Crypto World

Harvard endowment tilts harder into Bitcoin ETFs than Google stock

Harvard’s endowment has quietly made Bitcoin ETFs a top public holding, surpassing Google and joining other elite universities in rotating long‑term capital into digital assets.

Summary

- Filings show Harvard built and then tripled its BlackRock iShares Bitcoin Trust stake, lifting IBIT above Alphabet and other big‑tech names in its public portfolio.

- Brown, Emory, and other U.S. universities have also disclosed multi‑million‑dollar Bitcoin ETF and trust positions, signaling a broader endowment shift into crypto.

- The rotation comes as Bitcoin trades near $68,400, with Ethereum and Solana also rallying while digital assets again track global risk appetite.

Harvard University’s endowment is now leaning harder into Bitcoin (BTC) than into Silicon Valley’s most iconic search giant—and markets are taking note

Harvard’s Quiet Portfolio Pivot

“FUN FACT: Harvard University holds more in Bitcoin ETFs than it holds shares in Google,” Bitcoin Magazine posted on X on February 10, distilling a shift years in the making.

Regulatory filings show Harvard built a roughly $116.7 million position in BlackRock’s iShares Bitcoin Trust in 2025, lifting its Bitcoin exposure above stakes in Alphabet and other big‑tech mainstays.

Subsequent disclosures indicate Harvard increased that wager, with some estimates putting its Bitcoin ETF holdings in the hundreds of millions and ranking the position among its single largest listed assets.

Commentary from the digital‑asset industry has been blunt. “Most people think Bitcoin is the gamble, but Harvard’s math clearly suggests that not owning enough of it is the bigger risk to their long‑term portfolio,” wrote SIG Labs.

Another bitcoiner framed it more simply: “Bitcoin is moving from theory to balance sheets.”

Endowments Move Into Crypto

Harvard is not alone. Brown and Emory universities have both disclosed sizable Bitcoin ETF and trust positions, running into the tens of millions of dollars in IBIT and Grayscale’s Bitcoin Mini Trust. One crypto media noted that “several prominent U.S. university endowments have disclosed investments in cryptocurrency – including Emory, Brown, and Dartmouth Universities.”

Bitcoin, Google, and Macro Risk

Harvard’s rotation comes as digital assets again trade as a pure expression of global risk appetite. Bitcoin (BTC) is hovering around $68,400, with intraday swings pulling it below $70,000 twice in the past 24 hours as traders digest a near‑50% drawdown from its 2025 peak near $126,000.

Ethereum (ETH) changes hands near $4,760, up roughly 2.5% over the last day, while Solana (SOL) trades close to $208 after a gain of just over 5%, on volumes above $12 billion.

“This is Harvard flipping tech for BTC ETFs,” one trader wrote, calling it “wild” and a sign that “institutional adoption is officially peaking right now.”

If that proves true, Bitcoin beating Google inside the world’s richest university endowment may be remembered as more than just a memeable “fun fact.”

Crypto World

AI mania is helping cap crypto’s upside, Wintermute says: Crypto Daybook Americas

By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin slipped to $68,500 on Tuesday, having failed to reclaim $70,000 after trading above that level for a while over the weekend. The CoinDesk 20 Index (CD20) dropped 0.23% over the past 24 hours.

The market appears to be stabilizing after last week’s decline to $60,000, which erased all the cryptocurrency’s gains since Donald Trump’s presidential election victory in November 2024.

The slide prompted over $2.7 billion in liquidations, flushing out leveraged positions. It may not, however, have reflected a fundamental change in the crypto market. Rather, it might have been tied to declining liquidity in the broader financial ecosystem.

Raoul Pal, CEO of Global Macro Investor, said last week’s selloff across crypto and tech stocks stemmed from temporary drains in U.S. dollar liquidity tied to Treasury operations and government funding dynamics.

And then there’s artificial intelligence (AI). Investments in that technology have been “absorbing available capital for months at the expense of everything else,” Wintermute wrote in a note. The trading firm wrote that stripping AI companies from the Nasdaq 100 index sees crypto’s negative skew nearly disappear.

“The underperformance during rallies and amplified selling during drops is almost entirely explained by AI rotation,” Wintermute OTC trader Jasper De Maere wrote. “For crypto to outperform again, air needs to come out of the AI trade.”

Elsewhere, Japanese government bond yields, which rose after Prime Minister Sanae Takaichi’s decisive election victory at the weekend, are dropping. That could avoid further unwinding of the yen carry trade, which might have seen up to $5 trillion invested overseas moving back to the country.

Arthur Hayes, a co-founder of crypto exchange BitMEX, pointed to Takaichi’s victory as a potential catalyst for the yen to lose value against the dollar, making the Japanese currency a less attractive investment. That could be a boon for risk assets, including cryptocurrencies.

Still, prices are likely to remain rangebound for the time being. The Coinbase Premium Index, which measures demand from large U.S. investors on the exchange, remains negative, and spot bitcoin ETF flows also show hesitation, with daily net inflows coming in at just $145 million yesterday.

“While retail spreads attention across other asset classes, institutional flows through ETFs and derivatives now seem to dictate direction,” Wintermute wrote. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Feb. 10: Mantle to host Mantle State of Mind Ep. 06 live from Consensus HK.

- Macro

- Feb. 10, 7 a.m.: Brazil inflation rate YoY (Prev. 4.26%), MoM (Prev. 0.33%)

- Feb. 10, 8:30 a.m.: U.S. retail sales MoM for December Est. 0.5% (Prev. 0.6%)

- Feb. 10 8:30 a.m.: U.S. employment cost index QoQ (Prev. 0.8%)

- Feb. 10, 2 p.m.: Argentina inflation rate YoY (Prev. 31.5%), MoM (Prev. 2.8%)

- Earnings (Estimates based on FactSet data)

- Feb. 10: Canaan (CAN), pre-market, -$0.03

- Feb. 10: Robinhood Markets (HOOD), post-market, $0.63

- Feb. 10: Upexi (UPXI), post-market, -$0.07

- Feb. 10: Lite Strategy (LITS), post-market

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Unlocks

- Token Launches

- Feb. 10: Venice (VVV) token emissions to drop from 8 million to 6 million per year.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is down 1.9% from 4 p.m. ET Monday at $69,041.32 (24hrs: -0.06%)

- ETH is down 4.94% at $2,016.57 (24hrs: -0.8%)

- CoinDesk 20 is down 2.59% at 3,086.55 (24hrs: +0.43%)

- Ether CESR Composite Staking Rate is up 7 bps at 2.82%

- BTC funding rate is at -0.006% (-6.6247% annualized) on Binance

- DXY is unchanged at 96.83

- Gold futures are unchanged at $5,077.00

- Silver futures are down 0.43% at $81.88

- Nikkei 225 closed up 2.28% at 57,650.54

- Hang Seng closed up 0.58% at 27,183.15

- FTSE is down 0.38% at 10,346.98

- Euro Stoxx 50 is unchanged at 6,060.67

- DJIA closed on Monday unchanged at 50,135.87

- S&P 500 closed up 0.47% at 6,964.82

- Nasdaq Composite closed up 0.90% at 23,238.67

- S&P/TSX Composite closed up 1.7% at 33,023.32

- S&P 40 Latin America closed up 1.97% at 3,767.79

- U.S. 10-Year Treasury rate is down 1.4 bps at 4.184%

- E-mini S&P 500 futures are up 0.09% at 6,989.25

- E-mini Nasdaq-100 futures are unchanged at 25,359.00

- E-mini Dow Jones Industrial Average Index futures are unchanged at 50,260.00

Bitcoin Stats

- BTC Dominance: 59.27% (+0.05%)

- Ether-bitcoin ratio: 0.02921 (-2.66%)

- Hashrate (seven-day moving average): 1,005 EH/s

- Hashprice (spot): $34.72

- Total fees: 2.92 BTC / $204,792

- CME Futures Open Interest: 118,215 BTC

- BTC priced in gold: 13.6 oz.

- BTC vs gold market cap: 4.6%

Technical Analysis

- The ratio of altcoins (excluding Top 10) to BTC weekly chart continues to maintain its core support, suggesting the broader altcoin market did not experience an extreme selloff during the bitcoin’s recent slide.

- The weekly RSI has been climbing, indicating some momentum in altcoins relative to BTC.

- There’s no clear breakout at the moment, but it’s worth keeping an eye on.

Crypto Equities

- Coinbase Global (COIN): closed on Monday at $167.25 (+1.29%), -1.44% at $164.84 in pre-market

- Circle Internet (CRCL): closed at $60.10 (+5.36%), -1.31% at $59.31

- Galaxy Digital (GLXY): closed at $21.15 (+7.03%), +0.61% at $21.28

- Bullish (BLSH): closed at $32.05 (+16.76%), unchanged in pre-market

- MARA Holdings (MARA): closed at $8.06 (-2.18%), -1.49% at $7.94

- Riot Platforms (RIOT): closed at $14.97 (+3.60%), -1.27% at $14.78

- Core Scientific (CORZ): closed at $18.55 (+10.35%)

- CleanSpark (CLSK): closed at $10.19 (+1.09%), -1.77% at $10.01

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $43.83 (+8.41%)

- Exodus Movement (EXOD): closed at $10.74 (+1.70%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $138.44 (+2.6%), -2.61% at $134.82

- Strive (ASST): closed at $10.15 (-14.86%), +1.03% at $10.25

- SharpLink Gaming (SBET): closed at $7.11 (+1.14%), -0.7% at $7.06

- Upexi (UPXI): closed at $1.05 (-7.89%), +2.86% at $1.08

- Lite Strategy (LITS): closed at $1.05 (-0.94%), -2.86% at $1.02

ETF Flows

Spot BTC ETFs

- Daily net flows: $144.9 million

- Cumulative net flows: $54.82 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: $57 million

- Cumulative net flows: $11.9 billion

- Total ETH holdings ~5.8 million

Source: Farside Investors

While You Were Sleeping

Crypto World

Blockchain.com wins UK registration nearly four years after abandoning FCA process

Cryptocurrency exchange and wallet provider Blockchain.com has won regulatory approval in the U.K nearly four years after seemingly giving up.

Blockchain.com was added to the Financial Conduct Authority’s (FCA) registry of licensed crypto companies on Tuesday under its trading name “BC Operations.”

The London-based company elected to withdraw its application for FCA licensing in March 2022 having not won approval ahead of an impending deadline. Blockchain.com pivoted to its registered business in Lithuania.

Registration in the U.K. allows Blockchain.com to carry out certain crypto-related activities in the U.K. on the basis that it complies with money laundering and counter-terrorist financing rules.

“Blockchain.com is now operating under the same rigorous standards as traditional finance and banks in the U.K.,” the company said in a post on X on Tuesday.

The FCA’s crypto company licensing regime, however, stops short of full financial services authorization — this is set to be introduced under a new licensing framework taking effect from October next year.

Read More: Ripple wins UK regulatory approval from Financial Conduct Authority

Crypto World

BTC holding in tight range as markets brace for January employment data

Following the usual recent pattern, crypto markets fell sharply as U.S. stocks opened for trade Tuesday, but recovered most of those losses in a similarly quick fashion.

In mid-morning trade, bitcoin was at $69,200, down marginally from 24 hours ago. Ether underperformed, down 1.8%, with similar declines in XRP and Solana .

While bitcoin’s current drawdown is the most significant since the 2024 halving, trading volume stayed low during the decline, suggesting retail investors stepped back rather than rushed to sell, according to Kaiko.

The “market [is now] approaching critical technical support levels that will determine whether the four-year cycle framework remains intact,” Kaiko research analyst Laurens Fraussen wrote in a report Tuesday.

Trading firm Wintermute expects bitcoin to remain in the current range as it’s still in price discovery.

Recent bitcoin moves have been driven by leveraged derivatives rather than spot demand, the firm said, with light spot volumes leaving prices sensitive to crowded positions. Wintermute pointed to last Friday’s rebound as a short squeeze in perpetual futures and said the return of volatility caught investors off guard after a period of complacency.

January jobs report on tap

Originally scheduled for last Friday, the government’s January Nonfarm Payrolls Report is now coming out on Wednesday morning due to the brief federal shutdown last month.

Economist forecasts are for 70,000 jobs to have been added, up from 50,000 in December. The unemployment rate is expected to remain at 4.4%.

White House trade counselor Peter Navarro, however, said in a Fox interview Tuesday that expectations need to be significantly revised lower. His comments follow those of White House economic adviser Kevin Hassett, who advised markets not to panic on weak jobs data.

Those remarks appear to have been noted by the bond market, where the 10-year Treasury yield is lower by 5 basis points to 4.14%. Lower interest rates and easier Federal Reserve monetary policy are typically assumed to be good for assets like bitcoin, but it hasn’t been the case this cycle, with bitcoin plunging even as the Fed has trimmed rates by 75 basis points in recent months.

Crypto World

Tether invests in LayerZero Labs as it doubles down on cross-chain tech, agentic finance

Tether Investments, the investment arm of the leading stablecoin issuer, has made a strategic investment in LayerZero Labs, which develops an interoperability protocol called LayerZero.

The move is essentially a bet on the technology underpinning USDt0, a blockchain-agnostic version of Tether’s dollar-pegged token that has moved over $70 billion across blockchains in less than a year, according to a press release the company shared.

LayerZero’s infrastructure enables cryptocurrencies to flow across different blockchains without fragmentation or illiquidity. That allows developers building financial tools to rely on stablecoins without getting their funds locked in a single network.

That same architecture also supports more experimental use cases, like AI agents managing their own wallets and sending payments autonomously, in what Tether called “agentic finance.”

Tether’s investment comes on the heels of USDt0’s deployment by Everdawn Labs and is built using LayerZero’s Omnichain Fungible Token (OFT) standard. Alongside their tokenized Tether gold token, XAUt0, the projects are seen as real-world tests of LayerZero’s interoperability framework.

The financial terms of the deal were not disclosed, and Tether did not reply to a request for comment.

The stablecoin giant has been using the billions it generates from backing USDT tokens in circulation to make a wide range of investments. These include a majority stake in Latin American agricultural firm Adecoagro (AGRO), a privacy-focused health app, and a stake in video-sharing platform Rumble (RUM).

The company has been aggressively accumulating gold, and earlier this month, itbought a $150 million stake in Gold.com to boost the distribution of tokenized gold.

LayerZero’s ZRO token gained as much as 10% on the news, but quickly reversed, now lower by 3% over the past 24 hours.

Crypto World

Bad Bunny’s Super Bowl Zara Moment Signals Luxury Shift

Editor’s note: This press release examines the market implications of Zara’s recent cultural visibility during the Super Bowl, framing it as more than a one-off branding moment. Through commentary from an eToro market analyst, the announcement explores how global consumer brands are redefining value by prioritizing cultural relevance, accessibility, and identity over traditional luxury signals like exclusivity and price. While rooted in fashion and consumer culture, the analysis connects directly to long-term brand positioning, investor perception, and how intangible assets such as narrative and cultural alignment can shape competitive advantage over time.

Key points

- Zara’s Super Bowl moment is positioned as a strategic signal, not a traditional advertising play.

- The brand is increasingly framed as “accessible luxury” rather than fast fashion.

- Cultural embedding is highlighted as a form of earned media that reduces marketing dependence.

- Employee inclusion is cited as a source of internal cohesion and intangible capital.

- The growing influence of Hispanic culture is identified as a structural demand driver.

Why this matters

For investors and market observers, the analysis highlights how cultural relevance can reshape long-term brand valuation even when near-term financials remain unchanged. As attention costs rise and consumer identity becomes central to purchasing behavior, companies that successfully shift their perceived category may unlock durable advantages that are not immediately priced in by markets. This dynamic is especially relevant for consumer-facing companies competing across global, demographically diverse markets.

What to watch next

- How Zara’s brand positioning continues to evolve in future cultural moments.

- Whether market perceptions begin to reflect a reclassification beyond fast fashion.

- Signals of sustained alignment with emerging demographic and cultural trends.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Abu Dhabi, United Arab Emirates – 10 February, 2026: Zara’s appearance on the Super Bowl stage has sparked renewed debate around the evolving definition of luxury, highlighting a broader shift in how global brands compete for cultural relevance, consumer identity, and long-term value.

Commenting on the development, Javier Molina, Market Analyst at eToro, said the moment carries strategic significance beyond its cultural visibility.

What may initially appear as a high-profile cultural moment reflects a deeper change in perceived value hierarchies, where cultural resonance and accessibility increasingly rival traditional notions of exclusivity.

The episode underscores Zara’s ability to generate global relevance without relying on direct advertising expenditure. As the cost of consumer attention continues to rise, embedding the brand within culture has become a powerful source of earned media — supporting brand strength while limiting the need for incremental marketing investment.

More importantly, the moment signals a potential repositioning. Zara is increasingly being viewed beyond the confines of fast fashion, occupying a middle ground best described as accessible or functional luxury. Rather than competing on price or scarcity, the brand is engaging consumers through narrative, identity, and cultural alignment — factors that resonate strongly with younger generations and are structurally difficult for traditional luxury brands to replicate.

There are also internal implications. By placing employees at the centre of the story as recipients of symbolic value rather than passive observers, the brand strengthens cohesion and execution within a business model built on speed, scale, and operational efficiency. This intangible capital can translate into improved performance over time.

Finally, the moment reinforces a broader structural trend shaping Western consumption: the growing influence of Hispanic culture as a driver of both demand and cultural leadership. For Zara, this represents not just visibility, but strategic alignment with the demographic and cultural momentum of its core markets.

From an investment perspective, Molina noted that such cultural shifts may not immediately impact quarterly results, but they play a meaningful role in redefining long-term brand positioning. When a company begins to change the category in which it operates, markets are often slow to fully reflect that transformation — creating potential value over time.

About eToro

eToro is the trading and investing platform that empowers you to invest, share and learn. We were founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way. Today we have 40 million registered users from 75 countries. We believe there is power in shared knowledge and that we can become more successful by investing together. So we’ve created a collaborative investment community designed to provide you with the tools you need to grow your knowledge and wealth. On eToro, you can hold a range of traditional and innovative assets and choose how you invest: trade directly, invest in a portfolio, or copy other investors. You can visit our media centre here for our latest news.

Disclaimers:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is a group of companies that are authorised and regulated in their respective jurisdictions. The regulatory authorities overseeing eToro include:

- The Financial Conduct Authority (FCA) in the UK

- The Cyprus Securities and Exchange Commission (CySEC) in Cyprus

- The Australian Securities and Investments Commission (ASIC) in Australia

- The Financial Services Authority (FSA) in the Seychelles

- The Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM) in the UAE

- The Monetary Authority of Singapore (MAS) in Singapore

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Crypto World

This Trending Meme Coin Explodes by 100% Weekly: What Comes Next?

Is this the new crypto sensation or just another scam?

The cryptocurrency market experienced a severe pullback in the past few weeks, culminating in a sharp crash on February 6.

The meme coin sector was significantly affected by the red wave, and most leading tokens in that niche have posted substantial losses. However, the lesser-known pippin (PIPPIN) defied the carnage and its valuation soared by over 100% in the past week.

Swimming Against the Tide

PIPPIN is a Solana-based meme coin that began trading in late 2024. It is themed around an AI-generated unicorn character named “Pippin,” which has become the logo of the token.

The meme coin had its glory days toward the end of 2025, when its price reached an all-time high of almost $0.60, and its market capitalization surpassed $500 million. While January was also positive, the beginning of February offered a deep correction.

In the past week, though, the asset entered another major uptrend, which contrasts with the overall bearish environment in the crypto market. As of press time, PIPPIN is worth roughly $0.38, or a 114% increase on a weekly basis.

Analysts are curious if the bull run is sustainable since there isn’t an evident catalyst driving the move north. X user ALTS GEMS Alert claimed the price has initiated a “strong bounce” from the demand zone at around $0.26, predicting that if buyers remain active, PIPPIN could soar to $0.40 and even $0.60.

Satori chipped in, too. The analyst told their over 700,000 followers on X that they have added the coin to their watchlist, arguing it has potential for much more impressive gains ahead.

You may also like:

A Ticking Time Bomb?

At the same time, some industry participants warned investors to stay away from PIPPIN, claiming its valuation is driven by pure speculation, and its utility is questionable.

X user Dippy.eth described the asset as “the largest scam of the past year,” arguing it has reached the first “take profit” zone. “0 technologies, 0 real metrics, 0 real users, 0 attention from real CT degens,” they added.

Crypto_Jobs is also pessimistic, envisioning a possible plunge to as low as $0.21. Some indicators, such as PIPPIN’s Relative Strength Index (RSI), support the bearish scenario. The technical analysis tool measures the speed and magnitude of recent price changes to help traders identify potential reversal points.

It ranges from 0 to 100, and readings above 70 suggest the valuation has risen too much in a brief period and could be due for imminent correction. Currently, the RSI stands at around 85.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

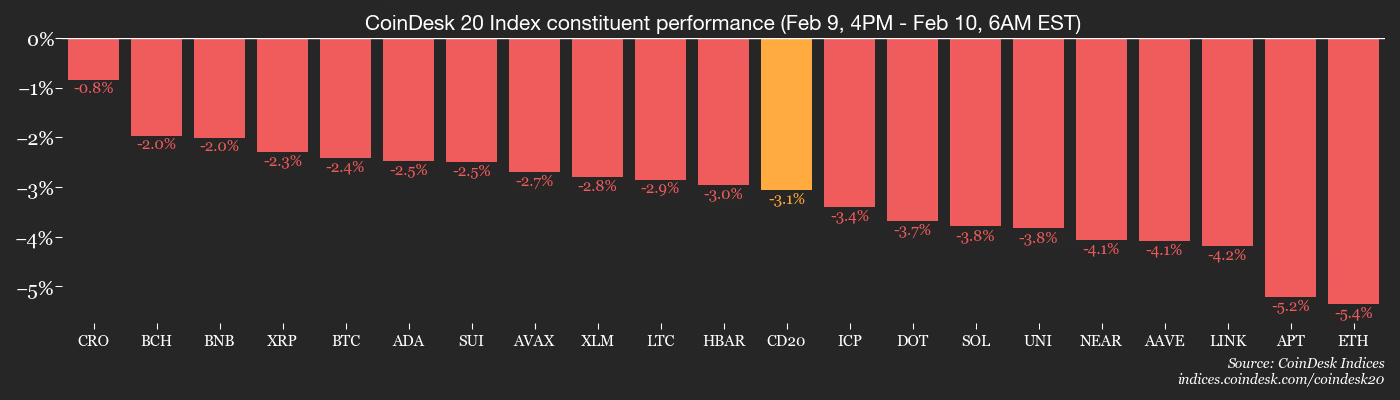

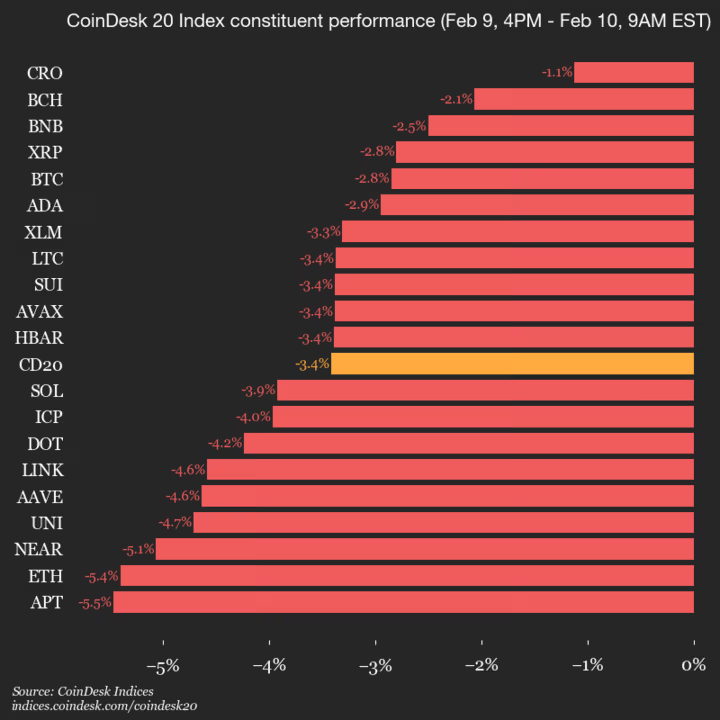

index falls 3.4% as all constituents trade lower

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1968.37, down 3.4% (-69.59) since 4 p.m. ET on Monday.

None of the 20 assets are trading higher.

Leaders: CRO (-1.1%) and BCH (-2.1%).

Laggards: APT (-5.5%) and ETH (-5.4%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Crypto exchange Kraken fires CFO Stephanie Lemmerman as long-awaited IPO draws closer

Kraken sacked its chief financial officer, Stephanie Lemmerman, just as the crypto exchange prepares to publicly list in the U.S. in the early part of this year, according to two people familiar with the matter.

Lemmerman joined Kraken from Dapper Labs in November 2024 and was the exchange’s CFO for one year and four months. She now has a strategic advisory role at Kraken, one of the people said.

Robert Moore, formerly VP of business expansion, has basically taken over her job, the person said. An updated leadership page on the website of Kraken’s parent company, Payward Inc., lists Moore as deputy CFO. Lemmerman does not appear.

Clearly it matters that Kraken has removed its CFO after lodging a confidential filing with U.S. regulators in November. That came just days after Kraken raised $800 million at a $20 billion valuation, including $200 million from Citadel Securities.

Other people who have been promoted to senior roles include Curtis Ting, who was made chief operating officer in December, and Kamo Asatryan was made chief data officer in January.

A second person familiar with the changes said finance at Kraken is changing to become more of a product than a back-office function.

Kraken declined to comment.

Crypto World

Michael Saylor downplays Strategy credit risk as bitcoin tumbles: ‘We’ll refinance the debt’

Strategy CEO Michael Saylor brushed off concerns about the company’s credit risk if bitcoin continues to tumble.

In fact, Saylor said he plans to keep accumulating the cryptocurrency for the company every quarter.

“If bitcoin falls 90% for the next four years, we’ll refinance the debt,” the executive said Tuesday on CNBC’s “Squawk Box.” “We’ll just roll it forward.”

Asked whether he believed banks would continue to lend to the digital asset treasury firm if bitcoin collapses, Saylor said, “Yeah, because the volatility of bitcoin is such that it’s always going to be a value.”

Bitcoin was last trading at $68,970.45, down 9% over the past five days. It has retreated as investors broadly reassess its utility, with the token tumbling 15% to $60,062.00 on Thursday — its lowest level in roughly 16 months. At its trough, the crypto was down more than 50% from its record.

Strategy has more than $8 billion in total debt on its balance sheet, in part due to its issuance of convertible notes used to buy bitcoin.

The executive also dismissed suggestions that Strategy would sell any of its digital asset holdings: “I expect we’ll be buying bitcoin every quarter forever,” Saylor said.

Strategy, 1 year

Strategy holds 714,644 bitcoins worth about $49 billion as of writing time, per its website. That makes it the largest corporate owner of the digital asset.

Saylor noted his firm has two-and-a-half years worth of cash on its balance sheet to cover dividends.

Strategy shed about 2% on Tuesday as bitcoin broke below $70,000 again. The stock has tumbled more than 40% over the past three months.

Crypto World

Vitalik Buterin outlines how the blockchain could play a key role in the future of AI

Ethereum co-founder Vitalik Buterin called for a rethink of how crypto and AI should come together, warning that a growing focus on developing artificial general intelligence (AGI) risks missing the bigger picture.

In a post on X that revisits ideas he first outlined two years ago, Buterin argues that the accelerated push toward artificial general intelligence often resembles the kind of unchecked speed and scale that Ethereum itself was created to challenge.

Rather than racing to build more powerful AI systems, he says the goal should be to guide AI development in a way that protects human freedom, spreads power more evenly and avoids both extreme AI risks and everyday security failures.

Buterin outlines a near-term vision where Ethereum plays an important — though not exclusive — role as infrastructure for AI. That includes tools to allow people to interact with AI models more privately, reducing the need to trust centralized providers. For example, running models locally, making anonymous payments for AI services and using cryptography to verify how AI systems behave.

He also describes Ethereum as a way for AI systems to coordinate economically, allowing bots to pay other bots, post security deposits, build reputations and resolve disputes without relying on a single company. Paired with AI tools that help people evaluate decisions and outcomes, Buterin argues these systems could make long-discussed ideas like decentralized governance work at real-world scale.

“To me, Ethereum, and my own view of how our civilization should do AGI, are precisely about choosing a positive direction rather than embracing undifferentiated acceleration of the arrow,” Buterin wrote on X.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat20 hours ago

NewsBeat20 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World9 hours ago

Crypto World9 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports19 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World9 hours ago

Crypto World9 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoDriving instructor urges all learners to do 1 check before entering roundabout