Crypto World

Ethereum Price Falls to 9-Month Low as Investors Panic Sell

Ethereum has suffered a sharp correction, with price falling nearly 29% over the past week and slipping below the $2,000 mark. ETH is now trading at levels last seen nine months ago, reflecting severe weakness across the market.

Diminishing buyer support has worsened conditions, with on-chain data confirming growing stress among Ethereum holders.

Sponsored

Sponsored

Ethereum Holders Move Back To Selling

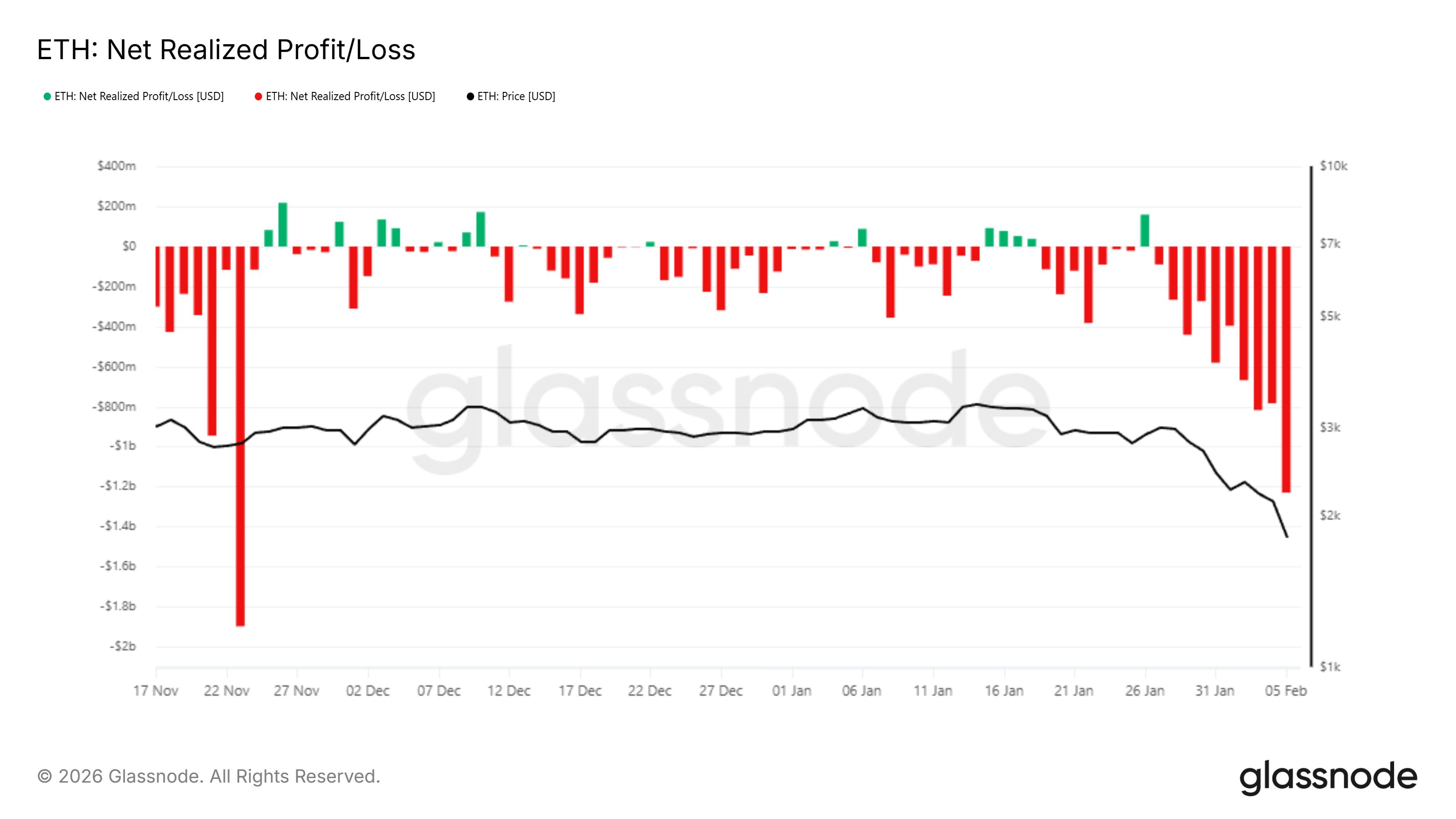

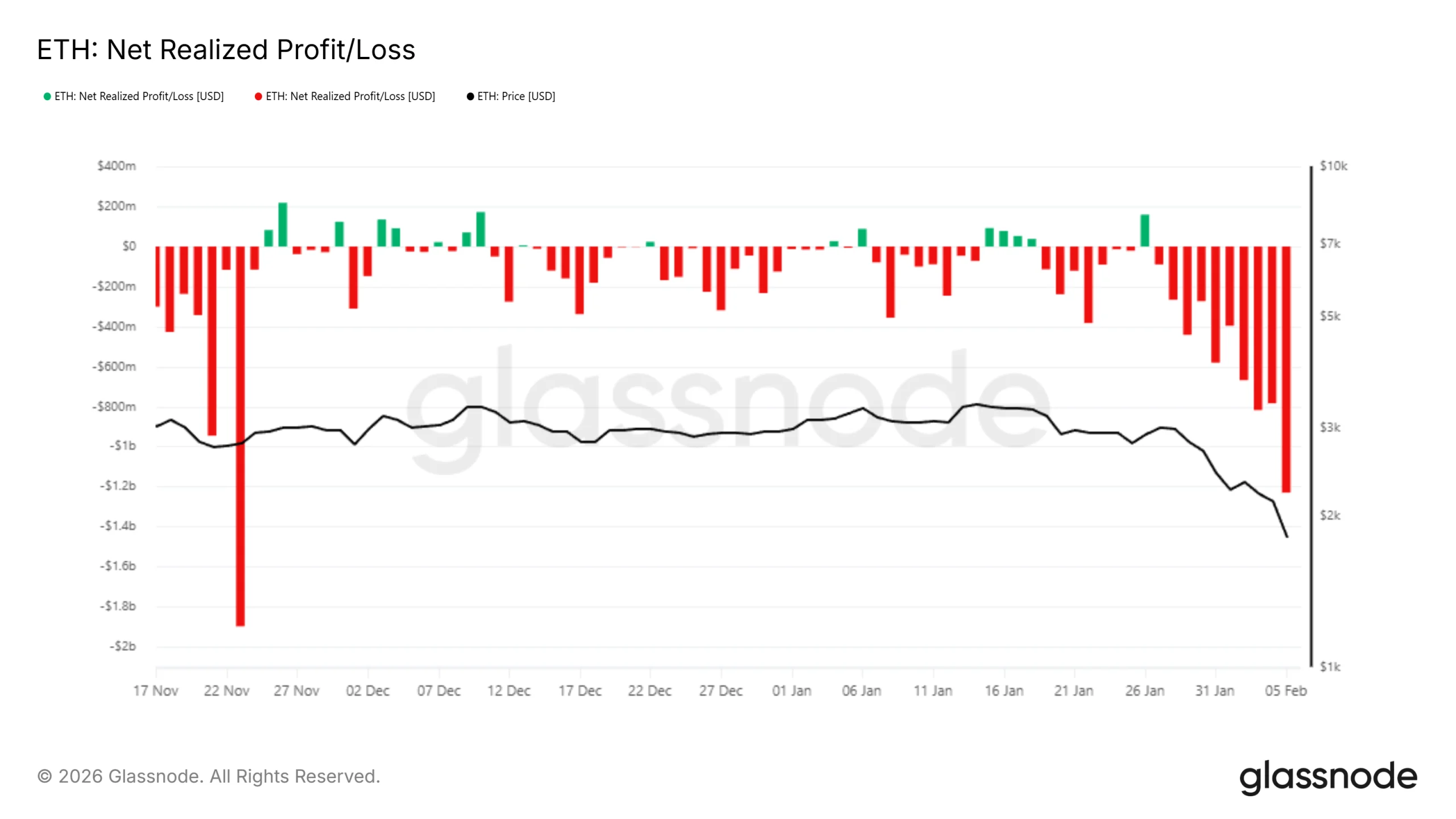

Ethereum holders have increasingly resorted to panic selling as broader market conditions deteriorated. On-chain data from the Realized Profit/Loss indicator shows investors selling despite being underwater. Realized losses surged past $1.2 billion within 24 hours, highlighting widespread capitulation as holders prioritize risk reduction over recovery.

Such elevated realized losses often extend declines by reinforcing negative momentum. As more ETH is sold at a loss, the price faces additional downward pressure. This behavior suggests confidence remains fragile, limiting the ability of Ethereum to stabilize until selling activity meaningfully subsides across the network.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ETH Long-Term Investors Change Stance

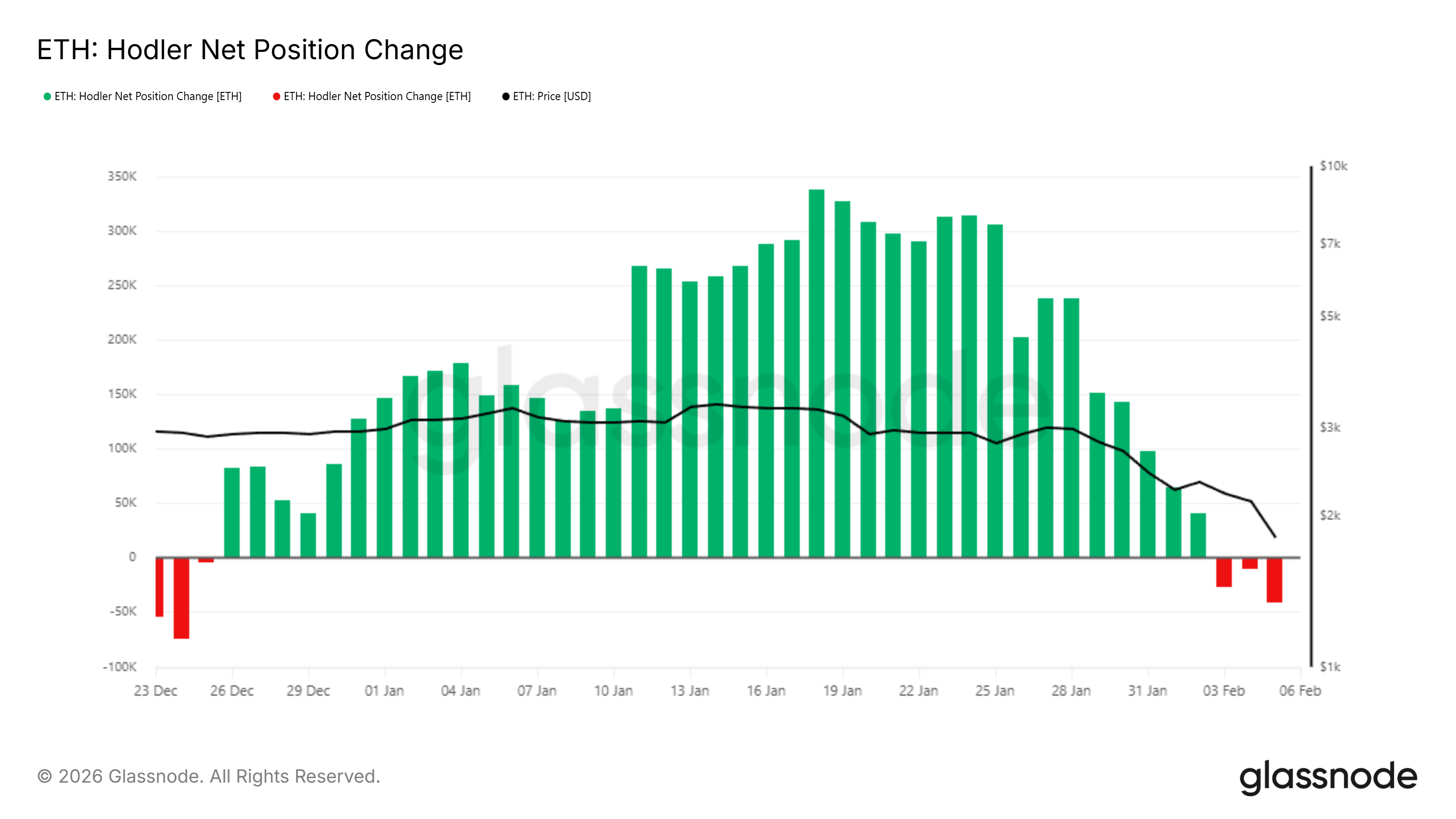

Long-term holder behavior reflects similar stress. The HODLer Net Position Change has declined, with bars flipping red, signaling net outflows from long-term wallets. This shift is notable because long-term holders are typically considered the backbone of Ethereum’s market structure and price stability.

Sponsored

Sponsored

When long-term holders distribute rather than accumulate, it often signals deep concern. Their decision to sell amid mounting losses indicates rising panic even among conviction-driven investors. This development adds macro-level pressure and increases the risk that Ethereum’s decline could deepen before a meaningful recovery begins.

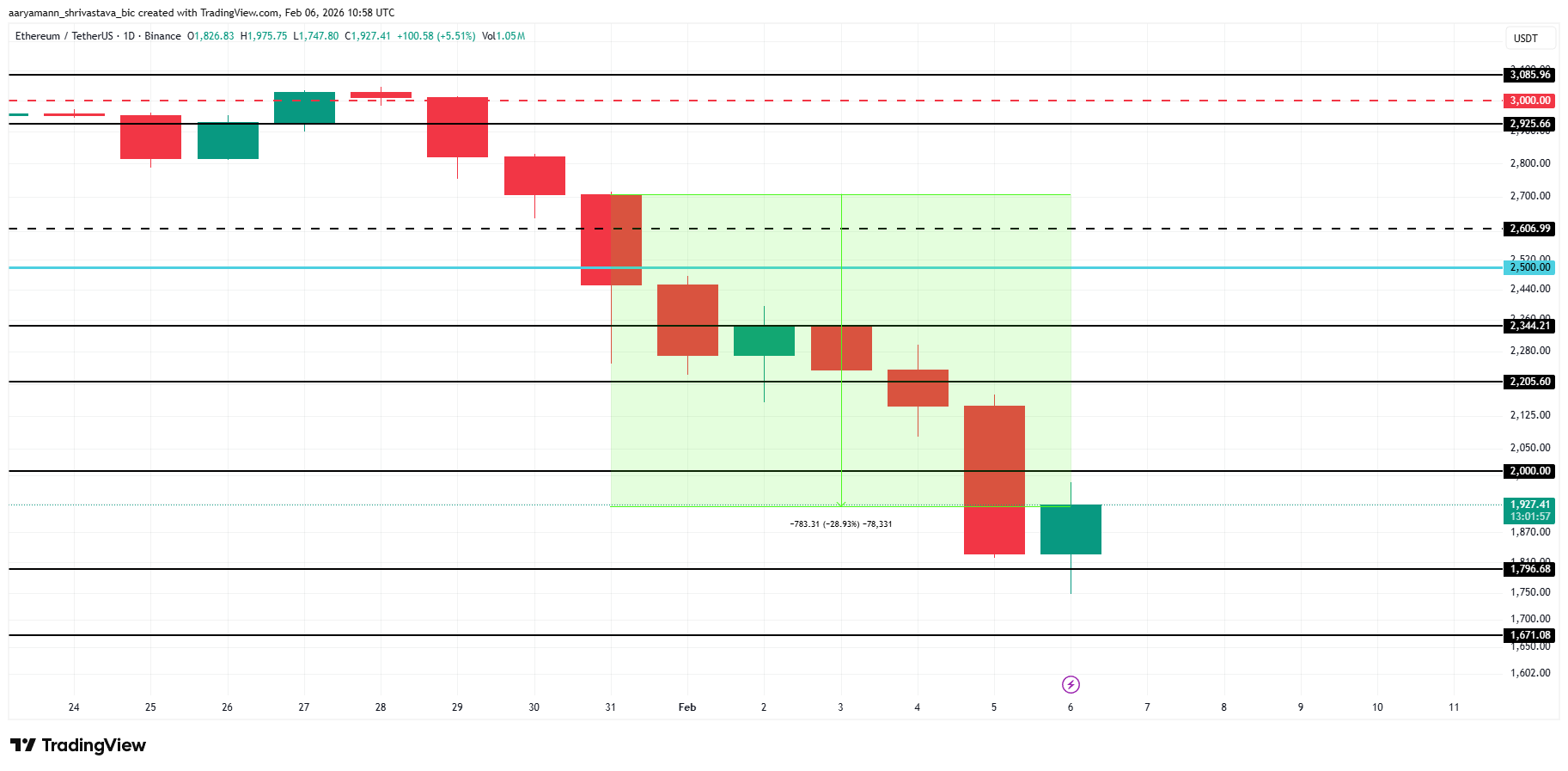

ETH Price Could Note A Reversal

Ethereum price is trading near $1,920 at the time of writing after a 29% drop in one week. The move below $2,000 has reinforced bearish structure across multiple timeframes. Given the prevailing on-chain and sentiment indicators, ETH remains vulnerable to additional downside in the near term.

ETH is currently holding above the $1,796 support level. If this level fails, price could slide toward $1,671 or lower. Ethereum is already at a nine-month low, last seen in May 2025, increasing the risk of further liquidation-driven selling if support breaks.

A recovery scenario remains possible if selling pressure eases. Ethereum could reclaim $2,000, supported by oversold conditions. The Money Flow Index sits well below the 20.0 threshold, indicating selling pressure has likely saturated. Historically, such readings have preceded short-term relief rallies.

A similar rebound could unfold if investors refrain from further selling. Holding supply off exchanges may allow ETH to regain momentum. Under this scenario, Ethereum could push beyond $2,000 and advance toward $2,500. Securing that move would invalidate the bearish thesis and restore market confidence.

Crypto World

“It’ll Get Worse. It’ll Get Redder.”

Cardano founder Charles Hoskinson sought to steady market sentiment during a sharp crypto sell-off, arguing that short-term price pain does not undermine the long-term case for blockchain-based financial systems.

Summary

- Cardano founder Charles Hoskinson warned that crypto markets could face further losses, telling viewers, “It’ll get worse. It’ll get redder,” as digital assets extended a broad sell-off.

- Hoskinson said he has personally lost more than $3 billion during past market cycles, arguing that his commitment to blockchain development is driven by conviction rather than profit.

- He said Cardano is entering a commercialization phase, citing full decentralization, completed governance upgrades, and upcoming initiatives such as Hydra and privacy-focused project Midnight.

Speaking during a public livestream from Tokyo, Hoskinson acknowledged worsening market conditions and warned that further volatility could lie ahead. “It’ll get worse. It’ll get redder,” he said, urging developers and investors to focus on building rather than retreating.

“I’ve lost over $3 billion”

Addressing criticism that crypto founders are insulated from downturns, Hoskinson said he has personally absorbed substantial financial losses over the years, estimating them at more than $3 billion.

“I’ve lost more money than anyone listening to this,” he said, adding that he could have exited the industry long ago but chose to remain involved out of principle rather than financial incentive.

Hoskinson emphasized that his continued participation in the sector is driven by conviction rather than profit, arguing that integrity and long-term vision matter more than short-term market cycles.

Cardano ready for commercialization

Hoskinson said Cardano (ADA) has reached a point where years of infrastructure development are beginning to translate into real-world use cases. According to him, the network is now fully decentralized, with governance mechanisms largely in place.

“The infrastructure is strong. We’re ready for commercialization,” Hoskinson said.

He highlighted Hydra, Cardano’s layer-2 scaling solution, as well as privacy-focused initiatives such as Midnight and StarStream, positioning them as key components of the ecosystem’s next phase. These projects are aimed at improving throughput, enhancing data protection, and supporting applications beyond speculative trading.

Crypto as a global economic tool

The Cardano founder also broadened his remarks to include a critique of existing financial and political systems, arguing that global economic coordination is becoming increasingly difficult under traditional frameworks.

“The only way to run a world like this is through a cryptocurrency,” Hoskinson said, contending that blockchains provide rule-based systems that reduce reliance on centralized authorities in a more interconnected global economy.

He framed blockchain adoption as a response to structural shifts driven by artificial intelligence, demographic change, and declining trust in institutions.

Looking beyond the downturn

Hoskinson closed the livestream by urging the crypto community to maintain long-term focus despite ongoing volatility. He stressed that progress should not be judged solely by token prices or short-term sentiment.

“I’ll be with you on the red days and the green days,” he said. “I ain’t going anywhere.”

Crypto World

Ripple ETF Investors Unfazed by Market Crash as XRP Price Begins Recovery

XRP went through some intense volatility but was stopped at $1.54 during its recoveyr attempt.

Unlike investors who use the spot Bitcoin and Ethereum ETFs to gain exposure to the two market leaders, those opting for the XRP funds seemed unfazed by the latest crypto crash.

Data from SoSoValue shows that the past week ended well in the green for the Ripple ETFs, even though the underlying asset’s price went through some of its darkest periods.

XRP ETFs Keep Gaining

Recall that the previous business week ended in the red for the XRP funds because of a single trading day – January 29, when investors pulled out nearly $93 million, making it the worst performance in terms of net flows since the products’ inception. The data on Monday shows a minor outflow of just over $400,000, which was rather negligible given the fact that the entire market crumbled once again during that weekend.

However, XRP ETF investors began putting funds back into the financial vehicles, with $19.46 million on Tuesday, $4.83 million on Wednesday, and $15.16 million on Friday, according to SoSoValue. For some reason, the monitoring resource has not updated the data for Thursday, but other websites and reports still show a minor net inflow.

Additionally, the cumulative net inflows for the spot XRP ETFs have grown from $1.18 billion at the end of the previous business week to $1.22 billion as of February 6, showing a net gain of around $40 million.

The spot ETH ETFs bled out around $170 million, while the BTC counterparties are down by $358 million within the same timeframe.

XRP Price Goes Nuts

The past week or so has been nothing short of a wild rollercoaster ride for the entire crypto market, but Ripple’s cross-border token was at the forefront. Last Saturday, it crashed from $1.75 to $1.50, which was already bad enough given the fact that it traded at $2.40 on January 6.

You may also like:

However, the bears were not done yet as they initiated a few consecutive leg downs, culminating in a massive plunge to $1.11 (on Bitstamp) on Friday morning. This meant that XRP had dumped by over 50% in just a month.

However, then came the big bounce as some metrics suggested so. In a matter of mere hours, the asset skyrocketed by 40% to $1.54, where it was rejected again and now struggles to remain above $1.40. The data above clearly shows that ETF investors are not to blame for these wild swings, at least not in XRP’s case.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BlackRock Bitcoin ETF Posts $231.6M Inflows After Turbulent Week For BTC

BlackRock’s spot Bitcoin exchange-traded fund (ETF) saw $231.6 million in inflows on Friday, following two days of heavy outflows during a turbulent week for Bitcoin.

The iShares Bitcoin (BTC) Trust ETF (IBIT) saw $548.7 million in total outflows on Wednesday and Thursday as crypto market sentiment declined to record-low levels, with Bitcoin’s price briefly dropping to $60,000 on Thursday, according to Farside.

Preliminary Farside data show inflows across nine US-based spot Bitcoin ETF products totaling $330.7 million, following three days of collective outflows totaling $1.25 billion.

Bitcoin ETF flows reveal investor sentiment

So far in 2026, IBIT has posted just 11 trading days of net inflows.

Bitcoin holders and crypto market participants closely watch Bitcoin ETF flows for clues about where the price is headed and whether interest in the asset is rising.

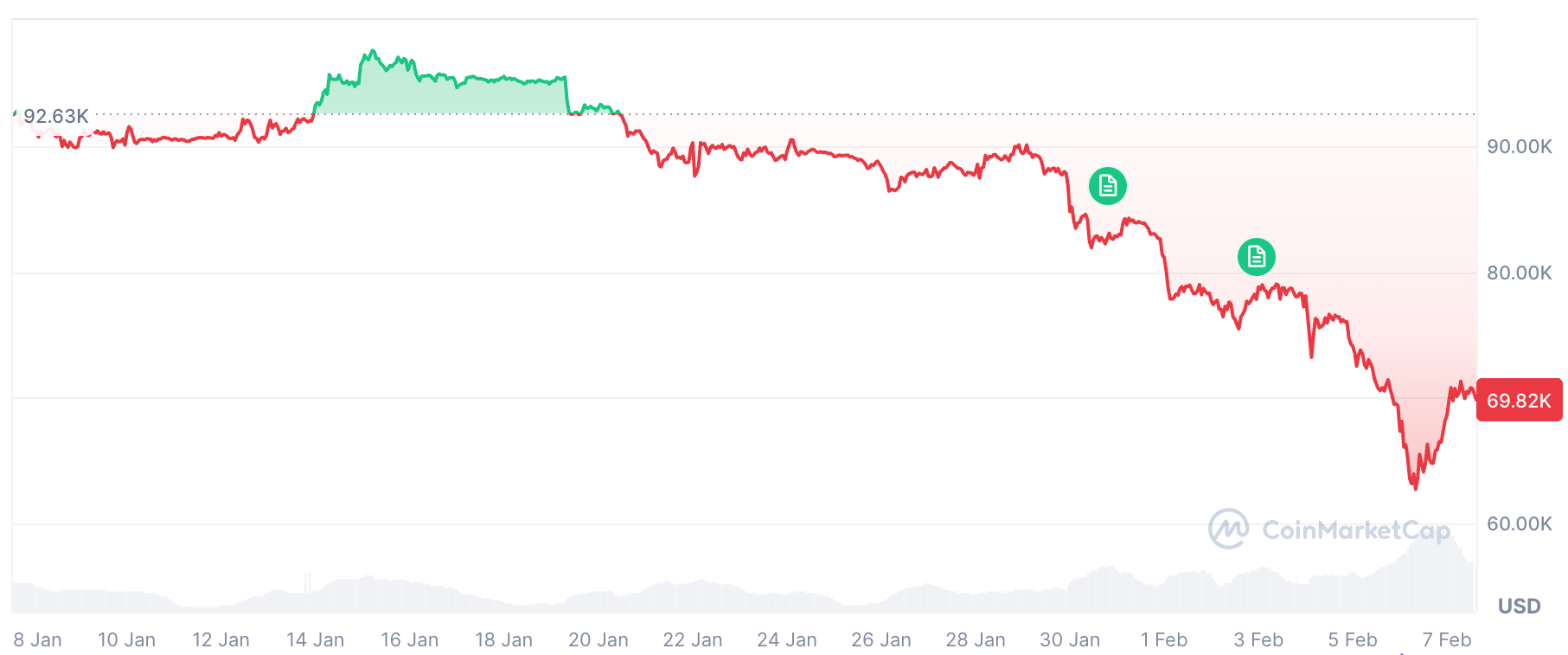

It comes as Bitcoin’s price has fallen 24.30% over the past 30 days, with Bitcoin trading at $69,820 at the time of publication, according to CoinMarketCap.

On Thursday, the IBIT “crushed its daily volume record,” with $10 billion worth of shares trading hands, according to Bloomberg ETF analyst Eric Balchunas.

IBIT rebounds on Friday after price plunge

Balchunas added that IBIT dropped 13% on the day, its “second-worst daily price drop since it launched,” with its largest daily price decline at 15% on May 8, 2024.

However, the IBIT rebounded 9.92% on Friday, closing at $39.68, according to Google Finance.

Related: Google search volume for ‘Bitcoin’ skyrockets amid BTC price swings

ETF analyst James Seyffart noted on Wednesday that while Bitcoin ETF holders are facing their “biggest losses” since the US products launched in January 2024 — paper losses of around 42% with Bitcoin below $73,000 — the recent outflows still pale compared with the inflows seen at the market’s peak.

Before the October downturn, spot Bitcoin ETF net inflows were around $62.11 billion. They’ve now fallen to about $55 billion.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

China Bans Unapproved Yuan-Pegged Stablecoins Abroad to Protect Currency Stability

Chinese regulators have moved to tighten control over digital assets, banning the unauthorized issuance of yuan-pegged stablecoins overseas and extending restrictions to tokenized real-world assets linked to the country’s currency.

Key Takeaways:

- China banned unauthorized yuan-pegged stablecoins and related tokenized assets to protect monetary sovereignty.

- Authorities reaffirmed crypto payment prohibitions while promoting the state-backed digital yuan.

- Japan and Hong Kong are moving toward regulated stablecoin markets, highlighting a regional policy divide.

In a joint statement released Friday, the People’s Bank of China (PBOC) and seven government agencies said individuals and companies, domestic or foreign, may not issue renminbi-linked stablecoins without official approval.

Authorities argued that such tokens mimic key functions of money and could threaten monetary sovereignty.

China Says Yuan Stablecoins Threaten Currency Stability

Stablecoins pegged to fiat currencies “perform some of the functions of fiat currencies,” the notice said, warning that circulation outside regulatory oversight could undermine the stability of the yuan.

The rules also target services tied to tokenized financial assets, including blockchain-based representations of bonds or equities.

Overseas entities are barred from offering related products to users inside China without permission from regulators.

Beijing reaffirmed its longstanding position on crypto payments, stating that assets such as Bitcoin and Ether do not hold legal tender status and that facilitating transactions or related services constitutes illegal activity.

The policy builds on a sweeping prohibition introduced by the central bank in 2021 that effectively removed cryptocurrency trading and payments from the domestic financial system.

Legal scholar and former sovereign wealth fund executive Winston Ma said the restrictions apply to both onshore and offshore versions of the renminbi.

The offshore yuan, known as CNH, is designed for foreign exchange flexibility while preserving capital controls.

The measures appear to fit a broader strategy of limiting privately issued digital currencies while promoting the state-backed digital yuan.

China has spent several years developing the e-CNY central bank digital currency and recently allowed commercial banks to share interest with users holding digital yuan wallets in an effort to increase adoption.

Japan, Hong Kong Embrace Stablecoin Regulation as China Tightens Rules

Elsewhere in Asia, policymakers have taken a different path. Japan introduced a legal framework for stablecoin issuance in 2023, while Hong Kong plans to begin licensing stablecoin issuers this year.

China briefly explored allowing private firms to issue yuan-pegged tokens in 2025, but later halted pilot programs.

Last year, the People’s Bank of China unveiled a framework that will allow commercial banks to pay interest on balances held in digital yuan wallets starting January 1, 2026.

Lu Lei, a deputy governor at the PBOC, said the change would shift the e-CNY beyond its original role as a digital version of cash and integrate it into banks’ asset and liability operations.

Global stablecoin transaction value reached $33 trillion in 2025, marking a 72% increase from the previous year, according to Bloomberg data compiled by Artemis Analytics.

USDC emerged as the most-used stablecoin by transaction volume, processing $18.3 trillion, while Tether’s USDT handled $13.3 trillion, despite maintaining its lead by market capitalization at $187 billion.

The surge in activity followed the passage of the GENIUS Act in July 2025, the first comprehensive U.S. regulatory framework for payment stablecoins.

The post China Bans Unapproved Yuan-Pegged Stablecoins Abroad to Protect Currency Stability appeared first on Cryptonews.

Crypto World

Vitalik Buterin Donates to Shielded Labs for Zcash Crosslink Security Upgrade

TLDR:

- Buterin’s donation funds Crosslink development from prototype to incentivized testnet and production phase.

- Crosslink adds finality layer to Zcash’s PoW chain, preventing reversals and strengthening settlement guarantees.

- The upgrade enables shorter exchange confirmations and improves cross-chain integration reliability for Zcash.

- Shielded Labs operates independently from Zcash Dev Fund, relying on donations from network supporters.

Ethereum co-founder Vitalik Buterin has donated to Shielded Labs to advance Crosslink development for Zcash. The contribution will fund progression from prototype to incentivized testnet and production readiness.

Crosslink adds a finality layer to Zcash’s proof-of-work consensus, protecting against chain reorganizations and rollback attacks. This marks Buterin’s second donation to the organization.

Crosslink Enhances Zcash Security Architecture

Shielded Labs announced the donation will support Crosslink’s continued development. The upgrade strengthens Zcash’s existing proof-of-work consensus through a parallel finality layer.

Block production and economic activity remain on the proof-of-work chain. Meanwhile, the finality gadget anchors blocks and provides stronger settlement guarantees.

The architecture prevents confirmed transactions from being reversed. This reduction in double-spend risk increases confidence in transaction settlement across the network.

Exchanges can implement shorter confirmation requirements as a result. Cross-chain integrations gain improved reliability through the enhanced security model.

Applications requiring predictable settlement benefit from the increased consistency. The improvements facilitate easier integration into the broader crypto ecosystem.

Zcash maintains its existing security properties throughout the upgrade process. The design preserves the network’s core characteristics while adding protective measures.

Commenting on the donation, Buterin stated that Zcash is one of the most honorable crypto projects. He praised the network’s steadfast focus on privacy as a defining characteristic.

According to Buterin, Shielded Labs’ Crosslink work will allow Zcash to be more secure. The upgrade will enable operation on a lower security budget, supporting long-term sustainability.

Production Phase Will Focus on Technical Readiness

The donation will fund the productization of the existing Crosslink prototype. Shielded Labs plans to launch a persistent, incentivized testnet where participants can earn ZEC.

The transition into productionization involves multiple technical components. Design specifications require completion before mainnet consideration.

Security analysis will form a critical component of the development process. Audits will verify the robustness of the finality layer implementation.

Coordination with wallets and infrastructure providers ensures smooth integration. Proactive engagement with the Zcash community maintains transparency throughout development.

Progress toward mainnet activation depends on several factors. Technical readiness must meet established standards before deployment.

Security review processes need completion to validate the upgrade’s safety. Broad community support remains essential for major protocol changes.

Shielded Labs operates as a Swiss-based Zcash support organization. The team focuses on protocol development projects that strengthen network security.

Funding comes from donations by Zcash holders and supporters. The organization maintains independence from the Dev Fund and block rewards.

Buterin’s first contribution in 2023 supported formation of a dedicated Crosslink team. He has contributed to discussions around protocol design and security for years.

Shielded Labs acknowledged his continued engagement with the Zcash ecosystem. The organization expressed appreciation for his support in advancing network resilience.

Crypto World

VC in Latin America must throw out Silicon Valley’s playbook

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

The formulas that work well for venture capitalists investing in the United States — the blitzscaling mindset, the obsession with user growth over revenue, the eagerness to fund abstract infrastructure bets — simply don’t map onto Latin America, a region defined by macro instability and a consumer base that uses crypto out of necessity rather than ideology.

Summary

- Latin America isn’t Silicon Valley on a delay: Crypto adoption is driven by necessity — inflation, capital controls, remittances — not ideology or yield, so growth-at-all-costs models break fast.

- Revenue, liquidity, and licenses beat hype: Winning startups control local rails, banking relationships, and regulatory access; community buzz and abstract network effects don’t survive real-world stress.

- Scaling looks like logistics, not SaaS: Each new country is a new financial system, with political and macro risk baked in — VCs who don’t reprice that reality will keep misfiring.

The Silicon Valley playbook assumes two things: that capital is abundant, and that markets are homogenous. In Latin America, neither is true. Liquidity is thinner, operating costs are higher, and each major market has its own idiosyncratic rules, banks, tax environments, and political risks. VCs entering the region must unlearn the idea that a “regional rollout” is just a matter of translating the app and hiring a local general manager. Crypto companies here scale more like logistics companies than software startups.

If VCs from the United States want to fund projects in Latin America’s crypto scene, they must write a completely new investing thesis. That means funding revenue-first businesses, valuing regulatory licensing more than “community,” prioritizing teams who understand local corridors, and letting go of the idea that what works in San Francisco will work in São Paulo. Latin America’s crypto market is not a derivative of the U.S. market; it is its own ecosystem with its own constraints and opportunities. Investors who recognize that early will dominate the next decade.

Latin America’s unique characteristics

The biggest mistake venture capitalists make when investing in Latin America is assuming the region is merely an earlier stage of the same market dynamics they understand in the United States. That assumption quietly shapes everything, from how they evaluate products to how they price risk… and it is wrong.

In the United States, crypto adoption is often fueled by ideology, experimentation, and yield-chasing. Failure is tolerated. Switching costs are low. In Latin America, crypto adoption is more utilitarian than aspirational. People use blockchain technology to protect savings from inflation, access dollars, move money across borders, or navigate capital controls. These users are not early adopters in the typical Silicon Valley sense; they are economically constrained actors solving immediate problems.

This distinction matters because it breaks the growth-at-all-costs mindset. Latin American crypto users are pragmatic and price-sensitive. If a product is slow, expensive, unreliable, or confusing, it is abandoned immediately. There is no patience for onboarding funnels or roadmap promises. Products must work from day one, under stress, at a reasonable scale. So applying Valley-style growth models (subsidizing usage and deferring monetization) is a mistake.

The error compounds when investors treat Latin America as a downstream extension of U.S. crypto trends. Too many funds approach the region looking to localize whatever is hot in San Francisco: the next DeFi primitive, the next infrastructure layer, the next community-first protocol.

But Latin America is not waiting for imported innovation. It is already pioneering real-world crypto use cases under conditions far harsher than those faced by developed markets. In that sense, Latin America is a leading indicator, not a lagging one. Many of the problems crypto claims it will solve in the future are already present in the region today.

Trust dynamics reinforce this divergence. In Silicon Valley’s online-native culture, Crypto Twitter still matters enormously. As does Discord. In Latin America, trust is built offline, through institutions, brands, customer support, regulatory standing, and physical presence. Users care less about slick community strategies and more about whether a product works during a currency crisis or a banking disruption.

The art of investing

The Silicon Valley model assumes abundant capital and forgiving markets; assumptions that simply do not hold in Latin America. That’s why revenue matters much earlier for startups in the region. Liquidity is thinner, fundraising cycles are longer, and macro shocks are frequent. A startup that fails to generate revenue early is very exposed.

Scaling further exposes the limits of software-first thinking. In the United States, expanding regionally is largely a question of marketing spend and infrastructure. In Latin America, each new country is a new financial system. It involves new banks, new payment rails, new tax regimes, new FX controls, new regulators, and new political risks. Expanding jurisdictionally is like building a logistics corridor. Investors who expect SaaS-style expansion curves systematically misjudge timelines and execution risk.

Liquidity is another axis where the Silicon Valley model fails. VCs tend to prioritize abstract network effects, assuming global scale will naturally translate into defensibility. In the Latin American crypto scene, the real bottleneck is liquidity fragmentation. Winning companies control local fiat on- and off-ramps and maintain strong banking relationships. Local liquidity, not global narratives, determines success.

Regulation completes the picture

U.S. crypto investors often celebrate regulatory gray zones as opportunities to move fast. In Latin America, regulatory arbitrage is not a viable long-term strategy. Regulation is fragmented, but unavoidable. Banking relationships, licenses, and compliance frameworks are competitive moats. Companies that “move fast and break things” often destroy their ability to operate at all. Investors who fail to value regulatory depth consistently underestimate what durability looks like in this market.

Finally, risk itself must be reframed. Silicon Valley underwriting models focus heavily on product-market fit and technical execution. In Latin America, risk is just as macro and political. Elections can trigger capital controls overnight. Banking partners can disappear. Regulatory frameworks can shift abruptly. Investors need to adapt their risk models to avoid mispricing outcomes.

Investing in Latin America isn’t necessarily harder; it’s just different. Crypto adoption here is real, demand-driven, and already embedded in daily economic life in many places. Investors who insist on applying Silicon Valley’s playbook will continue to misunderstand the market. Those who shift their mindset will end up backing the companies with the right DNA.

Crypto World

Bitcoin Mining Stocks Plunge As Earnings Fall Short

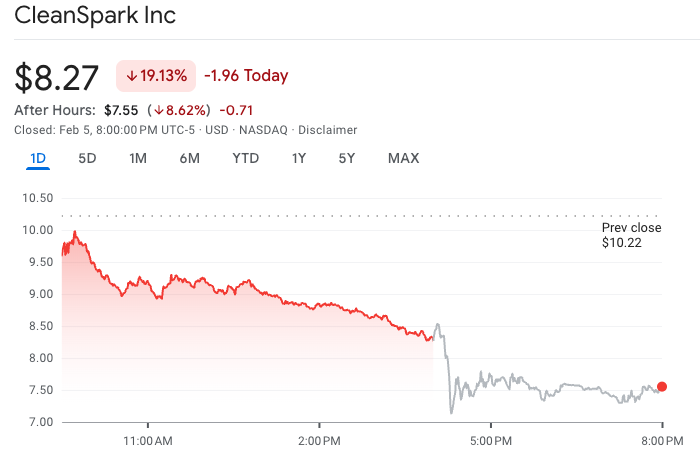

Shares in crypto mining companies IREN and CleanSpark sank on Thursday as their earnings came in below Wall Street expectations and Bitcoin’s slide saw traders turn risk-off.

Bitcoin (BTC) has fallen 12% over the past 24 hours to briefly touch a low of $60,000 early on Friday. Meanwhile, the crypto market capitalization fell by almost 9%, according to CoinMarketCap.

CleanSpark (CLSK) led the decline, closing trading on Thursday down 19.13% and falling another 8.6% after-hours to $7.55 after its results for the quarter ended Dec. 31 came in below analyst predictions.

CleanSpark said on Thursday that its revenues for the quarter ended Dec. 31 came in at $181.20 million, missing analyst estimates of $186.66 million by around 2.9%.

CleanSpark misses earnings, but eyes AI as profit booster

Analysts at Zacks said that the reduced mining rewards following the Bitcoin halving in April 2024 likely led to “lower mining efficiency” and therefore potentially “constrained profit” during the period.

CleanSpark reported a net loss of $378.7 million, a sharp year-on-year decline compared to the net profit of $246.8 million it reported for the same period in 2024.

CleanSpark’s chief financial officer and president, Gary Vecchiarelli, said that the company is “no longer a single-track business,” as it looks to artificial intelligence to boost profits.

“Bitcoin mining generates the cash flow, AI infrastructure monetizes the assets over the long term, and our Digital Asset Management function optimizes capital and liquidity across cycles,” Vecchiarelli said.

IREN shares fall on earnings miss

IREN Ltd, which has moved its core operations from Bitcoin to providing AI infrastructure, also missed earnings on Thursday, with its shares closing the day down 11.46% and falling an additional 18.5% after hours to $32.42.

IREN reported revenues of $184.69 million for the last quarter of 2025, missing Wall Street’s expectations by 16.49%. It posted a net loss of $155.4 million, compared to a net income of $384.6 million in the year-ago quarter.

Related: Crypto figures address connections mentioned in latest Epstein file release

Other major crypto mining stocks also fell sharply on Thursday, with RIOT Platforms (RIOT) down 14.71% and MARA Holding (MARA) falling 18.72%, according to Google Finance.

With Bitcoin’s price down 29% over the past 30 days, sentiment across the crypto market has crashed to levels not seen in months.

The Crypto Fear & Greed Index fell to a score of 9 out of 100 on Friday, its lowest since the fallout of the Terra collapse in mid-2022.

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

Bitcoin Briefly Crashes on Bithumb After Alleged 2,000 BTC Airdrop

South Korean crypto exchange Bithumb was thrust into the spotlight on Friday after claims surfaced on social media that an internal error led to the accidental distribution of 2,000 Bitcoin to users, triggering a sharp price dislocation on the platform.

Summary

- Bitcoin on Bithumb briefly traded more than 10% below other major exchanges following reports of an internal airdrop error.

- Social media claims, echoed by Lookonchain, allege a staff mistake sent 2,000 BTC ($133M) instead of a small KRW reward, triggering heavy sell pressure.

- Bithumb has not confirmed the incident, leaving uncertainty around whether trades will be reversed or funds recovered.

Bitcoin (BTC) on Bithumb briefly traded more than 10% below prices on other major exchanges, an unusual divergence for the world’s largest cryptocurrency.

The allegations were first shared by users on X who claimed that a staff mistake during an airdrop resulted in users receiving Bitcoin instead of the intended token.

https://twitter.com/EvanLuthra/status/2019738608933232796

BTC trades at 10% discount on Bithumb

On-chain analytics firm Lookonchain also flagged the anomaly, noting that Bitcoin on Bithumb suddenly dropped to more than 10% below prices on other markets.

According to Lookonchain, reports suggest a staff mistake during an airdrop led to 2,000 BTC, worth roughly $133 million, being distributed instead of a small KRW-denominated reward. Some recipients allegedly sold the Bitcoin immediately, accelerating the price drop on the exchange.

Exchange-specific price deviations of this magnitude are rare for Bitcoin, given its deep liquidity, and typically point to operational issues or sudden liquidity shocks rather than broader market moves.

As of press time, Bithumb had not publicly confirmed the details of the alleged transfer error or the exact amount of Bitcoin involved. It also remains unclear whether the funds were successfully withdrawn, frozen, or reversed, or whether affected trades will be rolled back.

Bithumb is one of South Korea’s largest cryptocurrency exchanges and has previously faced scrutiny over outages, regulatory compliance, and operational controls, making the latest reports particularly sensitive.

Crypto.News reached out to Bithumb for comment, but had not received a response as of press time.

Crypto World

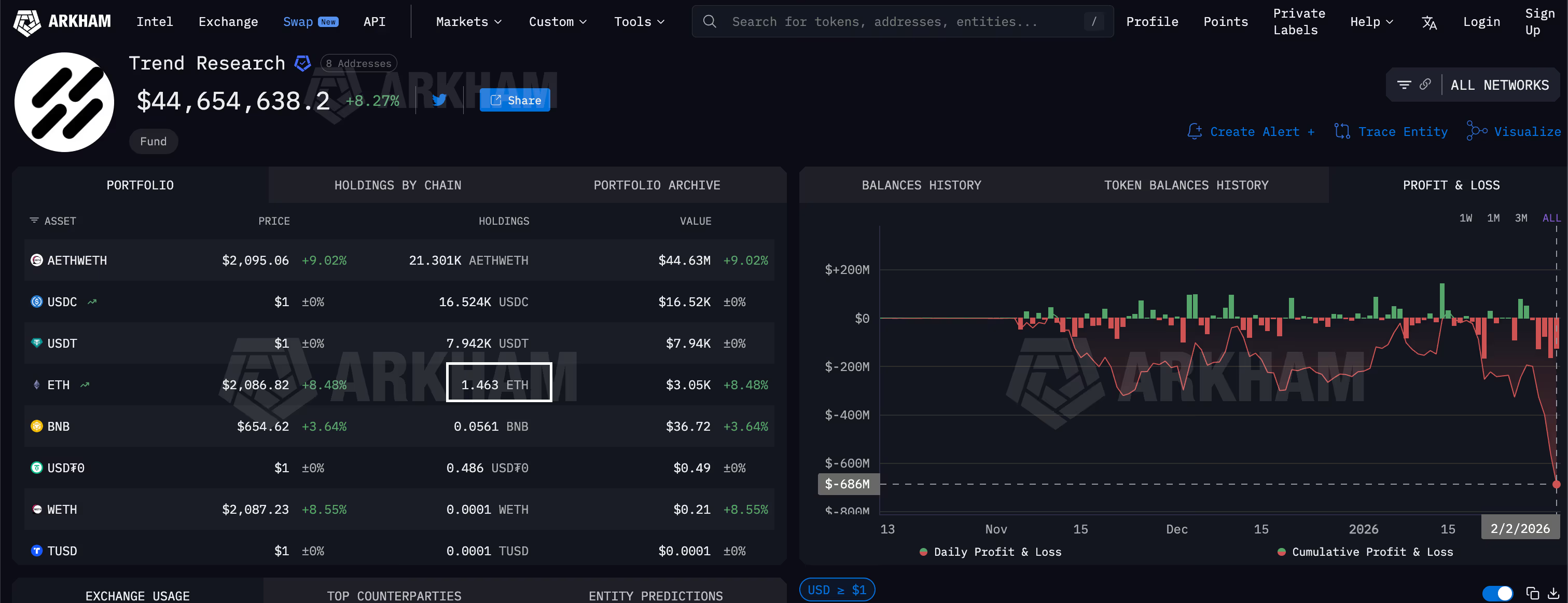

Ether’s crash leaves $686 million gaping hole in trading firm’s book

An ether bull was caught leaning hard into the upside this week as the cryptocurrency tanked, turning the whale bet into a multi-million dollar horror story.

That bull is Trend Research, a trading firm headed by Liquid Capital founder Jack Yi. The firm spent recent months building a bullish (long) bet worth $2 billion on ether by borrowing stablecoins from DeFi giant Aave, which were reportedly collateralized by ether.

The position blew up this week, leaving the firm with a $686 million loss, according to Arkham.

The blow up underscores the crypto market’s unchanged reality: Volatility can still make or break traders in a single week. It also shows how traders keep chasing risky leveraged loop plays – borrowing stablecoins against ETH collateral – despite these bets exploding spectacularly every downtrend.

How it went down

The team was convinced of ether’s long-term potential and expected a quick rebound from its October drop below $4,000.

But that never materialized – ether kept sliding, endangering their “looped ether” long position. As prices fell, the stablecoin collateral backing the leveraged bet shrank, while the fixed debt loomed large in classic leveraged fashion.

The final blow came this month as ether started falling rapidly with bitcoin and on Feb. 4 prices tanked to $1,750, the weakest level since April 2025. Trend Research responded by liquidating over 300,000 ether, according to data source Bubble Maps.

“Trend Research started sending large amounts of ETH to Binance to repay debt on AAVE In total, this cluster moved 332k ETH worth $700M to Binance over 5 days,” Bubble Maps said on X. The firm now holds just 1.463 ETH.

Jack Yi described these sales as a risk-control measure.

“As multi-heads in this round, we remain optimistic about the performance of the new bull market: ETH reaching over $10,000, BTC exceeding $200,000 USD. We’re just making some adjustments to control risk, with no change in our expectations for the future mega bull market,” Yi said in a post on X.

He added that now is the best time to buy tokens, calling volatility as the biggest feature of the crypto circle. “Historically, countless bulls have been shaken off by this volatility, but often what follows is a doubled rebound,” he noted.

Crypto World

Bitcoin Google Searches Surge as Price Dips to $60K

Bitcoin drew renewed attention last week as price action met a renewed wave of retail-focused interest. Google Trends provisional data show worldwide searches for “Bitcoin” reached a score of 100 for the week starting Feb. 1, the highest level in roughly 12 months. The price picture reflected the mood: BTC started February around $81,500 and slid to about $60,000 within five days, before a partial rebound toward the mid-$70,000s as markets steadied (CoinMarketCap).

Key takeaways

- Global search interest for “Bitcoin” surged to a 12-month high, hitting a Trends score of 100 in the week beginning Feb. 1.

- Bitcoin’s price fell from ~ $81,500 to around $60,000 within five days and then recovered to about $70,700 at press time.

- Retail participation appears to be returning, with market observers noting renewed shopper enthusiasm on social media.

- The Coinbase premium turned positive for the first time since mid-January, signaling fresh US buying interest, per CryptoQuant.

- The Crypto Fear & Greed Index dipped into Extreme Fear, underscoring a cautious mood even as some traders see a potential buying opportunity.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Negative in the near term as BTC slipped toward $60,000, followed by a partial rebound to near $70,700.

Market context: The move highlights ongoing volatility in crypto markets and the sensitivity of retail-driven sentiment to price swings. Elevated search activity and mixed indicators—institutional signals and retail metrics—illustrate how traders are weighing risk in a broader macro backdrop. Watch for whether on-chain and sentiment signals converge as price stabilizes.

Why it matters

Retail interest can act as a catalyst for direction, and the early February price swing underscores how quickly sentiment can shift in a market known for sharp reversals. The spike in search activity, when paired with signals like the Coinbase premium and the Fear & Greed Index, provides a richer picture of market psychology beyond price alone. For investors and users, this episode reinforces the importance of triangulating signals—price levels, sentiment gauges, and on-chain activity—before drawing conclusions about trend beginnings or endings.

From a broader perspective, the data point to a market that remains comfortable with high volatility and sensitive to both macro cues and microflows. While some market participants view the Extreme Fear reading as a potential bottoming signal, others caution that sentiment can stay negative for extended periods if liquidity tightens or negative catalysts emerge. In this environment, the resilience of price above key support zones and the pace at which sentiment shifts back toward optimism will likely determine the next phase of the cycle.

Beyond price, observers continue to weigh how these signals translate into longer-term momentum. The conversation around a potential recovery hinges not only on how quickly Bitcoin stabilizes but also on the durability of renewed retail demand, the direction of institutional interest, and the evolving regulatory and macro backdrop. The current mix of indicators—some suggesting cautious optimism, others signaling caution—reflects a crypto market still navigating a high-velocity environment where news, liquidity shifts, and investor sentiment can diverge for extended periods.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports7 days ago

Sports7 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World7 days ago

Crypto World7 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech12 hours ago

Tech12 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports4 hours ago

Sports4 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports22 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat18 hours ago

NewsBeat18 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat5 hours ago

NewsBeat5 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”