Crypto World

CZ Flags AI-Generated Fake Account Behind Binance FUD

CZ exposed a long-running fake account using AI-generated images to pose as a Binance supporter before spreading BNB-related FUD.

Changpeng “CZ” Zhao, the founder of Binance, has publicly identified and dismantled a coordinated misinformation campaign against him and the exchange.

CZ exposed a long-running fake account that apparently used AI-generated images to pose as a loyal supporter before posting critical “feedback.”

The Unraveling of a Fake Supporter

The incident began when CZ noticed a post from an account named “Wei 威 BNB” claiming to close a Binance account due to alleged manipulation. The account had 863,000 followers and used imagery from a BNB Chain event, making it appear legitimate.

However, the former Binance CEO said that concerns about the account’s veracity emerged after some close inspection. For starters, the account, which had blocked him, had posted several images purportedly featuring Zhao posing with the user, all of which appeared altered.

One photo showed Zhao wearing a shirt in a color he said he does not own, while another mixed low-resolution images of him and Binance executive Yi He with a sharper image of the account holder. CZ claimed the original photo featured Aster CEO Leonard.

He also claimed the account history suggested it either changed hands or was compromised years ago. The account’s history shows it originally belonged to a woman and posted exclusively female photos until July 2015, when it abruptly switched to crypto-only content without removing earlier material.

“Either a hacked takeover or bought,” CZ wrote.

He criticized the campaign as “lazy” and suggested it was likely orchestrated by a “self-perceived” competitor more focused on Binance than its own business.

You may also like:

Influencer ShirleyXBT also noted the account’s profile picture was an artificial copy of her own photo.

Community Backing and a Pattern of Scrutiny

The exposure drew some support from the crypto community, with World of Dypians CEO Teki thanking CZ for the clarification and admitting the initial post had briefly seemed believable.

Commentator Vegas offered a broader analysis, suggesting attackers fall into three categories: opportunists farming engagement, genuinely frustrated traders, and organized FUD campaigns. They also claimed to have been offered payment to spread negative sentiment about Binance, implying possible coordination by large market players or direct competitors.

This latest revelation has come amid sustained scrutiny of CZ and Binance. On January 28, the crypto entrepreneur faced backlash for allegedly promoting harmful market behavior after he advocated a buy-and-hold investment strategy, forcing him to clarify that his advice was personal and did not apply to every token.

Furthermore, on January 30, Binance announced it would convert the $1 billion in its SAFU insurance fund from stablecoins back into Bitcoin, a move some commentators viewed as a bullish signal but which also kept focus on the exchange’s financial strategies.

Despite the criticism, Binance’s market position is still quite strong, with data shared by CryptoQuant at the beginning of the year showing the exchange captured 41% of spot trading volume and 42% of Bitcoin perpetual futures volume among top-tier platforms in 2025.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Stablecoins for B2B Payments: Faster Cross-Border Settlement

Cross-border B2B payments in 2026 still pose problems that everyone agrees on. Yet the day-to-day barely changes.

Cut-off times, intermediaries, manual reconciliation, surprise fees. It’s still all too common for a simple international transfer to turn into a days-long exercise in waiting, chasing, and explaining variance on the ledger.

As a matter of fact, the ECB has pointed out that in 2024, one-third of retail cross-border payments took more than one business day to settle, and for nearly one-quarter of global corridors, costs exceeded 3%.

Even the G20 roadmap telegraphs how big the gap is. By end-2027, the target is for 75% of cross-border wholesale payments to be credited within one hour. That’s the ambition.

This is part of the reason stablecoins keep coming back into the conversation. Settlement in seconds, 24/7/365, anywhere in the world, and fees you won’t even notice. Let’s dive deeper.

It’s Time for Programmable Money

Stablecoins make the most sense when you think about them in the context of payments, instead of crypto. In a B2B context, they function like digital cash. Always-on settlement, global reach, and the ability to plug straight into workflows via APIs.

Where it gets interesting is that stablecoins are programmable. Once you treat dollars as programmable objects, you can start building treasury logic around them.

- Automated sweeps. For example, automatically moving excess stablecoin balances from operational wallets into a treasury wallet at the end of each day, or rebalancing liquidity across regions without manual intervention.

- Conditional payments. Releasing funds only once predefined conditions are met, such as confirming goods have been delivered, a milestone has been completed, or compliance checks have cleared.

- Real-time reporting hooks. Integrating wallet activity directly into internal dashboards or ERP systems, so treasury teams can see balances and flows update instantly instead of waiting for bank statements.

- On-chain cash segmentation. Separating funds by function (payroll, vendor payments, reserves, tax liabilities) across distinct wallets or smart contracts, creating clean internal accounting boundaries.

- On-chain yield as a policy decision. Allocating a portion of idle stablecoin balances into tokenized T-bills or structured on-chain lending markets as part of a formal treasury strategy, rather than treating yield as opportunistic trading.

Norman Wooding, Founder & CEO of SCRYPT, builds on that final point:

“”DeFi yields respond to real-time supply and demand – structurally different from traditional fixed income. Leading CFOs already know: as rate compression continues, stablecoins offer sources of diversification and yield without crypto price exposure, or 1:1 correlation with traditional solutions. SCRYPT provides institutional access, with risk management built into the architecture.”

Indeed, stablecoins can act like settlement cash, while opening optionality for treasury returns that don’t depend on being long crypto.

Exploring Volumes and Separating ‘Settlement’ From ‘Payments’

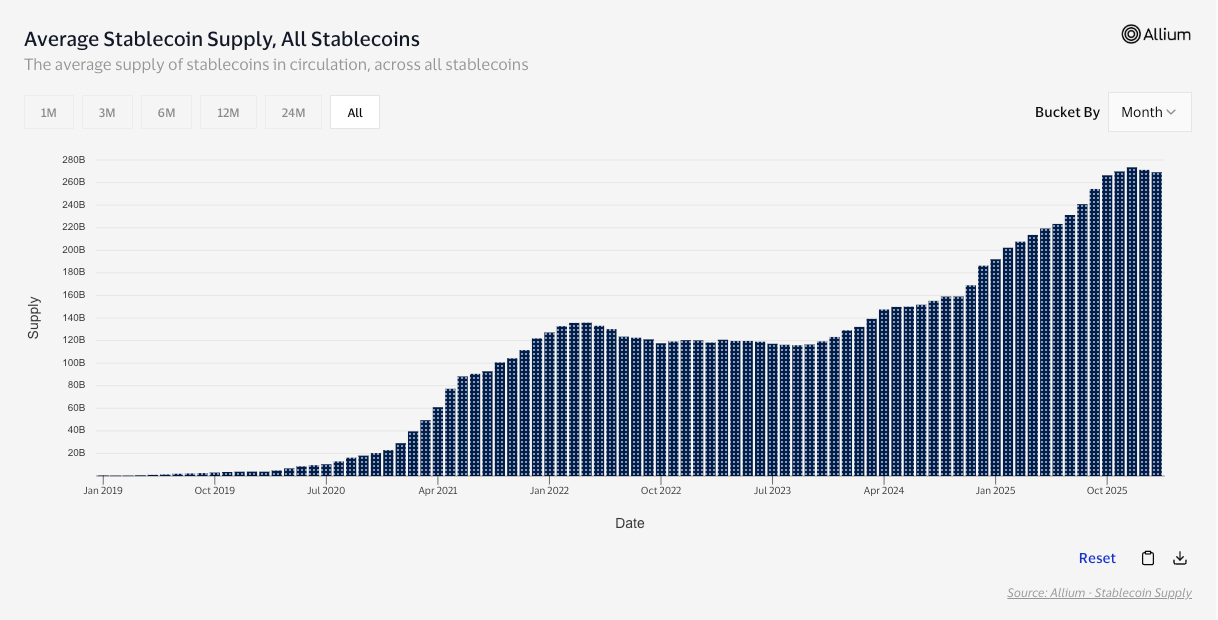

On raw transaction value, total stablecoin volume hit $35 trillion in 2025, according to media reports, citing McKinsey and Artemis Analytics.

But big on-chain volume doesn’t necessarily mean big payments. A lot of stablecoin flow is exchange rebalancing, arbitrage, and DeFi routing – activity that’s economically meaningful, but not the same as a business paying a supplier. This is why adjusted lenses matter. Visa’s on-chain stablecoin work points to $10.2T in adjusted transaction volume over the last 12 months, aiming to filter out non-payment static.

When you home in on real-economy usage, the signal sharpens further. According to the Stablecoin Payments from the Ground Up report, B2B stablecoin volumes have surged from under $100 million monthly in early 2023 to over $3 billion by mid-2025, roughly a 30-fold increase.

So, stablecoins are moving serious value. Let’s move deeper into the ‘why’.

Why B2B Keeps Choosing Stablecoins

Talk to anyone actually moving money cross-border for a living, and you’ll hear the same complaints regarding traditional systems: cut-off times, intermediaries, fee leakage, and manual reconciliation.

Stablecoins are an obvious win. They lack intermediaries, work constantly, offer low fees and even lower rejection rates. Moreover, they open up new audiences for the merchant, positioning them as forward-thinking and adding a competitive advantage.

It’s not like the legacy world isn’t trying to respond. Swift itself has started pushing new rules aimed at predictable retail cross-border payments, cutting out hidden fees, focusing on full value transfers, and faster settlement where domestic infrastructure allows.

But global coordination is hard, and even the G20’s programme to make cross-border payments cheaper and faster is now widely expected to miss its 2027 targets.

Federico Variola, CEO of Phemex, speaks to the adoption curve:

“For younger generations, sending value internationally via stablecoins already makes more sense than using SWIFT. Traditional bank transfers are slow, cumbersome, and expensive, while stablecoins are immediate and easier to operate. As regulation becomes clearer and reporting more straightforward, there’s little structural friction left. From a pure money-transfer perspective, stablecoins are well positioned to overtake traditional banking systems. What’s required now is broader adoption of the mindset.”

While little friction remains, some still exists. Let’s expand on that.

The Real Blockers: Compliance, Redemptions, and Career Risk

Redemption has to be reliable, liquidity has to hold under stress, controls have to be auditable, and the “what happens if…” scenarios need strong answers.

Even the IMF’s pro-innovation framing comes with a warning. Stablecoins can make payments faster and cheaper, but the upside gets undermined fast if the market fragments into non-interoperable coins and networks that can’t cleanly connect.

Central banks are even harsher. The BIS argues stablecoins fall short on core money properties (particularly singleness and integrity) which is a polite way of saying they don’t automatically earn “no questions asked” trust.

Regulation is trying to close that gap. In the EU, MiCA bakes in specific protections for e-money tokens, including issuance and redemption rules at par value, and the EBA is already publishing guidance on redemption plans, liquidity stress testing, and recovery planning. FSB recommendations push in the same direction globally: consistent oversight, governance, and risk management standards.

Then, there’s the softer limiter: reputational comfort (something Variola framed earlier). What’s needed now might be a more constructive public narrative so skeptical users feel comfortable engaging. For CFOs, this ‘reputational comfort’ translates to a low career risk.

Final Thoughts

Stablecoins move value fast, at any hour, across borders, without the usual chain of intermediaries and delays.

The programmable money layer is what thickens the plot. Once dollars can be moved, segmented, and reported on like software, you start to get treasury use cases that aren’t really possible on banking legacy infrastructure. Automated sweeps, conditional releases, real-time visibility, and, in some cases, policy-driven yield.

At the same time, the remaining friction is real. CFOs care about redemption certainty, liquidity under stress, auditability, and whether the compliance posture is defensible. Until those boxes are consistently ticked, stablecoins will keep growing as a practical option rather than becoming the default everywhere.

But directionally, it’s hard to miss what’s happening. The volumes are rising, the B2B highways are being laid, and the mindset is spreading. The only question left is how quickly the compliance and trust layer catches up.

Crypto World

Michael Saylor went from ‘sell a kidney’ to $20 billion loss at Strategy

When bitcoin (BTC) was above $84,000, Strategy (formerly MicroStrategy) founder Michael Saylor said, “sell a kidney if you must, but keep the bitcoin.” Yesterday, BTC hit $63,000.

Since his February 27, 2025 advice, BTC has crashed by $19,000, and his company has lost $20 billion in market capitalization.

Strategy’s February 2025 holdings (499,096 BTC) have declined in value by 22% and incinerated $9 billion of his shareholders’ wealth.

Another $11 billion in market capitalization evaporated as Strategy raised more capital for acquisitions, and investors paid less premium for MSTR relative to its BTC holdings: 1.5x then to under 0.9x today.

Incredibly, Saylor’s loss of $9 billion by deciding “keep the BTC” is a better number than the company’s actual market cap losses of $20 billion over the same time period.

Read more: How would Michael Saylor refinance Strategy’s $8.2B debt?

Saylor was wrong to have kidney-selling conviction

Rather than refrain from adding leverage to his already risky enterprise when BTC was at $84,000, Saylor insisted on purchasing more BTC.

BTC has responded by relentlessly declining.

Strategy now owns 717,722 BTC for which it paid over $76,000 apiece. Its entire treasury and the Rube Goldberg machine of convertible debt, preferred stock, and common stock offerings has lost at least $7.9 billion dollars for investors.

Those investing losses are in addition to the cost of operating the Rube Goldberg machine itself.

In fact, the loss for Strategy investors is substantially higher after adjusting for the compensation of executives, bankers, lawyers, consultants, contractors, event planners, compliance officers, operations personnel, media liaisons, assistants, and everyone who helps Strategy capitalize itself.

For example, Strategy has to pay $896 million every year just to service its interest and dividend payments.

It also pays tens of millions of dollars for executive compensation, and has paid for the rest of its loss-generating, BTC-focused enterprise at additional losses for over five years.

Specifically, it’s lost $7.9 billion dollars buying all of its BTC and shedding $20 billion in market cap as investor confidence has waned.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

UK FCA Launches Stablecoin Regulatory Sandbox with Four Firms in 2026

TLDR:

- FCA selects four firms to test stablecoin issuance under proposed UK rules.

- Sandbox trials begin Q1 2026 to assess payments, settlement, and trading use cases.

- Findings will shape final UK stablecoin rules ahead of October 2027 regime.

- Firms receive guidance from FCA specialists to ensure safe and compliant testing.

UK FCA stablecoin Regulatory Sandbox is set to launch in Q1 2026, selecting four firms to test stablecoin issuance under proposed rules.

Monee, ReStabilise, Revolut, and VVTX will participate in the controlled trials, chosen from a pool of 20 applicants.

The Sandbox aims to evaluate how stablecoin services operate in real-world conditions while shaping the UK’s final regulatory framework. Findings will inform rules ahead of the wider crypto regime scheduled for October 2027.

Firms Selected for Stablecoin Testing

The FCA’s Sandbox allows firms to trial stablecoin issuance safely with oversight from regulators. The selected participants cover diverse use cases including payments, wholesale settlement, and crypto trading.

Each company will receive guidance from FCA specialists throughout the testing period to ensure regulatory alignment.

Monee and ReStabilise will focus on payment-related stablecoins, exploring operational models under the proposed safeguards.

Revolut and VVTX will test solutions linked to settlement and trading infrastructures. The trials aim to provide practical insights into how stablecoins function under draft rules.

The Sandbox framework ensures that firms can operate in live conditions with appropriate consumer protections. The FCA will monitor risk management, compliance, and governance practices while reviewing operational performance. Feedback from these exercises will inform adjustments to policy before finalisation.

Matthew Long, director of payments and digital assets at the FCA, stated that the initiative supports trusted stablecoin use for payments, settlement, and trading.

The regulator emphasized that testing contributes to the UK’s National Payments Vision and broader financial innovation strategy.

Timeline and Regulatory Preparations

The FCA confirmed that consultations on stablecoin issuance, cryptoasset custody, and related conduct standards are now largely complete.

Policy Statements defining the future regime are expected later in 2026. This timeline aligns with the launch of the full crypto regulatory framework in October 2027.

Past consultation papers covered prudential requirements, market abuse controls, and the application of FCA Handbook rules.

These documents guide the operational and legal standards for firms participating in the Sandbox. Firms are expected to demonstrate compliance with these frameworks during testing.

All UK firms offering crypto activities must apply for authorisation once the regime goes live. The FCA will open the application gateway in September 2026, giving companies time to prepare.

Authorisation-focused webinars are also being hosted, including sessions on anti-money laundering requirements.

The Prudential Regulation Authority released guidance on deposit, e-money, and regulated stablecoin innovations.

Together, these measures support responsible testing while preparing the market for the broader regulatory environment.

The FCA stablecoin Regulatory Sandbox provides a structured pathway for innovation under careful supervision.

Crypto World

Morpho price soars 15% but can bulls cement gains above key level?

- Morpho price jumped 15% to intraday highs of $1.83 to lead altcoin gainers.

- Morpho’s token has risen since touching lows of $1.02 on February 5, 2026.

- However, overbought RSI levels above 70 indicate a possible consolidation or pullback.

Morpho (MORPHO) price has surged 15% in the past 24 hours, reaching a high of $1.83.

The move sees the real-world assets-focused crypto platform solidify its latest bullish flip, with bulls extending control above a pivotal technical threshold.

MORPHO is trending higher despite broader market weakness.

Morpho’s price surges, up 64% year-to-date

Morpho’s token has risen since touching lows of $1.02 on February 5, 2026, during the recent sharp downturn in the cryptocurrency market.

While most altcoins have remained under pressure, Morpho has moved into a new upward trend.

The token has rebounded about 15% to around $1.83, translating into a weekly gain of roughly 22% and a year-to-date increase of about 64.

Much of this performance has been linked to growing demand for its vault products.

The latest rally follows earlier bullish signals driven by Morpho’s expanding presence in the real-world asset (RWA) ecosystem.

As Wall Street firms and other institutional investors increase their engagement with blockchain-based infrastructure, Morpho has emerged as a key platform in this segment.

Deposits on the lending network have risen sharply, supported by the growing adoption of on-chain payments, tokenized assets, and lending activity.

An extremely large set of RWAs is now on @Morpho‘s platform. https://t.co/Vmx0pjdsl2

— Paul Frambot 🦋 (@PaulFrambot) February 24, 2026

Price momentum in recent weeks also comes as the token attracts attention, with Apollo Global pledging to acquire up to 90 million tokens over the next 48 months.

The latest bounce may also relate to Morpho Markets and vaults going live on Celo.

Intraday volumes have increased sharply to over $45 million.

MORPHO price analysis

The uptick from lows of $1.02 has MORPHO trading above a multi-month descending trendline that links to the highs of $2.80 reached in August 2025.

Bulls are showing conviction as price holds above the 50-day and 200-day exponential moving averages (EMAs).

Notably, oscillators are hovering neutral-buy and moving averages have flipped to “strong buy.”

As such, trading well clear of the 200 EMA at roughly $1.51 cements the uptrend potential.

Bulls are also looking at a hint of a golden cross, with buy-side bias from key technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD).

A sustained close above $1.76, which aligns with prior resistance from May 2025, could propel MORPHO toward $2.15-$2.35.

Next resistance levels lie around $2.80-$3.20.

However, the RSI is in overbought territory above 70, and while not overextended, it suggests a reversal may halt the uptick.

Downside protection could be at $1.50, backed by the 200 and 50-day EMA cluster.

The area around $1.10 and $1.02 offers a strong buy zone.

Crypto World

The chief of the SEC is headlining an event sponsored by a crypto firm at war with it

U.S. Securities and Exchange Commission Chairman Atkins is a top speaker at the Digital Chamber’s DC Blockchain Summit next month, and the event’s chief sponsor — Unicoin — is in a legal fight with the agency, claiming the SEC’s chairman is being misled into perpetuating a legacy war on crypto.

The chief executive for Unicoin, which is the summit’s “platinum” sponsor, says his company is not allowed to speak with the SEC’s leaders due to the agency’s ongoing legal action against the crypto platform. In May last year, the SEC sued the company and its executives, including CEO Alexander Konanykhin, accusing them of raising $100 million for tokens that weren’t backed by real estate in the way the firm represented.

Konanykhin said that the legal clash is pursued by rogue agency enforcers (the “henchmen” of former SEC Chair Gary Gensler) that have misled current SEC Chairman Paul Atkins. (The case may have begun under Gensler’s tenure, but the resulting lawsuit was filed last year under then-Acting Chair Mark Uyeda.)

“We are prohibited from talking to Atkins or other commissioners, so they have no way of knowing that they have been defrauded by ‘dirty cops,’ holdovers from Gensler’s War on Crypto,” Konanykhin wrote in a message to CoinDesk.

Unicoin executives may not be able to speak with Atkins, but the company is helping pay for the event at which Atkins and Commissioner Hester Peirce are the first two speakers highlighted on the summit’s website, in a list that also includes Konanykhin.

When asked about the confluence of Unicoin and its agency adversary at the upcoming summit, the organizers responded with a statement, saying, “Companies come to the Digital Chamber’s DC Summit because it is an opportunity to educate and build bridges.”

An SEC spokesman declined to comment on the situation.

Konanykhin’s company has further sought to educate the SEC with a campaign involving trucks circulating around the center of Washington and past the agency, decorated with pointed messages that included the sentiment, “The War on Crypto is NOT over.”

The CEO has been threading a needle in his sharp criticism of the SEC. He praised Atkins for “steadily repairing the damage on the crypto industry inflicted by his predecessor,” but he insisted that the agency’s enforcement staff is sabotaging Atkins by maintaining Gensler’s legal fight with the digital assets sector, despite the fact the SEC dismissed or delayed the other major crypto enforcement cases pursued under Gensler.

Also, the current securities-fraud charges against Unicoin were made last year, when Republican Commissioner Uyeda was the stand-in chairman. The lawsuit was approved by a commission that then included two Republicans and a Democrat, with no dissenting statements issued. But Konanykhin says the enforcement lawyers got the approval rubber-stamped, arguing that “rejection of a staff recommendation is the exception rather than the rule.”

The policy summit, among the most prominent annual crypto events in Washington, features a code of conduct that calls for “a safe and welcoming environment that fosters open dialogue and the free expression of ideas.” While Konanykhin might want to tell Atkins that his enforcement crew “crudely fabricated absurd charges against Unicoin and its executives,” the legal constraints against him won’t permit that open dialogue.

Crypto World

Is a BTC Short Squeeze Brewing as Funding Rates Turn Negative?

Bitcoin has recently experienced volatility, pushing the price back toward a critical demand zone. Although a short-term reaction has emerged, the market has yet to show convincing signs of trend reversal, keeping the focus on consolidation and corrective movements.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, BTC is still struggling to reclaim the channel’s mid-trendline at $68K, which continues to act as a firm dynamic resistance. Multiple attempts to push above this boundary have failed, reinforcing the presence of sellers and confirming that the broader bearish structure remains intact.

The recent sharp sell-off drove prices toward the $60K region, where buyers stepped in and triggered a modest bounce. However, this rebound has so far lacked strong follow-through, and the price continues to consolidate below the channel’s midline. As long as Bitcoin remains capped beneath this dynamic resistance, upside movements are likely corrective in nature.

Given the current structure, short-term consolidation between the $60K demand zone and the channel’s middle boundary appears likely until a decisive breakout occurs.

BTC/USDT 4-Hour Chart

On the 4-hour timeframe, Bitcoin recently broke below a symmetrical triangle pattern, signaling short-term seller dominance. The breakdown invalidated the prior compression structure and accelerated downside momentum, confirming that bears remain in control at lower highs.

The asset has since found support near the $62K zone, where demand has temporarily stabilized the decline. A minor rebound is underway, and there is potential for a short-term pullback toward the underside of the broken triangle trendline. Such a move would likely act as a technical retest of prior support-turned-resistance.

Unless Bitcoin decisively reclaims the broken trendline and builds structure above it, any recovery toward that area should be viewed as corrective. Sustained weakness below the trendline keeps the short-term bias tilted to the downside, with the $60K–$62K region remaining the key support cluster.

Sentiment Analysis

Funding rates across exchanges have recently turned negative following the latest sell-off, reflecting increased short positioning and a shift in market sentiment toward caution. The spike in negative funding during the sharp drop suggests aggressive short exposure entering the market as the price approached the $60K region.

Historically, sustained negative funding can create conditions for short squeezes if the price stabilizes and begins to recover. However, at present, funding appears moderately negative rather than extreme, indicating that while bearish sentiment has increased, the market is not yet at capitulation levels.

The combination of price holding near support and funding remaining below neutral suggests a fragile equilibrium. If Bitcoin maintains stability above $60K, the elevated short positioning could fuel a corrective bounce. Conversely, renewed downside pressure could push funding deeper into negative territory, reinforcing bearish continuation.

Overall, Bitcoin is consolidating beneath major resistance, holding above critical support, and experiencing rising short bias in derivatives markets. The interaction between price structure and funding dynamics will likely dictate the next significant move.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

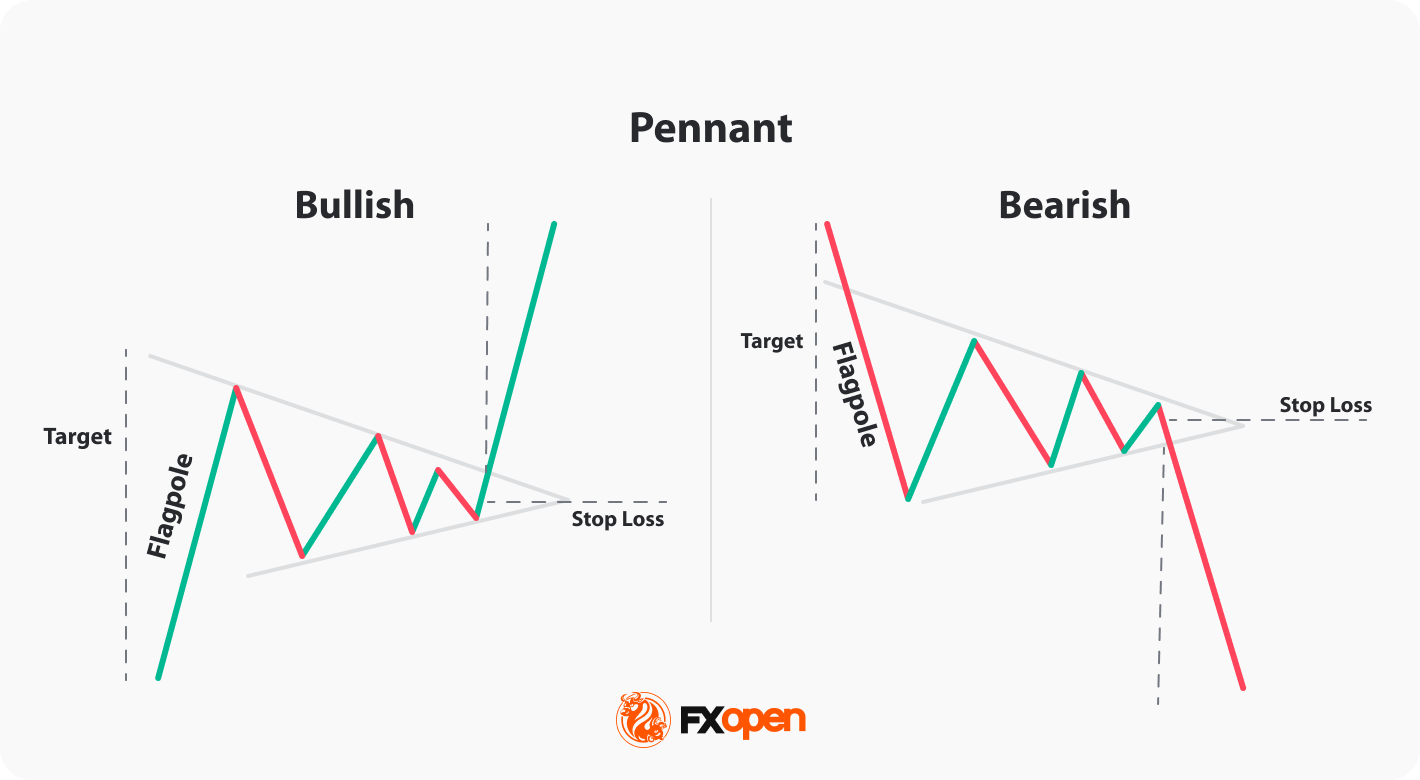

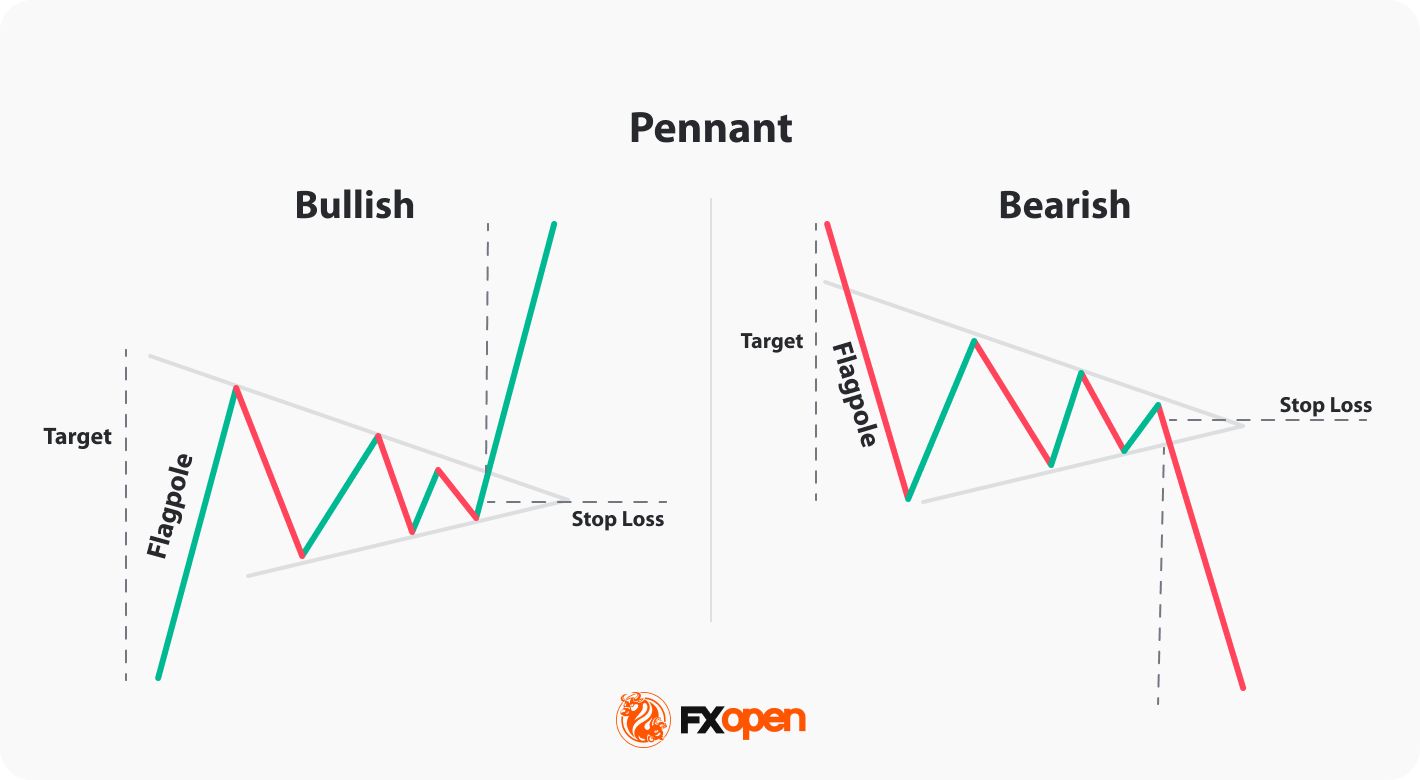

Pennant Pattern in Trading: Identification and Breakout Strategy

The pennant pattern is a continuation chart formation frequently observed in forex and CFD markets during periods of strong directional momentum. It develops after a sharp price movement followed by a brief consolidation phase, reflecting temporary equilibrium before potential trend continuation.

Unlike reversal patterns, a pennant forms within an existing trend structure and is commonly used by traders to analyse breakout conditions, organise entry planning, and define risk parameters using measurable price projections. The pattern’s compact structure allows market participants to evaluate volatility contraction and subsequent expansion within a clearly defined technical framework.

This article examines how bullish and bearish pennant patterns are identified across different market environments, how breakout scenarios are evaluated step by step, how price targets are derived using the flagpole measurement method, and how false breakouts can be filtered through confirmation techniques and professional trading tools.

Key Takeaways for Professional Traders

- A pennant is a continuation chart pattern in forex, equity, commodity, and crypto* markets. It’s formed during volatility contraction.

- Breakout confirmation requires volume expansion.

- Targets are typically projected using flagpole measurement.

- The pattern is more popular in trending, high-momentum markets.

What Are Pennant Chart Patterns?

A pennant pattern is a short-term continuation chart formation that develops after a sharp directional price move and signals a potential breakout in the direction of the prevailing trend. The pennant pattern’s structure is:

- Flagpole — a strong impulsive move driven by momentum and liquidity imbalance.

- Consolidation phase — price compresses within converging trendlines.

- Breakout — volatility expansion as price exits the pattern in the direction of the prior trend. The breakout should be accompanied with high volumes.

Pennants reflect a pause in momentum rather than a structural reversal.

Bullish Pennant Pattern

A bullish pennant pattern forms after a strong upward impulse. The consolidation appears as a small symmetrical triangle sloping slightly against the prior trend. A breakout above the upper boundary signals potential continuation higher.

This setup frequently appears in trending currency pairs such as EUR/USD during macro-driven momentum phases.

Bearish Pennant Pattern

A bearish pennant develops after a sharp decline. Price consolidates within converging trendlines before breaking below the lower boundary, indicating further downside continuation.

In high-volatility markets such as cryptocurrencies*, bearish pennant trading setups often form during strong sentiment-driven selloffs.

How Pennant Patterns Form in Live Forex & CFD Markets

In real market environments, pennants often develop during:

- Central bank policy decisions

- Important macroeconomic data releases

- Institutional repositioning

- Liquidity imbalances

The initial impulse creates directional imbalance. During consolidation, volatility contracts and volume typically declines. As price compresses, stop orders accumulate outside the structure. The breakout phase triggers these orders, accelerating momentum through volatility expansion.

This contraction-to-expansion transition is the core edge of pennant trading strategies.

Pennant Pattern Checklist for Traders

- Strong flagpole (impulsive move)

- Tight symmetrical consolidation

- Declining volume during compression

- Volume confirmation breakout

- Breakout aligned with higher timeframe trend

How Traders Identify and Trade a Pennant Pattern (Step-by-Step)

Identifying a valid pennant pattern requires precision. Not every consolidation qualifies.

If you would like to find the formations yourself, consider using the TickTrader trading platform with over 700 instruments and 1200 trading tools.

Step 1: Identify a Strong Flagpole

A valid pennant begins with a sharp, one-sided move supported by expanding momentum.

Without a strong flagpole, the pattern loses statistical edge.

Step 2: Confirm Tight Consolidation

Characteristics:

- Decreasing volatility

- Converging trendlines

- Shallow retracement (ideally <50–60% of flagpole)

Step 3: Wait for a Confirmed Breakout

Breakout should:

- Close decisively beyond upper/lower boundary

- Align with higher timeframe direction

- Show strong momentum expansion

Traders avoid entering inside the pattern. The setup becomes valid only after confirmed breakout structure not to be trapped by false breakouts.

Breakouts during major news events may cause slippage and spread widening.

Step 4: Apply Entry Techniques

Professional traders typically choose between:

- Momentum entry (enter immediately after breakout close)

- Retest entry (wait for pullback to broken boundary). Retest entries might improve risk-to-reward ratio.

Step 5: Use Pennant Pattern Target Calculation

Use the flagpole projection method:

- Measure the length of the flagpole

- Project it from breakout point

Alternative targets:

- Key support/resistance

- Fibonacci extensions

- Fixed risk-reward ratios (1:2 or 1:3)

Step 6: Implement Pennant Pattern Stop-Loss Placement and Risk Management

Common stop-loss placements:

- Beyond opposite pennant boundary

- Below/above recent swing point

Additional risk management considerations:

- Minimum risk-to-reward ratio (e.g., 1:2)

- Trailing stop adjustments after breakout confirmation

- Limit exposure across correlated instruments

When Traders Avoid Trading Pennant Patterns

Traders don’t trade if:

- Retracement exceeds 60%

- Breakout lacks momentum

- Higher timeframe contradicts setup

- Major resistance/support sits inside projected target

Case Study: Bullish Pennant Breakout Strategy

To understand how a pennant pattern works in live market conditions, let’s examine a structured bullish breakout example on EUR/USD.

Market Context

The downtrend reversed with a solid upward momentum. Although there was no confirmation on a higher timeframe, traders could consider trading the pennant pattern.

A strong, impulsive bullish move developed over two days with large-bodied candles and no pullbacks. This created the flagpole, establishing directional bias.

Following the impulse, the price entered a tight consolidation, with converging trendlines forming and momentum temporarily pausing. This compression phase lasted for several days.

The breakout occurred in the direction of the prior trend with a strong bullish candle close.

Aggressive traders could enter on a breakout close. Conservative traders could wait for a retest of the broken resistance.

Trade Structure

Entry: Traders could enter at a retest of the broken trendline

Stop-Loss: Below the lower boundary

Target: Flagpole projection method, but with amendments. Although one of the rules states that the price is supposed to rise as far as the length of the flagpole, markets aren’t perfect. Therefore, many traders prefer to set a smaller target, taking into account recent price movements.

Why This Setup Worked

This example aligned with several high-probability conditions:

- Clean compression structure

- Breakout with momentum expansion

- No immediate resistance overhead

The setup demonstrates that pennants are not traded based on shape alone — they require context, confirmation, and disciplined execution.

You can test your own strategies across more than 700 instruments at FXOpen’s TickTrader trading platform.

Statistical Reliability of Pennant Patterns

Professional traders evaluate pennant formations within a broader market framework rather than as isolated chart patterns. Pattern performance is primarily influenced by objective market conditions, including:

- Higher-timeframe trend alignment

- Momentum persistence following the impulse leg

- Relative volume expansion during breakout

- Presence of directional liquidity and absence of equilibrium conditions

Trade outcomes, however, also depend on execution variables specific to the trader, such as:

- Entry model and confirmation criteria

- Risk management methodology

- Position sizing discipline

- Behavioural consistency during volatility expansion

According to research by Thomas Bulkowski in Encyclopedia of Chart Patterns, pennants are classified as moderately reliable continuation patterns.

In trending environments, measured-move targets are frequently achieved. In low-liquidity or sideways markets, failure rates increase.

Timeframes for Trading Pennants

Timeframe affects pattern’s reliability:

- Intraday (M15–H1): More signals, more noise

- H4–Daily: Cleaner structure

- Weekly: Institutional continuation setups

According to Thomas Bulkowski’s Encyclopedia of Chart Patterns, pennants form within up to 3 weeks. They are shorter than symmetrical triangles and wedges.

Brian Shannon explains how to trade in multiple timeframes in his Technical Analysis Using Multiple Timeframes.

Market-Specific Considerations

- Forex. Major pairs like EUR/USD respond strongly to policy divergence cycles.

- Cryptocurrencies*. Cryptocurrencies* display higher volatility, which may result in more false breakouts.

- Equity indices. Stock indices often form cleaner structures in sustained institutional trends. However, the pattern usually lasts no longer than three weeks, which means that it’s not very common on index charts.

Pennant vs Flag vs Symmetrical Triangle

Understanding structural distinctions between pennant pattern vs flag pattern vs symmetrical triangle pattern might improve trade selection and risk control.

Pennants differ from flags in that they show price compression rather than gradual retracement. Compared to symmetrical triangles, pennants are smaller and typically form over shorter durations during high-momentum conditions.

John Murphy widely explains the difference between pennant and flag patterns in his book Technical Analysis of the Financial Markets.

Common Pennant Trading Mistakes

Even experienced traders misinterpret compression structures. Frequent errors include:

- Entering before breakout confirmation. Acting inside the pennant, without confirmation, often means making a wrong decision. The pattern only matters once the price breaks cleanly.

- Trading consolidation without a clear flagpole. Not every consolidation is a pennant. If the lines don’t converge, or if the move before it wasn’t sharp and one-sided, it’s probably not a pennant. Forcing the pattern can lead to poor results.

- Ignoring higher timeframe trends. A pennant ahead of major resistance/support or against the broader trend weakens the setup. Context always matters more than the shape alone.

- Overlooking key macro catalysts. Important economic and political events can invalidate technical compression structures by abruptly shifting liquidity and volatility conditions.

- Neglecting volume analysis. A valid pennant typically shows declining volume during consolidation followed by expansion on breakout; without participation confirmation, price moves are statistically more prone to false breakouts.

Pattern shape alone is insufficient. Context and confirmation determine the edge.

Advantages and Limitations

Pennants are useful in strong trending markets, but they’re not perfect. Let’s take a look at the formation’s advantages and disadvantages.

Advantages

- Clear Structure: Pennants have three clear parts — the sharp flagpole, the tight consolidation, and the breakout offer a straightforward sequence.

- Works Across Timeframes: Pennants occur on many timeframes: from 5-minute charts to daily or weekly ones. That makes them useful for numerous kinds of strategies.

- Defined Breakout Levels: The converging trendlines naturally give a clear area to watch for breakout behaviour.

Limitations

- False Breakouts: Breakouts that stall quickly can trap traders, especially in choppy markets.

- Easily Confused: A messy pennant can look like a triangle or flag. If the structure isn’t clean, the signal can be harder to interpret.

- Relies on Existing Trend Strength: If the initial move is weak or inconsistent, the pennant can be less meaningful. It needs momentum to have the highest probability of working out.

Is It Possible to Improve Pennant Signals?

Like any pattern, the pennant isn’t foolproof. However, traders use certain methods when building a trading strategy around pennants.

Aligning With Trend Tools

Pennants are used in strong trends. You can use tools like moving averages to confirm them. For example, if the price is above the 50-period EMA and the pennant forms during a steady uptrend, that adds weight. A breakout above a short-term moving average can strengthen the case.

Momentum indicators can also help. If the Relative Strength Index (RSI) sits comfortably above 50 while the bullish pattern forms, or breaks out above 50 alongside the pennant, that can confirm a bullish trend and vice versa. However, if the RSI shows overbought/oversold conditions and the market does look very overstretched, that might be a sign to hold off or manage risk more carefully.

Using Volume as a Filter

Volume can give clues. During the pennant, volume may dry up and signal a pause. However, if the breakout coincides with strong volume, that can show genuine interest as buyers or sellers rush in to take advantage of a possible new trend leg. If it stays low, the move may fail or reverse due to a fake breakout.

Pairing It with Context

A pennant is just part of a broader story. For instance, if the market is bouncing off of a resistance level, creates an impulsive flagpole and then forms a bear pennant, that might add conviction to the pattern. However, if the breakout is straight into a major support level, traders might consider looking for a bullish reversal pattern instead.

Alignment between timeframes and correlated assets can be valuable too. If a pennant on the 1-hour chart occurs during a larger trend on the daily, that may add weight. Likewise, if there’s a bullish pennant forming on EUR/USD while dollar weakness is apparent across the board, there might be a higher probability that the bullish breakout is genuine.

Final Thoughts

The pennant pattern is a valuable tool, which provides useful insights into potential price trends. However, it may provide false signals; therefore, to trade with a pennant, you need to be familiar with technical analysis and be able to interpret charts.

You can explore live charts and apply these techniques using the FXOpen TickTrader platform, which provides 700+ instruments and advanced charting tools.

Consider opening an FXOpen account today and trade forex and CFDs on indices, commodities, and crypto* with:

- Spreads from 0.0 pips**

- Commission from $1.50**

- Fast execution

- Institutional-grade liquidity

FAQ

What Is a Pennant Pattern?

The pennant meaning refers to a short-term continuation pattern that forms after a sharp price move. It’s made up of a brief consolidation phase with converging trendlines, then followed by a breakout in the same direction as the original move. It can signal an impending continuation trend leg.

How Do Traders Trade a Pennant Pattern?

Traders usually wait for the price to break out of the pennant on rising volume in the same direction as the initial move. The height of the flagpole is typically used as a rough target, while stop losses are set beyond the last swing high/low or opposite pattern’s boundary.

What Happens After a Bullish Pennant?

A bullish pennant typically leads to further upside if the price breaks above the pattern’s upper trendline with strong momentum.

What Is the Difference Between a Bull Flag and a Bull Pennant?

Bull flags and bull pennants both follow strong upward moves and signal a trend continuation. The key difference between a pennant and a flag is structure. The price in a flag drifts lower or moves sideways within parallel lines that form a sloping or horizontal channel. The price in a pennant contracts into a small symmetrical triangle with converging trendlines.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

**Additional fees may apply.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

US Seizes $61M in USDT Linked to Pig-Butchering Crypto Scam

North Carolina federal authorities have seized more than $61 million in a dollar-pegged stablecoin tied to a wide-ranging “pig butchering” scheme that exploited fake online romances and fraudulent trading platforms to ensnare victims. Prosecutors in the Eastern District of North Carolina in Raleigh disclosed that the defendants posed as romantic partners and claimed to possess special trading expertise, luring individuals into convincing but fraudulent crypto sites. These sites displayed manipulated portfolios showing outsized returns, encouraging victims to invest more. When victims attempted to withdraw funds, the scammers blocked withdrawals and imposed additional fees, extracting ever-larger sums before the scheme collapsed under law enforcement scrutiny. Investigators from Homeland Security Investigations traced the proceeds across multiple wallets used to launder the money and ultimately identified several addresses holding substantial sums that were seized and earmarked for forfeiture. In a notable detail, the Department of Justice highlighted that Tether cooperated in transferring these assets, underscoring how stablecoin issuers are increasingly cooperating with authorities in asset freezes and recoveries. The following items are drawn from the DOJ release and related enforcement documents: the investigation’s trajectory, the role of the fake platforms, and the collaboration with the stablecoin issuer that helped secure the funds. The press release can be found here: US Attorney’s Office for the Eastern District of North Carolina.

Key takeaways

- The seizure showcases a growing convergence of romance-scams and fraudulent trading platforms within crypto-enabled fraud, illustrating how fraudsters adapt to sophisticated, multi-channel schemes.

- Law-enforcement agencies traced assets across laundering wallets and secured forfeiture actions against addresses still holding sizable holdings, signaling a persistent focus on traceability in crypto-fueled crime.

- Stablecoin issuers, notably Tether in this case, are increasingly cooperating with investigators to freeze and recover illicit funds routed through dollar-pegged tokens.

- Market data from Chainalysis indicates that crypto scam losses surged in 2025, with AI-driven impersonation and social-engineering tactics driving a sharp rise in profitability for criminals.

- Enforcement actions have begun translating into longer sentences for key figures connected to pig-butchering networks, highlighting a tougher stance on crypto-laundering operations.

Tickers mentioned: $USDT

Sentiment: Neutral

Market context: The North Carolina seizure comes as regulators and enforcement agencies escalate efforts to counter crypto fraud, particularly schemes that blend romance, fake investment platforms, and laundering networks. It reflects a broader pattern of increased cooperation between authorities and stablecoin issuers as asset tracing tools and compliance checks mature, a trend reinforced by recent sentencing in related pig-butchering cases and ongoing scrutiny of illicit flows through tokenized markets. Chainalysis data cited by industry coverage shows that annual losses from crypto scams reached $17 billion in 2025, underscoring the scale of risk facing ordinary users and the importance of enhanced diligence in an increasingly complex ecosystem across digital assets.

Why it matters

The seizure underscores how sophisticated crypto fraud has become, adapting to the optics of romance and trust to avoid early detection. By weaving convincing narratives and presenting fake performance dashboards, perpetrators exploit victims’ emotions as a gateway to financial loss, often moving funds through multiple wallets and across exchanges to complicate traceability. The involvement of a stablecoin issuer in the asset-transfer process signals a notable shift: authorities are not only prosecuting individuals but also pressing the infrastructure that underpins crypto payments to assist in asset recovery. As the DOJ release notes, the collaboration with Tether illustrates a broader regulatory and investigative push to freeze and seize illicit flows tied to dollar-pegged tokens, which are frequently used for cross-border fraud and money laundering.

For investors and users, the case reinforces the importance of skepticism in online investment pitches and due diligence when confronted with unusually high returns advertised on crypto platforms. It also highlights the evolving role of law enforcement in crypto markets, where traditional financial crime frameworks are increasingly applied to digital assets. The convergence of romance scams and fake investment products complicates the risk landscape, making it critical for individuals to verify counterparties, examine investment portfolios, and avoid sharing sensitive information or funds with unverified partners. The broader context—rising scam sophistication, AI-enabled impersonation, and the stability of the crypto ecosystem—demands continued vigilance from consumers, platforms, and regulators alike. Earlier related coverage on pig-butchering and crypto laundering, including detailed analyses of how trust is weaponized in these schemes, provides useful context for staying ahead of evolving fraud vectors.

What to watch next

- Potential additional forfeitures or asset recoveries tied to linked addresses and other wallets identified in the case, including any future DOJ updates.

- Sentencing developments for other individuals connected to pig-butchering networks, including cases involving laundering operations valued at tens of millions of dollars.

- Regulatory and industry responses to stablecoins and their use in fraud, including enhanced due diligence and stricter KYC/AML controls on platforms that facilitate token transfers.

- Ongoing law-enforcement efforts to track AI-enabled impersonation and social-engineering fraud, with a focus on international cooperation and cross-border asset tracing.

Sources & verification

- U.S. Attorney’s Office for the Eastern District of North Carolina — press release announcing the seizure of $61 million in cryptocurrency linked to the pig-butchering scheme.

- Department of Justice and Homeland Security Investigations statements within the same release on cooperation from Tether (stablecoin issuer) to transfer the assets.

- Chainalysis 2026 Crypto Scams report cited in coverage detailing 2025 losses and the rise of AI impersonation and social-engineering scams.

- Cointelegraph coverage of pig-butchering crime and related sentencing, including the 20-year federal sentence in a connected laundering operation and analyses of how these scams operate.

- Related explainer and investigative pieces linked in the source material on how pig-butchering scams manipulate trust and funnel funds into fake investment platforms.

Cryptocurrency seizure and enforcement in focus: what the case reveals

The North Carolina action marks a convergence of traditional financial-crime enforcement with the uncertainties and complexities of digital assets. The authorities’ ability to trace the proceeds through laundering wallets and eventually freeze or seize assets demonstrates progress in on-chain analytics and cross-institutional cooperation. The involvement of Tether underscores a willingness among stablecoin issuers to participate in investigations that aim to recover funds and deter future illicit flows, a trend increasingly echoed across the industry as watchful regulators seek greater accountability for crypto-native crime.

As investigations unfold and courts issue longer sentences for prominent figures in pig-butchering networks, stakeholders should expect ongoing enhancements to enforcement strategies, including more aggressive asset-recovery efforts and stricter platform-level protections to deter scammers. The evolving landscape requires ongoing attention from users, policymakers, and market participants to recognize and mitigate these multifaceted threats—where trust, technology, and regulation intersect in real time.

Crypto World

South Korea to require crypto, stock influencer holdings disclosure

South Korea is moving to tighten the supervision of online voices that promote crypto and traditional stocks, with a bill that would require finfluencers to disclose what they own and whether they receive compensation for their endorsements. The plan, being drafted by Democratic Party lawmaker Kim Seung-won, targets communications that influence public investment decisions, from articles and blogs to podcasts and broadcasts. It builds on two laws—the Capital Market and Financial Investment Business Act and the Act on the Protection of Virtual Asset Users—and would push for clear disclosures that could help investors gauge potential conflicts of interest. The details, reported by Herald Business, would center on criteria established by presidential decree for when those disclosures must occur.

Key takeaways

- The proposed amendments would compel individuals who repeatedly promote financial products or virtual assets to reveal compensation, and to disclose the assets they hold and their ownership quantities.

- Promotional content delivered through publications, online posts, and broadcasts could fall under the disclosure mandate, with criteria to be set by presidential decree.

- Financial authorities point to a surge in semi-advisory activity via media channels, citing rising numbers of quasi-investment advisors (QIAB) in Korea—through 2018 to 2024.

- International regulators have pursued similar steps: the UK requires pre-approval for promotions; the US has issued penalties for undisclosed endorsements; and EU guidance is shaping expectations for finfluencers across member states.

- The core aim is to reduce conflicts of interest and improve transparency in online investment promotion, protecting everyday investors from biased or misleading guidance.

Sentiment: Neutral

Market context: The move aligns with broader regulatory attention to online investment promotions as crypto markets remain volatile and retail participation high. Global regulators have intensified scrutiny of finfluencers, signaling a trend toward greater transparency and accountability in digital finance communications.

Why it matters

The Korean initiative reflects a growing concern among policymakers about how information disseminated online can influence investment flows, especially in high-volatility assets like cryptocurrencies. By proposing mandatory disclosures of compensation and holdings, the bill seeks to illuminate potential conflicts of interest that might otherwise go unseen by viewers and readers. Proponents argue that transparent disclosures can help investors distinguish independent analysis from paid promotion, reducing the risk of losses caused by biased recommendations.

Observers note the potential practical impact on content creators and media outlets that cover finance and crypto. If enacted, the rules could require finfluencers to maintain records of sponsorships and assets, and to publish those disclosures in a consistent format. This would add a new compliance dimension to a space already under scrutiny from regulators in other jurisdictions, including the United Kingdom, the United States, and Europe, where authorities have moved to curb undisclosed promotions and to sanction misrepresentations. The approach signals a broader move toward harmonizing standards for financial promotions in an era of rapid digital outreach, where impressionable audiences can be reached instantly across platforms.

For investors, the potential changes may improve confidence in online investment content, but they could also reshape the incentives for creators who monetize audiences through endorsements. Critics warn that rigid disclosure regimes might suppress independent commentary or push some analysts to alter how they present opinions to avoid penalties. Yet, the overarching rationale remains straightforward: when opinions carry material financial consequences for large swaths of the public, transparency should be a baseline expectation rather than an optional add-on.

On a global scale, the discussion around finfluencers is not unique to Korea. Regulators in other regions have moved to curb promotional activity that lacks disclosure, with the UK’s Financial Conduct Authority (FCA) requiring pre-approval for financial promotions, while the US SEC and FINRA have pursued enforcement actions tied to undisclosed promotions. In Europe, ESMA guidance circulated through national watchdogs underscores that EU advertising rules apply to digital influencers promoting high-risk assets, including crypto. These international developments provide a backdrop for Korea’s draft legislation, suggesting a convergence toward more stringent norms governing online investment communications.

Whatever the final shape of the proposals, the public debate centers on how to balance open information with consumer protection. Lawmakers emphasize reducing conflict of interest when influential online voices sway investment decisions, while critics warn against stifling legitimate commentary or imposing overly burdensome reporting requirements. The conversation is likely to evolve as presidential decrees clarify the scope of the disclosures and as regulatory bodies outline enforcement mechanisms for violations.

What to watch next

- Clarification of the presidential decree criteria that will define when disclosures are required for finfluencers.

- A timeline for the legislative process in the National Assembly, including committee review and potential amendments.

- Regulatory guidance from the Financial Services Commission and the Financial Supervisory Service detailing how disclosures should be implemented and verified.

- Responses from media outlets, content creators, and crypto exchanges about how the new rules could affect promotional practices.

- Comparative developments in other jurisdictions, particularly updates to FCA guidance, SEC/FINRA actions, and ESMA-adopted standards that may influence Korea’s final approach.

Sources & verification

- Herald Business report on amendments to Korea’s Capital Market and Financial Investment Business Act and the Act on the Protection of Virtual Asset Users.

- Financial Supervisory Service data on quasi-investment advisors (QIAB) activity trends from 2018 to 2024.

- UK Financial Conduct Authority guidance on pre-approval for financial promotions.

- US Securities and Exchange Commission and FINRA enforcement actions related to undisclosed promotions.

- European guidance via ESMA on finfluencer advertising and crypto promotions (as cited in regional reporting).

South Korea scrutinizes finfluencers: a push for disclosure in crypto and stock promotions

South Korea is intensifying its regulatory focus on the voices that guide retail investors toward or away from financial assets, including virtual currencies. The leadership plan, steered by lawmaker Kim Seung-won, seeks to codify a formal disclosure regime for individuals who frequently dispense investment recommendations or benefit financially from such endorsements. The core of the proposal rests on two pillars: first, amendments to the Capital Market and Financial Investment Business Act; second, a revision to the Act on the Protection of Virtual Asset Users. In essence, those who act as financial promoters across media—whether in print, online, or on air—would face obligations to reveal compensation and to disclose their asset holdings and positions. The presidential decree would specify the criteria that trigger those disclosures, ensuring that the rules are not uncoupled from real-world practices in media and marketing.

The motivation behind the plan, according to the policy discourse, is to curb conflicts of interest that may arise when highly influential individuals shape public opinion about investments without full transparency. Kim is quoted as underscoring the risk that fin-influencers can disseminate inappropriate guidance and create unpredictable outcomes for ordinary investors. The approach aims to temper the influence wielded by these figures by making their financial incentives transparent, thereby helping the public assess the reliability of the information they encounter online.

Beyond Korea’s borders, the global regulatory canvas is moving toward similar aims. In the United Kingdom, the FCA’s stance is to require pre-approval for financial promotions, a model designed to prevent misleading or underinformed pitches. In the United States, the SEC and FINRA have pursued penalties tied to undisclosed endorsements, signaling that regulators continue to elevate scrutiny of online investment recommendations. Within Europe, ESMA guidance circulated by national authorities points to a broad application of EU advertising standards to finfluencers, including those active in crypto markets. These cross-border developments shape a regulatory environment in which Korea’s draft amendments may find resonance, potentially aligning local rules with international best practices while addressing domestic market dynamics.

The data backdrop in Korea underscores a regulatory imperative. The Financial Supervisory Service notes a surge in organized quasi-investment analysis activity via media channels, with reports of QIAB cases rising from 132 in 2018 to 1,724 in 2024. This trend highlights the scale of promotional content that can influence investor decisions and the corresponding need for clarity about who is paying for such content and what holdings underpin those recommendations. The proposed framework would compel disclosures of compensation and asset ownership, widening the information set available to the public and enabling more informed comparisons across different promotional sources.

As this policy debate unfolds, observers will watch for how the presidential decree and legislative language balance investor protection with the open flow of information that characterizes crypto and finance media. The Korea case could set a precedent for how regulators manage finfluencer activity in a rapidly evolving digital landscape, where rapid dissemination of content intersects with complex financial relationships. While the path from draft bill to law is rarely linear, the implications for advertisers, content creators, exchanges, and everyday investors could be substantial if the final framework demands consistent, verifiable disclosures across channels and formats.

Crypto World

Enterprise AI Strategy Consulting to Fix ROI Collapse

Artificial intelligence spending is accelerating globally. Boards are approving larger budgets. Innovation teams are experimenting aggressively. Yet across North America, Europe, and Asia-Pacific, enterprise leaders are facing the same uncomfortable reality: AI investments are not translating into measurable enterprise value. The problem is not model accuracy. It is structural misalignment. When AI initiatives operate independently without a unified enterprise AI strategy, ROI erosion becomes inevitable. Disconnected deployments create fragmented data ecosystems, unclear financial attribution, governance exposure, and diluted competitive advantage.

This is precisely why leading enterprises are turning toward structured AI strategy and consulting services to transform scattered AI experimentation into disciplined, value-driven enterprise transformation.

The Structural Problem: AI Without Enterprise Architecture

Many organizations adopt AI in pockets:

- Marketing launches personalization engines

- Finance deploys forecasting models

- Operations experiments with automation

- HR introduces AI-driven talent tools

Individually, these initiatives appear progressive. But collectively, they lack coordination. Without oversight from an experienced AI strategy consulting Company, enterprises unknowingly create:

- Redundant infrastructure investments

- Conflicting data standards

- Vendor sprawl

- Inconsistent governance protocols

- Limited enterprise-wide impact visibility

This fragmentation does not just reduce ROI. It destroys scalability.

Why ROI Collapses in Disconnected AI Environments

AI does not fail because it lacks intelligence. It fails because it lacks integration. When artificial intelligence is deployed without financial discipline, strategic sequencing, and governance alignment, ROI erosion becomes inevitable. The collapse is not dramatic; it is structural.

Industry Evidence: AI ROI Underperforms Without Enterprise Alignment

The risks of fragmented AI investment are not theoretical – they are substantiated by recent enterprise research.

A 2026 study from the IBM Institute for Business Value reports that while executives remain highly optimistic about AI’s long-term revenue contribution, many organizations acknowledge significant integration challenges across operating models, data architecture, and financial planning. The research highlights a clear execution gap between AI ambition and enterprise-wide value realization.

Complementing this, Gartner’s 2025 survey on AI strategy adoption found that only a small minority of organizations, for example, just 23% of supply chain leaders, reported having a formal AI strategy in place. This indicates a broader enterprise trend: most AI spending occurs without a structured strategy or governance, which in turn makes measurable ROI harder to achieve.

Taken together, these findings reinforce a critical point: AI performance is not determined by model sophistication alone. It is determined by architectural alignment across financial, operational, and governance dimensions.

1. Financial Detachment

AI initiatives frequently lack alignment with capital allocation models. When projects are not embedded into structured financial planning, leadership cannot measure EBITDA contribution, cost compression, or margin expansion.

A mature AI strategy consulting for enterprises approach ensures every initiative is linked directly to financial performance indicators.

2. Absence of Enterprise Sequencing

Disconnected AI projects often launch simultaneously without prioritization logic. This overwhelms data teams, strains infrastructure, and slows adoption.

A structured AI roadmap development framework ensures that investments are sequenced according to clear strategic priorities. Rather than launching parallel initiatives without coordination, organizations align AI programs based on:

- Strategic leverage across the value chain

- Scalability across business units

- Measurable financial impact

- Regulatory and governance complexity

When sequencing is absent, AI initiatives compete for resources, dilute focus, and create operational noise instead of enterprise value.

3. Governance Risk Amplification

Global regulatory scrutiny is intensifying. From evolving AI regulatory frameworks across the EU and other major markets to risk-based governance expectations across international markets, enterprises must embed accountability into AI architecture.

Without expert AI Strategic Advisory, organizations face:

- Model bias risks

- Compliance violations

- Reputational damage

- Legal exposure

Disconnected governance models are no longer sustainable.

4. Value Attribution Failure

One of the most common executive frustrations is the inability to quantify AI returns. This is where structured AI value engineering services become essential. Instead of asking whether an algorithm works, leadership evaluates:

- Revenue uplift contribution

- Cost avoidance metrics

- Productivity amplification

- Risk-adjusted return

A disciplined AI value engineering framework transforms AI from experimental expenditure into a measurable performance driver.

The Enterprise Solution: From Fragmentation to Financial Engineering

To fix disconnected AI, enterprises must move beyond tool deployment toward architectural transformation. Here is the structured approach that leading organizations follow:

Step 1: Enterprise AI Portfolio Audit

An experienced AI Consulting Services team evaluates:

- Existing AI initiatives

- Vendor landscape

- Data infrastructure maturity

- Governance gaps

- Financial alignment

This diagnostic phase uncovers duplication, inefficiencies, and unrealized value.

Step 2: Define a Unified Enterprise AI Strategy

A robust enterprise AI strategy defines:

- Where AI drives margin expansion

- Which workflows become autonomous

- How predictive intelligence compresses decision cycles

- How compliance architecture mitigates regulatory exposure

- How workforce capability evolves

This ensures AI investments align with long-term strategic differentiation.

Step 3: Implement AI Strategy and Value Engineering Services

Through integrated AI strategy and value engineering services, enterprises establish:

- Capital allocation models for AI

- Risk-adjusted ROI forecasting

- Performance attribution dashboards

- Continuous optimization loops

This is the foundation of sustainable AI business value optimization.

Step 4: Redesign Operating Models

Advanced AI Business Strategy Services embed intelligence directly into

- Market expansion planning

- Supply chain resilience modeling

- Capital allocation simulations

- Risk forecasting systems

AI should not optimize yesterday’s process. It must redefine tomorrow’s competitive structure.

What Differentiates Elite AI Strategy Consulting

Not all AI providers are created equal. A truly leading AI strategy consulting Company operates at the intersection of business insight, technical expertise, and enterprise-scale transformation. What differentiates top-tier firms is their ability to move beyond deploying isolated tools and instead create systemic, organization-wide value.

1. Financial Engineering Expertise

Enterprise-focused providers integrate AI initiatives directly into capital planning and financial strategy. They quantify potential ROI, optimize investment allocation, and ensure AI contributes to margin expansion, cost reduction, and risk-adjusted performance. Every project is evaluated not as a technical experiment, but as a strategic capital allocation decision that drives measurable business outcomes.

2. Governance Architecture Mastery

Top-tier consulting firms design robust governance frameworks that enforce accountability, compliance, and operational resilience. They embed regulatory foresight, data stewardship, and ethical AI practices into enterprise architecture, ensuring AI scales safely across departments and global markets without regulatory or reputational exposure.

3. Cross-Industry Implementation Depth

Leading AI consultants bring experience from multiple industries, enabling them to apply proven frameworks, accelerate deployment, and anticipate domain-specific challenges. Whether in finance, manufacturing, supply chain, or marketing, they translate AI potential into actionable enterprise strategies, avoiding common pitfalls that siloed initiatives encounter.

4. Enterprise Transformation Leadership

Experienced advisors don’t just implement technology; they transform organizations. They guide leadership in redesigning workflows, integrating predictive intelligence into operations, and aligning workforce capabilities with AI-driven decision-making. The focus is on creating an intelligence infrastructure that becomes a durable competitive advantage, not a collection of disconnected pilots.

The difference is clear: Tools alone don’t drive results. Leading AI strategy consulting Companies architect intelligence ecosystems that convert AI initiatives into measurable business impact and sustainable advantage.

The Global Competitive Reality

Across global markets, AI maturity is no longer experimental; it is a competitive differentiator. Enterprises that integrate AI into their core operating architecture are not just improving efficiency; they are building structural advantages that compound over time:

- Proprietary data flywheels that continuously strengthen decision accuracy

- Autonomous operational systems that reduce latency and human dependency

- Predictive capital allocation engines that optimize investments in real time

- Accelerated innovation cycles powered by continuous intelligence feedback

These organizations are embedding intelligence into the foundation of how they compete. In contrast, companies running scattered AI pilots experience the opposite effect. Instead of compounding advantage, they accumulate technical debt, governance risk, and operational complexity.

The result is a widening intelligence divide. AI leaders are scaling clarity, speed, and precision. Others are scaling experimentation without integration. In a market where decision velocity and predictive foresight determine competitive position, that gap does not remain static; it expands.

If AI isn’t aligned to capital strategy, it isn’t aligned at all.

Disconnected AI does not fail because the technology is weak. It fails because the architecture is missing. Enterprises that operate without a unified enterprise AI strategy will continue to see fragmented impact, unclear ROI, and rising governance complexity.

The path forward is disciplined integration through structured AI strategy and consulting services, measurable AI value engineering services, and executive-level AI Strategic Advisory that aligns intelligence with capital strategy and competitive positioning.

If AI investment has not translated into a measurable financial impact, the issue is not technology. It is architecture. Antier delivers enterprise AI strategy consulting that aligns intelligence with capital, governance, and competitive advantage.

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World1 day ago

Crypto World1 day agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business3 days ago

Business3 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment7 days ago

Entertainment7 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Tech3 days ago

Tech3 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Tech21 hours ago

Tech21 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World7 days ago

Crypto World7 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat16 hours ago

NewsBeat16 hours agoPolice latest as search for missing woman enters day nine

-

Crypto World6 days ago

Crypto World6 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

Sports2 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Crypto World16 hours ago

Crypto World16 hours agoEntering new markets without increasing payment costs