Crypto World

Perp Pioneer BitMEX Launches Hyperliquid Copy Trading

The feature allows CEX users to copy top traders on the largest perp DEX.

Crypto derivatives-focused centralized exchange BitMEX has expanded its copy trading feature to let users copy the strategies of top traders from Hyperliquid, the largest decentralized perpetual futures platform by trading volume and open interest.

The new feature, called Hyperliquid Copy Trading, lets BitMEX users automatically replicate trades from selected Hyperliquid traders, according to a press release viewed by The Defiant.

Trades are opened directly on BitMEX and users can copy up to five Hyperliquid traders at once. Other features include basic risk-management tools, such as take-profit and stop-loss options.

The launch illustrates how CEXs continue to push into decentralized finance as on-chain platforms for both spot and derivatives trading gain popularity. A spokesperson for BitMEX told The Defiant, “We’ve basically leveraged Hyperliquid L1’s open-source code to track their users’ positions and have that as an automated system as part of our copy trading feature,” noting that the offering lets traders replicate trades using the CEX’s interface and risk management features they’re used to:

“It’s an opportunity for users to make the same perp trades as top hyperliquid traders and have that automatically reflected to their accounts.”

The Rise of DEXs

The move comes as trading activity continues to grow across DEXs, with volumes in some cases overtaking those on CEXs.

Over the past 24 hours, BitMEX reported about $655 million in trading volume and $14.5 billion in open interest, which represents the value of outstanding derivatives contracts. While OI on Hyperliquid is smaller at $5.8 billion, the perp DEX saw nearly $13 billion in trades in the past 24 hours, outpacing the CEX by nearly 20x.

The contrast is notable given BitMEX’s role as a first mover in crypto derivatives, and as the pioneer of perpetuals futures in particular, a version of which it first launched in 2016.

“BitMEX pioneered the perpetual swap, which has since become the industry standard for futures trading,” BitMEX CEO Stephan Lutz said in the release, continuing:

“The launch of Hyperliquid Copy Trading completes the circle, bringing the alpha available on the world’s leading PerpDEX to BitMEX users and incorporating it into their existing workflow.”

In the face of rising competition from decentralized platforms, as well as centralized giants, smaller CEXs have had to get proactive with their strategies. For example, in December, Bitfinex removed all trading fees across its spot and derivatives markets in an effort to attract and retain users.

The announcement comes as crypto markets have swung sharply in recent weeks, with Bitcoin falling to levels not seen since April 2025.

In October, self-custody crypto wallet MetaMask integrated Hyperliquid to offer perpetual futures trading from directly within the wallet.

Crypto World

Will Markets Crash Further When $2B Bitcoin Options Expire Today?

Friday has come around again, which means another batch of expiring Bitcoin options as spot markets continue to melt down.

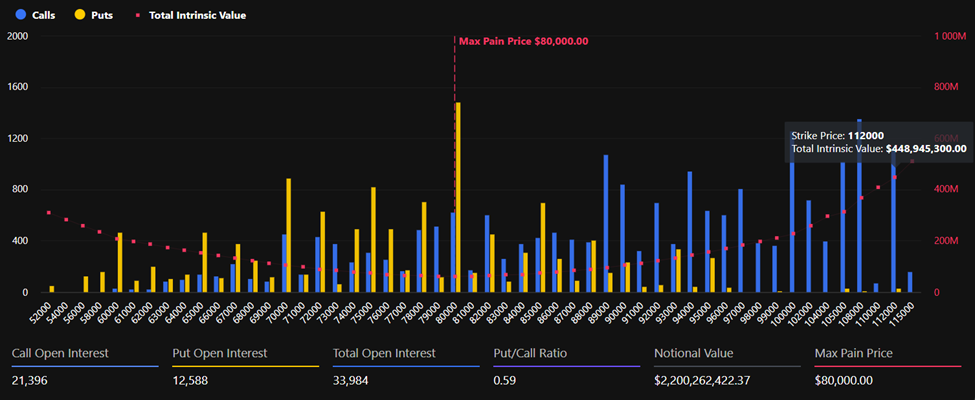

Around 34,000 Bitcoin options contracts will expire on Friday, Feb. 6, with a notional value of roughly $2.1 billion. This event is much smaller than last week’s end-of-month expiry.

Crypto markets have collapsed into bear market territory, losing around $686 billion since the start of the week, as sentiment plunges and both retail and institutional investors dump crypto assets.

Bitcoin Options Expiry

This week’s batch of Bitcoin options contracts has a put/call ratio of 0.59, meaning that there are more expiring calls (longs) than puts (shorts). Max pain is around $82,000, according to Coinglass, which is well above current spot prices, so many will be out of the money on expiry.

Open interest (OI), or the value or number of Bitcoin options contracts yet to expire, remains highest at $100,000 and $70,000, which have $1.1 billion at these strike prices on Deribit. Total BTC options OI across all exchanges has been in decline for a week and is at $32.5 billion.

“BTC option flows suggesting downside plays not over,” said Deribit.

“Bitcoin’s open interest is stacked through the $80K to $90K region, with elevated put activity showing traders leaned defensive into the move.”

🚨 Options Expiry Alert 🚨

At 8:00 UTC tomorrow, over $2.5B in crypto options are set to expire.$BTC: $2.15B notional | Put/Call: 1.42 | Max Pain: $82K$ETH: $408M notional | Put/Call: 1.13 | Max Pain: $2.55K

Bitcoin’s open interest is stacked through the $80K to $90K region,… pic.twitter.com/WPCdYeS2aC

— Deribit (@DeribitOfficial) February 5, 2026

“The upcoming $60,000 range represents the consolidation zone prior to the Trump rally, where support remains relatively strong. Should a rapid dip occur in the short term, it may present a buying opportunity,” said crypto derivatives provider Greeks Live.

In addition to today’s batch of Bitcoin options, around 217,000 Ethereum contracts are also expiring, with a notional value of $400 million, max pain at $2,550, and a put/call ratio of 1.15. Total ETH options OI across all exchanges is around $7.1 billion. This brings the total notional value of crypto options expiries to around $2.5 billion.

You may also like:

Spot Market Outlook

Crypto market capitalization has tanked to a 16-month low of $2.27 trillion as the digital asset exodus continued.

Bitcoin was smashed by double digits, tanking below $60,000 in early trading in Asia on Friday. The asset has now lost 50% from its all-time high, dumping more than $60,000 in just four months.

Ether is back at bear market lows, falling below $1,800 briefly, and the altcoins have been destroyed in what appears to be the start of another long, drawn-out crypto winter.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin Miner MARA Moves 1,318 BTC in 10 Hours, Traders Wary of Forced Miner Selling

Bitcoin miner Marathon Digital (MARA) has transferred 1,318 BTC, worth $86.9 million, in 10 hours as Bitcoin slumps to $64K. The miner moved to a mix of three crypto wallets, on-chain data revealed.

Per Arkham, MARA moved a large chunk of 653.773 BTC to credit and trading firm Two Prime, worth about $42.01 million in one transfer. Minutes later, a smaller amount of 8.999 BTC, worth about $578,000, was sent to the same Two Prime-tagged address.

A separate chunk of about 300 BTC was sent to crypto custodian BitGo-linked wallet, split into two transactions, worth roughly $20.4 million at the time.

Besides, MARA also moved 305 BTC to a fresh wallet address, valued at $20.72 million.

Tough Period for BTC Miners

Bitcoin has been crashing so hard in the recent past and is now hovering just above $63,000 at the time of writing, its lowest levels since October 2024.

The plunge has taken a toll on Bitcoin miners, making it far less economical for them. Bloomberg reported Thursday that the mining revenue value per unit of computing power, called the hash price index, has dropped to around 3 cents for each terahash.

Newhedge research notes that a biweekly figure mining difficulty is set to drop by over 13%, one of the largest decreases since China banned mining in 2021.

As a result, shares of major BTC miners tumbled. MARA Holdings slumped more than 18%, while CleanSpark Inc and Riot Platforms Inc fell 19.13 and 14.7%, respectively.

MARA Trading Under Pressure – Here’s Why

MARA stock is down over 30% in the past 5 days, and 34% in the last month, according to Google Finance.

The company’s share performance is also tied to MARA’s latest insider share transactions report. On January 30, 2026, 14,301 shares of common stock were withheld at $9.50 per share to cover his tax liability upon vesting of restricted stock units, per Stock Titan data.

Apart from the headwind from the Bitcoin market downturn, miners have been facing rising power costs largely due to winter storms across the US in late January.

Further, energy-rich BTC mining hubs in Texas and Tennessee faced power outages.

“It is due to the combination of both the sell-off and winter storms,” Harry Sudock, chief business officer at CleanSpark, told Bloomberg.

The post Bitcoin Miner MARA Moves 1,318 BTC in 10 Hours, Traders Wary of Forced Miner Selling appeared first on Cryptonews.

Crypto World

Bitwise Files for First Spot Uniswap (UNI) ETF With SEC

Bitwise Asset Management has filed a Form S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for a spot Uniswap ETF, marking a major step toward a regulated exchange-traded product tied directly to the UNI token.

Summary

- Bitwise has filed for a spot Uniswap ETF, seeking to offer regulated exposure to the UNI token through traditional markets.

- The proposed ETF would hold UNI directly, with Coinbase Custody named as custodian.

- UNI traded lower despite the filing, underscoring cautious market sentiment toward altcoins.

Uniswap ETF filing fails to lift UNI price

Despite the filing, Uniswap (UNI) showed little immediate upside. The token continued to trade lower, reflecting cautious sentiment across altcoins even as institutional interest grows.

At press time, UNI was exchanging hands at $3.22, down 14.5% over the past 24 hours.

The filing, submitted on February 5, 2026, proposes the launch of the “Bitwise Uniswap ETF,” a trust designed to hold Uniswap tokens as its primary asset. It provides investors with a regulated vehicle to gain exposure to UNI price movements through traditional brokerage accounts.

According to the SEC registration, the ETF would issue shares intended to trade on a U.S. exchange under a yet-to-be-announced ticker symbol.

Bitwise Investment Advisers will sponsor and manage the trust, while Coinbase Custody will hold the Uniswap tokens. The structure aims to offer investors exposure to Uniswap without requiring them to manage wallets or private keys.

If approved, the Bitwise Uniswap ETF would be the first regulated ETF focused on a DeFi protocol’s native token in the U.S. market. UNI is the governance token for the Uniswap decentralized exchange, one of the largest decentralized trading venues built on Ethereum.

Bitwise’s filing arrives in a market where demand for crypto ETFs is evolving. Bitwise and other issuers have recently filed for a range of altcoin-linked ETFs, including products tied to AAVE, Chainlink, and other major tokens.

Crypto World

$2.65 Billion Liquidated in 24 Hours. Are Bears Near Capitulation?

Trader losses intensified during the first week of February. Liquidation volume kept rising as the market repeatedly crushed recovery expectations, driven by consecutive red candles.

However, several analyses point to light at the end of the tunnel, even though a rapid recovery remains unlikely.

Sponsored

Over $2.6 Billion Liquidated in 24 Hours Reflects Structural Market Weakness.

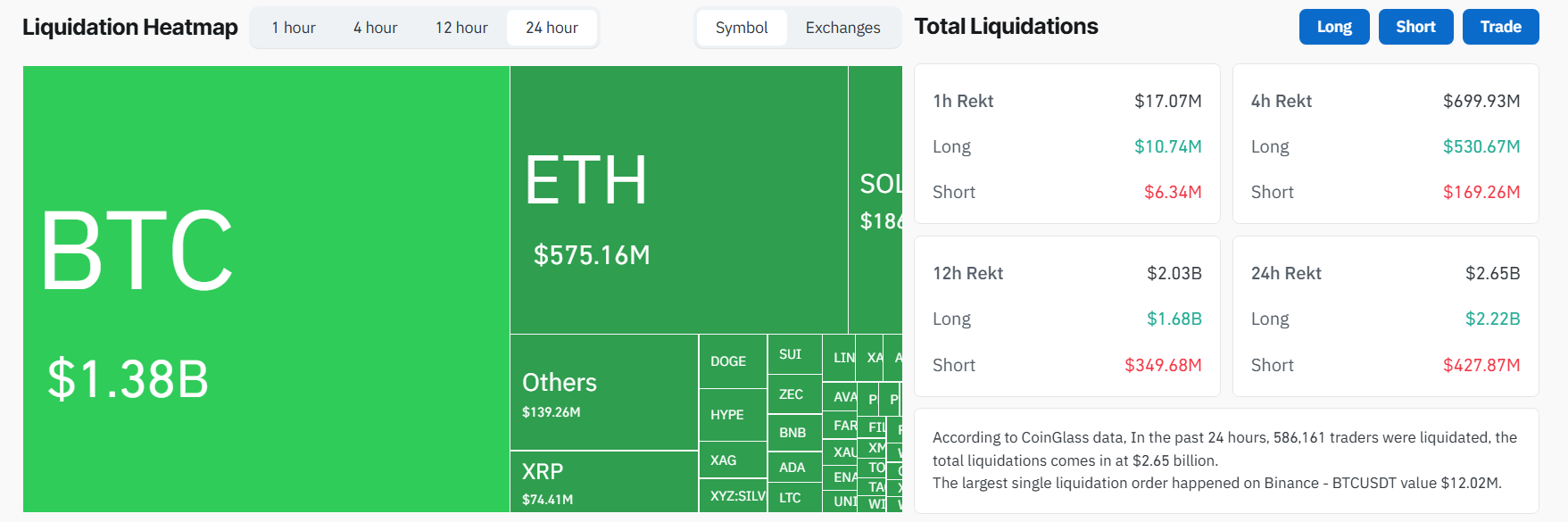

CoinGlass reported that total crypto market liquidations reached $2.65 billion over the past 24 hours. Long positions accounted for more than $2.2 billion of that total.

“According to CoinGlass data, in the past 24 hours, 586,053 traders were liquidated, with total liquidations reaching $2.65 billion,” CoinGlass reported.

CoinGlass data also shows that the smallest event in the Top 10 Crypto Liquidation Events of All Time occurred recently on January 31, with $2.56 billion in liquidations. This suggests the ranking could soon be reshuffled.

The market analysis account, The Kobeissi Letter, explained that this move is not a short-term shock. It reflects a structural downturn that has been developing since October last year.

Sponsored

The root causes include weak liquidity, negative sentiment, and cascading liquidation pressure across markets. The account emphasized that this is a recurring cycle: liquidations damage sentiment, and worsening sentiment triggers further liquidations.

Bitcoin’s intraday price swings of up to $10,000 were attributed to sharply reduced market depth. The current Bitcoin market depth is only 30% of its October peak. This condition mirrors the post-FTX collapse environment seen in 2022.

A BeInCrypto report noted that ongoing panic selling has pushed many crypto treasuries toward rising bankruptcy risk. Bitcoin’s drop to $60,000 pushed MicroStrategy’s holdings below cost basis, increasing balance-sheet pressure.

Against this backdrop, veteran technical analyst Peter Brandt offered a forecast based on the “Bitcoin Power Law” model. He suggested that Bitcoin could trade within a “banana peel” range, with potential support near $42,000.

Sponsored

Brandt argued that if Bitcoin enters this zone, similar to previous bear cycles, bullish investors are unlikely to remain below that level for an extended period.

Is a Major Opportunity Taking Shape?

Despite the bleak outlook, not all analysts remain pessimistic.

Sponsored

Glassnode reported that Bitcoin’s capitulation index recorded its second-largest spike in the past two years. This signals a sharp rise in forced selling. The metric tracks supply held at different price levels and measures market stress to identify potential local bottoms.

Such stress events often coincide with rapid de-risking and heightened volatility. Investors rebalance positions during these phases.

Large-scale liquidations also reduce overall market leverage. This process drives a shift away from leveraged speculation toward spot accumulation. “Weak hands” exit, making room for higher-conviction investors.

“Bitcoin deleveraging may create a strong opportunity soon,” economist Daniel Lacalle noted.

These observations suggest a buying opportunity may be forming. They do little, however, to pinpoint exactly when a recovery will begin.

Crypto World

Asia Market Open: Bitcoin Plunge to $64K Rattles Risk Assets as Tech Slump Ripples Through Asia

Bitcoin tumbled more than 10% toward $64,000, extending a brutal week for crypto as selling pressure spread across risk assets and shook markets from New York to Asia.

The drop dragged Bitcoin to its weakest level since late 2024, reversing momentum that had built after Donald Trump’s election win, when he signalled a more supportive stance on crypto during the campaign trail.

Crypto losses came as investors dumped tech stocks and even safe-haven trades turned jumpier. Volatility in precious metals also picked up, as leveraged bets and speculative flows amplified price swings.

Market snapshot

- Bitcoin: $64,798, down 9.2%

- Ether: $1,900, down 9.7%

- XRP: $1.27, down 12.4%

- Total crypto market cap: $2.29 trillion, down 8.2%

ETF Outflows Mount As Crypto Selloff Deepens Into February

CoinGecko data showed the global crypto market has lost about $2 trillion in value since its October peak, with roughly $800B erased over the past month. Bitcoin was down about 17% for the week and roughly 28% for the year so far, while Ether was headed for a 19% weekly slide and a 38% drop year-to-date.

Traders also kept an eye on the plumbing of the rally that powered crypto higher last year, especially flows into exchange-traded funds.

Analysts from Deutsche Bank said in a note that US spot Bitcoin ETFs witnessed outflows of more than $3B in January, following outflows of about $2B and $7B in December and November, respectively.

Akshat Siddhant, lead quant analyst at Mudrex, said currently bears remain in control of the crypto market.

“The recent decline was driven by softer US labour data and growing concerns around heavy capital spending in the AI sector, which weighed on broader risk sentiment,” he said.

“Continued ETF outflows and short-term holders moving nearly 60,000 BTC to exchanges have added to near-term selling pressure. That said, for long-term investors, this phase offers a favourable accumulation opportunity through disciplined, staggered buying.”

Matt Howells Barby, VP at Kraken, said Bitcoin’s recent tumble doesn’t rule out further short-term downside.

“Price is now entering a well-defined support zone between $54,000 and $69,000, but the weekly RSI has dipped below 30 for the first time since mid-2022 — a signal that has historically preceded major bottoms forming within a three-to-six-month window,” he said.

“In our view, a base is most likely to form in the $54,000–$60,000 range, particularly as the low-$50,000s align with the 200-day moving average.”

Risk Appetite Fades As Labour Data And Tech Losses Combine

In Asia, the risk-off mood hit equities early. MSCI’s broadest index of Asia-Pacific shares outside Japan fell about 1%, led by a 5% dive in South Korea’s Kospi that triggered a brief trading halt shortly after the open, and Japan’s Nikkei 225 also slipped.

US stock futures pointed lower too, after Wall Street ended sharply down overnight as tech heavyweights fell and investors questioned whether massive AI spending would translate into near-term profits.

Alphabet added to the anxiety after saying it could lift 2026 capital spending as high as $185B, part of an AI arms race that has investors watching cash burn as closely as revenue growth.

Fresh labour market signals also fed the unease, with a report showing US layoffs announced by employers surged in January to the highest level for the month in 17 years, reinforcing a broader pullback in risk appetite.

The post Asia Market Open: Bitcoin Plunge to $64K Rattles Risk Assets as Tech Slump Ripples Through Asia appeared first on Cryptonews.

Crypto World

BTC Crash to $65K: Analysts Explain Emotional Selling Behind Drop

TLDR

- Bitcoin has dropped to $65,000, erasing all gains since Donald Trump’s reelection in 2024.

- The cryptocurrency has lost nearly $25,000 since last Wednesday and is now almost 50% off its all-time high.

- Analysts suggest that the recent BTC crash is primarily driven by emotional selling and market sentiment.

- Experts from the Kobeissi Letter attribute the crash to fear and uncertainty, with no fundamental changes in Bitcoin’s ecosystem.

- Doctor Profit believes Bitcoin could hit a bottom between $57,000 and $60,000, presenting a potential buying opportunity.

Bitcoin has just dropped to $65,000, erasing all gains since Donald Trump’s reelection in 2024. The cryptocurrency has lost nearly $25,000 since last Wednesday. This drop marks almost a 50% decline from its all-time high in October 2025. Analysts are now speculating about the reasons behind the crash and where the bottom could be.

BTC Crash Driven by Emotional Selling

The recent BTC crash appears to be driven by emotional selling rather than any fundamental issues within the cryptocurrency ecosystem. Analysts from the Kobeissi Letter highlighted that market sentiment has been volatile. According to them, riskier assets like Bitcoin often experience large price swings due to shifts in investor sentiment.

The current bearish trend has seen a mass exodus of investors, although it doesn’t seem linked to any major changes in Bitcoin’s underlying fundamentals. The experts suggest that fear and uncertainty have been driving the market, leading many to sell without any clear reason tied to the market’s core fundamentals. As a result, BTC has struggled to maintain its value.

BTC May Bottom at $57,000–$60,000

Doctor Profit, a well-known analyst with a bearish outlook, has been predicting a Bitcoin crash for months. He believes that Bitcoin is nearing its bottom, which he places at around $57,000–$60,000. “I consider $57k to $60k as a great entry to make money for the short term and gain some serious % before we continue going down,” Doctor Profit stated.

Doctor Profit has set up “big buy” orders in that range, indicating that he believes Bitcoin will stabilize and possibly recover from that level. He plans to hold for a few months and is not looking to buy Bitcoin at higher prices than that. His outlook suggests a brief short-term recovery before the next decline.

Altcoins Struggling, XRP Takes the Biggest Hit

As Bitcoin falls, altcoins are also experiencing substantial losses. XRP, in particular, has faced a major drop, falling by nearly 20% in just 24 hours. It now struggles to maintain a price above $1.25, marking a troubling trend for the token. Other altcoins are also facing pressure, but XRP’s performance has been the poorest during this downturn.

The altcoin market is taking a heavy hit, with many tokens following Bitcoin’s downward trajectory. Investors are growing increasingly cautious, and the entire market seems to be undergoing a correction. This has resulted in significant losses for many, with XRP leading the decline.

Crypto World

Large Bitcoin Holders Supply Hits 9-Month Low

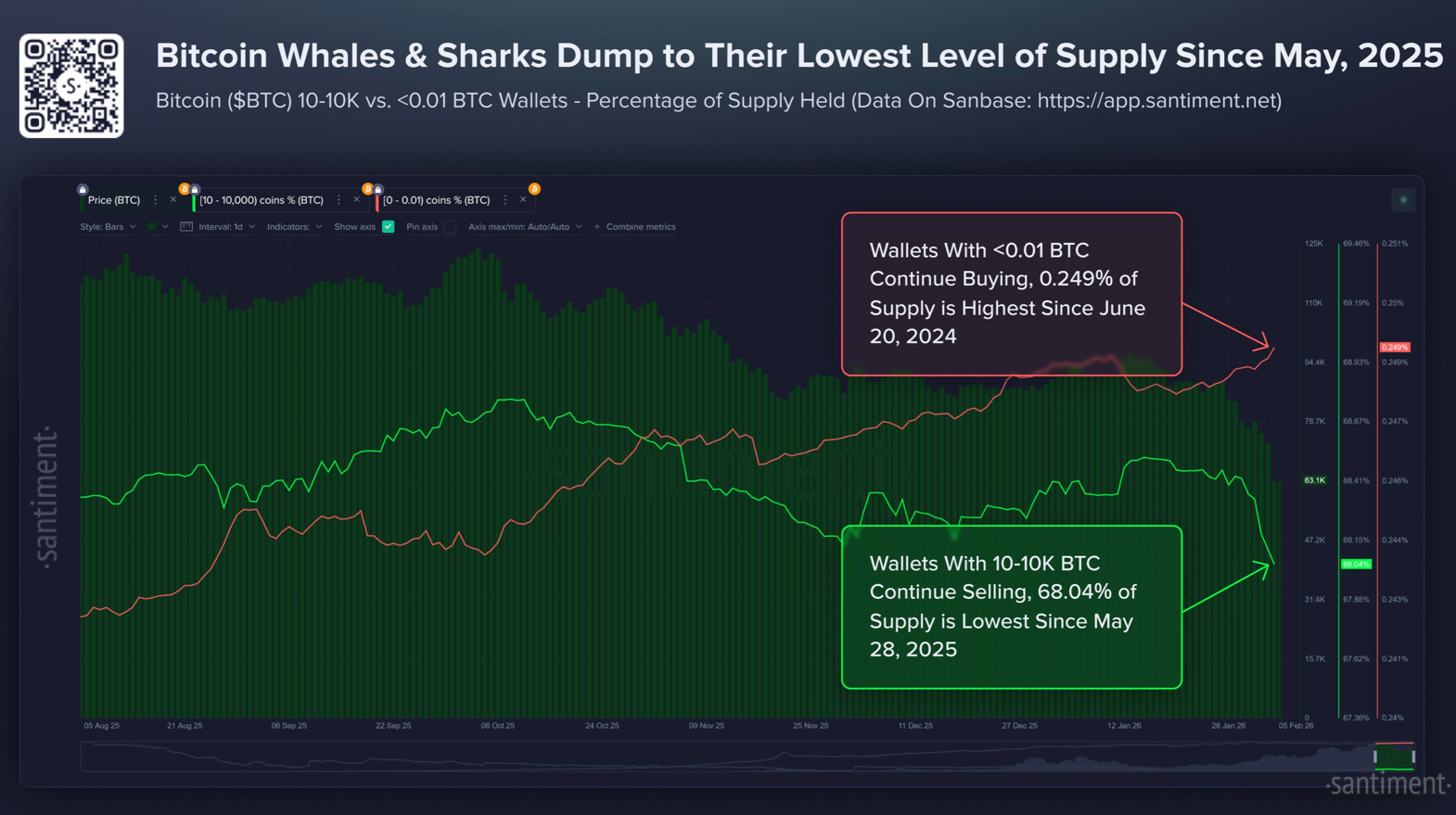

Large Bitcoin holders are now controlling the smallest share of the cryptocurrency’s supply since late May, when it first reclaimed $100,000 after more than three months, according to crypto sentiment platform Santiment.

Santiment posted to X on Thursday that “whale and shark wallets” holding between 10 and 10,000 Bitcoin (BTC) have fallen to a nine-month low, collectively accounting for about 68.04% of the entire Bitcoin supply.

“This includes a dump of -81,068 BTC in just the past 8 days alone,” Santiment said, as Bitcoin fell from around $90,000 to $65,000 over the same period, a roughly 27% decline, according to CoinMarketCap. Bitcoin is trading at $64,792 at the time of publication, up from a 24-hour low of just over $60,000.

Crypto market participants often track large Bitcoin holders to spot signs of accumulation or offloading, as these moves can signal whether whales believe the asset has peaked or is poised for an uptrend.

It isn’t just large Bitcoin holders that are showing signs of caution. CryptoQuant CEO Ki Young Ju posted to X on Wednesday that “every Bitcoin analyst is now bearish.”

The Crypto Fear & Greed Index, which measures overall crypto market sentiment, dropped to a score of 9 out of 100 on Friday, its lowest score since mid-2022, when the market was reeling from the collapse of the Terra blockchain.

While there has been a sell-off among large holders, retail investors have been aggressively accumulating. Santiment said, “This combination of key stakeholders selling and retail buying is what historically creates bear cycles.”

Related: Bitcoin slips under $64K as record-high selling intensifies: Where is the bottom?

“Shrimp wallets,” which Santiment defines as those holding less than 0.1 Bitcoin, have risen to a 20-month high since June 2024, when Bitcoin was trading at around $66,000, before falling to $53,000 just two months later in August.

However, by December 2024, it had reached $100,000 for the first time amid a booming market after Donald Trump won the US presidential election.

The cohort now accounts for 0.249% of Bitcoin’s total supply, which is equivalent to roughly 52,290 Bitcoin.

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

Strategy Posts $12.4B Loss as Bitcoin Falls Below Cost Basis

Michael Saylor’s Strategy reported a $12.4 billion net loss for the fourth quarter, driven largely by mark-to-market declines in its massive Bitcoin holdings. The loss coincided with Bitcoin briefly slipping below $60,000, pushing the firm’s stash beneath its cumulative cost basis for the first time since 2023 and wiping out gains made after last year’s U.S. election rally.

For years, Strategy transformed itself from an enterprise software company into a leveraged Bitcoin proxy, exploiting a persistent premium in its stock price to raise capital and buy more BTC. That strategy is now faltering. The treasury company announced no new equity issuance or debt financing alongside earnings, signalling tightening access to capital as investor appetite cools.

While Saylor has insisted there are no margin calls and said the firm holds $2.25 billion in cash, enough to cover interest obligations for more than two years, pressure is mounting as Bitcoin continues to trade well below Strategy’s reported average acquisition price of $76,052. The company also reiterated that it does not expect to generate profits in the foreseeable future.

Strategy Holds 713,502 BTC Worth $46 Billion

Strategy currently holds more than 713,000 Bitcoin, valued at roughly $46 billion, per Bloomberg data. Although the firm added $75.3 million worth of BTC in late January, analysts say the broader model is under strain. Benchmark analyst Mark Palmer told Bloomberg that investors are now focused on whether Strategy can still raise capital to fund additional Bitcoin purchases under worsening market conditions.

Critics have grown louder. As reported earlier Michael Burry recently warned that continued declines in Bitcoin could trigger cascading losses for corporate holders, reviving concerns long raised by short sellers about Strategy’s reliance on leverage and non-yielding assets. Strategy’s shares are now down nearly 80% from their November 2024 peak, underscoring how quickly sentiment has turned.

BitMine Faces $8.2B Unrealized ETH Loss as Ether Slides Below $2,000

BitMine Immersion Technologies is also sitting on roughly $8.2 billion in unrealized losses after Ethereum’s price fell to around $1,930, well below the firm’s average purchase price of $3,826 per token. The company holds about 4.29 million ETH, acquired for roughly $16.4 billion, and has seen the value of those holdings shrink following a nearly 30% decline since early January.

Despite the drawdown, BitMine has staked more than 2.9 million ETH, generating about $188 million in annual yield, holds $538 million in cash with no debt, and says it views the sell-off as a buying opportunity, even as its shares have plunged 88% from their July peak, echoing losses seen at Michael Saylor’s Strategy.

The post Strategy Posts $12.4B Loss as Bitcoin Falls Below Cost Basis appeared first on Cryptonews.

Crypto World

BlackRock’s bitcoin ETF (IBIT) hits $10 billion volume record, hinting at capitulation

Talk about frenzied trading.

On Thursday, BlackRock’s spot Bitcoin exchange-traded fund, tickered as IBIT, hit a wild record with over 284 million shares traded, per Nasdaq data. That’s a whopping $10 billion-plus in notional value.

To put it in perspective, that smashed the old record of 169.21 million shares from Nov. 21 by a massive 169%.

The record volume came as IBIT plunged 13% to under $35, the lowest since Oct. 11, 2024, extending the year-to-date loss to 27%. Prices peaked at a high of $71.82 in early October.

The fund processed redemptions totaling $175.33 million on Thursday, accounting for 40% of the cumulative net outflow of $434.11 million across 11 funds, according to SoSoValue.

IBIT, the world’s largest publicly listed bitcoin fund, holds physical coins and is designed to mirror the spot price of the world’s top cryptocurrency, which has been declining recently, crashing to nearly $60,000 on Thursday. The fund has been a preferred alternative investment vehicle for institutions seeking exposure to cryptocurrency through regulated products.

Capitulation hints

The combination of record volume and price crash often signals capitulation – long-term holders throwing in the towel and liquidating their holdings at a loss.

It marks the bear market’s peak selling phase, potentially signaling the start of a slow, painful bottoming process.

IBIT options trading on Thursday told the same story. Longer duration put options. or contracts used to hedge against downturns, reached a record premium of over 25 volatility points above call options (bullish bets), according to data from MarketChameleon.

That kind of heavy put bias often signals peak fear as well.

That said, nothing’s guaranteed, as bear markets can drag on longer than even dip buyers can stay liquid.

Crypto World

Bitcoin Volatility Hits 100% Ahead of $2.6B Options Expiry

More than $2.6 billion worth of Bitcoin and Ethereum options are set to expire, a development that could reshape short-term price dynamics as traders unwind hedges and reposition.

The event comes amid elevated volatility, defensive positioning, and growing evidence that institutional participants are actively hedging downside risk.

Sponsored

Sponsored

Bitcoin and Ethereum Options Expiry Could Trigger Volatility as $2.6 Billion in Contracts Settle

Data from derivatives markets shows Bitcoin accounts for the bulk of the expiry, with roughly $2.2 billion in notional value tied to contracts. Ethereum represents an additional $419 million, bringing the combined total to more than $2.6 billion.

Bitcoin is currently trading near $64,686, significantly below its max pain level of $80,000, the price at which the greatest number of options would expire worthless.

Total open interest stands at 33,984 contracts, including 21,396 calls and 12,588 puts, resulting in a put-to-call ratio of 0.59.

Ethereum, meanwhile, is trading around $1,905, also below its $2,400 max pain level. Total open interest stands at 219,034 contracts, with call open interest of 113,427 and put open interest of 105,607.

The put-to-call ratio of 0.93 suggests a more balanced, yet still cautious, positioning compared with Bitcoin.

Sponsored

Sponsored

The gap between spot prices and max pain levels suggests that option sellers could benefit if prices remain suppressed into expiry. Meanwhile, traders holding directional bets may face losses if markets remain range-bound.

Notably, today’s expiring options are significantly lower than the $8.8 billion contracts that settled last Friday, because the January 30 event was for the month.

Institutions Hedge as Volatility Climbs

Nevertheless, analysts at Greeks.live say derivatives markets are showing clear signs of stress and repositioning, with volatility rising sharply and traders moving to protect portfolios.

“The $60,000 range [for Bitcoin] represents the consolidation zone prior to the Trump rally, where support remains relatively strong. Should a rapid dip occur in the short term, it may present a buying opportunity,” they wrote.

Sponsored

Sponsored

According to the analysts, options data indicate institutions and large players are urgently hedging and placing bets.

Bitcoin’s current-month implied volatility (IV) has surged to 100%, doubling since the start of the year, while the main contracts’ IV has also breached 50%, climbing 15% over two weeks.

With skew at a two-year low, the experts say options market structure is now entirely dominated by bearish sentiment, though some lottery-style buying of deeply out-of-the-money options has emerged.

“The market currently exhibits excessive panic, and conditions for a sustained BTC crash remain insufficient. Rapid risk-off liquidation could actually facilitate a market rebound,” Greeks.live analysts wrote.

Indeed, the market is in panic mode, and with good reason, as the Bitcoin price steadily edges toward the $60,000 psychological level.

Sponsored

Sponsored

The surge in implied volatility to 100% highlights the scale of uncertainty currently priced into Bitcoin markets, reflecting expectations of larger-than-normal price swings.

Expiry Could Reset Market Flows

Elsewhere, Deribit analysts note that options positioning is clustered around key strike levels, which may be influencing price behavior ahead of expiry.

“With protection demand already increasing and volatility repriced, this expiry could act as a short-term reset in dealer hedging flows. Expiry may remove positioning-related ‘gravity’ around big strikes, so price behavior after 08:00 UTC may differ from the days leading into expiry,” Deribit analysts stated.

The options expire at 08:00 UTC on Deribit. If those dynamics play out, markets could see increased volatility immediately after expiry as hedging flows unwind and liquidity conditions shift.

While bearish sentiment currently dominates derivatives positioning, panic-driven markets can sometimes produce sharp rebounds, particularly if large liquidations clear excess leverage.

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business13 hours ago

Business13 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat19 hours ago

NewsBeat19 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World13 hours ago

Crypto World13 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World12 hours ago

Crypto World12 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation