Crypto World

Dutch House of Representatives Advances Controversial 36% Tax Law

The Netherlands’ lower chamber moved a sweeping capital-gains plan forward on Thursday, proposing a 36% tax on savings and most liquid assets, including cryptocurrencies. The bill cleared the House of Representatives with 93 lawmakers voting in favor, meeting and surpassing the threshold of 75 required to advance the measure. It would apply regardless of whether the assets are sold, extending to savings accounts, crypto holdings, most equity investments and gains from interest-bearing instruments. If the Senate signs off, the policy would take effect in the 2028 tax year. Critics argue the plan risks driving capital out of the Netherlands as investors seek jurisdictions with more favorable tax conditions. The discussion comes amid a broader global conversation about crypto taxation and how unrealized gains should be treated for high-net-worth and retail investors alike. The Dutch tally, published by the House, confirms the legislative momentum behind the proposal.

Key takeaways

- The bill would impose a 36% capital-gains tax on savings and most liquid investments, explicitly including cryptocurrencies, with the tax levied even if assets are not disposed of.

- The measure advanced after a 93-to-what-it-took vote in the Dutch House, surpassing the 75-vote threshold to proceed, signaling strong political alignment in favor of the reform.

- Enactment hinges on Senate approval; if passed, the policy would apply beginning with the 2028 tax year, giving policymakers and investors time to prepare for the transition and for further details to emerge on implementation.

- Critics warn the proposal could trigger capital flight from the Netherlands to jurisdictions with lower tax burdens, drawing on historical examples where similar levies spurred relocation of entrepreneurship and investment activity.

- Analysts and industry figures have offered stark projections about the long-term impact on wealth accumulation, including widely cited calculations showing substantial reductions in compound growth under an unrealized-gains tax regime; comparisons to other tax debates in major markets underscore the broader risk environment for crypto and tech capital.

Tickers mentioned:

Sentiment: Bearish

Market context: The Netherlands’ proposal sits within a wider European and global dialogue on crypto taxation, where authorities weigh revenue needs against innovation incentives. As tax authorities assess how unrealized gains should be treated, the Dutch plan adds to considerations around how digital-asset holdings are accounted for in personal and investment taxation, echoing debates across the EU about consistency, enforcement, and the boundaries of capital taxation in a digital era.

Why it matters

The central premise — taxing unrealized gains on a broad swath of assets, including cryptocurrencies — marks a notable shift in how governments might approach wealth and investment in an era of rapid digital-asset adoption. Proponents argue that a real-time tax on gains helps address perceived inequities in how passive wealth is taxed versus earned income, potentially increasing public revenue to fund social and infrastructure initiatives. Yet, the immediate reaction from market participants and crypto executives has been skeptical, raising concerns about distortions to investment decisions and the long-run competitiveness of the Netherlands as a home for startups and asset management.

Analysts highlighted the unintended consequences of such a policy. Denis Payre, co-founder of logistics firm Kiala, invoked a historical parallel, noting that France’s experience with an earlier capital-sweep proposal led to a pronounced exodus of entrepreneurs. The sentiment among several industry observers echoed this caution, with crypto market analyst Michaël van de Poppe describing the proposal as counterproductive and predicting a material shift of capital to more favorable environments. The underlying critique is that high tax rates on unrealized gains could dampen risk appetite and deter early-stage capital formation, especially for innovative sectors where growth often hinges on reinvested profits rather than realized gains.

Beyond the Netherlands, the broader economic calculus is clear: tax policy can have a measurable impact on how wealth compounds over decades. For instance, a widely cited hypothetical scenario contrasts outcomes with and without unrealized-gains taxation. Starting with 10,000 euros and contributing 1,000 euros monthly for 40 years, one study suggested the pre-tax outcome might reach around 3.32 million euros, whereas applying a 36% unrealized gains tax would reduce the final tally to roughly 1.89 million euros, a gap of about 1.435 million euros. While such projections depend on many assumptions, they illustrate how timing and recognition of gains influence long-term wealth accumulation, particularly for asset classes that can experience both rapid appreciation and volatility.

The policy also lands in the context of a U.S. debate around wealth taxes and crypto regulation. California, for example, has faced controversy over proposals to impose wealth taxes on billionaires, sparking a broader discourse about the balance between tax fairness and the incentives for innovation. While the Dutch measure focuses on unrealized gains across a wide array of assets, the parallel debates illustrate a growing global sensitivity to how digital assets are taxed and how such tax rules interact with entrepreneurship and capital formation.

As investors digest these signals, the crypto community has echoed concerns about the practicalities of enforcing a 36% rate on assets that can be volatile and illiquid, and about how such taxation affects portfolio strategies, cross-border activity, and the flow of capital to jurisdictions deemed more crypto-friendly. The discussion points to a broader trend where policymakers are still navigating the line between revenue-generation aims and the need to sustain a supportive environment for innovation and decentralized finance.

What to watch next

- Whether the Dutch Senate approves the bill and whether amendments alter the scope or rate of the proposed tax.

- How the government and tax authorities define and enforce unrealized gains on a diverse set of assets, including cryptocurrencies.

- Potential investor behavior in response to the policy, including any observed shifts to foreign domiciliation or cross-border holdings.

- Any forthcoming data or studies assessing the macroeconomic impact of the reform on investment, entrepreneurship, and innovation in the Netherlands.

- Broader EU considerations on crypto taxation and cross-border consistency as other member states weigh similar approaches.

Sources & verification

- Tweep: Dutch House tally page showing the vote threshold and tally details for the bill (dossier 36748; id 2025Z09723). Verify the official tally and the threshold requirement here: https://www.tweedekamer.nl/kamerstukken/wetsvoorstellen/detail?dossier=36748&id=2025Z09723#wetgevingsproces

- Investing Visuals projection comparing compound growth with and without unrealized gains tax over 40 years. See the analysis referenced in coverage of the proposal’s long-term effects: https://x.com/InvestingVisual/status/2022221938840441335

- Statements from Denis Payre on the potential capital flight risk associated with such a tax proposal: https://x.com/DenisPayre/status/2022… (X post linked in coverage)

- Commentary from Michaël van de Poppe critiquing the plan: https://x.com/CryptoMichNL/status/2022209120322121928

- California’s wealth-tax discussion as a comparative reference in crypto regulation debates: https://cointelegraph.com/news/california-billionaire-tax-crypto-executives-slam

Netherlands advances 36% capital gains tax on savings and crypto

The House of Representatives’ decision to push the 36% capital gains tax proposal forward marks a pivotal moment in how the Netherlands could tax a broad spectrum of wealth. The measure targets not only traditional savings but also a wide range of liquid assets, explicitly including crypto assets, and would tax gains even when assets remain unrealized. The bill’s fate now rests with the Senate, and the clock is set for a 2028 effective date should the upper chamber approve the legislation in its final form. The political calculus surrounding this proposal underscores a broader concern among investors and industry observers: will such a tax regime dampen the country’s appeal as a hub for crypto and tech entrepreneurship, or can it be calibrated in a way that sustains public revenue without stifling innovation?

https://platform.twitter.com/widgets.js

Crypto World

IREN Joins MSCI USA Index, Elevating Visibility for Institutional Investors

TLDR

- IREN has been included in the MSCI USA Index, enhancing its visibility among institutional investors and index-tracking funds.

- The inclusion is expected to trigger automatic buying by index-tracking entities, potentially boosting IREN’s stock in the short term.

- IREN has shifted focus from BTC mining to AI-driven infrastructure, positioning itself as a leader in the tech sector.

- CEO Daniel Roberts believes the MSCI inclusion will broaden institutional access as the company executes its AI Cloud strategy.

- Since the announcement, IREN’s stock has increased by around 7%, reflecting investor optimism despite concerns over recent financial results.

IREN, a company transitioning from a BTC mining operation to a dual-focus entity, has announced its inclusion in the prestigious MSCI USA Index. This move is set to elevate the company’s profile, attracting more institutional investors and index-tracking funds. It is expected to create a short-term surge in the stock price as automatic buying from these entities takes effect.

The inclusion in the MSCI USA Index provides IREN with enhanced visibility. Investors and funds that track the index will now automatically consider IREN as part of their portfolios. This may trigger a short-term surge in its stock value, supporting the company’s broader business goals.

Why MSCI USA Index Inclusion Matters for IREN

Daniel Roberts, Co-Founder and Co-CEO of IREN, expressed that being added to the MSCI USA Index is a sign of the company’s growth. “We believe this milestone will broaden institutional access to IREN as we continue to execute on our AI Cloud strategy,” he said. This inclusion comes as IREN shifts its focus from BTC mining to AI-driven infrastructure, positioning itself as a leader in the tech space.

As IREN pivots towards AI, the company’s shift in priorities is evident in its investments. It is spending more on AI-centric assets, such as data centers, than on traditional Bitcoin mining operations. This strategic move aims to capitalize on the growing demand for AI infrastructure, with plans to expand its power portfolio and attract long-term partnerships.

IREN’s Stock Response and Future Plans

Since the MSCI inclusion announcement, IREN’s stock has seen an upward movement. The company’s share price rose by approximately 7%, demonstrating investor optimism. However, concerns about the company’s financial performance remain, as recent quarterly results showed lower-than-expected revenues and widening losses.

Despite these concerns, IREN’s long-term outlook remains promising. The company is in talks for several major deals, including a multibillion-dollar contract that could further drive its growth. As the AI infrastructure market expands, IREN aims to leverage its secured power capacity to attract new contracts and raise its recurring revenue.

IREN continues to make progress with its energy initiatives, securing new data center campuses and large power agreements. These efforts position the company to meet the growing demand for energy from tech giants, ensuring a robust pipeline for future growth.

Crypto World

Why Chainlink price could rally to $10 as oversold RSI signals a bounce

Chainlink’s price is stabilizing at key Fibonacci support, with oversold RSI readings and improving momentum pointing toward a potential relief rally into the $10 resistance zone.

Summary

- $8.33 Fibonacci support is holding, confirming a short-term swing low

- RSI remains oversold, signaling selling pressure exhaustion

- Bullish momentum building, with $10 as the next key resistance

Chainlink (LINK) price action is beginning to show constructive signs after an extended period of downside pressure. Following weeks of aggressive selling, LINK has established a clear swing low and is now attempting to build a base above a technically significant support zone. This shift comes as momentum indicators flash oversold conditions, suggesting that bearish pressure may be exhausting.

As prices stabilize and buyers step in, the broader setup increasingly favors a corrective bounce rather than continued downside. With multiple technical factors aligning near current levels, Chainlink appears positioned for a potential rally toward higher resistance as momentum normalizes.

Chainlink price key technical points

- $8.33 support aligns with the 0.618 Fibonacci, reinforcing demand

- RSI remains in oversold territory, signaling momentum exhaustion

- Bullish follow-through opens a path toward $10 resistance, a key upside level

Chainlink has successfully established support around the $8.33 region, an area that carries notable technical importance. This level coincides with the 0.618 Fibonacci retracement, often referred to as the “golden ratio,” which frequently acts as a high-probability reaction zone in corrective moves.

The formation of a swing low at this level suggests that sellers are losing control and that demand is beginning to absorb supply. Price has since reacted positively from this area, confirming it as a short-term base and increasing confidence that a local bottom may be in place.

Holding above this support keeps the broader corrective structure constructive and limits immediate downside risk.

Oversold RSI signals momentum exhaustion

One of the most compelling elements supporting a potential rally is the Relative Strength Index (RSI), which remains in oversold territory. Oversold RSI conditions typically reflect excessive selling pressure and often precede relief rallies as momentum begins to revert toward neutral levels.

In Chainlink’s case, the oversold RSI is occurring after an extended downtrend, increasing the probability that the market is entering a mean-reversion phase. As price continues to stabilize and push higher, the RSI is likely to recover toward neutral territory, supporting further upside continuation.

Importantly, RSI recoveries do not require full trend reversals. Even within broader corrective structures, oversold conditions often produce sharp counter-trend moves as selling pressure fades.

Bullish influxes support the bounce

Recent price action suggests that the current rise is not purely mechanical. Bullish influxes are beginning to appear, indicating renewed buying activity. This shift in behavior is critical, as sustainable bounces require demand to return rather than relying solely on short covering.

As long as bullish participation continues and price maintains acceptance above support, the probability of a continuation move higher increases. The structure now favors a rotation toward the next major resistance rather than an immediate retest of lows.

$10 resistance comes into focus

If the current momentum persists, the next key upside target sits near the $10 level. This zone represents a significant resistance area where price previously faced rejection and where sellers may re-emerge. A move into this region would be consistent with a corrective rally driven by oversold conditions rather than a full trend reversal.

Reaching $10 would allow the RSI to normalize and provide the market with a clearer view of underlying demand strength. How price behaves around this resistance will be crucial in determining whether the rally can extend further or transition into consolidation.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Chainlink appears poised for a relief rally as long as the $8.33 support holds. Oversold RSI conditions, Fibonacci confluence, and improving bullish participation all support further upside.

In the near term, consolidation above support followed by higher lows would strengthen the bullish scenario. A $8.33 loss on a closing basis would weaken the setup and reintroduce downside risk.

Crypto World

U.S. Senate Clash Over Crypto Policy

Key Insights

- Warren questions SEC case dismissals, warning politics may be shaping crypto enforcement and investor protection.

- SEC Chair Atkins defends a shift away from lawsuits, prioritizing fraud prevention and clearer regulatory guidance.

- Senate clash highlights divide: clearer crypto laws vs stricter enforcement to protect markets and innovation.

Senate Hearing Turn Into a Crypto Flashpoint

A heated Capitol Hill hearing on February 12 thrust US crypto regulation into the spotlight as Senator Elizabeth Warren challenged Securities and Exchange Commission (SEC) Chair Paul Atkins over the agency’s recent enforcement decisions.

🚨 WARREN CALLS OUT TRUMP’S SEC OVER CRYPTO DONORS!

Sen. Elizabeth Warren ( @ewarren ) grilled SEC Chair Paul Atkins ( @SECPaulSAtkins ) over dropped cases against major crypto firms tied to Donald Trump’s ( @realDonaldTrump ) inauguration.

New data shows sharp declines in SEC… https://t.co/MAZx9QxpnA pic.twitter.com/PIbQvlzl4y

— BSCN (@BSCNews) February 13, 2026

Warren directly questioned why several investigations into major crypto firms were dropped, particularly those connected to companies that financially supported Donald Trump’s inauguration. She argued the timing raised serious concerns about political influence and investor protection.

Atkins rejected the allegations, saying the SEC is moving away from “regulation by enforcement” and back toward its core mandate: preventing fraud, protecting investors, and maintaining fair markets. He insisted previous leadership relied too heavily on lawsuits instead of clear guidance.

Is SEC Enforcement Really Declining?

Warren cited public statistics suggesting enforcement has slowed:

- Securities offering cases fell 10.64% from 2024 to 2025

- Investment adviser actions dropped 23.71%

- Broker-dealer cases declined 29.51%

Independent research also reported fewer settlements in fiscal 2025. However, Atkins countered that final annual data has not yet been released and argued the agency is prioritizing fraud over technical registration violations.

Supporters say the shift corrects regulatory overreach seen under former Chair Gary Gensler. Critics warn fewer actions could weaken accountability in the digital asset market.

Registration Violations or Innovation Barriers?

Central to the debate is whether unregistered token offerings automatically constitute misconduct. Crypto companies have long argued unclear securities definitions made compliance difficult.

Atkins supports legislation similar to the Digital Asset Market Clarity Act, which would divide oversight between the SEC and the Commodity Futures Trading Commission. He compared the past environment to innovators stuck between two competing regulators.

Warren disagreed, warning reduced oversight could usher in a “golden age of fraud.”

Could Politics Be Influencing Crypto Policy?

Warren highlighted dismissed cases involving major exchanges including Kraken, Coinbase, Gemini, and Binance, noting their financial ties to inauguration events. She also questioned dropped actions tied to executives who later received presidential clemency.

Atkins maintained pardons do not erase civil liability and emphasized that fraud investigations continue regardless of industry.

Conclusion

The battle discloses a larger policy divide: is a more explicit legislation more crucial in fostering innovativeness or is weaker enforcement more likely to hurt investors. The future of the United States regulation of digital assets may be determined by the final effect of Congress discussing crypto-market-structure legislation.

Crypto World

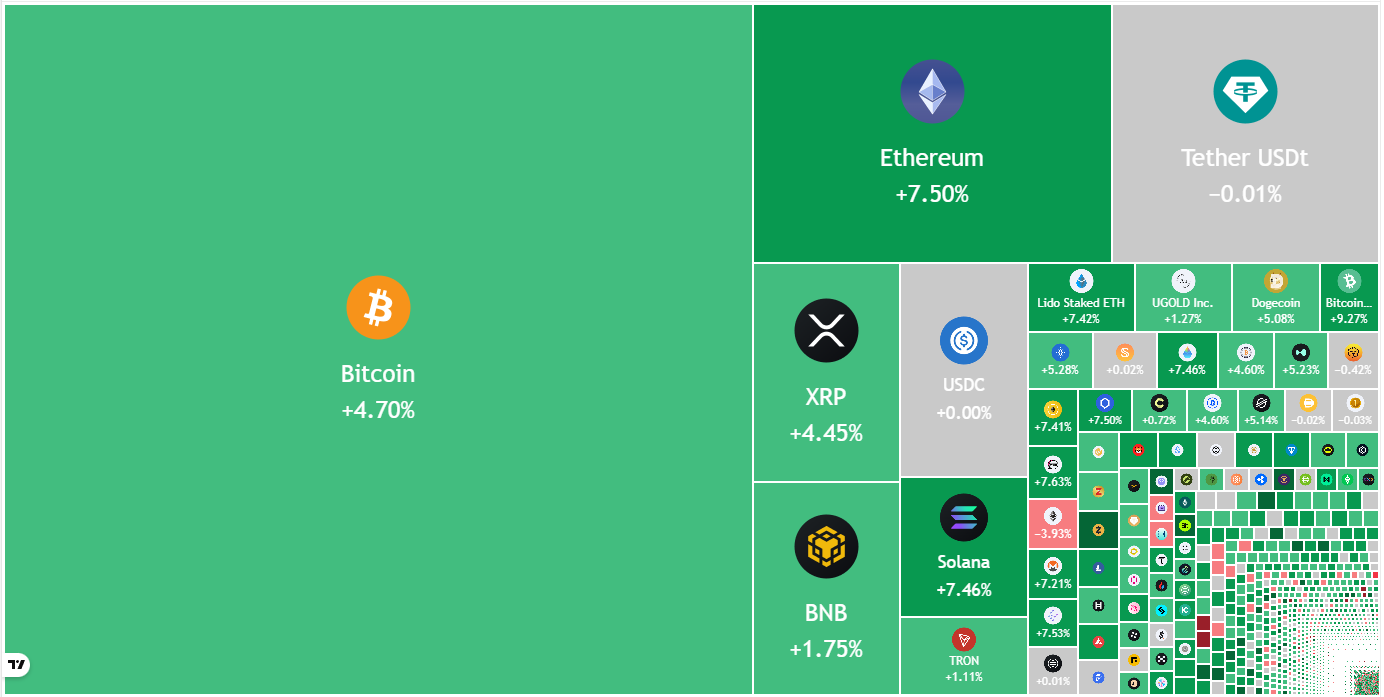

Bitcoin, Altcoin Relief Rally Aim To Restore Pre-crash Range Highs

Key points:

-

Bitcoin is attempting a comeback, which is expected to face stiff resistance at the breakdown level of $74,508.

-

Several major altcoins are attempting a recovery, signaling that lower levels are attracting buyers.

Bitcoin (BTC) has risen above $68,500, as buyers attempt to form a higher low near $65,000. According to Glassnode, BTC is stuck between the true market mean at $79,200 and the realized price near $55,000. The onchain data provider expects the range-bound action to continue until a major catalyst pushes the price either above or below the range.

Standard Chartered also had a muted forecast for BTC. It lowered BTC’s target to $100,000 from $150,000 for 2026. The bank expects BTC to fall to $50,000 over the next few months, followed by a recovery for the remainder of the year.

Several analysts also say that BTC has not yet bottomed out. Crypto analyst Tony Research said in a post on X that BTC will bottom in the $40,000 to $50,000 zone, possibly “between mid-September and late November 2026.”

Could BTC and the major altcoins start a recovery? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price prediction

BTC turned up from $65,118 on Thursday, indicating demand at lower levels. The bulls will try to push the price to the breakdown level of $74,508.

If the Bitcoin price turns down sharply from the $74,508 level, it suggests that the bears remain active at higher levels. That may keep the BTC/USDT pair between $74,508 and $60,000 for a few days. On the downside, a break below the $60,000 support may sink the pair to $52,500.

Alternatively, if buyers thrust the price above $74,508, it suggests that the selling pressure is reducing. The pair may then rally to the 50-day simple moving average (SMA) ($85,046).

Ether price prediction

Buyers are attempting to push and maintain Ether (ETH) above the $2,000 level, but the bears have kept up the pressure.

If the price turns down from the current level or the $2,111 resistance, it suggests that the bears are aggressively defending the level. The Ether price may then retest the critical support at $1,750. If the level cracks, the ETH/USDT pair may extend the decline to the next major support at $1,537.

On the upside, buyers will have to swiftly push the price above the 20-day exponential moving average (EMA) ($2,297) to signal a comeback. If they manage to do that, the pair may ascend to the 50-day SMA ($2,800).

BNB price prediction

BNB (BNB) continues to gradually slide toward the strong support at $570, which is a vital level to watch out for.

If the BNB price plunges below the $570 support, it signals the start of the next leg of the downtrend toward the psychological level of $500.

However, the relative strength index (RSI) is in oversold territory, indicating that a relief rally is possible in the near term. If the price turns up from the current level, the bulls will attempt to push the BNB/USDT pair above the $669 level. If they can pull it off, the pair may march toward the 20-day EMA ($710).

XRP price prediction

XRP (XRP) has been clinging to the support line of the descending channel pattern, increasing the risk of a breakdown.

If that happens, the XRP price may drop to the $1.11 level. This is a critical level for the bulls to defend, as a break below it may resume the downtrend. The XRP/USDT pair may then fall to $1 and subsequently to $0.75.

Contrarily, if the price turns up from the current level and breaks above the20-day EMA ($1.55), it suggests that the pair may remain inside the channel for some more time. Buyers will have to achieve a close above the downtrend line to signal a potential trend change.

Solana price prediction

Solana (SOL) is trying to find support at the $77 level, but the bears are likely to sell on rallies.

The SOL/USDT pair may reach the breakdown level of $95, where the bears are expected to pose a strong challenge. If the price turns down sharply from the $95 level, it suggests that the bears have flipped the level into resistance. The Solana price may then plummet to the $67 level.

Conversely, if buyers push the price above the $95 level, the pair may rally to the 50-day SMA ($119). That suggests the break below the $95 level may have been a bear trap.

Dogecoin price prediction

Dogecoin (DOGE) is attempting to bounce off the $0.09 level, but the bears continue to sell on minor rallies.

If the Dogecoin price turns down and breaks below $0.09, the DOGE/USDT pair may drop to the $0.08 level. This is a crucial level for the bulls to defend, as a break below it may extend the downtrend to $0.06.

The first sign of strength will be a break and close above the 20-day EMA ($0.10). The pair may then rally to the breakdown level of $0.12, which is likely to act as stiff resistance. A break above the $0.12 level opens the doors for a rally to $0.16.

Bitcoin Cash price prediction

Bitcoin Cash (BCH) broke below the $497 support on Thursday, but the bulls failed to sustain the lower levels.

The bulls are attempting to push the price above the 20-day EMA ($536) but are expected to face significant resistance from the bears. If the price turns down from the 20-day EMA and breaks below $493, the BCH/USDT pair may plunge toward the $443 level.

On the contrary, if the price breaks and closes above the 20-day EMA, it suggests demand at lower levels. The Bitcoin Cash price may then rally to the 50-day SMA ($581), where the bears are again expected to mount a strong defense.

Related: Bitcoin open interest hits lows not seen since 2024: Is TradFi abandoning BTC?

Hyperliquid price prediction

Hyperliquid (HYPE) has risen back above the 20-day EMA ($30.18) on Thursday, indicating buying on dips.

The flattish 20-day EMA and the RSI just above the midpoint suggest a balance between supply and demand. Buyers will have to propel the Hyperliquid price above the $35.50 level to indicate that the corrective phase may have ended. The HYPE/USDT pair may then ascend to $44.

Contrary to this assumption, if the price turns down and breaks below the 50-day SMA ($27.25), it signals that the bears have an edge. The pair may then slump to the $20.82 support.

Cardano price prediction

Cardano (ADA) remains inside the descending channel pattern, indicating that the bears remain in charge.

The bears will attempt to strengthen their position by pulling the price below the support line and the $0.22 level. If they manage to do that, the ADA/USDT pair may descend to $0.20 and later to $0.15.

Instead, if the Cardano price turns up from the current level and breaks above the 20-day EMA ($0.29), it signals that the pair may remain inside the channel for some more time. Buyers will seize control on a close above the channel.

Monero price prediction

Monero (XMR) is facing resistance at the breakdown level of $360, but the bulls have not ceded much ground to the bears.

That increases the likelihood of a break above $360. If that happens, the bears will again try to halt the recovery at the 20-day EMA ($385). However, buyers are likely to have other plans. They will try to pierce the 20-day EMA, clearing the path for a rally toward the 50-day SMA ($460).

This positive view will be negated in the near term if the Monero price continues lower and breaks below $309. The XMR/USDT pair may then plummet to $276, which is likely to attract buyers.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Ripple’s (XRP) Next Price Targets, Cardano (ADA) Whales on the Move, and More: Bits Recap Feb 13

Here’s everything most interesting around XRP, ADA, and BTC.

Ripple’s XRP has rebounded substantially from the crash on February 6, and now many analysts believe a further pump could be on the horizon.

Cardano’s (ADA) whales have been quite active in the past week, while an interesting development suggests that Bitcoin (BTC) may experience a new pullback in the short term.

What’s Next for XRP?

As of press time, Ripple’s cross-border token trades just below $1.40, representing a 3% increase on a weekly scale. As usual, it has been the subject of numerous price predictions in the past few days, and the majority seem to be optimistic ones.

The analyst who goes by the X moniker X Finance Bull recently claimed that the XRP bull catalyst “is loading,” based on the recent interview of Scott Bessent (US Secretary of the Treasury), who appeared on Fox News. The politician confirmed that the Clarity Act (a proposed legislative framework designed to regulate the crypto sector in America) needs to pass this spring.

X Finance Bull argued that Ripple has over 100 institutional partners waiting for the green light, forecasting that “once it’s signed, the rush to XRP begins.” CRYPTOWZRD also chipped in. The analyst assumed that a further bullish move is “very likely” for XRP, еmphasizing the importance of holding above the $1.3820 level.

Meanwhile, factors such as the declining number of coins held on Binance and the formation of certain technical patterns suggest that Ripple’s native cryptocurrency could indeed head north soon.

ADA Whales Make Moves

Cardano’s native token has also rebounded by roughly 3% over the past week; however, that move coincides with a selling spree by large investors, commonly known as whales. Ali Martinez revealed that these market participants have dumped almost 200 million tokens in the span of seven days, a stash with a current USD equivalent of around $50 million.

You may also like:

These actions are concerning since they could instill panic across the community and prompt smaller players to cash out as well. After all, whales are considered experienced investors whose buying or selling decisions may be based on potential inside information that most people lack.

Additionally, sell-offs increase the amount of ADA available on the open market, and fundamental economic principles suggest the price could decline if demand fails to keep pace.

Despite the bearish factor, some analysts remain optimistic that a revival could be on the way. X user Aman recently noted that ADA’s valuation dipped to the demand zone of $0.26, which in previous cases has sparked substantial revivals.

More Problems for BTC?

The primary cryptocurrency fell to roughly $60,000 last Friday, marking its lowest level since October 2024. As of this writing, it trades at around $67,000, but certain elements signal that a renewed downtrend could be on the horizon.

Just recently, an anonymous whale deposited 8,200 BTC into Binance. The analytics company Lookonchain disclosed that whenever they execute such transfers, the asset goes down. It is worth noting that BTC’s price hovered around $69,000 at the time of the deposit, but minutes later it dipped to as low as $65,000.

An analysis made by Alphractal showed another potential bearish signal. The platform revealed that BTC’s long-term Realized Cap Impulse (a metric that is used to assess whether new capital is entering the ecosystem) has turned negative after three years.

Alphractal explained that, historically, such developments have had major implications for the asset, coinciding with periods of significant corrections or prolonged bear markets.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Trump-linked Truth Social seeks SEC approval for two crypto ETFs

Yorkville America Equities, the asset manager behind a series of exchange-traded funds (ETFs) tied to U.S. President Donald Trump’s Truth Social brand, has filed registration documents for two new cryptocurrency ETFs, expanding its push into the digital asset market.

According to a filing with the U.S. Securities and Exchange Commission (SEC) submitted Friday, the firm is seeking approval for the Truth Social Bitcoin and Ether ETF, which would offer exposure to the two largest cryptocurrencies by market capitalization. Yorkville also filed for a second product, the Truth Social Cronos Yield Maximizer ETF, which would invest in and stake , the native token of Crypto.com’s Cronos blockchain.

While both ETFs remain subject to SEC approval, the filings mark an significant next step for the politically branded investment firm. If approved, the ETFs would be launched in partnership with Crypto.com, which is expected to serve as the digital asset custodian, liquidity provider, and staking services provider for the new funds.

The Cronos-focused ETF is especially notable for its inclusion of staking rewards, which are typically earned by helping to secure proof-of-stake networks like Cronos. That could position the fund as a yield-generating product in a space still largely dominated by passive spot ETFs.

Both funds would also be distributed through Foris Capital US LLC, the SEC-registered broker-dealer affiliated with Crypto.com.

Truth Social first signaled its crypto ambitions in June 2025, when it filed an S-1 registration statement for a spot bitcoin ETF under the same brand. That was followed by a Blue Chip Digital Asset ETF filing in July 2025, targeting a basket of large-cap altcoins. Neither product has yet launched.

President Trump, a primary owner of Trump Media & Technology Group that in turn owns Truth Social, has struggled politically with his personal business ties to the crypto sector. That relationship is currently among the primary sticking points for advancing the U.S. Senate’s Digital Asset Market Clarity Act that would govern the oversight of U.S. crypto markets.

Crypto World

Bitcoin Shorts Hit August 2024 Levels as Funding Rates Sink Deeply Negative

After recent liquidations, traders have piled into shorts again, pushing Bitcoin funding rates deeper into negative territory.

Aggregated funding rate data across major cryptocurrency exchanges revealed that the current wave of short positioning is the most extreme since August 2024, a period that coincided with a major bottom for Bitcoin, according to new analysis from Santiment.

At that time, funding rates sank deeply into negative territory as traders overwhelmingly positioned for further downside, amidst intense fear and bearish sentiment across the market.

Extreme Bear Bets Before 2024 Reversal

Instead of continuing lower, Santiment found that prices reversed sharply, and the forced unwinding of overcrowded short positions helped fuel a strong recovery. Following that August 2024 low, Bitcoin went on to climb roughly 83% over the next four months. The move illustrated how extreme negative funding conditions can emerge right before powerful rebounds.

Santiment explained that funding rates are a mechanism within perpetual futures markets, and are designed to keep futures prices aligned with spot prices. These rates represent small, periodic payments exchanged between traders. When funding is negative, short sellers pay long traders, and when it is positive, long traders pay shorts.

When aggregated funding rates across exchanges fall far below zero, it means that a major share of market participants is heavily positioned for declining prices, often driven by fear, uncertainty, and doubt. Such imbalances can create conditions ripe for sharp counter-moves.

Many short positions are opened using leverage, meaning traders borrow capital to amplify potential gains. If prices move higher instead of lower, losses on these leveraged shorts can accumulate rapidly. Once losses breach predefined thresholds, exchanges automatically liquidate those positions to manage risk.

When large numbers of shorts are forced to close simultaneously, the resulting wave of buying can accelerate price increases, a trend commonly referred to as a short squeeze. The deeper funding rates fall into negative territory, the more crowded short positions become, and the greater the potential fuel for a sudden reversal.

You may also like:

Aftermath of October Binance Liquidations

The analytics platform also pointed to recent market activity surrounding a liquidation event on Binance on October 10, 2025, when a wave of long liquidations contributed to a sharp drop in BTC’s price. In the aftermath of that move, traders increasingly shifted into short positions as they expected further downside, which ended up recreating a similar imbalance that could be observed through funding rate data.

Current aggregated metrics suggest sentiment has once again leaned heavily in one direction. While Santiment stated that heavy short positioning does not guarantee an immediate rally, it described the present environment as one of high risk, where positioning pressure could flip into rapid upside volatility if shorts are forced to unwind.

Based on broader sentiment indicators, it added that these short positions are unlikely to close voluntarily. This makes a liquidation-driven move higher a more probable resolution.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Binance France President Survives Crypto Kidnapping Attempt

Armed men attempted to break into the home of Binance France President David Prinçay on Thursday morning, marking the latest in a growing wave of crypto-linked attacks across France.

According to French outlet RTL, three hooded individuals entered a residential building in the Val-de-Marne region around 7:00 a.m. on February 12. They were reportedly armed and searching for Prinçay’s apartment.

However, the attackers fled after discovering he was not at home.

Sponsored

Armed Commando Flees, Then Strikes Again

Local reports suggested the group first forced another resident to help them locate the correct apartment. Police said the suspects searched the Binance executive’s residence before leaving with two stolen phones.

Shortly afterward, at approximately 9:15 a.m., police in Hauts-de-Seine responded to another incident. A resident in Vaucresson reported being struck in the head with rifle butts by hooded men.

Authorities later linked the two events.

Sponsored

According to RTL, surveillance footage showed the suspects using the same vehicle seen earlier in Val-de-Marne. The stolen phones were also traced to the second location.

Witnesses reportedly overheard the attackers saying the address was incorrect before fleeing again.

Arrested at Lyon Perrache Station

French law enforcement launched a coordinated operation involving the Paris Brigade de Répression du Banditisme (BRB), police units from Hauts-de-Seine, Val-de-Marne, Yvelines, and transport police.

Investigators tracked the suspects via public transportation.

Sponsored

The three men boarded a train to Lyon. Authorities alerted the Lyon BRI unit, which intercepted and arrested them at Lyon Perrache station later that day.

They are now in custody. The investigation remains ongoing.

Binance Co-Founder Yi He addressed the incident on X, confirming that the targeted executive and his family are safe.

Sponsored

Is France Becoming a Haven for Crypto Crime?

The attempted attack comes amid a surge in crypto-related kidnappings and home invasions across France.

In May 2025, French police arrested more than 20 suspects linked to a series of kidnappings in the greater Paris area and surrounding regions, where criminals targeted affluent crypto investors.

Throughout 2025, French law enforcement continued to dismantle cells linked to crypto-focused extortion.

Investigations revealed that attackers frequently used private information obtained from dark-web leaks or social-network scraping to profile potential targets.

Methods ranged from staged home invasions — often in the early morning — to coordinated abductions and forced movements between locations to evade detection.

Crypto World

Oracle (ORCL) Stock Rises on $88 Million U.S. Air Force Contract

TLDR

- Oracle (ORCL) stock turned positive Wednesday following an $88 million cloud contract award from the U.S. Air Force

- The firm-fixed price deal extends through December 2028 for Oracle Cloud Infrastructure services supporting Cloud One

- Shares had declined recently on revenue growth concerns even as Q2 cloud revenue surged 34% to $8 billion

- The agreement reinforces Oracle’s role in Department of Defense cloud modernization programs

- Stock climbed 0.78% to $158.40 in premarket trading after the contract announcement

Oracle stock posted gains Wednesday after landing an $88 million contract with the U.S. Air Force. The deal marks a turnaround for shares that had struggled in recent sessions.

The three-year task order runs through December 7, 2028. Oracle will provide Cloud Infrastructure services for Cloud One, the Air Force’s centralized cloud platform.

Investors had sold Oracle shares recently over revenue growth worries. The selling continued despite cloud revenue jumping 34% to $8 billion in the company’s second quarter of fiscal 2026.

The contract enables Department of Defense customers to access Oracle Cloud Infrastructure across various security classification levels. The platform includes advanced security tools like the Secure Cloud Computing Architecture.

Government Cloud Services Expand

Oracle AI Database 26ai forms part of the contract package. Government users can securely combine classified and public information when running agentic AI workflows.

The task order covers Oracle Cloud Infrastructure offerings used by Cloud One and its government customers. Services extend across the Air Force and broader DoD enterprise.

Oracle described the contract as bolstering its position in Department of Defense cloud modernization efforts. The company has built a growing presence in government cloud services over recent years.

Contractor facilities throughout the United States will perform the work. The Air Force issued the task order on Thursday.

Recent Performance and Recovery

Oracle shares only returned to positive territory in the past two days. Revenue growth concerns weighed on the stock despite strong cloud segment results.

The second quarter of fiscal 2026 ended in November with cloud revenue hitting $8 billion. The 34% growth rate failed to alleviate investor worries about overall revenue trends.

Premarket trading showed Oracle at $158.40, up 0.78% from the previous close. The Air Force contract helped lift shares out of recent declines.

The Cloud One program gives DoD customers access to Oracle Cloud Infrastructure’s security, performance and resiliency features. Users can deploy the platform based on specific classification requirements.

Oracle will deliver services across multiple security classification tiers. This approach provides flexibility for different government agencies with varying security needs.

The deal expands Oracle’s government contract portfolio. The Texas-based company has established itself as a trusted provider for sensitive government cloud operations.

Mission owners can leverage DoD security services through the program. The Secure Cloud Computing Architecture helps meet boundary protection requirements for the Defense Information Systems Network.

Oracle shares had faced downward pressure as investors assessed growth metrics. Cloud revenue growth of 34% in Q2 reached $8 billion but failed to satisfy market expectations.

The stock moved 0.78% higher in premarket sessions to $158.40. The Air Force contract provided the catalyst for the reversal in share price direction.

Government customers gain access to advanced AI capabilities while maintaining security compliance. Oracle AI Database 26ai enables sophisticated agentic AI workflows using both classified and public data.

Crypto World

Moderna (MRNA) Stock Slips Despite Beating Q4 Revenue and Earnings Estimates

TLDR

- Moderna reported Q4 revenue of $678 million, beating Wall Street estimates of $626.1 million, driven by COVID-19 vaccine sales

- The company posted a quarterly loss of $2.11 per share, narrower than the $2.54 per share loss analysts expected

- Moderna reiterated its 2026 revenue growth target of 10% and expects 50% of sales from U.S. markets and 50% from international

- FDA refused to review Moderna’s flu vaccine application this week, citing trial design flaws, despite internal staff reviewers supporting the review

- Moderna stock slipped 0.3% in premarket trading Friday despite beating earnings, after rising 36% year-to-date through Thursday

Moderna shares dipped 0.3% in premarket trading Friday even after the biotech company delivered quarterly results that topped Wall Street expectations. The mixed reaction highlights investor concerns about the company’s path forward after a rough week.

The Cambridge-based vaccine maker reported fourth-quarter revenue of $678 million. That beat analyst estimates of $626.1 million.

Full-year 2025 sales reached $1.94 billion, surpassing the $1.89 billion consensus estimate. COVID-19 vaccine sales drove the better-than-expected performance.

Moderna posted a quarterly loss of $2.11 per share. Analysts had projected a steeper loss of $2.54 per share. The latest loss was narrower than the $2.91 per share loss recorded in the same quarter last year.

CEO Stéphane Bancel said the company entered the year “with strong momentum despite the continued challenging environment in the U.S.” The company reaffirmed its expectation for 10% revenue growth in 2026 compared to 2025.

Wall Street currently expects revenue growth of about 6% for the year. Moderna forecast research and development expenses of roughly $3 billion for 2026, matching analyst estimates.

FDA Setback Casts Shadow

The earnings beat came days after a setback with regulators. The FDA refused Tuesday to review Moderna’s seasonal flu vaccine application.

FDA vaccine chief Vinay Prasad said the company should have compared its vaccine to standard high-dose flu shots for older adults. Moderna ran its trial using regular-dose comparisons, which the company says FDA approved 18 months ago.

Internal FDA staff reviewers had supported moving forward with the review. Prasad overruled them, according to a Wednesday report from Stat.

Moderna criticized the decision and said it was awaiting further guidance on refiling. The company has been counting on its flu vaccine and a future COVID-flu combination shot to drive future growth.

Looking Ahead to 2026

The company expects about 50% of 2026 sales to come from U.S. markets. International markets will account for the remaining half.

Bancel said Moderna expects to meet its 2026 targets through expansion of its next-generation COVID vaccine. Strategic partnerships in international markets will also play a role.

Shares had climbed 36% year-to-date through Thursday’s close. Positive Phase 2b trial results for an intismeran autogene vaccine used in melanoma treatment drove much of the rally.

The company continues working on newer products to offset declining COVID vaccine demand. Sales have struggled since the pandemic windfall years when demand for COVID shots collapsed.

Moderna’s full-year 2025 revenue of $1.94 billion came in above the $1.89 billion analyst consensus, while the company maintains its 10% revenue growth target for 2026.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video10 hours ago

Video10 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?