Crypto World

Dogecoin, Shiba Inu slid deeper as on-chain activity spike

Dogecoin and Shiba Inu slid deeper into selloff territory even as on-chain activity spiked, underscoring a growing disconnect between network usage and price action across the meme-coin sector.

Summary

- Despite a 36% surge in Dogecoin active addresses, prices fell 3%, with Shiba Inu also losing 2%.

- Increased network activity is driven more by distribution than accumulation, signaling vulnerability to further declines.

- Trading at $0.00000641, SHIB is down 92% from its 2021 peak, facing weak transaction volumes and uncertain future utility.

Dogecoin (DOGE) active addresses jumped 36% over the past week to more than 71,400, signaling renewed participation on the network.

But the surge failed to support prices, with DOGE falling 3% to about $0.102 and Shiba Inu dropping 2% to roughly $0.0000066.

Heavy net outflows, weakening technical structures, and broken support levels suggest both tokens remain vulnerable to further downside, as increased activity appears driven more by distribution than accumulation.

Dogecoin, originally created as a joke in 2013, briefly soared to a $90 billion market cap in 2021 but has since lost over 90% of its value.

Despite a rally in late 2024, the meme coin remains down 62% in 2025 and lacks a real use case like Bitcoin or Ethereum.

Its speculative nature and endless supply—leading to constant dilution—make it vulnerable to further declines. With no fundamental catalysts in sight, a 50% drop in 2026, potentially returning Dogecoin to its 2022 low of $0.05, seems likely.

Shiba Inu is the pits

Shiba Inu (SHIB) has been volatile after recently hitting a monthly low of $0.0000065 on February 1, following a high of $0.0000097 on January 6.

These price swings reflect SHIB’s sensitivity to sentiment and liquidity.

Shiba Inu is currently trading at $0.00000641, a 92% drop from its October 2021 all-time high. The token is below key moving averages, and while the RSI shows oversold conditions, no reversal has occurred. SHIB is testing critical support at $0.00000638, and a breakdown below this level could push it to $0.0000055.

The Shiba Inu ecosystem is facing challenges, including weak daily transaction volume and a lack of sustained utility, despite its integration of Fully Homomorphic Encryption (FHE) in Q2 2026, which could boost privacy and security. The launch of a crypto ETF by T. Rowe Price could also attract regulated capital, but approval odds are low.

According to one report, Shiba Inu’s price could range between $0.000015-$0.000025 by 2027 if privacy upgrades succeed and the ETF is approved, with conservative estimates placing it between $0.000010–$0.000015.

Key resistance levels are $0.00000732, $0.0000078, and $0.00000851. Monitoring Shibarium transaction volumes and burn rates, along with Bitcoin’s performance, will be key for investors tracking SHIB’s potential recovery.

Crypto World

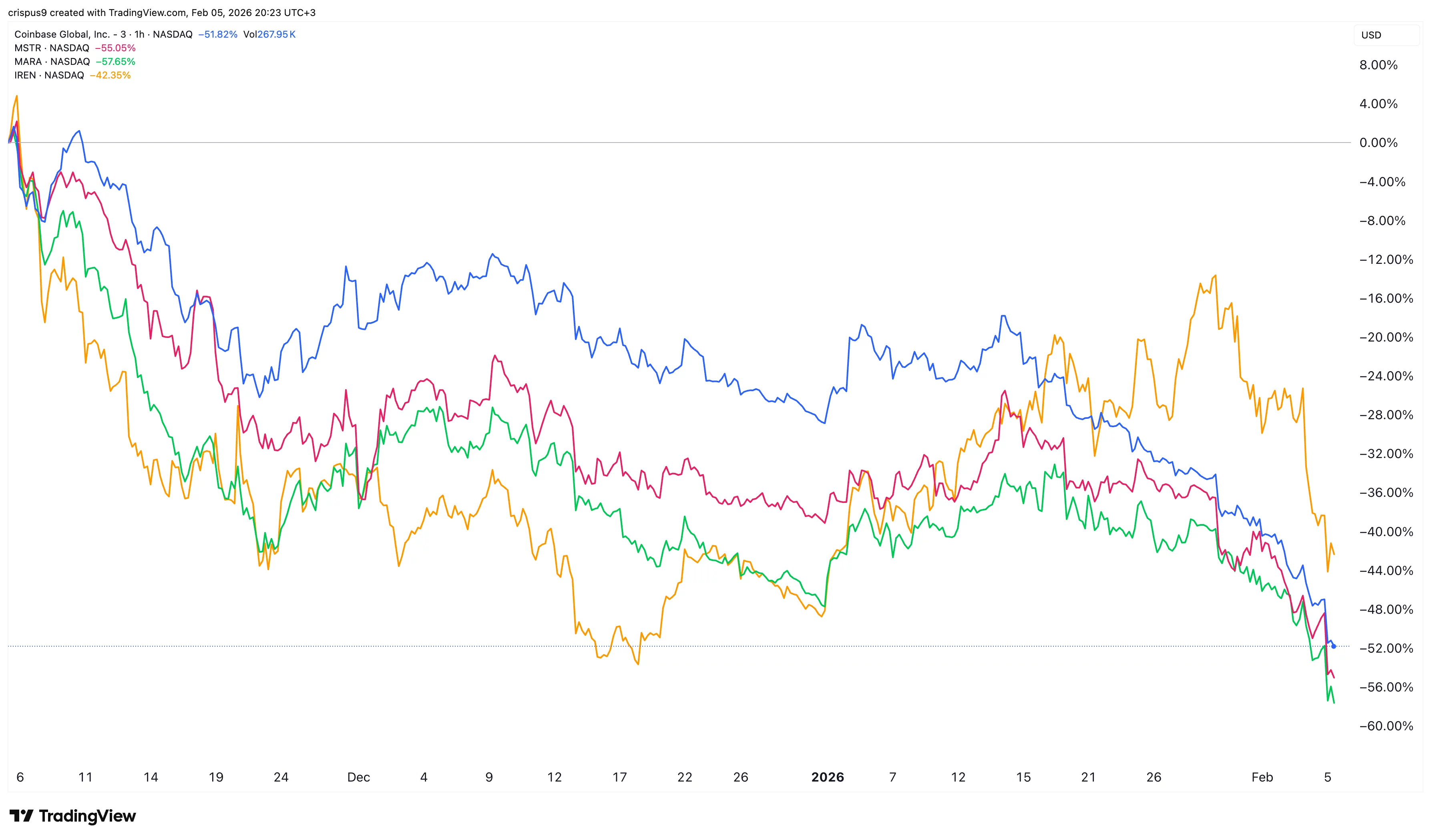

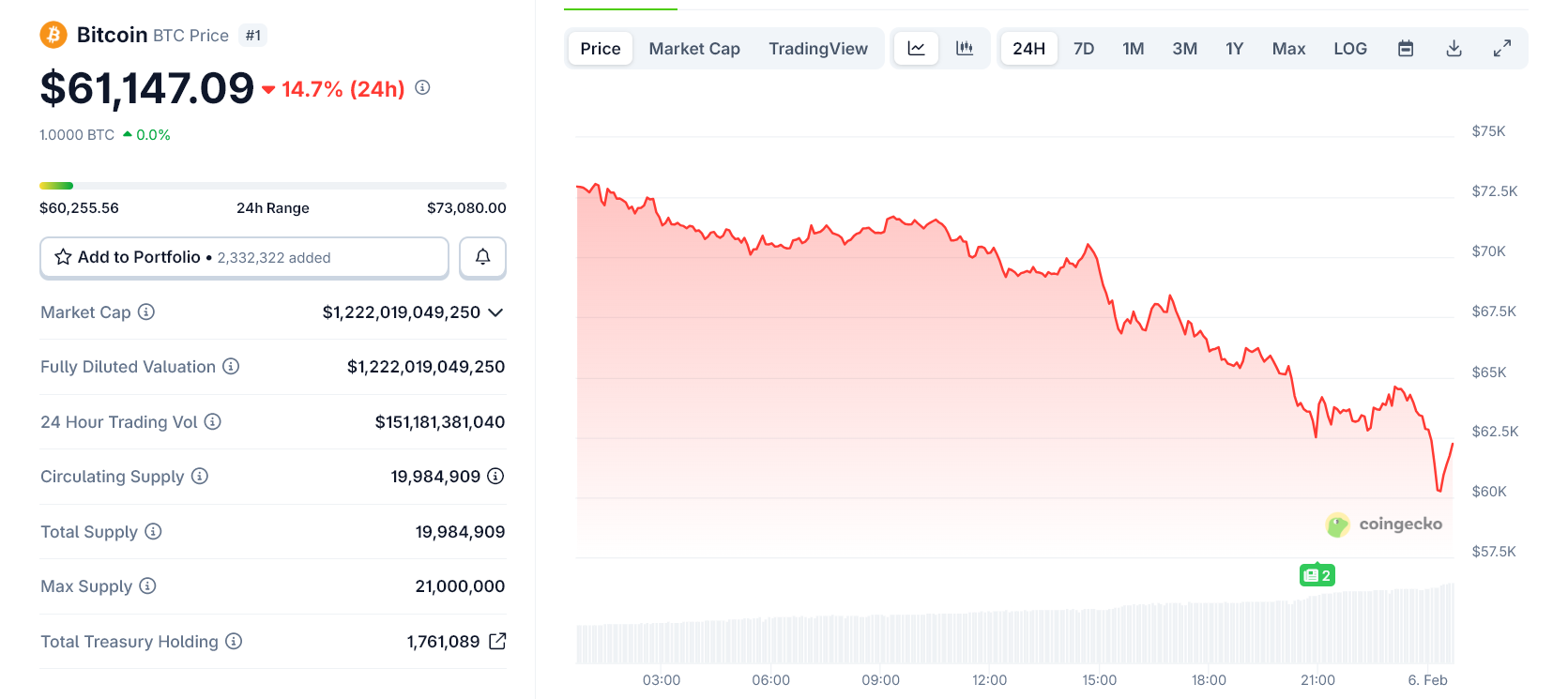

Bitcoin Crashes to $60K as Sentiment Hits 2022 Lows

Crypto market sentiment has slumped to its lowest level in over three and a half years amid Bitcoin falling by double-digit percentage points to a low of around $60,000.

The Crypto Fear & Greed Index fell to a score of 9 out of 100 on Friday, indicating “extreme fear” in the market and hitting its lowest point since June 2022, when sentiment and the market fell in the wake of the collapse of the Terra blockchain a month earlier.

The index has been at a low for the last fortnight as Bitcoin (BTC) has tanked 38% from its 2026 high of $97,000 in just three weeks, wiping out all gains for the past sixteen months.

Bitcoin falls to $60,000 on Coinbase

Bitcoin fell to its lowest level since October 2024 at a little over $60,000 on Coinbase in early trading on Friday morning, according to TradingView.

It is currently trading at just over $64,000 after dumping 13% over the past 24 hours and losing over $10,000 in its largest daily loss since mid-2022.

Related: Coinbase premium hits yearly low, hinting at institutional selling

Bitcoin has now collapsed below the 200-week exponential moving average, a long-term trend indicator, which has only previously happened in the depths of a bear market. It is currently 50% down from its all-time high of $126,000 in early October.

Over the past 24 hours, more than 588,000 traders were liquidated for $2.7 billion, 85% of them were leveraged longs predominantly in Bitcoin, according to CoinGlass.

Tech stock slump and Fed caution behind the crash

Jeff Ko, chief analyst at CoinEx Research, told Cointelegraph that Bitcoin’s more than 20% drawdown in a week comes alongside a selloff in US tech stocks “where stretched valuations and lingering concerns around an artificial intelligence-driven bubble have long been highlighted by the market.”

“Even Amazon suffered a double-digit decline overnight following a mixed earnings release,” he added. “Investors are increasingly reassessing Bitcoin’s failure to function as a safe haven compared to gold.”

LVRG Research director Nick Ruck said Bitcoin’s fall and a broader market decline comes amid “heightened risk aversion” triggered by “softer US job market signals, including rising unemployment claims that raise doubts about sustained economic strength and potential Fed caution on aggressive rate cuts.”

Magazine: DAT panic dumps 73,000 ETH, India’s crypto tax stays: Asia Express

Crypto World

Nvidia, Palantir stocks sink amid growth, value rotation

Nvidia shares slid to their lowest level since December, falling roughly 20% from record highs as an accelerating rotation from growth to value pushed the world’s most valuable company into bear-market territory.

Similarly, Palantir stock dropped to $130 as crypto.news predicted before its earnings.

Summary

- NVIDIA share price dropped into a bear market on Thursday.

- There are signs that investors are dumping growth stocks.

- Technical analysis points to a drop to $150.

Why is Nvidia down?

The ongoing Nvidia stock crash mirrors that of other growth companies. For example, AMD, its key competitor, tumbled to $194, down 27% from its December high.

The software sector slid into a technical bear market, with the iShares Expanded Tech-Software ETF (IGV) down more than 20% as investor anxiety around AI disruption fueled what some are calling a “SaaSpocalypse.” Fears that autonomous AI agents could replace traditional software licenses have weighed on stocks such as Palantir, which continued to sink.

Wedbush analyst Dan Ives pushed back on the pessimism, calling the selloff a “software garage sale” and arguing the market is pricing in an unrealistic doomsday scenario. Ives said enterprise software remains deeply embedded, citing data security risks and migration costs. He named Palantir, Microsoft, Snowflake, Salesforce, and CrowdStrike as long-term winners despite the recent panic.

On the other hand

Value companies are doing well, with the Vanguard Value ETF and the Schwab U.S. Dividend ETF (SCHD) rising by nearly 10% this year. They are all trading at their all-time highs.

Nvidia stock has crashed as traders reflect on key concerns. For example, there are concerns about whether big-tech companies will continue their spending. These concerns accelerated after Microsoft’s report showed that its cloud revenue slowed in the fourth quarter. Its stock has dropped to $400, down by 27 from its all-time high.

Therefore, there is a risk that the company and other top hyperscalers will begin to pare back their spending to please investors concerned about return on investment.

NVIDIA stock has sunk as investors remain concerned about its Chinese business. A report by the Financial Times said that the Trump administration was still conducting a review on sales of H200 chips to China. Beijing has allowed ByteDance, Tencent, and Alibaba to buy 400k chips.

At the same time, Nvidia’s biggest customers are working on their own ASIC chips. Google is working on its TPU chips, while Amazon, Microsoft, and OpenAI are hoping to launch theirs soon. This development may lead to competition and lower sales in the long-term.

The next key catalyst for Nvidia’s stock price is its financial results, which will provide more information about its business. Analysts anticipate its revenue will come in at $67 billion, up over 50% from 2024. Its annual revenue is expected to exceed $500 billion by 2027 or 2028.

NVIDIA share price technical analysis

The daily chart shows that the NVDA share price is flashing red signals. It has formed a head-and-shoulders pattern and is now at the neckline. This is one of the most common bearish reversal sign.

It has moved below the 23.6% Fibonacci Retracement level. Also, it retreated below the 50-day moving average and the Supertrend indicator. Therefore, the most likely forecast is that it continues falling, potentially to $150, the 50% retracement level.

Crypto World

Dubai Land Department Opens PropTech Connect 2026 With Focus on AI and Innovation

Editor’s note: Dubai Land Department has opened PropTech Connect Middle East 2026 with a programme centered on regulation-led innovation, digital transformation, and institutional capital in real estate. The first day combined policy direction, market data, and practical discussions on PropTech, asset management, customer experience, and capital flows. Alongside keynote remarks, the department announced multiple memoranda of understanding aimed at strengthening public-private collaboration and accelerating digital adoption. The event positions governance, data, and AI as enablers of market efficiency while aligning sector innovation with Dubai’s long-term economic and real estate strategies.

Key points

- PropTech Connect Middle East 2026 launched in Dubai under the supervision of Dubai Land Department.

- Leaders highlighted digital transformation and AI as drivers of sustainable economic value in real estate.

- Eight MoUs were signed with developers to support innovation, transparency, and first-time buyers.

- An additional MoU targets the promotion of real estate investment funds and institutional participation.

- Specialised sessions addressed governance, data-driven regulation, asset management, and capital flows.

Why this matters

The conference underscores how regulation, technology, and investment are converging in one of the world’s largest asset classes. For builders and investors, the focus on data, AI, and digital infrastructure signals a push toward faster transactions, clearer governance, and scalable investment frameworks. For the region, it reflects Dubai’s role in shaping PropTech standards that support market resilience, institutional confidence, and long-term growth across the real estate ecosystem.

What to watch next

- Implementation and scope of the signed memoranda of understanding.

- Progress of initiatives linked to the Dubai PropTech Hub.

- Follow-up engagement between regulators and international market entrants.

- Outcomes from sessions focused on AI, data governance, and asset management.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Dubai Land Department enriches PropTech Connect 2026 with strategic discussions on innovation, governance, and the future of real estate investment

Making its debut in Dubai with strong engagement and high-profile participation

- Signing of strategic agreements and partnerships to support innovation and expand the ecosystem of ownership and institutional investment.

- Majed Al Marri: Dubai is transforming real estate innovation into sustainable economic value through digital transformation and artificial intelligence.

- Matthew Maltzoff calls for high-impact partnerships and broader collaboration to accelerate innovation across the world’s largest asset class.

- Specialised sessions discussing PropTech, asset management, customer experience, and capital flows.

Dubai, United Arab Emirates, 4 February 2026: The activities of PropTech Connect Middle East 2026 officially kicked off today, Wednesday, under the organisation and supervision of Dubai Land Department (DLD), marking a strategic step that reflects its efforts to implement the vision of the wise leadership and the strategic directions of Dubai and the UAE to reinforce the emirate’s position as a global hub for real estate technology, accelerate digital transformation in the real estate sector, and align with the objectives of the Dubai Economic Agenda D33 and the Dubai Real Estate Strategy 2033.

The launch of the event was marked by the presence of senior government leaders, decision-makers, leading developers, investors, and global PropTech companies, underscoring the pivotal role of Dubai Land Department as a regulatory authority driving the development of an integrated real estate ecosystem and enhancing the market’s readiness for future requirements.

The first day of the event opened with a keynote address delivered by Matthew Maltzoff, CEO of PropTech Connect, in which he affirmed that the platform brings together leaders, innovators, and investors who share a unified vision to elevate the built environment through the adoption of advanced technologies and the development of high-impact partnerships capable of strengthening investment portfolios and unlocking new growth opportunities.

He called on participants to engage actively and contribute meaningfully to the discussions and dialogues, helping accelerate knowledge exchange and translate ideas into actionable opportunities that collectively and sustainably advance the world’s largest asset class.

Transforming Innovation into Sustainable Economic Value

During the event’s main session, Majed Al Marri, CEO of the Real Estate Registration Sector at Dubai Land Department, affirmed that Dubai’s hosting of the first regional conference fully dedicated to real estate technology reflects the emirate’s forward-looking vision under the leadership of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, to solidify Dubai’s position as a global hub for innovation in the real estate sector.

He noted that the event comes in implementation of the directives of His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai, Deputy Prime Minister and Minister of Defence of the UAE, and Chairman of The Executive Council of Dubai, in line with the objectives of the Dubai Economic Agenda D33 and the Dubai Real Estate Strategy 2033, particularly through the launch of the Dubai PropTech Hub as a strategic initiative aimed at transforming innovation into tangible economic value, with a strong focus on digital transformation and artificial intelligence.

Al Marri highlighted the pivotal role of Dubai Land Department in aligning technological innovation with regulatory frameworks, ensuring that digital solutions evolve from operational tools into drivers of sustainable economic value. He emphasised that fostering a competitive investment environment requires a flexible legislative framework, data-driven governance, and advanced digital infrastructure that enhance transparency, accelerate transaction processing, and improve overall market efficiency, in line with the requirements for long-term growth.

Al Marri also drew attention to the record-breaking performance indicators of Dubai’s real estate market at the beginning of 2026, with total real estate transaction values reaching approximately AED 111 billion and more than 22,108 transactions registered, reflecting notable growth compared to the same period last year. He noted that these figures underscore the market’s resilience and the effectiveness of DLD’s digital ecosystem.

Strategic Agreements to Strengthen Partnerships and Innovation in the Real Estate Market

On the sidelines of the conference, Dubai Land Department, in collaboration with the Dubai Department of Economy and Tourism, signed eight memoranda of understanding with real estate development companies, as part of efforts to support the First-Time Home Buyer Programme, strengthen public-private partnerships, and accelerate the adoption of advanced digital solutions. These agreements aim to enhance market efficiency, reinforce transparency, and improve the overall experience of investors and customers.

The agreements were signed with Samana Developers, Arada Developments, IRTH Signature Developments, Reportage Prime Properties, Qube Development, Manam Realty, Sky View Developments, and 4Direction Development.

In addition, Dubai Land Department signed a separate memorandum of understanding with Equitativa Dubai to launch and advance a global promotion initiative for real estate investment funds. The agreement aims to reinforce Dubai’s position as a global hub for institutional real estate investment and support the development of a robust legislative, regulatory, and promotional environment that enables the growth and sustainability of real estate investment funds, in line with the UAE’s strategic directions.

Workshop to Enhance Governance and Procedural Efficiency

As part of the first day’s programme, the event featured a specialised workshop bringing together Mohammed Yehya, Director of Real Estate Transactions at DLD, and Maryam Karmostaji, Manager of Jointly Owned Property Regulatory at DLD, moderated by Karim Hilal, Founder and CEO of ProTenders. The workshop focused on the role of technology, governance, and data-driven regulation in shaping the future of Dubai’s real estate sector.

During his intervention, Mohammed Yehya outlined the current priorities of Dubai’s real estate market, which centre on sustaining investor confidence, enhancing operational efficiency, and delivering long-term asset value. He explained that developers are increasingly focused on creating high-quality, future-ready assets aligned with end-user requirements, sustainability standards, and smart technologies. At the same time, investors continue to prioritise transparency, regulatory clarity, and stable returns within a globally competitive environment.

With regard to next steps following the conference, Mohammed Yehya emphasised Dubai Land Department’s openness to direct engagement with international companies seeking to enter or expand within the emirate’s real estate market, through its official platforms, investor services, partner networks, and ongoing sector initiatives. He also recommended engagement with strategic partners across Dubai’s economic ecosystem, including the Dubai International Financial Centre (DIFC) and Dubai Silicon Oasis, to provide an integrated framework that supports innovation, investment, and sustainable growth.

Jointly Owned Property in Dubai’s Real Estate Market

For her part, Maryam Karmostaji delivered a comprehensive overview of the concept of jointly owned property within Dubai’s real estate market, explaining that it applies to developments in which unit owners jointly own and manage common areas and shared facilities alongside their individual property ownership, across residential and mixed-use projects. She affirmed that such developments are governed by a clear regulatory framework overseen by Dubai Land Department, which defines ownership rights, responsibilities, and governance structures, ensuring transparency, protecting owners’ interests, and supporting the sustainability and long-term value of shared assets.

She further noted that Dubai Land Department has established an integrated regulatory framework for the management of jointly owned property, with a strong focus on transparency and rights protection. This framework clearly defines the roles and responsibilities of owners, owners’ associations, and management companies, while strengthening accountability and governance. She added that regulatory oversight, service charge governance, and the adoption of digital systems play a critical role in safeguarding owners’ interests, enhancing asset value, and ensuring the long-term sustainability of jointly owned developments.

Specialised Sessions Shaping the Future of the Real Estate Sector

The conference programme featured a series of high-impact sessions focused on practical objectives that support the development of the real estate sector, addressing key themes shaping the industry’s ongoing transformation. In the session titled ‘Building the Future: Dubai, Design, and the New Era of Real Estate,’ featuring Masih Imtiaz, CEO of Imtiaz Developments, the discussion highlighted the fundamental shift of PropTech from a supporting function into a core driver reshaping how cities are designed, developed, and operated.

Within the data-driven transformation track, the session ‘Catalysts of Change: Tech, Data, and the New Frontiers for Real Estate’ explored how data is evolving from a traditional reporting tool into a competitive advantage that enables faster decision-making and accelerates execution. Meanwhile, the session ‘Enhancing Tenant Experience and Building Stronger Communities within Developments’ focused on the shift in user expectations and the role of hospitality-inspired concepts, digital services, and smart connectivity in creating more engaging communities, with a direct impact on occupancy rates, tenant loyalty, and the long-term value of assets.

Reshaping the Global Real Estate Investment Landscape

At the level of global investment, the session titled ‘The Dominance of Capital Flows: Middle East Investment Strategies on the Global Real Estate Stage’ examined the growing role of capital originating from the region in reshaping the global real estate investment landscape.

In the context of portfolio management, the session ‘Tech-Driven Asset Management’ explored how artificial intelligence and automation are increasingly being deployed as practical tools to enhance net operating income, increase occupancy rates, and improve the efficiency of maintenance and energy management.

The session ‘Constructing Tomorrow: Scaling Innovation and Tech for Mega Projects’ addressed the requirements for embedding innovation throughout the full lifecycle of large-scale developments, from planning through to long-term operations. The discussion underscored the importance of the right tools, partnerships, and leadership models to move innovation from limited pilot phases to rapid, large-scale implementation with greater efficiency.

The mega projects track concluded with the session ‘Building Smart at Scale: Embedding Technology and Sustainability in the Middle East’s Mega Projects,’ which emphasised the need to embed smart solutions and sustainability from the earliest planning stages to ensure operational readiness, performance, and safety at scale.

A Platform Driving Transformation and Connecting Regulation, Innovation, and Investment

The conference is welcoming more than 4,000 participants and over 1,500 companies specialising in real estate technology, reaffirming PropTech Connect Middle East 2026’s role as a leading platform, led by Dubai Land Department, to connect regulation, innovation, and investment within a robust institutional framework driven by a clear, forward-looking vision. This approach supports the competitiveness of Dubai’s real estate market and reinforces the sustainability of its growth at both regional and global levels.

Crypto World

Betterment Confirms Data Breach After Crypto Phishing Attack

Betterment has confirmed a security incident in which attackers exploited social engineering to access third-party tools used by the company, exposing customer contact data and enabling a targeted crypto-themed phishing attempt. The breach, detected on January 9, did not involve compromised passwords or customer accounts, according to the firm. Still, the episode highlights how marketing and operations platforms can become a weak link, especially when attackers leverage trusted communication channels to deceive users.

Key takeaways

- Unauthorized access occurred on January 9 through social engineering targeting third-party platforms used for marketing and operations.

- Exposed data included names and email addresses, and in some cases postal addresses, phone numbers, and dates of birth.

- Attackers sent a fraudulent crypto-related message to a subset of customers, attempting to solicit funds.

- No customer accounts, passwords, or login credentials were accessed, according to the company’s investigation.

- Betterment engaged CrowdStrike for forensics and plans a post-incident review within 60 days.

Market context: Social engineering and phishing remain among the most common attack vectors in fintech, with third-party SaaS tools increasingly targeted as firms expand digital communications and customer outreach.

Why it matters

The incident underscores the risks associated with outsourced platforms that handle customer communications. Even when core infrastructure remains secure, attackers can exploit peripheral systems to reach users at scale.

For customers, the breach serves as a reminder that legitimate-looking messages can be deceptive, particularly when they reference popular investment themes like crypto. For fintech firms, it reinforces the need to secure not only internal systems but also the broader vendor ecosystem.

What to watch next

- Publication of Betterment’s post-incident review within the next 60 days.

- Results from the independent data analytics review assessing potential privacy risks.

- Any regulatory or customer notifications that follow the final investigation.

- Changes to Betterment’s controls and training aimed at preventing social engineering.

Sources & verification

- Betterment customer updates published between January 9 and February 3, 2026.

- Company statements confirming forensic findings and remediation steps.

- Details of the phishing message and affected data categories described in official updates.

How the breach unfolded and what it revealed

Betterment disclosed that an unauthorized individual gained access to certain company systems on January 9 by impersonating legitimate users and exploiting trust-based workflows. Rather than breaching core technical infrastructure, the attacker leveraged social engineering tactics against third-party software platforms that support marketing and operational functions.

This access allowed the attacker to view and extract customer contact information. According to the company, the data exposure primarily involved names and email addresses, though in a subset of cases it also included physical addresses, phone numbers, and birthdates. The total number of affected customers has not been disclosed.

Using the compromised access, the attacker distributed a fraudulent message that appeared to originate from Betterment. The notification promoted a fake crypto-related opportunity, claiming that users could triple the value of their holdings by sending $10,000 to a wallet controlled by the attacker. The message was sent to a limited group of customers whose contact details were accessible through the breached systems.

Betterment said it identified the unauthorized activity on the same day and immediately revoked access to the affected platforms. An internal investigation was launched, supported by the cybersecurity firm CrowdStrike, to determine the scope of the intrusion and verify whether customer accounts or credentials were at risk.

Subsequent forensic analysis found no evidence that the attacker accessed Betterment customer accounts, passwords, or login credentials. The company emphasized that multiple layers of security protected account-level systems and that the breach was confined to contact data and communications tooling.

In the days following the incident, Betterment contacted customers who received the fraudulent message and advised them to disregard it. The firm reiterated that it would never request passwords or sensitive personal information via email, text, or phone calls.

The security incident coincided with additional disruptions in mid-January. On January 13, Betterment experienced intermittent outages to its website and mobile app caused by a distributed denial-of-service attack. The company restored partial service within about an hour and full access later that afternoon, stating that the DDoS event did not compromise account security.

By early February, Betterment provided further updates on its investigation. The company confirmed that while some customer data had been accessed, the privacy impact appeared limited to contact information. An independent data analytics firm was engaged to review all accessed data, including information that a group claiming responsibility for the breach alleged it had posted online.

Betterment also noted that it plans to publish a comprehensive post-incident review within 60 days. In parallel, the company said it is strengthening controls and training programs to better defend against social engineering attempts, which rely on deception rather than technical exploits.

One aspect of the disclosure drew scrutiny from security observers. As of publication, Betterment’s security incident webpage included a “noindex” directive in its source code, instructing search engines not to index the page. While such tags are sometimes used during active investigations, they can make it harder for customers and the public to discover information about breaches through web searches.

The incident reflects a broader pattern across the fintech and crypto-adjacent sectors, where attackers increasingly target trusted communication channels instead of core systems. As companies integrate more third-party tools to manage customer relationships, marketing campaigns, and operational workflows, the attack surface expands beyond traditional network defenses.

For Betterment, the episode has so far not resulted in confirmed financial losses or account takeovers. Still, it highlights how quickly trust can be tested when attackers successfully impersonate a well-known financial platform. The company’s forthcoming post-incident review will likely provide further insight into how the breach occurred and what safeguards will be implemented to reduce the risk of similar attacks in the future.

Crypto World

Bitcoin surges to $65,000 after $700 million in early Friday liquidations

Bitcoin rebounded sharply in Asia on Friday after a fresh wave of selling briefly pushed the token toward $60,000, extending a brutal drawdown that has now taken the world’s largest cryptocurrency more than 50% below its October peak.

BTC fell as much as 4.8% to around $60,033 during late U.S. hours, before snapping back to as high as $65,926. The move followed Thursday’s 13% slide, bitcoin’s steepest one-day drop since November 2022, when the collapse of Sam Bankman-Fried’s FTX triggered a marketwide panic.

The bounce came as liquidations surged again, clearing out leveraged positions that had built up during the week’s decline.

Roughly $700 million in crypto bets were wiped out over the past four hours, according to liquidation tracker CoinGlass, including about $530 million in long positions and $170 million in shorts. That mix suggests traders were first crushed on the way down, then caught leaning the wrong way on the rebound.

The move also appears to have drawn in spot buyers, with $60,000 acting as a psychological line that traders have been watching for weeks.

Damien Loh, chief investment officer at Ericsenz Capital, said the rebound points to “strong support” around that level, but warned sentiment remains fragile given the broader market backdrop.

Altcoins mirrored bitcoin’s whipsaw. Solana at one point fell as much as 14% before erasing those losses entirely within hours, shows how quickly risk appetite is flipping as liquidity thins and forced selling takes over.

The broader crypto market has been shaky since a series of liquidations in October rattled confidence, and the latest drawdown has been amplified by turbulence in global markets, where investors have been dumping speculative assets.

Bitcoin’s weakness is now spilling into crypto-linked balance sheets. Strategy, the company led by Michael Saylor, reported a $12.4 billion fourth-quarter net loss on Thursday, driven by mark-to-market declines in its bitcoin holdings.

Even with Friday’s bounce, traders say the market still looks like one being pushed around by leverage rather than conviction.

Crypto World

The Market Is Trading Sideways, but Tech Stocks Are Still Sliding

Software stock selling continued Wednesday morning as the rest of the market traded sideways.

The Nasdaq Composite dropped 0.9%. The S&P 500 was down 0.3%. The Dow Jones Industrial Average rose 103 points, or 0.2%.

Wall Street is suddenly very concerned that artificial intelligence apps could eventually usurp popular software firms. The latest wave of worries were in response to an AI legal tool from Anthropic that sent shares of legal and data software firms tumbling on Tuesday.

Crypto World

Gemini Exits UK, EU, and Australia to Focus on the US Market

Gemini, the crypto exchange founded by the Winklevoss twins, is retreating from three major markets and slashing 25% of its staff as it recalibrates its global operations. In a Thursday disclosure, the firm cited artificial intelligence-driven automation that makes engineers significantly more efficient and a tougher operating environment in the United Kingdom, European Union, and Australia as primary drivers for the pivot. The decision underscores a broader push by crypto players to optimize cost structures amid a difficult macro cycle and regulatory headwinds. Gemini said it will concentrate resources on the US, where it believes capital markets are the strongest, and on developing its prediction market platform, Gemini Predictions, launched in December 2025.

Key takeaways

- Exit from the United Kingdom, European Union, and Australia accompanied by a 25% staff reduction, driven by AI-enabled efficiency gains and higher operating costs in those regions.

- Strategic shift toward the US market and the expansion of Gemini Predictions, a prediction market platform that debuted in December 2025 and has since grown to thousands of users.

- Prediction market momentum: quarterly growth in 2024 and early 2026 shows rising activity, with tens of millions of dollars in daily volumes and incumbents like Polymarket and Kalshi dominating the space.

- Broader market context: crypto prices have weakened during a downturn sparked by a October flash crash and regulatory uncertainty surrounding the CLARITY Act, complicating international expansion for crypto firms.

- The move highlights a strategic bet on data-driven markets and US-centric product development as a path to scale in an environment of tightening liquidity and evolving policy debates.

Market context: The exit comes amid a period of liquidity tightening and regulatory headwinds for the crypto sector. While international expansion has become harder, the emergence of prediction markets as a growth vertical has gained attention, even as liquidity remains concentrated among a few established platforms.

The decision underscores Gemini’s recalibration of its product portfolio around US-based opportunities. By prioritizing Gemini Predictions, the company is signaling that data-driven forecast markets could become a meaningful facet of mainstream crypto activity, potentially diversifying revenue beyond traditional custody and trading services.

Why it matters

The shift to a US-centric strategy matters for users and investors who are watching how crypto firms monetize niche segments beyond spot trading. Prediction markets—where participants bet on outcomes that pay out based on real-world events—have attracted interest as a way to hedge risk or speculate on probability, particularly around policy developments and elections. Gemini’s emphasis on this line of business aligns with a broader industry pivot toward platform-based services and synthetic markets that can scale with fewer physical infrastructure requirements than cross-border exchange operations.

For builders, the development of Gemini Predictions offers another data-rich venue to innovate around markets for information. The platform’s growth metrics cited by Gemini—thousands of users and a meaningful trading volume since its December 2025 launch—suggest there is appetite for structured market-based forecasting within crypto ecosystems. If these platforms can sustain liquidity and deliver low-friction experiences, they could reshape how users interact with information and risk in the digital asset space.

Competitively, the landscape remains led by Polymarket and Kalshi, which together command a substantial share of 24-hour prediction market volume. The dominance of a few incumbents highlights both the opportunity and the execution challenge for entrants attempting to carve out meaningful market share in a relatively nascent sector. The trajectory of Gemini Predictions will be watched as a proxy for whether the broader crypto market can translate interest in prediction markets into durable user engagement and revenue.

The international retreat also mirrors a broader caution among crypto operators as the industry grapples with macro headwinds and uncertain policy signals. The October flash crash that rattled asset prices and the stalled CLARITY Act—an anticipated US market-structure bill—have tempered enthusiasm for aggressive cross-border expansion. In that context, Gemini’s decision to concentrate resources on a domestically focused initiative may be a pragmatic bet on a clearer regulatory path and stronger demand within the US ecosystem.

Gemini asserts that America’s capital markets are unrivaled, a contention echoed by the firm’s leadership as it frames the US as the primary arena for future growth. The company’s push into predictions dovetails with a broader investor interest in alternative data and event-driven markets, where outcomes—such as policy decisions, elections, or corporate milestones—can be translated into traded forecasts. The announcement notes that Gemini Predictions has already attracted more than 10,000 users and generated about $24 million in trading volume since its launch, illustrating a tangible early traction that could underpin longer-term expansion plans in a US-centric environment.

The macro backdrop remains a critical driver behind the shift. Crypto markets have faced a prolonged downturn since a sharp October selloff, and the industry continues to weigh regulatory developments that could unlock or constrain new business lines. The CLARITY Act, a widely discussed US market structure proposal, has stalled, injecting a measure of policy uncertainty into expansion plans that rely on a favorable regulatory framework. In this context, concentrating on a domestic, potentially more predictable regulatory environment could help Gemini accelerate product development and user acquisition within a single jurisdiction before exploring broader international opportunities again.

What to watch next

- Metrics for Gemini Predictions: user growth, total trading volume, and new features or markets added in the US.

- Any re-entry or gradual expansion into other regions as regulatory frameworks evolve or as cost structures stabilize.

- Regulatory developments around the CLARITY Act and other US crypto market structure discussions that could influence platform-based offerings.

- Market share dynamics among prediction market platforms (Polymarket, Kalshi, and entrants) as liquidity and user demand evolve.

Sources & verification

- Gemini’s official announcement outlining the UK/EU/Australia exit, staff reductions, and a pivot to US-focused initiatives, including Gemini Predictions.

- Dune Analytics: prediction market overview and liquidity data used to illustrate market concentration and volume trends.

- Data points on Gemini Predictions: user counts and trading volume since launch (as cited in Gemini’s announcement).

- Cointelegraph coverage referencing US election-driven growth in crypto prediction markets and related market dynamics.

Gemini pivots to US-focused strategy as international markets wind down

Gemini’s Thursday disclosure makes clear that the firm intends to realign resources toward areas with higher growth potential and clearer path to scale. The company argues that foreign markets have been hard to win for a blend of regulatory complexity and operational friction, which has translated into a higher cost base and slower execution. The closure of UK, EU, and Australian operations reduces a layer of regulatory exposure and overhead that, in Gemini’s view, did not translate into commensurate demand. The 25% workforce reduction compounds this recalibration, reflecting a broader trend among crypto firms seeking to optimize cost structures in a market characterized by slower-than-expected adoption in some geographies.

At the core of the pivot is Gemini Predictions, the platform launched in December 2025 as part of the company’s broader push into event-based markets. The idea is to position prediction markets as a central pillar of the firm’s platform, with an ambition to become as large as, or larger than, traditional capital markets in the long run. While early metrics—10,000 users and $24 million in trading volume to date—signal credible traction, the path to scale will depend on maintaining liquidity, expanding the universe of tradable events, and delivering a user experience that can compete with incumbents in a market that already shows concentration of activity among a few established players. The platform’s visibility increased during periods of high political and economic uncertainty, where event-driven forecasting can provide a structured way to hedge or speculate on outcomes.

The strategic emphasis on the US market is notable given the size and maturity of American financial markets, but it also places Gemini in a framework where regulatory clarity could unlock new product use cases. While the CLARITY Act remains unsettled, the company’s approach suggests that a domestic, steady regulatory ground could enable more features, partnerships, and integrations that augment the value proposition of prediction markets for retail and professional participants alike. The shift may also influence how other exchanges and fintechs allocate resources between international expansion and US-focused product development, particularly for offerings that blend traditional financial concepts with blockchain-enabled capabilities.

In the broader crypto ecosystem, the exit from several major regions comes as digital asset prices continue a downcycle that began amid a complex mix of macro pressures and industry-specific headaches. The ongoing debate over crypto market structure and the pace of regulatory reform has kept some companies cautious about international expansion while emphasizing investments in products with clearer revenue models and user engagement metrics. Gemini’s decision to lean into predictions reflects a calculated wager that forecasting markets—grounded in data and user participation—could become a durable and scalable revenue stream even as the broader trading ecosystem faces volatility and scrutiny.

Ultimately, the trajectory of Gemini Predictions will be a useful barometer for this niche within crypto: can a prediction market platform, backed by a legacy exchange, attract sustained liquidity and mainstream interest? If the early momentum continues, the US-centric focus could accelerate product development, generate recurring revenue through offerings tied to real-world events, and deepen user engagement as traders seek structured ways to gauge probabilities in a fast-evolving landscape.

As the industry continues to navigate a shifting regulatory and macro backdrop, Gemini’s latest moves illustrate a pragmatic approach: shrink exposure where the cost-to-benefit ratio is unfavorable, and double down on product bets that align with evolving user demand and policy trajectories. Whether Gemini Predictions becomes a defining growth driver for the firm remains to be seen, but the current strategy signals a deliberate pivot toward building scalable, data-driven markets within the most active financial ecosystem in the world—the United States.

Crypto World

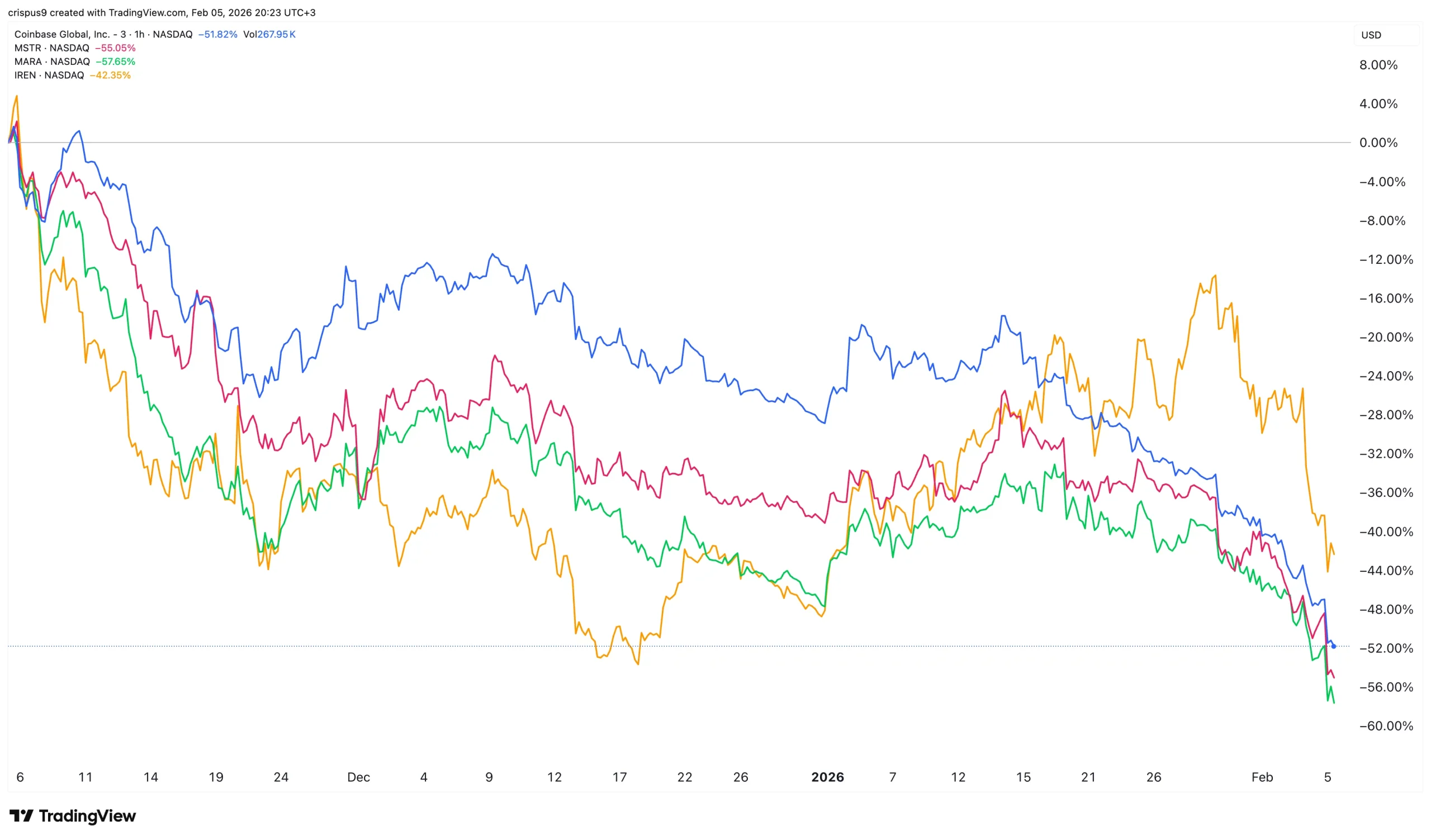

Crypto stocks MSTR, COIN, IREN, and MARA slump

Crypto stocks continued their strong downward momentum, erasing billions of dollars, as Bitcoin and other altcoins slumped.

Summary

- Most crypto stocks are in a strong freefall this year.

- Coinbase, IREN, MARA, and Strategy have fallen by over 40% from their all-time highs.

- The decline happened as the crypto market crashed and liquidations rose.

IREN, a Bitcoin (BTC) mining company that has expanded to AI data centers, dropped by 6.5%, reaching a low of $42. It has dropped by over 47% from its all-time high as investors focus on its upcoming earnings. Other mining companies like MARA and Bitfarms also dived.

Top crypto stocks have slumped this year

Michael Saylors’ MSTR stock slumped to $110, down sharply from its all-time high of $550. This crash has brought its market cap to $38 billion, down from over $130 billion.

Crypto exchanges were not spared either. Coinbase stock tumbled to $150 from a record high of $443. Other similar companies, like Bullish and Gemini, which went public last year, dropped to their record lows.

These stocks plunged due to the ongoing crypto market crash, which hurt Bitcoin and most coins. This decline led to a surge in liquidations, which jumped by 74% to $1.4 billion.

All these crypto companies do well when Bitcoin and altcoins are rising and vice versa. For example, Bitcoin mining companies like IREN and MARA do well when BTC is rising, as that leads to higher revenues when they sell their holdings.

Exchanges like Coinbase, Gemini, and Bullish struggle in bear markets as activity tends to drop. Most of Coinbase’s revenue comes from transactions, while the rest comes from subscriptions and services. Gemini and Bullish make more than 90% of their revenue in transactions.

Crypto crash nearing an end?

Data shows that the Crypto Fear and Greed Index has slumped to the extreme fear zone of 10. In most cases, a move to these lows is usually a key indicator of a reversal.

Additionally, Bitcoin, Ethereum, and other altcoins have become highly oversold on the daily and weekly charts. Rebounds typically occur when these assets reach these levels.

Another potential catalyst for cryptocurrencies and associated stocks is a Trump strike on Iran. Fears of this attack are one reason why the crypto market is falling.

As a result, there is a likelihood that these coins and their stocks will drop after the attack happens and then rebound. This is what happened in June last year during the 12-day war.

Crypto World

BlackRock’s Bitcoin ETF Sets $10B Daily Volume Record

BlackRock’s spot Bitcoin ETF, the iShares Bitcoin Trust ETF, captured the trading desk’s attention on a day of sharp crypto volatility. Traders piled into IBIT amid a rapid retreat in Bitcoin, with the ETF recording a daily turnover near $10 billion — a new high for the product, according to Bloomberg ETF analyst Eric Balchunas on X. The move underscored how investors were reacting to a price rout that pushed Bitcoin lower as the broader risk-on bid cooled. On the same day, IBIT itself slid about 13%, marking its second-worst daily percentage drop since its launch, after a 15% decline logged on May 8, 2024. The combination of a price plunge and outsized trading activity highlighted the tug-of-war between traditional market participants and crypto markets during a period of heightened volatility.

Key takeaways

- IBIT achieved an all-time high daily trading volume of about $10 billion on the day in question, illustrating robust participation even as Bitcoin’s price declined.

- The ETF fell 13% on that session, marking a near-record daily drop since inception and signaling that the immediate price reaction to volatility continued to weigh on ETF performance.

- Bitcoin’s price trajectory remained under pressure, slipping about 12% over 24 hours to roughly $64,000 after a morning dip to around $60,300, extending a multi-month slide from the late-2023 rally.

- Overall market sentiment toward crypto ETFs remained sensitive to macro cues, with the fund recording notable net outflows in recent days even as near-term volatility persisted.

- Analysts warned that the backdrop of weak macro data and outsized capital flows into the AI space could sustain price pressure and influence ETF flows in the near term.

Tickers mentioned: $BTC, $IBIT

Sentiment: Bearish

Price impact: Negative. The day’s price action produced a meaningful pullback for both the spot BTC market and the ETF that tracks it, underscoring ongoing volatility and uncertainty about near-term price direction.

Trading idea (Not Financial Advice): Hold. While near-term volatility may persist, establishing a clear directional signal requires more stability in price action and a steadier inflow/outflow dynamic for the ETF.

Market context: The episode sits within a broader backdrop of liquidity shifts, risk-off sentiment, and macro chatter that has kept crypto-related instruments sensitive to headlines and data releases. The Bitcoin price and related ETF flows have been contending with macro headwinds and shifts in investor appetite, suggesting a fragile equilibrium between participation and retreat in crypto markets.

Why it matters

The record-setting volume for IBIT on a day when Bitcoin was sharply repricing illustrates a paradox at the intersection of traditional markets and crypto assets. On one hand, significant daily turnover signals deep liquidity and trader engagement in crypto products that were fast becoming mainstream investment choices, even for institutions. On the other hand, the concurrent price drop for Bitcoin and the ETF’s own drawdown reveal fragility in the face of sustained volatility. This duality matters for market participants who monitor ETF inflows and outflows as a gauge of general demand for cryptos through regulated vehicles. It also points to how price risk in the underlying asset can immediately translate into dislocation for the ETF, influencing asset managers, traders, and retail buyers alike.

From a broader perspective, the move underscores ongoing debates about how crypto assets behave in stressed market environments. Bitcoin, after peaking near all-time highs, has retraced substantially from earlier gains, reflecting a combination of profit-taking, risk-off flows, and shifting capital allocation. Data points cited by market observers show a rapid decline after a period of strong performance, reminding investors that even widely tracked benchmarks can experience pronounced pullbacks. The dynamics around IBIT prove that ETF liquidity and price action are not perfectly synchronized with the spot market, particularly during episodes of heightened selling pressure.

Industry voices have pointed to a mix of factors shaping this volatility. Analysts like the veteran trader Peter Brandt have argued that the current phase resembles “fingerprints of campaign selling,” with relatively few buyers stepping in to prop the price. That perspective aligns with the idea that a price downturn can co-exist with robust trading activity in related products, as market participants reassess risk, rebalance portfolios, and reposition themselves in response to evolving macro data. The narrative also intersects with broader capital flows, including surging investments in artificial intelligence that have drawn capital away from traditional risk assets, potentially amplifying price swings in the near term.

Beyond price dynamics, the ETF’s performance on these days provides insight into investor behavior around regulated crypto exposure. IBIT’s own flows have been inconsistent since a crypto market sell-off in October, with net outflows outpacing inflows in recent sessions. The latest data showed net outflows totalling hundreds of millions of dollars, further underscoring that even as market infrastructure like ETFs gain traction, fundamental demand for crypto exposure remains bifurcated — some investors seek hedges or strategic exposure, while others retreat amid volatility and risk-off environments.

The unfolding situation also ties into a broader media narrative about the health and maturity of crypto-related financial products. The concentration of activity in a single session — a record $10 billion turnover — may reflect a combination of algorithmic trading, liquidity provision by market makers, and a spillover of macro-driven selling pressure into crypto markets. The tension between rapid trading and price declines is a hallmark of a maturing, yet still volatile, asset class where institutional uptake coexists with a still-nascent appetite for risk management and hedging products.

The day’s events occurred against a backdrop of headlines about where Bitcoin could settle next, with traders watching levels near the mid-$60,000s as a potential pivot point for the next leg of the price discovery process. Notably, Bitcoin has seen a substantial retracement since its all-time peak around $126,000 in October, a retreat that has spanned multiple sessions and tested longer-term support zones across major exchanges. Bitcoin’s price volatility remains a key driver for ETF flows, as investors evaluate whether dips represent buying opportunities or continued risk signals.

In parallel, industry observers highlighted that a portion of IBIT’s trading activity may reflect rebalancing by large investors seeking regulated exposure to the asset class. The ETF’s price action and volume on days of sharp BTC moves can illuminate the dynamics of investor preferences between direct crypto holdings and regulated wrappers, with implications for liquidity provision, market making, and the perceived efficiency of these products as price discovery mechanisms in crypto markets. While fund flows have been uneven in 2026, the sheer scale of the day’s volume underscores active engagement with crypto strategies within traditional portfolios, even as price volatility persists.

The latest market moves also prompt continued monitoring of external catalysts. On the macro side, weaker US job data and broader risk-off sentiment can amplify sell pressure, while investor enthusiasm for AI-related capital inflows may siphon risk-bearing money away from crypto assets at times. Analysts argue that the current environment could sustain a pattern of episodic volatility, where sharp price swings in Bitcoin are accompanied by correlated, if not amplified, reactions in crypto ETFs and related derivatives. These cross-currents will likely shape the near-term trajectory for IBIT and the broader crypto ETF space as traders adjust to shifting risk appetites and evolving regulatory signals.

What to watch next

- Bitcoin price stabilization near critical support levels and any evidence of sustained buying interest above $60,000–$65,000.

- Weekly or monthly ETF inflows/outflows for IBIT, including net flow reversals after the recent outflows.

- Regulatory and policy developments affecting crypto ETFs and spot markets, including any changes to listing rules or disclosure requirements.

- Upcoming macro data releases and earnings that could influence risk sentiment and appetite for crypto exposure.

- Volume patterns on days of BTC volatility to assess whether the IBIT liquidity response remains robust or if liquidity retreats during selloffs.

Sources & verification

- Eric Balchunas on X reporting IBIT’s $10 billion daily volume record.

- Cointelegraph article on IBIT net outflows totalling $373.4 million and 2026 inflow cadence.

- Bitcoin price data and price levels from CoinGecko.

- Cointelegraph feature on Bitcoin slipping under $64k and price bottom dynamics with references to BTC price points.

- Related coverage of market commentary, including Strategy’s Q4 results and investor updates from Unlimited Funds.

Why it matters

Record trading activity in an ETF that tracks Bitcoin signals ongoing institutional and professional trader interest in regulated crypto exposure, even as prices retreat. The discrepancy between high turnover and a meaningful price drop highlights how liquidity and price discovery can diverge in a volatile market, a condition that investors, exchanges, and market makers must navigate. For market participants, the IBIT episode illustrates how ETF vehicles can amplify or dampen price signals depending on flows, liquidity, and the broader macro backdrop. As the crypto ecosystem continues to mature, these dynamics will influence product design, risk management, and strategic allocations for institutions assessing regulated routes to crypto exposure.

As traders weigh the next moves, the interplay between Bitcoin’s price trajectory, ETF liquidity, and macro catalysts will likely dictate the near-term mood in crypto markets. The possibility of further volatility remains, particularly if macro data disappoints or if capital reallocation toward AI and other sectors resumes. Yet the persistence of record volumes in ETFs like IBIT also suggests that a core investor base remains engaged, using regulated vehicles to express conviction about Bitcoin while seeking the transparency and governance frameworks that traditional markets demand.

Ultimately, the coming weeks are expected to reveal whether this volatility is a temporary spike or a broader shift in the risk calculus surrounding crypto assets and their traditional-market wrappers. Market participants will be watching for clearer price support, more consistent ETF inflows, and any regulatory clarity that could shape how investors access crypto markets going forward.

Crypto World

MicroStrategy Faces Catastrophic Risk as Bitcoin Falls to $60,000

MicroStrategy is under renewed market pressure after Bitcoin slid to $60,000, pushing the company’s vast crypto treasury deeper below its average acquisition cost and reigniting concerns about balance-sheet risk.

Shares of the company fell sharply as Bitcoin extended its sell-off, reflecting Strategy’s role as a leveraged proxy for the cryptocurrency. The stock’s decline also pushed its market valuation below the value of its underlying Bitcoin holdings. This is a key stress signal for the firm’s treasury model.

Bitcoin Price Crashes to a Yearly Low of $60,000

MicroStrategy holds approximately 713,500 Bitcoin, acquired at an average cost of about $76,000 per coin.

With Bitcoin now trading near $60,000, the company’s holdings are roughly 21% below cost basis, translating into billions of dollars in unrealized losses.

While these losses are unrealized and do not force immediate asset sales, they materially weaken MicroStrategy’s equity story.

The drawdown also shifts investor focus from long-term accumulation to short-term financial resilience.

Market Premium Collapses Below Asset Value

A more immediate concern is MicroStrategy’s market net asset value (mNAV), which has fallen to roughly 0.87x. This means the stock now trades at a discount to the value of the Bitcoin on its balance sheet.

That discount matters because MicroStrategy’s strategy relies heavily on issuing equity at a premium to fund additional Bitcoin purchases.

With the premium gone, issuing new shares would be dilutive rather than accretive, effectively freezing the company’s primary growth mechanism.

Strategy and Michael Saylor Still Have Some Short-Term Protection

Despite the pressure, the situation is not yet a solvency crisis. MicroStrategy previously raised around $18.6 billion through equity issuance over the past two years, largely at premiums to its net asset value.

Those capital raises occurred during favorable market conditions and helped the company build its current Bitcoin position without excessive dilution.

Importantly, the firm’s debt maturities are long-dated, and there are no margin-call mechanisms tied directly to Bitcoin’s spot price at current levels.

The Real Risk Lies Ahead

MicroStrategy has moved from an expansion phase into defensive mode.

Catastrophic risk would rise if Bitcoin remains well below cost for an extended period, mNAV stays compressed, and capital markets remain closed.

In that scenario, refinancing would become more difficult, dilution risk would increase, and investor confidence could erode further.

For now, MicroStrategy remains solvent. However, the margin for error has narrowed sharply, leaving the company highly exposed to the next phase of Bitcoin’s market cycle.

The post MicroStrategy Faces Catastrophic Risk as Bitcoin Falls to $60,000 appeared first on BeInCrypto.

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business10 hours ago

Business10 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat16 hours ago

NewsBeat16 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report