Crypto World

Institutions Favor Crypto Rails Over Tokens, Experts Say

Institutional capital is flowing into digital markets. But it is not chasing speculative altcoins. Instead, it is targeting tokenization, custody, and on-chain infrastructure.

That was the clear message from a recent BeInCrypto Digital Summit panel, where executives from across exchanges, infrastructure, and tokenization platforms discussed how traditional finance is approaching crypto.

The discussion featured Federico Variola, CEO of Phemex; Maria Adamjee, Global Head of Investor Relations and Market Structure at Polygon; Jeremy Ng, Founder and CEO of OpenEden; and Gideon Greaves, Head of Investment at Lisk.

Sponsored

Operating Exposure, Not Speculation

Maria Adamjee, Global Head of Investor Relations and Market Structure at Polygon, said institutions are no longer debating whether crypto belongs in portfolios. The question now is how to size it.

“Institutions aren’t debating if crypto belongs anymore,” said Maria Adamjee from Polygon . “They’re figuring out how to size it as a new asset class.”

However, she stressed that most large asset managers are not taking outright balance sheet risk on volatile tokens. Instead, they are seeking “operating exposure” through tokenization, custody, and on-chain settlement.

In other words, they are buying access to the infrastructure rather than speculating on price swings.

Conviction Still Being Tested

Federico Variola, CEO of Phemex, struck a more cautious tone. He questioned whether institutions have truly committed for the long term.

“Not many companies have gone really full crypto,” the Phemex CEO said. Many institutions, he added, structure partnerships in ways that do not disrupt their core business lines.

He warned that current enthusiasm may not survive a prolonged downturn. “If we enter a longer bear period, maybe we wouldn’t see as much interest as we are seeing today,” he said.

Sponsored

Sponsored

That raises a critical question. Are institutions building strategic allocations, or are they hedging against disruption while limiting risk?

Tokenization as the Bridge

Jeremy Ng, founder and CEO of OpenEden, argued that the strongest institutional case lies in tokenized real-world assets.

He pointed to growing hedge fund participation in crypto and rising plans to increase exposure in 2026. At the same time, he emphasized that tokenization solves a practical problem: cost.

“When large asset managers put products on-chain, it reduces costs,” Ng said. Blockchain can replace transfer agents and fund administrators by acting as a proof-of-record layer.

For institutions, this is less about ideology and more about efficiency.

Sponsored

Sponsored

The Market Structure Gap

Still, structural barriers remain.

Polygon’s Adamjee noted that institutions struggle to price most crypto tokens. “Are they priced based off revenues, or network value?” she asked. “There’s no real P/E ratio associated with them.”

As a result, institutional allocations skew heavily toward Bitcoin, Ethereum, and infrastructure plays. The broader altcoin market lacks the valuation frameworks traditional finance relies on.

Ng echoed that concern. “90% of these tokens that have been launched don’t really have a real business,” he said. “They are not really generating fees.”

Without revenue models and clear value accrual, many tokens fail institutional due diligence.

Fewer Tokens, More Real Businesses?

Variola acknowledged that the industry itself bears responsibility. Exchanges, he said, have often pushed new listings aggressively.

Sponsored

Sponsored

“As an industry we should be policing a little bit better,” Ng said, adding that there should likely be fewer tokens overall.

Polygon’s Adamjee agreed that current incentives reward token proliferation. Exchanges earn fees from listings, creating tension between growth and quality control.

That dynamic complicates institutional adoption. Large asset managers require transparency, durable revenue, and predictable market structure.

Infrastructure First

Taken together, the panel’s message was clear. Institutions are not embracing crypto culture wholesale. They are integrating blockchain, which improves efficiency.

They favor low-volatility assets, regulated wrappers, and tokenized versions of traditional products. They are building exposure to the rails.

For now, infrastructure and tokenization lead. Speculative tokens follow at a distance.

The next phase of institutional adoption may depend less on price cycles and more on whether crypto can build businesses that look familiar to traditional capital — with revenue, structure, and accountability to match.

Crypto World

Ether.fi Migrates Cash Product to OP Mainnet in Long-Term Optimism Enterprise Partnership

TLDR:

- Ether.fi Cash processes 28,000 daily spend transactions averaging $2 million in volume, doubling every two months.

- The migration covers 70,000 active cards, 300,000 accounts, and millions in user TVL moving to OP Mainnet.

- OP Stack processed 3.6 billion transactions in H2 2025, accounting for 13% of all global crypto transactions.

- ether.fi users will access OP token rewards, 3%+ cashback, travel perks, and free metal cards post-migration.

Ether.fi is migrating its flagship Cash product to Optimism’s OP Mainnet. The move covers roughly 70,000 active cards and 300,000 accounts.

Millions in user TVL will also transfer to the new network. The migration is part of a long-term OP Enterprise partnership.

Together, the teams aim to accelerate on-chain global payments. This positions OP Mainnet as a leading destination for payment activity in the broader crypto ecosystem.

Ether.fi Cash Brings Scale and Speed to OP Mainnet

Ether.fi Cash is a non-custodial digital banking product combining a credit card with a savings account. It runs DeFi protocols under the hood to generate yield for users.

The product allows movement between fiat and crypto while offering cashback and global spending. Users manage their assets without giving up custody.

Since launching last year, the product has grown quickly. Each day, the app processes 2,000 internal swaps and 28,000 spend transactions.

Daily spend volume averages around $2 million. These numbers have roughly doubled every two months since launch.

The migration to OP Mainnet will expand liquidity access for users making swaps. They will also gain access to more assets for deposits and withdrawals.

Gas fees and network costs for card transactions will be covered by ether.fi. More cashback rewards are also planned as part of the move.

For end users, the transition is designed to be seamless. Optimism has managed major ecosystem migrations before and has a structured process in place. Users should not experience disruption during the switch to the new network.

What the OP Enterprise Partnership Means for Ether.fi

As an OP Enterprise customer, Ether.fi gains access to several infrastructure benefits. These include established liquidity, a dedicated account manager, and priority access to new features. The same codebase works across all OP Stack chains, which reduces development overhead.

The OP Stack processed 3.6 billion transactions in the second half of 2025. That represented 13 percent of all crypto transactions during that period. OP Mainnet serves as a hub for DeFi activity and a launchpad for consumer apps.

As part of the integration, ether.fi users will receive access to OP token rewards. Ongoing reward programs include 3% or more cashback, in-app campaigns, travel discounts, and free metal cards. Membership tiers and lounge access are also part of the package.

ether.fi sees blockchain infrastructure as a way to expand globally at a lower cost than traditional fintech. Operating non-custodially allows the platform to scale without the overhead traditional banks carry.

The partnership with Optimism supports that model with enterprise-grade tools and network depth.

Crypto World

Fed Policymakers Raise Prospect of Interest Rate Hikes

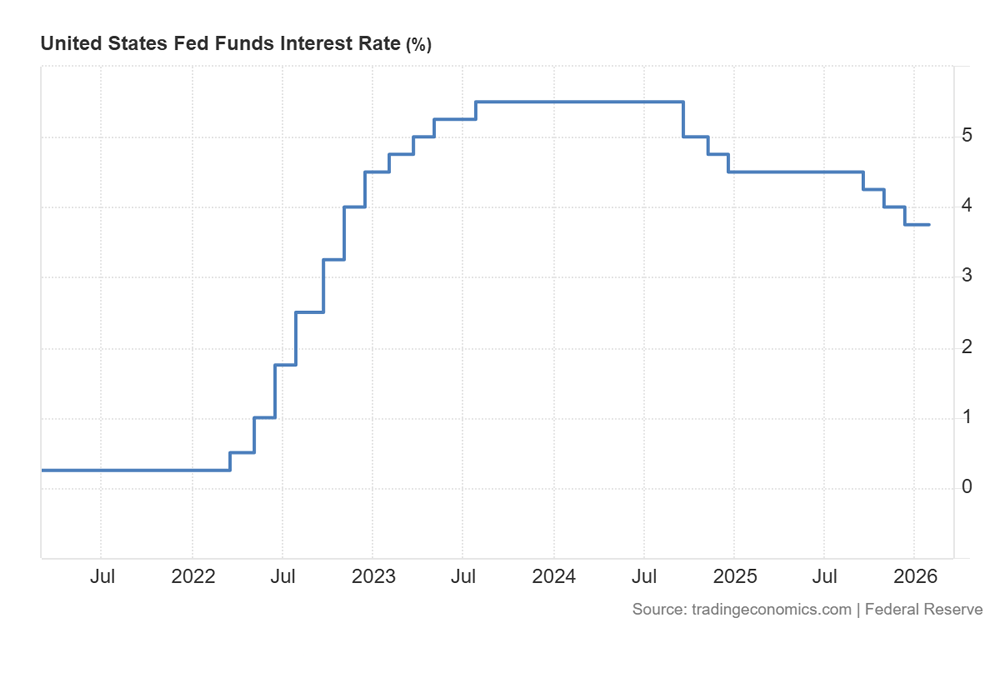

United States Federal Reserve policymakers discussed the possibility of interest rate increases last month, according to newly released comments from a January meeting.

The minutes of the Federal Open Market Committee meeting from late January were released on Wednesday, revealing that some policymakers were mulling a rate hike due to stubbornly high inflation.

Several participants indicated that they would support “the possibility that upward adjustments to the target range for the federal funds rate could be appropriate if inflation remains at above-target levels,” the minutes stated.

Central bank policymakers voted to keep interest rates unchanged at 3.5% to 3.75% at their January meeting after cutting rates three times at the end of 2025, from 4.5% to current levels.

If enacted, it would be the first rate hike since July 2023. However, CME futures markets indicate a 94% probability that rates will remain unchanged at the Fed’s next meeting on March 18.

The Federal Reserve has two primary mandates for its policy on rates: inflation and the labor market.

High inflation concerns persist

The minutes also revealed that there is a significant “hawkish” contingent that is not yet ready to commit to further cuts.

Some participants commented that it would likely be appropriate to “hold the policy rate steady for some time” to give them more time to assess economic data.

However, a number of these participants judged that “additional policy easing may not be warranted until there was a clear indication that the progress of disinflation was firmly back on track.”

Related: Why Bitcoin has recently reacted more to liquidity conditions than to rate cuts

Most participants cautioned that progress toward the 2% inflation objective “might be slower and more uneven than generally expected,” judging that there was a meaningful risk of it remaining above the target.

If inflation were to decline in line with expectations, rate reductions “would likely be appropriate,” the minutes stated.

US inflation as measured by the Consumer Price Index (CPI) is currently 2.4%, having increased 0.2% in January, according to the Bureau of Labor Statistics.

Rate hikes are typically bad for crypto prices

Higher rates are generally bearish for high-risk assets such as crypto, as safer assets like Treasury bonds or cash offer better returns with no risk.

Higher rates also make borrowing more expensive, which reduces speculative activity, leverage, and venture capital investments.

Crypto market sentiment, which is already at rock bottom, could also be further hit by a hawkish Federal Reserve.

Magazine: Chinese New Year boosts interest, TradFi buying crypto exchanges: Asia Express

Crypto World

Thiel’s Founders Fund Dumps ETHZilla Stake as ETH Treasuries Strain

The exit by billionaire tech investor Peter Thiel’s Founders Fund from ETHZilla marks a notable pivot in how crypto treasuries are managed and disclosed. A Tuesday filing with the U.S. Securities and Exchange Commission shows affiliates of Thiel no longer hold any stake in the Ether-focused treasury company, signaling a retreat from a venture that once intersected biotech finance with a crypto strategy. The move comes after an Aug. 4, 2025 filing disclosed a 7.5% stake in 180 Life Sciences Corp., comprising 11,592,241 shares valued at roughly $40 million when shares traded near $3.50. In crypto markets, the timing of this exit underscores growing scrutiny of Ether‑heavy treasury models as investors reassess risk, liquidity, and regulatory clarity.

ETHZilla’s lineage traces back to a biotech outfit rebranding around a dedicated Ether treasury program. The rebirth into ETHZilla followed a July 2025 fundraising drive that raised about $425 million to launch an Ether treasury strategy and reposition the company under the new name. That period underscored the appetite among certain investors for backing Ether-centric balance sheets, even as Ether‑heavy strategies faced volatile price swings and evolving risk controls. The narrative around ETHZilla intensified as the firm subsequently pursued additional liquidity through convertible debt, expanding its Ether holdings in a bid to deploy capital across decentralized finance (DeFi) and tokenized assets.

The sequence of events in late 2025 paints a fuller picture of how these strategies evolved. In September, ETHZilla tapped investors for roughly $350 million via convertible bonds, enabling further expansion of its Ether holdings. At one point, the firm held more than 100,000 Ether, positioning its balance sheet as a significant, if high‑volatility, exposure to the largest smart contract platform’s native asset. The strategy sought to diversify across DeFi protocols and tokenized assets, but the market environment subsequently prompted reallocation and liquidity management moves as macro and crypto-specific tides shifted.

By December, ETHZilla began liquidating a portion of its Ether holdings to meet debt obligations. Specifically, 24,291 Ether were redeemed for about $74.5 million, executed at an average price near $3,068.69 per Ether, leaving roughly 69,800 ETH on the balance sheet. The liquidation underscores how even large treasury positions can be trimmed in response to funding needs or risk controls, particularly when market liquidity and asset correlations complicate balance sheet management. The exit by Founders Fund, paired with ETHZilla’s own liquidity actions, reinforces a broader move among Ether-based treasury actors to reassess capital allocation, leverage, and the durability of non‑Bitcoin crypto treasury playbooks.

Thiel’s withdrawal from ETHZilla is framed by broader tensions in crypto treasury models that favored Ether over Bitcoin (CRYPTO: BTC) in earlier disclosures. While some managers pursued diversified holdings across multiple assets, a number of high‑profile Ether accumulators have taken different paths. BitMine Immersion Technologies, the largest listed Ethereum holder, expanded its Ether stake by purchasing 40,613 ETH on Feb. 9, driving total holdings beyond 4.3 million ETH and pushing the value of its portfolio into the tens of billions of dollars at prevailing prices. In contrast, Trend Research moved to unwind a substantial position, selling 651,757 ETH for about $1.34 billion and locking in roughly $747 million of realized losses. The varying approaches illustrate a market segment wrestling with how to balance liquidity, yield, and risk in a rapidly evolving crypto landscape.

ETHZilla itself did not stay static after the initial pivot. The firm launched ETHZilla Aerospace, a subsidiary intended to provide tokenized exposure to leased jet engines, as part of a broader diversification effort beyond plain Ether holdings. The pivot to tokenized real‑world assets (RWA) and crypto yield initiatives reflects the broader industry push to build revenue streams that can complement or hedge against crypto market cycles. Yet Thiel’s exit amplifies the narrative that Ether‑centric treasury structures—once viewed as a strategic differentiator—face renewed scrutiny from investors seeking clearer governance, transparency, and diversification in an environment defined by price volatility and shifting liquidity regimes.

The evolving story of ETHZilla and its contemporaries sits within a wider context of institutional attention to crypto treasuries. While Ether remains a focal point for many on-chain treasury strategies, observers are weighing whether the sector has adequate risk controls, valuation discipline, and regulatory clarity to sustain large, illiquid holdings. The SEC filings—along with company disclosures and market actions—will be watched closely for any further changes in ownership, debt facilities, or new collateral arrangements that could influence Ether’s standing in corporate balance sheets and in broader market sentiment.

Key takeaways

- Founders Fund affiliate holdings of ETHZilla were reduced to zero shares via a Schedule 13G amendment filed with the SEC, signaling an exit from the vehicle that once included a 7.5% stake in 180 Life Sciences Corp.

- 180 Life Sciences rebranded to ETHZilla after a July 2025 fundraising round that raised about $425 million to back a dedicated Ether treasury strategy.

- ETHZilla pursued additional capital through a September 2025 convertible debt round, enabling expansion of its Ether holdings and deployment across DeFi and tokenized assets, at one point exceeding 100,000 ETH.

- December 2025 saw a liquidation of 24,291 ETH for roughly $74.5 million to repay debt, leaving about 69,800 ETH on the balance sheet.

- Thiel’s exit underscores ongoing strain on Ether‑centric treasury models as the market consolidates and investors reassess risk, liquidity, and governance around crypto treasuries.

- Ethically and strategically, ETHZilla diversified into tokenized jet‑engine exposure through ETHZilla Aerospace, signaling a broader push to blend real‑world assets with crypto yields.

Tickers mentioned: $BTC, $ETH

Market context: The move reflects broader liquidity and risk considerations shaping crypto treasuries as investors weigh yield against volatility and regulatory risk. Transparency via 13G filings intersects with a sector still building governance norms around crypto treasury management.

Why it matters

For investors and developers in the crypto space, the Thiel/ETHZilla episode highlights the fragility and adaptability of Ether‑heavy treasury models. The sequence—from a high‑profile rebrand and a large capital raise to a substantial liquidation and a major investor exit—reveals how treasuries anchored to Ether can be exposed to rapid swings in token prices, funding needs, and balance sheet constraints. The development underscores the importance of governance clarity, valuation discipline, and diversified asset mixes for corporate treasury strategies that ride on volatile digital assets.

From a market perspective, the episode amplifies the ongoing debate over whether Ether is a suitable long‑term treasury anchor for publicly traded or VC‑backed entities. While some firms have pursued aggressive Ether accumulation to maximize yield opportunities in DeFi and tokenized assets, others are retreating or retooling their strategies in response to liquidity spikes, drawdown risks, and the potential for regulatory changes that could affect custody, reporting, and capital adequacy.

For builders and operators of treasury platforms, the ETHZilla case reinforces the value of transparent public disclosures and flexible architectures that can accommodate both Ether holdings and structured debt, while offering pathways to tokenize real‑world assets and monetize yield streams. It also cautions that even well‑capitalized Ether portfolios must be prepared to realign in a market where price sensitivities and funding requirements can abruptly alter risk profiles.

What to watch next

- Follow any additional SEC disclosures or updates to ETHZilla’s corporate filings that could reveal new ownership structures or debt instruments.

- Monitor developments around ETHZilla Aerospace and any further tokenized real‑world asset projects that could broaden the firm’s revenue mix.

- Track the pace of Ether liquidity movements from large holders like BitMine and Trend Research to gauge how the sector is balancing yield, risk, and capital preservation.

- Observe broader regulatory signals related to crypto treasuries, custody standards, and reporting requirements that could influence future treasury strategies.

Sources & verification

- SEC filing: Schedule 13G for Founders Fund and ETHZilla holdings — primary_doc.xml — https://www.sec.gov/Archives/edgar/data/1690080/000199596426000003/xslSCHEDULE_13G_X01/primary_doc.xml

- SEC filing: Schedule 13G reporting a 7.5% stake in 180 Life Sciences Corp. (Aug. 4, 2025) — primary_doc.xml — https://www.sec.gov/Archives/edgar/data/1690080/000141588925021455/xslSCHEDULE_13G_X01/primary_doc.xml

- 180 Life Sciences rebrands to ETHZilla — Cointelegraph article — https://cointelegraph.com/news/down-99-biotech-firm-180-life-sciences-pivots-crypto-eth

- ETHZilla raises $350M via convertible bonds — Cointelegraph article — https://cointelegraph.com/news/ethzilla-raises-350m-expand-ether-holdings-defi-yield

- Bitmine staked Ether holdings and broader ETH treasury data — Cointelegraph article — https://cointelegraph.com/news/bitmine-staked-ether-holdings-annual-staking-revenue

- Trend Research reduces ETH holdings — Cointelegraph article — https://cointelegraph.com/news/trend-research-reduces-eth-holdings-325k-187k-eth-binance

- ETHZilla liquidates Ether and restructures debt — Cointelegraph article — https://cointelegraph.com/news/ethzilla-liquidates-ether-redeem-convertible-debt

- ETHZilla tokenized jet engines RWA — Cointelegraph article — https://cointelegraph.com/news/ethzilla-tokenized-jet-engines-rwa-ethereum-liquidity-io

Crypto World

CFTC Defends Prediction Markets, Challenges State Crackdowns

Key Insights

- CFTC asserts federal control over prediction markets, countering state gambling claims.

- Prediction markets offer economic hedging and information aggregation value to society.

- Clear federal rules spur U.S. crypto innovation and limit fragmented state enforcement.

CFTC Files Amicus Brief to Protect Prediction Markets

The U.S. Commodity Futures Trading Commission has filed an amicus curiae (“friend of the court”) brief to defend its authority over prediction markets such as Polymarket and Kalshi, amid a rising wave of state enforcement actions. In an X post, CFTC Chair Mike Selig highlighted that prediction markets are under federal jurisdiction, not state oversight, and serve legitimate economic purposes.

I have some big news to announce… pic.twitter.com/3OBNTaOnIL

— Mike Selig (@ChairmanSelig) February 17, 2026

Federal Authority vs. State Crackdowns

Selig noted that prediction markets have been regulated by the CFTC for over 20 years and serve a real purpose in the U.S. economy. Despite the crackdowns, the United States remains a global leader in financial markets as it approaches its 250th anniversary.

These platforms are derivatives markets, where a user can hedge commercial risks and offer valuable insights to society. States such as Massachusetts claim that sport-themed contracts transform these platforms into unlawful gambling activities, prompting Polymarket to file a federal jurisdiction suit.

Prediction Markets Drive Risk Management and Market Insights

Prediction markets help increase economic efficiency by pooling information and providing risk-management facilities. Selig added that such markets serve as a significant countercheck to media narratives as well, offering society more data-driven information. The CFTC’s involvement ensures legal clarity and can influence court decisions that may shape the future of U.S. markets.

Federal Oversight: Key to Crypto Innovation and Clarity

Exchanges such as Coinbase and Crypto.com, which offer prediction-style products, are under scrutiny by state regulators. Under the CLARITY Act, the proposed legislation would explicitly separate regulatory jurisdiction, with the CFTC regulating crypto-asset commodities and the Securities and Exchange Commission regulating digital securities. CLARITY Act

Industry leaders: Tyler Winklevoss described the filing as “huge,” and Senator Bernie Moreno emphasized the need for a clear regulatory picture when it comes to innovation in the United States.

Crypto World

US CLARITY Act Could Pass by April, Says Senator Bernie Moreno

The US CLARITY Act, a long-awaited framework intended to clarify how the United States will regulate the burgeoning crypto sector, could be on track for a congressional pass in the coming weeks, according to crypto-friendly policymakers. Senator Bernie Moreno suggested a potential April milestone as he spoke to CNBC in Florida, where he was touring President Donald Trump’s Mar-a-Lago resort. The remarks came as Coinbase CEO Brian Armstrong joined Moreno for a discussion that touched on market structure and the regulatory path forward at a gathering organized by the World Liberty Financial crypto forum.

Armstrong described the current climate as offering a “path forward” that might yield a balanced outcome for the industry, traditional banks, and American consumers. He noted that earlier iterations of the draft included provisions that would ban interest-bearing stablecoins and would place the U.S. Securities and Exchange Commission in a central regulatory role over crypto markets. Those elements proved problematic for the exchange and had contributed to a pause in its public backing for the bill. At the same time, members of the crypto community have emphasized the need for a predictable regulatory framework that can spur investment and innovation while protecting consumers and the broader financial system.

Moreno, who co-authored or championed the legislation’s bipartisan path, signaled that the sticking point on stablecoins—particularly the idea of rewarding users with yield—has shifted toward a more workable compromise. In his view, the debate over stablecoin rewards “shouldn’t be part of this equation,” and he indicated that lawmakers were looking to refine the language so it could pass with broad support. The discussion has not been simple, given the various interests involved, from traditional banking to fintech platforms and consumer advocates. But with executives from the crypto industry at the table alongside bankers and lawmakers, the atmosphere has become more conducive to finding a compromise that can be signed into law.

From the trading floor to the Capitol, the conversation has also been about market structure and consumer protections. Armstrong invoked a vision of a “win-win-win” scenario where the bill would advance the interests of the crypto industry, safeguard banks, and benefit American consumers by consolidating a coherent national framework. The idea is to harmonize the fast-moving crypto markets with existing financial regulations, reducing uncertainty for businesses and investors alike. The discussions have taken place against a backdrop of broader regulatory activity, including ongoing policy reviews at the White House and within Congress, and amid an intensifying push from both parties to deliver tangible crypto reforms.

The regulatory conversation has not occurred in a vacuum. Polymarket, a prediction market for crypto policy, offered a glimpse into market sentiment by showing the odds of the CLARITY Act passing in 2026 swing between 90% and roughly 72% around the time of the interview. The volatility in these odds underscores the uncertainty that still surrounds the drafting process and the political dynamics at play in a year marked by competing priorities for lawmakers. While Moreno suggested a constructive path forward, he also acknowledged that the timetable is influenced by technical details that still require resolution, particularly around stablecoins and the precise allocation of regulatory authority among federal agencies.

Key takeaways

- The CLARITY Act is gaining momentum in Congress, with a potential passage window cited as “April” by Senator Bernie Moreno in a CNBC interview conducted at Mar-a-Lago.

- Coinbase previously withdrew support over provisions that would ban interest-bearing stablecoins and centralize crypto regulation under the SEC, complicating the bill’s path; the White House reportedly viewed the move as a unilateral action.

- Armstrong and Moreno signaled a renewed effort to achieve a balanced compromise that would advance crypto market structure while addressing concerns from the banking sector.

- Market-facing sentiment on the bill has fluctuated, with Polymarket showing odds of passage in 2026 ranging from 90% to 72% around the talks.

- The discussions emphasize restoring clarity for market participants, investors, and consumers, potentially shaping the United States’ stance on crypto policy for years to come.

Sentiment: Bullish

Market context: The rhetoric around the CLARITY Act reflects a broader push for regulatory clarity in a volatile asset class, as lawmakers seek a stable framework to accommodate innovation while safeguarding financial stability and consumer protections in a rapidly evolving market.

Why it matters

The CLARITY Act represents more than a regulatory tweak; it signals a concerted attempt to establish a nationwide standard for crypto assets, a move that could significantly influence how exchanges, wallet providers, and fintech firms operate in the United States. By aiming to clarify which activities trigger regulatory oversight and which agencies oversee them, the bill seeks to reduce the current fragmentation that has left many market participants navigating a patchwork of state and federal rules. If enacted, the act could provide a predictable environment for investment, product development, and institutional participation, potentially attracting capital that has been cautious due to regulatory ambiguity.

However, the path to passage remains contingent on reconciling divergent priorities. The debate over stablecoins—whether to treat certain yields as permissible rewards or to prohibit certain yield-bearing mechanisms—highlights the trade-offs lawmakers face between fostering innovation and protecting financial stability. The White House’s reaction to Coinbase’s withdrawal illustrates the delicate political optics involved in crypto legislation, with officials wary of any moves that could cast the administration as unfavorably aligned with industry players or skeptical of robust consumer protections. As talks continue, stakeholders on all sides are watching for a clearer set of draft language that can win broad bipartisan support and withstand evolving regulatory scrutiny.

For investors and users, the potential passage of the CLARITY Act could usher in a period of relative regulatory certainty, enabling more precise risk assessment and potentially more defined product offerings. The balance being sought is delicate: too lenient a regime could invite operational risk, while overly restrictive provisions might stifle innovation and push activity offshore or into less regulated ecosystems. The ongoing discussions at the WLF crypto forum, coupled with public comments from industry leaders, show a sector eager for governance that protects consumers without quashing growth.

What to watch next

- Upcoming committee hearings or markup sessions in Congress that could reveal the final language of the CLARITY Act.

- Any revisions to stablecoin treatment within the bill, particularly around yield-bearing arrangements and consumer protections.

- White House statements or official remarks that signal shifting positions or tailored guidance on crypto regulation.

- Respective statements or filings from Coinbase and other major players to gauge industry alignment with the revised draft.

- Follow-up coverage on the World Liberty Financial crypto forum and any subsequent policy pledges or compromises announced by lawmakers.

Sources & verification

- CNBC interview at Mar-a-Lago featuring Senator Bernie Moreno and Coinbase CEO Brian Armstrong.

- World Liberty Financial crypto forum discussions on market structure and regulatory pathways.

- Coinbase withdrawal of support for the CLARITY Act and White House reaction documenting the administration’s stance.

- Polymarket odds page tracking the CLARITY Act’s passage probability in 2026.

- David Sacks statements cited by Cointelegraph regarding confidence in the bill’s trajectory.

US CLARITY Act gains momentum as lawmakers edge toward April passage

The ongoing dialogue around the CLARITY Act underscores a broader shift in how the United States intends to regulate crypto markets. As policymakers seek a cohesive and comprehensive framework, industry leaders are pushing for a balance that preserves innovation while ensuring consumer protection and financial stability. The discussions at the Mar-a-Lago event and the WLF crypto forum point to a willingness to negotiate, even if core points—from stablecoin policy to the SEC’s regulatory role—remain contested. If April proves to be a viable milestone, as Moreno suggested, lawmakers may be positioned to deliver a bill that could redefine the U.S. market structure for years to come. The unfolding narrative will likely influence investor sentiment, the trajectory of exchange policies, and the pace at which traditional financial institutions engage with crypto products in a regulated environment.

As the sector awaits more precise legislative language, participants will be closely watching for any signals that the political calculus has shifted enough to secure bipartisan support. The balance of risk and opportunity in the year ahead will hinge on how effectively the bill reconciles the industry’s demand for clarity with the banking sector’s emphasis on safety and soundness. The next few weeks could prove pivotal for a piece of legislation that many view as a potential turning point for mainstream crypto adoption in the United States.

Crypto World

Coinbase and Ledn Scale Crypto Lending Amid Market Dip

Digital asset lending company Ledn has completed the first-ever transaction of its kind in the asset-backed debt market, selling $188 million in securitized bonds backed by Bitcoin (BTC).

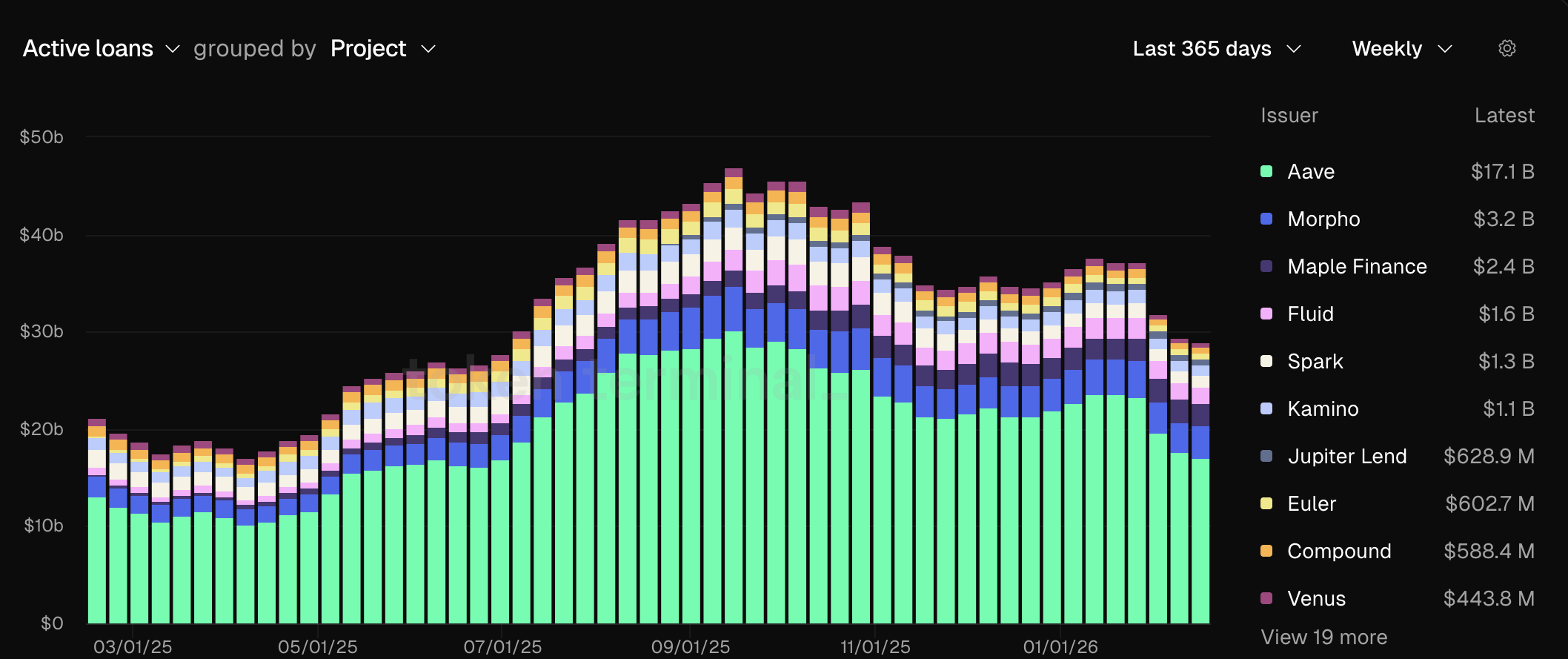

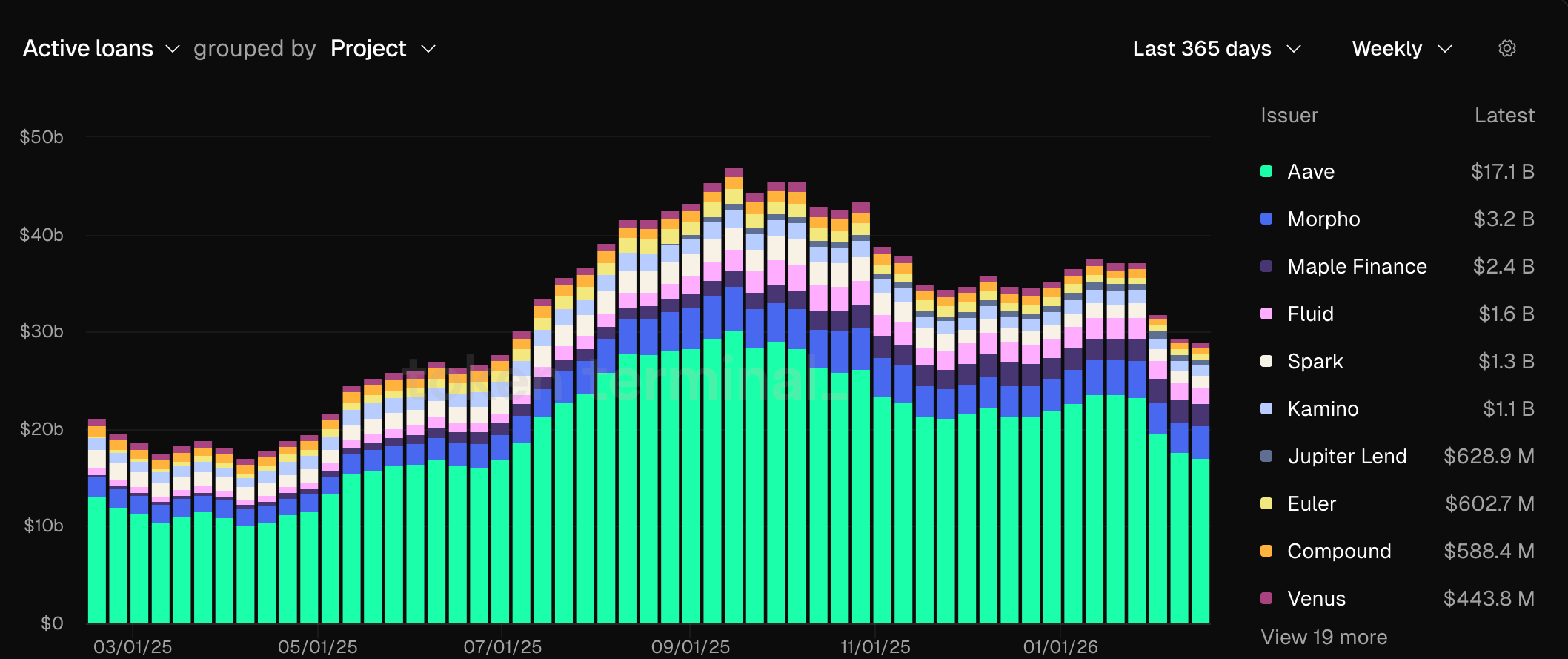

This development emerges as the lending market confronts a volatile environment. Active loans have fallen to around $30 billion, and liquidation risks are rising with persistent price declines.

Sponsored

Sponsored

Coinbase and Ledn Double Down on Crypto Lending

Bloomberg, citing sources familiar with the matter, reported that the deal consists of two bonds. One portion, rated investment-grade, was priced at a spread of 335 basis points above the benchmark rate.

According to a report from S&P Global Ratings, the bonds are secured by a pledge of 4,078.87 Bitcoin. The fair market value stands at approximately $356.9 million.

The loans carry a weighted average interest rate of 11.8%. Jefferies Financial Group Inc. served as the lead manager, structuring agent, and initial purchaser.

“Ledn’s liquidation engine is an algorithmic trading program that sources prices on multiple exchanges and/or is available through multiple trading partners. Ledn has successfully liquidated BTC collateral to repay 7,493 loans in its seven-year history, with an average LTV at liquidation of 80.32%, a maximum LTV at liquidation of 84.66%, and has never experienced a loss. On a WA basis, liquidation upon an LTV EOD has taken under 10 seconds, with minimal “price slippage” in execution,” the report reads.

Beyond Ledn, Coinbase is expanding its footprint in crypto-backed lending. In a recent update, the exchange said users can borrow up to $100,000 in USDC, the stablecoin issued by Circle, by pledging XRP (XRP), Cardano (ADA), Dogecoin (DOGE), or Litecoin (LTC) as collateral through the decentralized finance protocol Morpho.

The offering is available across the US, with the exception of New York, according to the company.

Sponsored

Sponsored

Crypto Lending Shrinks 36% as Active Loans Fall

This comes at a pivotal moment for the crypto lending sector, which has contracted sharply amid broader market weakness. Data from TokenTerminal showed that as of February 2026, total active loans across lending protocols stand at roughly $30 billion, down 36% from the September peak of $46.96 billion.

The decline coincides with a sustained downtrend in the crypto market since October, which likely amplified the contraction. Falling asset prices reduce the dollar value of posted collateral, tightening borrowing capacity and contributing to liquidations or voluntary deleveraging.

This compresses outstanding loan balances while mechanically lowering total value locked when measured in USD terms. Increased volatility further pressures leveraged positions, reinforcing the decline in active loans.

“Quick loan refresher during volatile markets: As BTC price drops, LTV rises, Higher LTV = higher liquidation risk, Adding collateral or repaying part of the loan lowers LTV, Tools exist to help, but understanding the mechanics always comes first,” Ledn posted.

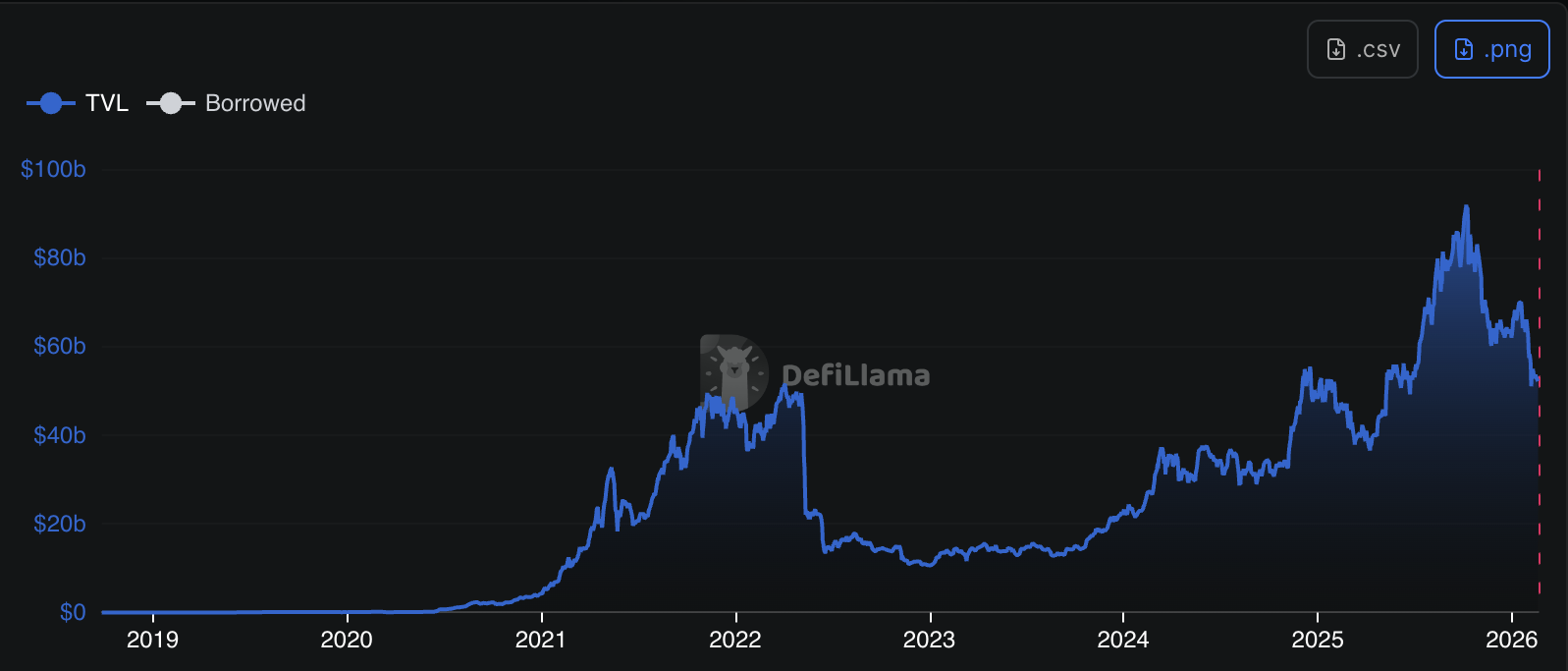

At the same time, total value locked across lending protocols fell from more than $89.7 billion in October to roughly $52 billion, according to DefiLlama. This represented a decline of around 42%.

The decline reflects both asset price depreciation and capital outflows, as weaker market conditions reduced risk appetite, suppressed new borrowing demand, and prompted users to deleverage or rotate into lower-risk assets.

Crypto World

What happens on prediction platforms can steer traditional markets, NYSE chief says

PALM BEACH, Fla. — Prediction markets are starting to play a role in how traditional financial markets move, New York Stock Exchange President Lynn Martin said Wednesday at the World Liberty forum in Palm Beach.

“It was very clear for us… that prediction markets [were being used] as an input to traditional markets,” she said at the event hosted at Mar-a-Lago, pointing to a moment during the 2024 U.S. presidential election when S&P futures spiked unexpectedly. According to Martin, the move was later explained by crypto-based prediction platform Polymarket having shown Donald Trump as the likely winner before other sources did.

The comment highlights a growing awareness among institutional players of how on-chain information can influence market behavior. Unlike traditional polling or slow-moving forecasts, Polymarket’s real-time pricing offers a kind of crowdsourced probability feed that traders may find useful.

The NYSE’s interest goes beyond observation. Intercontinental Exchange (ICE), which owns the NYSE, made a $2 billion strategic investment in Polymarket in October, signaling that the world’s largest stock exchange operator sees a future in blockchain-based forecasting tools.

CFTC Chair Michael Selig, who took office late last year, echoed Martin’s comments on prediction markets’ role in society, saying they have national security implications and act as a check on traditional newspaper journalism. He also referenced their role in entertainment and sports — the latter being an area state regulators are paying particular attention to.

“The states have really led this campaign of open warfare against markets that are in the jurisdiction of the CFTC,” Selig said. “The CFTC has for decades [overseen] prediction markets.”

He referenced the amicus brief the CFTC filed earlier this week in the Ninth Circuit Court of Appeals in one case, which hours later rejected prediction market provider Kalshi’s request for a stay against the state of Nevada’s efforts to shutter its sports-related prediction markets.

“We’re going to fight this, we’re going to make sure our markets are free and fair and have integrity,” he said. “We won’t have state gaming commissions telling us how to regulate our markets.”

Crypto World

Gemini Stock Drops Following Leadership Overhaul

Centralized exchange Gemini recently announced that it parted ways with three senior executives. The leadership changes come amid broader operational cutbacks and workforce reductions.

Following the announcement, the company’s shares declined further, extending a downward trend that has persisted since Gemini went public last September. The latest developments have prompted renewed scrutiny over the exchange’s long-term outlook.

Sponsored

Executive Shakeup Follows Deep Cuts

In a recent blog post, Tyler and Cameron Winklevoss announced that Gemini had parted ways with its Chief Financial Officer, Chief Legal Officer, and Chief Operating Officer. They said interim replacements had been appointed for the CFO and CLO roles, while the COO position would not be filled.

The founders characterized the changes as part of a broader transformation at the company, referring to the initiative as “Gemini 2.0.” They noted that recent developments in the crypto industry have influenced this shift.

“During this time, but really more recently, rapid breakthroughs in AI have begun to dramatically transform the way we work at Gemini. Simultaneously, the advent of prediction markets has begun to dramatically transform marketplaces, including our own,” the blog post stated.

The announcement drew heightened attention as it followed Gemini’s decision weeks earlier to reduce its global workforce by 25%. In addition, Gemini has exited several international markets, including the United Kingdom, the European Union, and Australia.

The latest developments prompted renewed volatility in the company’s stock, extending a steep decline that has persisted since its September listing. Investors who purchased GEMI at its $28 IPO price are now facing losses of roughly 77%.

Sponsored

In a recent SEC filing, the company also disclosed an estimated net loss of approximately $595 million for 2025.

Taken together, these developments have intensified scrutiny of the exchange’s valuation.

Public Markets Reprice Gemini Growth

The sharp repricing of Gemini’s stock has renewed debate over whether the exchange was fundamentally overvalued at its initial public offering (IPO).

Sponsored

Its initial valuation reflected expectations of sustained trading volumes and revenue expansion. Given the cyclical nature of the crypto market, pricing may have been influenced by elevated trading activity and heightened retail participation.

The subsequent decline, unfolding amid a broader market downturn, suggests a reassessment of earnings expectations.

The developments also highlight intensifying competitive pressures between centralized exchanges.

Market share and liquidity remain concentrated among larger platforms with deeper order books and stronger network effects. Meanwhile, mid-tier exchanges face rising fixed costs without equivalent trading scale to support margins.

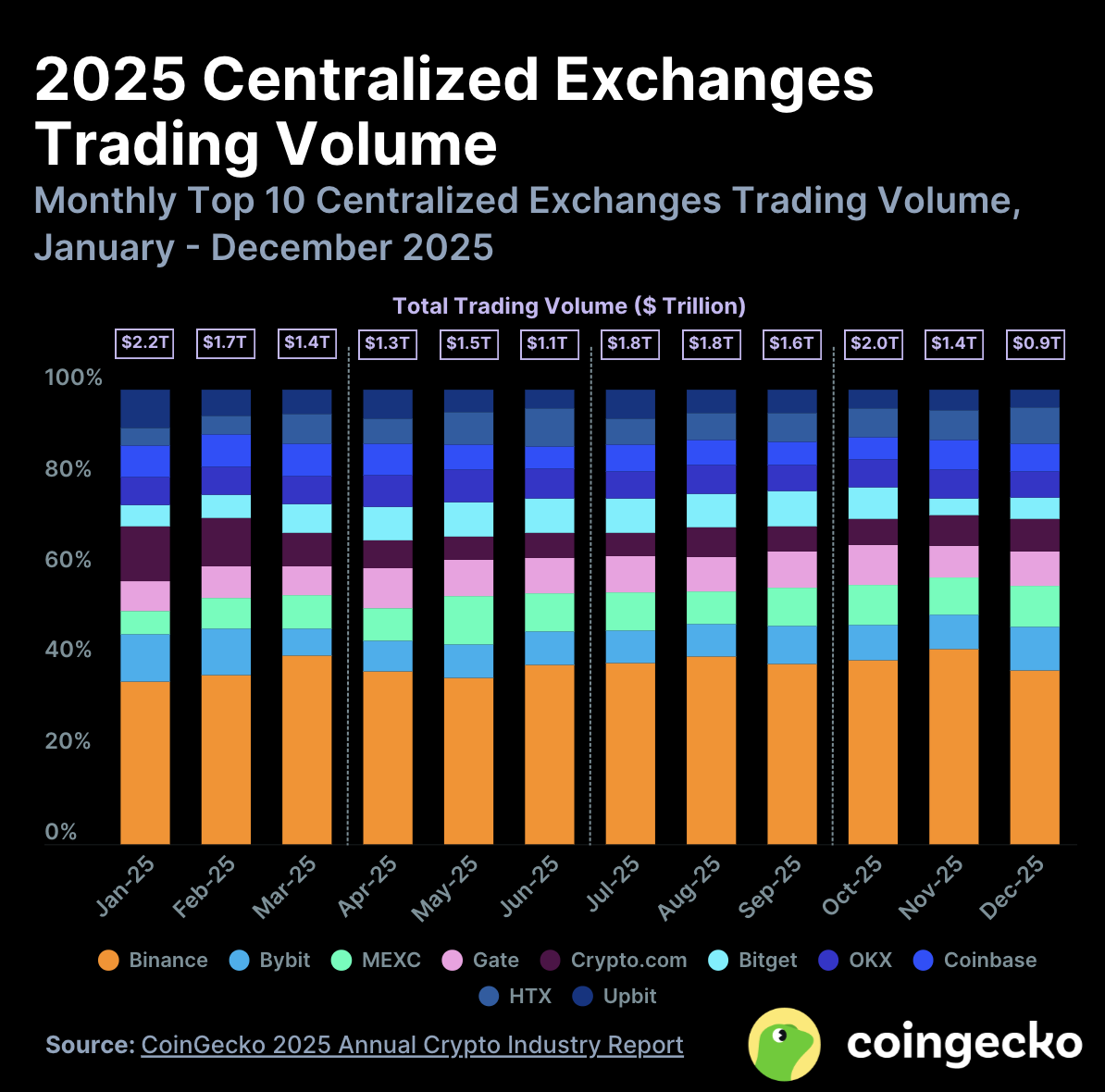

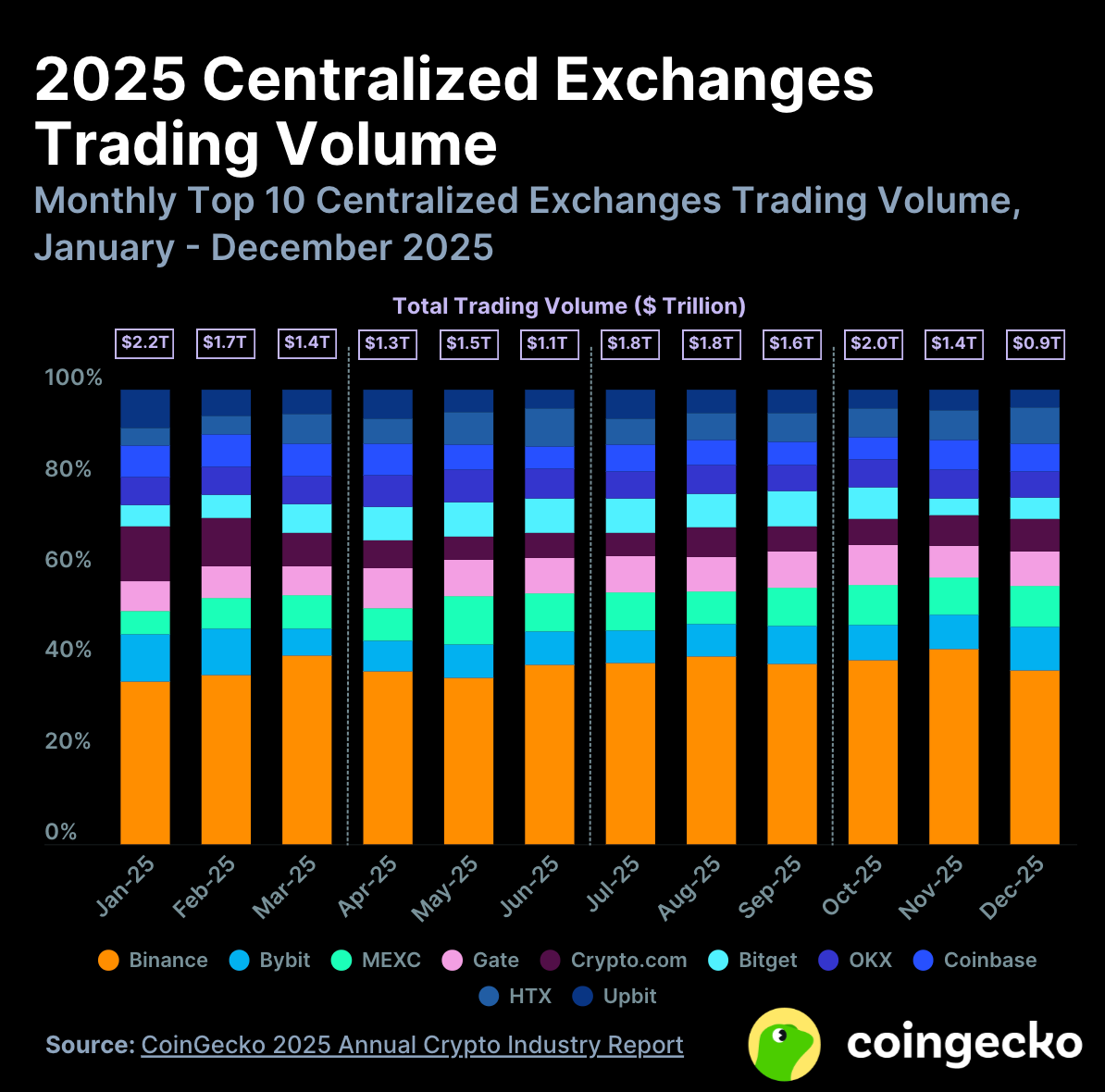

Recent data from CoinGecko supports the situation.

Sponsored

In a January report on centralized exchange market share by trading volume, the data aggregator found that in 2025, Binance accounted for 39.2% of total spot volume among the top exchanges, processing $7.3 trillion in volume. Other leading platforms, including Bybit, MEXC, and Coinbase, also maintained meaningful shares of global volume.

Gemini did not place among the top 10. According to CoinMarketCap data, the exchange currently ranks 24th, with a 24-hour trading volume of $54 million.

Within that context, workforce reductions and geographic pullbacks may represent cost-control measures and strategic adjustments to an increasingly consolidated market.

How Gemini executes this transition will likely shape whether shareholders view the current turbulence as a short-term adjustment or a sign of longer-term structural challenges.

Crypto World

OpenAI launches smart contract security evaluation system

OpenAI has introduced a new system called EVMbench, designed to measure how well artificial intelligence agents can find and fix security flaws in crypto smart contracts.

Summary

- OpenAI has introduced EVMbench, a new framework designed to measure how well AI agents can detect, fix, and exploit smart contract vulnerabilities.

- Developed with Paradigm, the benchmark is built on real audit data and focuses on practical, high-risk security scenarios.

- Early results show strong progress in exploit tasks, while detection and patching are still challenging.

The company announced on Feb. 18 that it has developed EVMbench in partnership with Paradigm. The benchmark focuses on contracts built for the Ethereum Virtual Machine and is meant to test how AI systems perform in real financial settings.

OpenAI said smart contracts currently secure more than $100 billion in open-source crypto assets, making security testing increasingly important as AI tools become more capable.

Testing how AI handles real security risks

EVMbench evaluates AI agents across three main tasks: detecting vulnerabilities, fixing flawed code, and carrying out simulated attacks. The system is built using 120 high-risk issues drawn from 40 past security audits, many of them from public auditing competitions.

Additional scenarios were taken from reviews of the Tempo blockchain, a payments-focused network designed for stablecoin use. These cases were added to reflect how smart contracts are used in financial applications.

To build the test environment, OpenAI adapted existing exploit scripts and created new ones where needed. All exploit tests run in isolated systems rather than on live networks, and only previously disclosed vulnerabilities are included.

In detection mode, agents review contract code and try to identify known security flaws. In patch mode, they must fix those flaws without breaking the software. In exploit mode, agents attempt to drain funds from vulnerable contracts in a controlled setting.

Early results and industry impact

OpenAI said a custom testing framework was developed to ensure results can be reproduced and verified.

The company tested several advanced models using EVMbench. In exploit mode, GPT-5.3-Codex achieved a score of 72.2%, compared with 31.9% for GPT-5, released six months earlier. Detection and patching scores were lower, showing that many vulnerabilities are still difficult for AI systems to handle.

Researchers observed that agents performed best when goals were clear, such as draining funds. Performance dropped when tasks required deeper analysis, such as reviewing large codebases or fixing subtle bugs.

OpenAI acknowledged that EVMbench does not fully reflect real-world conditions. Many major crypto projects undergo more extensive reviews than those included in the dataset. Some timing-based and multi-chain attacks are also outside the system’s scope.

The company said the benchmark is intended to support defensive use of AI in cybersecurity. As AI tools become more powerful, they could be used by both attackers and auditors. Measuring their capabilities is seen as a way to reduce risk and encourage responsible deployment.

Alongside the release, OpenAI said it is expanding security programs and investing $10 million in API credits to support open-source and infrastructure protection. All EVMbench tools and datasets have been made public to support further research.

Crypto World

Dogecoin and Ripple-linked token holders now eligible for U.S. loans

Coinbase is expanding its crypto-backed lending product in the U.S. to include XRP, , Cardano’s ADA and , widening access to a service it has pitched as a way for customers to unlock liquidity without selling their holdings.

The product allows users to post crypto as collateral and borrow up to $100,000 in Circle’s USDC stablecoin. The loans are routed through Morpho, a decentralized lending protocol, meaning the borrowing mechanics are handled on-chain rather than through Coinbase’s own balance sheet.

The service is available across the U.S., excluding New York.

The move brings some of crypto’s most retail-heavy tokens into a product that previously focused on bitcoin and ether. While Ethereum and Cardano holders can already earn yield through staking on their native networks, assets like XRP, DOGE and Litecoin do not offer built-in reward mechanisms.

For those investors, borrowing against their holdings has become one of the few ways to access liquidity without exiting the position.

Coinbase is also expanding the potential pool of collateral on its platform. The exchange reported it held $17.2 billion worth of XRP as of Dec. 31, according to an SEC filing, making the token one of the larger assets sitting in customer accounts.

Crypto-backed loans have long been marketed as a tax-efficient strategy, since borrowing against an asset does not trigger capital gains in the same way selling does.

But the structure comes with sharp risks when markets move quickly. If the value of the collateral falls too far relative to the loan, the position can be liquidated, meaning a third party can repay the debt and seize the collateral at a discount.

Coinbase applies an extra buffer when users take out a loan to reduce liquidation risk and sends notifications as the threshold is approached. Still, the exchange has also warned that collateral used through the product is wrapped, a process that allows tokens like XRP to exist on Ethereum-compatible networks.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment16 hours ago

Entertainment16 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech21 hours ago

Tech21 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports2 hours ago

Sports2 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment8 hours ago

Entertainment8 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business23 hours ago

Business23 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World11 hours ago

Crypto World11 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit