Is Mattel Inc. the undervalued gem savvy investors are overlooking? With its stock price near a 2025 low of $15.83, iconic brands like Barbie and Hot Wheels, and a robust $600 million buyback program, Mattel offers compelling value. As tariffs loom and Q1 2025 earnings approach (May 5), could this toy giant be poised for a breakout? Dive into our forecast for 2025–2029 and discover why now may be the perfect time to invest in Mattel.

Mattel Inc., headquartered in El Segundo, California, is a global leader in the toy and family entertainment industry. Founded in 1945, the company designs, manufactures, and markets a wide range of toys, games, and consumer products. Its portfolio includes iconic brands such as:

- Barbie: A flagship brand driving significant revenue through dolls, accessories, and media tie-ins.

- Hot Wheels: A leading brand in toy vehicles, popular among children and collectors.

- Fisher-Price: Focused on infant and preschool toys.

- American Girl: Premium dolls and storytelling experiences.

- Thomas & Friends, Monster High, and others, catering to diverse age groups.

Mattel’s operations span:

- Product Categories: Dolls, vehicles, infant/preschool toys, games, and action figures.

- Global Reach: Products are sold in over 150 countries through retail and e-commerce channels, with key partners like Walmart, Target, and Amazon.

- Content and Experiences: Mattel has expanded into media (e.g., Barbie movies, TV series) and live experiences to enhance brand engagement.

- Supply Chain: Manufacturing is primarily outsourced to third-party vendors in Asia, with design and marketing managed in-house.

Mattel Inc emphasizes sustainability and innovation, integrating digital play and eco-friendly materials to align with modern consumer trends. Its operational strategy focuses on optimizing its supply chain, reducing costs, and leveraging intellectual property (IP) for cross-platform growth (toys, films, and digital content).

Mattel’s financial performance in recent years reflects its recovery from past challenges and strategic transformation under CEO Ynon Kreiz. Below is an analysis based on the latest available data up to Q4 2024, as Q1 2025 results are scheduled for release on May 5, 2025.

Recent Financial Highlights (Full Year 2024, as reported in February 2025):

- Revenue: Approximately $5.4 billion, up 3% year-over-year, driven by strong Barbie and Hot Wheels sales, though tempered by softer demand in some categories.

- Net Income: $541.82 million, reflecting improved profitability from cost-cutting and higher-margin products.

- Operating Profit: Grew 10% year-over-year, despite elevated retail inventory levels.

- Earnings Per Share (EPS): Improved due to higher profits and share buybacks, with analysts noting optimism for 2025 guidance.

Key Financial Ratios (Based on 2024 Data):

- Gross Margin: ~48–50%, benefiting from cost optimization and premium product mix.

- Operating Margin: ~10–12%, up from prior years due to efficiency gains.

- Price-to-Earnings (P/E) Ratio: ~15–18x trailing earnings, competitive within the consumer discretionary sector.

- Debt-to-Equity Ratio: ~1.2, manageable but reflecting long-term debt from past restructuring efforts.

- Return on Equity (ROE): ~15%, indicating solid profitability relative to shareholder equity.

- Current Ratio: ~1.8, suggesting good liquidity to cover short-term obligations.

Mattel’s financial health has strengthened through its Optimizing for Profitable Growth program, which reduced costs by over $700 million since 2018. However, inflationary pressures and potential tariff impacts in 2025 could challenge margins, requiring vigilant cost management.

Mattel’s stock (NASDAQ: MAT) has faced volatility in 2025, influenced by broader market dynamics and company-specific factors:

- 52-Week Range: Hit a low of $15.83 in early April 2025, down from a high of ~$22 in 2024, reflecting an 18.18% decline over the past year.

- Recent Trends: As of April 24, 2025, MAT rose 3.5% following positive sentiment from rival Hasbro’s strong Q1 earnings, which beat expectations and boosted the toy sector. However, the stock remains under pressure from macroeconomic concerns, including Trump’s tariff announcements, which could raise costs for imported goods.

- Market Context: The S&P 500’s 10% year-to-date decline in 2025, driven by tariff-related recession fears, has weighed on consumer discretionary stocks like Mattel.

Analyst sentiment remains cautiously optimistic:

- Price Targets: UBS ($29), DA Davidson ($30), and CFRA ($26) raised targets in early 2025, citing Mattel’s earnings beat, buyback program, and 2025 guidance.

- Valuation: At ~$16–17, the stock trades at a discount to its historical P/E, appealing to value investors but vulnerable to trade policy risks.

Mattel operates in a competitive toy industry, facing both traditional and emerging challenges:

- Key Competitors:

- Hasbro (NASDAQ: HAS): A direct rival with brands like Nerf, Transformers, and Play-Doh. Hasbro’s recent 16% stock surge after strong Q1 2025 earnings and a renewed Disney licensing deal highlights its competitive strength.

- LEGO: A private company dominating construction toys, with strong brand loyalty and retail presence.

- Spin Master: Gaining traction with innovative toys like PAW Patrol and kinetic sand.

- Digital and Gaming Companies: Roblox, Nintendo, and mobile gaming platforms compete for children’s attention, pressuring traditional toy sales.

- Market Dynamics:

- Shift to Digital Play: Kids increasingly favor video games and digital experiences, forcing Mattel to invest in hybrid physical-digital toys and media content.

- Retail Consolidation: Dependence on major retailers like Walmart and Amazon exposes Mattel to pricing and inventory risks.

- Sustainability: Competitors like LEGO emphasize eco-friendly products, pushing Mattel to accelerate its sustainability initiatives.

- Mattel’s Advantages:

- Strong IP portfolio (Barbie, Hot Wheels) with cross-platform potential (films, games).

- Global distribution network and brand recognition.

- Strategic partnerships, such as licensing deals with Disney and Universal.

Mattel’s challenge is to maintain market share amid declining toy industry growth (~1–2% annually) and rising competition from digital entertainment. Its pivot to content (e.g., Barbie movie success in 2023) and digital play is critical to staying relevant.

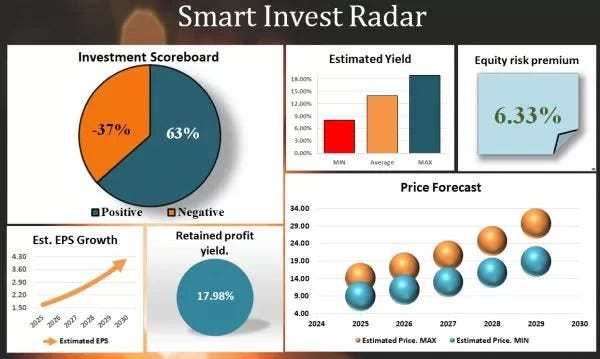

Over the past few years, the company has emerged from losses and is now demonstrating steady growth. Its Investment Scoreboard rating has improved significantly, rising from 48 to 63. While we previously only monitored the company, it now merits inclusion in our investment portfolios.

However, it does not currently pay dividends, so investors should expect returns primarily through capital appreciation. As a result, we recommend allocating a relatively small portion of the portfolio to these shares. The stock is an excellent choice for diversification.

2025–2029 Price Targets:

At the time of writing, the stock price is hovering near a local low, indicating that the shares are trading at a discount in the market. This presents an opportune moment for savvy investors to purchase shares and/or bolster their portfolio.

Investment Strategy:

- Value Investors: Consider accumulating shares at current levels (~$16–17) for long-term upside, given the discount to analyst targets and buyback support.

- Growth Investors: Monitor Mattel’s digital and content initiatives, which could drive revenue diversification.

- Risk-Averse Investors: Await clarity from the May 5, 2025, earnings report and tariff policy developments before entering, as volatility remains high.

Dividend: Mattel does not currently pay a dividend, having suspended it in 2017 to focus on debt reduction and restructuring. The company prioritizes reinvesting in growth and share repurchasing over resuming dividends in the near term.

Share Buyback: Mattel has an active buyback program, with $600 million authorized through 2024, reducing outstanding shares and boosting EPS. In 2024, management continued repurchasing shares, signaling confidence in long-term value. The buyback program is a key pillar of its capital allocation strategy, alongside investments in IP and digital expansion.

Recent developments have shaped Mattel’s outlook for 2025:

- Q1 2025 Earnings Announcement: Mattel is set to release Q1 2025 results on May 5, 2025, with a conference call to discuss performance and guidance. Investors anticipate insights into tariff impacts, holiday season projections, and progress on cost-saving initiatives. Strong guidance could boost the stock, while tariff-related cost pressures may dampen sentiment.

- Hasbro’s Positive Earnings Spillover: On April 24, 2025, Hasbro’s stock surged 16% after beating Q1 expectations and renewing its Disney licensing deal, lifting Mattel’s stock by 3.5%. This suggests investor confidence in the toy sector’s resilience, but Mattel must deliver comparable results to sustain gains.

- Tariff Concerns: President Trump’s proposed 10% baseline tariffs on all U.S. trading partners, announced in early April 2025, have sparked market volatility. As Mattel relies heavily on Asian manufacturing, higher import costs could squeeze margins unless offset by price increases or supply chain adjustments. Analysts estimate tariffs could reduce GDP growth by 1% in 2025, potentially curbing consumer spending on discretionary items like toys.

- Analyst Upgrades: UBS, DA Davidson, and CFRA upgraded Mattel’s stock in early 2025, citing its $

- Analyst Upgrades (Continued): $600 million buyback program, improved EPS estimates, and optimistic 2025 guidance. Price targets of $26-$30 reflect confidence in Mattel’s ability to navigate challenges, though the stock’s 52-week low of $15.83 indicates market skepticism.

- Inventory Levels: Slightly higher-than-ideal retail inventory at the end of 2024 could pressure Q1 2025 margins if not cleared efficiently. Mattel’s ability to manage inventory amid tariff uncertainties will be critical.

Mattel Inc. presents a compelling opportunity for investors in 2025. Trading at a discount (~$16–17), backed by strong brands and a strategic buyback program, the stock offers upside potential despite tariff risks. With Q1 earnings on May 5, 2025, looming, smart investors should monitor Mattel’s execution. For long-term value and diversification, Mattel is a toy stock worth playing with.

A cup of coffee from you for this excellent analysis.

Or Donate:

*Investment analysis involves scrutinizing over 50 different criteria to assess a company's ability to generate shareholder value. This comprehensive approach includes tracking revenue, profit, equity dynamics, dividend payments, cash flow, debt and financial management, stock price trends, bankruptcy risk, F-Score, and more. These metrics are consolidated into a straightforward Investment Scoreboard, which effectively helps predict future stock price movements.

**Use the price forecast to manage the risk of your investments.