Crypto World

Ethereum price prediction amid aggressive whale accumulation near $2k

- Ethereum whales continue to aggressively accumulate ETH amid falling prices.

- The dip below $2,000 offers an attractive entry point for bulls.

- Ethereum price touched intraday lows of $1,930 on Wednesday, February 11, 2026.

Ethereum has dipped below the $2,000 level again, with a 3% decline in the past 24 hours pushing the top altcoin to lows of $1,930 in early trading on February 11, 2026.

The decline mirrored Bitcoin’s retreat below $67,000, with the bellwether digital asset down 3% over the same period, trading around $66,805.

But despite the strong bearish sentiment across the cryptocurrency market, whales appear unfazed and are using the dip to aggressively add to their positions.

Ethereum whales buy the dip near $2k

On-chain data shows Ethereum has attracted aggressive whale accumulation for several months, despite a sharp decline in the altcoin’s price.

According to details shared by CryptoQuant on X, large holders began ramping up their positions in July 2025.

This trend has continued even as the ETH price plunged from its peak amid a bearish flip in the last quarter of the year, with inflows into accumulation addresses hitting record highs amid sustained buying.

Notably, analysts say the loading up has continued after the ETH price fell below the realized value of accumulation addresses.

This scenario also played out in April 2025, when the Ethereum price plunged to lows of $1,470 amid a broader market correction.

However, bulls quickly recovered as whales bought the dip, and the altcoin’s price went on to touch its all-time high near $5,000 in August 2025.

Recent data shows exchange balances have fallen to multi-year lows, with whales adding to their holdings as retail sells amid broader market panic.

This pattern persists as prices falter in early 2026.

With whales’ buying power intact, current levels are attractive, which has seen entities like Bitmine Immersion Technologies fully take advantage.

The company recently added over 40,600 ETH and currently holds over 4.3 million Ether tokens acquired at an average price of $2,125.

Of this, it has staked over 2.97 million ETH, which accounts for more than 68% of its holdings.

Tom Lee(@fundstrat)’s #Bitmine is still buying $ETH and staking it.

5 hours ago, #Bitmine staked another 140,400 $ETH($282M).

In total, #Bitmine has staked 2.97M $ETH($6.01B), 68.7% of its total holdings.https://t.co/yCucFPLdGs pic.twitter.com/R13lzSIQmE

— Lookonchain (@lookonchain) February 11, 2026

Ethereum price prediction

The crypto fear and greed index hovers in extreme fear territory, which means a short-term bearish outlook.

Ethereum has tapped this sentiment as bulls struggle near $2,000, with the altcoin’s current dollar value more than 60% down since touching the all-time high near $5,000.

On the technical front, prices are below key exponential moving averages (EMAs), and oscillators favour bears.

Ethereum charts formed a death cross in November.

This strengthened on February 5, 2026, when Bitcoin nosedived to $60k, and ETH plummeted past support at $2k to hit new lows near $1,740.

Despite a rebound to above $2k, downward pressure remains, and a pullback to that year-to-date low is possible.

If bears take further control, ETH could target $1,500-$1,300 next.

However, aggressive buying even as ETH falls below realized prices of accumulation addresses indicates a long-term conviction.

Analysts forecast a significant rebound, with institutional demand and network growth driving the next leg up.

On-chain metrics, including ETF inflows, will be key.

Notably, outflows have shrunk since the $1.4 billion in monthly flows exited Ethereum spot ETFs in November 2025, and the current total net assets sit at over $11.7 billion.

Recently, Bitmine’s Tom Lee said he expects a V-shaped recovery for ETH.

Crypto World

How US Investigators Traced $61M in Crypto Linked to Romance Scams

Key takeaways

-

Federal authorities in North Carolina seized more than $61 million in USDT, revealing how pig-butchering schemes combine emotional manipulation with fraudulent crypto investment platforms to defraud victims at scale.

-

Investigators leveraged the public, immutable nature of blockchain records to trace victim deposits across multiple wallets. Despite attempts to obscure the trail, every transfer remained permanently visible and reconstructable.

-

Using blockchain analytics, authorities clustered related addresses based on transaction flows, timing patterns and consolidation points, allowing them to connect dispersed wallets back to the broader scam network.

-

Because the stolen funds were held in USDT, Tether’s ability to freeze tokens at specific addresses upon legal request played a decisive role in preventing the funds from disappearing permanently.

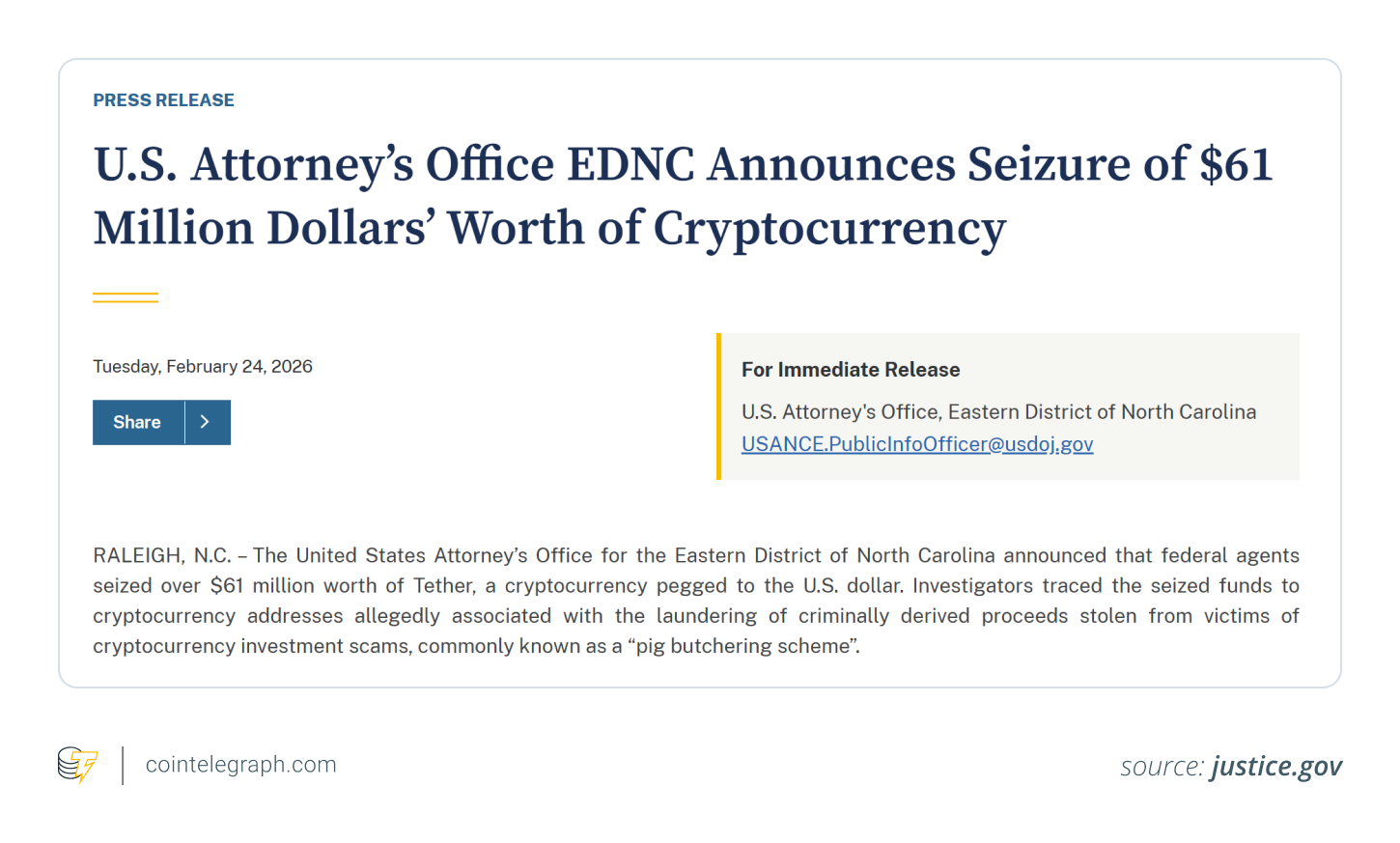

Federal authorities in North Carolina seized more than $61 million in Tether’s USDt (USDT) in February 2026, uncovering the inner workings of a massive cryptocurrency fraud.

The investigation targeted a romance-driven scam, also known as a pig-butchering scam, a deceptive practice in which criminals build romantic trust with victims to lure them into using fraudulent investment apps. While the amount of money recovered was significant, the case stands out for the technical skill investigators displayed. By tracking digital footprints across multiple accounts and decoding complex money laundering tactics, investigators successfully froze the funds before they could disappear.

This article explores how US federal investigators traced and seized funds linked to a romance-driven pig-butchering crypto scam. It details how blockchain forensics, wallet clustering and stablecoin cooperation helped unravel a complex laundering network.

The anatomy of a romance crypto scam

Romance crypto scams begin by grooming victims.

Scammers may pretend to be romantic partners or friendly contacts on social media, dating sites or messaging apps. They spend weeks or months cultivating trust with their victims. They then pitch a unique crypto investment opportunity, often touting insider knowledge or a proprietary trading platform.

Victims are guided to visually appealing but entirely fake crypto websites featuring bogus trading dashboards, phony inflated returns and real-time charts mimicking real exchanges.

Visible “gains” prompt victims to pour in more money. However, when they try to withdraw funds, new demands are made for taxes, fees or additional deposits. Eventually, the accounts are locked completely.

By that point, the money disappears.

Did you know? Blockchain analysis firms can map millions of wallet addresses into clusters using behavioral fingerprints even when criminals try to obscure ownership through rapid transfers.

The $61-million seizure in North Carolina

According to the US Attorney’s Office for the Eastern District of North Carolina, federal authorities seized more than $61 million in USDT connected to a romance-fueled crypto fraud ring.

Homeland Security Investigations (HSI) agents traced victim funds through an intricate network of digital wallets. Scammers had tried to hide the trail by shuffling assets across a number of addresses, a standard crypto laundering technique. However, blockchain’s public, immutable ledger records every transaction permanently.

That transparency ultimately enabled the breakthrough.

How investigators traced the funds

A systematic digital footprint recorded on the blockchain resulted in the $61-million seizure. Law enforcement reconstructed wallet transactions step-by-step, converting publicly available ledger information into solid proof.

Tracing transactions on the blockchain

When victims transferred money to fraudulent accounts, these transactions appeared transparently on the blockchain. Investigators could:

-

Pinpoint the addresses where victims made deposits

-

Monitor follow-up transfers between wallets

-

Map transfer patterns across clusters of interconnected addresses.

While the scammers quickly shifted funds across wallets, the full transaction record remained intact on the blockchain.

Blockchain analytics tools enabled investigators to group wallets based on behavioral patterns such as shared transaction flows, fund consolidation points and timing correlations.

Eventually, investigators were able to zero in on multiple addresses holding significant USDT amounts.

Wallet clustering and laundering patterns

Pig-butchering operations frequently employ multi-tiered transfers:

-

Dividing assets among various wallets

-

Channeling them through intermediary accounts

-

Merging funds into larger storage wallets.

Such tactics aim to create confusion and delay detection, yet they fail to erase the verifiable record.

Through reconstruction of the funds’ path, investigators linked several wallets to the broader fraudulent scheme.

With critical storage addresses confirmed, officials acted swiftly.

Did you know? The US Federal Bureau of Investigation’s Internet Crime Complaint Center (IC3) receives thousands of crypto-related fraud complaints annually, with romance-investment scams ranking among the fastest-growing categories.

Tether’s key role in freezing the assets

Since the stolen funds were held in USDT, a centralized stablecoin, active cooperation from the issuer became essential.

The Department of Justice (DOJ) publicly recognized Tether’s support in transferring and freezing the seized assets. Stablecoin issuers possess the technical capability to immobilize tokens at designated addresses when served with legitimate legal orders.

Tether’s CEO emphasized that the inherent transparency of blockchain allows law enforcement to respond swiftly and decisively to illicit activity.

This case highlights that although cryptocurrency transactions operate on decentralized networks, many stablecoins maintain centralized control features that authorities can invoke during investigations.

Cooperation by the issuer can play a major role in whether victims are able to recover their funds.

Did you know? Some pig-butchering operations are run from large overseas compounds where victims of human trafficking are forced to carry out online scams under coercion.

The escalating wave of crypto fraud

The $61-million seizure is far from an isolated incident.

Crypto scams have exploded in both volume and complexity. According to industry analyses, total losses from cryptocurrency fraud approached about $17 billion in 2025, with AI-enhanced impersonation schemes showing especially sharp year-on-year growth.

Pig-butchering operations stand out as particularly destructive due to their combination of:

-

Psychological manipulation and trust-building

-

Extended grooming periods

-

Aggressive, high-stakes investment pressure

-

Sophisticated, professionally designed fraudulent platforms.

In many instances, perpetrators have begun using AI-generated images and deepfake videos to bolster their credibility and deceive victims more effectively.

Judicial responses have grown markedly tougher. In early 2026, a central participant in a pig-butchering-related money laundering network tied to more than $73 million in illicit funds received a 20-year federal prison sentence. This signaled the heightened priority authorities now place on dismantling these schemes.

Why blockchain transparency is a game-changer

This investigation challenges a widespread myth that cryptocurrency transactions are impossible to trace.

While privacy-focused coins and mixing services do exist, the vast majority of widely used cryptocurrencies, including Bitcoin (BTC) and Ether (ETH), run on fully public blockchains. Every transaction is permanently recorded on an open, immutable ledger.

For law enforcement and investigators, this transparency delivers powerful advantages:

-

Complete, permanent visibility into historical transaction flows

-

Advanced wallet clustering to link related addresses

-

The ability to cross-reference blockchain data with Know Your Customer (KYC) records from regulated exchanges

-

Detection of behavioral patterns that span multiple networks.

The moment illicit funds interact with compliant exchanges, custodial services or other identifiable entities, the odds of connecting anonymous wallets to real individuals rise dramatically.

Why crypto price volatility doesn’t shield criminals

A related myth holds that perpetrators can simply “wait out” authorities by parking stolen funds in volatile assets until scrutiny fades.

In this seizure, however, the funds were held in a dollar-pegged stablecoin, USDT. That price stability protects the value of the stolen assets, but it also keeps them firmly within the traceable realm.

Because blockchain records are permanent and publicly queryable, investigators can patiently reconstruct cases over months or even years. The digital trail typically remains available indefinitely, allowing authorities to return and execute seizures long after the initial crime occurred.

What this means for scam victims

For individuals targeted by romance-driven crypto scams, recovering stolen money remains an uphill battle.

Once funds reach self-custodied wallets under the scammers’ control, successful recovery hinges on several critical factors:

-

Prompt reporting by victims as soon as the fraud is suspected

-

Strong coordination among law enforcement agencies across countries

-

Active participation from cryptocurrency exchanges

-

The ability of stablecoin issuers to freeze assets on short notice.

The $61-million seizure in North Carolina shows that significant recoveries are achievable. However, they demand tight collaboration between victims, federal investigators, blockchain forensic specialists and compliant crypto companies.

The shifting landscape of crypto enforcement

This high-profile seizure reflects a clear evolution in how authorities handle cryptocurrency crime:

-

Law enforcement teams are steadily improving their expertise in blockchain tracing techniques.

-

Major stablecoin issuers are showing greater willingness to assist in active criminal probes.

-

Judges and prosecutors are handing down substantially longer prison terms to participants in large-scale fraud and money laundering networks.

While pig-butchering schemes continue to grow more advanced and deceptive, investigative tools and international partnerships are advancing at a comparable pace.

The main question is no longer whether cryptocurrency transactions can be traced. The real challenge now is speed. The question is how fast authorities and their partners can freeze and seize assets before the funds are scattered across unreachable wallets or jurisdictions.

Crypto World

Crypto-friendly fintech giant Revolut files for U.S. banking license

Revolut, the U.K. fintech giant that offers crypto trading, filed an application for a U.S. banking license with the Office of the Comptroller of the Currency (OCC), a key step in its push to expand in the American financial system.

If approved, the license would allow the London-based company to operate more like a traditional bank in the world’s largest economy. The company said it would gain direct access to payment networks such as Fedwire and the Automated Clearing House (ACH), systems that move trillions of dollars between banks each year.

A license could also open the door to lending products, including credit cards and personal loans. Today, Revolut offers banking services in the U.S. through Lead Bank, a Kansas City-based partner. That arrangement allows it to provide accounts and payments without holding its own charter.

The filing comes after Revolut dropped its plans to buy a U.S. bank in January to instead get a de novo banking license, which allows banks to start up from scratch.

It also comes a day after Kraken became the first cryptocurrency exchange to secure a Federal Reserve “master account,” which gives its banking arm direct access to the Fed’s core payment system.

Revolut, valued at about $75 billion, has said the U.S. market is central to its goal of building a global digital bank. Approval of a charter would mark one of the company’s biggest regulatory milestones outside Europe.

The crypto-friendly bank secured a restricted U.K. banking license in 2024 and holds banking licenses elsewhere. It isn’t a bank, however, in every region where it operates.

Crypto World

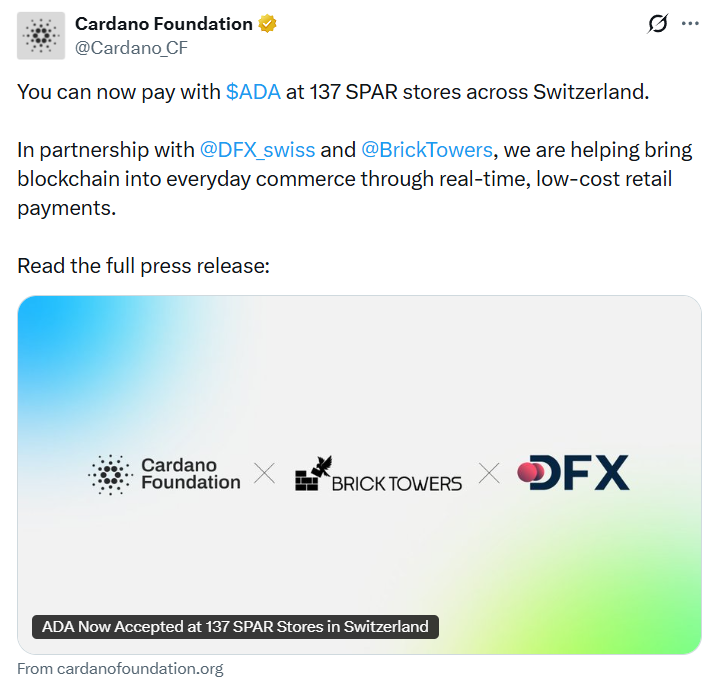

Cardano Now Accepted at 137 Spar Stores Across Switzerland

Cardano (CRYPTO: ADA) users can now pay for groceries at Spar stores in 137 locations across Switzerland, following a new Open Crypto Pay integration from Swiss fintech DFX.swiss, announced this Thursday by the Cardano Foundation. The arrangement allows real-time processing and direct wallet-to-wallet settlements for ADA payments, avoiding routing through centralized exchanges. For merchants, the system promises a significant reduction in processing costs—about two-thirds lower than traditional card networks—marking a practical step in Switzerland’s broader exploration of crypto-friendly retail infrastructure. The rollout adds to Spar’s evolving strategy to mix everyday shopping with digital asset conveniences as the country presses ahead with its hub ambitions.

In a broader sense, the move underscores Switzerland’s ambition to become a global hub for crypto and blockchain activity, moving beyond experimental trials toward widespread financial use cases. Open Crypto Pay’s architecture is designed to keep value transfers on-chain between ADA wallets, minimizing friction for consumers and merchants alike. The Cardano Foundation highlighted the initiative as a meaningful milestone in the ongoing maturation of the crypto sector, framing it as a shift in how value moves through society rather than a standalone pilot.

Executives at Spar have signaled that the integration builds on an earlier sweep of crypto payments. In August 2025, Spar rolled out nationwide crypto and stablecoin payments across 100 stores through partnerships with Binance Pay and DFX.swiss, with an objective to scale to about 300 stores. The latest expansion to 137 locations represents a continuation of that program, leveraging ADA and the broader Swiss crypto ecosystem to facilitate practical, everyday use of digital assets at the point of sale. Cardano’s presence in retail is not merely symbolic; it is designed to demonstrate real-time settlement and customer usability in a familiar shopping context.

Cardano Foundation Chief Executive Frederik Gregaard described the milestone as the “beginning of a fundamental shift in how value moves through society,” signaling a transition from experiments to genuine financial transformation. The aspirational framing reflects a broader narrative in which blockchain networks step out of early-stage pilots and into mainstream commerce, with merchants and customers sharing a common, largely seamless digital payment experience. The Cardano Foundation’s social post (via its official X account) underscored the collaboration as a proof point for real-world utility rather than a theoretical construct.

From a technical standpoint, the Open Crypto Pay integration is engineered to process transactions in real time and to enable payments directly from ADA wallets. That direct wallet-to-wallet flow helps avoid routing through centralized exchanges, which in turn can reduce liquidity constraints and settlement times for merchants. The cost advantage cited by Spar—roughly two-thirds lower transaction costs compared with traditional card schemes—could incentivize additional retailers to explore crypto rails as a cost-control measure while expanding consumer options for crypto payments in everyday shopping contexts.

Beyond Spar’s retail commitments, Switzerland’s crypto ambitions dovetail with broader regional momentum. Lugano, a city often cited as a pioneer in integrating digital assets into municipal life, is receiving new support from Tether. On Tuesday, Tether and the city announced a CHF 5 million ($6.4 million) commitment to a second phase of Lugano’s Plan B forum, set to run from 2026 through 2030. The aim is to position Lugano as a global hub for digital asset infrastructure, with ongoing projects focused on policy, infrastructure, and use-case deployments that blend fiat currency with digital assets in public services and commerce.

That momentum is complemented by Lugano’s existing experiments with asset-native payments. Residents can already pay certain municipal fees in Bitcoin (BTC) and USDt (USDT), an approach that integrates digital assets into local governance and services in a tangible way. The town’s efforts are part of a broader Swiss trend toward regulatory clarity and practical usage scenarios for crypto, which includes ongoing discussions about tax information sharing and compliance timelines in the country. The Swiss crypto tax landscape has evolved in recent years, and policy developments continue to influence how institutions and municipalities approach digital assets in everyday life.

Taken together, the Spar ADA rollout and Lugano’s Plan B initiative illustrate how Switzerland is attempting to bridge high-profile blockchain research with concrete commercial and civic applications. The Cardano Foundation’s involvement in Spar’s rollout signals a push to test not just the acceptance of ADA as a payments instrument but also the viability of a broader, open-pay ecosystem that prioritizes on-chain settlement, user control of funds, and cost efficiencies for merchants. If successful, this model could serve as a template for other retailers and municipalities seeking to blend digital assets with real-world value transfer in a regulated, consumer-friendly manner.

Why it matters

Retail adoption of crypto rails in Switzerland highlights a growing appetite among merchants to diversify payment methods beyond traditional card networks. By enabling ADA payments at Spar, the case demonstrates that digital assets can provide tangible benefits—faster settlements, lower fees, and greater control over funds—without sacrificing convenience for shoppers. The direct wallet-to-wallet approach reduces exposure to centralized custodians, potentially improving transparency and security in everyday transactions.

For the Cardano ecosystem, the Spar collaboration provides a real-world reference point for ADA’s utility beyond speculation. The emphasis on real-time processing and on-chain settlement aligns with Cardano’s broader mission of delivering scalable, sustainable blockchain solutions for mainstream use. As regulatory clarity improves and user experience grows more seamless, ADA and other digital assets could increasingly appear in ordinary retail environments, expanding the repertoire of payment choices available to consumers and businesses alike.

From a macro perspective, Switzerland’s ongoing crypto strategy—coupled with Lugano’s municipal experiments—suggests a broader trend toward integrating digital assets into public life. The Lugano funding, alongside ongoing tax and regulatory discussions, underscores a coordinated approach to creating ecosystems that can attract investment, talent, and technology providers while maintaining consumer protections and compliance. If such initiatives gain traction, they could influence how other European cities and regions design their own crypto-friendly frameworks, potentially shaping liquidity flows, user adoption curves, and the pace at which retailers are willing to experiment with digital payments.

What to watch next

- Spare expansion plans: Will Spar scale ADA acceptance from 137 stores toward the previously stated target of 300 locations?

- Regulatory developments in Switzerland: How will tax information-sharing timelines and disclosure rules evolve, and what impact might that have on crypto retail pilots?

- Lugano’s Plan B progress: What concrete milestones arise in Phase II (2026–2030), and how will they shape infrastructure for digital assets in public services?

- Additional retail partners: Which other Swiss retailers or European merchants might adopt Open Crypto Pay or similar wallets-first rails?

Sources & verification

- Official Cardano Foundation announcement and Cardano Foundation blog post detailing ADA acceptance at Spar Switzerland.

- DFX.swiss press materials describing the Open Crypto Pay integration and real-time wallet-to-wallet settlement.

- Spar’s August 2025 rollout of crypto and stablecoin payments across 100 stores via Binance Pay and DFX.swiss, with expansion plans to 300 stores.

- Tether and Lugano Plan B forum funding announcement for CHF 5 million to advance Lugano’s digital asset infrastructure program.

- Public statements on Lugano’s acceptance of BTC and USDT for municipal payments and related coverage of Switzerland’s crypto regulatory developments.

Key figures and next steps

Market reaction and key details

The Swiss initiative continues to attract attention as a testbed for mainstream crypto payments, with Cardano positioning itself as a practical vehicle for real-world value transfer. If the real-time, wallet-based payment model proves scalable and cost-effective, it may encourage broader merchant adoption across retailers and municipal services in Switzerland and beyond.

Why it matters

For users and investors, the expansion of ADA into everyday shopping environments underscores ADA’s potential as a usable digital asset rather than a speculative instrument. For builders and developers, the emphasis on on-chain settlement and merchant economics points to design principles that prioritize user experience and cost efficiency. For policymakers, the evolving landscape offers concrete data points on how digital assets can integrate with regulatory frameworks and public services while maintaining consumer protections.

Tickers mentioned: $ADA, $BTC, $USDT

Sentiment: Neutral

Market context: The push to embed crypto payments in retail and municipal services reflects a wider trend toward asset-native finance and on-chain settlement, compatible with regulatory progress and institutional interest in crypto infrastructure.

What to watch next

- Expansion milestones for Spar’s ADA payments and any new store openings or regional rollouts.

- Regulatory updates on Swiss tax information sharing and compliance requirements for crypto pilots.

- Progress on Lugano’s Plan B Phase II initiatives and how they influence regional crypto ecosystems.

Sources & verification

- Cardano Foundation announcement regarding ADA acceptance at Spar Switzerland.

- DFX.swiss Open Crypto Pay integration details and real-time settlement capabilities.

- Spar’s 2025 rollout news and store expansion plans.

- Tether and Lugano Plan B funding announcement for CHF 5 million.

- Reports on Lugano accepting BTC and USDT for municipal payments and Switzerland’s crypto tax discussions.

Retail rails for ADA in Swiss supermarkets signal broader crypto hub ambitions

Switzerland’s ongoing experimentation with crypto payments at the point of sale is moving beyond isolated pilots toward broader retail adoption. Spar’s 137-store ADA payments rollout, enabled by Open Crypto Pay and anchored by the Cardano Foundation, exemplifies a practical pathway for mainstreaming digital assets in everyday commerce. By delivering real-time settlement and wallet-to-wallet transactions, the initiative reduces dependence on centralized exchanges and cuts transaction costs for merchants—a meaningful consideration as retailers weigh new payment rails in a cost-conscious environment.

The collaboration also ties into Lugano’s broader strategy to become a global hub for digital asset infrastructure, reinforced by a CHF 5 million commitment from Tether to support the Plan B program through 2030. That funding, paired with Lugano’s existing acceptance of BTC and USDT for municipal duties, signals a coordinated effort to blend public governance with cutting-edge payment rails. If these pilots prove sustainable, they could catalyze similar initiatives across Switzerland and the broader European region, encouraging more retailers to pilot crypto-friendly checkout flows and more cities to explore asset-backed services in daily life.

Crypto World

Altcoin ETF Surge: SOL and XRP Pull $23M as Institutions Diversify

Institutional capital is widening its net and causing a surge in altcoin ETF inflows.

On March 4, Crypto ETFs tracking alternative assets recorded significant activity, with Solana Inflows hitting $19.06 million and XRP products securing $4.19 million in net entries, according to SoSoValue.

While Bitcoin continues to command the lion’s share of volume, this $23.25 million combined allocation signals that active managers are beginning to diversify aggressively beyond the market leader. No retail hype cycle. Just size moving in.

- Solana Leads Alts: Solana (SOL) ETFs recorded $19.06 million in net inflows on March 4, establishing dominance among non-ETH altcoin products.

- XRP Accumulation: XRP funds attracted $4.19 million, confirming steady XRP Institutional demand despite broader market volatility.

- Diversification Signal: The simultaneous inflows into SOL and XRP suggest institutional portfolios are increasingly rotating into high-utility Layer 1 assets.

Discover: The best meme coins on Solana

Solana ETFs: Does $19.06M Inflow Signal Future Stablecoin and Tokenization Demand?

Solana (SOL) is seeing a specific type of bid. The $19.06 million net inflow recorded on March 4 represents one of the strongest daily sessions for the asset since approvals normalized.

This isn’t just speculative rotation; it aligns with the growing narrative of Solana as the preferred infrastructure for institutional tokenization, backed by heavyweights like Franklin Templeton and BlackRock.

The flow data suggests that institutions are pricing in value beyond simple store-of-wealth mechanics.

Unlike the Bitcoin ETFs and MicroStrategy demand surge that focuses on scarcity, Solana Inflows are chasing yield and transaction velocity.

The network’s multibillion-dollar Total Value Locked (TVL) and record stablecoin volume continue to challenge Ethereum’s dominance, providing a fundamental floor for these investment products.

Technicals are responding to the flow. Solana is approaching another important level that could point to an explosive price prediction if these inflows sustain.

Watch the $158 level closely. If ETF buyers continue to soak up daily issuance and push the price above this resistance, a run toward $185 becomes the high-probability scenario. If flows dry up and price rejects, support at $138 must hold to preserve the bullish structure.

XRP Inflows: $4.19M Hints at Growing Support for Ripple’s Institutional-Grade Payments Infrastructure

XRP (XRP) is carving out its own lane. The $4.19 million inflow on March 4 might look small compared to Bitcoin’s billions, but for an altcoin asset class, it represents sustained conviction.

Following the approval of spot XRP exchange-traded funds in the U.S., the asset has transitioned from a retail-heavy volatility play to a component of diversified institutional portfolios.

The thesis here is utility. Investors are positioning for Ripple’s RLUSD stablecoin integration and the broader adoption of the XRP Ledger (XRPL) in cross-border settlements.

XRP Institutional interest is less about quick flips and more about long-term infrastructure bets. The capital entering these funds is sticky; it doesn’t tend to panic sell on minor dips.

Altcoin ETF Institutional Adoption: The Diversification Thesis

The March 4 data paints a clear picture: the “Bitcoin-only” era of institutional crypto is ending.

While Bitcoin remains the primary allocation, the simultaneous bid for SOL, XRP, and the massive $169.4 million into the Ethereum ETF sector indicates a maturing strategy. Institutions are effectively building a crypto-native index, weighting assets by sector dominance rather than just market cap.

This mimics movements seen in traditional finance. Just as Harvard picks ETH and trims Bitcoin ETF exposure, other large allocators are rebalancing to capture the upside of technological utility.

Institutional Adoption is moving down the risk curve. They aren’t gambling on memecoins; they are buying the protocols that run the new financial internet.

Watch the flow ratios next week. If the ratio of Altcoin ETF inflows to Bitcoin ETF inflows continues to rise, we are officially in a structural rotation. If Bitcoin dominance reasserts itself heavily, this was just a brief pause in the king’s rally.

Discover: The best crypto to buy today

The post Altcoin ETF Surge: SOL and XRP Pull $23M as Institutions Diversify appeared first on Cryptonews.

Crypto World

Bitcoin’s (BTC) drawdown hasn’t shaken institutional investors yet, says CoinShares

The first phase of bitcoin’s recent drawdown has not triggered panic among institutional investors, according to crypto asset management firm CoinShares.

Professional allocators reduced exposure modestly but largely maintained their positions compared with last year. Advisors trimmed holdings while hedge funds scaled back alongside the broader leverage unwind and shifting opportunities in other markets, the crypto investment manager said in a Tuesday report.

Longer-duration investors kept accumulating. “Endowments, pensions, and sovereigns continued to build quietly,” wrote analyst Matt Kimmell.

Bitcoin has struggled to regain momentum since hitting a record high near $125,000 in early October. The world’s largest cryptocurrency was trading around $72,370 at publication time.

Crypto markets have delivered muted performance in recent months as a mix of macro and market-specific pressures weighed on prices. Higher interest rates and a stronger dollar have dampened appetite for risk assets, while leveraged positions built earlier in the rally have been unwound. At the same time, profit-taking from long-term bitcoin holders and uneven flows into spot exchange-traded funds (ETFs) have limited momentum, leaving the sector struggling to regain a sustained upward trend.

Despite bitcoin falling about 23% during the period, global bitcoin ETF flows remained positive, suggesting the sell-off in the fourth quarter was driven more by long-time holders taking profits than by new institutional money exiting the market, Kimmell said.

Historically, crypto bear markets have redistributed supply from short-term traders to long-term holders. According to Kimmell, the emergence of ETFs now offers a new way to observe whether institutional capital follows the same pattern.

So far, the data points in that direction. A roughly 25% quarterly drawdown did not trigger broad institutional capitulation, the report said, with most declines in assets under management reflecting price moves rather than large investor outflows.

Still, CoinShares cautioned that the sample size remains small. The firm said the real test may appear in upcoming regulatory filings, which will capture institutional behavior during sharper moves, including bitcoin’s slide toward $60,000 and a single-day 17% drop.

Bitcoin and the broader crypto market moved higher this week, rebounding after weeks of choppy trading. The rally was driven in part by renewed risk appetite across markets and steady demand for bitcoin ETFs, helping the largest cryptocurrency regain momentum and lift major altcoins alongside it. Traders also pointed to short covering and positioning resets following the recent sell-off as factors behind the move.

Read more: CEO of crypto investment firm Keyrock says bitcoin is undervalued, entering ‘transition year’

Crypto World

Revolut Files for US Bank Charter and Names Former Visa Executive Cetin Duransoy as New US CEO

TLDR:

- Revolut has filed for a US bank charter with the OCC and FDIC to offer full banking services in America.

- Former Visa executive Cetin Duransoy has been named Revolut’s new CEO for United States operations.

- Revolut plans to invest $500 million in the US over three to five years covering capital, marketing, and hiring.

- Revolut’s global valuation reached $75 billion following a secondary share sale completed in November 2024.

Revolut has officially filed for a U.S. bank charter, marking a major move into the American financial market. The British fintech giant also named former Visa executive Cetin Duransoy as its new United States CEO.

With around 70 million clients across 40 markets, Revolut is targeting the U.S. as a core part of its global expansion.

The applications have been submitted to the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation for review.

Revolut Eyes US Banking Approval to Expand Financial Services

If regulators approve the applications, Revolut plans to gather deposits and issue loans in the U.S. The company also intends to offer credit cards and facilitate payments for American customers.

This would represent a full-scale banking operation, moving beyond its current limited U.S. presence. Revolut currently serves American users primarily through payment and foreign exchange services.

Revolut founder and CEO Nik Storonsky made the company’s intentions clear in a recent statement. “The United States is a key pillar of our global growth strategy,” Storonsky said.

He added that a stronger U.S. presence is necessary to reach 100 million global customers. The company is expected to invest $500 million in the U.S. over the next three to five years.

That $500 million figure covers bank capital, marketing, and new hiring across the country. Outgoing U.S. CEO Sid Jajodia confirmed the investment scope in a recent interview.

Jajodia will transition into a global chief banking officer role as Duransoy steps in. Duransoy’s background at Visa brings strong financial industry experience to Revolut’s U.S. operations.

Revolut’s strategy involves attracting users first as a secondary bank account. Services like payments and foreign exchange act as entry points for new customers.

Over time, the company woos users with perks and subscription-based offerings. This model has already proven effective across Europe and other international markets.

Revolut’s US Push Comes Amid Growing Neobank Competition

Revolut is not alone in pursuing a U.S. banking license among global neobanks. Brazil’s Nubank is currently awaiting full approval for its own U.S. banking license.

Spain’s Santander launched a digital bank in the U.S. in 2024 and recently announced an acquisition. These moves show that international digital banks are actively competing for U.S. customers.

To raise brand awareness in the U.S., Revolut plans to pursue sponsorship opportunities. The company already sponsors the Audi Formula 1 team, soccer clubs, and music festivals globally.

Similar partnerships in the U.S. could help boost its visibility among American consumers. Marketing investment is built into the $500 million U.S. spending plan.

On the topic of a potential IPO, Jajodia declined to comment on any timeline. He noted that private market capital remains available and accessible for the company.

Revolut completed a secondary share sale in November, valuing the company at $75 billion. That valuation places Revolut among the most valuable private fintech companies in the world.

Revolut’s U.K. bank continues to operate under some restrictions during a mobilization phase. The restrictions are tied to the bank’s size as it scales its operations.

However, the company appears focused on moving forward with its international growth plans. The U.S. charter application is the clearest sign yet of that ambition.

Crypto World

New Berkshire Hathaway CEO still talks with Warren Buffett nearly every day

Berkshire Hathaway CEO Greg Abel said he still speaks with Warren Buffett nearly every day, underscoring the continued presence of the legendary investor at the sprawling conglomerate, even after handing over the top job at the start of the year.

Buffett, who stepped down as CEO after more than six decades at the helm, remains chairman of the Omaha-based company and continues to come into the office regularly, Abel said.

“He’s in the office every day, so we’re talking every day if I’m in Omaha, we’re always connecting,” Abel said on CNBC’s “Squawk Box” Thursday. “If I’m traveling, like I was yesterday, I often check in just to catch up on what he’s seeing, what he’s hearing, what am I feeling. So if it’s not every day, it’s every couple days.”

Abel also acknowledged the challenge of stepping into Buffett’s role as Berkshire’s chief communicator to shareholders, particularly when writing his first annual letter to investors.

“The shoes to fill are tough on all fronts, but Warren is an exceptional communicator,” Abel said. “It was not easy. I’ve told Warren, ‘listen, the responsibilities transferred are great, but as far as the work and the task I had to do, that was the toughest.’”

Abel used the letter to shareholders to outline a clear framework of foundational values centered on financial strength and disciplined investing, vowing to preserve the blueprint Buffett carefully orchestrated since the 1960s.

Buffett offered little comfort, Abel added with a laugh. “When we were discussing it, he said, ‘the second letter doesn’t get any easier.’”

On investing, Abel said Berkshire is unlikely to move into cryptocurrencies, echoing Buffett’s longstanding skepticism of the asset class.

“I don’t think you’ll see crypto … I just don’t see it,” Abel said.

He left the door open to investments tied to technology, however.

“What I do see is that when it comes to technology, even from an operational perspective, where we’re seeing how we use it, the impact it’s having, it does allow us to develop strong views and a better knowledge base around certain companies that are technology companies, or how we’re using the technology. So technology will always be on the table,” Abel said.

Crypto World

ETH, XRP, ADA, BNB, and HYPE

This Thursday, we examine Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid in greater detail.

Ethereum (ETH)

With $2,000 support secured, Ethereum has a good shot at testing the $2,400 resistance in the near future. This also allowed the price to close the week with a 2% gain.

The current PA shows a clear reversal pattern, with a bullish engulfing candle indicating buyers are back in control. To secure their dominance, they will need to break above $2,400 as well.

Looking ahead, the most important resistance on the chart is found at $2,800. Thus, bulls may be able to keep Ethereum in a rally until then. Once there, sellers could return in force.

Ripple (XRP)

XRP turned bullish this week and reclaimed the $1.4 support level. While the price fell by a modest 2% compared to last week, the recent buying spree sends a strong bullish signal to market participants.

The most important resistance point is at $1.6, which will need to become support if buyers want to keep XRP in a sustained uptrend. Any weakness there will quickly be exploited by sellers.

Looking ahead, after a prolonged downtrend, this cryptocurrency is finally giving signs that the selloff may be behind us and a recovery is likely.

Cardano (ADA)

Cardano had a difficult start this week, falling by 7%. Buyers tried multiple times to reclaim the support at 28 cents, but each time they were rejected, including this week. This is a sign of weakness.

As long as ADA keeps failing to move above 28 cents, it is unlikely for any bullish momentum to form. Should selling intensify, the price may fall to 24 cents again, as it did earlier this year.

Looking ahead, this cryptocurrency is in a tough spot. While most altcoins are giving signs of a reversal, Cardano still lags behind its peers. Hopefully, this will change soon and push the price back into an uptrend.

Binance Coin (BNB)

Binance Coin moved higher by 4% this week after buyers defended the $580 support well. Their current target is the resistance at $690, which may be challenging to break through, given the previous price action.

Even if sellers attempt to defend the current resistance, bullish momentum is intensifying and may be enough to drive a quick relief rally towards $900.

Looking ahead, BNB has a clear shot at a rally in the weeks to come, considering that since late 2025, the price has been in a downtrend. A sustained rally appears likely and may be quite significant.

Hype (HYPE)

HYPE closed the week 12% higher and reclaimed a price above the key $30 support. As long as the price holds above this level, the bulls have the upper hand, and they may aim to break the resistance at $36 next.

While the momentum is bullish, there is a bit of lag since the price moved above $30. This should not last long since it would encourage sellers to return and put pressure on that support again.

Looking ahead, HYPE needs to break the $36 resistance to maintain a bullish bias in the coming weeks. Hopefully, buying volume will increase to sustain the current move into higher highs.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Cardano Gets Real-World Checkout Rails in 137 Swiss Spar Stores

Supermarket giant Spar has enabled ADA payment rails for customers in 137 Swiss stores, as the country moves closer to its global crypto hub ambitions.

Switzerland’s push as a crypto-friendly hub is getting a new retail test case, with Cardano’s ADA token now usable for grocery purchases at Spar stores across the country.

Cardano (ADA) users can start paying for their groceries in 137 Spar supermarkets across Switzerland after the latest Open Crypto Pay integration from Swiss fintech firm DFX.swiss, the Cardano Foundation said Thursday.

The system is designed to process transactions in real time and allow payments directly from ADA wallets without routing through a centralized exchange. For merchants, Open Crypto pay reduces transaction costs by about two-thirds compared to traditional cards, according to the announcement.

Frederik Gregaard, the CEO of the Swiss-based Cardano Foundation, called the development the “beginning of a fundamental shift in how value moves through society,” which marks the blockchain industry’s transition from an experimental phase to “genuine financial transformation.”

Spar first rolled out nationwide crypto and stablecoin payments in Switzerland in August 2025 for 100 stores via Binance Pay and DFX.swiss, with plans at the time to extend to 300 stores.

Related: Switzerland delays crypto tax info sharing until 2027

Tether, Lugano commit $6.4 million to global crypto hub ambitions

Separately, on Tuesday, Tether and the city of Lugano committed 5 million Swiss francs ($6.4 million) to a second phase of the city’s Plan B forum between 2026 and 2030, which aims to make Lugano a “global hub for digital asset infrastructure.”

Lugano has already allowed residents to pay certain municipal fees in Bitcoin (BTC) and USDt (USDT) as part of an effort to embed digital assets into the local economy.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

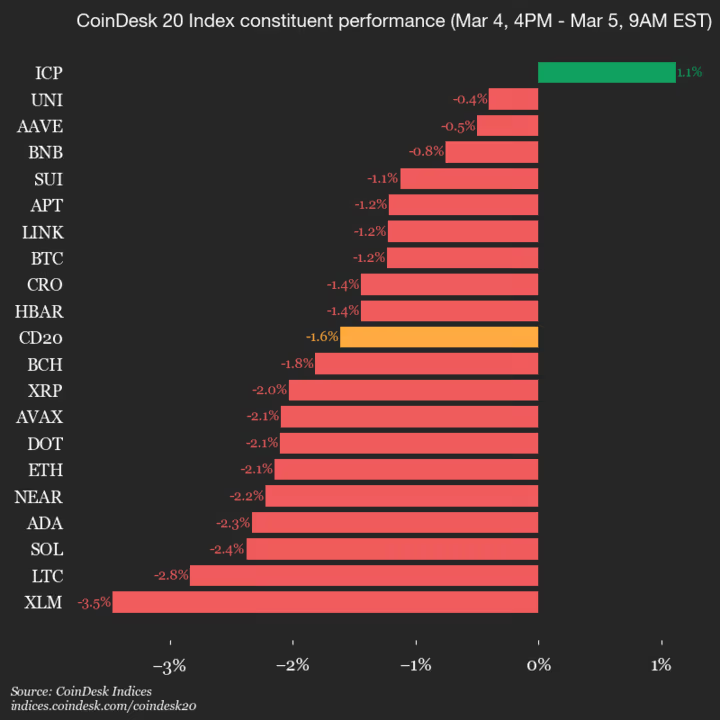

Stellar (XLM) drops 3.5% as nearly all assets decline

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 2064.51, down 1.6% (-33.92) since 4 p.m. ET on Wednesday.

One of 20 assets is trading higher.

Leaders: ICP (+1.1%) and UNI (-0.4%).

Laggards: XLM (-3.5%) and LTC (-2.8%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

Tech9 hours ago

Tech9 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World7 days ago

Crypto World7 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business7 days ago

Business7 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes

Spot ETF Flows: BTC, ETH, SOL and XRP spot ETFs saw net inflows on Mar. 4.

Spot ETF Flows: BTC, ETH, SOL and XRP spot ETFs saw net inflows on Mar. 4.