Crypto World

Did the WBTC DAO approve Justin Sun’s HTX as a merchant?

Wrapped Bitcoin (WBTC) spent years marketing itself as being governed by decentralized autonomous organizations (DAOs) that would have oversight over many parts of the product, including “the addition and removal of merchants and custodians.”

Its whitepaper claimed that “signatures are required from DAO members in order to add/remove members.”

Even as recently as a few months ago, WBTC has continued to emphasize that it “operates through a DAO.”

However, this supposed role of the WBTC DAO hasn’t always been respected.

HTX, formerly Huobi, was added as a merchant, the product’s term for an entity who can initiate mints and burns of WBTC, however, it was not approved by the DAO members listed on the Github, but a different set of signers from a different multisignature wallet.

A review of the smart contract reveals that 0xbE6d2444a717767544a8b0Ba77833AA6519D81cD is one of the merchants returned by the “getMerchants” function.

Read more: Is HTX redeeming 80% of TrueUSD?

This address was listed as HTX on the WBTC dashboard in late 2024 when Protos reported on it being used to redeem approximately half a billion dollars worth of WBTC.

However, this address isn’t listed as one of the merchants on the WBTC DAO GitHub page.

HTX is listed as one of the merchants on the WBTC website.

The entities that are still listed on GitHub include defunct and fraudulent entities such as Alameda Research and Three Arrows Capital, both of which are also still listed on the smart contract.

By further reviewing blockchain transactions on Ethereum, we can identify that this address was added as a merchant in November 2024, approximately two months after BiT Global and Justin Sun got involved in WBTC.

Read more: WBTC relaunches on TRON, but abandoned version is bigger

At the time, this transaction came from 0x4dbbbFb0e68bE9D8F5a377A4654604a62E851e80.

Strangely, this address isn’t listed as one of the multisignature wallets for WBTC on GitHub.

The listed multisignature wallet doesn’t include any transactions for the day when HTX was added as a merchant.

The inclusion of HTX as a merchant becomes increasingly important in light of some of the problematic behaviors that the exchange is engaged in.

Read more: Justin Sun defends HTX while it lends 92% of its USDT on Aave

It appears the publicly disclosed multisignature wallet, 0xB33f8879d4608711cEBb623F293F8Da13B8A37c5, appears to have been quietly replaced with a brand new multisignature wallet.

The wallet that was used lists several owners, many of whom differ from the WBTC DAO Github:

- 0xFDF28Bf25779ED4cA74e958d54653260af604C20 — Listed as Kyber on the Merchants list on the GitHub, isn’t listed as a DAO member.

- 0xb0F42D187145911C2aD1755831aDeD125619bd27 — Listed as BitGo on the custodian part of the GitHub, isn’t listed as a DAO member on the current GitHub commit, is listed as a small DAO member on a pull request.

- 0xd5d4aB76e8F22a0FdCeF8F483cC794a74A1a928e — Not listed on the current GitHub commit, is mentioned in a pull request as Maker.

- 0xB9062896ec3A615a4e4444DF183F0531a77218AE — Listed as Aave on the Merchants list on the GitHub, is not listed as a DAO member on the current commit, and is mentioned as a small DAO member on a pull request.

- 0xddD5105b94A647eEa6776B5A63e37D81eAE3566F — Not listed on the current GitHub commit, is listed on a pull request as Tom Bean and is listed as a small DAO member there, multisignature wallet that includes:

- 0x97788A242B6A9B1C4Cb103e8947df03801829BE4 — Not listed on the GitHub at all.

- 0x59150a3d034B435327C1A95A116C80F3bE2e4B5E — Not listed on the GitHub at all.

- 0x926314B7c2d36871eaf60Afa3D7E8ffc0f4F9A80 — Not listed on the current GitHub commit, appears to be a multisignature wallet created using BitGo’s technology, and is listed as BitGo 2 on a pull request describing it as a member of the small DAO.

- 0x51c44979eA04256f678552BE65FAf67f808b3EC0 — Not listed on the current GitHub commit, appears to be another multisignature wallet created using BitGo’s technology, is listed as BitGo 3 on a pull request describing it as a member of the small DAO.

- 0x0940c5bcAAe6e9Fbd22e869c2a3cD7A21604ED8D — Not listed on the GitHub at all.

- 0x5DCb2Cc68F4b975E1E2b77E723126a9f560F08E8 — Not listed on the GitHub at all.

It is not clear why these changes aren’t reflected on the current version of the GitHub repository. Protos reached out to WBTC for some clarification, but it didn’t respond before publication.

By further reviewing the smart contract at 0x4dbbbFb0e68bE9D8F5a377A4654604a62E851e80, we can identify the five addresses that approved the listing of HTX:

- 0xFDF28Bf25779ED4cA74e958d54653260af604C20 — Kyber

- 0xb0F42D187145911C2aD1755831aDeD125619bd27 — BitGo

- 0xddD5105b94A647eEa6776B5A63e37D81eAE3566F — Tom Bean

- 0x926314B7c2d36871eaf60Afa3D7E8ffc0f4F9A80 — BitGo

- 0x51c44979eA04256f678552BE65FAf67f808b3EC0 — BitGo

This means that although this multisignature wallet requires five signatures, three of them came from the same entity.

Only two non-custodian entities approved the addition of HTX as a merchant and those aren’t currently listed as DAO members on GitHub.

Adding to the intrigue, Tom Bean’s project, bZx, was built on Kyber.

It’s also worth highlighting the fact that this multisignature wallet requires five signatures, BitGo controls three, and there are two addresses that aren’t listed at all on GitHub.

If those are controlled by BitGo or BiT Global, then it would be possible for the custodians to make changes without approval from a single additional WBTC DAO member.

Protos reached out to WBTC to determine the identity of those two addresses, but again, didn’t get a response before publication.

BiT Global was added without WBTC DAO approval

This isn’t the first time that WBTC has appeared to ignore the advertised role of its DAO.

The whitepaper for WBTC claimed that “addition/removal of custodians” would be controlled by this DAO.

This used to be echoed on the website, which claimed, “The addition and removal of merchants and custodians will be an open process controlled by a multi-signature contract.”

Read more: Coinbase to delist WBTC months after Justin Sun controversy

Mike Belshe, the chief executive of BitGo, also claimed when BiT Global was being installed that there was a large DAO that “owns the smart contract” and “picks, you know, how we do custody of this thing.”

Strangely, despite that claim, the WBTC DAO didn’t seem to be consulted on the addition of Sun-affiliated BiT Global as a custodian for WBTC.

The Github for the WBTC DAO still doesn’t list BiT Global as a custodian.

The website for WBTC does list BiT Global as one of the custodians, alongside BitGo and BitGo Singapore.

The “members” smart contract still only lists a single custodian, 0xb0F42D187145911C2aD1755831aDeD125619bd27, a BitGo address.

This address is a multi-signature, so it’s possible that BiT Global was added as a signer to this wallet, meaning that the smart contract did not need to be updated with a new custodian address.

Broadly, despite the fact that WBTC manages over $8 billion in value, it seems to have neglected and ignored the DAO that has frequently been an important part of its marketing.

It’s replaced the multisignature wallet that governs it, without updates, with members whose identity we do not know.

This replacement made it possible, or convenient, for HTX to be added as a merchant, but other problems have been ignored, such as the fact that both Alameda Research and Three Arrows Capital are included as merchants.

The large DAO was apparently bypassed regarding the addition of BiT Global.

However it is that WBTC operates, it’s not principally through its DAO.

Its claims of transparency and decentralization have been dashed against the difficulty of coordinating a variety of actors around the world.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

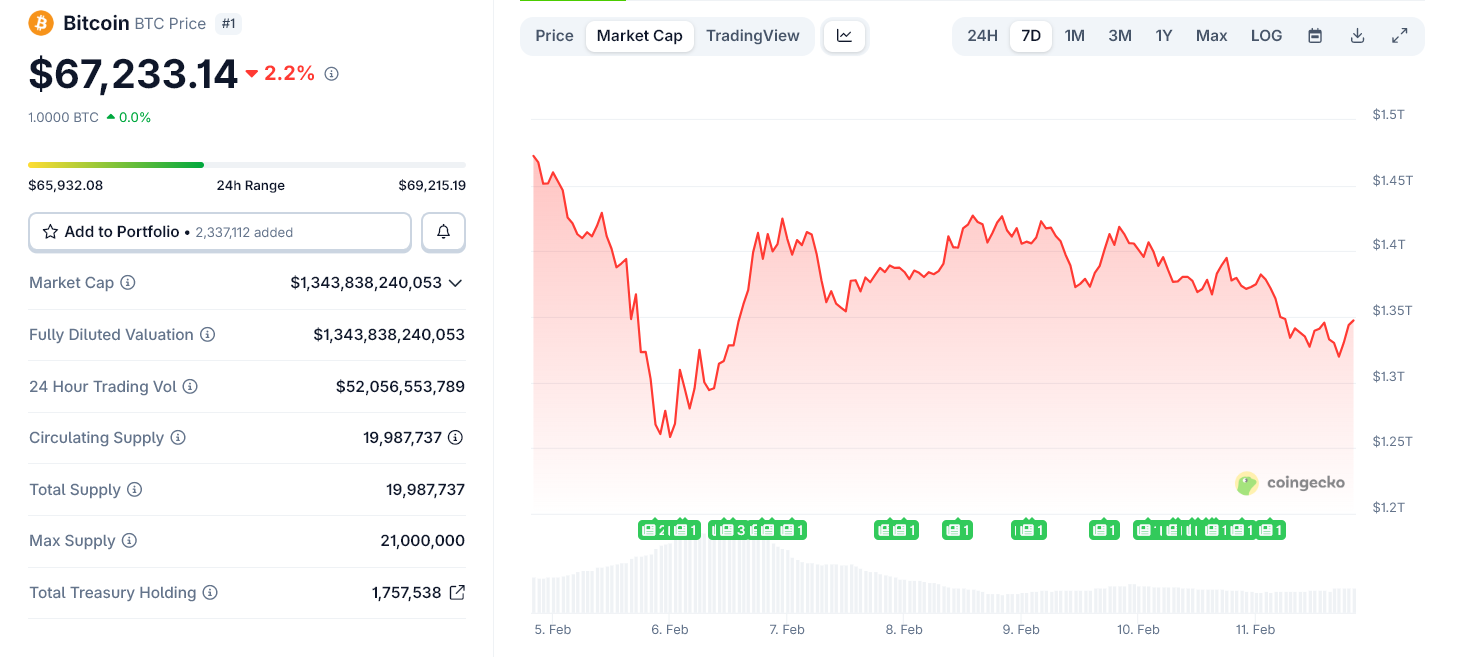

Bitcoin Surges After US Jobs Beat as Fed Pause Odds Near 95%

Bitcoin (CRYPTO: BTC) faced a volatile session as U.S. payrolls data surprised to the upside, complicating the path for the Federal Reserve and market risk appetite. After an early intraday spike toward the high $60,000s, the largest cryptocurrency retraced, leaving traders weighing whether a deeper pullback is coming or a temporary pause in risk-off sentiment is enough to support a rebound. The reaction came as the broader equity complex wobbled, with major indices trading in divergent fashion in response to the jobs release and the Fed’s likely response to it. The day’s price action underscores how macro news can quickly reframe crypto downside risk and the near-term technical setup.

Key takeaways

- Bitcoin briefly spiked toward the $69,000 mark intraday before reversing, with the move followed by a pullback that extended losses through the session.

- U.S. nonfarm payrolls rose by 130,000 in January, well above the 55,000 consensus, while the unemployment rate ticked down to 4.3% from 4.4%.

- Despite the strong jobs data, the signal for the Federal Reserve to hold rates at the March meeting persisted, supported by futures markets showing a high probability of a pause.

- The S&P 500 inched higher early but then gave back the gains, while the Nasdaq Composite slid, illustrating mixed risk-asset responses to the same macro print.

- Analysts and traders flagged a potential “slow bleed” scenario for BTC toward the sub-$60,000s or mid-$50,000s if buyers fail to reclaim key levels, with attention fixed on Friday’s CPI release for further clarity.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. A sharp intraday spike gave way to a renewed downward slope, signaling renewed anxiety about near-term downside risk.

Trading idea (Not Financial Advice): Hold. The market is testing whether downside pressure can be contained above key support levels, with forthcoming inflation data likely to drive the next leg.

Market context: The broader crypto environment remains sensitive to macro narratives—especially inflation trajectories and the likelihood of further monetary tightening or pauses—which shape liquidity and risk sentiment across digital assets.

Why it matters

The January employment report cemented a narrative in which a robust labor market reduces the near-term impulse for the Fed to cut rates, complicating the outlook for risk assets, including bitcoin. While stronger payrolls can intensify fears of higher-for-longer policy, the sheer resilience of the job market also mitigates the chance of a sharp recession, which can paradoxically support risk appetite in certain regimes. The market’s response in equities—modest gains in the S&P 500 that faded while tech-heavy indices retreated—reflects a nuanced equilibrium: traders are parsing whether macro strength translates into higher yields and tighter financial conditions, or whether cooling inflation signals will eventually embolden a broader risk-on posture.

Bitcoin’s price action over the session underscored those crosscurrents. The initial move higher suggested a renewal of demand, perhaps driven by the prospect of a Fed pause and the possibility of liquidity support from markets still navigating 2026’s macro landscape. Yet as the day evolved, the lack of follow-through on the upside and the re-emergence of selling pressure highlighted how quickly technical conditions can pivot on a single data release. For market participants, the takeaway is clear: macro prints will continue to define crypto volatility in the near term, even when the fundamental picture for blockchain technologies remains intact and the long-run adoption thesis remains intact.

Looking ahead, traders will be watching not only next week’s inflation data but also ongoing risk signals from both traditional markets and on-chain metrics. The interplay between macro cues and crypto-specific dynamics—such as exchange inflows, funding rates, and retail participation—will determine whether BTC stabilizes near current levels or tests critical supports in the low to mid-$60,000 range. The Fed’s eventual policy stance, as reflected in the FedWatch indicator and related market pricing, will remain a major driver, shaping whether risk assets get a sustained push or retreat into a risk-off regime.

What to watch next

- Friday’s Consumer Price Index (CPI) release to gauge inflation momentum and its impact on the Fed’s course.

- The March FOMC decision and the probability of a rate pause, as reflected in futures markets.

- BTC price action around key support levels near $64,000, $62,000, and the rumored $50,000 downside scenario.

- Market breadth signals in equities and whether risk-on appetite improves or deteriorates in the wake of inflation data.

- Any new official guidance from major market participants and notable traders regarding the balance of risk and potential upside catalysts for BTC.

Sources & verification

- U.S. Bureau of Labor Statistics January nonfarm payrolls report showing 130,000 jobs added and the unemployment rate at 4.3%.

- CME Group FedWatch Tool indicating high odds of a rate pause in March.

- TradingView BTCUSD price charts capturing intraday spikes and retracements on the session.

- Kobeissi Letter’s analysis on unemployment trends and the Fed’s expected stance.

- Price context and reference points discussed in market commentary noting BTC’s potential low-$60k to mid-$50k scenarios and prior coverage of $69,000 significance.

Bitcoin volatility and the jobs data backdrop

Bitcoin (CRYPTO: BTC) traded with pronounced sensitivity to the day’s macro data, underscoring how quickly crypto markets respond to shifts in macro policy expectations. The price momentum was highly event-driven: a brisk move up toward the $69,000 area was followed by a swift reversal, dragging the session into negative territory as the day wore on. The early move appeared to reflect a tempered optimism around a potential pause in rate hikes, but the subsequent pullback suggested that investors are not yet prepared to embrace a renewed up-leg without more convincing evidence of durable demand.

The January nonfarm payrolls report delivered numbers well above expectations—130,000 jobs added against a forecast of 55,000—while the unemployment rate declined to 4.3%. Such a strong labor market reduces the immediate pressure on the Fed to cut rates, implying a higher probability that policy normalization will proceed at a measured pace. In the near term, that translates to a cautious stance for crypto and other risk assets, even as the longer-term inflation trajectory remains a central question for market participants. The data fed into a narrative that a Fed pause would persist, a conclusion reflected by the CME FedWatch Tool’s readings that traders viewed the odds of a March pause as elevated, a signal that liquidity conditions may not tighten rapidly enough to derail risk appetite completely, but also that upside momentum in BTC would require a solid commitment from buyers at key price junctures.

Asset markets showed a mixed response. The S&P 500 edged higher in early trading before retracing, while the Nasdaq Composite slipped, highlighting a bifurcated risk environment where value and growth cohorts moved in different directions in response to the same macro release. Gold, often a proxy for macro uncertainty, also exhibited choppy behavior, briefly touching fresh February highs before trimming gains as traders weighed the likelihood of further volatility in the real economy. The nuance here is important: even with a robust January jobs report, the macro landscape remains unsettled, leaving markets to calibrate inflation expectations against the probability of a slower but still uncertain path for monetary policy.

Among traders, sentiment leaned toward caution. The Kobeissi Letter’s commentary framed the data as supportive of the view that the Fed would pause, a narrative that aligns with a broader market expectation of a softer near-term policy stance. Yet the absence of a decisive bounce in BTC underscored a critical point: macro strength does not automatically translate into immediate crypto upside, particularly when the price must contend with meaningful resistance around prior highs and the looming risk of a renewed downturn if buyers fail to reclaim and sustain momentum above critical levels. In this context, BTC’s journey from the intraday peak back toward sub-$70,000 territory epitomized the current tension between macro resilience and crypto-specific risk management.

https://platform.twitter.com/widgets.js

Crypto World

Coinbase Launches Crypto Wallets Purpose-Built For AI Agents

Coinbase has launched crypto wallet infrastructure that allows AI agents — programs that can think and transact without human input — to spend, earn and trade crypto.

In a post on Wednesday, Coinbase programmers Erik Reppel and Josh Nickerson said the new Agentic Wallets feature aims to build on today’s agents, which can answer questions, summarize documents, and assist with tasks, but can’t execute trades or orders on behalf of users.

“The next generation of agents won’t just advise — they’ll act,” the pair said, adding that AI agents will be able to do everything from monitoring decentralized finance positions and rebalancing portfolios to paying for compute and API access and participating in creator economies.

Reppel and Nickerson said Agentic Wallets build on Coinbase’s AgentKit framework, introduced in November 2024, which enabled developers to embed wallets into agents.

The agents can transact via Coinbase’s x402, a purpose-built payments protocol for autonomous AI use cases that has already reportedly seen 50 million transactions.

Through x402, “Agents acquire API keys, purchase compute, access premium data streams, and pay for storage – all autonomously, creating truly self-sustaining machine economies,” the programmers said.

Reppel and Nickerson said agents would be able to operate on the Ethereum layer-2 network Base, “Managing positions and executing strategies wherever the opportunities exist.”

“Build agents that monitor yields across protocols, execute trades on Base and manage liquidity positions 24/7. Your agent detects a better yield opportunity at 3am? It rebalances automatically, no approval needed because you’ve already set permissions and controls.”

AI agents now operable on the Bitcoin Lightning Network

Lightning Labs, the team behind the Bitcoin layer-2 Lightning Network, also released a new toolset on Wednesday that enables AI agents to transact on Lightning using the L402 protocol standard.

The AI agents can also run a Lightning node and manage a Lightning wallet containing native Bitcoin (BTC) without access to the private keys.

Meanwhile, Crypto.com CEO Kris Marszalek launched ai.com on Monday, a platform that lets users create personal AI agents to perform everyday tasks on their behalf.

Marszalek said the AI agents can perform anything from managing emails and scheduling meetings to canceling subscriptions, carrying out shopping tasks and planning trips.

Crypto leaders are bullish on agentic AI

Jeremy Allaire, the CEO of stablecoin issuer Circle, predicted on Jan. 22 that billions of AI agents will be transacting with crypto and stablecoins for everyday payments on behalf of users in three to five years.

Former Binance CEO Changpeng “CZ” Zhao has shared a similar view, stating that “native currency for AI agents is going to be crypto” and will do everything from buying tickets to paying restaurant bills.

Related: Deel taps MoonPay to roll out stablecoin salary payouts in UK, EU

Outside of crypto, tech giant Google introduced the Universal Commerce Protocol on Jan. 11 to power agentic commerce.

Google’s protocol uses its Agent Payment Protocol 2 to facilitate transfers on behalf of users, with Google Pay serving as the default payment handler for US dollar transactions.

Magazine: The critical reason you should never ask ChatGPT for legal advice

Crypto World

BNB price slips below $620 golden pocket

BNB price is now trading around $609, slipping below the previously defended $620 golden pocket level and putting long-term support to the test.

Summary

- Price dips under the $620 0.618 Fibonacci “golden pocket”

- Trading near the 200-week moving average, a key macro support

- Structure remains intact — but bulls need a reclaim of $620

Binance (BNB) is once again at a critical inflection point after losing the $620 region that had been acting as a high-timeframe support cluster. Following weeks of corrective pressure, price briefly stabilized at the 0.618 Fibonacci retracement before slipping modestly lower, now hovering near $609.

This move shifts the technical narrative slightly: rather than cleanly holding support, BNB is now probing the lower bounds of a major confluence zone. Whether this becomes a deviation below support or the start of deeper consolidation will likely define the next multi-week trend.

BNB price key technical points

- $620 remains the high-timeframe golden pocket (0.618 Fibonacci retracement)

- Price is hovering around the 200-week moving average

- A reclaim of $620 would strengthen the bullish case

- Sustained acceptance below opens the door to further downside exploration

The $620 level continues to carry heavy technical weight. It marks the 0.618 Fibonacci retracement of the broader advance — often referred to as the “golden pocket,” a zone that frequently acts as a high-probability reversal area.

However, with BNB now trading below that level, the focus shifts to whether this is a temporary liquidity sweep or a more meaningful breakdown.

Importantly, price remains near the 200-week moving average — a widely followed macro trend indicator. Historically, sustained closes below this level tend to invite extended consolidation, while swift recoveries often signal a false breakdown.

The next few weekly closes will therefore be critical.

Market structure supports a potential bottom

From a broader market structure perspective, the chart has not yet confirmed a full trend reversal. While the loss of $620 weakens the immediate bullish structure, BNB has not decisively broken down into lower macro territory.

This type of price action — slipping below support before reclaiming it — is common during bottoming formations. Markets often sweep liquidity below obvious levels before rotating higher.

If buyers step in and push price back above $620 with conviction and expanding volume, the move could be classified as a deviation, reinforcing the broader bullish structure.

If not, deeper consolidation becomes increasingly likely.

Upside targets come back into focus

Bullish case:

- Reclaim and hold above $620

- Strong weekly close back inside the golden pocket

- Gradual rotation toward higher resistance

- $932 remains the key high-timeframe resistance target

Bearish case:

- Continued weekly closes below $620

- Loss of the 200-week moving average

- Expansion in selling volume

- Potential move toward lower value areas before base formation

What to expect in the coming price action

The $932 high-timeframe resistance remains the primary upside objective if macro structure holds. However, reclaiming $620 is the first major hurdle bulls must clear before that target comes back into play.

With BNB now around $609, this is no longer simply a stabilization story — it is a support test.

High-timeframe setups require patience. The coming weekly closes will determine whether the current move becomes a confirmed breakdown or a classic deviation below major support.

For now, the broader structure is under pressure but not broken. A decisive reclaim of $620 would quickly restore bullish momentum. Failure to do so would shift focus toward extended consolidation before any meaningful upside rotation can begin.

Crypto World

MYX Finance Set For 43% Crash As Price Falls Below $5

MYX Finance price has dropped sharply, slipping below the critical $5.00 level and signaling growing downside risk.

The breakdown follows several sessions of declining momentum. Selling pressure accelerated after MYX failed to hold key intraday support. Market structure now reflects a bearish shift.

MYX Traders Turn Bearish

The recent dip has triggered increased short positioning among MYX traders. Funding rate data shows the futures market is dominated by short contracts. Negative funding reflects bearish conviction, as traders position for further declines in MYX Finance price.

Sponsored

Sponsored

A surge in short interest often signals expectations of a deeper correction. Traders appear to be anticipating a price crash they can capitalize on through leveraged positions. This imbalance in derivatives markets may amplify volatility and reinforce downward pressure if selling accelerates further.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Money Flow Index, or MFI, indicates heavy selling pressure on the MYX price, reinforcing the ongoing correction. The indicator has trended lower in recent sessions, reflecting sustained capital outflows. This weakness confirms that bearish momentum remains dominant across short-term trading activity.

Although the MFI is approaching the oversold threshold, it has not yet dropped below the 20.0 mark. A decisive move under that level typically signals selling saturation, where accumulation may emerge at discounted prices. If accumulation strengthens, MYX could attempt a technical rebound.

MYX Price May See Further Decline

MYX price is down 23% in the last 24 hours, trading at $4.87 after sliding below $5.00. The token now appears to be breaking down from a bearish ascending wedge pattern. Such formations often precede sharp corrections when support levels fail.

The wedge structure projects a potential 43% decline toward $2.81, coinciding with the 1.78 Fibonacci level. However, a more immediate and realistic target lies near the $4.07 (1.23 fib line) support zone. A confirmed break below $4.61 would increase the probability of testing $4.07, with further downside risk if broader crypto sentiment deteriorates.

A shift in investor behavior could alter this outlook should MYX end up being oversold, as the MFI hints at. If inflows begin to outweigh outflows and short positions unwind, MYX Finance may attempt stabilization. A decisive move above $5.75 resistance would invalidate the bearish thesis and potentially drive the price toward $6.00 in the near term.

Crypto World

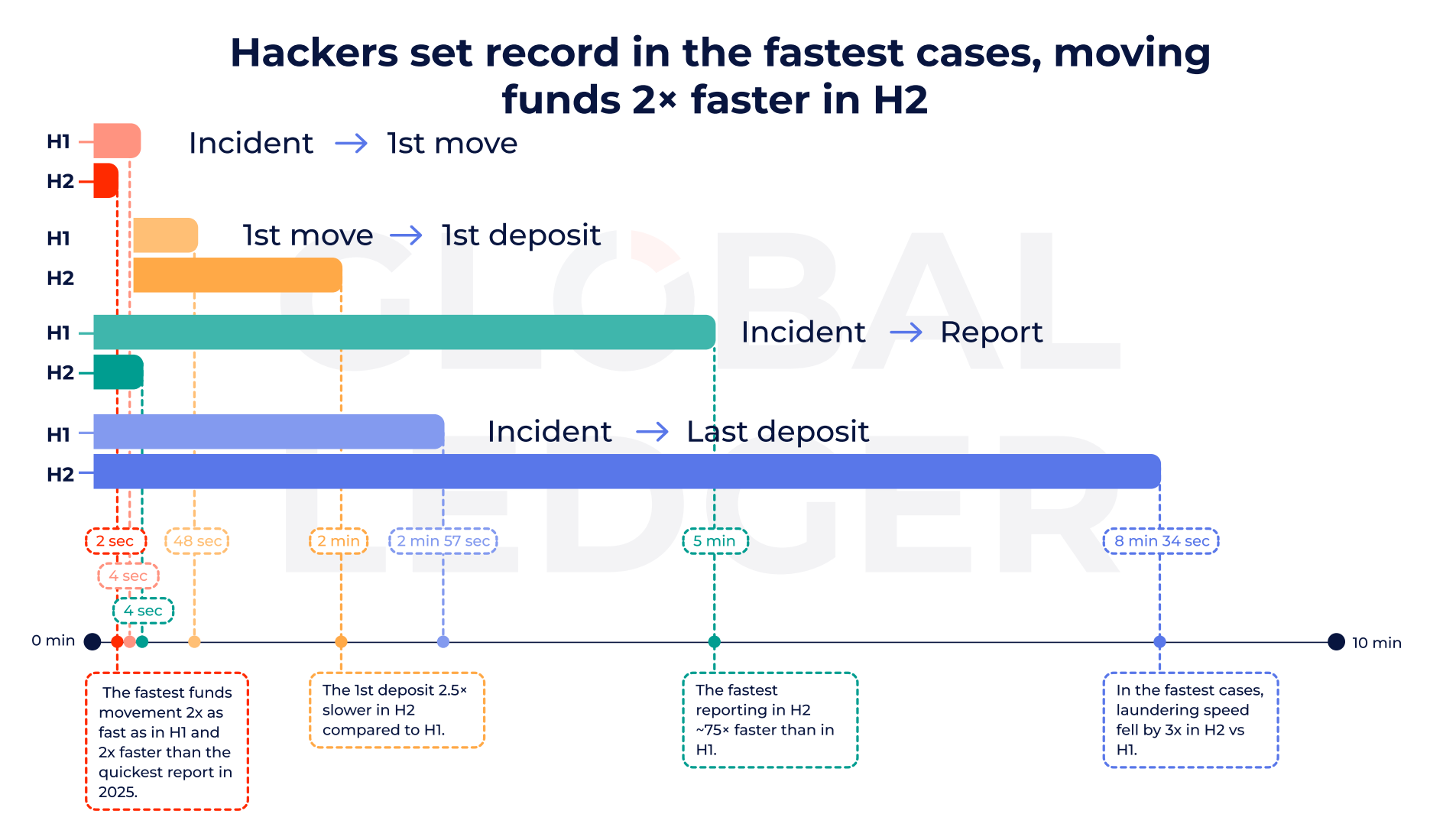

The 2-Second Crypto Laundering Shockwave

Crypto hackers are now moving stolen funds in as little as two seconds after an attack begins. In most cases, they shift assets before victims even disclose the breach.

That is the clearest finding from Global Ledger’s 2025 analysis of 255 crypto hacks worth $4.04 billion.

Sponsored

Sponsored

Blink and It’s Gone: Crypto Laundering Now Starts Before Disclosure

The speed is striking. According to Global Ledger, 76% of hacks saw funds move before public disclosure, rising to 84.6% in the second half of the year.

This means attackers often act before exchanges, analytics firms, or law enforcement can coordinate a response.

However, speed tells only part of the story.

While first transfers are now near-instant, full laundering takes longer.

On average, hackers needed about 10.6 days in the second half of 2025 to reach final deposit points such as exchanges or mixers, up from roughly eight days earlier in the year.

In short, the sprint is faster, but the marathon is slower.

Sponsored

Sponsored

This shift reflects improved monitoring after disclosure. Once incidents go public, exchanges and blockchain analytics firms label addresses and increase scrutiny.

As a result, attackers break funds into smaller pieces and route them through multiple layers before attempting cash-out.

Hacking Speed Increased, but Crypto Laundering Speed Became Slower. Source: Global Ledger

Sponsored

Sponsored

Bridges, Mixers, and the Long Road to Cash-Out

Bridges have become the main highway for that process. Nearly half of all stolen funds, about $2.01 billion, moved through cross-chain bridges.

That is more than three times the amount routed via mixers or privacy protocols. In the Bybit case alone, 94.91% of stolen funds flowed through bridges.

At the same time, Tornado Cash regained prominence. The protocol appeared in 41.57% of hacks in 2025. Its usage share jumped sharply in the second half of the year, following sanctions changes cited in the report.

Meanwhile, direct cash-outs to centralized exchanges fell sharply in the second half. DeFi platforms received a rising share of stolen funds. Attackers appear to avoid obvious off-ramps until attention fades.

Sponsored

Sponsored

Notably, nearly half of all stolen funds remained unspent at the time of analysis. That leaves billions sitting in wallets, potentially waiting for future laundering attempts.

The scale of the problem remains severe. Ethereum accounted for $2.44 billion in losses, or 60.64% of the total.

Overall, $4.04 billion was stolen across 255 incidents.

Yet recovery remains limited. Only about 9.52% of funds were frozen, and 6.52% were returned.

Taken together, the findings show a clear pattern. Attackers now operate at machine speed in the first seconds after a breach.

Defenders respond later, forcing criminals into slower, staged laundering strategies. The race has not ended. It has simply entered a new phase—measured in seconds at the start, and days at the finish.

Crypto World

ZRO Soars 40% After Unveiling Layer 1 Blockchain

LayerZero announced its Zero blockchain yesterday, built in collaboration with Citadel, ICE, and Google Cloud.

LayerZero’s ZRO token is leading the altcoin market today, rallying 40% after unveiling Zero, its new Layer 1 blockchain.

ZRO sold off immediately after yesterday’s announcement; however, after more details emerged – such as Ark Invest founder Cathie Wood stepping on board as an advisor – the token surged from $1.7 to $2.5.

The ZRO token has been pricing in an impending announcement throughout 2026, and has been one of just a handful of strong altcoins over the last six weeks. The move brings ZRO’s market capitalization to $481 million, its highest level since January 2025.

In addition to Wood, the protocol also added Michael Blaugrund, the vice president of Strategic Initiatives at Intercontinental Exchange (ICE), and Caroline Butler, the former Head of Digital Assets at the Bank of New York Mellon, and co-chair of the Commodities and Futures Trading Commission (CFTC), to its advisory board.

LayerZero brands Zero as “the first multi-core world computer” and says it’s been designed to address all existing bottlenecks in blockchain design, with an explicit goal of 2 million transactions per second (TPS) for every component in its system.

“We have replaced the fragmented, one-size-fits-all model with a unified high-performance system that treats multiple applications like concurrent processes on a single modern multi-core CPU. Due to this massive cost reduction, Zero is not only an alternative to existing blockchains; it provides a credible alternative to centralized cloud providers like AWS,” the Zero debut article claims.

“By stripping away the overhead of redundant replication, we have finally made decentralization viable on a global scale. Zero is the first truly scalable, multi-core world computer,” the article concluded.

Crypto World

Crypto ETFs are here to stay, downturn be damned

Despite a bearish cryptocurrency market, ETF issuers continue to push forward with new filings, betting that demand for digital asset funds will remain strong.

Summary

- ETF issuers like Bitwise, ProShares, and 21Shares are advancing with new filings, including plans for Uniswap-linked and leveraged Bitcoin/Ether ETFs.

- The crypto ETF market is crowded, with over 140 existing funds, 10 new launches this year, and more expected.

- Bitcoin’s sharp price drop has led to significant losses for ETF buyers, with $1.5 billion withdrawn from Ether ETFs and over $3.5 billion from Bitcoin ETFs in the past three months.

This month, Bitwise Asset Management filed for a Uniswap-linked ETF, while ProShares sought approval for leveraged Bitcoin and Ether ETFs. 21Shares also resubmitted plans for funds based on Ondo and Sei, signaling progress in its efforts.

Todd Sohn, chief ETF strategist at Strategas, told Bloomberg that while firms like 21Shares and Bitwise remain committed to the long-term potential of crypto, ongoing poor performance could affect future flows.

This comes amid a crowded market, with over 140 crypto-focused US ETFs already trading, and 10 more launched this year. A BNB staking ETF is expected soon.

Cryptos have faced renewed pressure after October’s selloff, with Bitcoin falling sharply, dragging smaller tokens down. Investors are stepping back as liquidity tightens and risk appetite wanes.

Data from Glassnode shows that buyers of U.S. spot-Bitcoin ETFs are sitting on average paper losses, having bought Bitcoin at around $84,100 per coin, while the price now hovers near $66,000. This has led to significant outflows, with over $1.5 billion withdrawn from Ether-focused ETFs and more than $3.5 billion pulled from Bitcoin ETFs in recent months.

Crypto World

Chainlink Feeds Live for Ondo Tokenized US Stocks on Ethereum

Ondo Finance’s Ondo Global Markets platform has integrated Chainlink as its official data oracle, enabling on-chain price feeds for tokenized US stocks such as SPYon, QQQon and TSLAon to go live on Ethereum. The feeds are now being utilized on Euler, where users can post tokenized equities as collateral to borrow stablecoins. This development provides on-chain pricing references for the tokenized assets and allows DeFi protocols to set collateral parameters and manage liquidations tied to underlying equities, while also accounting for corporate actions like dividends. The move marks a notable step in bringing traditional equities closer to decentralized finance, offering new avenues for lending and structured product design that hinge on reliable price data.

Key takeaways

- Chainlink has been designated as the official data oracle for Ondo Global Markets, supplying on-chain price feeds for tokenized US stocks on Ethereum.

- Initial support covers SPYon (SPDR S&P 500 ETF), QQQon (Invesco QQQ ETF), and TSLAon (Tesla stock), with the expectation of expanding to additional tokenized assets as coverage broadens.

- The price feeds feed into Euler, enabling tokenized equities to be used as collateral for borrowing stablecoins and for setting liquidation parameters in DeFi lending markets.

- Corporate actions, including dividends, are incorporated into the reference prices, helping maintain alignment between on-chain valuations and the underlying equities.

- Ondo’s move follows a broader push to tokenize US equities, underscored by regulatory and market actions across traditional finance and crypto venues, including Nasdaq’s rule-change efforts and public experiments by Robinhood and others.

- Industry developments highlight a growing ecosystem where tokenized stocks can feed DeFi protocols and potentially participate in broader on-chain trading and custody flows.

Tickers mentioned: SPYon, QQQon, TSLAon

Market context: The integration arrives amid a broader push to bring tokenized equities onto blockchain infrastructure as regulators in the United States refine custody and trading rules for tokenized securities. Observers note the convergence of traditional markets and DeFi as institutional and fintech players experiment with on-chain collateral, settlement efficiency and new product structures.

Why it matters

Ondo’s integration of Chainlink as the on-chain price oracle for tokenized stocks addresses a critical gap in DeFi’s treatment of synthetic equity representations. Before this development, tokenized equities had primarily served price exposure purposes or lightly simulated baseline risk rather than functioning as robust collateral. By linking on-chain prices to reference values tied to the underlying assets—and incorporating corporate actions—the ecosystem gains a more reliable mechanism for risk management, enabling lenders and protocol designers to calibrate collateral factors, liquidation thresholds and risk controls with greater fidelity to real-world equity behavior.

The partnership’s significance extends beyond Ondo. As markets experiment with tokenized versions of mainstream securities, the entire DeFi lending stack benefits from standardized, auditable price feeds that react to corporate actions and market dynamics. The collaboration with Chainlink—a long-standing oracle provider in the crypto space—also helps align DeFi protocols with real-world financial benchmarks, potentially fostering broader adoption of tokenized stocks within lending, derivatives and structured products. The move comes at a moment when traditional exchanges and fintechs are stepping up efforts to offer tokenized equity trading, custody and settlement on or near blockchain rails, signaling a converging trajectory for regulated tokenized assets and decentralized finance.

Regulatory and market developments underscore the momentum behind tokenized equities. Nasdaq has pursued a rule change with the U.S. Securities and Exchange Commission to enable listing and trading of tokenized stocks, aiming to integrate blockchain-based representations with a regulated exchange framework. Separately, the SEC issued a no-action letter allowing a Depository Trust & Clearing Corporation subsidiary to launch a tokenization service for securities already held in custody, adding clarity to custody pathways for tokenized assets. In the broader crypto ecosystem, tokenized stock offerings have already surfaced on various platforms, illustrating a multi-pronged approach to bringing on-chain exposure to blue-chip equities without sacrificing the transparency and programmability that DeFi affords.

On the liquidity and trading front, major market participants are pursuing ways to expand access to tokenized securities. The New York Stock Exchange and its parent company, Intercontinental Exchange, announced efforts to develop a blockchain-based trading platform for tokenized stocks and ETFs with 24/7 trading and near-instant settlement, subject to regulatory approval. Meanwhile, crypto-native tokenization initiatives have already brought dozens of tokenized US stocks to multi-chain ecosystems, with platforms like Kraken and Bybit hosting tokenized stock markets under the xStocks banner, and Robinhood launching a public testnet for Robinhood Chain, an Ethereum layer-2 network built on Arbitrum, designed to support tokenized assets and on-chain lending and derivatives. These moves collectively illustrate a cross-market push toward more flexible capital markets built on tokenized representations and on-chain data feeds.

For developers and users, the Ondo–Chainlink integration signals a more practical pathway for tokenized equities to function as collateral within DeFi. It binds the on-chain price determiners to the equity’s fundamentals, potentially enabling more sophisticated service models and risk management strategies in decentralized lending and beyond. The collaboration also reinforces the role of oracles as a bridge between traditional asset classes and DeFi ecosystems, an area that continues to attract attention as regulators, exchanges and fintechs map out the future of tokenized securities and on-chain finance.

Additional context around the broader tokenization wave is reflected in the ongoing coverage of tokenized assets across crypto media, including continued discussions of how tokenized stocks could operate within regulated frameworks and the evolving custody landscape. The ecosystem’s trajectory remains contingent on regulatory clarity, liquidity, and the ability of on-chain price feeds to reflect real-time market movements and corporate actions with high fidelity.

What to watch next

- Expansion of oracle coverage to additional tokenized equities and ETFs as Ondo and Chainlink broaden their integration footprint.

- Regulatory progress on tokenized securities, including potential approvals or filings related to further tokenized-stock listings and custody rules.

- Adoption by more DeFi protocols that may incorporate tokenized equities as collateral or reference price sources in lending and derivatives.

- New corporate actions and governance events for tokenized assets that could drive updates to reference prices and collateral models.

Sources & verification

- Ondo post: Defi adoption of Ondo tokenized stocks live — https://ondo.finance/blog/defi-adoption-of-ondo-tokenized-stocks-live

- Chainlink partnership with Ondo (PR Newswire, October 2025) — https://www.prnewswire.com/news-releases/ondo-and-chainlink-announce-landmark-strategic-partnership-to-jointly-bring-financial-institutions-onchain-302599151.html

- Nasdaq rule-change for tokenized stocks — https://cointelegraph.com/news/nasdaq-asks-sec-for-rule-change-to-trade-tokenized-stocks

- SEC no-action letter for tokenization services (DTCC) — https://cointelegraph.com/news/sec-clears-dtcc-to-offer-tokenization-service

- Robinhood Chain testnet (public) — https://robinhood.com/us/en/newsroom/robinhood-chain-launches-public-testnet/

Ondo and Chainlink bring tokenized stocks to DeFi on Ethereum

Ondo Finance’s Ondo Global Markets platform has integrated Chainlink as its official data oracle, enabling on-chain price feeds for tokenized US stocks such as SPYon, QQQon and TSLAon to go live on Ethereum (CRYPTO: ETH). The feeds are now being utilized on Euler, where users can post tokenized equities as collateral to borrow stablecoins. The integration anchors on-chain valuations to reference prices that reflect corporate actions like dividends, enhancing the reliability of on-chain pricing for collateral and liquidations. The collaboration marks a meaningful step in expanding the use cases for tokenized equities within decentralized finance and demonstrates how established oracle networks can support new asset classes on-chain.

Initial coverage includes SPYon (SPDR S&P 500 ETF), QQQon (Invesco QQQ ETF), and TSLAon (Tesla stock), with plans to expand as the oracle network and Ondo’s protocol integrations scale. The data feeds feed into lending markets on Euler, enabling users to collateralize tokenized stocks for stablecoin borrowing and to set risk controls based on up-to-date reference prices. This approach addresses a notable limitation: tokenized equities had been primarily used for price exposure rather than as robust collateral. By pairing exchange-linked liquidity with reliable on-chain price feeds, Ondo and Chainlink seek to unlock broader DeFi applications, including more sophisticated lending, risk management and perhaps new forms of on-chain structured products.

The broader ecosystem context includes a growing array of regulatory and market initiatives aimed at tokenized securities. Nasdaq’s pursuit of a rule change to permit listing and trading tokenized stocks signals a potential path for regulated, on-chain representations of listed shares. The same week, the SEC clarified custody rules for tokenized securities in collaboration with the Depository Trust & Clearing Corporation, which could streamline how tokenized assets move through the traditional custody pipeline. On the crypto front, platforms have already experimented with tokenized stock access, including tokenized stock offerings across Kraken and Bybit and the Robinhood Chain initiative, all pointing to increasing interoperability between on-chain finance and legacy markets.

With the Ondo–Chainlink integration, developers and users gain a practical mechanism to reference the true price of tokenized equities within DeFi protocols, enabling more reliable collateralization and liquidations. The development underscores the maturation of tokenized securities as a cross-border, cross-venue concept—one that depends on robust price oracles, regulatory clarity and continued collaboration between traditional finance operators and crypto infrastructure providers. As the market continues to experiment with tokenized assets, observers will watch for further asset coverage, governance updates, and regulatory milestones that could accelerate or recalibrate the adoption curve for tokenized stocks in DeFi and beyond.

Crypto World

US Jobs Data Could Shock Bitcoin, Here’s Why

Bitcoin faces renewed macro pressure after the latest US jobs report signaled a stronger-than-expected labor market, pushing Treasury yields higher and reducing the likelihood of near-term Federal Reserve rate cuts.

The US economy added 130,000 jobs in January, nearly double consensus expectations. At the same time, the unemployment rate fell to 4.3%, showing continued labor market resilience.

While strong employment is positive for the broader economy, it complicates the outlook for risk assets like Bitcoin.

Sponsored

Sponsored

Strong Jobs Data Delays Rate Cut Expectations

Markets had been anticipating potential rate cuts in the coming months amid slowing growth concerns. However, a resilient labor market reduces the urgency for monetary easing.

As a result, investors repriced expectations for Federal Reserve policy.

Bond markets reacted immediately. The US 10-year Treasury yield jumped toward the 4.2% level, rising several basis points after the report. The two-year yield also climbed, reflecting reduced probability of near-term cuts.

Higher yields tighten financial conditions. They increase borrowing costs across the economy and raise the discount rate used to value risk assets.

Sponsored

Sponsored

Why Higher Yields Pressure Bitcoin

Bitcoin is highly sensitive to liquidity conditions. When Treasury yields rise, capital tends to rotate toward safer, yield-generating assets such as government bonds.

At the same time, a stronger dollar often accompanies rising yields. A firmer dollar reduces global liquidity and makes speculative assets less attractive.

This combination creates headwinds for crypto markets.

Sponsored

Sponsored

Although Bitcoin briefly stabilized near the $70,000 level earlier in the week, the jobs data increases the risk of renewed volatility. Without a clear signal that the Fed will ease policy, liquidity remains constrained.

“For Bitcoin, this report is a short-term headwind. A beat of this magnitude dampens the probability of a March rate cut and reinforces the Fed’s pause at 3.50%-3.75%. The cheaper money catalyst that risk assets need to mount a sustained recovery just got pushed further out. Expect the dollar to firm and yields to reprice higher, both of which pressure BTC into a range in the near term,” David Hernandez, Crypto Investment Specialist at 21shares told BeInCrypto.

Market Structure Amplifies Macro Stress

The recent crash demonstrated how sensitive Bitcoin has become to macro shifts. Large ETF flows, institutional hedging, and leveraged positioning can accelerate moves when financial conditions tighten.

A stronger labor market does not guarantee Bitcoin will fall. However, it reduces one of the key bullish catalysts: expectations of easier monetary policy.

Sponsored

Sponsored

“In the short term, Bitcoin looks defensive. The key level to watch is $65,000. However, if this strong report turns out to be temporary rather than a sign the economy is heating up again, the Fed could still cut rates later this year. When that happens, Bitcoin’s limited supply becomes important again. Strong data today may delay a rally, but it doesn’t break the long-term bullish case,” Hernandez said.

The Bottom Line

The latest US jobs report reinforces a “higher-for-longer” rate environment.

For Bitcoin, that is not immediately catastrophic. But it does make sustained upside more difficult.

Unless liquidity improves or yields retreat, the macro backdrop now leans cautious rather than supportive for crypto markets.

Crypto World

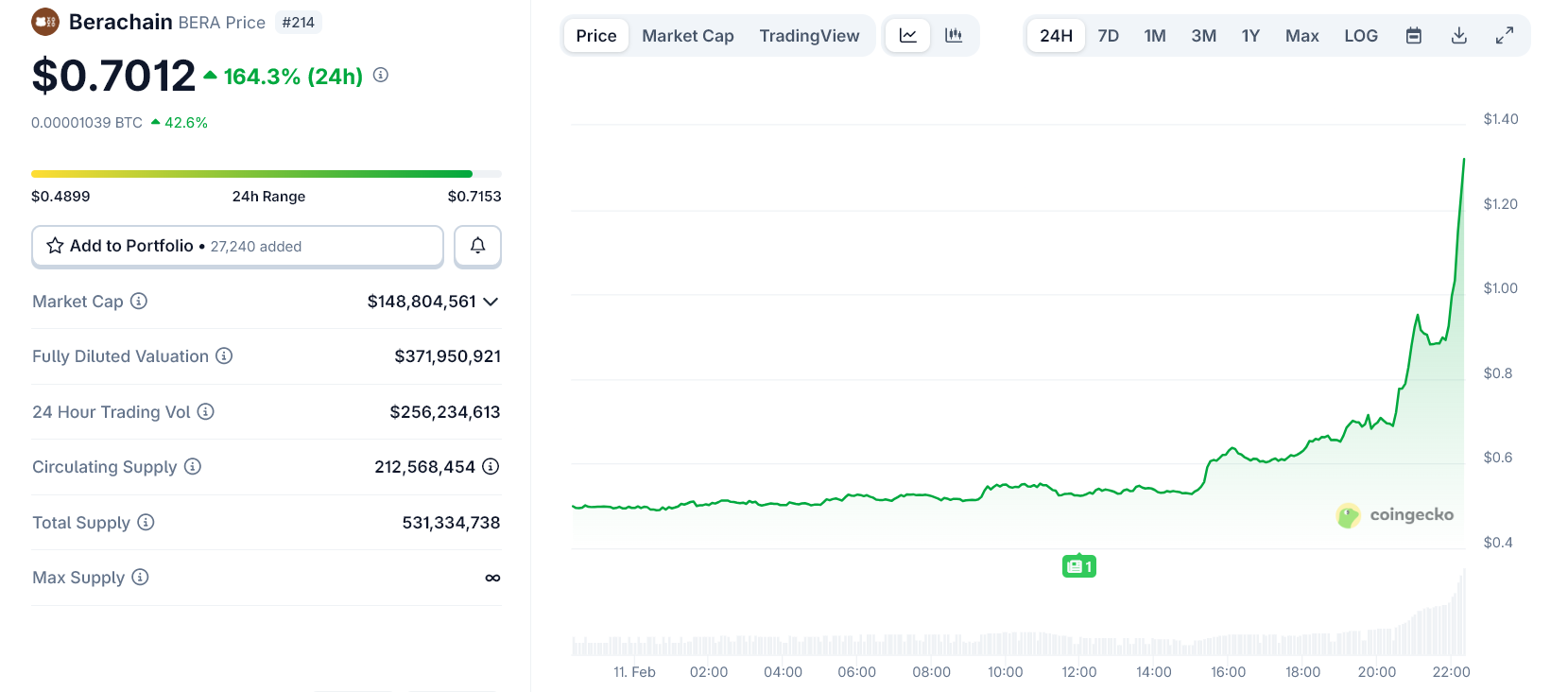

Why Is Berachain Up 150% Overnight After a Year of Silence?

Berachain’s native token, BERA, surged over 150% on February 11, marking its sharpest single-day gain in months. The rally follows weeks of renewed activity after the project spent much of 2025 under pressure from falling prices, token unlock concerns, and investor uncertainty.

The immediate catalyst appears to be the foundation’s strategic shift toward a new model called “Bera Builds Businesses.”

Sponsored

Sponsored

Berachain’s Refund Fears to Revenue Ambitions: What Changed?

Announced in January, the initiative aims to back three to five revenue-generating applications designed to create sustainable demand for BERA.

Instead of relying on heavy token incentives, the network now plans to focus on projects capable of producing real cash flow.

That pivot changed the narrative.

Throughout 2025, Berachain struggled as TVL (total value locked) collapsed from early highs, and the token fell more than 90% from its peak. Critics questioned whether its incentive-heavy growth model could survive a prolonged market downturn.

However, another major overhang also disappeared this month.

Sponsored

Sponsored

A controversial refund clause tied to Brevan Howard’s Nova Digital fund expired on February 6, 2026. The clause reportedly allowed the investor to request a $25 million refund if performance conditions were not met.

With the deadline passing, traders appear to view the removal of that risk as structurally positive.

At the same time, a large token unlock event also cleared without triggering heavy selling. That outcome fueled what analysts describe as a “relief rally.”

On-chain and derivatives data show rising trading volume and increasing open interest.

Liquidation heatmaps indicate clustered short positions above key resistance levels, suggesting that short covering may have amplified upward momentum.

Still, risks remain.

Berachain faces continued token distribution pressure and must prove that its business-focused strategy can generate sustained demand.

For now, however, the market appears to be rewarding clarity and the removal of uncertainty after a long period of silence.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech21 hours ago

Tech21 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World1 day ago

Crypto World1 day agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat7 days ago

NewsBeat7 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition