Crypto World

Is a hidden hedge fund blowup behind bitcoin’s crash to $60,000?

Bitcoin’s plunge to nearly $60,000 on Thursday, a nearly 30% drop over 7 days, has got traders on X began floating theories that the selloff was not purely macro or risk-off, but various reasons that contributed to the asset’s worst single-day performance since FTX crashed in 2022.

Flood, a prominent crypto trader, called it in an X post the most vicious selling he’s seen in years and said it felt “forced” and “indiscriminate,” floating possibilities ranging from a sovereign dumping billions to an exchange balance sheet blowup.

Few theories: – Secret Sovereign dumping $10B+ (Saudi/UAE/Russia/China) – Exchange blowup, or Exchange that had tens of billions of dollars of Bitcoin on the balance sheet forced to sell for whatever reason.

Pantera Capital general partner Franklin Bi offered a more detailed theory. He suggested the seller could be a large Asia-based player with limited crypto-native counterparties, meaning the market would not “sniff them out” quickly.

My guess is that it’s not a crypto-focused trading firm but someone large outside of crypto, likely based in Asia, with very few crypto-native counterparties. hence why no one has sniffed them out on CT. comfortably leveraged & market-making on Binance –> JPY carry trade unwind –> 10/10 liquidity crisis –> ~90-day reprieve granted –> backfired attempt to recover on gold/silver trade –> desperate unwind this week.

In his view, the chain of events may have started with leverage on Binance, then worsened as carry trades unwound and liquidity evaporated, with a failed attempt to recover losses in gold and silver accelerating the forced unwind this week.

But the more unusual narrative emerging from the crash is not about leverage. It is about security.

Charles Edwards of Capriole argued that falling prices may finally force serious attention on bitcoin’s quantum security risks.

Edwards said he was “serious” when he warned last year that bitcoin might need to go lower to incentivize meaningful action, calling recent developments the first “promising progress” he has seen so far.

$50K not that far away now. I was serious when I said last year that price would need to go lower to incentivize proper attention to Bitcoin quantum security. This is the first promising progress we have seen to date. I genuinely hope Saylor is serious about establishing a well funded Bitcoin Security team.

He would have significant sway across the network in affecting change. I am concerned that his statement today is a false flag, to simply diminish mounting quantum fear without substantive action, but I would love for this to be wrong. We have a lot of work to do, and it needs to be done in 2026.

Parker White, COO and CIO at DeFi Development Corp., pointed to unusual activity in BlackRock’s spot bitcoin ETF (IBIT) as a possible culprit behind Thursday’s washout.

He noted IBIT posted its biggest-ever volume day at $10.7 billion, alongside a record $900 million in options premium, arguing the pattern fits a large options-driven liquidation rather than a typical crypto-native leverage unwind.

The last small piece of evidence I have is that I personally know a number of HK-based hedge funds that are holders of $DFDV, which had the worst single down day ever, with a meaningful mNAV decline. The mNAV had been holding steady surprisingly well throughout this pull back until today. One of these fund(s) could have been connected to the IBIT culprit, as I highly doubt a fund taking that large of a position in IBIT and using a single entity structure would only have the one fund.

Now, I could easily see how the fund(s) could have been running a levered options trade on IBIT (think way OTM calls = ultra high gamma) with borrowed capital in JPY. Oct 10th could very well have blown a hole in their balance sheet, that they tried to win back by adding leverage waiting for the “obvious” rebound. As that led to increased losses, coupled with increased funding costs in JPY, I could see how the fund(s) would have gotten more desperate and hopped on the Silver trade. When that blew up, things got dire and this last push in BTC finished them off.

“I have no hard evidence here, just some hunches and bread crumbs, but it does seem very plausible,” White wrote on X.

Bitcoin’s drop over the past week has been less about a slow grind lower and more about sudden air pockets, with sharp intraday swings replacing the orderly dip-buying seen earlier this year.

The move has dragged BTC back toward levels last traded in late 2024, while liquidity has looked thin across major venues. With altcoins under heavier pressure and sentiment collapsing to post-FTX style readings, traders are now treating each rebound as suspect until flows and positioning visibly reset.

Crypto World

Gemini shutters operations across Europe and Australia to focus on the U.S. and prediction markets

Gemini Space Station Inc. (GEMI) is shutting down operations in the U.K., the European Union (EU) and Australia.

The crypto exchange is also reducing its staff by 25%, according to a blog post on Thursday that suggests it is focusing resources into prediction markets.

“Effective 6 April 2026, Gemini will be ceasing operations in the United Kingdom,” the crypto trading platform said in an email sent to customers seen by CoinDesk which does not mention Australia or Europe. “Starting 5 March 2026, all customer accounts in these regions will be placed in withdrawal mode.”

New York-based Gemini stated that it had partnered with brokerage platform eToro to assist customers with their offboarding process. It instructed customers to sign up with eToro so they could “assist in transferring your assets.” Full closures of all accounts will follow in April, the New York-based company said. New account creation and incentive programs will also be disabled.

Crypto equities have lagged broader markets as risk sentiment shifted in early 2026. While major stock indices have posted gains, leading digital-asset–linked equities have slid, reflecting waning investor appetite and tightening liquidity. This underperformance underscores a retrenchment of speculative capital from crypto-linked stocks.

Tyler and Cameron Winklevoss, CEO and President of Gemini, cited difficulties gaining traction in the U.K., Europe and Australian markets as their reason for exiting them, while saying the U.S. has been great to them.

“The reality is that America has the world’s greatest capital markets and America has always been where it’s at for Gemini,” they said. “So it’s time for Gemini to focus and double down on America.”

Tyler and Cameron also shared their view that prediction markets would outgrow capital markets, saying they have plans to venture into this sector.

“Our thesis is that prediction markets will be as big or bigger than today’s capital markets,” they said. “Our investment in securing a license to launch our own prediction marketplace positions us as an early mover on this new and exciting frontier.”

They added that more than 10,000 users have traded over $24 million since the debut of Gemini Predictions in mid-December.

Gemini, which went public in September, has seen its shares fall about 23% since the start of 2025 amid a broader downturn in crypto prices. The stock was down 2.8% on Thursday.

Read more: SEC dismisses lawsuit against billionaire Winklevoss twins-backed Gemini over Earn product

Crypto World

IREN and AMZ down on earnings miss, as BTC equities bounce back

IREN (IREN) earnings showed weaker than expected headline results, with the company missing consensus on both revenue and earnings per share (EPS) as it accelerates its transition from bitcoin mining to AI Cloud.

Financially, Q2 revenue declined to $184.7 million, missing expectations and down from $240.3 million in Q1, while the company reported a net loss of $155.4 million, also below consensus.

IREN secured $3.6 billion of GPU financing for its Microsoft contract which together with a $1.9 billion customer prepayment is expected to cover around 95% of GPU related capex.

Tech giant Amazon (AMZ) also missed expectations on EPS but beat on revenue, according to investing.com. Investor focus shifted to management’s plan to spend around $200 billion on capex in 2026, primarily AI related. Amazon shares are down 10%.

Pre-market update

Bitcoin rebounded from around $60,000 to $66,000, driving a broad rally across crypto exposed equities. Strategy (MSTR), the largest publicly traded holder of bitcoin, rose 7% in pre-market trading, mirroring a 7% gain for Galaxy (GLXY) and MARA Holdings (MARA) while Coinbase (COIN) increased by 6%.

Crypto World

Crypto market rebounds after BTC price tumbles to 2024 low: Crypto Markets Today

Thursday’s selloff was one of the sharpest and most devastating in crypto market history: More than $2.6 billion was liquidated as bitcoin tumbled to $60,000 to mark its lowest point since October 2024.

The drawdown led to bitcoin being the third most “oversold” in its history, according to the relative strength index (RSI), a momentum oscillator that tracks market conditions. Oversold conditions of this magnitude historically precede a major bounce.

The situation grew a bit brighter as Asia woke up, with bitcoin bouncing from $60,000 to above $65,000 while ether came off a low of $1,750 to trade back at $1,920.

Even so, the broader crypto market remains in a bear market. Privacy coin zcash has lost 34% of its value over the past week, while optimism , solana and ether are all dealing with losses of around 30%.

Traditional markets have also struggled in recent days. The Nasdaq 100 index dropped 6% since Jan. 28, and precious metals gold and silver are down by 12% and 38%, respectively, over the same period.

Derivatives positioning

- The crypto futures market is worth less than $100 billion for the first time since March 2025, as traders continue to reduce risk as prices slide and liquidations cause wealth destruction.

- Over $2.6 billion in leveraged futures bets have been liquidated, or forced closed, by exchanges due to margin shortage in 24 hours. Out of that, over $2.10 billion were long bets. This shows the degree of bullish leverage that was deployed around the pivotal $70,000 support, which was breached Thursday.

- Open interest (OI) has declined in futures tied to all major tokens, including recent outperformer HYPE.

- Annualized perpetual funding rates for major tokens such as BTC, SOL, XRP and DOGE have flipped negative as price crashes triggered demand for bearish bets. The negative rates could see arbitrageurs resort to reverse cash and carry bets.

- Bitcoin’s annualized 30-day implied volatility surged to nearly 100% late Thursday as traders scrambled to buy puts, with some snapping up these bearish bets at strike prices as low as $20,000. Since then, volatility has pulled back to under 70%. A similar pattern is seen in ether’s implied volatility.

- Still, bitcoin and ether short-term put options continue to trade at a volatility premium of 20 or more points to calls, a sign of lingering downside worries. Puts remain pricier at the long end as well.

- Options tied to BlackRock’s IBIT ETF saw record activity Thursday, with traders rushing to buy puts. The one-year skew rose to over 25 points, reflecting a massive premium for put options, indicating peak fear.

Token talk

- The altcoin sector presented a couple of unlikely winners despite the broader market decline on Thursday. Privacy-focused decred rose by 31% in 24 hours, seemingly unperturbed by the carnage as it added to a rally that has lifted it from $17.4 to $24.2.

- HyperLiquid’s HYPE token continues to perform well, relatively speaking, as it remains up 11% this week despite falling 4% in the past 24 hours.

- XRP was one of the most volatile altcoins, plunging by more than 30% before bouncing by 21%. Trading volume topped $14 billion, a 143% rise over 24 hours.

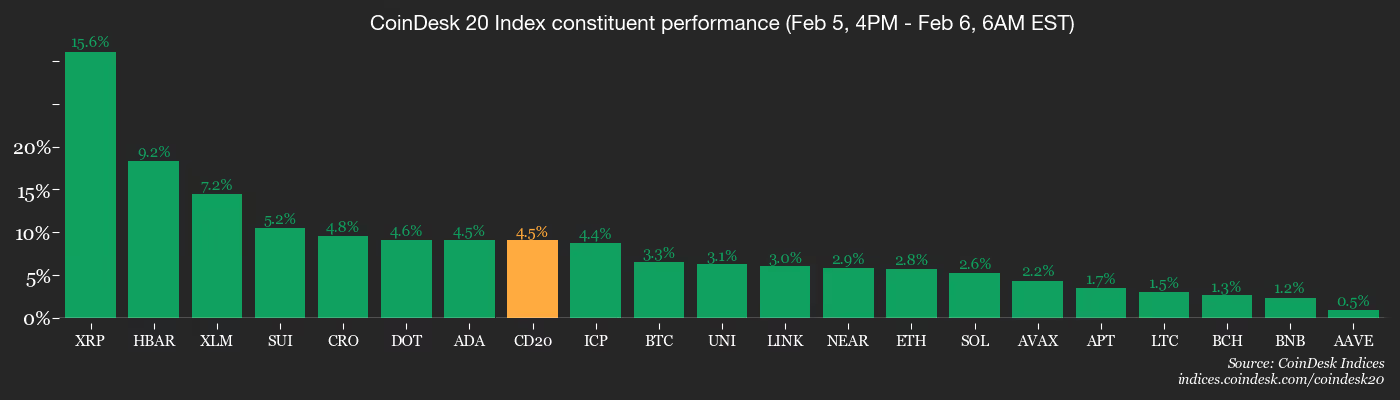

- The CoinDesk 20 (CD20) and CoinDesk 80 (CD80) both fell by around 6% in the past 24 hours, but the concerning corner of the market was DeFi, with the DeFi Select Index (DFX) underperforming the wider market with a decline of more than 10%.

- CoinMarketCap’s “altcoin season” indicator is now at 24/100, down from Wednesday’s high of 32/100, suggesting investors are seeking safer, less volatile assets like bitcoin or stablecoins.

Crypto World

Building Digital Economies with Metaverse Blockchain Games

For years, metaverse games were treated as experimental digital spaces, immersive, creative, but largely positioned as merely entertainment projects. However, that perception is changing rapidly.

Enterprises and forward-looking studios are no longer investing in metaverse blockchain games just to create virtual worlds. The focus is on building persistent digital economies where users socialize, trade, own assets, and generate value.

The shift is subtle but powerful. Metaverse game development is evolving from experiences into economic ecosystems. Businesses that understand this transition are positioning themselves at the forefront of the next digital economy wave. It is because the next generation of digital platforms will not simply be social networks or apps; they will be immersive environments where commerce, community, and ownership converge.

From Virtual Spaces to Economic Systems

A traditional virtual world offers exploration and interaction. On the other hand, a metaverse blockchain game introduces something far more powerful that is economic permanence. When assets exist on-chain & transactions are verifiable, the environment becomes more than just a playground, it becomes a marketplace and a functioning economy.

These ecosystems are built on several pillars:

- Digital Ownership

True digital ownership changes user psychology. When players genuinely own assets like characters, land, skins, or tools, they tend to treat them as investments rather than consumables. For enterprises, this increases willingness to spend and builds long-term emotional attachment. - Asset Scarcity

Scarcity drives perceived value. Limited or time-bound assets create collectability and stimulate secondary markets. When managed strategically, scarcity supports demand cycles and stabilizes ecosystem value. - Tokenized Economies

Tokens are not just rewards, they are economic instruments. At the time when structured properly, they guide participation, governance, and ecosystem sustainability. Enterprises can use tokenomics to align user incentives with platform growth. - Interoperable Assets

Assets usable across environments hold higher value. Interoperability reduces user risk and encourages deeper investment. It also enables cross-platform partnerships and larger ecosystem reach. - Transparent Transactions

Blockchain-backed transparency builds trust. Every trade and transfer is verifiable, thereby reducing disputes & reinforcing fairness both of which are critical for long-term economic health.

Players stop being mere participants. They become stakeholders. For enterprises, this transforms games into economic platforms.

Why Businesses Are Paying Attention

Decision-makers increasingly view metaverse blockchain games as strategic digital infrastructure rather than creative experiments.

- Brand Engagement at Depth

Unlike short campaigns, immersive worlds host users for hours. This builds emotional connection and stronger brand recall. - Digital Commerce Opportunities

Virtual goods, land, access passes, and collectibles open recurring revenue streams. These are not one-off purchases but parts of ongoing economies. - Loyalty & Membership Ecosystems

Ownership-based loyalty outperforms point systems. NFT or token memberships carry tradable value and exclusivity, driving retention. - Community-Led Growth

Users who own assets become advocates. When ecosystem success benefits participants, organic growth follows. - First-Mover Positioning

Early adopters gain insights, data, and ecosystem maturity before competitors enter. This builds defensible advantages.

It is exactly the reason why metaverse initiatives are now discussed in boardrooms, not just marketing teams.

Want to Build a Full-Scale Digital Gaming Economy?

The Role of Blockchain in Making Economies Work

Without blockchain, virtual economies rely on centralized control, which weakens trust and portability. The introduction of blockchain brings in:

- Verifiable Ownership

Ownership recorded on-chain gives users real control, not platform-dependent licenses. - Trustless Transactions

Peer-to-peer transactions reduce reliance on intermediaries, lowering costs and friction. - Smart Contract Automation

Rules execute automatically. Royalties, revenue splits, and governance can function without manual oversight. - Transparency

Open ledgers help reduce fraud and simplify the audit process. - Interoperability Potential

Shared standards allow assets to travel across platforms, increasing lifespan and utility.

When users trust the system, they invest more time and capital. That trust fuels sustainable economies.

Where Many Projects Go Wrong

Not every metaverse blockchain game succeeds. A number of them fail due to economic misdesign rather than technical flaws.

- Speculation-Driven Models

Short-term hype collapses without utility. - Inflationary Reward Systems

Over-issuance devalues tokens and drives users away. - Weak Governance

Without rules, economies tend to destabilize. - Poor Onboarding

Complex wallet flows deter mainstream users. - Infrastructure Gaps

Systems must be built to scale over time. Performance failures damage credibility.

What Sustainable Metaverse Economies Require

Persistent economies demand disciplined planning.

- Economic Modeling

Balanced supply-demand and token sinks maintain value. - Scalable Infrastructure

Cloud and blockchain must work together for real-time experiences. - Security Frameworks

Audited contracts and secure wallets protect ecosystems. - Governance Systems

Clear rules build confidence. - Live Economy Management

Economies need monitoring and tuning. - Content Pipelines

Fresh content sustains demand and engagement.

The Strategic Value for Businesses

Enterprises that invest thoughtfully gain:

- Recurring monetization channels

- High-value digital communities

- Long-term retention

- Behavioral data insights

- Brand differentiation

- Platform-level control over engagement

Instead of chasing users, they build environments users return to.

The Competitive Reality

The metaverse space is no longer empty. Major brands, gaming studios, and tech firms are actively experimenting and investing. As more players enter, the cost of late adoption rises.

Businesses that wait will have to face:

- Higher user acquisition costs

- Saturated virtual spaces

- Reduced novelty advantage

- Fewer partnership opportunities

Early movers, however, shape standards and user expectations. They build ecosystems before markets mature. This is not about rushing blindly; it’s about strategic timing. Businesses that plan now can enter with clarity rather than urgency later.

Why Development Expertise Matters

Metaverse blockchain games sit at the intersection of:

- Game design

- Blockchain engineering

- Economic architecture

- Security infrastructure

- Community mechanics

Poor execution doesn’t just create bugs; it destabilizes economies. A capable game development company understands how these layers interact to build sustainable ecosystems.

Final Thoughts

Metaverse blockchain games are no longer novelty projects. They are evolving into persistent digital economies where ownership, engagement, and value intersect. Enterprises recognizing this shift are not building games; they are building digital nations.

Antier, as a reliable metaverse game development partner, works with enterprises & studios to develop blockchain games designed for scalability, sustainability, and long-term economic participation. It is because the future of digital economies won’t just be visited, they’ll be lived in.

Frequently Asked Questions

01. What is the main shift in the perception of metaverse games?

The perception is shifting from viewing metaverse games as mere entertainment projects to recognizing them as platforms for building persistent digital economies where users can socialize, trade, own assets, and generate value.

02. How does digital ownership impact user behavior in metaverse games?

True digital ownership changes user psychology, leading players to treat their assets as investments rather than consumables, which increases their willingness to spend and fosters long-term emotional attachment.

03. What are the key pillars that support metaverse economic ecosystems?

The key pillars include digital ownership, asset scarcity, tokenized economies, interoperable assets, and transparent transactions, all of which contribute to a functioning economy within the metaverse.

Crypto World

Novo Nordisk (NVO) Stock Drops as Legal War Erupts Over $49 Wegovy Knockoff

TLDR

- Novo Nordisk shares fell 7% Thursday when Hims & Hers introduced a $49 compounded Wegovy pill, compared to Novo’s $149 branded version

- The Danish pharmaceutical company plans legal action, labeling the product “illegal mass compounding” that threatens patient safety

- Eli Lilly stock also declined 7% as investors worried about increased market competition for weight loss medications

- Hims & Hers argues its compounded version is legal as a “personalized” treatment with different formulation, despite semaglutide patents running through 2032

- Novo’s stock has crashed 50% in 2025 and dropped another 15% in 2026 following guidance predicting sales declines between 5% and 13%

Novo Nordisk experienced a 7% stock decline Thursday following Hims & Hers’ announcement of a $49 compounded Wegovy weight loss pill. The Danish drugmaker swiftly responded with plans for legal action.

The telehealth platform priced its alternative at $49 for the initial month and $99 monthly thereafter with a five-month plan. This represents a substantial discount from Novo’s $149 branded pill price.

Eli Lilly shares tumbled 7% alongside Novo on competitive concerns. Hims stock briefly rallied before retreating after legal threats emerged.

Novo condemned the launch as “illegal mass compounding that poses a risk to patient safety.” The company vowed to pursue legal and regulatory measures to protect its patents and the drug approval process.

“This is another example of Hims & Hers’ historic behaviour of duping the American public with knock-off GLP-1 products,” the company stated. The FDA previously cautioned Hims regarding deceptive GLP-1 product advertising.

Compounding Controversy

Semaglutide maintains U.S. patent protection through 2032. Hims contends its version qualifies as legal personalized compounding.

The company states its compounded product employs a different formulation and delivery mechanism than FDA-approved oral semaglutide. Hims previously sold compounded injectable semaglutide and now offers pills.

Novo produces Wegovy pills using specialized SNAC technology to facilitate oral absorption. The effectiveness of Hims’ alternative formulation remains uncertain.

The two companies briefly collaborated in 2025 on discounted weight loss shots. Novo severed the partnership within two months, accusing Hims of “deceptive” marketing.

Novo Faces Headwinds

The dispute intensifies pressure on Novo Nordisk during a challenging stretch. Shares plummeted nearly 50% throughout 2025, marking the company’s worst annual performance.

The stock has dropped an additional 15% in 2026 year-to-date. Investors question Novo’s capacity to maintain revenue growth against strengthening competition.

Novo forecasted last week that 2026 sales and profits would fall 5% to 13%. The company cited U.S. pricing challenges and patent expiration in markets including Canada and China.

CEO Mike Doustdar noted 170,000 patients started taking Wegovy pills since the January rollout. He framed the pessimistic outlook as temporary pain for future benefit.

“We are creating affordability for the patients, millions of patients that are right now in need of GLP-1 products, but simply could not afford it,” Doustdar explained.

Market Dynamics Shift

Eli Lilly plans to introduce its weight loss pill, orforglipron, in the first half of 2026 subject to FDA clearance. The company anticipates 25% sales growth this year, contrasting with Novo’s negative projection.

Leerink analyst Michael Cherny noted Hims should explore similar opportunities for upcoming weight loss medications as the market expands.

Eli Lilly did not provide comment on the Hims development. Novo launched its Wegovy pill in the United States during early January 2026.

Crypto World

ARK offloads $17 million of Coinbase, adds $18 million of Bullish amid crypto rout

ARK Invest sold $17.4 million worth of Coinbase (COIN) stock and bought a similar amount in Bullish (BLSH) stock on Thursday as crypto equities were routed.

Cathie Wood’s investment management company sold 119,236 COIN shares, worth $17.4 million as of Thursday’s close. COIN lost 13.3% on the day to close at $146.12 amid ongoing tanking of the crypto market which has seen bitcoin fall as low as $60,000, its lowest point since November 2024.

ARK also bought 716,030 shares in crypto exchange Bullish, according to an emailed disclosure. The shares are worth $17.8 million, based on BLSH’s closing price of $24.90, nearly 8.5% lower on the day. Bullish is also the parent company of CoinDesk.

It is common to see ARK Invest make sizeable purchases of crypto-adjacent companies when their prices slide due to broader downturns in the cryptocurrency market. The Florida-based company attempts to capitalize on the chance to capture greater value from equities and rebalance the holdings of its funds to reflect the different prices.

However, it is somewhat rarer to see ARK use this as a window to offload shares in a major crypto holding such as Coinbase.

Crypto World

Bitcoin (BTC) price recovery still faces macro risks: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

Friday’s crypto markets are a sea of green, bouncing from yesterday’s brutal drubbing in a classic oversold rebound. But real risks linger, threatening any lasting recovery.

Bitcoin has climbed back to $65,000 after flirting with $60,000, with BlackRock ETF action hinting at capitulation, that is, long-term holders dumping at a loss, often the bear market’s final gasp. The broader market has perked up, too, with XRP, SOL, ETH and other tokens regaining some poise, while the CoinDesk 20 Index added nearly 9% since midnight UTC.

Still, put options on bitcoin remain in demand, signaling persistent downside fear. It makes sense for a couple of key reasons: First, macro risks have eased, but aren’t gone. President Donald Trump signed a funding bill Tuesday to end the government shutdown, but the Department of Homeland Security cash runs dry in eight days, which means there could be another circus by Feb. 14.

Meanwhile, oil prices are buoyant on both sides of the Atlantic on concerns the Iran-U.S. tensions will escalate. A spike there could add to global inflation, triggering a flight to safety and hammering risk assets like crypto.

Most critically, the recent crash has pushed many holders and digital-asset treasuries underwater. Many of those may capitulate and become marginal sellers in the market, potentially capping rallies. Plus, confidence tends to rebuild only slowly after a crash, which is why snapback recoveries always crawl.

These things taken together indicate that the market may not be out of the woods yet. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Macro

- Feb. 6, 8:30 a.m.: Canada unemployment rate for January (Prev. 6.8%)

- Feb. 6, 10 a.m.: Canada Ivey PMI index for January (Prev. 51.9)

- Feb. 6, 10 a.m.: U.S. Michigan Consumer Sentiment preliminary for February (Prev. 56.4); Michigan inflation expectations (Prev. 4%)

- Earnings (Estimates based on FactSet data)

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Feb. 6: Chainlink to host an X Spaces session on “Building with the Chainlink Runtime Environment.”

- Unlocks

- Token Launches

- Feb. 6: MOVA (MOVA) to be listed on LBank, BingX, KuCoin, MEXC and others.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is up 4.55% from 4 p.m. ET Thursday at $66,022.00 (24hrs: -6.74%)

- ETH is up 4.14% at $1,924.90 (24hrs: -7.3%)

- CoinDesk 20 is up 4.75% at 1,905.03 (24hrs: -7.49%)

- Ether CESR Composite Staking Rate is up 39 bps at 3.48%

- BTC funding rate is at -0.0142% (-15.5862% annualized) on Binance

- DXY is unchanged at 97.81

- Gold futures are down 0.19% at $4,880.30

- Silver futures are down 4.39% at $73.35

- Nikkei 225 closed up 0.81% at 54,253.68

- Hang Seng closed down 1.21% at 26,559.95

- FTSE is up 0.01% at 10,309.76

- Euro Stoxx 50 is up 0.27% at 5,941.80

- DJIA closed on Thursday down 1.20% at 48,908.72

- S&P 500 closed down 1.23% at 6,798.40

- Nasdaq Composite closed down 1.59% at 22,540.59

- S&P/TSX Composite closed down 1.77% at 31,994.60

- S&P 40 Latin America closed down 1.01% at 3,616.07

- U.S. 10-Year Treasury rate is down 1.8 bps at 4.192%

- E-mini S&P 500 futures are up 0.3% at 6,841.00

- E-mini Nasdaq-100 futures are up 0.36% at 24,740.50

- E-mini Dow Jones Industrial Average Index futures are up 0.16% at 49,075.00

Bitcoin Stats

- BTC Dominance: 58.77% (+0.47%)

- Ether-bitcoin ratio: 0.02917 (0.43%)

- Hashrate (seven-day moving average): 913 EH/s

- Hashprice (spot): $29.76

- Total fees: 5.59 BTC / $377,330

- CME Futures Open Interest: 115,230 BTC

- BTC priced in gold: 13.5 oz.

- BTC vs gold market cap: 4.4%

Technical Analysis

- The chart shows bitcoin’s weekly price swings in candlestick format since 2019.

- Prices are rapidly approaching their average over 200 weeks, represented by the red line.

- BTC has consistently put in bear-market bottoms around this average, suggesting the current pullback could be in its final stages.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $146.12 (-13.34%), +5.97% at $154.84 in pre-market

- Circle Internet (CRCL): closed at $50.23 (-8.76%), +5.40% at $52.94

- Galaxy Digital (GLXY): closed at $16.84 (-16.47%), +6.35% at $17.91

- Bullish (BLSH): closed at $24.90 (-8.46%), +3.98% at $25.89

- MARA Holdings (MARA): closed at $6.73 (-18.72%), +6.39% at $7.16

- Riot Platforms (RIOT): closed at $12.06 (-14.71%), +5.14% at $12.68

- Core Scientific (CORZ): closed at $14.81 (-8.27%), +1.99% at $15.11

- CleanSpark (CLSK): closed at $8.27 (-19.13%), -3.33% at $7.99

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $35.23 (-12.56%), +2.24% at $36.02

- Exodus Movement (EXOD): closed at $9.42 (-11.96%), -1.27% at $9.30

Crypto Treasury Companies

- Strategy (MSTR): closed at $106.99 (-17.12%), +6.71% at $114.17

- Strive (ASST): closed at $9.86 (-16.75%)

- SharpLink Gaming (SBET): closed at $6.07 (-14.27%), +4.12% at $6.32

- Upexi (UPXI): closed at $1.09 (-19.85%), +7.34% at $1.17

- Lite Strategy (LITS): closed at $0.95 (-10.27%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$434.1 million

- Cumulative net flows: $54.3 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: -$80.8 million

- Cumulative net flows: $11.86 billion

- Total ETH holdings ~5.87 million

Source: Farside Investors

While You Were Sleeping

Bitcoin surges back above $65,000 after $700 million wipeout in Asia whipsaw (Coindesk): Bitcoin rebounded above $65,000 after its worst one-day drop since November 2022. About $700 million in leveraged crypto positions were liquidated in a few hours,

Stocks reel as AI fears dominate market action (Reuters): Global markets retreated as a stock rout on Wall Street spread worldwide, with volatility gripping precious metals and cryptocurrencies while AI fears weighed on equities.

Weak earnings drag IREN, Amazon; bitcoin stocks rebound in pre-market (CoinDesk): IREN earnings were weaker than expected, while Amazon missed EPS estimates and beat on revenue.

Big tech to spend $650 billion this year as AI race intensifies (Bloomberg): The high spending projections raise concerns about energy supplies, prices, and the potential distortion of economic data, raising questions about whether the companies can afford the costs.

Crypto World

$6 Million HBAR Liquidations Ahead If Price Breaks This Pattern

Hedera has remained under selling pressure after a steady decline brought HBAR back to retest a long-standing technical pattern. The token has been trading within this structure for several months, limiting upside attempts.

While multiple indicators now point toward a bullish setup, price action has yet to confirm the shift, keeping sentiment cautious.

HBAR Has An Underlying Bullish Trigger

HBAR’s Money Flow Index is showing early signs of strength despite continued price weakness. On the two-day chart, the indicator is forming a bullish divergence with the price. While HBAR has printed a lower low, the MFI has held higher lows, indicating rising buying pressure beneath the surface.

Sponsored

Sponsored

This divergence suggests that selling momentum is gradually fading. As sellers lose control, buyers begin to step in without immediately pushing prices higher. Such conditions often precede trend reversals, especially when supported by compression patterns and improving momentum indicators across higher timeframes.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Derivatives data highlights growing risk for bearish traders. The liquidation map shows that a breakout in HBAR price would place significant pressure on short positions. If the price reaches $0.1013, approximately $6.2 million in short liquidations could be triggered, forcing rapid position closures.

Given the pattern HBAR is currently trading within, a breakout could occur quickly once resistance is breached. Forced liquidations typically accelerate price movement, amplifying upside momentum. As a result, short traders face heightened exposure if HBAR breaks above its current range.

HBAR Price Breakout Is Possible

HBAR price is trading near $0.0826 at the time of writing, holding above the $0.0786 support level. The altcoin has been moving within a descending channel for nearly four months. This structure reflects prolonged consolidation while volatility continues to compress.

A breakout from this pattern appears increasingly likely as selling pressure dissipates on a macro scale. Confirmation would require HBAR to breach the channel’s upper trendline and flip $0.1042 into support. Such a move would trigger short liquidations and push the price toward $0.129, the pattern’s projected 32% upside target.

However, downside risk remains if broader market conditions fail to improve. A loss of the $0.0786 support would weaken the structure. Under that scenario, HBAR could slide toward $0.0622. A move to that level would invalidate the bullish thesis entirely.

Crypto World

Bitcoin Slides Below $70,000 After Breaking Key Support

Editor’s note: eToro crypto analyst Simon Peters outlines the forces behind bitcoin’s sharp pullback from its October 2025 highs, pointing to a broader risk-off environment, leverage unwinds, and fragile investor sentiment across global markets. The commentary focuses on key technical and on-chain indicators now in focus, including long-term support levels and valuation metrics that have historically marked major market bottoms. As bitcoin trades under renewed selling pressure, the analysis frames the current correction within past cycles, while highlighting the conditions that could help stabilize prices if macro and market dynamics begin to shift.

Key points

- Bitcoin has fallen sharply from its October 2025 peak amid global risk-off sentiment.

- Liquidation of leveraged positions has intensified downside pressure.

- The 200-week moving average is being watched as a potential long-term support level.

- Historical cycles show similar corrections in 2015, 2018, 2020, and 2022.

- On-chain MVRV Z-score signals bitcoin may be nearing long-term fair value.

Why this matters

The analysis offers a timely snapshot of market psychology as bitcoin navigates one of its deepest post-ETF drawdowns. For investors and builders, long-term indicators like the 200-week moving average and MVRV Z-score provide context beyond short-term volatility. In a market increasingly influenced by macro conditions and institutional flows, understanding where leverage resets and valuation metrics converge is key to assessing whether the current correction is a pause or a potential inflection point.

What to watch next

- Bitcoin’s behavior around the 200-week moving average.

- Evidence of reduced leverage and easing forced liquidations.

- Changes in ETF inflows as broader risk sentiment evolves.

- Shifts in macro and geopolitical conditions impacting risk assets.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Abu Dhabi, United Arab Emirates – February 05, 2026: “After reaching an all-time high of $126,500 in October 2025, bitcoin has continued to slide as broader risk-off sentiment spills into the crypto market,” said Simon Peters, Crypto Analyst at eToro.

“Heightened geopolitical tensions, macroeconomic uncertainty and disappointing earnings forecasts have led investors to reassess risk assets, including technology stocks and crypto, while the liquidation of leveraged long positions has further accelerated the downturn.

“After breaking multiple support levels, bitcoin is now trading just below $70,000 and remains under significant selling pressure.

“From a technical perspective, analysts are closely watching bitcoin’s 200-week moving average as a potential area where the price could find a bottom. Historically, this level has acted as strong support following major corrections and bear markets in 2015, 2018, 2020 during the Covid pandemic, and most recently in 2022.

“Could history repeat itself in 2026? It remains to be seen. Once leverage is flushed out of the system, selling pressure eases and ETF inflows resume, this could help stabilise prices and signal the end of the current correction.

“From an on-chain perspective, the widely used MVRV Z-score — which assesses whether bitcoin is trading above or below its fair value — is also pointing towards a potential long-term buying opportunity.”

Media Contact:

PR@etoro.com

About eToro

eToro is the trading and investing platform that empowers you to invest, share and learn. We were founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way. Today we have 40 million registered users from 75 countries. We believe there is power in shared knowledge and that we can become more successful by investing together. So we’ve created a collaborative investment community designed to provide you with the tools you need to grow your knowledge and wealth. On eToro, you can hold a range of traditional and innovative assets and choose how you invest: trade directly, invest in a portfolio, or copy other investors. You can visit our media centre here for our latest news.

Crypto World

DeFi Development Guide to Vault Infrastructure (2026)

In 2026, the biggest challenge for Web3 founders is no longer launching a protocol. It is building a business that lasts. While thousands of platforms compete for attention, only a few manage to convert liquidity into predictable revenue, retain users beyond incentive cycles, and operate with financial discipline. The difference is not marketing, but infrastructure supported by enterprise-grade DeFi development.

Today’s most resilient crypto platforms are built on systems that quietly compound capital, stabilize cash flow, and strengthen user loyalty in the background. Through advanced DeFi development practices, leading teams are moving beyond short-term yield tactics and embracing structured vault architectures as a core business layer. This shift is redefining how modern Web3 companies think about growth, monetization, and valuation. In this guide, we break down why DeFi vault infrastructure is becoming the foundation of sustainable Web3 business models, how top platforms are leveraging it to outperform competitors, and what founders must do now to stay ahead in an increasingly capital-efficient market.

The Changing Economics of Web3 Platforms

In early DeFi (2020–2022), growth was driven by hype, aggressive incentives, and short-lived liquidity mining, which boosted TVL but created unstable business models. Today’s on-chain data shows a far more nuanced reality. As of early 2026, TVL in DeFi is around $129 billion, with Ethereum accounting for roughly 55% of that share (~$71 billion), underscoring continued core liquidity concentration in blue-chip ecosystems. This sustained TVL also reflects stronger demand for protocols that offer real utility, like lending, stablecoin liquidity, and yield mechanisms, rather than simple token-incentive farming.

As capital becomes more selective, founders and product leaders are shifting focus toward sustainable infrastructure rather than one-off token rewards. Platforms with structured vault systems benefit from higher capital efficiency, treasury utilization, and user retention compared to those relying solely on manual yield farming or emission-driven inflows. Against this backdrop, serious teams now treat yield infrastructure as a core business function rather than an add-on. Partnering with an experienced DeFi development company enables protocols to embed automated yield generation directly into their platforms, boosting long-term TVL resilience, reducing dependence on external aggregators, and creating sustainable revenue streams that align with evolving market expectations.

What Is DeFi Vault Infrastructure?

DeFi vault infrastructure refers to a system of smart contracts, automation tools, and risk controls that manage user funds and deploy them into optimized yield strategies. In simple terms, vaults:

- Collect user or treasury assets.

- Execute predefined strategies

- Harvest and reinvest rewards.

- Optimize gas and liquidity.

- Protect capital with built-in safeguards.

When users search for DeFi vaults crypto solutions, they are usually looking for this complete infrastructure layer, not just a basic staking contract or manual farming setup. Professional vault systems are not “set and forget” products. They are continuously optimized, monitored, and upgraded frameworks built through advanced DeFi development processes to ensure long-term performance, security, and scalability.

Explore how enterprise-grade vault architecture can power your next growth phase.

Why DeFi Yield Vaults Are Becoming Business-Critical

For Web3 companies, vaults now serve three strategic purposes.

- Revenue Generation

Vaults create recurring income through:

- Performance fees

- Management fees

- Strategy incentives

- Protocol-owned liquidity

- Yield-sharing mechanisms

These revenue streams help platforms move beyond short-term token speculation and build sustainable monetization models. This transforms volatile token economies into predictable, long-term revenue engines powered by DeFi yield vaults.

- User Retention

Platforms that offer built-in yield products retain users longer and reduce capital outflows. Instead of moving funds to external protocols in search of better returns, users can access optimized strategies directly within your ecosystem.

This leads to:

- Higher platform stickiness

- Improved lifetime user value

- Stronger community loyalty

- Reduced dependency on third-party aggregators

Integrated vault systems turn yield generation into a core user experience rather than a separate activity, driven by professional DeFi development practices that ensure scalability, security, and long-term performance.

- Capital Efficiency

Treasuries and idle balances can be deployed into structured, risk-managed strategies instead of remaining dormant. This allows protocols to generate returns on unused capital while maintaining liquidity and operational flexibility.

Improved capital efficiency:

- Strengthens financial resilience

- Enhances treasury sustainability

- Improves investor confidence

- Supports long-term governance stability

Well-designed vaults ensure that capital continuously works for the platform.

Leading platforms such as Yearn Finance and Beefy Finance demonstrated early how vault-based models outperform manual yield farming at scale through automation, diversification, and continuous optimization. Today, many new protocols are adopting similar approaches through custom DeFi development company partnerships to accelerate deployment, strengthen security, and build revenue-focused infrastructure from day one.

Inside a Professional DeFi Vault Strategy

A sustainable DeFi Vault Strategy is not about chasing the highest advertised APY. Instead, it focuses on creating a balanced system that optimizes yield while maintaining liquidity, security, and long-term scalability. High-performing DeFi vaults are built on carefully engineered frameworks developed through advanced DeFi development, rather than short-term incentive exploitation.

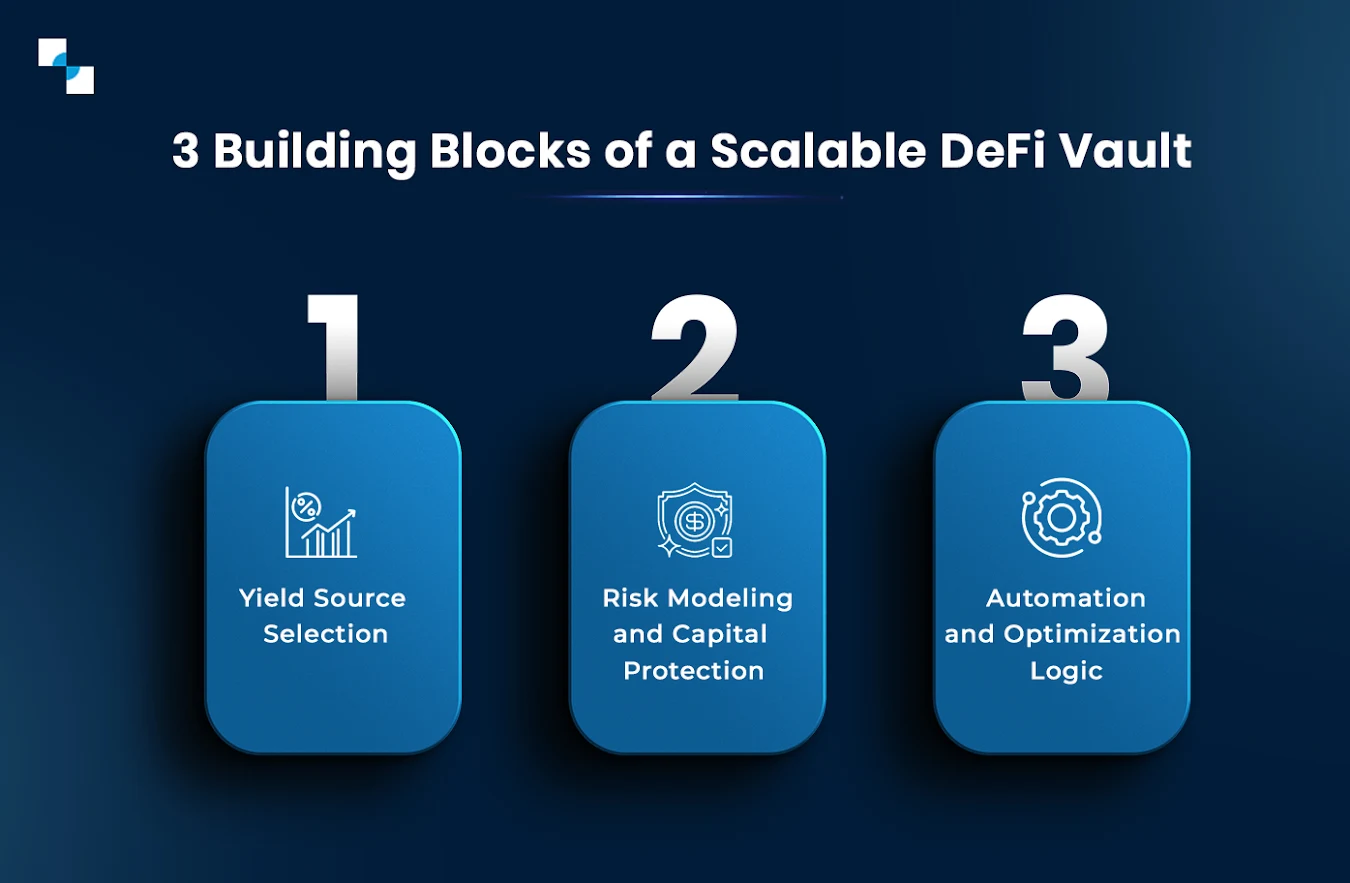

A mature vault strategy typically includes three core layers.

- Yield Source Selection

The first step is identifying reliable and diversified yield sources. Professional teams evaluate multiple income streams to reduce dependency on a single protocol.

Common sources include:

- Lending protocols that generate stable interest

- Stablecoin liquidity pools with low volatility

- LP incentive programs on major DEXs

- Staking mechanisms for network rewards

This diversified approach helps DeFi vaults maintain consistent returns across market cycles.

- Risk Modeling and Capital Protection

Every yield opportunity carries risk. Without proper modeling, high returns can quickly turn into major losses.

Enterprise-grade DeFi vault protocol systems apply strict risk frameworks, including:

- Comprehensive smart contract audits

- Slippage and liquidity impact controls

- Volatility exposure analysis

- Exit liquidity and stress testing

- Counterparty and protocol risk assessments

A professional DeFi development company integrates these safeguards into the strategy layer to protect both user funds and platform reputation.

- Automation and Optimization Logic

Automation transforms strategy design into a scalable financial engine. Without efficient execution, even strong strategies lose profitability.

Well-designed DeFi yield vaults rely on automation features such as:

- Dynamic harvest thresholds to balance rewards and gas costs

- Gas fee optimization mechanisms

- Rebalancing triggers based on market conditions

- Emergency withdrawal and fallback systems

- Strategy pause and redeployment tools

Through structured DeFi development, these systems operate continuously without manual intervention.

Get a customized vault strategy designed for performance and risk control.

Why Strategy Engineering Determines Long-Term Success

Together, yield selection, risk modeling, and automation form the operational backbone of every reliable DeFi vault system. When these components are poorly designed, platforms become vulnerable to volatility, liquidity disruptions, and long-term performance decline. Many teams underestimate these challenges and deploy fragile architectures that slowly lose TVL and user trust without experienced DeFi Development support. As a result, strategic planning, rigorous testing, and continuous optimization become essential for building resilient, scalable, and sustainable yield infrastructure.

Key Features Founders Should Demand in DeFi Vault Infrastructure

Before choosing any vault solution, founders and product leaders must assess whether the system is built for long-term growth or short-term experimentation. Not all DeFi yield vaults are designed for enterprise use, and weak infrastructure can expose platforms to financial and reputational risk. A reliable solution, built through professional DeFi development, should deliver the following core capabilities.

- Security Architecture

Since DeFi Vaults crypto platforms manage high-value assets, security must be the top priority. Founders should look for:

- Multi-layer smart contract audits

- Emergency pause and recovery systems

- Multisignature governance controls

An experienced DeFi development company ensures that these safeguards are embedded from day one.

- Strategy Flexibility

Markets change quickly, and vault systems must adapt. A scalable DeFi vault protocol should support:

- Modular and upgradeable strategies

- Custom risk parameters

- Automated rebalancing

This flexibility keeps DeFi yield vaults competitive in evolving market conditions.

- Transparency

Trust depends on visibility. Professional vault infrastructure must provide:

- On-chain fund tracking

- Performance dashboards

- Public reserve verification

These features strengthen user confidence and institutional credibility.

- Compliance Readiness

As regulations tighten globally, compliance has become essential. Mature vault systems should include:

- KYC-friendly integrations

- Geo-restriction controls

- Regulatory reporting tools

Through advanced DeFi development, platforms can balance decentralization with legal readiness. Together, these features separate enterprise-grade DeFi yield vaults from experimental deployments and enable sustainable, scalable Web3 business models.

Future Outlook: Vaults as Financial Operating Systems

Over the next three years, vaults will evolve beyond yield tools.

They will become:

- Treasury management systems

- Liquidity orchestration layers

- Cross-chain revenue engines

- Institutional onboarding gateways

Protocols that invest early in advanced DeFi yield vaults will control the financial infrastructure of their ecosystems. Those who delay will become dependent on external aggregators and lose margin.

Conclusion

In 2026, the difference between market leaders and market followers is no longer technology. It is infrastructure. Platforms that invest early in scalable DeFi yield vaults and professional DeFi development services are building predictable revenue systems, stronger user retention, and long-term capital resilience. Those who delay remain dependent on external aggregators and shrinking margins.

This is why forward-thinking founders choose Antier as their strategic DeFi development partner. With enterprise-grade security, customized strategies, and battle-tested architecture, we help Web3 businesses turn vault systems into growth engines.

If you want to lead your market instead of reacting to it, start building today. Book your vault strategy session now

Frequently Asked Questions

01. What is the biggest challenge for Web3 founders in 2026?

The biggest challenge is building a sustainable business that lasts, rather than just launching a protocol.

02. How are today’s resilient crypto platforms different from those in early DeFi?

Today’s platforms focus on stable cash flow and user loyalty through advanced DeFi development, moving away from short-term yield tactics.

03. Why is DeFi vault infrastructure important for Web3 business models?

DeFi vault infrastructure enhances capital efficiency, treasury utilization, and user retention, making it a core business function for sustainable growth.

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports2 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business19 hours ago

Business19 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World19 hours ago

Crypto World19 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”