Crypto World

Large Bitcoin Holders Supply Hits 9-Month Low

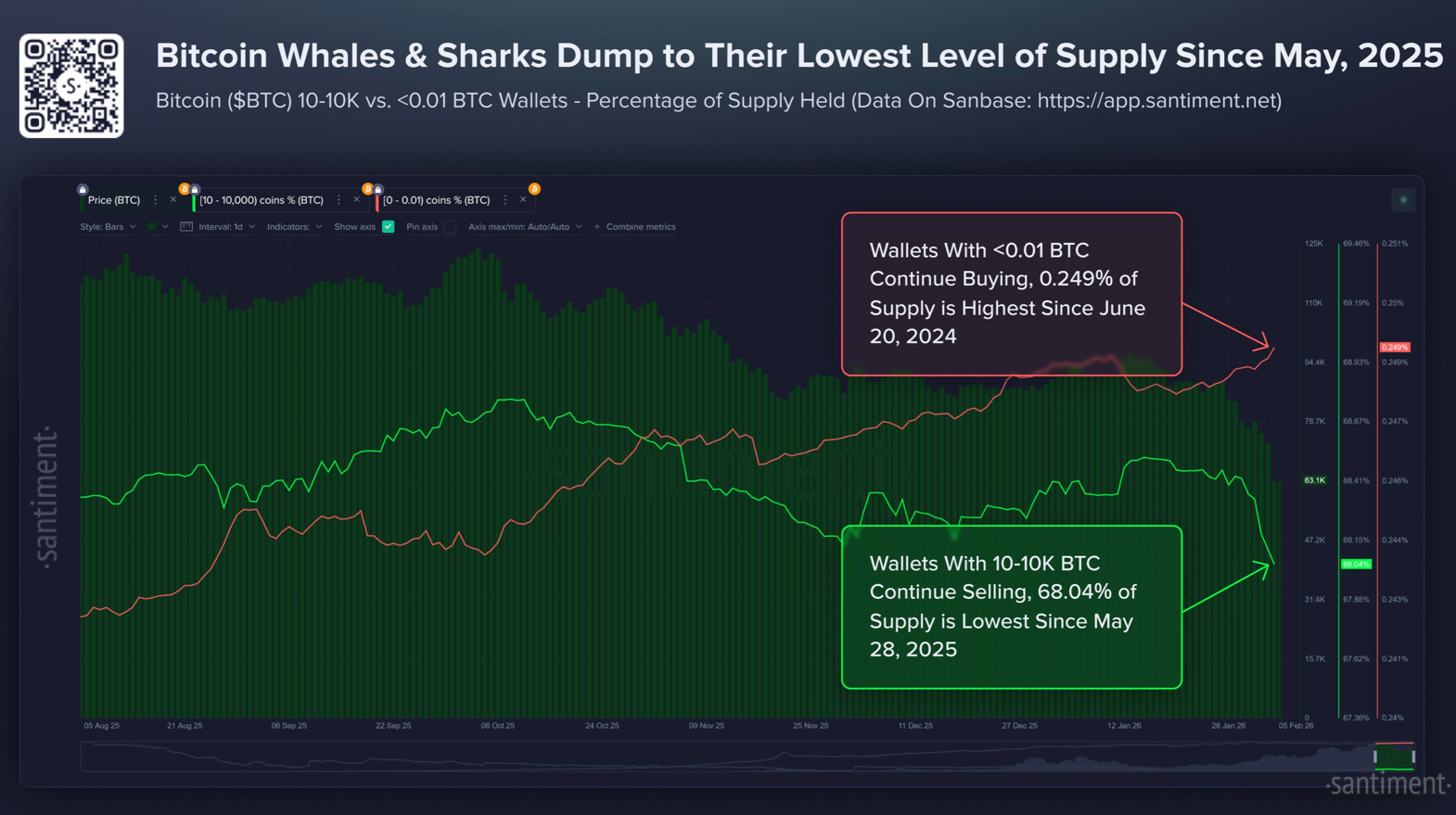

Large Bitcoin holders are now controlling the smallest share of the cryptocurrency’s supply since late May, when it first reclaimed $100,000 after more than three months, according to crypto sentiment platform Santiment.

Santiment posted to X on Thursday that “whale and shark wallets” holding between 10 and 10,000 Bitcoin (BTC) have fallen to a nine-month low, collectively accounting for about 68.04% of the entire Bitcoin supply.

“This includes a dump of -81,068 BTC in just the past 8 days alone,” Santiment said, as Bitcoin fell from around $90,000 to $65,000 over the same period, a roughly 27% decline, according to CoinMarketCap. Bitcoin is trading at $64,792 at the time of publication, up from a 24-hour low of just over $60,000.

Crypto market participants often track large Bitcoin holders to spot signs of accumulation or offloading, as these moves can signal whether whales believe the asset has peaked or is poised for an uptrend.

It isn’t just large Bitcoin holders that are showing signs of caution. CryptoQuant CEO Ki Young Ju posted to X on Wednesday that “every Bitcoin analyst is now bearish.”

The Crypto Fear & Greed Index, which measures overall crypto market sentiment, dropped to a score of 9 out of 100 on Friday, its lowest score since mid-2022, when the market was reeling from the collapse of the Terra blockchain.

While there has been a sell-off among large holders, retail investors have been aggressively accumulating. Santiment said, “This combination of key stakeholders selling and retail buying is what historically creates bear cycles.”

Related: Bitcoin slips under $64K as record-high selling intensifies: Where is the bottom?

“Shrimp wallets,” which Santiment defines as those holding less than 0.1 Bitcoin, have risen to a 20-month high since June 2024, when Bitcoin was trading at around $66,000, before falling to $53,000 just two months later in August.

However, by December 2024, it had reached $100,000 for the first time amid a booming market after Donald Trump won the US presidential election.

The cohort now accounts for 0.249% of Bitcoin’s total supply, which is equivalent to roughly 52,290 Bitcoin.

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

Ethereum Ecosystem Hits $15B in Tokenized RWAs and $1T in Aave Loans in a Single Month

TLDR:

- Tokenized real-world assets on Ethereum mainnet surpassed $15 billion in total market capitalization this month.

- Aave crossed $1 trillion in all-time cumulative loans, marking a major milestone for decentralized lending on Ethereum.

- BNP Paribas and BlackRock deepened their presence on Ethereum through new tokenized fund launches and integrations.

- Ethereum’s Layer 2 networks advanced significantly, with Linea peaking at 218 mGas/s and Optimism shipping Upgrade 18.

Ethereum builders delivered a remarkable month of progress across the ecosystem, with milestones that captured attention across both crypto and traditional finance.

Tokenized real-world assets on Ethereum mainnet crossed $15 billion in market cap. Aave surpassed $1 trillion in all-time loans, marking a major threshold for decentralized lending.

These achievements arrived alongside 25 distinct ecosystem deliverables spanning privacy, scaling, institutional adoption, and developer tooling.

Tokenized Real-World Assets and Institutional Products Hit Record Levels

Ethereum builders pushed tokenized real-world assets past $15 billion in total market cap on mainnet. The figure reflects sustained growth in onchain financial products built on Ethereum infrastructure. Several institutions contributed directly to that growth through new product launches this month.

BNPParibas launched a euro-denominated money market fund directly on Ethereum’s public blockchain. The move brought one of Europe’s largest banks into Ethereum’s financial infrastructure in a meaningful way. It also added to the growing list of regulated financial products now operating onchain.

OndoFinance brought tokenized stocks, SPYon and QQQon, live as DeFi collateral on @Morpho. @eulerfinance also accepted tokenized equities as collateral through a collaboration with Ondo Finance, Sentora, and Chainlink. Traditional financial exposure is now usable inside Ethereum-native lending markets without leaving the chain.

Uniswap integrated with Securitize to make BlackRock’s BUIDL fund tradeable through UniswapX. @StartaleGroup introduced JPYSC, the first trust bank-backed Japanese yen stablecoin on Ethereum. Together, these launches show institutions treating Ethereum as core financial infrastructure rather than experimental technology.

Aave Crosses $1 Trillion as DeFi Activity Compounds Across the Ecosystem

Aave crossing $1 trillion in cumulative all-time loans stands as one of the month’s most watched milestones. The figure represents years of consistent lending activity built on Ethereum’s open financial layer. It also reflects growing trust in decentralized protocols to handle serious financial volume over time.

MetaLeX_Labs added to DeFi’s expanding use cases by launching cyberSign this month. The product allows users to sign legally binding agreements using Ethereum or Base as the signing infrastructure. It bridges legal execution with blockchain-native identity in a practical and accessible way.

RobinhoodApp launched the public testnet for Robinhood Chain, an Ethereum L2 powered by Arbitrum. The platform targets institutional settlement and aims to bridge traditional brokerage activity with public rollup infrastructure. It joins a growing set of financial platforms building directly on Ethereum’s Layer 2 ecosystem.

@base also announced that Y Combinator startups can now receive funding in USDC on Base. The development connects early-stage startup capital with Ethereum’s stablecoin and payment rails. It opens a practical path for new companies to operate natively within the Ethereum ecosystem from day one.

Builders Advance Privacy Tools, Scaling Capacity, and Staking Infrastructure

Ethereum builders made parallel progress in privacy, performance, and staking throughout the month. @payy_link announced Payy Network, a privacy-first EVM Layer 2 with default private token transfers.

@hinkal_protocol enabled private ETH and stablecoin payments on Arbitrum, extending privacy further across L2s.

Starknet integrated Nightfall for confidential institutional DeFi and released Starkzap, an open-source SDK for consumer apps. @blockscout launched a Tor-native onion service, giving users a private way to view Ethereum state.

The @ethereumfndn also released the One Trillion Dollar Security Dashboard, offering a full view of ecosystem security.

LineaBuild sustained over 100 mGas per second throughout the month, peaking at 218 mGas per second. @Optimism shipped Upgrade 18, targeting a more performant and customizable OP Stack for builders. These results confirm that Ethereum’s rollup layer is actively delivering on its throughput promises.

Rocket_Pool activated Saturn One, introducing 4 ETH megapool validators to strengthen decentralized staking. @ether_fi released its Android app, lowering the barrier for mobile users entering staking and DeFi.

The @ethereumfndn also published its 2026 priorities — Scale, Improve UX, and Harden the L1 — keeping long-term development coordinated and public.

Crypto World

Will BTC See $60K Again?

Key points:

-

Analysts believe that Bitcoin will have to stay above the $68,000 level to continue its recovery.

-

Several major altcoins have turned down from their overhead resistance levels, indicating that bears remain in control.

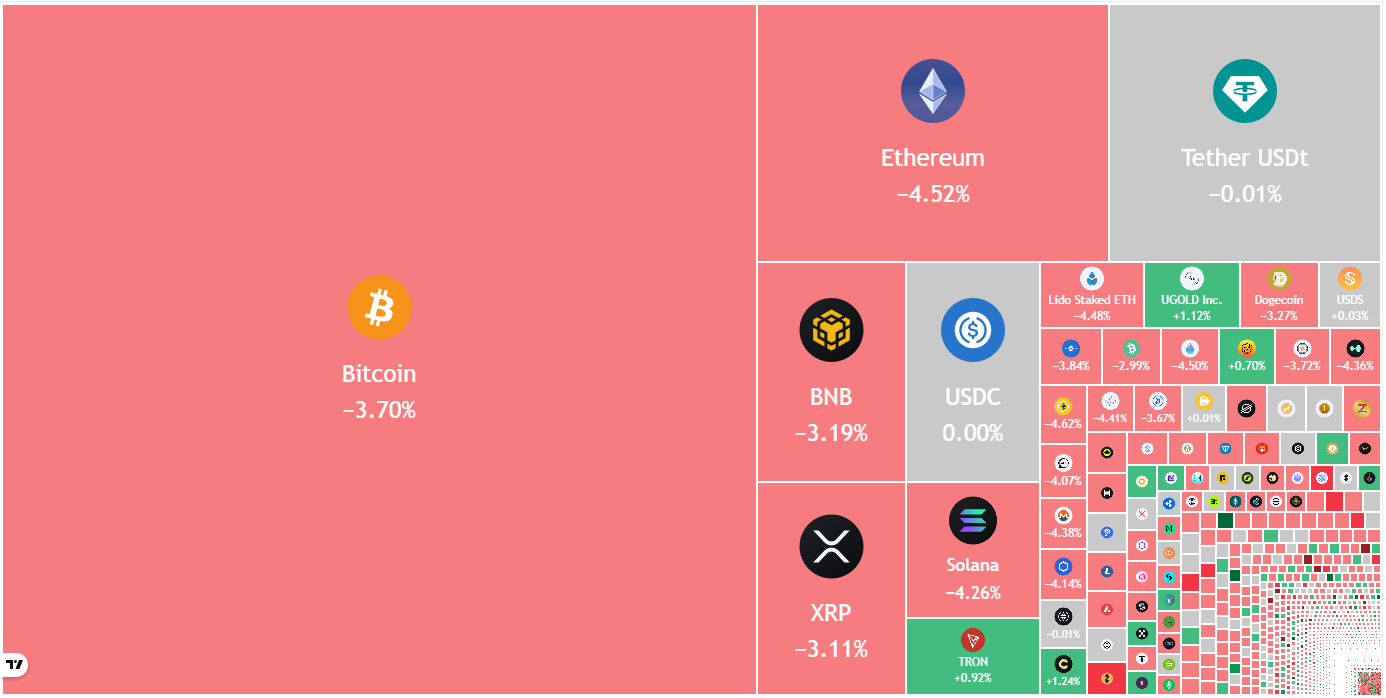

Bitcoin’s (BTC) relief rally was rejected at the $74,000 level, and the bears have pulled the price below $68,500. Select analysts believe that BTC will have to hold the $68,000 to $70,000 zone to continue its short-lived bull trend.

The big question on traders’ minds is whether BTC has bottomed out or if it could fall further. Coinbureau CEO Nic said in a post on X that BTC’s price relative to gold has historically “taken about 14 months to go from peak to bottom.” The bottom of the ratio has been followed by a sharp rally of more than 300% in BTC on every occasion. The current 13-month decline from the previous ratio peak suggests that BTC may be close to bottoming out.

Not everyone believes that BTC’s bear market may be ending. On-chain analytics company CryptoQuant said in a post on X that BTC is in a bear market as per their Bull Score Index, which remains deep in bearish territory. The platform said data shows the current rally is “likely just a relief rally, not the start of a new bull phase.”

Could BTC and select major altcoins hold on to their support levels? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price prediction

BTC turned down from the breakdown level of $74,508 on Thursday, indicating that the bears are defending the level with all their might.

The 20-day exponential moving average ($69,003) is the critical support to watch out for on the downside. If the Bitcoin price turns up from the 20-day EMA, the bulls will again attempt to clear the obstacle at $74,508. If they can pull it off, the BTC/USDT pair may soar to $84,000. Such a move suggests that the pair may have bottomed out at $60,000.

On the contrary, a close below the 20-day EMA may pull the price to the support line. This is a vital level to keep an eye on as a break below the support line tilts the advantage in favor of the bears. The pair may then collapse to $60,000.

Ether price prediction

Ether (ETH) cleared the $2,111 resistance on Wednesday, but the bears pulled the price back below the level on Thursday.

The Ether price continued lower and broke below the 20-day EMA ($2,032), suggesting that the market rejected the break above the $2,111 level. The ETH/USDT pair is likely to oscillate between $1,750 and $2,200 for some time.

Conversely, if the price turns up from the current level and breaks above the 50-day SMA ($2,328), it suggests that the selling pressure has weakened. The pair may then start an up move to $2,600.

BNB price prediction

BNB (BNB) turned down from the $670 level on Thursday, indicating that the bears are vigorously defending the level.

The bears have pulled the price below the 20-day EMA ($637), indicating that the bulls have given up. That suggests the BNB/USDT pair may remain inside the $570 to $670 range for a while longer.

The bulls will be back in the driver’s seat on a close above the $670 level. That opens the doors for a rally to the 50-day SMA ($718) and later to $790. Sellers will have to yank the BNB price below the $570 level to start the next leg of the down move to $500.

XRP price prediction

XRP (XRP) closed above the 20-day EMA ($1.41) on Wednesday, but the bulls could not sustain the higher levels.

The bears are attempting to pull the XRP/USDT pair below the $1.27 support. If they manage to do that, the XRP price may slump to the support line of the descending channel pattern.

On the contrary, if the pair turns up and breaks above the 20-day EMA, it suggests that the bulls are attempting a comeback. The pair may then rally to $1.61, which could again act as stiff resistance.

Solana price prediction

Solana (SOL) turned down from the $95 level on Thursday and has slipped below the 20-day EMA ($86).

The flattish 20-day EMA and the RSI just below the midpoint indicate a balance between supply and demand. The Solana price may oscillate between $76 and $95 for a few more days.

Buyers will have to secure a close above the $95 level to suggest that the bears are losing their grip. The SOL/USDT pair may then surge to the $117 level. Sellers will be back in the game on a close below $76.

Dogecoin price prediction

Dogecoin (DOGE) rose above the 20-day EMA ($0.10) on Wednesday, but the bulls could not pierce the 50-day SMA ($0.11).

The Dogecoin price turned down and reached the critical $0.09 support. If the bears pull the price below the $0.09 level, the DOGE/USDT pair may retest the Feb. 6 low of $0.08. Buyers are expected to fiercely defend the $0.08 level, as a close below it may sink the pair to $0.06.

The bulls will have to thrust the price above the 50-day SMA to signal strength. The pair may then rally to the breakdown level of $0.12, where the bears are expected to step in.

Cardano price prediction

Buyers attempted to push Cardano (ADA) above the 20-day EMA ($0.27) on Thursday, but the bears held their ground.

However, a minor advantage in favor of the bulls is that they have not allowed the Cardano price to dip below the $0.25 level. If the price turns up from the current level or the $0.25 support, the bulls will again attempt to push the ADA/USDT pair to the downtrend line of the descending channel pattern.

On the other hand, a close below the $0.25 level opens the doors for a retest of the support line. A close below the support line may sink the pair to the $0.15 level.

Related: Was $74K a bull trap? Bitcoin traders diverge on 2022 crash repeating

Bitcoin Cash price prediction

The bounce off the $443 level in Bitcoin Cash (BCH) fizzled out at $476 on Wednesday, indicating a negative sentiment.

The bears will attempt to strengthen their position by pulling the Bitcoin Cash price below the $443 support. If they manage to do that, the BCH/USDT pair will complete a bearish head-and-shoulders pattern. The pair may then plummet to $375.

Buyers will have to propel the price above the 20-day EMA ($488) to signal strength. The pair may then reach the 50-day SMA ($533), which is likely to attract sellers. A close above the 50-day SMA indicates the start of a sustained recovery toward $600.

Hyperliquid price prediction

Hyperliquid (HYPE) has pulled back to the moving averages, which are a crucial support to watch out for.

If the Hyperliquid price rebounds off the moving averages with force, the bulls will again attempt to drive the HYPE/USDT pair to the $36.77 overhead resistance. A close above the $36.77 level signals the start of a new up move.

Contrary to this assumption, if the price continues lower and breaks below the moving averages, it suggests that the pair may remain inside the $20.82 to $36.77 range for a few more days.

Monero price prediction

Buyers are attempting to push Monero (XMR) above the $360 level, but are facing stiff resistance from the bears.

The 20-day EMA ($347) is the crucial support to watch out for on the downside. If the Monero price bounces off the 20-day EMA, the possibility of a break above the 50-day SMA ($396) increases. The XMR/USDT pair may then rally to the 61.8% Fibonacci retracement level of $414.

Instead, if the price turns down and breaks below the 20-day EMA, it signals that the bears are active at higher levels. That may keep the pair range-bound between $384 and $302 for some time.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Exclusive Ukrainian National Football Team Card Skin and Match Tickets Giveaway

[PRESS RELEASE – Vilnius, Lithuania, March 6th, 2026]

WhiteBIT, the largest European cryptocurrency exchange by traffic and the official title crypto partner of the Ukrainian National Football Team, has introduced a new fan-focused initiative that blends digital innovation with real-world experiences.

As part of the initiative, WhiteBIT is launching an exclusive Ukrainian National Football Team skin for its WhiteBIT Nova VISA card and giving fans the chance to win tickets to upcoming national team qualification matches.

This campaign reflects WhiteBIT’s broader mission to make crypto accessible and meaningful to everyday users by connecting digital assets with real-life passions. For football fans, crypto becomes a gateway to exclusive experiences, community engagement, and moments that extend far beyond the screen.

New Ukrainian National Team Skin Unlocks Matchday Perks

From March 3, WhiteBIT Nova VISA card holders gain access to a limited-edition skin designed in collaboration with the Ukrainian National Football Team. It celebrates national pride while turning a daily payment tool into a symbol of support for the team.

WhiteBIT also introduces functional perks for fans attending the Ukraine–Sweden games in Valencia on March 26 and March 31. The WhiteBIT Nova VISA cardholders will receive 50% cashback on purchases made with the card at the stadium bars on the match day. Further prize giveaways are also planned at the stadium, extending the campaign beyond the digital environment into the live event experience.

Ticket Giveaway: Chance to See Ukraine Live

In parallel, WhiteBIT is rolling out a ticket giveaway campaign for fans eager to see the Ukrainian National Football Team live. The image of the Ukrainian National Football Team skin is hidden on the WhiteBIT website and must be found to participate in the giveaway. Five randomly selected participants will each receive two tickets to the Ukraine–Sweden game at Estadi Ciutat de València on March 26, creating an unforgettable matchday experience for supporters.

To participate in the ticket draw, users should:

- Open a WhiteBIT Nova card in the WhiteBIT app

- Find the image of the Ukrainian National Football Team skin on the official WhiteBIT website — a hint: the skin image can be found “where everything begins”.

- Click on the skin and complete the required action

- Five random users who successfully find the skin will receive two tickets to a Ukrainian national team match in Valencia.

With this initiative, WhiteBIT once again reinforces its position as a brand that brings crypto closer to real life — where passion meets opportunity, and every fan can unlock more than just a payment experience.

About WhiteBIT

WhiteBIT is the largest European cryptocurrency exchange by traffic, offering over 900 trading pairs, 350+ assets, and supporting 8 fiat currencies. Founded in 2018, the platform is a part of W Group which serves more than 35 million customers globally. WhiteBIT collaborates with Visa, FACEIT, FC Juventus and the Ukrainian national football team. The company is dedicated to driving the widespread adoption of blockchain technology worldwide.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

SuperRare Unveils Liquid Editions – “The Defiant”

SuperRare has launched Liquid Editions, generative art that adapts in real-time to market dynamics.

NFT marketplace SuperRare has launched Liquid Editions, which are ERC-20 tokens with embedded liquidity pools, enabling artworks to evolve based on live market data.

The debut piece by artist Ripe visualizes the friction and discovery of value in real-time, offering collectors a dynamic experience tied to market conditions. This new medium allows artists to use on-chain data, such as price and depth, as creative inputs, introducing a novel way for art to interact with the financial ecosystem.

Liquid Editions are designed to integrate with SuperRare’s existing “Cultural Liquidity Stack,” which includes 1/1 artworks and community-focused ERC-1155 tokens.

A unique aspect of Liquid Editions is the ability for artists to issue companion ERC-721 NFTs, serving as distinctive visual “lenses” over a shared market state. This feature allows artworks to morph in real time, responding to collectors’ trading activity.

As the digital art world evolves, SuperRare’s Liquid Editions are a novel way to integrate real-time financial data into the creative process, offering a glimpse into the future of art in the blockchain era.

This article was generated with the assistance of AI workflows.

Crypto World

Why Bitcoin suffered a $110 billion wipeout despite its best week of Wall Street news in months

Bitcoin briefly pushed toward $74,000 this week, buoyed by a string of bullish developments that have tied the crypto industry ever closer to traditional finance.

Some market observers began calling this a bullish rally, with one analyst even saying that the new run ‘has legs.’

Yet the rally didn’t last. By the end of the week, the largest cryptocurrency had slipped back below $69,000, losing $110 billion in market cap.

The pullback came despite what might otherwise have been considered one of the most positive stretches of institutional news for the sector in months.

Morgan Stanley named Bank of New York Mellon as a custodian for its spot bitcoin ETF exposure, adding another layer of Wall Street infrastructure around the asset class. Crypto exchange Kraken gained access to the Federal Reserve’s payment system, a milestone in integrating crypto firms with the U.S. banking network. Intercontinental Exchange (ICE), the owner of the New York Stock Exchange, invested in crypto exchange OKX, valuing it at $25 billion, while U.S. President Donald Trump publicly suggested traditional banks should strike a workable relationship with the crypto industry.

Individually, any one of these developments might have sparked a market rally in earlier crypto cycles, when institutional adoption was seen as the catalyst that would send crypto into a massive bull run. Instead, now that adoption is here, the market is ignoring it as macro forces have taken over.

Why the selloff

The selloff was mainly triggered by U.S. dollar strengthening as the conflict in Iran intensified, after U.S. President Donald Trump seemingly quashed any chance of some sort of negotiated settlement with Iran, saying, “There will be no deal with Iran.”

This spurred a spike in oil prices, new inflation concerns and shifting expectations around interest rates (despite jobs data showing a weakening market), which put pressure on risk assets globally. Equities moved to the downside as the dollar index rose, and crypto — which has increasingly traded alongside technology stocks (read: risk assets) — followed.

If that’s not enough, Cracks in the global private credit market expanded to Wall Street giant BlackRock, which reportedly began limiting withdrawals from its $26 billion private credit fund amid rising redemption requests. Following similar stress at Blue Owl, which sold $1.4 billion in loans last month to meet withdrawals, the events started to rattle investors.

Reality check

So what does this week’s episode mean? A growing reality in crypto markets: macro matters more than crypto-native news.

Over the past several years, bitcoin has become more tightly correlated with the Nasdaq and other risk assets as institutional investors entered the market. Hedge funds, asset managers and ETF flows increasingly treat bitcoin as part of a broader portfolio of macro-sensitive assets, reacting to liquidity conditions, interest rates and dollar strength.

Ironically, the same institutional adoption that many in the industry have long sought may be contributing to this dynamic.

As bitcoin becomes embedded in traditional financial portfolios, its price is increasingly influenced by the same forces that move equities, commodities and currencies. When the dollar rallies or interest-rate expectations rise, liquidity tightens across markets — and crypto is rarely immune.

That doesn’t mean the steady drumbeat of institutional developments is irrelevant. The expansion of custody services, banking access, and exchange investment points to a deeper, more mature crypto market structure forming beneath the surface.

Who is selling?

One question investors ask when such conflicting price action batters the markets is: Who is selling?

The macro risk seemed to have spooked mostly the short-term bitcoin holders, who cashed out as bitcoin hit $74,000.

These short-term holders transferred more than 27,000 BTC ($1.8 billion) to exchanges in profit over the past 24 hours — one of the largest spikes in recent months, according to CryptoQuant analyst Darkfost.

Short-term holders are typically the most reactive group in the market, and their selling reflects lingering caution amid the ongoing war in Iran and other macro uncertainties. These holders act more like traders, going in and out of an asset to make quick profits, rather than investors who want to buy and hold for the long term. And with bitcoin’s thin liquidity, these moves make a dent in the price action

And the data shows that.

The only short-term investors currently in profit are those who accumulated bitcoin between one week and one month ago, at a realized price of roughly $68,000, suggesting some recent buyers above that price are choosing to lock in gains rather than extend their positions.

In the short term, with crypto in the midst of a bear market dating back to early October and macro uncertainty, price is the only thing that matters to investors.

Silver lining

But it’s not all doom and gloom.

A recent Binance Research report noted that U.S. spot bitcoin ETFs recorded roughly $787 million in net inflows last week — their first positive weekly flows since mid-January — suggesting that some institutional investors may be beginning to re-engage with the market after several weeks of persistent outflows.

In fact, in a recent conference, giant university endowment funds, which tend to focus on long-term return, said that they have begun looking into other alternative investment ideas, including digital assets-related ETFs, given the sky-high valuations of traditional equities.

The report also pointed to signs that speculative excess may already have been flushed out.

Bitcoin funding rates have fallen to their lowest levels since 2023, indicating that leveraged long positions have largely been unwound — conditions that historically create a cleaner foundation for more durable rallies driven by spot demand rather than short-term speculation.

In the end, it all comes down to conviction and market moves.

Some traders called the sharp rally earlier this week a “bull trap” — a brief breakout that lures in late buyers before reversing lower. While institutional conviction is on the rise, with thin liquidity, a skittish market, macro headwinds and a lack of clear catalysts, bitcoin’s price action, at least this week, seems to have proven them right so far.

Read more: Bitcoin is stuck in a rut but JPMorgan says new legislation could be the ultimate spark

Crypto World

DeFi Tensions Rise as Aave Rift Deepens

Bitcoin and the broader crypto complex staged a cautious recovery this week as investors recalibrated risk in the wake of a US-Israel conflict with Iran. The flagship asset briefly dipped to $63,245 on Sunday, before a late-week rally pushed prices toward the $73,000 region on Thursday, aided by renewed demand from U.S.-listed spot Bitcoin exchange-traded funds that logged about $1.1 billion in net weekly inflows. In the wider DeFi space, governance tensions at Aave resurfaced as the Aave Chan Initiative said it would not seek renewal of its engagement with the Aave DAO and plans to wind down operations over roughly four months, signaling a broader recalibration of governance dynamics within the ecosystem. The week’s moves underscore a blend of price catalysts, security incidents, and governance shifts that continue to shape Bitcoin and decentralized finance in 2026.

Key takeaways

- Bitcoin traded below $64,000 early in the week and rebounded to around $73,000 as ETF demand returned, with spot-BTC ETFs logging about $1.1 billion in net inflows.

- The Aave Chan Initiative (ACI) announced it would not renew its engagement with the Aave DAO and will wind down over the next four months, transferring infrastructure and responsibilities to the DAO or successor providers.

- A Strive forecast argues that AI-driven deflation could push Bitcoin toward an $11 million price by early 2036, a scenario that hinges on aggressive assumptions about monetary policy and global wealth growth.

- Stablecoins saw a rebound in inflows, with weekly net inflows reaching $1.7 billion as on-chain activity picked up amid renewed retail participation.

- Solv Protocol disclosed a $2.7 million vault exploit, offering attackers a 10% bounty to return funds, as 38.05 Solv Protocol BTC (SolvBTC) were involved in the incident and security firms probe the vulnerability.

- Bybit reported that its AI-assisted risk-monitoring system intercepts blocked or disrupted more than $300 million of risky withdrawals in Q4 2025, with thousands of users protected by real-time risk alerts.

- In DeFi, the market remained broadly green for the largest currencies, with River (RIVER) surging and the Humanity Protocol (H) token also among notable weekly gainers.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Positive. Bitcoin rebounded toward the $73k mark aided by renewed ETF inflows and improving risk appetite.

Market context: The week’s activity sits at the intersection of macro-driven liquidity shifts, evolving DeFi governance, and ongoing security reviews in a landscape where institutions are reassessing exposure to Bitcoin and related networks. ETF flows remain a meaningful barometer of institutional interest, while on-chain activity and governance dynamics continue to influence price trajectories and user engagement.

Why it matters

The week’s developments illuminate how price catalysts, governance mechanics, and security events interact in a maturing crypto market. The resurgence in Bitcoin prices, supported by spot-BTC ETF inflows, signals that institutional channels remain a primary conduit for capital, even as volatility persists amid geopolitical and regulatory headlines. The Aave governance shift, driven by the ACI’s departure, highlights how governance standards and voting dynamics can affect the trajectory of major DeFi protocols. For builders and users, governance transitions can reframe risk, funding, and the allocation of developer resources across ecosystems.

On the technology and policy front, the AI-deflation thesis around Bitcoin underscores how long-term macro dynamics—productivity gains, monetary expansivity, and the role of Bitcoin as a potential reserve asset—continue to fuel debate among analysts. While views vary, the conversation about Bitcoin’s strategic role in the global financial system is sharpening, particularly as asset flows and macro expectations evolve.

Security remains a critical concern. The Solv Protocol incident underscores the fragility of cross-chain and vault-based models, even as networks attempt to harden defenses with audits and third-party oversight. The Bybit risk framework demonstrates the industry’s ongoing move to deploy AI-assisted tools that can curb fraud and protect users, a trend that could become a baseline requirement for exchanges seeking to manage burgeoning threat surfaces.

Meanwhile, the DeFi landscape continues to show resilience in the face of headwinds. The top-100 assets’ overall green turnover, along with notable gains for River and Humanity Protocol, suggests that liquidity and activity remain robust enough to absorb security events and governance shifts without derailing longer-term momentum.

What to watch next

- The Aave governance timeline: monitor developments over the next four months as ACI winds down and responsibilities transition to the DAO or other providers.

- Bitcoin price action in relation to ETF inflows: watch next week’s inflows data and price response near key resistance levels around $73k.

- The Strive AI-deflation scenario: assess updates to Joe Burnett’s analysis and any rebuttals or alternate forecasts from the research community as 2036 approaches.

- Solv Protocol security post-mortem: await findings from Hypernative, SlowMist, CertiK, and any disclosed patch deployments or contract fixes.

- Bybit risk-monitoring rollout: track adoption by other exchanges and any regulatory responses to AI-driven security tooling.

Sources & verification

- Aave Chan Initiative’s departure announcement and related governance thread documenting the wind-down plan.

- Spot Bitcoin ETF inflows data and coverage detailing $1.1 billion in weekly net inflows.

- Strive’s Joe Burnett AI-deflation forecast and the accompanying Mustard Seed Substack piece outlining the 11 million per BTC scenario.

- Messari’s report on stablecoin inflows, including the $1.7 billion weekly inflow figure and on-chain activity indicators.

- Solv Protocol’s exploit disclosure, the SolvBTC minting incident, and security firm investigations.

- Bybit’s security post detailing the AI-assisted risk framework and the quarter’s intercepted threats.

Market reaction and governance shifts reshape DeFi and BTC outlook

Bitcoin (CRYPTO: BTC) moved in a volatile arc as markets absorbed a mix of geopolitical risk, regulatory signals, and liquidity dynamics. Early-week weakness gave way to an earnest recovery, aided by renewed appetite for spot-BTC ETFs that registered about $1.1 billion in net weekly inflows. The resilience of BTC prices in the face of macro pressures underscores how institutional inflows continue to shape the market’s tempo, even as retail activity and on-chain usage remain a trusted barometer of ongoing interest in the asset class.

In governance news, the Aave Chan Initiative announced it would not renew its engagement with the Aave DAO and would wind down its operations over roughly four months. Marc Zeller, the ACI founder, indicated that the organization would continue governance activity and complete outstanding commitments before transferring its infrastructure and responsibilities to the DAO or successor providers. This development marks a notable shift in Aave’s governance landscape as the protocol’s funding and operational model evolves, potentially affecting proposals, resource allocation, and community-driven decisions in the near term.

Separately, a bold AI-influenced forecast from Strive’s Joe Burnett posits that productivity-driven deflation could accelerate BTC’s ascent to a multi-million-dollar price by 2036, with a base case of $11 million per BTC. Burnett’s scenario hinges on aggressive assumptions, including Bitcoin reaching roughly 12% of global financial asset value and wealth compounding at 7% annually. Critics and supporters alike caution that such a trajectory would require unprecedented capital formation and continued regulatory permissiveness, but the debate highlights investors’ ongoing interest in Bitcoin’s potential to serve as a store of value amid macro policy shifts.

Stablecoins also captured attention as inflows rebounded to about $1.7 billion, signaling renewed issuance demand and stronger on-chain activity despite a broader regulatory headwind around yield strategies. The uptick, which lifted the 30-day average into positive territory, suggests a healthy cycle of liquidity entering the market and a willingness among participants to allocate funds to on-chain uses, even as policy debates around stablecoin yields unfold in Washington.

Security and resilience were front and center as well. Solv Protocol disclosed a $2.7 million vault exploit, offering a 10% bounty to the attacker to return the stolen funds. The incident involved Solv Protocol BTC (SolvBTC) and affected fewer than 10 users, but it illuminated the vulnerabilities associated with minting and collateralized tokens in vault-based systems. The project is coordinating with security firms and has implemented measures to prevent recurrence as investigators scrutinize the chain of events and the root cause, including a vulnerability reportedly tied to a minting issue in one of Solv’s contracts. The episode serves as a reminder that even established cross-chain platforms must maintain rigorous security protocols to protect a sizeable on-chain Bitcoin reserve reported to sit at around 24,226 BTC (>$1.7 billion).

On the exchange front, Bybit reported a notable milestone in its risk-control efforts. The firm’s AI-assisted monitoring system purportedly flagged and disrupted more than $300 million in suspected scam-related withdrawals during Q4 2025, with thousands of users receiving real-time risk alerts that helped prevent losses. Bybit’s leadership stressed that most of the “blocked” withdrawals represented user-cancelled actions after warnings, meaning assets stayed in users’ accounts. The exchange also highlighted the protection of about 8,000 users through high-risk address monitoring and defense against credential-stuffing attempts—an indication that AI-driven security tools are becoming a standard feature in the fight against crypto fraud.

Market observers note that the DeFi sector ended the week broadly in the green among the 100 largest assets, with notable winners such as River (RIVER), which surged about 94%, and Humanity Protocol’s token (H), up around 39% over the period. The broader context remains one of cautious optimism: while governance shifts and security incidents pose challenges, liquidity and participant activity persist, supported by a mix of retail interest, institutional traffic, and risk-control technologies that collectively define the sector’s current trajectory.

https://example.com/placeholder.js

Crypto World

Why Is Bitcoin’s Price Down 4% to $68K Now?

BTC dipped below $68,000 minutes ago, thus erasing most of this week’s gains.

Bitcoin’s impressive price surge to $74,000 earlier this week came to a somewhat expected halt, and the asset has lost $6,000 since then, dropping to and under $68,000 today.

The latest price slip came after the US jobs report that came out on Friday and Trump’s new set of threats against Iran and Cuba.

The report, published earlier today, indicated that the country lost 92,000 jobs in February and the unemployment rate rose to 4.4%. This meant that the nation’s labor market had lost steam last month, which contrasted with experts’ expectations. Most anticipated before the report went out that the US had gained around 60,000 jobs last month.

The second reason behind the price correction today could be linked to the new remarks from the POTUS. At first, he threatened Cuba, indicating that the country’s regime is “going to fall pretty soon.”

He added that the US is currently focused on the war against Iran, but they want to make “a deal badly” and suggested that Marco Rubio could handle the negotiations with Cuba.

Additionally, while weighing in on the situation with Iran, Trump said there will be no deal with the Middle Eastern country. Instead, he wanted “unconditional surrender.”

The analysts from the Kobeissi Letter, though, outlined a similar development last year when the US attacked Iran again. At the time, the POTUS made the same strong statement on his social media platform, but the two sides made a deal just six days later.

You may also like:

Today, President Trump called for Iran’s “unconditional surrender.”

The last time we saw this happen was on June 17th, 2025.

6 days later, on June 23rd, a ceasefire was announced.

Will history repeat itself on March 12th? pic.twitter.com/2NxZ6rxBKY

— The Kobeissi Letter (@KobeissiLetter) March 6, 2026

Unlike BTC, which is down by 4% in the past 24 hours, US oil prices have skyrocketed in the past several hours after Trump’s statements, going past $92 per barrel. USOIL now trades at its highest levels since September 2023.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Ethereum eyes faster, tougher finality with Minimmit

Ethereum co-founder Vitalik Buterin backs a controversial shift from Casper FFG to Minimmit, betting that making censorship harder matters more than preserving textbook fault‑tolerance as ETH trades near $2,000.

Summary

- Vitalik proposes replacing Ethereum’s two‑round Casper FFG finality gadget with Minimmit, which finalizes blocks in a single round.

- The trade‑off: fault tolerance drops from 33% to 17%, but censorship resistance and recovery from bugs or attacks arguably improve.

- The debate lands as ETH hovers around $2,000, with markets weighing whether faster, more resilient finality can justify a premium in a choppy macro tape.

Vitalik Buterin has put his weight behind one of the most sensitive changes to Ethereum’s (ETH) core: ripping out the Casper FFG finality gadget and replacing it with Minimmit, a one‑round Byzantine fault‑tolerant scheme that deliberately relaxes some purity‑theory guarantees in exchange for what he frames as more “real world” safety.

Casper today requires validators to attest twice — once to justify a block, again to finalize it — and can tolerate up to 33% of stake behaving maliciously before the system’s guarantees break. Minimmit cuts that to a single round: faster and simpler, but with formal fault tolerance falling to 17% in the current proposed parameters.

On paper, that looks like a downgrade. But Buterin’s thread makes a blunt argument: the worst real‑world attack is not finality reversion, it is censorship. Finality reversion creates undeniable cryptographic evidence and leads to massive slashing — millions of ETH, or billions of $, vaporized on‑chain — which makes such attacks economically absurd for any rational actor with that kind of capital. Censorship, by contrast, is messy: it forces users and developers into social coordination, soft forks, and political fights. In both the “ideal” three‑slot‑finality (3SF) model and Minimmit, an attacker needs 50% of stake to censor, but Minimmit shifts the thresholds at which an attacker can unilaterally finalize bad history, raising that bar from 67% to 83%. That, Buterin argues, maximizes scenarios where the network defaults to “two chains dueling” instead of “the wrong thing finalized” — an outcome that is chaotic but fixable.

The backdrop is a market that is no longer paying for narratives alone. ETH trades around $2,000, down from prior cycle highs near $4,900, with volatility elevated and macro headwinds still in play. Traders have already seen the outline of Ethereum’s “fast L1” strawmap, which aims to cut slot times from 12 seconds to as low as 2 seconds and drive finality down to single‑digit seconds using Minimmit. If this redesign sticks, Ethereum stops competing only on rollup ecosystem and DeFi liquidity and starts competing on something brutally simple: how quickly and credibly your transaction becomes irreversible. In a market where ETH is still repricing its role versus L2s and rival L1s, Minimmit is not just a consensus tweak; it is an attempt to re‑anchor the asset’s value in raw, observable user experience: click, confirm, done.

Crypto World

Robinhood’s venture fund, which gives investors access to private companies, tanks 11% on first day

Robinhood signage during a media event at John F. Kennedy International Airport (JFK) in New York, US, on Wednesday, March 4, 2026.

Adam Gray | Bloomberg | Getty Images

Robinhood’s Venture Fund I plunged 11% in its public market debut on the New York Stock Exchange on Friday, casting doubt on investors’ appetite for riskier investment amid swirling geopolitical tensions.

The fund, which is trades under the ticker RVI, offers exposure to notable private companies such as financial services firm Revolut and software company Databricks. It aims to democratize access to an area of capital markets that has often been off limits to retail investors, Robinhood CEO Vlad Tenev told CNBC’s “Squawk on the Street” on Friday.

“You have companies that are out there at valuations in the hundreds of billions, even getting into the trillions in private markets before retail investors get a chance to come in at all and this is happening more and more,” Tenev said. “We’re trying to solve this by not just opening the door to private markets but completely blowing them off the hinges so that they can never be closed.”

Retail investors can buy and sell shares of the closed-end fund, which is structured like an investment firm, much like they would shares of a traditional company.

However, the launch comes during a tough time for public markets. The major U.S. stock averages are on pace for weekly declines as traders sell equities on fears the U.S.-Iran conflict could continue longer than anticipated.

Robinhood Ventures Fund priced its initial public offering at $25 per share. It opened at $22 and hit a low of $21 before trading around back around $22.12.

RVI were last trading at $22.17 per share.

Crypto World

US Senator Calls for Anti-Corruption Provisions in Crypto Bills

Massachusetts Senator Elizabeth Warren, one of the more outspoken voices in Congress often connecting cryptocurrencies to illicit activities, slammed the US Securities and Exchange Commission’s settlement with Tron founder Justin Sun.

In a Thursday notice, Warren accused the SEC of “giving a free pass” to Sun after he “poured $90 million” in crypto investments tied to US President Donald Trump and his family.

Sun has invested millions of dollars through token purchases in the Trump family’s crypto platform, World Liberty Financial, and the SEC settled an unrelated case against the Tron founder and his companies for $10 million.

“Justin Sun poured $90 million into Trump’s crypto ventures, and today the SEC agreed to drop its case against him,” said Warren. “The SEC should not be a lap dog for Trump’s billionaire buddies, and any crypto legislation moving through Congress must stop the President’s crypto corruption.”

Warren did not specifically refer to the digital asset market structure bill moving through the Senate, but the legislation has been a focus of the White House and many pro-crypto lawmakers for months after it passed the House of Representatives as the CLARITY Act. The bill, which advanced from the Senate Agriculture Committee in January, is being considered by the Senate Banking Committee, where Warren is the ranking Democrat.

Related: Binance slams US Senate probe over Iran as based on defamatory reports

Crypto observers await markup for market structure bill

Among the issues at stake in the market structure bill include provisions on tokenized equities, ethics and stablecoin rewards. The White House has hosted three meetings between officials and representatives of the crypto and banking industries, but it was unclear as of Friday whether the discussions had made any impact on the legislation.

Both Trump and his son, Eric, posted to social media this week to criticize banks over their position on the market structure bill. Some banking organizations have argued that including provisions on stablecoin rewards in the legislation could undermine credit and lead to deposit flight risk.

In January, the Senate Banking Committee indefinitely postponed a markup on the market structure bill after Coinbase CEO Brian Armstrong said the exchange could not support the legislation “as written.” As of Friday, the body had not rescheduled the event, which would be necessary to address securities law concerns before a potential vote in the full Senate.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Business6 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports7 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports1 day ago

Sports1 day ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion5 days ago

Fashion5 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker