Crypto World

OpenAI Pits AI Agents Against Each Other to Red-Team Smart Contracts

OpenAI has unveiled a benchmarking framework aimed at measuring how effectively AI agents can detect, mitigate, and even exploit security vulnerabilities in crypto smart contracts. The project, titled “EVMbench: Evaluating AI Agents on Smart Contract Security,” was released in collaboration with Paradigm and OtterSec, two organizations with deep exposure to blockchain security and investment. The study assesses AI agents against a curated set of 120 potential weaknesses drawn from 40 smart contract audits, seeking to quantify not just detection and patching capabilities but also the theoretical exploit potential of these agents in a controlled environment.

Key takeaways

- EVMbench tests AI agents against 120 vulnerabilities culled from 40 smart contract audits, emphasizing vulnerabilities sourced from open-source audit competitions.

- Among the models tested, Anthropic’s Claude Opus 4.6 led with an average detect award of $37,824, followed by OpenAI’s OC-GPT-5.2 at $31,623 and Google’s Gemini 3 Pro at $25,112.

- OpenAI frames the benchmark as a step toward measuring AI performance in “economically meaningful environments,” not just toy tasks, highlighting the real-world implications for attackers and defenders in the crypto security landscape.

- The researchers note that smart contracts secure billions of dollars in assets, underscoring the strategic value of AI-enabled tooling for both offensive and defensive activities.

- Industry observers have tied these developments to broader discussions about AI-driven payments and the role of stablecoins in everyday transactions, with major executives predicting growing agentic usage in the coming years.

- The context for such work is underscored by 2025’s crypto-security incident data, which shows a continued flow of funds through vulnerabilities and attacks, reinforcing the demand for robust AI-enabled auditing and defense mechanisms.

Detect awards for AI agents are detailed in the OpenAI PDF accompanying the study, which also describes the evaluation methodology and the scenarios used to simulate real-world smart-contract risk. The authors emphasize that while AI agents have evolved to automate a wide range of routine tasks, assessing their performance in “economically meaningful environments” is essential to understanding how they’ll perform under pressure in production systems.

“Smart contracts secure billions of dollars in assets, and AI agents are likely to be transformative for both attackers and defenders.”

OpenAI notes that it expects agentic technologies to broaden the scope of payments and settlement, including stablecoins used in automated workflows. The discussion around AI-enabled payments extends beyond security testing to the broader question of how autonomous systems will participate in daily financial activity. The company’s own projections suggest that agentic payments could become more commonplace, grounding AI capabilities in practical use cases that touch everyday consumer transactions.

In tandem with the benchmark results, Circle CEO Jeremy Allaire has publicly forecast that billions of AI agents could be transacting with stablecoins for everyday payments within the next five years. That view intersects with a recurring theme in crypto circles: the potential for crypto to become the native currency of AI agents, a narrative that has gained notable attention from industry leaders and investors alike. While such predictions remain speculative, the underlying trend is clear—AI automation is moving from the lab to the transaction layer, where it could reshape how value moves across networks.

The study arrives at a moment when crypto security continues to be a significant risk factor for investors. The data point about 2025’s assault on crypto funds—where attackers pulled roughly $3.4 billion—highlights the urgency of improved tooling and faster, more reliable patching mechanisms. The EVMbench framework is positioned, in part, as a way to measure whether AI agents can meaningfully contribute to defensive capabilities at scale, reducing exploitation opportunities and accelerating threat mitigation.

To build the benchmark, researchers drew on 120 curated vulnerabilities spanning 40 smart contract audits, with many weaknesses traced back to open-source audit challenges. OpenAI argues the benchmark will help track AI progress in recognizing and mitigating contract-level weaknesses at scale, offering a standardized way to compare future AI models as they evolve. The study also provides a lens into how AI might be applied to normalizing risk assessment across a wide range of smart-contract architectures, rather than focusing solely on isolated cases.

Smart contracts weren’t built for humans: Dragonfly

In a contemporaneous thread on X, Haseeb Qureshi, a partner at Dragonfly, argued that crypto’s promise of replacing property rights and traditional contracts never materialized not because the technology failed, but because it was never designed with human intuition in mind. He has highlighted the persistent fear associated with signing large transactions in an environment where drainer wallets and other attack vectors remain a constant threat, in stark contrast to the comparatively smoother experience of traditional bank transfers.

Qureshi contends that the next phase of crypto transactions could be enabled by AI-intermediated, self-driving wallets. Such wallets would monitor risk, manage complex operations, and autonomously respond to threats on behalf of users, potentially reducing the friction and fear that characterize large transfers today.

“A technology often snaps into place once its complement finally arrives. GPS had to wait for the smartphone, TCP/IP had to wait for the browser. For crypto, we might just have found it in AI agents.”

The broader takeaway from this thread is that AI agents may play a critical role in transforming how people interact with crypto—shifting from manual, error-prone transactions to automated, risk-aware processes that can scale with adoption. As AI agents begin to demonstrate more competence in handling security concerns, users could see improved reliability and resilience in decentralized finance workflows, even as the underlying technologies continue to mature.

What to watch next

- Publication and independent replication of the full EVMbench dataset across additional AI models and architectures.

- Broader adoption of AI-assisted auditing workflows by auditors, exchanges, and DeFi projects looking to bolster security postures.

- Explorations into agentic wallets and autonomous payment flows, including regulatory and compliance considerations for AI-managed assets.

- Follow-up benchmarks comparing more AI systems as new versions roll out, tracking improvements in detection accuracy and patching speed.

Sources & verification

- OpenAI: EVMbench: Evaluating AI Agents on Smart Contract Security — PDF: https://cdn.openai.com/evmbench/evmbench.pdf

- OpenAI: Introducing EVMbench — https://openai.com/index/introducing-evmbench/

- Crypto security losses in 2025 (reporting coverage): https://cointelegraph.com/news/crypto-3-4-billion-losses-2025-wallet-hacks

- Dragonfly: Haseeb Qureshi on AI and crypto UX (X post): https://x.com/hosseeb/status/2024136762424185208

- China’s AI lead and crypto implications (analysis): https://cointelegraph.com/news/china-ai-lead-future

- AI Eye — IronClaw and AI bot developments in Polymarket coverage: https://cointelegraph.com/magazine/ironclaw-secure-private-sounds-cooler-openclaw-ai-eye/

Key figures and next steps

The EVMbench study demonstrates that large language models and related AI agents are beginning to perform meaningful security work in the smart contract space, with clearly quantifiable differences across models. Claude Opus 4.6’s lead in average detect awards signals that certain architectures may be more adept at spotting and mitigating vulnerabilities within complex contract logic, while others trail, offering a spectrum of capabilities that researchers will likely want to refine. The inclusion of multiple industry partnerships in the project underscores the growing consensus that AI-enabled security and automated risk management could become essential to scale in decentralized environments.

As the field evolves, observers will be watching for how quickly AI agents can transition from detection to remediation, and whether these agents can operate reliably in live systems without introducing new risks. The conversation about AI-driven wallets and autonomous payments touches on a broader set of questions around security governance, user consent, and regulatory alignment. If the trajectory suggested by OpenAI and its partners continues, AI-assisted tools could become a core component of future crypto infrastructure, changing both the risk calculus and the user experience in meaningful ways. The next round of benchmarks, alongside real-world deployments, will help determine how quickly this vision materializes and what safeguards must accompany it.

Crypto World

Outset Media Index debuts to standardize media analysis as AI answers challenge the old search model

Outset Media Index (OMI) is now in soft launch, introducing what its creators describe as the first standardized system for benchmarking media outlets.

OMI organizes familiar traffic indicators from partner sources such as Similarweb and Moz, adds proprietary research metrics for practical context and turns this data into a single analytical framework that makes analysis repeatable, transparent and adaptable to different workflows.

Teams that run media operations, including advertisers, marketers, PR agencies and publishers, can use OMI to plan campaigns with greater clarity, manage media budgets more deliberately and improve campaign outcomes over time.

Internally, the platform is supported by a broader analytical layer within the Outset PR ecosystem. While OMI focuses on measuring how outlets perform, Outset Data Pulse interprets those signals through research reports that examine media trends and structural changes shaping the industry.

Additional tools help track how coverage circulates after publication. A syndication map follows how articles travel through aggregators and secondary outlets, while an automated parser monitors republications across large numbers of media sites.

Behind the index sits a methodology designed to keep rankings consistent. Before scoring, inputs are reviewed, normalized and consolidated into several weighted parameters that apply across all listed outlets.

Importantly, OMI operates independently from commercial influence. Positions in the index cannot be bought or negotiated. Publications do not pay for placement, and scores cannot be adjusted on request.

Structured intelligence that examines what other monitoring tools miss

Outset Media Index currently tracks over 340 outlets with active crypto coverage, including specific publications and broader fintech portals with dedicated crypto sections, through 37 metrics and two scoring frameworks.

Traffic estimates, SEO visibility, pricing, referral patterns and market knowledge all reveal something, but rarely in one comparable structure. OMI brings those signals together so users can see not just how visible a media outlet looks at a glance, but also how it behaves over time, how audiences interact with it, how the editorial team approaches collaboration and how coverage continues to move after publication.

Some metrics focus on scale and traffic quality. Others show where the readership is concentrated and how well a publication fits regional or language-specific campaigns. The framework also includes indicators designed to capture signals that traffic alone cannot explain.

For example, Unique Score separates outlets with a stable audience from those driven mostly by short bursts of attention. Reading Behavior highlights where people spend time with content and where they simply pass through. Reprints and a corresponding Reprints Score track how original coverage echoes through aggregators and help identify strong syndication networks.

“We also introduced two summary scores,” said Sofia Belotskaia, product lead at Outset Media Index. “The General Score shows how an outlet performs overall, while the Convenience Score looks at the practical side of collaboration – editorial control, turnaround speed, coverage options and price-to-reach alignment. The idea is to make it possible for users to see both the actual performance of a publication and the realities of working with it without having to dig through dozens of separate indicators.”

Among other things, OMI reflects the discovery layer forming around AI, surfacing outlets that receive traffic from LLM-driven interfaces.

If AI answers the question, who clicks the article?

Across the publishing industry, AI-generated answers now appear directly inside search results. Users no longer need to click through to websites for information. The change raises an uncomfortable question: what happens when search stops sending readers?

Some findings suggest referrals from search engines could fall by as much as 43% over the next three years as AI summaries and chat-style tools increasingly answer questions directly on the results page.

The Guardian recently cited data showing that search traffic to news sites has already fallen by roughly a third in the past year, and AI-generated overviews are showing up in about 10% of search results in the United States.

For publishers that spent years building strategies around search visibility, the change is impossible to ignore. If readers no longer need to click through to a story to get information, the click itself becomes a less reliable signal of where attention is actually going.

“Since AI answers started replacing links, the way we look at media performance has had to change as well,” said Mike Ermolaev, founder of Outset Media Index and Outset PR. “That’s the kind of environment OMI is meant to help people navigate.”

When discovery changes, measurement follows

For now, Outset Media Index enters the industry conversation as an early attempt to make sense of ongoing media shifts. The platform offers one way of analyzing how media attention moves today – not only through traffic, but through engagement, distribution and the practical dynamics of working with outlets.

What that approach ultimately becomes will depend on how the system develops from here. The soft launch will reveal how the index may grow into a broader reference point for teams working in a complex, high-cost media landscape where the path between a story and its audience is becoming less direct.

Crypto World

DeepSnitch AI Price Prediction: Dune Gives You Queries, Nansen Gives You Flows; DeepSnitch AI the 1000x Bet if Traders Want the Full Stack in One Place

Crypto just entered America’s retirement accounts, and $10 trillion in long-term capital is now in play. VanEck’s move to embed digital-asset ETPs in 401(k) plans isn’t a headline to scroll past.

Retirement capital is slow, sticky, and recurring, exactly the demand that builds durable price floors over years. With a Trump executive order clearing the regulatory path, this is the opening of a pipeline that could dwarf every ETF inflow record set so far.

But 401(k) exposure to crypto ETPs won’t deliver 100x returns. It’s designed to preserve and grow capital slowly at scale. That’s the institutional trade. The early-stage trade looks different.

DeepSnitch AI has already surged 191% in presale and has a TGE confirmed for March 31st on Uniswap.

As VanEck raises the floor across the board, the highest leverage sits in what that capital hasn’t priced in yet. DSNT is still that asset, and the DeepSnitch AI price prediction looks at 100x returns from now.

VanEck brings crypto ETFs to 401(k) plans

VanEck has made its digital asset ETPs available through Basic Capital, a fintech 401(k) provider, marking one of the first moves to embed crypto-focused products directly into US employer-sponsored retirement accounts.

The development follows a Trump executive order directing federal agencies to expand alternative asset access in 401(k) plans, reversing prior Labor Department guidance that had effectively blocked crypto from retirement accounts.

The scale of the opportunity is substantial. US 401(k) plans hold roughly $10 trillion in assets, and with nearly half of participants increasing contributions in 2024, the pool of potential crypto exposure is enormous.

For crypto markets, this is a structural demand story. Retirement capital is long-term, recurring, and largely passive, precisely the inflow that could provide a durable bid beneath crypto prices over years, not months.

Top 3 cryptocurrencies to own in 2026

DeepSnitch AI price prediction: Analysts expect 100x returns

Here’s what the DeepSnitch AI price prediction case actually rests on. VanEck’s 401(k) integration means retirement capital starts flowing into crypto consistently, as a recurring structural bid.

That raises the floor for the entire market over the years. The assets that benefit most from a rising floor are the ones positioned to catch the demand before it arrives. DeepSnitch AI is at $0.04399 with the TGE on March 31st. Early buyers are already up 191% without a single exchange candle printed.

The 100x–300x post-launch DeepSnitch AI price predictions, with some analysts calling 1,000x before year-end, are grounded in a specific logic: a low-cap AI-native platform launching into a market where the total capital pool is structurally expanding. VanEck is opening the pipeline. DSNT goes live before that capital fully flows through it.

The staking program is live, with 42M+ tokens already locked, holders who’ve committed long-term rather than waiting to flip at listing.

Over $2M raised while most top altcoins, and even Bitcoin, bleed confirms the conviction is real. At this price, before the Uniswap listing and tier-1 CEX listings that follow, the entry is still genuinely early-stage. After March 31st, DeepSnitch AI isn’t.

Cardano trades below $0.3 while investors turn bullish

Cardano traded at $0.26 on March 11, up over 5% in three days and closing in on descending trendline resistance between $0.27 and $0.30.

The catalyst matters. Charles Hoskinson’s 2026 funding model proposes using treasury returns to buy ADA on the open market, a structural buyback mechanism that speculative momentum alone can’t replicate.

Derivatives tell a cautious story. Open Interest drops to $410 million. Funding rate flips positive to 0.0075%. Bulls return quietly, without conviction.

The chart sits in the same uncertain middle. ADA trades below the 50-day and 100-day EMAs near $0.29. RSI stays under 50. MACD fades near zero. Close above $0.29, and the recovery gains real traction. Lose $0.24, and this bounce unravels entirely.

Ethereum

Ethereum traded at $2,055 on March 11, holding above the 20-day EMA at $2,024. That level separates cautious optimism from renewed selling pressure.

What makes this setup unusual is the disconnect between network activity and price. Daily active addresses hit a record 2 million in February, double the 2021 bull market peak. Total contract calls surpassed 40 million daily. The network thrives. The price doesn’t.

ETH shed over 50% in four months. CryptoQuant analysts point to the mechanism: realized capitalization growth turned negative, and ETH exchange inflows outpace Bitcoin’s. Capital leaves while usage climbs.

Reclaim $2,108, and $2,389 comes next. Lose the 20-day EMA, and $1,741 arrives fast, with $1,524 and $1,405 waiting beneath it.

Closing thoughts

VanEck is routing retirement capital into crypto, building the structural floor that benefits the entire market over the years. Early DeepSnitch AI investors are already up 191%, without waiting for a 401(k) to do it for them.

The presale closes March 31st, with Uniswap and tier-1 exchange listings to follow. At $0.04399, the entry is still early-stage, with a massive DeepSnitch AI price prediction.

A $30,000 position with the bonus campaign enters launch day worth $90,000 in tokens, and if the 100x projections land, that math rewrites portfolios entirely.

Visit the official website for more information, and join X and Telegram for community updates.

FAQs

What is the DeepSnitch AI price target analysts are projecting ahead of its March 31st launch?

The DeepSnitch AI price predictions range from 100x to 300x post-launch, with some analysts projecting 1,000x before year-end. The case rests on a low-cap AI-native platform launching into a market where VanEck’s 401(k) integration is structurally expanding the total capital pool.

What does the DeepSnitch AI forecast look like heading into Q2 2026?

Bullish. As VanEck’s retirement capital pipeline opens and raises the market floor, the highest leverage sits in pre-listing assets that institutional money hasn’t yet priced in. DSNT is still that asset.

What is the DeepSnitch AI market outlook compared to Cardano and Ethereum right now?

Cardano’s buyback mechanism and Ethereum’s network strength are credible long-term stories. DeepSnitch AI’s March 31st TGE is a fixed, near-term catalyst at $0.04399 with uncapped staking yields and a post-launch price structure that neither large-cap asset can replicate.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

SEC chair backs “minimum effective dose” disclosure and targeted tokenization pilots

The U.S. Securities and Exchange Commission (SEC) is signaling support for streamlined “minimum effective dose” disclosure rules and tightly scoped equity‑tokenization pilots via an innovation exemption, according to new remarks from Chair Paul S. Atkins.

Summary

- Atkins calls for materiality‑focused, scaled disclosure and extending the JOBS Act “IPO on‑ramp” so smaller issuers face lighter reporting as they enter public markets.

- He attacks “comply or explain” governance mandates as “shaming regulation,” arguing board structures and ESG metrics should be set by shareholders, not backdoor pressure.

- On tokenization, he backs an “innovation exemption” that would cap volumes and scope but allow limited trading of tokenized securities to inform a longer‑term rule framework.

The U.S. Securities and Exchange Commission (SEC) is signaling support for streamlined disclosure rules and controlled experiments with equity tokenization, according to a new speech by Chair Paul S. Atkins at the agency’s Investor Advisory Committee meeting.

SEC chair pushes “minimum effective dose” regulation

Atkins focused first on cutting what he called unnecessary disclosure burdens, arguing for a “minimum effective dose” approach to regulation that keeps rules tightly centered on material information and adapts requirements to company size. He also proposed extending the JOBS Act “IPO on‑ramp” regime, giving small and mid-size firms a longer glide path with scaled reporting so that more issuers are willing to go public.

Atkins sharply criticized the SEC’s use of “comply or explain” disclosure mandates in corporate governance, branding them a form of “shaming regulation” that effectively forces companies into preferred governance models by public pressure rather than law. In his view, decisions on board structure, ESG metrics, and related governance questions should remain in the hands of shareholders and directors, not be indirectly dictated through disclosure threats.

Green light for targeted tokenization exemptions

On tokenization, Atkins took a more openly experimental stance, arguing that turning equity securities into digital tokens can improve settlement efficiency, reduce settlement risk, and strip out unnecessary intermediaries. He revealed that the SEC is considering an “innovative exemption mechanism” to allow limited trading of specific tokenized securities, using tightly scoped pilots to build experience for a long-term regulatory framework.

That approach would effectively let tokenized equity projects move forward under controlled conditions, rather than waiting for a full top‑down rule overhaul. For crypto markets, the message is clear: the SEC is not ready to rewrite securities law for tokenization, but it is prepared to grant targeted exemptions that could bring regulated, on‑chain equity settlement closer to reality.

Crypto World

Anchorage Digital Integrates Puffer to Offer Institutional ETH Restaking

Anchorage Digital has integrated with Puffer Finance to give institutional clients access to Ethereum liquid restaking through its custody platform.

According to Thursday’s announcement, institutions can stake Ether held with Anchorage and receive Puffer’s liquid restaking token, pufETH, directly into their accounts. The token represents a restaked ETH (ETH) position that can be transferred or deployed across supported onchain applications while continuing to earn staking and restaking rewards.

Institutions using the platform can participate in restaking without running validators or managing staking infrastructure themselves.

The integration allows clients to access Puffer’s restaking protocol while keeping assets within Anchorage’s custody and governance framework, avoiding the need to move funds across multiple platforms.

Anchorage said the integration is part of a broader effort to expand institutional access to onchain services through its platform, including staking, restaking, governance and settlement.

Anchorage Digital is a crypto custody company headquartered in San Francisco that operates the first federally chartered crypto bank in the United States.

In January, the company was reported to be seeking between $200 million and $400 million in new funding as it explores a potential initial public offering sometime next year.

Related: Sharplink reports $735M loss in 2025 as Ethereum slumped

Liquid restaking expands across Ethereum ecosystem

Restaking has emerged as a new layer of activity in proof-of-stake networks such as Ether, allowing already staked tokens to be reused to secure additional decentralized services while generating additional rewards.

In liquid restaking systems, staked Ether is represented by a tradable token that can be reused through restaking protocols to help secure additional decentralized services.

Much of the restaking ecosystem has developed around EigenLayer, a protocol launched by Eigen Labs that enables staked Ether or liquid staking tokens to secure additional onchain services beyond the Ethereum network.

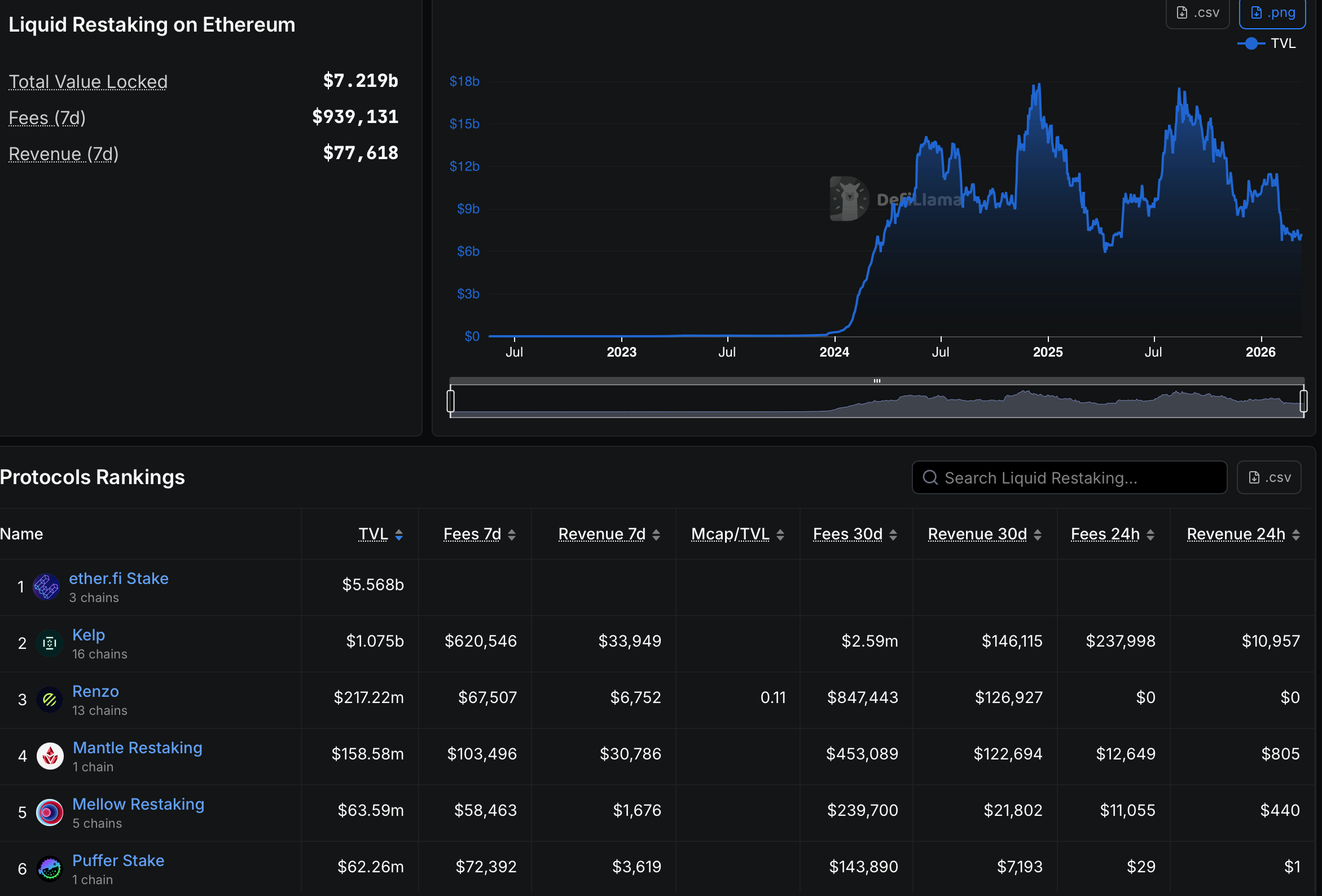

Over the past few years, liquid restaking has grown into a multibillion-dollar sector within the Ethereum ecosystem. According to data from DefiLlama, protocols offering liquid restaking collectively hold about $7.2 billion in total value locked (TVL).

The sector is dominated by ether.fi with around $5.6 billion in TVL, followed by Kelp DAO with about $1 billion and Renzo with roughly $217 million. Puffer Finance, the protocol integrated by Anchorage Digital, currently manages around $62 million in restaked Ether.

Ethereum treasury companies are also increasingly exploring these strategies to generate yield from their Ether holdings. In October, SharpLink Gaming said it planned to deploy $200 million worth of Ether from its corporate treasury across staking and restaking strategies through ether.fi and EigenCloud on Linea.

Magazine: What’s a ‘Network State’ and are there real-life examples? Big Questions

Crypto World

Whale Swaps $50 Million in Stablecoins for Just $36,000 of AAVE

The massive transaction routed through CowSwap on Ethereum resulted in a 99.9% loss.

The decentralized finance (DeFi) community is buzzing after an unidentified wallet swapped $50.4 million in USDT for just $36,000 worth of AAVE tokens.

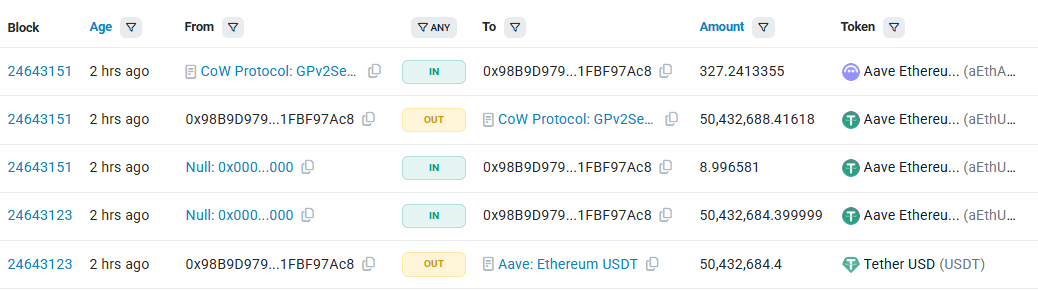

Etherscan data shows that the wallet received 50.4 million USDT from Binance 20 days ago. Roughly two hours ago, the user deposited the stablecoins on Aave, DeFi’s largest lending protocol and attempted to swap their position for AAVE tokens.

Transaction logs show that the user placed an order via CoW Protocol, which is integrated in the Aave interface, to swap roughly 50.43M aEthUSDT for aEthAAVE. A CoW solver picked up the order and executed it through this routing:

- aEthUSDT to USDT: The solver burned 50.43M aEthUSDT via Aave V3, withdrawing 50.43M USDT.

- USDT to WETH via Uniswap V3: 50.43M USDT went into the Uniswap V3 USDT/WETH pool and came out as 17,958 WETH. At $2,050/ETH, $50.4M should yield roughly 24,600 WETH. That’s roughly $13.6 million lost to slippage at the Uniswap step alone.

- WETH to AAVE via SushiSwap: Here’s where it gets catastrophic. The SushiSwap AAVE/WETH pool currently has only about $73,000 in total liquidity. The solver pushed 17,958 WETH through this tiny pool and got back only 331 AAVE, worth $36,400. That’s effectively 99.9% slippage.

- AAVE to aEthAAVE via Aave deposit: 331 AAVE was deposited back into Aave V3, minting 327 aEthAAVE, which was delivered to the trader.

Aave founder Stani Kulechov said the user confirmed the trade despite being warned of “extraordinary slippage” by the Aave interface.

“We sympathize with the user and will try to make contact with the user, and we will return $600K in fees collected from the transaction,” he added.

Crypto World

Donald Trump to hold another Mar-a-Lago lunch for his token holders

Holders of the $TRUMP token will have another opportunity to dine with the U.S. President after the company behind the token announced a “gala luncheon” with Donald Trump set for late next month.

The luncheon, scheduled for April 25, comes just under a year after token holders were invited to a previous dinner with Trump. That one was open to the top 220 holders of the token, while this new one will bring in 297, with 29 invited to a VIP tour of Mar-a-Lago, the event venue, the issuer of the token said Thursday.

“Join 18 global giants at one of the world’s most historic residences… the exclusive members-only club, Mar-a-Lago,” the announcement said. “You’ll enjoy a once-in-a-lifetime experience. This event will be a memory you will talk about forever!”

Mar-a-Lago hosted a crypto conference put on by World Liberty Financial, another company co-owned by Trump and his family, last month.

The TRUMP token spiked briefly when the announcement came out, though the price fell back almost immediately. The token is trading at around $2.98, up about 2% on the day’s trading. The token’s volume is up to its highest level since Feb. 20, 2026.

The token’s price is still down significantly from its all-time high of over $46, and even down from the roughly $13 average it traded at during the last dinner announcement in April 2025.

That earlier dinner prompted Democratic lawmakers to lodge protests and raise concerns about Trump profiting off of his own crypto token while simultaneously championing legislation to support the industry and appointing regulators to oversee crypto. These concerns have, in part, delayed legislation sought by the crypto industry.

“GetTrumpMemes.com is not political and has nothing to do with any political campaign or any political office or governmental agency,” the website’s footer said.

“There will be no private meetings with the President and no solicitations.”

Crypto World

Chainlink price compresses beneath Fibonacci resistance, downside risk

Chainlink price is stalling below a major Fibonacci resistance zone near $9.17 as momentum weakens.The probability of a corrective rotation toward lower support increases.

Summary

- Key Resistance: $9.17 aligns with the 0.618 Fibonacci, VWAP, and value area high.

- Weak Momentum: The recent rally occurred on low volume, increasing rejection risk.

- Support Target: Potential rotation toward the $8.24 confluence support zone.

Chainlink (LINK) has entered a technically significant zone as price action compresses beneath a cluster of resistance levels around $9.17. The asset recently attempted to extend its upward momentum but has begun to stall as it approaches a confluence of technical barriers.

With several resistance indicators aligning in the same region and trading volume declining during the recent move higher, the market may be preparing for a temporary pullback before any sustained continuation toward higher resistance.

Chainlink price key technical points

- Major Resistance Zone: $9.17 aligns with the 0.618 Fibonacci retracement, VWAP, and value area high.

- Low-Volume Rally: Weak participation increases the probability of a rejection.

- Downside Target: Potential rotation toward the $8.24 support level.

Chainlink’s current price action is approaching a technically important resistance cluster situated around $9.17. This level represents the 0.618 Fibonacci retracement of the recent swing structure, a zone that frequently acts as a decisive turning point in market trends. The presence of the value area high in this region adds additional significance, as it represents an area where a large portion of previous trading activity has occurred. When price revisits these zones, the market often reacts strongly as liquidity is redistributed.

Adding further weight to this resistance zone is the presence of the volume-weighted average price (VWAP), which overlays the same region. VWAP is widely monitored by both institutional and retail traders as a benchmark for fair value. When price trades beneath the VWAP while simultaneously encountering Fibonacci resistance and a value area boundary, the probability of rejection increases significantly.

Despite the recent push higher, the rally toward this resistance has occurred on relatively low trading volume. This is an important factor in technical analysis because sustainable breakouts typically require expanding volume to confirm strong market participation. When price approaches major resistance levels without strong volume support, it often signals that buyers may be losing momentum.

As a result, the current price compression beneath resistance could lead to a rotational move toward lower support before the market attempts another breakout. In range-bound market structures, price frequently oscillates between key liquidity zones as traders reposition their orders. The lack of strong bullish volume suggests that sellers may soon regain control near the $9.17 region.

Meanwhile, developments within the ecosystem continue to expand Chainlink’s broader utility, with the network recently enabling Coinbase’s cbBTC bridging to Monad, unlocking more than $5 billion in Bitcoin-backed liquidity for decentralized finance applications.

If a rejection occurs, the next major technical support level sits near $8.24. This area forms a strong confluence zone where several technical indicators align. Notably, the value area low is positioned close to this region, marking a historical liquidity zone where buyers have previously stepped in to defend price.

Additionally, the lower Fibonacci support derived from the recent swing structure aligns closely with this level. When multiple technical indicators converge at a single price zone, it often creates a strong support region where price may stabilize or bounce.

Because of this confluence, the $8.24 level could act as the next liquidity magnet for price action if Chainlink begins to rotate lower from the current resistance. A move toward this level would also represent a natural retracement within the broader trading structure rather than a complete breakdown in market sentiment.

Such rotational movements are common in consolidation phases where assets oscillate between support and resistance before establishing a clearer directional trend. The current compression beneath resistance suggests that the market is still searching for liquidity before determining the next decisive move.

What to expect in the coming price action

As long as Chainlink remains below the $9.17 resistance zone, the probability favors a rejection and rotational move toward the $8.24 support region. A break above resistance with strong volume would invalidate the bearish scenario and open the path toward the higher timeframe resistance near $9.72.

Until that occurs, the market structure suggests that downside risk remains elevated within the current trading range.

Crypto World

Whale opens 20x oil short on Hyperliquid with 5.6M USDC at risk

A whale has used 5.6M USDC on Hyperliquid to take a 20x leveraged oil short near $96, effectively betting that Iran‑driven crude prices will mean‑revert and ease macro pressure on BTC.

Summary

- On‑chain data shows a single whale address depositing 5.6M USDC to Hyperliquid, then using the entire balance to short crude oil with 20x leverage, setting liquidation near $147.94 per barrel.

- The entry coincides with WTI April futures spiking over 10% above $96 and Shanghai SC crude jumping 7% on Iran conflict risk, turning the trade into a macro call that current prices overshoot fundamentals.

- For Bitcoin and broader crypto, the position is a sentiment gauge: if oil rolls over and the short pays, it implies softer inflation and rates, easing pressure on high‑beta assets and reinforcing BTC’s “macro hedge” narrative.

A large whale has bet aggressively against surging oil prices on Hyperliquid (HYPE), opening a 20x leveraged short worth 5.6 million USDC with a liquidation level near 148 dollars per barrel, according to on-chain monitoring data.

Whale piles into 20x oil short on Hyperliquid

Lookonchain data shows that over the past two hours, a single whale address deposited 5.6 million USDC onto derivatives venue Hyperliquid and used the entire balance to short oil with 20x leverage. At that leverage, the position’s liquidation price sits at 147.94 dollars per barrel, implying the trader is willing to tolerate a further violent squeeze in crude but is ultimately positioning for mean reversion after this week’s Iran‑driven spike.

The timing aligns with WTI April futures ripping more than 10% intraday and breaking above 96 dollars, while Shanghai’s SC crude contract climbed over 7%, as war risk and supply fears pushed energy markets toward triple‑digit crude. Against that backdrop, the whale’s short is effectively a macro punt that current oil prices overshoot fundamentals and that either de‑escalation, policy intervention, or demand destruction will pull the curve back down.

Signal for crypto macro traders

Because the trade is funded entirely in USDC and executed on a crypto-native derivatives platform, it offers a rare, transparent look at how large on-chain participants are expressing views on traditional commodity risk. Rather than simply rotating between BTC and stablecoins, this address is using crypto infrastructure to take a leveraged stance in one of the key variables driving the entire macro and risk‑asset complex.

For Bitcoin and the broader digital asset market, the position matters as a sentiment gauge. If oil does roll over and the short pays, it would support a softer inflation and rate path than the current tape implies, easing pressure on high‑beta assets and potentially reinforcing the emerging narrative of BTC as a relative winner versus gold and U.S. equities in a volatility‑heavy regime.

Crypto World

Strong Investor Demand Meets Weak Bitcoin Futures as Price Slumps

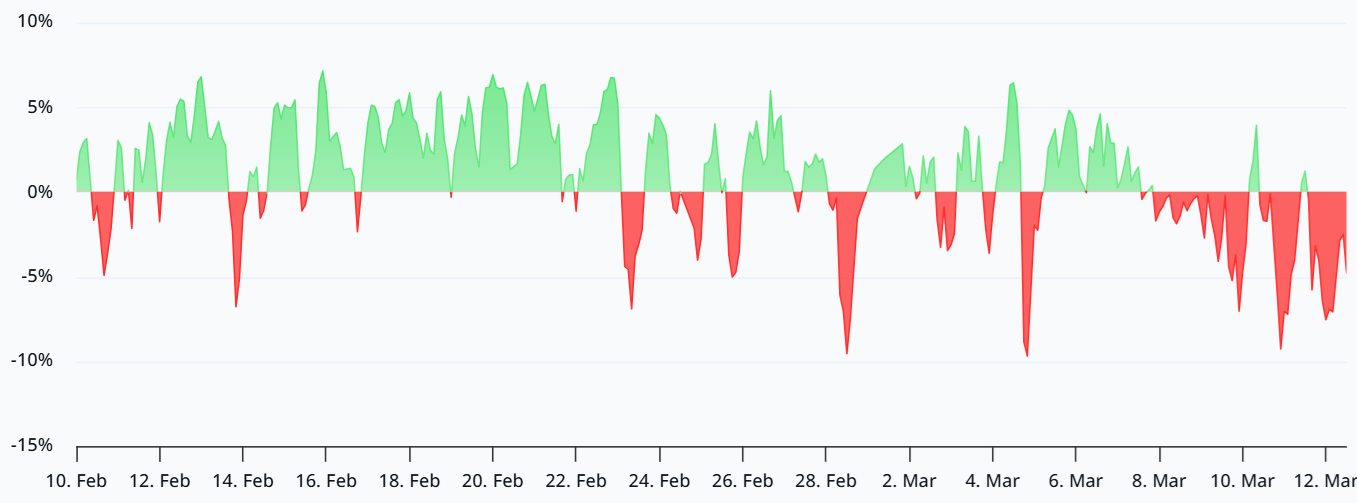

Bitcoin (BTC) failed to break beyond $71,000 on Thursday, partially driven by the decline in the US stock market, with BTC funding rates dropping deeper into negative territory.

Key takeaways:

-

Bitcoin bears show high conviction as funding rates drop, but steady institutional buying keeps sellers in check.

-

Gold and government bond yields are rising, making it harder for Bitcoin to compete as a top-tier store of value.

Bitcoin futures imply moderate market stress

Traders fear that a prolonged war in Iran could cause havoc in the energy markets, negatively impacting the already weakened global economic prospects.

Bitcoin’s perpetual futures displayed signs of moderate stress, signaling a potential $66,000 retest. However, institutional inflows show increased demand, reducing the odds of a major Bitcoin price correction.

The Bitcoin perpetual futures annualized funding rate dropped to -7% on Thursday, meaning shorts (sellers) were the ones paying to keep their positions open.

The growing conviction from bears is concerning, but the lack of demand from longs (buyers) should come as no surprise, given that Bitcoin is 45% below its all-time high.

Bitcoin’s derivatives remain muted

The tech-heavy Nasdaq 100 index traded merely 6% below its all-time high on Thursday. Even the US-listed small capitalization Russell 2000 Index stood 9% from its highest mark ever.

Hence, the worsening economic conditions or fear of contagion due to logistics issues in the Middle East can hardly be used to justify Bitcoin’s sluggishness.

The latest US jobless data released on Thursday revealed 1.85 million continuing claims in the week ended on Feb. 28, slightly above consensus, according to Yahoo Finance.

US President Donald Trump vowed to “finish the job” in Iran, a war that further weakens the government’s fiscal debt conditions and does not help labor market prospects.

The Bitcoin monthly futures premium relative to regular spot markets has stood below the neutral 5% threshold for the past couple of weeks. But despite being far from bullish, there is no evidence that Bitcoin derivatives presently signal continued stress.

This lack of interest is a reflection of Bitcoin’s failure to rally despite the anticipation of monetary expansion.

Rising institutional demand may push BTC above $75,000

Gold strength above $5,100 undermines Bitcoin’s store of value premise, especially as yields on US bonds rose sharply in March, meaning traders are demanding higher returns to hold those instruments.

Yields on the 5-year US Treasuries jumped to 3.80% on Thursday after dipping below 3.50% in late February. Hence, investors exited fixed-income investments.

Related: Bitcoin catching up to gold hints at an ‘opportunity within risk’

The US Federal Reserve is in a tough spot since lowering interest rates is needed to boost the job market and reduce risks in credit markets. But rising oil prices create sustained upward pressure on inflation.

Presently, Bitcoin’s hard-coded and transparent monetary policy is not being valued as a safe haven, but this could change as institutional demand picks up.

Additionally, a single Bitcoin derivatives metric (funding rates) should not be interpreted as a driver for a sharp price correction.

Particularly, amid a sequence of Bitcoin spot exchange-traded fund (ETF) net inflows and Strategy (MSTR US) yield products, resulting in accelerated Bitcoin accumulation. Sellers below $75,000 will eventually run out of coins, paving the way for a sustained bull run.

As Cointelegraph reported, Bitcoin bulls will likely need to wait until after March for a chance to break the $78,000 resistance

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Senate Includes CBDC Ban Amendment in Housing Affordability Bill

The United States Senate voted on Thursday to include an amendment in the 21st Century Road to Housing Act that would prohibit the Federal Reserve from issuing a central bank digital currency (CBDC).

The CBDC prohibition will remain in effect until Dec. 31, 2030, according to the amendment in the bill. The legislation, which passed 89-10, stated:

“The Board of Governors of the Federal Reserve System or a Federal Reserve Bank may not issue or create a central bank digital currency or any digital asset that is substantially similar to a central bank digital currency, directly or indirectly through a financial institution or other intermediary.”

However, the bill does not prohibit any dollar-denominated digital currency that is “open, permissionless, and private,” such as stablecoins.

US Treasury Secretary Scott Bessent and President Donald Trump have presented dollar-pegged stablecoins as a way to extend US dollar hegemony, while Trump and other Republican lawmakers have taken a hardline stance against CBDCs.

Related: Republican opposition to CBDC could hold up housing affordability bill

Lawmakers slam CBDCs as authoritarian surveillance technology

More than 30 US lawmakers signed a letter on March 6, urging the Senate to pass a permanent CBDC ban, rather than a temporary moratorium.

“A CBDC would give unelected bureaucrats unprecedented power over Americans’ finances and threaten basic economic freedom,” Representative Ralph Norman, one of the signatories of the letter, said.

Representative Warren Davidson, a long-time critic of CBDCs, has also criticized regulated dollar-pegged stablecoins as having the same surveillance capabilities as CBDCs.

Warren also warned that regulations under the Guiding and Empowering Nation’s Innovation for US Stablecoins (GENIUS) Act create an avenue to “control” and “coerce” the US population through financial surveillance techniques and programmable money.

Hedge fund manager Ray Dalio also recently warned that CBDCs would expand the government’s control over people’s finances.

“There will be no privacy, and it’s a very effective controlling mechanism by the government,” Dalio said in an interview with independent journalist Tucker Carlson.

CBDCs likely won’t be yield-bearing, meaning they do not offer inflation protection and can be automatically taxed or frozen by the government, he added.

Magazine: GENIUS Act reopens the door for a Meta stablecoin, but will it work?

-

Business6 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

News Videos3 days ago

News Videos3 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Ann Taylor

-

Crypto World3 days ago

Crypto World3 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech2 days ago

Tech2 days agoA 1,300-Pound NASA Spacecraft To Re-Enter Earth’s Atmosphere

-

Tech2 days ago

Tech2 days agoChatGPT will now generate interactive visuals to help you with math and science concepts

-

Politics6 days ago

Politics6 days agoTop Mamdani aide takes progressive project to the UK

-

Business2 days ago

Business2 days agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Sports5 days ago

Sports5 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports5 days ago

Sports5 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

NewsBeat1 day ago

NewsBeat1 day agoResidents reaction as Shildon murder probe enters second day

-

Entertainment6 days ago

Entertainment6 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business4 days ago

Business4 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Business2 days ago

Business2 days agoSearch Enters Sixth Week With New Leads in Tucson Abduction Case

-

NewsBeat3 days ago

NewsBeat3 days agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech3 days ago

Tech3 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Business3 days ago

Business3 days agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat1 day ago

NewsBeat1 day agoI Entered The Manosphere. Nothing Could Prepare Me For What I Found.

-

Business6 days ago

Business6 days agoIran war enters second week as Trump demands ’unconditional surrender’

-

Sports3 days ago

Sports3 days agoSkateboarding World Championships: Britain’s Sky Brown wins park gold