Crypto World

Ondo and Securitize discuss at Consensus Hong Kong

Hong Kong — Tokenization is gaining traction, but its success depends less on market hype and more on real-world utility, say executives from Ondo Finance and Securitize.

“There’s no shortage of firms, of issuers, of companies that are interested in tokenizing,” said Graham Ferguson, head of ecosystem at Securitize, during a panel discussion at Consensus Hong Kong. “But it’s on us to figure out how to distribute these assets on-chain via exchanges in a way that is compliant, regulatory-friendly globally.”

Ferguson emphasized that despite high interest on the institutional side, distribution and compliance remain the bottlenecks. “The biggest issue that we run into is communicating with exchanges and DeFi protocols about the requirements that are necessary to adhere to our obligations as a regulated entity,” he said.

Securitize has partnered with firms such as BlackRock to tokenize real-world assets, including U.S. Treasury funds. BlackRock’s BUIDL fund, launched in 2024, now holds over $2.2 billion in assets, making it the largest tokenized Treasury fund on the market.

Ondo Finance, which also focuses on tokenized Treasuries and exchange-traded funds (ETFs), has about $2 billion in total value locked (TVL) according to data from rwa.xzy. Min Lin, Ondo’s managing director of global expansion, said tokenized Treasuries today are a fraction of the potential market.

Both speakers stressed that the next phase of tokenization will be driven by what users can actually do with tokenized assets. Ondo recently enabled tokenized stocks and ETFs to be used as margin collateral in DeFi perpetuals — a first, Lin said.

“That brings a lot more capital efficiency in terms of the utility of those tokenized assets,” he added.

Ferguson agreed, arguing that technological advantages like programmable compliance and fast settlement aren’t enough on their own. “Utility is absolutely far and away number one,” he said. “That’s what will drive the next phase.”

Crypto World

Paxful Hit with $4 Million Penalty Over Illegal Transactions and Crimes

TLDR

- Paxful has been sentenced to pay a $4 million fine after pleading guilty to money laundering and prostitution charges.

- The company processed over $3 billion in crypto trades between 2017 and 2019, including transactions linked to Backpage.

- The U.S. Department of Justice initially sought a $112 million penalty but reduced it to $4 million based on Paxful’s financial situation.

- Paxful also agreed to pay a separate $3.5 million civil penalty to the Financial Crimes Enforcement Network.

- The case highlights the legal risks faced by cryptocurrency exchanges involved in facilitating illegal activities.

Paxful Holdings, a peer-to-peer Bitcoin marketplace, has been sentenced to pay a $4 million fine after pleading guilty to charges of fostering illegal prostitution, violating money-laundering laws, and knowingly handling criminal proceeds. The company, which ceased operations in 2023, processed over $3 billion in crypto trades between 2017 and 2019. U.S. authorities also revealed that Paxful had facilitated transactions linked to Backpage, a platform notorious for promoting illicit sex work.

Paxful Pleads Guilty to Criminal Charges

Paxful entered a plea agreement with U.S. authorities in December, admitting to its involvement in illegal activities. The peer-to-peer exchange knowingly transferred Bitcoin for customers linked to criminal schemes, including money laundering and fraud. During this period, Paxful made substantial profits, collecting approximately $30 million from its operations.

The Justice Department emphasized that Paxful’s actions allowed illegal transactions to take place undisturbed. “By putting profit over compliance, the company enabled money laundering and other crimes,” said Eric Grant, U.S. Attorney for the Eastern District of California. The company also processed Bitcoin for Backpage, a platform heavily involved in prostitution and trafficking, further complicating its legal standing.

Impact of the $4 Million Fine on Paxful

Originally, the Justice Department had sought a fine exceeding $112 million. However, the company’s inability to pay that amount led to a drastically reduced penalty. After considering Paxful’s financial situation, the final fine was set at $4 million, which a federal judge affirmed during a sentencing hearing.

In addition to the criminal fine, Paxful agreed to pay a separate $3.5 million civil penalty to the Financial Crimes Enforcement Network (FinCEN). The company’s founders were also implicated, with Artur Schaback, Paxful’s co-founder from Estonia, pleading guilty to violating anti-money laundering laws in 2024. Paxful’s operations and marketing strategies were scrutinized, with the company once boasting about the “Backpage Effect” in boosting its business.

The court’s ruling reflects a broader commitment to holding companies accountable for facilitating illegal activity. U.S. Attorney Eric Grant emphasized that the sentence serves as a clear warning. Companies that fail to prevent criminal activities on their platforms will face severe legal consequences under U.S. law. Paxful’s plea deal marks a pivotal moment in the ongoing effort to regulate cryptocurrency exchanges and curb illegal use.

The $4 million fine, while a fraction of the initial demand, underscores the seriousness of the charges and Paxful’s role in criminal networks. This case serves as a reminder of the legal and financial risks faced by cryptocurrency exchanges that fail to comply with U.S. laws.

Crypto World

Mastercard, Central Bank of Syria Launch Payments Knowledge Exchange Program

Editor’s note: Mastercard and the Central Bank of Syria have launched a series of structured knowledge-sharing exchanges and technical workshops focused on payments, regulation, and financial infrastructure. The initiative follows a memorandum of understanding signed in September 2025 and aims to strengthen institutional capacity within Syria’s financial sector. Through tailored sessions led by Mastercard experts, the program targets regulatory frameworks, compliance practices, and global trends in digital payments. The collaboration reflects broader efforts by the Central Bank to modernize financial systems, align with international standards, and support a more resilient and future-ready payments ecosystem.

Key points

- Mastercard and the Central Bank of Syria are running technical workshops under a 2025 cooperation framework.

- The program focuses on regulatory capacity, compliance, and modern payments infrastructure.

- Knowledge transfer is delivered by Mastercard’s global subject matter experts.

- The initiative supports financial sector modernization and institutional resilience.

Why this matters

Strengthening regulatory and institutional capabilities is a foundational step in rebuilding trust and functionality within a national financial system. For Syria, exposure to international best practices in payments and compliance can support safer, more efficient financial services and help lay the groundwork for broader digital finance adoption. For the market, this type of capacity-building initiative signals a focus on long-term infrastructure, governance, and alignment with global standards, all of which are essential for sustainable financial development.

What to watch next

- Additional workshops or technical sessions delivered under the cooperation framework.

- Policy or regulatory updates informed by the knowledge exchanges.

- Further collaboration between the Central Bank and international technology providers.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Damascus, Syria; 11 February 2026: Mastercard and the Central Bank of Syria have launched a series of structured knowledge sharing exchanges and technical workshops aimed at strengthening institutional capabilities and advancing best practices in payments and financial services.

The initiative builds on the strategic cooperation framework established through a memorandum of understanding (MoU) signed in September 2025, and reflects the Central Bank’s broader efforts to modernize the financial sector and create an enabling regulatory framework that is aligned with international standards.

Under the program, Mastercard’s global subject matter experts will deliver tailored technical sessions and knowledge transfer aligned with the Central Bank of Syria’s policy priorities. The exchanges focus on regulatory capacity, compliance frameworks, and emerging global trends in payments and financial infrastructure, supporting a more resilient and future-ready financial ecosystem.

“These workshops represent a pivotal step in strengthening institutional capacity and aligning our regulatory and market practices with international standards. By drawing on Mastercard’s global expertise, we are equipping policymakers, regulators, and market participants with the tools needed to modernize Syria’s financial infrastructure. This next phase of collaboration reflects our shared commitment to rebuilding trust, enhancing resilience, and advancing Syria’s reintegration into the international financial system.” said His Excellency Dr. Abdulkader Husrieh, governor, Central Bank of Syria.

“At Mastercard, we are dedicated to working with the Central Bank of Syria and local financial sector players to strengthen the country’s digital payments infrastructure and expand access to financial services for consumers and businesses. In line with our belief that capacity building is a foundational element of sustainable and inclusive financial development, we are keen to share our knowledge to support institutional learning and raise awareness about global best practices in financial systems,” said Adam Jones, division president, West Arabia, Mastercard.

Building on its extensive experience, gained from operating payment networks in more than 200 countries and territories, Mastercard serves as a trusted partner, technology provider and policy advisor to governments worldwide. The company’s collaboration with the Central Bank of Syria stands to benefit millions of potential financial services users across the country.

About Mastercard

Mastercard (NYSE: MA) powers economies and empowers people in 200+ countries and territories worldwide. Together with our customers, we’re building a resilient economy where everyone can prosper. We support a wide range of digital payments choices, making transactions secure, simple, smart and accessible. Our technology and innovation, partnerships and networks combine to deliver a unique set of products and services that help people, businesses and governments realize their greatest potential.

Crypto World

Bitcoin Surges After US Jobs Beat as Fed Pause Odds Near 95%

Bitcoin (CRYPTO: BTC) faced a volatile session as U.S. payrolls data surprised to the upside, complicating the path for the Federal Reserve and market risk appetite. After an early intraday spike toward the high $60,000s, the largest cryptocurrency retraced, leaving traders weighing whether a deeper pullback is coming or a temporary pause in risk-off sentiment is enough to support a rebound. The reaction came as the broader equity complex wobbled, with major indices trading in divergent fashion in response to the jobs release and the Fed’s likely response to it. The day’s price action underscores how macro news can quickly reframe crypto downside risk and the near-term technical setup.

Key takeaways

- Bitcoin briefly spiked toward the $69,000 mark intraday before reversing, with the move followed by a pullback that extended losses through the session.

- U.S. nonfarm payrolls rose by 130,000 in January, well above the 55,000 consensus, while the unemployment rate ticked down to 4.3% from 4.4%.

- Despite the strong jobs data, the signal for the Federal Reserve to hold rates at the March meeting persisted, supported by futures markets showing a high probability of a pause.

- The S&P 500 inched higher early but then gave back the gains, while the Nasdaq Composite slid, illustrating mixed risk-asset responses to the same macro print.

- Analysts and traders flagged a potential “slow bleed” scenario for BTC toward the sub-$60,000s or mid-$50,000s if buyers fail to reclaim key levels, with attention fixed on Friday’s CPI release for further clarity.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. A sharp intraday spike gave way to a renewed downward slope, signaling renewed anxiety about near-term downside risk.

Trading idea (Not Financial Advice): Hold. The market is testing whether downside pressure can be contained above key support levels, with forthcoming inflation data likely to drive the next leg.

Market context: The broader crypto environment remains sensitive to macro narratives—especially inflation trajectories and the likelihood of further monetary tightening or pauses—which shape liquidity and risk sentiment across digital assets.

Why it matters

The January employment report cemented a narrative in which a robust labor market reduces the near-term impulse for the Fed to cut rates, complicating the outlook for risk assets, including bitcoin. While stronger payrolls can intensify fears of higher-for-longer policy, the sheer resilience of the job market also mitigates the chance of a sharp recession, which can paradoxically support risk appetite in certain regimes. The market’s response in equities—modest gains in the S&P 500 that faded while tech-heavy indices retreated—reflects a nuanced equilibrium: traders are parsing whether macro strength translates into higher yields and tighter financial conditions, or whether cooling inflation signals will eventually embolden a broader risk-on posture.

Bitcoin’s price action over the session underscored those crosscurrents. The initial move higher suggested a renewal of demand, perhaps driven by the prospect of a Fed pause and the possibility of liquidity support from markets still navigating 2026’s macro landscape. Yet as the day evolved, the lack of follow-through on the upside and the re-emergence of selling pressure highlighted how quickly technical conditions can pivot on a single data release. For market participants, the takeaway is clear: macro prints will continue to define crypto volatility in the near term, even when the fundamental picture for blockchain technologies remains intact and the long-run adoption thesis remains intact.

Looking ahead, traders will be watching not only next week’s inflation data but also ongoing risk signals from both traditional markets and on-chain metrics. The interplay between macro cues and crypto-specific dynamics—such as exchange inflows, funding rates, and retail participation—will determine whether BTC stabilizes near current levels or tests critical supports in the low to mid-$60,000 range. The Fed’s eventual policy stance, as reflected in the FedWatch indicator and related market pricing, will remain a major driver, shaping whether risk assets get a sustained push or retreat into a risk-off regime.

What to watch next

- Friday’s Consumer Price Index (CPI) release to gauge inflation momentum and its impact on the Fed’s course.

- The March FOMC decision and the probability of a rate pause, as reflected in futures markets.

- BTC price action around key support levels near $64,000, $62,000, and the rumored $50,000 downside scenario.

- Market breadth signals in equities and whether risk-on appetite improves or deteriorates in the wake of inflation data.

- Any new official guidance from major market participants and notable traders regarding the balance of risk and potential upside catalysts for BTC.

Sources & verification

- U.S. Bureau of Labor Statistics January nonfarm payrolls report showing 130,000 jobs added and the unemployment rate at 4.3%.

- CME Group FedWatch Tool indicating high odds of a rate pause in March.

- TradingView BTCUSD price charts capturing intraday spikes and retracements on the session.

- Kobeissi Letter’s analysis on unemployment trends and the Fed’s expected stance.

- Price context and reference points discussed in market commentary noting BTC’s potential low-$60k to mid-$50k scenarios and prior coverage of $69,000 significance.

Bitcoin volatility and the jobs data backdrop

Bitcoin (CRYPTO: BTC) traded with pronounced sensitivity to the day’s macro data, underscoring how quickly crypto markets respond to shifts in macro policy expectations. The price momentum was highly event-driven: a brisk move up toward the $69,000 area was followed by a swift reversal, dragging the session into negative territory as the day wore on. The early move appeared to reflect a tempered optimism around a potential pause in rate hikes, but the subsequent pullback suggested that investors are not yet prepared to embrace a renewed up-leg without more convincing evidence of durable demand.

The January nonfarm payrolls report delivered numbers well above expectations—130,000 jobs added against a forecast of 55,000—while the unemployment rate declined to 4.3%. Such a strong labor market reduces the immediate pressure on the Fed to cut rates, implying a higher probability that policy normalization will proceed at a measured pace. In the near term, that translates to a cautious stance for crypto and other risk assets, even as the longer-term inflation trajectory remains a central question for market participants. The data fed into a narrative that a Fed pause would persist, a conclusion reflected by the CME FedWatch Tool’s readings that traders viewed the odds of a March pause as elevated, a signal that liquidity conditions may not tighten rapidly enough to derail risk appetite completely, but also that upside momentum in BTC would require a solid commitment from buyers at key price junctures.

Asset markets showed a mixed response. The S&P 500 edged higher in early trading before retracing, while the Nasdaq Composite slipped, highlighting a bifurcated risk environment where value and growth cohorts moved in different directions in response to the same macro release. Gold, often a proxy for macro uncertainty, also exhibited choppy behavior, briefly touching fresh February highs before trimming gains as traders weighed the likelihood of further volatility in the real economy. The nuance here is important: even with a robust January jobs report, the macro landscape remains unsettled, leaving markets to calibrate inflation expectations against the probability of a slower but still uncertain path for monetary policy.

Among traders, sentiment leaned toward caution. The Kobeissi Letter’s commentary framed the data as supportive of the view that the Fed would pause, a narrative that aligns with a broader market expectation of a softer near-term policy stance. Yet the absence of a decisive bounce in BTC underscored a critical point: macro strength does not automatically translate into immediate crypto upside, particularly when the price must contend with meaningful resistance around prior highs and the looming risk of a renewed downturn if buyers fail to reclaim and sustain momentum above critical levels. In this context, BTC’s journey from the intraday peak back toward sub-$70,000 territory epitomized the current tension between macro resilience and crypto-specific risk management.

https://platform.twitter.com/widgets.js

Crypto World

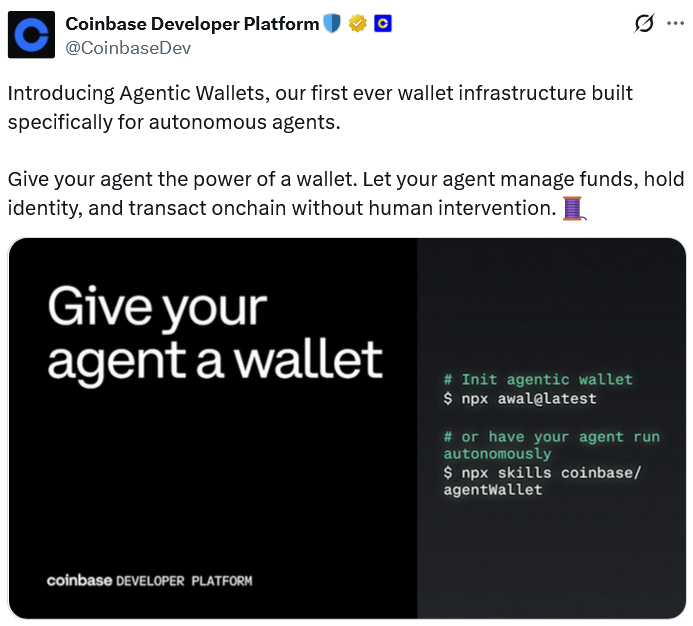

Coinbase Launches Crypto Wallets Purpose-Built For AI Agents

Coinbase has launched crypto wallet infrastructure that allows AI agents — programs that can think and transact without human input — to spend, earn and trade crypto.

In a post on Wednesday, Coinbase programmers Erik Reppel and Josh Nickerson said the new Agentic Wallets feature aims to build on today’s agents, which can answer questions, summarize documents, and assist with tasks, but can’t execute trades or orders on behalf of users.

“The next generation of agents won’t just advise — they’ll act,” the pair said, adding that AI agents will be able to do everything from monitoring decentralized finance positions and rebalancing portfolios to paying for compute and API access and participating in creator economies.

Reppel and Nickerson said Agentic Wallets build on Coinbase’s AgentKit framework, introduced in November 2024, which enabled developers to embed wallets into agents.

The agents can transact via Coinbase’s x402, a purpose-built payments protocol for autonomous AI use cases that has already reportedly seen 50 million transactions.

Through x402, “Agents acquire API keys, purchase compute, access premium data streams, and pay for storage – all autonomously, creating truly self-sustaining machine economies,” the programmers said.

Reppel and Nickerson said agents would be able to operate on the Ethereum layer-2 network Base, “Managing positions and executing strategies wherever the opportunities exist.”

“Build agents that monitor yields across protocols, execute trades on Base and manage liquidity positions 24/7. Your agent detects a better yield opportunity at 3am? It rebalances automatically, no approval needed because you’ve already set permissions and controls.”

AI agents now operable on the Bitcoin Lightning Network

Lightning Labs, the team behind the Bitcoin layer-2 Lightning Network, also released a new toolset on Wednesday that enables AI agents to transact on Lightning using the L402 protocol standard.

The AI agents can also run a Lightning node and manage a Lightning wallet containing native Bitcoin (BTC) without access to the private keys.

Meanwhile, Crypto.com CEO Kris Marszalek launched ai.com on Monday, a platform that lets users create personal AI agents to perform everyday tasks on their behalf.

Marszalek said the AI agents can perform anything from managing emails and scheduling meetings to canceling subscriptions, carrying out shopping tasks and planning trips.

Crypto leaders are bullish on agentic AI

Jeremy Allaire, the CEO of stablecoin issuer Circle, predicted on Jan. 22 that billions of AI agents will be transacting with crypto and stablecoins for everyday payments on behalf of users in three to five years.

Former Binance CEO Changpeng “CZ” Zhao has shared a similar view, stating that “native currency for AI agents is going to be crypto” and will do everything from buying tickets to paying restaurant bills.

Related: Deel taps MoonPay to roll out stablecoin salary payouts in UK, EU

Outside of crypto, tech giant Google introduced the Universal Commerce Protocol on Jan. 11 to power agentic commerce.

Google’s protocol uses its Agent Payment Protocol 2 to facilitate transfers on behalf of users, with Google Pay serving as the default payment handler for US dollar transactions.

Magazine: The critical reason you should never ask ChatGPT for legal advice

Crypto World

BNB price slips below $620 golden pocket

BNB price is now trading around $609, slipping below the previously defended $620 golden pocket level and putting long-term support to the test.

Summary

- Price dips under the $620 0.618 Fibonacci “golden pocket”

- Trading near the 200-week moving average, a key macro support

- Structure remains intact — but bulls need a reclaim of $620

Binance (BNB) is once again at a critical inflection point after losing the $620 region that had been acting as a high-timeframe support cluster. Following weeks of corrective pressure, price briefly stabilized at the 0.618 Fibonacci retracement before slipping modestly lower, now hovering near $609.

This move shifts the technical narrative slightly: rather than cleanly holding support, BNB is now probing the lower bounds of a major confluence zone. Whether this becomes a deviation below support or the start of deeper consolidation will likely define the next multi-week trend.

BNB price key technical points

- $620 remains the high-timeframe golden pocket (0.618 Fibonacci retracement)

- Price is hovering around the 200-week moving average

- A reclaim of $620 would strengthen the bullish case

- Sustained acceptance below opens the door to further downside exploration

The $620 level continues to carry heavy technical weight. It marks the 0.618 Fibonacci retracement of the broader advance — often referred to as the “golden pocket,” a zone that frequently acts as a high-probability reversal area.

However, with BNB now trading below that level, the focus shifts to whether this is a temporary liquidity sweep or a more meaningful breakdown.

Importantly, price remains near the 200-week moving average — a widely followed macro trend indicator. Historically, sustained closes below this level tend to invite extended consolidation, while swift recoveries often signal a false breakdown.

The next few weekly closes will therefore be critical.

Market structure supports a potential bottom

From a broader market structure perspective, the chart has not yet confirmed a full trend reversal. While the loss of $620 weakens the immediate bullish structure, BNB has not decisively broken down into lower macro territory.

This type of price action — slipping below support before reclaiming it — is common during bottoming formations. Markets often sweep liquidity below obvious levels before rotating higher.

If buyers step in and push price back above $620 with conviction and expanding volume, the move could be classified as a deviation, reinforcing the broader bullish structure.

If not, deeper consolidation becomes increasingly likely.

Upside targets come back into focus

Bullish case:

- Reclaim and hold above $620

- Strong weekly close back inside the golden pocket

- Gradual rotation toward higher resistance

- $932 remains the key high-timeframe resistance target

Bearish case:

- Continued weekly closes below $620

- Loss of the 200-week moving average

- Expansion in selling volume

- Potential move toward lower value areas before base formation

What to expect in the coming price action

The $932 high-timeframe resistance remains the primary upside objective if macro structure holds. However, reclaiming $620 is the first major hurdle bulls must clear before that target comes back into play.

With BNB now around $609, this is no longer simply a stabilization story — it is a support test.

High-timeframe setups require patience. The coming weekly closes will determine whether the current move becomes a confirmed breakdown or a classic deviation below major support.

For now, the broader structure is under pressure but not broken. A decisive reclaim of $620 would quickly restore bullish momentum. Failure to do so would shift focus toward extended consolidation before any meaningful upside rotation can begin.

Crypto World

MYX Finance Set For 43% Crash As Price Falls Below $5

MYX Finance price has dropped sharply, slipping below the critical $5.00 level and signaling growing downside risk.

The breakdown follows several sessions of declining momentum. Selling pressure accelerated after MYX failed to hold key intraday support. Market structure now reflects a bearish shift.

MYX Traders Turn Bearish

The recent dip has triggered increased short positioning among MYX traders. Funding rate data shows the futures market is dominated by short contracts. Negative funding reflects bearish conviction, as traders position for further declines in MYX Finance price.

Sponsored

Sponsored

A surge in short interest often signals expectations of a deeper correction. Traders appear to be anticipating a price crash they can capitalize on through leveraged positions. This imbalance in derivatives markets may amplify volatility and reinforce downward pressure if selling accelerates further.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Money Flow Index, or MFI, indicates heavy selling pressure on the MYX price, reinforcing the ongoing correction. The indicator has trended lower in recent sessions, reflecting sustained capital outflows. This weakness confirms that bearish momentum remains dominant across short-term trading activity.

Although the MFI is approaching the oversold threshold, it has not yet dropped below the 20.0 mark. A decisive move under that level typically signals selling saturation, where accumulation may emerge at discounted prices. If accumulation strengthens, MYX could attempt a technical rebound.

MYX Price May See Further Decline

MYX price is down 23% in the last 24 hours, trading at $4.87 after sliding below $5.00. The token now appears to be breaking down from a bearish ascending wedge pattern. Such formations often precede sharp corrections when support levels fail.

The wedge structure projects a potential 43% decline toward $2.81, coinciding with the 1.78 Fibonacci level. However, a more immediate and realistic target lies near the $4.07 (1.23 fib line) support zone. A confirmed break below $4.61 would increase the probability of testing $4.07, with further downside risk if broader crypto sentiment deteriorates.

A shift in investor behavior could alter this outlook should MYX end up being oversold, as the MFI hints at. If inflows begin to outweigh outflows and short positions unwind, MYX Finance may attempt stabilization. A decisive move above $5.75 resistance would invalidate the bearish thesis and potentially drive the price toward $6.00 in the near term.

Crypto World

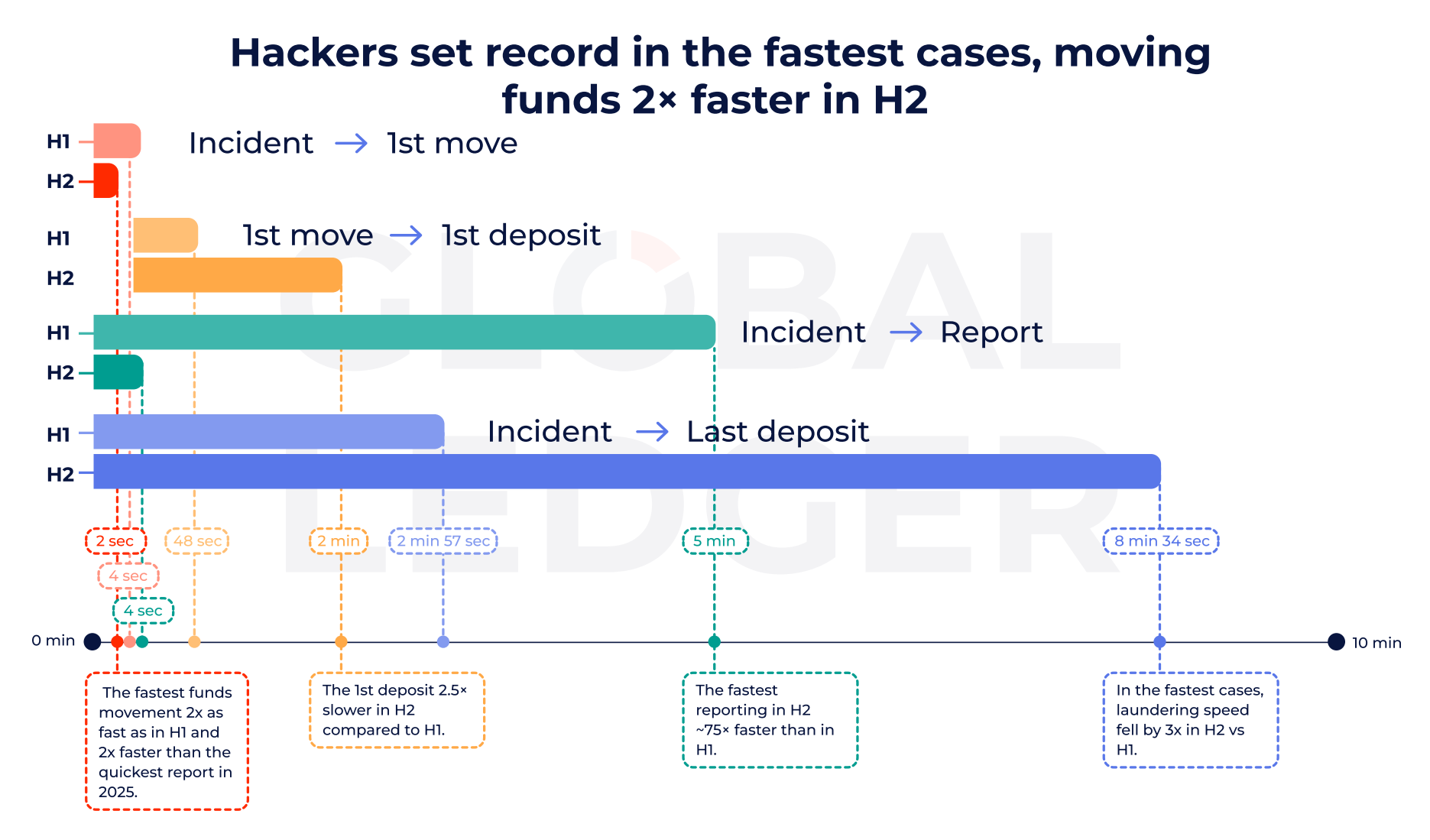

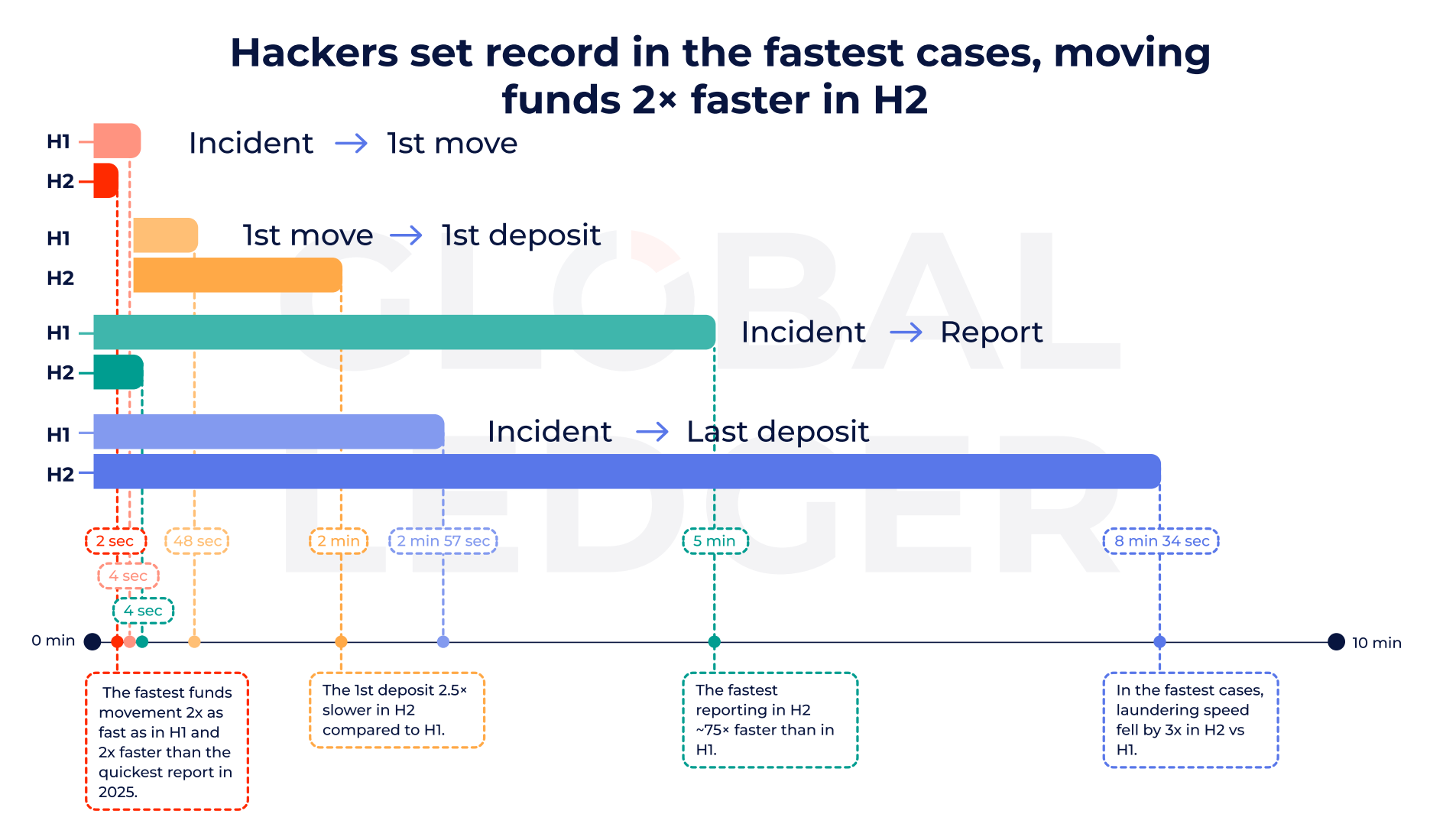

The 2-Second Crypto Laundering Shockwave

Crypto hackers are now moving stolen funds in as little as two seconds after an attack begins. In most cases, they shift assets before victims even disclose the breach.

That is the clearest finding from Global Ledger’s 2025 analysis of 255 crypto hacks worth $4.04 billion.

Sponsored

Sponsored

Blink and It’s Gone: Crypto Laundering Now Starts Before Disclosure

The speed is striking. According to Global Ledger, 76% of hacks saw funds move before public disclosure, rising to 84.6% in the second half of the year.

This means attackers often act before exchanges, analytics firms, or law enforcement can coordinate a response.

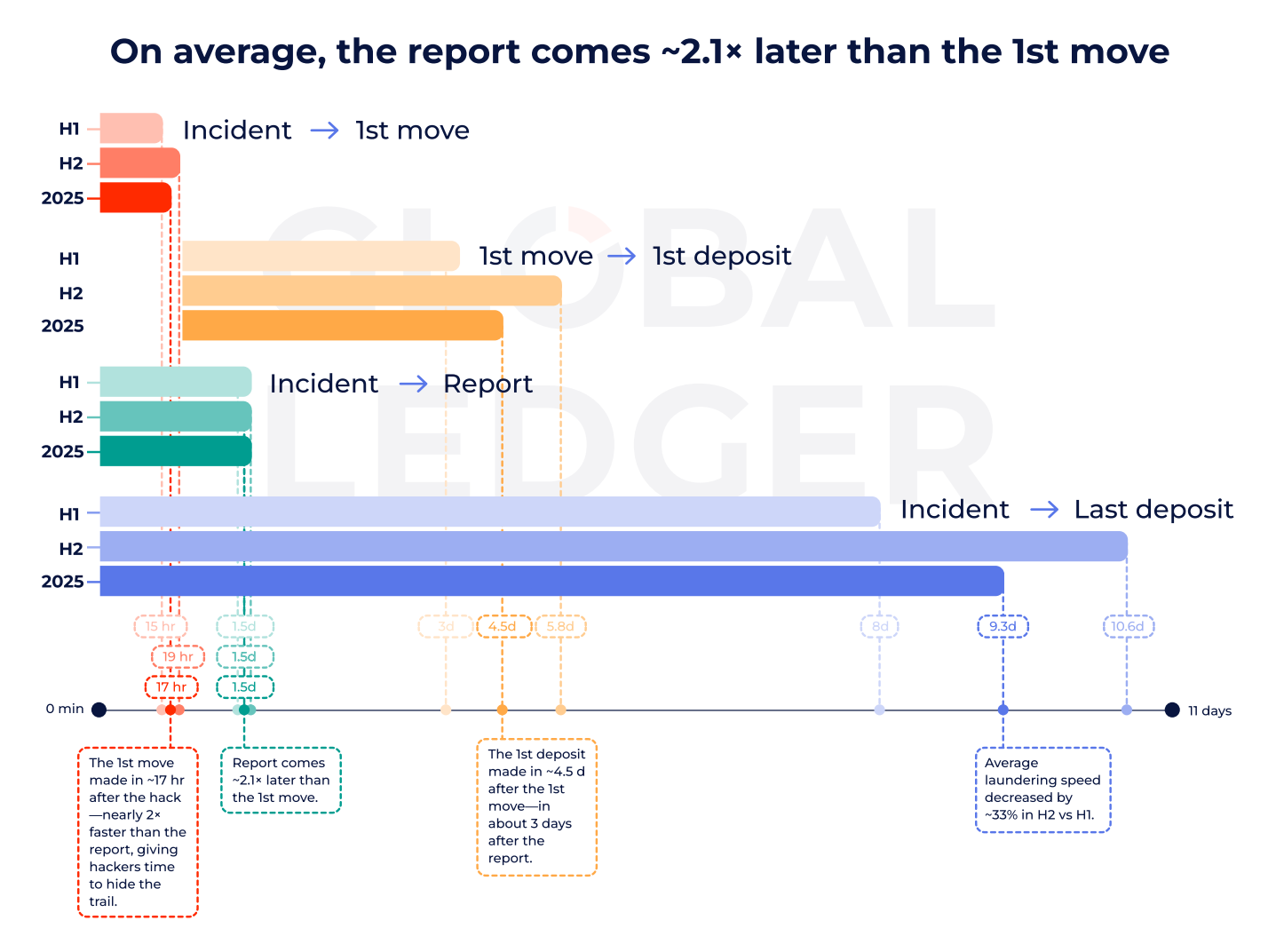

However, speed tells only part of the story.

While first transfers are now near-instant, full laundering takes longer.

On average, hackers needed about 10.6 days in the second half of 2025 to reach final deposit points such as exchanges or mixers, up from roughly eight days earlier in the year.

In short, the sprint is faster, but the marathon is slower.

Sponsored

Sponsored

This shift reflects improved monitoring after disclosure. Once incidents go public, exchanges and blockchain analytics firms label addresses and increase scrutiny.

As a result, attackers break funds into smaller pieces and route them through multiple layers before attempting cash-out.

Hacking Speed Increased, but Crypto Laundering Speed Became Slower. Source: Global Ledger

Sponsored

Sponsored

Bridges, Mixers, and the Long Road to Cash-Out

Bridges have become the main highway for that process. Nearly half of all stolen funds, about $2.01 billion, moved through cross-chain bridges.

That is more than three times the amount routed via mixers or privacy protocols. In the Bybit case alone, 94.91% of stolen funds flowed through bridges.

At the same time, Tornado Cash regained prominence. The protocol appeared in 41.57% of hacks in 2025. Its usage share jumped sharply in the second half of the year, following sanctions changes cited in the report.

Meanwhile, direct cash-outs to centralized exchanges fell sharply in the second half. DeFi platforms received a rising share of stolen funds. Attackers appear to avoid obvious off-ramps until attention fades.

Sponsored

Sponsored

Notably, nearly half of all stolen funds remained unspent at the time of analysis. That leaves billions sitting in wallets, potentially waiting for future laundering attempts.

The scale of the problem remains severe. Ethereum accounted for $2.44 billion in losses, or 60.64% of the total.

Overall, $4.04 billion was stolen across 255 incidents.

Yet recovery remains limited. Only about 9.52% of funds were frozen, and 6.52% were returned.

Taken together, the findings show a clear pattern. Attackers now operate at machine speed in the first seconds after a breach.

Defenders respond later, forcing criminals into slower, staged laundering strategies. The race has not ended. It has simply entered a new phase—measured in seconds at the start, and days at the finish.

Crypto World

ZRO Soars 40% After Unveiling Layer 1 Blockchain

LayerZero announced its Zero blockchain yesterday, built in collaboration with Citadel, ICE, and Google Cloud.

LayerZero’s ZRO token is leading the altcoin market today, rallying 40% after unveiling Zero, its new Layer 1 blockchain.

ZRO sold off immediately after yesterday’s announcement; however, after more details emerged – such as Ark Invest founder Cathie Wood stepping on board as an advisor – the token surged from $1.7 to $2.5.

The ZRO token has been pricing in an impending announcement throughout 2026, and has been one of just a handful of strong altcoins over the last six weeks. The move brings ZRO’s market capitalization to $481 million, its highest level since January 2025.

In addition to Wood, the protocol also added Michael Blaugrund, the vice president of Strategic Initiatives at Intercontinental Exchange (ICE), and Caroline Butler, the former Head of Digital Assets at the Bank of New York Mellon, and co-chair of the Commodities and Futures Trading Commission (CFTC), to its advisory board.

LayerZero brands Zero as “the first multi-core world computer” and says it’s been designed to address all existing bottlenecks in blockchain design, with an explicit goal of 2 million transactions per second (TPS) for every component in its system.

“We have replaced the fragmented, one-size-fits-all model with a unified high-performance system that treats multiple applications like concurrent processes on a single modern multi-core CPU. Due to this massive cost reduction, Zero is not only an alternative to existing blockchains; it provides a credible alternative to centralized cloud providers like AWS,” the Zero debut article claims.

“By stripping away the overhead of redundant replication, we have finally made decentralization viable on a global scale. Zero is the first truly scalable, multi-core world computer,” the article concluded.

Crypto World

Crypto ETFs are here to stay, downturn be damned

Despite a bearish cryptocurrency market, ETF issuers continue to push forward with new filings, betting that demand for digital asset funds will remain strong.

Summary

- ETF issuers like Bitwise, ProShares, and 21Shares are advancing with new filings, including plans for Uniswap-linked and leveraged Bitcoin/Ether ETFs.

- The crypto ETF market is crowded, with over 140 existing funds, 10 new launches this year, and more expected.

- Bitcoin’s sharp price drop has led to significant losses for ETF buyers, with $1.5 billion withdrawn from Ether ETFs and over $3.5 billion from Bitcoin ETFs in the past three months.

This month, Bitwise Asset Management filed for a Uniswap-linked ETF, while ProShares sought approval for leveraged Bitcoin and Ether ETFs. 21Shares also resubmitted plans for funds based on Ondo and Sei, signaling progress in its efforts.

Todd Sohn, chief ETF strategist at Strategas, told Bloomberg that while firms like 21Shares and Bitwise remain committed to the long-term potential of crypto, ongoing poor performance could affect future flows.

This comes amid a crowded market, with over 140 crypto-focused US ETFs already trading, and 10 more launched this year. A BNB staking ETF is expected soon.

Cryptos have faced renewed pressure after October’s selloff, with Bitcoin falling sharply, dragging smaller tokens down. Investors are stepping back as liquidity tightens and risk appetite wanes.

Data from Glassnode shows that buyers of U.S. spot-Bitcoin ETFs are sitting on average paper losses, having bought Bitcoin at around $84,100 per coin, while the price now hovers near $66,000. This has led to significant outflows, with over $1.5 billion withdrawn from Ether-focused ETFs and more than $3.5 billion pulled from Bitcoin ETFs in recent months.

Crypto World

Chainlink Feeds Live for Ondo Tokenized US Stocks on Ethereum

Ondo Finance’s Ondo Global Markets platform has integrated Chainlink as its official data oracle, enabling on-chain price feeds for tokenized US stocks such as SPYon, QQQon and TSLAon to go live on Ethereum. The feeds are now being utilized on Euler, where users can post tokenized equities as collateral to borrow stablecoins. This development provides on-chain pricing references for the tokenized assets and allows DeFi protocols to set collateral parameters and manage liquidations tied to underlying equities, while also accounting for corporate actions like dividends. The move marks a notable step in bringing traditional equities closer to decentralized finance, offering new avenues for lending and structured product design that hinge on reliable price data.

Key takeaways

- Chainlink has been designated as the official data oracle for Ondo Global Markets, supplying on-chain price feeds for tokenized US stocks on Ethereum.

- Initial support covers SPYon (SPDR S&P 500 ETF), QQQon (Invesco QQQ ETF), and TSLAon (Tesla stock), with the expectation of expanding to additional tokenized assets as coverage broadens.

- The price feeds feed into Euler, enabling tokenized equities to be used as collateral for borrowing stablecoins and for setting liquidation parameters in DeFi lending markets.

- Corporate actions, including dividends, are incorporated into the reference prices, helping maintain alignment between on-chain valuations and the underlying equities.

- Ondo’s move follows a broader push to tokenize US equities, underscored by regulatory and market actions across traditional finance and crypto venues, including Nasdaq’s rule-change efforts and public experiments by Robinhood and others.

- Industry developments highlight a growing ecosystem where tokenized stocks can feed DeFi protocols and potentially participate in broader on-chain trading and custody flows.

Tickers mentioned: SPYon, QQQon, TSLAon

Market context: The integration arrives amid a broader push to bring tokenized equities onto blockchain infrastructure as regulators in the United States refine custody and trading rules for tokenized securities. Observers note the convergence of traditional markets and DeFi as institutional and fintech players experiment with on-chain collateral, settlement efficiency and new product structures.

Why it matters

Ondo’s integration of Chainlink as the on-chain price oracle for tokenized stocks addresses a critical gap in DeFi’s treatment of synthetic equity representations. Before this development, tokenized equities had primarily served price exposure purposes or lightly simulated baseline risk rather than functioning as robust collateral. By linking on-chain prices to reference values tied to the underlying assets—and incorporating corporate actions—the ecosystem gains a more reliable mechanism for risk management, enabling lenders and protocol designers to calibrate collateral factors, liquidation thresholds and risk controls with greater fidelity to real-world equity behavior.

The partnership’s significance extends beyond Ondo. As markets experiment with tokenized versions of mainstream securities, the entire DeFi lending stack benefits from standardized, auditable price feeds that react to corporate actions and market dynamics. The collaboration with Chainlink—a long-standing oracle provider in the crypto space—also helps align DeFi protocols with real-world financial benchmarks, potentially fostering broader adoption of tokenized stocks within lending, derivatives and structured products. The move comes at a moment when traditional exchanges and fintechs are stepping up efforts to offer tokenized equity trading, custody and settlement on or near blockchain rails, signaling a converging trajectory for regulated tokenized assets and decentralized finance.

Regulatory and market developments underscore the momentum behind tokenized equities. Nasdaq has pursued a rule change with the U.S. Securities and Exchange Commission to enable listing and trading of tokenized stocks, aiming to integrate blockchain-based representations with a regulated exchange framework. Separately, the SEC issued a no-action letter allowing a Depository Trust & Clearing Corporation subsidiary to launch a tokenization service for securities already held in custody, adding clarity to custody pathways for tokenized assets. In the broader crypto ecosystem, tokenized stock offerings have already surfaced on various platforms, illustrating a multi-pronged approach to bringing on-chain exposure to blue-chip equities without sacrificing the transparency and programmability that DeFi affords.

On the liquidity and trading front, major market participants are pursuing ways to expand access to tokenized securities. The New York Stock Exchange and its parent company, Intercontinental Exchange, announced efforts to develop a blockchain-based trading platform for tokenized stocks and ETFs with 24/7 trading and near-instant settlement, subject to regulatory approval. Meanwhile, crypto-native tokenization initiatives have already brought dozens of tokenized US stocks to multi-chain ecosystems, with platforms like Kraken and Bybit hosting tokenized stock markets under the xStocks banner, and Robinhood launching a public testnet for Robinhood Chain, an Ethereum layer-2 network built on Arbitrum, designed to support tokenized assets and on-chain lending and derivatives. These moves collectively illustrate a cross-market push toward more flexible capital markets built on tokenized representations and on-chain data feeds.

For developers and users, the Ondo–Chainlink integration signals a more practical pathway for tokenized equities to function as collateral within DeFi. It binds the on-chain price determiners to the equity’s fundamentals, potentially enabling more sophisticated service models and risk management strategies in decentralized lending and beyond. The collaboration also reinforces the role of oracles as a bridge between traditional asset classes and DeFi ecosystems, an area that continues to attract attention as regulators, exchanges and fintechs map out the future of tokenized securities and on-chain finance.

Additional context around the broader tokenization wave is reflected in the ongoing coverage of tokenized assets across crypto media, including continued discussions of how tokenized stocks could operate within regulated frameworks and the evolving custody landscape. The ecosystem’s trajectory remains contingent on regulatory clarity, liquidity, and the ability of on-chain price feeds to reflect real-time market movements and corporate actions with high fidelity.

What to watch next

- Expansion of oracle coverage to additional tokenized equities and ETFs as Ondo and Chainlink broaden their integration footprint.

- Regulatory progress on tokenized securities, including potential approvals or filings related to further tokenized-stock listings and custody rules.

- Adoption by more DeFi protocols that may incorporate tokenized equities as collateral or reference price sources in lending and derivatives.

- New corporate actions and governance events for tokenized assets that could drive updates to reference prices and collateral models.

Sources & verification

- Ondo post: Defi adoption of Ondo tokenized stocks live — https://ondo.finance/blog/defi-adoption-of-ondo-tokenized-stocks-live

- Chainlink partnership with Ondo (PR Newswire, October 2025) — https://www.prnewswire.com/news-releases/ondo-and-chainlink-announce-landmark-strategic-partnership-to-jointly-bring-financial-institutions-onchain-302599151.html

- Nasdaq rule-change for tokenized stocks — https://cointelegraph.com/news/nasdaq-asks-sec-for-rule-change-to-trade-tokenized-stocks

- SEC no-action letter for tokenization services (DTCC) — https://cointelegraph.com/news/sec-clears-dtcc-to-offer-tokenization-service

- Robinhood Chain testnet (public) — https://robinhood.com/us/en/newsroom/robinhood-chain-launches-public-testnet/

Ondo and Chainlink bring tokenized stocks to DeFi on Ethereum

Ondo Finance’s Ondo Global Markets platform has integrated Chainlink as its official data oracle, enabling on-chain price feeds for tokenized US stocks such as SPYon, QQQon and TSLAon to go live on Ethereum (CRYPTO: ETH). The feeds are now being utilized on Euler, where users can post tokenized equities as collateral to borrow stablecoins. The integration anchors on-chain valuations to reference prices that reflect corporate actions like dividends, enhancing the reliability of on-chain pricing for collateral and liquidations. The collaboration marks a meaningful step in expanding the use cases for tokenized equities within decentralized finance and demonstrates how established oracle networks can support new asset classes on-chain.

Initial coverage includes SPYon (SPDR S&P 500 ETF), QQQon (Invesco QQQ ETF), and TSLAon (Tesla stock), with plans to expand as the oracle network and Ondo’s protocol integrations scale. The data feeds feed into lending markets on Euler, enabling users to collateralize tokenized stocks for stablecoin borrowing and to set risk controls based on up-to-date reference prices. This approach addresses a notable limitation: tokenized equities had been primarily used for price exposure rather than as robust collateral. By pairing exchange-linked liquidity with reliable on-chain price feeds, Ondo and Chainlink seek to unlock broader DeFi applications, including more sophisticated lending, risk management and perhaps new forms of on-chain structured products.

The broader ecosystem context includes a growing array of regulatory and market initiatives aimed at tokenized securities. Nasdaq’s pursuit of a rule change to permit listing and trading tokenized stocks signals a potential path for regulated, on-chain representations of listed shares. The same week, the SEC clarified custody rules for tokenized securities in collaboration with the Depository Trust & Clearing Corporation, which could streamline how tokenized assets move through the traditional custody pipeline. On the crypto front, platforms have already experimented with tokenized stock access, including tokenized stock offerings across Kraken and Bybit and the Robinhood Chain initiative, all pointing to increasing interoperability between on-chain finance and legacy markets.

With the Ondo–Chainlink integration, developers and users gain a practical mechanism to reference the true price of tokenized equities within DeFi protocols, enabling more reliable collateralization and liquidations. The development underscores the maturation of tokenized securities as a cross-border, cross-venue concept—one that depends on robust price oracles, regulatory clarity and continued collaboration between traditional finance operators and crypto infrastructure providers. As the market continues to experiment with tokenized assets, observers will watch for further asset coverage, governance updates, and regulatory milestones that could accelerate or recalibrate the adoption curve for tokenized stocks in DeFi and beyond.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech22 hours ago

Tech22 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World1 day ago

Crypto World1 day agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat7 days ago

NewsBeat7 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition