Crypto World

Compliance-First Prediction Markets for White-Label Neo Banks

Prediction markets moved from niche experimentation to institutional-grade financial infrastructure in a very short time. For serious investors, the question is no longer whether they are interesting, but how they can be built, governed, and monetized inside regulated financial rails. The acceleration we saw in 2025 proved two things:

1. The market can scale to multi-billion dollar notional flows while attracting retail and institutional liquidity.

2. The ecosystem matured technically, with interoperable oracles, hybrid settlement rails, and audited market logic that reduces systemic counterparty risk.

For an investor evaluating white-label neo-banking platforms, embedding a prediction-market module is not a gimmick. It is a strategic lever that can unlock new fee streams, create stickier customer lifecycles, and produce market signals that feed risk systems and trading desks. Let us scroll through the blog to uncover the architecture, the regulatory contours, the commercial levers, and how an end-to-end partner can deliver enterprise production.

Are Prediction Markets Really Winning in 2026 & Beyond?

“In 2025 alone, global prediction market trading volumes hit $44 billion across major platforms, while economics-focused contracts grew roughly 905% YoY to about $112 million in volume.”

By the end of 2025, prediction markets had reached a scale that turned heads across capital markets. Aggregate platform volumes for the year were reported in the high tens of billions of dollars, and specialized economic contract categories posted triple- and quadruple-digit growth rates. demonstrating real demand for event-based hedging and information products.

The competitive landscape now features two complementary rails. Regulated derivatives exchanges provide a compliant on-ramp for retail and institutional brokerage integration. On-chain platforms provide composability, programmable settlement, and tokenized liquidity. Both rails are attracting strategic partnerships and buy-side interest, which drives network effects and market depth. At the same time, regulators are moving from avoidance to active rulemaking and engagement, which reduces legal tail risk for properly structured products.

This is a clear implication for all the serious and visionary investors interested in launching their own crypto-friendly banking solutions. Prediction markets are no longer experimental curiosities. They are a fast-growing market infrastructure with real revenue potential and predictable paths to regulatory clarity. The winners will be platforms that combine robust legal frameworks, audited market logic, institutional liquidity, and seamless integration into existing financial products.

Who Should Build a Crypto Neo Banking Platform With a Prediction Market In It?

Not every financial platform needs prediction markets, but for some, the opportunity is too strategic to ignore. Platforms aiming to move beyond conventional digital banking and introduce high-engagement, event-driven financial products are already exploring this direction. Enterprises evaluating white label crypto neo bank development are particularly well-positioned, as the infrastructure foundation is already in place, allowing them to experiment, launch, and scale advanced market features far more efficiently.

| Investor Type | Why should they build? | Expected benefits |

|---|---|---|

| Institutional asset managers and hedge funds | Access alternative data signals and hedging instruments | Real-time macro signals, bespoke hedging, new alpha sources |

| Challenger neo-banks and fintechs | Differentiate the product suite and boost retention | Higher DAU, cross-sell of savings and credit, premium subscriptions |

| Traditional retail brokers and wealth platforms | Provide event hedging products to clients | New fee lines, increased platform trading volume, client stickiness |

| Payment platforms and digital wallets | Embed engagement and micro-bets tied to promotions | Improved LTV, conversion from marketing, monetized data streams |

| Sportsbooks and media companies | Expand event offerings and monetize audience engagement | White-label markets, sponsored liquidity pools, integrable odds feeds |

| Venture funds and platform investors | Strategic asset with platform-level defensibility | Tokenomics-enabled governance, network effects, data monetization |

| Banks exploring innovation | Pilot regulated event contracts as a low-risk product | Controlled rollouts, offline audit trails, compliance-first revenue |

Each ICP will value different delivery attributes. Institutional buyers prioritize auditability, custody, and settlement certainty. Consumer platforms prioritize UX, onboarding friction and fraud protection. A good integration plan into a customized BaaS platform maps these priorities to architecture, compliance, and go-to-market.

Benefits of Integrating Prediction Markets Into Existing BaaS Solutions?

- New diversified revenue: trading fees, market creation fees, subscription products, and data licensing.

- Improved user engagement: gamified markets increase DAU, cross-sell rates, and deposit retention.

- Alternative hedging instruments: event-based positions for macro and idiosyncratic risk management.

- Premium product differentiation: unique features for high-value clients and institutional desks.

- Proprietary data assets: structured event outcomes become monetizable signals for research and asset management.

- Elastic scaling of product offerings: markets can be white-labeled for partners and sponsors.

- Regulatory arbitrage mitigation: hybrid designs enable compliant offerings that would otherwise be restricted to on-chain-only models.

- Operational synergy: integrates with existing KYC, custody, and customer support infrastructure to keep the marginal cost of new products low.

Essential Components of NeoBank App Platform Development with Prediction-Market

- Market engine: deterministic, auditable smart contracts or exchange matching logic with replayable trade history.

- Oracle fabric: redundant oracle sets with economic incentives, cryptographic proofs and dispute resolution.

- Liquidity stack: AMM templates, maker incentives, and external market maker APIs for deep order books.

- Settlement rail: choice of on-chain (USDC / stablecoin), off-chain clearing, or hybrid settlement to meet FX, custody, and reconciliation needs.

- Custody & KYC integration: segregated hot and cold custody, administrator keys, and seamless KYC/AML flows tied into the bank rails.

- Governance and dispute layer: tokenized or multisig dispute escalation, transparent resolution windows, and legal arbitration interfaces.

- Risk controls: real-time exposure limits, automated position throttles, and scenario stress testing.

- Front-end and trading UX: low latency order entry, tick-level market depth, market creation UI, and clear risk disclosures.

- Audit and verification: formal verification of contracts, third-party security audits, and reproducible testnets.

- Data and analytics: streaming market telemetry, user cohort metrics, pricing oracles, and API endpoints for downstream quant and trading desks.

These components should be architected as modular services, allowing regulated institutions to activate or restrict specific functionalities in alignment with their compliance frameworks. Delivering such a system with precision typically requires collaboration with a seasoned and certified crypto banking development company that brings extensive domain experience, a multidisciplinary engineering team, and in-house legal expertise to navigate regulatory and licensing complexities. In addition, the partner you engage should possess strong API integration capabilities and established working relationships with reputable third-party infrastructure providers, ensuring seamless interoperability and dependable operational continuity.

Evaluate Your Platform Architecture With Our Experts

How Does Antier Help Build Enterprise-Grade Prediction Market Integrated White-Label Neo Bank Apps?

Antier delivers a full A-to-Z white label neo bank app solution built for institutional buyers. The following is a pragmatic flow that maps to investor expectations and operational controls.

1. Discovery and requirements engineering

- Regulatory scoping for jurisdictions of operation.

- Product definition with investor KPIs such as take rates, expected volumes and settlement currencies.

- Risk appetite and allowed event categories.

2. Architecture and design

- Define settlement topology: L1, L2 or hybrid.

- Design oracle strategy: primary and fallback feeds, economic incentives and slashing rules.

- Select a liquidity approach: built-in AMM, partner market makers, and provisioned maker funds.

3. Smart contract and exchange development

- Build auditable market logic, a matching engine, or AMM contracts.

- Code formal verification where required.

- Implement staking, fee routing, and governance modules.

4. Compliance, legal, and controls

- Integrate KYC/AML providers and transaction monitoring.

- Draft product legal wrappers, customer terms and disclosure templates.

- Engage counsel for derivatives and gambling law as applicable.

5. Security and audit

- Comprehensive security audits from multiple independent firms.

- Penetration testing, bug bounty setup, and continuous monitoring.

- Operational runbooks and incident response plans.

6. Custody and settlement integration

- Integrate institutional custody providers for fiat and crypto.

- Implement ledger reconciliation, proofs of reserves, and audit trails.

7. UX, SDKs and APIs

- White-label web and mobile front ends designed for low-friction onboarding.

- Provide SDKs for market creation, order execution, data streams and settlement APIs.

8. Pilot and liquidity seeding

- Execute controlled pilots with predefined resolution windows.

- Provide initial liquidity incentives and market maker agreements.

9. Ops, reporting and monetization

- Build compliance reporting pipelines, audit logs, and tax reporting.

- Implement fee routing, subscription management and data productization.

10. Post-launch governance and scaling

- Ongoing legal support for emerging rules.

- Scalable infra upgrades for peak market days and institutional integrations like broker partners.

Being the leading blockchain and AI development company, Antier’s delivery emphasizes the separation of concerns. The bank retains control over custody and regulatory reporting. Antier provides the market logic, oracles, integration and production runbooks so that a neo-bank can operate prediction markets with institutional safeguards.

How Prediction Markets Create a Competitive Advantage for White-Label Neo Banking Platforms?

Prediction markets act as a true differentiation layer for white-label neo banks when they move the platform from a set of commoditized utilities into an interactive financial ecosystem. Rather than another feature checkbox, a well-designed prediction module changes how users interact with money, risk, and information inside the app. For investors, this matters because differentiation must translate into measurable business outcomes: higher retention, new revenue line,s and proprietary assets that are hard to copy.

How does it work in practice?

a) New financial primitives inside the product stack. Markets let customers take positions, hedge exposures or acquire probabilistic insights directly from the bank’s interface. These are not marketing gimmicks. They are real instruments that increase transaction frequency and stickiness.

b) quidity footprints and behavioral cohort patterns. Over time, those signals become a defensible data moat that can be monetized through research products, premium analytics,s or B2B feeds.

c) Network effects and liquidity defensibility. Active markets attract makers and takers. As liquidity deepens, spreads tighten, and user experience improves. This creates a virtuous cycle that raises the barrier to entry for competitors.

d) Faster monetization with modular integration. White-label neo bank solutions already have custody, KYC, and payment rails. Adding a prediction layer is largely incremental engineering that yields multiple monetization levers: fees, market creation commissions, and subscription analytics.

Investor-focused metrics to watch

- Incremental daily active users attributable to markets

- Fee per active market and margin after liquidity incentives

- Data revenue per month from market analytics and API clients

- Churn delta for users who participate in markets versus control group

Takeaway

For investors, prediction markets are not simply product innovation. When implemented with institutional rigor, they create measurable differentiation, recurring revenue, and a proprietary data asset that collectively strengthen the platform’s defensibility and valuation.

How Much Does a Prediction Market in White-Label BaaS Platforms Cost?

Cost is driven by architecture, jurisdiction, and desired speed to market. White label neo banking platform development with prediction market cost drivers includes legal and compliance, security audits, Oracle integration, liquidity seeding, smart contract engineering, and UI/UX. Choosing a true hybrid settlement model increases integration complexity and therefore cost but often lowers long-term operational risk and regulatory friction. From a strategic perspective, investors should focus less on headline integration cost and more on unit economics. That means modeling fee capture per market, expected liquidity depth, projected churn reduction, and data product revenue. Practical tactics to control spending include phased delivery, reusing audited open standards for AMMs and oracles, and using partner liquidity before committing proprietary capital.

Join Hands With Antier’s Accredited Fintech & Crypto Experts!

For institutional investors evaluating white-label neo-bank opportunities, prediction markets are a force multiplier. They provide distinct monetization avenues, generate proprietary data, and offer new hedging instruments. The market has matured to an inflection point where volumes and institutional participation justify production deployments, but regulatory work remains an essential part of the build plan.

Get in touch with Antier to launch your white label banking solution in just a few weeks and under professional guidance. Our approach combines deep technical engineering, formal verification, institutional custody integration, and specialist regulatory support so the client can scale markets responsibly. We help clients define the product, build robust market logic, integrate custody and compliance, seed liquidity, and operate at enterprise SLAs. If you are an investor or platform executive, integrating prediction markets is a strategic decision. With the right partner and a defensible compliance posture, it becomes a predictable, accretive growth engine.

Frequently Asked Questions

01. What are prediction markets and why are they gaining traction in 2026?

Prediction markets are platforms that allow users to bet on the outcomes of future events. They are gaining traction due to significant growth in trading volumes, reaching $44 billion in 2025, and the maturation of the ecosystem, which now features regulated exchanges and on-chain platforms that enhance liquidity and reduce risks.

02. How can embedding a prediction-market module benefit neo-banking platforms?

Embedding a prediction-market module in neo-banking platforms can unlock new fee streams, enhance customer engagement, and provide valuable market signals that inform risk management and trading strategies.

03. What regulatory changes are impacting prediction markets?

Regulators are shifting from avoidance to active engagement, which is leading to clearer rulemaking and reducing legal risks for properly structured prediction market products, thereby fostering a more stable environment for investment.

Crypto World

What Are The Chances Of Ethereum Price Recovery To $2,500

Ethereum has shown early signs of recovery after a prolonged period of weakness that pushed prices sharply lower. ETH has attempted to stabilize near key support levels, but further upside depends on sustained backing from investors and broader market conditions.

At present, Ethereum appears to have at least one of these factors working in its favor, keeping recovery prospects alive.

Sponsored

Sponsored

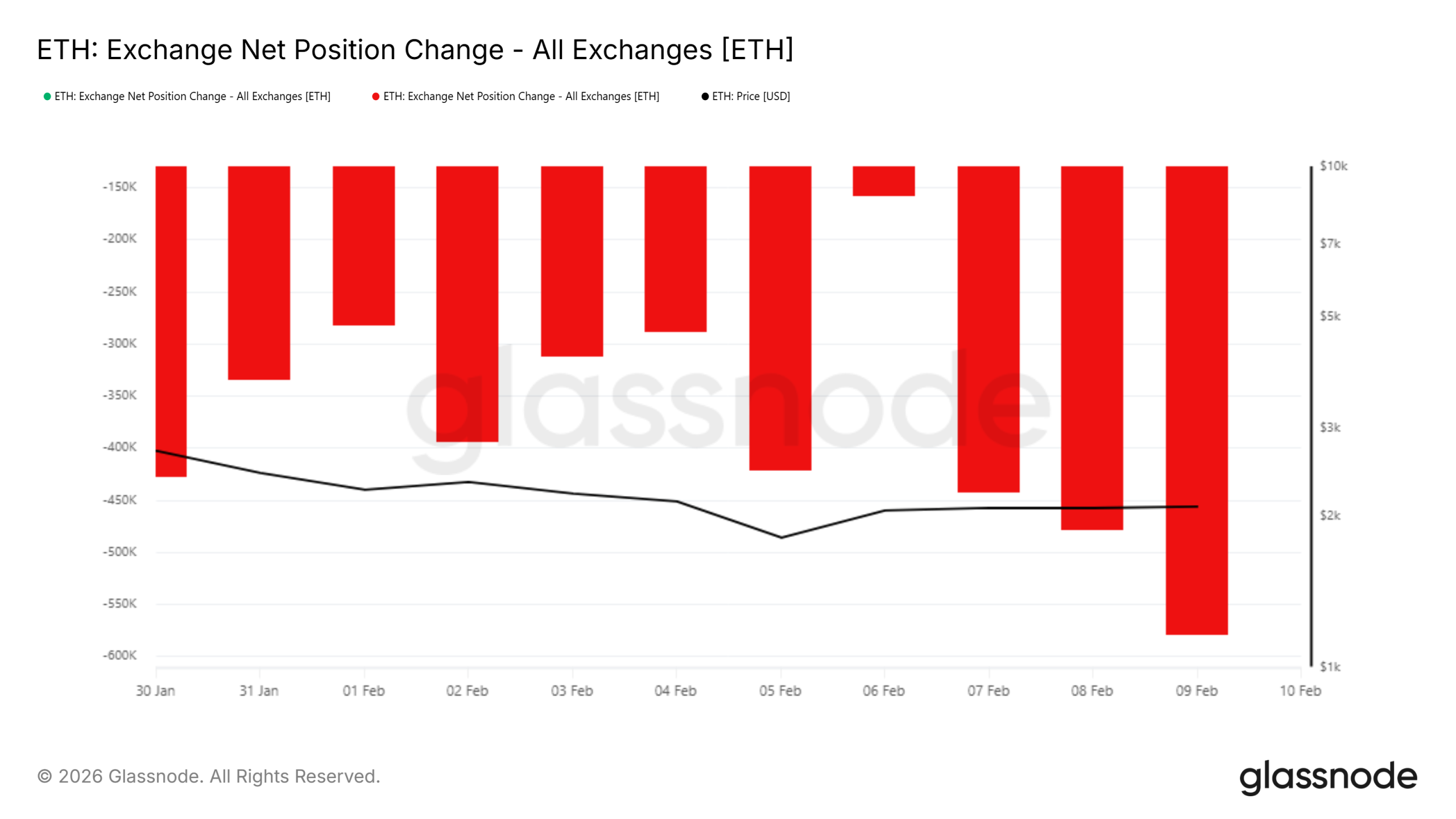

Ethereum Investors Change Stance

On-chain data suggests a notable shift in investor behavior. The exchange net position change indicator, which tracks capital flows into and out of exchanges, has turned negative for Ethereum. This signals that more ETH is leaving exchanges than entering them, a pattern typically associated with accumulation rather than distribution.

Such outflows suggest holders are choosing to buy and move ETH into private wallets instead of preparing to sell. Lower prices often encourage this behavior as investors position for potential rebounds. This shift in stance reflects improving confidence, even as the price has yet to fully reflect rising demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Broader momentum indicators support this narrative. The Chaikin Money Flow has shown a steady uptick over the past week, reinforcing the trend observed in exchange data. Rising CMF values indicate declining outflows and improving capital flow dynamics across Ethereum markets.

Sponsored

Sponsored

A move above the zero line would mark inflows overtaking outflows, a bullish development for ETH. At the same time, Ethereum has managed to hold above the 23.6% Fibonacci retracement near $2,054. Maintaining this level often acts as a trigger for renewed participation, encouraging investors to deploy capital as downside risk appears more contained.

What Is ETH Price’s Next Target?

Ethereum is trading near $2,018 at the time of writing, signaling that demand remains present beneath current prices. The challenge lies in translating that demand into sustained upward movement. A successful bounce from the $2,000 level could push ETH through $2,205, a key short-term resistance. Beyond that, the psychological target of $2,500 comes into focus.

Reaching $2,500 may not prove difficult from a structural standpoint. Cost basis distribution data shows relatively light accumulation around this zone, suggesting limited overhead supply. As a result, ETH could move through this range with less resistance once momentum builds. Stronger accumulation clusters appear closer to $2,800, which is likely to act as a more meaningful barrier.

Before that scenario plays out, Ethereum must clear intermediate hurdles. A decisive move above $2,344 would confirm recovery strength and validate the path toward $2,500 and potentially higher levels. Failure to sustain current support, however, would undermine the bullish setup. A loss of the $2,000 level would expose ETH to renewed downside risk, with $1,796 emerging as the next major support area.

Crypto World

AAVE price risks fresh plunge under $100, bears eye 2-year lows

- Aave price could plummet under $100 and risk new multi-year lows.

- Bears can decisively take out the psychological level and test the $75-$80 range.

- However, dips can offer a buy-the-dip opportunity before a sharp rebound.

Aave fell to around $108 as decentralised finance tokens broadly moved into negative territory.

With broader market pressures weighing on sentiment, AAVE faces rising downside risks and is at risk of slipping below the key $100 support level.

The outlook reflects continued volatility across the sector, with a notable decline in total value locked, highlighting growing vulnerability to further price weakness.

Aave price retests $108

Aave’s AAVE token was trading near $370 in August 2025 but has since declined sharply amid persistent bearish sentiment across the crypto market.

Prices fell steadily through late 2025 before sliding more aggressively toward the $100 zone.

A double-top pattern formed in the latter months of last year, and the subsequent drop to around $95 last week marked a significant downturn for the DeFi token.

Although AAVE rebounded briefly to about $120, selling pressure has remained strong, with prices retesting the $108 support level.

The token is down roughly 15% over the past week and about 25% year-to-date.

It has also fallen around 67% since August 2025 and more than 80% from its all-time high above $667 in 2021.

The price weakness has coincided with a sharp decline in Aave’s total value locked, reflecting reduced liquidity and softer protocol revenues.

AAVE price forecast: bears eye 2-year lows

Bulls are not completely out of the picture despite the recent bloodbath.

However, sentiment is battered, and momentum is with bears.

For Aave, technical indicators signal this increasing bearish momentum.

While momentum oscillators remain in neutral territory and point to the possibility of a short-term bullish shift, moving averages continue to signal strong selling pressure for Aave.

A slide toward the psychologically important $100 level, after the token fails to hold above the $112 support zone, will reinforce this bearish outlook.

As reflected on the daily chart, a breakdown similar to the pattern that has defined AAVE’s price action since late 2025 could accelerate seller dominance and deepen near-term downside risks.

The current downturn could push the price toward the $75–$80 demand zone in the near term, an area that aligns with a key Fibonacci retracement level.

A move into this range would place Aave back at levels last seen in early 2024.

On the upside, renewed momentum would likely require a sustained weekly close above $140.

Such a move would depend on rising trading volumes, with $120 acting as initial support and $144 as a secondary resistance level before higher targets come into view.

Meanwhile, the daily Relative Strength Index is hovering near neutral territory around 34, giving sellers some room to maintain pressure.

Analysts note this setup could increase the risk of a short-term false breakout before a clearer directional move emerges.

Crypto World

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Kyle Samani, the recently departed co-founder of Multicoin Capital, has launched a blistering attack on the high-flying Hyperliquid decentralized exchange (DEX), labeling it a systemic risk despite his former firm’s reported aggressive accumulation of its underlying HYPE token.

Key Takeaways:

- Kyle Samani publicly slammed Hyperliquid’s closed-source model days after leaving Multicoin Capital.

- On-chain analysts report Multicoin-linked wallets holding over $40 million in HYPE tokens.

- Hyperliquid recently surpassed Coinbase in volume following its HIP-4 prediction market launch.

Why is Samani Targeting Hyperliquid Now?

Samani stepped down from Multicoin Capital on February 5, 2026, ending a decade-long tenure.

Just three days later, on February 8, he broke his silence to target Hyperliquid, the biggest DEX in the world. His acerbic criticism highlights a deep ideological rift in the industry, with Kyle championing permissionless open-source protocols, which he claims Hyperliquid is not.

Samani also implies criminal or untoward things about the exchange, facilitating “crime and terror”, although he mistakenly calls the Bay Area-born Hyperliquid founder Jeff Wan an immigrant.

This clash of philosophies comes at a time when capital flows are ignoring ideology; investors pour $258 million into crypto startups regardless of technical decentralization, chasing the massive returns that high-performance apps are currently delivering.

With a dizzying plethora of features that give it some of the utility of a CEX, Hyperliquid has surged in recent months by prioritizing vertical integration and performance over open-source transparency.

“Walled Garden” or Market Leader?

Samani didn’t hold back, asserting that Hyperliquid “is in most respects everything wrong with crypto.”

His critique specifically targets the project’s closed-source architecture and permissioned validator set.

He argues this “walled garden” approach, combined with the founder’s choice to set up shop in the non-extradition jurisdiction of Singapore, creates unacceptable seizure risks.

Samani also alleged that the platform’s opacity acts as a shield for potential illicit financial activity.

This rhetoric taps into growing fears regarding unchecked crypto platforms, a narrative underscored recently when two high schoolers were charged in an Arizona home invasion targeting $66m in crypto, reminding the market of the darker side of unparalleled anonymity.

Despite Samani’s reservations, the market continues voting with its wallet. Hyperliquid recently overtook Coinbase in trading volume, doubling the centralized exchange’s figures in early 2026.

With a market cap above $7 billion, the HYPE token remains one of the 20 largest cryptocurrencies and among the top cryptos to diversify with. This calls to mind how the Post-Quantum QONE token sold out in 24 hours, proving that traders value cutting-edge tech narratives above the social media feuds.

The $40 Million Contradiction

The timing of these comments has also fueled speculation concerning internal disagreements at Multicoin.

A wallet widely believed to be linked to Multicoin was recently spotted accumulating over $40 million in HYPE tokens. This creates a stark contradiction: the firm Samani founded is betting heavily on the very asset he claims could ruin the industry.

Samani’s response to the firm’s purchasing behavior was blunt: “I don’t work at multicoin.” Since leaving, he has stated his intention to branch into other technologies, but announced he will remain chair of Forward Industries, a Solana treasury.

Samani’s clash with Hyperliquid underscores the deep divisions still rife in crypto as the industry awaits regulation by US lawmakers.

The post Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary appeared first on Cryptonews.

Crypto World

AI mania is helping cap crypto’s upside, Wintermute says: Crypto Daybook Americas

By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin slipped to $68,500 on Tuesday, having failed to reclaim $70,000 after trading above that level for a while over the weekend. The CoinDesk 20 Index (CD20) dropped 0.23% over the past 24 hours.

The market appears to be stabilizing after last week’s decline to $60,000, which erased all the cryptocurrency’s gains since Donald Trump’s presidential election victory in November 2024.

The slide prompted over $2.7 billion in liquidations, flushing out leveraged positions. It may not, however, have reflected a fundamental change in the crypto market. Rather, it might have been tied to declining liquidity in the broader financial ecosystem.

Raoul Pal, CEO of Global Macro Investor, said last week’s selloff across crypto and tech stocks stemmed from temporary drains in U.S. dollar liquidity tied to Treasury operations and government funding dynamics.

And then there’s artificial intelligence (AI). Investments in that technology have been “absorbing available capital for months at the expense of everything else,” Wintermute wrote in a note. The trading firm wrote that stripping AI companies from the Nasdaq 100 index sees crypto’s negative skew nearly disappear.

“The underperformance during rallies and amplified selling during drops is almost entirely explained by AI rotation,” Wintermute OTC trader Jasper De Maere wrote. “For crypto to outperform again, air needs to come out of the AI trade.”

Elsewhere, Japanese government bond yields, which rose after Prime Minister Sanae Takaichi’s decisive election victory at the weekend, are dropping. That could avoid further unwinding of the yen carry trade, which might have seen up to $5 trillion invested overseas moving back to the country.

Arthur Hayes, a co-founder of crypto exchange BitMEX, pointed to Takaichi’s victory as a potential catalyst for the yen to lose value against the dollar, making the Japanese currency a less attractive investment. That could be a boon for risk assets, including cryptocurrencies.

Still, prices are likely to remain rangebound for the time being. The Coinbase Premium Index, which measures demand from large U.S. investors on the exchange, remains negative, and spot bitcoin ETF flows also show hesitation, with daily net inflows coming in at just $145 million yesterday.

“While retail spreads attention across other asset classes, institutional flows through ETFs and derivatives now seem to dictate direction,” Wintermute wrote. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Feb. 10: Mantle to host Mantle State of Mind Ep. 06 live from Consensus HK.

- Macro

- Feb. 10, 7 a.m.: Brazil inflation rate YoY (Prev. 4.26%), MoM (Prev. 0.33%)

- Feb. 10, 8:30 a.m.: U.S. retail sales MoM for December Est. 0.5% (Prev. 0.6%)

- Feb. 10 8:30 a.m.: U.S. employment cost index QoQ (Prev. 0.8%)

- Feb. 10, 2 p.m.: Argentina inflation rate YoY (Prev. 31.5%), MoM (Prev. 2.8%)

- Earnings (Estimates based on FactSet data)

- Feb. 10: Canaan (CAN), pre-market, -$0.03

- Feb. 10: Robinhood Markets (HOOD), post-market, $0.63

- Feb. 10: Upexi (UPXI), post-market, -$0.07

- Feb. 10: Lite Strategy (LITS), post-market

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Unlocks

- Token Launches

- Feb. 10: Venice (VVV) token emissions to drop from 8 million to 6 million per year.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is down 1.9% from 4 p.m. ET Monday at $69,041.32 (24hrs: -0.06%)

- ETH is down 4.94% at $2,016.57 (24hrs: -0.8%)

- CoinDesk 20 is down 2.59% at 3,086.55 (24hrs: +0.43%)

- Ether CESR Composite Staking Rate is up 7 bps at 2.82%

- BTC funding rate is at -0.006% (-6.6247% annualized) on Binance

- DXY is unchanged at 96.83

- Gold futures are unchanged at $5,077.00

- Silver futures are down 0.43% at $81.88

- Nikkei 225 closed up 2.28% at 57,650.54

- Hang Seng closed up 0.58% at 27,183.15

- FTSE is down 0.38% at 10,346.98

- Euro Stoxx 50 is unchanged at 6,060.67

- DJIA closed on Monday unchanged at 50,135.87

- S&P 500 closed up 0.47% at 6,964.82

- Nasdaq Composite closed up 0.90% at 23,238.67

- S&P/TSX Composite closed up 1.7% at 33,023.32

- S&P 40 Latin America closed up 1.97% at 3,767.79

- U.S. 10-Year Treasury rate is down 1.4 bps at 4.184%

- E-mini S&P 500 futures are up 0.09% at 6,989.25

- E-mini Nasdaq-100 futures are unchanged at 25,359.00

- E-mini Dow Jones Industrial Average Index futures are unchanged at 50,260.00

Bitcoin Stats

- BTC Dominance: 59.27% (+0.05%)

- Ether-bitcoin ratio: 0.02921 (-2.66%)

- Hashrate (seven-day moving average): 1,005 EH/s

- Hashprice (spot): $34.72

- Total fees: 2.92 BTC / $204,792

- CME Futures Open Interest: 118,215 BTC

- BTC priced in gold: 13.6 oz.

- BTC vs gold market cap: 4.6%

Technical Analysis

- The ratio of altcoins (excluding Top 10) to BTC weekly chart continues to maintain its core support, suggesting the broader altcoin market did not experience an extreme selloff during the bitcoin’s recent slide.

- The weekly RSI has been climbing, indicating some momentum in altcoins relative to BTC.

- There’s no clear breakout at the moment, but it’s worth keeping an eye on.

Crypto Equities

- Coinbase Global (COIN): closed on Monday at $167.25 (+1.29%), -1.44% at $164.84 in pre-market

- Circle Internet (CRCL): closed at $60.10 (+5.36%), -1.31% at $59.31

- Galaxy Digital (GLXY): closed at $21.15 (+7.03%), +0.61% at $21.28

- Bullish (BLSH): closed at $32.05 (+16.76%), unchanged in pre-market

- MARA Holdings (MARA): closed at $8.06 (-2.18%), -1.49% at $7.94

- Riot Platforms (RIOT): closed at $14.97 (+3.60%), -1.27% at $14.78

- Core Scientific (CORZ): closed at $18.55 (+10.35%)

- CleanSpark (CLSK): closed at $10.19 (+1.09%), -1.77% at $10.01

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $43.83 (+8.41%)

- Exodus Movement (EXOD): closed at $10.74 (+1.70%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $138.44 (+2.6%), -2.61% at $134.82

- Strive (ASST): closed at $10.15 (-14.86%), +1.03% at $10.25

- SharpLink Gaming (SBET): closed at $7.11 (+1.14%), -0.7% at $7.06

- Upexi (UPXI): closed at $1.05 (-7.89%), +2.86% at $1.08

- Lite Strategy (LITS): closed at $1.05 (-0.94%), -2.86% at $1.02

ETF Flows

Spot BTC ETFs

- Daily net flows: $144.9 million

- Cumulative net flows: $54.82 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: $57 million

- Cumulative net flows: $11.9 billion

- Total ETH holdings ~5.8 million

Source: Farside Investors

While You Were Sleeping

Crypto World

Blockchain.com wins UK registration nearly four years after abandoning FCA process

Cryptocurrency exchange and wallet provider Blockchain.com has won regulatory approval in the U.K nearly four years after seemingly giving up.

Blockchain.com was added to the Financial Conduct Authority’s (FCA) registry of licensed crypto companies on Tuesday under its trading name “BC Operations.”

The London-based company elected to withdraw its application for FCA licensing in March 2022 having not won approval ahead of an impending deadline. Blockchain.com pivoted to its registered business in Lithuania.

Registration in the U.K. allows Blockchain.com to carry out certain crypto-related activities in the U.K. on the basis that it complies with money laundering and counter-terrorist financing rules.

“Blockchain.com is now operating under the same rigorous standards as traditional finance and banks in the U.K.,” the company said in a post on X on Tuesday.

The FCA’s crypto company licensing regime, however, stops short of full financial services authorization — this is set to be introduced under a new licensing framework taking effect from October next year.

Read More: Ripple wins UK regulatory approval from Financial Conduct Authority

Crypto World

BTC holding in tight range as markets brace for January employment data

Following the usual recent pattern, crypto markets fell sharply as U.S. stocks opened for trade Tuesday, but recovered most of those losses in a similarly quick fashion.

In mid-morning trade, bitcoin was at $69,200, down marginally from 24 hours ago. Ether underperformed, down 1.8%, with similar declines in XRP and Solana .

While bitcoin’s current drawdown is the most significant since the 2024 halving, trading volume stayed low during the decline, suggesting retail investors stepped back rather than rushed to sell, according to Kaiko.

The “market [is now] approaching critical technical support levels that will determine whether the four-year cycle framework remains intact,” Kaiko research analyst Laurens Fraussen wrote in a report Tuesday.

Trading firm Wintermute expects bitcoin to remain in the current range as it’s still in price discovery.

Recent bitcoin moves have been driven by leveraged derivatives rather than spot demand, the firm said, with light spot volumes leaving prices sensitive to crowded positions. Wintermute pointed to last Friday’s rebound as a short squeeze in perpetual futures and said the return of volatility caught investors off guard after a period of complacency.

January jobs report on tap

Originally scheduled for last Friday, the government’s January Nonfarm Payrolls Report is now coming out on Wednesday morning due to the brief federal shutdown last month.

Economist forecasts are for 70,000 jobs to have been added, up from 50,000 in December. The unemployment rate is expected to remain at 4.4%.

White House trade counselor Peter Navarro, however, said in a Fox interview Tuesday that expectations need to be significantly revised lower. His comments follow those of White House economic adviser Kevin Hassett, who advised markets not to panic on weak jobs data.

Those remarks appear to have been noted by the bond market, where the 10-year Treasury yield is lower by 5 basis points to 4.14%. Lower interest rates and easier Federal Reserve monetary policy are typically assumed to be good for assets like bitcoin, but it hasn’t been the case this cycle, with bitcoin plunging even as the Fed has trimmed rates by 75 basis points in recent months.

Crypto World

Tether invests in LayerZero Labs as it doubles down on cross-chain tech, agentic finance

Tether Investments, the investment arm of the leading stablecoin issuer, has made a strategic investment in LayerZero Labs, which develops an interoperability protocol called LayerZero.

The move is essentially a bet on the technology underpinning USDt0, a blockchain-agnostic version of Tether’s dollar-pegged token that has moved over $70 billion across blockchains in less than a year, according to a press release the company shared.

LayerZero’s infrastructure enables cryptocurrencies to flow across different blockchains without fragmentation or illiquidity. That allows developers building financial tools to rely on stablecoins without getting their funds locked in a single network.

That same architecture also supports more experimental use cases, like AI agents managing their own wallets and sending payments autonomously, in what Tether called “agentic finance.”

Tether’s investment comes on the heels of USDt0’s deployment by Everdawn Labs and is built using LayerZero’s Omnichain Fungible Token (OFT) standard. Alongside their tokenized Tether gold token, XAUt0, the projects are seen as real-world tests of LayerZero’s interoperability framework.

The financial terms of the deal were not disclosed, and Tether did not reply to a request for comment.

The stablecoin giant has been using the billions it generates from backing USDT tokens in circulation to make a wide range of investments. These include a majority stake in Latin American agricultural firm Adecoagro (AGRO), a privacy-focused health app, and a stake in video-sharing platform Rumble (RUM).

The company has been aggressively accumulating gold, and earlier this month, itbought a $150 million stake in Gold.com to boost the distribution of tokenized gold.

LayerZero’s ZRO token gained as much as 10% on the news, but quickly reversed, now lower by 3% over the past 24 hours.

Crypto World

Bad Bunny’s Super Bowl Zara Moment Signals Luxury Shift

Editor’s note: This press release examines the market implications of Zara’s recent cultural visibility during the Super Bowl, framing it as more than a one-off branding moment. Through commentary from an eToro market analyst, the announcement explores how global consumer brands are redefining value by prioritizing cultural relevance, accessibility, and identity over traditional luxury signals like exclusivity and price. While rooted in fashion and consumer culture, the analysis connects directly to long-term brand positioning, investor perception, and how intangible assets such as narrative and cultural alignment can shape competitive advantage over time.

Key points

- Zara’s Super Bowl moment is positioned as a strategic signal, not a traditional advertising play.

- The brand is increasingly framed as “accessible luxury” rather than fast fashion.

- Cultural embedding is highlighted as a form of earned media that reduces marketing dependence.

- Employee inclusion is cited as a source of internal cohesion and intangible capital.

- The growing influence of Hispanic culture is identified as a structural demand driver.

Why this matters

For investors and market observers, the analysis highlights how cultural relevance can reshape long-term brand valuation even when near-term financials remain unchanged. As attention costs rise and consumer identity becomes central to purchasing behavior, companies that successfully shift their perceived category may unlock durable advantages that are not immediately priced in by markets. This dynamic is especially relevant for consumer-facing companies competing across global, demographically diverse markets.

What to watch next

- How Zara’s brand positioning continues to evolve in future cultural moments.

- Whether market perceptions begin to reflect a reclassification beyond fast fashion.

- Signals of sustained alignment with emerging demographic and cultural trends.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Abu Dhabi, United Arab Emirates – 10 February, 2026: Zara’s appearance on the Super Bowl stage has sparked renewed debate around the evolving definition of luxury, highlighting a broader shift in how global brands compete for cultural relevance, consumer identity, and long-term value.

Commenting on the development, Javier Molina, Market Analyst at eToro, said the moment carries strategic significance beyond its cultural visibility.

What may initially appear as a high-profile cultural moment reflects a deeper change in perceived value hierarchies, where cultural resonance and accessibility increasingly rival traditional notions of exclusivity.

The episode underscores Zara’s ability to generate global relevance without relying on direct advertising expenditure. As the cost of consumer attention continues to rise, embedding the brand within culture has become a powerful source of earned media — supporting brand strength while limiting the need for incremental marketing investment.

More importantly, the moment signals a potential repositioning. Zara is increasingly being viewed beyond the confines of fast fashion, occupying a middle ground best described as accessible or functional luxury. Rather than competing on price or scarcity, the brand is engaging consumers through narrative, identity, and cultural alignment — factors that resonate strongly with younger generations and are structurally difficult for traditional luxury brands to replicate.

There are also internal implications. By placing employees at the centre of the story as recipients of symbolic value rather than passive observers, the brand strengthens cohesion and execution within a business model built on speed, scale, and operational efficiency. This intangible capital can translate into improved performance over time.

Finally, the moment reinforces a broader structural trend shaping Western consumption: the growing influence of Hispanic culture as a driver of both demand and cultural leadership. For Zara, this represents not just visibility, but strategic alignment with the demographic and cultural momentum of its core markets.

From an investment perspective, Molina noted that such cultural shifts may not immediately impact quarterly results, but they play a meaningful role in redefining long-term brand positioning. When a company begins to change the category in which it operates, markets are often slow to fully reflect that transformation — creating potential value over time.

About eToro

eToro is the trading and investing platform that empowers you to invest, share and learn. We were founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way. Today we have 40 million registered users from 75 countries. We believe there is power in shared knowledge and that we can become more successful by investing together. So we’ve created a collaborative investment community designed to provide you with the tools you need to grow your knowledge and wealth. On eToro, you can hold a range of traditional and innovative assets and choose how you invest: trade directly, invest in a portfolio, or copy other investors. You can visit our media centre here for our latest news.

Disclaimers:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is a group of companies that are authorised and regulated in their respective jurisdictions. The regulatory authorities overseeing eToro include:

- The Financial Conduct Authority (FCA) in the UK

- The Cyprus Securities and Exchange Commission (CySEC) in Cyprus

- The Australian Securities and Investments Commission (ASIC) in Australia

- The Financial Services Authority (FSA) in the Seychelles

- The Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM) in the UAE

- The Monetary Authority of Singapore (MAS) in Singapore

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Crypto World

This Trending Meme Coin Explodes by 100% Weekly: What Comes Next?

Is this the new crypto sensation or just another scam?

The cryptocurrency market experienced a severe pullback in the past few weeks, culminating in a sharp crash on February 6.

The meme coin sector was significantly affected by the red wave, and most leading tokens in that niche have posted substantial losses. However, the lesser-known pippin (PIPPIN) defied the carnage and its valuation soared by over 100% in the past week.

Swimming Against the Tide

PIPPIN is a Solana-based meme coin that began trading in late 2024. It is themed around an AI-generated unicorn character named “Pippin,” which has become the logo of the token.

The meme coin had its glory days toward the end of 2025, when its price reached an all-time high of almost $0.60, and its market capitalization surpassed $500 million. While January was also positive, the beginning of February offered a deep correction.

In the past week, though, the asset entered another major uptrend, which contrasts with the overall bearish environment in the crypto market. As of press time, PIPPIN is worth roughly $0.38, or a 114% increase on a weekly basis.

Analysts are curious if the bull run is sustainable since there isn’t an evident catalyst driving the move north. X user ALTS GEMS Alert claimed the price has initiated a “strong bounce” from the demand zone at around $0.26, predicting that if buyers remain active, PIPPIN could soar to $0.40 and even $0.60.

Satori chipped in, too. The analyst told their over 700,000 followers on X that they have added the coin to their watchlist, arguing it has potential for much more impressive gains ahead.

You may also like:

A Ticking Time Bomb?

At the same time, some industry participants warned investors to stay away from PIPPIN, claiming its valuation is driven by pure speculation, and its utility is questionable.

X user Dippy.eth described the asset as “the largest scam of the past year,” arguing it has reached the first “take profit” zone. “0 technologies, 0 real metrics, 0 real users, 0 attention from real CT degens,” they added.

Crypto_Jobs is also pessimistic, envisioning a possible plunge to as low as $0.21. Some indicators, such as PIPPIN’s Relative Strength Index (RSI), support the bearish scenario. The technical analysis tool measures the speed and magnitude of recent price changes to help traders identify potential reversal points.

It ranges from 0 to 100, and readings above 70 suggest the valuation has risen too much in a brief period and could be due for imminent correction. Currently, the RSI stands at around 85.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

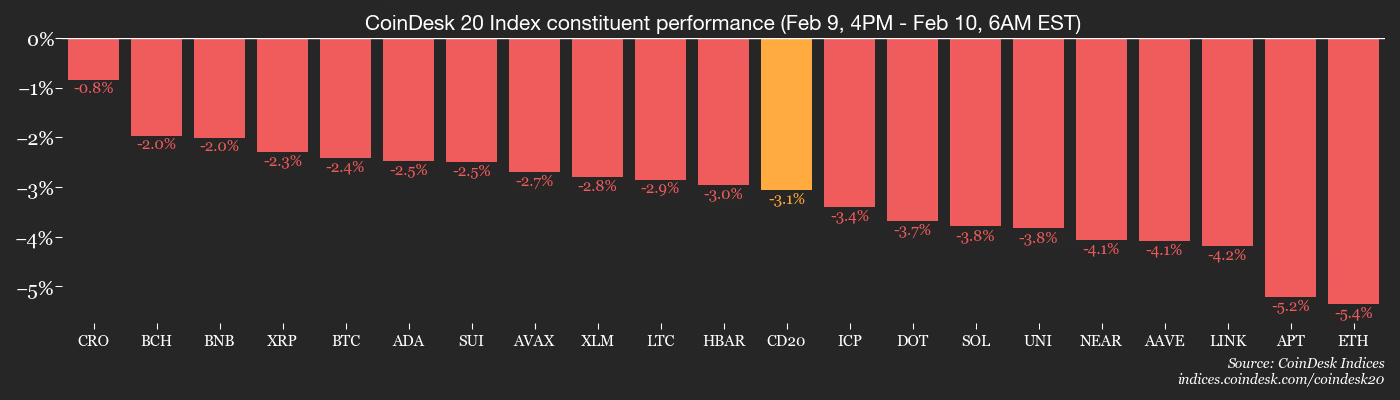

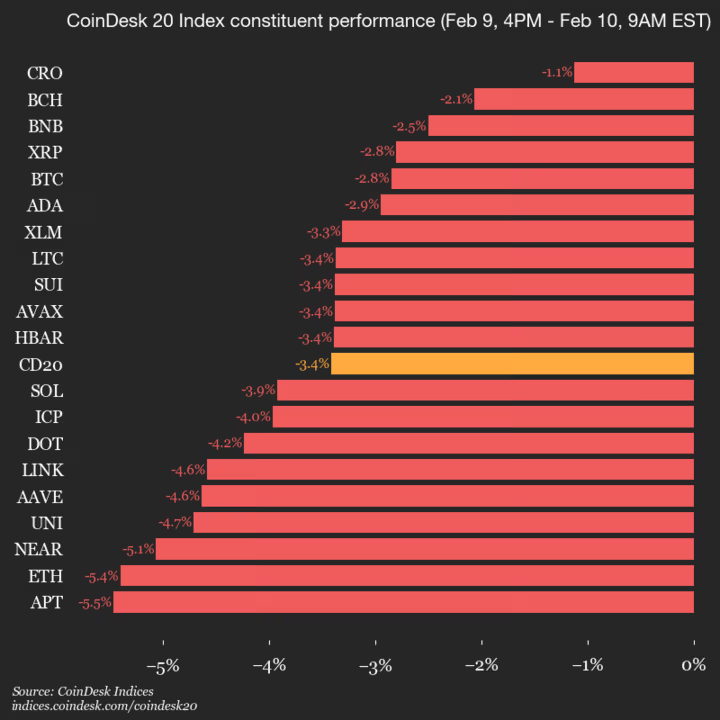

index falls 3.4% as all constituents trade lower

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1968.37, down 3.4% (-69.59) since 4 p.m. ET on Monday.

None of the 20 assets are trading higher.

Leaders: CRO (-1.1%) and BCH (-2.1%).

Laggards: APT (-5.5%) and ETH (-5.4%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat21 hours ago

NewsBeat21 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World9 hours ago

Crypto World9 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports20 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World9 hours ago

Crypto World9 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoDriving instructor urges all learners to do 1 check before entering roundabout