Crypto World

Over 9 million XRP transferred to KT DeFi, whale activity comes into focus

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The transfer of more than 9 million XRP to KT DeFi has sparked fresh discussion about whale activity and shifting capital flows within the crypto market.

Summary

- Blockchain data shows a whale moved over 9 million XRP to the KT DeFi platform, drawing attention to large-holder strategies and DeFi trends.

- Analysts suggest the transfer could be linked to liquidity management, yield optimization, or participation in cloud mining models.

- KT DeFi positions itself as a regulated UK-based digital asset mining platform with third-party audits, insurance coverage, and a multi-layered security framework.

Recent blockchain monitoring data shows that a whale address has transferred more than 9 million XRP to the KT DeFi platform. At current market prices, the transaction represents a substantial amount, quickly drawing market attention to large-holder capital movements and evolving trends within the DeFi ecosystem.

Industry analysts suggest the transfer may be related to liquidity allocation strategies, yield optimization adjustments, or participation in emerging models such as cloud mining.

KTDeFi: A regulated global digital asset mining service platform

KTDeFi is a UK-headquartered global digital asset mining service platform dedicated to providing compliant, transparent, and high-security digital asset participation solutions to users worldwide.

The company operates in accordance with applicable UK regulations and complies with relevant requirements under the European Union’s Markets in Financial Instruments Directive (MiFID II) framework. All operational processes, including platform management, asset custody, and profit distribution, are conducted within a clearly defined legal structure to ensure a secure and reliable investment environment.

Compliance and audit framework

To enhance operational transparency and system integrity, KT DeFi undergoes annual security and compliance audits conducted by the independent third-party firm PricewaterhouseCoopers (PwC).

In addition, client fund protection mechanisms are supported by insurance coverage through Lloyd’s of London, further strengthening risk mitigation and investor confidence.

Technology and security infrastructure

From a technical standpoint, KT DeFi employs a multi-layered security architecture to ensure stable platform operations and data protection:

- Cloudflare enterprise-grade protection, providing network acceleration and DDoS mitigation

- McAfee cloud security solutions, enabling real-time threat detection and data security

- High-performance ASIC and GPU hardware, optimizing computational efficiency and operational performance

The platform maintains 99.99% system uptime, supporting continuous and stable service delivery. To date, no major security incidents have been publicly disclosed.

User feedback from Europe

Amelie M. Kirk, IT Consultant from Munich, Germany, stated: “I have followed the digital asset market for years, but prefer stable and transparent yield models. KTDeFi’s cloud mining service offers clear information disclosure and fee structures that align with my long-term asset allocation strategy.”

Isabella, a business owner from Vienna, Austria, commented: “Compared to directly holding cryptocurrencies, this model feels less exposed to short-term price volatility. The platform’s emphasis on green energy is particularly important to me and enhances trust.”

Alexandra S. Wheeler, a finance professional from Zurich, Switzerland, added: “Compliance and risk management are essential to me. KTDeFi’s audit structure and European energy and operational infrastructure standards align closely with traditional financial frameworks.”

Management statement

Emma Louise Stevens, CEO of KT DeFi, stated: “KT DeFi is committed to helping global investors enhance the value of their digital assets within a lawful, transparent, and secure framework. We place particular emphasis on meeting European regulatory standards and continuously strengthening our risk management systems and sustainable development strategies.”

How to get started with KT DeFi

1. Register an account

Visit the official KT DeFi website and complete the registration process. New users may receive a $17 welcome bonus.

2. Deposit digital assets

Deposit XRP or other supported cryptocurrencies. Funds will be reflected in the users’ personal account dashboard.

3. Select a mining contract

Users can choose a cloud mining contract that suits their needs. Once activated, the system will automatically manage the mining or computational allocation process and distribute earnings according to the agreed terms.

For more information, please visit the official website.

Conclusion

As the digital asset market continues to evolve, whale capital movements and innovative yield models such as cloud mining are becoming key focal points for investors. The transfer of more than 9 million XRP to KT DeFi provides another significant data point for observing trends in the broader crypto ecosystem.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Pi Network’s (PI) Price Soars 16% Again as Team Reveals Distributed AI Computing Plans

The project released a case study showing that the vast number of nodes can support decentralized AI training and computing usng spare processing power.

Pi Network’s native token has been on a spectacular run lately, defying the overall market-wide trend by registering consecutive double-digit gains that drove it to a fresh three-month peak of over $0.23 earlier today.

The most probable reasons behind these gains are related to protocol updates and the latest Pi Node case study published by the team earlier this week.

The Case Study

The team’s statement indicated that they are exploring how the global network of distributed nodes could support decentralized AI training and computing tasks, which could unlock a new layer of utility beyond securing the Pi Network blockchain.

They claimed that the network itself is relatively energy efficient and does not require the full computational capacity of its worldwide node community. Consequently, a large portion of that unused computing power remains available across thousands of machines running Pi Nodes.

The team believes this untapped capacity could be utilized by third parties requiring larger-scale computing resources, especially for AI model training and inference workloads. Pi Node operators who choose to participate in such a system could lend their computing resources and receive cryptocurrency-based compensation for completing computational tasks.

With over 421,000 Pi Nodes globally, representing more than a million CPUs, the network already operates as a large distributed computing environment, continued the statement. Its ecosystem includes tens of millions of claimed KYC-verified users who could potentially provide human-in-the-loop input for AI training tasks.

“This, in addition to the computing power from Pi nodes, can offer a unique resource for scalable, authentic human input in AI systems, and further complete the one-stop service to AI clients.”

The team said they already ran a pilot with 7 volunteer Pi Node operators. The results were quite promising, as tasks were “correctly pushed to the external testers (volunteer Pi node operators) and valid results were sent back to OpenMind.” They added that the use case was proven: Pi Nodes can opt in to run computations defined and requested by a third party, unrelated to their blockchain obligations, and return meaningful results to a third-party client.

You may also like:

PI’s Rally

In addition to the promising news for the vast Pi Node community, another possible reason behind the underlying token’s massive run lately could be related to the successful implementation of the protocol v19.9 upgrade and the approaching next one – v20.2, which should be completed by March 12.

PI continues to be the top performer from the larger-cap alts, surging by 16% daily to over $0.23. This is its highest price tag in roughly three months. The asset is now the 40th-largest, according to CoinGecko, with a market cap of over $2.2 billion.

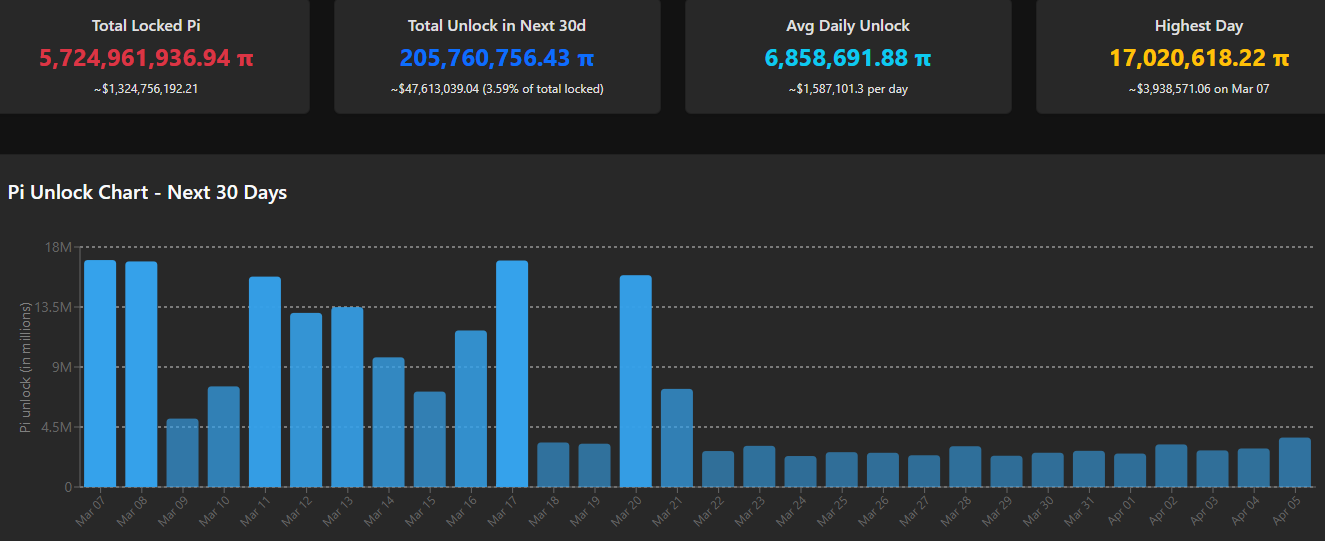

Even the substantial number of unlocked tokens today (almost 21 million) couldn’t shake it off. However, the upcoming schedule shows that more similar days are ahead, which could lead to an upcoming correction.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Best Crypto to Buy Now: Kraken Becomes First Crypto Firm With Federal Reserve Payment Access, While Pepeto Is Where the Biggest Returns Live

Kraken just became the first crypto firm with a Federal Reserve master account, giving it direct access to Fedwire and the payment rails reserved for traditional banks until this week.

When a crypto exchange plugs into the Fed, it is infrastructure becoming permanent, and the best crypto to buy now is the presale entry capturing the bull run returns before institutions absorb supply. Pepeto with $7.5M raised is the 267x setup the best crypto to buy now keeps circling back to.

Bloomberg reported Kraken secured a Federal Reserve master account through the Kansas City Fed, making it the first crypto native company to gain direct access to the US central bank’s core payment infrastructure, while CoinDesk confirmed US Senator Cynthia Lummis called it a watershed moment for the digital asset industry.

When a crypto firm operates on the same rails as JPMorgan, the best crypto to buy now captures the institutional wave before it hits open markets.

The Best Crypto to Buy Now: Pepeto’s 267x Exchange Infrastructure and the Large Caps Waiting to Recover

Pepeto: the Best Crypto to Buy Now

When you compare every project attracting attention in this market, Pepeto wins that comparison before you even look at the numbers, because while Kraken plugs into the Fed and institutions build the rails, the exchange presale at six decimal zeros is where the listing math creates the kind of returns the best crypto to buy now at large cap scale cannot produce.

The cross chain bridge connecting Ethereum, BNB Chain, and Solana routes assets in seconds. The zero tax engine keeps every trade whole. The risk scoring system checks contracts before your capital commits. The SolidProof audit backs every line of code, and the cofounder of the Pepe ecosystem who built a token to $7 billion leads the team.

From zero to $7.5M raised entirely during consolidation, Pepeto has proven that real utility at presale pricing creates its own demand. The 267x math requires only the listing valuation that exchange tokens with real cross chain infrastructure routinely achieve, and the best crypto to buy now is the one where the returns do not depend on the Fed approving more master accounts or Bitcoin reclaiming $100,000.

The 209% APY staking compounds daily for wallets already inside, and every round that fills while Kraken celebrates its Fed access brings the Binance listing closer, because the exchange infrastructure being built inside the best crypto to buy now Pepeto are the ones able to realistically deliver big returns this year.

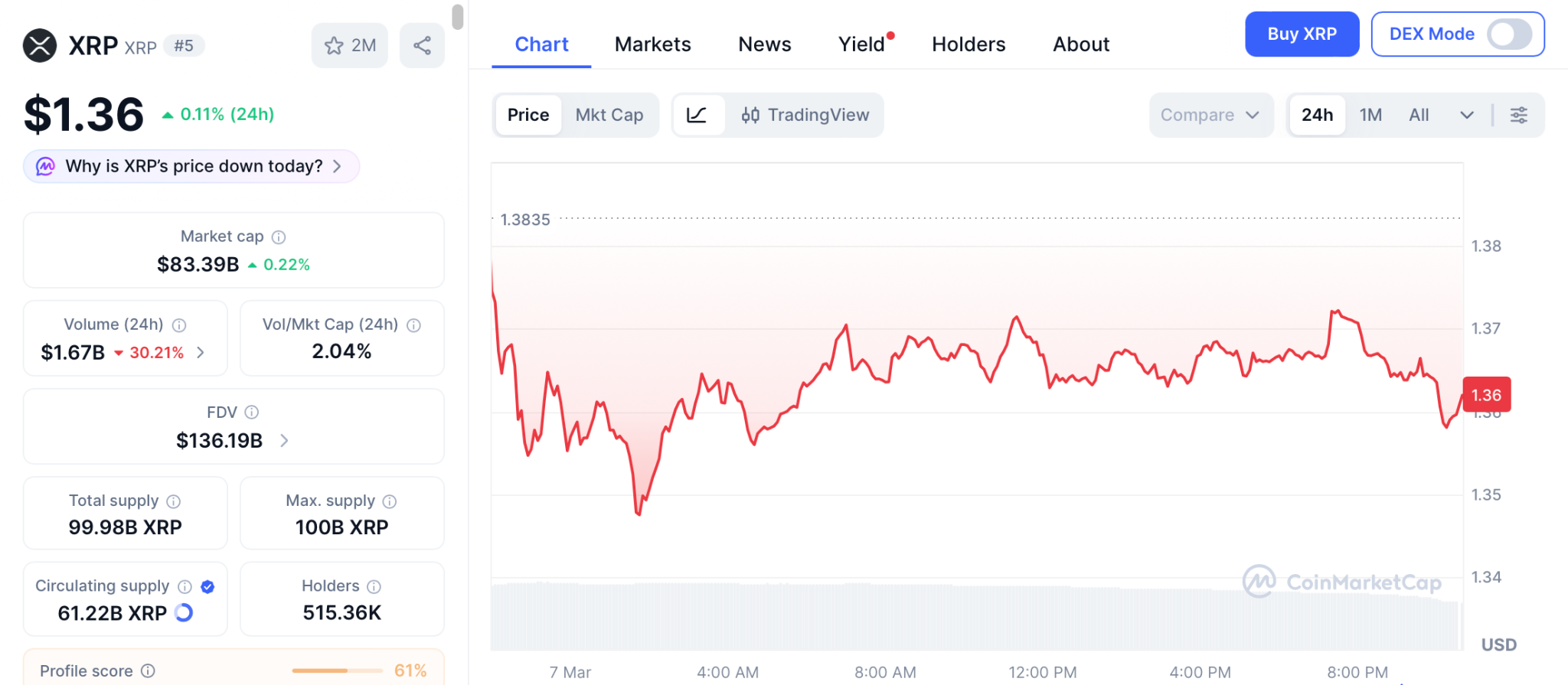

XRP Holds $1.36 as ETF Inflows Reach $1.24 Billion but Returns Stay Capped at $85 Billion

XRP holds at $1.36 according to CoinMarketCap with $1.24 billion in cumulative ETF inflows. Standard Chartered targets $8, but at $85 billion market cap even that target is a 5.6x that takes the full year.

The best crypto to buy now at large cap scale offers store of value, not the multiples exchange presales deliver.

Cardano Sits at $0.25 as Protocol Version 11 Hard Fork Approaches With Modest Targets

ADA trades at $0.25 with Protocol Version 11 targeting March. Even the bullish $1 target is 270% that requires multiple catalysts over months.

The best crypto to buy now conversation confirms large caps during consolidation need patience, while exchange presales deliver faster returns.

The Bottom Line

Kraken just plugged directly into the Federal Reserve, XRP ETFs pulled $1.24 billion, and still none of that institutional firepower can produce what happens when an exchange presale at six decimal zeros lists on Binance with $7.5M in conviction behind it. The wallets inside right now are not waiting for the Fed to approve anything, they are compounding 209% APY every single day, which means $57 per day on a $10,000 position flowing in while large cap holders sit on drawdowns earning zero.

Those same wallets will be the ones selling to latecomers at 50x after listing day, and the latecomers will be the ones who read this, understood the math, and still chose to wait. Right now, at this exact price, is the lowest entry this presale will ever offer again, because every round that closes pushes the floor higher and the returns smaller. Visit the Pepeto official website and enter the presale now while the maximum return window is still wide open.

Click To Visit Pepeto Website To Enter The Presale

FAQs

What is the best crypto to buy now?

The best crypto to buy now is Pepeto with $7.5M raised, 209% APY, and 267x exchange infrastructure delivering returns large caps cannot match. Visit the Pepeto official website.

Why is Kraken’s Fed access important?

Kraken is the first crypto firm with Federal Reserve payment access, confirming crypto infrastructure is becoming permanent, and the best crypto to buy now captures the wave before institutions absorb supply.

Should I buy XRP or Pepeto?

Hold your XRP for the $8 target, but also position in Pepeto because the presale to listing math delivers multiples XRP at $85 billion physically cannot produce.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Bitcoin’s ‘Golden Cross’ Signal Points to Explosive Rally

Meanwhile, another analyst said that BTC’s run could resume soon as long as it remains above $60,000.

Bitcoin’s deviation from its price compression below $70,000 didn’t last long despite the price surge to $74,000 on Wednesday, and the asset struggles below $68,000 as of press time.

Although it has essentially returned to its familiar trading range as of the past month, one analyst believes the best is yet to come, at least according to the BTC Inter-exchange Flow Pulse metric.

30 to 40 Days for the Next Rally?

CW noted on X that the metric, which tracks the flows of BTC between spot and derivatives exchanges, had just formed a golden cross, which has acted as the catalyst for an “explosive upward movement” in the past. However, the rally hasn’t been instant after the formation of such a golden cross in previous years.

The analyst said that it took BTC roughly 30 days to go on a wild run after the bear market had ended in 2019. In 2023, the necessary timeframe went up by 10 days. As such, CW believes the next month could be similarly choppy for bitcoin as the previous one was, but added that “the trend has reversed, and an explosive upward rally is not far away.”

The $BTC Inter-exchange Flow Pulse (IFP) has formed a golden cross. This indicator’s golden cross marks the beginning of an explosive upward movement.

However, the rally did not begin immediately after the golden cross.

In 2019, the explosive upward movement began 30 days… https://t.co/QZDHPO9oZs pic.twitter.com/6oVS7mlG01

— CW (@CW8900) March 7, 2026

Late Bitcoin Buyers to Be Humiliated?

Merlijn The Trader also weighed in on BTC’s current cycle and latest moves, indicating that the cryptocurrency’s patterns are quite obvious and easy to follow. After each “blow-off top,” which was the early October all-time high of over $126,000, the liquidity drains, momentum fades, and the price returns to the macro trendline.

In the case of the current cycle, that level sits around $60,000. He added that as long as BTC doesn’t lose that coveted support for good, the “cycle structure survives.”

You may also like:

THE BITCOIN CYCLE ALWAYS HUMILIATES LATE BUYERS.

After every blow-off top comes the same pattern.

Liquidity drains.

Momentum fades.

Price returns to the macro trendline.That level now sits near 60K.

Hold it and the cycle structure survives.

Lose it and history may repeat. pic.twitter.com/XpPsAETajM

— Merlijn The Trader (@MerlijnTrader) March 7, 2026

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Those who cheered U.S. Bitcoin reserve have spent year watching Trump order languish

President Donald Trump’s move to establish what he called a “Strategic Bitcoin Reserve” within the federal government was greeted with crypto-sector celebration at the start of his administration. The industry cheered it as further cementing the arrival of bitcoin as a mature asset, but a year has passed, and there’s still no reserve.

Trump’s administration performed the initial job of accounting for the government’s crypto holdings, but the U.S. bitcoin reserve is no closer to forming because of the outcome of one concept in the March 6, 2025, order: “the need for any legislation to operationalize any aspect of this order.” Trump’s Treasury Department lacks the needed authorizations for building the specialized accounts. That requires action from Congress, the White House has acknowledged, with Trump’s crypto adviser, Patrick Witt, saying the situation presents “novel legal questions” that must be answered.

Lawmakers such as Senator Cynthia Lummis have pitched reserve legislation, and the current best chance for passage, according to people familiar with the legislative strategy, may be to get it into the National Defense Authorization Act at the end of the year. But Trump’s White House would probably have to re-adopt the issue as a priority cause in order to make that happen.

Conjecture about the planning and funding of the reserve — and its cousin, a separate digital assets stockpile also ordered by Trump to gather every other type of cryptocurrency — has ebbed and flowed. Last month, CNBC markets talking head Jim Cramer spouted a rumor that Trump’s people were poised to start filling the reserve when BTC hit $60,000, despite the lack of a place to put it or money to buy it with.

The president’s crypto officials continue to demur when asked how much bitcoin the feds actually possess, though some estimates put it at more than 300,000, totalling more than $20 billion.

The major disappointment from the crypto sector about Trump’s bitcoin order was that it didn’t come with any new government purchases of the leading crypto asset. It instead encouraged creative policies that would allow the government to add to the stockpile without spending taxpayer dollars.

Witt, Trump’s adviser, hasn’t been willing to share the leading ideas for obtaining more bitcoin for the fund, which is meant to be held for long-term appreciation, not technically as a strategic reserve that would imply its contents would be released to mitigate any emergencies.

The White House didn’t respond to a request for comment on the halt in progress, but it further underlines that executive orders — a mainstay of Trump’s administration — don’t have the power of law and often act as little more than a high-level steer from the president.

If Trump’s congressional allies come up with a pitch for the reserve bill to be tucked into the defense bill later this year, that legislative process usually concludes in December. The must-pass funding bill is often used as what DC insiders like to call a “Christmas tree,” a piece of legislation on which they hang a wide array of unrelated bill ornaments, because the package has to get passed. If that’s the plan, it would happen in this session’s “lame duck” period, the point at which some members of Congress will have been voted out of office or chosen to retire — like Lummis — but haven’t yet come to their departure dates.

Lummis’ own bitcoin reserve bill calls for a spending program that gets the U.S. to a holding of a million tokens — about 5% of the total eventual supply. The Wyoming Republican, who is the inaugural chair of the Senate Banking Committee’s first digital assets subcommittee, has so far only managed to get the legislation into the committee, but the panel’s major priority is another crypto matter: passing the Digital Asset Market Clarity Act.

Read More: Why Doesn’t the U.S. Have a Bitcoin Reserve, Yet?

Crypto World

Binance Formally Rejects US Senate Claims of Iran Sanctions Violations

The response comes after Senator Blumenthal’s letter raised concerns about Binance’s AML controls and cited reports from outlets such as the New York Times, Fortune, and the WSJ.

The world’s largest crypto exchange has issued a formal response to a letter from US Senator Richard Blumenthal, strongly rejecting claims that its compliance systems are weak or that it enabled any sort of illicit financial activity.

Binance indicated that the media reports cited in the Senate inquiry contain “false, unsupported, and defamatory claims” about its sanctions controls and AML procedures.

Binance Responds

The statement emphasized that Binance operates a robust compliance program supported by more than 1,500 specialists worldwide and advanced monitoring tools designed to detect suspicious activity. In addition, the company said it had been highly cooperative with law enforcement, adding that it processed over 71,000 such requests in 2025 alone.

It explained that its team helped authorities seize more than $750 million in illicit assets, including almost $580 million for US agencies. Binance also claimed that its exposure to wallets linked to some sort of illegal activity has declined by nearly 97% since early 2024, which includes a 97.3% drop in exposure to major Iranian crypto trading platforms.

Hexa Whale and Blessed Trust, two of the entities named in the inquiry, were proactively investigated and removed from the platform following internal reviews triggered by law enforcement requests. It added that no Binance account conducted direct transactions with Iran-based entities. It also rejected allegations about internal whistleblowers by explaining that employee departures were part of normal turnover.

Nevertheless, the company also said it “acknowledges that absolute zero risk is impossible on public blockchains but relies on robust monitoring and controls to minimize and mitigate risks.”

The Inquiry

11 Democratic senators, led by Richard Blumenthal, urged the DOJ and Treasury in a letter sent in late February to investigate Binance over alleged Iran sanction violations in 2026. The inquiry cited findings uncovered by the exchange’s own compliance personnel last year, in which they discovered that $1.7 billion in digital assets had flowed to Iranian-linked entities.

You may also like:

Some of the names identified in the letter included Iran-backed Houthis and the Islamic Revolutionary Guard Corps. It also claims that a Binance vendor allegedly directed $1.2 billion in one instance to Iran-linked accounts.

“We urge you to conduct a prompt, comprehensive review of sanctions compliance on the platform to ensure that it is not once again violating the law and threatening U.S. national security,” wrote the Senators.

They added that Iranians had reportedly accessed more than 1,500 accounts on Binance, and further alleged that the exchange may have been used to help Russia evade US sanctions.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Circle shifts $68 million in internal payments via its own stablecoin to bypass legacy banks

Circle has begun using its own stablecoin infrastructure to move money between internal entities, settling $68 million in transfers using USDC, CEO Jeremy Allaire said Saturday.

The transactions were executed through Circle Mint, the company’s platform for minting and redeeming USDC. The firm’s treasury team used the system to carry out intercompany transfer pricing — routine internal payments between subsidiaries — that would normally be handled via bank wires.

Those transfers often take one to three days to settle and depend on banking hours and cut-off windows. Meanwhile, stablecoin settlement runs around the clock, and the company completed the transfers in under 30 minutes, Allaire said in the X post.

In the first month of using the setup, Circle moved more than $68 million across 11 transactions between eight entities. The firm said roughly 90% of its transfer pricing activity was completed within a single day.

Treasury teams executed the payments using role-based permissions and approval workflows inside Mint, a setup designed to mirror controls common in corporate banking portals. The platform also produces transaction-level reports aligned with bank statement standards, allowing accounting teams to reconcile onnchain transfers with internal ledgers and external accounting systems.

One persistent challenge in intercompany transfers is “cash in transit,” where funds leave one entity but cannot yet be booked as available by the recipient while the payment clears. Stablecoin settlement shortens that gap because transfers confirm within minutes.

Circle said upcoming updates to Mint will focus on multi-entity treasury operations, including easier transfers between accounts and APIs that connect transaction reporting with accounting systems such as Oracle.

The changes are scheduled to roll out in March, the firm said in a blog post.

Crypto World

Vertiv (VRT) Stock Drops 3% as Heavy Volume Overshadows Strong Earnings and Analyst Upgrades

Key Takeaways

- Vertiv shares declined 3.1% to $241.91 Friday, touching an intraday bottom of $238.65 with trading volume jumping 33% beyond typical levels

- Analyst sentiment stays positive — RBC increased its price objective to $266, Mizuho pushed theirs to $290, and Roth MKM set a $275 target

- Fourth-quarter results surpassed expectations: earnings per share hit $1.36 versus the anticipated $1.29, while sales climbed 22.7% from the prior year

- Company insiders offloaded approximately 412,467 shares totaling around $104.4M during the last three months

- Directors authorized a $0.0625 per share quarterly dividend on Class A stock, with distribution scheduled for March 26

Vertiv (VRT) shares retreated 3.1% during Friday’s trading session, settling at $241.91 following a dip to $238.65 earlier in the day. The previous session closed at $249.75.

Trading activity revealed significant action beneath the surface. Approximately 8.07 million shares traded hands — representing a 33% surge compared to the typical daily average of 6.05 million shares. This heightened activity during a negative price movement suggests genuine distribution rather than random market fluctuation.

The decline occurred even as Vertiv’s board of directors declared a quarterly cash distribution of $0.0625 for each Class A common share. Shareholders registered by March 17 will receive payment on March 26.

Such dividend announcements typically indicate leadership’s faith in the company’s ability to generate consistent cash flow. The stock’s performance year-to-date remains robust at 54.16%, meaning this retreat follows substantial gains.

Regarding operational performance, the numbers paint an encouraging picture. Vertiv unveiled its fourth-quarter results on February 11, delivering earnings per share of $1.36 — exceeding the Street’s $1.29 projection by $0.07.

Quarterly revenue reached $2.88 billion, marginally shy of the $2.89 billion forecast but representing a solid 22.7% increase versus the year-ago period. The prior year’s EPS stood at $0.99, highlighting meaningful profitability expansion.

Looking forward, Vertiv established first-quarter 2026 EPS guidance between $0.950 and $1.010, with full-year 2026 projections ranging from $5.970 to $6.070. The analyst community currently models $3.59 EPS for the ongoing fiscal year.

Street Analysts Maintain Elevated Price Objectives

Wall Street’s conviction hasn’t wavered. After the February earnings disclosure, Mizuho elevated its price objective from $198 to $290 while maintaining an “outperform” designation. Royal Bank of Canada adjusted its target upward from $200 to $266, also with an “outperform” stance. Roth MKM confirmed its “buy” recommendation alongside a $275 valuation.

Weiss Ratings enhanced VRT from “hold” status to “buy” on February 13. Wolfe Research stood as the exception, downgrading from “outperform” to “peer perform” during December.

According to MarketBeat’s compilation, the consensus includes 1 strong buy, 19 buy, 2 hold, and 1 sell recommendation — translating to a “Moderate Buy” rating with an average price target of $230.28.

Executive Stock Sales Draw Attention

The pattern of insider transactions deserves scrutiny. Throughout the trailing 90-day window, company insiders divested 412,467 shares with an aggregate value approaching $104.4 million.

Director Roger Fradin liquidated 101,666 shares on February 27 at an average transaction price of $252.13, generating proceeds exceeding $25.6 million. Executive Vice President Anders Karlborg disposed of 30,487 shares on February 26 at $246.92 — reducing his ownership position by 46.74%.

Company insiders collectively maintain 2.63% of outstanding shares, while institutional stakeholders control 89.92%.

The equity commands a market capitalization of $92.55 billion, trades at a price-to-earnings multiple of 70.94, and exhibits a beta coefficient of 2.02. The 50-day simple moving average rests at $201.78, with the 200-day average positioned at $174.70. Current pricing remains substantially elevated above both technical benchmarks.

As of Friday’s close, technical indicators continue signaling a “buy” recommendation.

Remember: Preserve all tokens like [[EMBED_0]], [[IMG_0]], [[LINK_START_0]], [[LINK_END_0]], [[SCRIPT_0]], [[FIGURE_0]] etc. exactly as they appear. These are placeholders for embeds, images, and links that must not be changed.

Crypto World

Top 5 Oil Stocks to Invest In Now: Exxon (XOM), Chevron (CVX), Shell (SHEL) Lead the Way

Quick Summary

- On March 6, 2026, Brent crude prices climbed above the $90 threshold, creating upward momentum for energy sector equities

- Exxon Mobil delivered annual earnings of $28.8 billion for 2025 while distributing $37.2 billion back to investors

- Chevron achieved a 12% production increase in 2025, reaching 3.7 million barrels of oil equivalent daily

- Shell produced $26 billion in free cash flow throughout 2025 and implemented a 4% dividend increase

- Among the group, ConocoPhillips holds the strongest analyst backing with 20 Buy recommendations from financial experts

Energy stocks are commanding renewed attention from market participants. On March 6, 2026, Brent crude oil prices broke through the $90 per barrel mark following renewed tensions in Middle Eastern regions that created uncertainty in global energy markets. This price surge has repositioned major petroleum producers into focus for investment portfolios.

Five companies currently stand out as compelling opportunities: Exxon Mobil, Chevron, Shell, TotalEnergies, and ConocoPhillips. Each offers distinct advantages in terms of operational capacity, shareholder returns, and professional analyst coverage.

Let’s examine each investment option and explore what sets them apart in today’s market environment.

Exxon Mobil

Exxon Mobil currently trades near $151.21 per share. The energy giant posted annual 2025 profits of $28.8 billion and channeled $37.2 billion back to investors throughout the year — comprising $17.2 billion through dividend payments and $20 billion via share repurchases.

During the final quarter alone, Exxon generated $12.7 billion in operating cash flow alongside $5.6 billion in free cash flow. This consistent cash-generating capability positions it as a dependable option for long-term investors.

Wall Street sentiment leans cautiously optimistic. Recent analyst tallies reveal 9 Buy recommendations, 8 Hold positions, and 1 Sell rating, resulting in a Hold consensus overall. An alternative assessment rated it as a Buy according to 18 financial analysts. The investment community generally views it as a foundational energy sector position.

Chevron

Chevron is currently valued at approximately $189.94. The company’s global production expanded roughly 12% during 2025 to reach 3.7 million barrels of oil equivalent daily, with particularly robust domestic output contributing significantly to this expansion.

Regarding professional assessments, Chevron holds 13 Buy ratings, 7 Hold opinions, and 4 Sell recommendations across 24 analysts monitored by MarketBeat, establishing a Hold consensus. Another analytical source categorizes it as a Buy from 18 experts.

Chevron maintains its reputation as a premium, steady operator. Financial professionals respect the underlying business fundamentals but express measured enthusiasm about immediate upside potential following recent price appreciation.

Shell

Shell is currently priced around $84.70 per share. The international major produced $26 billion in free cash flow during 2025, implemented a 4% dividend hike, and completed $13.9 billion worth of stock buybacks throughout the year.

Professional sentiment toward Shell exceeds that of its American counterparts. A recent compilation indicated a Moderate Buy consensus among 18 analysts, including 7 Buy ratings, 10 Hold positions, and 1 Strong Buy recommendation.

Shell’s balance of robust free cash flow generation and financial prudence establishes it as among the most attractive international oil majors available for investment currently.

TotalEnergies

TotalEnergies trades near $78.77 currently. The French energy company concluded 2025 with gearing levels around 15% and distributed approximately $15.6 billion to shareholders. Its portfolio spans oil, natural gas, and liquefied natural gas operations while maintaining investments in renewable energy initiatives.

Analyst perspectives show divergence. MarketBeat data indicates 7 Buy ratings, 8 Hold recommendations, and 2 Sell opinions, suggesting a Hold consensus. A wider analyst sample assigns it a Buy rating based on 14 Buy, 7 Hold, and 1 Sell recommendation.

TotalEnergies presents attractive valuation and strong financial positioning for investors seeking diversified international energy market exposure.

ConocoPhillips

ConocoPhillips is changing hands at $117.07. The company reported 2025 annual earnings of $8.0 billion and carries a price-to-earnings multiple around 13.3. Among this group, it represents the purest upstream production-focused investment.

Wall Street demonstrates the greatest optimism toward ConocoPhillips. One analytical source tallies 19 Buy ratings, while another documents 20 Buy, 7 Hold, and 1 Sell recommendation — establishing the most robust Buy consensus among the five companies examined here.

For investors seeking direct exposure to production expansion without owning a fully integrated supermajor structure, ConocoPhillips emerges as the exceptional choice.

Final Thoughts

Each of these five corporations demonstrates substantial cash flow generation, established dividend payment histories, and the balance sheet resilience to navigate softer commodity pricing environments. With Brent crude prices returning above $90 per barrel, market conditions for oil equities have improved considerably compared to recent months.

For investors entering positions today, Exxon represents the most comprehensive quality pick overall. Shell and ConocoPhillips rank as close alternatives. Chevron and TotalEnergies complete the selection as reliable, trustworthy options for extended-timeframe portfolios.

ConocoPhillips presently carries the most favorable analyst consensus among these five companies, supported by 20 Buy ratings from Wall Street professionals.

Crypto World

OmniPact Secures $50 Million to Advance Trust Infrastructure

[PRESS RELEASE – New York, United States, March 7th, 2026]

OmniPact, a decentralized protocol building a trust layer for peer-to-peer transactions of physical and digital assets, announced today it has raised $50 million in a private funding round. The investment will speed up the development of its mainnet, integration of cross-chain features, and deployment of its decentralized arbitration module.

The funding round was backed by a consortium of institutional investors and family offices that requested anonymity. Investors voiced confidence in OmniPact’s technical roadmap and its ability to set new standards for secure, intermediary-free transactions across Web4 and traditional commerce.

A significant share of the proceeds will fund the final development and security audits of OmniPact’s core contracts and multi-chain infrastructure. The funds will also support the protocol’s testnet launch, scheduled for Q1 2026, and expand the engineering team to accelerate the integration of real-world asset (RWA) and AI agent transaction capabilities.

“The funding validates our thesis that the future of commerce requires a neutral, transparent, and trustless foundation,” said Alex Johnson, Co-founder and CEO of OmniPact. “Our infrastructure eliminates intermediaries entirely, returning power to users. This investor confidence lets us execute our roadmap and bring secure, decentralized custody to a global audience.”

OmniPact protocol addresses the “trust problem” in peer-to-peer transactions by using smart contracts as on-chain guarantors. Combining algorithmic custody with decentralized arbitration and reputation systems, it enables secure exchanges without centralized platforms—with the new funding set to bring this vision to market.

About OmniPact

OmniPact is a decentralized protocol founded in 2024 with the mission to create a neutral, transparent, and trustless foundation for peer-to-peer commerce. By leveraging smart contracts as on-chain guarantors, OmniPact enables secure transactions of physical and digital assets without intermediaries. The protocol combines algorithmic custody, decentralized arbitration, and reputation systems to solve the “trust problem” in both Web4 and traditional commerce. With a focus on cross-chain interoperability and real-world asset integration, OmniPact is committed to returning control and security to users worldwide. For more information, visit [www.omnipact.io].

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Nvidia (NVDA) Stock Slides 3% Amid Fresh U.S. Export Control Concerns

Key Takeaways

- NVDA closed down approximately 3% Friday at roughly $177.83, retreating from Thursday’s close of $183.34

- New reports suggest Washington may implement stricter oversight requiring approval for most international AI chip exports

- The chipmaker has reportedly paused H200 deliveries to China as it shifts TSMC manufacturing capacity to newer Rubin architecture

- Fourth quarter results showed $68.13 billion in revenue — a 73.2% annual increase — surpassing Wall Street expectations

- Wall Street analysts maintain bullish outlook with average price target of $273.64, supported by 47 Buy recommendations versus just 2 Hold ratings

NVIDIA (NVDA) experienced a roughly 3% decline Friday, hitting an intraday bottom at $176.82 before closing near $177.83. The previous session ended at $183.34. Trading volume reached approximately 187.4 million shares — running about 4% higher than typical daily activity.

The downward momentum stemmed primarily from emerging reports regarding possible new U.S. export control measures. Washington officials have allegedly prepared regulations requiring government clearance for virtually all international shipments of cutting-edge AI processors.

These proposed rules would implement tiered approval processes depending on order volume. Bulk orders exceeding 200,000 chips might necessitate foreign capital commitments to U.S. data infrastructure or enhanced security protocols, based on reporting from Bloomberg and Reuters.

The Commerce Department stated it wasn’t reverting to the Biden administration’s “AI diffusion” strategy, instead highlighting recent Middle Eastern chip agreements as the template for future arrangements.

However, those Middle Eastern transactions weren’t without complications. Washington greenlit sales of up to 70,000 advanced processors to entities in the UAE and Saudi Arabia — but only following extended delays linked to investment negotiations and national security reviews.

This precedent suggests potential bottlenecks if comparable vetting procedures become standard worldwide.

Chinese Market Complications Weigh on Sentiment

NVDA encountered additional headwinds from separate reports indicating suspended H200 processor deliveries to Chinese customers. This decision appears connected to reallocating TSMC production resources toward the upcoming Rubin generation rather than stemming from regulatory mandates.

Nevertheless, any curtailment of Chinese market access represents a short-term revenue challenge, prompting investor caution.

AMD (AMD) similarly retreated, declining roughly 3.52% during the same session. Both semiconductor giants have underperformed year-to-date as the AI sector momentum has moderated.

Underlying Business Strength Remains Intact

The stock pullback occurred despite exceptionally robust earnings released just weeks prior. NVDA reported fourth quarter revenue of $68.13 billion, reflecting 73.2% year-over-year growth and exceeding the $65.56 billion consensus projection.

Earnings per share reached $1.62, topping the $1.54 Street estimate. Net profit margin stood at 55.60%, while return on equity achieved 97.37%.

Data center segment revenue set company records. In response, analysts have been upgrading price objectives, with Bank of America and Rosenblatt both establishing $300 targets. Deutsche Bank increased its forecast to $220.

Across 53 analysts, the consensus price objective stands at $273.64 — representing significant upside from current trading levels.

CEO Jensen Huang recently noted that the company’s capital positions in OpenAI and Anthropic might be final investments before these firms pursue public offerings — indicating reduced future equity participation.

Institutional ownership remains robust. Norges Bank initiated a new holding valued at approximately $62.2 billion during Q4. J. Stern & Co. expanded its position by over 13,000%.

NVDA maintains a market capitalization of $4.32 trillion. The shares trade at a P/E ratio of 36.29 with a beta coefficient of 2.33.

The 50-day moving average registers at $186.02. The 200-day average sits at $183.87 — placing Friday’s closing price beneath both technical benchmarks.

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business1 day ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat7 days ago

NewsBeat7 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion21 hours ago

Fashion21 hours agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics7 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

Crypto World5 days ago

Crypto World5 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown