Crypto World

Ethereum price risks capitulation below $1,800 as high-volume support weakens

Ethereum’s price is consolidating at a critical high-volume support near $1,800, but fading bullish participation raises the risk of a deeper corrective move and potential capitulation to the downside.

Summary

- $1,800 point of control is weakening, increasing downside vulnerability

- Sideways price action lacks bullish volume, signaling distribution risk

- Loss of support could trigger capitulation, toward the value area low

Ethereum (ETH) price action is approaching a pivotal moment as it continues to trade around a major support zone defined by the point of control (POC) near $1,800. This level represents the area of highest traded volume in the current range and has acted as temporary support following the recent sell-off. However, despite holding this zone for several sessions, Ethereum has failed to produce a convincing bullish continuation on the daily timeframe.

As consolidation drags on and volume weakens, concerns are growing that this pause may not represent accumulation, but rather distribution before another leg lower. If Ethereum fails to defend this high-volume support on a closing basis, the probability of a capitulation-style move increases.

Ethereum price key technical points

- Point of control near $1,800 is under pressure, acting as the last major high-volume support

- Daily consolidation shows weak follow-through, signaling fragile demand

- Loss of support opens downside toward the value area low, aligned with Fibonacci extension targets

Ethereum’s current behavior around $1,800 is technically significant. While price has not yet broken down, the lack of upward follow-through following the initial bounce is a warning sign. In strong reversals, consolidation at support is typically accompanied by expanding bullish volume and higher daily closes. Instead, Ethereum has spent multiple sessions moving sideways, suggesting that buyers are struggling to regain control.

This type of price action often precedes continuation moves rather than reversals. When markets consolidate at high-volume nodes without renewed demand, the likelihood increases that support will eventually give way as sellers absorb remaining bids.

Volume profile highlights lack of bullish commitment

From a volume profile perspective, Ethereum’s current bounce lacks conviction. Bullish volume has steadily declined since price first reacted from the $1,800 region, indicating that buying interest is not strong enough to sustain a meaningful recovery. This imbalance between price stabilization and falling volume often points to exhaustion rather than strength.

As a result, the current structure resembles a pause within a broader corrective trend rather than a base for reversal. Without a clear volume expansion, Ethereum remains vulnerable to renewed selling pressure.

Capitulation risk grows below the point of control

The point of control often acts as a stabilizing force during consolidation phases. However, once the price loses the POC on a daily closing basis, it typically signals a shift from balance into imbalance. In Ethereum’s case, such a move would likely trigger an acceleration lower as price seeks the next major area of acceptance.

Below the current range, the next key target sits at the value area low, which aligns with the 1.618 Fibonacci extension of the current downside move. This zone represents a classic capitulation target, where emotional selling and liquidity sweeps often occur before markets attempt to form durable bottoms.

A move into this region would not necessarily imply long-term bearish continuation. Instead, it could represent the final stage of the current corrective cycle, flushing weak positioning and resetting market structure.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Ethereum is at a make-or-break level. Continued consolidation without bullish expansion increases the probability that the $1,800 support will eventually fail. A confirmed daily close below the point of control would significantly raise the risk of a capitulation move toward the value area low.

For the bearish scenario to be invalidated, Ethereum would need to reclaim higher value levels with strong volume and demonstrate sustained acceptance above current resistance. Until that occurs, downside risk remains elevated.

Crypto World

Crossover Markets Closes $31M Series B at $200M Valuation With Tradeweb Leading the Round

TLDR:

- Crossover Markets closed a $31M Series B round at a $200M valuation, led by Tradeweb Markets.

- Tradeweb will route institutional spot crypto orders to CROSSx using algorithmic order-routing tech.

- CROSSx has matched over $50 billion in notional volume across 12 million trades since its launch.

- Investors include Ripple, Virtu Financial, Wintermute Ventures, XTX Markets, and DRW Venture Capital.

Crossover Markets has closed a $31 million Series B funding round at a $200 million valuation. Tradeweb Markets led the round, joined by DRW Venture Capital, Illuminate Financial, Ripple, Virtu Financial, Wintermute Ventures, and XTX Markets.

The investment strengthens CROSSx, an execution-only cryptocurrency electronic communication network. Through the deal, Tradeweb will route institutional spot crypto orders to the platform.

This partnership reflects the growing convergence between traditional finance and digital asset trading infrastructure.

Tradeweb Partnership Brings Institutional Crypto Access to Global Clients

Tradeweb plans to connect its global clients to Crossover’s institutional spot crypto liquidity. It will use its algorithmic order-routing technology to direct trades to CROSSx.

This move marks Tradeweb’s formal entry into institutional crypto markets. The integration combines CROSSx’s microsecond matching speed with Tradeweb’s established global distribution network.

Crossover Markets CEO Brandon Mulvihill welcomed the development with a clear statement of intent.

“We are pleased to announce our Series B financing and are grateful to both our existing and new investors, whose support is a testament to the transformative role CROSSx is playing in the digital asset ecosystem.” — Brandon Mulvihill, Co-Founder and CEO, Crossover Markets

Mulvihill further noted that institutions are demanding speed, transparency, and efficiency similar to traditional markets. He added that few Wall Street leaders understand those standards better than Tradeweb.

Combining CROSSx’s single-digit microsecond matching with Tradeweb’s global reach marks a significant step forward. He also stressed that clear separation of duties remains fundamental to sound market structure.

Tradeweb CEO Billy Hult echoed that view, framing the deal as a natural progression.

“This collaboration marks Tradeweb’s entry into institutional crypto, a natural next step in our multi-asset strategy. Institutional investors are increasingly turning to crypto to express macro views and manage risk in a 24/7 global market.” — Billy Hult, CEO, Tradeweb

Hult added that as adoption grows, markets now require trusted, institutional-grade infrastructure. The planned integration aims to extend Tradeweb’s electronic execution standards into the crypto space.

Clients can expect the liquidity, transparency, and discipline Tradeweb is known for delivering. That commitment aligns directly with what CROSSx was built to provide.

Crossover also shared its excitement across social media, reinforcing the milestone.

“This milestone marks the continued convergence of traditional finance and digital assets.” — Crossover Markets (@crossover_mkts)

Proceeds to Fund Technology Growth and Expanded Global Operations

Crossover Markets will direct funding toward enhancing its core technology infrastructure. Additionally, the company plans to expand its global operations and deepen institutional integrations.

Since launching, CROSSx has matched over $50 billion in notional trading volume. The platform now supports nearly 100 live participants across 12 million completed trades.

Crossover Markets also highlighted participation from firms like Virtu Financial and XTX Markets. These traditional finance players bring regulatory expertise and disciplined risk management to the table.

Their involvement helps bridge conventional capital markets with cryptocurrency trading infrastructure. Together, they strengthen the institutional credibility of the CROSSx platform.

Crypto-native firms Ripple and Wintermute Ventures also joined the round as participants. Their inclusion reflects confidence from within the digital asset community itself.

CROSSx supports low-latency execution, advanced order types, and FIX protocol connectivity. These features cater directly to institutional participants requiring reliable, professional-grade trading tools.

With this financing in place, Crossover Markets is now better positioned to lead institutional crypto trading. The company aims to solidify CROSSx as the venue of choice for digital asset execution.

As traditional and crypto markets continue merging, Crossover Markets stands at the center of that shift.

Crypto World

Tech Giants Sign Pledge to Cover AI Power Costs

US technology giants have signed a White House pledge to cover the power costs of their artificial intelligence data centers, which the Trump administration says will prevent consumers from paying higher utility bills.

The non-binding “Ratepayer Protection Pledge” was signed by Amazon, Google, Meta, Microsoft, OpenAI, Oracle and xAI on Wednesday, promising the companies would “build, bring, or buy” the energy needed to build and operate data centers and would not pass on costs to consumers.

“The data centers […] need some PR help,” US President Donald Trump said at a roundtable attended by government officials and representatives from Big Tech firms.

“People think that if a data center goes in, their electricity prices are going to go up, and that’s not happening. It’s not going to happen — and for the areas where it did happen, it won’t happen anymore,” he added.

Data centers are cropping up across the US amid an AI boom, with the power-hungry technology exceeding the available capacity in some parts of the country, according to a Harvard Kennedy School report from February.

The report said that data centers could demand up to 12% of all US electricity consumption by 2028. US Energy Information Administration data show that residential energy prices increased 6% in 2025 and are expected to continue rising through 2027 and 2028.

Voters concerned about bills ahead of midterms

Trump announced the pledge in his State of the Union address, and it comes ahead of the midterm elections in November, where voters are concerned about cost-of-living pressures and the impact of AI data centers on the energy grid.

“Some centers were rejected by communities for that, and now I think it’s going to be just the opposite,” Trump said, referring to data centers canceled after locals opposed the projects.

Related: Mining companies move deeper into AI, HPC as MARA may sell Bitcoin

The pledge promises that companies will pay for all new power infrastructure required for their data centers and will pay the cost for the infrastructure and power brought online, whether they use it or not.

The companies also promised to hire locally, offer skill development programs and make their backup generators available to the grid to prevent power shortages.

It’s not clear how Big Tech will be held to its promises, and the White House did not share how it would ensure the companies follow through on the pledge.

AI Eye: IronClaw rivals OpenClaw, Olas launches bots for Polymarket

Crypto World

Coinbase Helps Dismantle Major Phishing Platform

A coalition of tech companies and law enforcement, including Coinbase, has dismantled the core infrastructure of Tycoon 2FA, a major phishing-as-a-service platform that offered tools to bypass multi-factor authentication.

Europol announced Wednesday that Microsoft helped block 330 domains linked to the platform, while law enforcement seized additional key infrastructure.

Financial tracing was also a key aspect. Coinbase said it assisted by tracing blockchain-related transactions funding Tycoon 2FA, which helped identify the phishing platform’s alleged administrator and buyers.

“Taking Tycoon’s core infrastructure offline cuts off a major pipeline for credential theft and initial access, and forces criminals to rebuild, retool, and take on more risk,” Coinbase added.

Phishing scams were flagged as the second-largest threat in 2025 by blockchain security firm Certik, costing crypto investors $722 million across 248 incidents. A PeckShield spokesperson told Cointelegraph on Monday that phishing remains a “persistent threat” in 2026.

Tycoon tools used to bypass multi-factor authentication

Tycoon’s toolkit included spoofed landing pages designed to steal user credentials on legitimate websites. It also captured session cookies and tokens, allowing attackers to bypass MFA protections, according to Coinbase.

Generally, when a user logs in using MFA, the system generates a session token. The token acts as proof of authentication and is stored in the user’s browser. If a hacker steals the token, they can use it to fool the system and bypass MFA.

“That combination, high-fidelity lures plus session-token theft, turns phishing into a reliable on-ramp for bigger crimes like account takeovers, business email compromise, invoice fraud, and follow-on social engineering,” Coinbase added.

One of the largest scam platforms in the world

Tycoon has been active since at least 2023, according to Steven Masada, assistant general counsel at Microsoft’s Digital Crimes Unit. By mid-2025, Tycoon accounted for 62% of phishing attempts Microsoft blocked, including over 30 million emails in a single month.

Related: Traveling? ‘Evil Twin’ WiFi networks can steal crypto passwords

“That placed Tycoon 2FA among the largest phishing operations globally,” he added. “By lowering the technical barrier to entry, it allowed criminals with limited expertise to run sophisticated impersonation campaigns.”

Masada said industries from healthcare to education fell victim to Tycoon 2FA, resulting in rerouted invoices, stolen sensitive data, locked networks and disruptions to patient care.

“Taking this infrastructure offline cuts off a major pipeline for account takeovers and helps protect people and organizations from follow‑on attacks such as data theft, ransomware, business email compromise, and financial fraud.”

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

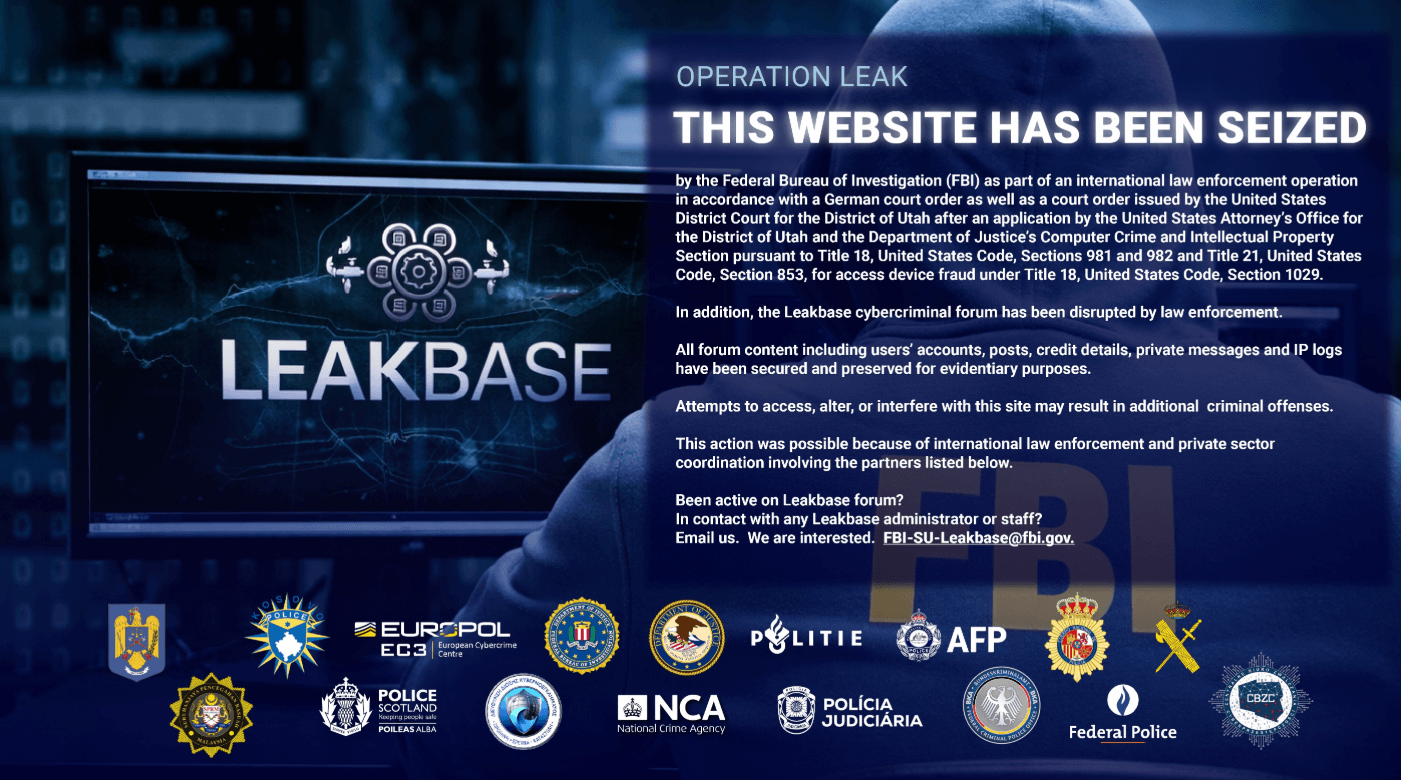

Europol, FBI Wipe Major Crime Forum LeakBase Off The Web

An international law enforcement operation involving the US Federal Bureau of Investigation, Europol and other agencies has taken down one of the internet’s most notorious cybercrime forums, LeakBase.

The forum was a place for hackers to buy and sell stolen data and cybercrime tools, amassing more than 142,000 members and over 215,000 messages.

“The FBI, Europol, and law enforcement agencies from around the world executed a takedown of LeakBase, one of the largest online cybercriminal platforms, seizing users’ accounts, posts, credit details, private messages, and IP logs for evidentiary purposes,” the FBI cyber division assistant director Brett Leatherman said in a statement on Wednesday.

LeakBase takedown involved 14 countries

The takedown operation, which ran on March 3 and 4, involved law enforcement agents and officers in 14 countries taking synchronized actions against LeakBase and its users.

Following the operation, authorities replaced the site with seizure banners, issued prevention notices to members, and collected additional evidence.

Law enforcement also executed search warrants and arrests in the United States, Australia, Belgium, Poland, Portugal, Romania, Spain, and the United Kingdom.

“The takedown of this cyber forum disrupts a major international platform that cybercriminals use to obtain and profit from the theft of sensitive personal, banking, and account credentials,” said Assistant Attorney General A. Tysen Duva of the Justice Department’s Criminal Division.

While there was no specific reference to crypto-related accounts, its predecessor cybercrime marketplace Raidforums, which was shut down in 2022, previously hosted leaked data containing approximately “272,000 detailed personal information” of users of crypto wallet firm Ledger.

Crypto industry sees rise in leaked data

Over the past year alone, the crypto industry has seen a rise in leaked exchange credentials, insider data exposure and social engineering attempts.

Related: Crypto treasury inflows slow to the lowest since October 2024

In May 2025, cybercriminals reportedly bribed overseas customer service contractors to gain access to crypto exchange Coinbase’s internal systems. This allowed them to steal personal data that could be used in social engineering scams or even physical extortion attempts.

Around the same time, almost 60,000 Bitcoin addresses tied to LockBit’s ransomware infrastructure were leaked after hackers breached the group’s dark web affiliate panel.

More recently, on Feb. 23, a trader who goes by the name TraderSZ said a former Revolut employee threatened to expose his identity and private information unless he paid a ransom and also contacted members of his family.

Magazine: Bitcoin may face hard fork over any attempt to freeze Satoshi’s coins

Crypto World

Morgan Stanley Lays Off 2,500 Employees Across All Divisions as AI Drives Major Workforce Shifts in Finance

TLDR:

- Morgan Stanley cut 2,500 jobs, roughly 3% of its workforce, despite record $70.6B revenue in 2025.

- AI adoption linked to an 11% job elimination rate and 11.5% productivity gain across 1,000 surveyed firms.

- Block’s Jack Dorsey cut 4,000 jobs, nearly half its staff, citing AI tools making human roles unnecessary.

- Anthropic’s CEO warned AI could eliminate 50% of entry-level white-collar jobs in law, finance, and consulting.

Morgan Stanley layoffs have reached approximately 2,500 employees across all divisions as of March 2026. The cuts span investment banking, trading, wealth management, and investment management.

Financial advisors, however, are not included in the reductions. This follows the bank’s best financial year ever, with annual revenue hitting a record $70.6 billion in 2025.

The move reflects a growing industry shift toward artificial intelligence adoption at major financial institutions.

Record Profits Do Not Protect Jobs

Morgan Stanley posted a banner year in 2025, beating Wall Street estimates for fourth-quarter profit. Investment banking revenue jumped 47%, while debt underwriting fees nearly doubled during the same period.

Banking executives had expressed an optimistic tone heading into 2026, citing healthy pipelines for mergers and acquisitions. Yet the bank still moved forward with cutting roughly 3% of its global workforce of 82,992 employees.

The cuts are based on strategy and individual performance, according to a source familiar with the matter. The bank also plans to add headcount in select areas following the reductions.

Volatile markets continue to boost trading desks as clients reposition portfolios against risk. Meanwhile, the broader workforce faces mounting pressure from rising AI adoption across financial services.

Social commentary has drawn attention to the pattern emerging across industries. As one widely shared post noted, “Record profits, record layoffs while AI gets the credit and workers get the door.”

The Anthropic CEO stated on national television that AI could wipe out 50% of entry-level white-collar jobs. Those roles include positions in law, finance, and consulting — precisely where Morgan Stanley made cuts.

Morgan Stanley’s own research team surveyed nearly 1,000 companies already using AI tools. The findings showed an 11% job elimination rate alongside a 4% net headcount decline.

Productivity, however, rose by 11.5% across those surveyed companies. The bank had also previously predicted 200,000 European banking jobs would disappear within five years.

AI Drives Layoffs Across the Broader Financial Sector

Morgan Stanley is not alone in linking workforce reductions to AI adoption strategies. Jack Dorsey-led payments firm Block cut over 4,000 employees in late February 2026.

That figure represented nearly half of Block’s entire workforce at the time. Dorsey publicly stated that AI tools had made human workers unnecessary for many functions.

He further stated that most companies would reach the same conclusion within a year. The Block layoffs came as part of an overhaul designed to embed AI across its operations.

These developments followed a broader wave of workforce reductions across U.S. companies since early 2026. Businesses have been streamlining operations as AI tool adoption continues to accelerate.

Observers note that Washington has yet to produce a formal policy response to AI-driven job displacement. Corporate boards are increasingly choosing technology over headcount to sustain profit margins.

Workers across entry-level white-collar roles continue to face an uncertain employment outlook entering the remainder of 2026.

Crypto World

Cyclops raises $8m for enterprise stablecoin infrastructure

Cyclops has raised $8m to build compliant stablecoin infrastructure for payment firms.

Summary

- Cyclops closed an $8m funding round led by Castle Island Ventures, with participation from F-Prime and Shift4.

- The startup will provide B2B infrastructure so payment processors and fintechs can issue and manage stablecoin products.

- BTC traded around $71.7k and ETH near $2.1k, with majors up 7%–9% as stablecoin volumes on chains like SOL hit record highs.

Stablecoin infrastructure company Cyclops has secured $8m in fresh funding to expand its platform for enterprises that want to issue, manage, and integrate stablecoin products into their existing payments and banking stacks. The round was led by Castle Island Ventures, with participation from F-Prime and payment processor Shift4, underscoring how traditional fintech investors are positioning around regulated, dollar-linked assets rather than pure-speculation tokens. Cyclops aims to act as a middleware layer between banks, processors, and public blockchains, offering APIs for minting and redeeming stablecoins, managing reserves, and handling compliance workflows such as KYC and transaction monitoring. The company is targeting payment companies and fintechs that want to support on-chain settlement and tokenized balances without building their own infrastructure from scratch.

The raise comes as stablecoins continue to gain share in both trading and real-world payment activity. On networks such as Solana, monthly stablecoin trading volumes have hit new highs, supported by low fees and a shift from speculative meme trading toward SOL and stablecoin pairs, while Ethereum remains the dominant venue for larger stablecoin and tokenized-asset flows. For investors like Castle Island and Shift4, backing Cyclops is a bet that the next phase of growth will come from enterprise-grade adoption, where merchants and platforms move parts of their settlement and treasury stack onto public chains. In that model, infrastructure providers handle integration with blockchains and custody partners, while brands focus on user experience and regulatory engagement in their home markets.

Enterprise demand for stablecoin rails

Cyclops is entering a competitive but expanding field where payment firms, exchanges such as Coinbase, and networks like Visa are racing to support stablecoin settlement across multiple regions and currencies. For corporates and fintechs, key requirements include reliable issuance and redemption, clear segregation of reserves, and straightforward integration with existing ledgers and compliance systems. In practice, that means infrastructure providers must connect bank accounts, custodians, and public chains while maintaining audit trails that satisfy regulators and institutional risk teams. By focusing on B2B tooling, Cyclops is positioning itself as a behind-the-scenes provider rather than a consumer-facing brand, similar to how card processors and acquiring banks operate under the logos of retail-facing platforms.

The timing of the round reflects a broader shift in market structure. After a period of deleveraging and ETF-driven repositioning in Bitcoin (BTC) and Ethereum (ETH), liquidity has rotated back into spot markets and stablecoins, with on-chain data showing increased usage for cross-border payments and micro-transactions. At the same time, policymakers in jurisdictions implementing frameworks like MiCA are clarifying capital, reserve, and disclosure rules for fiat-backed tokens, creating a clearer environment for banks and payment institutions to participate. For Cyclops and its backers, success will depend on convincing risk-averse enterprises that tokenized dollars can reduce friction and cost without adding unacceptable complexity or regulatory exposure, turning stablecoin rails from a niche experiment into a core part of global payments infrastructure.

Crypto World

Ethereum price eyes $2,200 as local structure flips bullish

Ethereum price has begun showing early signs of recovery as local market structure turns bullish. Consecutive higher highs and higher lows above key volume levels now place the $2,200 resistance zone in focus.

Summary

- Higher highs and higher lows signal bullish structure shift

- $1,862 high timeframe support held at value area low

- $2,200 major resistance becomes next upside target

Ethereum’s (ETH) recent price action suggests a shift in short-term momentum after a successful defense of major support. While the broader market remains range-bound, the internal structure has begun to show bullish characteristics.

This shift is raising the probability of a continued move higher toward the next significant resistance level.

Ethereum price key technical points

- Bullish Structure: Higher highs and higher lows forming above the Point of Control.

- Key Support Held: $1,862 acted as strong high timeframe demand.

- Upside Target: $2,200 high timeframe resistance above the value area high.

Ethereum’s current price action reflects an important local structural change. After previously trading in a corrective phase, the asset has begun forming consecutive higher highs and higher lows, a classic signal that momentum may be shifting in favor of buyers. This structural transition occurred as price reclaimed and held above the Point of Control (POC), which represents the area with the highest traded volume within the current trading range.

Holding above the POC typically signals that the market is establishing acceptance at higher prices. When buyers manage to sustain price above such an equilibrium level, it often opens the probability of a continuation move toward the upper boundary of the range.

A key factor supporting this shift was Ethereum’s reaction at the $1,862 high timeframe support level. This region aligns closely with the Value Area Low, a technical level where markets frequently find demand. The strong defense of this zone provided the catalyst for the initial bullish rotation that is now unfolding.

From a market structure perspective, this reaction marked the beginning of the internal trend shift. Buyers stepped in aggressively at support, absorbing selling pressure and pushing price back above key volume levels. The resulting momentum has allowed Ethereum to build a short-term bullish structure within the broader range environment.

Despite this positive development, it is important to note that Ethereum remains confined within a larger trading range on higher timeframes. Range-bound markets often produce multiple internal rotations between support and resistance before a decisive breakout occurs. As a result, short-term bullish expansions can still occur even while the broader structure remains neutral.

The next major technical level to watch is the $2,200 resistance zone, which sits above the current Value Area High. This area represents a significant supply region where sellers previously stepped in. If Ethereum continues to maintain its current bullish structure, price could attempt to test this level in the near term.

However, resistance zones such as $2,200 often attract selling pressure, particularly within range environments. Should price reach this area, the market may encounter renewed supply that could trigger a rotational move back toward support levels.

Volume dynamics will play a key role in determining the outcome. A strong expansion in bullish volume as price approaches resistance would increase the probability of a breakout attempt. Conversely, weakening participation could lead to rejection and continuation of the broader range-bound structure.

Overall, Ethereum’s internal market structure currently favors upside continuation, but the presence of strong overhead resistance means traders should remain cautious.

What to expect in the coming price action

If Ethereum maintains higher lows above the Point of Control, the probability of a rally toward the $2,200 resistance zone increases. However, failure to break and hold above this level could trigger another rotation within the broader range, sending price back toward high timeframe support near $1,862.

Crypto World

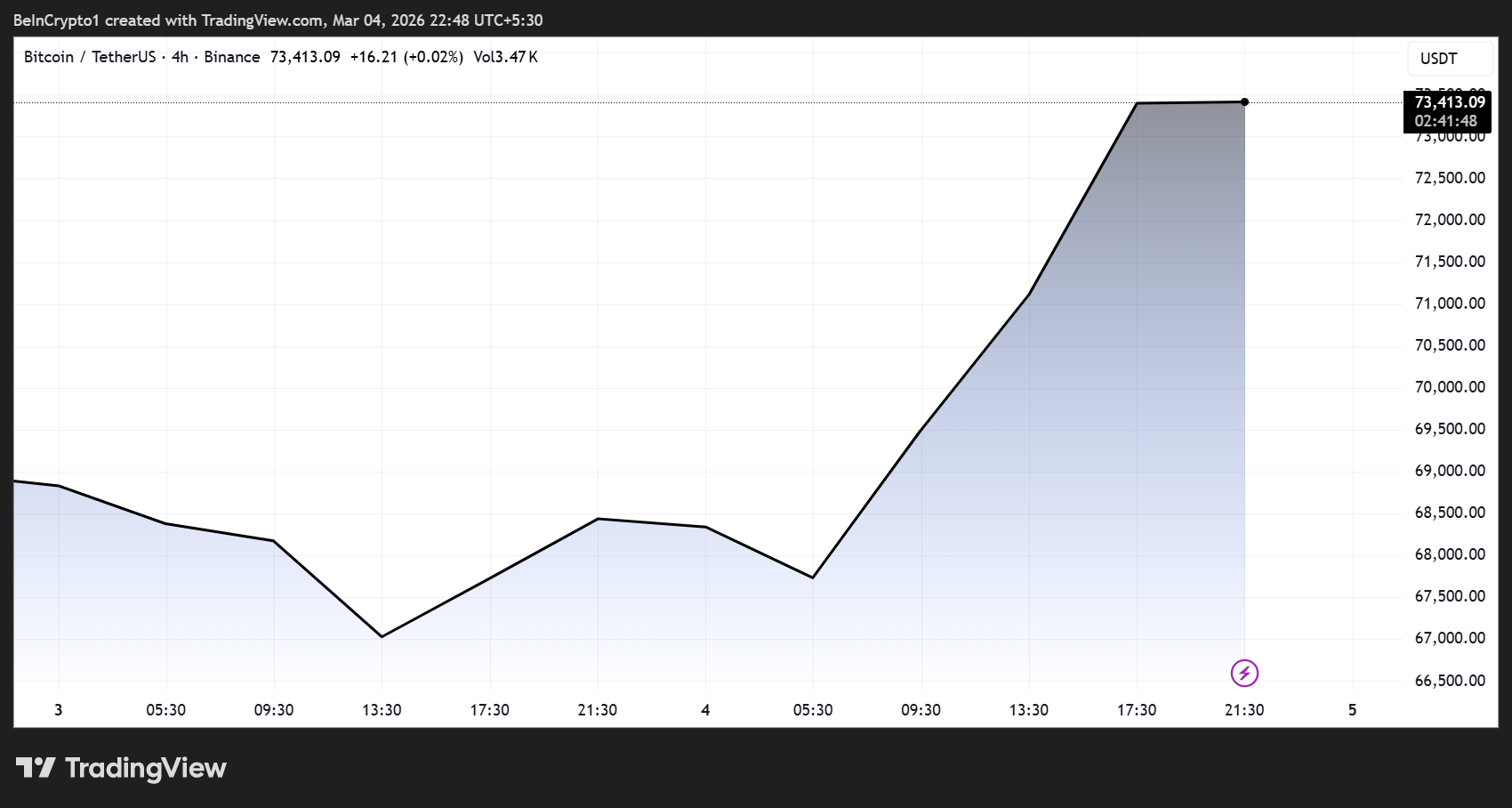

Bitcoin Short Sellers Caught Off Guard in New White House Move

Over $530 million in Bitcoin (BTC) short positions were liquidated today as the White House nominated pro-Bitcoin Kevin Warsh as Federal Reserve Chairman, triggering a broad crypto market rally.

Bitcoin is up by 9% in 12 hours, adding $123 billion to its market cap. Ethereum (ETH) climbed 11% over the same period, adding $26 billion.

Bitcoin Short Sellers Caught Offguard As White House Officially Nominates Pro-BTC Fed Chair

Bitcoin reclaimed the $73,000 psychological level and was trading for $73,413 as of this writing.

The move forced a cascade of short liquidations across derivatives markets, with Coinglass data showing nearly $30 million in short positions blown out over the past hour. This brings total liquidations to $530 million over the last 24 hours.

The move caught short sellers exposed. Traders betting against BTC and ETH were squeezed out as prices rose sharply, amplifying upward momentum through forced buybacks.

Warsh Nomination Serves as Macro Catalyst

The policy trigger behind the rally came from Washington. The White House officially nominated Kevin Warsh, a former Federal Reserve Governor widely regarded as sympathetic to digital assets, to serve as Fed Chairman for a four-year term.

“Kevin Warsh, of Florida, to be Chairman of the Board of Governors of the Federal Reserve System for a term of four years. Kevin Warsh, of Florida, to be a Member of the Board of Governors of the Federal Reserve System for a term of fourteen years from February 1, 2026,” read the announcement.

Meanwhile, the divergence between Bitcoin and traditional safe havens widened. Bitcoin is up by almost double digits, while Gold fell 3%. This stark contrast suggests capital rotation from traditional stores of value into digital assets.

The Warsh nomination and Saylor’s public stance, indicating potential for buying more BTC than sellers can offload, point to a market increasingly driven by macro policy expectations and institutional positioning.

Crypto World

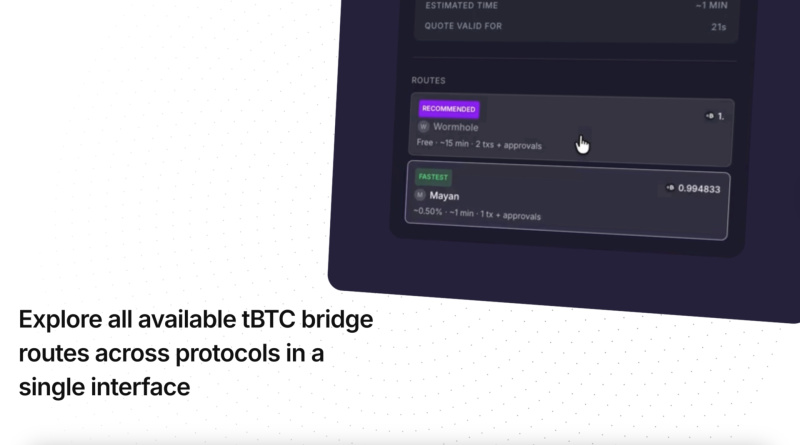

Threshold Launches All-in-One Bitcoin Liquidity App

[PRESSS RELEASE – New York, United States, March 3rd, 2026]

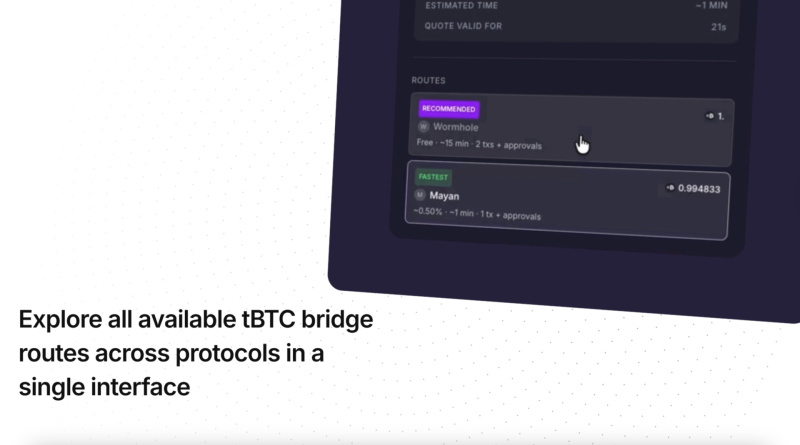

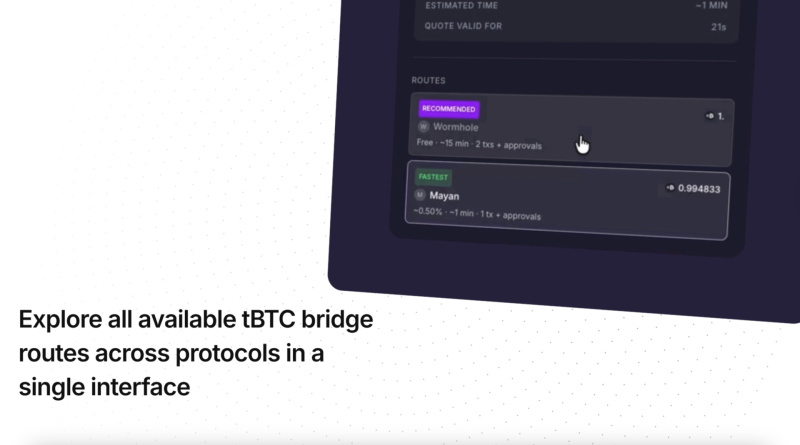

Threshold Network, the decentralized blockchain protocol behind tBTC, has introduced an update to its decentralized application featuring an all-in-one Unified Bitcoin App that enables users to route Bitcoin across major chains through a single interface.

This new unified routing interface brings minting, redeeming, bridging, tracking, and native BTC swaps into a single application: The Threshold App. Users can now move Bitcoin across ecosystems through a coordinated system, rather than stitching together multiple tools or navigating between different Decentralized protocols.

This release simplifies how Bitcoin enters and moves across DeFi, offering a more user-friendly on-chain experience with tBTC. Whether a transaction requires a swap, a bridge, or multiple steps, execution is seamlessly coordinated through a single interface

Coordinated Execution Instead of Fragmented Workflows

Historically, moving BTC into tBTC and across chains required multiple disconnected workflows: minting in one app, bridging via another protocol, swapping on separate exchanges, and manually checking the best price for each transaction. This fragmented process introduced friction, higher execution risk, added costs, and unnecessary complexity for users attempting to access DeFi with Bitcoin.

The Threshold All-in-one Bitcoin Liquidity App streamlines this experience by consolidating minting, bridging, swapping, and cost tracking into a single coordinated interface. Instead of manually comparing bridges and liquidity venues, users receive optimized routing options based on cost, speed, and reliability, such as the fastest or lowest-cost path: all within the Threshold Network App.

By abstracting multi-step transactions into a single seamless flow, the router significantly lowers the barrier for Bitcoin holders to use BTC across major ecosystems, including Ethereum, Arbitrum, Base, Sui, Starknet, and other integrated chains. The result is a simpler, more efficient way to move Bitcoin into DeFi.

Native BTC Execution with Deep Liquidity

Native BTC Execution with Deep Liquidity

Native BTC swaps are integrated directly into the routing engine, leveraging deep Ethereum liquidity to deliver competitive pricing and more efficient execution compared to fragmented, chain-specific pools.

“Capital should move efficiently across chains without requiring users to manage infrastructure decisions,” said MacLane Wilkison, Co-Founder of Threshold Network. “The new Threshold Bitcoin app coordinates liquidity sourcing and settlement behind the interface, enabling more efficient Bitcoin deployment across ecosystems.”

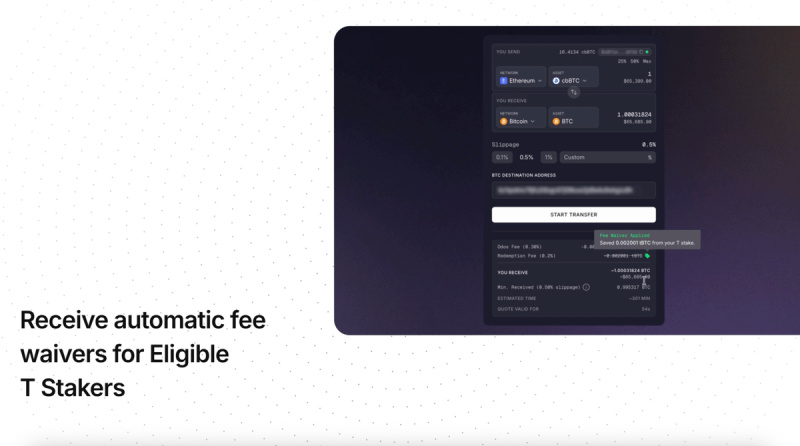

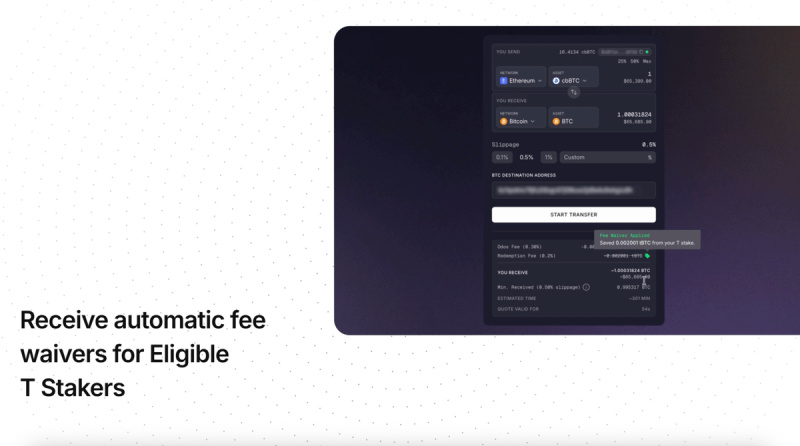

The update also strengthens the utility of Threshold’s token (T). The App tracks staked $T from the connected wallet and automatically applies minting and redemption fee waivers for eligible users. Gasless minting remains available as an opt-in feature, further reducing transaction costs.

Additionally, the router enables streamlined conversions from assets such as WBTC and cbBTC directly into tBTC on the destination chain, providing more direct and efficient access to Bitcoin liquidity across DeFi ecosystems.

Integrated Infrastructure Across Major Networks. Currently, the router connects Bitcoin, Ethereum, Arbitrum, Base, Sui, and Starknet within one coordinated framework. It integrates native tBTC mint and redeem flows, established bridging infrastructure, and DEX aggregation to ensure reliable settlement across chains.

All transactions are tracked in real time and are fully resumable. If a user disconnects or closes a session, progress is preserved. Fee logic is staking-aware, with eligible T stakers seeing applicable redemption fees waived directly within the interface.

New Features:

New Features:

- Unified Routing Interface: Enables minting, redeeming, swapping, and bridging from a single entry point. Users select source and destination assets, and the system automatically constructs the optimal execution path.

- Multi-Chain Connectivity: Supports Bitcoin, Ethereum, Arbitrum, Base, Sui, and StarkNet within a single coordinated framework. Users can move BTC or tBTC across ecosystems without managing separate bridge interfaces.

- Smart Route Discovery and Ranking: Automatically evaluates possible transaction paths and ranks them by cost, speed, reliability, and simplicity. Users are presented with clearly labeled best options.

- Native BTC Swaps: Provides direct access to BTC liquidity with competitive execution, while enabling seamless conversion of assets such as cbBTC or wBTC into tBTC on a user’s chosen destination network.

- Integrated Liquidity and Bridging Stack: Connects tBTC mint and redeem flows with established bridging infrastructure and DEX aggregation to coordinate multi-step transactions seamlessly.

- Resumable Transactions: Persists in-flight operations, allowing users to refresh, disconnect, or return later without losing progress. Reduces failed cross-chain flows and operational friction

- $T Staking-Aware Fee Display: Recognizes T staking status and surfaces fee waivers directly in the interface, reinforcing participation incentives.

- Unified tBTC Explorer and Transaction Tracking: The new explorer section of the app consolidates historical mint, redeem, bridge, and swap activity into a single view, improving transparency and user oversight.

Impact for Users and Stakeholders

This release expands the utility of tBTC across six ecosystems while increasing throughput across minting, bridging, and swap flows. By embedding routing intelligence directly into the protocol interface, Threshold captures more activity within its infrastructure and further strengthens staking incentives tied to network usage.

With this launch, Threshold advances its role from Bitcoin asset issuance to core infrastructure for Bitcoin mobility, coordinating capital movement seamlessly across chains and unlocking more efficient access to decentralized finance.

Users can explore the new Bitcoin App today at https://app.threshold.network

About Threshold Network

Threshold Network is the decentralized protocol behind tBTC, a non-custodial, 1:1 Bitcoin-backed asset secured by a 51-of-100 threshold signer model. tBTC enables native BTC to move across chains like Ethereum, Base, Sui, Arbitrum, and Starknet without requiring custodians or compromising security. With over 6 years of proven security and about $5.1B in bridge volume, Threshold offers the most battle-tested, trust-minimized Bitcoin infrastructure on-chain.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Why GENIUS Act Could Lead to CBDC-Like Surveillance

For many, the passage of the GENIUS Act closed the doors on the creation of a Central Bank Digital Currency (CBDC). Stablecoins, though digital, were marketed as a private form of currency, in contrast to a government-issued digital dollar.

Aaron Day, a fellow at the Brownstone Institute and a staunch critic of the crypto industry, argued that the GENIUS Act facilitates increased government surveillance despite this ban.

Surveillance Concerns Under the GENIUS Act

The GENIUS Act explicitly prevents the Federal Reserve from issuing a CBDC directly to individuals or through a third party. Its goal was to block the creation of a government-issued digital dollar at all costs.

Its July 2025 passage tied in nicely with President Trump’s early campaign promises to oppose the creation of a CBDC, describing it as a form of tyranny.

According to Day, stablecoins and CBDCs are essentially the same thing. The only difference is that the former is privately issued, whereas the latter is issued by a central bank. Yet, as long as the government is involved, the degree of surveillance remains the same.

“The issuance by the Federal Reserve is not actually the part of this that people are concerned about. The Federal Reserve is a private organization that is a collection of banks. Whether you end up having a stablecoin issued by Jamie Dimon at JP Morgan Chase or by the Federal Reserve doesn’t matter,” Day told BeInCrypto.

What privacy-preserving people are really concerned about, he argued, is a government entity being able to program, track, and censor money.

This line of thinking has prompted him to define the GENIUS Act as a “backdoor CBDC.” Day highlighted the urgency of the issue, especially given the exponential growth in stablecoins.

“Last year, there was $33 trillion worth of stablecoin transactions. Globally, this is larger than the amount processed through Visa,” he said, adding, “What they’ve done essentially is they’ve taken stablecoins… and they put [them] under the surveillance and control of Congress.”

According to him, this level of surveillance already existed before the passage of the GENIUS Act. The recently signed bill only represents a new degree to an already established order.

Day noted that most of the dollar is already digital.

When asked for examples, he pointed to the Bank Secrecy Act (BSA). This legislation, passed in 1970, requires financial institutions to assist government agencies in detecting and preventing money laundering, terrorism financing, and other illicit activities.

According to Day, the BSA allows government agencies to engage in overreach in certain contexts.

“We have something called suspicious activity reports. Anytime you do a financial transaction through your bank greater than $10,000, a report is automatically generated and sent to the Treasury Department. This shows you that we already have tracking within the system,” he said.

While these tools are often used for public protection, government agencies can implement them without specific authorization.

Day pointed to a specific example. In March 2025, the Financial Crimes Enforcement Network (FinCEN), a bureau of the US Treasury Department, issued a geographic targeting order to combat money laundering activities in the southwest border of the United States.

As part of that order, FinCEN mandated that money services businesses in 30 ZIP codes report transactions over $200.

“Understand what this means. The Treasury Department, without Congress, without a bill, without a law, can simply send a memo and banks will start adjusting the dollar transaction amount with which they start automatically reporting to Treasury,” he said.

In light of these examples, he argued that surveillance frameworks already exist. The GENIUS Act merely allows Congress to supervise stablecoins, potentially expanding control over digital currencies in ways that mirror those of a CBDC.

-

Politics6 days ago

Politics6 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat4 days ago

NewsBeat4 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business6 days ago

Business6 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics4 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

Crypto World6 days ago

Crypto World6 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business7 days ago

Business7 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video7 days ago

Video7 days agoXii English top Selected mcq “Money Madness” Board Exam 2026, #chseodisha #hksir #mychseclass

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes