Crypto World

Is The Bull Market Over?

Key takeaways:

-

BTC open interest falls to $34 billion, but stable BTC-denominated volume suggests leverage demand remains unchanged.

-

Weak US jobs data and Bitcoin options skew indicate a bearish shift, even as gold and stocks show relative strength.

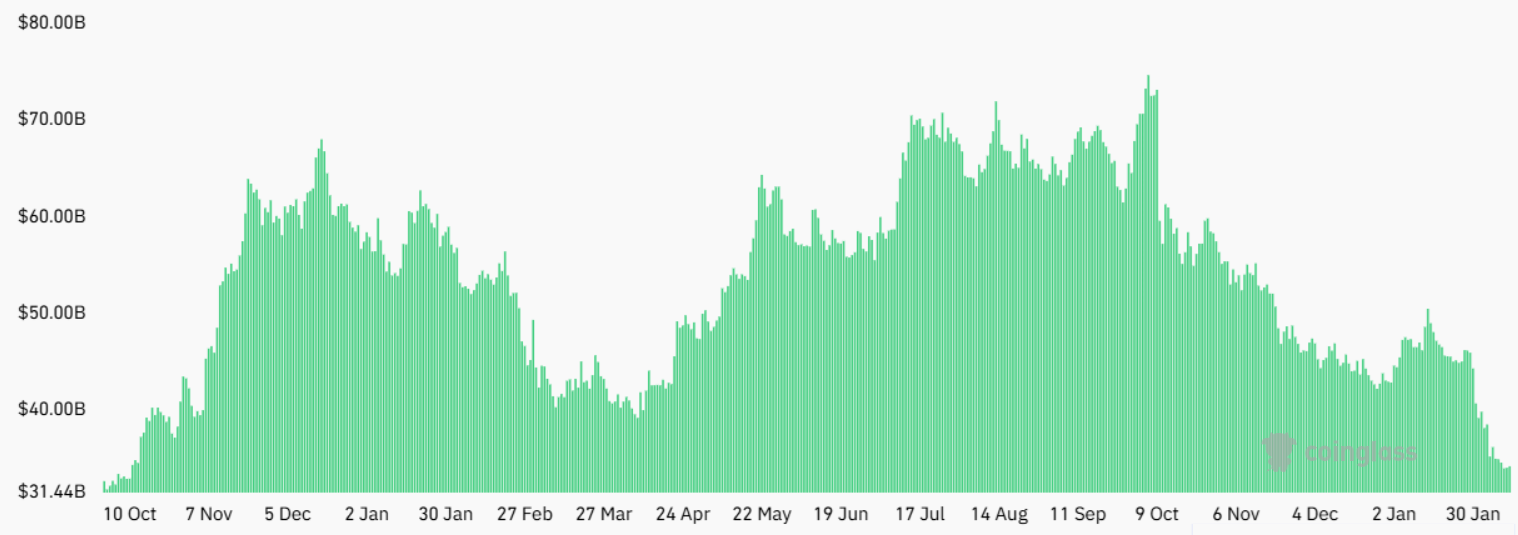

Bitcoin (BTC) price has struggled to sustain levels above $72,000 for the past week, leading investors to question whether institutional demand has evaporated. The aggregate Bitcoin futures open interest plummeted to its lowest level since November 2024, fueling fears of a retest of the $60,000 support as uncertainty grows.

The aggregate BTC futures open interest hit $34 billion on Thursday, a 28% drop from 30 days prior. However, when measured in Bitcoin terms, the metric remains virtually flat at BTC 502,450, suggesting that demand for leverage has not actually decreased. Part of this decline is also attributable to forced liquidations, which totaled $5.2 billion over the past two weeks.

Weak bullish leverage demand confirms BTC’s worrisome market decoupling

Investors are increasingly frustrated by the lack of a clear catalyst for Bitcoin’s 28% decline over the last month, especially as gold reclaimed the $5,000 psychological level and the S&P 500 traded just 1% below its all-time high. Some analysts argue that this risk-aversion stems from emerging signs of weakness in the US labor market.

The US Labor Department revealed on Wednesday that the US economy added only 181,000 jobs in 2025, a figure weaker than previously reported. However, the White House has downplayed these concerns. According to the BBC, officials argue that the slowdown in population growth as a result of its immigration policies has reduced the number of working positions the US needs to create.

Bitcoin’s record 52% crash on March 13, 2020, occurred during the peak of the COVID-19 pandemic fears, which anticipated a surge in jobless claims. If economic growth is currently at risk, odds are the US Federal Reserve will cut interest rates sooner than anticipated. This reduces the cost of capital for companies and eases financing conditions for consumers, explaining the stock market strength seen in 2026.

The lack of confidence in Bitcoin is evident through the weak demand for bullish leveraged positions, making the decoupling from traditional markets even more worrisome.

The annualized funding rate on Bitcoin futures held below the neutral 12% threshold for the past four months, signaling fear. Thus, even as the indicator recovered from the negative levels of the prior week, bears continue to have the upper hand. Professional traders remain unwilling to take downside price risk exposure, according to Bitcoin options markets.

Related: Is this crypto winter different? Key observers reevaluate Bitcoin

The BTC options delta skew at Deribit surged to 22% on Thursday as put (sell) instruments traded at a premium. Under normal circumstances, the indicator should range between -6% and +6%, reflecting balanced upside and downside risk aversion. This skew metric last flipped bullish in May 2025 after Bitcoin reclaimed the $93,000 level following a retest of $75,000.

While derivatives metrics reflect weakness, the $5.4 billion average daily trading volume in US-listed Bitcoin exchange-traded funds (ETFs) contradicts speculation of fading institutional demand. Although it is impossible to predict what will cause buyers to display strength, Bitcoin’s recovery likely depends on improved visibility into the US job market conditions.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

is Patos token Solana’s Shiba Inu?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

A new Solana-based meme coin, Patos, is preparing for launch as traders increasingly shift attention from Ethereum to faster, lower-cost networks. The project aims to attract meme-coin liquidity by leveraging Solana’s speed, low fees, and native SPL integration.

This report analyzes the impending launch of Patos Meme Coin, a novel project set to disrupt the dominant paradigm within the cryptocurrency meme market. Built on the high-performance Solana blockchain, this initiative aims to attract capital moving away from the crowded Ethereum ecosystem, specifically targeting investors currently engaged with tokens like Pepe, Shiba Inu, and Dogecoin. By analyzing data on current ERC-20 meme coin performance, recent Solana-based successes like Bonk and Wen, and emerging market data on Solana whale movements, this analysis paints a bullish case for Patos.

The article explores how the project’s strategic deployment on Solana addresses the primary pain points for retail and institutional investors alike, namely Ethereum’s prohibitive gas fees. By leveraging Solana’s superior transaction speeds and minimal costs, Patos offers a frictionless alternative for a high-frequency trading strategy often associated with the speculative nature of meme coins. This analysis is crucial for any market participant monitoring capital flows between rival layer-one blockchains and seeking to capitalize on the next wave of meme coin volatility. Investors are advised to conduct thorough due diligence, as this report highlights both the potential rewards and the inherent risks associated with early-stage crypto assets.

New Kid on the Block: Patos Meme Coin Prepares to Shake Up the Meme Economy

Meme coins are a persistent fixture in the volatile world of crypto. Everyone is always looking for the next breakout star. Ethereum’s dominant ERC-20 tokens are facing new competition from Solana. A fresh contender, Patos Meme Coin, aims to be that next viral sensation. Here is what we know about this intriguing new project.

Leaving Ethereum Behind: The Solana Advantage for Meme Coins

For a long time, the Ethereum network was the undisputed home of meme coins. Iconic tokens like Dogecoin (DOGE) and Shiba Inu (SHIB) were originally ERC-20 assets before launching their own chains or Layer 2s. This created a strong network effect, making Ethereum the initial landing spot for almost all speculative liquidity.

However, a serious problem began to emerge during bull markets: exorbitant transaction fees. This issue became an insurmountable barrier for small-scale, high-frequency meme coin traders. Trading a $20 asset when gas fees cost $100 made no economic sense. This limitation hindered these coins’ ability to achieve truly rapid and widespread retail adoption.

This inefficiency provided a perfect entry point for Solana. This rival layer-one blockchain, built for speed and affordability, became an enticing alternative for developers and investors alike. Transactions that might take minutes and cost substantial sums on Ethereum are completed in milliseconds for a fraction of a cent on Solana.

The launch of successful meme coins like Bonk (BONK) and Wen (WEN) served as strong proof of concept for this new ecosystem. Traders, weary of high costs, flocked to these projects, generating massive daily volume. Patos Meme Coin has strategic plans to capitalize on this migration, establishing its entire ecosystem and future utility directly on the Solana network. This conscious choice allows the new token to side-step the cost and congestion issues that continue to plague its Ethereum counterparts.

Whale Watching: Institutional Interest and Strategic Investments

The cryptocurrency market is often heavily influenced by “whales.” These are investors holding massive quantities of a particular digital asset, capable of shifting prices with a single trade. Recently, blockchain data has revealed a significant and telling trend among these major crypto players.

Market intelligence consistently shows a pattern of capital rotation. High-net-worth individuals and investment funds are actively reallocating their assets, moving significant amounts of Ethereum from old ERC-20 giants to the more efficient Solana ecosystem. This shift suggests a professional interest in Solana’s superior scalability.

A noteworthy rumor is now circulating within deep crypto circles. A major investor, often identified as a “Solana Whale” due to their immense holdings of SOL, is purportedly conducting research into the Patos Meme Coin project.

While unconfirmed, the potential investment from such a significant player could validate the project’s ambition. It suggests that major capital allocators see genuine long-term value in this new venture. This potential interest from large-scale traders may create a significant advantage for the token at its launch, positioning it far ahead of its competitors.

The Mechanics of Momentum: How Token Presales Build Buzz

In the high-stakes world of meme coins, building and sustaining momentum is critical for long-term survival. The most successful projects don’t launch directly into an open market, risking instant volatility. Instead, they strategically utilize a structured token presale to establish a dedicated, community-driven foundation.

This approach offers several significant advantages for both the new project and its earliest participants. By selling tokens directly to the public before the official exchange listing, the team behind Patos Meme Coin can secure critical funding to support ongoing development, widespread marketing, and crucial liquidity on decentralized exchanges (DEXs).

For investors, participation in a presale often means securing tokens at the lowest possible entry price. This structure is strategically designed to attract early adopters who believe in the project’s potential. These early holders, often highly vocal advocates, become a key pillar of the project’s long-term success.

The Patos team has designed a tiered presale structure that progressively increases the token price across stages. This method is carefully crafted to reward the project’s earliest and most dedicated supporters. This strategic approach is crucial for generating the early interest and widespread hype that are essential for a new asset to capture significant mindshare and market share in the highly competitive meme coin landscape.

A New SPL Standard: Patos Aims for Superior Trading

One technical detail is paramount to Patos Meme Coin’s long-term strategy. The project has committed to launching its token as an SPL token, the native token standard of the Solana blockchain. This choice has profound implications for its future.

The integration with the Solana Program Library ensures native compatibility. Patos can be easily supported by the entire ecosystem of Solana wallets, explorers, and decentralized applications (dApps). This makes it far simpler to integrate into liquidity pools, yield farms, or new utility-driven products than cross-chain solutions.

This native integration simplifies trading dramatically. On Solana, investors can execute trades through highly efficient, liquid decentralized exchanges (DEXs). This streamlined experience contrasts sharply with the often-cumbersome process of swapping Ethereum tokens, which can involve complex approvals and high slippage on top of transaction fees.

By adhering to this standard, the Patos team is prioritizing future utility and accessibility. The goal is to build a coin that is not just speculative, but also fundamentally integrated into the burgeoning Solana economy. The project intends to offer superior trading capability, unmatched liquidity, and future use cases that go far beyond what many simple meme coins achieve.

Diversification Play: Why Meme Coin Traders are Looking Beyond Ethereum

Meme coin traders are rarely known for their long-term, passive-holding strategies. They are active, opportunistic, and constantly searching for the highest potential returns. This means they are highly attuned to emerging market cycles and new opportunities.

A strategic realization is now spreading among veteran market participants. Concentrating exclusively on a single network, such as Ethereum, can be incredibly risky during periods of high congestion. To maximize their returns, investors are actively diversifying their portfolios.

This new mindset naturally benefits projects like Patos. Experienced traders are moving capital into other ecosystems with strong fundamentals and booming activity. Solana, with its high-speed performance and dynamic community, is the primary beneficiary of this asset rotation.

The Patos project is carefully designed to attract this exact type of market player. The project offers these traders a fresh opportunity to participate in a viral asset class with significantly reduced technical friction. This makes it an appealing and pragmatic addition for any well-rounded crypto portfolio exploring the high-reward potential of meme coins.

Analyzing the Contenders: How Patos Stacks Up Against Pepe and Shiba Inu

When analyzing a new meme coin, it’s necessary to examine the existing competitive landscape. The ERC-20 tokens Pepe (PEPE) and Shiba Inu (SHIB) currently sit at the pinnacle of the meme economy, boasting massive followings. They are, essentially, the benchmarks against which all new projects are measured.

Pepe, for example, achieved its massive valuation through rapid, viral internet culture. This success was achieved despite the high transaction fees that frequently occurred during its peaks. This phenomenon demonstrated the pure, irrational power of community sentiment.

Similarly, Shiba Inu built an extremely loyal community of proponents known as the “ShibArmy.” This group championed the coin’s development of a native decentralized exchange and other ecosystem components.

The strategy behind Patos Meme Coin appears to be to leverage the strengths of both models while avoiding their primary weakness. By launching on Solana, Patos intends to cultivate the same fervent, organic community engagement while also offering a practical, cost-effective trading platform. The aim is to prove that high-speed, minimal-cost transactions can accelerate community growth more effectively than any ERC-20 network.

From Hype to Utility: The Long-Term Plan for Patos

The initial success of any meme coin is almost always fueled by speculation, community engagement, and a good narrative. However, sustaining that interest over months or years is an entirely different challenge. Longevity in the crypto space requires practical utility.

A persistent criticism of tokens like Dogecoin has been their lack of tangible real-world application. The Patos team is aiming to proactively address this critical point by outlining a long-term roadmap that goes beyond the initial launch phase.

The whitepaper for Patos outlines planned expansions and partnerships that are intended to give the token a genuine purpose. These proposed use cases include potential integrations into future gaming initiatives, NFT staking systems, and even exclusive access to unique physical merchandise.

The plan is to leverage the unique advantages of the Solana network—such as its low costs—to make microtransactions, rewards, and in-game items economically feasible. By integrating the token into functional applications early in its life cycle, Patos aspires to transition from a purely speculative meme coin into a resilient utility asset within the Solana ecosystem.

Risks and Rewards: A Balanced View of the Meme Coin Market

It is absolutely essential for every investor, from absolute beginners to professional funds, to understand that the meme coin market is an inherently high-risk, speculative environment. These assets are incredibly volatile, with prices that can fluctuate dramatically in very short periods.

Investing in a new project, especially one still in its presale phase, like Patos Meme Coin, carries unique risks. The success of any new cryptocurrency depends on countless factors, from achieving widespread adoption to the simple execution of a technological roadmap. Any participant must approach these investments with extreme caution.

The primary lure of this sector is, of course, the potential for staggering returns. Meme coins, when successful, have demonstrated the ability to generate unparalleled profits for their early backers, often yielding returns that are simply impossible in traditional equity or commodity markets.

A prudent approach is paramount. This requires thorough research, a deep understanding of the project’s fundamentals, and a clear comprehension of the potential pitfalls. Investors are strongly advised to commit only capital they can afford to lose and to carefully manage their risk exposure in highly speculative markets like cryptocurrency.

Community and Culture: The Essential Recipe for Viral Success

In the decentralized world of cryptocurrency, the strength and dedication of a project’s community are arguably more important than its underlying code or technological breakthroughs. Without a passionate group of advocates, a new asset is simply code on a ledger.

The entire team behind Patos Meme Coin is acutely aware of this fundamental principle. This realization has shaped their entire strategy, placing a paramount focus on building a robust, engaged, and authentic community from day one. This effort is already visible in their organic growth across various social media platforms.

The project is actively encouraging user participation. This strategy extends beyond simple token ownership and involves fostering a creative culture of meme sharing, community-driven content, and active participation in decentralized governance decisions.

By emphasizing transparency and authentic engagement, the project aims to build an inclusive ecosystem where every holder feels a deep sense of shared ownership and purpose. This focus on building a sustainable culture may prove crucial for maintaining momentum and ensuring the project’s resilience in an incredibly crowded market.

Cross-chain to Solana for a generational SPL token

The impending launch of Patos Meme Coin marks another potential milestone for the rapidly maturing Solana ecosystem. By prioritizing efficiency, affordability, and community above all else, the new project represents a direct and potent challenge to the established order of the Ethereum-based meme coin market. This unique value proposition may prove highly effective.

Whether this new initiative can truly capture the viral imagination and replicate the staggering success of its predecessors remains to be seen. However, its arrival is yet another undeniable signal that the meme coin economy is rapidly evolving, with capital and attention continuing to flow toward high-performance, cost-effective networks. Market participants would be wise to continue to monitor these developments closely.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Here’s why Pi Coin price is in a bull run amid the crypto crash

Pi Coin price is in a technical bull run after soaring by 56% from its lowest level this year. It has soared to its highest level in over two weeks despite the ongoing crypto crash.

Summary

- Pi Coin price has moved into a technical or local bull market.

- The rally is happening despite the ongoing crypto crash.

- Technical analysis suggests that the token will continue soaring.

Pi Network (PI) token jumped to $0.2010 on Friday, continuing an uptrend that started on March 10. This rally is likely driven by potential announcements next week when the world will mark Pi Day.

Pi Day is an annual celebration of the mathematical constant and is celebrated on March 14. In most cases, the event is celebrated in schools by doing fun activities. Some people also celebrate it by eating pies.

Historically, Pi Network marks the day by making some major announcements. For example, in a recent post, the team noted that they hope that the current phase of the Pi Network upgrade will end on that day.

Some crypto traders hope that other major announcements will be made on Pi Day. For example, some are speculating that Kraken, a top American exchange, may decide to list it on that day. It added it to its listing roadmap for the year in February.

Another possible announcement on that day is the decentralized exchange, automated market maker, and token generation feature. The developers hope that this feature will lead to more demand for the token over time.

Pi Coin price is also rising as investors buy the dip after it dropped to a record low in February. It is common for investors to buy whenever an asset falls and to short it whenever it moves to a record high. A good example of this is Zcash (ZEC), which has moved into a bear market after hitting its all-time high last year.

Pi Coin price chart analysis

The eight-hour chart reveals that the Pi Coin price has staged a strong comeback after falling to $0.1300. This rally happened amid the crypto crash. It has moved above the ultimate resistance level of the Murrey Math Lines tool.

The token has jumped above the 50-period moving average. Crossing above this indicator is a sign that the bull market is continuing. Another sign that the momentum is continuing is that the Average Directional Index has soared to 32.

Therefore, the token will likely continue soaring in the coming days as buyers target the key resistance at $0.2500.

Crypto World

Price Predictions 3/6: BTC,ETH,BNB,XRP,SOL,DOGE,ADA,BCH,HYPE,XMR

Bitcoin (CRYPTO: BTC) faced a renewed test after a brief relief rally, sliding back below the $68,500 mark as sellers reasserted control. The move comes after the asset briefly flirted with the $74,000 threshold, a level that previously functioned as a ceiling during the latest ascent. Traders now eye whether the crypto bellwether can defend the $68,000–$70,000 zone to sustain any upside or if renewed selling pressure could push Bitcoin toward the lower end of its recent range. On-chain analytics add a cautious tone: CryptoQuant notes that its Bear Score Index remains firmly in bearish territory, suggesting the current bounce may be a relief rally rather than the onset of a sustained trend reversal.

Ether (CRYPTO: ETH) attempted to clear the $2,111 barrier but could not sustain the breakout, slipping back below the level and signaling that demand remains uncertain. The broader narrative across the top assets is one of mixed momentum, with several major altcoins retreating from overhead resistance as selling pressure persists. The market has also been grappling with a sense of caution, as traders weigh whether the recent rally was a temporary reprieve or the precursor to a longer-term bottom formation.

Bitcoin’s price action sits at a crossroads as the $69,000 region now acts as a critical fulcrum. A sustained bounce off the 20-day exponential moving average near $69,003 would keep hopes alive for another test of the higher ceiling around $74,508. If bulls manage to clear that resistance, the next target could be an ascent toward $84,000, a move that would bolster the view that a bottom may be forming after last year’s volatility. Conversely, a collapse below the $69,000 level could open the path to the support line, potentially pulling the pair down toward the $60,000 area and inviting renewed bearish sentiment.

Beyond Bitcoin, the price action across the broader top-10 cohort remains telling. Bitcoin Cash (CRYPTO: BCH) shows the bears pressing at the $443 support, with a rally back to $476 failing to gain traction. A breakdown below $443 would underscore a bearish continuation pattern, while a breakout above the 20-day EMA near $488 could ignite a move toward the 50-day simple moving average around $533 and, in turn, toward $600 if momentum sustains. Cardano (CRYPTO: ADA) has also flirted with the 20-day EMA near $0.27 but has not sustained gains above it, leaving the downside risk contained near $0.25 for now. A decisive rebound could push ADA back toward the channel’s upper boundary, but a close below $0.25 would open the door to a retest of the lower support around $0.15.

XRP (CRYPTO: XRP) traded above the 20-day EMA near $1.41 briefly but could not maintain the gain, and bears are working to push the price below the $1.27 support. If that support gives way, the下降 pattern could steer XRP toward the lower boundary of its current channel. On the flip side, a sustained move above the 20-day EMA could signal a reclaim by bulls and set up a test toward $1.61, a level that has repeatedly presented a challenge in recent sessions.

Solana (CRYPTO: SOL) experienced a rejection at $95, slipping below the 20-day EMA around $86. The market appears balanced, with the 20-day EMA and the relative strength index hovering near midpoints, suggesting a digestion period in which SOL could oscillate between roughly $76 and $95 for several days. A close above $95 would shift the balance toward a run to the $117 mark, while a drop below $76 could accelerate downside moves toward broader support levels.

Dogecoin (CRYPTO: DOGE) showed a brief uptick above the 20-day EMA near $0.10 but failed to clear the 50-day moving average at $0.11. The next decisive benchmark lies at the $0.12 breakdown level, where a sustained push could clear intermediate resistance and trigger a rally toward higher targets. A move below $0.09 would increase the likelihood of a retest of the February lows, with potential downside to $0.08 or lower if selling pressure intensifies.

Bitcoin-related altcoins aren’t alone in the tug-of-war. Hyperliquid (CRYPTO: HYPE) has pulled back toward major moving averages, a zone that will determine whether buyers regain control or sellers extend the range. If the price can rebound with vigor off the moving averages and clear the $36.77 overhead resistance, the onset of a fresh upmove could be on the cards. If the price breaks below the moving averages, HYPE could remain trapped in a $20.82–$36.77 corridor for a while longer.

Monero (CRYPTO: XMR) is contending with uphill resistance near the $360 threshold as buyers attempt to push higher. The crucial line in the sand remains the 20-day EMA around $347; a bounce from that level could lift XMR toward the 50-day SMA near $396 and, if momentum persists, toward the 61.8% Fibonacci retracement at $414. A drop below the EMA could keep XMR range-bound between roughly $384 and $302 for an extended period.

Among the most watched charts, Ethereum’s predecessor narratives persist, with traders keeping a close eye on whether the broader market can sustain any updrafts. The balance of evidence suggests a market that is more cautious than euphoric, with risk appetite still tethered to macro signals and liquidity conditions rather than a clear, durable uptrend. The next few sessions could prove pivotal in determining whether the bounce collects steam or dissolves into another leg lower.

What the movement means for the market

The current pattern highlights the fragility of any sustained rebound in the near term. While there are clear pockets of buoyancy in assets such as ETH and select layer-1s, the macro tone remains cautious, and traders are wary of fading rallies that fail to hold key support. The stubbornness of oversold levels around the 20-day EMAs across multiple coins suggests that a broad-based acceleration will require a decisive catalyst—be it a macro shift, favorable ETF-related flows, or a notable improvement in on-chain metrics that overturn the prevailing Bear Score tone.

From a risk-management perspective, the emphasis appears to be on defense at notable support zones. Traders are closely watching whether Bitcoin can anchor in the $68k–$70k corridor, as a break below this band would likely reintroduce selling pressure and push the market toward more pessimistic pricing. Conversely, any sustained move above critical resistance levels, especially for BTC near $74,508 and ETH near $2,328, could inject optimism and invite more aggressive positioning in the days ahead.

Why it matters

For investors, the present environment underscores the importance of discerning genuine trend reversals from bear-market rallies. The interplay between major assets and the resilience (or lack thereof) of their support and resistance levels provides insight into the health of liquidity in the sector. If the relief rally proves ephemeral, market participants may opt for selective exposure to assets showing relative strength in the face of headwinds, rather than broad, all-encompassing bets on a full-blown bull cycle.

Developers and builders in the space will be watching how market dynamics affect user onboarding, product launches, and ecosystem activity. A sustained dip could delay capital deployment in areas like DeFi and NFT-related applications, while a credible revival might spur renewed interest in network upgrades and cross-chain interoperability initiatives. Regulators and institutional participants are likewise assessing risk tolerance and liquidity considerations, which could influence future product offerings and filing activity, including potential ETF developments and institutional custody solutions.

As always, risk remains the defining theme. This cycle continues to emphasize capital preservation, careful risk assessment, and a disciplined approach to position sizing, especially in the absence of a clear macro-driven momentum shift. The trajectory over the next several weeks will help determine whether the market is contending with a deeper structural bottom or simply oscillating within a longer consolidation channel before the next phase of volatility.

What to watch next

- Bitcoin must hold the $68,000–$70,000 zone; a sustained close above $74,508 would be a tape-reading cue for possible upside toward $84,000.

- Ether needs to clear and sustain above $2,111, with a breakout above the 50-day SMA at $2,328 opening the door to around $2,600.

- A sustained move above $670 for BNB would recalibrate the short-term bias toward $718 and potentially $790, while a break below $570 could deepen near-term downside.

- XRP: a break above the 20-day EMA near $1.41 could set the stage for a rally toward $1.61; a drop below the $1.27 support would tilt sentiment bearish.

- SOL: a daily close above $95 would suggest a revival toward the $117 level, while a close below $76 could signal further consolidation or downside.

Sources & verification

- Bitcoin price action and key levels around $74,508 and the 20-day EMA near $69,003 as discussed in the market analysis.

- Ether’s struggle to sustain above $2,111 and next potential target after clearing the 50-day SMA around $2,328.

- BNB’s resistance near $670 and the implications of a move above or below the 20-day EMA at about $637.

- XRP’s price dynamics with the 20-day EMA near $1.41 and the critical $1.27 support level.

- Solana’s action around $95 and the balancing zone between $76 and $95, with a potential move to $117 on breakout.

- Dogecoin’s test of the 50-day SMA at $0.11 and the support zone around $0.09 to $0.08.

- Monero’s attempts to push above $360, with key levels at the 20-day EMA ($347), 50-day SMA ($396), and $414 as the 61.8% retracement target.

Tickers mentioned

Tickers mentioned: $BTC, $ETH, $BNB, $XRP, $SOL, $DOGE, $ADA, $BCH, $HYPE, $XMR

Sentiment

Sentiment: Neutral

Market context

Market context: The current price action unfolds in a cautious environment where liquidity and risk appetite are sensitive to macro signals, while on-chain metrics temper any optimism with a note of caution about potential further volatility.

Why it matters

The ongoing tension between support and resistance across major assets suggests that traders should distinguish between temporary bounces and durable trend reversals. A confirmed break of key levels could reframe the outlook for the next phase of the cycle, while persistent lack of follow-through may keep markets in a prolonged consolidation. For developers and investors alike, this environment emphasizes risk discipline, selective exposure, and attention to cross-asset correlations as the market digests incoming liquidity and regulatory signals.

What to watch next

- Bitcoin holds above the $68,000–$70,000 band; a weekly close above $74,508 would be a meaningful bullish signal.

- Ether sustains above $2,111 and closes above $2,328 to open a path toward $2,600.

- Bullish continuation for BNB requires a breakout above $670, with local targets around $718 and $790.

Sources & verification

Crypto World

Bitcoin price eyes reversal as IFP indicator flips bullish

Bitcoin price is showing early signs of a possible trend shift after a key on-chain indicator flashed a rare bullish signal, even as the market continues to consolidate.

Summary

- Bitcoin’s Inter-exchange Flow Pulse crossed above its 90-day moving average for the first time since early 2025.

- BTC is consolidating between $67K and $72K after a sharp drop from the $95K region.

- A breakout above $72K could open the path toward the $75K–$78K resistance zone.

Bitcoin (BTC) was changing hands at around $70,080 at the time of writing. That represents a 3.7% decline over the past 24 hours. Even so, the price remains close to the top of its weekly trading band, which currently spans from $63,176 to $73,669.

Short-term weakness hasn’t erased the gains seen over the past week. BTC is still up about 5.8% during that period. Over the last month, however, the trend is slightly negative, with the asset down around 8%. Compared with its October 2025 peak of $126,080, Bitcoin is still trading roughly 44% below its all-time high.

Market participation has also slowed. During the last 24 hours, trading volume dropped to $47.99 billion, a decline of more than 32%. Such pullbacks in activity are common during consolidation phases, when traders step back and wait for clearer direction.

The derivatives market tells a similar story. Data from CoinGlass shows trading volume in derivatives contracts falling by 23% to $72 billion. Open interest also slipped, declining 8% to $45 billion as some leveraged positions were closed.

IFP indicator signals renewed risk appetite

Amid this quieter market environment, fresh on-chain data is drawing attention. Analysts at CryptoQuant report that Bitcoin’s Inter-exchange Flow Pulse has moved above its 90-day moving average.

The shift marks the first time the metric has crossed that level in roughly a year, according to a March 6 report by CryptoQuant contributor RugaResearch.

To understand why this matters, it helps to look at what the indicator measures. The IFP tracks Bitcoin transfers between spot exchanges and derivatives platforms.

A rise in flows toward derivatives venues often signals that traders are preparing leveraged positions in anticipation of potential upside. When the movement heads toward spot exchanges instead, speculation in the market usually declines.

Looking back at historical data adds more context. Since 2016, similar IFP crossovers have frequently appeared near the early stages of bullish cycles. That said, the signal does not always translate into immediate price rallies. In some cases, the market took time to react.

The indicator had spent nearly a full year below its long-term average before this latest development. It turned bearish in early 2025 and remained there throughout much of the year, making it one of the longest negative stretches recorded for the metric.

Bitcoin price technical analysis

On the price chart, Bitcoin appears to be stabilizing after a steep fall earlier in the year. The drop began in the $95,000–$100,000 range and eventually pushed the price down to around $63,000, where buyers finally stepped in.

Since reaching that level, price movement has been largely sideways. This type of behavior often signals that selling pressure is easing while demand slowly returns.

For several weeks now, BTC has traded within a relatively tight corridor between $67,000 and $72,000. Markets often behave this way during accumulation phases, when participants quietly re-position before the next significant move.

The immediate hurdle sits at $72,000. If buyers manage to push the price above that level and secure a strong daily close, a breakout from the range could follow. In that case, attention would likely shift toward the $75,000–$78,000 region, where another supply zone is expected.

Below the current price, support continues to hold around $67,000. A deeper demand area can be found near $63,000, the same region that previously stopped the earlier sell-off.

That dip toward $63,000 may not have been accidental. In many markets, prices briefly fall below a key support level to trigger stop-loss orders before reversing direction.

This type of move is often referred to as a liquidity sweep. Bitcoin quickly rebounded after touching that area, reclaiming $67,000 soon afterward as buying pressure absorbed the sell-off.

Volatility has also been shrinking as the range tightens. Historically, quieter phases like this tend to precede stronger directional moves.

A breakout above $72,000 would likely strengthen bullish momentum and open the path toward higher resistance levels. On the other hand, losing support at $67,000 could weaken the recovery structure and bring the $63,000 demand zone back into focus.

Crypto World

Will Polkadot price rebound as 21Shares launches first DOT ETF?

Polkadot price retreated by 3% today, March 6, even as market participants waited for the first DOT ETF and tokenomics overhaul.

Summary

- 21Shares will launch the first spot DOT ETF today.

- The fund will be seeded with $11 million.

- History suggests that the fund may struggle to attract inflows.

Polkadot (DOT) token dropped to $1.4753, down substantially from this month’s high of $1.745. This retreat happened ahead of the launch of the 21Shares DOT ETF today.

Bloomberg’s Eric Balchunas noted that the fund has been seeded with $11 million in assets. This is a substantial amount considering that the three Dogecoin ETFs have accumulated $7.45 million in inflows and have $9.27 million in net assets.

In theory, the launch of the DOT ETF should boost its price as it will make it available to American retail and institutional investors. However, data shows that demand for altcoin ETFs is limited.

Spot Avalanche ETF has added just $8.98 million in inflows. It has had no inflow since February 24. Similarly, spot Hedera and Chainlink ETFs have had less than $100 million in inflows since their launch.

Polkadot’s situation is worse because of its smaller ecosystem than the other chains. For example, while Ethereum holds over $165 billion in stablecoins, Polkadot’s parachains hold less than $100 million.

DOT price will also react to the upcoming tokenomics overhaul on March 12. This overhaul will cap the supply to 2.1 billion and cut emissions by 53.6%. Staking unbonding days will drop from 28 days to between 24 and 48 hours.

Polkadot price prediction: technical analysis

DOT token has pulled back in the past few days, moving from this month’s low of $1.7445 to the current $1.4673. A closer look shows that it has retested the neckline of the double-bottom pattern that happened at $1.2260. A break and retest pattern is a common continuation sign.

The coin has also formed a bullish flag pattern. This pattern has a flagpole and a descending channel, resembling a hoisted flag. Therefore, the coin may attract bids in the next few days. If this happens, the next key target to watch will be at $1.7445. A break above that price will point to more gains, potentially to $2.

Crypto World

How Ethereum buys are powering the next wave of utility protocols

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Institutional accumulation of Ethereum signals rising confidence and renewed momentum for DeFi expansion.

Summary

- Institutional Ethereum inflows are boosting new DeFi protocols like Mutuum Finance, which has raised over $20.7m from 19k holders.

- Mutuum Finance builds non-custodial crypto lending on Ethereum, using mtTokens and debt tokens to manage liquidity and loans.

- Mutuum Finance expands DeFi lending with over-collateralized loans, letting users borrow against assets without selling them.

The top crypto market is currently witnessing a concentration of capital as institutional players increase their holdings of Ethereum (ETH). This trend of accumulation is providing a foundation of liquidity that often precedes a broader expansion in the decentralized finance (DeFi) sector.

As large-scale purchases signal growing confidence in the Ethereum network, the focus of the market is shifting toward utility-driven protocols that utilize this infrastructure to provide automated financial services.

Ethereum

Recent market data highlights a substantial increase in Ethereum accumulation. On March 2, the firm BitMine executed a significant acquisition of 50,928 ETH. This purchase brings the company’s total holdings to approximately 3.71% of the total Ethereum supply, moving them closer to their stated target of 5%.

Several analysts have noted that such large-scale movements often indicate potential growth for the asset regardless of short-term price fluctuations. Technical indicators like the Chaikin Money Flow (CMF) and Money Flow Index (MFI) currently suggest a high level of investor confidence and sustained buying pressure.

At present, Ethereum is trading within a range that has established a market capitalization of several hundred billion dollars. Following this recent accumulation, market observers are watching key resistance zones near the $3,800 and $4,000 levels. If the asset can maintain its support above $3,400, it may provide the necessary stability for the rest of the ecosystem to grow.

How massive Ethereum buys power utility protocols

Large Ethereum purchases do more than just influence the price of ETH; they act as a catalyst for the next wave of utility protocols. When institutional capital enters the Ethereum ecosystem, it validates the network’s security and longevity.

This confidence encourages developers and investors to explore new complex protocols like Mutuum Finance (MUTM), which is building a non-custodial framework for automated lending and borrowing. According to its official whitepaper, Mutuum Finance aims to create a decentralized environment where digital assets can be managed through code rather than human intermediaries.

The project has already achieved significant milestones, raising over $20.7 million in funding and establishing an investor base of 19,000 participants. The MUTM token is currently priced at $0.04. By building on the Ethereum network, protocols like Mutuum Finance benefit from the deep liquidity and security provided by the massive ETH accumulation currently taking place.

The Protocol’s mechanics

The economic model of Mutuum Finance relies on a transparent system of receipts and obligations. When a user deposits an asset like ETH into a liquidity pool, the protocol issues mtTokens (such as mtETH) as a yield-bearing digital receipt. These tokens represent the user’s share of the pool. As borrowers pay interest, the value of the mtToken increases. For example, if a pool has a 5% Annual Percentage Yield (APY), a user who deposits 20 ETH will find that their 20 mtETH is redeemable for 21 ETH after one year.

To manage the other side of the transaction, the protocol uses Debt Tokens. When a user borrows against their collateral, the system mints these tokens to track the principal and the accrued interest in real-time. The safety of these loans is managed by the Loan-to-Value (LTV) ratio. If the LTV for a specific asset is set at 75%, a user providing $4,000 in ETH as collateral can borrow a maximum of $3,000 in another asset, like a stablecoin. This ensures that every loan remains over-collateralized, protecting the protocol from potential bad debt.

Furthermore, this mechanism benefits the borrower by allowing them to access liquidity without having to sell their original assets. By borrowing against their ETH instead of selling it, the user can obtain liquidity for immediate use while still maintaining their investment position. If the value of the ETH increases during the loan period, the borrower still gains from that price growth.

The V1 protocol and risk-free testing

The Mutuum Finance V1 protocol is currently the primary environment for testing these features. It focuses on high-liquidity assets including USDT, ETH, WBTC, and LINK. By using the V1 testnet, users can interact with the system’s automated smart contracts. This provides a risk-free environment to understand how mtTokens grow in value, how Debt Tokens track interest, and how LTV ratios function under different market conditions.

In this V1 setup, the protocol uses decentralized oracles to provide live price feeds. These feeds are essential for calculating the “Stability Factor” of each user’s position. If the value of a user’s collateral drops and their Stability Factor falls below a safe threshold, automated liquidation bots sell a portion of the collateral to repay the loan. This mechanical approach ensures that the system remains solvent at all times, regardless of market volatility.

The synergy between Ethereum and protocol roadmaps

The future of both Ethereum and Mutuum Finance is defined by their respective roadmaps. Ethereum is continuing its transition toward greater scalability and lower transaction costs through its “Dencun” and subsequent upgrades. These improvements are vital for DeFi protocols, as they allow for more frequent and cheaper interactions with smart contracts. As Ethereum becomes more efficient, the cost of lending, borrowing, and staking decreases for the end-user.

The Mutuum Finance roadmap is also entering a critical phase. The protocol moves toward the launch of the Safety Module and its staking system. These two components work together to ensure the protocol remains healthy while rewarding users who help protect it.

In decentralized finance, sudden market shifts or technical issues can sometimes create a gap between what the protocol owes and what it holds. The Safety Module acts as a backstop by holding a pool of assets that the protocol can use to cover these unexpected losses. By having this reserve, the system ensures that lenders can always withdraw their funds, even during periods of high market stress.

Staking is the process by which users contribute to this security. When a user stakes MUTM tokens or mtTokens, they are essentially locking them into the Safety Module. By doing this, the user is acting as a guarantor for the protocol’s stability. Because the user is providing a vital service by backing the system’s safety, the protocol compensates for commitment.

This is where the Buy-and-Redistribute mechanism comes in to provide rewards. The protocol collects fees from every loan and trade made on the platform. A portion of these fees is used to buy MUTM tokens directly from the open market. Those tokens are then distributed to the people who have staked mtTokens in the Safety Module. This creates a sustainable cycle: as more people use the protocol, more fees are generated, which leads to more rewards for the stakers who keep the system secure.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

SEC Schedules April Roundtable on Options Market Structure

TLDR

- The SEC will hold a public roundtable on April 16, 2026, at its Washington headquarters.

- The agency will examine the structure of the U.S. listed options market during the event.

- Officials will discuss competition among trading venues in the quote-driven market.

- The roundtable will address the overall customer experience for investors.

- Commissioner Hester M. Peirce said the market has seen growth among retail investors.

The U.S. Securities and Exchange Commission will hold a public roundtable on April 16, 2026, in Washington. The agency will examine the structure of the U.S.-listed options market during the event. It will host the session at its headquarters and stream it live on its official website.

Focus on Market Structure and Competition

The SEC will center the roundtable on Market Structure and competition within the listed options market. The agency will review how trading venues compete in a quote-driven environment. It will also assess how this structure affects order handling and price formation. Officials plan to gather input from market participants and industry representatives.

Hester M. Peirce, commissioner at the SEC, addressed the market’s recent expansion. She said, “The U.S.-listed options market has seen remarkable growth, particularly among retail investors.” She added that the roundtable will allow regulators and participants to reflect on the market’s development. She stated that discussions will identify areas where improvements could support continued expansion.

Public Access and Submissions

The SEC will hold the roundtable at 100 F Street, N.E., in Washington, D.C. The agency will open attendance to the public, although seating may remain limited. Visitors will undergo security checks before entering the building. The SEC will provide a live webcast through its website for remote viewers.

The agency will allow members of the public to submit comments electronically or by mail. It will include all submissions in the official public record without modification. The SEC will post these comments on its website for public access. It said it will release the agenda and list of speakers closer to the event date.

Crypto World

Binance formally denies Iran sanctions violation allegations

Binance has rejected allegations that its platform allowed transactions linked to entities in Iran.

Summary

- Binance issued a formal response to a U.S. Senate inquiry denying claims that it allowed transactions linked to Iran.

- The exchange said media reports cited in the inquiry contain false and unsupported allegations about its compliance program.

- Binance pointed to investigations that led to the removal of certain entities and its expanded compliance measures.

The exchange issued a response on March 6 to a letter sent by Richard Blumenthal regarding sanctions compliance and anti-money laundering controls. The inquiry referenced several recent media reports. Binance said those reports contain false and unsupported claims about its compliance program.

Binance said it runs a large compliance operation to prevent sanctioned users from accessing the platform. Identity verification is required for every user, and individuals located in Iran are not allowed to use the exchange.

Compliance program and monitoring systems

According to the company, millions of dollars have been invested in compliance infrastructure in recent years. The compliance team now includes more than 1,500 professionals around the world. Many focus on sanctions monitoring, financial crime investigations, and counter-terrorism financing checks.

More than 25 monitoring tools are used to screen users and review transactions. Customer onboarding checks, sanctions screening, and behavioral analysis are also applied to detect suspicious activity. When concerns appear, cases are reviewed and information can be shared with law enforcement.

The company also pointed to its cooperation with investigators. In 2025 alone, Binance handled more than 71,000 law-enforcement requests. Over the past three years, authorities seized more than $752 million with assistance from the exchange.

Blockchain analytics data cited by Binance shows a decline in exposure to wallets linked to illicit activity. Between January 2024 and July 2025, the share of exchange volume connected to such wallets dropped from 0.284% to 0.009%.

Investigations involving flagged entities

The inquiry also mentioned two trading entities, Hexa Whale and Blessed Trust, which were reported to have indirect exposure to wallet addresses with possible links to Iran.

Binance said it became aware of those concerns after receiving requests from law enforcement in 2025. Investigations were then carried out by the exchange’s internal team. Transaction records were reviewed and user information was provided to authorities.

After the reviews were completed, both entities were removed from the platform. Hexa Whale was offboarded in August 2025, while Blessed Trust was removed in January 2026. Binance said it is not aware of any account on the exchange that directly transacted with an Iran-based entity.

The company also rejected claims that it had identified thousands of Iranian-linked accounts. Binance said it never made such a determination and noted that any attempt to bypass location restrictions using a VPN violates its terms of service.

Binance said it investigates credible risks, removes accounts when necessary, and works with authorities to address potential misuse of its platform.

Crypto World

MiniMed (MMED) IPO Falls Flat as Medtronic (MDT) Spinoff Debuts Below Price

TLDR

- MiniMed (MMED) started trading at $19.05 on Friday, March 6, falling 4.8% below the $20 IPO offering price in its Nasdaq launch.

- The diabetes technology firm generated $560 million through the sale of 28 million shares — significantly lower than the anticipated $25–$28 pricing range.

- The opening price established MiniMed’s market capitalization at $5.35 billion.

- Medtronic (MDT) continues to control approximately 90% ownership following the initial public offering.

- Market conditions were challenging on debut day, with the VIX surging to its highest level in four months after disappointing employment data.

The highly anticipated public market entrance of MiniMed fell short of expectations on Friday. Shares of the diabetes device manufacturer began trading at $19.05 on Nasdaq — representing a 4.8% decline from the $20 offering price — establishing a company valuation of $5.35 billion.

MiniMed Group, Inc. Common Stock, MMED

Market sentiment proved challenging across the board. The CBOE Volatility Index climbed to its highest point in four months, fueled by disappointing employment figures that rattled investor confidence. These conditions created far from ideal circumstances for a debut listing.

The transaction generated $560 million in proceeds through the placement of 28 million shares. This represented a significant reduction from initial expectations — the marketed pricing range stood at $25 to $28 per share, forcing MiniMed to accept a substantial discount to complete the transaction.

Market observers had expressed skepticism about whether the original valuation made sense, and the final pricing appears to validate those concerns.

A Tough Market for New Listings

The IPO environment has faced significant headwinds in recent weeks. Anxieties surrounding artificial intelligence disruption and global political instability have reduced enthusiasm for new public offerings, constraining activity throughout the market.

MiniMed’s challenging debut reflects this broader trend. Even established brands are struggling to achieve premium pricing in the current environment.

Medtronic (MDT) executed the separation to generate funds and create an independent diabetes-focused entity. Following completion of the IPO, Medtronic maintains approximately 90.03% ownership of MiniMed — a figure that would drop to 88.70% should underwriters fully exercise their 30-day option to acquire an additional 4.2 million shares.

The transaction is expected to finalize on March 9, 2026.

MiniMed intends to deploy the capital raised for general operational needs, settling intercompany obligations owed to Medtronic, and covering expenses related to asset transfers completed during the separation.

Back to Growth After Regulatory Headwinds

The organization previously encountered regulatory challenges regarding quality control systems and cybersecurity vulnerabilities associated with certain products. Those issues have been resolved, and the company has demonstrated renewed growth momentum in recent reporting periods.

MiniMed operates in a competitive landscape alongside Beta Bionics, Dexcom (DXCM), Insulet (PODD), and Tandem Diabetes Care (TNDM) within the diabetes technology sector.

The company’s portfolio encompasses insulin delivery pumps, continuous glucose monitoring platforms, and sensor technology designed for individuals managing both type 1 and type 2 diabetes.

Medtronic (MDT) finished Thursday’s session lower at $93.01 before the spinoff company’s market debut.

Crypto World

Kalshi Sued Over $54M Market on Iran Leader Exit

TLDR

- Kalshi faces a proposed class action over a $54 million market on Iran’s Supreme Leader Ali Khamenei leaving office.

- Traders allege the platform failed to honor payouts on “yes” positions after halting the market.

- The lawsuit claims Kalshi did not clearly disclose a death-related carveout before reports of airstrikes surfaced.

- Plaintiffs argue the contract language promised full payouts if Khamenei exited the role by set dates.

- Kalshi CEO Tarek Mansour said the company does not offer markets directly tied to a person’s death.

Kalshi faces a proposed class action over a halted market tied to Iran’s Supreme Leader Ali Khamenei. Traders claim the platform failed to honor payouts on “yes” positions after trading surged. The dispute centers on contract language and disclosures tied to a reported death exception.

Kalshi Market Rules at Center of Payout Dispute

The complaint states that Kalshi structured the market as a binary contract tied to Khamenei leaving office by set dates. Traders argue the language promised full payouts to “yes” holders if he exited the role. However, the filing says the platform did not clearly disclose a death-related carveout before reports of airstrikes surfaced.

Plaintiffs claim Kalshi allowed trading to continue on Feb. 28 as reports of US and Israeli strikes spread. They allege the platform encouraged more “yes” bets despite knowing those contracts would not pay. According to Bloomberg Law, the suit argues the rules were “clear, unambiguous, and binary,” yet traders say the death carveout appeared only after trading intensified.

The disputed market drew about $54 million in trading volume before Kalshi halted it. Traders contend they expected payouts if Khamenei left office for any reason. The lawsuit states that the platform’s disclosures failed to highlight any exclusion tied to death until after the reports emerged.

Plaintiffs Adam Risch and Yonatan Gliksman filed the case in the US District Court for the Central District of California. Novian & Novian LLP represents the proposed class of US traders. The complaint alleges breach of contract and violations of California law.

Kalshi Response and Legal Claims

Kalshi CEO Tarek Mansour addressed the dispute in public posts after criticism increased. He stated that the company does not offer markets directly tied to a person’s death. He wrote, “While the rules were clear and we tried our best to highlight them, traders vocalized they were not prominent enough.”

Mansour later said the company would reimburse traders for fees and net losses linked to the halted market. He added that Kalshi would update how similar contracts disclose death-related exceptions. He wrote that the firm would reimburse losses out of pocket.

The plaintiffs seek damages and restitution from the platform. They also request court orders requiring improved disclosure practices for future contracts. The filing argues that Kalshi’s conduct misled traders about payout conditions.

The market asked participants to predict whether Khamenei would leave office by specific deadlines. Trading accelerated after reports of airstrikes circulated. Kalshi halted the market shortly after the reports, and the dispute now proceeds in federal court.

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Business12 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Fashion8 hours ago

Fashion8 hours agoWeekend Open Thread: Ann Taylor

-

Sports7 days ago

The Vikings Need a Duck

-

NewsBeat7 days ago

NewsBeat7 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports1 day ago

Sports1 day ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion5 days ago

Fashion5 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker