Crypto World

Is a 37% Drop Next?

Bitcoin has entered a critical phase after its recent correction dragged the price toward the $70,000 level. Viewed through a macro lens, this move has exposed BTC to elevated downside risk.

Several on-chain and technical indicators now align with a bearish outlook. However, large holders are actively accumulating, attempting to slow or reverse the developing trend.

Sponsored

Bitcoin Loses A Major On-Chain Support

Bitcoin has dropped below the True Market Mean for the first time since September 2023. This metric reflects the aggregate cost basis of actively circulating supply. Trading below it signals weakening conviction among participants and marks a structural shift in market behavior.

The loss of this anchor confirms deterioration that has been forming since late November. From a mid-term perspective, Bitcoin is now confined within a broader valuation corridor. Upside momentum has weakened, while downside pressure continues to build across multiple timeframes.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the downside, the Realized Price near $55,800 represents the historical level where long-term capital re-enters. On the upside, the True Market Mean of around $80,200 has flipped into resistance. This configuration limits recovery potential and increases the probability of further downside exploration.

Sponsored

Bitcoin’s Macro Outlook Suggests 37% Crash

This structural weakness aligns with a macro bearish setup visible on the charts. Bitcoin is breaking down from a Head and Shoulders pattern that has been developing for months. This formation carries a projected downside of roughly 37%, targeting $51,511 if fully realized.

The sharp 20% decline over the past week accelerated this breakdown. Rapid selling pressure confirmed the pattern’s neckline breach, intensifying bearish momentum. Such moves often lead to follow-through declines as trapped long positions unwind.

The next critical support below $70,000 sits at $68,072. Losing this level would validate the bearish projection. A decisive break would likely trigger additional liquidations, increasing volatility, and accelerating price movement toward lower structural levels.

Sponsored

BTC Whales Jump In As Rescue

Despite mounting bearish signals, Bitcoin whales are actively attempting to prevent further downside. Addresses holding between 10,000 and 100,000 BTC have accumulated more than 50,000 BTC in just four days. At current prices, this accumulation exceeds $3.58 billion.

This behavior reflects strategic positioning rather than speculative trading. Large holders often accumulate during periods of fear, especially after sharp corrections. Bitcoin slipping below $75,000 appears to have created an attractive entry zone for long-term capital.

If whale accumulation continues, it could absorb sell-side pressure and stabilize the price. Historically, such activity has preceded short-term rebounds. However, sustained impact depends on broader market sentiment and whether retail selling pressure subsides.

Sponsored

BTC Price Is Close To Falling Below $70,000

Bitcoin price is trading near $69,500 at the time of writing after a 20% weekly decline. For now, BTC is yet to close a daily candle below $70,000 psychological support. This level has acted as a demand zone in previous corrections, making it critical for near-term stability.

From a short-term perspective, downside risks remain elevated. A breakdown below $68,442 would likely trigger accelerated selling. Under that scenario, Bitcoin could fall toward $65,360. Losing that support may expose BTC to a deeper slide toward $62,893.

Alternatively, whale accumulation could influence price direction. A successful defense of $70,000 may allow Bitcoin to rebound toward $75,000. Reclaiming that level as support would invalidate the immediate bearish thesis and reopen the path toward $80,000 if momentum improves.

Crypto World

Tether Invests $150M in Gold.com to expand gold tokenization

The investment arm of stablecoin issuer Tether has acquired a $150 million stake in the precious metals platform Gold.com to expand access to tokenized gold.

Tether said on Thursday that it acquired an approximately 12% stake in the company, which will integrate Tether Gold (XAUt), its gold-backed cryptocurrency, into Gold.com’s platform.

Gold.com is a publicly listed online marketplace that sells gold and other precious metals, such as silver and platinum, to several markets, including the US.

“Gold has played a central role in preserving value for centuries, particularly during periods of monetary stress and geopolitical uncertainty,” said Tether CEO Paolo Ardoino. “Gold exposure is not a trade for Tether; it is a hedge and a long-term allocation to protect our user base and ourselves in a world that is becoming increasingly unstable.”

He added the company’s investment in Gold.com “reflects a long-term belief that gold should be as accessible, transferable, and usable as modern digital money, without compromising on physical backing or ownership.”

Tether explores stablecoin payments for gold

Tether and Gold.com are also exploring options to enable customers to purchase physical gold with Tether’s flagship stablecoin USDt (USDT) and its new stablecoin specifically for the US market, USAt (USAT), which it launched with crypto-native bank Anchorage Digital on Jan. 27.

Related: Bhutan makes second Bitcoin transfer in a week, worth $22M

Tether’s expanded gold offerings come as gold rallied more than 80% over the past 12 months to $5,600 on Jan. 29, before cooling off to $4,800 at the time of writing.

The partnership comes after Tether announced earlier on Thursday that it made a $100 million equity investment in Anchorage, a move that helps boost adoption of the USAt stablecoin in the US market as the bank looks to go public next year.

Tether reported a profit of $10 billion in 2025, earned mostly through interest on US Treasury holdings backing its $185.6 billion USDt reserve.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

US Stocks Climb on AI Boom as Bitcoin Weakness Deepens

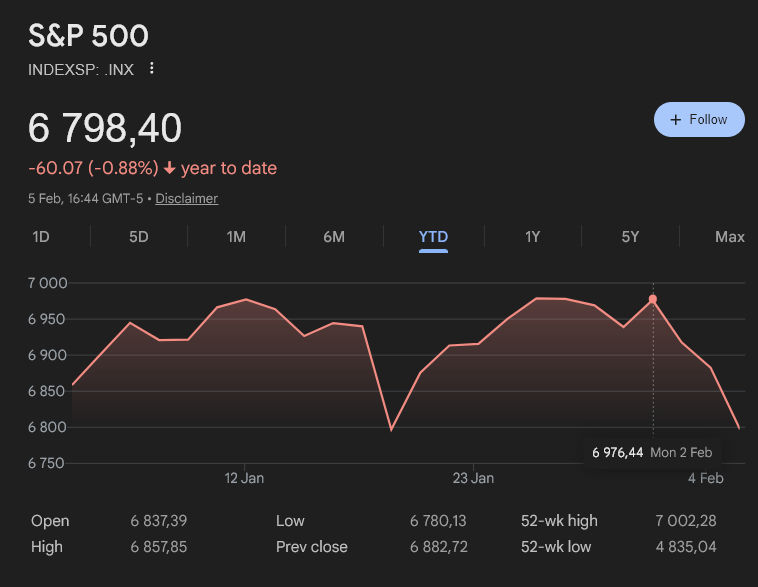

US equities rebounded as the S&P 500 climbed to $6,976, before correcting. Earlier in the week, the benchmark index closed just shy of its prior record before briefly moving higher in subsequent trading, while risk appetite in equities contrasted sharply with continued weakness across crypto markets.

At the same time, Bitcoin continued to underperform, with selling pressure accelerating as broader capital flows favored traditional risk assets. The divergence has become more pronounced in recent sessions, reinforcing the growing split between equity and crypto sentiment.

Sponsored

Sponsored

AI Stocks and Small Caps Drive Equity Momentum

The latest leg higher in the S&P 500 was led by large-cap technology and semiconductor stocks, as investors rotated back into AI-linked names after a brief pause driven by valuation concerns.

Alphabet rose to a new record, Amazon advanced ahead of earnings, and chipmakers posted broad-based gains as demand expectations firmed.

Beneath the surface, market breadth also improved. Small-cap stocks outpaced megacaps, with the Russell 2000 gaining around 3% year-to-date.

That relative strength is often interpreted as a signal of confidence in domestic growth and has added support to broader stock market predictions that point to continued upside as long as earnings momentum holds.

Sponsored

Sponsored

Earnings, Not Valuations, Now Anchor the Rally

Corporate results remain the central driver of the market’s advance. Analysts now expect S&P 500 companies to deliver close to 11% earnings growth for the December quarter, up sharply from estimates earlier in January.

More than 80% of reporting firms have exceeded expectations so far, according to FactSet data cited by market strategists.

Recent research suggests earnings growth has accounted for roughly 84% of total S&P 500 returns in the current cycle, marking a shift away from multiple expansion as the primary engine of gains. This transition has softened concerns around an AI-driven bubble, as profits and cash flow increasingly justify higher prices.

Macro Backdrop Keeps Risk Appetite Intact

The broader macro environment has so far supported equity risk-taking. US GDP growth remains near 3.3%, inflation trends are relatively contained, and productivity indicators have improved. Even political disruptions, including a federal government shutdown that delayed key data releases, failed to dent market confidence materially.

Sponsored

Sponsored

Major US indices posted solid gains alongside the S&P 500, with the Dow Jones Industrial Average rising more than 1% YTD. But the Nasdaq Composite dropped roughly 2.6%.

Investors now look ahead to upcoming economic data and the Federal Reserve’s next policy signals for confirmation that financial conditions will remain supportive.

Bitcoin Weakness Highlights Cross-Market Divergence

While equities pushed higher, crypto markets moved in the opposite direction. Bitcoin price dropped below $65,000, marking its lowest level in roughly a year and extending a broader downtrend that has weighed on digital assets.

Sponsored

Sponsored

The decline has come amid fading momentum, reduced speculative appetite, and capital rotation toward equities offering visible earnings growth.

The contrasting performance reflects a growing divergence between traditional risk assets and crypto, at least in the near term.

While both markets can benefit from liquidity-driven rallies, current conditions favor assets tied more directly to corporate profits.

Outlook

The S&P 500’s move to new highs reflects a rally increasingly grounded in earnings delivery rather than expanding valuations. AI investment, small-cap strength, and resilient macro data continue to support the upside case, even as record levels invite selective caution.

Bitcoin’s slide to a one-year low highlights where risk appetite is thinning, but for now, equity markets remain firmly in control of the broader risk narrative.

Crypto World

Kalshi steps up surveillance amid growing scrutiny of prediction markets

Kalshi, the federally regulated prediction market platform, announced a major expansion of its market surveillance and enforcement framework aimed at preventing insider trading and market manipulation across its platform.

Summary

- Kalshi has expanded its market surveillance framework to prevent insider trading and market manipulation on its regulated prediction markets platform.

- The company formed an independent Surveillance Advisory Committee and partnered with Solidus Labs to strengthen trade monitoring and enforcement.

- The move positions Kalshi as a compliance-focused alternative as prediction markets face growing regulatory and public scrutiny.

The updates were shared on February 5, 2026, as part of a broad initiative to boost trading integrity.

Kalshi tightens market surveillance

Founded in 2018, Kalshi established prediction markets as a regulated financial asset class in the United States. Unlike many offshore trading platforms, Kalshi operates under oversight from the U.S. Commodity Futures Trading Commission (CFTC), enforcing rules similar to those in traditional financial markets.

At the center of Kalshi’s announcement is the formation of an independent Surveillance Advisory Committee. The committee includes industry experts such as Lisa Pinheiro, Managing Principal at Analysis Group, and Daniel Taylor, Director of the Wharton Forensic Analytics Lab, known for his work on fraud and insider trading detection.

The group will review flagged trades, monitor investigations, and issue public quarterly reports on enforcement activity.

Kalshi also unveiled partnerships with Solidus Labs, a provider of advanced trade surveillance technology, and other market integrity advisors. The Solidus platform will augment Kalshi’s internal systems with deeper data analysis, helping detect sophisticated manipulation or suspicious trading patterns across more than 4,000 active markets.

The enhanced surveillance measures come amid growing scrutiny of prediction markets worldwide. Platforms like Polymarket have faced criticism and controversy over alleged insider advantage and market manipulation, leading lawmakers to consider new regulations targeting such practices.

The announcement also follows recent legal friction involving prediction markets more broadly. In Nevada, a state court recently declined to immediately block Coinbase’s prediction markets, which operate in partnership with Kalshi, after state regulators sought an emergency halt under gaming laws.

Crypto World

Copy-Paste L2s Are Hurting Ethereum’s Progress

Vitalik Buterin warns copy-paste Layer 2s and generic EVM chains are stalling Ethereum’s long-term scaling vision.

Ethereum co-founder Vitalik Buterin has said that many new Layer 2 (L2) networks are repeating shallow design patterns, and warned that generic EVM chains with optimistic bridges are holding back meaningful progress.

His comments extend the public debate over whether today’s L2 ecosystem still aligns with Ethereum’s original scaling goals.

No More “Copypasta” EVM Chains

In a February 5 post on X, Buterin argued that comfort and familiarity, not technical necessity, are driving many L2 launches, leading to copy-paste designs that add little beyond surface-level Ethereum compatibility.

The developer drew a comparison between infrastructure choices and governance habits, writing that making yet another EVM chain and adding “an optimistic bridge to Ethereum with a one-week delay” has become routine in the same way forking Compound once dominated DAO governance.

“That’s something we’ve done far too much for far too long, because we got comfortable, and which has sapped our imagination and put us in a dead end,” Buterin wrote.

He was even more direct about alternative designs that drop Ethereum bridges entirely.

“If you make an EVM chain without an optimistic bridge to Ethereum, that’s even worse,” he said, adding, “We don’t friggin need more copypasta EVM chains, and we definitely don’t need even more L1s.”

Buterin insisted that Ethereum’s base layer is already scaling and will continue to add EVM block space through 2026, though not without limits. He noted that some workloads, such as AI-related applications, may still require lower latency or specialized execution environments. In his view, those needs should push developers toward genuinely new architectures rather than lightly modified replicas.

Matching “Vibes” With Real Ethereum Connection

Buterin’s criticism builds on comments he made earlier, suggesting many L2s no longer meet the original definition of scaling Ethereum because they fail to fully inherit its security.

You may also like:

He argued that Ethereum no longer needs L2s to act as branded shards, especially considering mainnet fees are falling and gas limits are rising.

In his latest post, the 32-year-old stressed that public positioning should reflect technical reality. “Vibes need to match substance,” he wrote, criticizing projects that market themselves as tightly connected to Ethereum while treating that link as an afterthought.

The blockchain’s co-founder outlined two models he considers reasonable. One is an app chain that depends deeply on Ethereum, such as prediction markets that settle and manage accounts on the L1 while handling execution on a rollup. The other is what he called “institutional L2s,” where systems like government registries publish cryptographic proofs on-chain for transparency, even if they are not trustless or credibly neutral.

“If you’re the first thing, it’s valid and great to call yourself an Ethereum application,” Buterin said. “If you’re the second thing, then you’re not Ethereum… so you should just say those things directly.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Crypto sentiment gauge hits FTX-era lows as ‘extreme fear’ reaches a 9 reading

Crypto market sentiment sank to its bleakest level since the FTX collapse after bitcoin’s sharp drop this week dragged prices across the board and forced a wave of deleveraging.

The widely followed Crypto Fear and Greed Index fell to 9 on Friday, a reading categorized as “extreme fear” and one that has historically only appeared during major breakdowns in market confidence.

The index stood at 12 a day earlier, 16 last week and 42 last month, suggestive of how quickly traders have shifted from cautious to outright defensive.

The fear gauge is built primarily around bitcoin, combining several indicators that attempt to quantify investor mood rather than price direction. It includes volatility and drawdowns, market momentum and trading volume, social media engagement, bitcoin dominance and Google Trends data tied to bitcoin-related searches.

A sharp rise in volatility, a spike in defensive positioning and an increase in fear-driven search interest typically push the index lower.

The collapse in sentiment comes as bitcoin briefly traded near $60,000 in late U.S. hours Thursday before bouncing back toward $65,000, a whipsaw move that reflected both forced liquidations and opportunistic dip-buying.

While the rebound suggests some buyers are willing to step in near major psychological levels, the sentiment reading implies the broader market remains in “sell first, ask questions later” mode.

In past cycles, extreme fear has often coincided with local bottoms, largely because panic conditions tend to flush out leveraged traders and short-term holders. But that is not a rule, and the index is better read as a snapshot of stress rather than a timing tool.

The index does not predict where bitcoin goes next, however. But it does show that the market has returned to the kind of fear typically reserved for systemic events.

Crypto World

Bitcoin Logs $3.2B In Loss-Taking Wave, Beating Luna And FTX-Era Shock Levels

Bitcoin’s latest slide did more than knock prices lower, it forced investors to lock in losses at a pace rarely seen in crypto’s short history.

On-chain analyst Murphy noted Friday that Bitcoin’s entity-adjusted realized loss hit a record $3.2B on Feb. 5, a sign that traders rushed for the exits as the market buckled.

Murphy framed the move as capitulation, arguing the scale of loss-taking surpassed what the market absorbed during some of its most infamous shocks.

It came as Bitcoin fell about 10% on Friday to around $64,000, sinking to its weakest level since late 2024 and unwinding the momentum that had built after Donald Trump’s election win.

Feb. 5 Marks Largest Realized Bitcoin Loss Day On Record, Analyst Says

“Epic-level! A massive loss-taking wave has appeared,” the analyst said in a post translated from Chinese.

“On February 5th, the realized loss (after entity adjustment) of BTC reached a historic record high of $3.2 billion. After seeing this number, everything that came before is just small potatoes.”

He went further, listing crisis moments that he said failed to produce a comparable flush. “Whether it was the Luna collapse, the FTX bankruptcy, or the 312/519 black swan events — none of them ever triggered loss-taking on this massive scale.”

Murphy also pointed to a past data wrinkle that some traders may cite when comparing extremes. “There was also one instance on 2025.11.21, but that time Coinbase reorganized wallet data afterwards and the figures were adjusted. This time, though… it really looks like genuine panic.”

He described the Feb. 5 move as unusual because the market did not need a single headline shock to unravel.

Realized Loss Metrics Watched Closely For Signs Of Seller Exhaustion

Murphy also pushed back on critics who prefer measuring realized losses in Bitcoin terms.

“(Some people think we should use BTC-denominated statistics — this is a misunderstanding. The price of BTC is dynamic; only by measuring in USD value can we truly gauge the level of panic selling pressure the market was under at that moment.)”

The claim lands as traders debate what the washout means for the next phase of the cycle, especially as large swings in price can trigger forced selling and accelerate realized losses.

Markets often watch this metric for clues on whether sellers have exhausted themselves, or whether fear still has room to run.

Michael Burry has added a fresh dose of nerves. The Scion Asset Management founder, who rose to fame predicting the 2008 housing crisis, shared a Bitcoin chart on X that compared the current pullback to the 2021 to 2022 crash, implying Bitcoin could slide into the low $50,000s before it finds a more durable bottom.

In that post early Thursday, Burry pointed to the shape of the decline from Bitcoin’s October high of $126,000 to around $70,000, and matched it against the late 2021 to mid-2022 plunge, when Bitcoin slid from roughly $35,000 to below $20,000.

The post Bitcoin Logs $3.2B In Loss-Taking Wave, Beating Luna And FTX-Era Shock Levels appeared first on Cryptonews.

Crypto World

LSEG Shares Surge 7.4% After JPMorgan and Goldman Sachs Defend Stock

TLDR

- LSEG shares rose by 7.4% on Thursday after a 19% drop in the previous two days.

- JPMorgan and Goldman Sachs reassured investors by downplaying AI risks to LSEG’s business.

- JPMorgan’s Enrico Bolzoni clarified that AI companies are working with LSEG, not replacing it.

- LSEG’s partnership with Anthropic provided AI access to the company’s financial data.

- Goldman Sachs analyst Oliver Carruthers set a price target of 14,550 pence for LSEG.

LSEG shares bounced back on Thursday, rising by 7.4% after facing a 19% drop in the prior two days. The rally followed reassurances from major financial institutions, JPMorgan and Goldman Sachs, who downplayed fears that artificial intelligence would threaten LSEG’s core business. The recovery came after a tumultuous period where AI-related market panic had hurt the stock.

London Stock Exchange Group plc, LSEG.L

Rebound Driven by Analyst Confidence

The sharp decline in LSEG shares began earlier in the week when Anthropic introduced its Claude Cowork product, designed to automate workplace tasks. Traders feared that AI advancements could severely impact companies like LSEG, which specializes in providing financial data, not software. However, JPMorgan’s Enrico Bolzoni stepped in to correct what he called “misunderstandings” surrounding LSEG’s business model, stating that AI would not replace but instead work alongside LSEG.

Bolzoni emphasized that LSEG is deeply involved in AI, noting the October partnership with Anthropic that provided the AI company access to LSEG’s financial data. This partnership, he argued, demonstrated LSEG’s pivotal role in the growing AI landscape, counteracting the market’s misconception that AI would push the company aside. “AI companies are working with LSEG, not replacing it,” Bolzoni clarified in his statement.

LSEG Shares: Calm After the Panic

Goldman Sachs also weighed in, with analyst Oliver Carruthers reiterating the value of LSEG’s data-driven business model. Carruthers downplayed the potential impact of AI, explaining that just 6% of LSEG’s revenue from workflow products might be exposed to any risk from automation. He further set a price target of 14,550 pence, which was the highest among analysts tracking LSEG.

The comments from both JPMorgan and Goldman Sachs played a significant role in calming investor nerves. Shares of LSEG, which had taken a hit in the wake of AI-related concerns, saw a sharp reversal, rising 7.4%. This bounce was a direct result of analysts stepping in to assure the market that LSEG’s core business was secure, even in the face of AI innovation.

The broader tech market also saw turbulence as fears over AI’s impact on the software and data sectors took hold. The Nasdaq 100 recorded its worst two-day drop since October, shedding over $550 billion in value. LSEG, despite being a data provider, became caught in the broader selloff, with tech investors looking to offload anything related to software or data businesses.

Crypto World

Bitcoin miner MARA moves $87 million BTC to various trading desks and exchanges

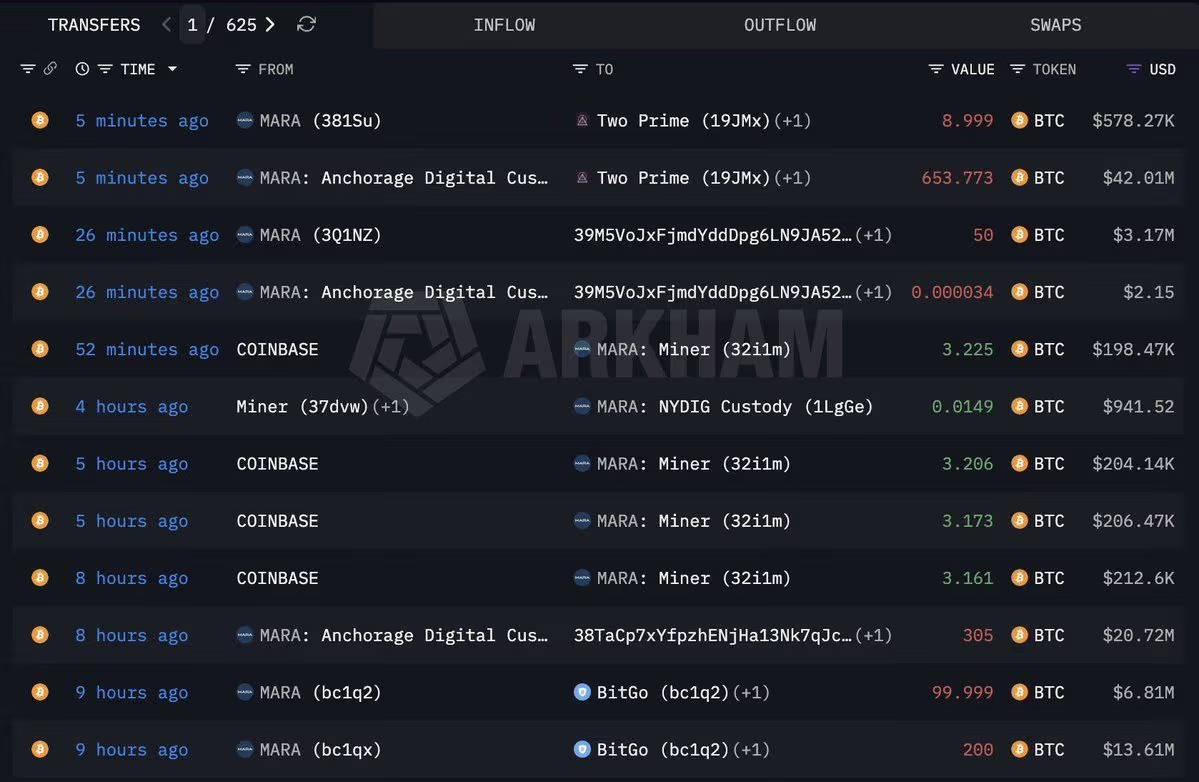

Bitcoin miner MARA moved 1,318 BTC worth about $86.89 million to a mix of counterparties and custody venues over the past 10 hours, onchain data tracked by Arkham shows.

The biggest slice went to Two Prime. One transfer sent 653.773 BTC, around $42.01 million, to a Two Prime tagged address, alongside a smaller 8.999 BTC top up worth about $578,000 just minutes later.

Separate outbound transactions sent 200 BTC and 99.999 BTC to a BitGo tagged address, together about $20.4 million at the time of transfer, while another 305 BTC moved to a fresh address, worth roughly $20.72 million.

The flow matters mainly because of timing. Crypto markets have been swinging hard since this week’s liquidation driven selloff, and traders are on edge for any sign that miners are turning into forced sellers.

Large miner related transfers can be routine treasury management, custody reshuffling, collateral moves, or preparation for an over the counter sale, but in a thin market they often get read as a supply signal.

The Two Prime leg will draw the most attention because it is a credit and trading counterparty. If the bitcoin is being posted as collateral or rotated into a strategy, it does not necessarily imply spot selling.

The transfers comes amid a tough period for miners, with bitcoin down nearly 50% from peak prices above $126,000 last year.

Bitcoin is now approximately 20% below its estimated average production cost, as CoinDesk reported Thursday, increasing financial pressure across the BTC mining sector.

The average cost to mine one bitcoin is around $87,000, according to data from Checkonchain, while the spot price has fallen toward a weekly low of $60,000 Historically, trading below production cost has been a feature of a bear market.

Crypto World

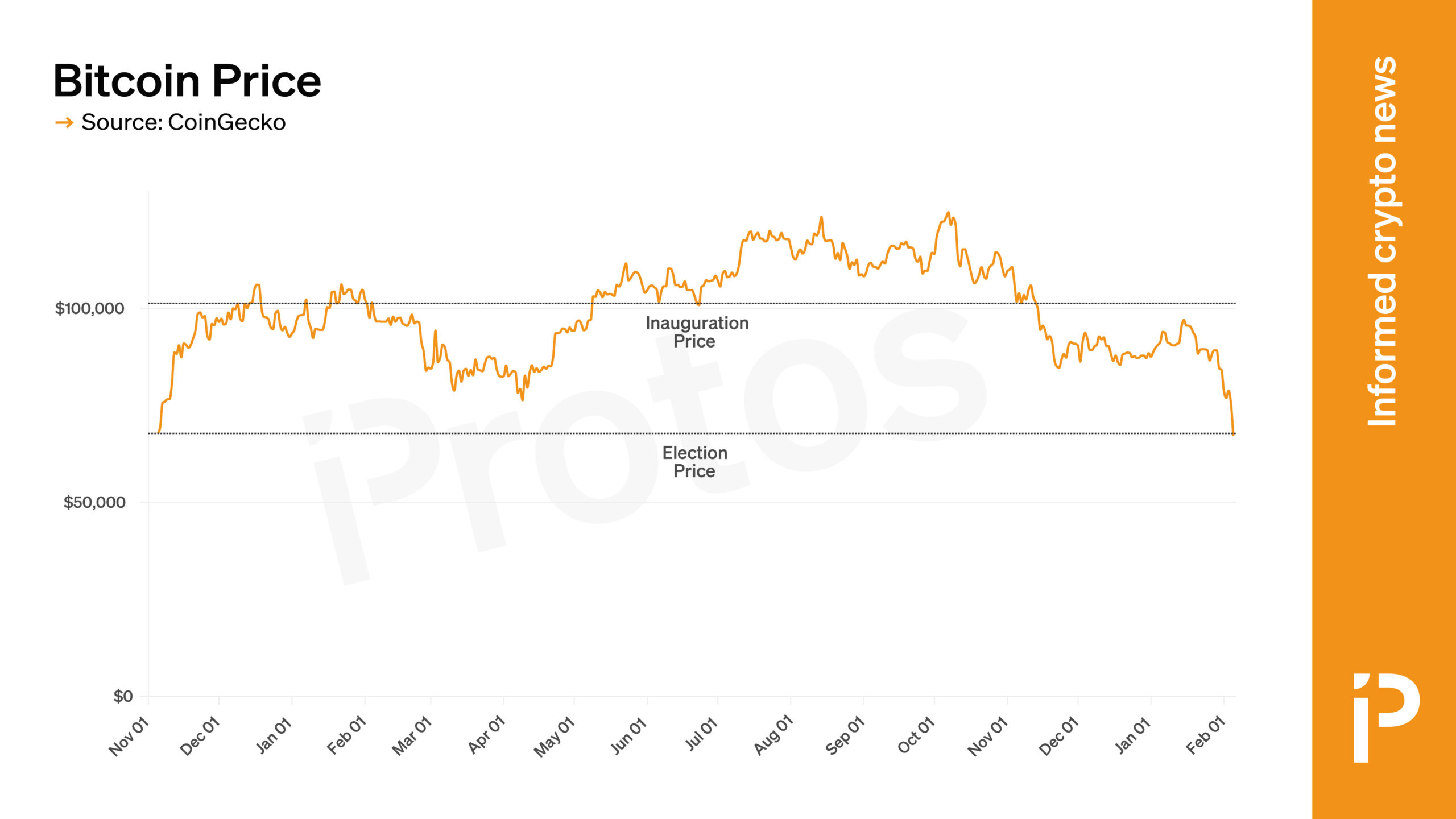

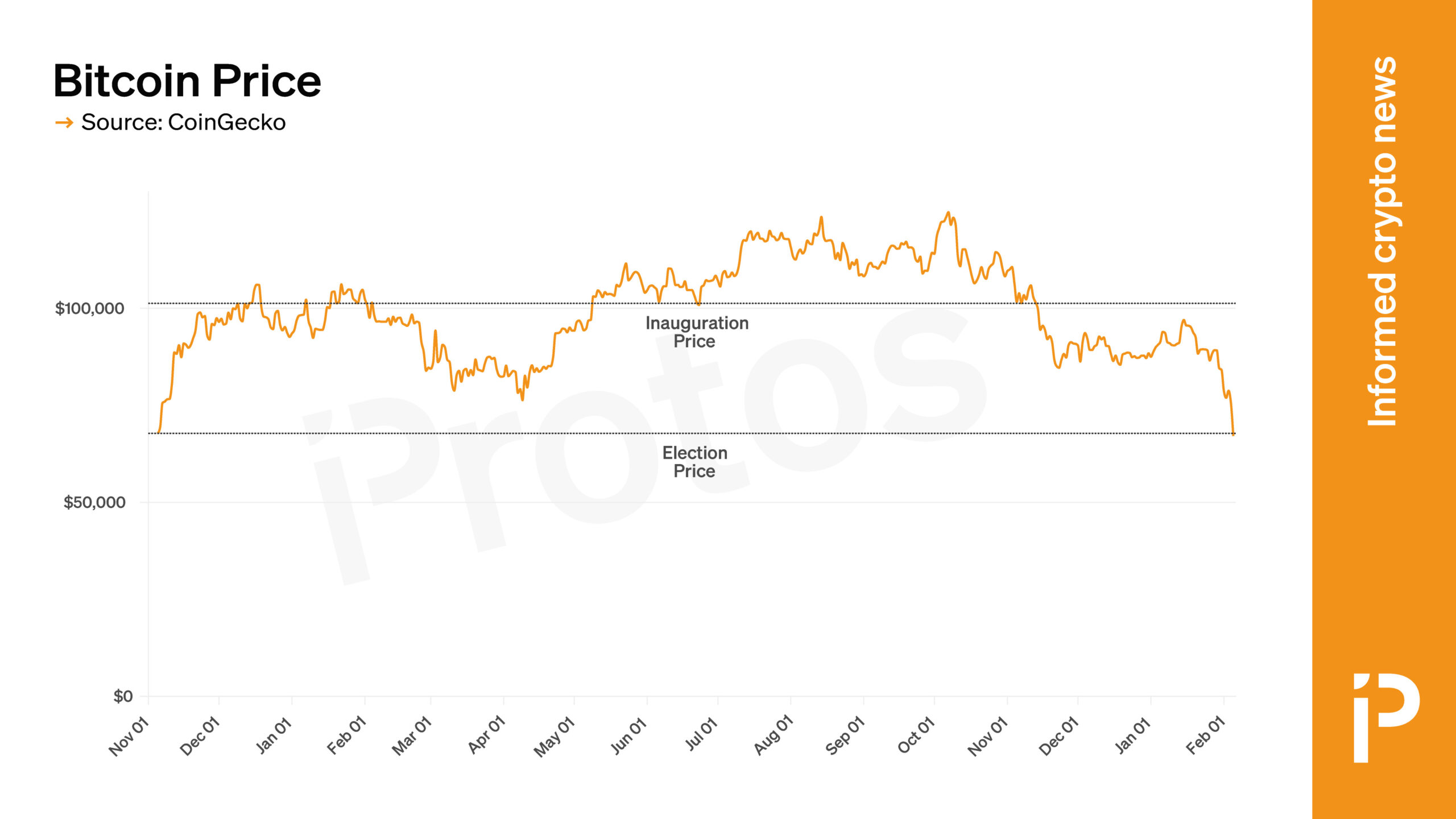

Bitcoin has lost all of its gains since Trump’s election

Donald Trump has embraced bitcoin (BTC) as a core part of his second administration, creating a strategic BTC reserve, insisting all BTC should be made in the United States, and destroying or disabling huge portions of the regulatory apparatus that had previously pursued cryptocurrency firms.

Additionally, both he and his sons have vigorously embraced the industry in ways that continue to generate massive profits for this family.

Many Bitcoiners and crypto enthusiasts were similarly ecstatic for the opportunity to support Trump and free themselves from the perceived tyranny of the Joseph Biden administration and the enforcement work of then-SEC head Gary Gensler.

Jesse Powell, Tyler Winklevoss, and Cameron Winklevoss all ended up making donations to Trump that would have been illegal had they not been refunded.

Read more: Who is behind World Liberty Financial, Trump’s new crypto?

Despite this mutual embrace, the price of BTC hasn’t benefitted from the Trump administration.

When Trump was inaugurated as president, BTC was trading for approximately $101,000.

Today, it trades for approximately $67,000, a fall of approximately 33%.

Even if we imagine that the value of BTC began increasing as soon as Trump was elected, before he had any real power, in anticipation of what he might do, BTC is still down since then.

On November 5, 2024, the date of the presidential election, BTC was trading for approximately $67,800.

Today, as mentioned before, it’s several hundred dollars less than that.

Despite all the hopes Bitcoiners may have pinned on Trump, he’s done little to benefit their portfolios.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

BitMEX Launches Hyperliquid Copy Trading for PerpDEX Alpha

BitMEX, one of the safest exchanges, announced today the launch of Hyperliquid Copy Trading, giving its users the ability to copy the best Hyperliquid perps traders. The release allows traders to enjoy the best of both worlds, combining access to Hyperliquid’s best traders with the user experience and safety of the BitMEX platform.

Hyperliquid Copy Trading marks a major expansion to BitMEX’s existing Copy Trading feature, which allows users to automatically replicate the trading strategies and positions of elite traders. This ensures access to the sharpest trader strategies without any exposure to underlying DeFi risk. Designed for effortless trading, BitMEX Copy Trading saves time by enabling less experienced traders to follow the wisdom of profitable professionals.

Hyperliquid remains a dominant force in the decentralized perpetual exchange (PerpDEX) landscape, capturing over 60% of all open interest. It combines features of futures contracts with spot trading flexibility, allowing traders to speculate on asset prices without an expiration date.

Users who navigate to BitMEX’s Copy Trading Marketplace will see a Hyperliquid sub-tab. This displays a leaderboard of the top Hyperliquid traders that they can copy or reverse copy trade. Positions are automatically opened on BitMEX, replicating the strategy of the Hyperliquid trader in question. Each Hyperliquid trader is ranked by metrics such as PnL, Drawdown, Win Ratio, and AUM (Assets Under Management), making it easy to identify top-performing traders.

BitMEX CEO Stephan Lutz said:

“BitMEX pioneered the perpetual swap, which has since become the industry standard for futures trading. The launch of Hyperliquid Copy Trading completes the circle, bringing the alpha available on the world’s leading PerpDEX to BitMEX users and incorporating it into their existing workflow.”

Up to five Hyperliquid traders can be copied simultaneously using BitMEX’s Copy Trading Marketplace, with users able to customize their preferred risk management settings for each, such as by implementing Take Profits and Stop Loss. Choosing a Copy Leader that suits their needs allows them to automate their crypto derivatives trading and make more informed decisions.

To celebrate the launch, BitMEX is offering a 100,000 USDT prize pool for eligible users who trade Copy Trade on their platform. Additional educational resources and product guides are available through the BitMEX website and blog.

About BitMEX

BitMEX is the OG crypto derivatives exchange, providing professional crypto traders with a platform that caters to their needs with low latency, deep crypto native and especially BTC liquidity and unmatched reliability.

Since its founding, no cryptocurrency has been lost through intrusion or hacking, allowing BitMEX users to trade with confidence that their funds are secure and that they have access to the products and tools required to be profitable.

BitMEX was also among the first exchanges to publish on chain Proof of Reserves and Proof of Liabilities data. The exchange continues to publish this data twice a week, providing assurance that customer funds are safely stored and segregated.

For more information, users can visit the BitMEX Blog or www.bitmex.com and follow Discord, Telegram and Twitter.

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business12 hours ago

Business12 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat18 hours ago

NewsBeat18 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World12 hours ago

Crypto World12 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

Bitcoin slid more than 10% toward $64,000 Friday, hitting its weakest level since late 2024 as a broad risk asset selloff erased post-election crypto gains.

Bitcoin slid more than 10% toward $64,000 Friday, hitting its weakest level since late 2024 as a broad risk asset selloff erased post-election crypto gains.