Crypto World

Explore the most cutting-edge non-custodial crypto wallets of 2026

“In 2026 and thereafter, Non-Custodial Wallets Will Be Critical to Your Strategy.”

Think of two users:

User A stores all of their cryptocurrency on the exchange and third-party services.

User B has complete control of their private keys, can automate DeFi strategies, and connects directly to Web3-native solutions.

This elucidates the reason why non-custodial crypto wallets are becoming so important to the infrastructure market –

“Retail as well as large-scale crypto users are demanding it because of its expected benefits.”

They are no longer a fringe technology; they are now becoming part of the foundational structure—as significant as your identity access management, treasury systems, and security keys.

According to industry research studies, the non-custodial wallet industry will be approximately $1.5-2.5 billion by the year 2026, and the anticipated growth rate over the next decade is expected to be very high as well, often exceeding 20-25% compound annual growth rate (CAGR), varying by report methodology.

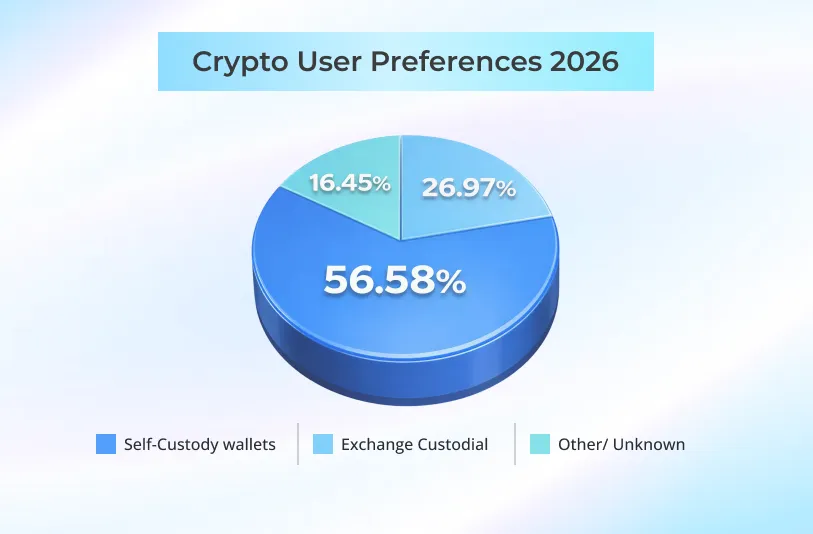

Various recent studies show that the bulk of all cryptocurrency wallets being used today are self-custodial, indicating a growing trend toward individual control over assets and financial transactions as a whole.

Source: https://coinlaw.io/self-custody-wallet-statistics/

For enterprise leaders currently planning to roll out their own Web3 crypto wallet, the extreme diversity of self-custodial wallet options — from hardware air-gapped wallets to smart contract-based wallets — presents an important question:

- What trends and tactics should your enterprise’s wallet strategy look at moving forward?

Now that we have defined an overall strategic environment, let’s look at the wallets that you came to evaluate.

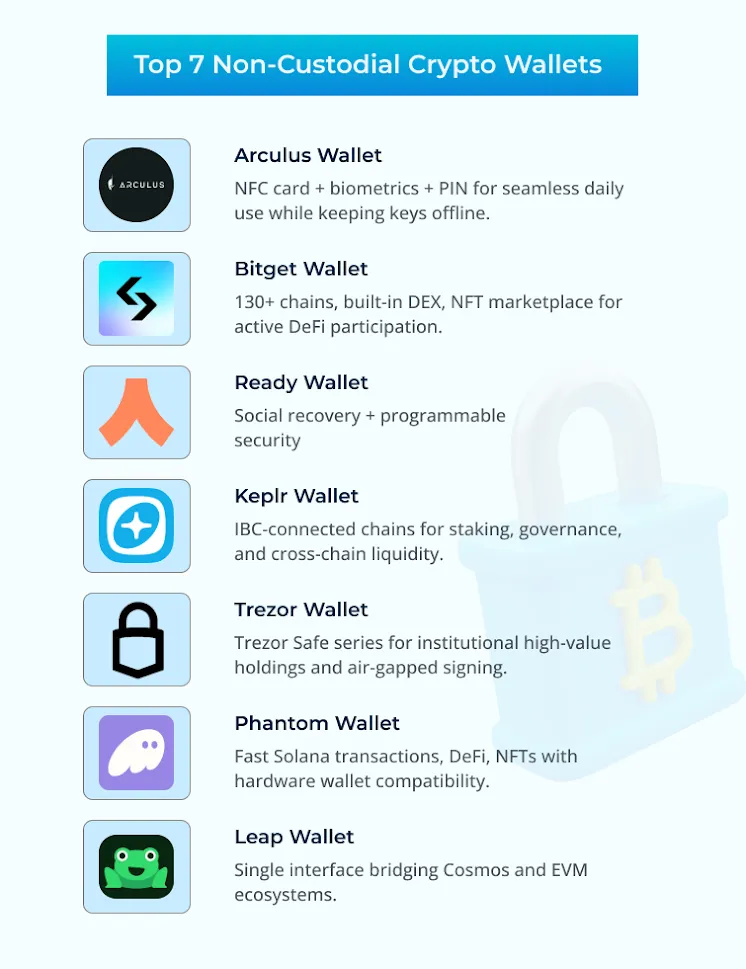

A Look at Today’s Peak Value Non-Custodial Crypto Wallets

Here, we will analyze the top self-custodial wallets of 2026, not just simply by looking at a list of ‘features,’ but instead from an enterprise perspective: how relevant is each wallet’s use case for you? What security models do they utilize? How do they compare in the overall ecosystem, and how can developing similar wallets give you a competitive advantage?

1. Arculus Wallet

The Arculus wallet offers a unique solution for securing digital assets.

The Arculus card, using NFC technology, connects to the user’s smartphone through an app. The private keys are stored offline on the card.

As a result, consumers are able to use the wallet daily without handling private keys or seed phrases frequently (though a one-time recovery phrase is generated at setup).

To use crypto in day-to-day use, the users will be required to first unlock the app using biometrics, enter their 6-digit PIN when prompted, and then tap their NFC-enabled Arculus card against the back of their phone.

For enterprise teams, launching an Arculus-like wallet will provide the following merits:

- When a user’s interaction with their wallet is limited to their hardware card or application, the user’s exposure to their written seed phrases (physically/electronically stored) or chances of losing possession of the seed phrase during routine usage (such as for migrating devices or support issues) are greatly reduced.

- It helps facilitate an authentication consumer experience that feels similar to existing payment processes with a physical card plus phone journey.

- A physical NFC-enabled card that functions as a hardware wallet helps maintain mobile accessibility.

The Rationale Behind This Trend:

Self-custodial wallets like Arculus aim to minimize how often users must interact with their recovery phrase and front-load their access using hardware, digital PIN numbers, and biometric means.

Why This Is Important for You:

Reimagining how users store their keys and recover them can potentially lead to new user experience innovation opportunities; your goal should not be to replicate other wallet solutions; rather, you should focus on solving the challenges that users face with current wallets.

2. Bitget Wallet

The Bitget Wallet is a multi-chain wallet with a built-in DEX aggregator that offers customers access to NFT marketplaces, too, where they can buy, sell, and trade. This non-custodial crypto wallet provides multiple DeFi integrations with support for 130+ chains (Ethereum, Solana, Polygon, etc.) – hence encouraging direct user participation in the broader ecosystem.

Bitget Wallet is designed with integrative value for users, providing an aggregated view of assets and activity across EVM networks, non-EVMs’ Layer-1, and Layer-2 chains.

DEX integrations reduce time lost switching between applications.

MARK

Native NFT marketplace support is valuable for targeting users pursuing content ownership, loyalty rewards, and digital goods strategies.

Critical Insight For Web3 Wallet Businesses

Based on projections of future digital wallet usage, white label crypto wallets that combine the functions of “secure storage” and “active finance”—trading, staking, liquidity participation, and governance—will be the most successful in helping you capture long-term adoption.

3. Ready Wallet (formerly Argent)

Ready is typically characterized as an Ethereum-focused smart contract wallet, with the goal of improving user experience by incorporating concepts like social recovery, programmable security, and DeFi-compatible functionality.

Specific features that align with this are

- The use of social recovery methodologies leads to lower total cost of support due to being more streamlined than traditional recovery methods that only rely on seed phrases.

- Programmable security through policy-based controls (e.g., daily transfer limits, whitelisted addresses, and other guardrails) provides a clear, consistent, and adaptable level of protection for wallet operations.

- Native capabilities for staking on L2 systems and connection to DeFi protocol features cement the idea that the wallet is intended to serve as a facilitator of financial actions.

Enterprise Lens

Crypto wallet development with account abstraction and configurable defense will become a critical enabler of automated financial flows within Web3-based applications.

4. Keplr Wallet

Keplr is one of the major wallets used by those actively engaged with the Cosmos ecosystem. It is a self-custodial hub for IBC-connected chains.

In addition to participating in staking and governance on their native protocol, consumers can move value in a multitude of ways between other Cosmos chains as well as across the entire Cosmos ecosystem.

Web3 leaders need to take notice of what this can mean for your audience if you engineer a Keplr-grade wallet:

- A way to engage on a large scale in governance (both as validators and via delegations in DAO votes) rather than relying on ad hoc participation.

- When linking to other blockchain networks, IBC-enabled assets allow for a higher level of liquidity movement & redirection.

- This will be possible using a method that does not require customers to retain custody of their relevant assets on any one blockchain within the Cosmos universe.

A Signal To Watch

As cryptocurrency wallet development initiatives continue to create more tools and data services over diverse Cosmos blockchains, wallets that promote interactivity & interoperability among users will spur the ongoing development of both DeFi & app-specific chains.

5. Trezor Wallet

Hardware wallets are becoming an integral part of many institutions’ high-security operations, and Trezor wallets (Trezor Safe 3, Trezor Safe 5, Trezor Safe 7) are considered to be one of the best non-custodial hardware wallets available for the safe storage of numerous types of digital assets.

Trezor offers high-security, isolated keys that can be stored offline and are ideal for longer-term or treasury-type holdings.

- The ability to integrate with a desktop suite and 3rd party applications helps facilitate policy enforcement & audit workflows.

- Offline signing adds a strong security shield for high-value or high-risk transactions.

A Thought to Carry Forward

Security professionals often refer to hardware security modules, cold wallets, and air-gapped signing technology when it comes to developing treasury-based wallet systems.

Get Your Enterprise’s Crypto Wallet Launch Checklist Now

6. Phantom Wallet

Phantom is one of the premier decentralized wallets for the Solana ecosystem. It provides people with a non-custodial wallet experience with all of the key features for staking. interacting with DeFi directly within the wallet and managing NFTs while prioritizing UX.

This wallet product is compatible with hardware wallet integrations, adding extra security for end-users.

Why should you care?

- Solana wallets serve as transaction engines that empower high volume, low fees, and fast settlement.

- Enterprise use cases include gaming and loyalty programs, payroll experiments, and cross-chain financial services.

An Industry Cue

Solana-centric crypto wallet development as a whole is increasing in volume and velocity across multiple verticals; thus, the trend is towards active wallet activity instead of passive storage.

7. Leap Wallet

Leap Wallet supports both the Cosmos network and the EVM environment, enabling users to bridge the gap between these two through a single interface.

The Core Message

Wallets that reduce their operational footprint across Cosmos + EVM or other multi-technology stacks will position themselves for success when catering to corporate clients willing to adopt seamless workflows.

Decoding 2026’s Self-Custodial Wallet Success Codes – X-Factors Enterprises Can Use

| Wallet | Core Trend | Build Inspiration For You | Security Innovation |

|---|---|---|---|

| Arculus | NFC mobile payments | Card+phone UX like traditional finance | NFC card + biometrics + 6-digit PIN |

| Bitget | Multi-chain DeFi hub | DEX aggregator eliminates app switching | Unified risk control across 130+ chains |

| Ready | Account abstraction | Social recovery cuts support costs | Programmable security through policy-based controls |

| Keplr | Cosmos interoperability | IBC enables governance at scale | Security-hardened IBC cross-chain liquidity hub |

| Trezor | Institutional cold storage | Air-gapped treasury operations | Offline hardware isolation |

| Phantom | High TPS transaction engine | Solana gaming/loyalty enablement | Hardware wallet compatibility |

| Leap | Multi-stack unification | Single UI for Cosmos+EVM workflows | Fail-safe cross-ecosystem bridging |

Conclusion: The wallet is not the ultimate objective; it’s just the base level

If your organization is creating a non-custodial wallet & you are currently or will be looking for the ideal technical or product partner to help you achieve your vision for your project, make sure they help you navigate the security, compliance & UX trade-offs first.

Whether you want to create crypto wallets like the ones discussed above or want to create an AI smart crypto wallet with features like cross-chain composability, physical key storage, reg-ready governance core, or customized functionalities, Antier’s properly designed tech stack will help you craft a top-tier solution. That would grow into a durable component of your Web3 infrastructure, not just an application included in your product portfolio.

Schedule a tactical meeting to architect a self-custodial wallet product with the potential to be in a league of its own.

Frequently Asked Questions

01. Why are non-custodial wallets becoming critical for cryptocurrency users?

Non-custodial wallets are essential because they provide users with complete control over their private keys, enabling automation of DeFi strategies and direct connections to Web3-native solutions, which are increasingly demanded by both retail and large-scale crypto users.

02. What is the projected market size for non-custodial wallets by 2026?

The non-custodial wallet industry is expected to reach approximately $1.5-2.5 billion by 2026, with a high anticipated growth rate often exceeding 20-25% compound annual growth rate (CAGR).

03. What factors should enterprises consider when developing their own Web3 crypto wallet strategy?

Enterprises should evaluate the diversity of self-custodial wallet options, the relevance of each wallet’s use case, the security models they utilize, and how developing similar wallets can provide a competitive advantage in the overall ecosystem.

Crypto World

ZKsync and Phylax Launch Bank Stack: A Full-Scale Institutional Architecture Built on Ethereum

TLDR:

- Bank Stack operates across three integrated planes: blockchain platform, money and assets, and services and governance layer.

- Prividium enables institutions to run private, compliant transactions while inheriting Ethereum’s security and global settlement guarantees.

- Phylax adds pre-committed assertions and circuit breakers that block unsafe transactions before execution, not after settlement occurs.

- Platforms like Fireblocks already integrate with Prividium, letting banks reuse existing policy stacks for new institutional networks.

Bank Stack is emerging as a new institutional architecture for on-chain finance. ZKsync and Phylax have jointly introduced this framework, anchored on Ethereum and powered by Prividium.

The architecture is designed to address fragmented payment rails, rising compliance costs, and security risks. Financial institutions are no longer debating whether blockchain matters.

They are now choosing which architecture will run their settlement, liquidity, and balance sheet operations.

A Three-Layer Architecture Built for Institutions

Bank Stack operates across three integrated planes. The blockchain platform layer combines Ethereum with Prividium for private execution, compliance primitives, and interoperability.

Above that sits the money and assets layer, which covers tokenized deposits, stablecoins, and real-world assets. The third plane handles services and governance, including identity, custody, policy enforcement, and reporting.

Prividium serves as the institutional transaction layer at the foundation. It is a private, compliant, ZK-powered blockchain that remains anchored to Ethereum.

Institutions run confidential transaction environments while inheriting Ethereum’s security and global interoperability. Execution and data stay private, while ZK proofs posted to Ethereum provide integrity and finality.

ZKsync’s L1 interoperability solution connects any ZK Chain to Ethereum natively. Institutions no longer need to sacrifice governance, privacy, or execution environments for access to public market liquidity.

Prividiums become the first architecture where both can coexist. This removes one of the largest structural barriers to institutional blockchain adoption.

Compliance is built into the infrastructure surface rather than added on top. Prividiums embed permissioned participation, KYC/AML enforcement, and auditability directly into the system.

This shifts compliance from an operational burden to an architectural guarantee. Policy becomes enforceable in production, not just observable.

Circuit Breakers and Onchain Money Primitives

ZKsync shared via its official channel: “The Bank Stack is not a product. It is an institutional architecture for on-chain finance.” Phylax adds execution-time controls through pre-committed assertions and invariant enforcement during block building.

Transactions that violate safety conditions are excluded before execution. This prevents catastrophic states rather than detecting them after settlement.

Phylax also supports on-premises deployment, colocated with block production. There is no critical-path SaaS dependency and no custody of keys or funds.

Private assertions keep internal controls confidential inside an institution. Risk teams, underwriters, and regulators can use verifiable evidence for governance and coverage workflows.

The monetary foundation of Bank Stack includes tokenized deposits, fiat-backed stablecoins, and tokenized cash equivalents. These primitives compose with identity and policy controls.

Real-world assets such as tokenized securities, funds, and collateralized instruments are also supported. Platforms like Fireblocks already integrate with Prividium, allowing banks to reuse existing policy stacks.

Together, Ethereum provides global settlement, Prividium provides private execution, and Phylax provides deterministic operational controls.

Crypto World

Phemex integrates Ondo tokenized stocks and ETFs for 10m users.

Phemex integrates Ondo tokenized equities, giving 10m users onchain access to 14 major stocks and ETFs.

Summary

- Phemex completed integration with Ondo Finance’s full tokenized equity suite, listing 14 real‑world assets including NVDA, TSLA, AAPL, AMZN, QQQ, and SPY‑style ETFs.

- The exchange says the move is part of a broader push into RWA tokenization, allowing clients to hold tokenized stocks and ETFs while preserving digital asset liquidity.

- Founded in 2019, Phemex now serves more than 10m traders with spot, derivatives, copy trading, and yield products as it positions itself between TradFi and DeFi.

Cryptocurrency exchange Phemex announced the completion of its integration with Ondo Finance’s full suite of tokenized equities, according to a statement released by the company.

The integration provides the platform’s 10 million users access to 14 tokenized traditional assets, including shares of technology companies and exchange-traded funds, the company stated.

The tokenized equity offerings include shares of NVIDIA, Tesla, Apple, and Amazon, as well as the Nasdaq 100 ETF and the SPDR S&P 500 ETF, according to the announcement.

The platform describes the integration as part of its expansion into real-world asset (RWA) tokenization, allowing users to access traditional financial instruments through blockchain technology while maintaining digital asset liquidity.

Phemex stated the initiative represents part of its strategy to bridge traditional finance and decentralized finance platforms.

Founded in 2019, Phemex operates as a cryptocurrency exchange offering spot trading, derivatives trading, copy trading, and wealth management products, according to company information. The platform reports serving more than 10 million traders globally.

Crypto World

XRP ‘Coiling’ for a Breakout? Liquidity Patterns Mirror Previous Explosive Rallies

Historical data depicts XRP rallies followed periods of tight liquidity, though sustained moves required expanding USD market depth.

XRP’s market structure is showing signs of renewed liquidity compression, as evidenced by exchange flows and on-chain liquidity conditions aligning in a way that has historically preceded increased volatility.

Data tracking Binance exchange inflows revealed that large deposits previously surged ahead of a major XRP rally, a pattern often associated with rising volatility rather than immediate selling.

Fragile Market Setup

CryptoQuant explained that while exchange inflows are commonly interpreted as potential sell-side pressure, past behavior indicates that they can also mark positioning phases before sharp price expansions. During the earlier rally period, USD liquidity, which represents the depth of capital supporting XRP markets, expanded significantly. This allowed prices to support upward momentum despite high volatility.

Current conditions, however, differ, as USD liquidity has been declining. Such a setting points to thinner market depth compared with prior expansion phases. Reduced depth typically increases sensitivity to flows and amplifies price reactions.

On the supply side, the amount of XRP actively available for trading dropped sharply ahead of the previous breakout, a period that marked the start of the rally. That same pattern is beginning to reappear, as XRP liquidity is trending lower once again. In past cycles, similar setups, where exchange inflows spiked while overall liquidity tightened, were followed by sharp increases in price volatility.

Whether those moves turned into steady trends depended largely on how much capital entered the market. Right now, exchange inflows remain relatively contained, but liquidity on both the USD and XRP side is shrinking. This points to a thinner market than during earlier expansion phases, where even modest changes in buying or selling pressure can have an outsized impact on price.

With less liquidity to absorb trades, XRP’s price may react more quickly if activity picks up, which makes market conditions even more fragile than they appear on the surface.

You may also like:

XRP Most Talked-About Asset After Bitcoin

Even against this backdrop, investor interest in the asset has not faded. As recently reported by CryptoPotato, XRP has emerged as the second-most talked-about digital asset after Bitcoin, as per Grayscale. The asset manager observed that the crypto continues to attract significant attention due to steady interest from its user base and investors, even as market sentiment remains cautious.

Speaking during Ripple Community Day, Grayscale’s Head of Product and Research, Rayhaneh Sharif-Askary, described XRP as having a large and committed community, and added that client inquiries about the token remain consistently high. Advisors at Grayscale have reported that the token frequently ranks just behind Bitcoin in terms of discussion volume.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ripple CEO Garlinghouse Predicts CLARITY Bill Has 90% Chance of Approval Soon

His remarks came after the most recent meeting in the White House.

Ripple chief executive Brad Garlinghouse said he now sees a 90% chance that the CLARITY Act will become law by April 2026. He described the outlook as stronger than before, citing steady legislative progress in Washington.

According to the CEO, the improved odds reflect recent engagement between lawmakers, the White House, crypto firms, and banking representatives. He noted that discussions have shifted from broad disagreements to resolving specific policy details.

Legislative Momentum Builds in Washington

Garlinghouse shared his updated view during an appearance on Fox Business, pointing to growing bipartisan interest in market structure legislation. He said recent meetings helped narrow differences that had previously slowed progress.

That momentum follows the CLARITY Act’s passage in the House of Representatives in 2025 with bipartisan support. Senate consideration has taken longer, though observers say the current pace signals renewed urgency.

To maintain progress, officials involved in the talks reportedly aim to settle remaining policy disputes by March 1, 2026. Supporters see the timeline as critical, given that legislative schedules often tighten ahead of midterm elections.

Stablecoins and Regulatory Clarity at the Center

The CLARITY Act, formally known as the Digital Asset Market Clarity Act, seeks to establish a unified federal framework for digital assets. It would define oversight roles by assigning assets that resemble securities to the securities regulator and commodity-like assets to the Commodity Futures Trading Commission.

Supporters argue that clearer boundaries would reduce legal uncertainty and provide consistent guidance for firms operating in the United States. They say this could lower compliance risks and support broader participation from established financial institutions.

You may also like:

Despite this support, stablecoins remain a central issue in negotiations, particularly whether issuers can offer yield-style features on reserve-backed holdings. Banking groups warn such practices could affect deposits, while crypto firms argue restrictions may push activity to other jurisdictions.

Against that backdrop, Garlinghouse said prolonged uncertainty has limited innovation, citing Ripple’s legal experience as partial but incomplete progress. He stressed that individual court outcomes cannot replace clear, industry-wide rules.

Market expectations have also shifted, with prediction platforms such as Polymarket showing rising confidence in passage within the proposed timeframe. Analysts view the coming months as a key window before political dynamics complicate the process further.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Is Blue Owl Redemption Halt an Early Alarm for Crypto Markets?

Private capital firm Blue Owl Capital, with over $307 billion in assets under management, has permanently halted investor redemptions at a retail-focused private debt fund.

The suspension has triggered concerns among economists. Furthermore, it has raised a key question about whether the private credit market could impact the broader crypto market.

Everything to Know About Blue Owl’s Redemption Changes

According to Bloomberg, the private credit firm has seen a rise in withdrawal requests in recent months. This was partly driven by investor concerns over its exposure to software companies amid the artificial intelligence surge.

FT noted that Blue Owl Capital Corp II (OBDC II) has been closed to redemptions since November. The firm had previously indicated it might reopen withdrawals later this quarter, but it has now abandoned that plan.

Earlier this week, the company revealed that quarterly redemptions would no longer be available to OBDC II investors. Instead, the firm plans to distribute cash through periodic payments tied to asset sales.

“We’re not halting redemptions, we are simply changing the method by which we’re providing redemptions,” Blue Owl co-President Craig Packer told analysts on a conference call Thursday, as per Reuters.

According to Packer, payouts to fund holders are expected to be roughly 30% of the fund’s value, up from the prior 5% cap.

“We are returning six times as much capital and returning it to all shareholders over the next 45 days. In the coming quarters we will continue to pursue this plan to return capital to OBDC II investors,” Blue Owl commented on its latest plan.

Blue Owl also moved to sell approximately $1.4 billion in assets from three of its credit funds. Bloomberg revealed that Chicago-based insurer Kuvare, the California Public Employees’ Retirement System, Ontario Municipal Employees Retirement System, and British Columbia Investment Management Corp. purchased the debt, according to people familiar with the matter. Blue Owl added that the loans were sold at 99.7% of par value.

Private Credit Market Faces Growing Strain

Market analyst Crypto Rover suggested that Blue Owl’s redemption freeze reflects mounting pressures across the $3 trillion private credit sector. He outlined several warning signs.

First, about 40% of direct lending firms now report negative free operating cash flow. Default rates among middle-market borrowers have climbed to 4.55% and continue to rise.

Notably, 30% of firms with debt due before 2027 show negative EBITDA, making refinancing challenging. Meanwhile, credit downgrades have outpaced upgrades for seven straight quarters.

“If the stress continues in the private credit market, it’ll first impact the small businesses for whom the private credit market is a critical funding source. Additionally, it’ll cause refinancing costs to go up and will result in more defaults, which will create a vicious cycle. The only way to stop this is by lowering interest rates and providing liquidity,” the analyst added.

Economist Mohamed A. El-Erian questioned whether the situation could represent an early warning signal similar to those seen in 2007 before the 2008 global financial crisis.

Implications for Crypto Markets

Stress in the private credit market does not automatically translate into direct contagion for crypto, but indirect linkages deserve attention. A recent analysis from BeInCrypto indicates Bitcoin has closely tracked US software equities.

A meaningful share of private credit is allocated to software companies, linking these markets through shared growth-risk exposure. If lending conditions tighten or refinancing risks rise, valuations in the software sector could come under pressure.

Rising defaults, widening credit spreads, and constrained capital access would likely weigh on growth stocks. Given Bitcoin’s correlation with high-growth equities during tightening cycles, sustained weakness in software could spill over into crypto markets.

That said, this remains a second-order macro effect rather than direct structural exposure. The critical variable is the broader financial response. If stress leads to tighter financial conditions, Bitcoin could face downside alongside tech.

If it triggers monetary easing or renewed liquidity support, crypto may ultimately benefit. For now, the risk is cyclical and liquidity-driven, not systemic to digital assets themselves.

Crypto World

Silver Supply Shock? Binance Hits $70B as CME Goes 24/7

While silver inventories on COMEX continue to decline, Binance’s newly launched gold and silver perpetual futures have already surpassed $70 billion in trading volume within weeks.

The sharp convergence across metals and crypto derivatives markets signals surging demand for 24/7 synthetic exposure to precious metals.

Binance recorded over $70 billion in trading volume across its XAU/USDT and XAG/USDT perpetual contracts.

It points to a strong appetite for always-on, on-chain access to gold and silver price movements. The milestone highlights how traders are increasingly turning to crypto-native platforms to gain exposure to metals without traditional market-hour constraints.

At the same time, physical silver dynamics are tightening. Silver backing futures keep falling, with the March-to-May contract roll reaching 30 million ounces per day. This pace could clear the current open interest.

“At that pace, COMEX is out of silver by February 27,” wrote investment specialist Karel Mercx, adding that from April onward, the market risks a physical shortage unless meaningful inflows arrive in the coming weeks.

The structure of the futures curve adds to the urgency. When adjusting for financing costs such as SOFR (Secured Overnight Financing Rate) and storage, the March–May spread is approaching backwardation. This condition effectively signals immediate demand for physical metal over future delivery.

In carry-adjusted terms, backwardation signals that physical silver is more valuable now than later.

Rising futures prices can intensify this dynamic, as higher forward pricing encourages speculative buying. It also prompts producers and holders to retain physical supply in anticipation of further appreciation, pulling additional metal out of the market.

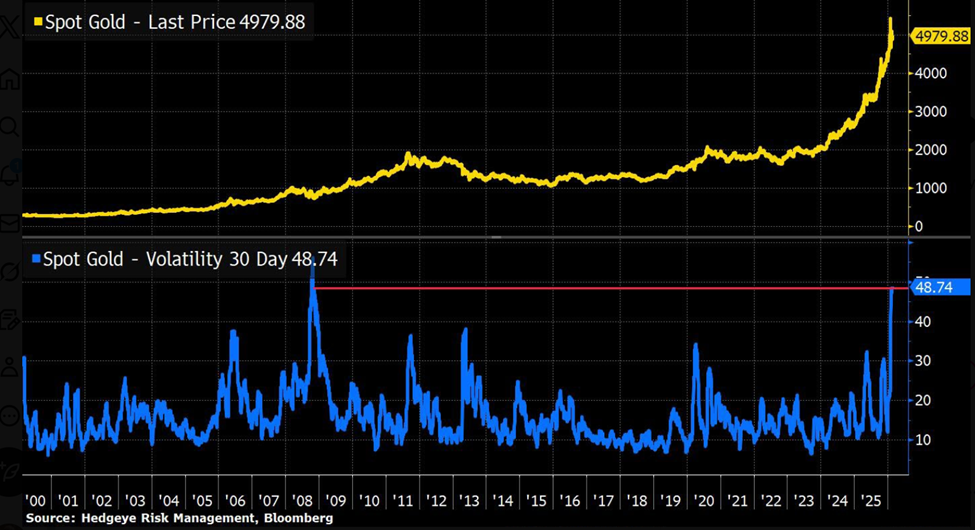

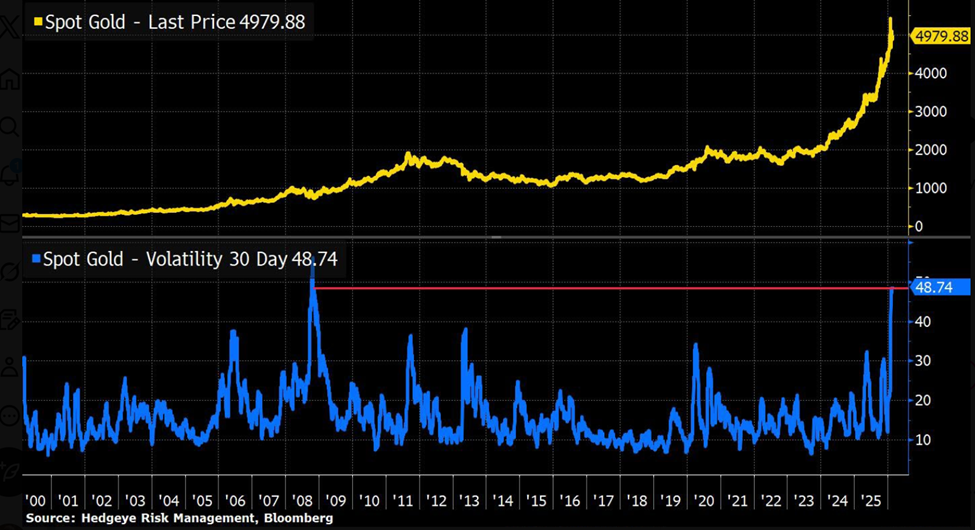

Meanwhile, gold volatility has surged, with its 30-day volatility at its highest level since 2008. The surge reflects heightened macro uncertainty and rapid shifts in positioning across derivatives markets.

The structural shift toward round-the-clock trading is not limited to crypto exchanges. CME Group announced that beginning May 29, crypto futures and options will trade 24 hours a day, seven days a week on CME Globex, pending regulatory review.

CME reported a record $3 trillion in notional volume across crypto futures and options in 2025, citing record-high demand for digital asset risk management.

Year-to-date 2026 data show average daily volume up 46% year-over-year and futures ADV up 47%, reinforcing sustained institutional participation.

The development may also reduce the risk of weekend price gaps. This would allow markets to respond instantly to geopolitical or macro shocks. Notably, the feature is already native to crypto exchanges like Binance.

Taken together, the surge in derivatives activity, accelerating silver inventory drawdowns, elevated gold volatility, and the normalization of 24/7 trading suggest markets are entering a structurally different phase.

As physical supply tightens and financial access expands, traders are positioning for potential scarcity in both metals vaults and digital order books.

Crypto World

Silver Price Breaks February Resistance Line

As seen on the XAG/USD chart, silver has today breached the upper boundary of the descending channel formed by February’s lower highs and lows.

Bullish sentiment is supported by heightened geopolitical tensions and rising demand for safe-haven assets. According to media reports:

→ On Thursday, US President Donald Trump warned Iran that it must reach an agreement on its nuclear programme, or “really bad things” would happen, setting a 10–15 day deadline.

→ In response, Tehran threatened retaliatory strikes on US bases in the region if attacked.

On 11 February, analysing the XAG/USD chart, we noted that silver was consolidating between two key levels:

→ resistance around $87.5–95

→ support near $70

Today’s bullish breakout of the channel’s upper boundary – which acted as resistance in February – can be interpreted as a move towards the $87.5–95 zone.

Confidence for bulls is further reinforced by an inverted head and shoulders (SHS) pattern. If buyers are determined, this should be confirmed by XAG/USD holding above:

→ the channel breakout level near $79

→ the psychological $80 mark.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Blockchain technology upgraded political campaign financing

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

In U.S. politics, campaign finance reporting is one of the most crucially vital parts of any election. While still important, the reporting standards and practices are dated. Currently, candidates must fill out and send reports to the Federal Election Commission every three months. Which then means voters, donors, or any other campaign stakeholders have to wait months before they see vital information on campaign financing and funding. Although today, using blockchain technology, a lot of this information can reliably be delivered in real time.

Summary

- Campaign finance is stuck in batch mode: Quarterly filings delay transparency, while blockchain can deliver real-time visibility into funding flows.

- Public wallets enable live verification: Voters, journalists, and donors can independently track contributions and spending without waiting for intermediaries.

- Transparency shifts incentives: Continuous on-chain disclosure makes questionable activity easier to flag early — turning reporting into active accountability.

Real-time verification through a public wallet

During our campaign, we chose to use a public crypto wallet so donors and voters could verify activity directly. Instead of waiting for a filing window, anyone could view the wallet, check balances, and see transactions as they occurred. The ledger created a live record of campaign funds, allowing people to follow the flow of money without intermediaries interpreting or summarizing it later.

In practical terms, on-chain records show the transaction amount, the sending address, and the timestamp. Journalists, analysts, and voters can review activity themselves rather than relying on delayed reports or second-hand explanations. Expenditures can be tracked the same way, creating a permanent record of spending that remains visible over time. Anyone with basic tools can confirm activity independently, without relying on summaries released weeks later.

Public ledgers already operate at scale

There is a global rise in demand for blockchain technology as regulations and policies are opening the gates for the industry. With the CLARITY Act set to pass this year, there is a lot of momentum now within the legislative branch.

Currently, nearly 1 in 10 people own cryptocurrencies. At the same time, government and corporate interest in crypto is increasing as stablecoin regulation is advancing across more than 70 percent of major jurisdictions, and roughly 80 percent of jurisdictions have new digital asset initiatives from financial institutions.

The idea of real-time public reporting aligns with other sectors that have embraced digital auditability. Finance departments in corporations are increasingly exploring crypto workflows. A mid-2025 survey found that nearly 24 percent of North American chief financial officers expect to use digital currency in their finance operations within two years.

A practical use case for political finance

With the financial systems and the modern infrastructure already set in place, blockchain can easily be implemented in the political environment. Apart from transparency, on-chain features could prevent errors and fraud as it automatically links and timestamp transactions.

Apart from the transparency, implementing blockchain features in the campaign can prevent errors and fraud. Traditional batch reporting can lead to mistakes because it relies on manual reconciliation and delayed submission.

Meanwhile, distributed ledgers automatically link and timestamp transactions. Academic research highlights how on-chain systems can enhance traceability and trust across sectors by eliminating opaque intermediaries and enabling third parties to validate records independently.

Oversight and practical accountability

Transparency around who is funding a campaign is not only expected, it is imperative for accountability. Blockchain infrastructure modernizes how that transparency happens. Rather than relying on delayed filings and databases, on-chain systems can provide real-time visibility to funding whilst still using blockchain standards to ensure accuracy, integrity, and compliance. This is about making disclosures clearer, faster, and harder to manipulate.

Public wallets can transform campaign finance from retrospective reporting into active verification. Instead of waiting weeks or months to learn how money moved, voters can see live transactions and trust the campaign’s contributions are from legitimate sources. This can change incentives, questionable activity is flagged earlier, and accountability happens continuously, making empty promises harder to sustain. By aligning transparency with the pace of modern decision-making, blockchain restores confidence in the system and gives voters a clearer basis for choosing leaders who operate in the open.

Crypto World

Tennessee judge sides with Kalshi in ongoing sports markets battle

A federal judge in Tennessee has granted a preliminary injunction preventing state officials from enforcing gambling laws against prediction market platform Kalshi, marking a significant win for the federally regulated exchange in its escalating legal battles with state regulators.

Summary

- A Tennessee federal court granted a preliminary injunction blocking the Tennessee Sports Wagering Council from enforcing state gambling laws against Kalshi while litigation continues.

- U.S. District Judge Aleta A. Trauger signaled Kalshi is likely to succeed in arguing its sports event contracts fall under federal derivatives law regulated by the Commodity Futures Trading Commission, not state betting statutes.

- The ruling adds to a growing nationwide legal patchwork, including enforcement efforts by the Nevada Gaming Control Board, highlighting an escalating federal-versus-state regulatory clash over prediction markets.

Tennessee court halts state crackdown on Kalshi

U.S. District Judge Aleta A. Trauger ruled that Kalshi is likely to succeed in its argument that its sports-related event contracts fall under federal derivatives law, rather than state gambling statutes. The decision temporarily blocks enforcement actions by the Tennessee Sports Wagering Council while the broader lawsuit proceeds.

Kalshi operates as a designated contract market regulated by the CFTC offering event-based contracts that allow users to trade on the outcome of real-world events, including sports.

The company argues that these contracts qualify as “swaps” under the Commodity Exchange Act, placing them squarely within federal jurisdiction and preempting state-level gambling laws.

Tennessee regulators had issued cease-and-desist letters alleging that Kalshi’s sports markets constituted unlicensed sports betting. In granting the injunction, the court indicated that subjecting Kalshi to both federal derivatives oversight and state gaming regulation could undermine the uniform regulatory framework established by Congress.

The ruling adds to a growing patchwork of legal decisions nationwide. In Nevada, the Nevada Gaming Control Board has filed a civil enforcement action accusing Kalshi of offering unlawful wagering, while other states have taken mixed approaches in court.

Though temporary, the injunction underscores a broader jurisdictional clash between federal derivatives regulators and state gaming authorities. The outcome could have sweeping implications for prediction markets across the United States, potentially reshaping how sports-related event contracts are classified and regulated nationwide.

Crypto World

The 100-Day Crypto Bloodbath That’s Crushing Altcoins

According to CoinGlass, momentum gauges sit in neutral territory, reinforcing views that neither bulls nor bears dominate yet across majors.

The crypto market has lost about $730 billion in value in the past 100 days, according to data shared by on-chain analyst GugaOnChain on February 20.

The scale and speed of the drawdown point to heavy capital outflows, with smaller altcoins falling faster than large assets and traders watching for signs of stabilization.

Deepening Bearish Sentiment

According to GugaOnChain, Bitcoin’s market cap fell from $1.69 trillion on November 22, 2025, to $1.34 trillion currently, a decline of 21.62%. The top 20 cryptocurrencies, excluding Bitcoin and stablecoins, also suffered a major blow, dropping 15.17% from $1.07 trillion to $810.65 billion.

Just as vulnerable were mid- and small-cap altcoins, which plunged 20.06% from $390.38 billion to $267.63 billion over their respective 100-day windows.

Meanwhile, the selling pressure shows no sign of abating. Separate figures posted by Arab Chain show whale inflows to Binance reached a 30-day average near $8.3 billion, the highest level since 2024.

Large transfers to exchanges can signal preparation to sell or rebalance holdings, though such flows can also reflect derivatives positioning or liquidity management. The spike followed months of stable activity, which analysts often treat as a sign of changing sentiment among major holders.

Price action seems to be matching that cagey tone. At the time of writing, BTC was trading just below the $68,000 level after falling by more than 24% in the last month and roughly 30% over the past year.

You may also like:

Market-wide metrics also paint a similar picture, with total crypto capitalization standing near $2.4 trillion, up just 0.5% in 24 hours. According to CoinGlass, the average RSI sits near 45, indicating neutral momentum, and the Altcoin Season Index reads 45, also neutral.

Additionally, Bitcoin dominance holds near 57%, which signals that capital has not rotated aggressively into altcoins.

On-Chain Activity Slows

Recent data from market intelligence provider Santiment shows that network activity has also collapsed alongside prices. According to the firm, Bitcoin’s active supply stopped growing, with fewer coins moving across the network.

Per the data, there are 42% fewer unique Bitcoin addresses making transactions compared to 2021 levels, and 47% fewer new addresses are being created. Analysts describe this phenomenon as “social demotivation,” which is emotional fatigue and reduced engagement that often precedes narrative shifts.

Elsewhere, Glassnode reported that Bitcoin has broken below the “True Market Mean” and slipped into a defensive range toward the realized price of approximately $54,900. Historically, deeper bear market phases have tended to find their lower structural boundary around this level, which represents the average acquisition cost of all circulating coins.

Furthermore, the Accumulation Trend Score sits near 0.43, well short of the 1.0 level that would signal serious large-entity buying. At the same time, Spot Cumulative Volume Delta has turned negative across major exchanges, meaning sellers are still in control.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video9 hours ago

Video9 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World14 hours ago

Crypto World14 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show