Crypto World

LSEG Shares Surge 7.4% After JPMorgan and Goldman Sachs Defend Stock

TLDR

- LSEG shares rose by 7.4% on Thursday after a 19% drop in the previous two days.

- JPMorgan and Goldman Sachs reassured investors by downplaying AI risks to LSEG’s business.

- JPMorgan’s Enrico Bolzoni clarified that AI companies are working with LSEG, not replacing it.

- LSEG’s partnership with Anthropic provided AI access to the company’s financial data.

- Goldman Sachs analyst Oliver Carruthers set a price target of 14,550 pence for LSEG.

LSEG shares bounced back on Thursday, rising by 7.4% after facing a 19% drop in the prior two days. The rally followed reassurances from major financial institutions, JPMorgan and Goldman Sachs, who downplayed fears that artificial intelligence would threaten LSEG’s core business. The recovery came after a tumultuous period where AI-related market panic had hurt the stock.

London Stock Exchange Group plc, LSEG.L

Rebound Driven by Analyst Confidence

The sharp decline in LSEG shares began earlier in the week when Anthropic introduced its Claude Cowork product, designed to automate workplace tasks. Traders feared that AI advancements could severely impact companies like LSEG, which specializes in providing financial data, not software. However, JPMorgan’s Enrico Bolzoni stepped in to correct what he called “misunderstandings” surrounding LSEG’s business model, stating that AI would not replace but instead work alongside LSEG.

Bolzoni emphasized that LSEG is deeply involved in AI, noting the October partnership with Anthropic that provided the AI company access to LSEG’s financial data. This partnership, he argued, demonstrated LSEG’s pivotal role in the growing AI landscape, counteracting the market’s misconception that AI would push the company aside. “AI companies are working with LSEG, not replacing it,” Bolzoni clarified in his statement.

LSEG Shares: Calm After the Panic

Goldman Sachs also weighed in, with analyst Oliver Carruthers reiterating the value of LSEG’s data-driven business model. Carruthers downplayed the potential impact of AI, explaining that just 6% of LSEG’s revenue from workflow products might be exposed to any risk from automation. He further set a price target of 14,550 pence, which was the highest among analysts tracking LSEG.

The comments from both JPMorgan and Goldman Sachs played a significant role in calming investor nerves. Shares of LSEG, which had taken a hit in the wake of AI-related concerns, saw a sharp reversal, rising 7.4%. This bounce was a direct result of analysts stepping in to assure the market that LSEG’s core business was secure, even in the face of AI innovation.

The broader tech market also saw turbulence as fears over AI’s impact on the software and data sectors took hold. The Nasdaq 100 recorded its worst two-day drop since October, shedding over $550 billion in value. LSEG, despite being a data provider, became caught in the broader selloff, with tech investors looking to offload anything related to software or data businesses.

Crypto World

Crowd Fear Triggers Bitcoin Bounce, $70K Rally in Focus

Santiment says extreme fear after Bitcoin’s $60K drop helped trigger a rebound, with a potential push toward $70K.

Bitcoin (BTC) slipped to around $60,000 earlier today before rebounding toward $65,000, following one of the sharpest daily sell-offs in its history.

The move has split traders between those calling the rebound a temporary technical reaction and others pointing to extreme fear as a setup for a recovery toward $70,000.

Fear Spikes as Bitcoin Rebounds From Sell-Off

On February 6, Santiment noted that social media mentions calling for Bitcoin to go “lower” or “below” shot up after the drop to $60,000, a pattern the analytics firm said often appears near short-term price rebounds.

The asset did indeed bounce back to about $65,000, with the uptick coming after what The Kobeissi Letter described as BTC’s first-ever daily drop of more than $10,000, alongside claims that a large leveraged position had been liquidated.

“Is this nothing but a dead cat bounce?” Santiment asked, while positing that enough retail may have been shaken out to justify a quick rally back up to the $70,000s.

The sell-off capped weeks of heavy downside pressure, as CryptoPotato previously reported, with Bitcoin wiping out gains seen after Donald Trump’s re-election and dragging most major altcoins lower. XRP fell 13% on the day, while Ethereum, Solana, and BNB also posted steep losses.

Meanwhile, on-chain and derivatives data are painting a mixed picture beneath the rebound. According to DeFi commentator Marvellous, “smart money” has taken a net short position, while whales and public figures are adopting long positions. The market watcher argued the move looked more like a mechanical response after $2.2 billion in long liquidations than renewed conviction, noting that open interest remained elevated and funding rates had stayed flat.

You may also like:

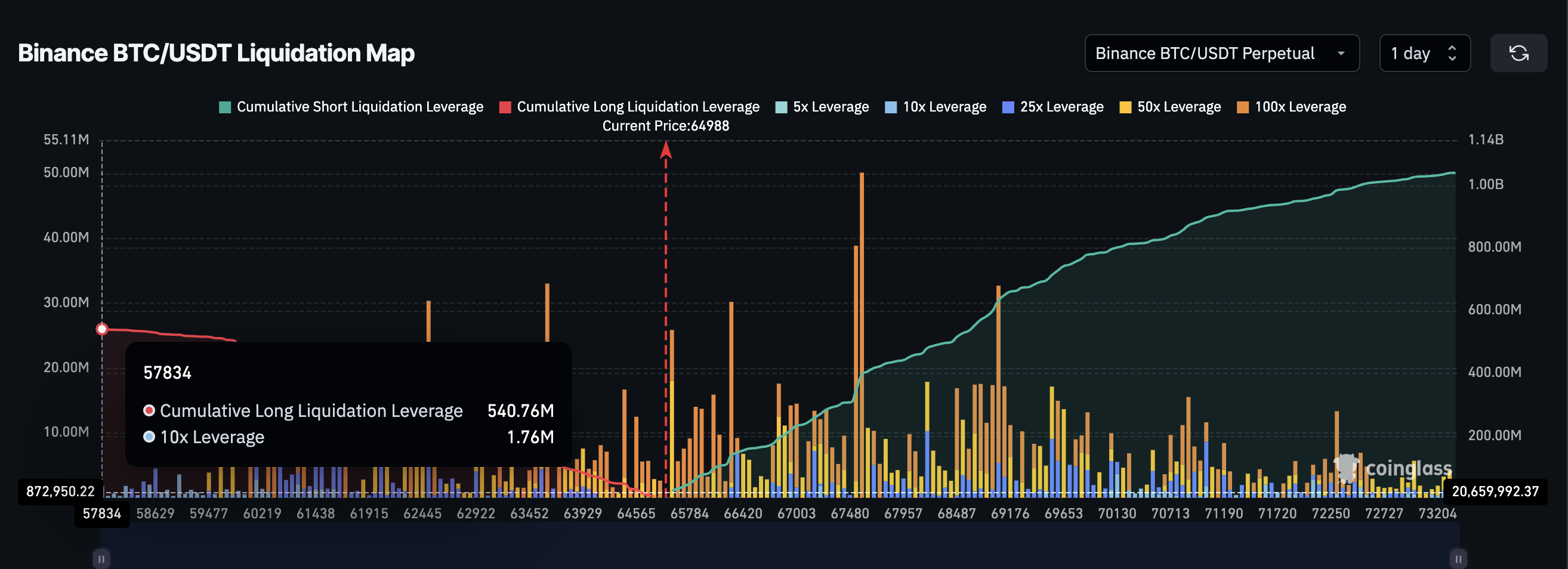

Elsewhere, trader Sykodelic highlighted a lopsided liquidation map, claiming the market had cleared most long positions, leaving roughly $29 billion in shorts versus about $100 million in longs over a one-year view.

Price Action Shows Heavy Damage Despite Short-Term Bounce

Bitcoin was trading around the $65,000 level at the time of writing, down nearly 9% in the last 24 hours and more than 21% over the past seven days. Across the previous month, the losses stand close to 30%, pushing BTC about 48% below its peak from October 2025, when it surpassed the $126,000 mark.

Analysts from CryptoQuant have said that the current downturn is developing faster than the 2022 bear market, with their data showing the OG cryptocurrency fell 23% within 83 days of losing its 365-day moving average, compared with a 6% decline over the same period in early 2022.

Santiment added that sentiment toward both Bitcoin and Ethereum (ETH) had turned “extremely bearish,” a condition that can coincide with short-lived relief rallies when retail fear stays elevated.

For now, traders remain divided. Some see the concentration of short positions and fearful sentiment as fuel for a move back toward $70,000, while others have warned that without a collapse in open interest and prolonged sideways trading, the recent bounce may only be the precursor to another test of lower levels.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin’s Lightning Network clears record $1M transfer to Kraken

Secure Digital Markets sent $1M in Bitcoin to Kraken over Lightning, showcasing near-instant, low-fee settlement for institutional-size payments.

Summary

- Secure Digital Markets completed a $1M Bitcoin transaction to Kraken via Lightning on Jan. 28, the largest publicly reported Lightning payment so far.

- The pilot, powered by Voltage’s enterprise Lightning infrastructure, aimed to test high-value settlement between regulated counterparties with near-zero fees.

- SDM, Kraken, and Voltage executives say the transfer signals Lightning’s readiness for institutional treasury, venue-to-venue settlements, and faster exchange payments.

Secure Digital Markets (SDM) completed a $1 million Bitcoin transaction via the Lightning Network on January 28 in a pilot project with cryptocurrency exchange Kraken, the companies announced.

The transaction represents the largest Lightning payment ever publicly recorded, according to the companies. The payment settled almost instantly with minimal fees.

The operation was facilitated by Voltage’s Lightning enterprise infrastructure. Voltage is a Bitcoin payments and infrastructure provider focused on institutional clients.

The pilot project was designed to test whether the Lightning Network can support high-value transfers between regulated counterparties, according to SDM. The institutional trading and lending desk said the pilot demonstrated how Lightning can support use cases such as internal treasury movements, high-value settlements, and transfers between trading venues without the delays associated with on-chain settlement.

“Moving $1 million to Kraken via Lightning Network marks a definitive shift in global settlement architecture,” said Mostafa Al-Mashita, co-founder and director of sales and trading at SDM. “We have moved beyond the era of questioning Bitcoin’s institutional capacity.”

Kraken has supported Lightning for retail payments for several years. The company said the transaction reflects growing demand from institutional clients for faster settlement options.

Bitcoin Lightning Network used in investment

“Milestones like this demonstrate what’s possible when innovation meets real-world demand,” said Calvin Leyon, head of on-chain at Kraken. “By drastically reducing settlement times, Lightning Network unlocks Bitcoin’s potential on a global scale.”

Graham Krizek, founder and CEO of Voltage, said the transaction highlights the network’s maturity and its ability to meet enterprise requirements.

Crypto World

Kalshi Ramps Up Surveillance Ahead of Super Bowl

Kalshi is expanding its surveillance framework on its prediction markets platform through an independent advisory committee and strategic partnerships designed to deter insider trading and market manipulation, a move announced just days before a major U.S. betting event. The company said the committee will provide a quarterly briefing to outside counsel and publish statistics detailing investigations into suspicious activity on the platform. In parallel, Kalshi is partnering with Solidus Labs, a crypto trading surveillance platform, and Daniel Taylor, director of the Wharton Forensic Analytics Lab, to bolster detection, auditing, and response to potential market abuse. The timing places the initiative squarely ahead of Super Bowl 60, as Kalshi’s bet volume continues to climb well ahead of the big game. The company disclosed that more than $168 million in bets had already been placed on Kalshi ahead of the event, underscoring the scale of activity in its event-contract market.

Key takeaways

- Kalshi formalizes an independent advisory committee that will deliver quarterly oversight reports to external counsel and publish platform-cleaning statistics on investigations into suspicious activity.

- The collaboration with Solidus Labs and Wharton’s Daniel Taylor signals a structured, cross-disciplinary approach to detecting and mitigating market abuse on prediction markets.

- As regulators and lawmakers intensify scrutiny of prediction markets, Kalshi faces ongoing regulatory attention while seeking to expand access to institutional participants.

- Market context around margin trading for event contracts is evolving, with Kalshi reported by the Financial Times to be seeking U.S. regulatory approval for margin-enabled trading, potentially broadening participation beyond accredited or high-net-worth investors.

- Key personnel in the enforcement and analytics sphere—Lisa Pinheiro of Analysis Group, Kalshi’s head of enforcement Robert DeNault, and former U.S. Treasury official Brian Nelson—anchor the program’s governance and compliance posture.

- State regulator focus on whether sports-event contracts constitute gambling persists, highlighting a broader regulatory risk backdrop for Kalshi and peers in the prediction-market space.

Sentiment: Neutral

Market context: The move comes amid heightened regulatory attention on prediction markets and a broader push toward compliant, institution-friendly structures in crypto-related markets. As lawmakers debate the boundaries of insider trading and official influence, Kalshi’s governance enhancements and potential margin-trading roadmap align with a sector-wide push toward transparency and risk controls.

Why it matters

The expansion of Kalshi’s surveillance apparatus marks a significant step in maturing prediction markets as legitimate financial venues. By embedding an independent advisory committee and engaging third-party researchers and surveillance firms, the platform seeks to reduce the risk of manipulation and improve trust among users and potential institutional participants. The quarterly reporting obligation to outside counsel and the public release of investigation statistics could create a measurable benchmark for the platform’s compliance processes, offering a model that other prediction-market operators may emulate in a landscape where regulatory expectations are converging with industry practices.

Partnering with Solidus Labs, a known surveillance provider in the crypto trading space, and with Daniel Taylor of Wharton’s Forensic Analytics Lab signals a deliberate attempt to fuse technocratic oversight with academic rigor. This combination can enhance anomaly detection, forensic tracing, and incident response. In a market where a single high-profile manipulation incident or insider-trading allegation could reverberate across platforms, a robust governance framework is not merely a compliance checkbox but a practical risk-management tool.

At the same time, the industry faces a regulatory environment that can shift quickly. The sector has seen proposals in Congress and state-level actions that challenge the legality or structure of prediction-market contracts, especially when they intersect with political events or government insiders’ moves. Kalshi’s effort to cement a governance layer alongside external expertise is thus as much about resilience against ongoing regulatory scrutiny as it is about preventing abuse. If the market can demonstrate lower risk through transparent processes and independent oversight, it may unlock broader participation from institutional players who have been hesitant to engage with prediction markets under uncertain compliance regimes.

The Financial Times reporting that Kalshi is pursuing margin-trading authorization in the United States adds another dimension to the story. Margin trades could allow participants to leverage bets on event outcomes in a manner eerily reminiscent of traditional futures markets, potentially expanding the pool of capital and the depth of liquidity. Kalshi is said to be in discussions with the Commodity Futures Trading Commission for months to enable this feature, which would structure margin exposure similarly to other futures contracts—depositing a fraction of the contract value and settling at close. If approved, such a feature could attract a broader spectrum of investors, from hedge funds to family offices, while heightening the need for robust surveillance and risk controls to manage leverage and systemic risk.

The governance roster backing Kalshi’s new program includes prominent names. Lisa Pinheiro, a managing principal and data scientist at Analysis Group with a focus on market manipulation, brings a rigorous analytics lens to the effort. Kalshi’s own enforcement head, Robert DeNault, has been positioned to coordinate enforcement with the new committee, ensuring alignment between policy and day-to-day operations. Adding to the advisory depth is Brian Nelson, a former U.S. Treasury official who previously handled terrorism financing and financial-intelligence matters, who has been brought in to advise on trading surveillance and compliance issues. This blend of academic insight, legal enforcement leadership, and government-facing regulatory experience suggests a holistic approach to risk management that goes beyond surface-level compliance checks.

While the shift toward enhanced governance is framed as a proactive defense against abuse, it also occurs within a broader debate about the legal status of prediction markets. Kalshi remains among a handful of prediction-market operators that regulators have scrutinized, with some states arguing that sports-event contracts can resemble illegal gambling. Kalshi and its peers dispute that characterization, highlighting their compliance posture and the distinctions between prediction-market mechanics and gambling. The evolving regulatory dialogue—coupled with potential margin-trading approvals—could reshape how prediction markets function in practice, potentially increasing their legitimacy in the eyes of mainstream financial markets and mainstream regulators alike.

Finally, the strategic angles extend beyond regulatory maneuvering. The Kalshi announcements come as the broader market looks to how prediction markets can coexist with traditional financial infrastructure and institutions. The push toward more formal governance, transparency, and risk controls may help anchor the industry’s legitimacy in a landscape that is increasingly sensitive to issues of surveillance, data integrity, and governance. If Kalshi’s approach proves effective, it could become a blueprint for how prediction-market platforms demonstrate resilience, attract capital, and operate within a stricter regulatory framework that emphasizes accountability as a condition for growth.

What to watch next

- Publication of Kalshi’s quarterly surveillance report to outside counsel and any accompanying public statistics.

- Regulatory developments from the CFTC regarding margin trading for event contracts and Kalshi’s progress on any required approvals.

- State regulator updates related to the classification of sports-event contracts and any enforcement actions affecting Kalshi and peers.

- Updates on Super Bowl 60 betting volumes and any shifts in participant composition or contract availability on the Kalshi platform.

Sources & verification

- Kalshi press release announcing an independent advisory committee and quarterly reporting on investigations into suspicious activity: https://news.kalshi.com/p/kalshi-surveillance-insider-trading-prevention

- Financial Times report on Kalshi seeking regulatory approval to offer margin trades in the US

- U.S. congressional coverage of insider-trading concerns in prediction markets, including the Ritchie Torres bill

- Related market coverage on Polymarket/Circle and USDC settlement context

Market reaction and key details

Kalshi is actively expanding governance and surveillance as it positions itself for broader participation and potential product expansion. The combination of an independent advisory committee, external partnerships, and leadership with enforcement and analytical credentials aims to strengthen confidence in the platform’s integrity, particularly during a peak betting period like Super Bowl 60 and amid regulatory uncertainty. The reported margin-trading initiative, if approved, would mark a notable shift in the platform’s approach to liquidity and investor access, coordinating with ongoing regulatory dialogue and risk-management enhancements to support a more institutional-grade operation.

Why it matters

Kalshi’s governance push matters because it signals a maturing industry that recognizes the need for structured oversight to sustain growth. Independent advisory input and transparent reporting can improve user trust, reduce perceived risk, and potentially attract a wider array of participants who require verifiable controls before committing capital. For developers and operators building in the prediction-market space, the Kalshi framework may serve as a reference point for blending legal compliance with advanced analytics and cross-industry surveillance expertise.

From an investor perspective, enhanced risk controls and the prospect of margin trading represent both opportunities and caveats. While the potential for deeper liquidity and broader participation can support price discovery and volatility management, it also heightens the importance of robust risk management, real-time monitoring, and clear compliance protocols. In an environment where regulators are increasingly attentive to how digital markets operate, platforms that can demonstrate proactive governance are more likely to withstand regulatory shocks and sustain long-term growth.

For users, the development promises more transparency around how suspicious activity is identified and handled. Quarterly reports and external oversight may illuminate how the platform handles investigations, how often corrective actions occur, and how such actions influence market integrity. If the surveillance and enforcement ecosystem expands as described, users could benefit from a more predictable, accountable trading environment, especially during high-stakes events that generate outsized betting activity.

What to watch next

- Kalshi’s first quarterly surveillance report rollout and any accompanying data releases.

- Regulatory decisions from the CFTC on margin-trading approvals for event contracts.

- State-level regulatory actions related to prediction markets and sports contracts.

- Updates on Kalshi’s collaboration outcomes with Solidus Labs and Wharton analytics researchers.

Crypto World

XRP Plunges 17% in Steepest One-Day Drop Since 2025 as $46M in Leveraged Longs Get Wiped

A wave of leveraged liquidations totaling $46 million dragged XRP to its steepest one-day drop in over four months. This drop contrasts Ripple’s successful bids for new regulatory approvals across Europe.

Key Takeaways:

– XRP fell more than 17% to about $1.25 on Thursday, its worst one-day performance since October 2025, as broader crypto markets plunged.

– Roughly $46 million in XRP derivatives were liquidated in 24 hours, with $43 million coming from leveraged long positions, according to CoinGlass data.

– Despite the sharp drop, XRP spot ETFs have continued attracting net inflows, pulling in roughly $24 million this week and bringing cumulative inflows past $1.2 billion since their November 2025 launch.

The XRP price dropped more than 17% over the past 24 hours to around $1.25, making it the worst-performing major token on the day. Bitcoin fell roughly 10% toward $65,000 during the same period, while Ethereum slid below $2,000 and Solana traded near $82, as the selloff widened across the entire crypto market.

The move extended XRP’s weekly losses to nearly 30% and pushed its market cap down to approximately $75 billion, a steep fall from its July 2025 peak of $210 billion. XRP is now trading 45% below its January 2026 high of $2.41. This decline has been further fueled by deteriorating broader market conditions.

Leveraged Liquidations Amplified the Selloff Across Derivatives Markets

Data from CoinGlass showed roughly $46 million in XRP derivatives liquidations over 24 hours, with bullish bets accounting for about $43 million of that figure.

Prices bled slowly through most of Thursday before a sharp drop late in the session triggered a cascade of stop-loss orders and forced closings.

The break below the $1.44 support zone flipped that area into overhead resistance, leaving $1.00 as the next widely watched psychological level.

Across the broader market, traders saw approximately $1.42 billion in total crypto liquidations on Thursday, with long positions accounting for $1.24 billion.

XRP ETF Inflows Hold Up Despite the Price Collapse

Despite the steep decline, institutional flows into XRP exchange-traded funds have remained positive.

Since launching in November 2025, XRP spot ETFs have posted inflows on all but four trading days, according to SoSoValue data. Looking at this week’s performance, inflows totaled roughly $24 million, bringing cumulative net inflows past $1.2 billion.

That resilience stands in sharp contrast to Bitcoin ETFs, which recorded approximately $545 million in outflows on Wednesday alone.

Ripple’s Regulatory Wins Failed to Cushion the Drop

The selloff came during an otherwise active stretch for Ripple. Earlier this week, Ripple announced it had received full approval of an Electronic Money Institution license from Luxembourg’s Commission de Surveillance du Secteur Financier, enabling it to scale regulated payment services across the EU.

The Luxembourg approval followed a separate EMI license from the UK’s Financial Conduct Authority in January, bringing Ripple’s global license count past 75.

None of these developments cushioned XRP against the broader risk-off move. This price development underscores that the token’s valuation remains driven primarily by positioning and momentum rather than adoption narratives.

The post XRP Plunges 17% in Steepest One-Day Drop Since 2025 as $46M in Leveraged Longs Get Wiped appeared first on Cryptonews.

Crypto World

Bitcoin Price Faces 25% Risk as Buy-the-Dip Narrative Weakens

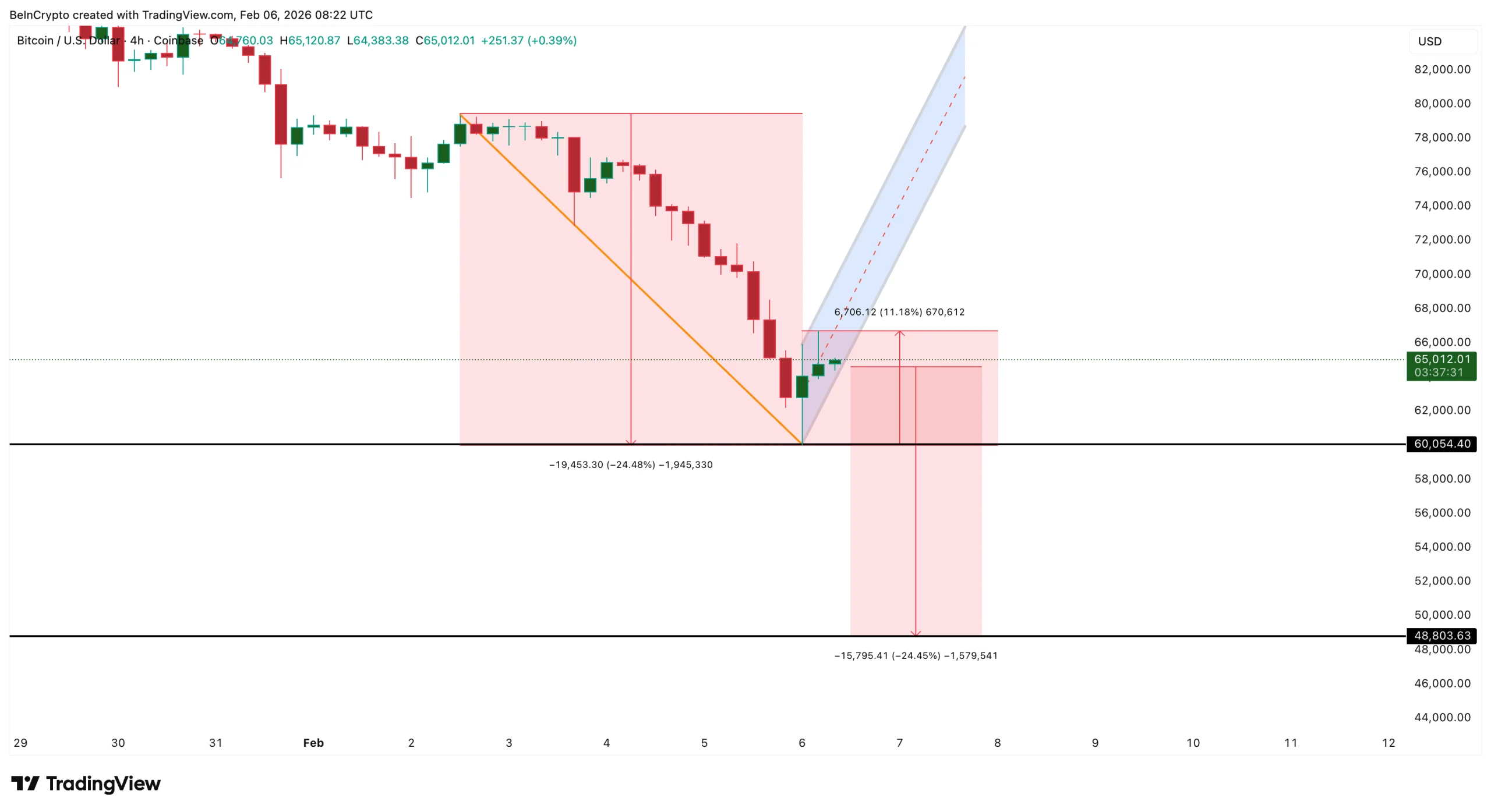

Bitcoin’s recent rebound has revived the buy-the-dip narrative, but the data tells a more complicated story. After falling nearly 15% and briefly touching the $60,000 zone, the Bitcoin price bounced more than 11%, drawing traders back into long positions.

At first glance, the bounce looks encouraging. However, bearish chart patterns, rising leverage, and fragile spot demand suggest the market may not be out of danger yet. With a potential 25% downside still in play, the latest bounce is now facing serious scrutiny.

Bear Flag, Rising Leverage, and Falling Exchange Supply Signal Risky Optimism

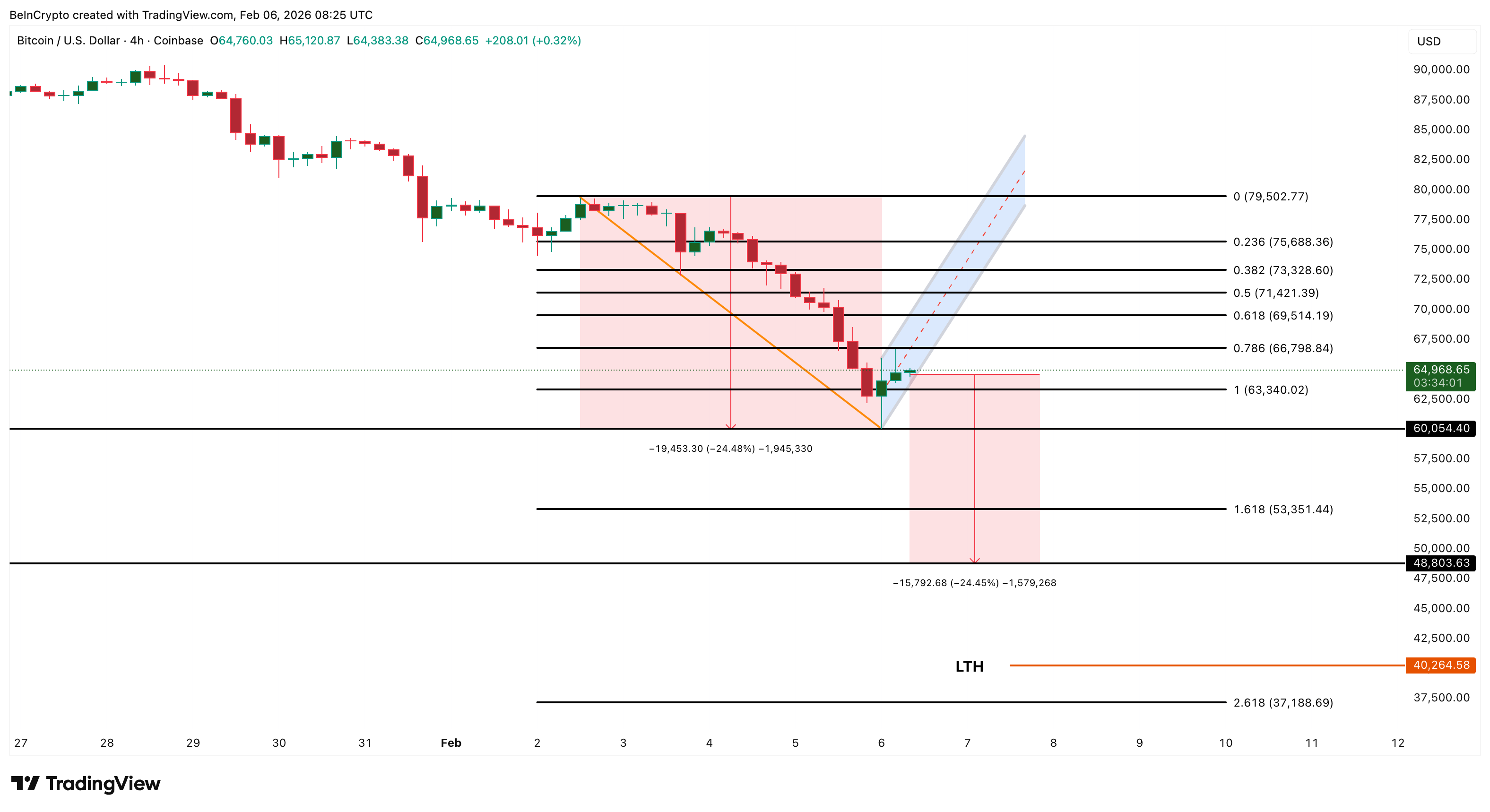

Bitcoin’s short-term risk is already visible on the 4-hour chart.

Sponsored

Sponsored

After the sharp sell-off toward $60,000, the Bitcoin price formed a rebound structure that now resembles a bear flag pattern. This setup typically appears when the price pauses after a strong drop before continuing lower. If the lower trendline breaks, the pattern points to a downside move of nearly 25%, targeting the $48,000–$49,000 zone.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Despite this technical warning, leverage is rising again.

Following the 11.18% rebound, more than $540 million in new long positions were built on Binance alone. This shows that traders are once again using heavy leverage, betting that the bottom is already in. Similar behavior has preceded major liquidations in past downturns.

At the same time, spot market behavior reflects a growing buy-the-dip mindset.

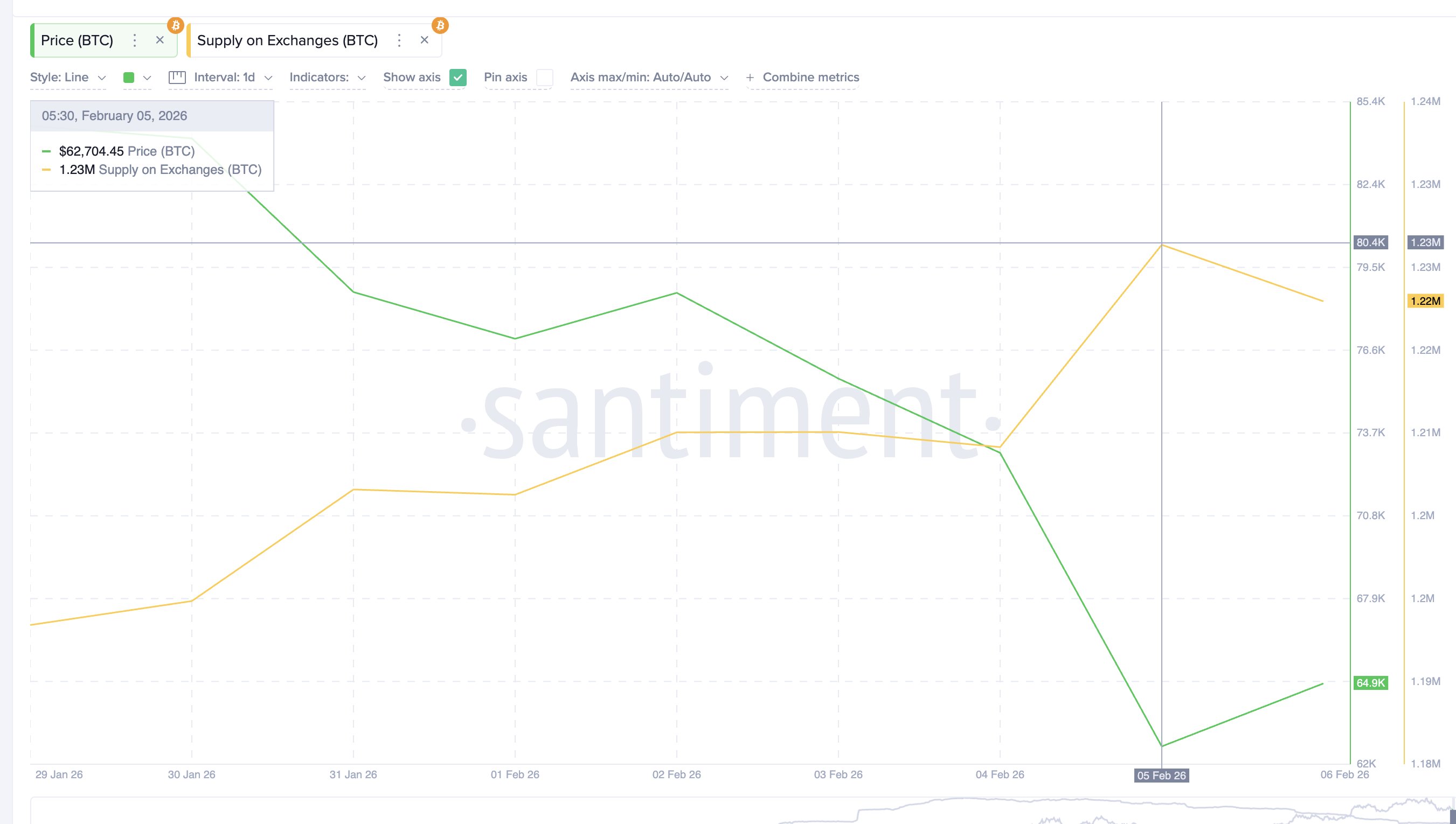

Bitcoin supply on exchanges fell from around 1.23 million BTC to 1.22 million BTC between February 5 and February 6. This decline suggests that traders are withdrawing coins, possibly for short-term holding, expecting higher prices.

Public figures and social media sentiment have also turned more optimistic, reinforcing the ‘Buy-the-Dip’ narrative.

Sponsored

Sponsored

Together, these signals possibly show misplaced confidence.

A fragile chart pattern, rising leverage, and early dip buying are forming at the same time. When optimism builds before structural weakness is resolved, downside risk often increases rather than fades.

Long-Term Holders Keep Selling as Realized Price Support Comes Into Focus

While short-term traders are turning bullish, long-term holders, the most stable folks, are moving in the opposite direction.

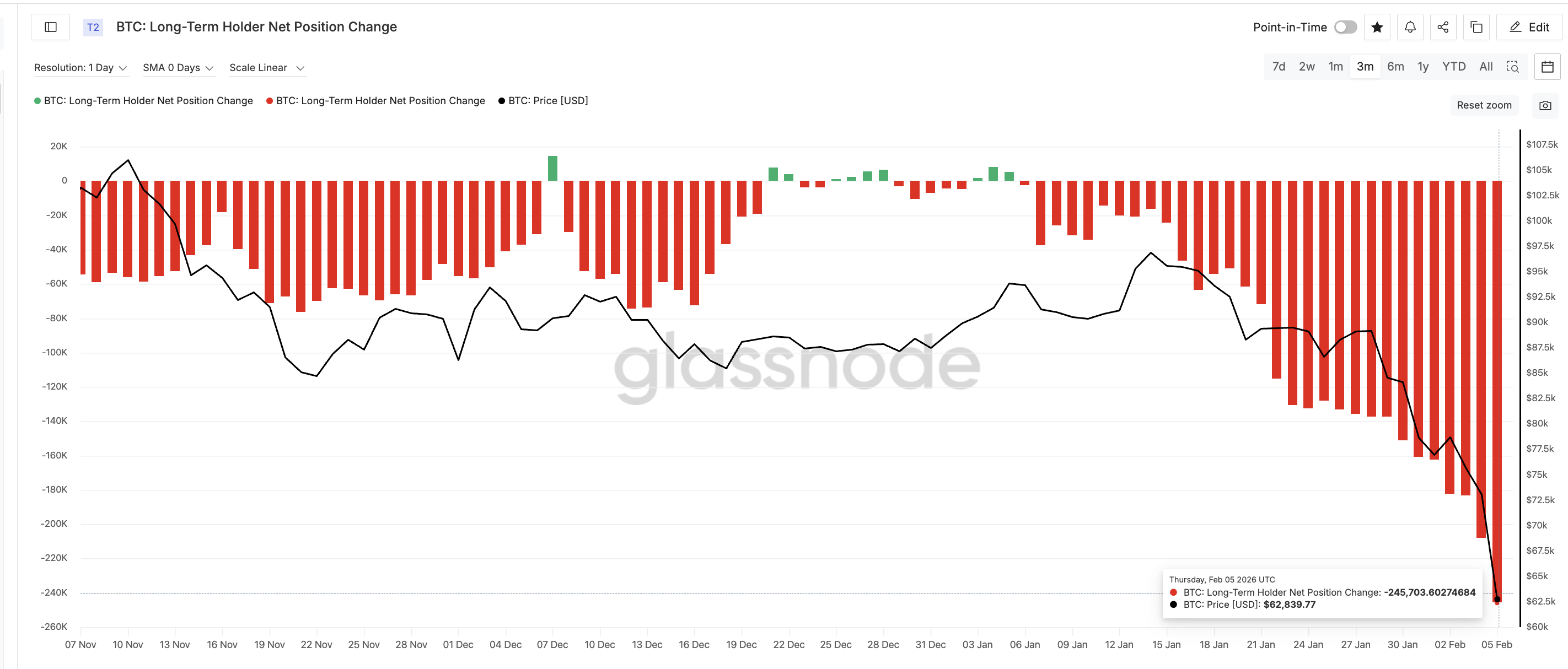

The Long-Term Holder Net Position Change, which tracks the 30-day supply shift among investors holding for more than one year, has remained deeply negative since early January. On January 6, this metric showed net selling of around 2,300 BTC. By February 5, that figure had worsened to roughly 246,000 BTC.

This represents a nearly 10,500% increase in long-term distribution in just one month. In simple terms, the most conviction-driven investors are still reducing exposure.

Sponsored

Sponsored

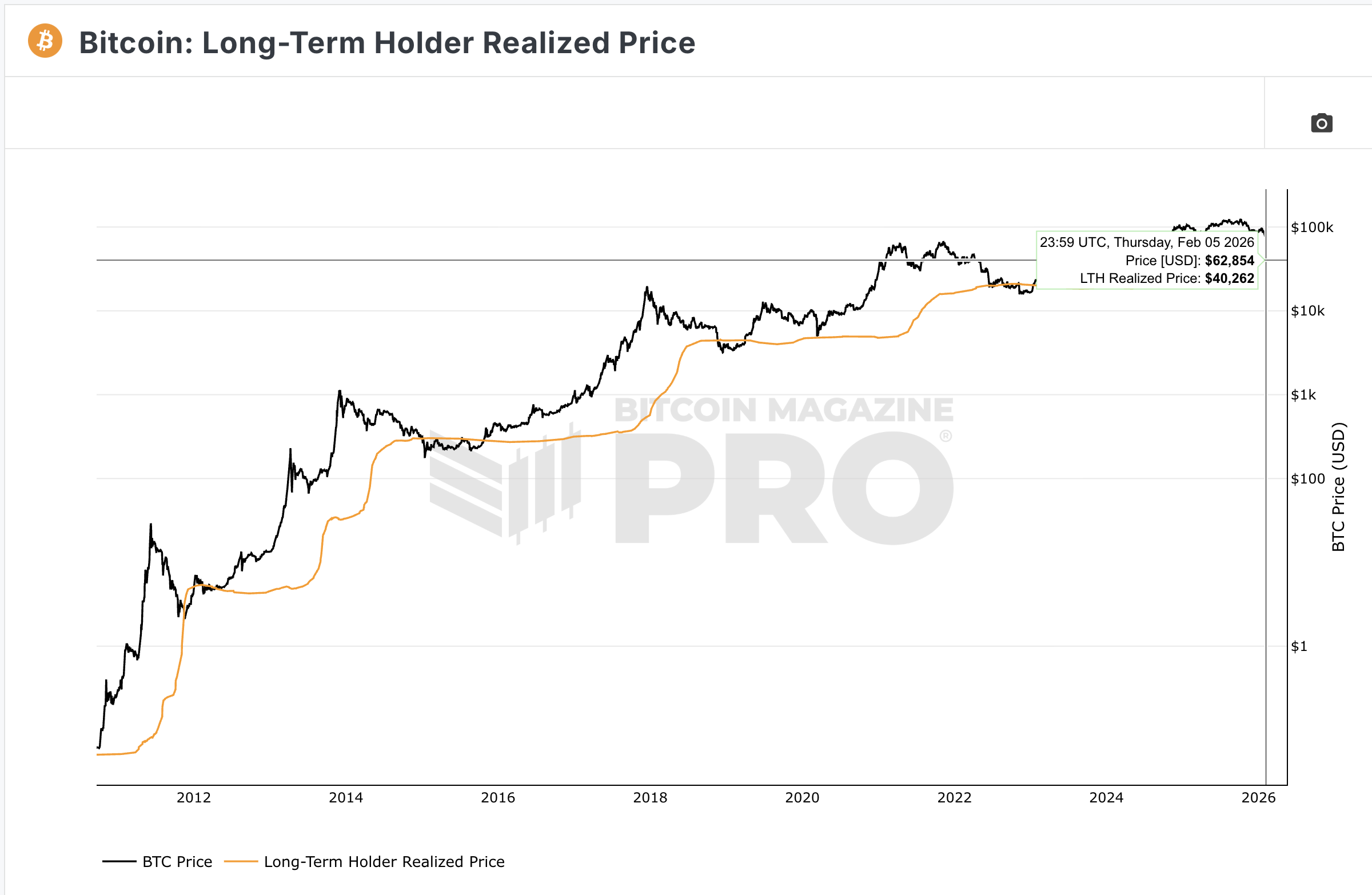

This behavior becomes more concerning when combined with the long-term holder realized price.

The realized price represents the average acquisition cost of coins held by long-term investors. Historically, when Bitcoin approaches or falls below this level, it signals deep market stress. In past cycles, major rallies only began after the price stabilized around this zone; however, not immediately.

Currently, the long-term holder realized price sits near $40,260.

As Bitcoin moves closer to this level, more long-term investors approach breakeven. If the price drops below it, many enter losses, often accelerating capitulation. This dynamic played out in late 2022 before the final bear market bottom formed.

So far, that reset has not happened.

Long-term holders are still selling, not accumulating. Their realized price is becoming a key downside magnet. This suggests the market has not completed its full deleveraging and redistribution phase.

Sponsored

Sponsored

Key Bitcoin Price Levels Show Why $48,000 and $40,000 Matter Next

All technical and on-chain signals now converge around a few critical price zones.

On the downside, the first major support sits near $53,350. A failure here would expose the $48,800 region, which aligns with the bear flag target and prior consolidation zones.

If $48,800 breaks, attention shifts to the long-term holder realized price near $40,260.

This zone represents the deepest structural support in the current cycle. A move into this region would indicate broad capitulation among long-term investors and confirm a deeper bear phase.

In a worst-case scenario, extended weakness could even open the door toward $37,180, based on longer-term projections and historical support clusters.

On the upside, Bitcoin must reclaim $69,510 on a sustained 4-hour closing basis to regain short-term credibility. A move above $73,320 would be required to invalidate the bearish pattern.

Until that happens, rallies remain vulnerable.

With leverage rebuilding, long-term holders still selling, and critical support levels approaching, the current rebound lacks structural confirmation. Under these conditions, buy-the-dip strategies remain exposed to sharp reversals rather than sustained upside.

Crypto World

BitMine (BMNR) faces $8 billion paper loss on ether holdings

BitMine Immersion Technologies (BMNR), the world’s largest Ethereum-focused treasury company is now sitting on nearly $8 billion in paper losses after ether fell below $2,000 on Thursday.

The firm, helmed by well-followed Wall Street bull Thomas Lee, accumulated 4.29 million ETH at an estimated cost of $16.4 billion, according to data from DropStab. That stash is now worth just $8.4 billion at current prices.

BMNR stock fell another 9% Thursday to its lowest point since the company pivoted to an Ethereum strategy. It has now tumbled 88% from its July peak, as investor concern grows on the firm’s ETH exposure and collapsing prices.

Despite the sharp drawdown, BitMine is under no immediate pressure to liquidate its assets. Unlike many other digital asset treasuries, the company used equity issuance — and not borrowed funds — to fund its ether purchase spree and other investments.

The firm also holds $538 million in cash and has begun generating income from staking more than 2.9 million ETH, according to its Monday update.

“There is no pressure to sell any ETH at these levels, because there are not debt covenants or other restrictions/provisions,” Thomas Lee said in a statement, “BitMine is in a position to ride out crypto volatility while earning recurring income and staking rewards.”

Crypto World

Metaplanet Doubles Down on Bitcoin as Stock Slumps

Metaplanet’s CEO Simon Gerovich doubled down on the company’s Bitcoin-first strategy as the wider crypto market suffered one of its harshest drawdowns since 2022.

“[T]here is no change to Metaplanet’s strategy. We will steadily continue to accumulate Bitcoin, expand revenue and prepare for the next phase of growth,” Gerovich said Friday on X, according to a machine translation of his post.

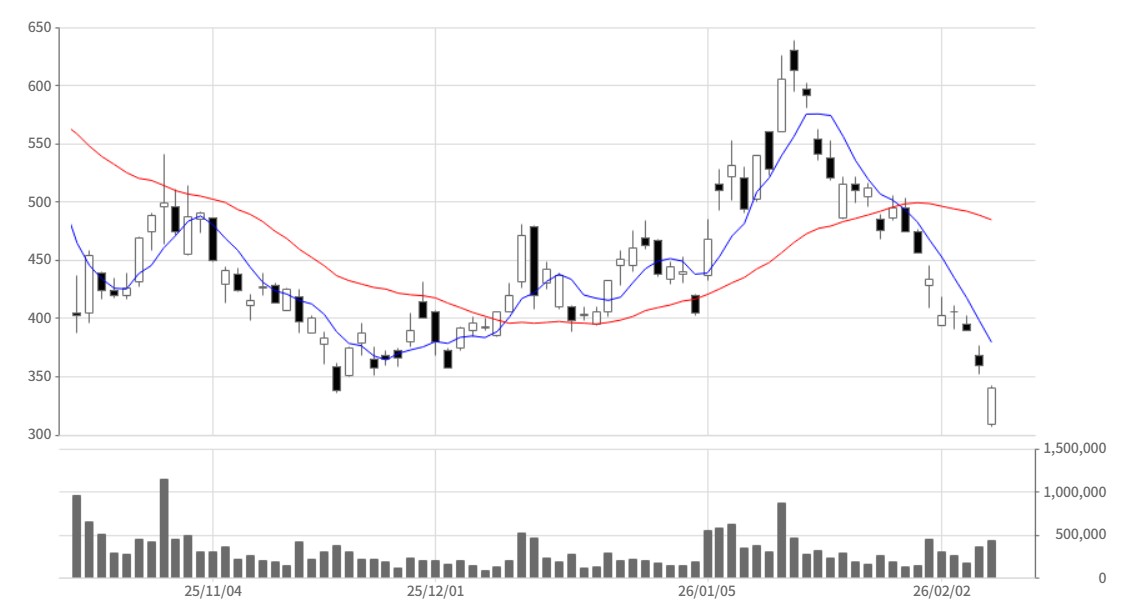

Metaplanet’s stock on the Tokyo Stock Exchange closed Friday down 5.56% at 340 yen (about $2.16).

The corporate crypto whale is ranked fourth among public Bitcoin (BTC) treasury companies behind Strategy, MARA holdings and Twenty One Capital. Metaplanet held 35,102 on Friday, according to BitcoinTreasuries.NET.

Related: Metaplanet approves $137M overseas raise to buy Bitcoin and repay debt

Bitcoin treasuries are sitting on unrealized losses

As of Friday, Bitcoin was down about 50% from its all-time high of $126,080 set in October, 2025. The Crypto Fear & Greed Index, a gauge of market sentiment, fell to its lowest reading since the Terra Luna crash in May 2022.

According to Coinglass, $1.844 billion of crypto long positions were liquidated on Thursday.

Corporate Bitcoin whales were also displaying losses on their balance sheets. Strategy, the largest public holder of Bitcoin, logged a $12.4 billion net loss in the fourth quarter of 2025, as Bitcoin dropped below the firm’s average purchase price of $76,052.

Strategy’s shares had dropped 17% on its Thursday call, even as the company said that its capital structure remained “stronger and more resilient” and that it had no major debt maturing until 2027.

Bitcoin treasuries are sitting on unrealized losses

Strategy’s latest disclosure showed it bought another 855 BTC on Monday, worth about $75 million.

Like Strategy, Metaplanet hasn’t signaled plans to unwind its exposure or sell its Bitcoin holdings. Metaplanet’s average cost for its Bitcoin holdings is $107,716, according to BitcoinTreasuries.NET.

Crypto treasuries based on assets other than Bitcoin are feeling the pressure as well. Ethereum treasury Bitmine held around 1.17 million Ether (ETH), while sitting on more than $8.25 billion in unrealized losses.

Big questions: Would Bitcoin survive a 10-year power outage?

Crypto World

JPMorgan (JPM) says bitcoin’s (BTC) lower volatility relative to gold might make it ‘more attractive’ in long term

Despite its long-standing reputation as “digital gold,” bitcoin has sharply diverged from traditional safe havens like gold and silver, but that might not be a bad thing for the digital asset’s future, according to JPMorgan analysts.

Gold surged more than 60% in 2025 on sustained central bank buying and flight-to-safety demand, while bitcoin has struggled into 2026, posting repeated monthly declines and underperforming major risk assets. JPMorgan’s report suggests this widening gap reflects bitcoin’s fading appeal as a hedge against market turmoil.

Digital assets “came under further pressure over the past week as risk assets and in particular tech came under pressure and as gold and silver, the other perceived hedges to a catastrophic scenario, saw a sharp correction,” analysts led by Nikolaos Panigirtzoglou wrote.

This selloff has also spilled over into spot bitcoin and ether exchange-traded funds (ETFs), signaling broad-based negative sentiment among institutional and retail investors, according to JPMorgan analysts. The bearish sentiment has also affected the stablecoin supply, which has contracted, the note said.

‘Catastrophic scenario’

However, JPMorgan still sees a longer-term case for bitcoin.

The report said gold has outperformed bitcoin since last October, but with sharply higher volatility, which makes bitcoin “even more attractive compared to gold.”

In theory, if bitcoin were to match the recent volatility seen in gold, the price of the digital asset would have to rise to near $266,000 to match the investments being made in gold, which, the analysts agree, is unlikely. What this low volatility does for bitcoin is that it highlights bitcoin’s future potential as a safe haven.

“This $266k volatility-adjusted comparison to gold is in our opinion an unrealistic target for this year, but it shows the upside potential over the long term once negative sentiment is reversed and once bitcoin is again perceived equally attractive to gold as a potential hedge to a catastrophic scenario,” the analysts wrote.

Read more: Bitcoin nears pre-election floor as ETF flows stall, Citi says

Crypto World

Bitcoin ETFs Record $434M Outflows Amid BTC Slide Below $70K

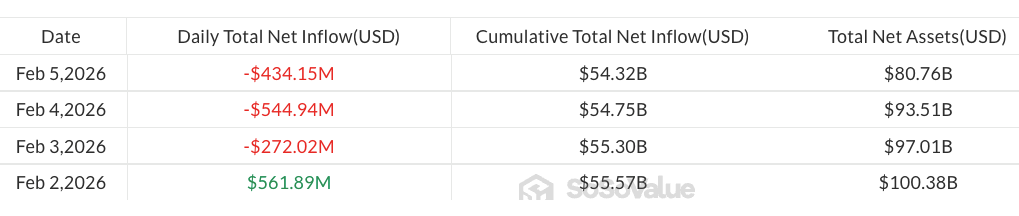

Bitcoin exchange-traded funds (ETFs) continued to see outflows on Thursday, shedding almost $1 billion over the past two days as debate grows over their potential impact on the market.

Data from SoSoValue shows that spot Bitcoin (BTC) ETFs recorded $434 million in net outflows on Thursday, following $545 million in redemptions the previous day.

Monday’s $561 million in inflows was not enough to offset losses, leaving net weekly outflows at about $690 million as of Friday morning.

The latest withdrawals came amid a sharp drop in Bitcoin’s price, which briefly touched $60,000 for the first time since October 2024, according to CoinGecko.

The community has struggled to identify clear catalysts for the downturn, and some have started to criticize Bitcoin ETFs even as analysts point to their resilience.

ETFs face “paper Bitcoin” criticism

The launch of spot Bitcoin ETFs in January 2024 was one of the most anticipated events in Bitcoin history, and was widely expected to accelerate BTC adoption through institutionalization.

Some analysts, however, argue that the institutionalization of Bitcoin via ETFs may have done more harm than good, claiming it contributed to undermining the asset’s scarcity — a key feature of Bitcoin’s fixed supply of 21 million coins.

“The same 1 BTC can now support an ETF unit, a future contract, a perpetual swap, an options delta, a broker loan, a structured note. All at once,” Bob Kendall, technical analyst and author of The Kendall Report, said in a Wednesday X post.

“That is not a market. That is a fractional reserve price system,” he added.

Kendall’s concerns echo those previously raised by his peers about Bitcoin ETFs becoming a tool for Wall Street to “trade against” Bitcoin.

Before crypto ETFs launched, Josef Tětek, a Bitcoin analyst at hardware wallet provider Trezor, warned that such products could enable the “creation of millions of unbacked Bitcoin,” potentially depressing the value of actual Bitcoin.

Related: BlackRock’s IBIT hits daily volume record of $10B amid Bitcoin crash

As of Friday, total assets in spot Bitcoin ETFs stood at about $81 billion, with cumulative net flows totaling $54.3 billion, according to SoSoValue.

Altcoin ETFs showed a mixed picture, with Ether (ETH) funds shedding $80.8 million in outflows, while XRP (XRP) and Solana (SOL) ETFs saw minor inflows at $4.8 million and $2.8 million, respectively.

Magazine: Bitcoin’s ‘miner exodus,’ UK bans some Coinbase crypto ads: Hodler’s Digest, Jan. 25 – 31

Crypto World

How to Build Event-Driven & Prediction-Ready Crypto Exchange Software?

When TradFi Launches Prediction Markets, Exchange Design Changes

Robinhood rolled out its YES/NO event contracts, and it wasn’t a quirky new trading format experiment. Traders aren’t just seeking exposure to prices, but also to outcomes.

“Will the Fed cut rates?”

“Will a Bitcoin ETF get approved?”

“Will a protocol ship its upgrade on time?”

These aren’t random casino questions but decision markets. And they’re far more intuitive, engaging, and scalable than yet another spot or perpetual pair.

For founders building cryptocurrency exchange software in 2026, this matters because price-based trading markets are getting saturated. Fees are compressing, UI differences barely make a difference, and liquidity is expensive to bootstrap.

Event-based trading opens a new frontier for cryptocurrency exchange development, including new markets, users, and revenue streams. Major market trading platforms already sensed the air and have already launched their event contracts trading platforms.

Major Crypto Trading Platforms & Their Prediction Market Strategies

| Platform | Status | The Engine (Provider) | Key Details & Differentiator |

|---|---|---|---|

| Coinbase | Live (Jan 2026) | Kalshi (Partnership) | Integrated Kalshi markets directly into the main app. Users trade election/econ events alongside their spot crypto portfolio. |

| Webull | Live | Kalshi (Partnership) | Focuses on “Hourlies” (e.g., Will S&P 500 be up at 2 PM?) and Sports. Targets active retail traders with short-term outcomes. |

| Crypto.com | Live (B2B) | CDNA (Own Exchange) | Instead of just a retail app, they use their CFTC-regulated exchange (CDNA) to power other platforms. Currently powering Truth Social’s “Truth Predict” and High Roller casino. |

| Gemini | Live (Dec 2025) | Gemini Titan (Own Exchange) | Built their own CFTC-licensed exchange (Gemini Titan). They frame predictions as a serious asset class (“Gemini Predictions”), not a game. |

| Kraken | Planned (2026) | Small Exchange (Acquisition) | Acquired Small Exchange (a regulated futures exchange) to build a native event contract product from scratch, aiming for lower fees than the Kalshi partners. |

| ForecastEx | Live | Interactive Brokers (Subsidiary) | A dedicated CFTC exchange for “Forecast Contracts.” Key Feature: They pay interest on the collateral you lock up in positions, attracting institutional hedging flow. |

| Jupiter | Live (Feb 2026) | Polymarket (Integration) | Became the first Solana UI to natively integrate Polymarket. Allows Solana users to trade Polymarket events without bridging to Polygon. |

| Hyperliquid | Live (HIP-4) | Native L1 (Outcome Trading) | Launched native “Outcome Trading” on their high-speed L1. Uses their massive perpetual liquidity to seed prediction markets, solving the “chicken and egg” liquidity problem. |

What Is YES/NO Event-Based Trading?

Event-based trading lets users trade outcomes rather than assets. Each market is framed as a simple YES/NO question tied to real-world or crypto-native events. Traders take positions based on conviction; the truth unfolds when the event concludes, and settlement is immediate.

Unlike traditional crypto exchange software, there’s no long-term holding, no complex leverage math, and no dependence on continuous price movement. The trade is binary, time-bound, and information-driven.

They are also called binary markets because they strip away all complexity and leave traders with only two possibilities. Unlike a stock or digital asset price, which can go up, down, or stay the same, a binary event contract has no middle ground. The event either happens (YES) or it doesn’t (NO).

How Event Contracts Trading Differs From Spot, Perpetual, and Prediction Markets?

| Dimension | Spot Trading | Perpetuals & Futures | Prediction Markets | Event-Based Trading |

|---|---|---|---|---|

| What users trade | Asset price | Leveraged price exposure | Forecasts | Event outcomes (YES/NO) |

| Complexity | Low | High (funding, liquidation) | Medium | Low |

| Time horizon | Open-ended | Continuous | Often long | Short, predefined |

| Risk profile | Capital-intensive | Liquidation risk | Thin liquidity | Capped, transparent |

| User intent | Hold or speculate | High-frequency speculation | Forecast accuracy | Decision-driven trading |

| Exchange advantage | Commoditized | Liquidity wars | Niche usage | High engagement, new markets |

For those planning retail-focused crypto exchange development, integrating these event tap trading games improves engagement and diversifies revenues, without adding leverage risk or launching tokens.

How Event-Driven Trading Fits Crypto Exchange Development?

Cryptocurrency exchange software is structurally built for event contracts trading. On-chain or hybrid trading software enables near-instantaneous settlement, global participation, and round-the-clock access, exactly what short-duration, outcome-based markets require. Like the spot or perpetual crypto markets, traders react to news and volatility in real time. Event-based trading only gives that behavior a cleaner, more explicit trading surface.

However, this model shifts the focus away from endless price charts toward outcome-driven markets with clear questions and resolution. Instead of asking whether BTC ticks up or down, cryptocurrency exchange software can list events such as ETF approvals, network upgrades, governance votes, or regulatory decisions. This way, YES/NO event trading merges into the existing exchanges and brings higher engagement, faster trader cycles, and diversified revenue.

Core Modules Required to Support Binary Event Contracts Trading At Scale

If you’re planning to integrate event contracts trading into cryptocurrency exchange software development, you must ensure to build and implement the following modules:

1. Event Lifecycle Engine

The backbone of the event contracts trading system.

- Event creation (question framing, expiry, resolution source)

- Status transitions: Market opens → the stakes on YES/NO are locked → event resolves → markets settle

- The event-trading system enforces non-negotiable technical locks once an event reaches its cutoff time.

Without deterministic lifecycle rules, outcome markets lose trust fast.

2. YES/NO Market & Pricing Logic

Each event spawns two tradable positions – YES and NO.

- People buy YES if they think it’ll happen.

- People buy NO if they think it won’t.

- The price moves based on how many people believe each side. If more people bet YES, it gets expensive, and if confidence drops, YES gets cheaper.

There’s no Bitcoin price here like in crypto exchange software. The price simply reflects belief and probability, not charts and candles.

3. Resolution & Oracle Layer

This layer is responsible for feeding the event contracts trading system with information about whether the event happened or not.

- The system checks a trusted source, which may be an official announcement, blockchain data, or a regulator notice.

- If needed, it checks more than one source.

- Only in rare cases do humans step in, and that action is recorded publicly.

If outcomes are disputed or distorted, users leave the cryptocurrency exchange software featuring event contracts trading instantly. This layer ensures the result is boring, obvious, and defensible.

4. Risk & Exposure Controls

These mechanisms impose limits that stop people or whales from breaking the market. The limits ensure the following:

- One user can’t bet unlimited money on one event.

- One event can’t grow so big that it threatens the platform.

- Some events are hidden or blocked in certain countries.

Unlike crypto spot and perpetual markets, event markets don’t require leverage but guardrails. They keep the platform defensible and prevent whale distortion.

5. Settlement and Payout Engine

This exchange software development module is responsible for closing the market and paying winners. This is what happens at the settlement stage:

- Event ends.

- Outcome is confirmed.

- Winners get credited automatically.

- Losers are done.

No positions are ongoing after the event ends. There’s no waiting and no funding fees. The settlement in these event-based tap trading models is fast, clean, and without any drag or mess.

6. Admin and Compliance Layer

For centralized and hybrid settings, this dashboard lets the admin control:

- Which events go live?

- Audit trails for resolution decisions.

- Region-based market visibility

For regulated prediction markets and event contracts trading platforms, this control panel is the regulators’ first choice.

How Founders Can Build event contracts trading Platform Using White Label Crypto Exchange Software?

As stated above, event-trading infrastructure fits perfectly within the crypto exchange software, as the trading logic remains the same. By opting white label crypto exchange software that supports derivatives trading, exchanges can build outcome-driven trading modules. Here’s the blueprint:

1. Start With an Event-Native Core

- Businesses can choose white label crypto exchange software that supports event lifecycles, not just asset pairs.

- Events must have:

- fixed start and end times

- immutable rules once live

- deterministic settlement logic

If the platform treats events like “just another trading pair,” walk away.

2. Define Events as Financial Contracts (Just like Robinhood)

- Each event must be:

- binary (YES / NO)

- objectively verifiable

- time-bounded

- Resolution sources must be locked before trading opens.

3. Plug Event Markets Into the Existing Matching Engine

- Reuse your order-matching or liquidity logic

- Replace price feeds with probability-driven pricing

- Ensure markets auto-freeze at expiry

At this stage, you leverage an existing white label crypto exchange infrastructure to build outcome markets that feel native and not bolted on.

4. Use a Controlled Oracle, Resolution, and Risk Limiting Layer

As stated above, these layers ensure the following:

- Pre-approved data sources only

- Multi-source validation, where possible

- Public audit trails for every resolution

- Cap exposure per user per event

- Max open interest per market

- Region-specific event visibility

5. Automate Settlement and Setup Admin and Compliance Layer

As said above, the settlement layer ensures fast and efficient settlement of the events and automates payouts. The administration and compliance layer, on the other hand, ensures that event workflows are supervised, immutable, and can be stopped anytime during an emergency.

How to Ensure that Event Contracts Trading Doesn’t Seem Like Gambling?

If you’re building event-based trading into your cryptocurrency exchange software development, this question will come up from partners, regulators, and even internal teams. The answer depends on how you design the product.

Robinhood didn’t present YES/NO events as entertainment or betting. It framed them as financial contracts linked to verifiable outcomes. Similarly, these are the factors that differentiate gambling platforms, unregulated prediction markets, and event-based trading.

| Aspect | Gambling Platforms | Unregulated Prediction Markets | Event-Based Trading |

|---|---|---|---|

| What users act on | Chance | Opinions | Known events |

| Outcome logic | Random / house-defined | Often subjective | Predefined & verifiable |

| Risk exposure | Open-ended | Unclear | Capped upfront |

| Settlement | House-controlled | Inconsistent | Rule-based & automatic |

| Product intent | Entertainment | Forecasting | Trading decisions |

If outcomes are random or house-controlled, regulators call it gambling. If outcomes are unclear or poorly governed, it lands in grey territory.

Event contracts trading avoids both if structured correctly.

Founders seeking regulatory defensability while building event trading into cryptocurrency exchange software development must ensure the following:

- Events are tied to objective, externally verifiable facts.

- Resolution rules are defined before trading starts.

- No post-expiry changes happen ever.

- Clear limits on exposure and participation are imposed.

- Full audit trails are maintained for event approval and settlement

Monetization Models Founders Can Actually Scale

- Per-event trading fees: This is usually a small and flat fee per YES/NO trade. It ensures predictable revenue without relying on leveraged volume.

- Event creation fees: The event trading enabling crypto exchange software charges projects, institutions, and DAOs for launching custom or premium events

- Liquidity incentives: The event contracts trading platform rewards early market makers on high-value events to ensure tight spreads and faster price discovery.

- Institutional & B2B event markets: The cryptocurrency exchange software featuring YES/NI event contracts may also charge funds, DAOs, enterprises, or research firms for private or permissioned events.

- Revenue diversification advantage: Earnings come from several events and engagements, not just raw trading volume, reducing dependence on fee wars.

Expand tradeable markets with YES/NO binary event trading

Closing: Build Before the Giants Dominate

Event contracts trading platforms aren’t for pure meme exchanges or platforms without risk or compliance maturity, but if you’re any of the following, you must start building event contracts trading infrastructure:

- Exchange operators seeking differentiation

- Web3 startups fighting fee compression

- Fintechs expanding into crypto trading

Many market giants have launched event-based trading as a core-primitive and not a side feature. Even if you’re leveraging white label crypto exchange software to build your event contracts trading platform, you must not treat it as a side feature. This is why Gemini, Kraken, Hyperliquid, and ForecastEx launched separate platforms for outcome-driven trading. This way, event-based exchanges look more like:

- Information markets

- Decision markets

- Outcome-based financial layers

Robinhood and other major event contracts trading platforms just validated a direction, and the rest of the founders can blaze the trail with product differentiation. They can also target new trader segments or create stronger engagement loops by partnering with an exchange software development company that specializes in digital asset trading infrastructures as well as prediction markets.

Antier delivers enterprise-grade white label crypto exchange software with native event-contract trading infrastructure, engineered for compliant, outcome-driven markets at scale.

Share your requirements today.

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business16 hours ago

Business16 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat23 hours ago

NewsBeat23 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World16 hours ago

Crypto World16 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World15 hours ago

Crypto World15 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

Bitcoin’s slide to $64,000 sparked a record $3.2B in realized losses, a capitulation event that surpassed even the Luna and FTX era market shocks, an on-chain analyst said.

Bitcoin’s slide to $64,000 sparked a record $3.2B in realized losses, a capitulation event that surpassed even the Luna and FTX era market shocks, an on-chain analyst said.