Crypto World

MetaMask Integrates Ondo Finance for Tokenized US Stocks and ETF Trading

TLDR:

- MetaMask users can now trade 200+ tokenized US stocks and ETFs directly through their wallet interface.

- Trading operates 24/5 from Sunday 8:05 PM ET to Friday 7:59 PM ET with continuous token transfer capability.

- Integration uses USDC on Ethereum mainnet through MetaMask Swaps to acquire Ondo Global Markets tokens.

- Service excludes major regions including US, UK, Canada, China, and European Economic Area jurisdictions.

MetaMask has partnered with Ondo Finance to introduce tokenized US stocks, ETFs, and commodities directly within its self-custodial wallet.

Eligible users in supported non-US jurisdictions can now access over 200 tokenized securities, including major stocks and ETFs, without traditional brokerage accounts.

The integration went live on February 3, 2026, marking a shift in digital asset management infrastructure.

Bringing Traditional Securities to Self-Custodial Wallets

The collaboration between MetaMask and Ondo Global Markets represents a notable development in blockchain-based financial services.

Users can now purchase, hold, and trade tokenized versions of popular US securities such as Tesla, NVIDIA, Apple, Microsoft, and Amazon. The offering also includes commodity-tracking ETFs like SLV for silver, IAU for gold, and QQQ.

This integration was announced at the Ondo Global Summit in Fort Worth, Texas. The launch comes as tokenized real-world assets have grown to exceed $22 billion globally.

MetaMask users can access these securities through the MetaMask Swaps feature, using USDC on Ethereum mainnet to acquire Ondo Global Markets tokens.

Joe Lubin, Founder and CEO of Consensys, addressed the limitations of existing market infrastructure. “Access to US markets still runs through legacy rails. Brokerage accounts, fragmented apps, and rigid trading windows haven’t meaningfully evolved,” Lubin said.

He added that bringing Ondo’s tokenized US stocks and ETFs directly into MetaMask demonstrates an improved model where people can move between crypto and traditional assets without intermediaries.

The move extends MetaMask’s functionality beyond cryptocurrency management into broader financial markets. For Ondo Finance, the integration expands distribution through one of the most widely adopted self-custodial wallets worldwide.

Ian De Bode, President at Ondo Finance, explained that MetaMask serves as the platform where millions already manage on-chain assets, and the integration introduces an entirely new asset class into that familiar experience.

Extended Trading Hours and Portfolio Management Features

MetaMask’s implementation of Ondo Global Markets tokens offers trading availability 24 hours daily, five days weekly.

Trading operates from Sunday 8:05 PM ET through Friday 7:59 PM ET. Token transfers remain available continuously, operating on a 24/7 basis throughout the week.

The GM tokens function as blockchain-based assets designed to track underlying securities’ market values. Users conduct transactions subject to applicable terms and fees.

De Bode noted that the integration offers users access to tokenized US stocks and ETFs with pricing that reflects traditional brokerage markets, bringing the economics of platforms like Robinhood into a self-custodial, on-chain wallet.

The platform launches with access to more than 200 tokenized US stocks and ETFs on Ethereum mainnet. Users can manage these tokenized securities alongside cryptocurrency holdings within a single multichain account.

The integration maintains the MetaMask app experience without requiring external platforms or applications.

Portfolio management occurs entirely within the MetaMask Mobile interface for eligible users. The service is available today in supported jurisdictions outside the United States.

However, numerous regions face exclusions, including the European Economic Area, United Kingdom, Canada, China, Singapore, and various other territories.

The restrictions apply to users in Afghanistan, Algeria, Belarus, and multiple additional countries spanning different continents.

Crypto World

Bitcoin (BTC) mining stocks rallied in January despite softer BTC prices: JPMorgan

Bitcoin mining stocks kicked off 2026 on a strong note, buoyed by falling network competition and fresh enthusiasm around high-performance computing (HPC), Wall Street bank JPMorgan said in the Monday report.

The bank noted that the 14 U.S.-listed bitcoin miners and data center operators it tracks ended last month with a combined market capitalization of $60 billion, up 23% month over month, far outpacing the S&P 500’s 1% gain.

The rally was helped in part by news that Riot Platforms signed a HPC agreement with AMD at its 700-megawatt Rockdale facility, underscoring miners’ push to diversify beyond bitcoin.

Facing record-low margins after the 2024 halving, bitcoin miners are repositioning as digital infrastructure providers, repurposing power-dense mining sites into AI-ready data centers in search of steadier, long-term revenue.

At the same time, valuations continued to stretch. Analysts Reginald Smith and Charles Pearce said mining stocks were trading at roughly 150% of the four-year block reward opportunity at year-end, about three times the post-2022 average, highlighting a growing disconnect between miner valuations and bitcoin’s price.

Operationally, January brought relief. Winter storms across the U.S. forced widespread curtailments, dragging the average network hashrate down 6% month over month to 981 exahashes per second (EH/s), JPMorgan said. The hashrate briefly dipped as low as 700 EH/s during the month, while mining difficulty fell 5% from December and sat 10% below November’s all-time high.

The hashrate refers to the total combined computational power used to mine and process transactions on a proof-of-work blockchain, and is a proxy for competition in the industry and mining difficulty. It is measured in exahashes per second.

That drop in competition helped offset weaker bitcoin prices. The analysts estimated miners earned about $42,350 per EH/s in daily block reward revenue in January, up slightly from December, while gross profit jumped 24% to roughly $21,200 per EH/s as network efficiency improved. Still, profitability remains well below pre-halving levels, the bank noted.

Stock performance was broadly positive. Twelve of the 14 miners tracked by the bank outperformed bitcoin’s 4% decline in January, with IREN (IREN) rising 42% and Cango (CANG) falling 18%. Even after the rally, the group’s combined valuation remains about 15% below October 2025 highs.

Read more: Bitcoin miners HIVE, Bitfarm and Bitdeer downgraded as analyst warns on AI shift

Crypto World

HV-MTL Sets To Launch Its NFT Strategy This Month

HV-MTL, one of the leading non-fungible token collections in the global non-fungible token market, has skyrocketed in terms of trading sales volume and floor price value after Mr. Adam Weitsman announced that there would be an HV-MTL strategy token. In the past 24 hours, the HV-MTL NFT collection has recorded trading volume of 2.28 ETH, a +70% increase from the previous day.

HV-MTLs Jump +100% In The Past 24 Hrs

Data compiled by coingecko.com, an on-chain crypto and non-fungible token data explorer that tracks NFT collections from more than 20 blockchain networks, shows that the HV-MTLs NFT collection has recorded positive growth today. In the past 24 hours, the HV-MTL NFT collection has amassed trading volume of 2.28 ETH, a 73% increase from the previous day.

In response to today’s surge, the HV-MTL NFT collection has climbed by 118% over the past seven days, 119% over the past two weeks, and 229% over the past 30 days. The Hv-MTL NFT floor price has reacted vigorously today. On January 18, the HV-MTL NFT floor price jumped from 0.05 ETH to 0.07ETH. At the time of publication, the HV-MTL NFT floor price is 0.06 ETH.

Launched in 2022, HV-MTL (Heavy Metal) is an NFT collection featuring a limited edition of 30,000 unique NFTs representing a different mech with evolving traits, unlocked through seasonal gameplay and player action. These NFTs were originally launched by the Bored Ape creator Yuga Labs, then acquired by Faraway Games, and are now owned by entrepreneur Adam Weitsman, who purchased the IP from Faraway in late 2024 to further develop the collection and integrate it into the Otherside metaverse.

HV-MTL Strategy Token Is Coming Soon

In a January 18 blog post, Billionaire Adam Weitsman announced that his company has partnered with Token Works to launch its new token strategy. TokenWorks is the team behind the innovative NFT Strategy protocols like PunkStrategy and PudgyStrategy, which transform static NFTs into dynamic, cash-flowing assets using automated trading strategies and a self-reinforcing flywheel of fee collection, NFT buybacks, and token burns to create perpetual value and liquidity for NFT collections. The highly anticipated HV-MTL NFT strategy will be launched on January 26, 2026.

HV-MTLs are up 128% after @AdamWeitsman announced that there will be a HV-MTL strategy token with @token_works

The STR token isn’t even launched but you can already see that the token… works https://t.co/lMCPH08Uvf pic.twitter.com/y27qWnAfS4

— JBond (@jbondwagon) January 18, 2026

Related NFT News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Crypto World

Will ETH Inevitably Drop Below $2K This Month?

Ethereum has extended its corrective phase and is now trading at a technically decisive area, where higher-timeframe demand and market structure intersect. The price behaviour around this zone is critical in determining whether ETH stabilizes in a broader range or resumes its downside momentum.

Ethereum Price Analysis: The Daily Chart

On the daily timeframe, Ethereum has reached a crucial support zone around the $2K area, which aligns with a major prior yearly low and a historically significant demand region. This level has previously acted as a strong base for accumulation, and the market’s reaction here suggests growing sensitivity among participants.

The sharp sell-off into this zone reflects aggressive bearish momentum, but the absence of immediate continuation lower indicates that selling pressure may be temporarily exhausting. From a structural perspective, this area represents a decision point where sustained acceptance below it could open the door to deeper downside, while stabilization above it increases the probability of consolidation.

At this stage, the most likely outcome on the daily chart is a consolidation and range-bound phase as the market digests recent losses and awaits fresh demand or a clear macro catalyst.

ETH/USDT 4-Hour Chart

On the 4-hour timeframe, the price action shows a descending fluctuation while holding within the critical $2K support range. The market is compressing after the impulsive sell-off, with lower highs forming against relatively stable lows, a behaviour often seen near short-term exhaustion points.

This structure leaves room for a temporary bullish rebound, driven by short-covering or reactive demand, particularly after the steep downside move. However, this potential rebound should be viewed as corrective rather than trend-reversing.

The dominant scenario remains an expanded range environment, where Ethereum oscillates within a defined structure, bounded by $2K and $3K threhsolds, until meaningful demand enters the market or a new supply zone forms above, reasserting directional bias.

Sentiment Analysis

The Ethereum Coinbase Premium Index is currently deeply negative and has dropped to levels last seen around the previous year’s major market lows, signalling a clear bearish state in market sentiment. This persistent negative premium reflects sustained selling pressure from US-based investors, with Ethereum trading at a discount on Coinbase relative to offshore exchanges.

Historically, such conditions indicate weak spot demand from institutional and high-conviction buyers, reinforcing the broader corrective structure seen on price charts.

However, it is also important to note that in past cycles, Ethereum has consistently shifted into a bullish phase only after this indicator recovered and turned positive, signalling the return of strong spot demand. As long as the premium remains negative, downside risk and range continuation dominate, leaving the market in a bearish state.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

DeFi Wallets vs Centralized Wallets: Who Really Owns Your Crypto?

Imagine this: You wake up, check your exchange account, and… your funds are frozen. Or worse, gone. Meanwhile, a friend using a DeFi wallet hasn’t even touched a centralized platform—and they control every penny. This isn’t just luck. It’s the difference between true ownership and handing over your crypto to someone else.

So, who really owns your crypto?

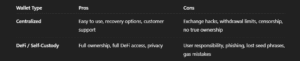

Centralized vs. DeFi Wallets: The Basics

Centralized Wallets live on platforms like Coinbase, Binance, or Kraken. You trust these companies to store your crypto safely. The perks? Convenience, easy password recovery if you forget it, and customer support. The catch? You don’t own your private keys. That means technically, you don’t own your crypto. Exchanges can freeze, lose, or even hack your funds.

DeFi Wallets, or self-custody wallets, put private keys in your hands. Popular examples include MetaMask, Argent, and Ledger hardware wallets. You hold the keys, you hold the power. Want to interact with DeFi protocols, stake, lend, or trade directly on-chain? These wallets are the only way to do it. The downside: if you lose your keys or fall for a phishing scam, there’s no one to call for help.

Private Keys: The Soul of Crypto Ownership

Your private key isn’t just a password—it’s your financial identity. Lose it, and the crypto is gone forever. Share it carelessly, and someone else can drain your wallet in minutes.

But innovations are making this safer:

-

Smart wallets automate transaction approvals and allow social recovery.

-

Multi-signature wallets (multisig) require multiple keys to approve transactions, reducing single-point-of-failure risks.

-

Hardware wallets keep keys offline, safe from phishing and malware.

The message? Ownership is powerful—but with power comes responsibility.

Risks & Tradeoffs

Here’s the hard truth: no wallet is 100% safe.

Think of it like this: centralized wallets are like renting an apartment—you’re protected in some ways, but ultimately someone else holds the keys. DeFi wallets are like owning a house—you have freedom, but the roof collapses on you if you neglect maintenance.

Think of it like this: centralized wallets are like renting an apartment—you’re protected in some ways, but ultimately someone else holds the keys. DeFi wallets are like owning a house—you have freedom, but the roof collapses on you if you neglect maintenance.

Use Cases: When Each Makes Sense

-

Beginners or small investors: Centralized wallets for simplicity and minimal risk of mistakes.

-

Active DeFi users/yield farmers: Self-custody wallets are a must. You can stake, lend, and earn directly without middlemen.

-

Traders across multiple chains: A hybrid approach works best—hardware wallets for storage, smart wallets for daily transactions.

The Future of Wallets

Wallets are evolving fast:

-

Smart contract wallets are making UX much smoother.

-

Account abstraction and gasless transactions are lowering entry barriers.

-

Wallets as identity layers are on the rise—your wallet could become your login, reputation, and financial footprint online.

Ownership isn’t just about money anymore—it’s about digital identity and freedom.

Conclusion: Ownership Matters

Crypto promises financial sovereignty. But that promise only exists if you actually control your assets. Centralized wallets offer convenience but at the cost of control. DeFi wallets put the responsibility—and the power—in your hands.

Start small. Experiment with a self-custody wallet. Learn how to store keys safely. Once you get the hang of it, you’ll understand why ownership isn’t just about holding crypto—it’s about being in charge of your financial destiny.

Bonus Tips: Don’t Lose Your Crypto

-

Store your seed phrase offline, never online.

-

Use hardware wallets for large amounts.

-

Enable multisig for team or family wallets.

-

Double-check contracts before approving transactions.

-

Keep a small testing wallet for DeFi experiments.

REQUEST AN ARTICLE

Crypto World

Bitcoin slides toward $70,000 as on-chain data flags bear market and traders bet Fed holds in April: Asia Morning Briefing

Good Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

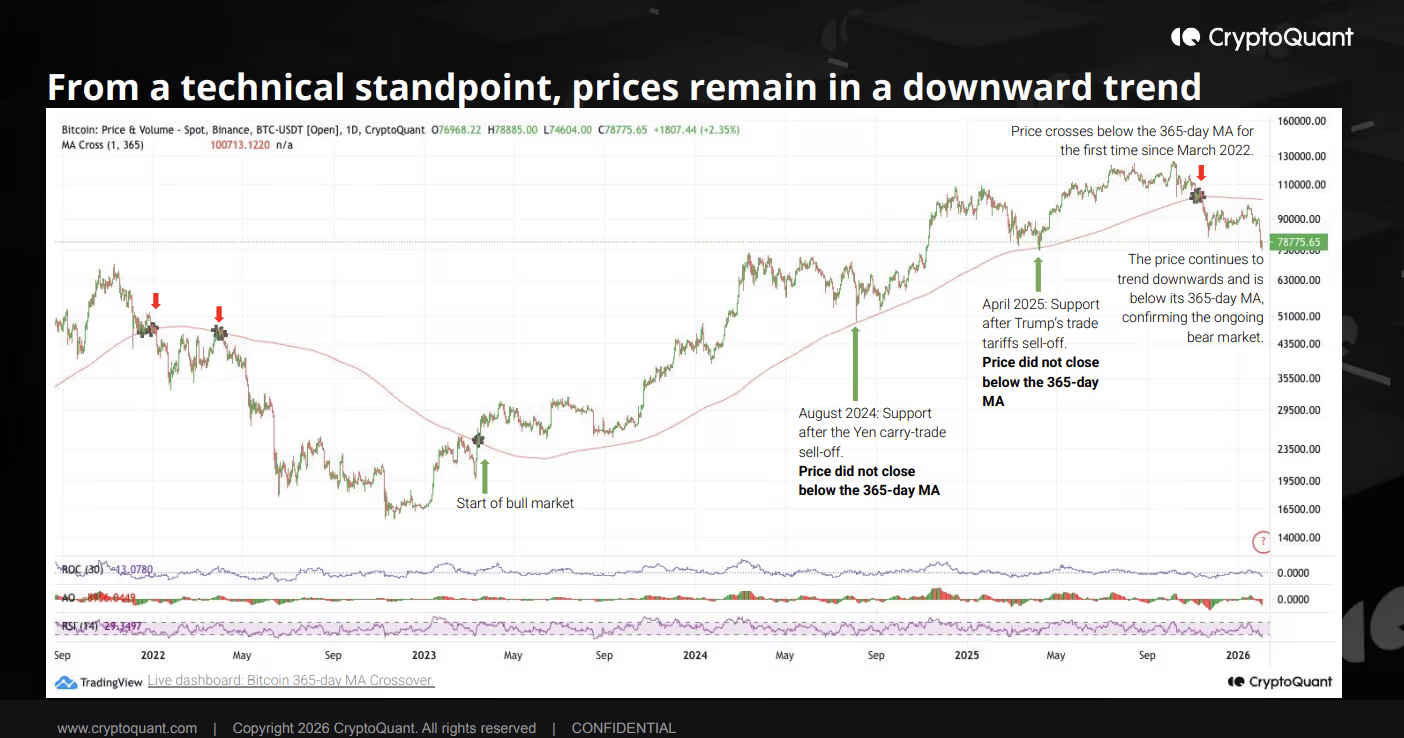

Bitcoin is entering the Asian trading day with on-chain data flashing full bear-market signals, as prices hover in the mid-$70,000s and global equity markets continue to search for direction.

CryptoQuant’s latest weekly report frames the weakness as structural rather than cyclical, with its Bull Score Index sitting at zero while bitcoin trades far below its October peak. The report argues the market is no longer digesting gains but operating with a thinner buyer base and tightening liquidity.

Glassnode data reinforces that picture, pointing to weak spot volumes and a demand vacuum where selling pressure is not being met with sustained absorption. In effect, the issue is less panic than participation.

Institutional flows underline the shift. U.S. spot bitcoin ETFs, which were net accumulators at this time last year, have flipped into net sellers, creating a year over year demand gap measured in tens of thousands of bitcoin.

At the same time, the Coinbase premium has remained negative since October, signaling that U.S. investors are not meaningfully stepping in despite lower prices. Historically, sustained bull phases have coincided with strong U.S. spot demand. That engine is currently idling.

Liquidity conditions are also tightening beneath the surface. Stablecoin expansion, which typically fuels risk appetite and trading activity, has stalled, with USDT market cap growth turning negative for the first time since 2023.

Longer-term apparent demand growth has likewise collapsed from last year’s highs, suggesting this is not merely leverage being flushed but participation itself fading. Technically, bitcoin remains below its 365-day moving average, with on-chain valuation bands clustering major support in the $70,000 to $60,000 corridor.

Overlaying this is a macro backdrop where bitcoin is increasingly behaving like high-beta software rather than digital gold. Prediction markets show traders still leaning heavily toward no change at the Federal Reserve’s April meeting, with only modest expectations for a June rate cut. That hesitancy limits the prospect of near term liquidity relief.

The policy narrative is further complicated by politics. President Donald Trump recently spoke to the press about his Fed nominee Kevin Warsh and said during an interview with NBC News a Fed chair who wanted to raise rates “would not have gotten the job,” a remark that tempers earlier optimism about central bank independence.

For Asia, the result is a market defined less by shock than by absence, where bounces remain possible, but conviction remains thin.

Market Movement

BTC: Bitcoin drifted lower into the mid $70,000s after briefly testing support, with rebounds fading quickly as spot demand remained thin and tech stocks stayed under pressure.

ETH: Ether hovered just above the low $2,000s, struggling to build momentum as broader risk sentiment softened and flows remained muted across major exchanges.

Gold: Gold rebounded toward the $5,000 to $5,100 range, extending a volatile recovery driven by safe-haven buying after U.S.–Iran tensions flared and softer private payroll data offset mixed economic signals while traders reassessed the Fed outlook under Trump’s new chair pick.

Nikkei 225: Japan’s Nikkei 225 edged lower by roughly 0.3% as chip and tech heavyweights tracked Wall Street’s sell-off, though broader Japanese equities remained relatively resilient compared with regional peers.

Elsewhere in Crypto:

Crypto World

Asia Market Open: Bitcoin Tumbles To $72K As Asian Equities Track Global Tech Slump

Bitcoin tumbled 6% to $72,000 on Thursday as the sell-off in global tech spilled into Asia, keeping traders defensive across crypto and equities after another bruising session on Wall Street.

Fresh liquidation data showed forced selling accelerated as prices slid. CoinGlass data showed $627.96M in liquidations over the past 24 hours, with $497.10M from longs and $130.86M from shorts.

Bitcoin liquidations led at $255.4M, followed by Ether at $181.75M and Solana at $70.84M, with another $24.09M spread across smaller tokens.

Market snapshot

- Bitcoin: $72,209, down 5.1%

- Ether: $2,137, down 5.3%

- XRP: $1.47, down 7.2%

- Total crypto market cap: $2.53 trillion, down 4.4%

Asian Equities Slide As Tech Jitters Weigh On Risk Appetite

In Asia, markets opened on the back foot. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1%, South Korea’s Kospi dropped 1.7% and Taiwan’s benchmark lost 0.7%. China’s CSI300 slid 0.7% and Hong Kong’s Hang Seng eased 0.8%, with Japan’s Nikkei flat.

Sentiment stayed fragile on AI spending fears after Alphabet flagged $175B to $185B in capital expenditure, sending its shares swinging before settling 0.4% lower after-hours.

Samer Hasn, senior market analyst at XS.com, said the crypto asset is currently suffering from weak overall sentiment in the broader stock market amid the battle for the AI throne and tumbling liquidity.

“Futures traders are retreating further, and spot ETF flows remain unsustainable. Meanwhile, the risk of a broader all-out war in the Middle East, combined with the anticipation of new economic data and corporate earnings, is keeping traders on edge,” he said.

Market Focus Shifts To Earnings And Delayed Jobs Data

Wall Street ended lower on Wednesday as investors questioned pricey valuations and whether the AI rally has started to peak. The S&P 500 fell 0.51%, the Nasdaq dropped 1.51% and the Dow rose 0.53% to 49,501.30.

Chip stocks drove much of the damage. Advanced Micro Devices tumbled 17% after forecasting quarterly revenue that disappointed investors, Nvidia slid 3.4%, and the PHLX semiconductor index sank 4.4%, while Palantir fell nearly 12% after reversing the prior day’s surge.

Even so, futures tried to stabilize as traders weighed the implications of heavier equipment spending. Nvidia rose almost 2% after the bell, lifting Nasdaq futures 0.6% and S&P 500 futures 0.4%, as investors rotated away from expensive growth names and into value and cyclicals, with the S&P 500 value index extending gains for a fifth straight session.

Macro signals stayed in motion. The January US jobs report was pushed to Feb. 11 after a four-day government shutdown. ADP data showed weaker private payroll growth, with job losses in services and manufacturing.

In commodities, oil fell after two days of gains as the US and Iran agreed to hold talks in Oman on Friday. West Texas Intermediate slipped 1.4% to $64.23 a barrel and Brent also fell 1.4% to $68.47, while gold and silver ticked higher in early trade after last Friday’s sharp drop.

The post Asia Market Open: Bitcoin Tumbles To $72K As Asian Equities Track Global Tech Slump appeared first on Cryptonews.

Crypto World

CFTC Withdraws Proposal to Ban Sports Prediction Markets

The US Commodity Futures Trading Commission moved to reverse a Biden-era rule proposal that would have barred sports, politics and war-related prediction markets, signaling a recalibration under the agency’s current leadership. CFTC Chair Mike Selig announced on Wednesday that the agency is withdrawing the 2024 notice of proposed rulemaking that sought to ban event contracts tied to public-interest events, and that the commission does not plan to issue final rules on that proposal. Instead, the CFTC intends to pursue a new rulemaking anchored in a rational interpretation of the Commodity Exchange Act, aiming to balance investor protections with responsible innovation in derivatives markets. This shift comes as prediction-market platforms—widely used for forecasting events—navigate a patchwork of state enforcement actions and ongoing regulatory debates over how they should be treated within the U.S. financial framework. The move also echoes broader regulatory conversations about how digital-asset markets and related products should be supervised.

Key takeaways

- The CFTC formally withdrew the 2024 notice of proposed rulemaking that would have banned sports, political and other event contracts, labeling them as contrary to the public interest.

- Chair Mike Selig stated the agency will pursue a new rulemaking grounded in the Commodity Exchange Act to foster responsible innovation in derivatives markets aligned with congressional intent.

- The withdrawal signals a pivot away from a broader ban towards a more measured, standards-based approach to event contracts and related platforms.

- Prediction-market operators like Polymarket and Kalshi have faced state-level enforcement actions, with platforms arguing they are regulated by the CFTC and not unlicensed gambling.

- The agency also pulled a September staff letter that warned regulated entities to prepare for litigation and to maintain robust risk management in facilitating sports-related event contracts.

Sentiment: Neutral

Market context: The development arrives amid intensifying regulatory scrutiny of crypto-related products and event-driven contracts, while regulators explore a coordinated approach to oversight across asset classes. The shift follows a broader debate about how prediction markets fit within the U.S. securities and commodities frameworks and reflects ongoing conversations about how innovation can coexist with investor protection in a evolving market landscape.

Why it matters

The decision to withdraw the proposed prohibition on event contracts signals a more deliberate, regulator-led path forward for a sector that earned rapid traction in the crypto and fintech space. By signaling a move toward a rulemaking grounded in the Commodity Exchange Act, the commission acknowledges the complexity of product design, consumer risk, and market dynamics in prediction markets. For developers and operators, this could translate into a clearer, more predictable regulatory runway—albeit one that may still constrain certain product features or market access in the future.

Prediction-market platforms have been at the center of a legal and political struggle. Polymarket and Kalshi pressed ahead with contracts tied to a wide range of events, including sports outcomes, election results, and other timely topics. States such as Nevada have pursued enforcement actions, arguing that such contracts amount to unlicensed gambling, while platforms contend they are regulated under the CFTC. The tension highlights a broader policy question: should prediction markets be treated primarily as financial derivatives subject to federal oversight, or as a separate class of information markets with distinct rules? The withdrawal of the rulemaking proposal pushes regulators to develop a more nuanced framework that could determine whether such markets persist, mature, or evolve in structure and scope.

Moreover, the withdrawal of the September staff letter—issued amid a period of uncertainty and ahead of a potential government slowdown—suggests a period of recalibration in how the CFTC communicates expectations to market participants. The letter warned that firms should prepare for litigation and emphasize contingency planning, disclosures, and risk-management policies. While the agency framed the advisory as a reminder of litigation considerations, Selig noted it had unintentionally created confusion. The unfurling of a dedicated event-contract rulemaking implies a more deliberate approach to both enforcement and guidance as the market evolves.

The agency’s action aligns with broader regulatory shifts described in related reporting about coordination among U.S. market regulators on crypto oversight and a continuing reassessment of how innovation fits within established statutory authority. As the crypto ecosystem expands to include more complex financial instruments and cross-border activity, policymakers are weighing how to maintain investor protections without stifling beneficial market developments. The CFTC’s pivot—away from an outright ban toward a structured rulemaking—reflects a central tension in the regulatory landscape: balancing the allure of predictive- and event-based markets with the need for clarity, compliance, and consumer safeguards.

For stakeholders, the immediate implication is a clearer signal that the federal framework may offer a path for legitimate, regulated event markets to operate under defined standards. That does not guarantee-permanent permission for every product, but it increases the likelihood of formal guidance and a transparent process for evaluating individual contracts, platforms, and business models. The reshaped trajectory could influence funding, market participation, and strategic development for firms that have built significant user bases around event-focused trading, including those exploring tokenized and cross-chain versions of prediction markets.

In the broader context, the withdrawal reinforces the notion that the regulatory environment remains dynamic. While some participants seek quicker, broader access to innovative products, the evolving stance of U.S. regulators underscores the importance of compliance-readiness, robust risk controls, and an ability to adapt to changing rules. As the CFTC moves toward a new framework, market participants will be watching for forthcoming rulemaking notices, public-comment windows, and how state and federal authorities coordinate their enforcement and supervisory actions in this rapidly changing space.

What to watch next

- A formal rulemaking notice on event contracts under the Commodity Exchange Act, outlining permissible structures and registration requirements.

- Public-comment period and industry feedback shaping the final framework for prediction markets.

- Regulatory updates or clarifications regarding specific platforms (e.g., Polymarket, Kalshi) and their compliance posture with federal law.

- Any new guidance or reporting requirements from the CFTC related to sports and political event contracts.

Sources & verification

- CFTC press release: Withdrawal of 2024 notice of proposed rulemaking (9179-26).

- Chair Mike Selig’s public remarks and official communications (X post).

- Related reporting on the CFTC chair transition and policy discussions.

- State actions and platform responses regarding sports event contracts (e.g., Nevada actions; Coinbase/Crypto.com references in coverage).

Regulatory recalibration reshapes prediction markets

The renewal of this policy path begins with a recognition that the original 2024 proposal—seen by supporters as a bold move to curb what some labeled speculative gambling—did not reflect a holistic view of how event-driven contracts function within modern markets. By withdrawing the proposal, the commission opens space for a more measured, evidence-based approach to rulemaking. The new process will be anchored in the Commodity Exchange Act and guided by congressional intent to enable responsible innovation in derivatives markets, while preserving critical investor protections.

As stated in the agency’s communications, the commission intends to frame future rules through a rational interpretation of the existing statute, rather than relying on broad prohibitions. That nuance matters: it signals a potential for future, carefully scoped products that could be offered under a clear regulatory license regime, with defined risk disclosures, dispute-resolution mechanisms, and capital requirements. For participants who rely on prediction markets for price discovery, hedging, or information gathering, clearer federal guidance could improve certainty and reduce litigation risk, even as particular contract designs and market access criteria are vetted by regulators.

The ongoing dialogue between federal regulators, state authorities, and market participants underscores a broader theme in the cryptocurrency and derivatives space: innovation is not inherently at odds with oversight, but it requires a governance framework that is adaptive, transparent, and aligned with statutory authority. The CFTC’s decision to pivot away from an outright ban toward a formal rulemaking process reflects this balance-seeking impulse. It also positions the agency to address a spectrum of market models—from traditional exchange-based contracts to novel, tokenized formats—within a single, coherent regulatory architecture.

https://platform.twitter.com/widgets.js

Crypto World

How the 2026 “affiliate program” can help XRP and BTC users achieve millions in revenue

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As volatility grows in 2026, XRP and BTC holders turn to IO DeFi’s affiliate program for structured, stable income.

Summary

- As crypto volatility rises in 2026, XRP and BTC holders turn to IO DeFi’s affiliate model for market-neutral income.

- IO DeFi gains attention as XRP and BTC users seek stable, rules-based returns without trading or new capital.

- With price-only profits fading, IO DeFi’s affiliate program offers XRP and BTC holders a zero-investment income path.

Amidst the high volatility of the crypto market, the profit model relying solely on price increases is facing increasing uncertainty. For XRP and BTC holders, how to generate continuous returns on existing assets without frequent trading or blindly adding to positions has become a crucial issue in 2026.

In this context, the Affiliate Program launched by IO DeFi has gradually come into the market’s view. This program does not focus on short-term market predictions, but rather uses clear rules and long-term incentive mechanisms to help users build a relatively stable and sustainable income path, unaffected by market fluctuations. This shift from simply holding crypto to structured income generation is offering new possibilities for XRP and BTC users.

How to achieve long-term returns with zero investment through the IO DeFi affiliate program

In a market environment of increasing uncertainty, some XRP and BTC holders are starting to focus on a different approach than additional investment or frequent trading: accumulating long-term returns through a rules-based mechanism without investing additional funds. The IO DeFi Affiliate Program is designed based on this idea.

Step 1: Create an account and start earnings with zero investment

Visit the IO DeFi website.

Users can start participating simply by registering with their email address.

New users will receive a $15 platform reward upon registration.

This reward requires no additional investment and can be used to experience the platform’s yield mechanism, providing a foundation for future participation.

Step 2: Establish a long-term revenue source using an exclusive invitation link

After account creation, the system will generate a unique invitation link for each user. By sharing this link to invite friends to join, users can participate in the affiliate revenue sharing mechanism.

The IO DeFi Alliance plans to use a clear two-tier reward structure:

Direct Referral Reward: 3%

When a friend who is invited purchases a contract, the one who invited them will receive a 3% reward based on the contract amount.

Indirect Referral Reward: 2%

If the invited friend then invites other users to participate, the first person will still receive a 2% reward.

Example 1: Direct Referral (3% Reward)

Friend A is invited to join IO DeFi.

For every $1,000 contract A purchases

→ the one who invited them immediately receives a $30 reward.

For every $10,000 contract A purchases

→ The first person immediately receives a $300 reward.

Key Points:

A receives a reward for every purchase A makes;

Receive the reward for every purchase made, with no limit on the number of times A makes a purchase.

Example 2: Indirect Referral (2% Reward)

Fiend A then invited another friend B to join IO DeFi.

B: For every $1,000 contract purchased,

The one who invited friend A will receive a $20 bonus.

B: For every $10,000 contract purchased,

They receive a $200 bonus.

Same rule:

B: Receive a bonus for every purchase, and the bonus accumulates.

Example 3: The Cumulative Effect of Multiple Purchases

A: Purchases 10 $1,000 contracts this month

→ Receive: 30 × 10 = $300

B: Purchases 5 $10,000 contracts this month

→ Receive: 200 × 5 = $1,000

These two users alone earned $1,300 in bonuses in one month.

Example 4: Why Teams Earn Faster Than Individuals

Participation alone → Earnings come from a single source.

Inviting 10 people → 10 earning lines operate simultaneously.

These 10 people then invite even more people → Earnings continue to amplify.

Earning money alone relies on time,

Earning money as a group relies on structure.

In addition to earning rewards through the affiliate program, IO DeFi offers another way to generate income: purchasing yield contracts.

1. Users can choose yield contracts with different periods and amounts, ranging from $100 to $100,000, according to their needs.

2. After selecting a contract, pay the corresponding contract fee to activate it.

3. Once activated, the contract generates stable daily returns during its term, which are automatically credited to the user’s account balance.

4. The account balance can be withdrawn at any time or used to purchase higher-value contracts for even greater returns.

The core of the IO DeFi affiliate program is:

Every purchase earns rewards.

The more someone invites people and the larger their team, the faster their returns grow, with no upper limit.

All affiliate program rewards are automatically settled and credited to an account balance in real time:

Rewards arrive automatically, requiring no manual intervention.

Users can choose to withdraw at any time.

Or, they can continue to use their earnings for platform participation, further amplifying their returns.

This mechanism allows users to gradually accumulate sustainable returns through long-term, rule-based participation, unaffected by short-term market fluctuations.

Summary

IO DeFi is a UK-based cloud mining and digital asset yield platform. The platform operates within relevant international compliance frameworks, emphasizing transparent rules, traceable processes, and long-term stable operation.

Since 2016, IO DeFi’s services have covered approximately 180 countries and regions worldwide, accumulating over 3 million users and gradually forming a mature global operating system.

For more information, visit the official website or download the mobile app.

Official email: [email protected]

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Hong Kong Investors Would Double Fund Allocations With Tokenized Products: Aptos Labs

A survey shows strong demand for faster settlement, 24/7 access, and secondary trading.

Crypto World

Kyle Samani Exits Multicoin in Bittersweet Moment to Pursue New Tech

Kyle Samani, the co-founder and long-time managing partner of Multicoin Capital, is stepping down after a decade shaping crypto investment at the firm. In a Wednesday post, he described the move as bittersweet and said he plans to take time off to explore new areas of technology, including artificial intelligence and robotics. The announcement comes as Multicoin continues to navigate a regulatory and market backdrop that has intensified scrutiny of crypto, while the firm’s public stance on the sector remains resolute: crypto is at a pivotal moment, with potential for widespread adoption as clarity and infrastructure mature.

Key takeaways

- Kyle Samani will relinquish his role as Multicoin Capital’s managing partner after ten years, signaling a leadership transition for one of crypto’s best-known investment shops.

- He frames the move as a personal pivot toward other technologies, notably AI and robotics, while reaffirming his conviction that crypto will fundamentally reshape finance.

- Samani remains bullish on Solana and intends to continue investing personally in crypto and supporting Multicoin portfolio companies, even as he steps back from day-to-day management.

- The discussion around crypto’s structural reforms continues to hinge on regulatory clarity, with Samani suggesting policy developments will unlock a wave of new entrants into the space.

- Multicoin Capital has grown into a prominent firm, managing billions in assets; Samani’s departure coincides with ongoing market cycles and a broader push for scalable crypto infrastructure.

Tickers mentioned: $BTC, $ETH, $SOL

Sentiment: Bullish

Market context: The crypto industry remains attentive to regulatory clarity and infrastructure maturity as capital flows and investor interest shift toward assets with tangible, scalable utility, while venture firms weigh how policy will affect participation and fundraising.

Why it matters

The leadership change at Multicoin Capital underscores the endurance of one of crypto’s most influential investment firms, even as its co-founder pivots toward other technological frontiers. Samani’s exit does not appear to reflect retreat from crypto—rather, it signals a broader personal transition that could intersect with Multicoin’s ongoing strategy and sector bets. He has been a vocal figure in the industry, renowned for his willingness to critique established narratives and to back networks and ecosystems that he believes can deliver real, long-term value.

Samani’s remarks trace a throughline from his early days in crypto to his more recent stance on the technology landscape. He has credited Ethereum’s permissionless finance and smart contracts with catalyzing his initial interest in the space, though he later argued that scaling challenges constrained Ethereum’s progress. His evolving viewpoint reflects a broader industry dialogue about how to balance innovation with practical deployment, and how different ecosystems—Solana included—fit into a diversified strategy for long-term growth. Even as he contemplates stepping away from a formal leadership role, his insights into crypto’s trajectory—particularly around regulatory clarity and infrastructure readiness—remain influential within Multicoin and among its portfolio companies.

Solana’s place in Multicoin’s narrative has been pivotal. The firm identified Solana early and backed it through some of its initial rounds, a move that helped solidify Multicoin’s reputation for spotting promising ecosystems ahead of wider market recognition. Samani’s public remarks in recent years have highlighted Solana as a case study in throughput and user experiences that crypto networks aim to deliver, even as the industry continues to grapple with governance, network upgrades, and competition from other layer-1s. The departure does not alter Multicoin’s long-standing belief in the potential of crypto to disrupt traditional financial rails; it may, however, recalibrate how the firm allocates resources and mentors its portfolio in a slowly maturing market.

Beyond Solana and the broader ecosystem debates, the letter co-authored by Samani and Multicoin’s other co-founder, Tushar Jain, signaled a strategic openness to technologies beyond crypto. They proposed that Samani would explore AI, longevity, and robotics, signaling a shift toward interdisciplinarity that aligns with a broader tech industry trend: investors increasingly seek exposure to adjacent technologies with parallel growth trajectories. Within this context, Samani’s move can be read as a personal exploration that could feed back into Multicoin’s strategy as the crypto market cycles continue to evolve, and as the firm navigates a landscape increasingly defined by capital discipline and regulatory clarity.

What to watch next

- Samani’s next ventures and whether he will formalize new partnerships or ventures in AI, robotics, or related tech sectors.

- Multicoin Capital’s updated leadership and portfolio strategy in response to Samani’s departure, including any changes in fund allocation or emphasis on specific ecosystems.

- Regulatory developments around crypto, including any movement on the policy front that could accelerate or slow institutional participation and mainstream adoption.

- Continued performance and development within Solana’s ecosystem, given Multicoin’s historical early bets and Samani’s stated confidence in crypto’s ongoing evolution.

- Investor sentiment and capital flows into crypto infrastructure projects as the industry positions itself for the next phase of growth amid regulatory clarity and institutional partner engagement.

Sources & verification

- Official post by Kyle Samani announcing his stepping down and outlining future focus areas.

- Past statements indicating Samani’s criticism of Bitcoin and Ethereum ecosystems and subsequent discussions around scaling and governance.

- Historical context on Multicoin Capital’s early involvement with Solana and the firm’s later asset-management figures as of May 2025.

- Public letters co-authored by Samani and Tushar Jain describing Samani’s future interests beyond crypto.

- Public statements linking crypto’s trajectory to regulatory clarity and infrastructure maturity as drivers of adoption.

Samani’s leadership transition and the path ahead

The transition at Multicoin Capital arrives at a moment when the crypto industry is balancing the pursuit of rapid innovation with the demands of a more mature regulatory regime. Samani’s decision to step aside, while continuing to engage with the space through investments and portfolio support, suggests a nuanced approach to leadership during a period of significant opportunity and risk. For investors and builders, the development reinforces a pattern: vision and conviction around a given ecosystem—coupled with a willingness to adapt to new technologies and regulatory realities—remain central to navigating a crypto market that has moved beyond novelty toward mainstream-scale expectations.

As Samani shifts his focus toward AI and robotics, the industry will be watching whether his next ventures generate cross-pollination opportunities for crypto—from data privacy and computing architectures to new forms of digital asset interactions in AI-enabled services. In the near term, Multicoin’s stewardship of its portfolios and its response to evolving policy signals will be scrutinized by fund partners, researchers, and developers who view the firm as a bellwether for venture activity in the crypto space. The enduring takeaway is that leadership changes in high-profile crypto shops often herald reassessments rather than abrupt pivots, with the underlying conviction about crypto’s potential continuing to shape decisions across investment theses and risk tolerance in the months ahead.

https://platform.twitter.com/widgets.js

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech19 hours ago

Tech19 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards