Crypto World

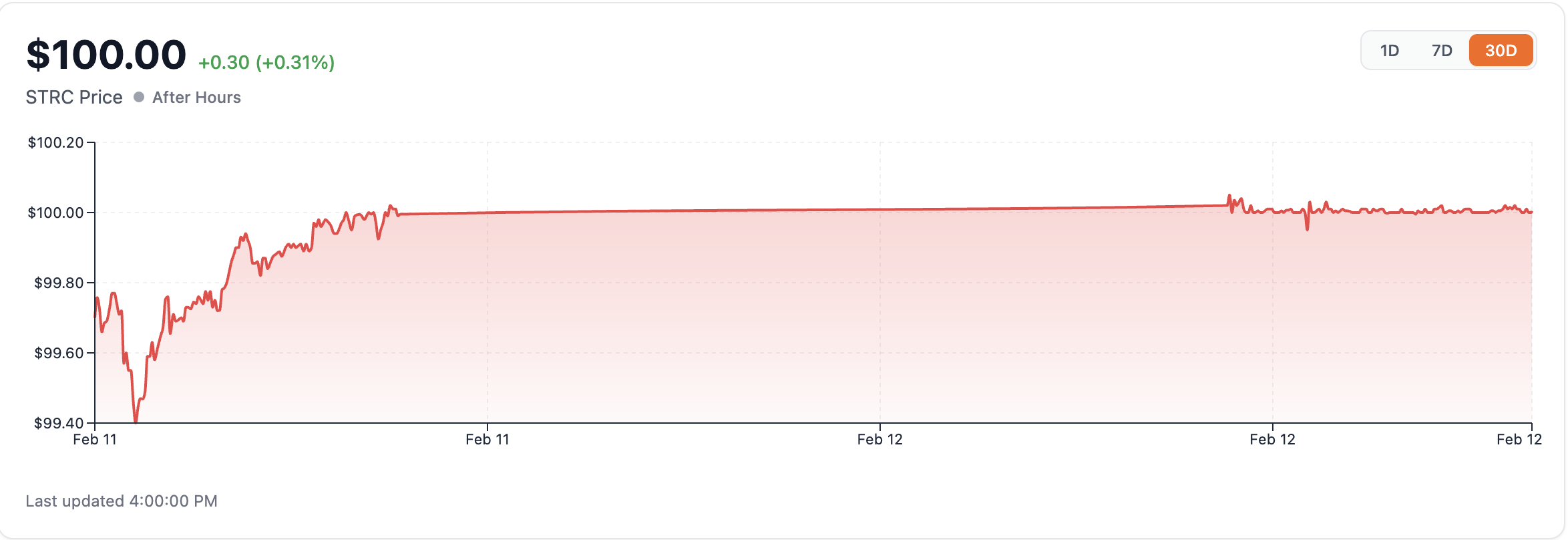

MSTR’s STRC returns to $100 par, poised to unlock more BTC accumulation

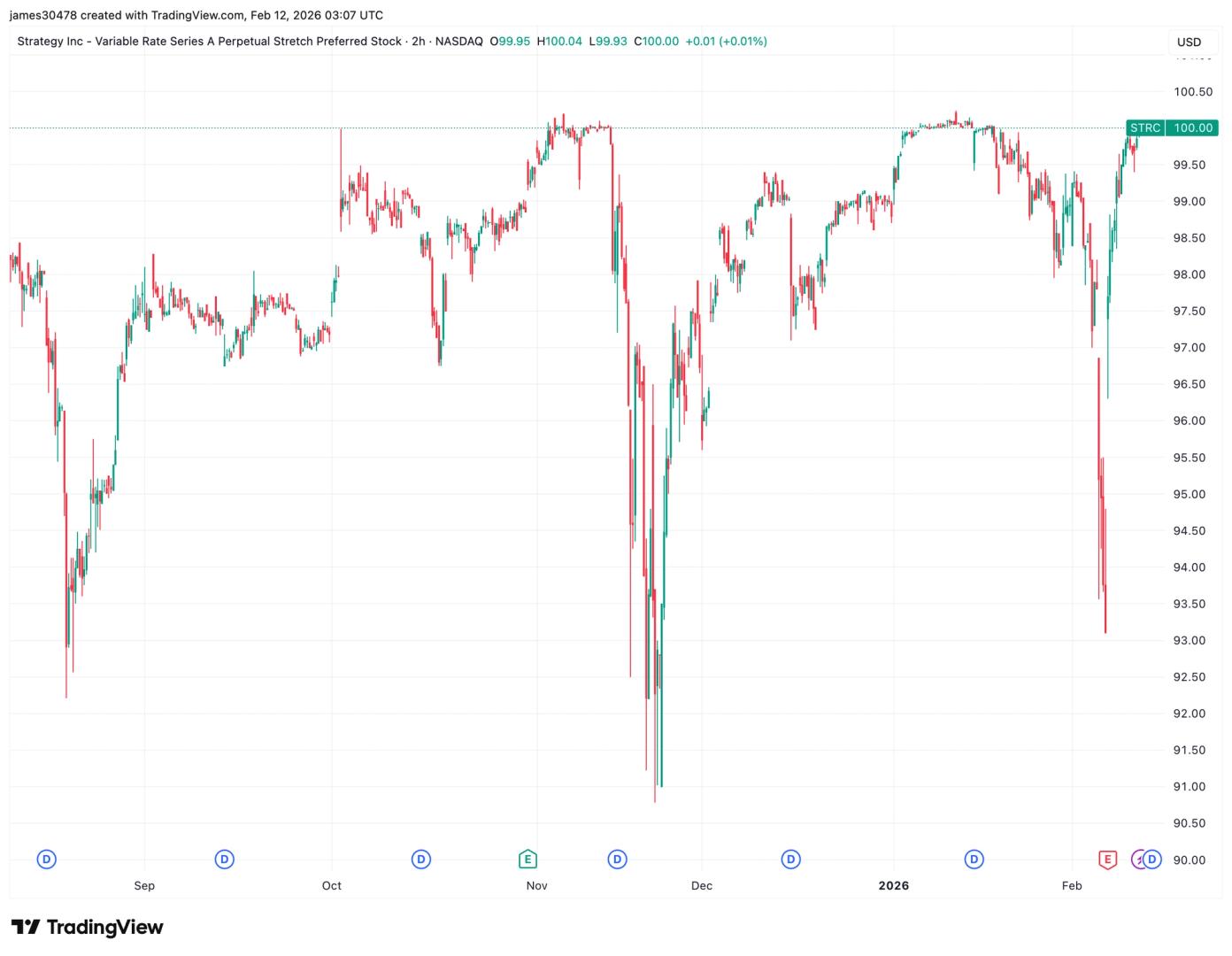

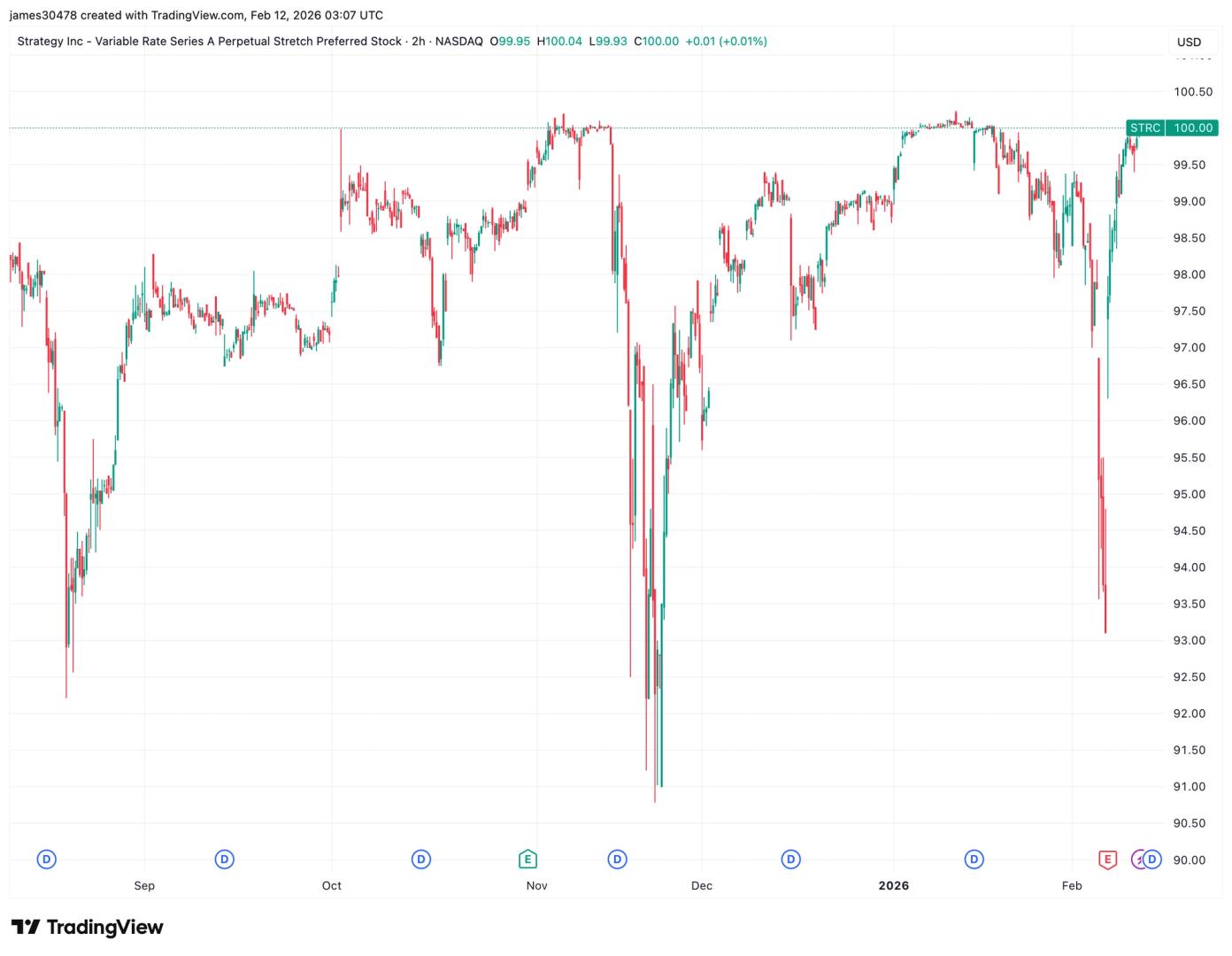

Stretch (STRC), the perpetual preferred equity issued by Strategy (MSTR) the world’s largest corporate bitcoin holder reclaimed its $100 par value during Wednesday’s U.S. session for the first time since mid-January.

STRC trading at or above par enables the company to resume at-the-market (ATM) offerings to fund further bitcoin acquisitions. STRC last hit the $100 level on Jan. 16 when bitcoin hovered near $97,000; however, as the largest cryptocurrency by market capitalization retreated to as low as $60,000 by on Feb. 5, STRC dipped to a low of $93 before its recent rebound.

Positioned as a short-duration, high-yield credit instrument, STRC currently offers an 11.25% annual dividend distributed monthly. To mitigate volatility and incentivize trading near par, Strategy resets this rate monthly, recently hiking it to the current 11.25% yield.

MSTR common stock faced pressure, sliding 5% on Wednesday to close at $126, as bitcoin hovers around $67,500.

Crypto World

Prediction Market Kalshi Sued Over Khamenei Trade Carveout

A federal class-action suit targets prediction platform Kalshi, accusing the company of failing to clearly disclose a death carveout tied to a market that forecast the fate of Iran’s former supreme leader. The case centers on the “Ali Khamenei out as Supreme Leader” market, which was halted after the death of Ayatollah Ali Khamenei was confirmed, leaving won bets unsettled in a way the plaintiffs say was not anticipated by users. The plaintiffs contend that the death carveout policy was never incorporated into the user-facing rules summary and was not presented in a way that would alert a reasonable consumer. Kalshi’s co-founder has acknowledged that earlier disclosures were grammatically ambiguous, though the company maintains it did not profit from such markets. The lawsuit also highlights disputes over payouts and reimbursements to traders who were affected.

Key takeaways

- The class-action alleges Kalshi concealed a death carveout in a major political market and failed to disclose how payouts would be handled when a death outcome was involved.

- Trading was halted and positions were voided after the death was confirmed, meaning the market did not resolve to a definitive “yes.”

- Kalshi maintains it does not list death-related markets and asserts the policy is stated in market rules; co-founder Tarek Mansour says no money was made from the market and losses were reimbursed out of pocket.

- Plaintiffs criticize the reimbursement method, arguing the last-traded-price approach and the exact timestamps used to compute it were not disclosed or transparent.

- The suit arrives as prediction-market volumes on Kalshi and peers rose to record levels in 2026, underscoring growing interest in off-exchange forecasting tools.

- The dispute spotlights ongoing scrutiny of how market-design rules are conveyed and enforced in politically sensitive event markets.

Sentiment: Neutral

Market context: The dispute sits at a time when prediction-market platforms have drawn heightened attention as volumes surge in 2026. Regulators and market participants are increasingly weighing how disclosures, rule wording, and risk-management practices shape user trust in event-based forecasts.

Why it matters

For users, the case underscores the importance of transparent disclosures when markets hinge on sensitive outcomes such as political leadership and life-and-death scenarios. The reimbursement mechanism—meant to mitigate losses when outcomes are blocked or unsettled—will come under greater scrutiny if procedural details remain opaque. For Kalshi and the broader prediction-market sector, the suit tests how clearly rules must be communicated within user interfaces and whether policies prohibiting certain outcomes can withstand legal challenges if not explicitly explained. The outcome could influence how platforms design carveouts, disclosures, and payout methodologies when markets intersect with real-world, high-stakes events.

Beyond Kalshi, the dispute feeds into a broader conversation about governance and consumer protection in the burgeoning forecasting economy. As platforms compete for liquidity and user engagement, the balance between creative market design and clear, auditable rules becomes a growing focal point for investors, policymakers, and users alike. The case also arrives amid visible pushback over how reimbursements are determined, raising questions about standardization across operators and the expectations set for participants in this niche trading space.

What to watch next

- Legal filings and court rulings in Risch v. Kalshi LLC, including any motions to dismiss or for class certification.

- Kalshi’s public updates to its market rules or disclaimers regarding death-related markets and any changes to the carveout policy.

- Public disclosure of the precise methodology and timestamps used to calculate last-traded prices for reimbursed trades.

- Any settlements or additional disclosures arising from related enforcement actions or disclosures in 2026 trading-volume activity.

- Follow-up reporting on how prediction-market operators adjust governance and risk controls in response to high-profile outcomes.

Sources & verification

- Court Listener docket for Risch v. Kalshi LLC, detailing the class-action complaint and filings.

- Public statements from Kalshi co-founder Tarek Mansour on X addressing the death-market carveout and reimbursements.

- Cointelegraph coverage on Kalshi’s response to the carveout and the reimbursement policy.

- Cointelegraph reporting on related Kalshi developments, including policy enforcement and market dynamics in 2026.

Market reaction and regulatory considerations surrounding Kalshi’s death-market carveout

A class-action alleging disclosure gaps around Kalshi’s death carveout has put the platform’s governance under a sharp lens. The complaint centers on the “Ali Khamenei out as Supreme Leader” market, which was voided after the death of the Iranian leader was confirmed, leaving a scenario where winners did not receive a payout and losers did not simply absorb gains. Plaintiffs emphasize that the carveout policy was not clearly present in the user-facing rules summary, and they point to statements from Kalshi acknowledging earlier disclosures were ambiguous rather than intentionally misleading.

“With an American naval armada amassed on Iran’s doorstep and military conflict not merely foreseeable but widely anticipated, consumers understood that the most likely, and in many cases the only realistic, mechanism by which an 85-year-old autocratic leader would ‘leave office’ was through his death. Defendants understood this as well.”

Kalshi’s co-founder, in defending the firm’s approach, reiterated that the company does not list markets directly tied to death and that the policy to avoid profit from such outcomes is embedded in the rules. He asserted that Kalshi did not profit from the market and that all losses were reimbursed out of pocket, a claim designed to counter arguments that the platform benefited from a misleading disclosure regime. The company’s stance aligns with a broader commitment it has publicly stated—that death-related markets are not listed and that the policy is clearly articulated within the market’s governance framework.

The debate over the reimbursed trades centers on the method used to determine compensation. Kalshi’s team has explained that reimbursements were calculated using the last traded price once the death confirmation occurred, a methodology designed to cap potential losses for participants while avoiding windfall profits. Critics, however, argue that the process and its exact timestamps should be transparent and auditable to ensure confidence in the remedy. The plaintiffs contend precisely that transparency is lacking, arguing that traders deserve a clear, reproducible account of how reimbursements were computed.

Trading activity in prediction markets continued to climb in 2026, with volumes reaching new highs even as legal questions surrounding rule disclosures and payout mechanics persist. The ongoing scrutiny reflects a maturing market where participants increasingly demand clarity on risk controls, governance, and the boundary between ambition in market design and consumer protection. In parallel, Kalshi has faced other regulatory and governance questions, including episodes related to insider trading and broader policy enforcement within its platform ecosystem.

As the case advances, observers will watch not only the court’s handling of disclosure questions but also whether Kalshi, and the wider ecosystem, respond with more explicit UI disclosures or refinements to how sensitive outcomes are treated in live markets. The outcome could influence how other platforms articulate carveouts and payout rules, shaping a more predictable framework for participants who use event-driven markets to hedge risk or speculate on real-world events.

Crypto World

How BetRivers and ZunaBet Stack Up in 2026

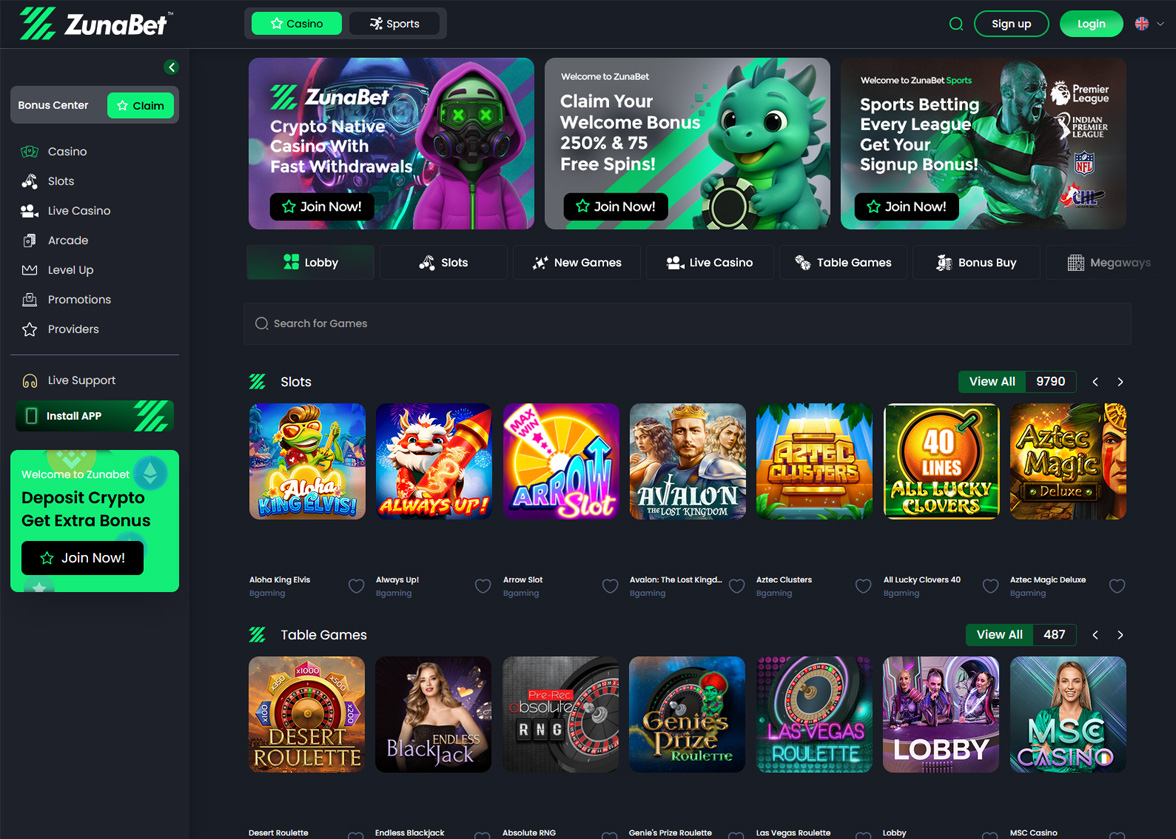

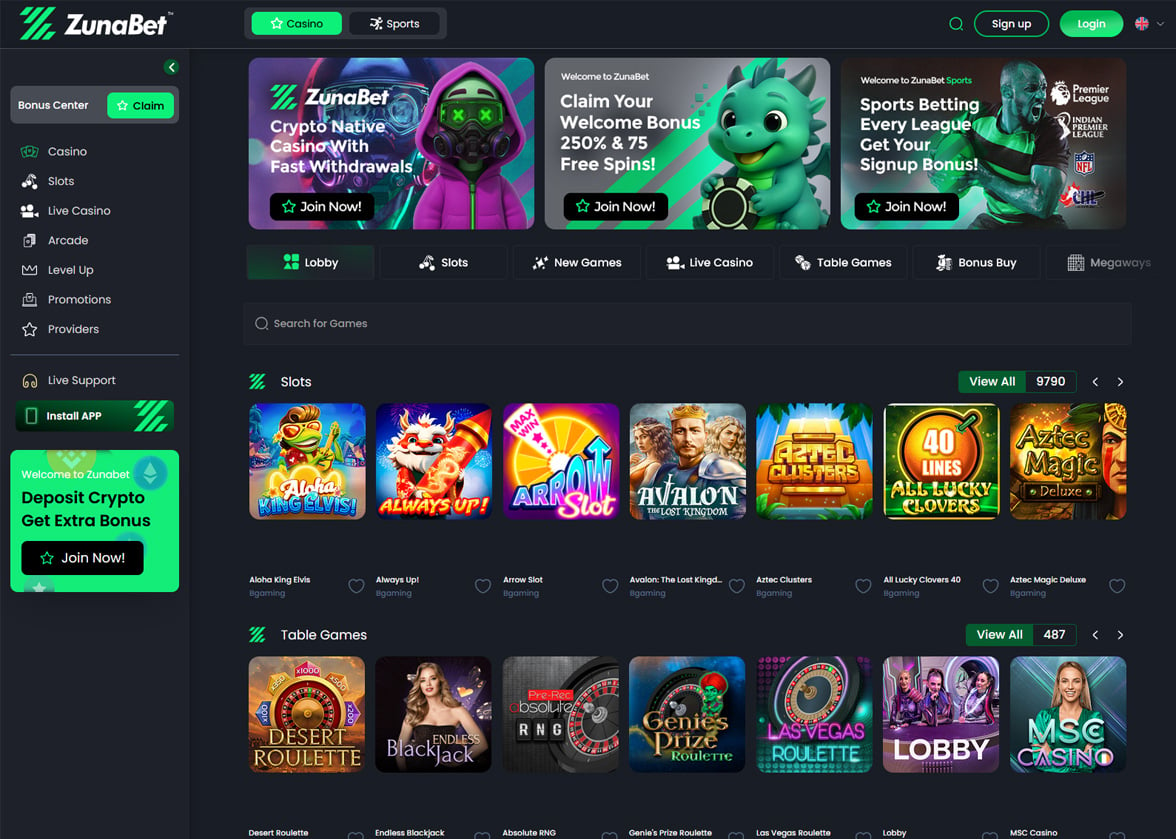

Online gambling is going through a clear split. One side sticks with the traditional model — state licenses, bank transfers, and familiar interfaces. The other side is pushing forward with cryptocurrency, massive game catalogs, and reward systems built for a new kind of player. BetRivers and ZunaBet sit on opposite sides of that divide, and looking at them together paints a useful picture of where the market stands right now.

What BetRivers Brings to the Table

BetRivers operates under Rush Street Interactive and holds active licenses across multiple US states, including New Jersey, Pennsylvania, Illinois, and Michigan. It runs both an online casino and sportsbook with a straightforward interface that prioritizes ease of use.

Game availability at BetRivers depends on your state. Most players can access somewhere between a few hundred and a couple thousand titles covering slots, table games, and live dealer rooms. The sportsbook handles NFL, NBA, MLB, soccer, and other popular leagues with competitive lines and a simple bet slip process.

Banking at BetRivers follows the traditional playbook. Credit cards, debit cards, bank wires, and approved e-wallets handle both deposits and withdrawals. Cash-outs typically land within one to five business days, which is standard across most regulated US platforms. Nothing surprising, but nothing fast either.

The loyalty offering is iRush Rewards, a points-based system where real-money play earns credits that can be redeemed for bonuses. It does the job but follows the same template the industry has relied on for over a decade.

What Makes ZunaBet Different

ZunaBet entered the market in 2026 with a completely different blueprint. Strathvale Group Ltd owns the platform, which operates under an Anjouan gaming license. The team behind it brings over 20 years of combined experience in the gambling industry, but they chose to build something forward-looking rather than copying existing models.

The first thing that stands out is scale. ZunaBet hosts 11,294 games from 63 different providers. That puts it among the biggest game libraries in the crypto casino category. Names like Pragmatic Play, Evolution, Hacksaw Gaming, BGaming, and Yggdrasil anchor the catalog, with slots making up the largest portion alongside a strong selection of live dealer and RNG table games.

The sportsbook runs as a fully integrated part of the platform, not an add-on. Coverage spans football, basketball, tennis, NHL, and other major global leagues. Esports betting is baked in with markets on CS2, Dota 2, League of Legends, and Valorant. Virtual sports and combat sports round out a sportsbook that holds its own against dedicated betting sites.

Payments run entirely on crypto. ZunaBet supports over 20 coins — BTC, ETH, USDT across multiple chains, SOL, DOGE, ADA, XRP, and more. The platform charges no processing fees and processes withdrawals quickly. For crypto holders, there is no need to convert to fiat or wait days for a bank to release funds.

New players can access a welcome package worth up to $5,000 plus 75 free spins, split across three deposits. The first deposit earns a 100% match up to $2,000 with 25 spins. The second gives 50% up to $1,500 with 25 spins. The third adds another 100% up to $1,500 with 25 spins. Spreading the bonus across three deposits rewards players who stay active past their first session.

The platform runs on modern HTML5 technology with a dark-themed interface that loads fast and works smoothly across devices. Dedicated apps are available for iOS, Android, Windows, and MacOS, and 24/7 live chat support is on hand whenever something comes up.

How Their Reward Systems Compare

Loyalty is where these two platforms tell very different stories about what they think players deserve.

BetRivers hands out points through iRush Rewards. Play enough, earn enough points, and convert them into bonus money. The conversion rates are modest, and the overall experience feels like something designed a long time ago and never meaningfully updated.

ZunaBet built a gamified loyalty system around a dragon mascot called Zuno that evolves as players progress through six tiers. It starts at Squire with 1% rakeback and goes all the way up to Ultimate at 20% rakeback. Along the way, players unlock benefits like up to 1,000 free spins, VIP club access, and double wheel spins.

Rakeback changes the math for regular players. Instead of collecting abstract points and hoping the conversion rate is decent, players receive a direct percentage of their wagering activity back. At 10% or 20%, that represents serious value over time — far more than what most point-based systems deliver. The dragon evolution theme gives the whole thing a sense of progression that keeps players engaged beyond just the financial return.

The Crypto Question

The payment infrastructure is one of the biggest practical differences between these platforms.

BetRivers works through banks. That means processing times, potential holds, and availability limited to states where the platform is licensed. It is a system that functions but has not evolved much in years.

ZunaBet was designed around crypto from the start. Twenty-plus supported coins, zero platform fees, and quick withdrawals make it a fundamentally smoother payment experience. Players who already use crypto in their daily lives do not have to jump through conversion hoops or wait for institutional banking timelines. The crypto-first approach also opens up access to a broader international audience that state-locked platforms simply cannot reach.

This is not a small distinction. As crypto adoption continues to grow, platforms built natively around digital assets have a structural advantage over those trying to bolt crypto onto traditional systems after the fact.

Which Direction Is the Market Moving

BetRivers occupies a stable position. It has regulatory backing in its licensed states, a known brand, and the resources of Rush Street Interactive behind it. Players who want a traditional, regulated experience in the US still have a good option here.

But the momentum in 2026 sits with platforms like ZunaBet. The combination of 11,000-plus games, 63 providers, a full sportsbook with esports, up to 20% rakeback, and crypto-native payments puts it ahead of most competitors on the metrics that matter to today’s players. It is not just offering more — it is offering a different kind of experience that aligns with how a growing segment of the market actually wants to play and pay.

BetRivers is a safe, known quantity. ZunaBet is the platform that feels built for what comes next. For players deciding where to put their time and money in 2026, that difference matters more than it used to.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Trump’s cyber strategy vows to ‘support the security’ of cryptocurrencies and blockchain

The Trump administration’s new national cyber strategy places the security of cryptocurrencies and blockchain technologies within the United States’ broader push to maintain leadership in emerging technology.

In a section focused on maintaining “superiority in critical and emerging technologies,” the document states that the government will support the security of “cryptocurrencies and blockchain technologies.”

The statement appears in President Trump’s Cyber Strategy for America, which outlines six policy pillars meant to guide federal cyber policy, including securing infrastructure, modernizing federal networks and strengthening U.S. advantages in areas such as artificial intelligence and quantum computing.

“We will build secure technologies and supply chains that protect user privacy from design to deployment, including supporting the security of cryptocurrencies and blockchain technologies. We will promote the adoption of post-quantum cryptography and secure quantum computing,” according to the document.

“And we will secure the AI technology stack—including our data centers—and promote innovation in AI security,” the document added.

By placing blockchain security alongside AI and post-quantum cryptography, the strategy frames decentralized financial infrastructure as part of the nation’s technology competition with foreign rivals.

The strategy does not introduce specific crypto regulations. Still, the language signals that federal policymakers see securing blockchain systems as part of protecting economic and technological leadership.

Still, it further underscores the Trump administration’s commitment to the cryptocurrency space (which came under scrutiny recently), a commitment he has supported since his 2024 campaign.

In July of that year, Trump addressed the Bitcoin 2024 conference in Nashville, promising to make the United States the “crypto capital of the planet” and a “Bitcoin superpower.” He pledged to end what he described as an anti-crypto regulatory push and proposed creating a national Bitcoin stockpile.

In early 2025, he directed the creation of a Strategic Bitcoin Reserve using seized bitcoin and launched a presidential working group on digital assets, while prohibiting a U.S. central bank digital currency (although a year has passed, and there’s still no reserve). Later that year, he promoted stablecoin legislation known as the GENIUS Act and continued to push for broader market-structure rules for the industry.

He has also eliminated various Biden-era anti-crypto policies and has seen U.S. lawmakers drop cases against major cryptocurrency firms, including Uniswap, Tron, Coinbase, and Binance.

Crypto World

The Multibillion-dollar shift turning prediction markets into a professional hedging tool

The dominant narrative around prediction markets still centers on elections and sports. Sports account for the majority of volume at major venues, and election contracts are what put the category on the front page. But based on what active traders are actually doing with real money, prediction markets are expanding for an even more impactful purpose: they’re a place to hedge risks that no existing financial instrument can price cleanly because the assets are new in nature. Their applicability spans geopolitical events, policy shifts, combined with commodity-linked outcomes, and this market has the potential to dwarf anything sports will ever produce.

Case in point: when Kevin Warsh was nominated as the next Federal Reserve chair in January, trading activity on Kalshi and Polymarket surged, and among frequent, multi-market traders, the volume spike dwarfed that of the Super Bowl. More recently, the 24-hour window around the Iran conflict produced more trading activity than any single sports day this year. Sports still account for the majority of the overall volume on both venues. But the traders driving the growth edge are building strategies across categories and venues. These traders are increasingly clustering around geopolitical, macro and policy-linked contracts. They are not looking for entertainment. They are looking for tools to price uncertainty that affects their other positions, their businesses, and (in some economies) their household budgets.

Serious institutional voices are now articulating that shift. In a February 2026 paper, Federal Reserve economists evaluated Kalshi’s macroeconomic prediction markets and argued that these markets can provide high-frequency, continuously updated, “distributionally rich” expectations data that could be valuable to researchers and policymakers.

From entertainment to infrastructure

To see where prediction markets are headed, we only need to monitor trader behavior, and the trend shows a growing number of participants integrating prediction market contracts into broader financial strategies.

This means a commodity trader monitoring oil exposure now tracks Russia-Ukraine ceasefire contracts as a live signal for geopolitical risk that directly affects energy prices. An equity trader managing a concentrated tech position watches tariff-related prediction markets to calibrate event risk that no single stock indicator captures cleanly. In both examples, contract prices are doing something no traditional instrument offers. They’re updating in real time as the narrative around a specific event shifts, and this gives traders a probability signal they can act on across their wider book.

The commodities market is a $60 trillion annual market in the United States. The entire category began with farmers hedging crop yields. This simple premise scaled because the underlying need was real. Prediction markets are approaching a similar threshold. The format is simplistic: what we currently have are binary yes/no contracts on time-elapsed events, but the need they address is both universal and largely unserved by existing instruments: they allow you to price and act on uncertainty.

Before prediction markets, there was no clean way to express a view on whether a central bank would hold rates, whether a military strike would occur or whether a trade policy would shift. Traders could try to infer these probabilities from currency pairs or futures, but they were always trading them as a proxy. Even elections, arguably the most closely watched political events, were priced indirectly, so that a clean-energy Democrat leading in the polls would suppress coal stocks. Prediction markets are a superior instrument as they price the event itself. That makes them useful as hedging tools, which is an order of magnitude more applicable.

The international dimension

The fastest-growing segment of prediction market participation is international, spread across Europe, Asia and, increasingly, emerging markets. In economies marked by currency volatility, inflation and policy unpredictability, the ability to price uncertainty is becoming a necessity for investors.

Stablecoins have already demonstrated this principle. Across Latin America and parts of Africa and Southeast Asia, digital dollars have become a mainstream store of value and remittance tool, not because users were drawn to crypto ideology, but because traditional banking infrastructure struggled with costs and volatility. Stablecoin adoption spread because it solved an everyday problem.

Prediction markets extend that applicability by providing a contract on whether a currency will depreciate next quarter, whether fuel subsidies will be cut, or whether a central bank will intervene. When such contracts are accessible through the same EVM infrastructure, a small position on a fuel price outcome starts to look less like a bet and more like insurance that provides a defined cost for a risk that is otherwise unmanageable.

Consumer-grade simplicity is not yet there, but the trajectory is visible, particularly for traders from high-volatility economies who are not treating prediction markets as entertainment. For them, they serve as an information layer that is also actionable.

What comes next

Prediction markets are now posting hundreds of millions in daily trading volume. Polymarket processed $8 billion in January; Kalshi processed $9 billion. Those figures have moved in only one direction.

But the more important evolution will be in format. The current generation of prediction markets operates on simple binary outcomes. As the category matures, expect conviction-weighted instruments, conditional contracts and markets that reference real economic indices, making these tools more useful for hedging and less dependent on novelty for adoption.

Prediction markets are gaining traction because they measure outcomes with direct economic consequences for traders. Weather and commodity-linked markets, inflation and monetary policy contracts, and geopolitical risk pricing all sit at this intersection. Prediction markets are beginning to overlap meaningfully with traditional finance.

Elections have consistently been the category that drives the deepest engagement and the largest volume spikes, and that will continue as the US midterms approach. Sports generate steady liquidity. But the long-term value of prediction markets will grow to serve a larger population of people and institutions that need to manage uncertainty as part of their daily economic lives.

Crypto World

Kalshi Faces Lawsuit Over Khamenei Prediction Market

A class action lawsuit has been filed against prediction market Kalshi, alleging that the death carveout in the “Ali Khamenei out as Supreme Leader” market was not properly disclosed to users and that the platform failed to pay out winning trades.

The plaintiffs said that the death carveout policy was “not incorporated into the user-facing rules summary,” and was not displayed in a way that would notify a “reasonable consumer” of the policy or its effects.

“Defendants, themselves, later acknowledged that their prior disclosures were ‘grammatically ambiguous,’” the lawsuit filing said.

Kalshi voided trading positions for the market after the death of Khamenei, the former Iranian Supreme Leader, was confirmed, meaning the market did not resolve to a “yes.”

“We don’t list markets directly tied to death. When there are markets where potential outcomes involve death, we design the rules to prevent people from profiting from death,” Kalshi co-founder Tarek Mansour said.

The plaintiffs characterized the carveout policy as “predatory” and an “unfair” business practice for this specific market. The lawsuit said:

“With an American naval armada amassed on Iran’s doorstep and military conflict not merely foreseeable but widely anticipated, consumers understood that the most likely, and in many cases the only realistic, mechanism by which an 85-year-old autocratic leader would ‘leave office’ was through his death. Defendants understood this as well.”

Mansour also announced reimbursements for users affected by the carveout policy, calculated using the “last traded price” for the market before the death of Khamenei was confirmed. The reimbursement policy also drew significant pushback from users.

The plaintiffs in the lawsuit say that the methodology and precise timestamps used to calculate the “last traded price” for the prediction market were not disclosed or transparent.

Related: Kalshi bans US politician over alleged insider trading violation

Kalshi co-founder fires back against lawsuit claims

Mansour maintained that Kalshi was simply adhering to its policy of not allowing “death markets” and said the policy was clearly stated in the market rules.

“Kalshi made no money here and even reimbursed all losses out of pocket. Not a single user walked away losing money from this market,” he said.

The incident came amid trading volumes on prediction markets surging to record highs in 2026, as the platforms gain popularity.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

How Much Bitcoin Can Saylor Buy?

Michael Saylor’s Strategy, linked to MSTR (EXCHANGE: MSTR), continues to funnel capital into Bitcoin (CRYPTO: BTC) via its STRC (EXCHANGE: STRC) stock program, with the potential for further purchases in the coming weeks. The publicly traded vehicle has built a BTC position that some estimates place near $50 billion across its corporate footprint—an all-time high among listed entities. STRC, launched in July 2025 as an income-focused preferred stock, powers an ATM-like mechanism designed to fund incremental BTC buys as demand for yield supports its price and par value. Investors will be watching the next SEC filing, due March 9, for signs of whether another wave of BTC acquisitions is materializing as Bitcoin trades against macro headwinds.

Key takeaways

- STRC (EXCHANGE: STRC) launched in July 2025 as an income-focused preferred stock to raise capital for Strategy’s Bitcoin accumulation plan and later expanded with an at-the-market program.

- In January 2026, STRC sold about 1.19 million shares for $119.1 million in net proceeds, complementing $1.12 billion raised through MSTR sales to fund BTC purchases totaling 13,627 BTC at roughly $1.25 billion.

- In February 2026, STRC proceeds of about $78.4 million were used to acquire 2,486 BTC net, underscoring the ongoing role of STRC in financing additional BTC accumulation.

- BitcoinQuant’s model suggests STRC could raise over $300 million in net proceeds this week, potentially funding about 4,334 BTC at prevailing prices; a Friday trading volume of $188 million implies substantial near-term capacity to finance BTC buys.

- Market observers note that the SEC filings—due March 9—will be a key data point to confirm whether the surge in STRC activity translates into a materially larger BTC purchase by Strategy.

Tickers mentioned: $BTC, $STRC, $MSTR

Sentiment: Neutral

Market context: The episode sits within a broader environment where institutional BTC programs coexist with ongoing regulatory scrutiny and fluctuating liquidity. STRC’s ATM-driven funding mechanism ties yield-seeking demand to active BTC accumulation, while public disclosures and SEC filings shape how much and how quickly Strategy can scale its purchases.

Why it matters

Strategy’s use of STRC to finance Bitcoin accumulation exemplifies a corporate approach to expanding a bitcoin treasury outside traditional balance-sheet buys. The IPO in mid-2025 laid the groundwork for a scalable, market-driven funding model: STRC’s initial proceeds enabled a sizable BTC accumulation, demonstrating how investor yield appetite can be monetized to propel crypto exposure at a scale uncommon for corporate treasuries. The strategy aligns with long-standing commitments by Saylor to increase the company’s BTC holdings, a stance that has helped position Bitcoin as a core reserve asset in some of the most visible corporate crypto bets.

From a market perspective, the unfolding STRC dynamic contributes to a broader dialogue about how public entities can leverage structured equity instruments to participate in crypto markets. The ATM program provides a controllable mechanism for deploying capital, which can help smooth BTC purchases over time and mitigate price impact when demand surges. If the next SEC filing confirms a larger tranche of BTC buys funded by STRC, it could reinforce a perception that corporate entities are leveraging public markets to sustain crypto accumulation even as online sentiment and macro conditions shift.

For investors, the STORY underscores the importance of following official disclosures and model-based analyses that attempt to quantify the potential BTC purchase power embedded in such programs. While the exact figure depends on STRC’s trading dynamics and market conditions, BitcoinQuant’s projection of hundreds of millions in possible proceeds highlights the scale at which STRC could influence short-term BTC demand if the firm chooses to monetize a sizable portion of its listed equity issuance in the near term. This balance between capital markets mechanics and crypto exposure is a focal point for traders watching the BTC market’s next phase of volatility and institutional participation.

What to watch next

- March 9, 2026: The next SEC filing from Strategy will shed light on STRC proceeds and BTC purchases that may have occurred since the last report.

- Any new STRC ATM activity or share sales that would indicate a ramp-up or moderation of BTC accumulation.

- Bitcoin price action and volatility surrounding the STRC-driven flow, as liquidity and macro sentiment evolve.

- Updates from BitcoinQuant on STRC’s ATM contributions and potential BTC purchase capacity under current market conditions.

Sources & verification

- SEC filing: https://www.sec.gov/Archives/edgar/data/1050446/000119312526009811/mstr-20260105.htm

- SEC filing: https://www.sec.gov/Archives/edgar/data/1050446/000119312526053105/mstr-20260105.htm

- SEC filing: https://www.sec.gov/Archives/edgar/data/1050446/000119312526084264

- BitcoinQuant STRC analysis: https://bitcoinquant.co/strc

- STRC IPO overview: STRC IPO

- Strategy expands STRC ATM program: ATM expansion

- Previous BTC buy references: Michael Saylor’s BTC purchases

Market reaction and key details

The ongoing STRC-driven BTC accumulation framework illustrates how publicly listed entities can leverage structured equity to expand crypto exposure. While the exact BTC total remains fluid, the combination of STRC sales, MSTR stock activity, and at-the-market issuance has created a measurable funding stream for BTC purchases. As the March 9 filing approaches, market participants will look for clarity on whether the most recent surge in STRC activity translates into a materially larger BTC allocation, and how this aligns with broader bitcoin-market liquidity and regulatory developments.

Key figures and next steps

Summary figures from the latest reporting cycles indicate a pattern: STRC proceeds are being deployed toward BTC purchases, with January and February activities showing multi-hundred-million-dollar movements and multi-thousand BTC acquisitions. If the trend continues, Strategy could edge closer to deploying hundreds of millions more into BTC over the next reporting window, potentially impacting micro- and macro-price dynamics depending on the pace and scale of new buys.

What this means for the crypto market

Beyond Strategy, the STRC mechanism may set a precedent for how other corporate holders approach crypto treasury expansion using equity-linked instruments. The transparency of SEC filings and the availability of market data will continue to influence investor expectations regarding the sustainability and pace of such programs. As Bitcoin (CRYPTO: BTC) remains a central reference point for institutional crypto exposure, the outcomes of STRC’s ongoing program could inform both treasury-management strategies and the wider discourse on corporate-level crypto adoption.

Crypto World

BTC Must Break This Key Level to Confirm a Real Rally

Bitcoin remains trapped in a broader corrective structure, but the price action is starting to stabilize after defending the $60,000 demand region. The daily chart still leans cautiously as BTC trades below the major moving averages and beneath the descending resistance trendline.

That leaves the cryptocurrency at an important crossroads, where a push higher could extend the recovery toward overhead supply, while failure would keep the broader downtrend intact.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, Bitcoin is still trading inside a well-defined bearish structure, with the price capped below both the 100-day and 200-day moving averages. The 100-day MA is now trending lower near the mid $80,000 region, while the 200-day MA sits even higher around the mid $90,000s, showing that the broader trend remains under pressure.

In addition, BTC is still moving beneath the descending trendline that has guided the correction for months, which means the buyers have not yet delivered a convincing structural reversal.

That said, the reaction from the blue support zone around $60,000 was technically important. Buyers stepped in aggressively after the sharp flush below $60,000, and BTC has since rebounded toward the $68,000 area. The first major resistance remains around $76,000 to $80,000, where previous horizontal support turned into supply. As long as Bitcoin stays below that region, rebounds are likely to be viewed as corrective.

BTC/USDT 4-Hour Chart

On the 4-hour chart, Bitcoin is consolidating inside a rising channel, suggesting that the recent move off the lows is more of a recovery phase than a full bullish reversal. The asset is currently hovering around $68,000 after rejecting from the upper boundary of the channel near the $72,000 to $75,000 resistance area. This rejection confirms that sellers are still active on rallies, especially when BTC approaches confluence resistance, where the channel top overlaps with horizontal supply.

Momentum has also cooled noticeably. The RSI pushed into overbought territory during the recent rally, but has since rolled over and dropped back toward neutral, showing fading upside strength in the short term.

For buyers, holding above the mid-channel area and continuing to defend the $64,000 to $65,000 region would keep the structure constructive for another attempt higher. On the downside, a breakdown below the lower boundary of the channel could send Bitcoin back toward the $60,000 support zone and potentially even lower.

On-Chain Analysis

From an on-chain perspective, Bitcoin’s Net Unrealized Profit and Loss, or NUPL, has fallen sharply and is now sitting around 0.20. That is a major reset compared to the euphoric readings seen during the rally toward the cycle highs.

In simple terms, the market has flushed out a large portion of paper profits, which usually reflects a substantial reduction in speculative excess. While this does not guarantee an immediate trend reversal, it often creates a healthier backdrop than the overheated conditions seen near major tops.

Historically, a NUPL reading around this zone points to a market that is no longer in euphoria and is instead moving closer to the kind of sentiment reset that can support medium term base building. That fits well with the current price structure, where Bitcoin is trying to stabilize after a heavy correction rather than accelerate into a fresh expansion leg.

So, on-chain data suggests downside risk may be more limited than it was near the highs, but for a stronger bullish case, that improving on-chain backdrop still needs confirmation from price through a reclaim of higher resistance levels on both the daily and 4-hour charts.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

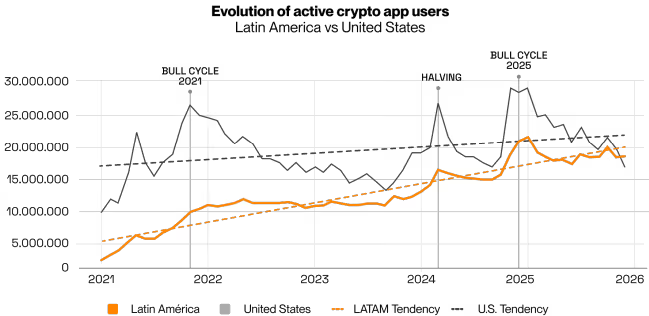

Latin America’s crypto user growth outpaced U.S. by 3x in 2025, report shows

Latin America’s crypto market is expanding far faster than that of the United States as users increasingly rely on cryptocurrencies for payments and cross-border transfers rather than speculation. a new report claims.

The region, according to a report from Argentinian crypto firm Lemon, received more than $730 billion in cryptocurrency transaction volume in 2025, a 60% increase from the previous year, representing roughly 10% of global crypto activity.

Growth was not only measured in transaction volume. Monthly active crypto app users in Latin America rose about 18% year over year, roughly three times faster than growth in the United States, the report said.

Brazil dominates the region by transaction size.

The country received $318.8 billion in crypto value with growth approaching 250% year over year, driven largely by institutional trading and expanding regulatory clarity for financial institutions.

Argentina shows a different pattern. Despite inflation falling to about 32% in 2025, crypto adoption continued to rise. Average monthly users were four times higher than during the 2021 bull market, according to the report.

One driver is cross-border payments. Argentine fintech companies linked crypto rails to Brazil’s PIX instant payment system, allowing users to pay Brazilian merchants using pesos while stablecoins such as USDT settle the transaction behind the scenes.

The integration led to 5.4 million crypto app downloads in Argentina during 2025, with January downloads hitting a record level.

Peru, which back in January saw Bybit Pay integrate with digital wallets Yape and Plin, emerged as one of the fastest-growing markets. Crypto app users doubled as interoperability rules allowed banks and digital wallets to connect. Transfers between banks and wallets surpassed 540 million transactions, up 120% year over year.

Stablecoins are playing a central role in the shift toward practical use cases. Across the region, users rely on digital dollars to send money abroad, receive funds from platforms like PayPal and bypass traditional banking networks, the report points out.

Crypto World

How Much Bitcoin Can Michael Saylor Buy via Strategy’s STRC Stock?

Michael Saylor’s Strategy may purchase more Bitcoin (BTC) in the coming weeks through the proceeds from its STRC stock sales.

Key takeaways:

What is STRC stock?

Michael Saylor’s Strategy (MSTR) owns about $50 billion in Bitcoin, the highest by any public company on record.

Stretch (STRC) is Strategy’s income-focused preferred stock launched in July 2025 to raise capital for its Bitcoin accumulation strategy.

In its IPO, the company raised about $2.521 billion gross and $2.474 billion net. It then used those proceeds to acquire 21,021 BTC at an average price of about $117,256.

Strategy later expanded that model by launching a $4.2 billion STRC at-the-market (ATM) program on July 31, 2025, allowing it to sell preferred shares gradually into market demand rather than all at once.

How does STRC work?

The mechanism works best when STRC trades near or above its $100 target. For that, Strategy pays a variable monthly yield to investors, adjusting it to keep the stock close to its par value.

Higher yield can support the price when it falls below par, while a lower yield can cool demand when it rises too far above it. For March 2026, the annualized STRC rate is 11.50%, or about $0.958 per share monthly.

In short, STRC turns investor demand for yield into funding for more BTC purchases.

For example, in January, Strategy sold about 1.19 million STRC shares for $119.1 million in net proceeds, alongside $1.12 billion raised through MSTR sales.

It used the combined capital to purchase 13,627 BTC for roughly $1.25 billion.

In February, STRC proceeds worth $78.4 million were used in the purchase of 2,486 BTC net.

Saylor may have $302 million in STRC proceeds

Strategy may soon raise over $300 million through sales of its STRC preferred stock, potentially giving Michael Saylor enough firepower to buy roughly 4,300 Bitcoin, according to estimates from BitcoinQuant.

The projection is based on STRC’s trading activity this week. BitcoinQuant’s model shows about $777 million in total volume, with roughly 97%, or $755 million, traded above the stock’s $100 par value.

Using a 40% capture rate, the model estimates around $302 million in net proceeds, enough to purchase about 4,334 BTC, based on average Bitcoin prices of $68,000 to $73,000 during market hours.

Friday alone saw a record $188 million in STRC trading volume, implying enough potential proceeds to fund the purchase of around 1,097 BTC, based on the same model.

Related: Michael Saylor’s Strategy buys $204M of Bitcoin in 101st purchase

The figures remain speculative for now, however. Strategy’s latest filing showed only $7.1 million in STRC sales contributing to a broader 3,015 BTC purchase.

Whether this week’s trading surge translates into a much larger Bitcoin buy should become clearer in the company’s next SEC filing, releasing on March 9.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

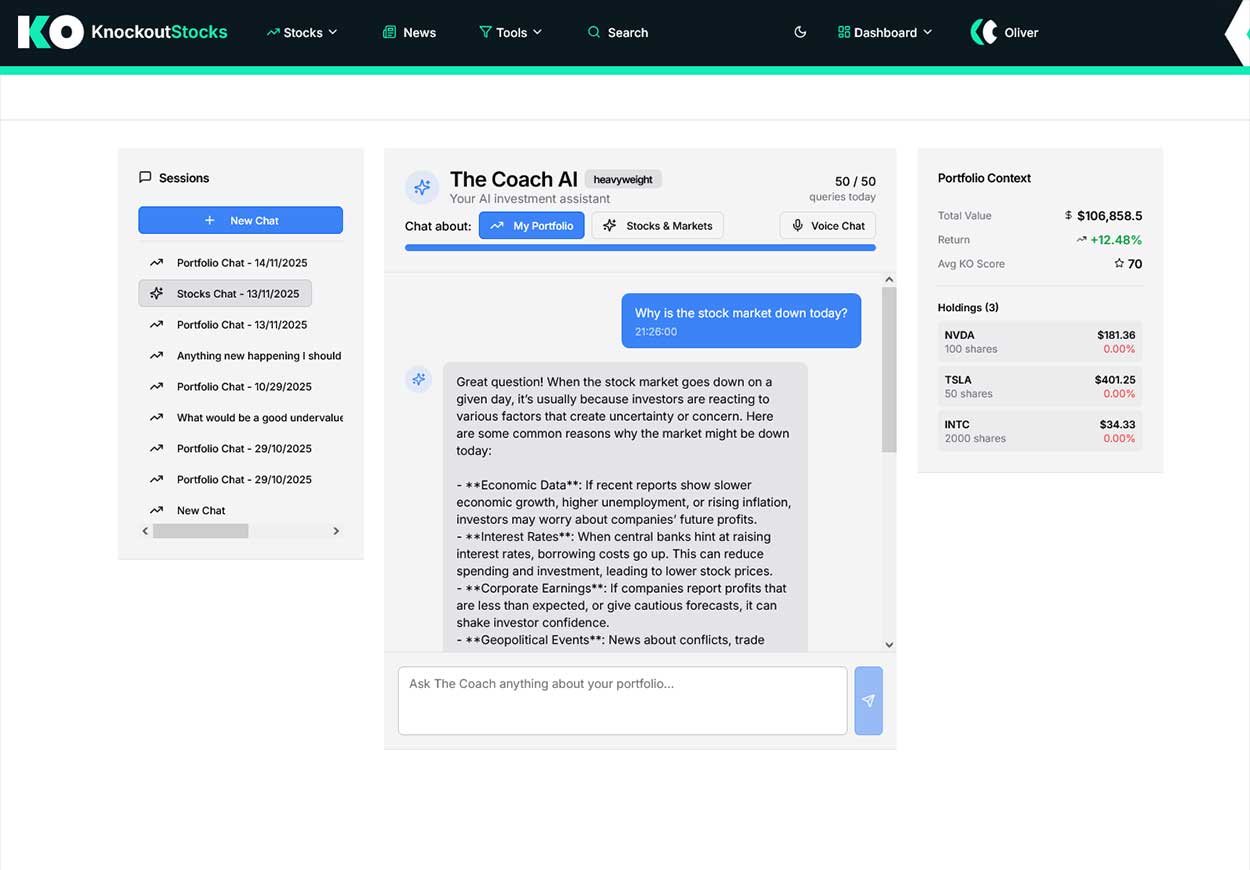

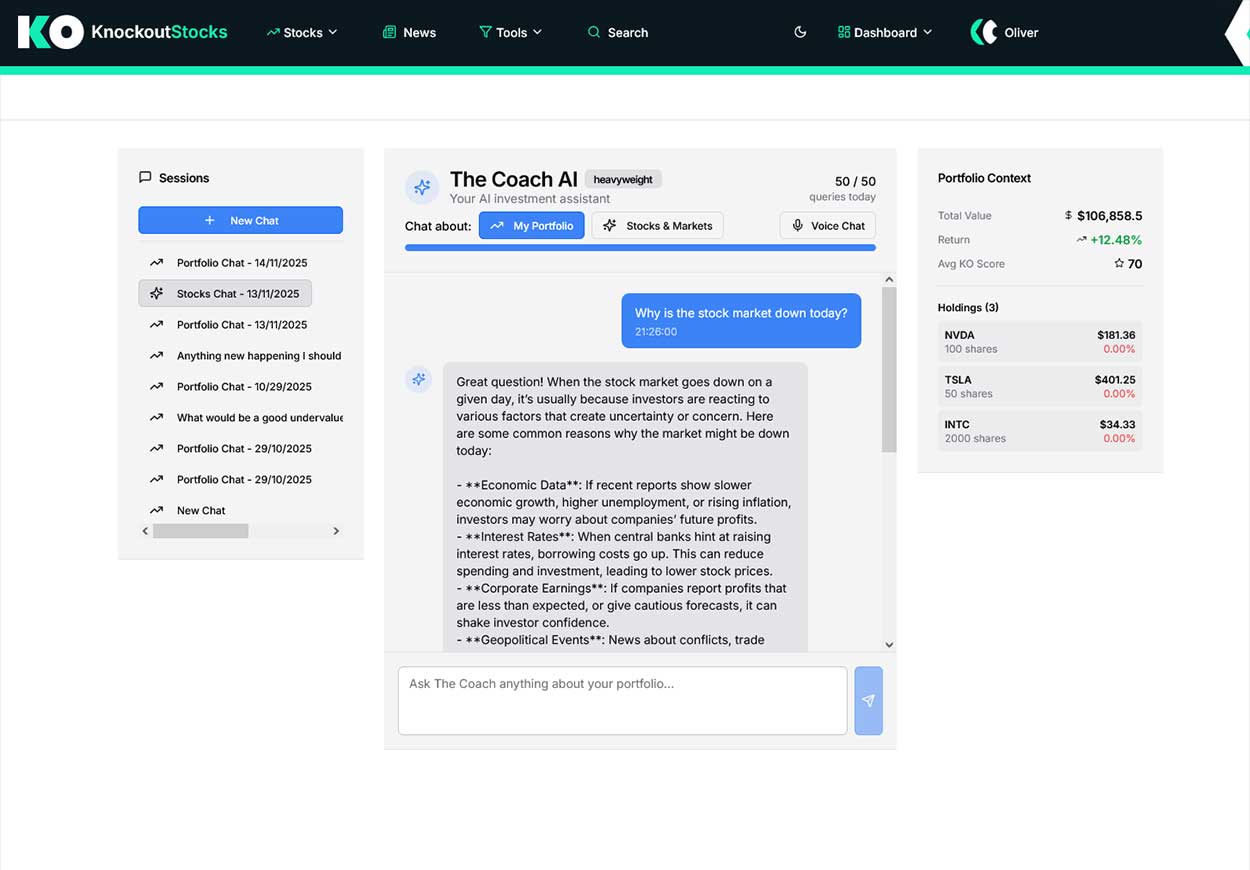

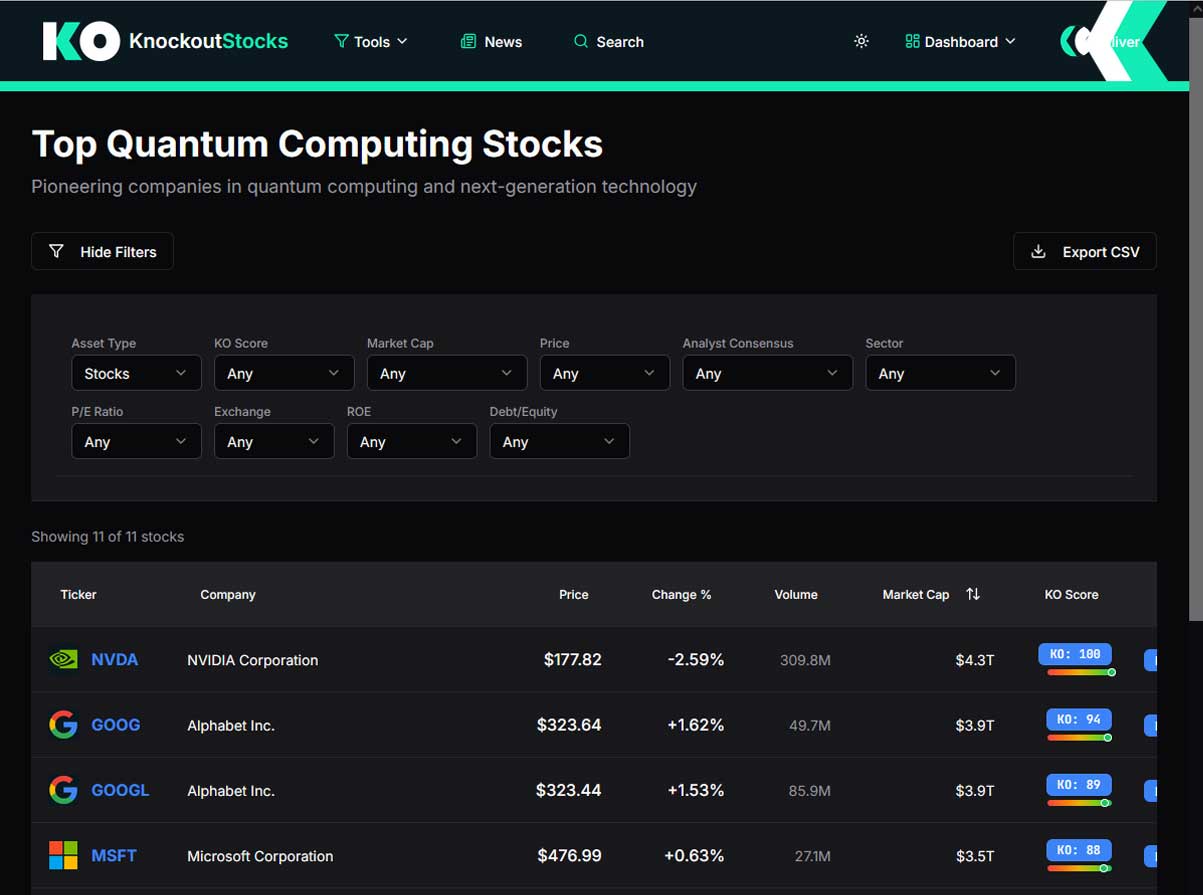

KnockoutStocks vs Zacks Investment Research: 2026 Stock Platform Showdown

Introduction

For decades, Zacks Investment Research has maintained its position as a leading authority in stock analysis. The company established its credibility through earnings estimate tracking, analyst revision monitoring, and its celebrated Zacks Rank methodology that evaluates stocks using earnings momentum indicators.

KnockoutStocks represents a fresh generation of AI-driven investment platforms that employs a more comprehensive methodology. It merges fundamental metrics, market indicators, and artificial intelligence capabilities within a unified system centered on the KO Score. While both services aim to guide investors toward superior stock selections, their approaches differ substantially.

Platform Overview

What Is KnockoutStocks?

[[LINK_START_4]]KnockoutStocks[[LINK_END_4]] operates as an artificial intelligence-enhanced stock analysis platform organized around the KO Score — a specialized ranking methodology that assigns stocks numerical ratings from 0 through 100. The scoring mechanism assesses every publicly traded company using five distinct categories: profitability metrics, balance sheet strength, expansion potential, price momentum, and analyst sentiment.

The service provides an AI-powered investment advisor, immediate AI-generated equity reports, sophisticated stock filtering tools, portfolio monitoring capabilities, and customized market intelligence. The platform delivers rapid, transparent, evidence-based investment guidance without requiring users to maintain multiple tool subscriptions or services.

What Is Zacks Investment Research?

Established in 1978, Zacks Investment Research ranks among the industry’s most enduring stock analysis organizations. The company’s primary offering is the Zacks Rank — an equity evaluation framework that assigns ratings from 1 through 5 determined by earnings projection modifications and analyst perspectives.

The service additionally features stock filtering utilities, investment research publications, portfolio management instruments, and numerous premium subscription offerings. Zacks maintains particular appeal among investors who prioritize earnings trajectory analysis and incorporate earnings revision data as a fundamental component of their investment methodology.

Feature Comparison

Stock Rankings and Ratings

The Zacks Rank forms the cornerstone of the company’s entire business model. This framework assigns scores from 1 (Strong Buy) through 5 (Strong Sell) based predominantly on earnings estimate revision patterns. The underlying principle suggests that upward analyst earnings revisions typically precede positive stock performance. This concentrated, extensively validated methodology carries substantial historical documentation.

The KO Score from KnockoutStocks adopts a more expansive evaluation framework. It synthesizes five weighted components — profitability, financial stability, growth trajectory, momentum indicators, and analyst consensus — into a single numerical rating spanning 0 to 100. Instead of concentrating exclusively on earnings revisions, it assesses overall business quality across multiple parameters. This methodology delivers a more comprehensive evaluation of a company’s fundamental strength.

AI Tools and Insights

Artificial intelligence serves as a foundational element throughout the KnockoutStocks platform. The AI advisory feature enables users to pose questions regarding specific securities, portfolio holdings, or market conditions on demand. Subscription tiers provide voice-activated AI functionality and unrestricted daily query volumes at premium levels.

Zacks has not integrated artificial intelligence capabilities into its primary platform infrastructure in any substantial capacity. The service continues operating as a data and research-focused offering built upon human analyst contributions and quantitative earnings frameworks. For investors who value AI-assisted research capabilities, KnockoutStocks maintains a decisive edge in this category.

AI-Generated Stock Reports

KnockoutStocks produces immediate AI-powered equity reports for any publicly traded security upon request. Each analysis encompasses company background, financial condition assessment, critical performance indicators, market behavior patterns, current developments, and analyst perspectives — compiled within seconds.

Zacks releases investment research documents on covered securities, authored by its analytical personnel. These publications offer thorough detail with substantial emphasis on earnings information. However, availability is restricted to stocks within Zacks’ coverage universe and reports are not produced instantaneously on demand.

Earnings Research

This category represents Zacks’ primary competitive advantage. The platform’s earnings projection data, earnings surprise historical records, and analyst revision monitoring rank among the finest resources accessible to individual investors. For those who construct investment decisions predominantly around earnings momentum and require comprehensive earnings intelligence, Zacks has constructed its complete infrastructure around this specialization.

KnockoutStocks incorporates analyst sentiment as one component within its five-pillar KO Score framework, which encompasses certain earnings and analyst perspective data. However, it does not provide the same depth of earnings estimate revision analysis and surprise history that characterizes the Zacks platform.

Stock Screener

KnockoutStocks provides an advanced filtering system featuring more than 20 criteria spanning KO Score metrics, market capitalization, price ranges, trading volume, fundamental indicators, and technical analysis parameters. Complete screener functionality is accessible through the no-cost subscription tier.

Zacks similarly offers a robust stock screening tool. The platform’s screener maintains strong industry recognition and permits filtering by Zacks Rank, earnings metrics, valuation multiples, and fundamental characteristics. However, comprehensive screener access requires premium membership, with the most sophisticated filtering capabilities reserved for higher-tier subscription packages.

Stock Picks and Investment Services

Zacks provides an extensive portfolio of premium investment advisory offerings beyond the foundational platform. These encompass curated equity recommendation portfolios, industry-specific investment ideas, and options strategy suggestions. Investors seeking a comprehensive menu of advisory services will discover abundant options.

KnockoutStocks features its proprietary Stock Picks collection — a concentrated portfolio carefully selected based on fundamental quality, competitive positioning, and sustainable growth prospects. This offering is available to Middleweight and Heavyweight subscribers. While more focused than Zacks’ extensive service range, it follows the same evidence-driven KO Score methodology.

Portfolio Tracking

KnockoutStocks delivers comprehensive portfolio monitoring with live performance metrics, profit and loss calculation, and AI-enhanced portfolio evaluation. The Heavyweight subscription accommodates up to 100 securities per portfolio with unlimited portfolio creation and AI-generated portfolio assessment reports.

Zacks offers portfolio tracking functionality that overlays Zacks Rank information and earnings data onto user holdings. The tool proves valuable for monitoring earnings-related indicators across portfolio positions but lacks AI-driven portfolio analysis capabilities or the tracking depth provided by KnockoutStocks.

Alerts and Updates

KnockoutStocks transmits customized daily or weekly email notifications covering watchlist activity, leading KO Score changes, earnings releases, analyst rating adjustments, and breaking developments customized to user holdings.

Zacks maintains a comprehensive alert infrastructure emphasizing earnings estimate modifications, Zacks Rank transitions, and analyst upgrade and downgrade activity. For investors who monitor earnings momentum closely, these notifications deliver authentic value and timeliness.

Pricing

KnockoutStocks presents three tiers. The complimentary plan includes complete screener access, single portfolio capability, five watchlist positions, one AI consultation weekly, and one AI equity report weekly. The Middleweight tier costs $19.99 monthly with 10 AI inquiries daily and 10 AI reports weekly. The Heavyweight tier runs $59.99 monthly with unlimited AI access, voice advisory services, PDF report exports, and CSV data downloads.

Zacks pricing commences with a no-cost tier providing limited Zacks Rank data access. The Zacks Premium subscription runs approximately $249 annually. Supplementary advisory services and premium portfolio offerings can substantially increase total subscription costs, positioning a comprehensive Zacks subscription among the market’s more expensive alternatives.

Pros and Cons

KnockoutStocks

Pros

- KO Score provides rapid, comprehensive quality assessment across thousands of publicly traded companies

- Integrated AI advisor for on-demand equity and portfolio inquiries

- Instantaneous AI equity reports accessible for any security at any moment

- Complete screener functionality on the complimentary subscription tier

- Robust portfolio monitoring with live data and AI evaluation

- Greater affordability across all subscription levels

- Voice-activated AI advisor accessible on premium subscription

- Comprehensive market coverage beyond earnings-focused securities

Cons

- Less comprehensive earnings estimate revision analysis compared to Zacks

- Emerging platform continuing to establish long-term performance history

- Limited premium advisory service offerings relative to Zacks

- Reduced historical earnings data comprehensiveness

Zacks Investment Research

Pros

- Zacks Rank maintains extensively documented long-term performance history

- Industry-leading earnings projection and revision intelligence

- Extensive selection of premium advisory offerings and equity recommendations

- Superior earnings surprise and estimate historical records

- Established platform with multi-decade research heritage

- Capable screener with comprehensive earnings-oriented filtering options

Cons

- Absence of dedicated AI investment advisory functionality

- No on-demand AI equity report generation

- Premium service costs can escalate rapidly

- Platform interface appears outdated relative to contemporary research tools

- Concentrated earnings emphasis results in diminished attention to other fundamentals

- Complimentary tier offers restricted meaningful functionality

Which Platform Is Best for Different Investors?

Use KnockoutStocks if you:

Prefer a rapid, comprehensive assessment of equity quality across thousands of companies utilizing one transparent scoring system. The KO Score evaluates profitability, balance sheet health, growth potential, momentum characteristics, and analyst sentiment — not merely earnings revision patterns.

Desire AI-enhanced capabilities on demand — submitting questions about securities, obtaining instant analytical reports, or evaluating your portfolio without awaiting analyst publications. KnockoutStocks incorporates this functionality throughout its core architecture.

Seek a contemporary, intuitive platform with superior portfolio monitoring and personalized notification systems at competitive pricing. The complimentary subscription tier alone delivers more functionality than Zacks’ free offering.

Aim to identify investment opportunities independently using sophisticated screening tools without encountering subscription barriers. Complete screener access on the free plan represents a meaningful competitive advantage.

Use Zacks if you:

Monitor earnings estimate revisions intensively and require the most comprehensive earnings momentum intelligence available to individual investors. Zacks has constructed decades of infrastructure around this particular data specialty.

Desire access to an extensive portfolio of premium advisory offerings, curated equity portfolios, and sector-focused recommendations beyond basic research platform functionality.

Operate as an earnings-focused investor who considers analyst estimate revisions the most reliable indicator of near-term equity performance. The Zacks Rank methodology is engineered specifically for this investment approach.

Require extensive historical earnings information and surprise history to guide your security selection methodology.

Final Verdict

Both Zacks and KnockoutStocks provide genuine investment value, though they reflect fundamentally different investing philosophies.

Zacks represents the superior solution if earnings momentum forms the central pillar of your stock selection methodology. The platform’s earnings projection data, revision monitoring, and Zacks Rank framework possess extensive historical validation and remain difficult to replicate for this particular application.

KnockoutStocks functions as the superior comprehensive platform. The KO Score methodology encompasses broader territory than the Zacks Rank, the AI capabilities introduce an on-demand intelligence dimension that Zacks completely lacks, and the portfolio tracking functionality extends considerably deeper. These advantages arrive at reduced pricing with a more accessible complimentary subscription tier.

For investors seeking a complete, contemporary research infrastructure that addresses fundamentals, market indicators, and AI-enhanced intelligence — KnockoutStocks delivers superior value in 2026. Zacks continues as a capable specialized instrument for earnings-focused investors, though as a comprehensive research platform it demonstrates its age against newer AI-powered alternatives.

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business1 day ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech7 days ago

Tech7 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat7 days ago

NewsBeat7 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion1 day ago

Fashion1 day agoWeekend Open Thread: Ann Taylor

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech3 days ago

Tech3 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics7 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech7 days ago

Tech7 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat6 days ago

NewsBeat6 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World7 days ago

Crypto World7 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

Crypto World5 days ago

Crypto World5 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat2 days ago

NewsBeat2 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter