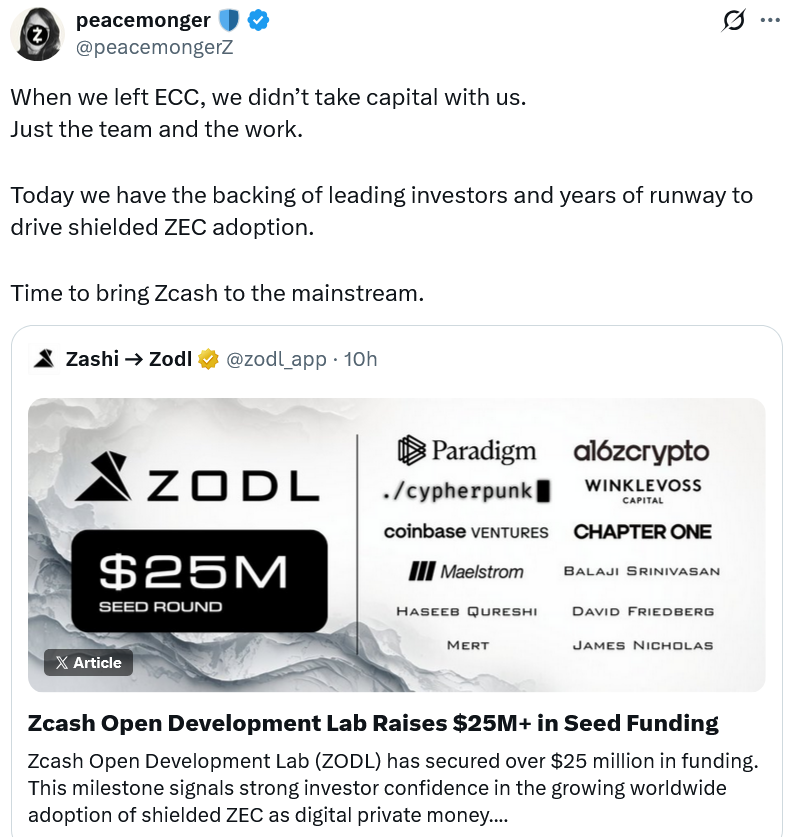

The development team that left Electric Coin Company in January to launch Zcash Open Development Lab (ZODL) has raised over $25 million from the likes of a16z Crypto and Coinbase Ventures to continue building the privacy-focused, self-custodial Zodl wallet.

ZODL was founded by former ECC CEO Josh Swihart and includes the entire engineering and product team that previously worked on the Zodl wallet at ECC. They resigned due to disputes with Bootstrap, the nonprofit that oversees ECC, over how Zcash should function as a privacy protocol.

ZODL said in an X post on Monday that crypto-focused investment firms Paradigm, Winklevoss Capital, Cypherpunk Technologies, Maelstrom, and Chapter One were among the other participants in the $25 million funding round.

Former Coinbase chief technology officer Balaji Srinivasan, Silicon Valley investor David Friedberg and Dragonfly managing partner Haseeb Qureshi also contributed.

ZODL said the widespread backing “reflects strong conviction from some of the most respected investors in crypto, not only in privacy as a principle, but in the continued growth of the Zcash ecosystem,” adding it would use the funds to expand its engineering team.

The open-source Zodl wallet is one of the main infrastructures powering the Zcash ecosystem.

Zodl wallet was initially launched by ECC under Swihart’s leadership as Zashi before ZODL renamed it to Zodl wallet in February.

Zcash jumps nearly 10% over 24 hours

Zcash (ZEC) was one of the better-performing privacy tokens last year, rising nearly tenfold from $55.86 to $527.84 amid renewed interest in privacy-focused protocols.

While ZEC has been impacted by the broader crypto market pullback to start 2026, it increased 4.1% to $217.80 on news of the latest funding round, CoinGecko data shows.

Related: US Treasury report notes legitimate privacy uses for crypto mixers

ZODL said the Zodl wallet facilitated more than $600 million in ZEC swaps since October 2025, while noting that the Zcash shielded pool has grown by over 400% since its launch in 2024.

The Zcash shielded pool is the protocol’s main feature to mix transactions so details of the sender, receiver and amount remain hidden and untraceable.

Magazine: 2026 is the year of pragmatic privacy in crypto — Canton, Zcash and more

Crypto World

Bithumb Could Face 6-Month Partial Suspension in South Korea

We must remove the first cover image as requested, so the final HTML will not include that image. Here is the rewritten article in the requested format.

Regulatory authorities in South Korea are intensifying oversight of cryptocurrency platforms as Bithumb—the country’s second-largest exchange by trading volume—faces a potential six-month partial suspension. The Financial Intelligence Unit (FIU) has issued a preliminary notice tied to alleged anti-money-laundering and know-your-customer deficiencies, including dealings with unregistered overseas virtual asset service providers and gaps in customer due diligence. In a parallel move, a reprimand was issued to Bithumb’s chief executive, signaling the seriousness of the regulator’s intent. While officials have signaled that a sanctions decision will be refined in March, the action remains at an early stage and could still be adjusted before any final measures are announced. Bithumb has framed the development as not yet final, underscoring that the scope of any sanction could change as the review unfolds.

Key takeaways

- The FIU has issued a six-month partial suspension notice to Bithumb over AML and KYC controls, including concerns about dealings with overseas service providers not registered in Korea and customer due-diligence gaps.

- A reprimand to Bithumb’s CEO accompanies the notice, a move regulators describe as a serious penalty that could influence leadership decisions and future appointments.

- A formal sanctions review is expected later in March, with the potential for adjustments before any final measures are imposed.

- If finalized, the suspension would restrict new users from transferring digital assets off the platform, while other services would presumably remain available to existing customers.

- Background context includes a high-profile miscredit incident during a February promotional event that incorrectly credited 2,000 BTC per user, triggering scrutiny of internal controls and security protocols.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The development comes amid a broader push by South Korean authorities to strengthen AML and KYC standards for crypto platforms, mirroring a global tightening in exchange compliance and risk controls as regulators expand oversight and enforcement actions.

Why it matters

The FIU action against Bithumb highlights how regulators are moving beyond generic compliance rhetoric to enforce concrete consequences for exchanges that fail to meet anti-money-laundering and know-your-customer requirements. The preliminary six-month suspension, if finalized, would directly curtail a gateway for new users to move digital assets off the platform, which could have downstream effects on liquidity and user onboarding for one of Korea’s largest trading venues. While Bithumb emphasized that this step is not a final sanction and that the scope could shift, the message from authorities is clear: robust AML controls are no longer optional in a highly regulated market.

The episode also situates Bithumb within a broader crackdown across the sector. Earlier in 2025, Upbit’s parent company Dunamu faced sanctions including a partial suspension and a substantial fine, underscoring regulators’ willingness to penalize organizational structures and processes that enable noncompliant activity. Korbit, another domestic exchange, received a significant but smaller penalty in the same wave. Taken together, these penalties reflect a policy pivot toward stronger accountability for the crypto ecosystem, particularly around interactions with overseas providers and customer verification processes.

Beyond regulatory signaling, the incident underscores the operational risks exchanges face in maintaining AML/KYC rigor. The February promotional miscredit—where 2,000 BTC per user was credited by mistake, culminating in a total distribution cited as 620,000 BTC—exposed gaps in internal controls and risk monitoring. That event, which occurred during a promotional period, has implications for governance, incident response, and customer trust as authorities scrutinize how platforms manage incentives, security, and compliance at scale. The combination of a potential sanction and a past misstep illustrates why exchanges are prioritizing robust onboarding checks, cross-border provider screening, and transparent reporting to regulators.

What to watch next

- The sanctions decision timetable: a March review by the FIU to finalize whether the six-month partial suspension will become binding and how it will be structured.

- Scope adjustments: authorities may limit or expand restrictions on withdrawals for new users, depending on ongoing assessments of the exchange’s AML/KYC posture.

- Regulatory activity at other exchanges: continued enforcement against Upbit and Korbit could foreshadow broader policy direction for the sector.

- Internal controls and governance responses at Bithumb: any governance changes, risk-management enhancements, or new compliance programs could influence the regulatory outcome and investor confidence.

Sources & verification

- FIU preliminary notice detailing a six-month partial suspension and the associated AML/KYC concerns at Bithumb.

- Bithumb’s public statements noting the action is at the pre-notification stage and that sanctions, if imposed, may evolve.

- Background reporting on a February promotional miscredit that credited 2,000 BTC per user, resulting in a reported distribution of 620,000 BTC.

- Regulatory actions against Upbit’s parent Dunamu, including a partial suspension and a 35.2 billion won fine in 2025, as reported by local sources.

- Regulatory penalties against Korbit, including a 2.73 billion won fine in December 2025.

Key figures and next steps

The unfolding situation at Bithumb sits at the intersection of intensified regulatory scrutiny and ongoing efforts by Korean authorities to tighten AML/KYC standards across crypto platforms. The FIU’s decision, the reprimand to the CEO, and the March review collectively determine whether a concrete sanction will anchor the exchange’s near-term operations. For market participants, the episode reinforces the importance of compliance-driven risk management, especially for platforms seeking to grow in a tightly monitored environment.

Where to verify

- Official FIU statements or notices related to Bithumb’s AML/KYC assessment and any forthcoming sanctions.

- Bithumb’s public responses or press releases addressing the pre-notification stage and the potential scope of sanctions.

- Independent reporting on the February miscredit incident and its impact on internal controls and regulatory oversight.

- Regulatory actions and penalties involving Upbit (Dunamu) and Korbit, including sanction amounts and the regulatory rationale behind them.

Crypto World

Hyperliquid price eyes breakout as technicals turn bullish

Hyperliquid price is pushing toward a key resistance zone as rising trading volume and strengthening technical signals point to growing bullish momentum in the market.

Summary

- Hyperliquid rose to around $32 in a possible recovery attempt towards $40..

- Volume and open interest climbed, indicating new positions as traders anticipate further price movement.

- Technical indicators show strengthening momentum, with resistance sitting between $33 and $36.

Hyperliquid (HYPE) edged higher on renewed buying, with the token trading around $32.63 at press time, up 6.6% in the past 24 hours. The price has stayed within a weekly range of $29.61 to $33.33, holding near the top of that band.

Over the past year, Hyperliquid has been one of the stronger performers among the top 100 cryptocurrencies, gaining about 136%. Even so, it still trades roughly 45% below its September 2025 peak of $59.30.

Trading activity has picked up as well. 24-hour spot volume reached about $289 million, a 98% increase compared with the previous day, which suggests fresh interest from traders.

Derivatives markets show a similar pattern. Data from CoinGlass shows trading volume climbing 84% to $1.36 billion, while open interest rose 9.56% to $1.33 billion. This mix open often signals that new positions are being added rather than closed.

Hyperliquid fundamentals grow stronger

Beyond price action, the platform itself continues to expand. Hyperliquid now accounts for roughly 70% of decentralized perpetual futures trading volume, while daily activity on the exchange is estimated at 9.9% of the level seen on Binance.

The network has also built a sizable user base. More than 665,000 traders are active on the platform, and monthly revenue is estimated at around $116 million. According to project data, about 38% of the token supply has been set aside for future ecosystem initiatives.

New features are gradually being introduced. These include HIP-4 outcome trading and efforts to connect real-world assets to the platform.

Supply mechanics may also play a role in the token’s dynamics. Hyperliquid runs an assistance fund that periodically buys back and burns HYPE tokens. Roughly 4.17% of the supply, valued at about $1.36 billion, has already been removed through these operations, reducing the number of tokens in circulation.

Hyperliquid price technical analysis

From a technical perspective, several signals have started to lean positive. The price currently sits above the mid-Bollinger Band, which corresponds to the 20-day moving average. That area, around $29 to $30, has been acting as support in recent weeks as buyers step in during pullbacks.

Volatility also appears to be returning. The Bollinger Bands are widening after a period of compression, a setup that traders often watch for stronger moves. At the moment, the price is pushing toward the upper band in the $33 to $36 range.

Momentum indicators point in the same direction. The relative strength index is hovering in the upper-50 zone. Before the market enters overbought territory, that level usually denotes growing momentum while allowing room for growth.

The chart also shows a pattern of higher lows since the rebound in late January, with buyers continuously protecting the $29 to $30 range. This kind of structure often depicts slow accumulation.

For now, the main barrier sits between $33 and $36, where the token has struggled to move higher in recent attempts. A clear break above that zone could shift attention toward the $40 level, which many traders see as the next psychological target.

If momentum fades, the first support lies near $29.9, while a deeper support zone sits around $26 to $27.

Crypto World

XRP Traders Face $50B in Unrealized Losses as Price Slips Below $1.40

XRP price has taken a brutal hit.

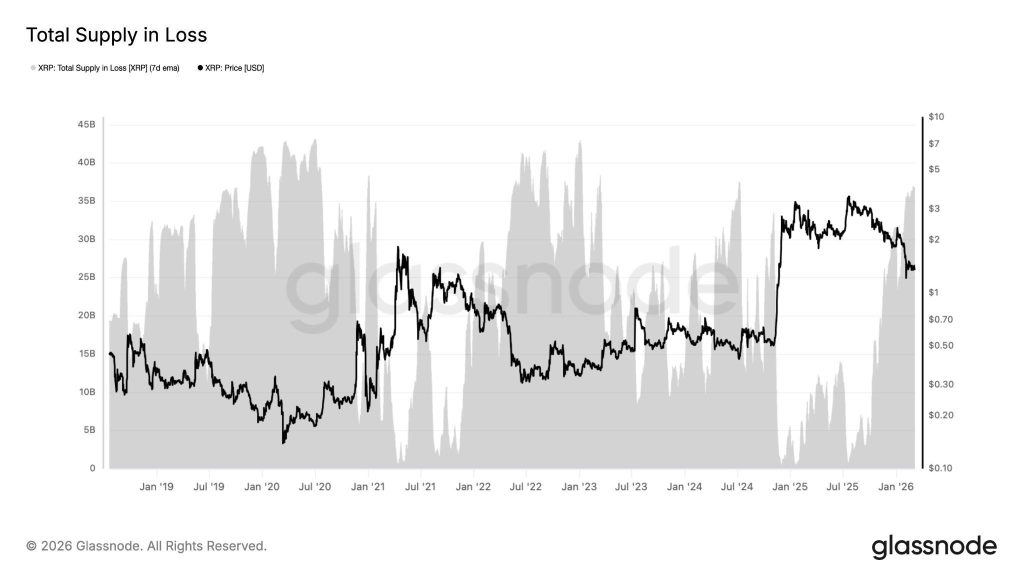

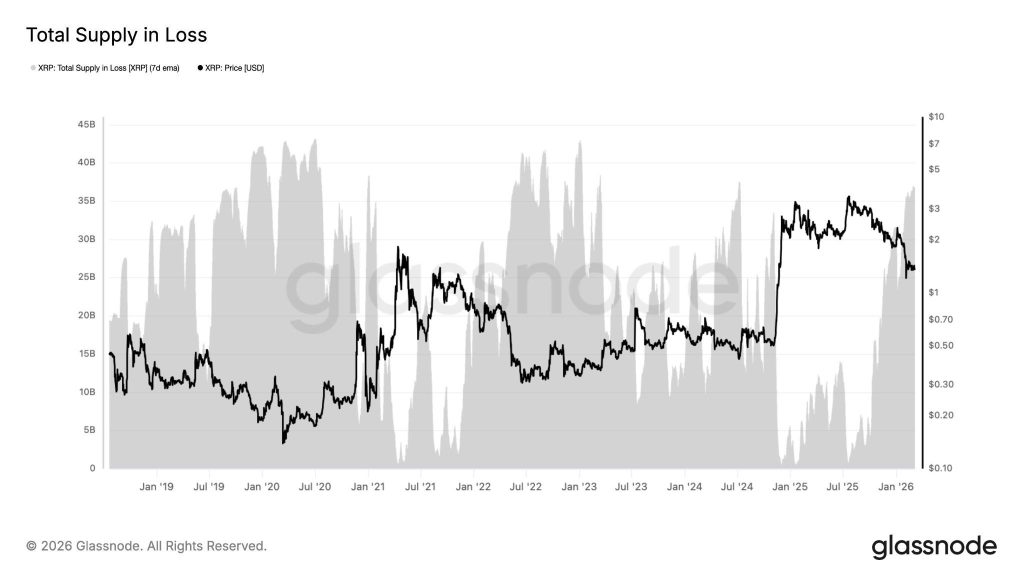

The token is down about 63% from its multi-year high and has slipped below $1.40. That drop has left more than $50.8 billion in unrealized losses in XRP, with a large portion of holders now underwater.

With price hovering near $1.35, traders are facing a big question. Is this deep pullback finally forming a market bottom, or is more downside still ahead?

The answer likely comes down to a few key levels that could decide where XRP moves next.

What the $50B Unrealized Loss Figure Actually Means for XRP Holders

On-chain data shows how heavy the pressure has become.

According to Glassnode, about 36.8 billion XRP are currently held at a loss. That puts the average holder cost around $1.44, meaning a large portion of investors are underwater while price trades below that level.

That creates an interesting dynamic. Traders sitting at a loss usually avoid selling unless support breaks and panic kicks in. But the moment price recovers near their entry, many rush to exit at break-even, turning that area into strong resistance.

At the same time, broader market pressure is not helping. XRP ETFs have seen steady outflows, including a $16.2 million redemption late last week.

With so many holders trapped and liquidity thinning, any sharp drop below current support could trigger a wave of forced selling.

Capitulation Risk: The Levels That Change Everything for XRP Price

Right now, everything revolves around a few key levels on the chart.

The biggest danger sits at $1.28. That is the monthly low XRP printed when momentum completely stalled earlier this year. If price breaks below that level, the next downside target appears near $1.11.

On the other hand, buyers have been defending the $1.31 to $1.34 zone. This area has repeatedly absorbed selling pressure and helped stabilize the market during recent dips.

For sentiment to improve, XRP needs to climb back above $1.48. That level roughly matches the average cost basis for many holders, meaning a recovery there could remove some of the heavy selling pressure.

In the short term, $1.43 is the first barrier to watch. A daily close above it would suggest the market is starting to recover.

The post XRP Traders Face $50B in Unrealized Losses as Price Slips Below $1.40 appeared first on Cryptonews.

Crypto World

Elon’s Grok AI Predicts the Price of XRP, Bitcoin and Ethereum by The End of 2026

When you feed Elon Musk’s Grok AI a carefully engineered prompt, it reveals explosive price predictions for XRP, Bitcoin, and Ethereum.

A surge in oil prices is adding fresh macro pressure to crypto markets, but Grok predicts the mid-to-long-term outlook for the three largest cryptocurrencies remains strong.

A mix of chart signals, regulatory developments, and ongoing industry momentum appears to support Grok’s analysis.

XRP ($XRP): Grok AI Predicts a Possible 9x Surge Within 10 Months

In a recent update, Ripple reiterated that XRP ($XRP) plays a central role in establishing the XRP Ledger (XRPL) as a scalable, enterprise-grade global payments network.

Thanks to rapid transaction settlement and extremely low fees, XRPL is can get an early lead in two of major blockchain use cases: stablecoins and tokenized real-world assets.

XRP is currently trading around $1.36, and Grok AI suggests the price could hit $14 during the year, delivering a tidy 10x for current HODLers.

Technical indicators reinforce the bullish outlook. XRP formed a bullish flag in recent months but has been held back by Bitcoin’s stagnation.

However, increased institutional participation following the US launch of XRP exchange-traded funds, Ripple’s expanding network of global partnerships, and possible regulatory clarity if the CLARITY Act passes Congress could all catalyze a price boom.

Bitcoin (BTC): Grok AI Says BTC Could Hit $250,000

Bitcoin ($BTC) reached a record high of $126,080 on October 6 before losing nearly half of its value during the following months.

Despite recent volatility, Grok AI says Bitcoin remains on a long-term upward trajectory, with the possibility of a price peak near $250,000 in 2026.

Often described as digital gold, Bitcoin continues attracting both investors who seek diversification and hedging against inflation and broader economic uncertainty.

At present, Bitcoin accounts for roughly $1.4 trillion of the $2.4 trillion cryptocurrency market. Its recent decline occurred after the US escalated rhetoric against Iran and Greenland, but it appears to have shaken off the effects of the US/Iran war.

Additionally, if Donald Trump follows through on proposals to establish a U.S. Strategic Bitcoin Reserve, Grok’s bull case becomes highly feasible.

Ethereum (ETH): Grok AI Sees an Eye-Watering $15,000 Price Target

Ethereum ($ETH) is the dominant smart contract platform, serving as the core infrastructure of decentralized finance.

With a market capitalization close to $244 billion and around $56 billion locked on chain, Ethereum is the primary settlement layer for on-chain financial applications.

Its strong security, leadership within the stablecoin sector, and early expansion into real-world asset tokenization position Ethereum well for broader institutional adoption.

However, growth depends on regulatory developments. Approval of the CLARITY Act in the United States could deliver the legal certainty many institutions need to deploy capital on Ethereum.

ETH is currently trading just above $2,000. Major resistance is expected around the $5,000 level, near its previous all-time high of $4,946.05 recorded last August.

If Ethereum decisively breaks $5,000, Grok’s model suggests a 6.5x run to $15,000.

Maxi Doge: Early-Stage Meme Coin Aiming for Major Gains

If XRP, Bitcoin, and Ethereum follow Grok’s calculations, then the ensuing meme season could top the halcyon days of 2021.

One meme coin is being hotly touted as next season’s BONK or WIF. Maxi Doge ($MAXI) has already raised $4.7 million ahead of launch as investors are drawn to its magnetic marketing and viral potential.

Maxi Doge is Dogecoin’s bigger, badder, degenerate gym bro cousin, channeling the comic culture that defined meme coin mania in 2021.

Built as an ERC-20 token on Ethereum’s proof-of-stake network, MAXI also has a significantly smaller environmental footprint compared with Dogecoin’s proof-of-work mining system.

Presale investors can currently stake MAXI tokens for yields of 67% APY, although rewards decline as more tokens enter the staking pool.

The token is $0.0002807 during the current presale phase, with automatic price increases scheduled as the project hits funding milestones.

Investors interested in purchasing MAXI can visit the Maxi Doge official website and connect a compatible wallet such as Best Wallet.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Maxi Doge Website Here

The post Elon’s Grok AI Predicts the Price of XRP, Bitcoin and Ethereum by The End of 2026 appeared first on Cryptonews.

Crypto World

S&P 500 Index and VOO stock drops as Wall Street bank predicts more downside

The S&P 500 Index and VOO, its biggest exchange-traded fund, plunged for three consecutive days, reaching its lowest level since November last year.

Summary

- The S&P 500 Index continued its strong downward trend.

- JPMorgan analysts expect the index to continue falling this month.

- The index may still rebound later this year if Donald Trump capitulates on his war.

The blue-chip index, which tracks the biggest companies in the United States, dropped to $6,637, down by over 5.2% from its highest point this year.

This retreat happened as the crisis in the Middle East escalated, pushing crude oil prices to the highest point in years. Brent and the West Texas Intermediate rose to over $115 before paring back the gains.

The rising crude oil prices pushed US bond yields higher, with the 10-year rising to 4.17% and the 30-year hitting 4.766%. This surge is a sign that market participants expects the Federal Reserve to maintain a hawkish tone this year.

JPMorgan predicts a S&P 500 Index crash

Wall Street analysts are getting antsy about the market. In a research note, analysts at JPMorgan predicted that the index will move into a correction if the war continues.

Dropping into a correction, which is defined as a 10% drop from its peak, will push it to $6,300, its lowest level since August last year.

However, the analyst noted that signs of an off-ramp on the war in Iran will invalidate the bearish outlook. He noted:

“A definitive off-ramp to the conflict will end this tactical call as the underlying macro fundamentals remain supportive of risk-assets.”

Similarly, Yardeni, a top research company, boosted its odds of a market meltdown to 35% from the previous 20%.

Still, as we wrote earlier, there is a possibility that the S&P 500 and VOO stock will bounce back as President Donald Trump often pays close attention to the stock market and inflation. As such, there is a possibility that he will start to capitulate soon.

Looking ahead, the S&P 500 Index will react to the upcoming US consumer inflation report, which will come out on Wednesday.

Economists expect the report to show that the headline Consumer Price Index rose to 2.5% in February. A higher inflation than that, coupled with the rising oil prices, may also push Trump to capitulate on his war.

The index will also react to the upcoming Oracle earnings, which will come out on Tuesday. Oracle has become a major player in the artificial intelligence industry thanks to its huge backlog.

Crypto World

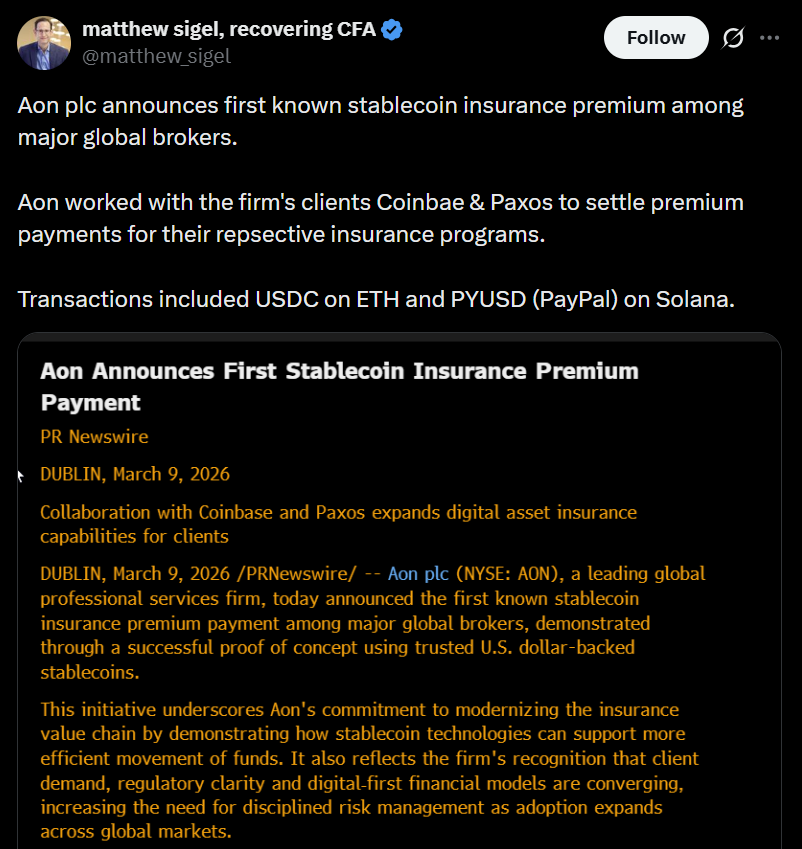

Aon Tests Stablecoin Payments for Insurance Premiums

Aon, one of the world’s largest insurance brokers, is testing the use of stablecoins to pay insurance premiums, highlighting the growing role of digital dollars in traditional financial infrastructure following the passage of the GENIUS bill last year.

In a Monday announcement, UK-based Aon said it completed a pilot that settled insurance premiums for clients, including Coinbase and Paxos, using USDC (USDC) on Ethereum and PayPal USD (PYUSD) on Solana.

Tim Fletcher, CEO of Aon’s financial services division, said the pilot reflects the company’s effort to explore stablecoins as a payment rail, predicting that tokenized assets will become more widely used in financial transactions.

Aon said in August that its analysis showed 120 re-insurers wrote nearly $2 trillion of gross written premium in 2024.

Instead of sending funds through traditional bank wires, the premiums were paid using stablecoins on blockchain networks. The pilot demonstrates how financial institutions are experimenting with blockchain settlement systems rather than relying solely on conventional payment infrastructure.

The approach could have implications for the insurance industry, where premium payments typically move through banks, clearing systems and international wire transfers — processes that can take several days, particularly for cross-border transactions. Stablecoin transfers can settle within minutes.

The pilot did not involve a new insurance product or an onchain policy. The underlying insurance coverage remained unchanged, with the only difference being the use of stablecoins to settle the premium payments.

Related: SoFi taps BitGo to provide infrastructure for bank-issued stablecoin

Stablecoins gain traction among financial institutions

Aon’s pilot also comes amid a more supportive regulatory backdrop for stablecoins following the passage of the GENIUS Act, which established a federal framework for issuing and supervising dollar-backed stablecoins in the United States.

The development reflects a broader shift as traditional financial institutions increasingly explore stablecoins for payments and settlement infrastructure. Several major banks, including Barclays, JPMorgan Chase, Bank of America and Citigroup, are either confirmed or reported to be in various stages of developing stablecoin or tokenized payment systems.

At the same time, crypto-native companies are expanding into the stablecoin payments stack. For example, Ripple has been building infrastructure aimed at supporting stablecoin custody, settlement and treasury management for institutions.

Related: US regulator mulls guidance for tokenized deposit insurance, stablecoins

Crypto World

Crypto-Backed PAC Spends $8.6M in Illinois Races ahead of US Midterms

Fairshake, the political action committee backed by crypto companies Ripple Labs and Coinbase, among others, has reported additional spending on Illinois congressional races with the US midterm elections less than eight months away.

In filings on Sunday with the Federal Election Commission, Fairshake reported a $16,000 media buy to oppose Illinois state representative La Shawn Ford in his run for the US Congress in 2026, adding to its roughly $1.8 million spent in 2026 on the race. The state is set to hold primary elections on March 17.

The filing followed others from Friday, showing that the PAC spent more than $5.5 million to oppose Illinois Lieutenant Governor Juliana Stratton, who is running as a Democrat for the US Senate in the midterm elections. Protect Progress, a Fairshake associated group supporting Democratic candidates, reported about $84,000 spent to support Nikki Budzinski for her 2026 House run representing Illinois, and $90,000 for Robin Kelly’s Illinois Senate race.

Altogether, according to The Daily Northwestern, the PAC and its associated groups have poured about $8.6 million in the Illinois races, a sixfold increase over what it spent in the 2024 elections for races in Midwestern US state. The committee has a larger war chest of funds from the cryptocurrency industry and others, reporting $193 million in its coffers as of January, and has publicly stated it will “oppose anti-crypto politicians and support pro-crypto leaders” in 2026.

Related: Crypto PACs secure massive war chests ahead of US midterms

Rather than support candidates directly through campaign donations, Fairshake and its associated groups typically fund ads to support or oppose politicians, often on issues completely unrelated to crypto policy. PACs are required to report spending and contributions to the Federal Election Commission.

Potentially influencing Texas primaries?

Fairshake has already made moves in 2026 for some of the early state primaries ahead of the midterm elections.

Last week, residents in North Carolina, Texas and Arkansas voted on some of the first candidates to be decided for the general election. Protect Progress reportedly spend $1.5 million opposing the reelection of Texas Representative Al Green, who has served in Congress since 2005.

While Democrat Christian Menefee, whom the advocacy organization Stand With Crypto rates as “strongly supports crypto,” did not win outright against Green, both candidates will head to a runoff in May.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

-

Politics7 days ago

Politics7 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

News Videos15 hours ago

News Videos15 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World11 hours ago

Crypto World11 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Politics4 days ago

Politics4 days agoTop Mamdani aide takes progressive project to the UK

-

Business1 day ago

Business1 day agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Sports7 days ago

Sports7 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

NewsBeat2 hours ago

NewsBeat2 hours agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech12 hours ago

Tech12 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death